Download Fillable Commercial Invoice Template for Streamlined Billing

Efficient and accurate billing is essential for maintaining smooth business operations. With the right tools, managing financial transactions becomes a straightforward task, saving both time and effort. Customizable billing forms provide a solution to meet specific needs, ensuring all relevant details are included without error.

Editable documents allow for flexibility, enabling you to quickly adjust and personalize each record according to the transaction. These customizable formats can accommodate various business types and ensure compliance with local regulations. The ease of filling in necessary fields manually or digitally means that invoices can be processed faster, minimizing delays in payment collection.

Whether you’re handling regular sales or international transactions, having a flexible and user-friendly solution simplifies the process. By choosing the right document style, you ensure clarity, transparency, and professionalism, which are crucial for building trust with clients and partners.

Complete Guide to Editable Billing Documents

Creating accurate and professional billing records is a vital part of any business transaction. The right forms not only ensure that all necessary details are included but also make the entire process more efficient. With customizable forms, businesses can streamline their financial processes while maintaining accuracy and clarity.

There are several key aspects to consider when using editable documents for billing purposes. These include the structure of the document, the fields it contains, and the flexibility to adjust it based on specific needs. Understanding how to utilize these tools effectively can significantly improve your billing workflow.

| Key Feature | Description |

|---|---|

| Custom Fields | Allow for personalized information based on the specific transaction or client. |

| Digital Access | Forms can be filled out electronically, reducing the need for paper and increasing efficiency. |

| Legal Compliance | Ensure that all required information is included, meeting local and international standards. |

| Easy Modifications | Quickly update fields or format according to changes in pricing or business requirements. |

By understanding these elements, businesses can create effective, professional, and legally compliant documents that simplify the billing process and improve overall productivity.

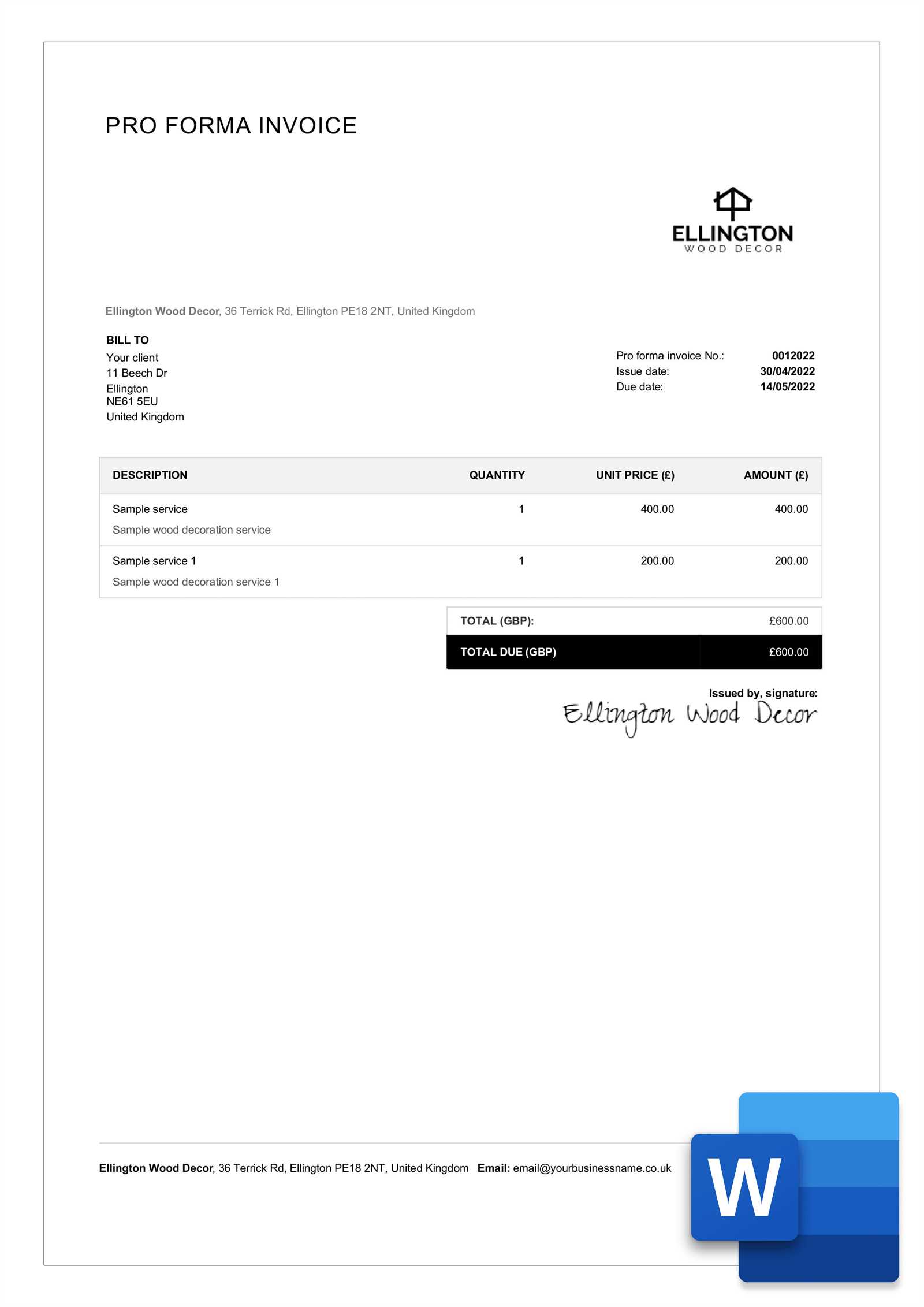

What is an Editable Billing Document

In business transactions, clear and accurate records are essential for both the buyer and seller. A customizable financial document provides a structured format where all necessary details can be easily filled out. These documents are designed to capture transaction specifics, ensuring that both parties understand the terms and amounts involved.

Editable forms are particularly useful as they allow users to personalize each record quickly. Whether done digitally or by hand, these forms enable businesses to track sales, payments, and other financial activities without errors. The flexibility of these documents ensures that the right information can be included every time, tailored to each unique situation.

From small businesses to larger enterprises, utilizing such adaptable tools ensures smoother operations and faster processing of payments. They are often used for various types of transactions, including goods delivery, service agreements, and international trade. Overall, these forms streamline the billing process and improve organizational efficiency.

Benefits of Using a Customizable Document

Utilizing adaptable business forms offers a range of advantages that can significantly improve workflow and accuracy. When the right structure is in place, filling out the necessary details becomes easier, reducing the chances of errors. Whether for routine transactions or special business deals, customizable documents simplify the process for both the business and the customer.

Increased Efficiency

- Time-saving: Quickly input details without the need to create documents from scratch each time.

- Reduced Errors: By using a pre-designed structure, you minimize the chances of omitting important information.

- Faster Processing: With all fields ready for quick entry, you can complete and submit records in less time.

Improved Accuracy and Consistency

- Standardization: Predefined sections ensure that essential data is always included, maintaining consistency across records.

- Flexibility: Tailor the document to your needs while keeping important fields intact for easy use in any situation.

- Compliance: Templates are designed to meet specific regulations, reducing the risk of mistakes that could lead to legal issues.

These benefits make customizable forms a practical solution for businesses of all sizes, enhancing operational efficiency and promoting professional standards in documentation.

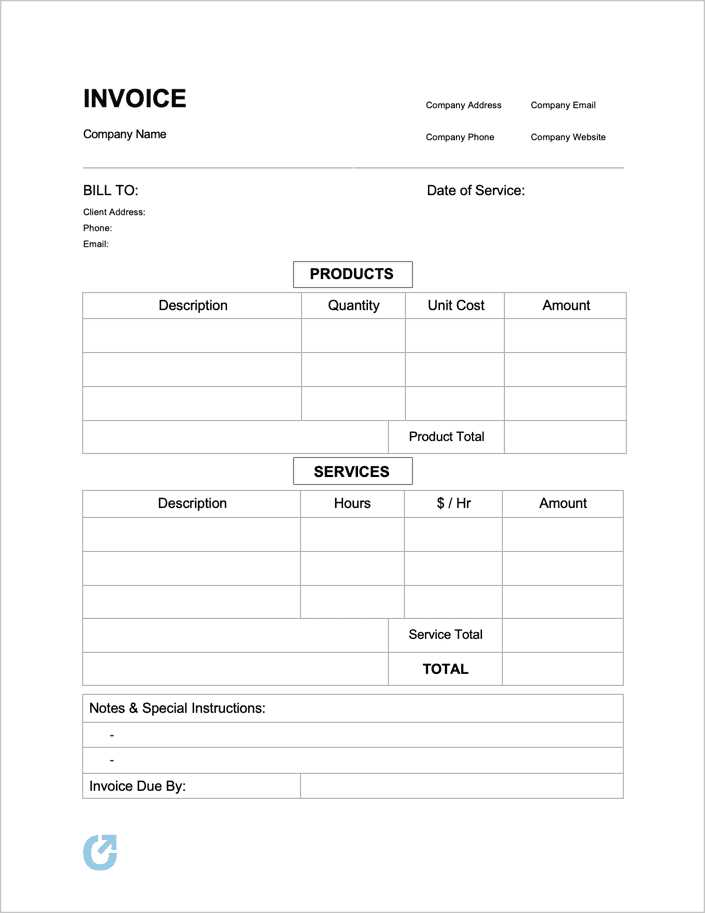

How to Create a Billing Document

Creating a well-structured financial record is essential for ensuring clarity and accuracy in any business transaction. A properly crafted document outlines key details such as the items or services provided, the agreed-upon price, and the terms of payment. With a clear format, the entire billing process becomes more efficient, reducing misunderstandings between the seller and the buyer.

Step-by-Step Process

- Gather Relevant Information: Ensure that you have all details such as customer name, contact information, product or service description, quantity, unit price, and total amount.

- Choose a Structured Layout: Use a clean format with clearly defined sections to input the data, making it easy for both parties to read and understand.

- Include Payment Terms: Specify payment methods, due dates, and any late payment penalties to avoid confusion.

- Review and Finalize: Double-check the document for accuracy before sending it to the client to avoid errors in the transaction.

Helpful Tips for Customization

- Design for Flexibility: Leave space for specific details that might change from transaction to transaction.

- Ensure Legal Compliance: Include all necessary legal requirements, such as tax numbers or disclaimers, to ensure the document is valid.

- Utilize Digital Tools: Digital formats can save time and allow easy updates when needed, especially for repeat customers or ongoing projects.

Following these steps helps ensure that your billing documents are both professional and legally sound, enhancing the overall transaction process for both your business and your customers.

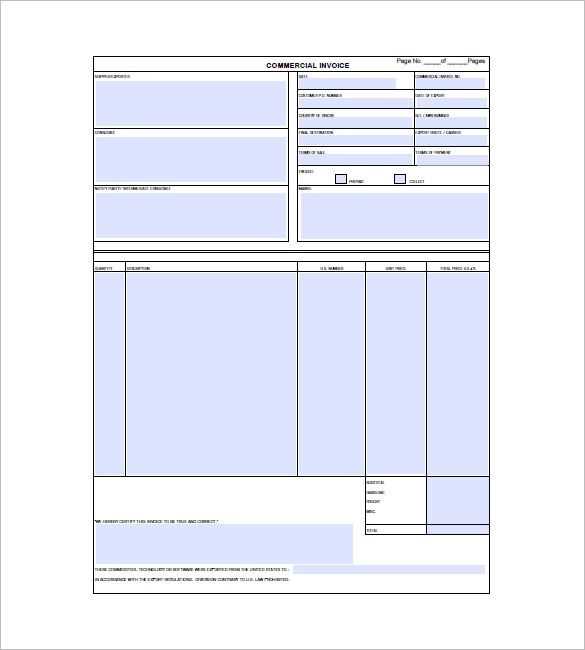

Key Elements in a Billing Document

A well-structured financial record should contain all essential details to ensure clarity and avoid confusion between the involved parties. These crucial elements help outline the terms of the transaction, providing both the seller and the buyer with the information needed to proceed with the payment and delivery process.

Essential Information for Accuracy

| Element | Description |

|---|---|

| Transaction Number | A unique identifier for the record, allowing easy tracking and referencing. |

| Client Details | Names, addresses, and contact information for both the seller and the buyer. |

| Description of Goods or Services | A detailed list of the items or services being provided, including quantities, unit prices, and any applicable discounts. |

| Payment Terms | Information about payment methods, due dates, and penalties for late payments. |

Additional Important Sections

- Tax Information: Include applicable tax rates and the total tax amount if necessary.

- Shipping Details: Specify delivery methods, expected delivery dates, and shipping costs if applicable.

- Legal Clauses: Add any legal disclaimers or terms that are necessary for the protection of both parties.

Incorporating these key elements ensures that your document is clear, complete, and compliant with business and legal standards, streamlining the transaction process.

Free Editable Forms Available Online

Many websites offer free downloadable forms that businesses can use to document transactions. These documents are designed to be easily customized to suit different business needs, saving time and effort in creating financial records from scratch. By using these resources, businesses can ensure accuracy and professionalism in their billing process.

Where to Find Free Documents

- Business Websites: Many business-related platforms provide free downloads for basic billing forms.

- Government and Tax Sites: Some government websites offer forms that meet regulatory standards for different types of transactions.

- Open Source Platforms: Various open-source platforms host collections of free, editable forms created by other businesses.

Advantages of Using Online Resources

- No Cost: Many of these forms are available at no charge, making them accessible for businesses with limited budgets.

- Easy Customization: The documents can be easily edited to match specific requirements, ensuring that all necessary details are included.

- Variety of Formats: Online resources offer a range of formats, including Word, Excel, and PDF files, making it easy to choose the one that best suits your workflow.

By utilizing these free online resources, businesses can streamline their document creation process, saving time and reducing the risk of errors while maintaining professionalism in every transaction.

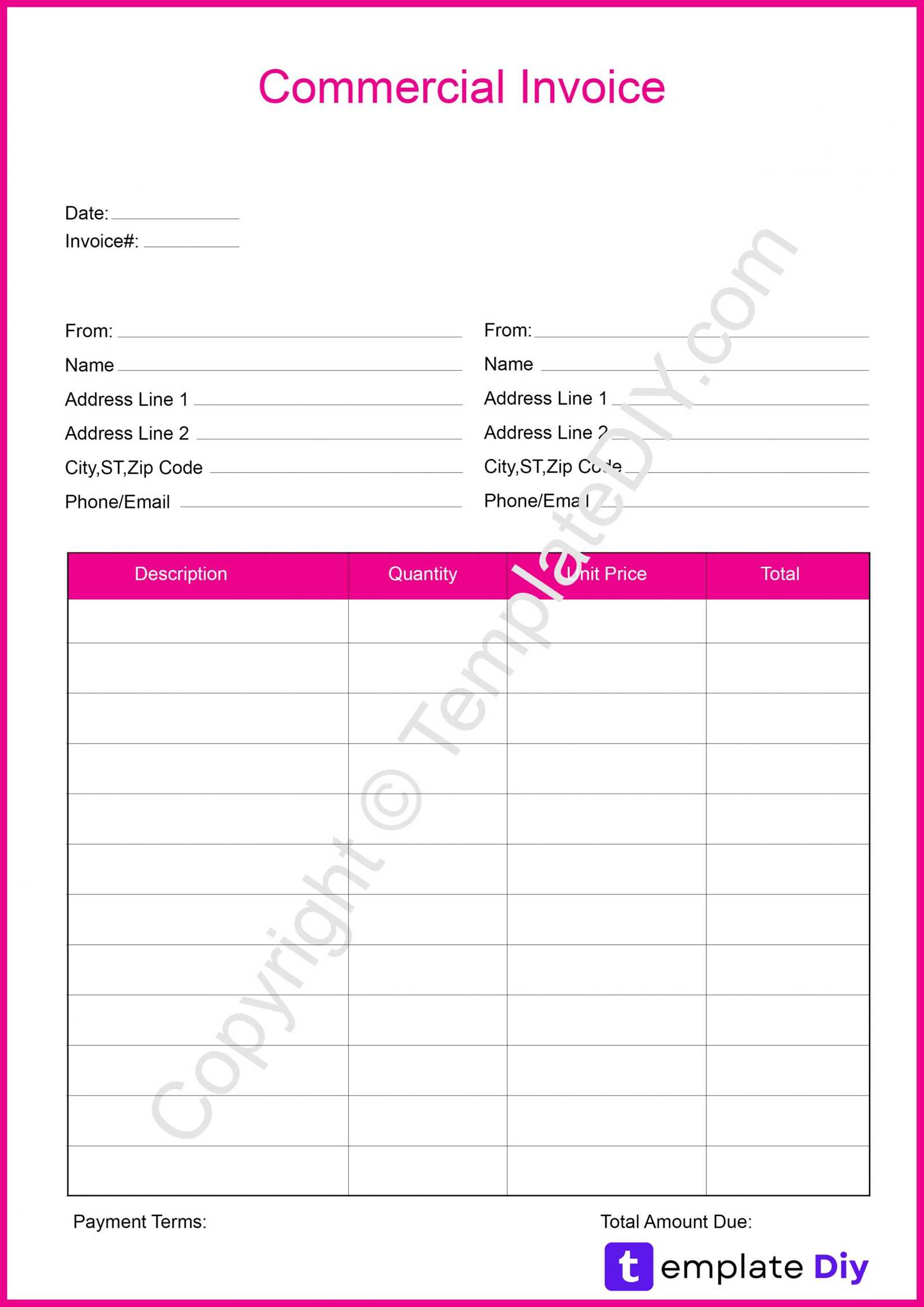

Customizing Your Billing Document

Personalizing your business forms allows you to better reflect your brand and meet specific operational needs. Customizing the structure of your financial records ensures that every transaction is documented in a way that works best for your business. Whether you’re working with clients locally or internationally, tailoring these documents can enhance both efficiency and professionalism.

Key Areas to Customize

- Company Branding: Add your logo, color scheme, and business contact information to reinforce your brand identity.

- Payment Details: Modify the sections related to payment terms to clearly define accepted methods, due dates, and any late fees.

- Itemized List: Adjust the sections for listing goods or services to fit the way you deliver your offerings, such as quantity, unit price, and description.

- Legal Information: Include any necessary legal disclaimers or terms and conditions relevant to your business practices.

Benefits of Personalization

- Professional Appearance: Customizing forms creates a more polished look, which can help build trust with clients.

- Efficiency: Tailored forms that match your business needs can streamline the process and reduce the time spent on filling out forms.

- Consistency: Using a consistent format ensures all documents are uniform, improving the organization and clarity of your records.

By customizing your business forms, you create a more efficient and professional process that reflects your company’s identity and meets both operational and legal requirements.

Common Mistakes to Avoid When Using Forms

While using pre-designed documents can save time, it’s important to be aware of common pitfalls that could lead to errors or confusion. Failing to properly customize or verify details can result in inaccuracies, missed opportunities, or even legal complications. Understanding these mistakes can help you make the most of these helpful resources while ensuring your records remain accurate and professional.

Common Errors to Watch For

- Leaving Fields Blank: Always ensure that all required fields are filled out completely. Missing information can lead to misunderstandings or delays in processing.

- Not Updating Details: Using outdated or incorrect client or product information can cause discrepancies that may affect payment or delivery.

- Overlooking Payment Terms: Always review and clearly define payment deadlines, methods, and penalties to avoid confusion and late payments.

How to Prevent Mistakes

- Double-check for Accuracy: Before sending any document, take the time to review each section carefully to ensure everything is correct.

- Customize as Needed: Tailor the document to fit the specific requirements of each transaction rather than using a generic version.

- Keep Templates Updated: Regularly update your documents to reflect any changes in pricing, services, or legal terms to avoid using obsolete information.

By being mindful of these common mistakes, you can enhance the accuracy and professionalism of your records and prevent unnecessary issues from arising during your transactions.

How to Ensure Accuracy in Your Billing Document

Ensuring that your financial records are accurate is essential for maintaining a professional reputation and preventing potential disputes. Small errors can lead to delayed payments or misunderstandings with clients. By taking the time to double-check your documents and implementing key strategies, you can ensure that all information is correct and clear.

Steps to Guarantee Precision

- Review the Details: Always double-check critical information such as client names, addresses, and contact details to ensure everything is accurate.

- Verify Product or Service Information: Ensure that the descriptions, quantities, and prices for items or services are correct and match your records.

- Confirm Payment Terms: Clearly outline payment deadlines, methods, and any applicable fees to avoid confusion later on.

- Double-check Totals: Before finalizing the document, make sure all calculations, including taxes and discounts, are correct.

Best Practices for Accuracy

- Use Clear Formatting: A well-organized layout helps prevent missing information and ensures that each section is easy to read and understand.

- Automate Where Possible: Using software tools that automatically calculate totals and apply consistent terms can reduce the risk of human error.

- Keep Records Up to Date: Regularly update your information to reflect any changes in your pricing, payment methods, or product offerings.

By following these simple steps and best practices, you can significantly reduce errors and ensure that your documents are always accurate, professional, and ready for use.

How to Save and Share Your Billing Document

Once your financial document is ready, the next step is to ensure it is stored securely and shared efficiently. Whether you’re sending it to a client or saving it for your records, using the right method to save and share the document can help you stay organized and maintain a professional image.

Saving Your Document

- Choose the Right File Format: Depending on your needs, you can save your document as a PDF, Excel file, or Word document. PDFs are often preferred as they maintain the document’s formatting across different devices.

- Organize Your Files: Create a dedicated folder for financial records, making it easier to locate and reference specific documents later on.

- Back-Up Your Files: Use cloud storage or external drives to back up important documents to avoid losing them in case of a system failure.

Sharing Your Document

- Email: Attach the saved document to an email and send it directly to your client or business partner. Ensure that the file name is clear and professional.

- Cloud Sharing: Use cloud platforms like Google Drive or Dropbox to share a link to the document, allowing the recipient to access it at their convenience.

- Physical Copies: In some cases, you may need to print out and send a hard copy. Ensure that the printed version is clear and legible before mailing.

Important Considerations

| Consideration | Details |

|---|---|

| File Size | Ensure that the file size is not too large for email or online sharing platforms. Compress the file if necessary. |

| Security | When sharing sensitive financial documents, consider encrypting the file or using a secure sharing method to protect confidential information. |

By following these steps to save and share your documents, you can ensure that your billing records are organized, accessible, and protected, allowing for smooth and professional business operations.

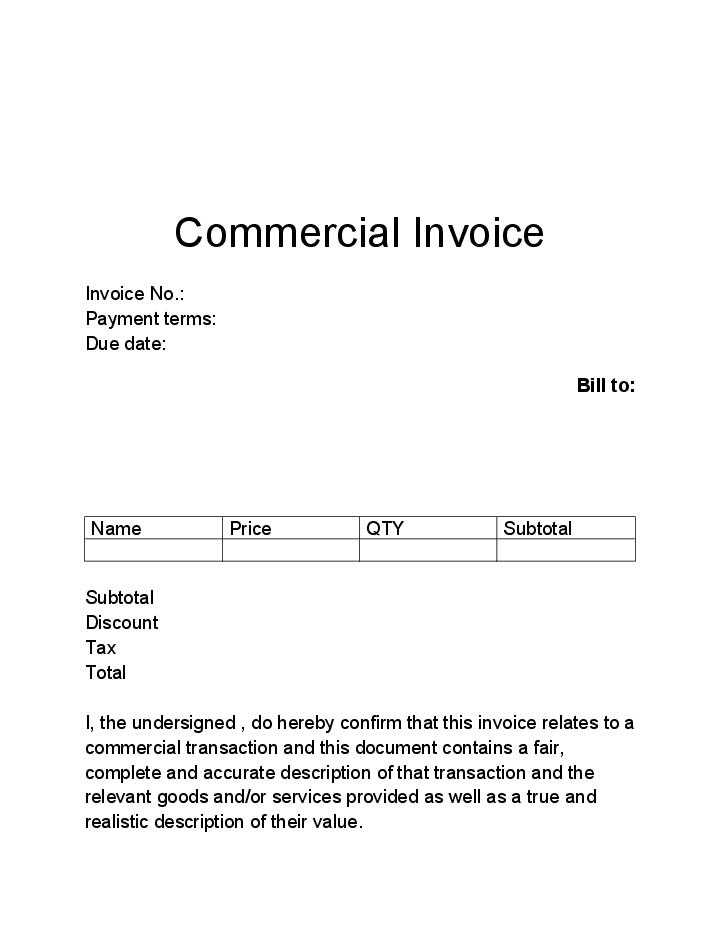

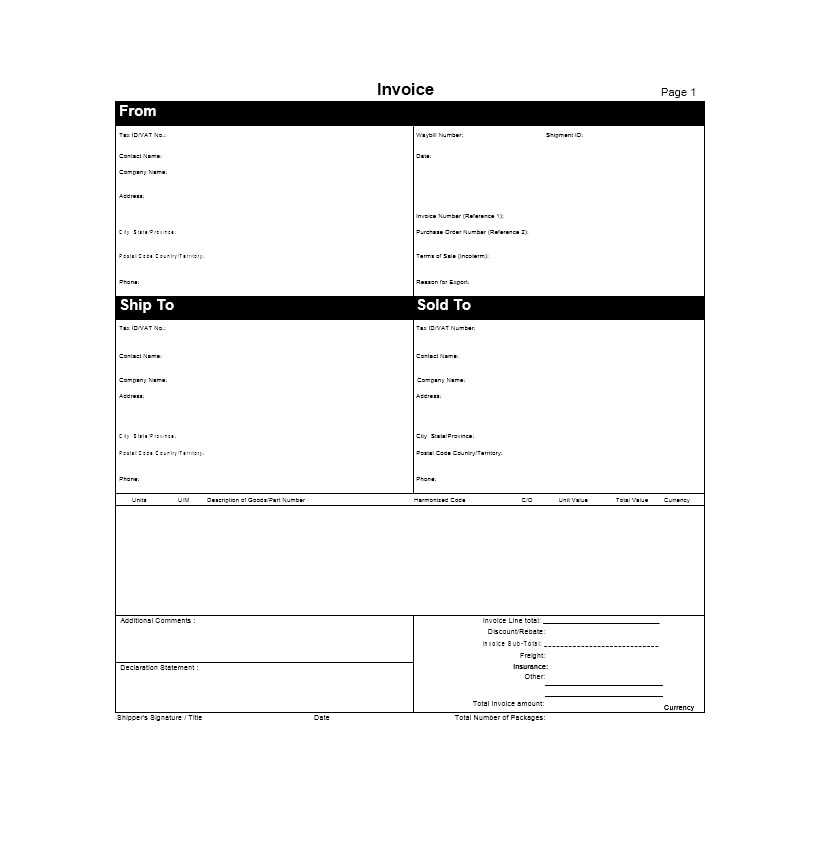

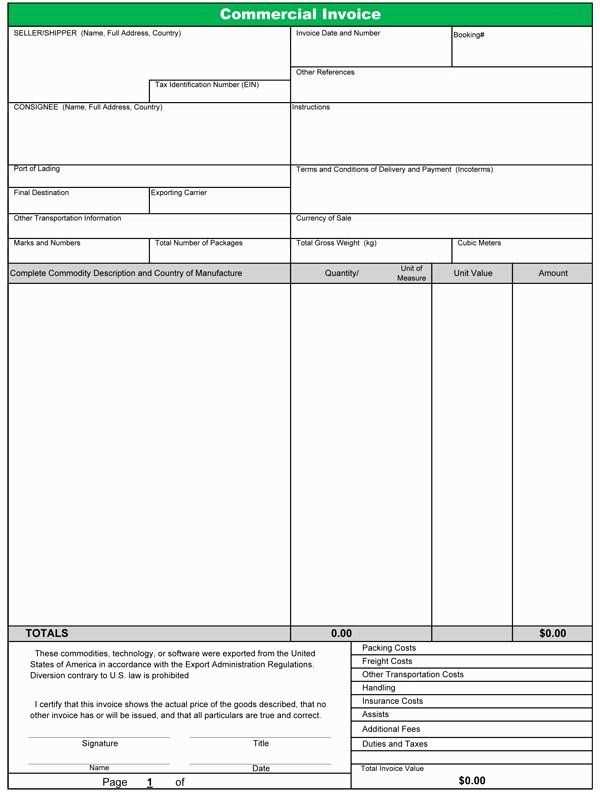

Understanding Legal Requirements for Billing Documents

When creating financial records for transactions, it’s essential to understand the legal requirements that govern these documents. Different countries and jurisdictions may have specific rules about what needs to be included, how the document should be structured, and what information must be provided to comply with tax laws and regulations. Failing to meet these requirements can result in delays, disputes, or even legal consequences. This section will guide you through the key legal aspects to consider when preparing your business documents.

Key Legal Components

- Tax Identification Numbers: Most countries require both the seller’s and the buyer’s tax identification numbers to be listed. This helps with reporting and ensuring compliance with tax laws.

- Item Descriptions: A clear description of each product or service provided, including quantities, unit prices, and any applicable taxes, is often legally required for proper tax calculation and auditing purposes.

- Dates: Both the issue date and the due date are essential for setting payment expectations and ensuring that deadlines are met according to the law.

- Legal Statements: In some jurisdictions, certain legal disclaimers or statements must be included, such as terms of payment, return policies, or liability clauses.

Regional Variations

- European Union: The EU has strict guidelines for VAT (Value Added Tax) invoicing, which include requirements like displaying VAT rates, customer and seller VAT numbers, and other transaction details.

- United States: In the U.S., the requirement to issue a billing document is typically driven by state tax laws, and while there’s no standard format, details like the seller’s legal name, address, and tax ID are essential.

- Asia-Pacific: Several countries in the Asia-Pacific region, such as Australia and Japan, have specific invoicing rules that often include a breakdown of goods and services, applicable taxes, and specific terms for international transactions.

It’s crucial to stay informed about the specific rules in your region or industry to avoid errors that could lead to legal complications. Always verify your documents with a legal advisor or accountant to ensure compliance with local regulations.

How to Handle Billing Disputes Effectively

Handling disagreements regarding payment documents can be a sensitive issue, but addressing them promptly and professionally is essential for maintaining good business relationships. Whether it’s a miscalculation, an overlooked detail, or a dispute over services rendered, knowing how to handle these situations effectively can prevent them from escalating and ensure smoother transactions in the future.

Steps to Resolve Disputes

- Review the Document Carefully: Before taking any action, thoroughly check the document in question. Make sure all amounts, terms, and details are accurate, and identify any areas that may have led to confusion or misunderstanding.

- Communicate Clearly: Contact the other party to clarify the issue. Be polite but direct in explaining your perspective, and encourage the other party to share their concerns. Open and honest communication is the first step toward a resolution.

- Offer Solutions: Once you’ve identified the root cause of the dispute, suggest reasonable solutions. This could involve correcting errors, offering discounts, or adjusting terms as needed. Flexibility and understanding are key.

- Document All Communications: Keep a written record of all communications related to the dispute. This helps protect both parties and ensures there is no ambiguity in the resolution process.

When to Escalate the Situation

- Unresolved Issues: If the dispute cannot be resolved through direct communication, it may be necessary to escalate the issue. This could involve involving a manager, a third-party mediator, or legal counsel to facilitate the resolution.

- Non-Payment: In cases where payment is being withheld despite all reasonable attempts to resolve the issue, consider sending a formal payment request or involving a collections agency to recover the owed amount.

Disputes, when handled correctly, don’t have to be a barrier to maintaining healthy business relationships. A calm, methodical approach can help ensure both parties feel heard, and that any disagreements are resolved quickly and fairly.

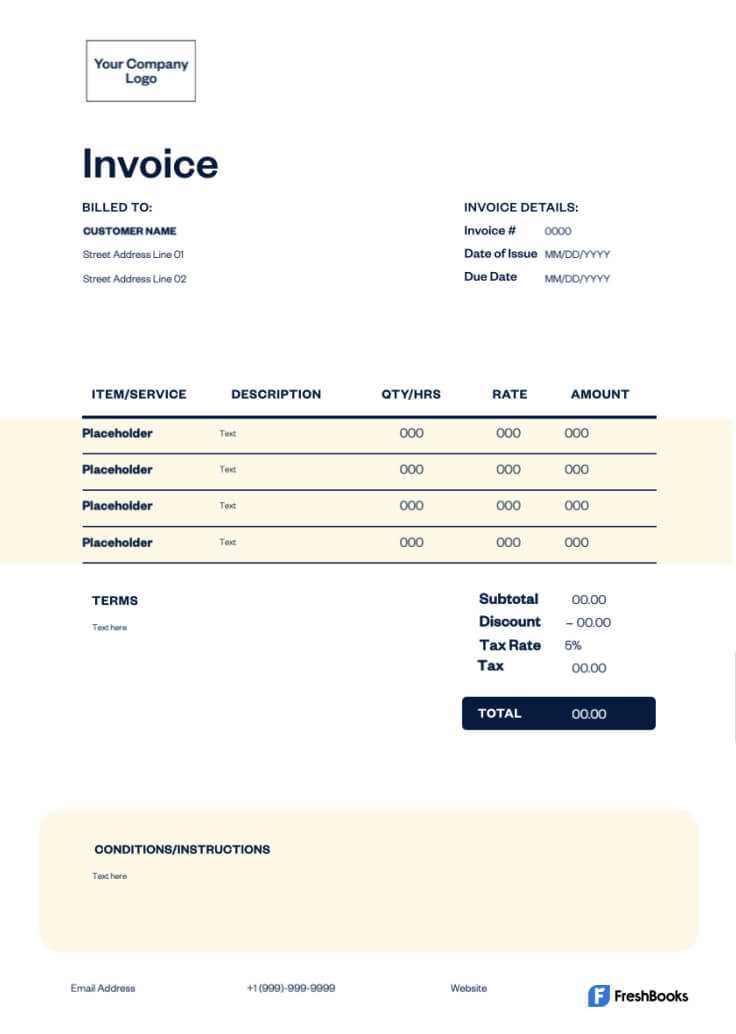

Best Practices for Document Formatting

Proper formatting of payment documents is crucial for clear communication, ensuring that the details of the transaction are easy to understand and that all necessary information is provided. A well-organized document reduces the likelihood of errors and disputes, making it easier for both parties to process the transaction efficiently. In this section, we will explore some of the best practices for formatting your business documents to ensure they are professional and effective.

Essential Formatting Tips

- Clear Layout: Keep the document layout clean and organized. Use headings, bullet points, and consistent spacing to ensure that all information is easily accessible.

- Readable Fonts: Use easy-to-read fonts like Arial, Calibri, or Times New Roman. Avoid overly decorative fonts that can distract from the content.

- Proper Alignment: Align text in a consistent manner. For example, align amounts to the right, headings to the left, and centralize the title to make the document look tidy.

- Use of Bold and Italics: Highlight important details using bold text for headings and italics for additional information. This helps draw attention to key sections without overwhelming the reader.

- Appropriate Color Scheme: Stick to a simple color scheme. Use black text on a white background for easy readability, and avoid using too many colors which can make the document appear cluttered.

Including Necessary Information

- Contact Information: Always include clear contact details at the top of the document for both parties. This ensures that any questions or issues can be addressed quickly.

- Transaction Details: Include a detailed list of products or services provided, quantities, prices, and any applicable taxes. This transparency helps prevent misunderstandings.

- Payment Terms: Clearly state the payment terms, including due dates, payment methods, and any late fees to avoid delays or confusion.

By following these best practices, you can ensure that your business documents are professional, clear, and easy to process. A well-formatted document not only enhances the image of your business but also helps streamline communication and prevent potential issues down the line.

Integrating Documents into Your Accounting System

Integrating financial documents into your accounting system is essential for maintaining accurate records, streamlining financial operations, and ensuring compliance with tax regulations. By automating the process, you can reduce human errors, improve efficiency, and maintain up-to-date financial data. In this section, we’ll discuss the importance of integrating payment documents into your accounting system and how to do it effectively.

When you incorporate these documents into your accounting software, you can track all payments, monitor outstanding balances, and generate financial reports more easily. This integration helps you stay on top of your finances, ensuring that all data is synced and recorded in real time. It also allows for easy retrieval of historical records for auditing or reference purposes.

Additionally, integrating these documents allows for automatic reconciliation with your bank statements, helping identify discrepancies quickly. It also ensures that tax calculations are accurate, and all necessary documentation is in place for tax filing. By creating a seamless connection between your payment records and your accounting system, you can minimize the risk of mistakes and maximize financial control.

How to Automate the Document Process

Automating the process of creating and sending financial documents can significantly improve the efficiency of your business operations. By reducing manual tasks, you free up valuable time for other activities while ensuring accuracy and consistency. In this section, we’ll explore how to automate the preparation and delivery of financial records, from generation to payment tracking.

Steps to Automate the Process

- Choose the Right Software: Select an accounting or invoicing platform that offers automation features. Look for tools that allow for recurring entries, automatic calculations, and template customization.

- Set Up Templates: Create standardized templates for your business records. This will allow you to quickly generate new documents with pre-filled information such as your company details, payment terms, and common items or services.

- Integrate with Other Systems: Link your automation software with your customer relationship management (CRM) and financial systems to ensure seamless data flow. This integration helps pull relevant details directly from your CRM into your documents.

- Automate Payment Reminders: Set up automated reminders for clients when payments are due. This reduces the need for manual follow-ups and ensures that outstanding amounts are collected on time.

Benefits of Automating the Process

- Time Savings: Automation eliminates the need to manually create and track documents, allowing you to focus on other business operations.

- Improved Accuracy: By automating calculations and reducing human input, you decrease the likelihood of errors, ensuring that all figures are correct.

- Faster Processing: With automatic generation and delivery of documents, you can expedite your entire workflow, improving client satisfaction and speeding up payment cycles.

By implementing automation in your financial processes, you can not only save time and reduce mistakes but also increase consistency in your operations. Adopting these methods will streamline your workflows and help ensure that your financial documents are always accurate and sent on time.

Tips for Managing International Invoices

Managing financial documents across borders requires a comprehensive approach due to the complexities of different currencies, tax laws, and payment systems. To ensure smooth transactions and maintain proper documentation, it’s essential to adapt your practices to meet the unique requirements of international business. In this section, we will discuss strategies to effectively handle documents when dealing with international clients and suppliers.

Key Considerations for International Documents

- Currency Conversion: Ensure that the correct exchange rates are applied when dealing with international payments. This is critical to avoid discrepancies between the amounts owed and the actual sum received.

- Legal Requirements: Different countries may have varying tax rates, reporting standards, and compliance rules. Familiarize yourself with these regulations to ensure that your records meet the legal requirements of both your home country and the countries you’re trading with.

- Language Barriers: When working with international clients, consider providing documents in their preferred language. This helps ensure clarity and minimizes misunderstandings related to terms and conditions.

- Payment Methods: Be aware of the available payment systems in different regions. Electronic transfers, credit cards, and international payment platforms like PayPal or SWIFT are common, but it’s important to know which ones work best in specific countries.

Best Practices for Efficient Management

- Use Multilingual Software: Opt for invoicing software that supports multiple languages and currencies. This will help streamline your process and reduce the chances of making errors.

- Automate Currency Conversion: Use automated tools that can convert currencies in real-time. This will ensure you avoid mistakes and reduce the time spent manually calculating exchange rates.

- Clearly Define Payment Terms: Specify the due date, late fees, and payment methods in a clear and concise manner. Providing this information upfront helps prevent confusion and ensures timely payments.

- Track Transactions: Keep a detailed record of all cross-border transactions. Implement systems to track payments and identify overdue amounts efficiently.

By following these best practices, you can simplify the management of international transactions, reduce the risk of errors, and maintain smooth relationships with global partners. Adapting to different markets and legal environments is key to ensuring your operations remain efficient and compliant.

Why Digital Invoices Are More Efficient

In today’s fast-paced business world, using digital financial documents has become a standard practice. The shift from traditional paper-based methods to electronic formats has streamlined many aspects of business operations. By embracing digital solutions, companies can benefit from faster processing times, improved accuracy, and reduced costs.

One of the main advantages of digital documents is the speed at which they can be generated, sent, and processed. Unlike paper documents, which require time for printing, mailing, and manual entry, electronic files can be created and delivered instantly to clients or suppliers. This reduces delays and speeds up the entire payment cycle.

Key Benefits of Digital Financial Documents:

- Speed and Convenience: Documents can be prepared, modified, and shared with just a few clicks, eliminating the need for physical storage or manual handling.

- Enhanced Accuracy: Digital systems reduce human error by automating calculations, ensuring that all figures are correct and consistent throughout the document.

- Cost-Effective: By reducing the need for paper, ink, postage, and physical storage, businesses can cut down on overhead costs, ultimately increasing profitability.

- Eco-Friendly: Going digital means less paper waste, making it a more environmentally responsible choice.

- Better Record Keeping: Digital files are easier to organize and search, allowing for faster retrieval and more efficient management of records.

Security and Compliance: Digital documents also offer greater security than paper-based ones. They can be encrypted, password-protected, and backed up, ensuring that sensitive information remains safe. Additionally, they are easier to update to stay compliant with changing regulations.

Overall, digital documents are transforming the way businesses handle their financial paperwork, offering substantial benefits in terms of speed, accuracy, cost, and security. By shifting to digital formats, companies can streamline their operations and improve efficiency in every aspect of their transactions.