Free Auto Repair Invoice Template for Word

Running a vehicle service business requires efficient tools for handling client transactions. One of the most important aspects of managing finances is creating detailed and clear billing documents. These records not only provide clients with accurate costs but also ensure smooth operations for your business. By using well-structured documents, you can maintain professionalism and transparency in every interaction.

In this guide, we explore an accessible solution for generating billing statements that suit the specific needs of vehicle maintenance providers. With just a few simple customizations, you can streamline the process of issuing detailed charges for services rendered. The best part is that these customizable documents can save you time, reduce errors, and help you stay organized.

By the end of this article, you will understand how to efficiently create and manage billing forms that are clear, consistent, and ready for use in your daily operations. Whether you’re just starting or looking to improve your workflow, this approach will help you stay on top of your financial records.

Free Auto Repair Invoice Template for Word

When providing vehicle maintenance services, clear and professional billing is essential for both clients and businesses. A well-organized document that details the costs and services provided helps ensure accurate communication and quick payment processing. By using editable documents, you can easily customize the layout, add or remove details, and adapt the format to suit your specific needs.

Why Choose Editable Documents for Billing?

Editable files allow you to make quick adjustments to the content without the need for starting from scratch each time. With the ability to personalize the information–such as customer names, service descriptions, and pricing–you can create consistent, professional documents that reflect your business style. The flexibility of these formats makes them an excellent choice for busy professionals who need to focus on their work, not paperwork.

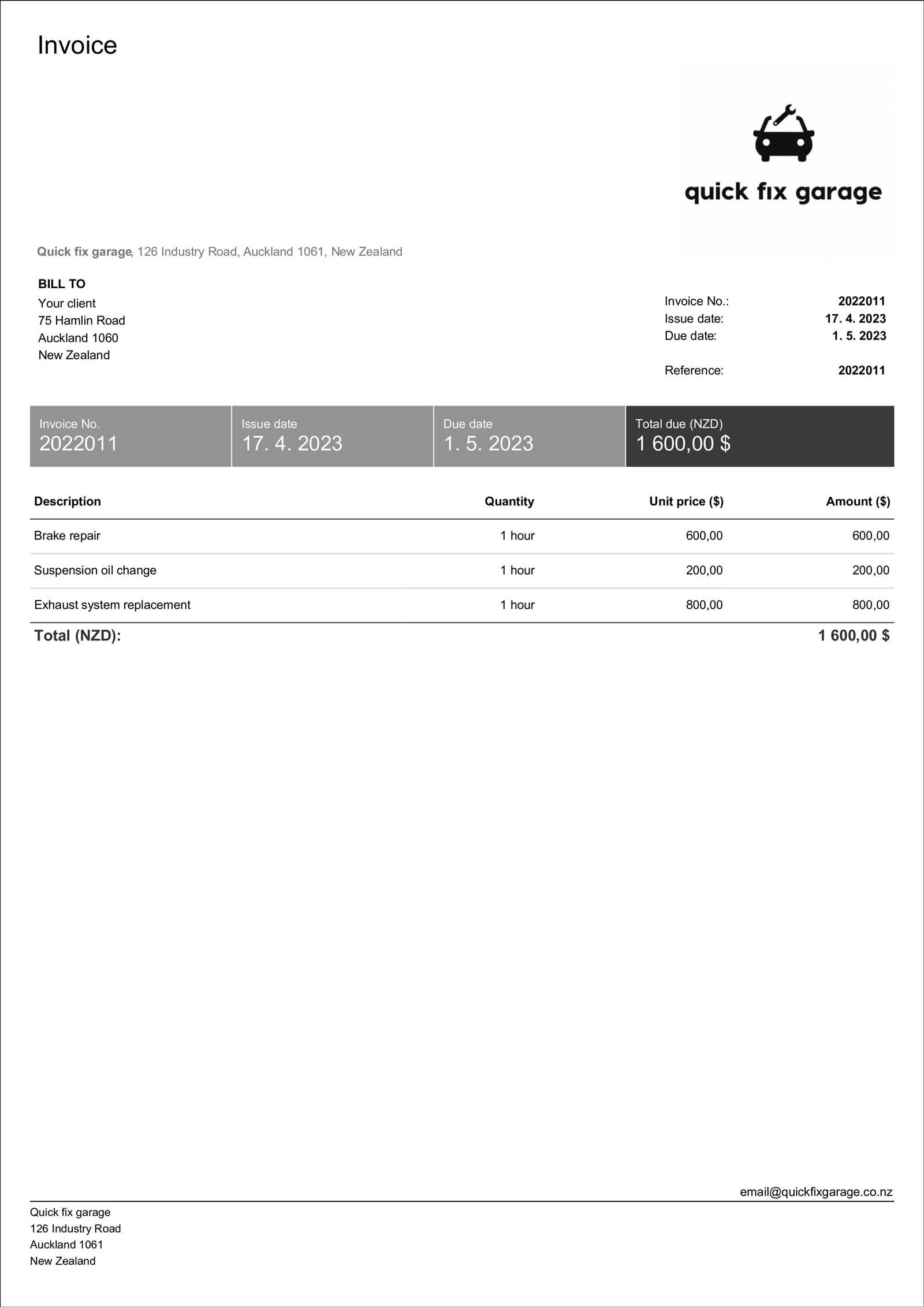

How to Get Started with a Customizable Document

To begin, simply download the document from a trusted source and open it in a compatible program. Once opened, you can easily input customer details, the services provided, and the total amount due. The document is designed to be intuitive, ensuring that anyone can create an accurate record with minimal effort. After filling in the necessary fields, you can save, print, or email the document to your client as needed.

Advantages: Using an editable document is an efficient way to manage your billing, keep records organized, and maintain a professional appearance. It eliminates the need for manually formatting each statement, saving you valuable time that can be better spent on client care and service improvement.

Why You Need an Auto Repair Invoice

In any vehicle service business, keeping accurate financial records is crucial for both legal and operational purposes. Providing clients with a detailed statement of services ensures transparency and helps avoid misunderstandings about costs. These documents are not just for the customer–they also protect your business by providing clear evidence of the services rendered and the agreed-upon charges.

Benefits of Having a Detailed Billing Document

Creating a well-structured bill brings several advantages to both your business and your clients. Here’s why maintaining proper records is essential:

- Clarity and Transparency: A detailed breakdown of services allows customers to see exactly what they are being charged for, which builds trust and reduces disputes.

- Proof of Transaction: Billing statements serve as official records that prove services were provided and payments were made, which is important for both legal and financial purposes.

- Efficiency in Financial Management: Organized records help you keep track of your revenue, identify repeat customers, and streamline accounting tasks.

- Professionalism: Providing a neatly formatted statement gives a professional impression to clients, enhancing your business’s credibility and reputation.

How This Helps You and Your Clients

Not only does this system improve your internal workflow, but it also enhances your relationship with customers. Clients appreciate knowing exactly what they’re paying for, and having these details on hand helps prevent confusion or conflicts. Furthermore, easy access to these documents allows clients to handle their own records efficiently, creating a more seamless transaction process for both parties.

How to Customize Your Invoice Template

Customizing your billing document allows you to tailor it to your business’s specific needs, ensuring it looks professional and includes all relevant details. By making a few adjustments, you can create a document that aligns with your brand, provides clear information, and is easy to use. Customization ensures that your statements are not only functional but also reflect your unique business identity.

Basic Elements to Customize

Before customizing, it’s important to focus on the key sections that will help make your document more effective. Here are the primary components to consider:

| Section | Customization Tips |

|---|---|

| Header | Include your business name, logo, contact details, and business address. This will help your client recognize your brand instantly. |

| Client Information | Ensure the client’s name, address, and contact details are accurate. You may also want to add a reference or order number for tracking purposes. |

| Services Rendered | List all services or items provided, including descriptions, quantities, and unit prices. This helps avoid confusion and ensures transparency. |

| Total Amount | Clearly highlight the total charge. If applicable, break it down by taxes, discounts, or additional fees for better clarity. |

Additional Customization Options

Once the main elements are in place, you can further personalize your document by adding additional sections. Consider including a thank you note or a payment terms section to set expectations clearly. Depending on your needs, you may also add a due date or any relevant legal disclaimers to make the document even more complete.

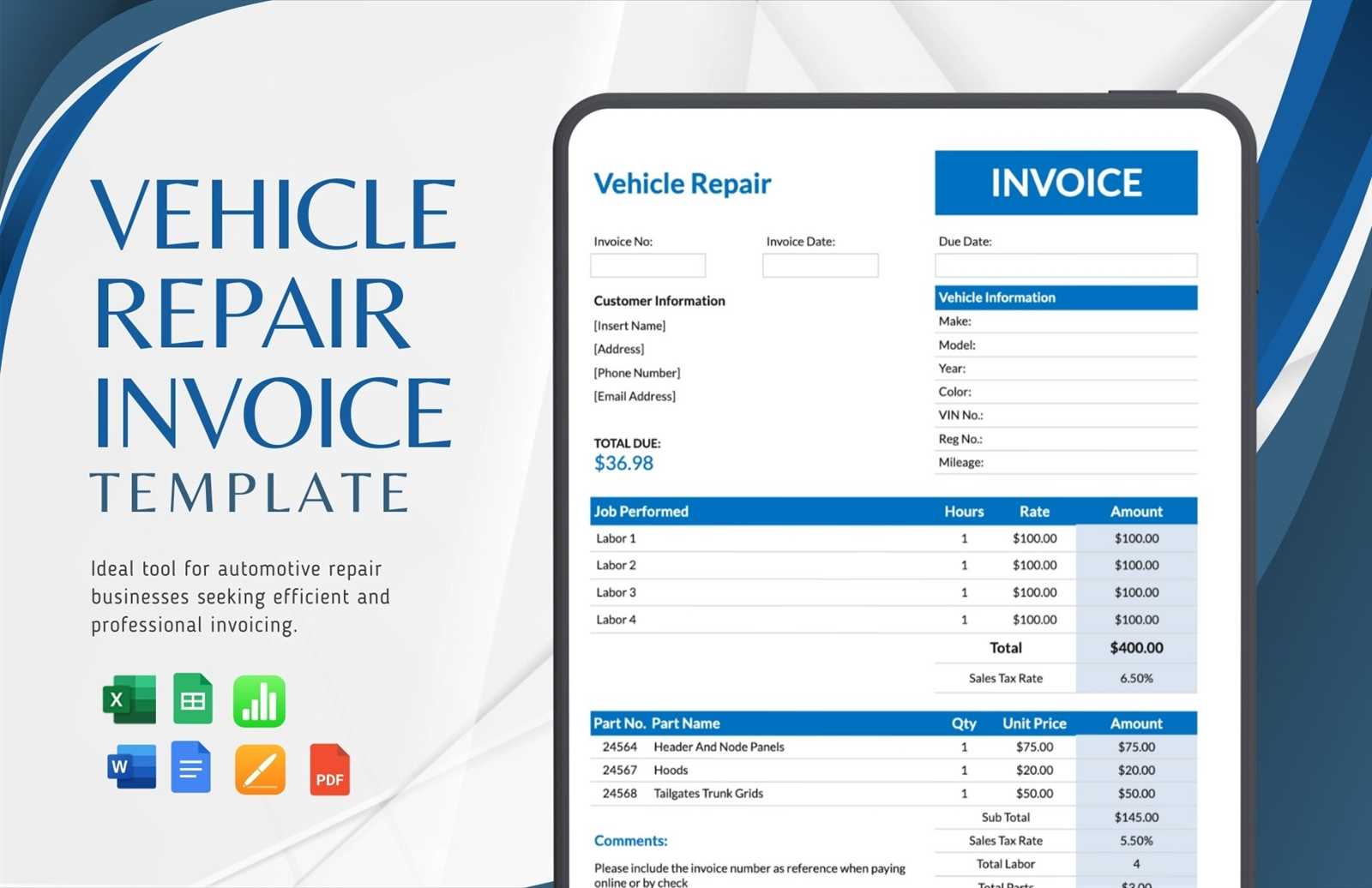

Top Features of a Good Invoice Template

Creating a high-quality billing document is essential for ensuring smooth transactions with clients. A well-designed record not only facilitates clear communication but also helps maintain professionalism in business dealings. The key to an effective document lies in its structure, clarity, and functionality, which can make a significant difference in the payment process.

When choosing or designing your own billing document, there are several important features to keep in mind. These elements ensure that the final product is both user-friendly and comprehensive, covering all necessary details while maintaining an organized layout.

Essential Elements to Include

- Business Information: A good document should prominently display your company’s name, contact details, and logo. This makes your brand recognizable and gives clients a clear point of contact.

- Client Details: Accurate customer information, including names, addresses, and contact details, ensures that the document is personalized and specific to the transaction.

- Clear Itemization: A well-organized list of services or products provided, with corresponding prices and quantities, helps clients understand exactly what they are paying for. Transparency in this section is key to preventing confusion.

- Total Amount: The total cost should be clearly displayed, with a breakdown of any taxes, discounts, or additional fees. This helps clients quickly assess the charges and ensures that all financial details are easy to understand.

- Payment Terms: Including a section that outlines payment due dates, methods of payment, and any applicable late fees helps set clear expectations for both parties.

Additional Features to Enhance Functionality

- Customization Options: A flexible document that allows easy updates or adjustments ensures it can be tailored for various types of services or clients.

- Professional Design: A clean, visually appealing layout that includes appropriate fonts, spacing, and alignment enhances readability and helps reinforce your brand’s image.

- Legal Information: In some cases, adding legal disclaimers or compliance statements is necessary, especially when dealing with large contracts or specific regulatory requirements.

By including these essential features, you can create a billing document that is both practical and professional, leading to smoother transactions and stronger client relationships.

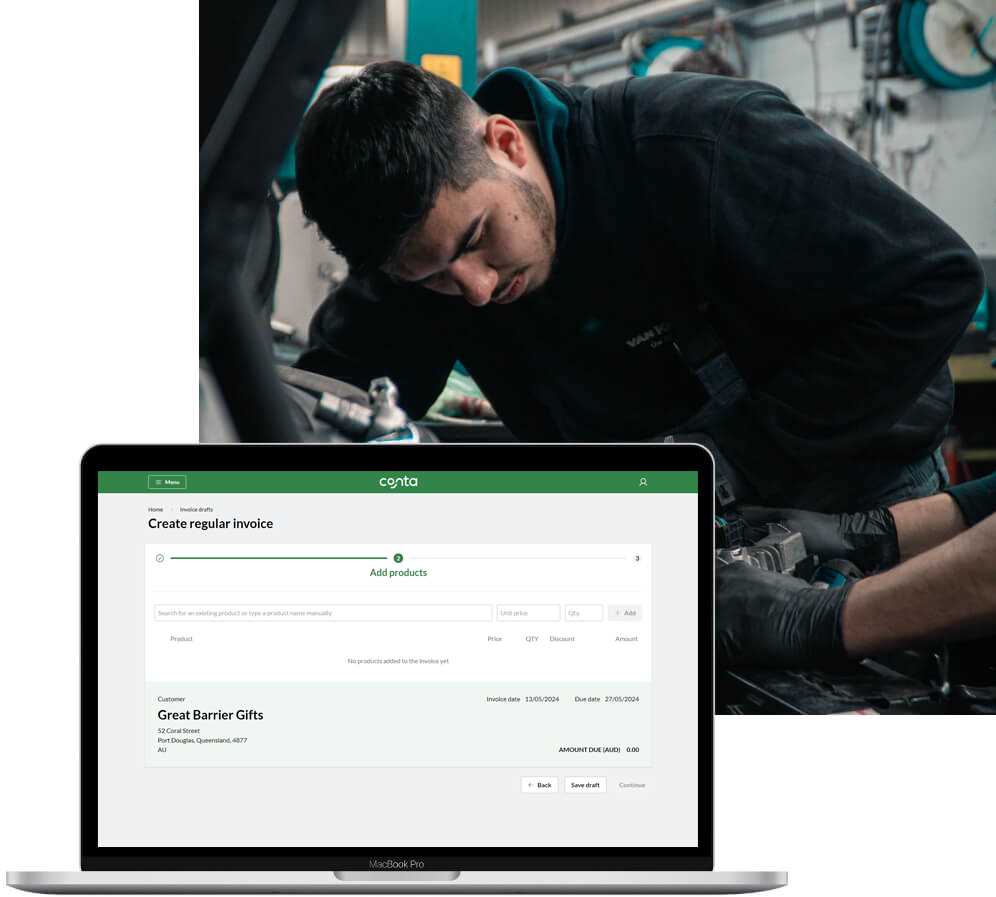

Advantages of Using Word for Invoices

Creating professional billing documents can be streamlined with the right software. Using a popular word processing program to design and manage billing records offers numerous benefits. This approach provides flexibility, ease of use, and accessibility, making it an excellent choice for businesses looking to maintain clear financial records.

Key Benefits of Using Word for Billing

- Ease of Customization: The flexibility of word processing software allows you to quickly adjust the layout, fonts, and content of your documents. Whether you need to update client details or change pricing, customization is simple and fast.

- Widely Accessible: Most people have access to word processing software, making it easy for both you and your clients to open, read, and print the document. This ensures that your records are accessible without requiring specialized tools or software.

- Professional Formatting: The program offers various templates and formatting options that can help make your documents look polished and well-organized. You can include logos, headers, footers, and other design elements that contribute to a professional presentation.

- Cost-Effective: Using word processing software eliminates the need for expensive accounting or invoicing software. It provides all the features you need for creating and managing billing documents at a minimal cost.

- Easy Storage and Sharing: Files created in word processing formats are easy to save, organize, and share electronically. Whether you need to send a bill via email or store records in a folder, the process is simple and efficient.

How It Enhances Business Efficiency

- Faster Document Creation: Using pre-designed structures, you can quickly create and issue records without starting from scratch each time. This saves valuable time, especially when dealing with multiple clients.

- Integrated with Other Tools: Word files can be easily combined with other software, such as spreadsheets, for additional features like cost calculations and tracking.

- Clear Record Keeping: All your financial records can be stored in one easy-to-access format, improving organization and reducing the chances of losing important documents.

In conclusion, using word processing software to manage billing offers both practicality and professionalism. It ensures that your documents are clear, accessible, and customizable, all while saving time and money in the process.

Step-by-Step Guide to Create Invoices

Creating a billing document doesn’t have to be complicated. With the right tools, you can generate professional and accurate records in just a few steps. This guide walks you through the essential process of creating a clear and organized statement that meets both your business needs and your client’s expectations.

1. Set Up Your Document

Start by opening your preferred document editing software and choose a clean, organized layout. Include spaces for your business name, logo, and contact details at the top. This ensures your document looks professional and provides the necessary information for your client to reach you easily. Don’t forget to include your business address and email as well.

2. Add Client Information

Next, input your client’s details, including their name, address, phone number, and email. This personalizes the document and ensures it’s clear who the statement is for. You can also add a reference number or order ID to help with tracking if you have a system for that.

3. List Services and Products

Include a detailed list of the services or items provided, along with a description of each one. It’s important to be clear and specific here, noting the quantity, price per unit, and the total cost for each service or product. Use bullet points or a table to keep the layout neat and easy to follow.

4. Specify Payment Information

Make sure to include the total amount due at the bottom of the document. Break down the charges into categories like taxes, discounts, or other fees, if applicable. Be sure to specify the payment method and include terms such as the due date and any late fees that may apply.

5. Review and Finalize

Before sending the document, double-check all the details for accuracy. Ensure all numbers are correct, and all relevant information is included. Proofreading the document for any errors or missing details will help maintain a professional image.

Once you’ve reviewed everything, save the document and send it to your client. You can also print or file the document for your own records. With this step-by-step process, you can create clear, accurate billing documents every time.

Key Information to Include in Invoices

For a billing document to be both effective and legally binding, it must include certain critical details. These elements ensure that the document is clear, transparent, and provides both parties with the necessary information for smooth financial transactions. By including the right information, you can avoid confusion and ensure prompt payment.

Essential Details for Every Billing Document

- Business Name and Contact Information: Always start by including your company’s name, address, phone number, and email. This makes it easy for clients to contact you if they have any questions or need clarification.

- Client Information: Include the client’s name, address, and contact details to ensure the document is personalized and traceable.

- Unique Reference Number: Assign a unique identification number or reference code to each document. This is especially useful for tracking payments and organizing your financial records.

- Detailed Description of Services/Products: Clearly list all the services rendered or products provided. Include relevant descriptions, quantities, unit prices, and the total for each item to avoid confusion.

- Dates: Include the date the document is issued, as well as the date when the services were provided or the products were delivered. This helps to set clear timelines for both parties.

- Total Amount Due: Clearly state the total amount that is due for payment. This should include a breakdown of individual costs, taxes, and any applicable fees, as well as the overall sum.

- Payment Terms: Specify the payment due date, acceptable methods of payment, and any penalties for late payments. This helps set clear expectations for when and how the payment should be made.

- Additional Notes: If necessary, you can add any additional instructions, terms, or disclaimers. This might include details about warranties, returns, or special agreements made with the client.

Optional Elements to Include

- Discounts: If applicable, make sure to list any discounts applied to the total amount. Clearly state how much is being deducted and why.

- Tax Information: Include any relevant tax information, such as the sales tax percentage or tax identification number, if required by law.

- Thank You Message: Adding a brief thank you note or a personalized message can enhance your client relationships and demonstrate professionalism.

By ensuring all these key details are included, your document will provide both clarity and transparency, helping avoid confusion and ensuring timely payments from your clients.

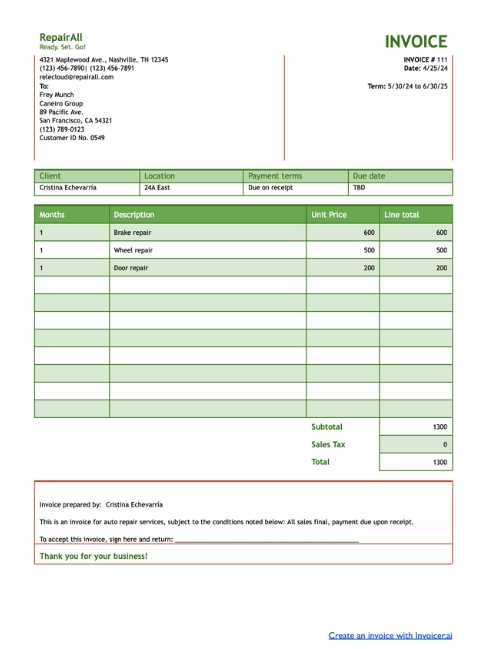

Best Practices for Writing Clear Invoices

To ensure smooth financial transactions and maintain professionalism, it’s essential to create clear, concise, and well-organized billing documents. A well-crafted statement not only helps clients understand exactly what they are being charged for, but it also reflects your business’s attention to detail and commitment to transparency. Following a few key guidelines can make your documents more effective and prevent misunderstandings.

Key Tips for Crafting Clear Billing Records

- Use Simple and Direct Language: Avoid jargon and complex terminology. Write in a straightforward manner that makes it easy for your client to understand the charges, even if they’re not familiar with your industry.

- Maintain Consistent Formatting: Keep the layout simple and consistent. Use clear headings, bullet points, and well-defined sections to make the document easy to follow. Bold important details, like the total amount due, to ensure they stand out.

- Break Down Charges Clearly: Itemize the services or products provided with a brief description. Include quantities, rates, and any taxes or discounts. This transparency helps clients see exactly what they are paying for and avoids confusion.

- Keep It Neat and Professional: Use proper spacing and alignment to ensure your document looks organized. A cluttered or poorly formatted document can create a negative impression and make it harder for clients to process the information.

- Double-Check for Accuracy: Ensure all information is accurate before sending the document. Verify the client’s details, pricing, dates, and the total amount. Small errors can cause delays in payment or damage your professional reputation.

- Clearly State Payment Terms: Be specific about payment deadlines, late fees, and accepted payment methods. Providing these details upfront will help avoid misunderstandings and set clear expectations for your clients.

Additional Considerations

- Use a Professional Tone: Even if the relationship with the client is informal, always keep the tone of your document professional and courteous. A polite “thank you” or “we appreciate your business” can go a long way.

- Consider Client Preferences: If possible, tailor the document to your client’s needs or preferences. Some clients may prefer more detailed descriptions, while others may want a more condensed version. Knowing your client’s expectations will improve satisfaction and streamline the process.

By following these best practices, you’ll ensure that your billing documents are not only clear and accurate, but also create a positive experience for your clients and encourage timely payments.

How to Avoid Common Invoice Mistakes

Creating accurate billing documents is crucial for smooth business operations and timely payments. However, there are several common mistakes that can lead to confusion, delayed payments, or even lost business. By being mindful of these pitfalls and following a few simple guidelines, you can ensure your documents are both accurate and professional.

Common Mistakes to Avoid

| Error | How to Avoid It |

|---|---|

| Missing or Incorrect Client Details | Always double-check the client’s name, address, and contact information before sending. This ensures the document is accurate and avoids confusion about who the charges are for. |

| Unclear Descriptions | Provide specific details about the products or services rendered. Avoid vague terms and include quantities, prices, and any other relevant information to eliminate potential misunderstandings. |

| Inaccurate Pricing or Calculation Errors | Double-check all pricing details, including unit rates, taxes, and discounts. Small calculation errors can cause issues and may result in delayed payments or dissatisfaction. |

| Omitting Payment Terms | Always include clear payment terms, such as due dates, accepted payment methods, and any late fees. This helps clients understand what is expected and avoids delays. |

| Neglecting to Include a Unique Reference Number | Assign a unique reference number to each document. This helps with tracking and makes it easier for both you and the client to locate specific records. |

Best Practices for Error-Free Billing Documents

- Proofread Before Sending: Always review your document for any errors before sending it out. A fresh set of eyes or a second review can help catch mistakes you may have overlooked.

- Use Clear and Consistent Formatting: Stick to a standard layout and formatting to avoid confusion. Clear headings, consistent font sizes, and well-organized sections make it easier for clients to understand the charges.

- Set Reminders for Due Dates: Implement a system to track due dates and follow up with clients on overdue payments. This ensures that nothing slips through the cracks.

By staying aware of these common mistakes and adopting best practices, you can create more accurate, efficient billing documents and foster better relationships with your clients.

Free vs Paid Invoice Templates

When it comes to creating billing documents, choosing the right solution can make a significant impact on the efficiency and professionalism of your transactions. There are both free and paid options available, each with its advantages and disadvantages. Understanding the key differences between these two types of resources can help you make an informed decision based on your business needs.

Advantages of Free Invoice Resources

- Cost-Effective: As the name suggests, free solutions come at no cost, making them ideal for small businesses or freelancers with limited budgets.

- Easy Access: Free templates are often widely available and easy to find online. With minimal effort, you can start using them right away to create your documents.

- Simple to Use: Many free templates are basic and straightforward, which can be ideal if you need a simple, no-frills solution for billing.

- Good for Small Volume: If your business is relatively small and you don’t generate many billing documents, free options can be sufficient for handling basic tasks.

Drawbacks of Free Resources

- Limited Features: Free templates often lack advanced functionality such as automatic calculations, customization options, or additional design elements.

- Basic Design: Many free options have a simple, generic design that may not align with your brand or convey a polished, professional image.

- Less Support: If you encounter issues, free templates often come with limited customer support, which can be a challenge if you need assistance.

Benefits of Paid Invoice Solutions

- Advanced Features: Paid resources usually come with more sophisticated options, such as automatic totals, tax calculations, and the ability to customize fields to better suit your business needs.

- Customization Options: Paid templates allow you to create more personalized designs, adding logos, custom fields, and more to make the document align with your branding.

- Better User Experience: With a premium solution, you typically receive more polished and visually appealing designs that can enhance your business’s professional image.

- Support and Updates: Paid options often come with ongoing updates, improvements, and customer support to help you resolve any issues efficiently.

Disadvantages of Paid Resources

- Cost: The main drawback of premium options is the cost. This can be a concern for small businesses or independent contractors on a tight budget.

- Learning Curve: Some paid solutions come with more complex features that may require some time to learn and fully utilize.

Ultimately, the choice between free and paid resources depends on the specific needs of your business. If you require advanced features, more customization, and a polished look, a paid solution may be worth the investment. However, if you’re just starting out or need a basic solution, free templates can provide everything you need to create simple, effective billing documents.

Where to Find Free Auto Repair Templates

If you’re looking to create professional billing documents without spending a lot of money, there are many places where you can access ready-made forms and layouts for your business. These resources are perfect for those who need a quick solution to manage their financial transactions, especially when just starting out or running a small operation. Below are some of the best places to find these free resources that can help you organize your invoicing process efficiently.

1. Online Websites and Marketplaces

Many websites offer a variety of downloadable documents for businesses, including layouts for billing. These resources are often customizable, allowing you to add your own details and branding. Some reliable sites include:

- Microsoft Office Templates: Microsoft’s official website has a range of basic and customizable billing layouts that you can download and modify directly in their suite of programs.

- Google Docs: Google offers a selection of free forms and documents, including options for billing. These can be easily edited online and stored in the cloud.

- Template Libraries: Websites like Vertex42 or Template.net provide collections of forms and documents for businesses. Many of these are available for free, though some may require you to sign up or create an account.

2. Business Forums and Communities

There are also a number of online communities and forums where business owners share their own resources, including customized billing documents. These platforms can be a great place to find niche or industry-specific templates that suit your needs. Some options include:

- Reddit: Subreddits like r/smallbusiness or r/Entrepreneur often feature discussions and resource-sharing where you can find free templates shared by fellow entrepreneurs.

- Small Business Forums: Many small business communities, such as those on sites like Bplans or BizWarriors, offer free resources, including customizable documents to help manage daily operations.

By searching through these websites and communities, you can find a variety of options that suit your business style, offering templates you can adapt quickly to meet your specific needs.

How to Save Time with Templates

Time is one of the most valuable resources for any business owner. When managing multiple tasks, especially administrative work, efficiency is key. Using pre-designed formats for routine tasks can significantly streamline your workflow, allowing you to focus more on providing quality services or expanding your business. Here’s how using structured documents can save you valuable time.

1. Standardized Process

Having a ready-made structure for your documents helps you avoid starting from scratch every time you need to create a new one. By following a consistent format, you can complete your tasks faster while ensuring that all necessary details are included. Benefits include:

- Less Time Spent on Design: Pre-formatted documents save you from having to design a layout each time. The design is already set, and you simply input the required details.

- Consistency Across Documents: Standardizing your documents ensures consistency in appearance and content, which helps maintain professionalism and prevents errors or omissions.

- Pre-set Fields: Many templates come with pre-defined sections for information like dates, addresses, and totals, which reduces the time spent thinking about the layout or what information needs to be included.

2. Easy Customization

Although templates provide a structure, they are also highly customizable to suit your specific needs. Once you get the hang of the process, you can quickly fill in the required fields for each new client or service. Here’s how it helps:

- Quick Updates: With a pre-built structure, updating details for new clients, services, or products is fast and easy. There’s no need to design or organize the content every time you need to create a document.

- Consistency Saves Time on Revisions: Once you get the format right, revisions are quick. Whether you need to change a price or adjust a service description, it’s easy to do without starting over.

3. Reduces Mistakes and Errors

Because the structure is predefined, you reduce the likelihood of leaving out important details or making mistakes. When documents are created from scratch each time, it’s easy to forget critical information. With a template, you ensure that all necessary components are included, saving time on corrections.

Incorporating pre-made structures into your workflow not only boosts productivity but also increases accuracy, allowing you to handle more tasks in less time and with greater efficiency.

Making Your Invoices Professional and Easy

Creating clear, well-organized, and professional billing documents is essential for maintaining a positive relationship with clients. An efficient, well-designed statement not only ensures faster payments but also reflects positively on your business. The key is to keep the document both professional in appearance and easy for clients to understand. Here are some strategies to help you achieve this balance.

1. Keep the Design Clean and Simple

The first step in making your billing records professional is ensuring the design is clean, minimal, and easy to navigate. A cluttered layout can confuse your clients and make the document look unprofessional. Stick to a basic, structured format with well-defined sections such as:

- Clear headings: Label sections like “Client Details,” “Services Provided,” and “Amount Due” to make the document easy to read.

- Consistent fonts: Use simple, professional fonts like Arial or Times New Roman. Keep the font size readable, and avoid using too many different styles.

- White space: Leave enough empty space between sections to make the document feel less cluttered and more organized.

2. Be Clear and Transparent with Pricing

When it comes to pricing, clarity is crucial. Clients should be able to easily understand how the total amount is calculated. Include itemized descriptions for each service or product provided, along with their respective costs. For example:

- List services and materials: Break down individual services, products, or labor hours, so clients can see what they are being charged for.

- Include taxes and discounts: Make sure any taxes or discounts are clearly noted, and ensure that the final amount due is easily identifiable.

- How to Track Payments with Templates

Tracking payments is an essential part of maintaining smooth financial operations in any business. Having a structured approach for monitoring outstanding balances and confirming completed transactions helps ensure that your cash flow remains healthy. Using organized documents for payment tracking allows you to stay on top of who owes what, when, and how much has been paid. Here’s how to use ready-made formats to track payments efficiently.

1. Include Payment Status Fields

One of the easiest ways to track payments is by adding a clear section for payment status in your forms. This section allows you to update the document as payments are made, providing a quick reference for both you and your clients. Key fields to include are:

- Payment Due Date: This helps keep track of when payments are expected, reducing the chances of missed deadlines.

- Amount Paid: Track the specific amount the client has paid towards the total balance. This makes it easy to see if partial payments have been made.

- Remaining Balance: Show the outstanding amount that still needs to be paid. Updating this amount will help you keep an accurate record of what is still owed.

2. Add Payment Method Details

It’s important to track how payments are made in case there are any issues with transaction verification or disputes. By adding a section for payment method, you can clearly see whether the payment was made by check, credit card, bank transfer, or cash. Include:

- Payment Method: Specify if the payment was made via cash, credit card, PayPal, or another method.

- Transaction ID: Including a unique transaction number can help in case you need to reference or verify the payment later.

- Payment Date: Keep track of when the payment was made to maintain an accurate payment history.

3. Use Automated Calculations

Many forms allow you to automate calculations for balances and totals. By utilizing automated calculations, you can ensure accuracy and save time on manual updates. For instance:

- Automatic Totals: Set up formulas that automatically calculate the remaining balance based on the amount paid and total owed.

- Tax and Discount Calculations: If applicable, set up automatic fields to calculate any taxes or discounts applied to the total amount, making it easier to track payments in full.

4. Maintain a Record of All Transactions

Another way to track payments effectively is by maintaining a record of all payment transactions in one place. This could be a separate sheet or section dedicated to payment history. Include:

- Client Name and Invoice Number: Link payments to specific clients or invoices for easy reference.

- Payment Date and Amount: Keep a detailed log of when each payment was made and the amount received.

- Payment Status Updates: Regularly update the payment status in your records to stay current on what has been paid and what is still outstanding.

By implementing these tracking methods into your routine, you can easily manage and follow up on payments, minimizing the chances of confusion or missed payments. Organized, structured documents provide clarity and ensure that both you and your clients have a clear understanding

Tips for Editing Your Invoice Template

Customizing your billing documents is crucial for ensuring they reflect your business’s branding and meet the specific needs of each client. Whether you’re updating information, adding new sections, or adjusting the design, making sure the final document is professional and clear is key. Here are some practical tips for editing your billing forms effectively and efficiently.

1. Focus on Consistency

Consistency in design and structure is essential for a polished, professional look. When editing your document, make sure that the font, layout, and color scheme remain uniform across the entire form. Some key points to consider include:

- Consistent Fonts: Use the same font type and size for similar sections. This creates a cohesive feel and makes the document easier to read.

- Uniform Sections: Ensure that headings, subheadings, and other text elements are aligned consistently across the form. This ensures that information is organized logically and looks neat.

- Simple Color Palette: Stick to a minimal color palette that matches your brand. Avoid using too many different colors, as this can distract from the information.

2. Personalize the Details

While structure is important, personalizing your forms with specific information helps make your billing documents more relevant to each client. Edit fields to reflect accurate, up-to-date details such as:

- Client Information: Always update client names, addresses, and contact details before sending out a bill to avoid errors and confusion.

- Service Descriptions: Be specific about the services provided. This ensures that your client understands exactly what they are paying for, reducing the chance of disputes.

- Your Business Information: Make sure your contact details, including email, phone number, and business address, are correct on every document.

3. Streamline the Payment Details

Make payment instructions clear and easy to follow. When editing the payment section of your document, keep it straightforward by including:

- Clear Payment Terms: Clearly state when the payment is due and any late fees or discounts. This helps set expectations from the start.

- Accepted Payment Methods: Specify the payment options available (e.g., bank transfer, credit card, PayPal), so your clients know how to pay without confusion.

- Easy-to-Understand Amounts: Ensure that the total amount is clearly labeled and easy to distinguish from individual items or services.

4. Utilize Built-In Features for Efficiency

Many editing tools come with built-in features that can help you streamline your process. Ta

Improving Client Communication with Invoices

Effective communication is a cornerstone of any successful business relationship. One often-overlooked aspect of this is the way businesses communicate through billing statements. These documents can serve as an excellent tool not only for requesting payment but also for maintaining clear, professional communication with clients. By structuring your billing documents in a way that is both informative and easy to understand, you can improve transparency and foster trust with your clients.

1. Be Transparent with Service Details

Clients appreciate clear explanations of what they are being charged for. By providing detailed descriptions of the services rendered or products provided, you reduce the likelihood of misunderstandings. This transparency can prevent confusion and build confidence in your business practices. Some key points to consider:

- Break down services: Itemize each service or product, including quantities and pricing. This shows clients exactly what they are paying for.

- Specify labor and materials: Clearly separate charges for labor and materials, allowing clients to see the full scope of the charges.

- Include dates: Add the date when the service was performed, making it clear when the work was completed and helping clients track their expenses more effectively.

2. Set Clear Payment Expectations

Clear communication about payment terms ensures that both parties are on the same page. By outlining payment due dates, accepted payment methods, and any late fees in advance, you set clear expectations and avoid confusion later. Be sure to include:

- Due date: Specify when the payment is expected and ensure there’s no ambiguity about the timeline.

- Payment methods: List the different ways clients can pay, whether via check, credit card, online transfer, or other methods. This gives clients options that suit their preferences.

- Late payment policies: Make sure to include any penalties or interest charges for late payments, so clients are aware of the consequences of not paying on time.

3. Use Professional Language and Tone

The tone you use in your billing documents can influence how clients perceive your business. A professional and polite tone in your payment requests not only conveys respect but also ensures that clients feel valued and respected. Avoid overly casual language or technical jargon that might be unclear to your clients. Keep the tone friendly yet professional to maintain a positive relationship.

4. Provide Contact Information for Queries

Always include your contact details in case clients have questions about the charges. This shows that you are available to resolve any issues or clarify details. Having a dedicated section with your business phone number, email, or customer service hotline fosters an open line of communication. It’s also helpful to provide a link or instructions for submitting payment inquiries online if applicable.

By improving your communication through well-structured and transparent billing documents, you create a more positive experience for your clients. This not only ensures timely payments but also helps build long-term, trusting relationships that can lead to repeat business and referrals.