Free Auto Repair Invoice Template PDF Download

When providing vehicle maintenance or repair services, clear and organized billing is essential for smooth business operations. A well-structured document helps ensure that customers are fully informed about the services rendered and the costs involved. It also streamlines record-keeping for both business owners and clients, making it easier to track payments and manage finances.

Using an efficient tool to create these records not only saves time but also adds a level of professionalism to your business. By utilizing a digital format, you can customize the document to meet specific needs, quickly update details, and share it instantly with your customers. Whether you’re a mechanic or running an entire service center, having the right resources at your disposal can significantly improve your workflow.

Organizing financial details accurately ensures that you maintain a trustworthy relationship with your clients, while also protecting your business interests. With the right documents, you can avoid misunderstandings, reduce errors, and provide clear breakdowns of labor, parts, and other related expenses. Implementing a digital solution that is both simple and effective is a key step toward achieving these goals.

Professional Billing Document for Vehicle Services

In any vehicle service business, having an organized and professional document for billing purposes is essential. A reliable record not only ensures clarity for both service providers and clients but also helps streamline accounting and payment processes. With a well-structured document, business owners can quickly provide customers with a clear breakdown of costs, services performed, and any additional charges, which enhances customer trust and satisfaction.

How a Digital Format Can Improve Efficiency

Using a digital format for your billing documents offers numerous advantages. The ability to quickly edit, update, and share the document makes it a more efficient solution compared to traditional paper-based methods. Additionally, the digital version can be stored and accessed easily, allowing business owners to keep accurate records for future reference. It also enables faster processing of transactions, reducing the time spent on administrative tasks.

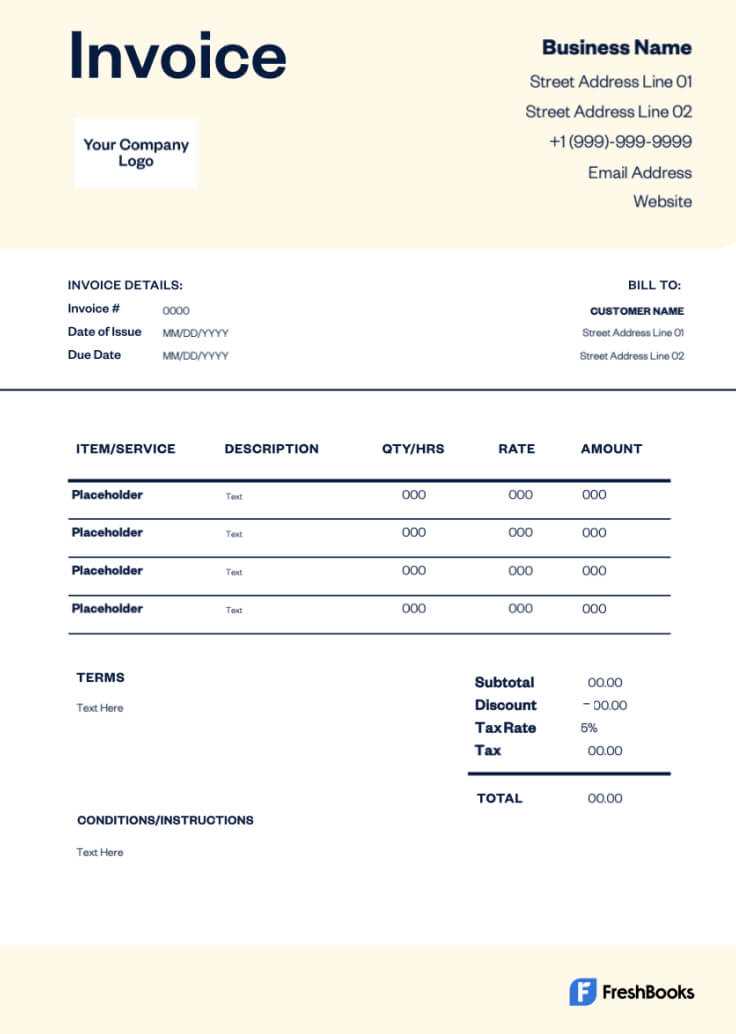

Why Choose a Pre-designed Document

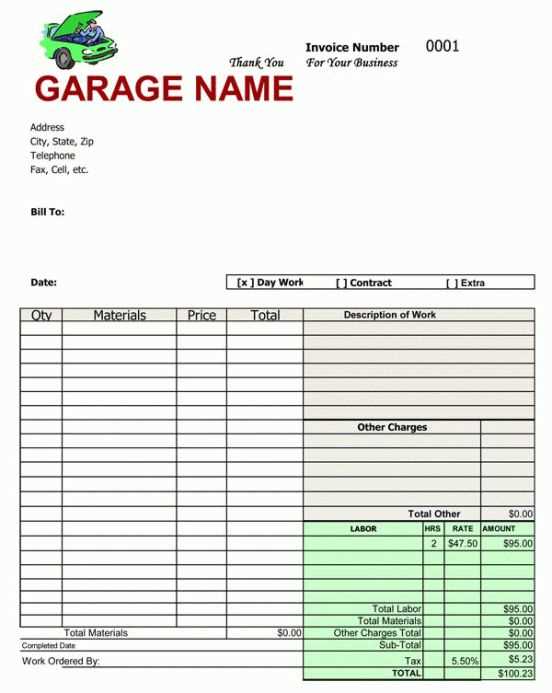

A pre-designed document can save valuable time by providing a ready-to-use structure that covers all necessary fields, such as labor charges, parts costs, and taxes. These documents are easily customizable, allowing you to add your business details and adjust the format as needed. With a professionally designed layout, you can ensure that every billing record looks polished and consistent, promoting a trustworthy image to your customers.

Using the right tools to generate these documents helps ensure accuracy and professionalism in every transaction. By offering customers a clear and easy-to-read statement, you avoid confusion and establish a positive business reputation. In today’s digital age, having quick access to such a tool is a crucial asset for any service provider in the vehicle maintenance industry.

Why Use a Vehicle Service Billing Document

Having a well-organized document for billing is essential for any business offering vehicle services. It provides a clear, professional way to communicate the cost of services rendered and helps ensure that both the service provider and the customer are on the same page. This tool simplifies the process of tracking payments, listing charges, and maintaining accurate records for future reference. It not only speeds up transactions but also contributes to a more professional image for your business.

Using a structured billing document saves time and reduces errors by providing a consistent format for every transaction. Rather than manually creating an invoice from scratch each time, you can use a pre-designed format that includes all the necessary fields. This minimizes the chance of overlooking important details such as labor costs, parts pricing, and taxes. A standardized document also helps keep your accounting organized and ensures that all critical information is captured in a consistent manner.

Additionally, offering a formal record of service transactions helps build trust with customers. By presenting clear, itemized details on the services provided and associated costs, you demonstrate transparency and professionalism. This fosters positive relationships with clients and increases the likelihood of repeat business and referrals.

Benefits of Downloading a Digital Billing Document

Downloading a digital version of a billing record offers significant advantages over traditional paper formats. It provides a more efficient, organized, and reliable way to manage financial transactions. By using a digital document, service providers can easily customize, store, and share records, streamlining the entire billing process. Additionally, digital formats ensure better accessibility and security for both businesses and clients.

Enhanced Accessibility and Convenience

One of the primary benefits of using a digital format is its accessibility. A digital file can be stored on various devices, making it easy to access from anywhere at any time. Whether you’re in the office or working remotely, you can quickly retrieve the document, make edits, and share it with clients without the need for printing or scanning. This level of convenience is particularly useful for businesses with multiple locations or those who frequently travel.

Increased Accuracy and Reduced Errors

Another key advantage is the reduction of human error. With a pre-designed structure, there’s less chance of missing crucial information or making calculation mistakes. Digital tools often include automated fields and calculations, ensuring that labor costs, parts prices, and taxes are correctly accounted for every time. This accuracy helps maintain financial integrity and avoids disputes with clients over billing discrepancies.

Digital documents not only make it easier to track payments and service records, but they also offer a more secure way of storing sensitive financial data. With encryption and password protection, businesses can safeguard their records against unauthorized access, reducing the risk of fraud or data loss. The long-term benefits of using a digital format far outweigh the limitations of paper-based systems, making it a smart choice for modern service providers.

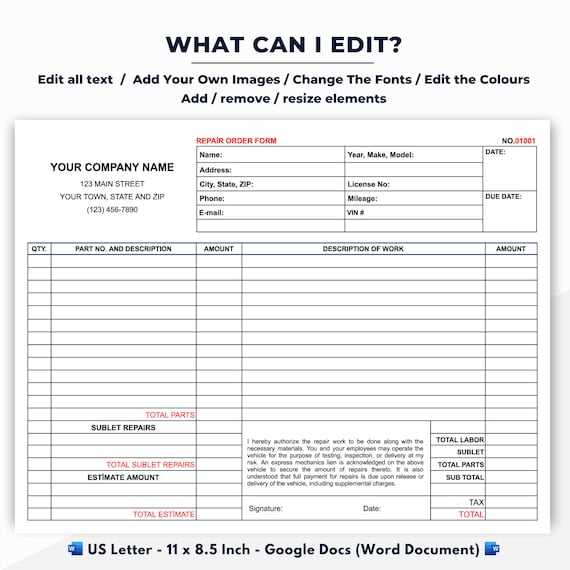

How to Customize Your Billing Document

Customizing your billing document ensures that it reflects your business’s branding and meets specific operational needs. Personalizing the layout and content helps make your financial records more professional, organized, and tailored to your preferences. With a few simple steps, you can easily adjust the document to include all the necessary details and present a polished image to your clients.

Steps to Personalize Your Billing Record

Follow these steps to make your document unique and functional:

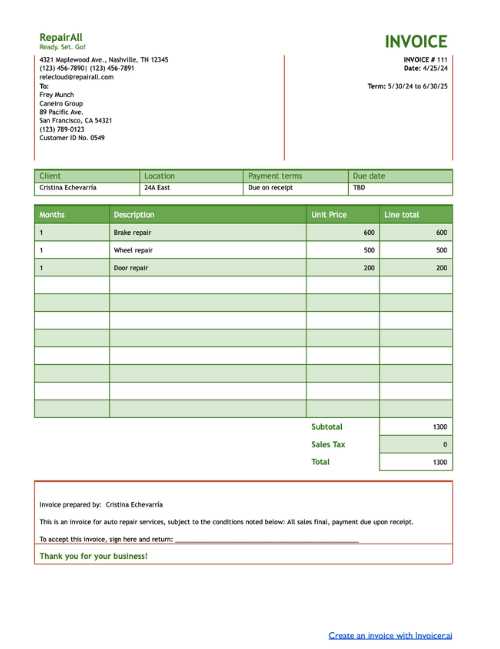

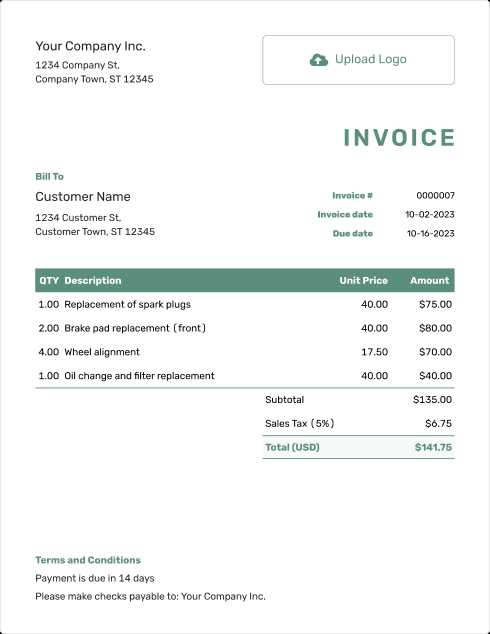

- Update Business Information: Include your company name, address, contact details, and logo at the top of the document. This gives it a personal and professional touch.

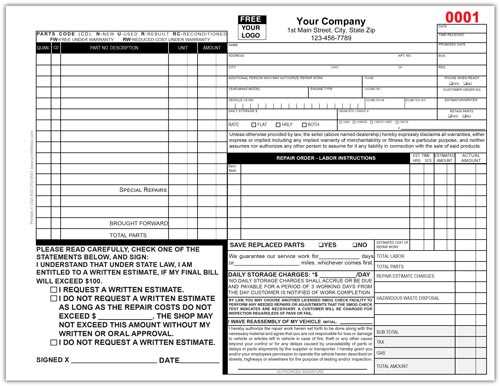

- Modify the Fields: Add or remove sections to suit your needs, such as labor charges, materials, taxes, or discounts. Ensure that all relevant details are included for transparency.

- Adjust Formatting: Customize fonts, colors, and layout to match your business’s style guide. A clean, readable design ensures the document is user-friendly.

- Include Terms and Conditions: Clearly state payment terms, late fees, and any warranties or guarantees related to the services provided.

Why Customization Matters

Customization offers a more personalized experience for your clients and helps avoid confusion. By including specific information about your services and payment conditions, you build trust and ensure clarity. A customized document also allows you to maintain a consistent brand identity across all business communications, helping you stand out in a competitive market.

Moreover, having a document that fits your business model can save time and effort by simplifying the process for both you and your clients. By ensuring all necessary information is clearly outlined, you can reduce follow-up queries and ensure smoother transactions.

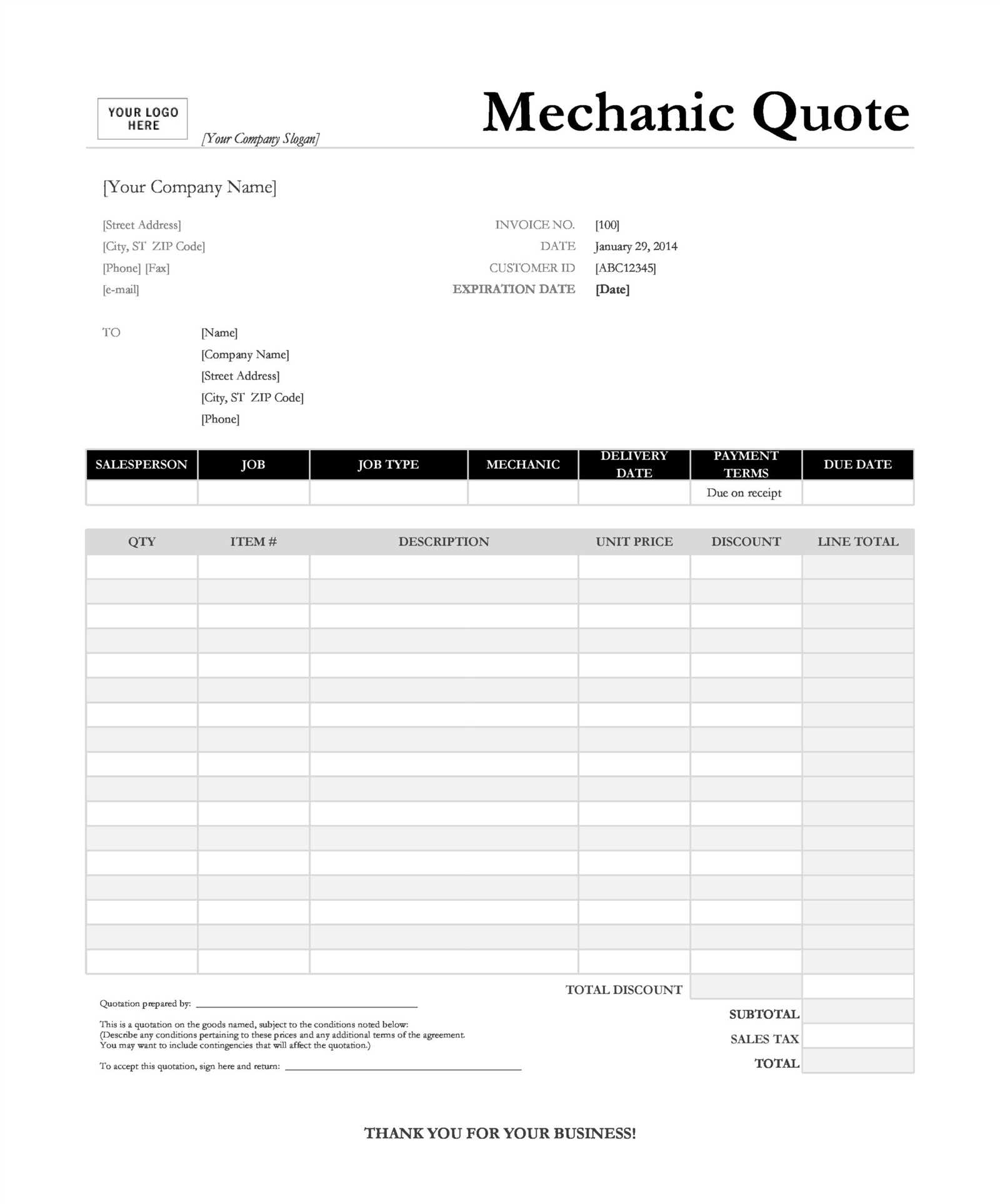

Essential Information for Vehicle Service Billing Documents

When preparing a billing document for vehicle services, it’s important to include all necessary details to ensure clarity and transparency for both the service provider and the customer. A well-structured record should cover all aspects of the transaction, from the type of services performed to the cost breakdown and payment terms. Providing clear and accurate information reduces the chance of disputes and fosters a professional image for your business.

Key Elements to Include

To create an effective and professional billing document, make sure to include the following information:

- Business Information: Include your business name, contact information, and logo at the top of the document for easy identification.

- Client Details: Clearly list the customer’s name, address, phone number, and email to ensure there is no confusion about the recipient.

- Description of Services: Itemize the services provided, specifying the work done on the vehicle and any repairs or maintenance performed.

- Parts and Materials: Detail any parts or materials used during the service, along with their individual costs. This allows the customer to see where their money is going.

- Cost Breakdown: Include labor charges, materials costs, taxes, and any other fees. Make sure each cost is clear to avoid misunderstandings.

- Payment Terms: State the payment due date, methods of payment accepted, and any late fees if applicable.

- Service Date: Include the date when the service was performed to provide a clear timeline of when the work was completed.

Why This Information Matters

Including this essential information ensures that both the service provider and customer have a mutual understanding of the charges and services rendered. It also protects your business by providing a clear record in case of any disputes or questions. Accurate, itemized documentation demonstrates professionalism, which can encourage customer loyalty and repeat business.

By ensuring your documents are complete and transparent, you create a foundation of trust and efficiency that benefits both parties in the long run.

Free Tools for Creating Vehicle Service Billing Documents

There are several digital tools available that make it easy to create professional billing records without the need for expensive software. These tools provide templates and customization options to help service providers quickly generate accurate documents. Many of these solutions are available at no cost and offer user-friendly interfaces, making them ideal for small businesses or freelancers in the vehicle service industry.

Top Free Tools for Creating Billing Records

Here are some of the best free tools to help you create detailed and professional financial documents for your vehicle services:

- Google Docs: A simple and effective option for creating customized records. You can use pre-made templates or start from scratch, adjusting the format to your specific needs.

- Wave Accounting: A cloud-based solution that offers invoicing features as part of its free accounting software. It allows you to generate, customize, and send documents directly to clients.

- Zoho Invoice: A free tool that enables you to create and manage billing records. It includes useful features like automatic payment reminders and recurring billing options.

- Invoice Generator: An easy-to-use online tool where you can quickly create professional documents by filling in simple fields like item descriptions, costs, and taxes.

- PayPal Invoicing: If you’re already using PayPal for payments, their invoicing tool allows you to create, customize, and send documents directly through the platform.

Why Use These Tools?

Using these free tools saves time, reduces the risk of errors, and ensures your documents maintain a professional appearance. With many offering cloud storage, you can easily keep track of your financial records, access them from multiple devices, and share them securely with clients. These tools also provide customization options, so you can tailor each document to reflect your business branding and service details.

By leveraging free tools for generating billing documents, service providers can streamline their operations, reduce administrative costs, and enhance the overall client experience.

Key Features of a Good Billing Document

Creating an effective billing document requires careful attention to detail and functionality. A well-designed document ensures clarity for both the service provider and the client, reducing the chance of confusion or disputes. The right features not only enhance the document’s professional appearance but also help ensure that all essential information is presented in a clear, easy-to-read format.

Here are the key features that should be included in a well-constructed billing document:

| Feature | Description |

|---|---|

| Business Information | Include your company name, logo, contact details, and address for easy identification and professionalism. |

| Client Details | Make sure the customer’s name, address, and contact information are clearly listed for accurate communication. |

| Service Description | Provide a detailed description of the work performed, including parts used and any specific actions taken during the service. |

| Breakdown of Costs | List individual costs for labor, materials, and any additional fees to ensure transparency and avoid misunderstandings. |

| Payment Terms | Specify payment methods, due dates, and any late fees or discounts to set clear expectations for the client. |

| Service Date | Include the date when the service was completed for clear reference and to avoid confusion regarding payment timelines. |

These essential features not only provide a professional and organized appearance but also help avoid potential disputes. A good document clearly communicates all necessary details, making transactions smoother and more transparent for both parties.

How to Include Taxes on Vehicle Service Billing Documents

When creating a billing document for vehicle services, it is important to properly include taxes to ensure that all charges are accurately reflected. Tax rates can vary by region or service type, and failure to include the correct tax amount can result in legal issues or customer dissatisfaction. Properly adding taxes to the document helps maintain transparency and ensures compliance with local tax regulations.

Here are the key steps to correctly include taxes on your billing document:

| Step | Description |

|---|---|

| Determine the Tax Rate | Identify the applicable tax rate for your location or the specific service being provided. This may be a sales tax or service tax, depending on the jurisdiction. |

| Calculate the Tax Amount | Multiply the subtotal (total of services and parts) by the tax rate. For example, if the subtotal is $200 and the tax rate is 8%, the tax would be $16. |

| Include Tax Breakdown | Provide a clear breakdown of taxes in the billing document. This should be listed separately from the subtotal and show both the tax rate and the tax amount for transparency. |

| Display Total Amount | After calculating the taxes, add the tax amount to the subtotal to get the total amount due. The total should clearly reflect the sum of services, parts, and taxes. |

For example, if the total service charge is $200 and the tax rate is 8%, the tax amount would be $16, resulting in a total of $216. Ensuring that taxes are clearly stated in this manner helps avoid confusion for your clients and ensures compliance with applicable tax laws.

Accuracy in calculating and presenting taxes on your billing documents not only reflects professionalism but also prevents errors that could lead to financial discrepancies or regulatory issues. By following these steps, you can provide clear and accurate financial records that both you and your customers can rely on.

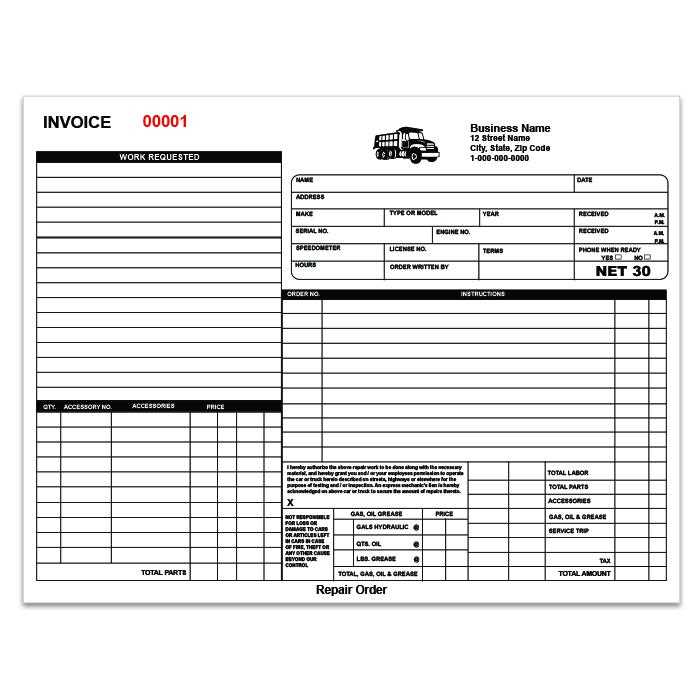

Organizing Vehicle Service Records with Billing Documents

Properly organizing service records is essential for maintaining a well-run business. Keeping accurate and detailed records helps service providers track completed work, manage finances, and ensure compliance with legal and tax regulations. By using billing documents, businesses can efficiently store and retrieve service details, making it easier to manage customer relationships and ensure that all transactions are properly documented.

To effectively organize service records using billing documents, it’s important to follow a consistent system. Here’s how you can structure and categorize your records:

| Category | Description |

|---|---|

| Customer Information | Store client contact details, including names, addresses, and phone numbers. This ensures easy access to customer data for future services or follow-ups. |

| Service History | Track every service performed, including descriptions, dates, and associated costs. This helps keep an organized log of the work done on each vehicle. |

| Payment Tracking | Record the amounts paid, outstanding balances, and payment methods. This ensures clear financial records and helps prevent issues with overdue payments. |

| Parts and Materials | Maintain a record of parts used for each service, including quantities, costs, and suppliers. This makes inventory management more efficient and helps control costs. |

| Tax and Legal Compliance | Ensure that each record includes applicable taxes and complies with local regulations. This is crucial for accurate tax reporting and avoiding legal issues. |

By organizing these categories effectively, you can create a comprehensive and easily navigable system that streamlines business operations. Maintaining a well-organized set of records allows you to quickly access past service details, track financial performance, and keep everything in order for future reference.

Consistency in organizing your service records will not only improve your workflow but also enhance customer satisfaction by ensuring accuracy and transparency in all transactions. Keeping well-structured records is a key component of managing a successful vehicle service business.

Choosing the Right Format for Billing Documents

Selecting the right format for your billing documents is crucial for ensuring clarity, professionalism, and ease of use. The format you choose determines how information is presented and how easily it can be accessed or processed by both you and your clients. Whether you prefer paper records, digital files, or a combination of both, each option has its advantages and considerations.

Here are some key factors to consider when choosing the right format for your billing documents:

- Ease of Access: Consider how easily you and your clients need to access the document. Digital files can be accessed on multiple devices, while paper documents may require physical storage and management.

- Customization Options: Some formats offer more flexibility in terms of design and content. Digital formats, like editable files, allow for easy customization, while printed forms are more rigid but can be quickly filled out manually.

- Record-Keeping: Think about how you will store and retrieve your records. Digital formats are easier to search and organize using cloud storage or accounting software, while paper records require more physical storage space and may be harder to retrieve in the future.

- Client Preferences: Understand your client’s preferred format for receiving documents. Some clients may prefer printed bills, while others may prefer digital copies for quicker processing and payments.

- Legal Compliance: Ensure that the format you choose meets any legal or regulatory requirements in your area. Some regions may have specific rules about how documents should be stored or shared.

When deciding between digital and paper formats, it’s important to balance convenience, security, and your clients’ needs. Both formats have their place, but digital documents tend to offer greater flexibility and efficiency, especially when it comes to storing and sharing records.

By carefully selecting the format that works best for your business, you can improve efficiency, enhance customer satisfaction, and ensure smooth transactions for all parties involved.

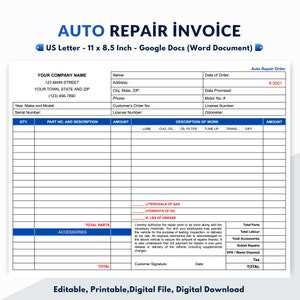

How to Calculate Labor and Parts Costs

Accurately calculating labor and parts costs is essential for generating an accurate billing document. These costs are often the largest components of the total amount due and must be clear and transparent for both the service provider and the customer. Understanding how to properly calculate and itemize labor charges and parts costs ensures that your documents are both fair and professional, while also protecting your business’s financial interests.

Here’s a step-by-step guide to calculating labor and parts costs for vehicle services:

| Category | Calculation Method | Example |

|---|---|---|

| Labor Costs | Multiply the hourly rate by the time spent on the service. If different technicians perform various tasks, calculate each task separately and sum the total labor charges. | Hourly Rate: $50 Time Spent: 3 hours Total Labor Cost: $150 |

| Parts Costs | For each part used, multiply the unit cost by the quantity purchased. Include any shipping or handling fees, if applicable. | Part 1: $30 (2 units) = $60 Part 2: $15 (1 unit) = $15 Total Parts Cost: $75 |

Once both labor and parts costs have been calculated, you can combine them to determine the total service cost. Be sure to break down these costs clearly in your document so that the customer can see exactly what they are being charged for.

Example: If the total labor cost is $150 and the parts cost is $75, the subtotal would be $225. Add any applicable taxes and fees to arrive at the final total.

Accurate calculations and transparency in billing not only help ensure customer trust but also protect your business from undercharging or overcharging. By following these steps, you can create clear, precise billing documents that reflect the true value of your services and materials.

Common Mistakes to Avoid in Billing Documents

Creating billing records may seem straightforward, but there are several common errors that can lead to confusion, delays in payment, or even legal issues. Ensuring that every document is accurate, clear, and professional is key to maintaining a good relationship with clients and avoiding misunderstandings. Identifying and avoiding these mistakes can save time, enhance trust, and streamline your business operations.

Key Mistakes to Watch Out For

| Mistake | Explanation |

|---|---|

| Missing Client Information | Not including the client’s full contact details, including their name, address, and phone number, can create confusion and lead to payment delays. |

| Incorrect Pricing | Using inaccurate rates for labor, parts, or services can result in discrepancies that might anger the customer or damage your credibility. |

| Omitting Tax Information | Failing to include applicable taxes or not showing them clearly can cause issues with compliance and potentially lead to legal fines. |

| Unclear Payment Terms | If the terms for payment, such as due dates, accepted payment methods, or late fees, are not specified, it can lead to confusion and missed payments. |

| Incomplete Descriptions | Failing to provide a clear and detailed description of the services performed or parts used makes the document seem unprofessional and can leave clients questioning the charges. |

How to Avoid These Mistakes

To avoid these common mistakes, ensure that every billing document you create is thorough, accurate, and easy to read. Double-check client details, pricing, tax rates, and payment terms before sending out any document. By keeping all the information clear and well-organized, you can avoid misunderstandings and reduce the chances of delayed payments.

Paying attention to these details will help you maintain professionalism and ensure smooth financial transactions for your business. Taking the time to avoid these mistakes demonstrates reliability and builds trust with your clients.

How to Send Billing Documents to Customers

Sending billing documents to customers in a timely and professional manner is a critical part of ensuring smooth transactions and fostering positive relationships. The way you deliver your documents can impact payment speeds, customer satisfaction, and even future business opportunities. It is essential to choose the right method for sending these documents and ensure that all relevant information is clear and accessible.

Methods for Sending Billing Documents

- Email: Sending a billing document via email is one of the most efficient ways to ensure quick delivery. Simply attach the document to an email and include a message summarizing the key details, such as the total amount due and the payment deadline.

- Postal Mail: For customers who prefer physical copies or when electronic communication is not possible, sending documents via postal mail can be a reliable option. Make sure to use a secure method of delivery, such as registered mail, for high-value transactions.

- Through an Online Payment Portal: If your business uses an online payment system, you can often send billing documents directly through the portal. This allows the customer to view and pay the bill in one seamless process.

- In Person: For smaller businesses or service providers who work closely with clients, delivering the billing document in person is another option. This allows you to immediately address any questions or concerns the customer may have.

Best Practices for Sending Billing Documents

- Confirm the Recipient’s Contact Information: Always ensure that the customer’s contact details, such as their email or mailing address, are up-to-date before sending the document.

- Provide Clear Instructions: Make sure the billing document is easy to understand and includes clear instructions on how to make the payment. Include any deadlines and accepted payment methods to avoid confusion.

- Follow Up: If payment is not received by the due date, send a polite reminder email or follow up with a phone call to ensure the customer is aware of the outstanding balance.

By choosing the right delivery method and following these best practices, you can streamline the payment process and ensure that customers have all the information they need to pay promptly. A clear and professional communication strategy will help you maintain good relationships and ensure your business operates smoothly.

Protecting Your Vehicle Service Business with Billing Documents

Properly managing billing documents is an essential part of safeguarding your business against financial disputes, fraud, and misunderstandings. Clear, detailed records not only help maintain smooth business operations but also provide a strong layer of protection in case of legal or financial issues. By using structured documents to track services, payments, and agreements, you can ensure both transparency and security for your business and clients.

Here are some ways in which billing documents can protect your business:

| Benefit | How It Protects Your Business |

|---|---|

| Clear Payment Terms | Including specific payment terms such as deadlines, interest rates for late payments, and accepted payment methods reduces the chances of disputes over payments. |

| Legal Documentation | Having a written record of the services performed, including parts used, labor hours, and agreed prices, can serve as crucial evidence in case of legal disputes. |

| Tax Compliance | Well-organized billing records help ensure that you comply with tax laws by keeping track of all income and expenses, making tax filing and auditing easier and more accurate. |

| Customer Accountability | Billing documents provide clients with a clear understanding of what they are being charged for, making it easier to resolve any disagreements over charges and enhancing accountability. |

| Protecting Financial Records | Consistent and accurate records of sales and transactions protect your business from financial mismanagement and can help track cash flow and profitability more effectively. |

By creating detailed and transparent billing documents for every transaction, you ensure that your business has a solid foundation for resolving potential issues. Whether it’s a disagreement over payment, tax audits, or legal action, having comprehensive records at your disposal will help protect your business and maintain professionalism.

Incorporating billing documents as part of your operational procedures not only enhances the customer experience but also serves as a shield for your business, providing clarity, security, and accountability across all transactions.

How to Track Payments with Billing Documents

Effective tracking of payments is essential to maintaining a healthy cash flow and ensuring the smooth operation of your business. By using well-organized billing documents, you can easily monitor outstanding balances, track when payments are made, and ensure that all transactions are properly recorded. This not only helps you stay on top of financial records but also reduces the risk of errors and late payments.

Steps to Track Payments Accurately

Here are some key steps to help you track payments effectively using your billing records:

- Assign a Unique Number to Each Document: Each billing document should have a unique identification number. This makes it easier to reference specific transactions and track the status of each payment.

- Include Payment Terms: Clearly outline the payment terms on the document, including the due date and accepted payment methods. This ensures both you and the customer understand when the payment is expected and how it should be made.

- Record Payment Details: When a payment is received, update the billing document with relevant details such as the payment amount, method (credit card, bank transfer, cash), and the date it was made.

- Mark the Document as Paid: Once payment has been received in full, mark the document as “paid” and note the date of payment. This helps you keep track of which accounts are settled and which are still pending.

- Regularly Review Outstanding Payments: Maintain a system to regularly review unpaid or overdue bills. By staying proactive, you can quickly follow up with customers and address any issues promptly.

Using Software to Streamline the Process

If you have many clients or need to handle numerous transactions, using accounting software or online billing platforms can significantly streamline the payment tracking process. These tools allow you to generate and send documents automatically, track payments in real-time, and keep accurate records without manual input. Many systems also send reminders for overdue payments, helping you stay on top of collections.

By staying organized and consistent in tracking payments, you can ensure your business maintains positive cash flow, minimize errors, and improve customer satisfaction by addressing payment issues swiftly and professionally.

Free Billing Documents vs Premium Options

When managing transactions, selecting the right type of billing record can greatly impact your workflow and the professionalism of your business. There are various options available, ranging from no-cost solutions to premium, feature-rich alternatives. Each has its advantages and disadvantages, and the right choice depends on the specific needs of your business. Understanding the differences between free and premium choices can help you make an informed decision about which one is best suited for your operations.

Advantages of Free Billing Documents

- Cost-Effective: The most obvious benefit is that these options come at no cost, making them ideal for small businesses or freelancers with a tight budget.

- Basic Functionality: Free solutions typically offer the basic tools needed to create and send documents, making them a good choice for businesses with simple needs.

- Ease of Use: Many free options are user-friendly and easy to navigate, which is helpful for those who want a quick, no-fuss solution.

- Good for Simple Transactions: If your transactions are straightforward and don’t require advanced customization or features, a free option can serve your needs well.

Drawbacks of Free Options

- Limited Features: Free tools often lack advanced capabilities, such as custom branding, automation, or detailed reporting, which might be necessary as your business grows.

- Less Customization: Many free solutions offer a one-size-fits-all approach, which may not meet the specific needs of your business or industry.

- Branding Limitations: Some free platforms include their branding on documents, which can make your business appear less professional.

Advantages of Premium Billing Solutions

- Advanced Features: Premium options typically come with advanced functionalities such as customizable designs, automation, and detailed reporting tools that can streamline your workflow.

- Customization: You can fully tailor your documents to reflect your brand’s identity, including logos, color schemes, and font choices, helping you maintain a consistent and professional appearance.

- Automation and Integration: Many premium solutions allow you to automate recurring transactions and integrate with other software, saving you time and reducing errors.

- Better Customer Support: Paid solutions often come with customer support, which can help resolve issues quickly and ensure a smooth experience.

Drawbacks of Premium Options

- Cost: Premium solutions come with a price tag, which might be an obstacle for small businesses just starting or those with limited budgets.

- Learning Curve: Some premium options can be more complex to use, requiring time and effort to learn and fully utilize all the features available.

Ultimately, the decision between free and premium billing solutions depends on the scale of your business, your need

Where to Find No-Cost Billing Documents

If you’re looking for simple and effective ways to generate billing documents for your services without spending any money, there are several online platforms that offer resources at no cost. These options are ideal for small businesses or individual service providers who need an efficient way to manage their financial records without a significant upfront investment. Below are some common places to find templates that suit your needs.

Popular Online Platforms

- Google Docs or Google Sheets: Google offers free, customizable templates for a variety of business documents, including those for tracking transactions and customer payments. You can easily modify them to fit your specific needs.

- Microsoft Office Online: Microsoft provides free versions of Word and Excel, which include basic templates that you can download and use. These templates are simple to customize and can be saved in different formats.

- Template Websites: Several websites specialize in offering free templates for various business needs, such as Template.net or Vertex42. These platforms offer easy-to-use options that can be customized according to your requirements.

- Open Source Tools: Websites like LibreOffice or OpenOffice provide open-source software that includes a range of free templates, including those for documenting transactions. These tools are perfect for users who prefer offline access.

- Freelance Platforms: Platforms like Fiverr or Upwork often have designers who offer free or low-cost customizable document templates, sometimes bundled with other business resources.

Additional Sources

- Accounting Software with Free Versions: Some accounting software providers, such as Wave or Zoho Invoice, offer free versions of their tools that include basic billing document templates and features for tracking payments.

- Government Websites: Some government websites, particularly in countries where small businesses are common, offer free resources to help entrepreneurs with business documentation, including sample transaction records.

- Online Marketplaces: Some e-commerce platforms, such as Shopify or Etsy, offer free downloadable resources that include billing documents for service providers and retailers.

By utilizing these resources, you can easily access free documents to create professional and clear records for your customers. Whether you’re looking for simple formats or slightly more complex designs, there are plenty of options available that cater to a wide range of business needs.