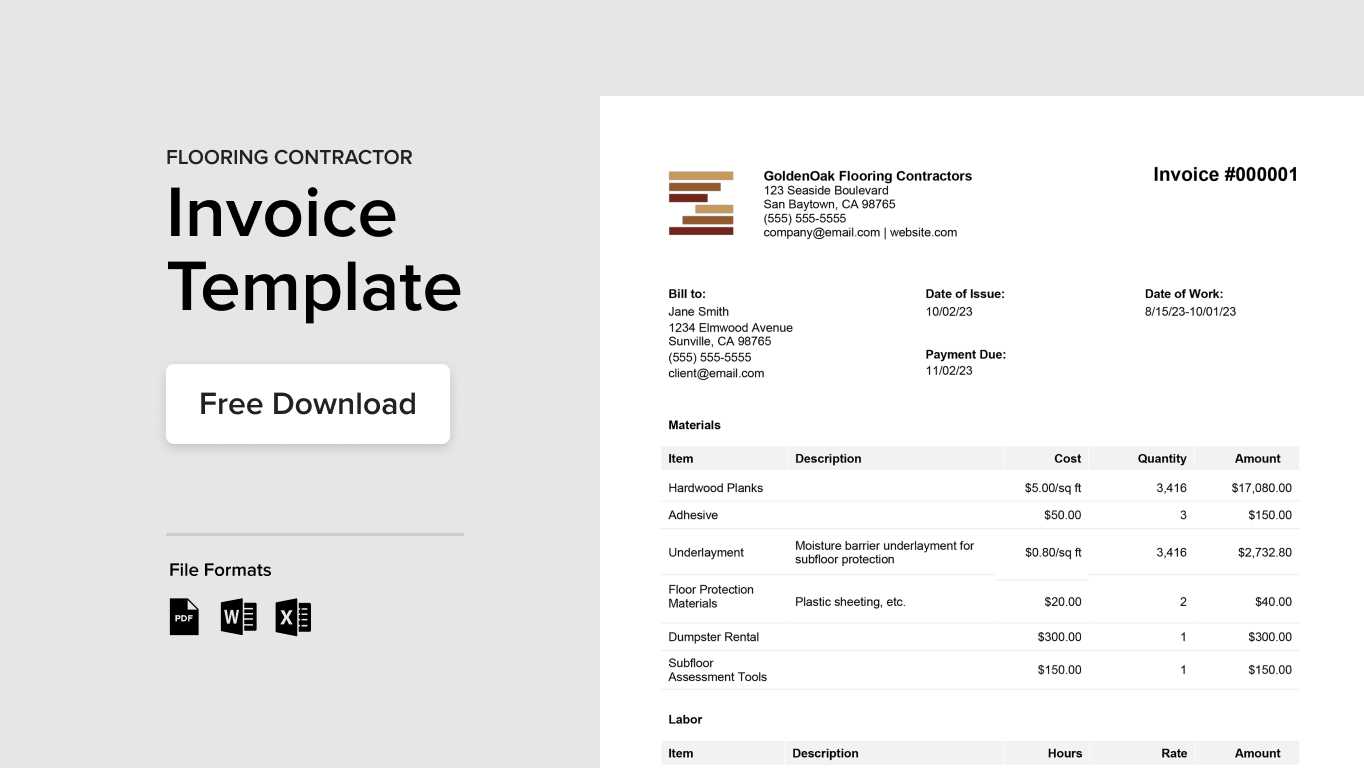

Flooring Installation Invoice Template for Seamless Billing

Efficient and clear billing is crucial when managing home renovation projects, especially when it comes to documenting work done and expenses incurred. A well-organized financial record not only ensures accurate payment but also reflects professionalism and transparency in business practices.

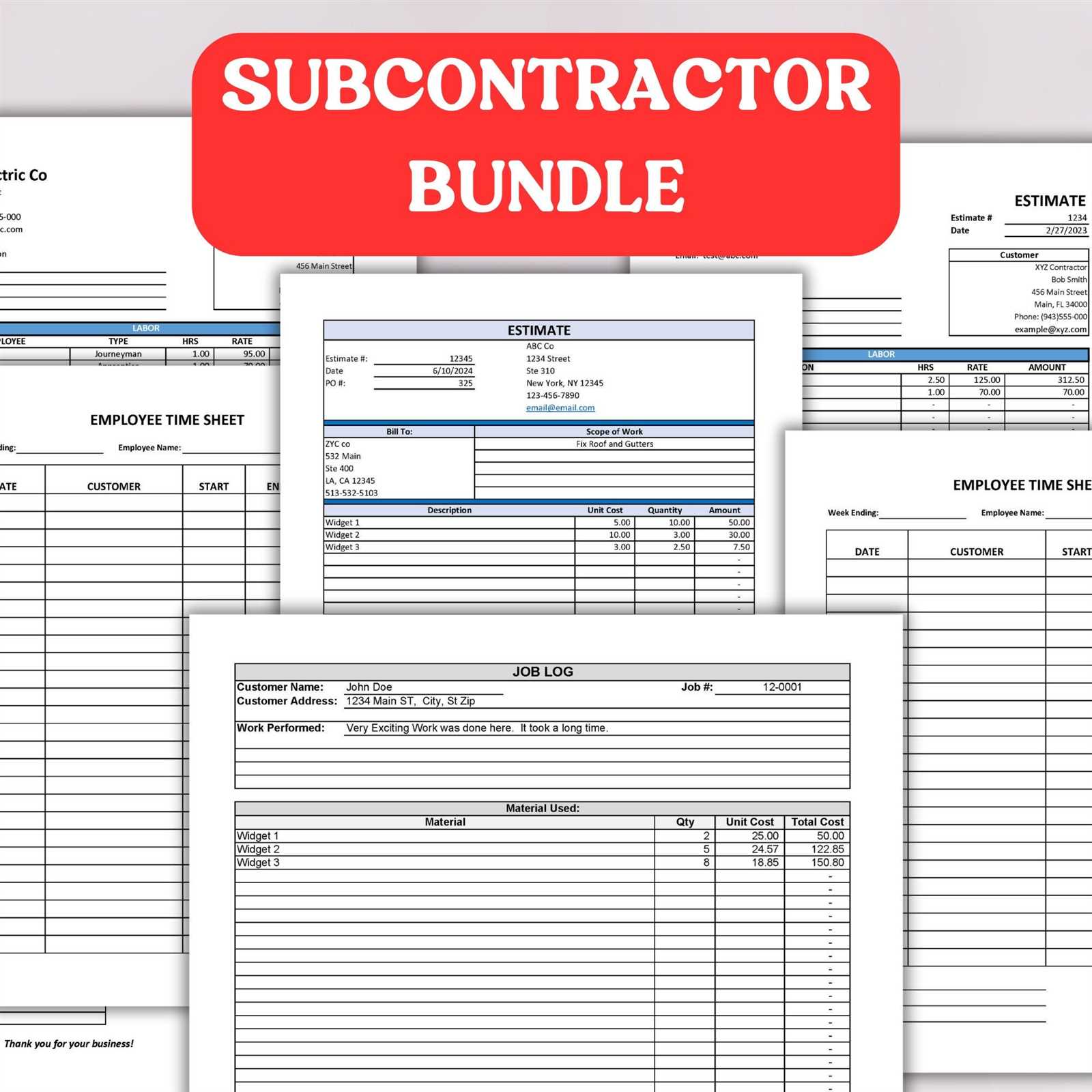

For contractors and service providers, using a structured document to outline costs, materials, and labor hours can simplify communication with clients and expedite the payment process. Whether you’re a seasoned professional or just starting, having the right document at hand can save you time and avoid costly errors.

Customizing your financial records to fit specific needs helps to maintain consistency across projects and ensures all necessary details are included. These records are not only essential for tracking payments but also for building trust and credibility with clients who appreciate clear and straightforward transactions.

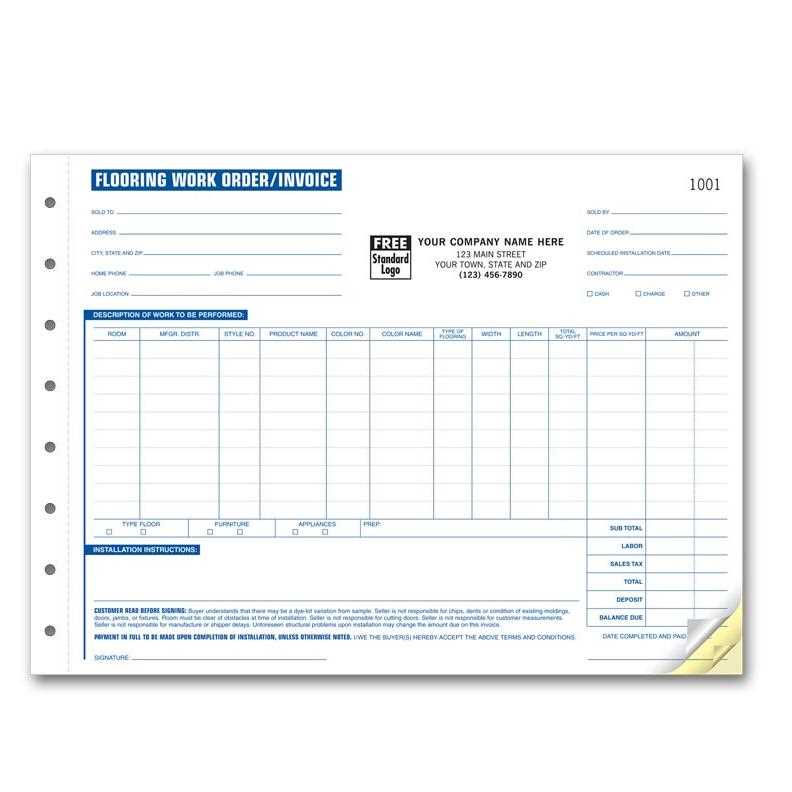

Flooring Installation Invoice Template Overview

Having a well-structured document to record and summarize work performed, materials used, and the costs involved is essential for any service-based business. A professional billing sheet can help ensure that both the client and service provider are on the same page regarding the services rendered and the agreed-upon payment. This type of document simplifies transactions and ensures accurate tracking of revenue and expenses.

The key to creating a useful record lies in its clarity and completeness. A clear document helps avoid confusion, disputes, and delays in payment. It should provide all relevant details, including labor charges, material costs, taxes, and payment terms, in an easy-to-read format that reflects professionalism.

Key Components of a Comprehensive Billing Record

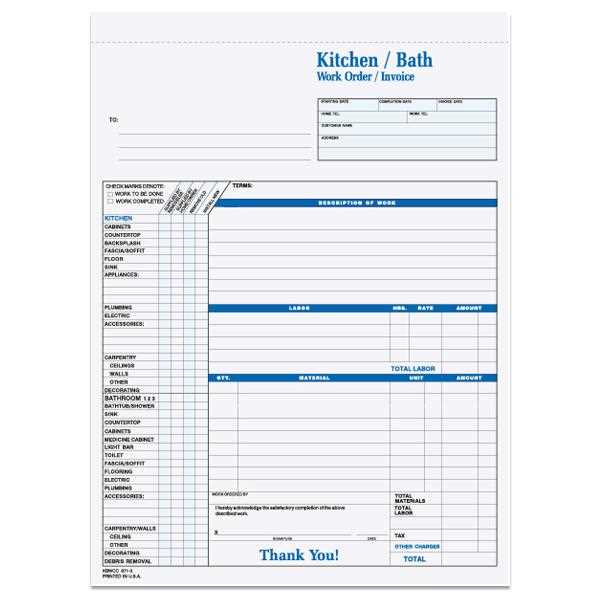

- Service Description: A detailed breakdown of the work completed, including a list of tasks and services provided.

- Itemized Costs: Clear pricing for labor, materials, and any other expenses incurred during the project.

- Payment Terms: Information about when payment is due and any penalties for late payments.

- Client Information: Accurate details about the client’s contact information, including name, address, and phone number.

- Project Dates: Dates for when the work started and when it was completed or expected to be finished.

Why You Need a Customized Billing Document

Every project is unique, and the billing process should reflect those differences. Customizing your records to suit specific project requirements and client expectations ensures that every detail is covered. By adjusting the format and content, you can make sure that all relevant information is easily accessible and tailored to the needs of both the client and service provider.

Using a well-organized financial document also strengthens your business’s credibility, making you appear more professional and reliable in the eyes of clients. This small step can have a big impact on client satisfaction and payment timelines.

Importance of a Professional Invoice

Having a professional document to capture the details of a completed project is a vital aspect of maintaining a smooth business operation. Such a record serves as both a formal request for payment and a clear summary of the services rendered, ensuring transparency for both the service provider and the client. A well-organized and accurate document not only fosters trust but also helps avoid misunderstandings and payment delays.

By using a polished and properly formatted record, businesses can project a sense of professionalism and attention to detail. This document is often the first official interaction a client will have with the service provider after the work is completed, making it an essential tool for maintaining positive business relationships.

Benefits of a Professional Document

| Benefit | Description |

|---|---|

| Clear Communication | Details of services, pricing, and payment terms are laid out, reducing the potential for disputes or confusion. |

| Timely Payments | A well-organized document sets clear payment expectations, increasing the likelihood of receiving payments on time. |

| Professionalism | Sending a formal record demonstrates that your business is organized, reliable, and trustworthy. |

| Record Keeping | Having a detailed record helps both parties track project expenses and payments for future reference or tax purposes. |

In addition, this type of document ensures compliance with industry standards and legal requirements. It can serve as an official proof of service and be used in case of any disputes, providing both parties with a clear, detailed record of the transaction.

How to Create a Flooring Invoice

Creating a comprehensive and accurate billing document is essential for any service-based business. The process of crafting such a record involves outlining all aspects of the work completed, as well as the associated costs. This ensures both the service provider and the client have a mutual understanding of the financial transaction, helping to avoid confusion or disputes.

To create an effective financial document, it’s crucial to include clear descriptions of the services performed, an itemized list of materials or products used, and the costs associated with each. You should also specify payment terms, including deadlines, and any applicable taxes or fees. A well-crafted document not only accelerates the payment process but also reflects professionalism and attention to detail.

Step-by-Step Guide to Creating the Document

- Start with Basic Information: Include your business name, contact details, and the client’s name and information. Be sure to include the date of the document and the unique reference number for easy tracking.

- Describe the Work Completed: Provide a detailed breakdown of the tasks performed. This should be clear and concise, allowing the client to understand the services rendered.

- List Materials and Costs: If applicable, itemize all materials or products used during the project, along with their respective costs. This ensures transparency and shows exactly what the client is paying for.

- Include Payment Terms: Specify when the payment is due and any late fees or discounts for early payment. If needed, provide payment methods available for the client.

- Review for Accuracy: Double-check all information, including costs and dates, to ensure there are no errors before sending the document to the client.

By following these steps, you will ensure that your billing record is professional, accurate, and transparent, helping to streamline the payment process and maintain strong business relationships with your clients.

Essential Elements of an Invoice Template

When preparing a billing document, it is important to include all necessary details that reflect the work completed, the materials used, and the cost involved. A comprehensive record should not only provide clear information to the client but also ensure transparency and prevent potential disputes. Every element plays a role in making the transaction process smooth and professional.

By structuring your billing document to include specific key components, you can improve the clarity and accuracy of the information. This helps establish trust with your clients and ensures that there is no ambiguity regarding the charges and services provided.

Key Information to Include

| Element | Description |

|---|---|

| Contact Information | Include both the service provider’s and client’s names, addresses, and phone numbers for easy communication. |

| Service Description | A clear and concise explanation of the work performed, with itemized details where necessary, so the client understands what they are being charged for. |

| Cost Breakdown | List the prices for labor, materials, and any other related expenses to ensure the client understands each charge. |

| Taxes and Fees | Include any applicable taxes or extra charges that might apply to the final amount due. |

| Payment Terms | Specify the due date for payment, any late fees, or discounts for early payments. |

Additional Considerations

While the basic elements of a billing document are essential, there are also additional features that can help improve its functionality. For example, you might choose to include a project reference number for easy tracking or a brief payment history if multiple payments have been made. These small details can help both the service provider and the client stay organized and ensure that all payments are processed correctly.

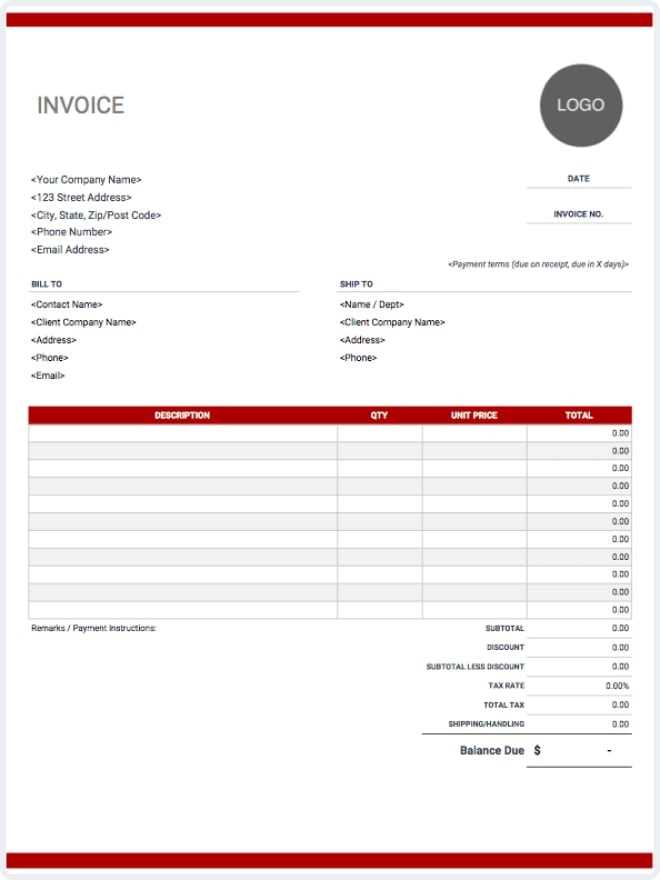

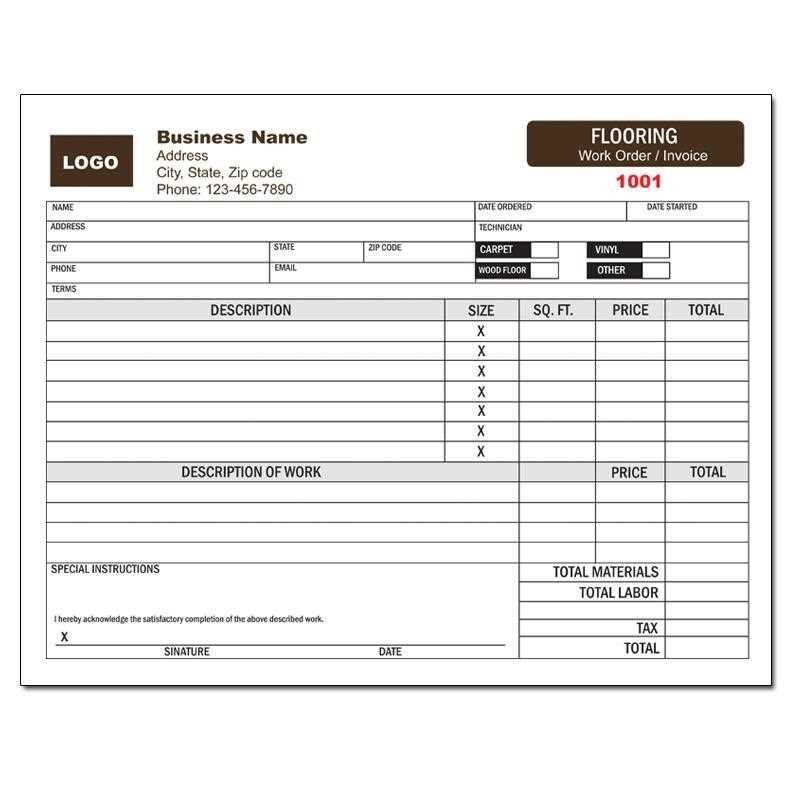

Customizing Your Flooring Invoice

Tailoring your billing document to fit the specific needs of each project is a key aspect of providing professional and efficient service. Customization allows you to include relevant details that reflect the unique nature of each job, ensuring both you and your client are fully aligned on expectations and costs. By adjusting the format and content, you can address the specifics of each transaction, providing clarity and avoiding potential confusion.

Personalizing your financial records can also strengthen your brand identity. Whether you include a logo, change the layout to match your company’s style, or modify the terminology to suit the type of work you do, a customized document can enhance the professional image of your business and leave a positive impression with clients.

Ways to Customize Your Billing Document

- Add Your Business Branding: Include your logo, company name, and contact information at the top to make your documents instantly recognizable.

- Modify Service Descriptions: Tailor the description of services rendered to match the specific tasks performed during the project. This helps your clients understand exactly what they are paying for.

- Adjust Payment Terms: Customize payment deadlines, discounts for early payment, or penalties for late payments according to your business policies and client agreements.

- Include Client-Specific Notes: Add any special notes or instructions for the client, such as care instructions for materials or recommendations for future services.

- Choose the Layout: Adjust the design and structure to make it easier for your clients to read and navigate. A well-organized format can help present the information in a clear and professional manner.

When to Customize Your Documents

Customizing your documents is especially important when handling large or complex projects, where detailed descriptions and a clear breakdown of costs are required. It’s also essential when dealing with repeat clients, as personalized records can help build rapport and encourage loyalty. In these cases, making sure every detail is specific to the project can lead to more efficient transactions and positive relationships.

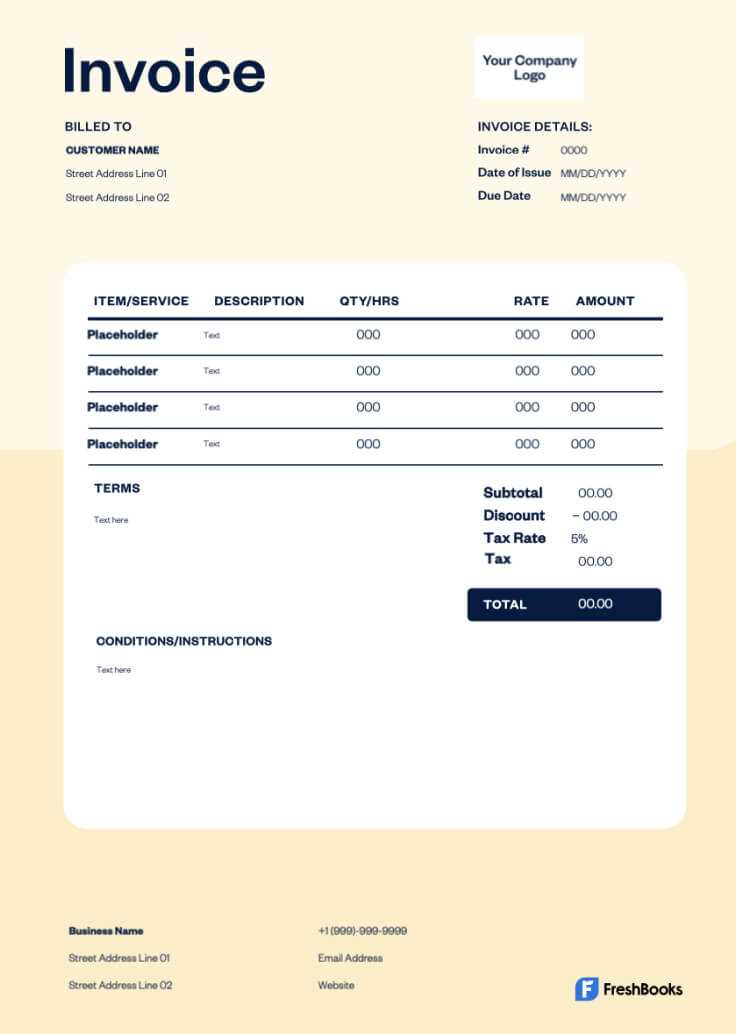

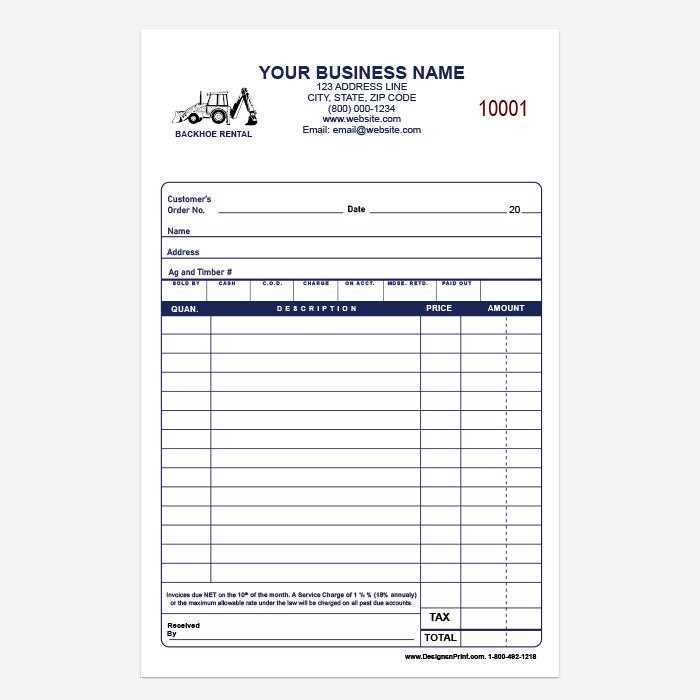

Free vs Paid Flooring Invoice Templates

When selecting a billing document for your business, you may face the decision between using a free or paid option. Both have their benefits and drawbacks, and choosing the right one depends on the complexity of your needs and the resources available to you. While free options are often accessible and easy to use, paid versions typically offer more advanced features and customization options, which may be worth the investment for larger or more complex projects.

Understanding the differences between these two types of options can help you decide which one is best suited for your business. Free documents might be sufficient for small or straightforward jobs, but for those seeking additional functionality, such as integrations with accounting software or more professional design options, a paid version could be more beneficial in the long run.

Benefits of Free Billing Documents

- Cost-Effective: Free options come at no cost, making them ideal for businesses with tight budgets or those just starting out.

- Easy to Use: Basic templates are typically simple to download, fill out, and send, with minimal setup required.

- Quick Access: Most free options are available immediately, allowing you to start using them right away without any delays.

- Good for Small Projects: If you manage only a few clients or small-scale jobs, a free document can meet your needs without unnecessary extras.

Benefits of Paid Billing Documents

- Advanced Features: Paid options often come with features like automatic calculations, professional design templates, and integration with accounting software, which can save time and reduce errors.

- Customization: Many paid versions offer more flexibility to customize fields, colors, and fonts, allowing you to match the document to your branding.

- Enhanced Security: Paid options may offer better data security, which is essential when handling sensitive financial information.

- Ongoing Support: With paid services, you often get customer support to help you troubleshoot any issues, ensuring your billing process runs smoothly.

Ultimately, the decision between free and paid options depends on your specific needs. If you only require basic functionality, a free document may be sufficient. However, if your business is growing or you need additional features and customization, investing in a paid solution could provide long-term v

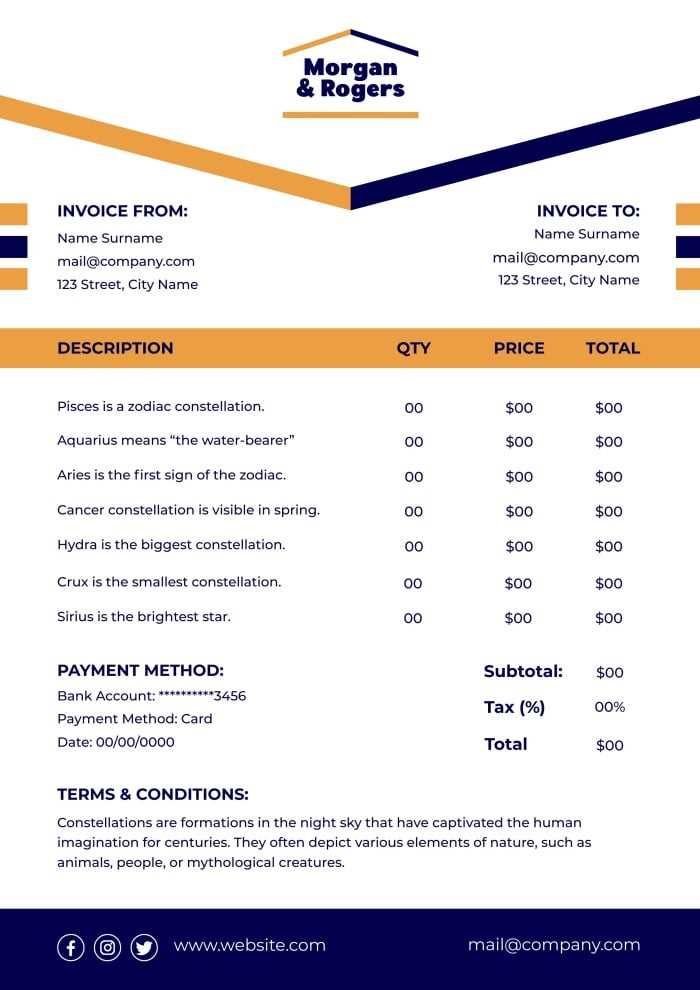

Using Digital Tools for Invoicing

In the modern business landscape, digital tools have become indispensable for managing financial transactions. These tools offer a more efficient, accurate, and streamlined way to create and send payment requests, compared to traditional methods. Leveraging technology for your billing process not only saves time but also reduces the risk of errors and improves overall organization.

Digital platforms allow businesses to generate professional-looking records with just a few clicks, ensuring that all necessary details are included and formatted correctly. Additionally, many digital solutions offer features such as automated calculations, payment tracking, and easy integration with accounting software, making the entire process more efficient.

Benefits of Using Digital Tools

- Speed and Efficiency: Automated processes reduce the time spent creating and managing records, enabling quicker turnaround times for clients and businesses alike.

- Reduced Errors: Digital tools often include features like auto-calculations, which help minimize the risk of manual mistakes in pricing or totals.

- Customization: Many digital platforms allow you to customize the design, layout, and content of your financial documents, offering a more professional presentation.

- Access Anywhere: Cloud-based tools provide access to your billing documents from any device, anywhere, making it easy to manage and track payments on the go.

- Integration with Other Software: Many digital solutions integrate with accounting, CRM, or project management software, helping you streamline your business operations and maintain accurate financial records.

Popular Digital Tools for Financial Documentation

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero offer comprehensive solutions for invoicing, payment tracking, and financial reporting.

- Online Platforms: Services like PayPal, Stripe, and Square not only allow for online payment processing but also enable you to generate and send billing records quickly.

- Document Creation Tools: Software like Google Docs, Microsoft Word, or specialized online invoicing platforms like Zoho Invoice and Invoice Ninja can help create professional records.

Incorporating digital tools into your billing process enhances your ability to manage finances efficiently, improving both client relationships and cash flow. The ease and accuracy that digital invoicing provides can help free up valuable time, allowing you to focus on other aspects of your business.

Best Practices for Invoice Accuracy

Ensuring the accuracy of your financial documents is critical for maintaining strong client relationships and smooth business operations. Mistakes on billing records can lead to payment delays, misunderstandings, and dissatisfaction from clients. By following best practices, you can reduce the risk of errors and ensure your documents are clear, professional, and precise.

Accurate billing is not only about correct pricing, but also about clear communication and attention to detail. Each element of the document, from labor costs to payment terms, must be double-checked to prevent issues down the line. Adopting consistent practices can help you avoid common pitfalls and streamline the billing process.

Key Practices to Ensure Accuracy

- Double-Check Information: Always verify the client’s name, address, contact details, and any project-specific information to avoid errors.

- Review Service Descriptions: Make sure the tasks performed are clearly and accurately described. Avoid vague language and be as specific as possible about the work completed.

- Accurately Itemize Costs: Break down each charge, including materials, labor, and any other fees, ensuring the total matches the sum of individual components.

- Confirm Pricing and Taxes: Recheck the rates, taxes, and discounts applied to ensure they are correct. Also, make sure any promotional offers or special terms are properly applied.

- Use Automated Tools: Utilize software with built-in calculation features to automatically add up totals and apply taxes, reducing the likelihood of manual errors.

- Verify Payment Terms: Clearly specify the payment due date, method, and any late fees or discounts for early payment to avoid confusion later.

Additional Tips for Maintaining Accuracy

- Standardize Your Process: Develop a consistent method for creating and reviewing documents, including checklists or templates, to minimize the chance of mistakes.

- Keep Detailed Records: Maintain a record of all transactions, communications, and agreements with clients, ensuring everything is documented in case of disputes.

- Review Before Sending: Always take a final moment to carefully review the document before sending it to the client. A second look can often catch overlooked details.

By adhering to these best practices, you can ensure your financial records are precise and professional, helping to prevent payment issues and build trust with your clients. Accuracy not only reflects well on your business but also enhances efficiency in y

How to Include Labor and Materials Costs

When preparing a billing document for completed work, it’s essential to break down all associated costs in a clear and transparent way. This includes both the labor involved and the materials used during the project. Accurately listing these charges helps avoid confusion and ensures that clients understand exactly what they are paying for. A detailed breakdown also supports trust between the service provider and the client.

Including both labor and materials costs properly requires a systematic approach. You need to calculate the hours worked, the hourly rate for labor, the materials used, and any additional charges related to the supplies. It’s important to be as detailed as possible to ensure the client can see exactly how the total cost is derived.

Including Labor Costs

- Calculate Hours Worked: Determine the total number of hours spent on the project. If multiple workers were involved, list the hours worked by each individual.

- Hourly Rate: Clearly indicate the rate charged per hour for labor. If you offer different rates for different types of work, be sure to break these down as well.

- Task Breakdown: If the project involved different types of tasks, such as preparation and finishing work, specify the time spent on each type of labor.

- Labor Total: Multiply the total hours worked by the hourly rate to calculate the total labor cost for the project.

Including Material Costs

- List All Materials Used: Itemize all materials used during the project, such as products, supplies, or equipment. Be specific about quantities and types of materials to ensure clarity.

- Price per Unit: For each material, include the price per unit (e.g., per meter, per kilogram) to justify the total amount charged.

- Subtotal for Materials: Calculate the cost for each material by multiplying the quantity used by the price per unit. Then, sum up all material costs for the total.

- Include Any Additional Costs: If there are extra charges, such as delivery fees or disposal costs, make sure to list these separately to ensure transparency.

By including detailed labor and material costs in your financial records, you provide a clear breakdown t

Adding Taxes to Flooring Invoices

Including taxes in your billing documents is a crucial step in ensuring compliance with local tax regulations and providing accurate cost breakdowns to your clients. Taxes can significantly affect the total amount due, so it’s important to calculate and display them properly. This process involves understanding the applicable tax rates, knowing how to apply them correctly, and ensuring that the taxes are clearly outlined in your documents.

By including taxes as a separate line item, you not only help the client understand what they are being charged, but you also make it easier to track and remit taxes to the appropriate authorities. This transparency promotes professionalism and helps avoid misunderstandings regarding the final cost of services or products.

How to Calculate Taxes

- Know the Applicable Tax Rate: Research the tax rates that apply in your location or for the specific goods or services you provide. These can vary by region, so it’s essential to be accurate.

- Calculate Taxable Amount: Determine the subtotal for your charges before taxes are applied. This may include labor, materials, and any other fees that are taxable.

- Apply the Tax Rate: Multiply the taxable amount by the tax rate to calculate the tax due. For example, if the taxable subtotal is $500 and the tax rate is 8%, the tax would be $40.

- Include Tax on the Document: Clearly list the tax amount as a separate line item under the subtotal to avoid confusion. This ensures your client understands the breakdown of costs.

Types of Taxes to Consider

- Sales Tax: This is the most common form of tax applied to goods and services. It is typically a percentage of the total price and varies by location.

- Value-Added Tax (VAT): Some regions use VAT, which is a consumption tax placed on a product or service at each stage of production or distribution.

- Excise Tax: This is a tax imposed on specific goods, such as luxury items, and may apply to certain types of services or products.

By correctly adding taxes to your billing documents, you ensure that all charges are accurately represented. This not only helps your clients understand the full cost of services rendered but also ensures that you remain compliant with relevant tax laws. Proper tax inclusion contributes to a professional image and a smooth payment process.

Invoice Payment Terms and Conditions

Setting clear and concise payment terms is a fundamental aspect of any financial document. These terms outline the expectations regarding payment deadlines, accepted methods of payment, and penalties for late payments. Having well-defined payment conditions helps ensure that both parties are on the same page, reducing the risk of disputes and delays in receiving payment for services rendered.

Including payment terms and conditions not only protects your business but also provides transparency for your clients. Whether you offer discounts for early payment or impose fees for late payments, these terms should be easy to understand and enforceable. Establishing these conditions up front helps to maintain professionalism and encourage timely payments.

Key Payment Terms to Include

- Payment Due Date: Clearly specify the date by which payment is expected. Common due periods are 30, 60, or 90 days from the issue date.

- Accepted Payment Methods: List the payment options available, such as bank transfer, credit card, checks, or online payment platforms like PayPal.

- Late Payment Fees: Define any penalties or interest charges that apply if payment is not made on time. For example, a late fee might be a fixed amount or a percentage of the total amount due.

- Discounts for Early Payment: Some businesses offer discounts if the client pays before the due date. For instance, a 2% discount for payments made within 10 days.

- Partial Payments: Specify whether partial payments are allowed and under what conditions. This can help clients who are unable to pay the full amount upfront.

- Consequences of Non-Payment: Outline the actions you will take if payment is not received, such as suspending services or taking legal action for recovery.

Why Payment Terms Matter

- Clarity and Transparency: Clear payment terms reduce confusion and set expectations from the start, helping to prevent misunderstandings.

- Improved Cash Flow: Clear terms encourage timely payments, helping your business maintain steady cash flow and avoid financial strain.

- Professionalism: By outlining payment conditions in your financial records, you demonstrate that your business is well-organized and serious about transactions.

Establishing and communicating payment terms upfront is essential for ensuring smooth transactions and protecting your business interests. When clients are aware of the expectations and consequences, they are more likely to make payments on time and avoid disputes.

Common Mistakes to Avoid in Invoices

When preparing financial documents, it’s easy to overlook certain details that can lead to errors or misunderstandings. Mistakes on these records can cause delays in payments, confusion with clients, and even potential legal issues. Being aware of common errors and taking steps to avoid them can help ensure a smooth, efficient billing process. A well-prepared statement is key to maintaining professionalism and securing timely payments.

Whether you’re just starting out or have been handling financial documentation for years, it’s essential to stay vigilant and avoid these frequent pitfalls. Ensuring accuracy, clarity, and transparency in every document you create helps to build trust and avoid unnecessary complications.

Common Errors to Watch For

- Incorrect Client Details: Always double-check the client’s name, address, and contact information. An incorrect name or address can delay payment or create confusion.

- Missing Payment Terms: Failing to specify when payment is due or neglecting to mention late fees can result in delayed payments or disputes.

- Unclear Descriptions: Vague descriptions of the work performed or products supplied can lead to misunderstandings. Be specific and include enough detail for clients to understand what they’re paying for.

- Errors in Pricing: Double-check unit prices, quantities, and totals. Even small errors in calculations can affect your payment an

Common Mistakes to Avoid in Invoices

When preparing financial documents, it’s easy to overlook certain details that can lead to errors or misunderstandings. Mistakes on these records can cause delays in payments, confusion with clients, and even potential legal issues. Being aware of common errors and taking steps to avoid them can help ensure a smooth, efficient billing process. A well-prepared statement is key to maintaining professionalism and securing timely payments.

Whether you’re just starting out or have been handling financial documentation for years, it’s essential to stay vigilant and avoid these frequent pitfalls. Ensuring accuracy, clarity, and transparency in every document you create helps to build trust and avoid unnecessary complications.

Common Errors to Watch For

- Incorrect Client Details: Always double-check the client’s name, address, and contact information. An incorrect name or address can delay payment or create confusion.

- Missing Payment Terms: Failing to specify when payment is due or neglecting to mention late fees can result in delayed payments or disputes.

- Unclear Descriptions: Vague descriptions of the work performed or products supplied can lead to misunderstandings. Be specific and include enough detail for clients to understand what they’re paying for.

- Errors in Pricing: Double-check unit prices, quantities, and totals. Even small errors in calculations can affect your payment and harm your professional reputation.

- Not Including Taxes: Failing to add taxes or not applying the correct tax rate can result in financial discrepancies and legal complications.

- Omitting Contact Information: Always include your business name, contact details, and any necessary identification numbers (e.g., tax ID) so clients can easily reach you with questions.

How to Prevent These Mistakes

- Double-Check All Information: Before sending any document, review the client’s details, dates, payment terms, and pricing for accuracy.

- Use Automation: Leverage software tools that can calculate totals, taxes, and due dates to reduce the risk of manual errors.

- Provide Clear Descriptions: Be as detailed as possible in your descriptions of services or products provided to avoid confusion about what the client is paying for.

- Include All Relevant Terms: Make sure your terms of payment, tax rates, and potential late fees are clearly outlined in every document.

- Test Your Document Layout: Ensure that your financial documents have a logical flow, with all necessary details placed in clear sections so the client can easily understand the charges.

Example of an Invoice Error

Error Type Impact Correction Missing Tax Details Causes confusion over the final amount due and may lead to disputes. Clearly itemize taxes and apply the correct rate based on the client’s location. Incorrect Pricing Results in incorrect charges and potential loss of payment. Double-check pricing, quantities, and totals before finalizing. Omitted Payment Terms Leads to delayed payments or confusion about due dates. Ensure payment due date and terms (including late fees) are clearly stated. By paying attention to these common mistakes and taking steps to avoid them, you can ensure that your financial documentation is clear, accurate, and professional. Proper preparation leads to smoother transactions, faster payments, and stronger relationships with your clients.

Tracking Payments and Managing Records

Efficiently tracking payments and managing financial records is crucial for maintaining a smooth cash flow and staying organized in any business. Properly monitoring when payments are made and ensuring all transactions are accurately recorded allows you to manage your finances more effectively. It also ensures that you can quickly resolve any discrepancies and maintain transparency with clients.

Keeping track of payments and organizing records allows you to identify overdue payments, reconcile your accounts, and have a clear understanding of your business’s financial health. By implementing a systematic approach, you can ensure that no payment is overlooked and that your financial documentation is always up to date.

Methods for Tracking Payments

- Digital Tracking Tools: Use accounting software or online tools that automatically update records when payments are received. These tools can also generate reminders for overdue payments.

- Manual Logs: For smaller businesses or those preferring a hands-on approach, maintain a spreadsheet or physical logbook where each payment is recorded along with client details, amounts, and dates.

- Receipts and Confirmation: Always provide clients with receipts or confirmation emails when payments are made. These documents should include payment amount, date, and method used, ensuring both parties have a record of the transaction.

- Regular Reconciliation: Frequently review your records to ensure they align with your bank statements or payment platforms. This helps catch discrepancies early on.

Best Practices for Managing Financial Records

- Organize by Client and Date: Keep detailed records for each client, organized by the date of service and payment. This makes it easier to locate specific transactions if needed.

- Track Outstanding Payments: Maintain a separate log or report of outstanding payments to stay on top of overdue accounts and follow up promptly.

- Backup Your Records: Regularly back up digital records and keep physical copies of important financial documents in a secure location. This ensures you have access to historical data when needed.

- Monitor Payment Methods: Track which payment methods your clients prefer, whether it’s bank transfers, checks, or online payments. This can help you streamline future transactions and manage fees associated with different payment methods.

By tracking payments diligently and maintaining organized records, you ensure that your business remains financially stable and well-prepared for audits or future projects. Establishing a robust system from the start will save time, reduce errors, and improve overall efficiency.

Invoice Design Tips for Clarity

A well-designed financial document not only helps maintain professionalism but also ensures that the information is easy to understand. Clear organization and a simple, user-friendly layout can prevent confusion and make it easier for clients to review and process payments. The key to a successful design is ensuring that all important details are highlighted and easy to find, without overwhelming the client with unnecessary information.

Effective design allows clients to quickly grasp the essential components of the charges, such as the services or products provided, total costs, and payment terms. A visually appealing document can enhance the customer experience, encourage faster payments, and reduce follow-up inquiries regarding charges or details.

Key Design Elements for Clear Documents

- Simple and Clean Layout: Use a minimalistic design with ample white space to avoid clutter. Ensure that each section is clearly separated, and the text is easy to read.

- Logical Structure: Arrange the content in a logical order, such as client details, services provided, payment breakdown, taxes, and total amount due. This makes the document easy to follow.

- Legible Fonts: Choose readable, professional fonts with appropriate sizing. Avoid decorative fonts that may make the document harder to read.

- Highlight Important Information: Use bold text or different font sizes to emphasize crucial details, such as the total amount due and payment due date.

- Clear Payment Terms: Include payment terms in a prominent place. Clearly state the due date, acceptable payment methods, and any late fee policies.

Design Tips for User-Friendly Presentation

- Brand Consistency: Ensure your design reflects your brand identity, using your company logo, colors, and fonts to maintain a consistent look across all business documents.

- Easy-to-Read Tables: Use tables for itemizing charges and taxes. This format allows clients to see the breakdown of each service and its cost clearly.

- Clear Contact Information: Make sure your contact details are easily accessible, including your business address, phone number, and email. This ensures that clients know how to get in touch if they have questions.

- Digital and Print Compatibility: Whether your document is being emailed or printed, ensure it is formatted to be clear and readable in both formats. Test the layout on different devices and paper sizes.

By focusing on a clear and simple design, you can create financial documents that are both prof

How to Send and Follow Up on Invoices

Sending financial documents and ensuring that they are paid on time is a critical part of maintaining smooth business operations. However, just sending the document isn’t enough. It’s equally important to follow up on payments, especially if the due date has passed. Clear communication and a structured follow-up process can help you manage your accounts receivable more effectively and maintain good relationships with clients.

Knowing how to properly send financial records and follow up without being pushy can help ensure that payments are made promptly and that any misunderstandings are cleared up quickly. Whether using digital platforms or traditional methods, a systematic approach to sending and tracking payments is essential for business success.

Steps for Sending Financial Documents

- Choose the Right Delivery Method: For digital communication, email is the most common and efficient way to send financial documents. Ensure the file is in a universally accessible format (e.g., PDF). If sending paper copies, choose reliable postal services.

- Include a Clear Subject Line: If you’re emailing the document, include a subject line that clearly identifies the document and its purpose, such as “Payment Request for Services Rendered” or “Account Balance Due.” This makes it easy for the recipient to recognize the message.

- Attach the Document Correctly: Always attach the correct file to your email. Double-check the document before sending to avoid confusion later on.

- Provide All Necessary Information: In your email or cover letter, briefly mention key details like the total amount due, payment due date, and accepted payment methods. This will give the client a quick overview before opening the document.

Best Practices for Following Up on Payments

- Set a Follow-Up Schedule: After sending the document, give the client a reasonable amount of time to pay, such as 7-14 days, depending on your agreed terms. If no payment is received, follow up with a reminder. A polite email or phone call can help nudge the client.

- Send Polite Reminders: If the due date passes without payment, send a friendly but firm reminder. Reference the document number, the amount due, and any payment terms. Be professional and courteous in your tone.

- Use Automated Tools: Many online invoicing platforms offer autom

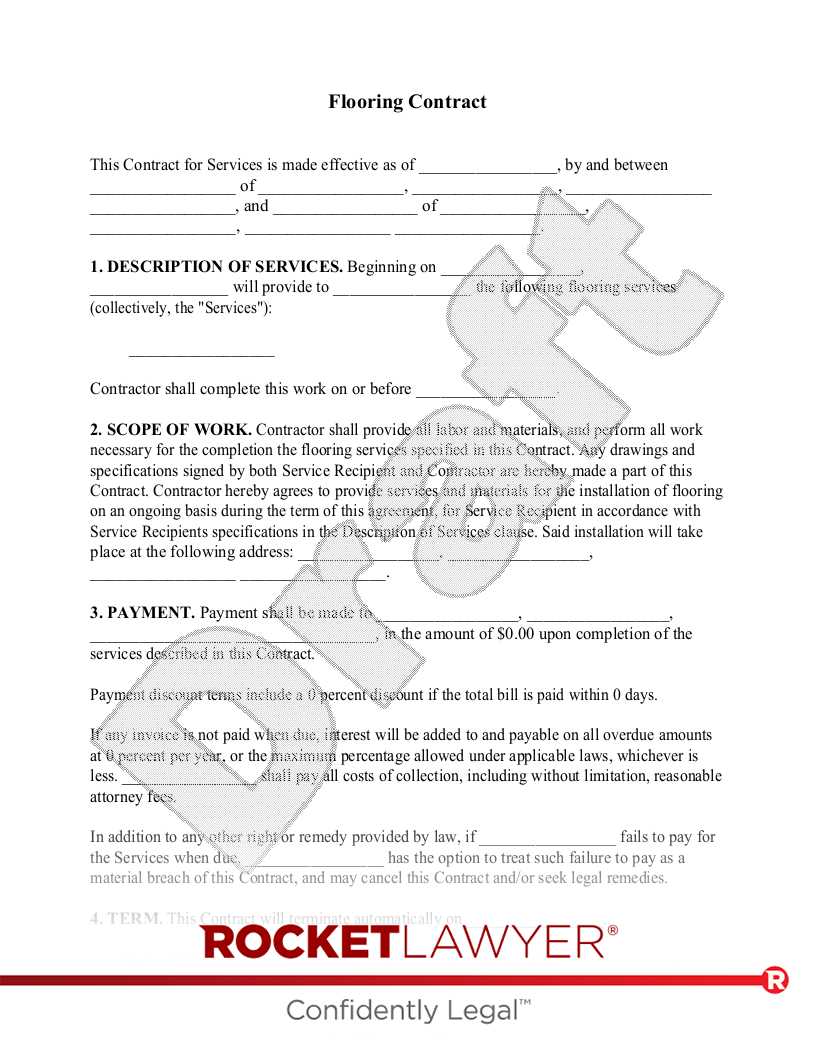

Legal Considerations for Flooring Invoices

When creating and sending financial documents for services rendered, it is important to be aware of the legal requirements and considerations that may apply to your business transactions. Ensuring that these documents are legally sound helps protect both parties in case of disputes and ensures compliance with local laws. From including proper terms and conditions to understanding tax obligations, there are several key legal aspects to consider when preparing financial records for payment.

Every business should be aware of the legal framework surrounding financial documentation to avoid any potential issues down the line. Legal compliance not only builds trust with your clients but also ensures that you can enforce payment terms if needed. Understanding the laws related to business transactions can save you from costly mistakes and help establish your company’s credibility.

Key Legal Considerations

- Accurate and Clear Payment Terms: Clearly stating payment terms such as due dates, late fees, and acceptable payment methods is crucial. Ambiguity can lead to misunderstandings or legal disputes.

- Proper Documentation of Services: Always ensure that the services or products provided are accurately described, including quantities, prices, and any other important details. This can help prevent misunderstandings in case of a dispute.

- Taxes and Tax Codes: Depending on your location, there may be specific tax regulations that apply to your services or products. Ensure that you comply with tax laws and correctly include any applicable taxes on your financial records.

- Compliance with Local Laws: Each country, state, or region may have its own set of rules regarding business transactions. Make sure that you are in compliance with local regulations regarding payment terms, interest rates, and other business practices.

- Late Payment Fees: If you choose to charge late fees, be sure they are legally permissible and clearly communicated to your clients. Ensure the fee structure is reasonable and compliant with local laws.

Protecting Yourself Legally

- Contractual Agreement: Whenever possible, include a formal contract or agreement that outlines the terms of service, payment details, and other critical aspects of the business relationship. This will serve as legal protection in case of a dispute.

- Retain Copies: Always keep copies of financial documents, communications with clients, and any other relevant records. These can serve as evidence if a legal issue arises.

- Dispute Resolution Clauses: Include terms outlining how disputes will be handled, such as through mediation or arbitration, to avoid lengthy legal proceedings.

Being proactive in understanding and addressing legal considerations can help protect your business from potential risks. By ensuring compliance with applicable laws and having clear, well-documented payment terms, you can mitigate legal issues and maintain smooth business operations.