Final Invoice Template for Seamless Billing and Payments

Key Elements of a Final Invoice

Why Final Invoices Matter for Businesses

Best Practices for Final Invoice Design

Legal Considerations for Final Invoices

How Final Invoices Streamline Payments

Invoice Templates for Different Industries

How to Handle Disputes Over Invoices

What is a Final Invoice Template

When a business completes a project or transaction, it’s essential to provide a formal document outlining the amount due for payment. This document serves as the last step in the billing process, summarizing all relevant charges and payment terms. It ensures that both parties have a clear record of the financial agreement and helps avoid misunderstandings.

A well-structured billing document includes several key components that make the payment process more transparent and organized. It typically details the products or services rendered, the amount owed, and the deadline for payment. Additionally, it may include payment methods, tax information, and any other specific terms related to the transaction.

- Details of goods or services provided

- Total cost with applicable taxes

- Payment instructions and methods

- Due date for payment

- Terms and conditions related to the transaction

By using a pre-designed structure for these documents, businesses can maintain consistency and professionalism, while also reducing the time spent creating each new one from scratch. A clear and effective billing document is an essential tool for ensuring smooth financial operations and maintaining strong business relationships.

Key Elements of a Final Invoice

A comprehensive billing document is crucial for a successful transaction. It provides a detailed breakdown of all charges, ensuring clarity and transparency between the service provider and the client. There are specific components that must be included to make this document clear and legally sound, and each part plays a significant role in the payment process.

Basic Information

The first section should include essential details about both the service provider and the client. This typically consists of names, addresses, and contact information. Identifying the involved parties ensures that both the sender and recipient are clearly established. Additionally, a unique reference number or identification code is often included for tracking purposes.

Itemized Breakdown and Total

One of the most critical sections of the document is the itemized list of products or services provided. Each entry should describe the work performed or the goods delivered, along with corresponding quantities and rates. The total sum is calculated after listing all charges, taxes, and discounts, leaving no room for confusion when it comes to payment expectations.

- Contact details of both parties

- Unique reference number

- Detailed list of charges

- Final amount due with taxes and discounts

- Payment methods and instructions

Including these essential elements ensures that the document serves its purpose efficiently, creating a clear and professional record of the transaction for both sides.

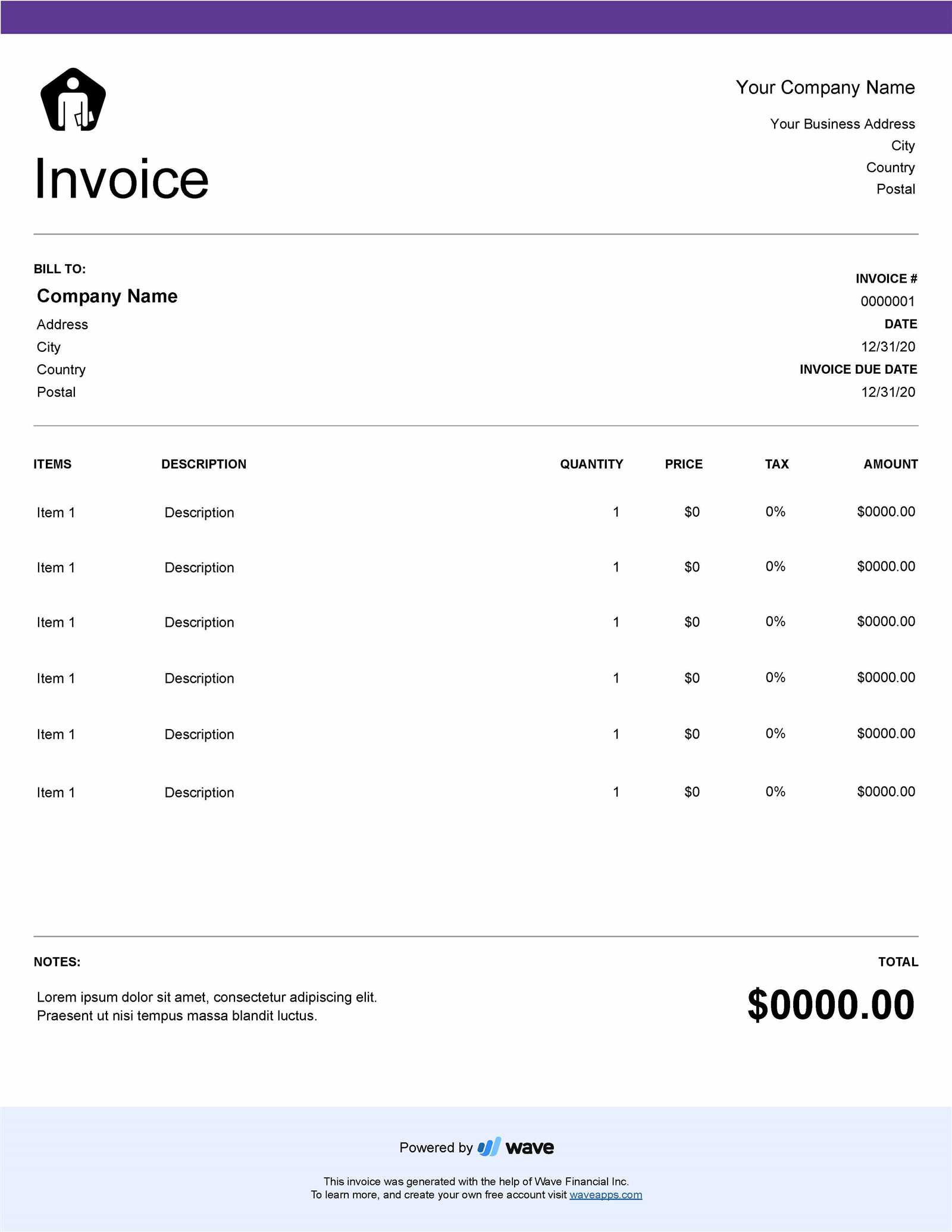

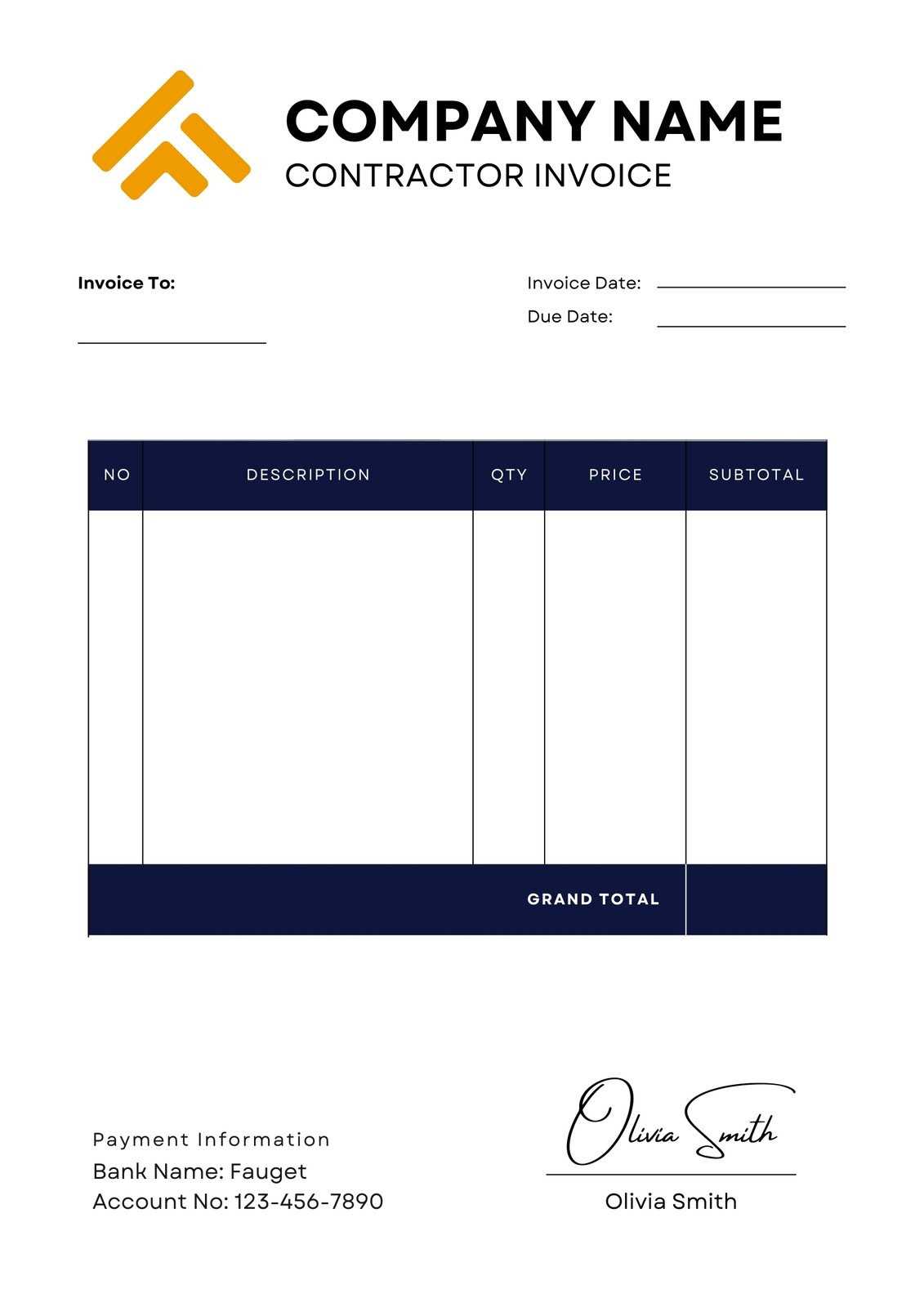

How to Create a Final Invoice

Creating a professional and clear billing document requires attention to detail and accuracy. This document should reflect the completed transaction in a way that leaves no room for confusion, ensuring both the provider and the client understand the payment terms. By following a systematic approach, you can generate a document that is both efficient and legally sound.

Start by including basic information such as the names, addresses, and contact details of both parties involved. You should also assign a unique reference number to the document for easy identification. This helps keep the transaction organized and makes future referencing simpler.

Next, include a detailed description of the services or products provided. Each item should be clearly outlined, with quantities, individual prices, and any relevant rates. If applicable, include a breakdown of taxes, discounts, and additional fees. The total amount due should be prominently displayed to avoid confusion.

Finally, provide payment instructions, including the accepted payment methods and any relevant deadlines. Clearly state when the payment is due and specify any penalties or fees that may apply if the payment is delayed. This ensures that both parties are fully informed about their obligations.

- Provide essential contact details

- Include a unique reference number

- Break down services/products with prices

- Show total amount due clearly

- State payment terms and instructions

By following these steps, you can create a clear and effective document that facilitates smooth transactions and minimizes the risk of misunderstandings.

How to Create a Final Invoice

Creating a professional and clear billing document requires attention to detail and accuracy. This document should reflect the completed transaction in a way that leaves no room for confusion, ensuring both the provider and the client understand the payment terms. By following a systematic approach, you can generate a document that is both efficient and legally sound.

Start by including basic information such as the names, addresses, and contact details of both parties involved. You should also assign a unique reference number to the document for easy identification. This helps keep the transaction organized and makes future referencing simpler.

Next, include a detailed description of the services or products provided. Each item should be clearly outlined, with quantities, individual prices, and any relevant rates. If applicable, include a breakdown of taxes, discounts, and additional fees. The total amount due should be prominently displayed to avoid confusion.

Finally, provide payment instructions, including the accepted payment methods and any relevant deadlines. Clearly state when the payment is due and specify any penalties or fees that may apply if the payment is delayed. This ensures that both parties are fully informed about their obligations.

- Provide essential contact details

- Include a unique reference number

- Break down services/products with prices

- Show total amount due clearly

- State payment terms and instructions

By following these steps, you can create a clear and effective document that facilitates smooth transactions and minimizes the risk of misunderstandings.

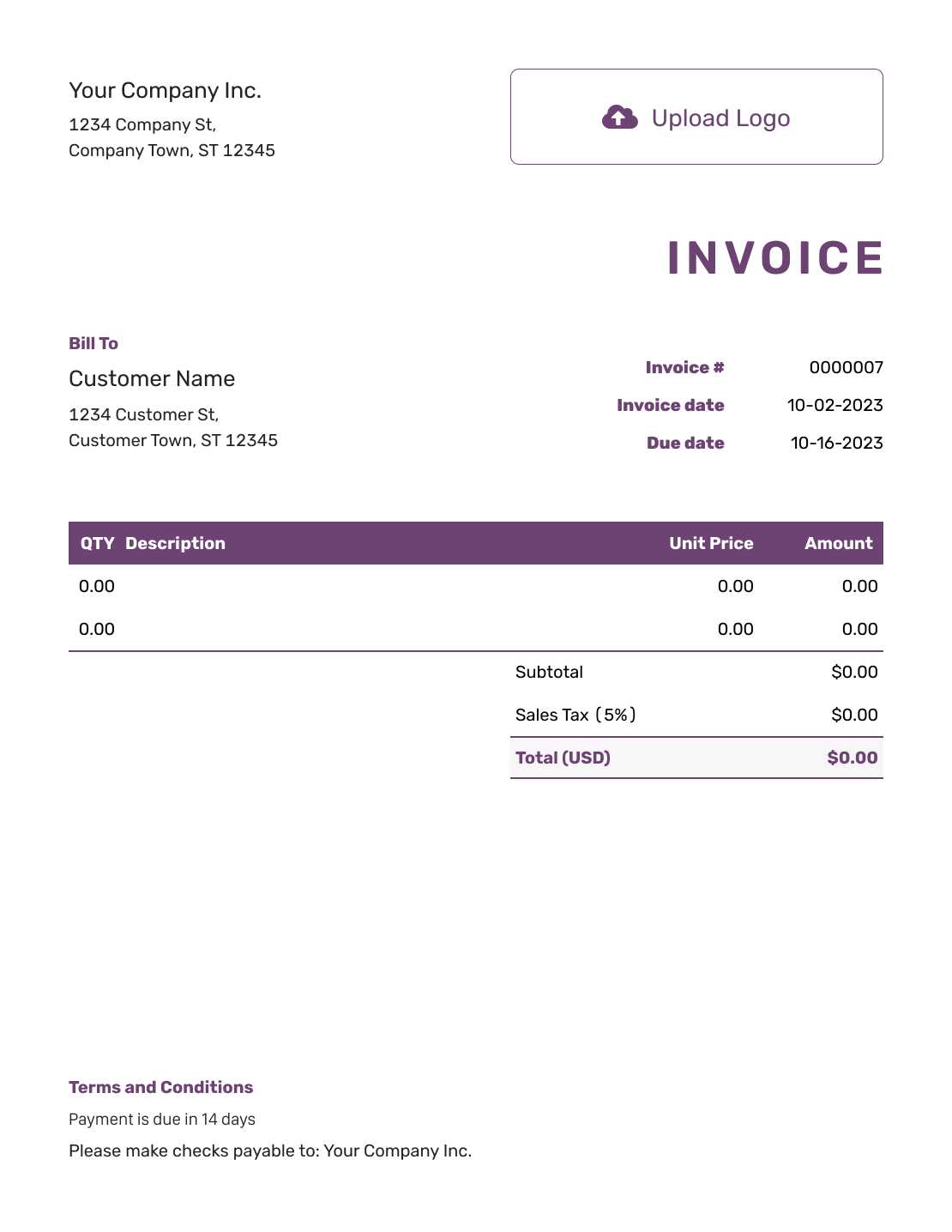

Customizing Your Final Invoice Template

Personalizing your billing document is an important step in making it align with your business needs and brand identity. Customization not only improves the professional appearance of the document but also ensures that it includes all the necessary elements specific to your company’s operations. A tailored billing document can make the entire transaction process smoother and more organized for both you and your client.

Start by adjusting the layout and design to match your company’s branding. This includes incorporating your company logo, colors, and font styles. A cohesive design reinforces your brand’s presence and creates a professional impression. Ensure that the document is easy to read, with a clear and logical flow.

- Include your company’s logo and contact details

- Use a consistent color scheme and fonts

- Organize information in a clear and logical way

Next, consider adding specific sections that apply to your business type. For example, if you provide recurring services, you might want to add a section for subscription dates or recurring billing cycles. If you deal with large quantities or complex projects, itemized sections for discounts, taxes, and additional charges can help ensure clarity.

- Tailor the layout for your business needs

- Include sections for recurring services, subscriptions, or discounts

- Consider adding additional notes or terms

Finally, make sure to include customizable fields where you can easily add or adjust information for each transaction. This flexibility allows you to quickly update details such as the amount due, payment terms, or any special instructions, ensuring that each document is unique to the transaction at hand.

Customizing Your Final Invoice Template

Personalizing your billing document is an important step in making it align with your business needs and brand identity. Customization not only improves the professional appearance of the document but also ensures that it includes all the necessary elements specific to your company’s operations. A tailored billing document can make the entire transaction process smoother and more organized for both you and your client.

Start by adjusting the layout and design to match your company’s branding. This includes incorporating your company logo, colors, and font styles. A cohesive design reinforces your brand’s presence and creates a professional impression. Ensure that the document is easy to read, with a clear and logical flow.

- Include your company’s logo and contact details

- Use a consistent color scheme and fonts

- Organize information in a clear and logical way

Next, consider adding specific sections that apply to your business type. For example, if you provide recurring services, you might want to add a section for subscription dates or recurring billing cycles. If you deal with large quantities or complex projects, itemized sections for discounts, taxes, and additional charges can help ensure clarity.

- Tailor the layout for your business needs

- Include sections for recurring services, subscriptions, or discounts

- Consider adding additional notes or terms

Finally, make sure to include customizable fields where you can easily add or adjust information for each transaction. This flexibility allows you to quickly update details such as the amount due, payment terms, or any special instructions, ensuring that each document is unique to the transaction at hand.

Common Mistakes to Avoid in Invoices

When preparing a billing document, it’s easy to overlook key details that could lead to confusion or delays in payment. Even small errors can cause significant problems, so it’s crucial to ensure every aspect is carefully checked. By avoiding these common mistakes, you can improve the clarity of the document and maintain professionalism with your clients.

One of the most frequent issues is the failure to include accurate contact details. Omitting the correct name, address, or payment information can delay the processing of the payment. Always double-check that the recipient’s information is up-to-date and complete.

- Incorrect or missing contact information

- Not using a unique reference number

- Omitting important details like taxes or discounts

Another common error is inaccurate or incomplete descriptions of services. Ensure that each item or service is clearly described, with the correct quantities and rates. This helps prevent misunderstandings and ensures that the recipient is clear about what they are being charged for.

- Vague or unclear descriptions of products/services

- Incorrect pricing or missing charges

- Failure to itemize the services properly

Finally, not stating payment terms clearly is a mistake that can lead to payment delays. Be sure to specify the due date, any applicable late fees, and preferred payment methods. Clear instructions will make it easier for the client to settle the amount on time.

- Unclear or missing payment terms

- Failure to specify due dates and penalties

- Not providing enough payment options

By avoiding these common mistakes, you ensure that the billing process is straightforward, transparent, and efficient, helping to maintain a positive business relationship with your clients.

Common Mistakes to Avoid in Invoices

When preparing a billing document, it’s easy to overlook key details that could lead to confusion or delays in payment. Even small errors can cause significant problems, so it’s crucial to ensure every aspect is carefully checked. By avoiding these common mistakes, you can improve the clarity of the document and maintain professionalism with your clients.

One of the most frequent issues is the failure to include accurate contact details. Omitting the correct name, address, or payment information can delay the processing of the payment. Always double-check that the recipient’s information is up-to-date and complete.

- Incorrect or missing contact information

- Not using a unique reference number

- Omitting important details like taxes or discounts

Another common error is inaccurate or incomplete descriptions of services. Ensure that each item or service is clearly described, with the correct quantities and rates. This helps prevent misunderstandings and ensures that the recipient is clear about what they are being charged for.

- Vague or unclear descriptions of products/services

- Incorrect pricing or missing charges

- Failure to itemize the services properly

Finally, not stating payment terms clearly is a mistake that can lead to payment delays. Be sure to specify the due date, any applicable late fees, and preferred payment methods. Clear instructions will make it easier for the client to settle the amount on time.

- Unclear or missing payment terms

- Failure to specify due dates and penalties

- Not providing enough payment options

By avoiding these common mistakes, you ensure that the billing process is straightforward, transparent, and efficient, helping to maintain a positive business relationship with your clients.

Common Mistakes to Avoid in Invoices

When preparing a billing document, it’s easy to overlook key details that could lead to confusion or delays in payment. Even small errors can cause significant problems, so it’s crucial to ensure every aspect is carefully checked. By avoiding these common mistakes, you can improve the clarity of the document and maintain professionalism with your clients.

One of the most frequent issues is the failure to include accurate contact details. Omitting the correct name, address, or payment information can delay the processing of the payment. Always double-check that the recipient’s information is up-to-date and complete.

- Incorrect or missing contact information

- Not using a unique reference number

- Omitting important details like taxes or discounts

Another common error is inaccurate or incomplete descriptions of services. Ensure that each item or service is clearly described, with the correct quantities and rates. This helps prevent misunderstandings and ensures that the recipient is clear about what they are being charged for.

- Vague or unclear descriptions of products/services

- Incorrect pricing or missing charges

- Failure to itemize the services properly

Finally, not stating payment terms clearly is a mistake that can lead to payment delays. Be sure to specify the due date, any applicable late fees, and preferred payment methods. Clear instructions will make it easier for the client to settle the amount on time.

- Unclear or missing payment terms

- Failure to specify due dates and penalties

- Not providing enough payment options

By avoiding these common mistakes, you ensure that the billing process is straightforward, transparent, and efficient, helping to maintain a positive business relationship with your clients.

How Final Invoices Streamline Payments

Providing a well-structured billing document helps both businesses and clients manage their financial obligations efficiently. By offering a clear and detailed summary of all charges, payment terms, and deadlines, this document reduces the chances of confusion and ensures timely payment. It acts as a formal request for payment, making the process smoother and more transparent for everyone involved.

Clear Breakdown of Charges

A detailed breakdown of all charges ensures that both parties are on the same page regarding the amount due. When each service, product, or task is clearly itemized with quantities, rates, and applicable taxes, the client can easily understand what they are paying for. This transparency helps eliminate disputes or questions about the charges.

- Itemized list of services or products

- Clearly displayed rates and quantities

- Detailed tax and fee breakdown

Improved Payment Tracking and Deadlines

Including a clear due date and payment instructions allows clients to know exactly when the payment is expected and how it should be made. This not only helps to avoid delays but also enables businesses to track payments efficiently. With payment methods clearly outlined, clients are more likely to pay promptly, reducing administrative follow-ups.

- Clear payment terms and due dates

- Multiple payment options for client convenience

- Easy-to-track reference numbers

By making the payment process more straightforward, this document helps businesses get paid on time while maintaining positive relationships with clients.

How Final Invoices Streamline Payments

Providing a well-structured billing document helps both businesses and clients manage their financial obligations efficiently. By offering a clear and detailed summary of all charges, payment terms, and deadlines, this document reduces the chances of confusion and ensures timely payment. It acts as a formal request for payment, making the process smoother and more transparent for everyone involved.

Clear Breakdown of Charges

A detailed breakdown of all charges ensures that both parties are on the same page regarding the amount due. When each service, product, or task is clearly itemized with quantities, rates, and applicable taxes, the client can easily understand what they are paying for. This transparency helps eliminate disputes or questions about the charges.

- Itemized list of services or products

- Clearly displayed rates and quantities

- Detailed tax and fee breakdown

Improved Payment Tracking and Deadlines

Including a clear due date and payment instructions allows clients to know exactly when the payment is expected and how it should be made. This not only helps to avoid delays but also enables businesses to track payments efficiently. With payment methods clearly outlined, clients are more likely to pay promptly, reducing administrative follow-ups.

- Clear payment terms and due dates

- Multiple payment options for client convenience

- Easy-to-track reference numbers

By making the payment process more straightforward, this document helps businesses get paid on time while maintaining positive relationships with clients.

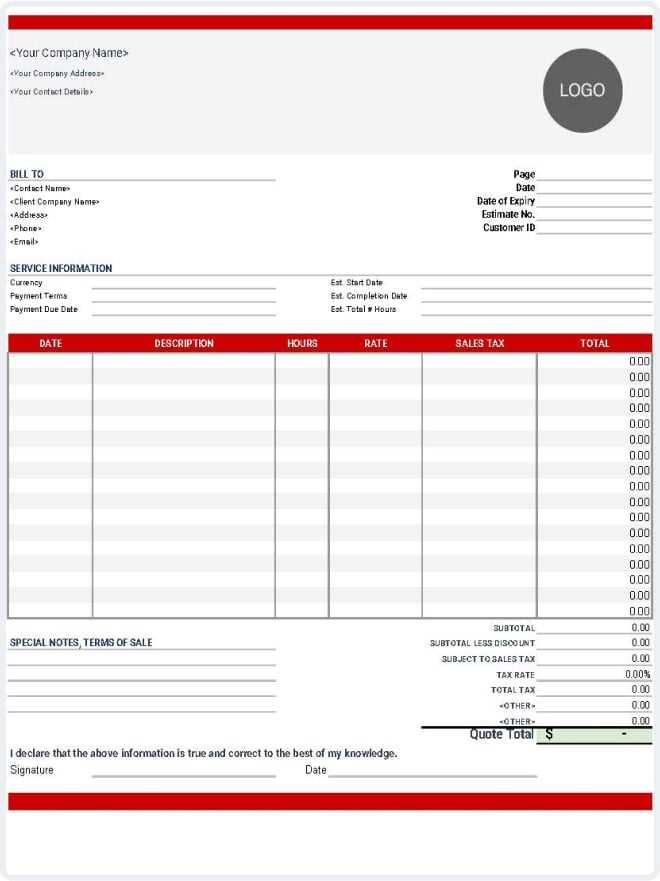

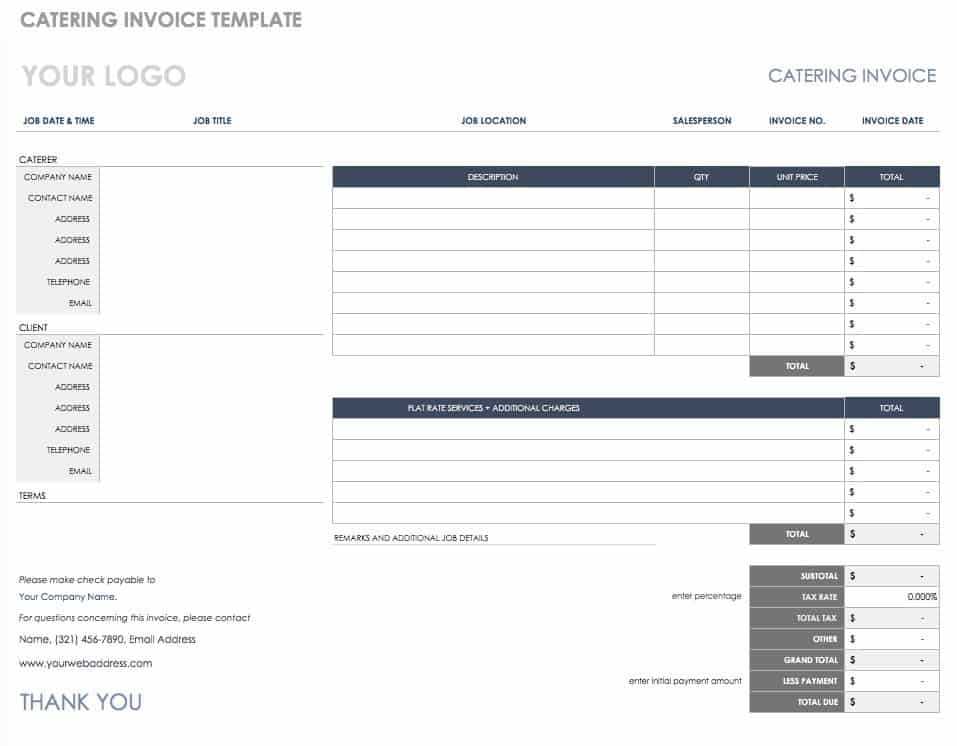

Invoice Templates for Different Industries

Each sector has its own unique requirements when it comes to documenting financial transactions. A standardized structure can be crucial to ensure that all necessary details are captured efficiently. By customizing forms to suit particular industries, businesses can streamline their processes and ensure accuracy, all while maintaining professionalism.

Construction and Engineering

For businesses in construction and engineering, accurate records are essential due to the complex nature of the projects, which often involve multiple parties, phases, and materials. A tailored billing document for this sector may include project names, work phase details, and materials and labor costs. Additionally, due to the potential for change orders, this kind of paperwork often has sections for modifications and adjustments in real-time.

Creative Services

Creative industries, such as design, photography, and marketing, tend to have varying project scopes and unique deliverables. For these services, a customized record can include line items for creative work hours, concept development, and final delivery formats. Also, the inclusion of payment milestones is common, ensuring that both parties agree on terms as the project progresses.

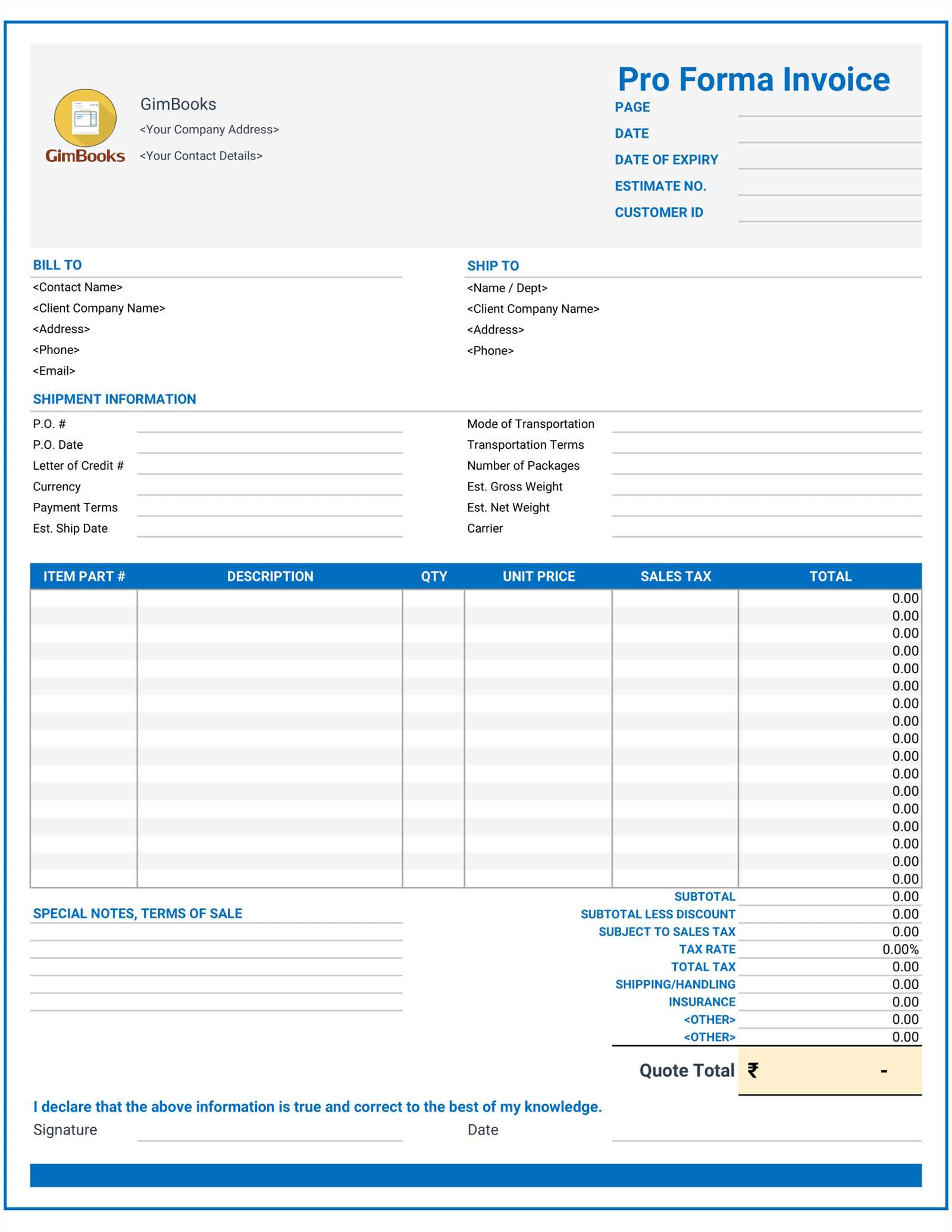

Final Invoice vs. Proforma Invoice

There are different types of financial documents used in business transactions, each serving a distinct purpose. While some are used to confirm the completion of a sale, others act as preliminary estimates or agreements before finalization. Understanding the difference between these documents is crucial for both businesses and clients to ensure proper handling of payments and expectations.

The main distinction lies in their timing and function. A conclusive statement reflects the actual cost after goods or services have been delivered, marking the final stage of a transaction. On the other hand, a preliminary statement is issued before the work is completed, providing an estimated cost to inform clients about expected charges, often for approval or as a reference for future adjustments.

How to Handle Disputes Over Invoices

Disagreements over payment details can arise at any point in a business relationship. Whether it’s due to discrepancies in amounts, missed services, or unmet terms, addressing these conflicts promptly and professionally is essential to maintaining good relations and ensuring smooth operations. Clear communication and a systematic approach to resolving issues can prevent minor misunderstandings from escalating into bigger problems.

Clarify the Details

The first step in resolving any dispute is to review the documentation thoroughly. Both parties should compare the terms agreed upon with what has been billed. Check for errors, such as incorrect quantities, pricing, or omitted items. In some cases, an honest mistake may have occurred, and a simple revision will resolve the matter.

Negotiate a Resolution

If the issue cannot be resolved by reviewing the paperwork, the next step is to discuss the matter directly. Maintain an open line of communication and approach the situation with a willingness to find a fair solution. Sometimes, partial adjustments or payment plans can help both parties reach an agreement without further conflict.

Ensuring Compliance with Invoice Standards

Maintaining consistency and accuracy in financial documentation is vital for both legal and operational reasons. Adhering to established guidelines not only helps businesses avoid penalties but also promotes transparency and trust between clients and service providers. To ensure compliance, it’s important to stay informed about industry requirements, local regulations, and any specific agreements that may apply.

One of the key aspects of staying compliant is ensuring that every document includes necessary details, such as item descriptions, payment terms, and contact information. Depending on the region or sector, certain data points may be required by law, such as tax identification numbers or compliance with digital invoicing standards. Regularly reviewing and updating your processes is also critical to address any changing rules or evolving business needs.