Free Florist Invoice Template for Easy Billing

Managing financial transactions efficiently is crucial for any small business, especially in creative industries. A well-structured document for charging clients can simplify this process, ensuring accuracy and professionalism. Whether you’re a flower shop owner or a freelance decorator, having a reliable tool to handle payments can save you time and reduce errors.

With the right tools, you can easily generate detailed receipts for services rendered. These documents help clarify charges, establish payment terms, and maintain records for tax purposes. Instead of starting from scratch each time, using a ready-made format allows for quick customizations and consistent results.

By utilizing a pre-designed solution, you can create polished, error-free statements that reflect your brand’s professionalism. Adapting this system to your needs can make the process faster and more efficient, while also fostering trust with your clients. The best part is that many options are available without any cost, making it easy to get started without a large investment.

Free Florist Invoice Template for Small Businesses

Small business owners in the floral industry often face the challenge of managing payments while maintaining a professional image. A reliable tool for creating billing statements is essential, as it ensures accurate record-keeping and efficient communication with clients. By utilizing a streamlined document, you can improve the overall efficiency of your business operations.

Why It’s Important for Small Businesses

For small businesses, time and resources are precious. Having a ready-to-use document to outline services and charges can save valuable time, allowing you to focus on growing your business. A professionally structured statement helps build credibility and keeps transactions transparent, which is vital for maintaining good customer relationships.

How to Get Started

Many businesses are opting for downloadable solutions that don’t require a significant financial investment. These resources can be customized to meet your specific needs, from adding your logo to adjusting payment terms. With a simple tool, you can create documents that look polished and reflect the values of your business. Moreover, these options often come with no cost, allowing you to enhance your processes without additional expenses.

Using a well-organized document system also reduces the risk of errors, such as missed payments or incorrect charges. With just a few clicks, you can generate accurate statements every time, helping your business stay on top of its financials and maintain a positive image in the eyes of your customers.

Why You Need an Invoice Template

For any small business, managing payments and maintaining clear financial records is essential. Having a consistent and reliable way to document transactions helps ensure professionalism and prevent misunderstandings with clients. A structured document not only makes the billing process easier but also provides a legal record of services provided and payments due.

Efficiency and Accuracy

Creating custom billing statements from scratch for each transaction can be time-consuming and prone to errors. A pre-designed solution allows you to quickly generate clear and accurate records without the hassle. By automating this process, you can reduce human error, ensure consistency, and stay organized in your business finances.

Building Professionalism

When you use a polished and well-organized document for all your transactions, it conveys a sense of professionalism to your clients. Clear and structured statements reflect the quality of your business and help build trust with your customers, making it more likely they’ll return for future services.

| Benefit | Impact |

|---|---|

| Efficiency | Speeds up the billing process and saves time. |

| Accuracy | Reduces the risk of errors and incorrect billing. |

| Professionalism | Enhances your business image and builds client trust. |

| Organization | Keeps financial records consistent and easy to track. |

In addition to these practical benefits, using a ready-made document for your business can ensure compliance with tax regulations and provide clear evidence of transactions when needed. This is particularly important for businesses that need to maintain accurate financial records for tax filings or audits.

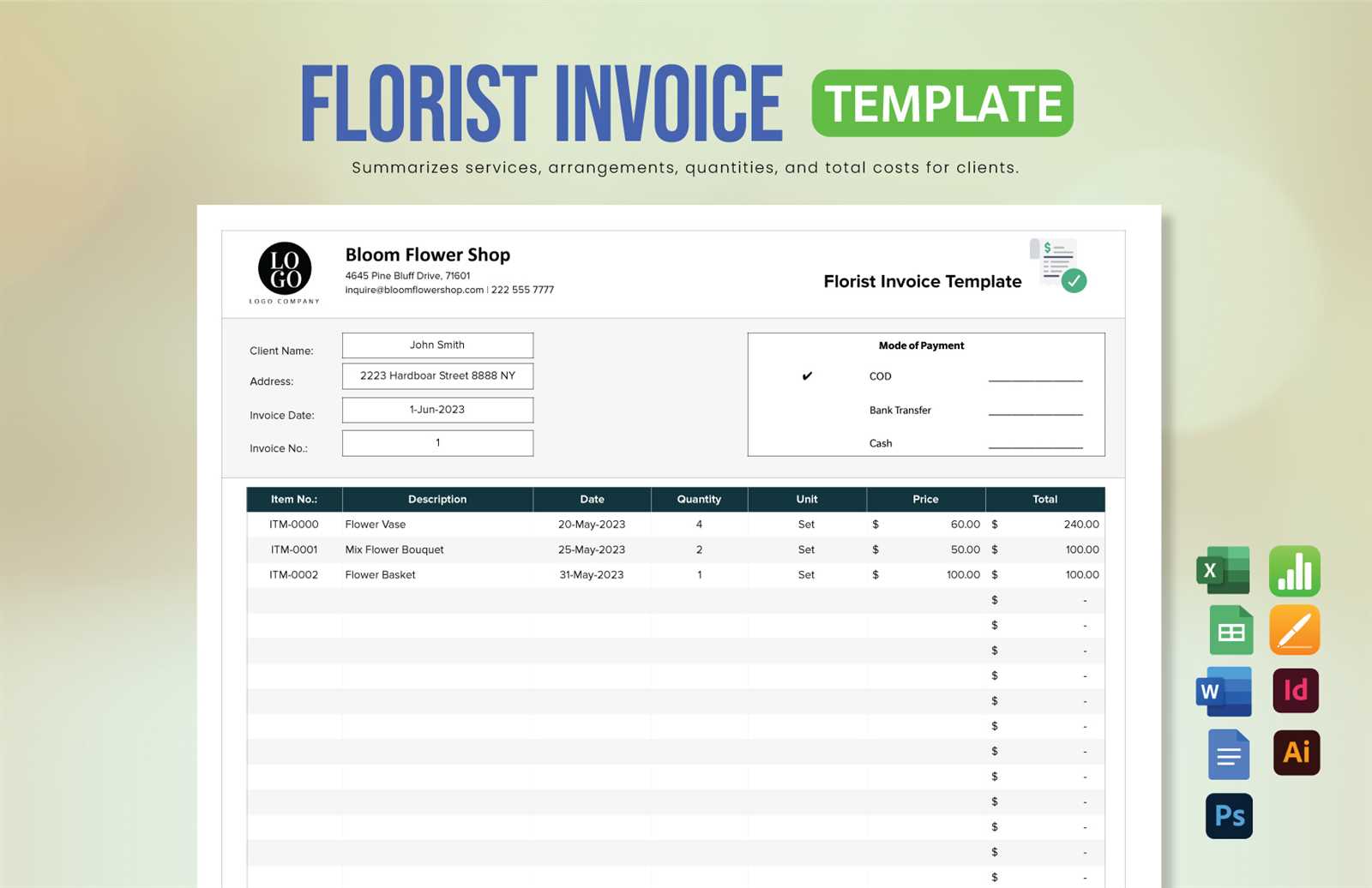

How to Customize a Florist Invoice

Customizing your billing statements is a key step in ensuring they meet the specific needs of your business. By personalizing each document, you can reflect your unique brand identity while maintaining a professional appearance. The ability to adjust key details such as payment terms, service descriptions, and visual design elements makes it easier to communicate with your clients and keep track of financial transactions.

Steps to Tailor Your Document

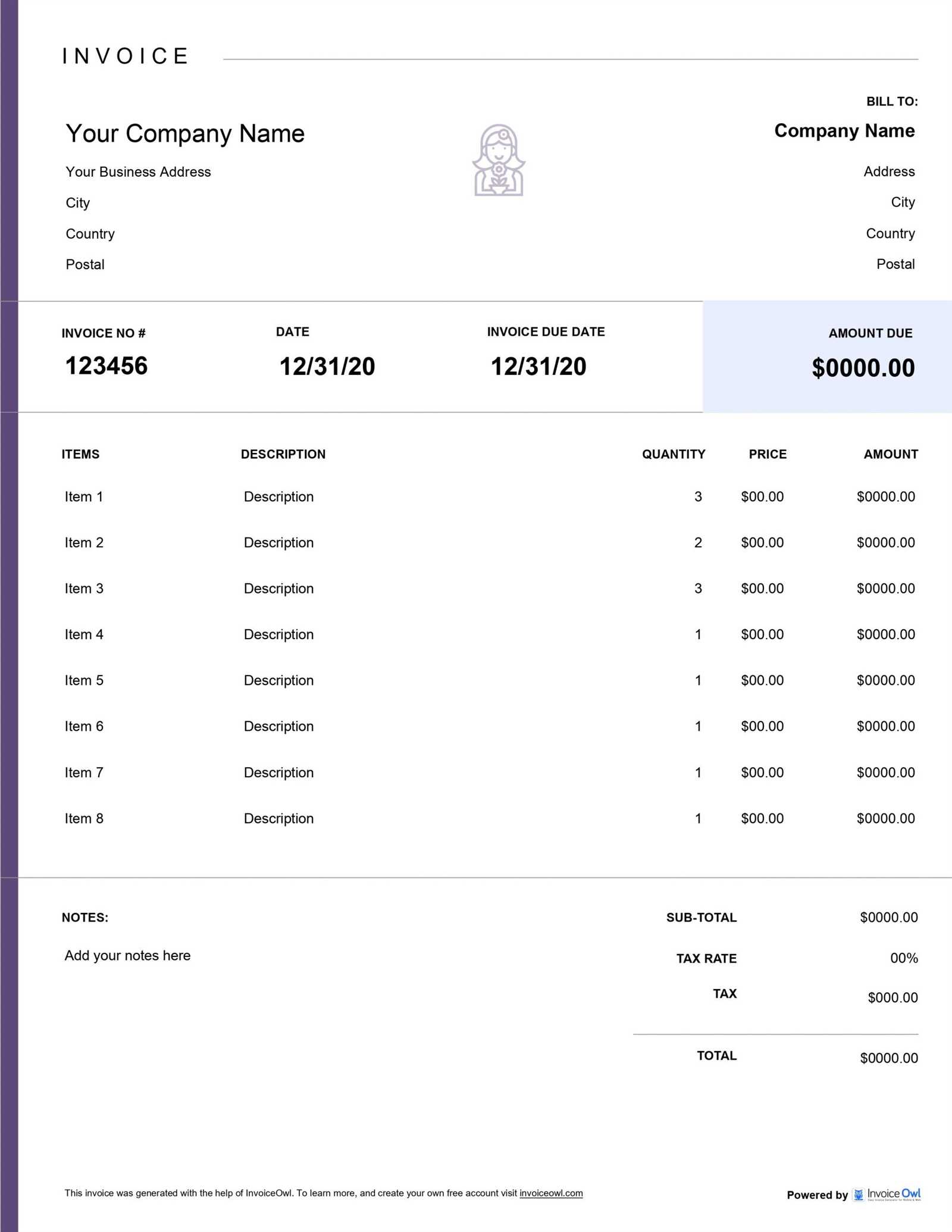

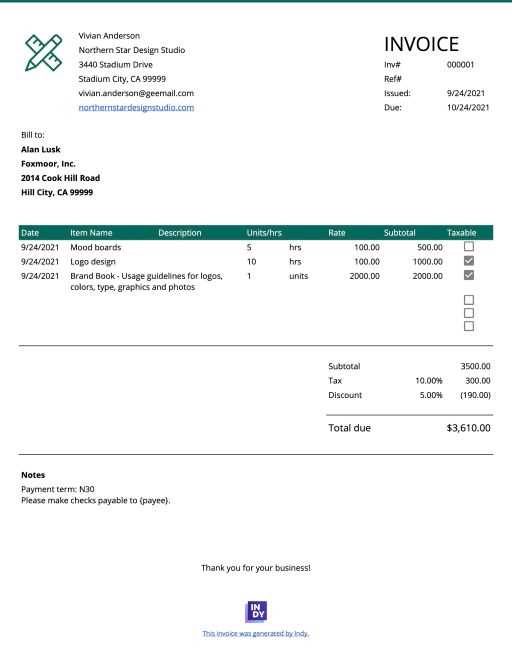

To customize your document, you will typically start by adding your business details. This includes your business name, contact information, and logo, which will help clients identify your brand. Next, ensure that the pricing and service descriptions are accurate and specific to each project. Finally, adjust the layout and design to match the style of your business, whether that be minimalistic or vibrant and decorative.

Key Elements to Modify

| Element | How to Customize |

|---|---|

| Business Information | Add your company name, address, phone number, and email. |

| Client Details | Input the name and contact information of the person receiving the services. |

| Service Description | List the services provided, ensuring accuracy and clarity. |

| Pricing | Update the prices for each item or service and calculate the total amount due. |

| Payment Terms | Adjust the payment due date and any other relevant terms, such as late fees or discounts. |

Once you’ve made these adjustments, you can also add additional features, such as payment options or a thank-you note for the client. Customizing your documents allows you to streamline your workflow and make your transactions more personal and professional, enhancing your brand image in the process.

Essential Information to Include in an Invoice

To ensure clarity and avoid disputes, it’s important to include all the necessary details in your billing documents. Properly documenting key information not only ensures that you and your clients are on the same page, but also helps maintain an organized record of all transactions. Clear and accurate statements help facilitate smooth communication and prompt payment.

Key Details to Include

At a minimum, your document should contain information that identifies both your business and your client, the services provided, and the agreed-upon payment terms. Each of these elements is essential for creating a professional and effective transaction record. Without them, confusion and delays can arise, leading to potential issues with payments and service disputes.

Critical Elements

| Item | Description |

|---|---|

| Business Information | Your company name, address, phone number, and email. |

| Client Details | Name, address, and contact information of the recipient. |

| Service Description | A clear list of services provided or products sold with detailed descriptions. |

| Pricing | Breakdown of costs, including individual service prices and the total amount due. |

| Payment Terms | Due date, accepted payment methods, and any late fees or discounts. |

By including these critical pieces of information, you create a comprehensive and understandable document that benefits both your business and your client. A well-detailed document reduces the chance of misunderstandings and ensures smoother transactions for both parties.

Benefits of Using a Template for Invoicing

Using a pre-designed solution for managing your billing process can significantly improve the efficiency and professionalism of your business transactions. Whether you’re handling a few transactions or a large volume of clients, these tools help streamline the process, minimize errors, and ensure consistency in every communication with customers.

Time-Saving Efficiency

One of the main advantages of using a ready-made document is the time it saves. Instead of manually creating each statement from scratch, you can quickly input the necessary details and generate a polished, error-free record. This allows you to focus on other important aspects of running your business, such as customer service or expanding your offerings.

Improved Professionalism and Consistency

A standardized document not only enhances the look of your transactions but also helps maintain consistency across all communications. Clients will appreciate the clear structure, and it will reflect positively on your business. Consistent documentation fosters trust and makes your brand appear more established and reliable in the eyes of your customers.

Moreover, the uniformity of pre-designed formats ensures that no important information is overlooked, such as payment terms, service descriptions, or due dates. This level of consistency can help reduce misunderstandings and prevent disputes about payments or services.

Increased Accuracy is another key benefit. Pre-built forms are designed to be comprehensive, meaning you don’t have to worry about missing critical information. The clear structure makes it easier to double-check each section for accuracy, reducing the likelihood of errors in pricing, quantities, or calculations.

Ultimately, using a ready-made solution for billing can improve your workflow, enhance the customer experience, and keep your financial records organized and up to date.

Where to Find Free Invoice Templates

For small business owners looking to streamline their billing process, there are numerous places to access pre-designed documents at no cost. Whether you’re new to the business world or looking to upgrade your current method, online resources provide a wide range of customizable options. These tools are perfect for creating professional-looking statements quickly and efficiently.

Online Platforms Offering Free Resources

Many websites offer ready-to-use solutions that can be easily downloaded and customized to meet your needs. These platforms typically provide various designs and formats, allowing you to choose one that fits your business style. Some platforms even allow you to personalize the design by adding your branding elements, such as logos and color schemes.

Popular Websites for Downloading Templates

| Website | Description |

|---|---|

| Canva | Offers a variety of customizable designs with simple editing options, perfect for creating personalized billing documents. |

| Microsoft Office | Provides free downloadable formats, including Word and Excel, which are easy to modify and use for billing. |

| Google Docs | Free and easily accessible templates that can be edited online and saved in various formats, such as PDF or Word. |

| Invoicely | Offers a free plan with basic invoicing tools and a wide variety of designs suitable for different industries. |

| Zoho Invoice | Free invoicing platform with customizable templates that integrate with other tools for a seamless experience. |

By exploring these platforms, you can find a solution that fits your needs, ensuring that your billing documents are clear, professional, and aligned with your business identity. Many of these sites offer templates for multiple industries, allowing for even greater customization as your business grows.

How to Organize Your Billing Process

Efficiently managing the payment process is key to running a successful business. An organized approach helps ensure timely payments, minimizes errors, and keeps your financial records in order. By streamlining your billing procedures, you can reduce administrative burdens and improve cash flow, making your business operations smoother and more predictable.

Set Clear Payment Terms

One of the first steps in organizing your financial process is to establish clear payment terms with your clients. This includes specifying due dates, accepted payment methods, and any late fees or discounts. Setting these expectations from the start ensures that both you and your clients understand when and how payments are to be made, preventing confusion down the line.

Automate and Streamline Tasks

Automation is a great way to stay on top of billing. Consider using accounting software or digital tools that allow you to generate and send statements with just a few clicks. These tools often come with features that automatically calculate totals, add taxes, and track payments, freeing up time for you to focus on other aspects of your business.

Additionally, maintaining a well-organized digital or physical filing system is essential for tracking payments, overdue amounts, and previous transactions. Keep all records easily accessible to avoid the stress of searching for documents when needed, especially during tax season or audits.

Creating Professional Invoices in Minutes

Generating polished and professional billing statements doesn’t have to be a time-consuming task. With the right tools, you can create clear, accurate, and attractive documents in just a few minutes. Whether you’re sending a single statement or multiple, quick and easy solutions allow you to handle payments efficiently, without compromising on quality.

Streamline the Process with Pre-Designed Solutions

Using pre-designed formats can significantly reduce the time spent on creating documents. These formats are structured and ready to be customized with your business details and client information. By simply filling in the required fields, you can generate a well-organized record in seconds. Whether it’s adjusting the service descriptions, adding prices, or modifying the payment terms, customization is straightforward.

Key Features for Quick Creation

Automation tools allow for quick population of common fields like customer details and pricing. Many platforms even provide the ability to store frequently used information, which further speeds up the process. Additionally, built-in calculations ensure that totals, taxes, and discounts are applied automatically, minimizing the risk of human error.

Design consistency is another advantage. Once you choose a layout, you can use it across all your billing statements, which helps maintain a professional and cohesive brand identity. You can also adjust the appearance to match your business’s style, ensuring that every document looks polished and personalized for your clients.

With these tools, you can produce high-quality statements quickly, allowing you to focus more on growing your business and providing excellent customer service.

Understanding Invoice Formats for Florists

Choosing the right format for billing statements is essential for ensuring clarity, efficiency, and professionalism. Different businesses may require different approaches, and for those in the floral industry, a clear and visually appealing format is just as important as accuracy. Understanding the various styles of documents and knowing when and how to use them can simplify your financial processes and improve your relationship with clients.

Common Formats Used in Billing

There are several document layouts that are commonly used across various businesses. When choosing the right one for your business, it’s important to consider how detailed the statement needs to be, the level of customization required, and the ease of use. Below are some popular formats:

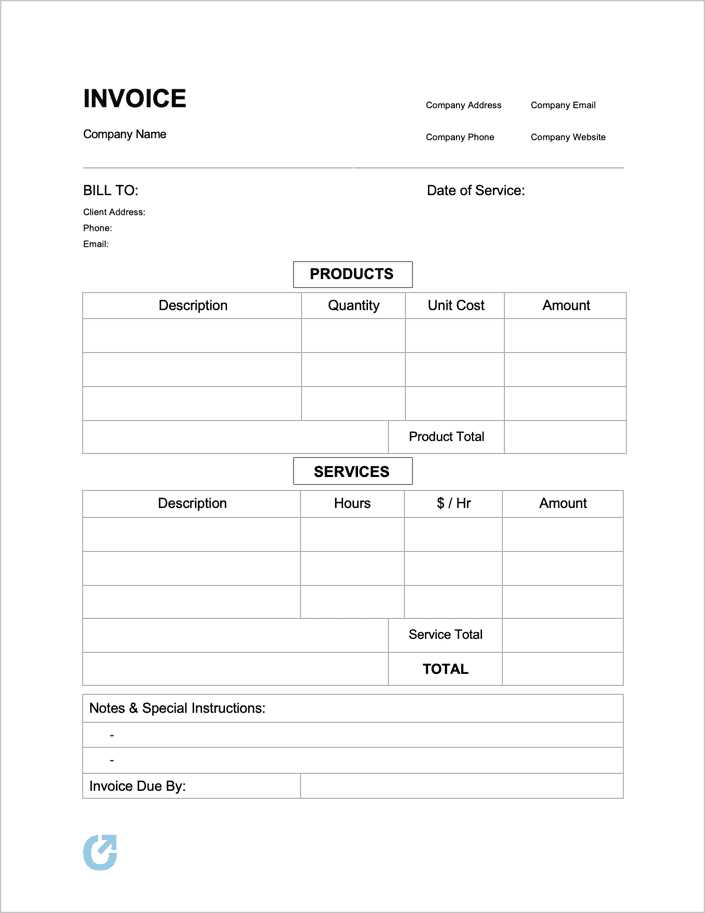

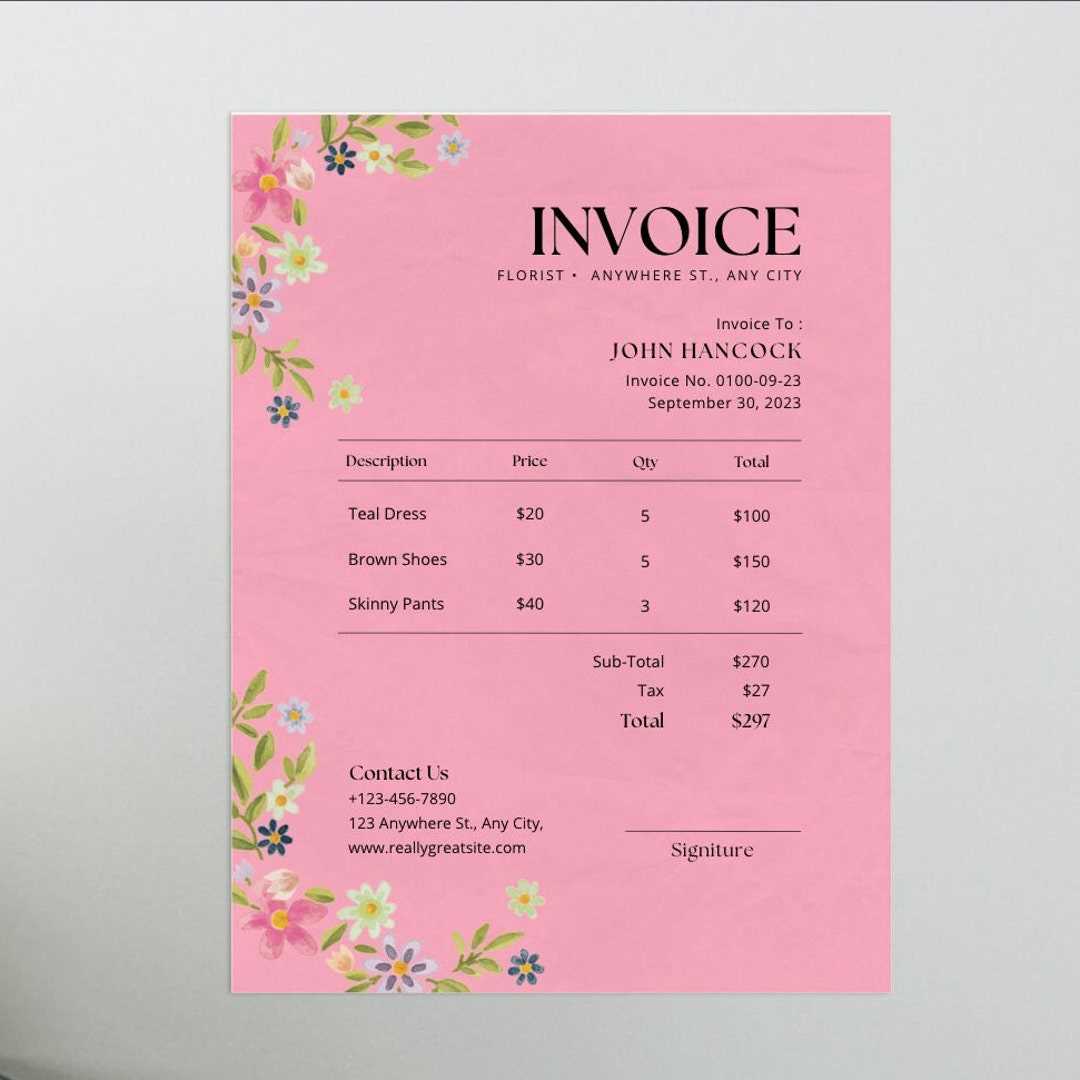

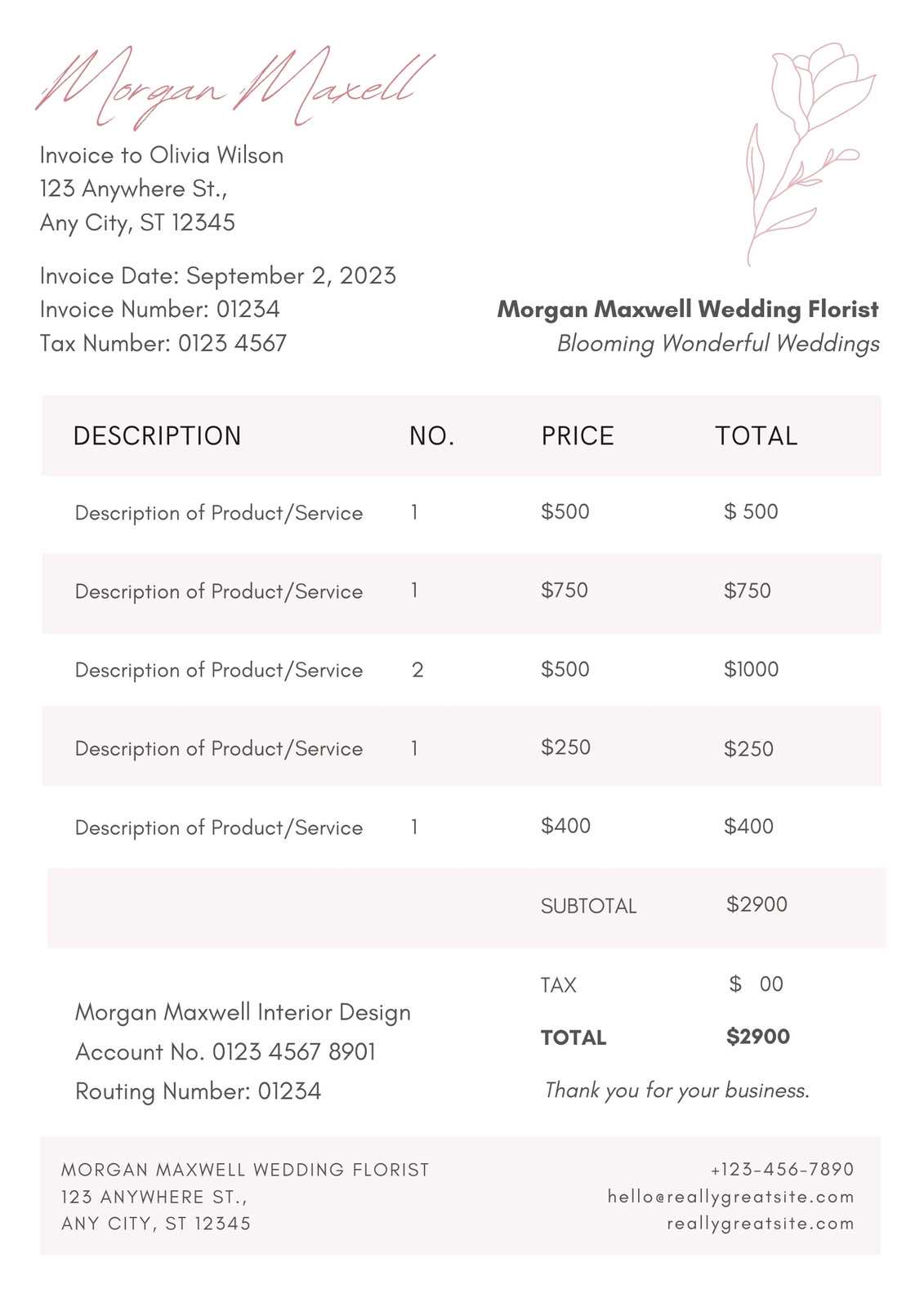

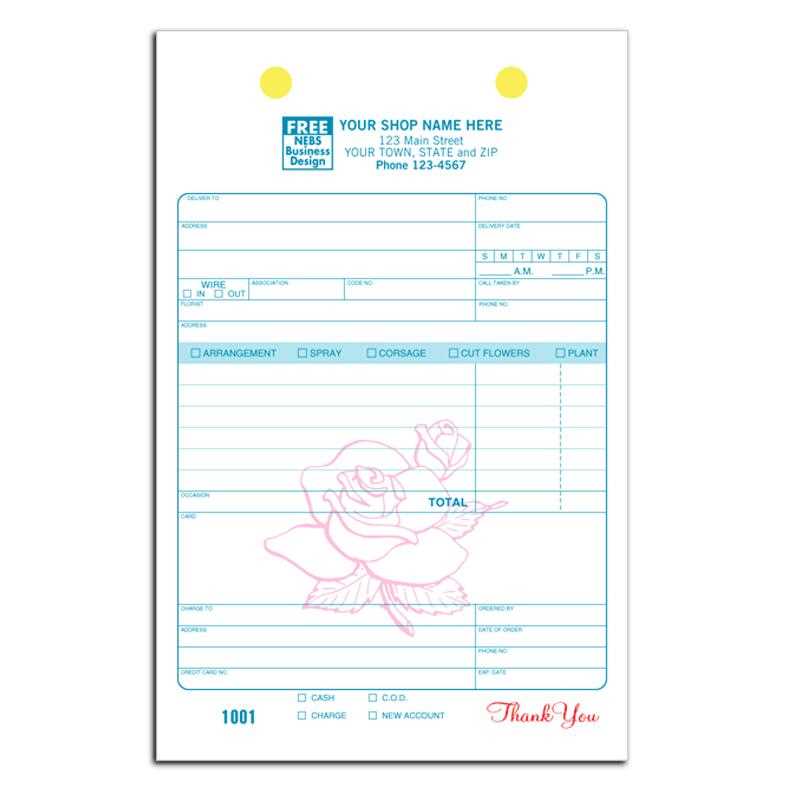

- Basic Format: Simple and straightforward, this layout includes key details such as service descriptions, prices, and totals. It is ideal for businesses that provide quick, one-time transactions.

- Detailed Breakdown: For businesses offering multiple products or services, this format includes itemized descriptions, quantities, individual pricing, and a final total. It’s useful for more complex transactions.

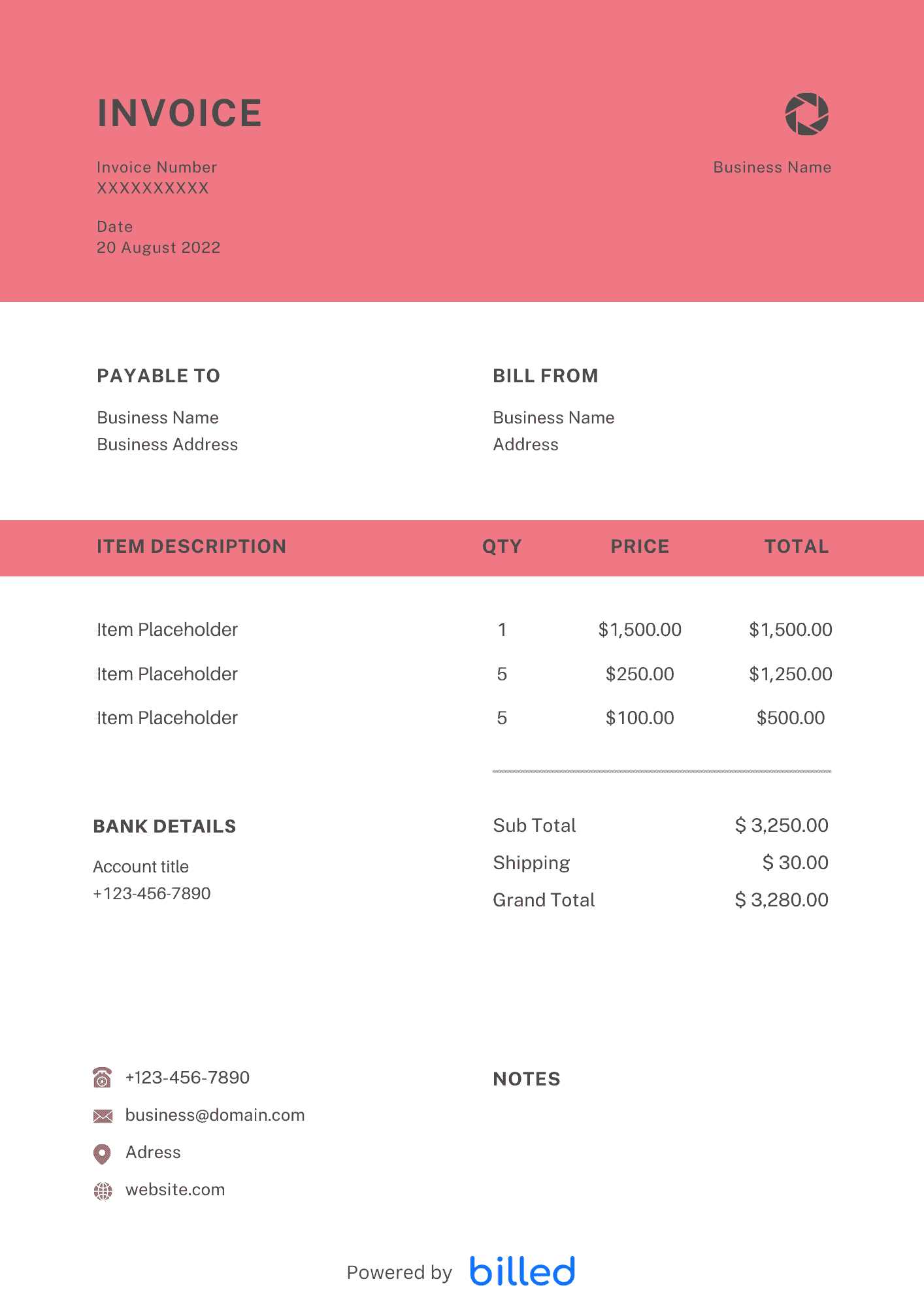

- Professional Design: A visually appealing format that includes branding elements such as logos and colors. This layout is perfect for businesses looking to reflect a premium image in every document.

Choosing the Right Layout for Your Business

Selecting the best layout depends on the type of services or products you provide. Consider the following when deciding:

- Transaction Complexity: If your services involve multiple items or packages, a detailed format with itemized descriptions is necessary.

- Client Preferences: Some clients may prefer a more straightforward, minimalist layout, while others may appreciate a more professional, branded design.

- Business Image: Choose a layout that aligns with your brand. If you want to convey a polished and high-end image, a professional design with clear structure and color customization may be appropriate.

Ultimately, the format you choose should enhance communication with your clients, making it easy for them to understand the details of their transactions and making your business appear organized and professional.

How to Avoid Billing Mistakes

Billing errors can lead to confusion, delayed payments, and damaged client relationships. To ensure smooth transactions and maintain professionalism, it’s crucial to adopt strategies that minimize the risk of mistakes. Proper organization, attention to detail, and the use of reliable tools can significantly reduce common billing errors and help you maintain accurate records.

Key Strategies for Accurate Billing

Here are some best practices that will help you avoid mistakes and ensure that all your transactions are handled efficiently:

- Double-Check Details: Always verify client information, service descriptions, and prices before finalizing any document. Small errors in names or service charges can create confusion and delays in payment.

- Use Consistent Formats: Stick to one standard layout for all your billing statements. This consistency makes it easier to spot mistakes and ensures that both you and your clients are familiar with the structure.

- Calculate Carefully: Ensure that all sums, taxes, and discounts are applied correctly. Use tools that automatically calculate totals to reduce the risk of mathematical errors.

- Include Clear Payment Terms: Always state the due date and payment methods explicitly. This helps prevent misunderstandings and ensures that clients know when and how to settle their accounts.

Additional Tips for Error-Free Billing

By following these tips, you can create a more streamlined and error-free billing process:

- Track Payments Promptly: As soon as a payment is made, mark it in your records. This prevents confusion over outstanding balances.

- Keep Digital Copies: Store all documents electronically to avoid losing important records and ensure easy access for reference or auditing purposes.

- Automate Where Possible: Use software tools to automate calculations, reminders, and document generation. This reduces human error and speeds up the process.

By implementing these strategies, you can minimize the chances of billing mistakes, enhance your business operations, and foster trust with your clients. The more organized and meticulous you are, the smoother your billing process will run.

Automating Your Billing Workflow

Automation is a game-changer for managing financial tasks. By streamlining repetitive processes such as generating payment statements, tracking due dates, and sending reminders, you can save time, reduce errors, and ensure consistency across all your transactions. Adopting an automated workflow allows you to focus more on serving your clients and growing your business while ensuring your billing process remains accurate and efficient.

Benefits of Automating Your Financial Tasks

Integrating automation into your billing process offers numerous advantages, including:

- Time Savings: Automated systems can create and send payment statements with just a few clicks, eliminating the need for manual input each time.

- Accuracy: Automation reduces human error by applying consistent rules for calculations, taxes, and discounts.

- Efficiency: With automated reminders and follow-ups, you can ensure that payments are received on time without having to manually track outstanding balances.

- Professional Appearance: Automated systems often offer polished, branded templates that help maintain a consistent and professional look for all your financial documents.

Key Steps to Automating Your Billing Workflow

Here are some steps to get started with automating your payment documentation process:

- Choose the Right Software: Select a billing or accounting platform that suits your business needs. Many software options offer automation features, including payment reminders, automatic tax calculations, and recurring billing.

- Customize Your Settings: Set up your client information, payment terms, and business details. This ensures that each generated document is tailored to your specific needs without manual adjustments.

- Schedule Automatic Reminders: Set up reminders that will automatically notify clients of upcoming or overdue payments. This can help reduce late payments and improve your cash flow.

- Integrate Payment Processing: Consider using tools that allow clients to pay directly from the billing statement. This streamlines the payment process and encourages timely settlement.

By automating your billing tasks, you can reduce administrative overhead, improve the accuracy of your records, and free up more time to focus on client relationships and growing your business. Automation helps you maintain control over your financial operations while ensuring that everything runs smoothly and efficiently.

Best Practices for Invoice Design

Designing clear, professional billing documents is essential for ensuring smooth transactions and maintaining positive client relationships. A well-structured document not only helps clients understand the charges but also reflects your business’s attention to detail and professionalism. Whether you’re sending a simple statement or a more detailed breakdown, the design of your document can make a significant impact on your clients’ experience.

Key Elements to Include in Your Billing Document

To create an effective and professional-looking statement, it’s important to include essential details that are easy to read and understand. Consider the following elements when designing your document:

- Clear Branding: Include your business name, logo, and contact details at the top. This helps reinforce your brand identity and makes it easier for clients to recognize your business.

- Client Information: Ensure that client names, addresses, and other relevant details are clearly listed. Accuracy here helps prevent confusion and ensures that the right person is billed.

- Service Description: Provide a clear breakdown of the products or services provided. Be specific and detailed, especially for complex transactions, to avoid misunderstandings.

- Payment Terms: Clearly state the due date, accepted payment methods, and any applicable late fees or discounts. This ensures that both you and your clients are on the same page regarding payment expectations.

Design Tips for a Professional Look

In addition to including the right information, the layout and visual appeal of the document play a crucial role in how it is perceived by clients. Here are some design tips to make your statement more professional:

- Use Readable Fonts: Choose clear, simple fonts that are easy to read. Avoid overly stylized fonts that may distract from the content.

- Maintain a Clean Layout: Use plenty of white space to break up sections and make the document easier to read. Keep margins consistent and align text properly.

- Be Consistent with Colors: Stick to a consistent color palette that matches your brand. Use colors sparingly, such as for headings or highlighting key information.

- Organize with Sections: Break your document into logical sections (e.g., service details, pricing, payment information). This helps guide the reader’s eye and makes the document easier to navigate.

- Use Visual Hierarchy: Highlight important details, such as totals and due dates, by making them bold or using larger fonts. This makes it easier for clients to quickly f

Choosing the Right Software for Billing Statements

Selecting the right software for managing payment documents is a critical decision for any business. The right tool can save time, reduce errors, and streamline your financial operations. With a variety of options available, it’s essential to find a platform that fits your specific needs, offering the features you require while being user-friendly and efficient.

Factors to Consider When Choosing Billing Software

When selecting a solution for managing your financial documents, there are several key features to evaluate to ensure you choose the right one for your business:

- Ease of Use: The software should be intuitive and easy to navigate. You don’t want to spend hours learning how to use it. Look for platforms that offer simple, drag-and-drop functionality or pre-designed layouts that make document creation fast and straightforward.

- Automation Features: Automation is one of the most valuable features to look for. Automated payment reminders, recurring billing, and automatic tax calculations can save a significant amount of time and reduce human errors.

- Customization Options: The ability to tailor the design and structure of your documents is crucial. Choose software that allows you to add your branding elements, such as logos, color schemes, and business details, to maintain a professional appearance.

- Integration with Other Tools: Consider whether the software can integrate with your existing accounting or payment processing systems. Integration simplifies record-keeping and ensures that everything is synced up across platforms.

Popular Billing Software Options

There are many software platforms designed to help businesses manage financial documents. Here are a few popular options:

- QuickBooks: Known for its powerful accounting features, QuickBooks offers solutions for managing payments, taxes, and financial reporting.

- FreshBooks: Ideal for small businesses, FreshBooks allows users to create and send professional statements quickly, track time, and set up recurring billing.

- Zoho Books: This platform provides comprehensive features for billing, including time tracking, automatic payment reminders, and multi-currency support, making it perfect for businesses with international clients.

- Wave: A free option for small businesses, Wave offers billing solutions with customizable templates and easy integration with payment systems.

By choosing the right software for your business, you can simplify your billing process, improve accuracy, and ultimately enhance your workflow, making financial management o

Tracking Payments with Your Billing Document

Accurately tracking payments is crucial for maintaining a healthy cash flow and ensuring that no payments are missed or overlooked. By implementing a clear and organized system for recording payments against your billing statements, you can streamline your financial management, avoid errors, and keep clients informed about their payment status. Tracking also helps with reconciliation and ensures that your business remains financially secure.

Key Information to Include for Payment Tracking

To effectively monitor payments, make sure your financial statements include the following details:

- Payment Due Date: This is the date by which the client is expected to pay. It helps both parties stay on schedule and minimizes the chances of overdue payments.

- Payment Status: Indicate whether the payment is pending, completed, or overdue. This status allows both you and your client to quickly see where things stand.

- Amount Paid: Specify how much the client has paid, and include any partial payments made over time. This ensures clarity and prevents confusion.

- Remaining Balance: Clearly show how much the client still owes. This will help prevent misunderstandings and ensure both you and your client are aware of the outstanding balance.

Using Tools to Track Payments

Tracking payments manually can be time-consuming and error-prone. Thankfully, various software tools can automate the process, making payment tracking easier and more accurate:

- Accounting Software: Platforms like QuickBooks or FreshBooks can automatically track payments, generate reports, and send reminders for overdue amounts.

- Spreadsheets: For smaller businesses, using a simple spreadsheet can help you track payments manually. However, this option requires more effort and can lead to mistakes if not regularly updated.

- Payment Systems: Many payment processors, such as PayPal or Stripe, offer built-in tools for tracking paid and pending transactions. These tools can help you match payments with your billing statements.

Tracking Payment Status Example

Here is an example of how payment tracking information can be organized in a table for easy reference:

Client Name Amount Due Amount Paid Payment Status Remaining Balance Due Date John Doe $150.00 $150.00 Paid $0.00 10/15/2024 Legal Requirements for Billing Statements

When managing financial transactions, it’s important to ensure that your payment documents comply with legal standards. Different regions and countries have specific regulations for what should be included in billing statements to make them legally valid and to ensure proper tax reporting. Understanding these requirements is essential to avoid potential fines or legal issues, as well as to build trust with your clients.

Essential Information for Legal Compliance

To ensure your billing documents are legally compliant, the following information must be included:

- Business Information: Include your business name, address, and contact details. This helps identify the entity responsible for the transaction.

- Client Information: Provide the full name or business name, address, and contact details of the client being billed.

- Unique Document Number: Each payment statement should have a unique identifier or reference number. This makes it easier to track payments and resolve disputes.

- Description of Products/Services: Clearly list the goods or services provided, including the quantity, unit price, and total cost. This transparency helps prevent misunderstandings and ensures the client is aware of exactly what they are paying for.

- Payment Terms and Due Date: Clearly state when the payment is due and any penalties for late payment. This is crucial for protecting your business’s cash flow.

- Tax Information: If applicable, include the appropriate tax rate, tax amount, and the total amount due, including taxes. This ensures that your transaction complies with local tax regulations.

Regional Differences in Billing Requirements

Billing requirements can vary depending on the country or region. For instance, some countries require additional tax registration numbers or specific details for international transactions. Here are some common differences:

- VAT Number: In many countries within the European Union and other regions, businesses must include a VAT (Value Added Tax) number on all commercial billing documents. This is important for tax reporting purposes.

- Currency and Language: Some regions require that the payment documents include the currency of the transaction and, in certain cases, that the document be provided in the local language.

- Electronic Billing Compliance: In many jurisdictions, electronic billing must meet specific legal standards. For example, it may be necessary to use a government-approved e-billing system or to store e-bills in a secure manner for a specified period.

By ensuring that your payment documents include all required information and comply with local legal standards, you pro

How to Send Billing Statements to Clients

Sending clear and professional payment documents is an essential part of maintaining strong client relationships and ensuring timely payments. It’s important to choose the right method for delivering these documents to your clients, as well as ensuring they receive all necessary details to process their payment promptly. Whether you’re sending documents digitally or through traditional means, understanding how to effectively deliver them can help you maintain good communication and improve your cash flow.

Methods for Sending Billing Documents

There are several common ways to send billing documents to clients. Below are some of the most popular options:

- Email: Sending documents via email is one of the most efficient and widely used methods. You can attach a PDF version of your document and include a brief message explaining the charges and due date. Make sure to use a professional subject line and ensure the document is easy to open and read.

- Postal Mail: For clients who prefer traditional methods, you may opt to mail a printed copy of the document. While this is more time-consuming and costly, some clients may appreciate a hard copy for their records.

- Online Billing Systems: If you use online billing software, many platforms allow you to send documents directly to your clients through the system. Some tools even offer the option to automate billing, meaning documents can be sent on a schedule without manual effort.

- Text Message or Messaging Apps: For smaller businesses or specific industries, sending a payment request via text message or a messaging app can also be an option. However, this is usually reserved for smaller amounts or clients with whom you have a strong relationship.

Best Practices for Sending Billing Statements

Regardless of the method you choose, there are several best practices to follow when sending payment documents:

- Use Professional Language: Ensure your email or message has a professional tone. Avoid using informal language, as it can make your business appear unprofessional. A polite and respectful tone helps build trust with your clients.

- Provide Clear Instructions: Clearly explain the payment terms, the total amount due, and the payment methods available. This reduces confusion and encourages faster payments.

- Send Reminders: If a payment is overdue, it’s essential to send a reminder email or message. Be polite, but firm, in asking for the outstanding payment. Include all relevant details, such as the invoice number, amount, and due date.

- Confirm Receipt: Ask your clients to confirm receipt of the document. This ensures they received the payment request and are aware of the due date.

By choosing the most appropriate method for sending payment documents and following best practices, you’ll enhance your professionalism, streamline your payment process, and improve your chances of getting paid on time. Make sure to maintain open communication

Maximizing Efficiency with Billing Documents

Streamlining your billing process can save time, reduce errors, and help you focus more on your core business activities. By using a standardized format for your payment requests, you can ensure consistency, accuracy, and speed in your operations. A well-organized document system minimizes the chances of mistakes and makes it easier to manage your finances. Efficiency in billing ultimately translates to faster payments, improved client relationships, and better cash flow management.

Key Benefits of Standardized Billing

Using a pre-designed, consistent structure for your payment requests offers several advantages for your business:

- Time Savings: Once you set up a standard document format, you can generate new requests quickly, without having to start from scratch every time.

- Consistency: A uniform design helps your clients recognize your documents easily, ensuring they don’t get confused with other correspondence. Consistency also reflects professionalism.

- Improved Accuracy: A structured format ensures that all necessary information is included, reducing the risk of missing essential details like payment due dates, amounts, or service descriptions.

- Automated Features: Many software programs allow you to automatically populate certain fields such as client name, services provided, and total amounts, further reducing the manual work required.

How a Consistent Billing Format Enhances Productivity

When you create a reusable structure for your payment documents, you eliminate repetitive tasks. This allows you to focus on higher-priority business activities, such as customer acquisition or service improvement. Here’s how you can maximize productivity:

- Reduced Data Entry: With a standardized format, most of the fields can be pre-filled with customer information, saving time and reducing the likelihood of human error.

- Faster Processing: Generating a billing document with a pre-set design allows you to send it to clients quickly, often within a few clicks. This can significantly speed up your billing cycle.

- Ease of Tracking: Consistent billing records help you stay organized, making it easier to track payments and follow up on overdue accounts.

Example of a Standardized Billing Document Format

Here’s an example of how a well-structured document might look, ensuring all critical details are included in a clean, easy-to-read layout:

Client Name Service Description Amount Due Payment Due Date Amount Paid Remaining Balance John Doe Event Floral Arrangement $250.00 10/25/2024 Common Mistakes When Creating Billing Documents

Inaccurate or poorly designed payment requests can lead to confusion, delayed payments, and even strained relationships with clients. When crafting payment documents, it’s crucial to ensure that all relevant details are included and formatted correctly. By avoiding common errors, you can streamline your payment collection process and maintain a professional image. Here are some of the most frequent mistakes businesses make when creating billing documents.

1. Missing Essential Information

One of the most critical errors in creating payment documents is failing to include necessary details. Incomplete or vague information can cause confusion and delays in processing payments. Some key pieces of information that should never be overlooked include:

- Client Details: Always include the client’s name, address, and contact information for proper identification.

- Description of Services: Be clear about the services or goods provided, with detailed descriptions that explain what is being billed for.

- Due Dates: Always specify the date by which payment is expected. Missing or unclear due dates can result in late payments.

- Payment Terms: Clearly state the payment methods accepted, as well as any applicable penalties for late payments.

2. Incorrect Amounts or Calculation Errors

Errors in calculating the total amount due or incorrectly listing unit prices can lead to disputes with clients and payment delays. Ensure the following:

- Accurate Pricing: Double-check all rates and quantities before finalizing the document. Even small errors in pricing can lead to confusion.

- Correct Total: Make sure the final total is calculated correctly, including applicable taxes, discounts, or other adjustments.

- Clear Tax Breakdown: If applicable, ensure taxes are clearly separated and calculated based on the correct percentage.

3. Lack of Professional Formatting

While the content of a payment document is important, the way it is presented matters as well. Poorly designed or disorganized documents can create a negative impression. To maintain a professional appearance, consider the following:

- Consistent Layout: Use a clear and consistent layout with legible fonts and enough white space. This makes the document easier to read and less cluttered.

- Clear Sections: Break the document into distinct sections for easy reference, such as the client information, services rendered, payment terms, and totals.

- Branding: Include your business’s logo and contact details to reinforce your brand identity and make your documents more official.

4. Not Keeping Accurate Records