Free Appliance Repair Invoice Template for Easy Billing

Managing business transactions effectively requires clear and concise documentation. One of the most important tools for service providers is creating accurate records of work completed and payments due. By using a structured document, you can ensure professionalism and maintain organization in your financial dealings.

Efficient billing is not only about sending a request for payment but also ensuring that all details, including labor, materials, and additional charges, are properly accounted for. This approach helps both parties involved stay on the same page and prevents misunderstandings.

Personalizing your documents to fit your business needs can significantly save time and enhance workflow. With the right system in place, you can streamline the process, avoid errors, and focus more on delivering quality service to your clients.

How to Create an Appliance Repair Invoice

Creating a detailed document to track the services provided and the amount due is a crucial part of managing a business. This record helps both the service provider and the customer stay informed about the work completed, the costs involved, and the payment terms. Crafting this document requires careful attention to key details to ensure clarity and transparency.

Key Information to Include

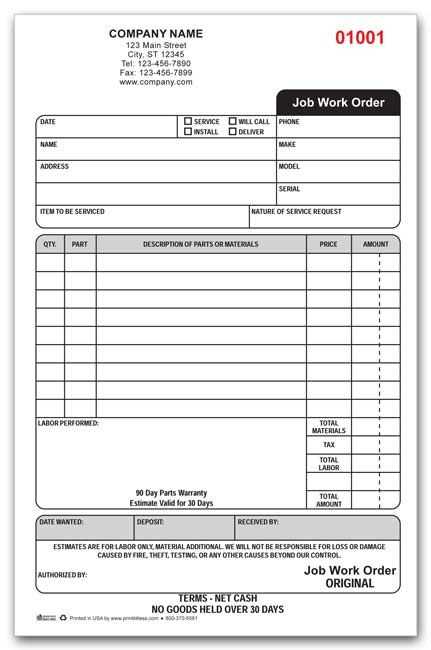

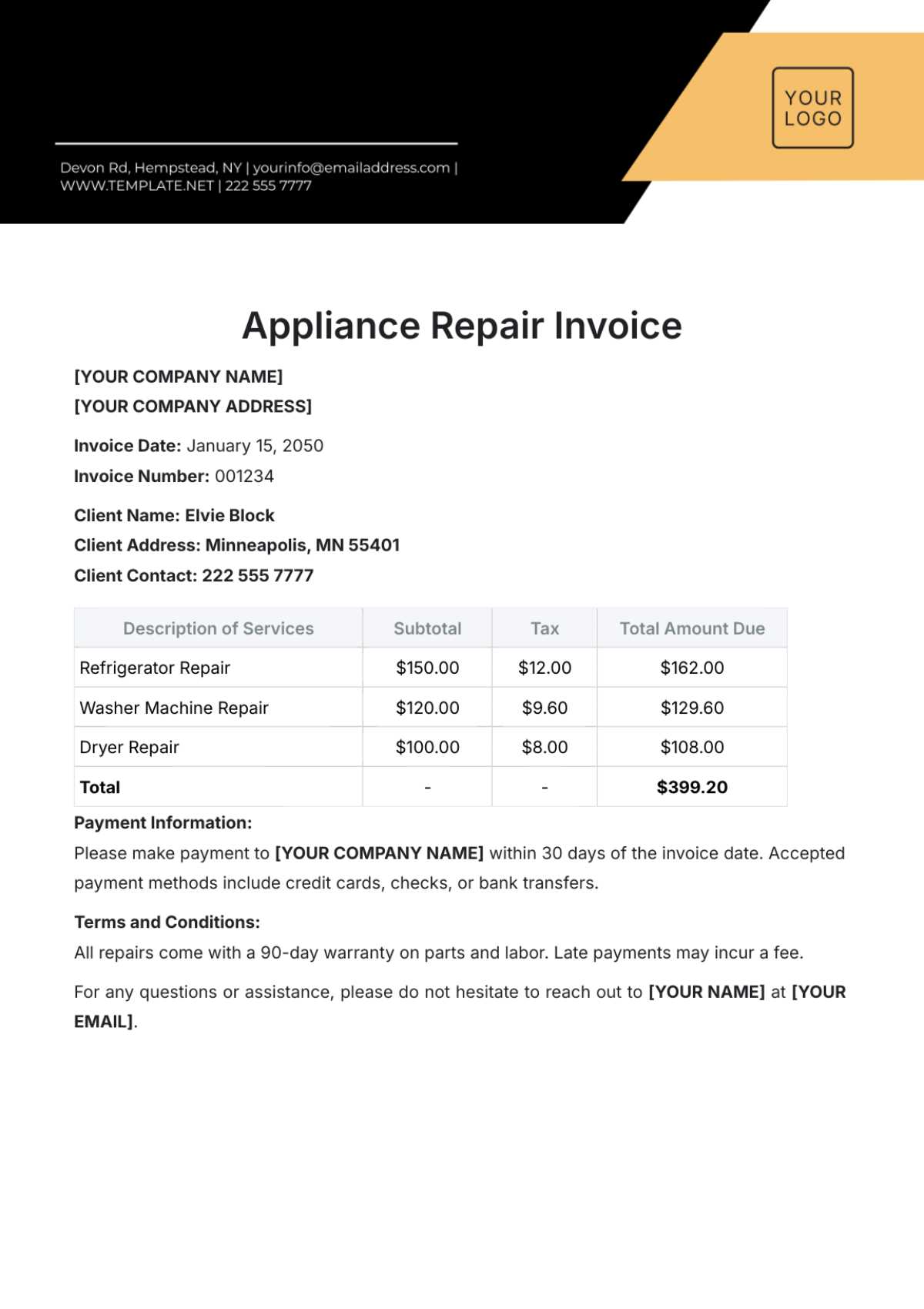

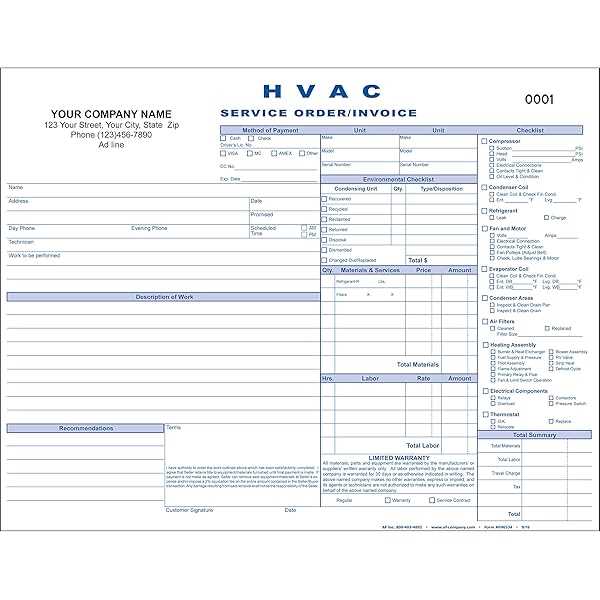

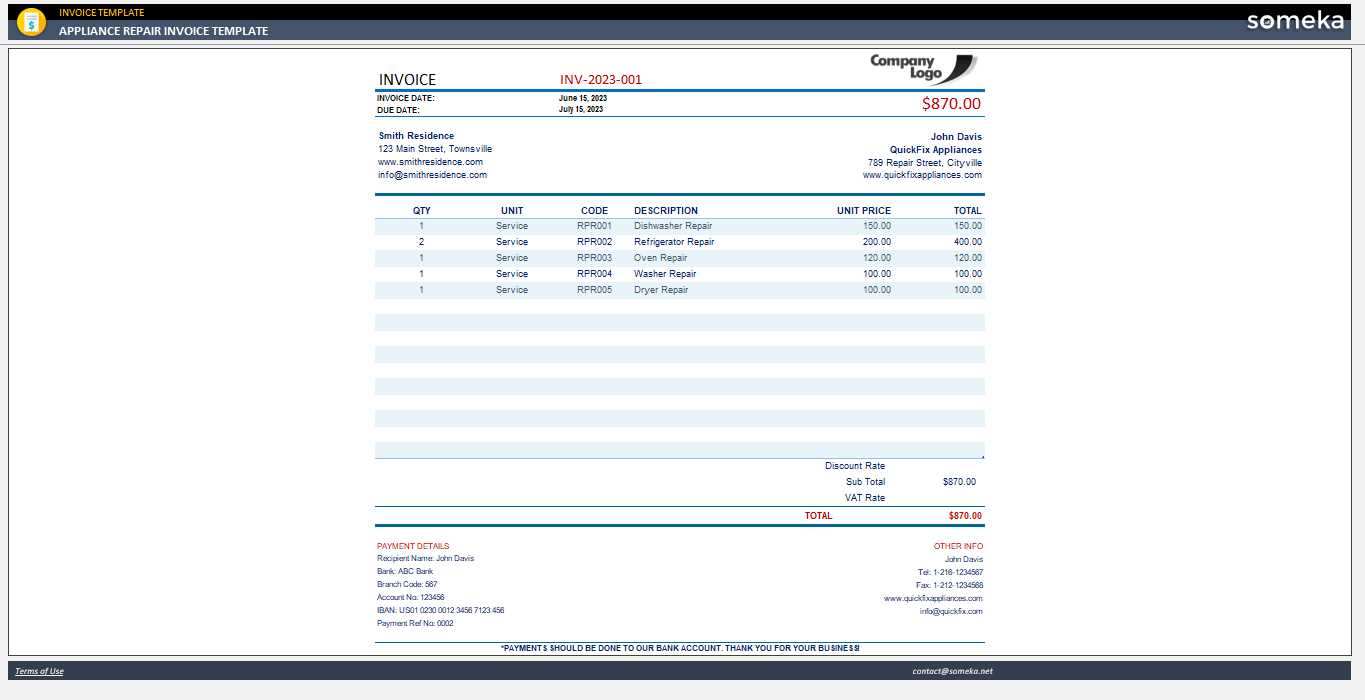

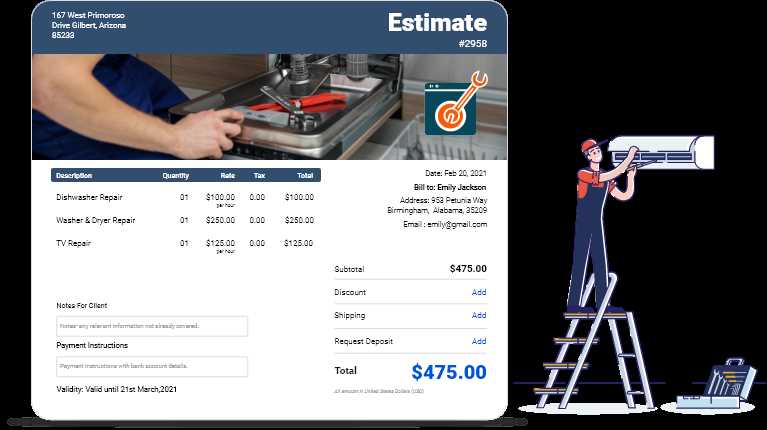

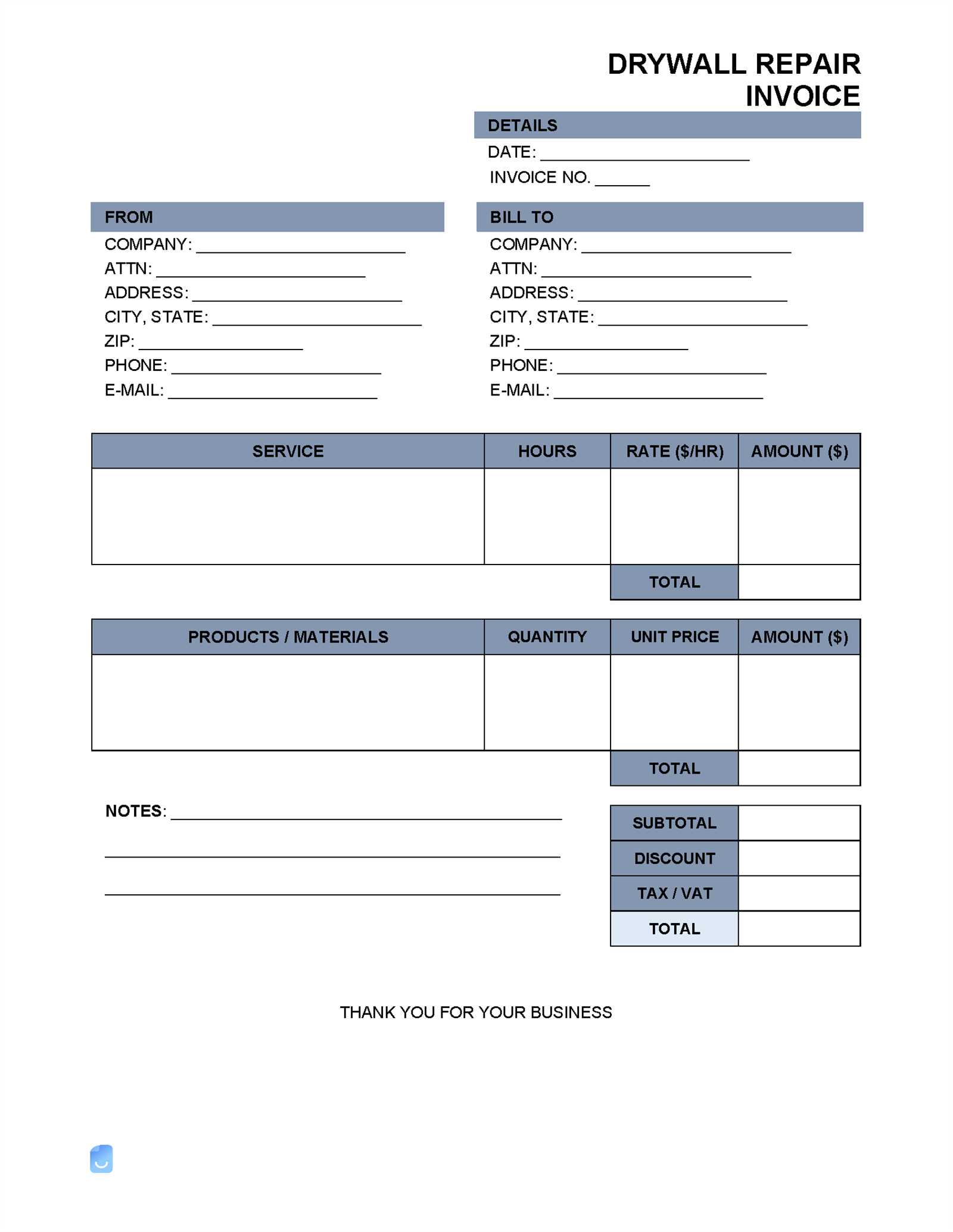

Start by listing the essential elements that should appear on your document. These include the date of service, the customer’s contact details, a description of the work performed, the cost of labor and materials, and the total amount due. By structuring the document clearly, you help prevent confusion and make it easier to process payments.

| Service Description | Cost |

|---|---|

| Labor | $50 |

| Materials | $30 |

| Total | $80 |

Organizing the Document

Once the key information is gathered, arrange it logically. Begin with the header, which includes your business name and contact information. Follow with the customer’s name, address, and contact details. Then, provide a breakdown of the work, as shown in the table. Conclude with the payment terms, including the due date and accepted payment methods.

Understanding the Importance of Invoices

Proper documentation of services provided and payments due is vital for maintaining clear financial records. These documents are not just for requesting payment; they also serve as legal proof of transactions and ensure that both parties are on the same page regarding what was delivered and the associated costs. A well-structured document promotes trust and professionalism in business relationships.

Ensuring Accuracy and Clarity

By creating a thorough and clear record, you reduce the likelihood of misunderstandings or disputes. Both the service provider and the client can refer to this document as a point of reference, ensuring that all terms and conditions are understood. This clarity is key to building strong, long-term relationships with customers.

Streamlining Financial Tracking

These documents also play a critical role in managing finances. They help track payments, monitor outstanding balances, and simplify accounting processes. With a proper system in place, keeping track of income and expenses becomes much more manageable, which is essential for business growth and sustainability.

Benefits of Using a Template

Utilizing pre-designed formats for financial records offers numerous advantages for service providers. These ready-to-use structures save time, reduce errors, and maintain consistency, ensuring a more professional approach to documenting business transactions. With a structured document, there is less room for mistakes, and it becomes easier to manage multiple clients and services.

Time Efficiency and Consistency

One of the most significant benefits is the amount of time saved. Instead of creating a new document from scratch each time, you can quickly fill in the necessary details. This allows for consistency in your records, making it easier to track previous work and payments. Over time, this efficiency can result in improved productivity and smoother operations.

Professional Appearance and Accuracy

Using a structured format also enhances the professional appearance of your business. A polished and standardized document reassures clients that you are organized and reliable. Furthermore, having all the necessary fields in place helps ensure that no critical details are missed, leading to more accurate and complete records.

Key Elements of an Invoice

To create a comprehensive and effective document, it’s important to include all the necessary information. This ensures transparency between both parties and helps prevent confusion. The essential components should cover details about the work performed, the amount due, and payment terms, allowing for smooth transactions and proper record-keeping.

Service Details and Costs

Clearly outlining the services rendered and the associated costs is crucial. This section should provide a breakdown of labor, materials, and any other charges. By specifying each aspect in detail, you help your client understand exactly what they are paying for, which reduces the likelihood of disputes.

Payment Terms and Deadlines

Payment terms outline when the client is expected to make payment, along with any penalties or discounts for early or late payments. Including this information ensures both parties are aware of the expectations, preventing delays and maintaining a professional relationship. Additionally, specifying the due date helps manage cash flow efficiently.

Essential Features of a Repair Invoice

Creating a clear and detailed document for billing is crucial to maintaining professionalism in business. To ensure accuracy and clarity, specific elements must be included. These features allow both the service provider and the client to understand exactly what is being charged, when payments are due, and what was provided in the service.

Contact Information and Dates

It is essential to include both the service provider’s and the customer’s contact details. This information ensures that the document can be easily identified and tracked. Additionally, the date of the service and the date the document is issued should be clearly stated, as these details help manage timelines and payment schedules.

Breakdown of Charges

One of the most important features is a detailed breakdown of charges. This includes labor costs, materials, and any additional fees. Providing this breakdown helps the client see exactly what they are being charged for and ensures that no confusion arises regarding the pricing structure.

Choosing the Right Template for Your Business

Selecting the right format for your business documents is key to maintaining professionalism and organization. A well-structured format can help streamline processes, reduce errors, and ensure that all necessary information is included. The right structure can also improve communication with clients and enhance overall efficiency.

Customizing for Your Needs

Every business has its own requirements, so it’s important to choose a format that fits your specific needs. Consider the type of services you offer, the typical clients you work with, and the information you need to include. Customizing a structure allows you to focus on the most relevant details while still maintaining a professional appearance.

Ensuring Simplicity and Clarity

While customization is important, it’s equally essential to keep the format simple and easy to understand. A cluttered or overly complex document can lead to confusion. Choose a structure that is clean, with clear sections for each detail, so both you and your clients can easily navigate the content.

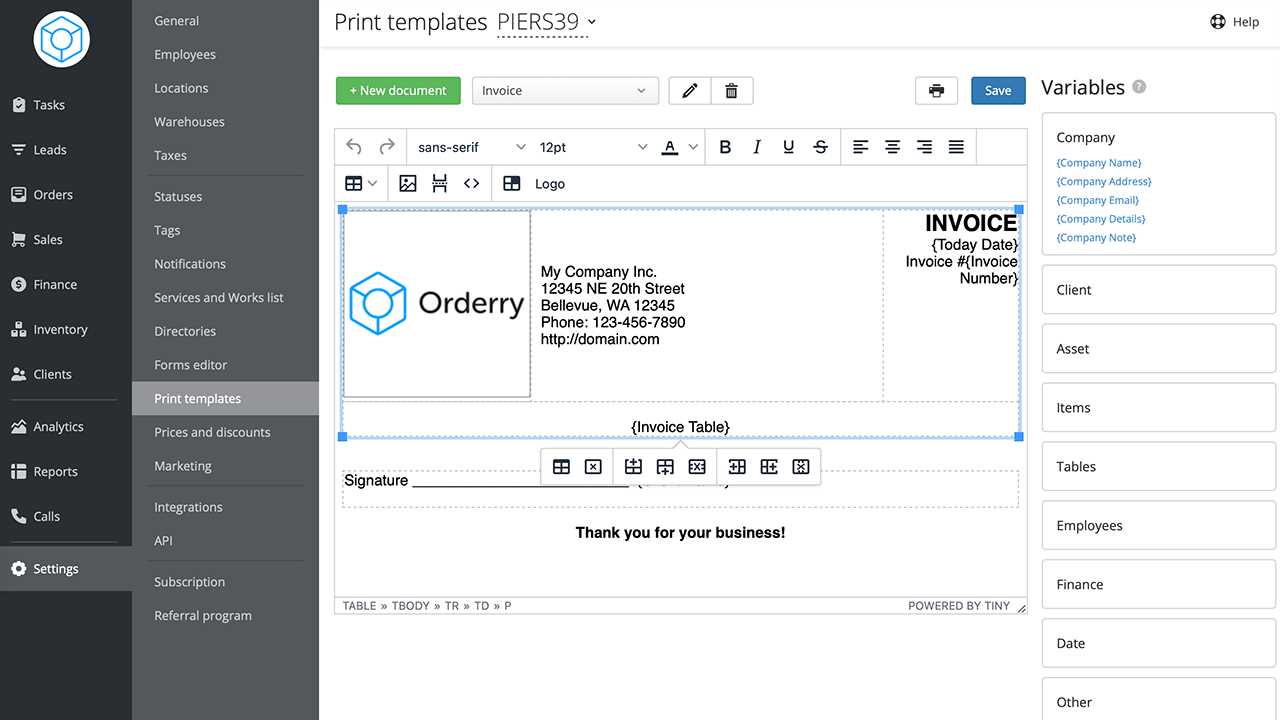

Customizing Your Invoice Template

Tailoring your document format is essential for ensuring it meets the unique needs of your business. A customized structure not only reflects your brand but also enhances clarity for both you and your clients. By adjusting specific elements, you can create a more personalized and efficient way to manage financial records.

Personalizing the Design

Customizing the design of your document can create a more professional and branded appearance. You can adjust the following aspects:

- Logo and Branding: Add your business logo and colors to ensure consistency with your other business materials.

- Font and Layout: Choose fonts and layout styles that are easy to read and professional, while aligning with your company’s image.

- Headings and Sections: Modify the headings and sections to suit the types of services you provide, making the document more relevant to your business operations.

Adjusting Content for Your Services

Depending on the nature of the work you offer, you may need to make specific adjustments to the sections within the document:

- Service Descriptions: Add or modify fields to specify the exact services provided, ensuring that your clients understand what is being charged.

- Payment Terms: Tailor the payment options and deadlines to fit your typical agreement with clients.

- Additional Charges: Include any potential additional charges, such as travel fees or urgent service premiums, that may apply to your work.

How to Add Service Details

Incorporating precise service information into your billing document is vital for transparency and clarity. By including all necessary details, you ensure that your clients fully understand what they are being charged for, which helps prevent misunderstandings and promotes professionalism. This section outlines the key components to include when documenting the services provided.

Essential Information to Include

There are specific details that should always be included to ensure the client has a full understanding of the services offered:

- Description of Services: Clearly outline the tasks completed, whether they are simple fixes or more complex tasks. This helps clients understand the scope of the work done.

- Service Duration: Include the time spent on each task, providing clarity on how long the job took and justifying labor charges.

- Materials Used: If any materials or parts were provided during the service, list them with their individual prices to show exactly what was supplied.

- Service Date: Always record the date of service to keep a timeline of the work completed and to help both parties keep track of when the work was done.

Organizing the Information for Clarity

To ensure the details are clear and easily readable, it’s important to organize the content in an easy-to-follow format:

- Break Down Tasks: If multiple tasks were completed, separate them into individual line items for each service provided. This will help your client review the information more efficiently.

- Use Clear Headers: Label each section (e.g., “Labor Charges”, “Materials”, etc.) to differentiate between the various types of services or charges.

- Provide Clear Pricing: Ensure each item listed is accompanied by the correct price and any applicable tax, so the client can clearly see the breakdown of the total amount due.

Calculating Costs and Adding Taxes

Accurately calculating the total cost for services rendered is essential for both business owners and clients. This process involves summing up the costs of labor, materials, and other fees, while also considering applicable taxes. It is important to ensure all figures are clearly outlined to avoid any confusion and maintain transparency.

Breaking Down the Costs

To accurately determine the amount to charge your clients, start by clearly identifying the various cost elements:

- Labor Charges: Calculate the time spent on the job and multiply it by your hourly rate or fixed charge.

- Materials: Include the cost of any parts or supplies provided during the service, ensuring each item is priced correctly.

- Other Fees: If applicable, add any additional costs for travel, setup, or disposal services that were part of the agreement.

Adding Taxes to the Total

Taxes are an important aspect of the final amount your client owes. Depending on your location, different tax rates may apply:

- Sales Tax: Check the local tax rate for goods and services provided in your area. Apply this percentage to the total amount before tax.

- Tax Calculation: After adding up the total costs, multiply the subtotal by the applicable tax rate to calculate the tax amount.

- Final Amount: Add the tax to the subtotal, providing the final amount due from the client.

Legal Considerations for Repair Invoices

When preparing documentation for services rendered, it is important to understand the legal aspects that ensure your documents hold up in case of disputes. Properly formatted records protect both service providers and clients, helping to prevent potential legal issues. Following the correct procedures for creating and managing payment records can save time, money, and potential lawsuits.

Essential Legal Elements to Include

To ensure compliance with regulations, there are several critical components that need to be part of any service-related documentation:

- Clear Terms of Service: Specify the agreement details, such as the scope of work, pricing, and expected delivery. This helps avoid misunderstandings later.

- Service Date and Location: Including these details confirms when and where the work was performed, which is important for both parties in case of discrepancies.

- Customer Identification: Always include the full name and contact information of the customer. This is necessary for proper record-keeping and communication.

- Legal Notices: In some regions, businesses must include specific terms, such as the right to charge for late payments or the inclusion of applicable taxes.

Managing Disputes and Liabilities

Understanding how to manage disagreements regarding charges or services is also crucial. Here are some tips for minimizing legal risks:

- Documenting Changes: If any changes or adjustments are made during the service process, document them promptly. This ensures both parties are aware and in agreement.

- Late Payment Clauses: Clearly state any penalties or interest rates for overdue payments to avoid complications should the customer delay payment.

- Dispute Resolution: It’s wise to specify a method for resolving conflicts, such as through mediation or arbitration, which can prevent court involvement.

Best Practices for Invoice Design

Creating an effective payment document is crucial for smooth transactions and professional relationships with clients. A well-designed document not only makes the payment process easier but also ensures clarity, accuracy, and legal compliance. It should be visually appealing, organized, and easy to read, providing all necessary details without overwhelming the recipient.

Key Elements to Consider

When designing a service record, there are several factors to keep in mind to ensure it is functional and professional:

- Clarity: Ensure the layout is clean and straightforward. Use headings and bullet points to break down information into easily digestible sections.

- Legible Fonts: Choose clear, easy-to-read fonts and maintain consistency throughout the document to enhance readability.

- Color Scheme: Use colors that reflect your business’s brand while maintaining readability. Avoid overly bright or harsh colors that can make the document difficult to navigate.

- Organization: Information such as the client’s details, services rendered, pricing, and payment terms should be logically structured, allowing for quick review.

Additional Tips for Professional Design

Here are some extra suggestions to enhance the professionalism of your document:

- Branding: Include your logo and contact information at the top of the page to ensure the document reflects your business identity.

- Space for Notes: Provide space for additional remarks or terms that might be specific to each client or service provided.

- Footer Information: A footer can be used to include terms of service, payment instructions, or other necessary legal notes.

- Consistency: Maintain consistent spacing and formatting across all sections of the document to create a cohesive and professional appearance.

Organizing Invoice Records for Efficiency

Proper organization of payment documents is essential for maintaining smooth financial operations. By ensuring that all records are clearly arranged and easily accessible, businesses can streamline their accounting processes, reduce errors, and improve overall efficiency. Effective record-keeping helps track payments, monitor outstanding balances, and generate reports when needed.

Best Practices for Organizing Records

Here are several strategies for keeping your records organized and ensuring ease of access:

- Digital Storage: Use a cloud-based storage system or accounting software to keep all documents in one place, making it easy to retrieve and manage them.

- Labeling and Categorization: Properly label and categorize each document according to the client, service date, and status (paid, pending, overdue). This will help you locate them quickly.

- Consistent Naming Conventions: Use consistent naming conventions for each document. For example, “ClientName_ServiceDate” can help ensure you can identify the records at a glance.

- Archiving Older Records: Periodically archive older documents that are no longer needed for day-to-day operations. This prevents clutter and makes it easier to find recent records.

Streamlining the Process

In addition to organizing, automating certain aspects of record-keeping can save time and effort:

- Automated Reminders: Set up automated reminders for outstanding balances or upcoming payments, reducing manual tracking.

- Custom Reports: Generate custom reports periodically to review your financial status, helping you make informed decisions.

- Integration with Accounting Tools: Integrate your document management system with accounting software for seamless tracking of payments and services.

Tracking Payments and Managing Due Dates

Efficiently tracking payments and managing due dates is crucial for maintaining cash flow and ensuring timely compensation for services rendered. Staying on top of deadlines and monitoring payments helps businesses avoid overdue balances and maintain positive client relationships. Proper tracking can also aid in identifying patterns, assessing financial health, and planning for future transactions.

Effective Payment Tracking Techniques

To effectively monitor payments and manage due dates, consider these practices:

- Centralized Record-Keeping: Keep a centralized system where all payment information is stored. This can include the status of payments (paid, pending, overdue) and relevant dates.

- Payment Reminders: Set up automated notifications to remind clients of approaching due dates, helping to avoid late payments and misunderstandings.

- Detailed Payment History: Maintain a detailed history for each transaction, including the date of payment, amount, and any adjustments made. This provides transparency and helps resolve disputes.

Managing Due Dates Efficiently

Managing due dates is essential to ensure timely payments and reduce the risk of overdue amounts. Here are some tips:

- Clear Terms and Deadlines: Clearly define payment terms and due dates in all documents to ensure clients understand the expectations. This reduces confusion and the likelihood of missed deadlines.

- Incentives for Early Payments: Offering discounts for early payments can encourage clients to pay before the due date, improving cash flow.

- Flexible Payment Options: Providing multiple payment options, such as credit cards, bank transfers, or digital payments, can make it easier for clients to meet deadlines.

Common Mistakes to Avoid in Invoicing

Properly managing billing and payment documentation is key to maintaining a smooth financial operation. However, several common errors can arise when preparing and sending such documents. Avoiding these mistakes can help prevent delays, misunderstandings, and disputes, ensuring that businesses get paid on time and maintain good client relations.

One of the most frequent mistakes is failing to include accurate and complete information. Omitting essential details like the service description, date, or payment terms can lead to confusion and slow down the payment process. Another common issue is unclear payment instructions. If clients don’t know how or when to pay, it increases the chances of overdue amounts.

Additionally, overlooking the importance of timely submission can cause unnecessary delays. Sending documents too late may lead to extended payment cycles or missed deadlines. Similarly, miscalculating amounts or taxes can create issues, requiring corrections that could delay processing and cause frustration for both parties.

How to Send Your Invoice to Clients

Delivering billing documents to clients is a crucial step in ensuring timely payment. The method you choose to send these documents can affect how quickly they are processed. Selecting the right communication channel, formatting the document correctly, and ensuring clarity in the details are all essential to a smooth transaction.

One effective way to send billing records is through email. Digital delivery is quick, efficient, and allows for easy tracking. When emailing the document, ensure that the file is in a widely accessible format, such as PDF, to avoid any compatibility issues. Including a clear subject line and a brief message explaining the attached document can also improve clarity and prompt attention.

For clients who prefer physical copies, sending a printed version via postal service may be necessary. In this case, double-check the address and use a reliable delivery service to avoid delays. Make sure that the physical copy is clear, legible, and properly formatted, as any mistakes can cause confusion or payment delays.

Lastly, consider providing clients with multiple payment options in your document to make the process more convenient. Clearly state payment methods, due dates, and any relevant terms to avoid misunderstandings and encourage timely payment.