Free Billing Invoice Template in Excel for Easy Invoicing

Managing payments and tracking transactions efficiently is essential for any business. A well-structured document that outlines the details of each transaction can save time, reduce errors, and ensure smooth operations. With the right tools, creating and managing these records becomes a much simpler task.

Pre-made solutions designed for this purpose are widely available, helping users generate precise and professional-looking documents quickly. These solutions allow easy customization, enabling individuals and businesses to tailor the layout to their specific needs. Whether you’re handling one-time deals or recurring transactions, organizing such records has never been easier.

From organizing amounts owed to specifying payment terms, these documents serve as a crucial part of business communication. The ease of use and flexibility offered by popular spreadsheet software makes it an ideal choice for creating these records. By utilizing the right tools, you can ensure accuracy and consistency with every transaction.

Free Billing Invoice Template Excel

Managing financial records efficiently is a fundamental task for businesses of all sizes. Having a ready-to-use structure for documenting payments ensures clarity and reduces the risk of errors. Using a pre-designed solution that fits your needs allows for quick creation of these documents without starting from scratch each time.

Why Choose a Pre-Made Solution?

Pre-built structures are designed with convenience and accuracy in mind. They help avoid the hassle of manually setting up rows, columns, and formulas. Instead, you can focus on customizing the details specific to each transaction while leaving the complex calculations and formatting to the tool.

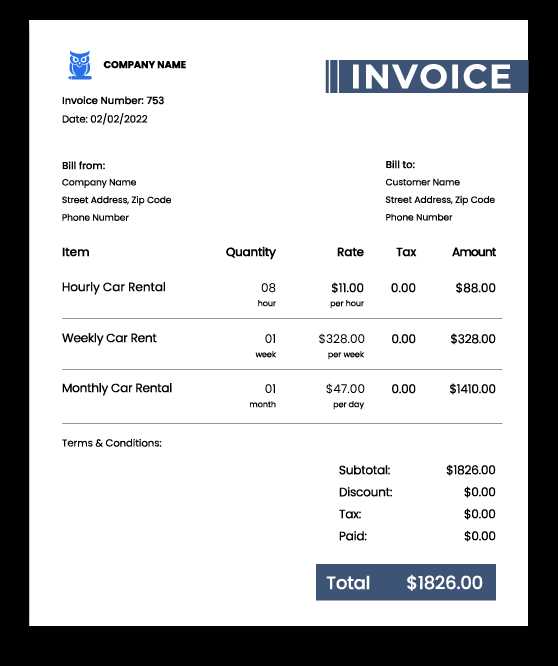

Key Features of an Effective Document Layout

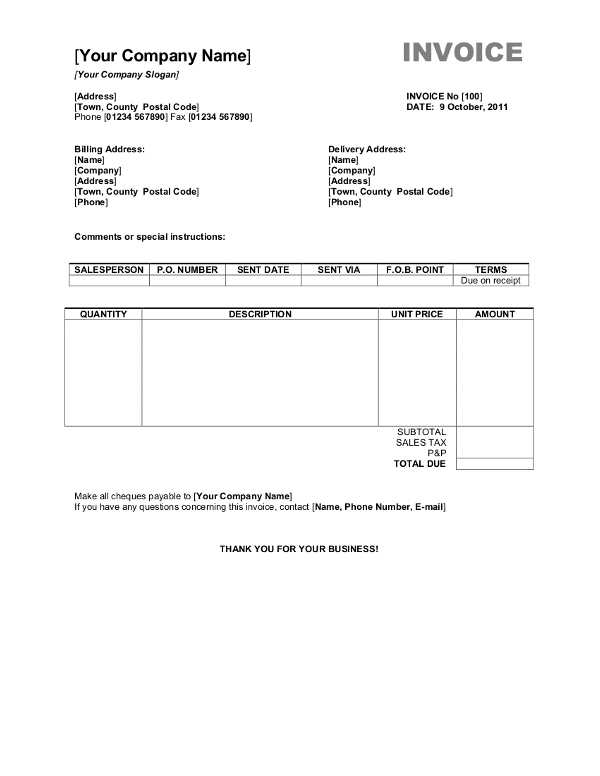

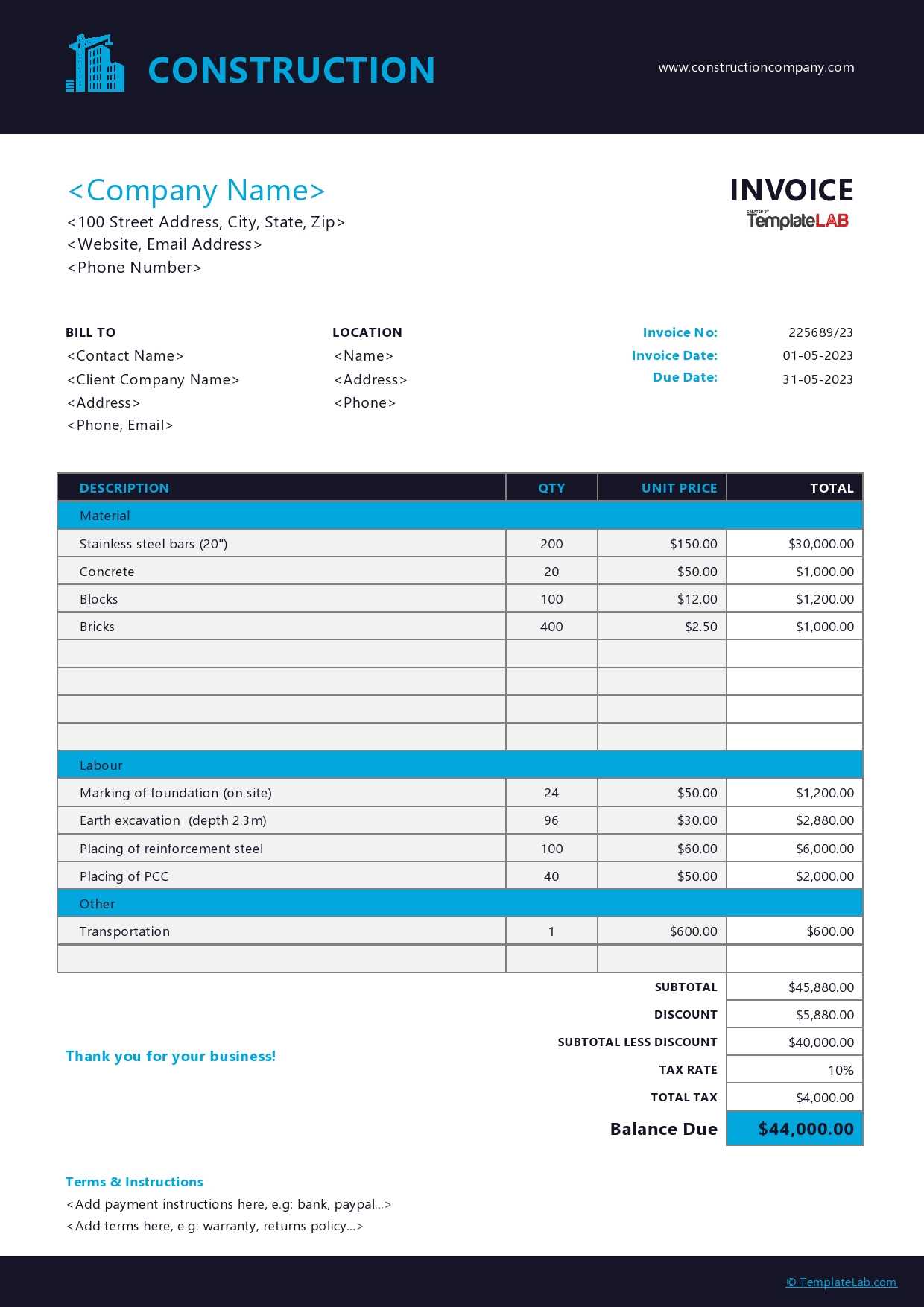

- Simple structure: Clear sections for amounts, services, or products provided, and payment terms.

- Automatic calculations: Integrated formulas to automatically compute totals, taxes, and discounts.

- Customizable fields: Easy-to-edit sections that allow you to personalize your document with your company logo, address, and client information.

- Time-saving templates: Ready to use with minimal setup, speeding up the process of generating new records.

These pre-designed solutions allow businesses to manage records effectively without dedicating excessive time to design and calculations. They’re especially helpful for smaller companies or freelancers who need to handle many transactions but don’t have the resources to create complex systems from scratch.

What is a Billing Invoice Template?

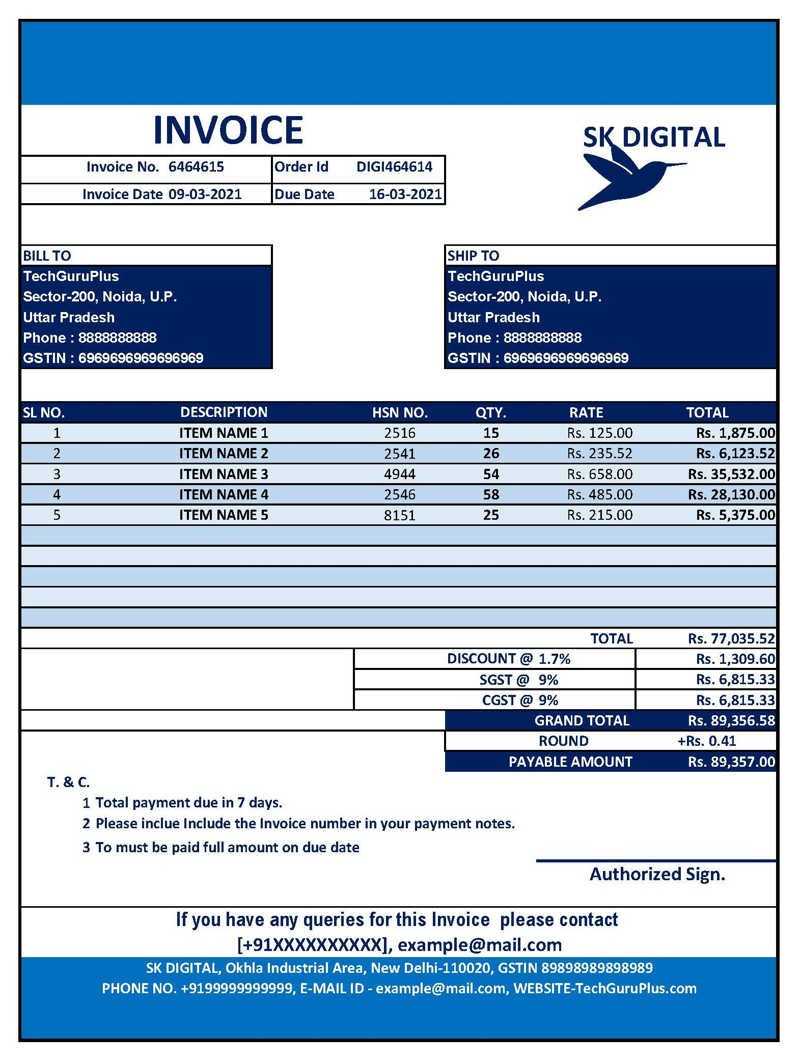

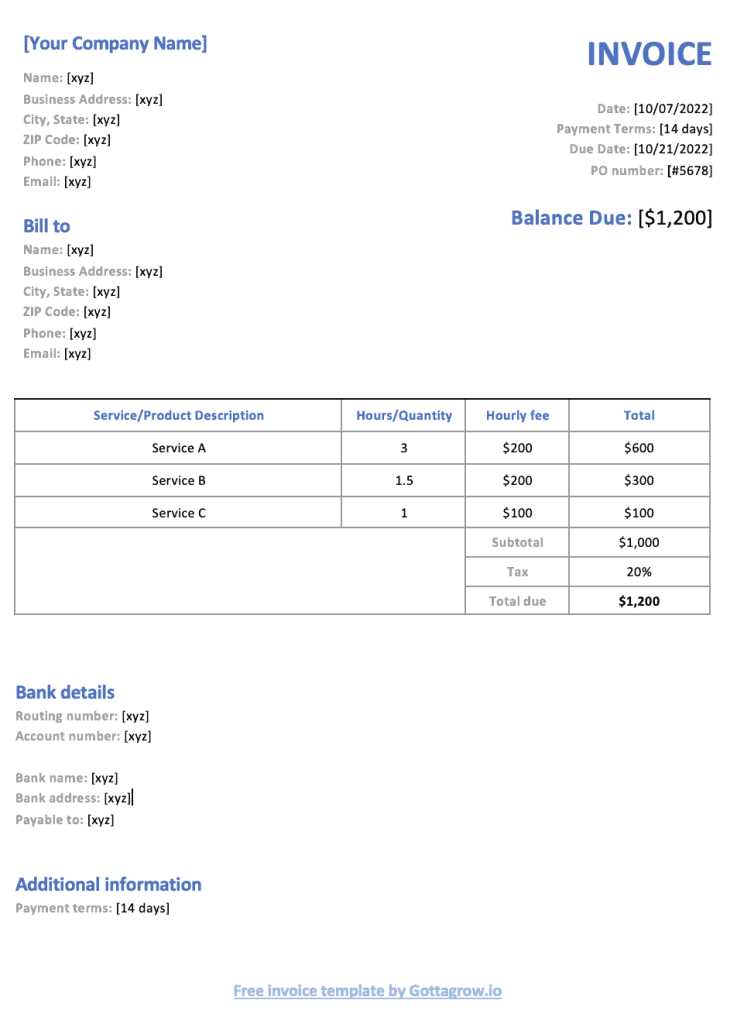

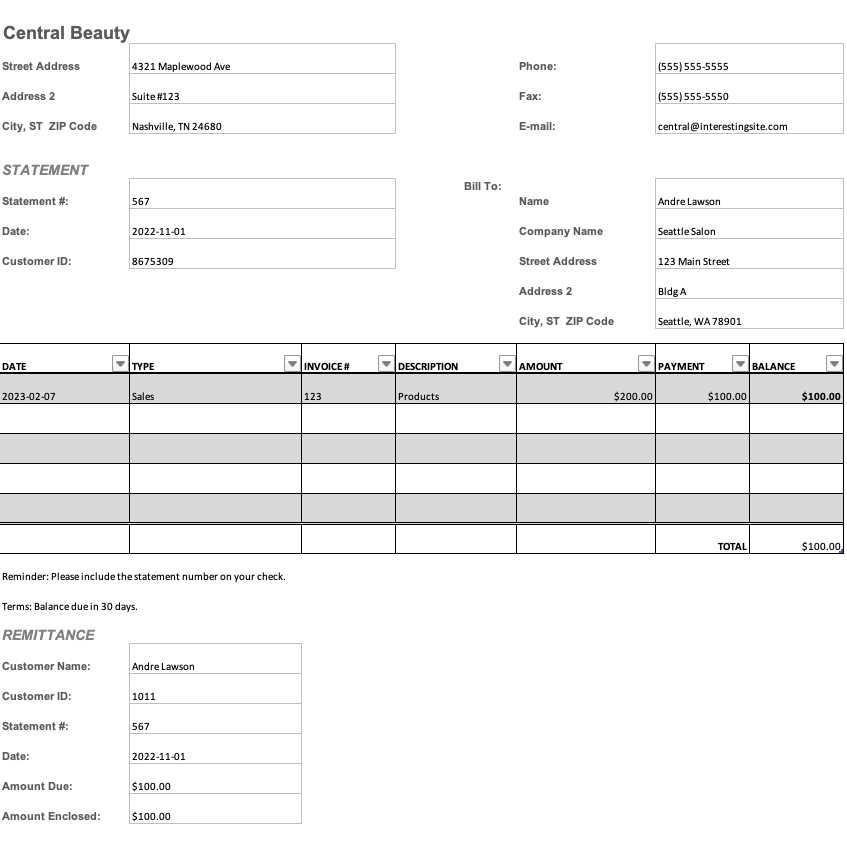

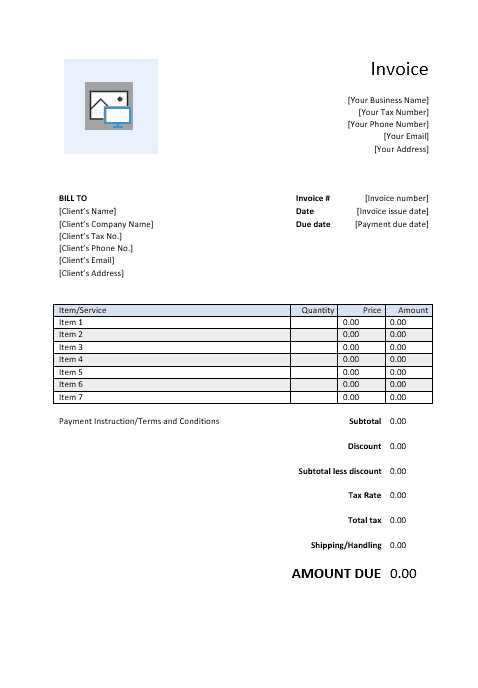

A document designed to outline the details of a transaction between a business and a customer serves as a crucial tool in financial record-keeping. It typically includes information such as the services provided or products sold, the amounts due, and payment terms. This document helps ensure that both parties have a clear understanding of the financial exchange, helping to avoid confusion or disputes later on.

It is structured in a way that makes it easy to record essential transaction data while maintaining a professional and organized appearance. Most solutions for creating such documents are pre-formatted, making it easier for users to focus on inputting specific details without worrying about the layout or complex calculations.

These structures are widely used in various industries, whether for one-time payments or recurring charges, and they help businesses maintain a consistent and efficient invoicing process. By using a standard format, businesses can streamline their accounting and ensure timely payments from clients and customers.

Benefits of Using Excel for Invoices

Using a popular spreadsheet software to create financial documents offers a wide range of advantages, particularly in terms of flexibility, accuracy, and ease of use. With built-in features and functionalities, it allows businesses to generate, track, and manage payments efficiently. The ability to customize the layout and use formulas for automatic calculations makes it a go-to tool for many professionals.

Efficiency and Time-Saving

Streamlined processes are one of the key benefits when using a spreadsheet for managing transactions. Rather than manually calculating totals or performing repetitive tasks, the software can handle much of the heavy lifting. Automatic summation and tax calculations reduce the risk of human error and save valuable time, allowing business owners to focus on more critical tasks.

Customization and Flexibility

Personalization is another major benefit. Spreadsheets allow full control over the document’s structure, making it easy to adapt the layout to suit specific business needs. Whether it’s changing font sizes, adjusting column widths, or adding company logos, users can create a professional-looking document in just a few steps. Additionally, templates can be reused, ensuring consistency and reducing the time spent on repetitive tasks.

Furthermore, using spreadsheet software for record-keeping ensures that all data is easily accessible and editable. Tracking previous records, managing recurring payments, and making adjustments as necessary become straightforward tasks.

How to Customize Your Invoice Template

Customizing a financial document layout allows businesses to tailor the format to their specific needs and brand identity. With a few simple steps, you can modify the structure, design, and details to make sure the document reflects your company’s style and clearly communicates essential transaction information. Personalization can help improve professionalism and ensure that all relevant information is included.

Adjusting Layout and Design

Design flexibility is one of the key advantages of using customizable tools. You can easily adjust the size of columns, rearrange sections, and format the text to create a visually appealing and organized document. For example, you might want to move payment terms or dates to more prominent positions for easy reference or adjust the spacing to make the document clearer.

Incorporating Brand Elements

Adding your company logo and branding colors is a simple way to make the document more personalized and professional. You can also include your business contact information, website, and social media links to increase visibility and provide customers with easy access to your services. Customizing these details ensures that the document is uniquely yours and adds an extra touch of professionalism.

In addition to design, you can also modify the fields within the document to suit the type of transaction. This includes adding or removing specific sections like discounts, taxes, or payment terms depending on your business model and customer needs.

Top Features of an Excel Invoice

When creating financial documents for transactions, it’s important to have a solution that is both efficient and easy to use. The right software can offer a wide range of features that streamline the process, helping users maintain accurate records, automate calculations, and ensure professional presentation. Below are some of the most important features that make these tools highly effective for managing financial transactions.

Automated Calculations

One of the most valuable features of using spreadsheet software is its ability to perform automatic calculations. With built-in formulas, users can instantly calculate totals, taxes, and discounts without having to manually add numbers. This reduces the risk of errors and saves time, ensuring that the document is accurate every time it’s created.

Customization Options

Customizing the document’s appearance and structure is another key feature. Users can adjust the layout to suit their needs, including changing column widths, font styles, and text alignment. The ability to add or remove specific sections–such as terms of service or item descriptions–allows for greater flexibility and ensures that each transaction is documented according to its unique requirements.

Additionally, users can save time by creating reusable files that only require minor adjustments for each new transaction. This makes it easy to maintain consistency across all records and reduce repetitive work.

Where to Download Free Templates

Finding the right document structures for your transactions doesn’t have to be complicated. There are many resources available online where you can download ready-made designs tailored to your needs. These solutions are often customizable, making it easy to adapt them to your specific requirements and brand style.

- Official Software Websites: Many spreadsheet software providers offer free pre-designed documents that you can download directly from their websites. These often come with basic features and are a great starting point for creating professional records.

- Online Template Marketplaces: Websites dedicated to offering various downloadable content often feature financial document structures. You can browse through hundreds of options and select one that fits your needs.

- Business Blogs and Resource Sites: Numerous business-oriented websites provide downloadable content, including customized designs for managing transactions. These resources typically offer additional tips and tutorials on how to effectively use these documents.

- Community Sharing Platforms: Platforms like forums and online communities where business owners share resources are another valuable option. You can often find highly rated designs from other professionals who have tailored them for specific industries.

By using these resources, you can quickly access a variety of formats and styles, allowing you to choose the one that best aligns with your business needs. Most downloads are straightforward and can be easily customized, saving you time while ensuring accuracy and professionalism in your financial records.

How Excel Templates Save Time

Using pre-designed structures for financial documents significantly reduces the amount of time spent on manual tasks. Instead of starting from scratch each time, you can rely on ready-made layouts that already include necessary sections and calculations. This streamlined approach ensures that key details are easily entered without the need to format or compute data repeatedly.

Here are some key ways in which these tools save valuable time:

| Feature | Time Saved |

|---|---|

| Automatic Calculations | Reduces the need for manual calculations, such as summing totals, applying taxes, or applying discounts. |

| Pre-built Structure | Pre-set sections allow for faster input, ensuring that all relevant information is included and properly formatted. |

| Reusable Format | Once customized, these files can be reused for future transactions, eliminating repetitive setup time. |

| Consistency | Maintains uniformity across all records, reducing the time spent on ensuring documents follow the same format. |

| Easy Updates | Simple adjustments to content or calculations ensure minimal effort when generating a new record. |

By using a pre-made structure, the time spent on creating each document is reduced drastically. This efficiency leads to faster payment cycles, improved workflow, and more time for other essential business tasks.

Best Practices for Invoicing in Excel

Creating and managing financial records in a spreadsheet can be incredibly efficient, but to maximize accuracy and professionalism, it’s important to follow best practices. By adhering to established guidelines, businesses can ensure that their financial documents are not only correct but also clear and easy for clients to understand.

Essential Guidelines for Accuracy and Clarity

Maintaining consistency in formatting and ensuring that all necessary details are included can help avoid misunderstandings and delays in payments. Here are some best practices to keep in mind:

| Best Practice | Reasoning |

|---|---|

| Use Clear and Concise Language | Ensure clients can easily understand what is being charged and the payment terms. |

| Double-Check Calculations | Automated formulas should be checked regularly to ensure accuracy, preventing errors in totals or taxes. |

| Incorporate Payment Terms | Clearly state due dates, penalties, or early payment discounts to avoid confusion. |

| Include Contact Information | Providing business details like contact info and payment options ensures easy communication with clients. |

| Save Consistent Formats | Using a standardized layout helps maintain consistency across all records and speeds up document creation. |

Additional Tips for Professionalism

To further improve the quality of your financial documents, consider the following:

- Branding: Incorporate your business logo, colors, and fonts for a more professional look.

- Track Payments: Use built-in features to mark payments as received, ensuring you can easily monitor outstanding balances.

- Keep a Record: Save each document in a dedicated folder and organize by client or date to make future reference easier.

By following these best practices, you can create documents that not only look professional but are also efficient and easy to manage. This helps build trust with clients and ensures a smooth payment process for your business.

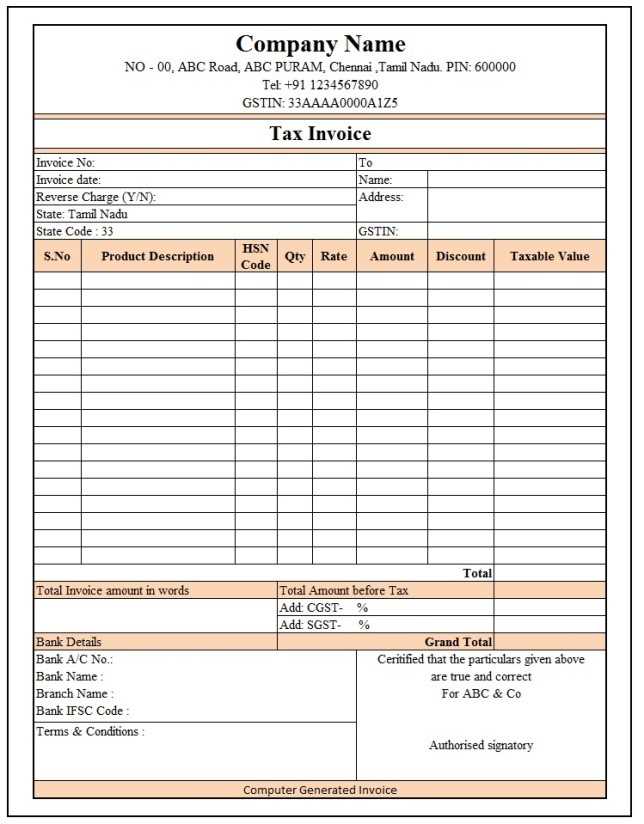

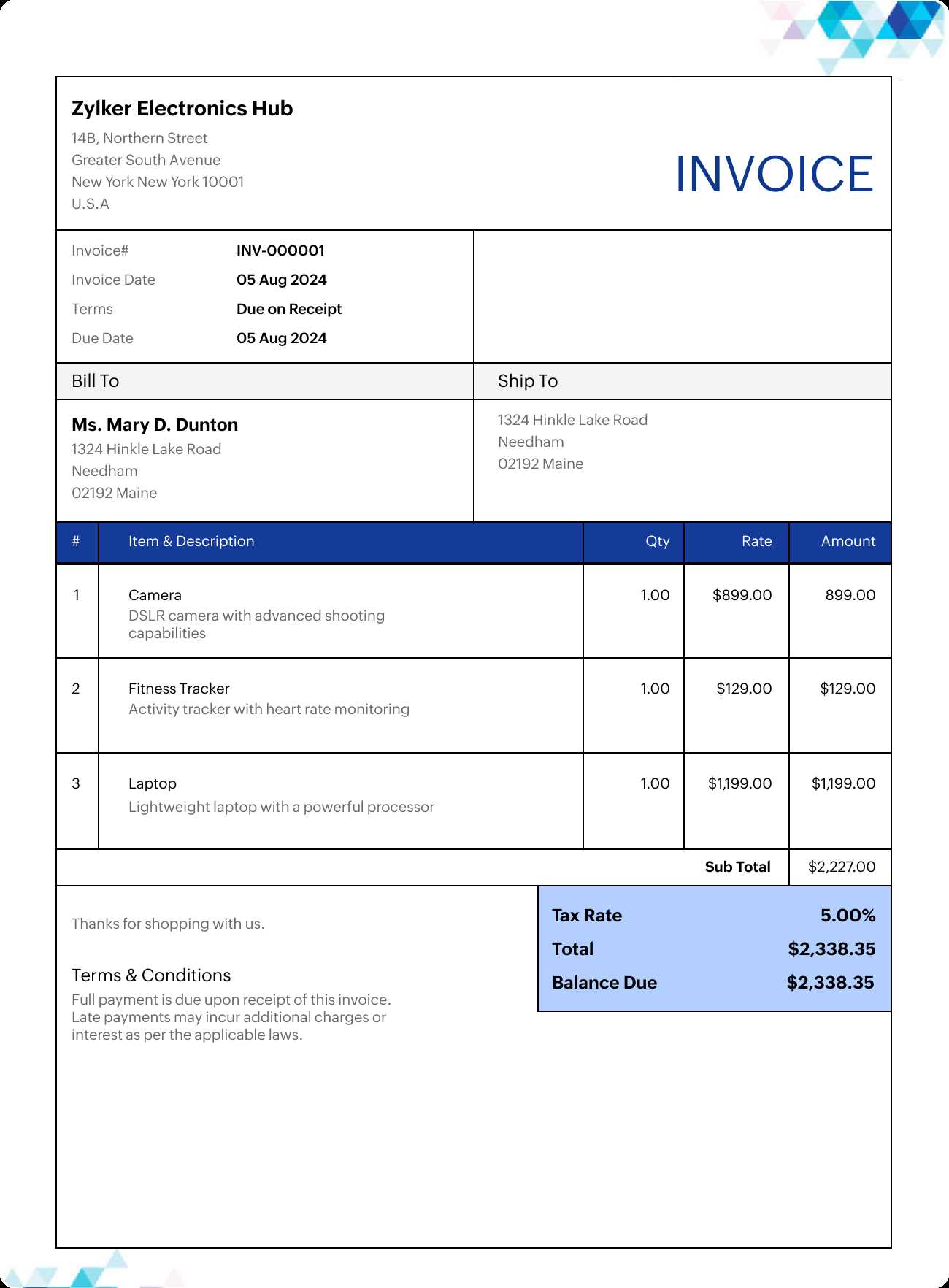

How to Include Taxes on Your Invoice

Including taxes correctly in financial documents is essential for ensuring compliance and avoiding confusion with clients. By incorporating accurate tax calculations, businesses can maintain transparency and avoid disputes. The process involves specifying the correct tax rate and applying it to the appropriate items or total amounts, depending on the structure of the transaction.

Step-by-Step Guide to Adding Taxes

To include taxes on your document, follow these steps:

- Identify the Applicable Tax Rate: Determine the local or national tax rate that applies to the goods or services being provided. This could vary depending on your location or the client’s location.

- Calculate the Tax Amount: Use the formula: Tax Amount = Item Price x Tax Rate. Make sure the tax is applied to the correct subtotal before any discounts or additional fees.

- Display Tax Separately: Show the tax amount as a distinct line item in the document for clarity. It should be listed separately from the subtotal and total amount due, making it easier for clients to understand.

- Include Tax Identification Information: For businesses that are required to show their tax identification number, be sure to include it along with other contact and registration details.

Example of Tax Calculation

Here’s an example of how you might present taxes in your financial document:

| Description | Amount |

|---|---|

| Product/Service | $100.00 |

| Sales Tax (8%) | $8.00 |

| Total Due | $108.00 |

By following these steps, you can ensure that tax information is clear, accurate, and compliant with regulations, making your financial documents both professional and transparent for your clients.

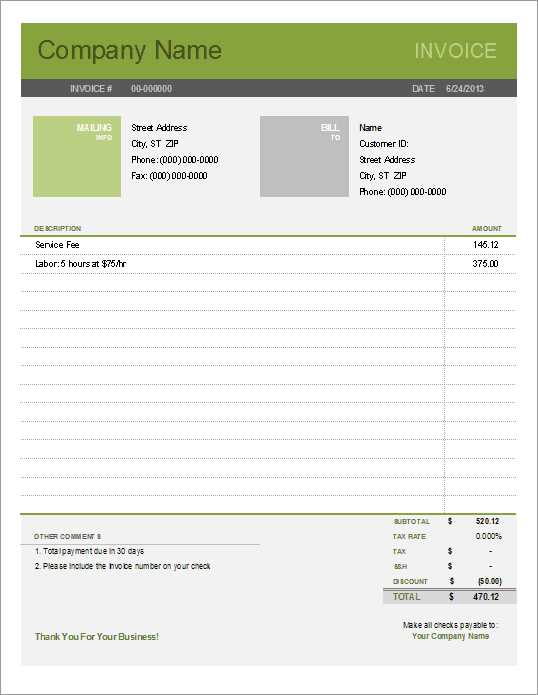

Design Tips for Professional Invoices

The design of a financial document plays a crucial role in how it’s perceived by clients. A well-designed record not only ensures that the content is clear but also reflects the professionalism of the business. Simple, clean designs with a clear structure make it easier for clients to understand the terms of the transaction and provide a better overall experience. Here are some key design tips to elevate your documents.

1. Keep It Clean and Simple

A cluttered document can make it difficult for clients to find the information they need quickly. Stick to a minimalist design that prioritizes clarity. Use a professional font, and keep the layout consistent across all sections. Proper spacing and alignment help improve readability and ensure that the document looks organized.

2. Focus on Essential Information

While it’s tempting to add lots of details, remember that only essential information should take priority. Your document should include the following key sections:

- Business details: Company name, address, and contact information.

- Client details: Name, company name, and contact information.

- Transaction details: Description of services or products, quantities, and prices.

- Payment terms: Due date, payment methods, and tax information.

3. Use Visual Hierarchy

Proper use of headings, subheadings, and bold text can help direct attention to the most important parts of the document. For example, you can make the total amount due stand out by using a larger font or bolding the text. This ensures clients know exactly what is expected of them at a glance.

Example of Professional Document Layout

Here’s an example of how to structure a financial record to ensure a clean and professional presentation:

| Description | Amount | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service Provided | $500.00 |

| Description | Amount |

|---|---|

| Product/Service | $500.00 |

| Discount (10%) | -$50.00 |

| Amount Due | $450.00 |

By fo

Using Excel for Recurring Invoices

For businesses with ongoing clients or subscriptions, managing regular payments can become time-consuming. However, with the right setup in a spreadsheet, you can streamline this process and automate the calculation and tracking of recurring charges. Setting up a system for these transactions ensures that payments are accurately tracked and delivered consistently without the need for manual intervention each time.

Steps to Set Up Recurring Payments in Your Document

Here’s how you can easily manage recurring charges using a spreadsheet:

- Create a Master Record: Start by creating a master sheet with all relevant details, such as client names, contact information, payment terms, and the service or product provided. This will be the foundation for each recurring entry.

- Set the Frequency: Add a column specifying how often the payment is due (e.g., monthly, quarterly, annually). This helps you keep track of when to issue the next payment request.

- Calculate the Amount Due: In the next column, enter the amount to be charged for each period. You can also apply any discounts, taxes, or additional fees that might vary for each cycle.

- Automate Date Calculations: Use formulas to automatically calculate the next payment due date. For example, you can add a formula that increments the due date by one month or one quarter based on the original start date.

- Track Payment Status: Set up a column to mark the payment status (e.g., “Paid”, “Pending”, or “Overdue”). You can also add a reminder system using conditional formatting to highlight overdue payments.

Example of Recurring Payment Setup

Here’s how your record might look when set up for recurring payments:

How to Ensure Invoice Accuracy

Maintaining accuracy in financial documents is essential to avoid disputes, maintain client trust, and ensure proper recordkeeping. Mistakes in the amounts, dates, or details of a transaction can lead to confusion, delayed payments, or even lost revenue. To ensure precision, it’s important to implement a reliable process and double-check every detail before sending out any financial records.

Key Practices to Avoid Errors

Here are some best practices for ensuring that your financial documents are accurate:

- Double-Check Amounts: Verify all amounts, including individual items, taxes, and discounts. Ensure that all totals match the sum of individual items and the final amount due is calculated correctly.

- Review Client Details: Always verify the client’s name, address, and contact information. Incorrect or outdated contact details can cause delays in communication and payment processing.

- Confirm Dates: Double-check that all relevant dates (e.g., transaction date, payment due date) are correct. Incorrect dates can lead to confusion about when payments are expected and may cause clients to miss deadlines.

- Check for Consistency: Use consistent formatting throughout your document. This includes consistent fonts, spacing, and alignment. Consistency adds clarity and helps prevent misunderstandings.

- Apply Proper Tax and Discount Calculations: If applicable, ensure that taxes and discounts are calculated correctly. A simple mistake in these fields can lead to a major discrepancy between what’s due and what is being charged.

Automating for Accuracy

Using spreadsheet tools can help reduce human error. Here’s how automation can assist in achieving accuracy:

- Use Formulas for Calculations: Set up formulas to automatically calculate totals, taxes, discounts, and final amounts. This eliminates manual errors and ensures accurate figures every time.

- Check for Duplicates: Use built-in functions to flag potential duplicate entries or duplicate client names to avoid sending the same financial document multiple times.

- Review the Template Layout: Ensure that your document structure is logically laid out and that the calculations are in the correct columns or rows. This helps maintain accuracy and makes future editing easier.

By applying these best practices and utilizing automation, you can significantly reduce the chance of errors in your financial documents and improve the overall accuracy of y

Common Mistakes to Avoid with Invoices

When creating financial documents, even small errors can lead to confusion, payment delays, or disputes with clients. To ensure that your records are professional and accurate, it’s crucial to avoid common mistakes that can affect the overall clarity and efficiency of the process. Being mindful of these mistakes will not only improve your relationships with clients but also streamline your workflow.

Frequent Errors and How to Prevent Them

Here are some of the most common mistakes and how to avoid them:

- Incorrect or Missing Client Information: Failing to include accurate client details (e.g., name, address, contact info) can lead to miscommunication or delays in payment. Always verify the contact information before sending a document.

- Wrong Payment Amounts: Simple errors in calculation, such as incorrect totals or wrong tax rates, can cause confusion. Always double-check the math and ensure that all figures align correctly with the service or product delivered.

- Failure to Include a Due Date: A missing or vague due date can cause confusion about when payments are expected. Always specify a clear, consistent payment deadline to avoid delays.

- Ambiguous Descriptions: Vague or unclear descriptions of goods or services can lead to misunderstandings. Be specific about the items or services provided, including quantities, rates, and any additional fees or discounts.

- Forgetting to Include Payment Terms: Make sure to include payment methods, such as bank transfer, credit card, or online payment services. Specify if you offer any discounts for early payment or charge penalties for late payments.

Example of a Common Mistake

Here’s an example of what a common mistake might look like in a financial record:

| Description | Amount |

|---|---|

| Consulting Service | $300.00 |

| Tax (7%) | $21.00 |

Total Amount D

How to Convert Excel to PDFConverting your spreadsheet documents into a PDF format is a simple and effective way to share them with clients, colleagues, or business partners. This format ensures that your document’s layout, fonts, and formatting remain consistent across different devices and operating systems. Whether you’re sending payment records, financial summaries, or contracts, converting to PDF guarantees a professional presentation. Steps to Convert a Spreadsheet to PDFFollow these easy steps to save your document as a PDF:

Advanced Settings for Customizing Your PDFIf you want more control over how your PDF appears, you can adjust several settings before saving:

Converting to PDF ensures that your document looks exactly as intended when opened on any device, eliminating the risk of formatting issues. This is especially useful when sharing important business records and communications. How to Protect Your Invoice DataEnsuring the safety and confidentiality of your financial documents is crucial to maintaining trust with your clients and protecting your business. Sensitive information such as payment details, client addresses, and service descriptions must be kept secure to prevent unauthorized access and potential fraud. Here are some effective strategies for safeguarding your financial records. Key Practices to Secure Your DocumentsImplementing these best practices can help protect your data from unauthorized access:

Additional Security MeasuresBesides protecting the document itself, consider these additional steps to keep your data safe:

By taking these precautions, you can ensure that your financial documents remain secure and protected from unauthorized access, helping you maintain both confidentiality and trust with your clients. |