Free Blank Invoice Template for Excel Download

Managing business transactions efficiently requires having a reliable structure for documenting payments and services. Whether you’re an entrepreneur or a freelancer, organizing financial records in a clear and professional way is essential. A well-designed document can make the entire billing process more streamlined, reducing errors and improving client satisfaction.

Customizable solutions allow users to adjust fields and calculations, ensuring that each entry suits their specific needs. By using these structured formats, individuals can avoid the hassle of building documents from scratch and focus on the more important aspects of their business. The flexibility of such tools also ensures that they can adapt to a variety of industries and services.

With these systems, the time-consuming aspects of creating financial records are significantly reduced, and users can produce professional-looking paperwork in just a few clicks. The integration of formulas and clear sections helps in maintaining accuracy and consistency, making it easier to keep track of payments and due amounts.

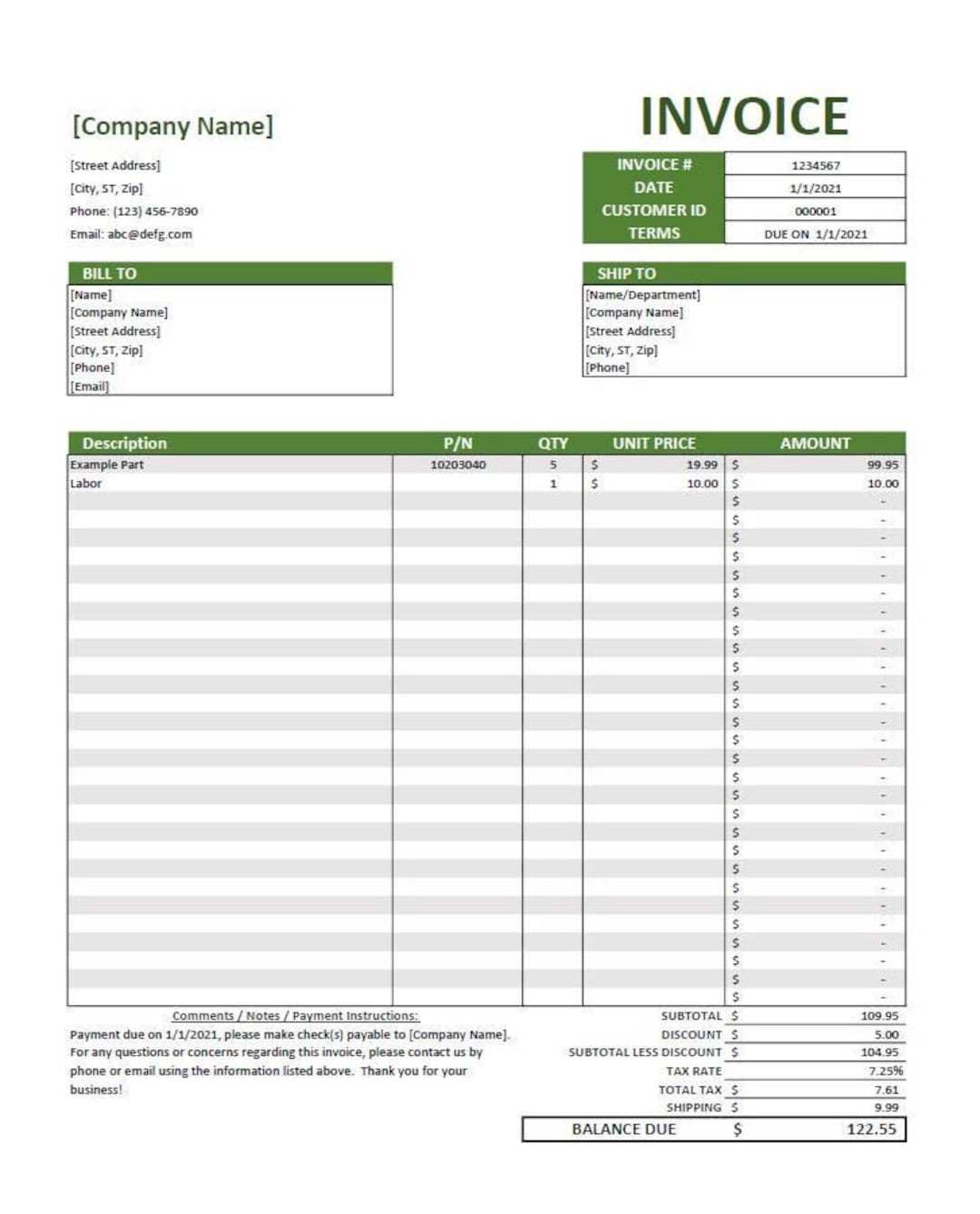

Free Blank Invoice Template for Excel

Having a ready-made solution to handle financial documentation can save both time and effort. With a properly structured file, you can quickly generate records for payments, services, and transactions without starting from scratch each time. These easily accessible files allow for customizations, making them suitable for various business needs and client preferences.

Customizable Fields for Every Need

One of the key advantages of using such a document is its adaptability. Each section can be tailored to include specific details relevant to your business, such as product descriptions, pricing, and payment terms. This level of customization helps maintain consistency and professionalism across all transactions, providing a clear view of the services rendered and the corresponding charges.

Simple Calculations and Tracking

The use of built-in formulas ensures accuracy when calculating totals, taxes, or discounts, making the process faster and reducing the risk of manual errors. In addition, these systems allow you to track payments and outstanding balances, ensuring that your records are always up to date and reflecting the correct amounts due. This not only saves time but also streamlines financial management, making it easier to stay organized.

Why Use Excel for Invoices

Utilizing a spreadsheet program for creating financial records offers numerous benefits, especially when it comes to flexibility and ease of use. The structured environment of a spreadsheet allows users to customize each document to suit their specific needs, all while providing a straightforward and efficient way to manage calculations and organization. This can simplify tasks for both small business owners and freelancers who need to generate professional paperwork regularly.

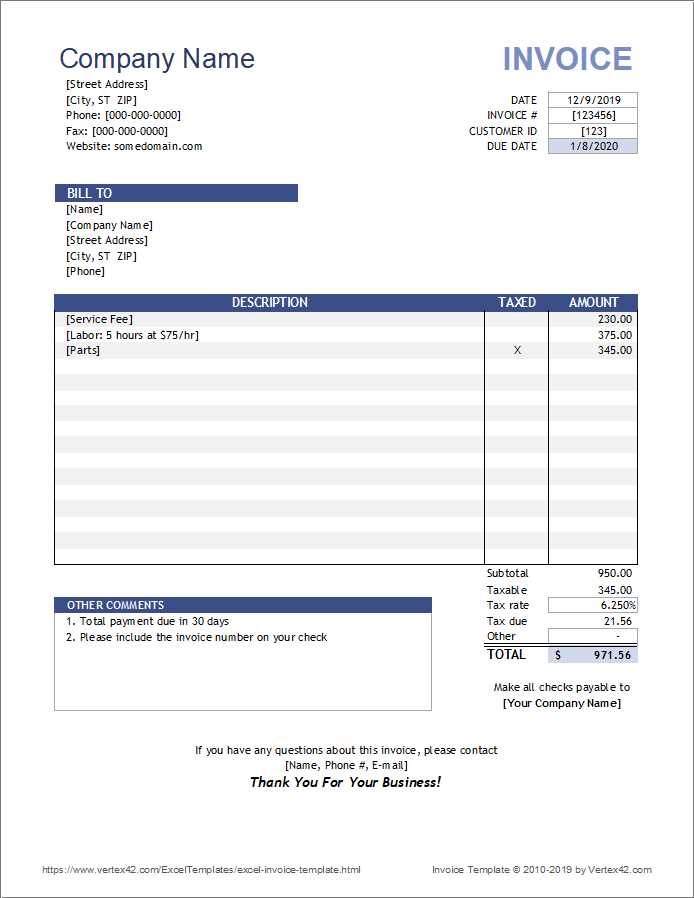

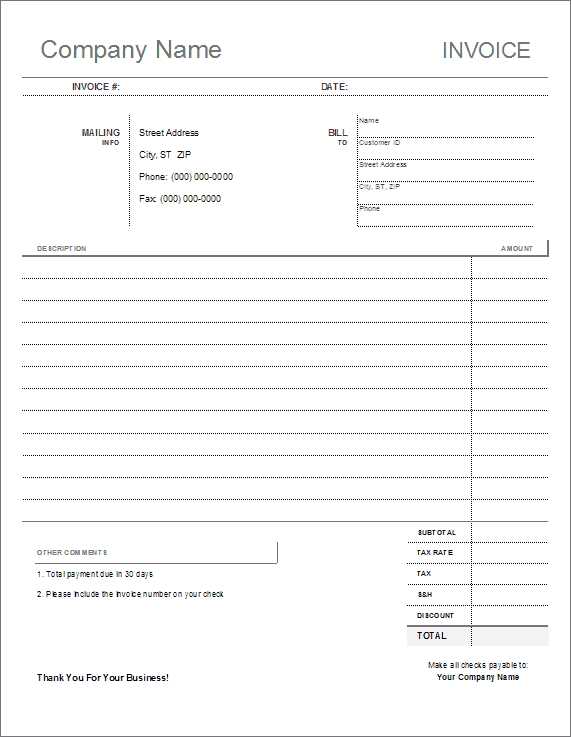

The ability to modify fields, include automated calculations, and format content easily makes this a preferred option for many. Additionally, spreadsheets are highly accessible and provide a reliable way to store and update financial information without the need for specialized software. Below is an example of how various sections can be organized within such a document:

| Section | Description |

|---|---|

| Header | Business name, address, and contact details |

| Itemized List | Services or products provided with quantity and price |

| Total Amount | Subtotal, taxes, and final total calculation |

| Payment Terms | Due date and accepted payment methods |

By utilizing such a platform, users gain full control over the presentation and functionality of their financial records, ensuring they are both accurate and professional in appearance.

Advantages of Free Invoice Templates

Using pre-designed documents for generating financial records offers several notable benefits. These solutions eliminate the need for manual design and ensure consistency across all paperwork. By simply customizing the fields, users can save valuable time while still maintaining a professional standard for their business transactions. The availability of such resources helps streamline the entire process, from creation to delivery, without the complexities of building custom formats each time.

Time and Effort Savings

One of the most significant advantages is the amount of time saved by using ready-made structures. Users don’t have to spend time deciding on layout or format, as everything is already set up. This allows you to focus more on the content, ensuring that the details of each transaction are accurately recorded and presented. Furthermore, it removes the need for manual calculations, as many systems include built-in formulas to handle taxes and totals automatically.

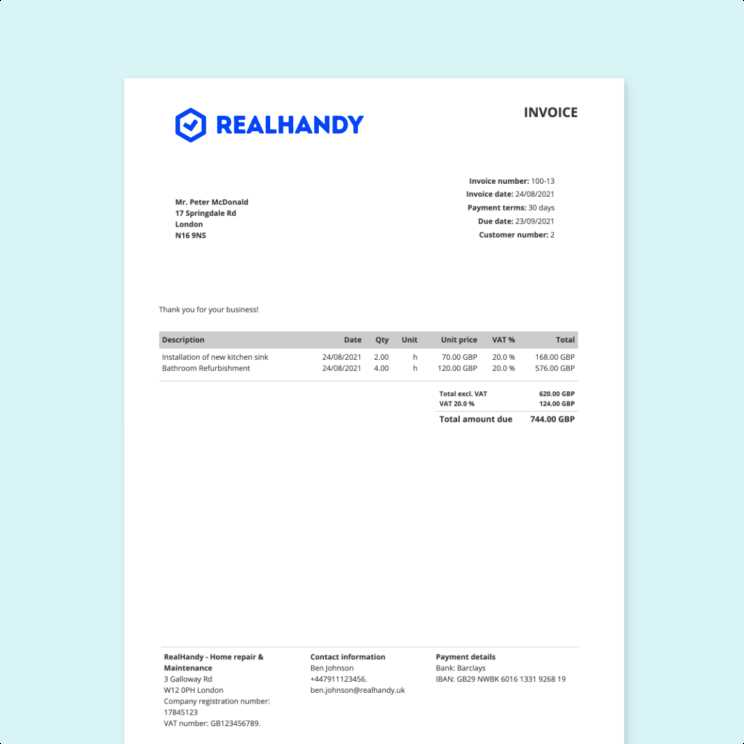

Improved Professionalism and Consistency

Another benefit is the enhanced professionalism that comes from using a standardized design. Having a consistent format for all your financial records boosts your business’s credibility and demonstrates attention to detail. The uniformity of these formats helps create a cohesive brand image, especially when dealing with multiple clients or projects. Additionally, these systems ensure that important information like payment terms and due dates are always present, reducing the risk of misunderstandings.

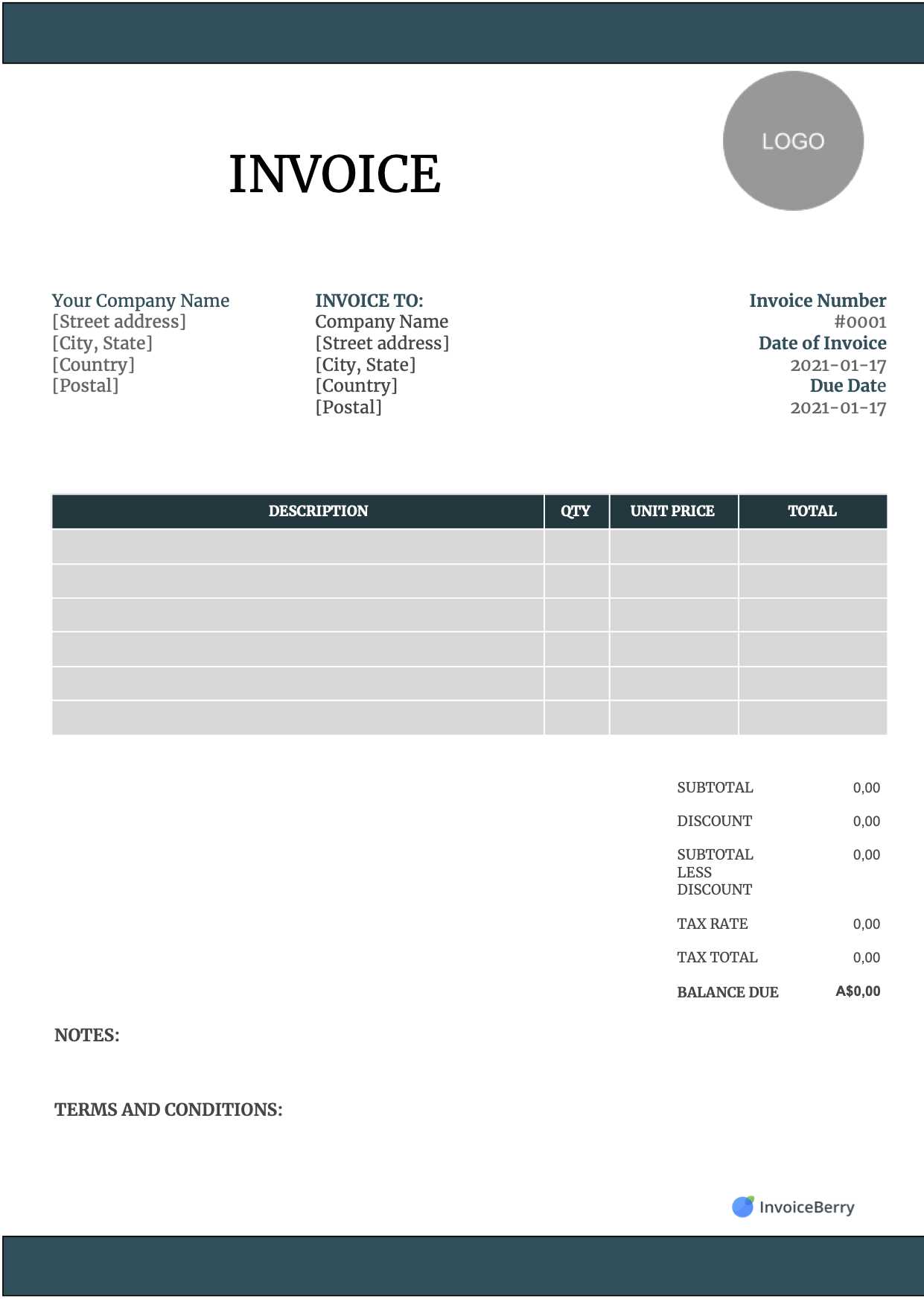

How to Customize Your Template

Customizing a pre-designed document to fit your specific business needs can greatly improve its functionality and relevance. By adjusting various sections, you can ensure that each record reflects your brand and clearly communicates the necessary details. This process is simple and allows you to make your records more efficient and tailored to your workflow.

Here are some essential steps to customize your document:

- Modify Header Information: Change the company name, address, and contact details to reflect your business identity.

- Adjust Item Descriptions: Customize the product or service sections to match your offerings, including any unique specifications.

- Set Payment Terms: Add or update payment terms, such as due dates and accepted methods of payment, to match your policies.

- Include Custom Fields: Add extra fields for specific information that may be required, such as discounts or shipping details.

- Personalize Appearance: Adjust the font style, colors, and layout to match your business’s branding.

By making these adjustments, you create a document that not only looks professional but is also more practical and aligned with your needs. Customization helps improve communication with clients and ensures that all necessary details are captured accurately.

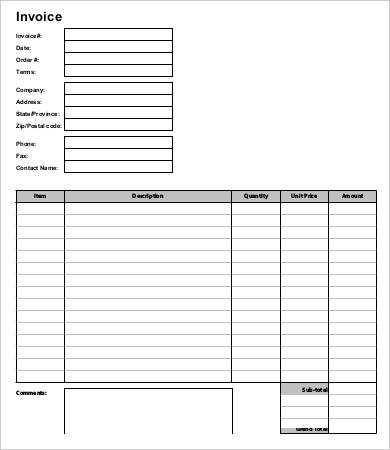

Essential Fields in an Invoice

For a financial document to be clear and effective, it must include specific elements that ensure both the issuer and the recipient understand the transaction. These key sections provide structure, making it easier to communicate the details of a sale or service. By including the right information, you can avoid confusion and ensure that payments are processed smoothly.

1. Business Information

This section should include the name, address, and contact details of both parties involved. It helps establish the legitimacy of the transaction and provides a way for both parties to reach each other if needed.

2. Transaction Details

This includes a description of the products or services provided, including quantities and unit prices. Clear and accurate descriptions help prevent misunderstandings and make the document easier to review.

3. Payment Terms

Including the due date, late fees, and accepted payment methods is crucial for setting expectations and ensuring timely payments. This section outlines how and when the transaction should be completed.

4. Total Amount

The final total, including applicable taxes, discounts, and shipping fees, should be clearly stated. This ensures transparency and helps both parties confirm the amount due.

5. Unique Reference Number

A unique identifier, such as a number or code, is essential for tracking and managing records. It simplifies the process of referencing past transactions and helps with future bookkeeping.

Automating Invoice Calculations in Excel

Automating the calculation process in financial records can significantly improve accuracy and efficiency. By using built-in functions and formulas, you can eliminate the need for manual calculations, reducing the risk of errors and saving time. Automation makes it easy to update totals, apply taxes, and calculate discounts instantly, ensuring your documents are always accurate and up to date.

Key Calculations to Automate

Here are some common calculations that can be automated in your financial document:

- Subtotal Calculation: Automatically calculate the sum of the individual items or services by multiplying quantities by their unit prices.

- Tax Calculation: Use formulas to apply a percentage tax rate based on the subtotal, ensuring that tax is correctly calculated and included.

- Discount Application: Implement discounts based on specific criteria (e.g., early payment), allowing for automatic adjustments to the final amount.

- Total Amount: Sum up the subtotal, taxes, and discounts to calculate the final amount due.

How to Implement Formulas

To set up automatic calculations, you can use basic formulas such as:

- SUM: Add up the values in a range of cells. For example, to calculate the subtotal, you can use the formula =SUM(B2:B10), where B2 to B10 represents the range of prices.

- Multiplication: For item total, use a formula like =C2*D2, where C2 is the quantity and D2 is the unit price.

- Percentage Calculation: To calculate tax, use a formula like =E2*0.05, where E2 is the subtotal and 0.05 represents a 5% tax rate.

By incorporating these functions, you ensure that all financial figures are calculated automatically, allowing for faster and more reliable document generation.

Tips for Professional Invoice Design

Creating a well-designed financial document is essential for making a lasting impression and ensuring clarity in business transactions. A clean, organized format reflects professionalism and helps clients easily understand the details of the charges. By focusing on layout, typography, and branding, you can make your documents not only functional but also visually appealing.

1. Keep it Simple and Organized

One of the most important aspects of a professional design is simplicity. Avoid clutter by leaving adequate white space around sections, making it easier for the reader to navigate the document. Group similar information together, such as billing details and service descriptions, to create a logical flow.

- Use Clear Section Headers: Use bold or slightly larger fonts for each section (e.g., services provided, payment terms, total amount), helping readers quickly find the information they need.

- Align Text Consistently: Ensure that all text and numbers are aligned neatly, making the document look structured and balanced.

2. Include Your Branding Elements

Incorporating your company’s branding helps strengthen your identity and adds a personal touch. Use your logo, business colors, and fonts to make the document reflect your business’s image.

- Logo Placement: Position your logo at the top of the document where it’s easily visible.

- Color Scheme: Choose a color scheme that complements your brand and ensures readability. Avoid using too many colors, as this can make the document look unprofessional.

By paying attention to design details, you create a document that not only looks professional but also supports effective communication with your clients.

Creating Recurring Invoices in Excel

Automating repetitive financial records can save you a significant amount of time, especially when you deal with regular transactions such as subscriptions or service fees. By setting up a system for recurring charges, you can easily generate the same document at scheduled intervals without manually entering details each time. This process ensures consistency and reduces the chances of errors while maintaining accurate billing records.

1. Set Up the Base Document

Start by creating a base layout that includes all the necessary fields, such as customer details, payment terms, and item descriptions. Once the structure is in place, you can reuse it for each new period with minimal adjustments.

2. Use Date Functions for Automation

Excel offers various date functions that can help automate the process. For example, you can set up a column to automatically calculate the next billing date based on the initial transaction date. This way, you won’t need to manually update dates each time a new charge is generated.

3. Utilize Simple Formulas for Calculations

Incorporate formulas to calculate recurring amounts. These might include monthly charges, applicable taxes, and totals. You can set the same values for each period, which will update automatically without requiring manual input each time.

4. Save as a New Document for Each Period

Once everything is set up, you can save the document as a new version for each billing period. This ensures that all records are archived while keeping the original format intact for future use.

By leveraging these steps, you can streamline the process of generating regular payment documents, keeping your operations efficient and reducing the administrative burden.

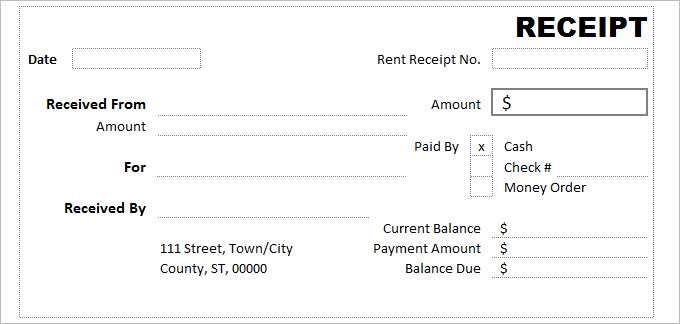

How to Share Your Invoice Template

Once you’ve created a professional document for billing purposes, sharing it with clients, team members, or other stakeholders is essential for smooth operations. Whether it’s for sending regular statements or ensuring consistency across your organization, making the sharing process seamless helps maintain accuracy and transparency in your business transactions.

Emailing the Document

The most common way to share is by sending the document as an attachment via email. Most clients or recipients will appreciate receiving a well-formatted file that they can download, review, and even save for their records. You can either send it in a common file format such as .xls or .csv or convert it to a PDF for easy viewing on any device.

Cloud-Based Sharing

Another option is using cloud services like Google Drive, OneDrive, or Dropbox. Upload your document to the cloud and provide a link for access. This method is especially useful for collaboration or when sharing the same document with multiple recipients. Additionally, cloud storage allows for easy updates and version control, ensuring that everyone works with the most up-to-date version.

Sharing via Collaboration Tools

For teams using project management or collaboration platforms (e.g., Trello, Slack, or Asana), you can upload the document directly into the relevant workspace or project. This method provides visibility to all involved parties, allowing for real-time collaboration and feedback.

Printing and Delivering Physically

In some cases, a physical copy may be required for official purposes or client preference. You can print the document and mail it or hand it over directly. This ensures a formal, tangible record, which may be important in certain industries or for specific clients.

By selecting the right method based on your needs, you ensure that the document is shared efficiently and securely, facilitating smooth transactions and communication with clients or business partners.

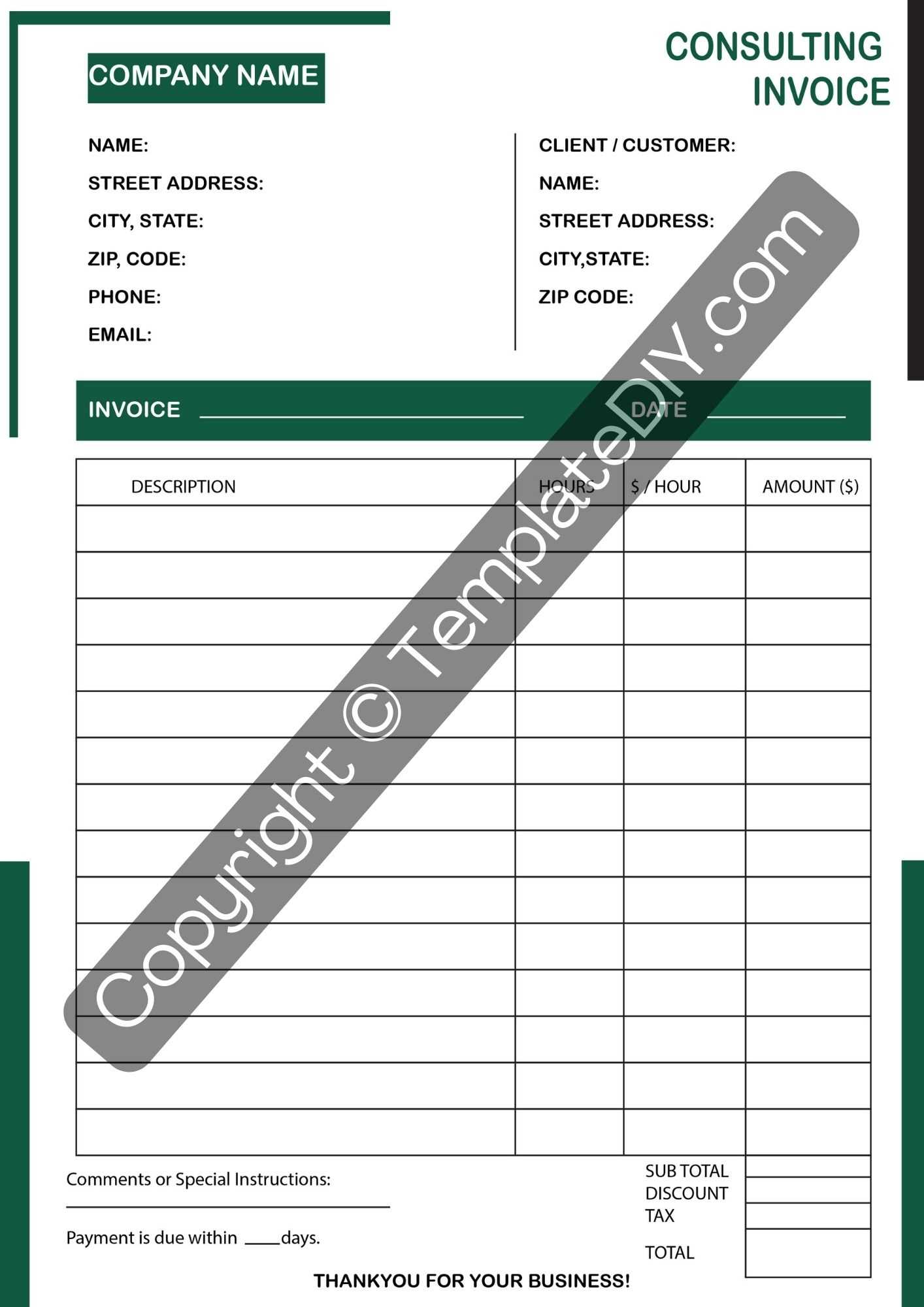

Customizing Your Template for Different Services

Adapting your financial documents to suit various services can significantly enhance their relevance and clarity. Different types of work or transactions may require specific details or structures, so customizing your document ensures that it accurately reflects the services provided. Whether you’re billing for consulting, repair work, or subscription-based services, adjusting the format to match the nature of the service can make the document more professional and easier to understand.

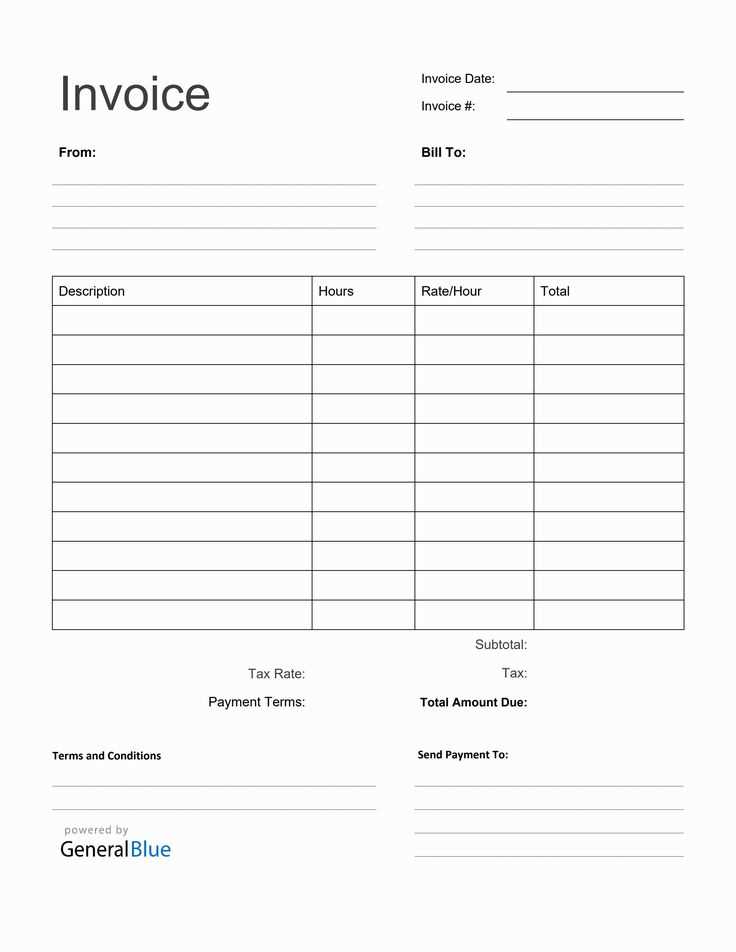

For example, if you’re offering consulting services, you might want to include sections for hourly rates and the number of hours worked, along with a description of the services rendered. On the other hand, if you’re providing a product or tangible service, including SKU numbers, product descriptions, or itemized pricing might be necessary to clearly communicate the charges.

In addition, including relevant tax information, payment terms, and specific client requirements can ensure that each document is tailored to meet the expectations of both the service provider and the client.

By customizing your documents to reflect the particularities of each service or transaction, you not only streamline your billing process but also improve transparency, making it easier for clients to review and process payments promptly.

Using Formulas for Invoice Accuracy

Automating calculations in your financial documents not only saves time but also ensures precision. By incorporating formulas, you can minimize human error and create a more reliable record of transactions. Whether it’s calculating totals, taxes, or discounts, formulas provide a seamless way to handle complex arithmetic without the need for manual input every time.

1. Calculating Totals Automatically

One of the most important formulas to implement is the one for calculating the total amount. By using basic multiplication and addition formulas, you can automatically calculate the sum of individual charges, applying any applicable discounts or taxes. This reduces the risk of incorrect calculations and helps maintain consistency across multiple documents.

2. Applying Taxes and Discounts

Another useful formula is for applying taxes and discounts. By setting up a formula to calculate percentages, you can easily adjust rates as needed. For example, if your services require a specific tax rate or a time-sensitive discount, formulas can update these figures in real-time, ensuring that each entry reflects the correct charges.

3. Automating Due Dates

To further automate your process, consider adding a formula that calculates the due date based on the issue date. This can help ensure that clients receive reminders for upcoming payments, especially if your business operates on specific terms like net 30 or net 60. This small detail can improve both client relationships and cash flow management.

By leveraging these basic and advanced formulas, you can create more efficient, error-free documents that are easy to update and customize. Automation reduces manual effort and helps you focus more on delivering great service and less on administrative tasks.

Printable Invoice Options in Excel

When creating financial documents, having the option to print them directly from your working file offers convenience and flexibility. A well-designed printable format ensures that your records are not only easy to share digitally but also provide a professional appearance when printed. Customizing the print layout to fit your needs is a crucial step in streamlining both online and offline business processes.

Many programs allow you to adjust the print settings, including paper size, orientation, and margins, to ensure that everything fits neatly on a standard page. You can also include or exclude specific sections based on your requirements, such as payment instructions, company logos, or additional notes. By adjusting these settings, you can ensure that your document prints exactly as you want it, making it suitable for physical delivery or archiving.

One of the key advantages of using a program for creating and printing documents is the ability to include automatic updates. When details such as pricing or terms change, the document can update instantly, ensuring that the printed version always reflects the most current information. This eliminates the need for manual adjustments and guarantees accuracy.

To further enhance the document’s professionalism, consider using built-in styling options. By customizing fonts, colors, and borders, you can ensure that the printed version aligns with your brand identity, adding a polished touch to every document you send or store.

Common Mistakes to Avoid in Invoices

While preparing financial documents, it’s crucial to ensure that all details are accurate and clear to avoid confusion and delays. Mistakes, even minor ones, can lead to misunderstandings, payment delays, or disputes with clients. Recognizing and correcting common errors can help maintain a smooth billing process and preserve your professional reputation.

Here are some of the most common mistakes to avoid:

| Mistake | Consequence | Solution |

|---|---|---|

| Missing or Incorrect Contact Information | Delays in communication or payments | Ensure that client and business contact details are accurate and up-to-date |

| Unclear Payment Terms | Late payments or confusion over deadlines | Always specify due dates, payment methods, and any applicable penalties |

| Not Itemizing Charges | Uncertainty about charges and potential disputes | Break down services and products clearly with quantities and prices |

| Omitting Tax Calculations | Legal issues or incorrect amounts | Double-check tax rates and include them in the totals |

| Using Inconsistent Formatting | Confusion or difficulty understanding the document | Maintain uniform formatting for clarity and ease of reading |

Avoiding these common errors will help ensure that your documents are professional, clear, and free from confusion, leading to quicker payments and stronger relationships with clients.

How to Keep Templates Organized

Maintaining an organized system for your financial documents ensures efficiency and reduces the risk of errors or misplaced records. Whether you handle a few documents or have a large number to manage, keeping them well-structured will save time and prevent confusion. By setting up a clear and logical filing system, you can easily access and update your documents whenever needed.

To effectively organize your documents, start by categorizing them into folders based on types or clients. For instance, you might have separate folders for each client, or you could organize by service type. It’s also important to establish a consistent naming convention for each file, so you can identify the contents at a glance. Using dates or client names in file names can help further differentiate them.

Use Cloud Storage for Easy Access

Storing your files in cloud storage services allows you to access them from any device, anywhere, while also providing secure backups. With cloud-based solutions, you can avoid the clutter of physical storage and the risk of losing important files. Most services also offer the ability to tag documents for easier searching and sorting.

Implement Version Control

As you update documents or create new variations, version control can help you track changes and avoid confusion. By labeling each file with a version number or date, you can ensure you are always working with the most current version of a document. This practice is especially useful when dealing with ongoing projects or repeated billing cycles.

By using these strategies, you’ll keep your financial documents neatly organized, easily accessible, and always up to date, which streamlines your workflow and enhances productivity.

Free vs Paid Invoice Templates

When choosing a tool to create financial documents, one of the first decisions you’ll face is whether to go for a no-cost option or invest in a paid version. Both choices offer distinct advantages, depending on your business needs and the level of customization required. Understanding the pros and cons of each can help you make the right decision for your organization.

Advantages of Free Options

- No Initial Cost: The most obvious benefit is that there is no upfront expense, making them ideal for small businesses or individuals with a limited budget.

- Ease of Access: Most no-cost solutions are easy to download or use online, providing quick access to basic tools.

- Basic Features: Free options are often sufficient for simple transactions, providing essential fields like amount, description, and client details.

Advantages of Paid Options

- Customization: Paid tools often offer more flexibility, allowing you to tailor documents to meet your brand’s specific needs with logos, color schemes, and custom fields.

- Additional Features: These may include automated calculations, recurring billing functions, and integration with accounting software, making them ideal for businesses that need advanced features.

- Support and Updates: When you purchase a solution, you typically receive customer support and regular updates, ensuring the tool remains functional and secure.

Choosing between free and paid solutions ultimately depends on your business requirements. If you need basic functionality and have a tight budget, no-cost options may suffice. However, for more professional features, customization, and support, a paid option may be a better long-term investment.

Where to Find Quality Invoice Templates

Finding reliable and professionally designed documents for billing purposes can make a significant difference in streamlining your financial processes. There are numerous sources, both paid and free, that offer well-designed solutions suited to various business needs. Depending on the complexity and features required, you can select the right option for your organization.

Online Marketplaces

Many online platforms provide a wide selection of professionally designed files, both for personal and business use. These sources often offer customizable options tailored to specific industries and business models. Here are a few places to consider:

| Platform | Features | Price |

|---|---|---|

| Etsy | Unique designs, customizable layouts | Varies (typically low cost) |

| Creative Market | Professional designs, business-oriented features | Varies (usually affordable) |

| Envato Elements | High-quality templates with advanced features | Subscription-based |

Software Solutions

Various software applications, including accounting software and document management systems, offer integrated tools to create customized billing documents. These often come with additional features, such as automated calculations, which can save valuable time and reduce errors.

- QuickBooks: Well-suited for small to medium-sized businesses, offering customizable financial documents and automated features.

- Zoho Invoice: A cloud-based solution that provides professional designs with flexible formatting options for different industries.

With a little exploration, you can find the right solution for creating professional documents that fit your business needs and enhance your brand image.

Excel Templates for Small Businesses

Small businesses often face the challenge of managing administrative tasks efficiently while keeping costs low. One of the most effective ways to streamline financial operations is by using pre-designed documents that simplify processes like billing, tracking, and reporting. These ready-made documents can be tailored to suit specific needs, providing an easy solution for business owners to stay organized without needing advanced software or extensive training.

For small businesses, having access to simple yet professional tools can save time and reduce errors in daily operations. Using these documents ensures consistency in the information provided to clients, helping build a trustworthy and professional reputation. Additionally, they can be easily customized for various purposes, including transactions, reports, and financial summaries.

Key Benefits for Small Businesses:

- Cost-effective: No need to invest in expensive software–basic versions of these files are often available for download at minimal cost or even without charge.

- Customizable: Adjust the layout and content to fit the unique needs of your business, whether you’re a service provider, retailer, or freelancer.

- Simple and Efficient: Templates often come with built-in formulas for easy calculations, making the process of generating documents quick and accurate.

Whether you’re just starting or looking to simplify your current processes, using these documents can improve organization and reduce the time spent on repetitive tasks, ultimately allowing you to focus more on growing your business.