Free Billing Invoice Template for Microsoft Word

In today’s fast-paced business world, having a clear and efficient way to manage payments is crucial. Whether you are a freelancer, small business owner, or independent contractor, being able to send organized and accurate financial statements helps build trust with your clients. A well-structured document can ensure that transactions are processed smoothly and can serve as a reference for both parties.

Customizing your own documents for financial transactions not only saves time but also adds a professional touch. With a few simple tools, you can create a personalized record-keeping system that aligns with your brand’s identity. The right format ensures all necessary details are included, reducing errors and the need for follow-up communication.

By using commonly available software, you can easily design a layout that works best for your specific needs. These documents can be modified as your business grows, ensuring you always have an efficient way to manage invoicing and payment tracking. With the right approach, these documents can be a valuable asset in maintaining accurate financial records.

Free Billing Invoice Template for Microsoft Word

Having the right documents for financial transactions is essential for maintaining a smooth business operation. The ability to generate consistent, professional records for services rendered or goods provided can help build credibility and streamline communication with clients. With the proper format, these documents ensure that all necessary details are included, avoiding confusion or delays in payments.

For those who prefer to handle their financial paperwork using basic word processing tools, a versatile document format can be a valuable asset. These customizable files allow users to easily fill in essential information like payment amounts, dates, and client details. They are designed to be both functional and simple to use, making them an excellent solution for individuals and small businesses alike.

Customizing Your Document for Your Needs

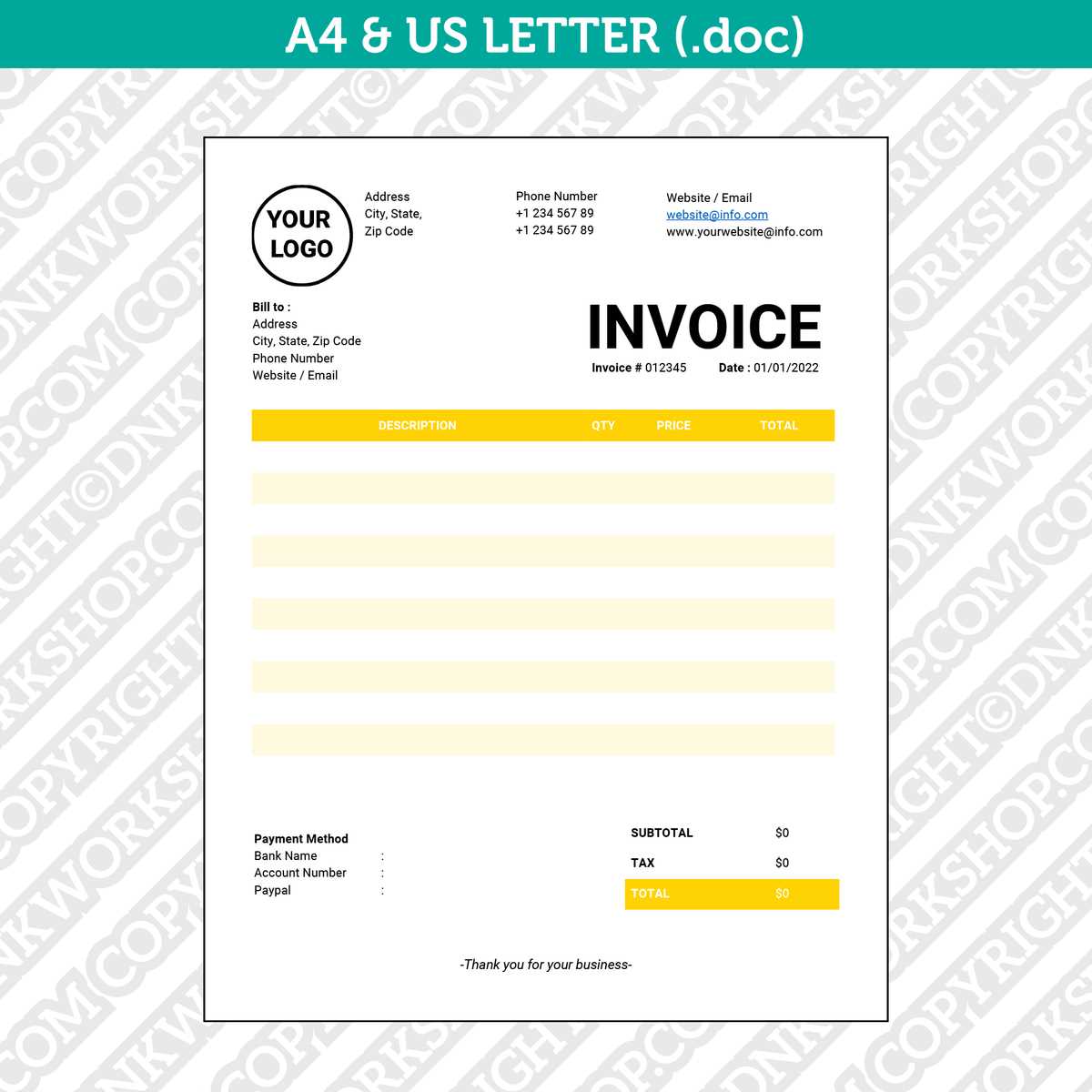

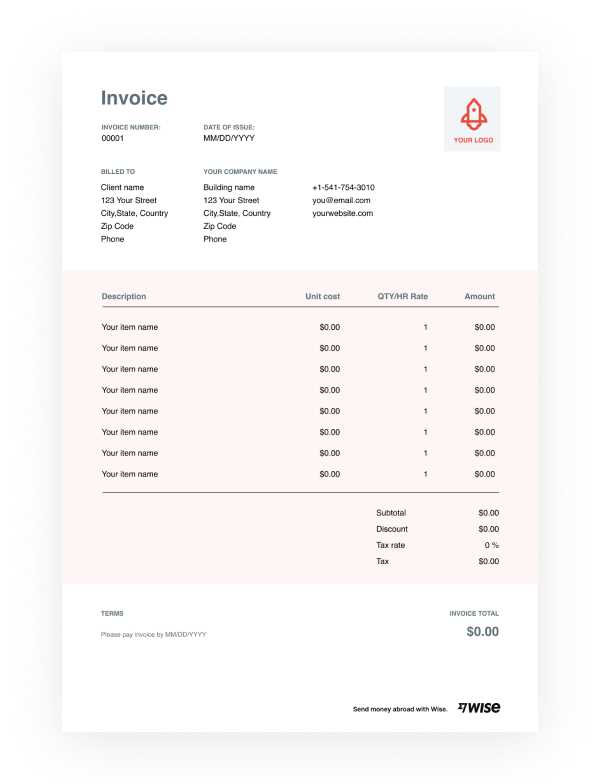

One of the primary benefits of using a word processing format is its flexibility. Whether you need to adjust the layout, add logos, or modify sections to match your brand, these documents can be tailored to meet your exact specifications. You can add or remove fields, change fonts and colors, and include any additional information you deem necessary to ensure your records are complete and accurate.

Simple and Efficient Setup

Setting up these documents is straightforward, even for those with limited experience in document creation. With easy-to-follow guidelines, anyone can prepare their financial statements in a matter of minutes. Once the layout is established, it becomes simple to duplicate and reuse the format for every new transaction, allowing you to maintain consistency across your business dealings.

What is a Billing Invoice Template?

A document designed to request payment for goods or services is an essential tool in any business. It serves as a formal record that outlines the specifics of a transaction, such as the amount owed, the date, and the services provided. By using a pre-designed structure, businesses ensure that every important detail is included, reducing the chances of misunderstandings and delays in payment.

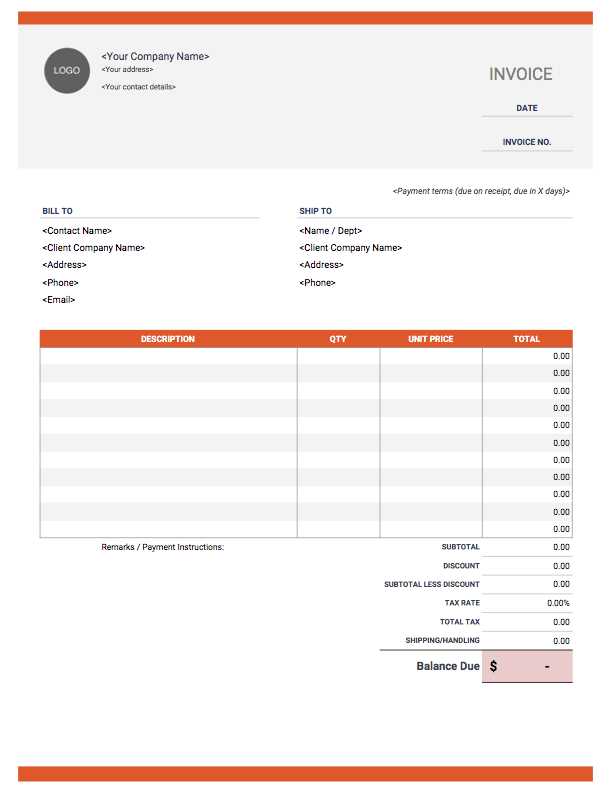

This type of document typically features designated areas for all relevant information, such as client details, item descriptions, and payment terms. The goal is to provide a clear, organized summary that can be easily understood by both the provider and the recipient. By using a ready-to-use structure, creating these records becomes a faster and more efficient process, allowing business owners to focus on other important tasks.

Key Components of a Payment Request Document

Each record includes several crucial elements that need to be captured accurately. These typically include the business name, contact information, a breakdown of products or services, and the total amount due. Additionally, payment terms such as due dates and late fees are often included to clarify the expectations surrounding payment completion.

Advantages of Using a Pre-Formatted Document

Pre-formatted documents eliminate the need for creating records from scratch. With a consistent structure, businesses can quickly fill in the necessary fields, ensuring accuracy and reducing the risk of errors. This streamlined approach helps maintain professionalism and ensures that the necessary details are always accounted for in every transaction.

Why Use Microsoft Word for Invoices?

Creating and sending payment requests doesn’t have to be a complex task. Using widely accessible word processing software allows businesses to easily manage financial documents with minimal effort. This software offers a user-friendly interface, a variety of customizable options, and the ability to format documents to fit any business need. Here are several reasons why it’s an excellent choice for crafting payment requests.

One of the main reasons many opt for this tool is its simplicity. Even those with minimal experience can create professional-looking documents in just a few steps. The familiarity of the interface makes it easy to focus on the content rather than the process of document creation.

| Advantages | Description |

|---|---|

| Easy to Use | The intuitive interface ensures anyone can quickly create and format professional documents without needing specialized skills. |

| Customization | Users can modify layouts, fonts, and colors, allowing them to align the document with their brand’s identity. |

| Widely Accessible | This software is available on most devices, making it easy to access and edit documents from anywhere. |

| Fast Setup | Once set up, creating new records is quick and easy, helping businesses save time in routine tasks. |

Using a familiar tool like this helps streamline administrative processes and improve overall efficiency. Whether for a one-time use or recurring transactions, it’s a reliable and convenient solution for anyone looking to manage payment requests with ease.

Benefits of Using Free Invoice Templates

Utilizing pre-made document formats for payment requests can save significant time and effort in business operations. Instead of creating documents from scratch, using ready-made layouts allows you to focus on the core aspects of your work. This approach not only improves productivity but also ensures that your financial records are both professional and consistent.

One of the primary advantages is the time-saving aspect. By using a pre-designed structure, all of the critical fields are already in place, and you only need to enter specific details related to each transaction. This allows you to quickly create and send payment requests, reducing the administrative workload and freeing up time for other tasks.

Another benefit is the professional look that these pre-designed formats provide. With a polished layout, clients are more likely to take your business seriously and are less likely to question the legitimacy of the request. A neat, consistent appearance helps build trust and enhances your brand’s reputation.

Finally, these layouts are often customizable, allowing you to add personal touches such as your company logo or adjust the structure to suit your specific needs. This flexibility ensures that your documents are aligned with your business’s identity while maintaining the efficiency of a pre-designed structure.

How to Customize a Billing Invoice

When creating a document to request payment for services or goods, it’s essential to ensure that the format reflects your business’s professionalism and specific needs. Customizing your document allows you to add your company’s branding, adjust the layout to highlight critical information, and include any necessary details that make the document unique to each transaction.

Customizing a document is a simple process, even if you don’t have design experience. By focusing on a few key areas such as the layout, font style, and the inclusion of personalized elements, you can create a document that is both functional and aligned with your business identity. Below are some basic steps to get you started with personalizing your payment request document.

Step 1: Modify Document Layout

The first step in customization is choosing an appropriate layout. You can start with a simple structure and then adjust sections to suit your needs. For instance, you may want to move the payment details section to the top of the page or highlight specific fields, like the total amount due, by increasing the font size or changing the font style.

Step 2: Add Personal Branding

Including your logo, company name, and contact details at the top of the document gives it a personalized touch. This not only makes the document look professional but also ensures that your client can easily reach out to you if needed. You can also change the colors of the text or background to match your brand’s color scheme.

| Customization Option | How to Implement |

|---|---|

| Company Logo | Insert your logo at the top of the document to reinforce your brand identity. |

| Font Style | Choose a font style that matches your business tone–professional or creative. |

| Header/Footer | Add business details like address, website, or phone number to the header or footer. |

| Color Scheme | Adjust text and background colors to align with your brand’s visual style. |

Once these initial customizations are done, you can further adjust the layout or content as needed for each individual transaction, ensuring every document sent is accurate and professional.

Best Practices for Creating Professional Invoices

Creating well-structured financial documents is crucial for maintaining a professional image and ensuring that clients receive clear and accurate information about their payments. A well-crafted document helps avoid confusion, reduces the chances of errors, and ensures smooth transactions. Implementing best practices in document creation can help your business stand out and build trust with clients.

One of the most important practices is to ensure that all essential details are included and clearly presented. This means having a clearly defined list of products or services, with corresponding amounts, dates, and payment terms. Proper organization is key to making sure clients understand exactly what they are being charged for and by when payment is due.

Another important consideration is consistency. Using the same format for every transaction ensures that clients become familiar with your documents and can quickly find the information they need. A consistent structure also reflects well on your business’s organization and attention to detail.

Timeliness is also a key factor in professional document creation. Sending financial requests promptly after a transaction or service ensures that the payment process stays on track. Delays in sending out these documents can lead to misunderstandings or late payments, which can affect cash flow.

Lastly, clear communication is essential. Ensure that your terms are easy to understand,

Essential Elements of an Invoice

For a payment request document to be effective, it must include all the necessary information in a clear and organized manner. Each element plays a critical role in ensuring that both parties understand the terms of the transaction. Whether you are a freelancer, small business owner, or service provider, including the right details in your document is essential for a smooth and professional process.

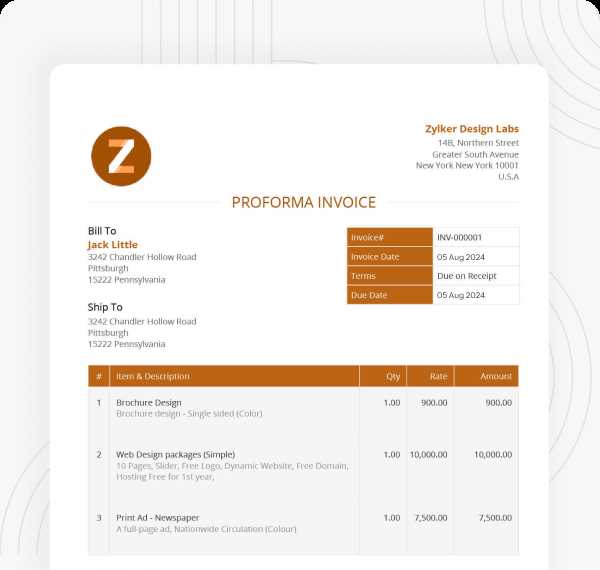

Key Information for Clarity

Every payment document should start with basic details such as the recipient’s and sender’s contact information. This includes the names, addresses, and phone numbers of both parties. These details are vital for communication and serve as a reference point should any issues arise with the payment.

Specifics of the Transaction

Next, the document should clearly list the goods or services provided, including quantities, prices, and a brief description. This helps the client understand exactly what they are being charged for. The total amount due, payment terms, and due date should also be prominently displayed to avoid confusion. Clear payment instructions–such as the accepted methods of payment–are important for ensuring that clients know how to complete the transaction.

| Element | Description |

|---|---|

| Sender’s Details | Includes the business name, contact information, and address of the provider. |

| Recipient’s Information | Displays the client’s name, address, and relevant contact details. |

| Description of Products/Services | Details the specific items or services provided, including quantity and unit price. |

| Total Amount | Clearly shows the total amount owed, including applicable taxes or discounts. |

| Payment Terms | Includes the payment due date and any additional instructions, such as late fees. |

By including these essential elements, you ensure that your payment request is professional, clear, and easy to understand, helping to avoid confusion and ensure prompt payment.

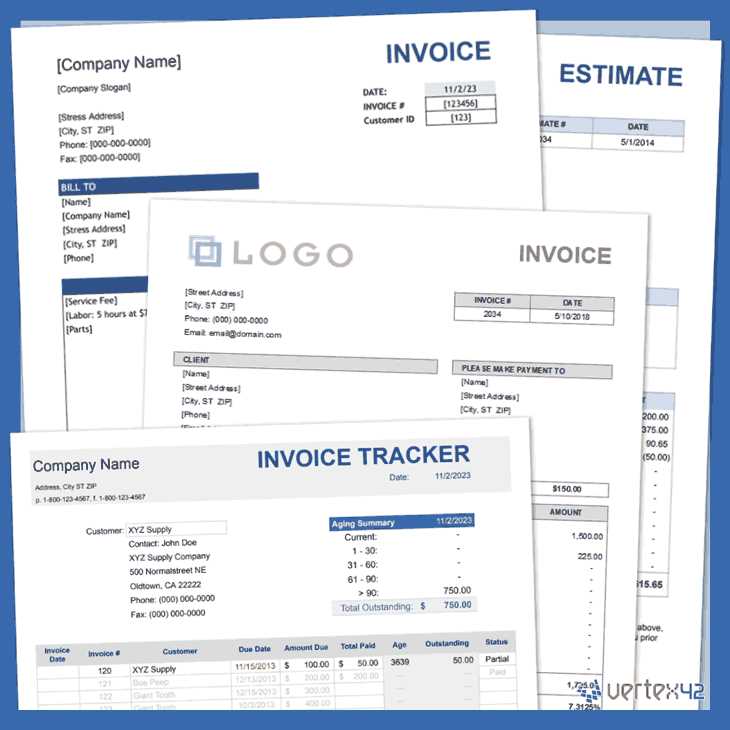

Where to Find Free Invoice Templates

Finding the right document structure for payment requests is easier than ever, with many resources available online. Whether you’re a small business owner, freelancer, or contractor, there are numerous platforms that provide pre-made formats that can be customized to meet your specific needs. These resources can help you save time and ensure your records are organized and professional.

Many websites offer various formats that can be downloaded instantly. These pre-built structures are designed to help you quickly create financial documents without the need for extensive formatting. Some sites even allow for quick customization, so you can tailor the document to fit your business identity.

Online Platforms for Templates

Several websites specialize in offering customizable formats that can be used for any transaction. These sites typically provide a variety of designs, from simple layouts to more complex, industry-specific templates. Many of these resources allow you to filter by style, category, or complexity, making it easy to find a layout that suits your business.

Built-In Software Options

In addition to online platforms, popular office software applications often include built-in formats that can be easily customized. These pre-designed structures are readily available within the program, allowing you to start working immediately without needing to search the web for a suitable design.

| Source | Description |

|---|---|

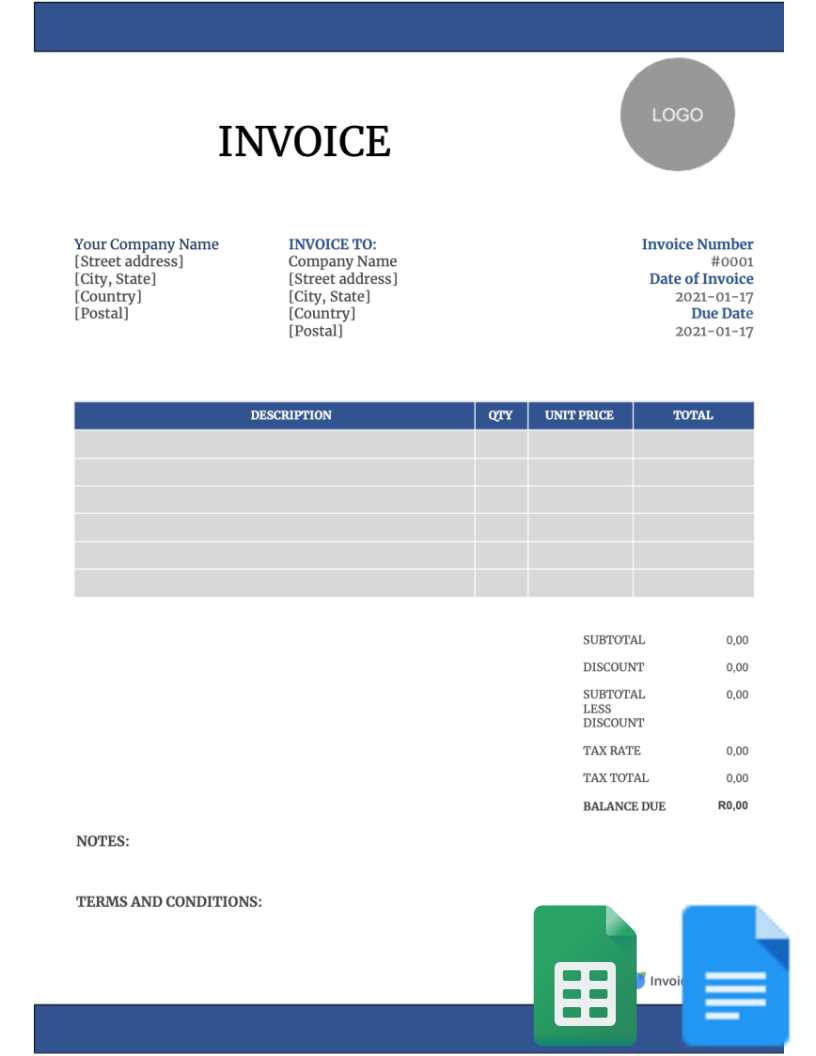

| Online Template Libraries | Websites such as Canva, Zoho, or Invoice Generator offer a variety of downloadable and customizable formats for different industries. |

| Software Programs | Office suites like Google Docs, LibreOffice, or OpenOffice provide pre-made formats that can be modified directly within the program. |

| Business Resource Websites | Websites like FreshBooks or QuickBooks may offer free designs for clients who need both document creation and accounting tools. |

With these numerous options, you can quickly find and download a format that works for your business. Whether you prefer working with online tools or software suites, there’s an accessible resource available to meet your needs.

Step-by-Step Guide to Downloading Templates

Downloading ready-made document structures for financial records is a straightforward process, but knowing where to look and how to choose the right one is essential. Whether you’re a business owner or a freelancer, having a simple and effective template can help you save time and ensure your documents are professionally formatted. Below is a step-by-step guide to help you download a suitable layout for your needs.

Step 1: Choose a Reliable Platform

The first step is to select a reliable website or platform that offers customizable document structures. You can find these resources through search engines or by visiting popular online design tools and business software sites. Make sure the platform is reputable and provides templates that fit your needs. Look for sites with positive reviews and clear customization options.

Step 2: Select a Layout and Customize

Once you’ve chosen a platform, browse through the available document formats and select one that meets your business requirements. Many platforms allow you to preview each layout before downloading. Pay attention to the details and make sure the design is suitable for your business and includes all necessary fields like contact details, payment terms, and services provided. Once you’ve found the perfect format, most sites will offer customization options, allowing you to adjust text, fonts, and colors to match your brand.

Step 3: Download and Save the Document

After making any necessary adjustments, simply click the download button. Depending on the platform, the document may be available in various file formats such as PDF, Excel, or document formats compatible with your preferred software. Choose the format that best fits your editing needs and save the document to your computer or cloud storage for easy access.

Step 4: Reuse for Future Transactions

Now that you have your downloaded document, you can reuse the layout for every future financial record. Simply update the details with each transaction, such as the client’s name, the amount, and the services rendered, while keeping the overall structure consistent. This will save you time and ensure that your documents are always professional and standardized.

How to Fill Out Your Invoice Correctly

Filling out a payment request document correctly is essential for ensuring clarity and accuracy in your transactions. A well-completed document not only helps avoid confusion with clients but also streamlines the payment process. Each section of the document should be carefully filled in to reflect the transaction details accurately. Below are the key steps to make sure your document is completed correctly.

1. Include Your Business Details

The first step is to fill in your business information. This includes your business name, address, contact number, and email. It’s also a good idea to include your company’s logo if you have one, as it adds a professional touch.

- Business Name

- Business Address

- Phone Number

- Email Address

- Logo (optional)

2. Add the Client’s Information

The next section should include the client’s details. Make sure to include their full name, address, and contact information. This ensures that both parties know who is responsible for the payment and helps avoid any potential confusion about the recipient.

- Client’s Full Name

- Client’s Address

- Client’s Contact Information

3. List the Products or Services Provided

Clearly list the products or services you have provided, including a brief description of each item, the quantity (if applicable), and the price. You may also want to include any taxes or discounts applied to the total amount.

- Product/Service Description

- Quantity

- Unit Price

- Taxes or Discounts

4. Specify the Total Amount Due

After listing the services or items, calculate the total amount due. This should include any applicable taxes and discounts. Be sure to break down the costs clearly so the client understands how the total was calculated.

- Subtotal

- Taxes

- Discounts (if applicable)

- Total Amount Due

5. Add Payment Terms and Due Date

Clearly state your payment terms, such as when the payment is due and any late fees that might apply. Including the due d

Tips for Formatting Your Billing Invoice

Proper formatting is crucial for creating professional-looking documents that are easy to read and understand. When preparing a payment request, how the document is laid out can affect how quickly and efficiently the client processes it. A well-structured layout ensures clarity, reduces errors, and helps maintain a professional image for your business.

1. Keep It Simple and Clear

When it comes to document design, simplicity is key. Avoid cluttering the page with unnecessary details or overly complex formatting. Stick to clean lines and well-spaced sections to make the document easy to navigate. Focus on making the important information stand out, such as the total amount due, payment terms, and key contact details. This will ensure that the client can find the most critical information quickly.

2. Use Consistent Fonts and Styles

Consistency in font styles and sizes is essential for readability. Choose professional, easy-to-read fonts such as Arial or Times New Roman, and make sure to use them throughout the document. Additionally, use bold or larger text for headings and key sections, such as the total amount due and payment due date. This helps break up the information and highlights important details.

Tip: Limit the number of different fonts to two or three to keep the document looking clean and unified. This will help the reader focus on the content rather than being distracted by different styles.

3. Organize Information Logically

Structure the content in a logical, easy-to-follow order. Start with your company details at the top, followed by the client’s information, the transaction details, and then the payment terms. This ensures that the document flows in a way that makes sense to the reader. Group similar information together and leave space between sections for better readability.

Tip: Use bold headers for each section (such as “Client Information”, “Services Rendered”, “Payment Terms”) to guide the reader’s eye and make the document more organized.

4. Leave Plenty of White Space

White space, or the empty space between elements of the document, is just as important as the content itself. It makes your document look less crowded and allows the reader to process information more easily. Ensure there is enough spacing between text blocks, tables, and sections so that everything has room to breathe.

By following these formatting tips, you’ll create a document that not only looks professional but also communicates the necessary information clearly, helping to speed up the payment process and maintain positive client relationships.

How to Save and Send Invoices

Once you’ve created a payment request document, the next crucial step is saving it properly and sending it to the recipient in a way that ensures it is received and processed smoothly. Proper file management and communication can help you avoid delays in payment and maintain a professional image. Below are the steps for efficiently saving and sending your document.

1. Save the Document in the Right Format

When saving your document, it’s important to choose a file format that ensures both easy access and security for both you and the recipient. The most common formats for sharing payment requests are PDF and Excel, as they are widely accessible and maintain the document’s original formatting. PDFs are particularly useful as they ensure the recipient cannot accidentally alter the document’s content.

- PDF: This is the most recommended format for sending payment requests as it is universally accessible and protects your document from edits.

- Excel or CSV: These formats are suitable if the recipient needs to make adjustments or process data, but they are less secure for sending final documents.

2. Name the File Clearly

When naming your document file, ensure that it is easy for both you and the recipient to recognize. A clear and descriptive file name helps avoid confusion, especially if you send multiple documents over time. Include relevant details such as the client name, the date, and a brief reference to the service or transaction.

Example: JohnDoe_Consulting_Services_Invoice_March2024.pdf

3. Send the Document via Email or Preferred Communication Method

Email is the most common and efficient way to send payment documents. When sending the document via email, ensure your message is professional and clear. Include a brief explanation of the document in the body of the email, stating the amount due and the payment due date. Always attach the saved document to the email and double-check that you are sending it to the correct recipient.

- Email: Attach the document and include a polite, professional message with instructions for payment and due dates.

- Other Methods: If your client prefers using other communication tools (such as invoicing platforms or project management tools), ensure you upload the document in the specified format.

4. Follow Up if Necessary

If you don’t receive payment by the due date, it’s important to follow up. Send a polite reminder, reiterating the details of the payment request and attaching the document once again if needed. Keeping a polite tone and maintaining professional communication can help preserve your relationship with the client while ensuring t

Tracking Payments Using Invoice Templates

Effective tracking of payments is essential for any business to maintain cash flow and ensure that all transactions are accounted for. By using well-structured payment request documents, you can easily track the status of each transaction, monitor outstanding amounts, and follow up on overdue payments. A well-designed payment document not only helps with tracking but also keeps your financial records organized.

1. Include a Payment Status Section

One of the most important features for tracking payments is including a dedicated section for payment status. This allows you to keep track of whether the payment has been made, is pending, or overdue. Regular updates to this section help you stay organized and ensure you don’t miss any follow-ups.

- Paid: Mark this option when the payment has been received in full.

- Pending: Use this status if the payment is due but has not yet been received.

- Overdue: If the payment date has passed and no payment has been received, mark it as overdue and consider adding a reminder to the client.

2. Use Unique Reference Numbers

Assigning a unique reference number to each payment request can significantly help with tracking. This number should be used consistently in your records and correspondence. It makes it easier to reference specific transactions when following up with clients or reviewing financial statements.

- Unique IDs: Assign a sequential or custom numbering system to each document (e.g., INV-001, INV-002, etc.) to ensure you can easily track each request.

- Record Keeping: Include this reference number in both your digital and paper records for consistency and easy retrieval.

3. Update Payment History Regularly

It’s crucial to update the payment history regularly, especially if you are managing multiple transactions. Keeping track of each payment’s due date, received amount, and any partial payments made will help you monitor the overall financial status of your business. By updating your records immediately after receiving a payment, you avoid confusion and ensure your financial records are always up to date.

- Record the date when the payment is received.

- Note the amount received and any outstanding balance.

- If applicable, update the status (paid, pending, overdue).

4. Follow Up on Overdue Payments

Timely follow-ups on overdue payments are necessary to ensure that you don’t lose revenue. By keeping an organized list of all transactions with clear payment statuses, you can easily identify any overdue payments and reach out to clients to resolve them. Sending a polite reminder or invoice update can prompt clients to pay without damaging your relationship.

- Reminder Emails: Send gentle reminders with updated payment

Common Mistakes to Avoid in Invoices

Creating a payment request document may seem straightforward, but there are several common errors that can cause confusion, delays, and even disputes with clients. Avoiding these mistakes is essential to ensure your documents are professional, accurate, and effective in getting you paid on time. Here are some of the most frequent pitfalls to watch out for when preparing these documents.

1. Missing or Incorrect Contact Information

One of the simplest but most critical mistakes is not including accurate or complete contact information. If the recipient cannot easily reach you with questions or issues, it can cause delays or prevent payment altogether. Double-check that your business name, address, email, and phone number are correct, as well as your client’s details.

- Client Information: Ensure that the client’s name and address are up to date and accurately entered.

- Your Contact Info: Make sure your phone number, email, and address are visible and accurate.

2. Incorrect or Missing Payment Details

Without clear payment instructions, it’s easy for clients to miss the deadline or send payment to the wrong account. Always specify the correct payment method, bank details, or online payment link, as well as the exact due date. Omitting or miswriting this information can lead to confusion and delays.

- Payment Methods: Clearly state whether you accept credit cards, bank transfers, or other forms of payment.

- Due Date: Always include a specific due date to avoid misunderstandings about when payment is expected.

3. Failing to Include Tax Information

If your services or products are subject to tax, it’s essential to include the correct tax rate and total amount on the document. Failing to do so can lead to discrepancies and potential issues with both clients and tax authorities. Always double-check the applicable tax rate and ensure that it’s clearly noted.

- Sales Tax: Be sure to include the applicable tax percentage, or note that the service is tax-exempt if that applies.

- Tax Breakdown: Clearly list the tax amount so the client understands how the total is calculated.

4. Incorrect Item Descriptions or Quantities

Inaccurate descriptions of goods or services, as well as incorrect quantities, can lead to disputes or delays in payment. Ensure that each item or service listed is described clearly and in detail, including quantity, unit price, and any applicable discounts. Double-check all figures to ensure they match your records and ar

How to Use Templates for Recurring Invoices

For businesses that need to bill clients on a regular basis, having a reliable and efficient system in place is essential. Using pre-designed documents for repeat transactions allows you to save time, maintain consistency, and reduce the risk of errors. Whether you’re invoicing for monthly services, subscription-based products, or ongoing projects, templates can simplify the process of creating recurring payment requests. Here’s how you can take advantage of them.

1. Customize the Template to Fit Your Needs

To get started, select a format that best suits the type of service or product you are providing. Pre-designed documents can be easily customized to include your business logo, client information, payment terms, and any other specific details relevant to the transaction. Make sure to personalize the content for each client and service period.

- Client Information: Include the client’s name, address, and other contact details.

- Service or Product Details: List the services or products being billed and any relevant descriptions.

- Payment Frequency: Clearly state whether it’s a monthly, quarterly, or annual payment cycle.

2. Set a Standard for Recurring Payments

When dealing with recurring transactions, it’s important to set a consistent structure for your requests. Using a predefined document allows you to maintain a consistent layout and format, which makes it easier to track payments and stay organized. Set standard terms for each cycle, including due dates and payment methods.

- Due Dates: Define the payment due date for each billing cycle, ensuring it is clear and consistent.

- Payment Methods: Specify how payments should be made (e.g., bank transfer, credit card, online platform) to streamline the process.

3. Save and Update for Each Cycle

Once you’ve set up your initial document, saving it as a template allows you to quickly update the details for each new billing period. You can change the dates, amounts, and other client-specific information while keeping the overall structure intact. This reduces the need for repetitive work and ensures consistency across all documents.

- Save as a Template: Store the document as a reusable file to save time on future cycles.

- Quick Edits: Easily update the details for each cycle, such as the billing period and the amount due.

4. Automate Reminders and Follow-Ups

Many businesses find it useful to send reminders before or after a payment cycle. Using templates allows you to set automated follow-up schedules, helping you avoid late payments and ensuring your clients are informed about upcoming or overdue payments. Automating this process can further reduce administrative work.

- Reminder Emails: Schedule email reminders that automatically notify clients of upcoming payments.

- Late Payment

Improving Client Relations with Professional Invoices

Maintaining strong and positive relationships with clients goes beyond providing excellent services or products–it also involves clear, timely, and professional communication. One often overlooked but vital aspect of this communication is the payment request document. When crafted professionally, it not only facilitates smoother transactions but also builds trust and reinforces your business credibility. Here’s how you can improve client relations by creating polished and reliable payment documents.

1. Demonstrating Professionalism and Attention to Detail

A well-organized and clearly presented document reflects the professionalism of your business. Clients appreciate receiving clear and straightforward documents that leave no room for confusion. This approach helps to establish you as a trustworthy and reliable business partner.

- Accurate Information: Ensure all client details, dates, and financial amounts are correct to avoid misunderstandings.

- Polished Design: Use a clean, consistent layout with your branding elements, such as logo, colors, and fonts, to reflect your company’s identity.

- Clear Instructions: Provide easy-to-follow payment instructions to minimize any potential delays or confusion.

2. Enhancing Transparency with Detailed Breakdown

Clients appreciate transparency, and a well-structured document provides a detailed breakdown of charges, which helps avoid disputes or questions. By clearly itemizing services or products, clients know exactly what they are paying for, which builds trust and confidence in your business.

- Itemized Charges: List each service, product, or expense with its corresponding price and quantity.

- Tax Breakdown: Include applicable taxes and explain how the total amount was calculated.

- Discounts and Offers: Highlight any discounts or promotional offers, so clients feel they are receiving value.

3. Offering Flexible Payment Terms

Another way to improve client relations is by offering clear and flexible payment terms. Whether you offer installment plans, early payment discounts, or various payment methods, these options can make your clients feel more comfortable and valued, which can improve long-term business relationships.

- Flexible Payment Options: Allow clients to choose their preferred payment method, such as credit cards, bank transfers, or online payment platforms.

- Clear Due Dates: Specify when the payment is due to avoid confusion, and consider offering payment plans for larger amounts.

- Incentives for Early Payment: Offering a small discount for early settlement can be an attractive incentive for clients.

4. Building Trust with Timely and Consistent Communication

Consistent and timely communication is key to developing strong client relationships. By sending payment requests promptly and keeping clients updated on any changes, you show that you are organized and attentive to their needs. Sending reminders and thank-you notes after receiving payments can further enhance the relationship.

Choosing the Right Template for Your Business

Selecting the right document format for your payment requests is crucial for streamlining your financial processes and maintaining professionalism. A well-chosen format ensures clarity, helps avoid errors, and conveys your business’s attention to detail. The ideal document structure will depend on the type of products or services you provide, the volume of transactions, and your clients’ preferences. Here’s a guide to help you make an informed decision when choosing the right structure for your business needs.

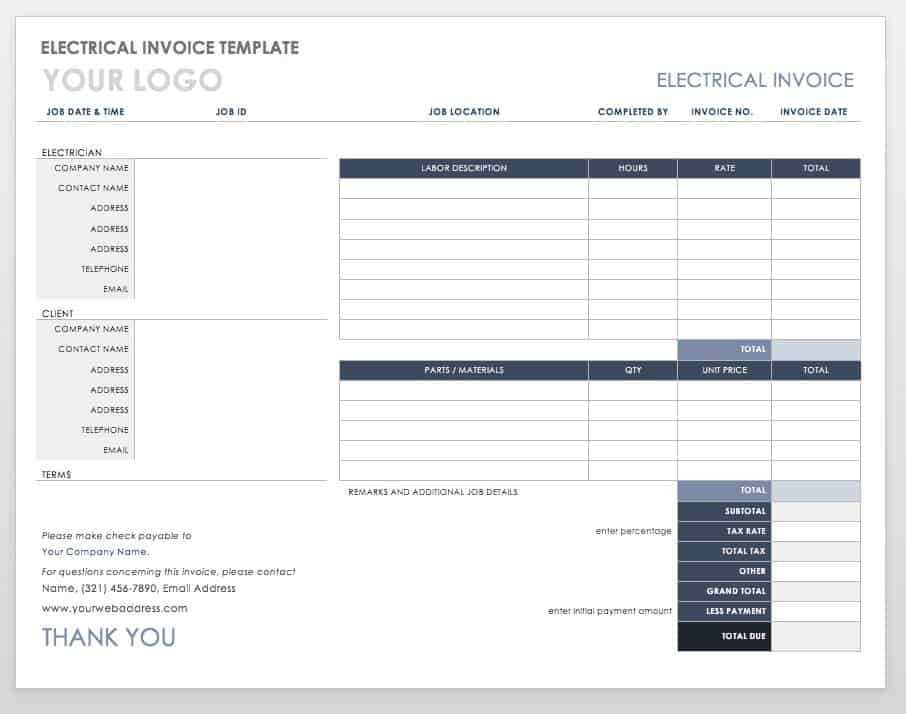

1. Consider the Nature of Your Business

The first step in selecting the appropriate format is understanding the nature of your business. Different industries and services require different kinds of documentation, and it’s important to select a structure that matches your specific needs.

- Product-Based Businesses: If you sell tangible products, your document should clearly itemize each item, quantity, and price to provide a transparent breakdown for your client.

- Service-Based Businesses: For services like consulting or freelance work, a format that allows you to detail your hours worked, project scope, and rate may be more suitable.

- Subscription Services: If your business relies on subscriptions, it’s important to select a structure that includes recurring billing terms and payment cycles.

2. Simplicity vs. Detail

The complexity of your document format should be balanced with the needs of your business. Some businesses require highly detailed breakdowns, while others may benefit from a simpler approach. Choose a layout that strikes the right balance between clarity and comprehensiveness.

- Simple Format: Ideal for small businesses or freelancers who deal with straightforward transactions.

- Detailed Format: Best suited for businesses that provide multiple services, have long-term contracts, or deal with large-scale projects.

3. Aligning with Client Expectations

Your clients’ preferences should also guide your decision in choosing the right structure. Some clients may prefer more detailed information, while others may appreciate a simple, concise layout. Understanding your clients’ needs will ensure that your documents are both effective and efficient.

- Corporate Clients: Larger organizations may prefer detailed and formal documentation that outlines terms, taxes, and multiple line items.

- Small Business or Individual Clients: For smaller clients, a simpler and more straightforward format might be more appropriate, with a clear summary of costs and due dates.

4. Choose a Compatible Format for Your Workflow

Lastly, consider your workflow and how the format integrates into your existing systems. Some businesses require customization options, while others pr