Download and Customize Your Form Invoice Template for Easy Billing

In business, creating clear, professional documents for transactions is crucial. These documents not only ensure accurate record-keeping but also help establish trust with clients. Whether you’re an independent contractor or running a larger company, having a pre-designed structure for such paperwork can save valuable time and reduce errors.

Efficient design and organization are key when it comes to crafting such essential papers. Using a well-organized layout that includes all necessary information can simplify the process and enhance your professionalism. Tailoring these structures to suit your business needs can improve overall workflow and ensure that every detail is covered.

By utilizing a flexible, customizable structure, you gain the ability to present consistent, accurate records for every transaction, making it easier to track payments and manage finances effectively.

What is a Billing Document Structure

A billing document structure is a pre-designed format used to outline the details of a transaction between a business and its clients. It typically includes essential information such as the services or products provided, the amount due, payment terms, and contact details. The purpose of using such a structure is to ensure clarity and accuracy in communication, making it easier for both parties to understand the terms of the transaction.

Rather than creating this paperwork from scratch each time, businesses often rely on customizable designs that allow for quick adjustments. This approach not only saves time but also helps maintain consistency in appearance and content across different transactions.

Customizable structures enable professionals to add or remove sections depending on their specific needs, ensuring that all necessary details are included. By utilizing a structured format, businesses can effectively manage their financial records and streamline their workflow.

Benefits of Using Billing Document Structures

Using pre-designed structures for transaction records offers several advantages, particularly for businesses looking to streamline their financial processes. These ready-made formats eliminate the need to create each record from scratch, saving time and reducing the likelihood of errors. With everything laid out in a clear, consistent manner, managing finances becomes much more efficient.

Time Efficiency and Consistency

By adopting a structured layout, businesses can generate documents quickly, ensuring that each transaction is recorded promptly. This consistency in format also enhances professionalism and helps maintain a cohesive image across all client communications. Whether it’s a small enterprise or a larger organization, time is valuable, and using these predefined designs helps to optimize workflow.

Reduced Risk of Errors

When you work with a standardized framework, the chances of missing critical details are greatly minimized. By following a set format, the risk of overlooking important information, such as payment terms or service descriptions, is lowered. This reduces potential disputes with clients and ensures smoother business operations.

Overall, using these structures helps create a more organized and efficient system for managing transactions, which benefits both businesses and their customers in the long run.

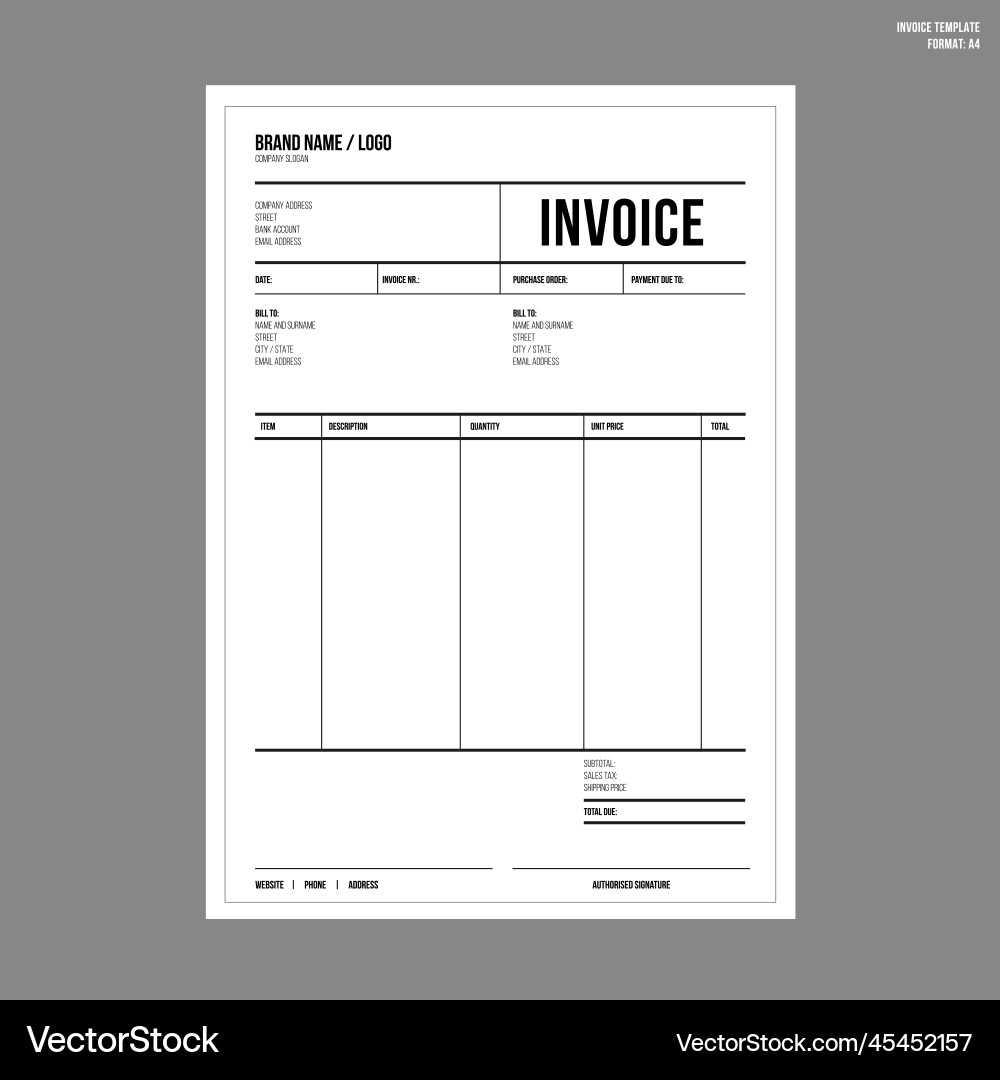

How to Create a Custom Billing Document

Creating a personalized billing document involves more than just filling in basic details. It’s about structuring the layout to suit your business needs while ensuring that all relevant information is included. A custom design allows you to tailor every section, from client details to payment instructions, making it easier to communicate terms and keep accurate records.

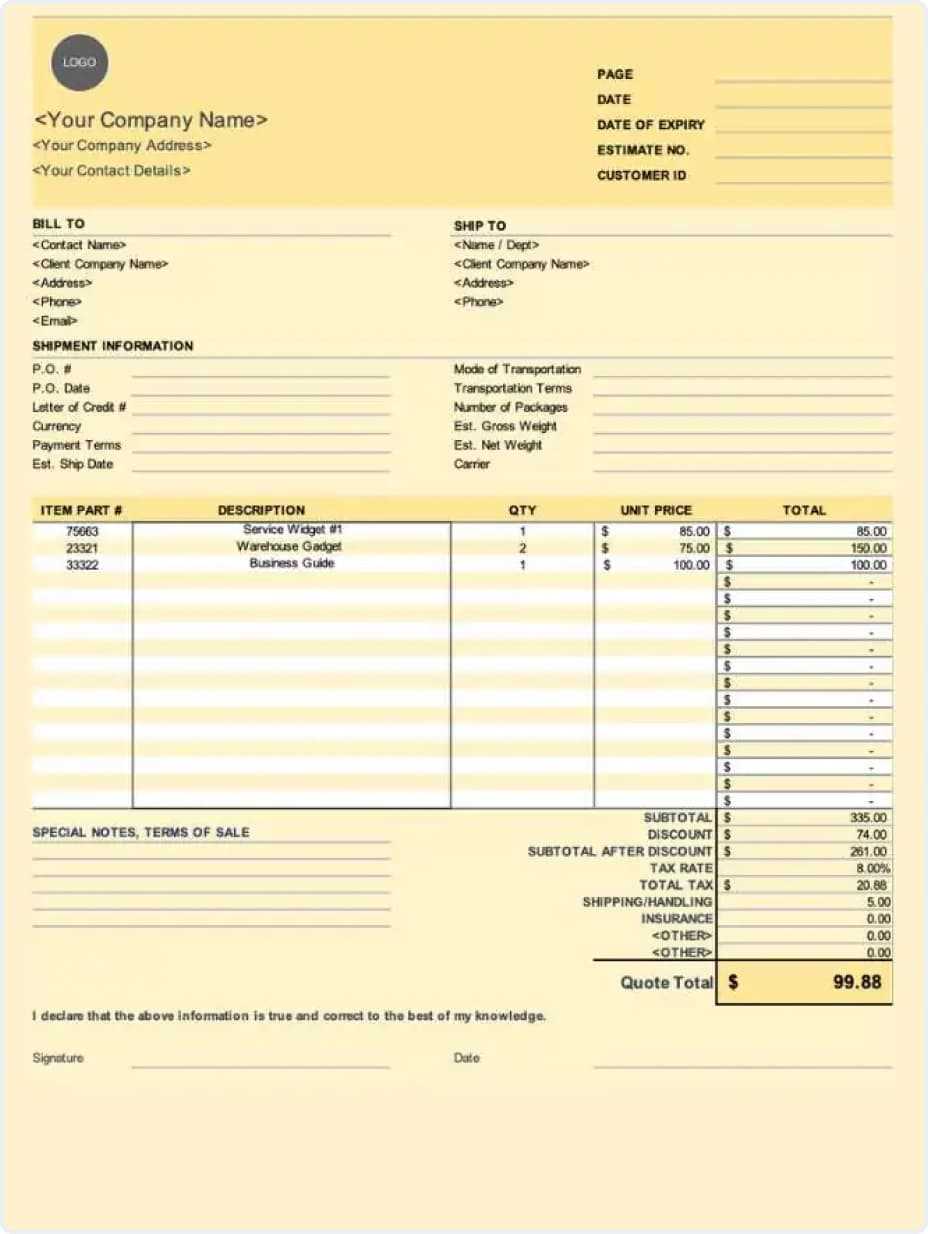

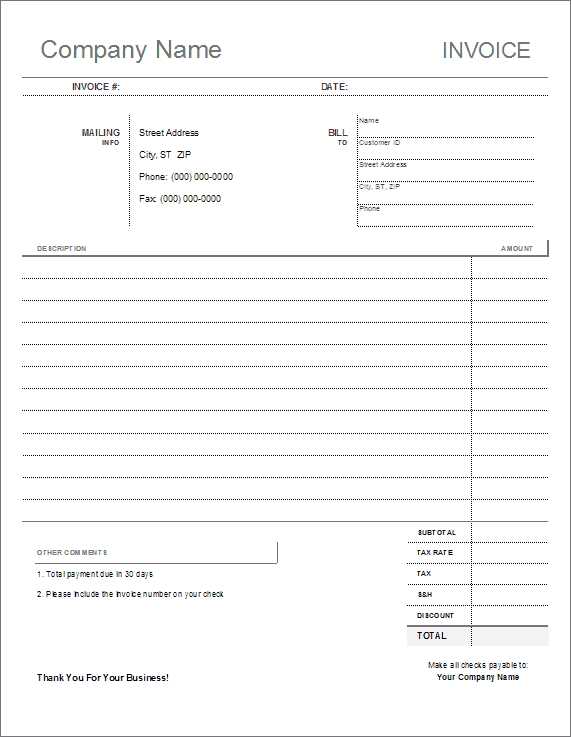

Step 1: Choose Essential Sections

Start by identifying the key elements that should be included in your document. These may vary depending on the type of business you run, but the most common sections are:

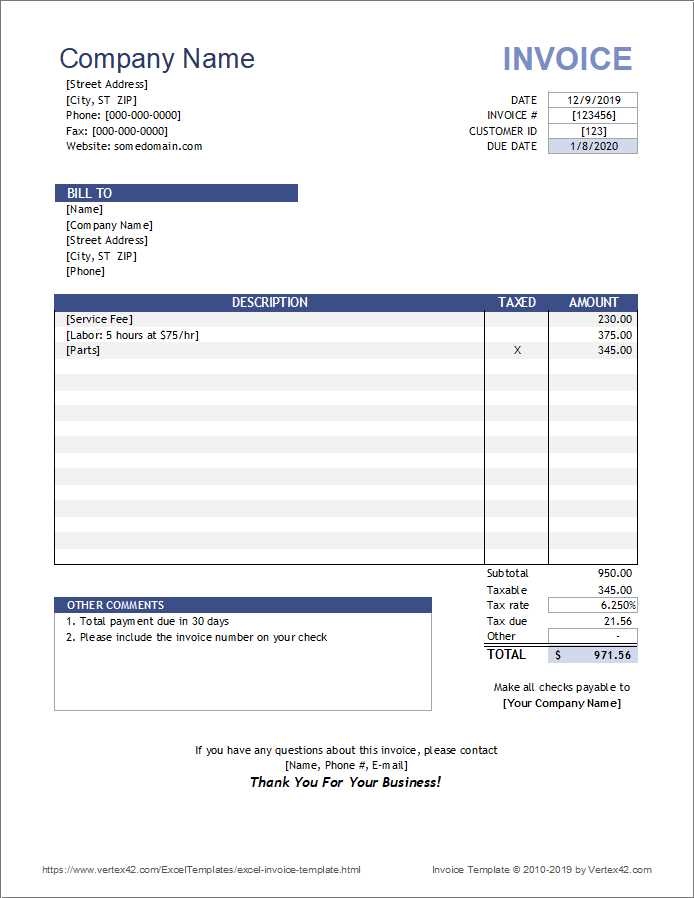

| Section | Description |

|---|---|

| Client Information | Include the client’s name, address, and contact details. |

| Service/Product Description | Describe the products or services provided, including quantities and rates. |

| Payment Terms | Specify the due date and any late payment penalties. |

| Total Amount Due | Clearly state the total amount that the client owes. |

Step 2: Customize the Layout

Once you’ve determined the essential sections, you can begin to customize the layout. Adjust the positioning of each section to ensure readability and logical flow. Make sure there is enough space between the different elements so the document looks clean and organized. Add your business logo and contact details at the top to personalize the layout further.

By following these steps, you can create a functional and professional document tailored to your needs, ensuring clarity in every transaction.

Key Elements of a Good Billing Document

For any business transaction, clear and complete documentation is essential. A well-structured record helps prevent misunderstandings and ensures smooth communication between the business and its clients. The document should provide all necessary details in an easy-to-read format, leaving no room for ambiguity. Each part of the document should serve a specific purpose and contribute to the overall clarity of the transaction.

Client Information: It’s crucial to include the client’s full name, address, and contact details. This ensures that both parties are on the same page regarding who is responsible for the payment.

Description of Products or Services: Clearly outline the items or services provided, including quantities, unit prices, and a brief description. This not only helps clients understand exactly what they’re being charged for but also facilitates smooth record-keeping for the business.

Payment Terms: Specify when the payment is due and any late fees or penalties that might apply if the payment isn’t made on time. Clear payment terms help manage client expectations and reduce potential disputes.

Total Amount Due: Always display the total amount owed in a clear and prominent place. This section should be easy to find and understand, with all applicable taxes and discounts included in the final total.

Having these key elements in place ensures that your billing records are professional, accurate, and easy for both you and your clients to reference.

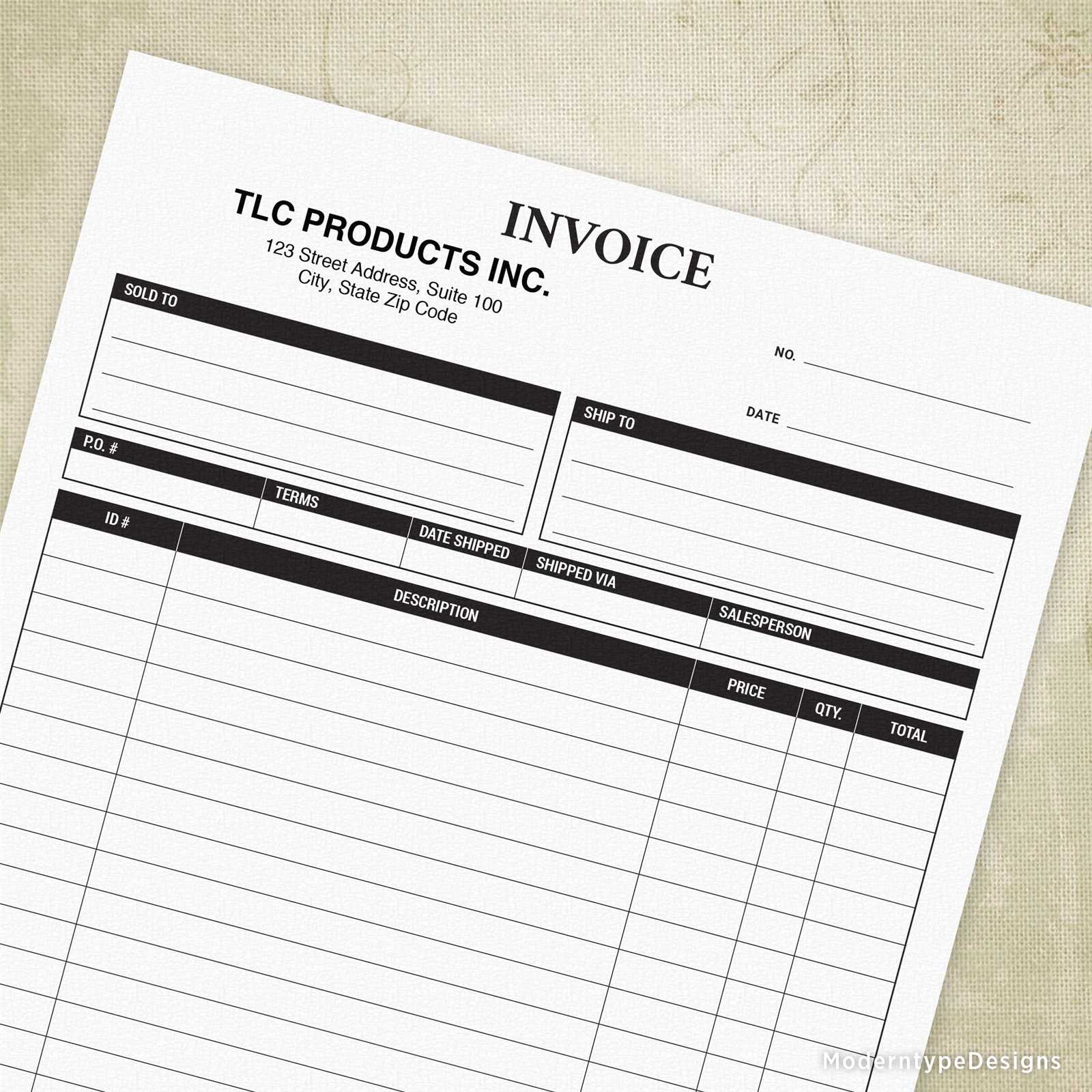

Choosing the Right Billing Document Layout

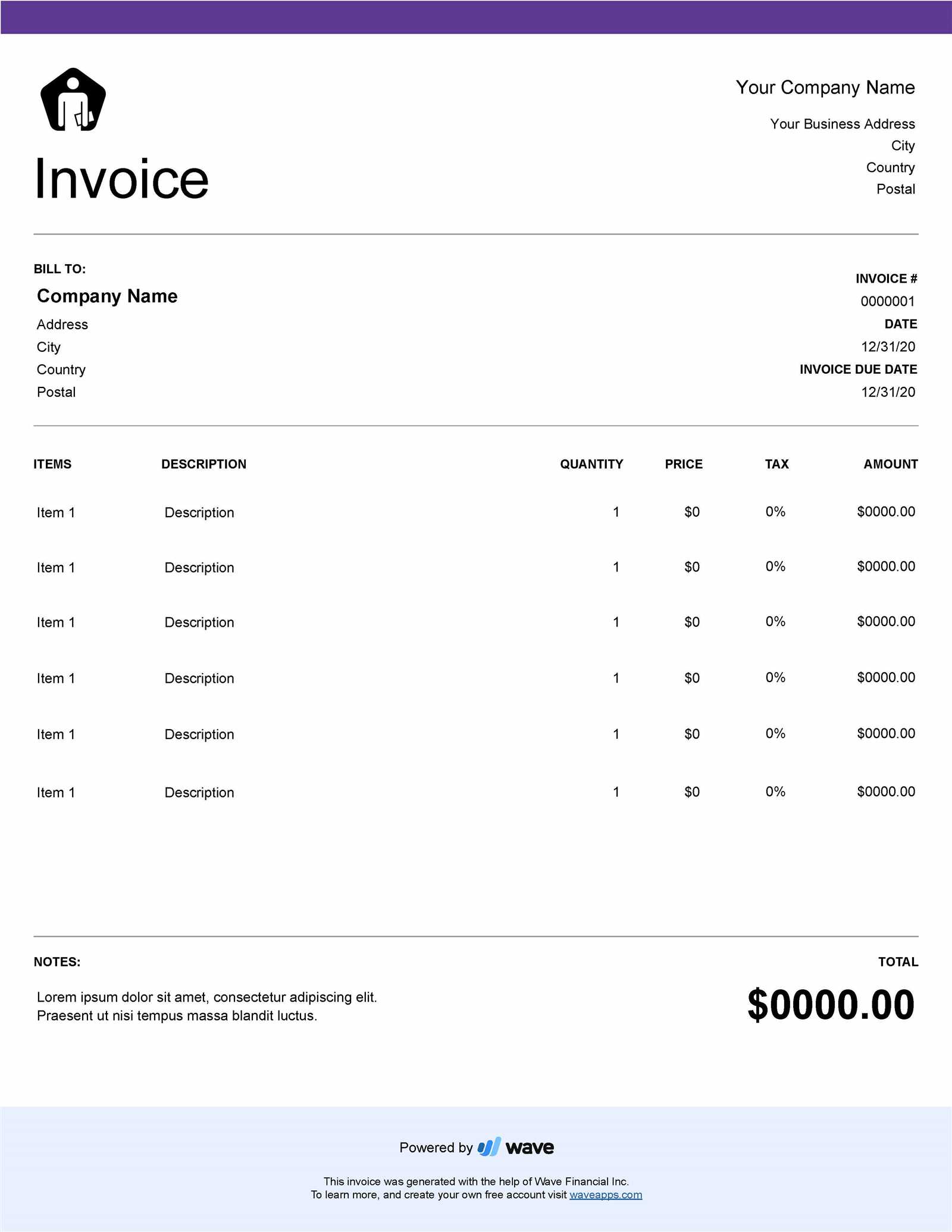

Selecting the right layout for your transaction records is a crucial step in ensuring clarity and professionalism. The layout should align with your business type, helping you present information in an organized and easy-to-understand manner. A well-chosen structure can enhance your brand image and improve communication with clients, making your financial processes smoother.

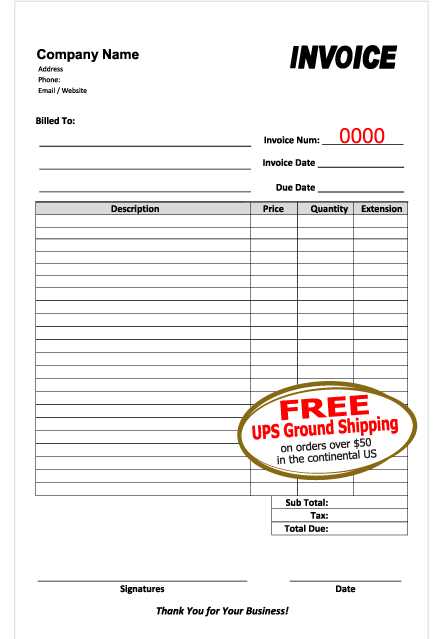

Consider Your Business Needs

The first step in choosing the right design is understanding the specific needs of your business. If you offer multiple products or services, you may require a more detailed structure that allows space for descriptions, quantities, and prices. For smaller businesses or freelancers, a simpler layout might be sufficient. Ensure that the design reflects the scale and complexity of your operations.

Look for Flexibility and Customization

When selecting a layout, choose one that offers flexibility. You should be able to modify key sections such as payment terms, service descriptions, or tax rates. A customizable structure ensures that you can adjust the document to suit different clients or projects. Look for options that allow you to add your company logo, contact information, and any branding elements to maintain a consistent and professional look.

Ultimately, the right design should make your billing process efficient, professional, and aligned with your business goals.

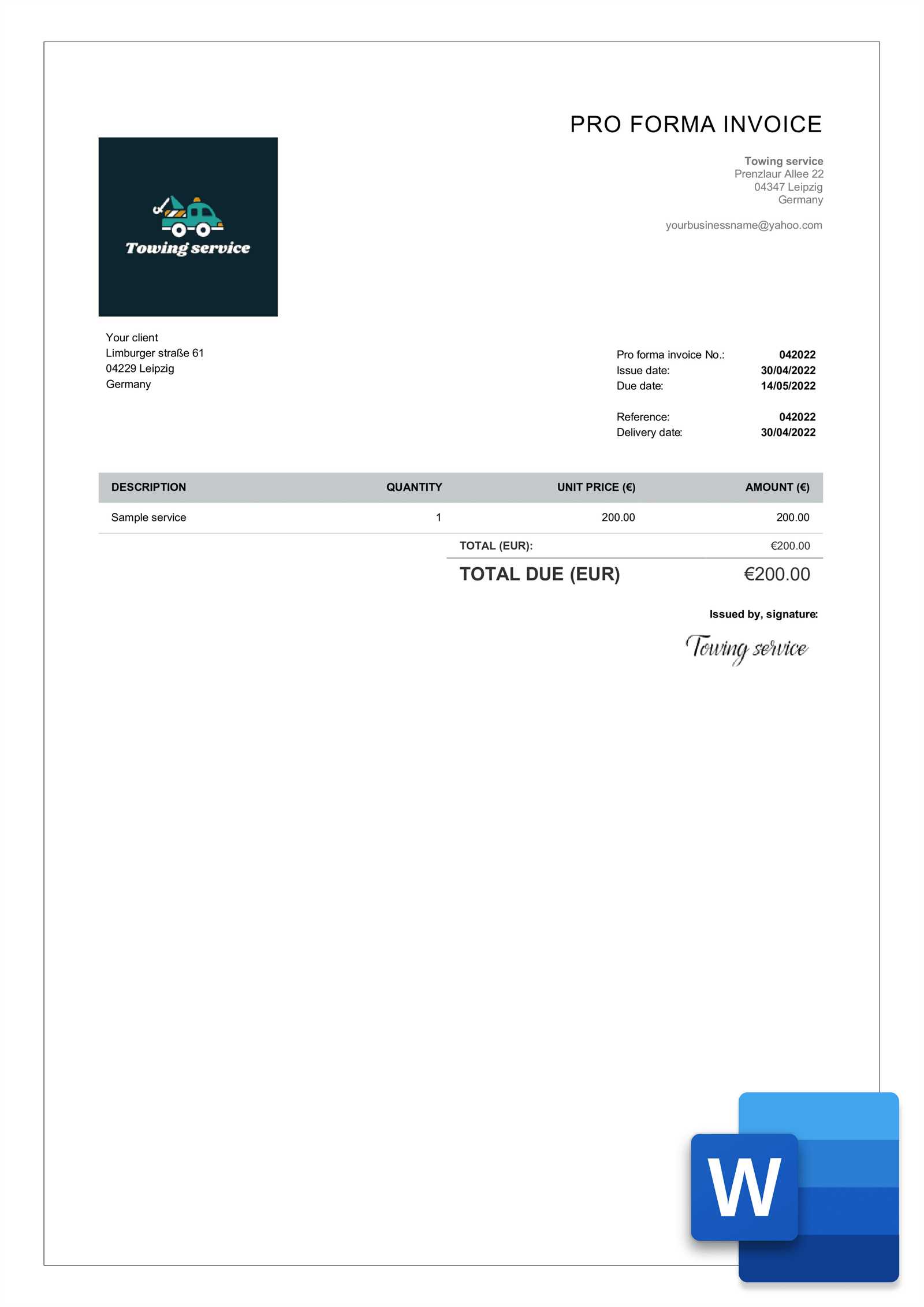

Free vs Paid Billing Document Designs

When choosing a design for your transaction records, you may encounter both free and paid options. While both can serve their purpose, understanding the differences between them is essential to select the best choice for your business. Free designs are often basic and suitable for small-scale operations, while paid options generally offer more advanced features and customization, helping businesses maintain a professional image.

Advantages of Free Designs

Free designs can be an excellent option for startups or freelancers who need a simple, no-cost solution. They are typically easy to use and quick to implement, allowing small businesses to get started without making an initial investment. However, free layouts might have limited features, and some may lack customization options or advanced features like automatic calculations and built-in branding options.

Benefits of Paid Designs

Paid designs offer more comprehensive features and better customization, which can be crucial for businesses aiming to scale. These options often come with advanced functionalities, such as automated calculations, payment tracking, and better integration with accounting software. Additionally, paid layouts are typically more professional in appearance, allowing for greater brand consistency and client trust. Investing in a premium design can save time and increase efficiency in the long run.

Ultimately, the choice between free and paid layouts depends on your business’s needs, budget, and desire for a polished, customizable solution.

Common Billing Document Formatting Mistakes

Even with the best intentions, it’s easy to make mistakes when preparing billing documents. These errors can lead to confusion, delayed payments, or even disputes with clients. Proper formatting is crucial for maintaining professionalism and ensuring that all information is clear and accessible. Below are some of the most common formatting issues businesses encounter and how to avoid them.

Missing or Incomplete Details

One of the most frequent mistakes is failing to include all necessary information. Important sections like client details, payment terms, or service descriptions may be left out, leading to confusion or missed payments. Always double-check that every section is filled in completely, including any additional notes or special instructions that might be relevant to the client.

Poor Layout and Organization

A cluttered or disorganized document can make it difficult for clients to find key details, such as the total amount due or payment due date. Ensure that your document is easy to navigate by clearly separating sections and using appropriate headings. Avoid crowding too much information into one area, and leave adequate white space to enhance readability. A clean, organized layout helps clients quickly identify what they owe and when they need to pay.

By paying attention to these common mistakes, you can improve your documentation process and maintain a smooth, professional relationship with your clients.

How to Use a Billing Document Layout for Business

Using a pre-designed structure for your business transactions can streamline the billing process and ensure accuracy. Whether you’re a freelancer or managing a larger company, adopting a standardized layout helps maintain consistency and professionalism. It also saves time by eliminating the need to manually create each document from scratch. Here’s how to use such a layout effectively for your business operations.

Step 1: Customize the Document for Your Business

To start, personalize the layout to reflect your business’s unique information. This includes adding your company name, logo, contact details, and any other branding elements that help make the document professional. Customizing your layout ensures that your records are aligned with your brand image, which fosters trust with clients.

- Insert your business name and logo at the top.

- Include contact information, such as phone number and email address.

- Make sure to adjust the currency and tax details based on your location or industry standards.

Step 2: Fill in the Relevant Transaction Information

Once your layout is ready, use it to input the specific details for each transaction. This includes the client’s information, a description of the services or products provided, the price, and the payment terms. Ensure that all fields are correctly filled in to avoid errors that could delay payment or lead to misunderstandings.

- Enter the client’s name, address, and contact information.

- List the items or services with their quantities, rates, and total cost.

- Specify payment terms, including due dates and any late fees or discounts.

By following these steps, you can quickly generate professional and accurate transaction records that improve communication and efficiency for your business.

Top Tools for Designing Billing Documents

Creating professional and customized billing records is essential for maintaining clear communication and efficient business operations. Fortunately, there are numerous tools available that can help you design and manage these documents with ease. From simple drag-and-drop builders to more advanced software with automation features, the right tool can streamline your process and save you time.

1. Canva

Canva is a user-friendly online design tool that offers a wide range of customizable layouts. It provides templates specifically for transaction records, allowing you to easily add logos, adjust colors, and include any necessary details. With its drag-and-drop interface, you can create professional-looking designs without needing any graphic design experience.

2. Microsoft Excel or Google Sheets

If you prefer a more straightforward approach, spreadsheet tools like Excel or Google Sheets can be a great choice. These programs allow you to create simple, customizable documents that can include calculations for totals, taxes, and discounts. Their familiarity and accessibility make them ideal for small businesses or freelancers looking for a quick and efficient solution.

Choosing the right tool depends on your business’s needs and the level of customization you require. Whether you’re designing from scratch or using a pre-made layout, there’s a tool that can help you produce clear and accurate records for every transaction.

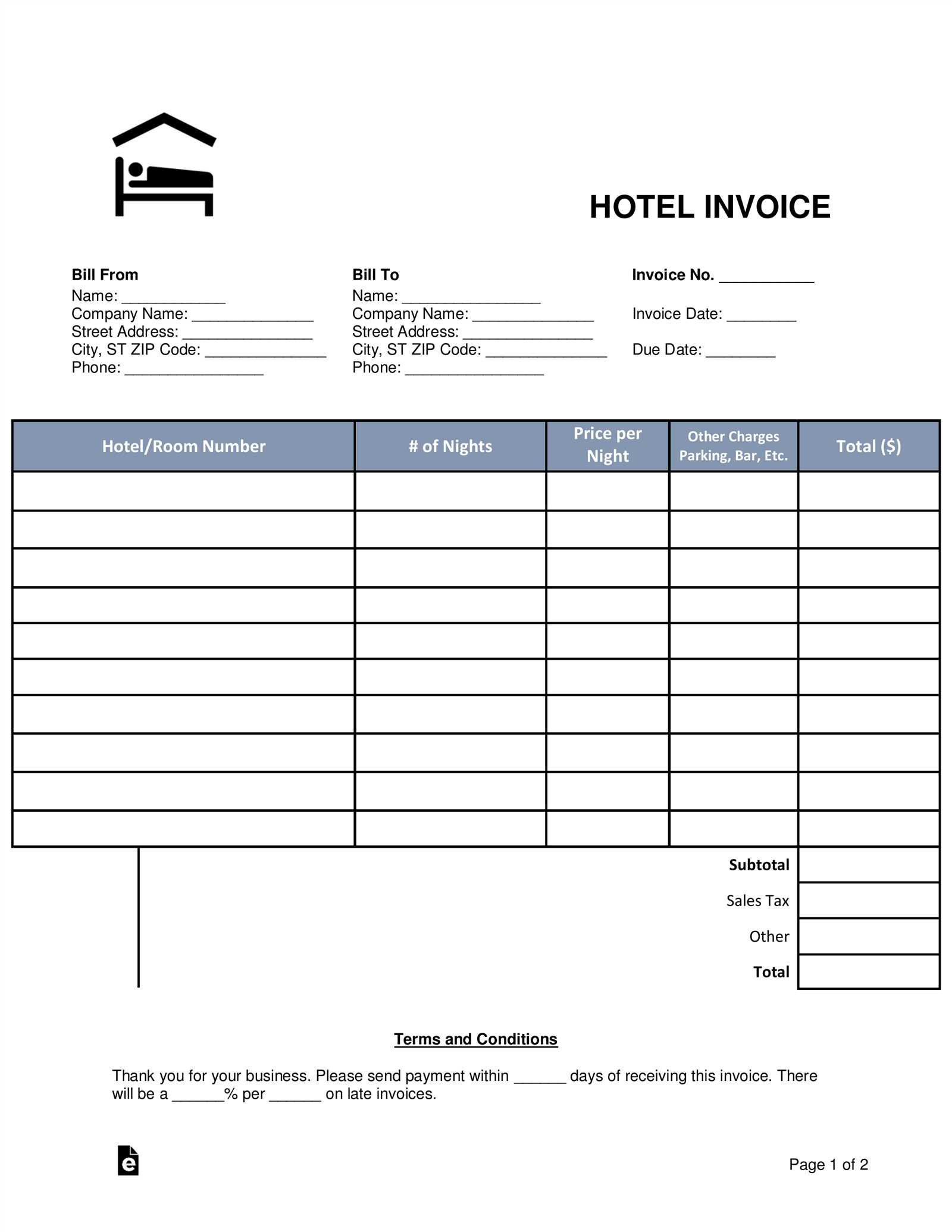

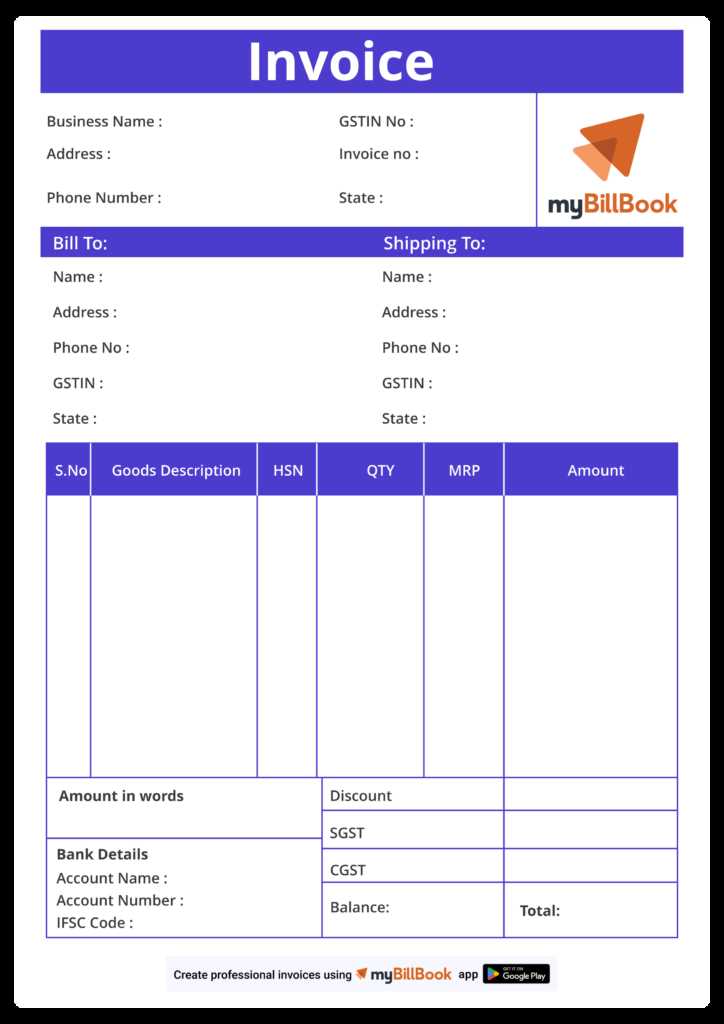

Billing Documents for Different Industries

Every industry has unique requirements when it comes to transaction records, from the level of detail required to the specific terms and conditions included. Understanding these differences is crucial for designing effective documents that meet both business needs and industry standards. Whether you’re in construction, consulting, or retail, tailoring your billing documents can ensure they are both professional and comprehensive.

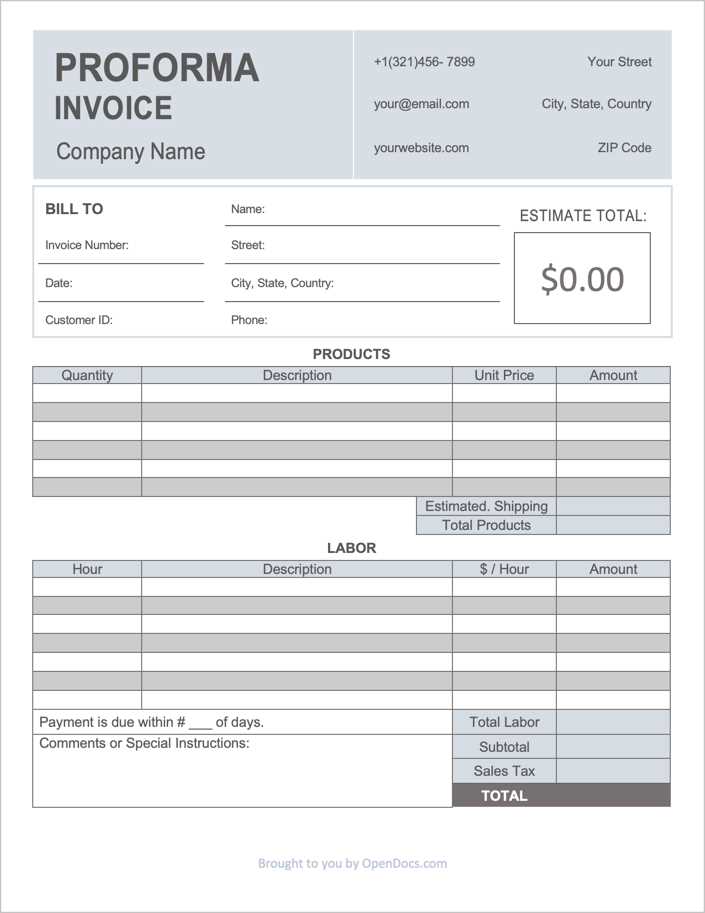

1. Construction and Contracting

For businesses in construction or contracting, billing documents need to include specific details related to labor, materials, and project milestones. These industries often work with large projects, requiring detailed breakdowns to reflect progress and payment schedules. Common sections might include:

- Labor costs and hours worked

- Material costs and quantities

- Project milestones and payment schedules

- Tax calculations specific to construction

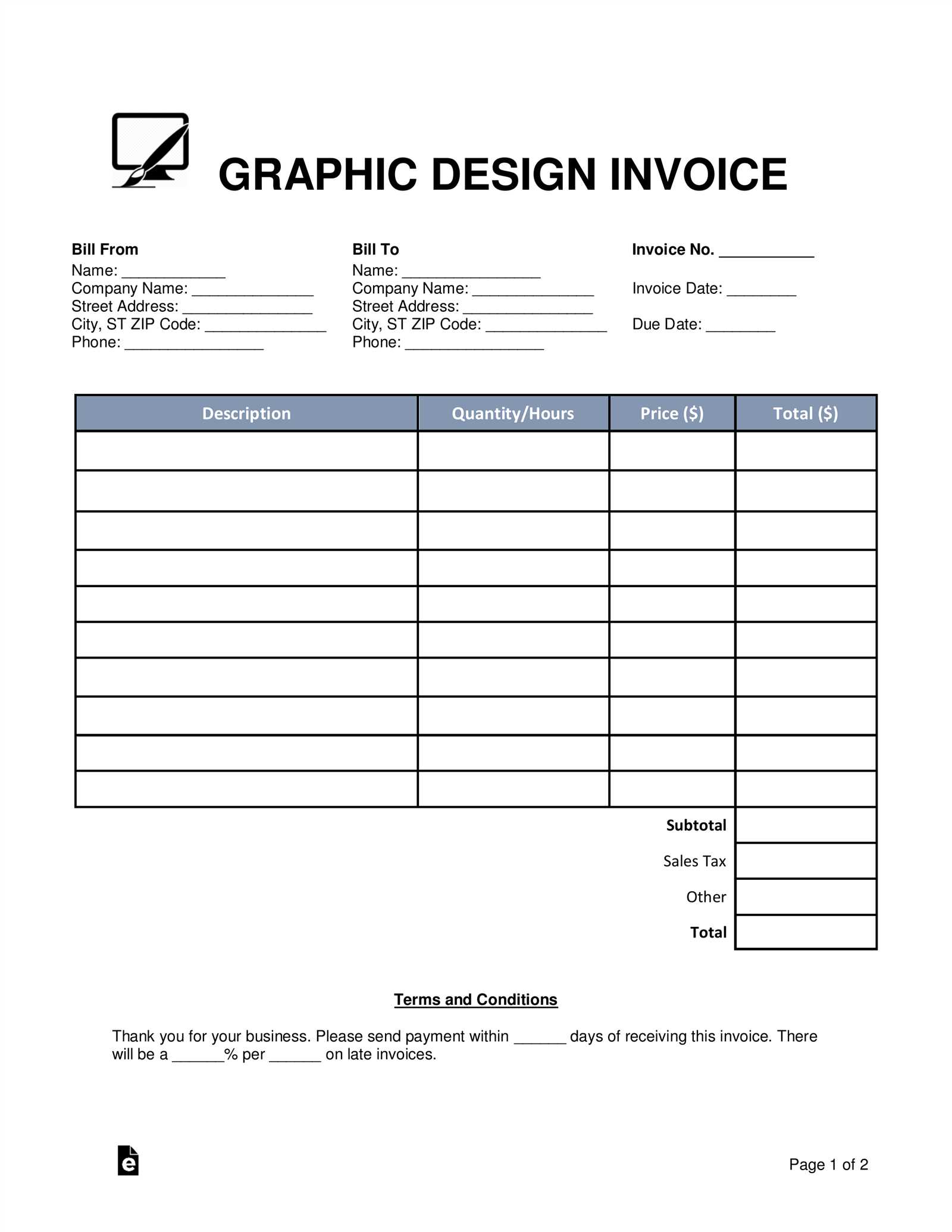

2. Consulting and Freelance Services

Consultants and freelancers typically offer services on an hourly or project basis. Their billing records need to clearly outline the time spent or the deliverables provided, with a focus on transparency and accuracy. These documents should include:

- Hourly rates or project fees

- Detailed descriptions of services rendered

- Dates and times of service, if applicable

- Terms of payment and due dates

3. Retail and Product Sales

In retail or product-based businesses, billing documents usually focus on itemized lists of products or services sold, along with their corresponding prices. These layouts need to be straightforward and easy to read for both the business and the customer:

- Item descriptions and quantities

- Unit prices and total amounts

- Applicable taxes and discounts

- Clear total amount due

Adapting your documents to your specific industry ensures accuracy, professionalism, and clarity, fostering positive relationships with clients and customers.

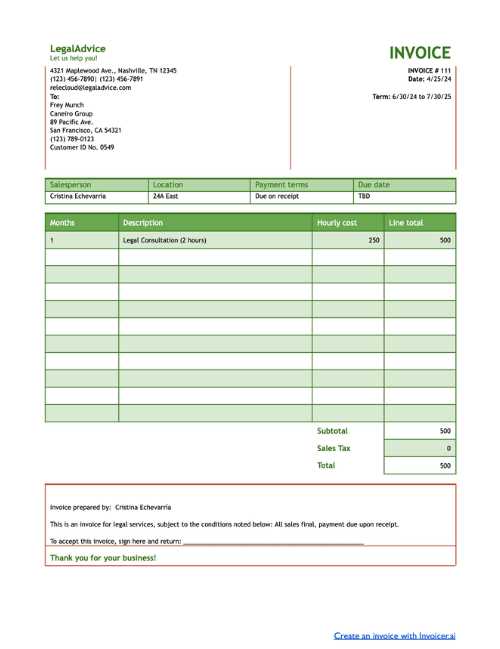

How to Edit and Personalize Billing Document Layouts

Customizing a pre-designed document layout allows you to make it uniquely yours while ensuring that it aligns with your business’s specific needs. Personalizing these records is essential for maintaining a professional image and making the document easier to read for clients. The process typically involves adjusting sections, adding branding elements, and ensuring all relevant details are included for a smooth transaction.

1. Adjust the Layout to Fit Your Business

The first step in personalizing any document is to ensure that the structure suits your business model. Depending on your industry, you may need to add sections or adjust the layout to make sure that all important details are clearly presented. For example, service-based businesses might want a section for hours worked, while product-based businesses will need space for product descriptions and quantities.

- Rearrange sections to prioritize important information (e.g., total amount due at the top).

- Adjust fonts, colors, and logos to match your brand style.

- Add any legal or payment terms specific to your business.

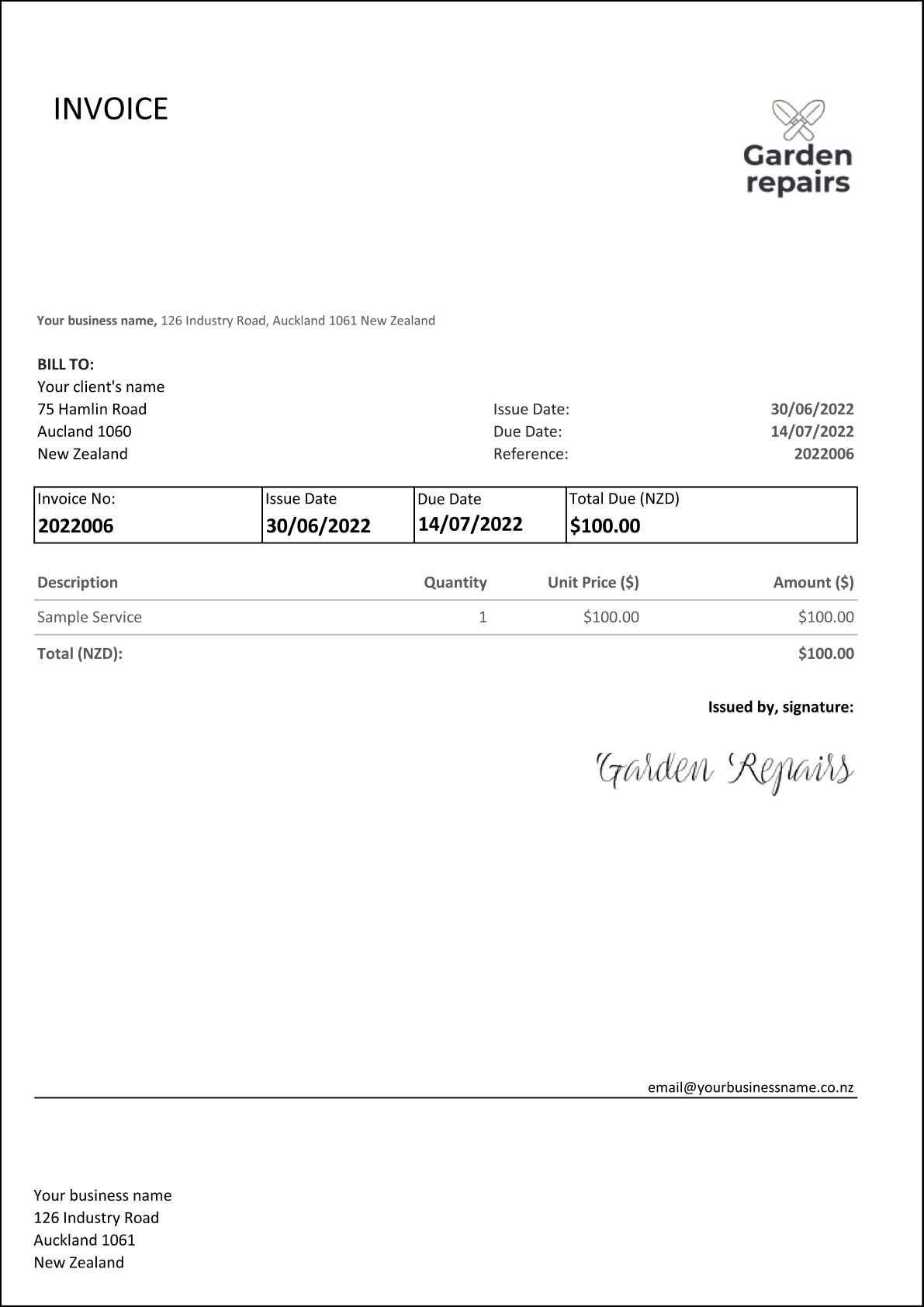

2. Include Personal Branding Elements

Personalizing a document layout goes beyond just the text. You can incorporate your brand’s visual identity to make your transaction records more professional and memorable. Adding your company’s logo, color scheme, and contact details creates consistency across all communications with clients.

- Upload your company logo and place it prominently.

- Customize the colors and fonts to match your branding guidelines.

- Ensure your business contact information is always up to date.

By editing and personalizing your billing layouts, you create a cohesive and professional experience for your clients while keeping track of your business transactions more effectively.

How to Save and Share Your Billing Documents

Once you’ve created your transaction records, it’s important to save them securely and share them efficiently with your clients. Proper storage ensures that you can access your documents when needed, while sharing them in a professional manner helps maintain smooth communication and quick payments. Here’s how you can save and distribute these records effectively.

1. Saving Your Documents

There are several ways to save your transaction records, depending on your preference and business needs. Digital storage is the most common and secure option, allowing easy access and organization of documents. You can save your records in various file formats like PDF or Excel for easy sharing and long-term storage.

| File Format | Benefits |

|---|---|

| Preserves formatting, easy to share and print, widely accessible. | |

| Excel | Allows for easy calculations, flexible for editing, supports larger datasets. |

| Word | Easy to edit and customize, commonly used for more detailed records. |

2. Sharing Your Documents

Once your billing document is saved, sharing it with clients is the next step. The most efficient way to send these records is via email, which ensures quick delivery and easy tracking. You can attach the document directly to an email or share it via cloud storage services, such as Google Drive or Dropbox, if the file size is large or if you need to share multiple documents at once.

- Send the document as a PDF attachment for easy access and viewing

Automating Billing Document Creation with Pre-designed Layouts

Automating the creation of transaction records can save significant time and reduce the chances of errors. By utilizing pre-designed structures, you can streamline the process of generating professional and consistent documents for your business. Automation tools allow you to input essential information once and automatically populate it into the appropriate sections, making the process quicker and more efficient.

Benefits of Automating the Process

- Time-Saving: Once you set up the automation system, you can generate records in a fraction of the time it would take to create them manually.

- Consistency: Automated layouts ensure that every document you send is uniform in style, layout, and content.

- Accuracy: Automation minimizes human errors, such as incorrect calculations or missing information, by pulling data directly from your database or software.

- Professionalism: Customizable automation tools allow you to include branding elements like logos and company details, enhancing the professional appearance of each document.

How to Set Up Automation

Setting up automation for your transaction records involves selecting the right software or tool and configuring it to fit your needs. Most invoicing tools and accounting software offer automated features that can help with document creation. Here’s how to get started:

- Choose an Automation Tool: Select software or an online service that suits your business size and type. Some options include QuickBooks, FreshBooks, or even Microsoft Excel with macros.

- Input Essential Data: Fill in your basic company information, payment terms, and any other details that remain consistent across documents.

- Connect Your Financial Data: Many tools integrate directly with accounting software, allowing them to automatically pull data such as amounts, tax rates, and client details.

- Customize Your Layout: Choose or design a layout that fits your business style and client needs. Ensure it includes all the necessary sections, such as service descriptions, pricing, and payment terms.

- Test and Refine: Generate a few sample records to ensure the automation is working correctly. Check for any missing fields or errors and adjust your settings as necessary.

By automating the creation of your transaction documents, you not only save time but also enhance efficiency and consistency in your billing process.

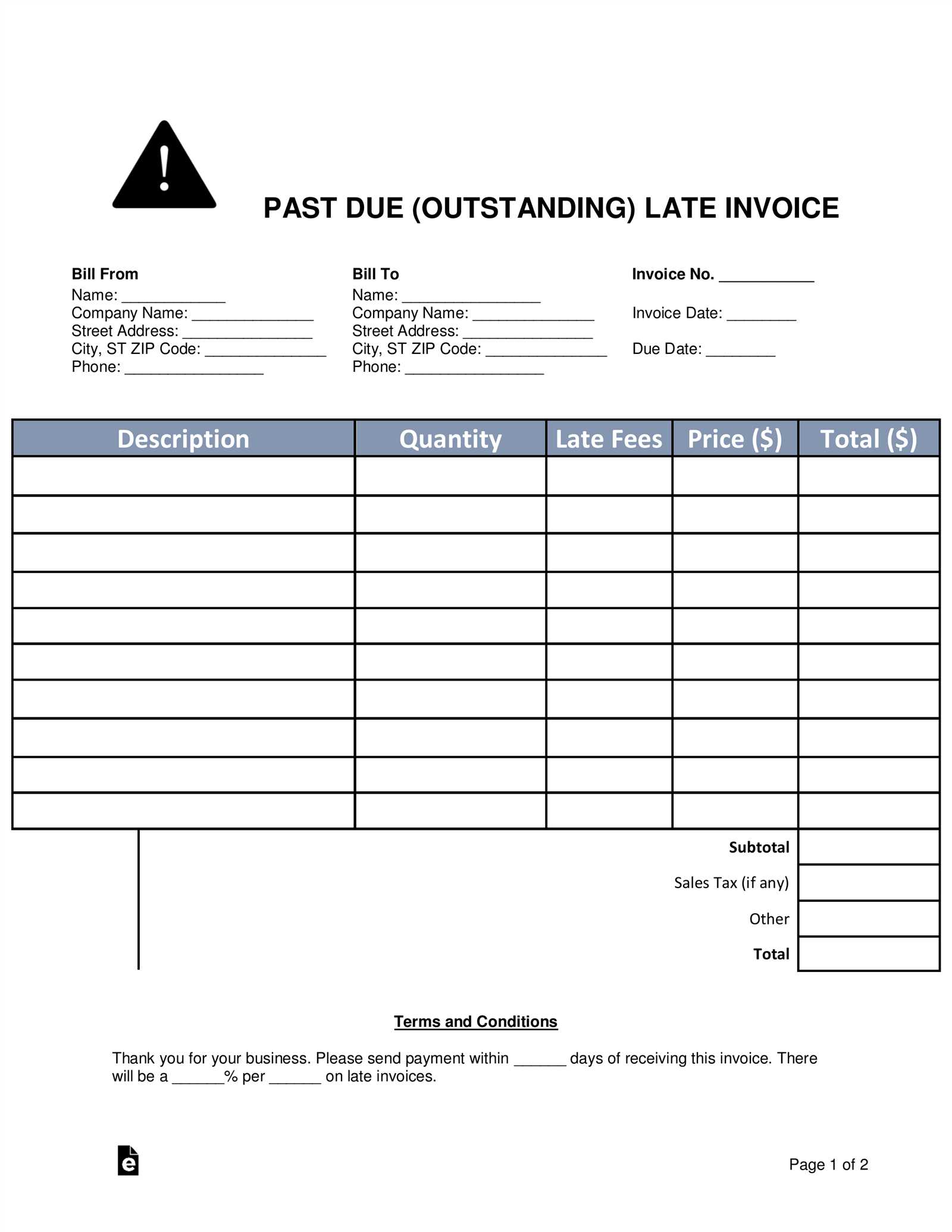

Tracking Payments with Billing Document Layouts

Tracking payments is a critical part of managing any business. With the right structure, you can easily monitor outstanding balances, due dates, and payment statuses. A well-organized billing document layout not only helps ensure timely payments but also provides a clear record for both you and your clients. By including specific payment tracking sections within your layout, you can efficiently follow up on overdue amounts and maintain financial transparency.

Key Sections for Payment Tracking

To effectively track payments, certain sections should be included in your layout. These sections help you keep a clear record of when payments were due, when they were made, and any outstanding balances. Below are key elements to consider:

Section Description Payment Status Indicates whether the payment has been made, is pending, or overdue. Due Date Clearly marks when payment is expected, helping you monitor overdue amounts. Amount Paid Shows the exact payment amount received to date. Remaining Balance Displays the outstanding amount that still needs to be paid. Payment Method Records how the payment was made (e.g., bank transfer, credit card, cash). Using Software for Payment Tracking

Many accounting and invoicing tools offer integrated payment tracking features. By linking your billing documents to these tools, you can automate the tracking process. These tools automatically update payment statuses and notify you of overdue amounts, saving you time and reducing errors. You can also generate reports to view all outstanding payments in one place, ensuring better financial management.

By adding payment tracking features to your billing documents, you can improve cash flow management, reduce overdue payments, and maintain a professional relationship with your clients.

Legal Considerations in Billing Document Design

When creating transaction records for your business, it’s crucial to consider the legal requirements that ensure both compliance and protection. A well-structured document should not only serve as a professional communication tool but also meet any legal obligations. Depending on your location and industry, there are certain pieces of information that must be included to make the document legally valid and enforceable.

Required Legal Information

To ensure that your billing documents are legally compliant, certain key elements should always be included. Missing even one of these details can lead to confusion, delayed payments, or legal issues down the line. The essential components typically include:

- Business Information: Your company’s full legal name, address, and contact details should be clearly listed on the document.

- Client Information: The recipient’s name, address, and contact information must also be included to avoid any confusion or disputes.

- Tax Identification Number: In many jurisdictions, businesses are required to display their tax ID number to validate the transaction.

- Transaction Date: Clearly state the date of the transaction, as well as the due date for payment.

- Terms of Payment: This includes payment deadlines, late fees, and accepted payment methods, which help protect both parties.

Jurisdiction-Specific Requirements

Different countries and regions may have specific laws regarding billing records. For example, in some countries, it may be mandatory to include certain tax rates or offer specific formats for documenting sales tax. It’s essential to stay informed about local regulations and ensure that your documents meet all necessary legal criteria. Failing to comply could result in fines or complications with tax authorities.

Ensuring legal compliance in your billing documents is not just about meeting government requirements–it also helps build trust with clients and avoids potential disputes.

Best Practices for Document Accuracy

Ensuring the accuracy of transaction records is crucial for maintaining a professional reputation and fostering trust with clients. Accurate documents help prevent disputes, ensure timely payments, and streamline business operations. To achieve this, it’s essential to follow best practices during the creation and management of these documents, which will reduce the risk of errors and improve overall efficiency.

1. Double-Check All Financial Information

One of the most common errors in business documents is incorrect financial details. This includes incorrect totals, tax calculations, or missing amounts. Always double-check these values before sending the record to your client. Some best practices include:

- Ensure that all amounts are correctly calculated, including taxes and discounts.

- Review any numerical values to ensure they align with the terms of the agreement.

- Check the currency format to avoid any confusion, especially if working with international clients.

2. Consistently Use Clear and Precise Descriptions

Vague or unclear descriptions can lead to misunderstandings between you and your clients. Always include detailed information about the services or products provided, including quantities, unit prices, and delivery dates. This clarity helps prevent confusion and disputes later on. Key points to remember include:

- Provide a detailed breakdown of each service or item included in the transaction.

- Use precise descriptions to avoid ambiguity, especially for custom work or specialized products.

- Incorporate product or service codes, if applicable, to make it easier for clients to reference.

By following these practices, you ensure that your records are clear, precise, and free from errors, which builds client confidence and helps maintain smooth financial transactions.