Fitness Instructor Invoice Template for Easy and Professional Billing

Managing payments and keeping track of client sessions can be a challenge for professionals in the health and wellness industry. Without a proper system in place, it can become difficult to ensure timely compensation for services rendered. Having a clear, professional document to handle these transactions is essential for maintaining transparency and building trust with clients.

Creating a structured document allows for easy management of financial interactions, ensuring accuracy and consistency. By using a well-organized format, trainers can include all necessary details, such as session dates, rates, and personal information, which help streamline the payment process.

Furthermore, having a reliable system in place reduces the risk of errors and prevents misunderstandings regarding payment terms. This type of tool saves time, reduces stress, and improves the overall professionalism of a trainer’s business operations.

Fitness Instructor Invoice Template Overview

For professionals offering training and coaching services, it is essential to have a systematic way to handle client payments. A well-organized document can help outline the specifics of the services provided, including session dates, rates, and the total amount due. This ensures both the client and service provider are on the same page when it comes to financial matters.

This tool typically includes all necessary fields to ensure accuracy and clarity. Key elements like personal details, service descriptions, and payment terms are laid out in a clear, easily accessible format. Such a resource allows trainers to maintain consistency in their billing process and ensures no important information is overlooked.

Furthermore, using a reliable document reduces administrative work and increases professionalism. It can be customized to fit the needs of any professional, helping to avoid potential confusion or discrepancies regarding charges, session frequency, or overdue payments. With a comprehensive and user-friendly layout, these documents enhance efficiency and help build stronger client relationships.

Why You Need an Invoice Template

Managing financial transactions with clients can become disorganized and prone to errors without a standardized method. A structured document not only ensures that all essential details are captured but also serves as a professional tool that enhances the overall business operations. Without such a resource, keeping track of payments and maintaining consistency in billing can become a time-consuming challenge.

Having a pre-designed format in place allows you to quickly and efficiently create accurate records for each transaction. This reduces the risk of mistakes, such as omitting critical information or miscalculating fees. Moreover, using a uniform approach for all clients strengthens your business image, showing that you operate in a methodical and transparent manner.

In addition, using a reliable format helps speed up the payment process. Clients will appreciate receiving clear and easy-to-understand documents, which can expedite their ability to review and settle accounts promptly. Ultimately, adopting this practice improves both your administrative efficiency and your client relationships.

Key Elements of a Fitness Invoice

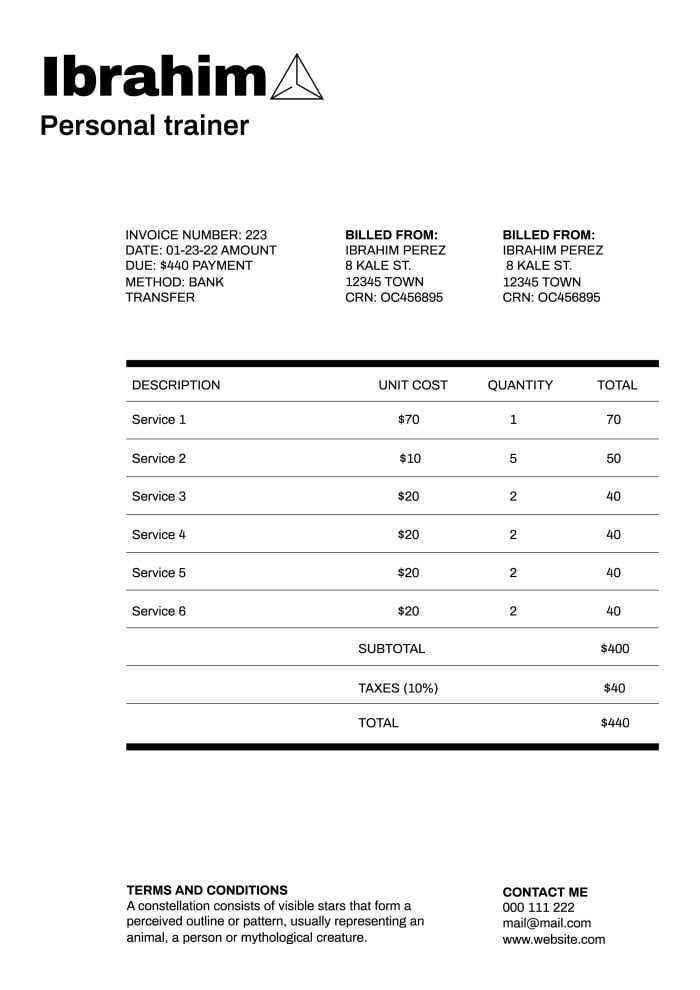

When it comes to creating a professional document for billing, it is important to include all necessary details to avoid confusion and ensure accurate payments. A well-structured form captures relevant information about the services provided, payment terms, and both parties’ contact details. Incorporating these key elements helps make the process smooth and transparent for both the service provider and the client.

Basic Information

Every document should begin with clear identification details. This includes the name and contact information of both the service provider and the client. These details are critical for proper communication and to ensure there is no confusion regarding who is involved in the transaction.

Service Breakdown and Payment Terms

It is essential to clearly list the services provided, the date of each session, and the rate charged for each service. Additionally, specifying the total amount due, along with any taxes or discounts, helps avoid misunderstandings. Including payment due dates and terms ensures that both parties are aware of when and how payment should be made.

| Item | Description | Amount |

|---|---|---|

| Session 1 | Personal training, 1 hour | $50 |

| Session 2 | Group workout, 1 hour | $30 |

| Total | $80 |

These components are essential for creating a professional and effective billing document, ensuring both clarity and accuracy in the financial exchange.

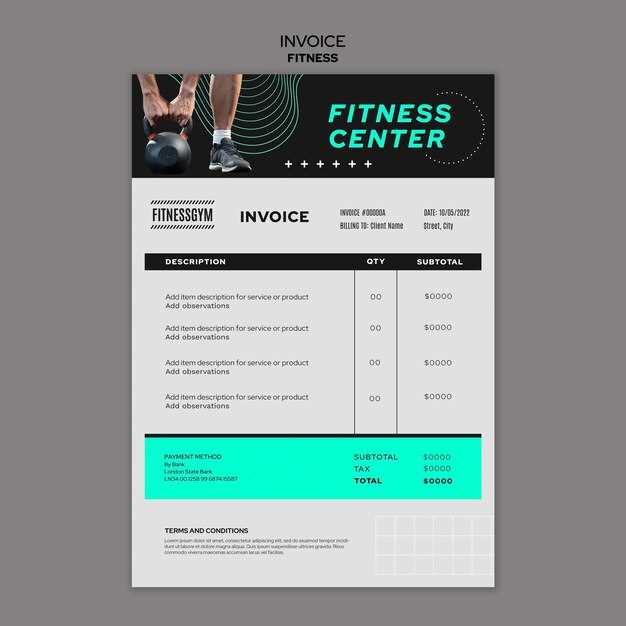

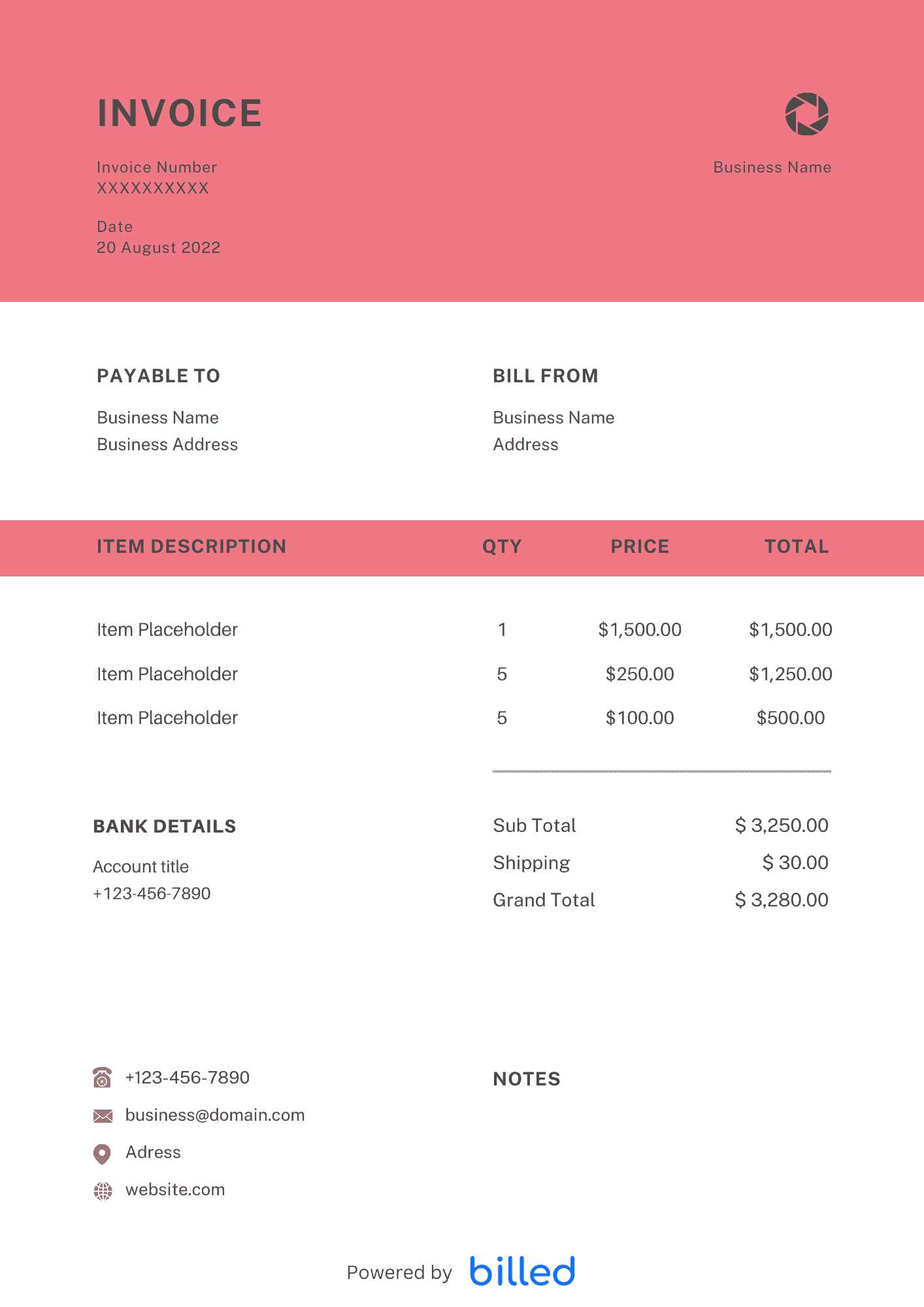

Customizing Your Fitness Invoice Template

Personalizing your billing document allows you to tailor it to your specific business needs while maintaining a professional appearance. Customization not only helps reflect your brand identity but also ensures that all relevant details are included in a way that suits both you and your clients. By modifying certain sections, you can create a document that feels more aligned with your services and the way you conduct business.

Here are some key areas to focus on when customizing your billing document:

- Logo and Branding: Adding your logo and business name at the top makes your document look more professional and recognizable.

- Color Scheme: Choose colors that align with your brand’s visual identity. A consistent color scheme can help reinforce your business’s aesthetic.

- Contact Information: Ensure your contact details, including email, phone number, and website, are clearly visible for easy communication.

- Payment Terms: You may want to add specific payment methods you accept, such as bank transfers, credit card payments, or online payment systems.

- Custom Notes or Discounts: If you offer promotions or loyalty discounts, make sure there’s space to include these on the document.

Once these key areas are customized, your document will not only be informative but also reflect your personal touch and professionalism, ensuring clients feel confident in their financial interactions with you.

How to Create an Invoice for Clients

Creating a clear and professional billing document is an essential task for any service provider. This document ensures that both you and your clients are on the same page regarding the payment for services rendered. The process of creating such a document involves including key details that make the transaction straightforward and transparent.

Follow these steps to craft a precise and organized document for your clients:

- Start with Contact Information: Include your name, business name, and contact details at the top of the document. Don’t forget to add the client’s name and contact information for reference.

- List the Services Provided: Clearly describe the services rendered, including the date of each session or service, and the duration or number of sessions. This ensures there is no confusion about what the client is being billed for.

- Specify Rates and Charges: Outline the cost per session or service and the total for each. This could also include any taxes or additional charges, if applicable.

- Include Payment Terms: Clearly state the payment due date, preferred payment methods (such as bank transfer, cash, or online platforms), and any late payment fees if applicable.

- Add a Unique Reference Number: Assign a unique reference number to each document to help both you and your client easily track payments and records.

Once these elements are included, your document will be comprehensive and easy for your client to understand. Make sure to review the document before sending it to ensure all information is correct and properly formatted. A well-organized document helps build trust and promotes timely payments.

Choosing the Right Invoice Format

Selecting the proper structure for your billing document is crucial for maintaining clarity and professionalism. The format you choose affects how easily clients can understand the details and make payments. Whether you opt for a simple layout or a

Incorporating Tax Details in Invoices

When preparing a billing document, it is essential to include accurate tax information to comply with legal requirements and avoid discrepancies in payments. Taxes can significantly affect the total amount due, so it’s important that both you and your client clearly understand how much is being charged and how it is calculated. By including tax details, you ensure transparency and professionalism in your transactions.

Here are the key points to consider when adding tax information:

- Include the Tax Rate: Make sure to specify the tax rate applied to the services rendered, whether it’s a standard rate or a special one based on your location or service type.

- Clearly Label Tax Amount: List the tax amount separately from the total cost of the services, so your client can easily see how much of the payment is going toward taxes.

- Specify the Tax Type: Indicate what type of tax is being charged, such as VAT, sales tax, or any other relevant tax, based on your region’s regulations.

- Use Accurate Tax Calculation: Double-check that the tax is calculated correctly, based on the subtotal or individual services, to avoid errors.

Here is an example of how to structure tax details in your billing document:

| Item | Description | Amount |

|---|---|---|

| Service | One-on-one training session | $100 |

| Tax (10%) | Sales tax | $10 |

| Total | $110 |

By including these details, you ensure that both you and your clients have a clear understanding of the financial breakdown, which fosters trust and reduces the chance of misunderstandings regarding the total amount owed.

Tracking Payments with Invoices

Accurately tracking payments is essential for maintaining a well-organized financial system. A clear record of all transactions helps you monitor outstanding balances, identify overdue payments, and ensure that you’re receiving the correct amount for services rendered. By utilizing a proper document to track payments, you can avoid confusion and keep both you and your clients informed about their financial obligations.

Here’s how you can effectively track payments using a billing document:

- Assign Unique Reference Numbers: Each document should have a unique reference number. This makes it easier to track individual transactions and quickly locate payment history when needed.

- List Payment Status: Clearly mark whether the payment is pending, completed, or overdue. This helps you stay organized and follow up when necessary.

- Record Payment Dates: Always document the date when the payment was made or when it is due. This provides a clear timeline and helps avoid missed deadlines.

- Include Total Amount and Balance: Display the total amount due and the amount paid so far. If any balance remains, clearly show the outstanding amount.

Here’s an example of how to organize payment tracking:

| Item | Description | Amount Due | Amount Paid | Balance | Status |

|---|---|---|---|---|---|

| Session 1 | Personal training session | $50 | $50 | $0 | Paid |

| Session 2 | Group training session | $40 | $20 | $20 | Partial Payment |

| Total | $90 | $70 | $20 |

By keeping detailed records of payments, including amounts paid and outstanding balances, you can ensure smooth financial management and minimize errors or disputes related to payments.

Design Tips for a Professional Invoice

A well-designed billing document can make a significant difference in how your clients perceive your business. A clear, organized, and visually appealing layout not only improves the professionalism of your communication but also enhances your credibility. The design should ensure that important details are easy to find and understand, making the payment process smoother for both you and your clients.

Keep It Clean and Simple

One of the most important design principles is simplicity. Avoid overcrowding the document with excessive text or complicated graphics. A clean layout helps clients quickly find the information they need, such as the amount due and payment terms. Stick to a simple, easy-to-read font and ensure there is enough white space around text to prevent the page from feeling cluttered.

Highlight Key Information

Important details like the total amount due, payment methods, and due dates should stand out. Use bold or larger fonts for these sections to guide the client’s eye directly to the most critical information. This ensures that your client knows exactly what they owe and when it’s due at a glance.

Consider using lines or boxes to separate sections like services provided, taxes, and payment terms. This creates a clear distinction between different parts of the document, making it easier for the client to understand the breakdown of charges.

Finally, ensure that your document looks professional by including your business logo and consistent branding elements, such as color schemes. A polished design reinforces the image of a trustworthy, organized business.

Benefits of Using Invoice Templates

Using a pre-designed billing document offers numerous advantages for any service-based business. These ready-made forms help streamline the payment process, ensuring that you spend less time on administrative tasks and more time focusing on delivering your services. By using a standardized document, you not only simplify your workflow but also create a more professional image for your clients.

Efficiency and Time-Saving

One of the greatest benefits of using a pre-made format is the significant time saved in preparing documents. Instead of creating a new document from scratch for every client, you can simply fill in the necessary details like the service provided, amount due, and payment terms. This efficiency allows you to generate invoices quickly and send them out promptly, speeding up your payment cycle.

Consistency and Professionalism

Using a standardized document ensures that all your billing records are consistent in format, layout, and structure. This consistency not only helps you maintain a professional appearance but also makes it easier for clients to review and understand the details of each transaction. By keeping your documents uniform, you enhance your business reputation and help build trust with clients.

Additionally, many pre-designed forms come with customizable features, allowing you to tailor them to your branding and specific business needs. This flexibility ensures that your documents reflect your identity while maintaining a high level of professionalism.

Free vs Paid Invoice Template Options

When selecting a billing document for your business, you’ll find options available for both free and paid solutions. Each type offers distinct advantages and limitations, and choosing between the two depends on your business needs, budget, and the level of customization you require. Understanding the differences between free and paid options can help you decide which one best suits your specific requirements.

Free Options

Free billing documents are easily accessible and a great choice for small businesses or freelancers just starting out. These documents often come with basic features such as space for service descriptions, amounts, and payment terms. Since they are available at no cost, free options can be a cost-effective way to get started with organizing payments.

However, free templates might lack advanced features or customization options. They may have limited styling options, fewer design elements, or no room for adding your branding. If you need a simple, no-frills document to record transactions, a free option might be sufficient, but it may not offer the professional touch some clients expect.

Paid Options

Paid options generally provide more advanced features and greater flexibility. These documents often include customization options that allow you to add your branding, logos, and color schemes, making them look more professional and aligned with your business identity. Paid versions may also offer additional functionalities such as automatic tax calculations, integration with accounting software, and the ability to save and track payment history.

While paid solutions come at a cost, they often provide better support and more sophisticated design elements. For growing businesses with more complex billing needs, investing in a premium option can be worthwhile. These tools not only improve the client experience but can also help streamline your financial management processes.

How to Use Invoice Templates Efficiently

Using a pre-designed billing document can greatly simplify your administrative tasks, but to maximize its effectiveness, it’s important to use it strategically. Efficiently utilizing these documents allows you to save time, reduce errors, and maintain consistency in your financial records. With the right approach, you can ensure a smoother workflow and quicker payments.

Here are some key tips for using these documents efficiently:

- Customize Once, Use Often: Customize the document format to include your business name, logo, and preferred payment details. Once you have set up your document, you can reuse it for each client, minimizing the need for frequent changes.

- Save Time with Digital Formats: Use digital formats (like PDFs or online billing software) to avoid the hassle of printing and mailing. These formats are easily editable and can be sent instantly via email.

- Automate Calculations: If your document allows, enable automatic calculations for totals, taxes, and discounts. This ensures accuracy and saves time on manual calculations.

- Pre-fill Client Information: Keep a list of common client details like their name, address, and contact information. Some tools allow you to pre-fill these details, which saves time when generating documents for repeat clients.

- Set Up Payment Reminders: If the tool you’re using offers payment tracking, set reminders for unpaid balances. This helps you stay on top of overdue payments without needing to manually track each one.

By following these practices, you can streamline your billing process, ensure that every transaction is recorded properly, and maintain a more organized financial system.

Legal Requirements for Fitness Invoices

When preparing billing documents, it’s crucial to comply with local and national regulations to avoid legal issues. These documents must include certain elements to ensure they are legally valid and meet tax reporting requirements. Understanding these requirements helps you maintain accurate records and ensures transparency in your transactions with clients.

Essential Legal Elements

Every billing record should contain specific information to meet the legal standards in many regions. Here are the key elements to include:

- Business Information: Include your business name, address, and contact details. This helps establish the document’s authenticity and allows for easy communication if there are any issues or questions.

- Client Information: Include the client’s full name or business name, address, and contact details. This ensures that the transaction is clearly linked to the correct party.

- Unique Reference Number: Each billing record should have a unique identifier for easy tracking and reference, particularly for tax purposes.

- Clear Description of Services: The document should outline the services provided, including the date(s) and nature of the work. This provides clarity on the transaction and serves as a point of reference in case of disputes.

- Payment Terms: Clearly state the total amount due, the due date, and any applicable taxes or discounts. Include payment methods and terms for late payments.

- Tax Identification Numbers: Depending on your location, you may need to include your business’s tax identification number (TIN) or VAT number. This is necessary for tax reporting and for ensuring compliance with local tax laws.

Tax Considerations

Tax requirements can vary depending on your location, but it is important to ensure that the appropriate taxes are included. In some regions, services provided may be subject to a sales tax, VAT, or other forms of indirect taxation. Be sure to:

- Include applicable tax rates: Ensure the correct tax rate is applied to the services rendered and clearly shown on the document.

- Show tax breakdown: Separate the tax amount from the service cost for transparency.

By follow

Common Mistakes in Fitness Invoices

When preparing a billing document, even small errors can lead to confusion or delays in payment. These mistakes can be easily avoided with attention to detail. Ensuring that all information is accurate and clearly presented will help maintain professionalism and prevent misunderstandings with clients.

Here are some of the most common mistakes to watch out for:

- Incorrect Client Information: Double-check the client’s name, contact details, and address before sending the document. Mistakes in this area can lead to confusion or delayed payments, as the client may not recognize the document or may misplace it.

- Missing or Incorrect Dates: Ensure the date of the service and the due date for payment are clearly stated. If either of these is missing or incorrect, it can create confusion about the timeline for payment, which may lead to late fees or disputes.

- Failure to Specify Payment Terms: Always include clear payment terms, such as the due date, accepted payment methods, and penalties for late payments. Without these terms, clients may delay payment, assuming that there is no urgency.

- Omitting Tax Information: Depending on your region, you may need to include taxes such as sales tax or VAT. If this information is missing or incorrect, it could cause problems for both you and your clients when filing taxes.

- Inconsistent or Unclear Pricing: Be transparent with your pricing. Vague descriptions or incorrect pricing can create confusion about the services provided or the amount due. Make sure the service description and pricing are clear and accurate.

- Not Including a Unique Reference Number: Without a unique reference number or invoice number, it becomes difficult to track payments or handle potential disputes. Always use a unique number for each document to keep your financial records organized.

By avoiding these common mistakes, you can ensure that your billing documents are clear, accurate, and professional. This will not only make it easier for your clients to pay you on time but also help you maintain a well-organized financial system.

How to Handle Late Payments with Invoices

Late payments are a common challenge for many businesses, and managing them effectively is crucial to maintaining healthy cash flow. When payments are delayed, it’s important to address the situation professionally while still ensuring that your business is compensated for the services provided. Clear communication and well-structured payment terms can help resolve these issues efficiently.

Here are some strategies for managing overdue payments:

- Establish Clear Payment Terms: From the start, make sure your payment terms are well-defined. Include a specific due date and outline late payment fees or penalties. This sets clear expectations for your clients, making it easier to enforce consequences if payments are delayed.

- Send Payment Reminders: If a payment becomes overdue, send a polite reminder to the client. You can do this via email, phone, or even text. A gentle nudge often encourages prompt payment without causing tension.

- Offer Payment Flexibility: If a client is struggling to pay, consider offering a payment plan or a temporary extension. This shows goodwill and can help ensure you receive payment eventually while maintaining a good relationship with the client.

- Apply Late Fees: If your payment terms include late fees, make sure these are applied when appropriate. Clearly state the fees in your billing document to avoid disputes, and be consistent in enforcing them when payments are delayed.

Late Payment Example Breakdown

Here’s an example of how you can structure a payment reminder and late fee on a billing document:

| Description | Amount |

|---|---|

| Original Amount Due | $100 |

| Late Fee (10% after 7 days) | $10 |

| Total Amount Due | $110 |

Enforce Payment Deadlines: Consistently following up and enforcing payment deadlines is key to avoiding long delays. Setting firm policies and sticking to them helps prevent late payments from becoming a recurring issue.

By t

Streamlining Your Billing Process

Efficient billing is essential for maintaining smooth cash flow and reducing administrative time. By automating and simplifying the process, you can minimize errors, ensure timely payments, and free up valuable time to focus on serving your clients. Streamlining your financial documentation process not only saves you time but also helps to build a more professional and reliable reputation.

Here are some ways to simplify and optimize your billing workflow:

- Automate Recurring Transactions: If you have regular clients, consider automating the billing for repeat services. Setting up recurring payments ensures that invoices are sent on time and reduces the manual effort needed each time you need to bill for similar services.

- Use Digital Billing Solutions: Switch to digital platforms for creating and sending your documents. These tools often come with built-in features like automatic calculations, customizable fields, and tracking systems that can save you hours each week.

- Centralize Your Client Information: Keep a client database with key details such as contact information, services rendered, and payment history. This allows you to easily pull up relevant data when creating new documents, reducing the time spent gathering information.

- Pre-fill Common Fields: If your document provider allows it, set up templates where you can pre-fill common fields like your business name, client information, payment methods, and services. This reduces the time spent on repetitive data entry.

- Integrate with Accounting Software: Link your billing process to accounting software or platforms that automatically record transactions and update your financial records. Integration can help track payments, send reminders for overdue balances, and generate financial reports without needing to manually input data.

By implementing these practices, you can significantly reduce the time spent on administrative tasks while ensuring that your billing process remains accurate, professional, and timely. Simplifying your workflow allows you to focus more on providing excellent services to your clients while maintaining an organized and efficient business.