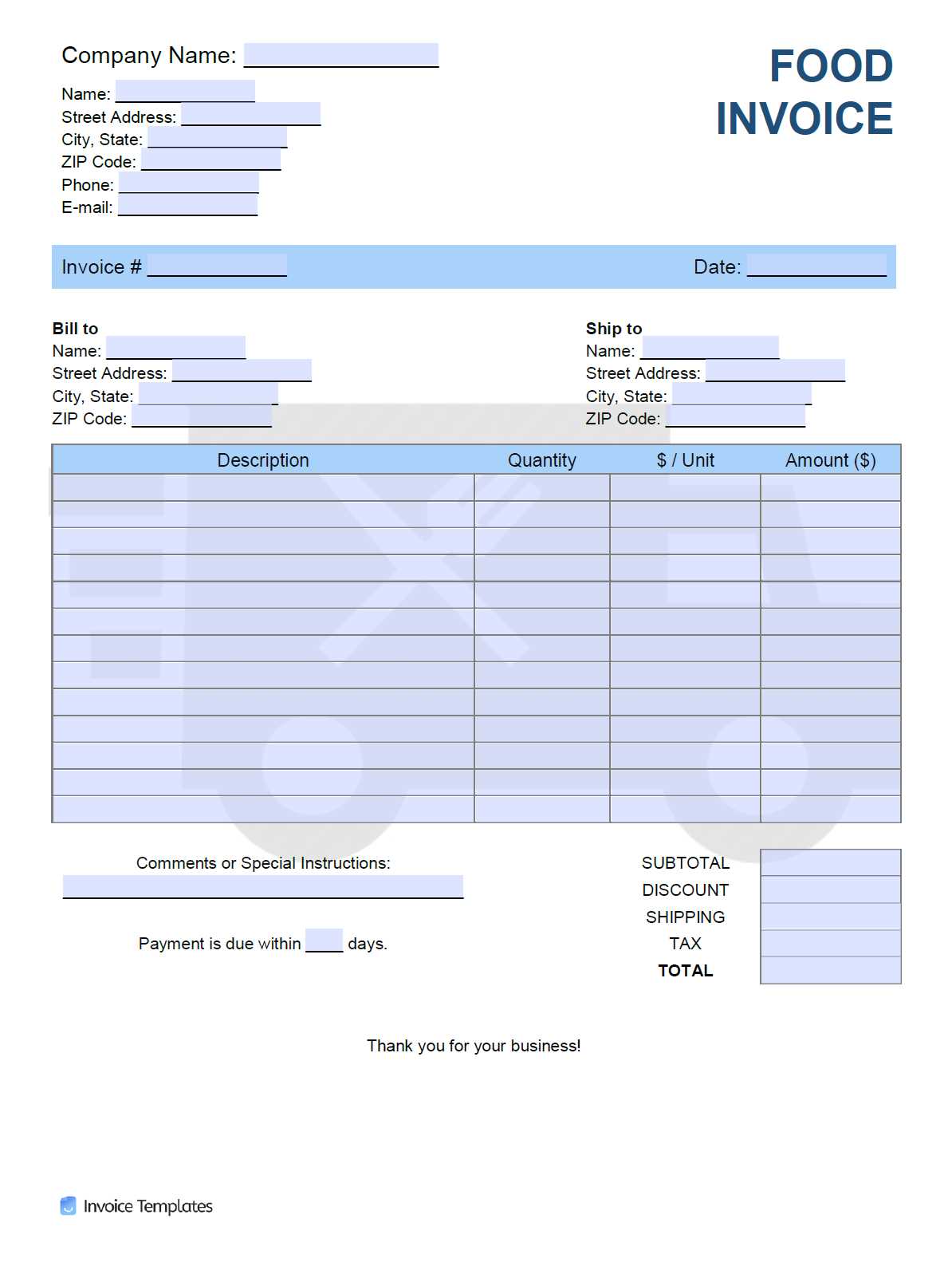

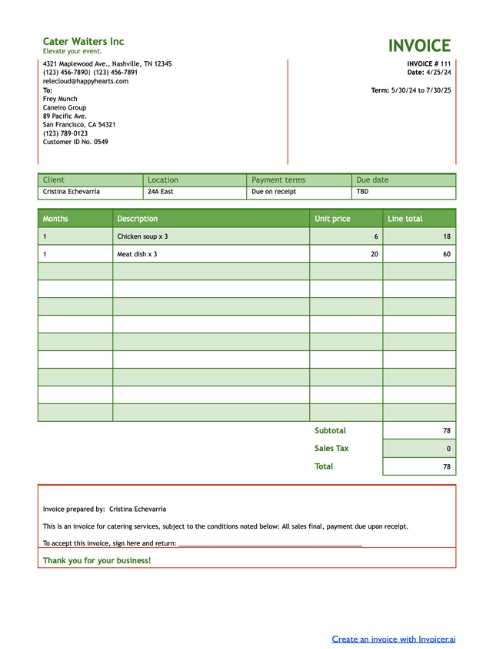

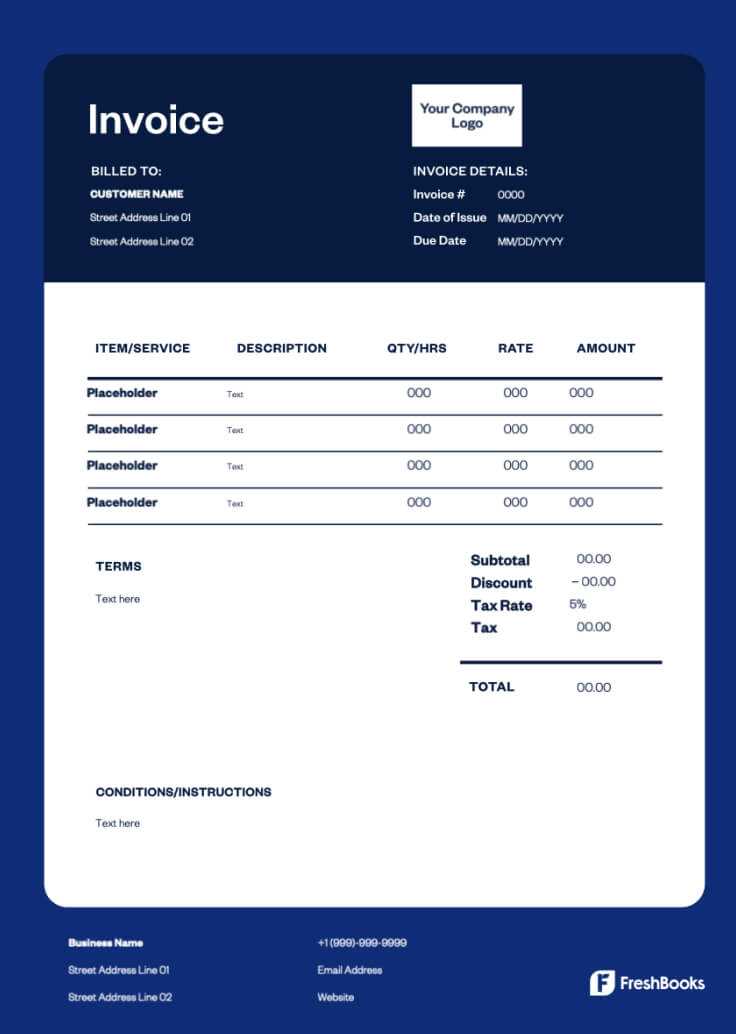

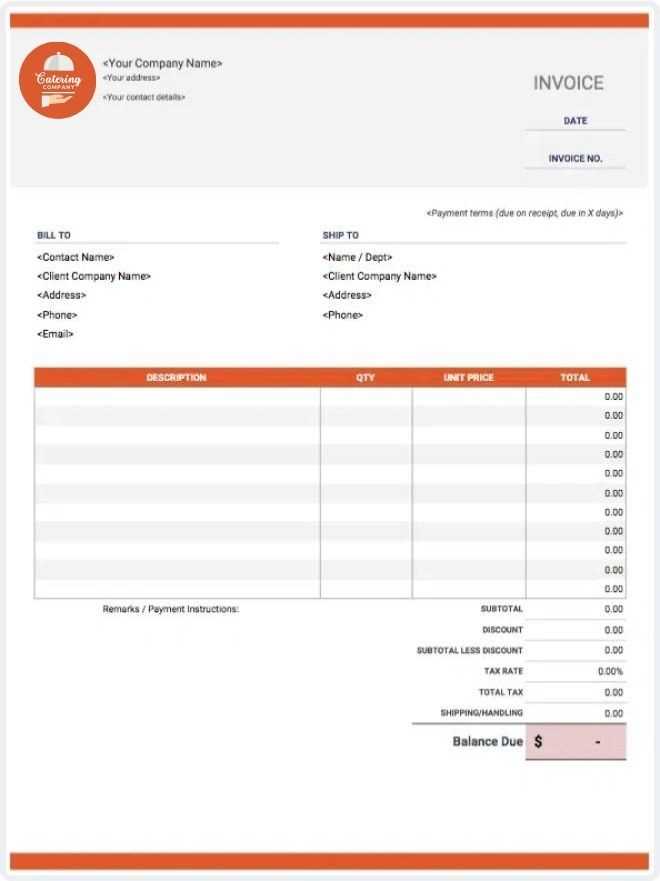

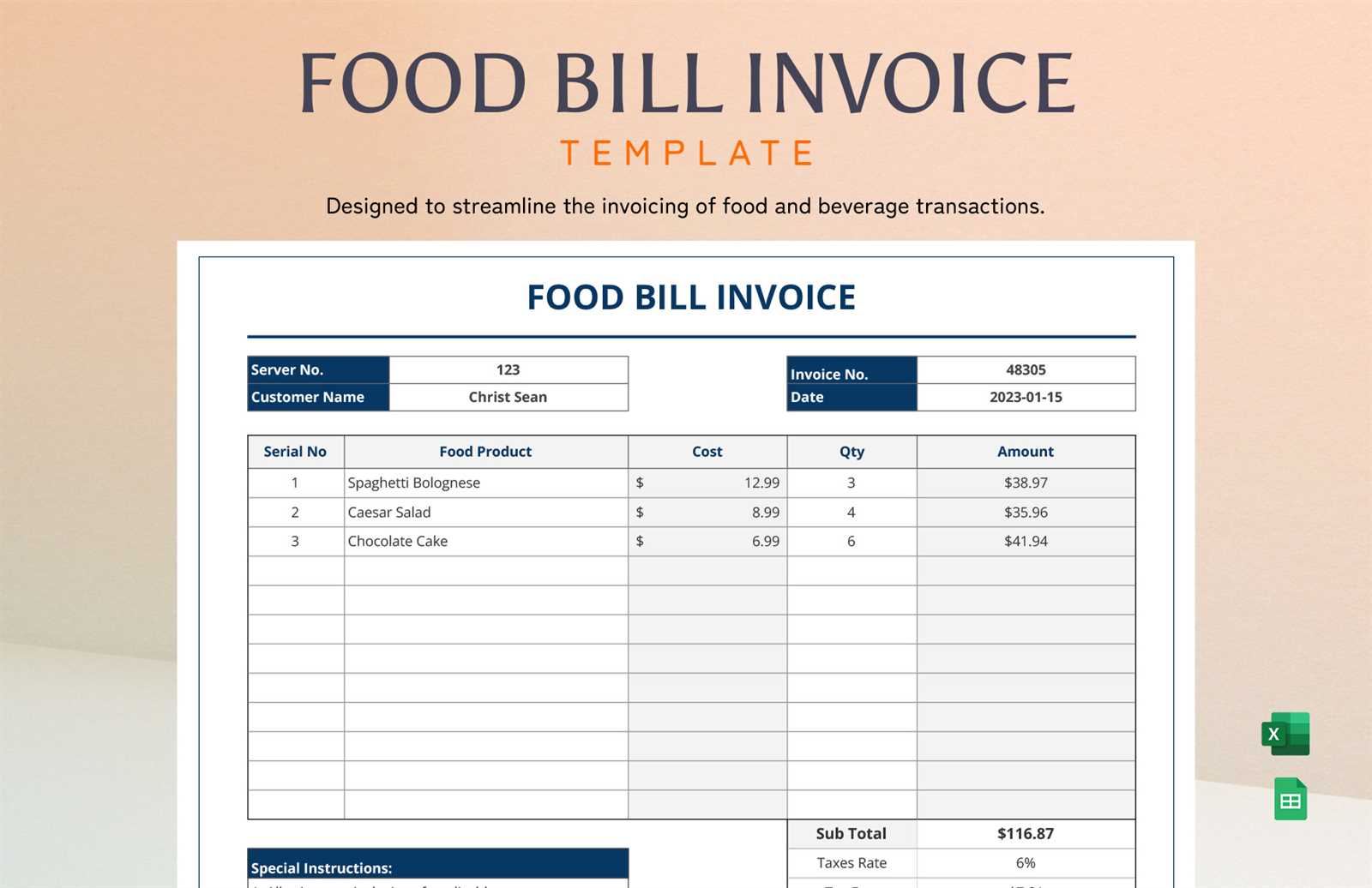

Download a Food Service Invoice Template

Managing payments and ensuring proper documentation is a crucial part of running a business. Clear, well-organized records help establish trust and professionalism while reducing errors and misunderstandings. When it comes to documenting transactions, having an effective way to present charges is key to maintaining a smooth operation.

By using a well-structured form to outline the details of each transaction, you can ensure transparency for both you and your clients. These documents not only simplify the process but also make it easier to track payments, manage accounting, and maintain a professional image.

Customizable options allow you to tailor the design and content to your needs, making them suitable for various industries and requirements. Whether you’re just starting or looking to improve your current processes, adopting a systematic approach can help you stay organized and focused on growing your business.

Understanding the Importance of Billing Documents

Effective financial documentation plays a pivotal role in the success of any business. Accurate records not only ensure that payments are properly processed but also help in managing accounts and maintaining healthy relationships with clients. Having a standardized way to outline charges helps create clarity and avoid misunderstandings between parties.

For businesses that rely on transactions with customers, detailed and well-organized documentation is vital. It serves as a proof of agreement and provides a reference for both parties, allowing businesses to maintain financial integrity. The document becomes an essential part of tracking income and handling tax reporting.

Key Benefits of Proper Documentation

- Transparency: Clear records help clients understand what they are paying for and how charges are calculated.

- Accountability: Properly structured forms help businesses track payments and outstanding amounts efficiently.

- Legal Protection: In case of disputes, these documents serve as a reference point for both parties.

- Financial Management: Well-kept records help businesses manage cash flow and streamline their accounting processes.

How Proper Billing Supports Business Growth

By ensuring accurate and timely documentation, businesses can focus on providing quality and expanding their reach without worrying about financial discrepancies. A simple, professional record-keeping process boosts customer confidence and helps the business stay on top of its financial obligations. Ultimately, it reduces administrative costs and saves time for both the business and its clients.

Why You Need a Structured Billing Form

Having a predefined structure for documenting transactions is essential for any business that handles regular payments. Without a clear and consistent method, tracking payments and managing client relations becomes more prone to errors. A standardized form ensures that all necessary details are included, helping both parties stay organized and avoid confusion.

By using a consistent format, you can save time, reduce the risk of mistakes, and present a more professional image to clients. A well-designed document makes it easier to understand charges, track financial records, and maintain smooth operations in your business.

Benefits of Using a Structured Form

- Efficiency: A ready-made design saves time, allowing for quick creation of documents.

- Consistency: Every transaction will include the same key details, minimizing errors.

- Professionalism: A well-organized document enhances your business image and builds trust with clients.

- Legal Protection: A standardized document ensures all necessary information is included for legal clarity.

How a Predefined Format Helps Manage Finances

Using a standardized approach not only reduces administrative work but also ensures that important information–such as payment terms, charges, and client details–are always accurately documented. This can help streamline bookkeeping and assist with tax filing. It also makes it much easier to track overdue payments or potential discrepancies.

Key Features of a Billing Document

To ensure a smooth transaction and avoid any confusion, it’s essential that certain elements be included in any financial document. These components serve not only to outline the charges but also to provide clarity, ensure accuracy, and make the payment process as straightforward as possible for both parties. Each detail must be clear and organized for proper record-keeping and client trust.

A well-structured document should contain specific pieces of information that make it easy to understand and process. From identifying the buyer and seller to listing the agreed-upon amounts, each part plays a crucial role in the overall effectiveness of the document.

- Contact Information: Names, addresses, and contact details of both the buyer and seller ensure clear communication.

- Unique Reference Number: A distinct identifier for each transaction helps with tracking and record-keeping.

- Itemized List of Charges: A breakdown of all items and services provided, along with their corresponding prices, ensures transparency.

- Payment Terms: Clear payment deadlines and methods inform the client when and how payments are expected.

- Tax Information: Detailed tax rates and amounts ensure compliance with legal standards and help clients understand their total cost.

Incorporating these essential features not only simplifies the financial documentation process but also provides both the business and its clients with a reference point for future transactions. A thorough and accurate document helps avoid disputes and fosters better business practices.

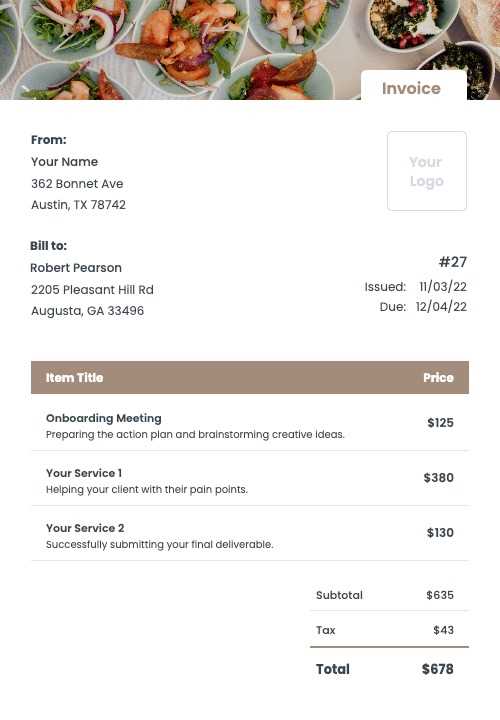

How to Customize Your Billing Document

Creating a personalized financial document allows you to better align it with your business needs and branding. Customizing your document ensures that it accurately reflects the nature of your transactions while maintaining a professional look. Whether you are adding your logo, adjusting the layout, or incorporating specific details, tailoring the document to your preferences can help you streamline operations and provide a more cohesive experience for clients.

The customization process should include selecting relevant fields, choosing appropriate fonts, and deciding on the overall design. You can also incorporate elements that reflect your business’s unique identity, such as color schemes or specific sections that address your billing process.

Key Customization Options

- Branding Elements: Adding your company logo, color palette, and contact details creates a personalized touch.

- Layout Adjustments: Modifying the layout ensures that the most important information is highlighted and easy to read.

- Additional Sections: You can add specific fields like discounts, delivery charges, or order numbers based on your business requirements.

- Payment Methods: Clearly define the accepted payment methods and terms for clarity and convenience.

Tips for Effective Customization

When customizing your document, keep in mind that clarity is key. A clean, organized layout with relevant information placed in a logical order will help clients easily navigate the document. Avoid overcrowding the page with unnecessary details–focus on what matters most for the transaction and your business operations.

Essential Information to Include in a Billing Document

For any transaction to be properly documented, certain critical details must be included. These pieces of information ensure that both parties have a clear understanding of what is being exchanged and on what terms. A complete and accurate financial document not only facilitates smooth payment processing but also serves as a reference for future record-keeping or potential disputes.

By including the correct details, businesses can improve their accounting accuracy, maintain transparency with clients, and streamline payment tracking. Below are the key elements that must be present to ensure the document meets professional and legal standards.

Key Components of a Financial Document

- Contact Information: The full names, addresses, and contact details of both the business and the customer.

- Transaction Date: The date the transaction took place helps in maintaining accurate records and payment timelines.

- Unique Identifier: A reference number for easy tracking and to avoid confusion with other documents.

- Itemized Charges: A detailed list of products or services, including quantities and unit prices, with subtotals for clarity.

- Tax Information: A breakdown of applicable taxes, showing tax rates and amounts separately.

- Total Amount Due: The final amount payable, including taxes, discounts, and any other relevant fees.

- Payment Terms: Clearly defined terms regarding payment deadlines, methods, and any late fees if applicable.

Why These Details Matter

Including all these essential elements ensures that both parties have the necessary information to complete the transaction smoothly. It helps prevent misunderstandings, supports accurate accounting, and facilitates timely payments. Furthermore, well-documented transactions are invaluable for business reporting and compliance with tax regulations.

How to Calculate Charges and Taxes

Accurately calculating additional fees and applicable taxes is a critical part of creating a financial document. These calculations ensure that both the business and the client understand the total cost and avoid confusion when making payments. Knowing how to properly compute service charges, taxes, and any other fees ensures that the document is complete and complies with legal standards.

The process begins with identifying the relevant rates for your location and industry. Once the base cost of the products or services is determined, you can apply the necessary charges and taxes. Below is an overview of how to calculate these elements efficiently.

Steps for Calculating Charges

- Determine Base Cost: Start by identifying the price of the items or services being provided before any additional charges or taxes.

- Apply Service Fees: If applicable, calculate any additional charges such as delivery fees, handling charges, or administrative costs.

- Include Discounts: If there are any discounts offered, subtract them from the total cost before applying taxes.

Steps for Calculating Taxes

- Know the Tax Rate: Research the local sales tax or VAT rate that applies to your business.

- Calculate Tax Amount: Multiply the subtotal (after adding any charges and discounts) by the tax rate to find the total tax amount.

- Add Tax to Total: Finally, add the tax amount to the subtotal to determine the final total payable amount.

By following these simple steps, businesses can ensure that their financial documents are accurate and legally compliant, making the transaction process smoother for both parties.

Designing a Professional Billing Layout

Creating a well-organized and visually appealing document layout plays an essential role in ensuring that your financial records are clear and easy to understand. A professional design not only enhances the document’s readability but also reflects positively on your business. A clean, structured layout can improve client trust and make the payment process smoother for both parties.

When designing your document, it’s important to prioritize clarity. Every element should be easy to locate and understand. The layout should highlight essential information, such as transaction details, due dates, and totals, without overcrowding the page.

Key Design Principles for a Billing Document

- Simple and Clean Layout: Avoid clutter by using white space effectively and organizing sections logically.

- Consistent Fonts and Colors: Use legible fonts and a consistent color scheme that aligns with your branding.

- Clear Section Headings: Ensure each section is clearly labeled for easy navigation (e.g., “Client Information,” “Payment Terms,” “Amount Due”).

- Alignment: Align text and numbers properly to improve readability and maintain a professional appearance.

Additional Design Elements

- Company Branding: Incorporate your business logo, contact details, and any other relevant branding elements to personalize the document.

- Highlight Important Details: Use bold text or different font sizes to draw attention to crucial information, such as the total amount due or the payment deadline.

- Use of Tables: When listing products or charges, tables help organize the information clearly and concisely.

A well-designed document not only makes a positive impression but also helps clients understand their charges at a glance, reducing the likelihood of payment delays or misunderstandings.

Automating Billing Documents for Efficiency

Automating the creation and distribution of financial documents can significantly increase efficiency in any business. By using automation tools, businesses can reduce manual effort, minimize errors, and ensure that every document is generated and sent on time. This leads to faster processing, better cash flow management, and improved client satisfaction.

Implementing automation tools not only saves time but also provides a streamlined approach to managing records. By reducing repetitive tasks and improving accuracy, businesses can focus more on strategic growth rather than administrative work. Below are some key benefits and strategies for automating billing processes.

Advantages of Automation

- Time-Saving: Automatically generating financial documents eliminates the need for manual data entry, saving hours of work.

- Consistency: Automation ensures that all documents follow the same format and include the necessary details, reducing the chances of errors.

- Accuracy: By using predefined templates, calculations are done automatically, minimizing human error.

- Timely Delivery: Set up schedules to automatically send documents at the right time, improving payment follow-up and reducing delays.

How to Implement Automation

- Choose the Right Tool: Select a reliable software or platform that integrates with your accounting system and meets your specific needs.

- Set Up Templates: Create a reusable layout that automatically fills in customer and transaction details, streamlining the process.

- Customize Payment Reminders: Schedule reminders to be automatically sent to clients, reducing follow-up efforts.

- Track Payments: Utilize automation features to track payments and mark invoices as paid, helping you stay on top of your finances.

By automating billing processes, businesses can reduce administrative burden, improve client relations, and create a more efficient system for managing payments. This approach helps you focus on growing your business rather than being bogged down by routine tasks.

Legal Requirements for Billing Documents

When creating financial documents for transactions, businesses must ensure they comply with local and national laws. Legal requirements for such records help maintain transparency and protect both parties involved in the exchange. Compliance not only prevents potential legal issues but also ensures that your business operates ethically and responsibly.

There are various regulations and guidelines regarding the information that must be included in each document, as well as how they should be formatted. Understanding these legal obligations is essential for avoiding fines or penalties. Below are some key legal aspects to consider when preparing your financial documentation.

Essential Legal Elements for Business Documents

- Business Identification: Always include the name, address, and legal entity of your business, as well as a valid registration or tax identification number.

- Accurate Transaction Details: Each document should clearly state the date, description of the goods or services exchanged, and any agreed-upon terms.

- Correct Tax Information: Indicate the correct tax rates, and ensure taxes are calculated accurately and shown separately from the total amount.

- Compliance with Local Laws: Ensure that your billing practices comply with local business regulations, including tax laws, and any industry-specific rules.

Additional Considerations

- Payment Terms: Clearly state payment deadlines, accepted payment methods, and any applicable late fees or interest for overdue payments.

- Currency and Amounts: Ensure that amounts are accurately calculated and displayed, and if applicable, state the currency used in the transaction.

- Legal Notices: Some regions require specific disclaimers or legal terms to be included in billing documents. Make sure to check for any regional requirements.

By adhering to legal requirements, businesses can avoid costly mistakes and build trust with customers. A well-structured and legally compliant financial record helps ensure a smooth transaction process and reduces the risk of misunderstandings or disputes.

Common Mistakes to Avoid on Billing Documents

When preparing financial documents for your clients, it is crucial to avoid common errors that can lead to confusion, delayed payments, or even disputes. Small mistakes can create a negative impression and harm your business relationships. Ensuring accuracy and attention to detail is key in maintaining professional and transparent transactions.

Below are some common mistakes that should be avoided to ensure that your financial records are clear, correct, and trustworthy.

- Incorrect or Missing Information: Failing to include essential details, such as the client’s name, transaction date, or item descriptions, can lead to misunderstandings or delays in payment.

- Errors in Pricing or Calculations: Incorrectly listing prices or failing to properly calculate totals, taxes, or discounts can cause confusion and mistrust.

- Lack of Clear Payment Terms: Not specifying when the payment is due, accepted payment methods, or late fee policies can result in missed or delayed payments.

- Omitting Tax Details: Failing to clearly list applicable taxes or incorrectly applying tax rates can cause legal issues and confusion for clients.

- Unclear Formatting: A cluttered or difficult-to-read layout can make it challenging for your client to find important information quickly, leading to frustration and delays.

- Not Tracking Payments: Failing to keep track of payments or forgetting to mark a document as paid can lead to confusion about outstanding balances.

By avoiding these mistakes and ensuring that your financial records are thorough and well-organized, you can improve communication with your clients and maintain a smooth payment process.

Creating Clear Payment Terms and Conditions

Establishing clear and concise payment terms is essential for ensuring smooth transactions and avoiding confusion. Well-defined conditions help both parties understand their responsibilities, ensuring timely payments and reducing the risk of disputes. Clear terms set expectations from the start and provide a reference point for resolving any potential issues.

When drafting payment terms, it’s important to be transparent and specific about deadlines, fees, and acceptable payment methods. Below are some key elements to consider when outlining your payment policies.

- Payment Due Dates: Clearly state the exact date by which payment is expected. You may also want to offer early payment discounts or provide an extended payment window if needed.

- Accepted Payment Methods: Specify the payment options available, such as bank transfers, credit cards, checks, or online platforms, ensuring that your clients know how to pay.

- Late Payment Fees: Outline any additional charges that will apply if payment is not received by the due date. Clearly communicate the amount or percentage added to the original amount for overdue payments.

- Discounts for Early Payments: Offering incentives for early payments can encourage timely settlements. Make sure to specify the discount rate and conditions for qualifying clients.

- Partial Payments: If you accept installment or partial payments, outline the structure, deadlines, and how outstanding balances will be handled.

- Consequences of Non-Payment: Indicate the steps that will be taken if payment is not received, such as collection efforts or suspension of services or deliveries.

By clearly articulating these terms, you help foster trust and avoid misunderstandings. Establishing transparency in your payment process also demonstrates professionalism and improves cash flow management.

How to Handle Discounts on Billing Documents

Offering discounts is a common way to incentivize clients and encourage timely payments. However, it’s important to handle these discounts carefully to ensure clarity and accuracy in your financial records. Properly applying and documenting discounts ensures both you and your clients are on the same page and can help avoid any misunderstandings or disputes.

When including discounts, it’s crucial to specify the terms under which the discount applies, the discount amount, and how it affects the total payment. Below are key considerations for managing discounts effectively in your financial documentation.

| Discount Type | Discount Amount | Conditions | Final Total After Discount |

|---|---|---|---|

| Percentage Discount | 10% | For payments made within 10 days | $90.00 |

| Fixed Amount Discount | $20.00 | For orders over $200 | $180.00 |

| Seasonal Discount | 15% | Available during holiday sales | $85.00 |

It’s essential to include the type of discount (percentage or fixed amount), the conditions for receiving the discount, and the adjusted total after the discount is applied. This transparency ensures that the client understands how the discount was calculated and how it affects the final amount they owe.

By clearly outlining these details, you help build trust and maintain smooth financial operations with your clients, reducing the risk of payment delays or confusion.

Tracking Payments and Outstanding Bills

Properly tracking payments and outstanding balances is crucial for maintaining a healthy cash flow and avoiding confusion. Keeping accurate records of transactions helps ensure that you are paid on time and that any issues with overdue payments can be addressed promptly. It also provides a clear overview of your financial status, helping you make informed business decisions.

To effectively manage and track payments, consider the following strategies:

- Maintain Detailed Records: Always record every transaction, including payment dates, amounts, and the payment method used. This will help you track what has been paid and what is still owed.

- Use Clear Payment Terms: Clearly state the due dates and payment conditions upfront to avoid confusion and ensure that clients know when payments are expected.

- Send Reminders for Overdue Payments: If a payment is not received by the due date, send a polite reminder or follow-up communication. Make it clear how long the payment has been overdue and what actions will be taken if it remains unpaid.

- Track Partial Payments: If a client makes a partial payment, ensure that the balance is updated, and the remaining amount is tracked accurately.

- Monitor Accounts Receivable: Keep an eye on your accounts receivable regularly to ensure no payments are overlooked. If there are any outstanding balances, prioritize them according to their due dates.

- Utilize Digital Tools: Use accounting software or online platforms to automate payment tracking. These tools can help you generate reports, send reminders, and track overdue payments more efficiently.

By implementing these practices, you can stay on top of outstanding balances, reduce the likelihood of payment delays, and ensure that your business operates smoothly and profitably.

Using Online Tools for Document Creation

Creating and managing billing documents manually can be time-consuming and prone to errors. Online tools streamline this process, offering a more efficient and accurate way to handle financial paperwork. These digital platforms allow for easy customization, automated calculations, and the ability to generate and send documents quickly, making them ideal for busy professionals.

Benefits of Using Online Tools

Online tools offer several advantages over traditional methods:

- Time Efficiency: Automated calculations and pre-made fields help speed up the document creation process, reducing the time spent on manual entries.

- Customization Options: Many online platforms allow you to personalize the layout and design, ensuring that the document aligns with your branding.

- Ease of Use: Most online tools are user-friendly, requiring minimal technical knowledge, so you can create professional documents with little effort.

- Instant Accessibility: With cloud-based tools, you can access your documents anytime, from any device, ensuring you never lose track of important paperwork.

- Secure and Organized: Online platforms often come with security features that ensure your documents are stored safely and remain easily accessible.

Choosing the Right Tool for Your Needs

When selecting an online tool for document creation, consider the following factors:

- Features: Look for tools that offer the features you need, such as customizable fields, recurring billing options, and support for various file formats.

- Integration: Ensure the tool integrates with other software you use, such as accounting programs or payment gateways, for seamless operation.

- Customer Support: Choose a platform that offers good customer service in case you encounter any technical difficulties or need assistance with the tool.

By leveraging the power of online tools, you can simplify the process of generating, sending, and tracking financial documents, allowing you to focus more on running your business.

Why Consistency Matters in Billing

Maintaining uniformity in financial documentation is crucial for both businesses and clients. Consistent practices not only help streamline administrative tasks but also enhance the professional image of a company. Whether you are creating documents manually or using automated systems, consistency ensures clarity, minimizes errors, and fosters trust with clients.

Benefits of Consistency

There are several key reasons why it’s important to establish a consistent approach to billing:

- Professional Appearance: Consistent document formatting and terminology make a business look more professional and organized, which can positively influence clients’ perceptions.

- Reduced Errors: By following the same structure each time, businesses can reduce the chances of overlooking important details, such as payment terms or due dates.

- Improved Efficiency: Standardizing the format and content makes the process quicker, allowing businesses to create documents faster and avoid repetitive tasks.

- Better Tracking: When all documents follow a similar pattern, it becomes easier to track payments, outstanding balances, and discrepancies, leading to smoother financial management.

How to Ensure Consistency

To maintain uniformity in billing, businesses should:

- Create Standardized Templates: Use the same format and layout for every document to make them instantly recognizable and professional.

- Use Clear Language: Adopt consistent language and terminology across all documents to avoid confusion and provide clarity for clients.

- Automate Where Possible: Automating the creation of financial documents can reduce human error and ensure that the same standards are applied every time.

By prioritizing consistency in financial documents, businesses can build stronger relationships with clients, improve internal processes, and maintain a higher level of professionalism.