Fitness Trainer Invoice Template for Easy and Professional Billing

Managing payments is a crucial part of running a coaching business, ensuring both clear communication with clients and timely compensation for services rendered. With the right tools, coaches can streamline this process, reducing administrative time and avoiding confusion. Having a structured method for handling payments can significantly enhance your business operations.

Creating an effective document that outlines services provided, payment terms, and due amounts is essential. This document serves as a record for both you and your clients, helping to avoid misunderstandings and providing legal clarity when needed. An efficient billing system can help maintain professionalism while offering flexibility for customization.

By utilizing an easy-to-use, customizable system, coaches can focus on what matters most–helping their clients achieve their goals. The right solution will ensure accurate records, timely payments, and a polished image for your business.

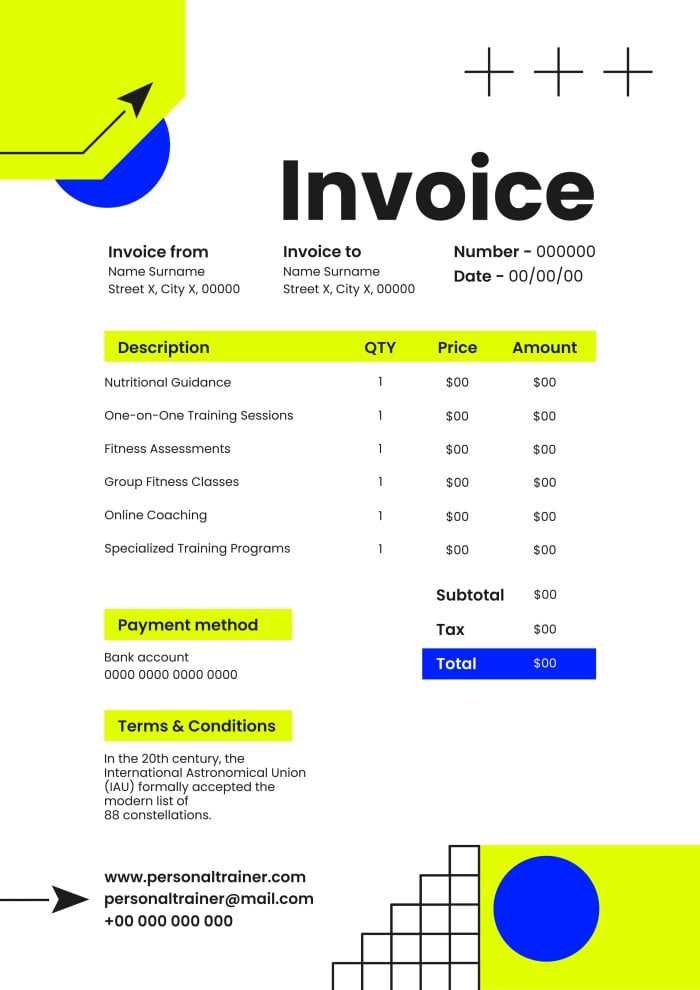

Fitness Trainer Invoice Template Overview

For personal coaches, having a professional billing system is essential for ensuring smooth financial transactions and maintaining trust with clients. A well-structured document that details services rendered, payment amounts, and deadlines not only helps streamline the business process but also serves as a clear record for both parties. It is crucial for any coach to have access to an easy-to-use and customizable billing tool that can handle various payment scenarios effectively.

Why a Structured Billing Document Matters

When offering services, clarity in payment terms is key. A clear, consistent format helps clients understand their obligations and ensures that payments are made on time. Having a standard approach can reduce confusion, build client trust, and maintain a professional image. Whether you are managing individual sessions or package deals, a reliable document helps keep track of all transactions, ensuring nothing is overlooked.

Customization and Flexibility

One of the main benefits of using a customizable billing solution is the ability to tailor the document to fit your business needs. Coaches can include important details such as hourly rates, discounts for bulk sessions, and payment methods. Flexibility also means adapting to different types of clients, whether they prefer electronic or printed copies, making the process as efficient and client-friendly as possible.

Why Use an Invoice Template

For any business, maintaining a consistent and professional approach to billing is essential. A pre-structured document designed for easy customization simplifies the payment process for both the service provider and the client. It ensures that all necessary details are included, saving time and preventing errors that can occur when creating bills from scratch each time.

Using a ready-made document allows for greater accuracy and organization in financial management. It helps you present a clear breakdown of services, rates, and due dates, which enhances communication and reduces the likelihood of disputes. Additionally, it supports better record-keeping and helps in tracking payments over time.

Key Benefits of Using a Pre-Formatted Billing Document

| Benefit | Explanation |

|---|---|

| Time-Saving | Pre-designed layouts eliminate the need to create a new document every time you need to bill a client. |

| Consistency | Using the same format for every client helps maintain professionalism and ensures all necessary information is included. |

| Accuracy | Pre-set fields help avoid mistakes such as incorrect rates, missing details, or wrong dates. |

| Easy Customization | Editable documents allow for quick adjustments to suit different services or client preferences. |

| Legal Protection | A standardized document provides a clear record of transactions, helping resolve disputes if they arise. |

By using such a tool, businesses can improve the efficiency of their operations and provide a seamless experience for clients while maintaining a professional image.

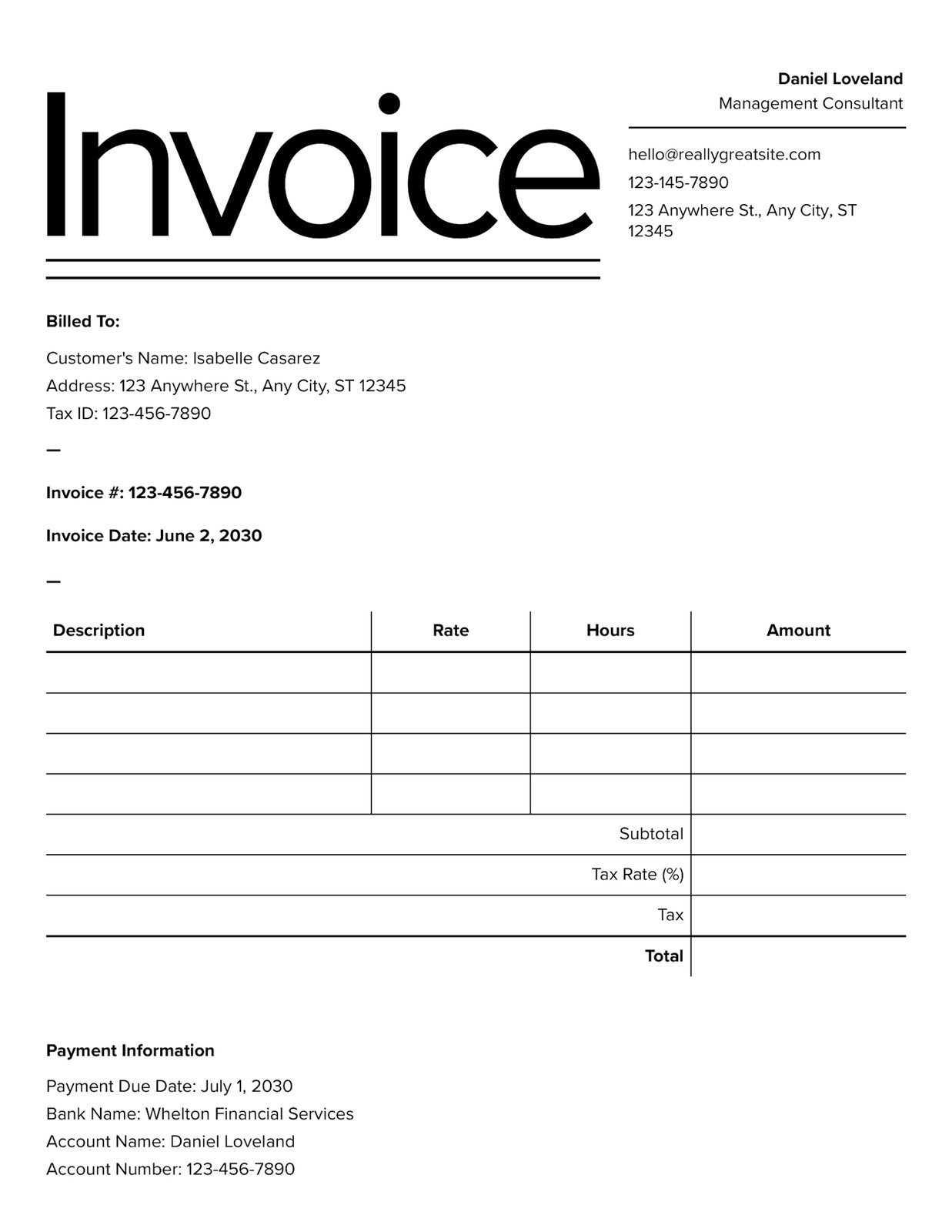

Key Elements of an Invoice

When creating a billing document, it is essential to include all the necessary details to ensure clarity and avoid confusion. A well-structured record should outline both the services provided and the terms of payment, leaving no room for ambiguity. The right components not only make the process easier for both parties but also help maintain a professional image.

Here are the core elements that should be included in any billing document:

- Business Information: Your name, business name (if applicable), contact details, and address should be clearly visible to identify your business.

- Client Information: Include the client’s full name, contact information, and address to ensure the bill reaches the correct recipient.

- Service Description: A detailed list of the services rendered, including dates, duration, and any special notes related to the session or package.

- Rates and Fees: Clearly state the charges for each service, along with any discounts, taxes, or additional fees.

- Payment Terms: Specify payment deadlines, accepted payment methods, and any late fees or penalties if payments are not received on time.

- Invoice Number: Assign a unique identification number to each document for easy reference and record-keeping.

- Date of Issue: Include the date the bill was created to track payment timelines effectively.

Including these key elements ensures that both the service provider and the client have a clear understanding of the transaction, fostering transparency and trust. It also helps maintain accurate records for future reference or accounting purposes.

Customizing Your Billing Document

Every business has its own unique needs, which is why it’s essential to tailor your billing records to reflect your specific services and brand identity. Customizing your payment request document not only ensures that it aligns with your business model but also helps maintain a professional appearance. A personalized format allows for flexibility in showcasing the services you offer while keeping the process simple and organized.

Personalizing Your Billing Layout

There are several aspects you can adjust to create a more tailored experience for both you and your clients:

- Branding: Include your logo, brand colors, and fonts to make the document visually consistent with your business identity.

- Contact Information: Make sure your business contact details (email, phone, website) are prominent, so clients can easily reach you.

- Service Descriptions: Customize the descriptions to match the specific offerings you provide, whether they are one-on-one sessions, group classes, or package deals.

- Payment Methods: Specify the payment options that are most convenient for you and your clients, such as bank transfers, online payments, or checks.

- Discounts and Offers: Add sections for any seasonal promotions or bulk session discounts that you may offer to clients.

Adding Flexibility for Different Clients

Not all clients are the same, so your billing document should have the flexibility to cater to different needs:

- Adjustable Rates: Set different rates depending on session length, frequency, or package deals.

- Multiple Billing Periods: If you offer ongoing services, consider adding options for weekly, bi-weekly, or monthly payments.

- Late Fee Clauses: Include a clear policy on late payments with automatic penalties if needed, helping to enforce timely transactions.

By customizing your billing document to reflect your services and client preferences, you not only streamline your administrative tasks but also create a professional, consistent experience for everyone involved.

How to Create an Invoice in Word

Creating a document to request payment for services rendered can be done easily using Microsoft Word. This approach allows for flexibility in design, while ensuring that all necessary details are included. Whether you’re working independently or running a small business, a well-crafted payment request is crucial for maintaining professionalism and clarity in transactions.

Follow these steps to create an effective payment request document using Word:

- Start with a Blank Document: Open Microsoft Word and create a new blank document. This will give you a clean slate to structure your details.

- Add Contact Information: At the top of the document, include your full name or business name, address, email, and phone number. Below that, include the recipient’s details, such as their name, address, and contact information.

- Title the Document: Clearly label the document at the top with a title that indicates its purpose, such as “Payment Request” or “Amount Due.”

- Include a Unique Number: For tracking purposes, add a reference number to the document. This helps both you and the recipient keep track of the payment request.

- Detail the Services Provided: List the services, products, or work completed in a clear and organized manner. Include a brief description, the quantity (if applicable), and the cost for each item.

- Specify Payment Terms: Clearly state the total amount due, the due date, and any late payment penalties. This ensures both parties are aware of the expectations and deadlines.

- Provide Payment Instructions: Include the methods of payment you accept, such as bank transfer details, online payment options, or physical address for checks.

- Include Additional Notes: If necessary, add any other relevant information, such as discounts, tax rates, or reminders about future transactions.

Once you have filled in all the required information, review the document for any errors or missing details. Saving it as a Word document or converting it to a PDF for sending ensures the recipient can view it easily and without formatting issues.

Setting Your Payment Terms Clearly

Clear payment terms are essential to ensure that both you and your client understand the expectations regarding financial transactions. By defining when and how payments should be made, you can avoid confusion, delays, and potential disputes. Setting these terms upfront helps establish professionalism and creates a transparent working relationship.

Here are some key elements to consider when defining your payment conditions:

- Due Date: Always specify a precise due date for payment. It can be a set number of days after the service is completed or a specific calendar date. This eliminates ambiguity and makes it easier for the client to plan accordingly.

- Accepted Payment Methods: Clearly outline the ways in which clients can settle the amount due. Whether it’s through bank transfer, credit card, checks, or digital payment platforms, be sure to list all available options and any necessary details.

- Late Fees: It’s important to state whether you charge a fee for overdue payments. A late payment policy helps encourage prompt settlement and provides a sense of accountability. Specify the amount or percentage that will be added if payment is delayed.

- Deposit Requirements: If you require an upfront payment, mention the percentage or flat amount that needs to be paid before work begins. This helps secure the commitment of the client and ensures you’re compensated for your time and effort.

- Payment Frequency: If the service is ongoing, clarify whether payments are expected weekly, bi-weekly, or monthly. Defining a consistent schedule helps maintain cash flow and makes it easier for both parties to manage financial planning.

Once these conditions are set, make sure they are clearly communicated in writing. Including them in your contracts or agreements ensures that the client is fully aware of the payment structure from the start, which can prevent misunderstandings later on.

Choosing the Right Invoice Format

Selecting the appropriate structure for your payment request document is essential for both clarity and professionalism. A well-organized layout ensures that all the necessary information is easy to find and understand, making the transaction process smoother for both you and your client. The right format will reflect your brand’s professionalism while maintaining simplicity and functionality.

When choosing a format, consider the following aspects to ensure that it meets your needs:

- Clarity and Simplicity: Choose a layout that is clean and easy to read. Avoid unnecessary clutter, and ensure that important details, such as amounts due and due dates, stand out clearly. This reduces the chance of confusion and mistakes.

- Customization Options: Select a structure that allows you to easily customize it to your business needs. For example, if your services vary in pricing, a flexible format with space for descriptions and costs is beneficial.

- Professional Appearance: A well-designed format helps establish trust. Choose one that aligns with your brand identity, such as using your logo, company colors, or fonts, to create a cohesive look.

- Digital or Paper-Friendly: Depending on your preferences, consider whether you need a format that is suited for printing or one that works best for online submissions. Some formats may be easier to customize and send electronically, while others are better for physical mailings.

- Compatibility: Ensure the format is compatible with the software you use. If you often edit documents in word processors or spreadsheets, choose a format that integrates well with those programs to avoid technical issues.

Once you’ve chosen a format, test it with a few mock documents to ensure it meets your needs. Adjust as necessary to make sure all critical information is easy to input and well-organized for the recipient’s convenience.

Benefits of Digital Invoice Templates

Using digital formats for payment requests offers numerous advantages over traditional methods. By leveraging digital tools, you can streamline the entire process, reduce errors, and enhance the overall experience for both you and your clients. Digital documents are not only more convenient but also provide various efficiencies that save time and effort.

Efficiency and Time Savings

One of the primary benefits of digital formats is the ability to save time. Once you have a ready-to-use document, you can quickly fill in the details for each transaction and send it instantly. Here’s how it can help:

- Speed: You can generate and send payment requests within minutes, avoiding the need to manually write or print documents.

- Automation: With digital options, you can automate certain fields, like dates or amounts, reducing the risk of errors.

- Easy Editing: Making adjustments is quick and simple. If any details change, such as service costs or due dates, they can be updated with just a few clicks.

Cost-Effectiveness

Digital documents also offer a cost-saving edge over paper-based methods. Here’s how:

- No Printing Costs: There’s no need for paper, ink, or postage fees. All transactions can be completed online, reducing overhead costs.

- Reduced Errors: By using a pre-designed structure, you reduce the likelihood of mistakes that could require reprints or corrections, saving both time and money.

Adopting digital formats for your payment requests enhances professionalism, reduces administrative burden, and offers greater flexibility in managing and tracking transactions. This makes it an excellent option for anyone looking to streamline their business operations and improve client communication.

How to Add Tax Information to Invoices

Incorporating tax details into your payment request documents is essential for legal compliance and transparency. Including accurate tax information ensures that both you and your client understand the total amount due and helps prevent misunderstandings. It also allows you to stay in line with local regulations and maintain proper financial records.

Here’s how to correctly add tax information to your payment requests:

- Specify Tax Rates: Clearly state the applicable tax rate for the service or product being provided. This could be a fixed percentage or tiered, depending on local tax laws. Make sure to mention whether the tax rate is inclusive or exclusive of the total amount.

- Separate Tax Calculation: It’s best to break down the tax separately from the main amount due. This provides clarity on how the total was calculated. For example, list the service charge and then the tax applied on a new line, showing the total amount after tax is added.

- Include Your Tax Identification Number: Depending on your country or region, you may be required to provide your tax ID number. This is typically a legal requirement for businesses to collect and report taxes.

- Tax Exemptions (if applicable): If certain goods or services are tax-exempt, make sure to indicate this clearly. For example, if a client qualifies for tax exemption, note this on the payment request along with the relevant details of the exemption.

Once you have included the tax information, double-check that all numbers, rates, and identification details are accurate to ensure proper reporting and avoid any potential issues with tax authorities.

Incorporating Your Branding into Invoices

Your payment request documents offer an excellent opportunity to showcase your brand identity. Adding personalized elements to these documents helps create a professional and consistent experience for your clients, reinforcing your image and making your business more memorable. By incorporating your logo, colors, and fonts, you ensure that all your communications are aligned with your brand, even in transactional documents.

Here are a few effective ways to incorporate your branding into your payment requests:

- Logo Placement: Include your business logo at the top of the document to ensure it’s the first thing your client sees. This establishes your identity and adds a professional touch.

- Brand Colors: Use your brand’s color palette for headings, borders, or background accents. This adds a cohesive feel to your document and makes it stand out while maintaining your business’s visual identity.

- Consistent Font Choices: Stick to the fonts used in your other business materials, such as marketing collateral or your website. This consistency helps reinforce your brand’s character and makes the document easier to read.

- Personalized Notes: Add a short thank-you note or a personalized message that aligns with your brand’s tone. Whether it’s professional, friendly, or informal, this creates a personal connection with your clients.

To give you an idea, here’s an example of how branding can be reflected in the document layout:

| Brand Element | Example Usage |

|---|---|

| Logo | Placed at the top-center or top-left of the document for visibility |

| Colors | Use primary brand colors for headers, borders, and important text highlights |

| Font Style | Apply the same font used in your marketing materials for headings and body text |

| Footer | Include business contact details, website, or social media links in a clean footer design |

By incorporating these elements, you not only create a visually appealing document but also enhance your business’s professional image and consistency across all communication channels.

Best Practices for Sending Invoices

Sending payment requests professionally and efficiently is essential to maintaining strong client relationships and ensuring timely payments. The way you send these documents not only reflects on your business but also sets the tone for how your clients perceive the process. Following best practices can help you avoid delays and confusion, while ensuring your business gets paid on time.

Timing and Delivery

When you send your payment requests matters just as much as how you send them. Consider the following to ensure your documents are delivered appropriately:

- Send Promptly: As soon as the work is completed or a service is provided, send your document without unnecessary delays. This shows professionalism and helps prevent forgetting important details.

- Choose the Right Method: Use email or a secure online platform to send your document. Email is fast, traceable, and allows for attachments, while digital platforms can offer additional features like automated reminders or payment tracking.

- Include Clear Subject Lines: When sending via email, ensure your subject line clearly indicates the purpose of the message. For example, use a subject like “Payment Request for [Service Name] – [Invoice Number].” This helps your client easily identify and prioritize the document.

Follow-up and Payment Tracking

Once the document is sent, it’s important to track its status and follow up if necessary. These practices will help ensure you receive payment on time:

- Set Clear Payment Terms: Always include a due date on your document and ensure your client is aware of it. Clear terms can minimize confusion and reduce delays.

- Send Payment Reminders: If payment is not received by the due date, follow up promptly with a polite reminder. You can use email reminders or automated systems to ensure timely communication without seeming too aggressive.

- Track Payments: Keep a record of all sent documents and payments. This can be done manually or through accounting software. Having an organized system helps you stay on top of unpaid balances and can assist in financial planning.

By implementing these best practices, you’ll improve the chances of receiving prompt payments while maintaining a professional image with your clients.

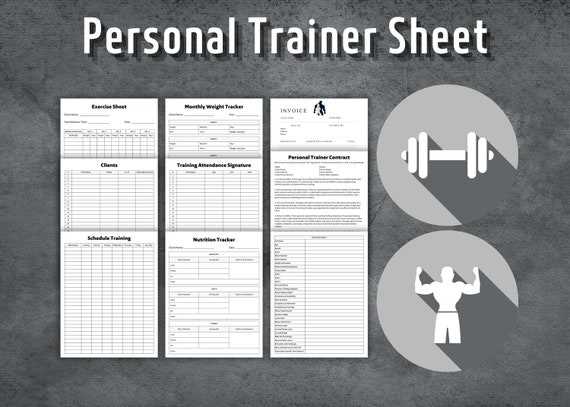

How to Track Payments from Clients

Effectively tracking payments from clients is crucial for maintaining healthy cash flow and ensuring that your business remains financially stable. By keeping an organized record of all incoming payments, you can easily monitor outstanding balances, identify overdue accounts, and stay on top of your financial situation. This process not only helps you manage your accounts but also improves communication with clients regarding their payment status.

Here are some practical steps to help you track payments efficiently:

- Use a Payment Tracking System: Whether it’s a spreadsheet, accounting software, or an online payment platform, having a dedicated system to record payments is essential. These tools can automate much of the process, allowing you to focus on your business.

- Record Every Transaction: For each payment received, document the amount, date, client name, and method of payment. This creates a clear history of transactions that can be easily referenced later.

- Mark Payments as Received: Once you’ve received a payment, make sure to update your records to reflect the change in the balance. This helps you avoid double billing or confusion with clients regarding amounts due.

- Monitor Outstanding Balances: Regularly check for any overdue payments and send polite reminders to clients if necessary. Keeping track of unpaid amounts helps you stay on top of your accounts and ensures that you don’t miss out on income.

Here’s an example of how you might track payments in a simple table format:

| Client Name | Amount Due | Amount Paid | Payment Date | Remaining Balance |

|---|---|---|---|---|

| John Doe | $500.00 | $250.00 | 2024-10-10 | $250.00 |

| Jane Smith | $300.00 | $300.00 | 2024-10-12 | $0.00 |

By maintaining a detailed payment record like this, you can quickly identify any outstanding balances and follow up accordingly, ensuring smooth financial operations for your business.

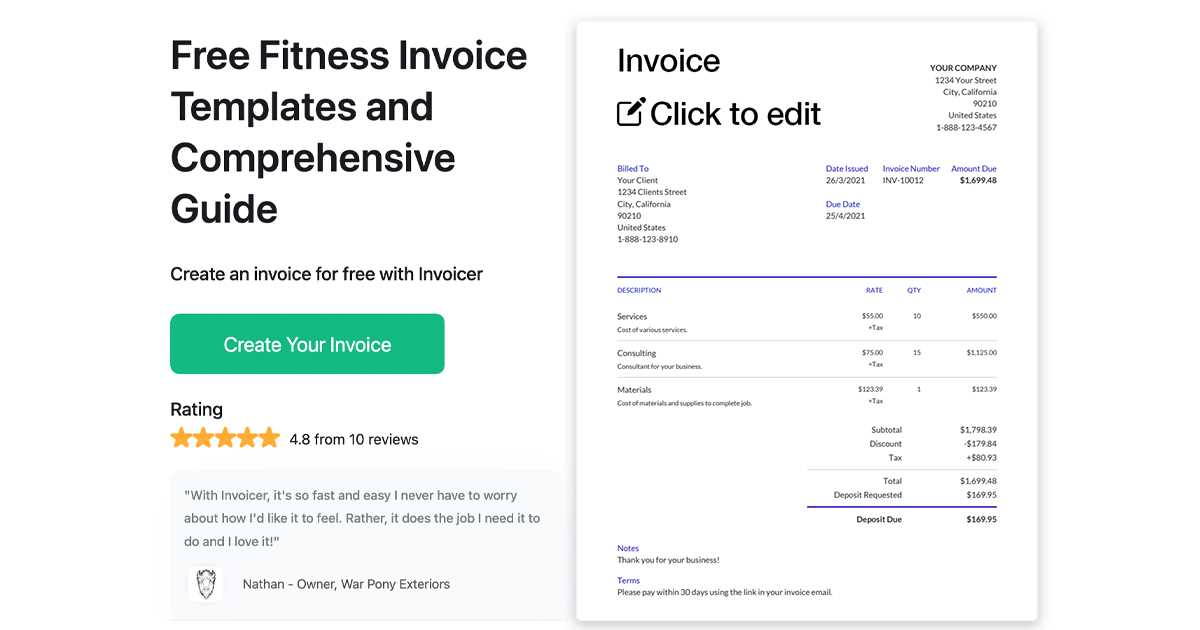

Using Invoice Software for Fitness Trainers

For professionals offering personalized services, managing payment requests and financial records can quickly become overwhelming. Invoice software provides an efficient solution to streamline this process, automate repetitive tasks, and ensure that payments are tracked accurately. By leveraging the right tools, you can save time, reduce errors, and maintain a professional appearance with minimal effort.

Here are some key advantages of using software for creating and managing payment requests:

- Automation: Invoice software allows you to automate repetitive tasks, such as creating recurring requests for ongoing services or generating reminders for unpaid amounts. This saves you time and reduces the risk of missing important steps.

- Customizable Templates: Many platforms offer pre-designed, customizable layouts that can be tailored to your business. This ensures that every document reflects your brand and includes all necessary details without needing to start from scratch each time.

- Tracking and Reporting: Most software includes built-in features for tracking payment statuses, providing reports on overdue accounts, and giving an overview of your income. This makes it easy to manage finances and identify patterns in client behavior.

- Online Payments: Some software integrates directly with online payment platforms, allowing clients to pay quickly and easily. This can speed up the payment process and improve cash flow.

- Professional Appearance: Using a dedicated software solution ensures that every document you send is polished and professional. With neatly formatted payment requests, your clients will appreciate the clarity and organization, enhancing their overall experience.

With so many options available, it’s important to choose the right software that fits your business needs. Look for features that align with the services you provide, your preferred payment methods, and your client base. Whether you’re working solo or with a team, invoice software can make your business operations much more efficient and hassle-free.

How to Handle Late Payments Professionally

Late payments are an inevitable part of business, but handling them professionally can maintain good relationships with clients while ensuring financial stability. It’s crucial to address overdue payments promptly, yet tactfully, in order to avoid damaging the professional rapport. The approach you take can significantly influence how clients perceive your business practices and can help you resolve payment delays without unnecessary conflict.

To ensure smooth transactions and maintain positive client relations, clear communication and consistency are key. Below are several strategies for addressing late payments in a manner that is both respectful and effective.

| Step | Action | Notes |

|---|---|---|

| 1. Send a Reminder | Politely remind the client about the due payment, including details of the agreed terms. | Keep the tone friendly and professional; an early reminder can prevent delays from escalating. |

| 2. Offer Flexible Payment Options | Sometimes, clients face unexpected issues. Offer installment plans or extended deadlines if necessary. | Being flexible shows empathy and a willingness to collaborate, which can encourage quicker resolution. |

| 3. Apply Late Fees | If the payment remains overdue, clearly inform the client about any late fees as outlined in the contract. | Late fees should be reasonable and aligned with the initial agreement to avoid alienating the client. |

| 4. Send a Formal Notice | After several reminders, escalate the matter by sending a more formal notice requesting immediate payment. | A formal notice emphasizes the seriousness of the issue while still maintaining professionalism. |

| 5. Consider Legal Action | If all attempts fail, consulting with a legal professional may be the next step to recover the debt. | This should be a last resort, and it’s crucial to weigh the cost of legal action against the outstanding amount. |

By following these steps, you can manage late payments in a way that safeguards your interests while still preserving professional relationships with clients. The goal is always to remain calm, clear, and fair, ensuring that business operations continue smoothly despite occasional delays in payment.

Legal Considerations for Fitness Invoices

When providing services, ensuring that all financial transactions are conducted legally and transparently is crucial. Clear terms and conditions, along with proper documentation, help protect both parties and establish a professional framework for payment agreements. Legal considerations are vital not only for safeguarding business operations but also for avoiding disputes that may arise due to misunderstandings or non-compliance.

Contractual Agreements and Terms

One of the most important legal aspects is having a solid agreement in place before any services are rendered. This agreement should outline the specific terms of payment, including fees, due dates, and penalties for late payments. It’s advisable to have clients acknowledge these terms in writing to avoid future disputes. Clear contracts not only set expectations but also serve as legal protection in case of a disagreement.

Tax Compliance and Reporting

Proper tax documentation is essential when engaging in any business activity. Ensure that all earnings are reported in accordance with local laws and regulations. This includes providing clients with the necessary paperwork for tax purposes, such as receipts or official records of payments received. Failing to maintain accurate financial records can lead to legal issues or complications with tax authorities.

By adhering to these legal principles, service providers can maintain a trustworthy and compliant business while minimizing the risk of legal complications. Clear, documented agreements and tax compliance are the foundation for a smooth and professional business operation.

Invoice Templates for Group Training Sessions

When conducting group sessions, it’s essential to have a clear and organized method for documenting payments. A well-structured billing statement helps both the service provider and clients keep track of services rendered and amounts due. Group settings can involve multiple participants, and each one’s payment needs to be accurately recorded to ensure fairness and clarity. Creating a customized record for group activities ensures that all financial details are transparent and easily understood.

For group sessions, the key is to outline the number of participants, individual rates, and any applicable discounts or packages. In cases where multiple sessions are involved, providing a summary of the total cost for each person and the overall group can help avoid confusion. This way, each participant can see their contribution while the provider keeps track of the collective payment.

Customizing Your Billing Records

For each group session, it’s important to include the following details:

- Service description: Clearly list the type of activity or program provided.

- Number of participants: Specify the total number of clients involved.

- Rate per person: Break down the cost for each participant.

- Total amount: Calculate the full payment expected for the session or program.

Additionally, if any promotional discounts or packages apply, make sure to detail those adjustments so that participants understand how the final price was determined.

Handling Payments from Multiple Clients

When working with a group, collecting individual payments can be time-consuming. A convenient solution is to request payments upfront or offer a system where clients can pay their share directly. If any outstanding amounts remain after the session, it’s important to send reminders with a clear breakdown of the amount due for each participant. This practice will help ensure smooth financial management and avoid any payment delays.

Saving Time with Automated Invoices

Managing payments manually can be time-consuming, especially for businesses with a high volume of clients. Automating the billing process not only reduces administrative work but also minimizes the risk of errors. By using automated systems, you can streamline the entire process, from generating statements to sending reminders, which ultimately saves valuable time and ensures timely payments.

Automated billing systems can be set up to create and send payment requests automatically, often with customizable features that align with your business needs. With such systems, you can eliminate repetitive tasks like manually entering payment details or tracking outstanding amounts, leaving more time to focus on client service and business growth. Additionally, many platforms offer recurring billing options, making it even easier to handle ongoing client commitments without extra effort.

Using automation tools, you can also reduce the chances of missing deadlines or forgetting to send payment requests. These systems can automatically issue reminders when payments are due, ensuring that both the service provider and the client are always on the same page regarding financial obligations. This level of consistency leads to smoother operations and greater efficiency.

Common Mistakes to Avoid in Invoicing

Accurate billing is essential for maintaining a smooth cash flow and fostering good relationships with clients. However, mistakes in the billing process can lead to delays, misunderstandings, and even disputes. Recognizing and avoiding common errors in your payment requests is critical to running a successful and professional operation. Below are several common pitfalls to watch out for when creating payment documents.

| Error | Impact | How to Avoid |

|---|---|---|

| Incorrect Client Details | Sending invoices to the wrong address or with incorrect client information can delay payments and create confusion. | Always double-check the client’s contact details and ensure they match your records before sending any billing statements. |

| Missing Payment Terms | Not specifying due dates, late fees, or accepted payment methods can lead to delayed payments and confusion over expectations. | Clearly outline payment terms, including the due date and any penalties for late payments, in every billing statement. |

| Not Itemizing Services | Vague or unclear descriptions of services can result in disputes or clients questioning the charges. | Provide a detailed breakdown of all services rendered, including hours worked, rates, and any applicable taxes or discounts. |

| Overlooking Taxes | Failure to include taxes can lead to underpayment and legal complications. | Ensure that all applicable taxes are included and clearly stated in the billing document. |

| Not Following Up | Missing follow-ups on overdue payments can result in long delays or non-payment. | Set up automated reminders or a structured follow-up process for overdue payments to keep cash flow steady. |

By avoiding these common errors, you can maintain a more efficient and professional billing process, ensuring timely payments and reducing the likelihood of conflicts with clients.