Complete Fedex Customs Invoice Template for Efficient Shipping

When sending goods across borders, accurate documentation is crucial for a smooth delivery process. Ensuring that all required paperwork is completed correctly can help avoid delays, fines, and unnecessary complications with authorities. A key aspect of this process involves preparing detailed forms that clearly describe the contents and value of the shipment, as well as its intended destination.

Properly formatted shipping documents not only streamline the clearance process but also prevent goods from being held at customs. These documents serve as an official record of the transaction and are required by various regulatory bodies to verify the legitimacy of the shipment. Having the right set of forms ready can make the difference between quick processing and extended wait times.

In this guide, we will explore the essentials of creating and managing shipping forms, highlighting important fields, best practices, and tools to ensure that all your international deliveries meet the necessary criteria for quick and efficient handling.

Understanding Shipping Documentation Requirements

When shipping goods internationally, it is essential to provide specific documentation that ensures smooth processing through regulatory checkpoints. These forms contain key details about the shipment, which are used by authorities to assess the goods and determine the necessary duties and taxes. Inaccurate or incomplete documentation can lead to delays, fines, or even shipment rejection.

To avoid such complications, it is important to understand the required fields and the role they play in the shipping process. Each document must include detailed information about the items being shipped, their value, origin, and destination. The more accurate and complete the details, the faster the goods can clear regulatory procedures.

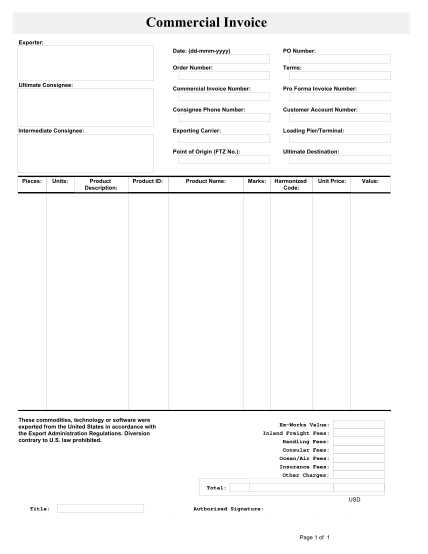

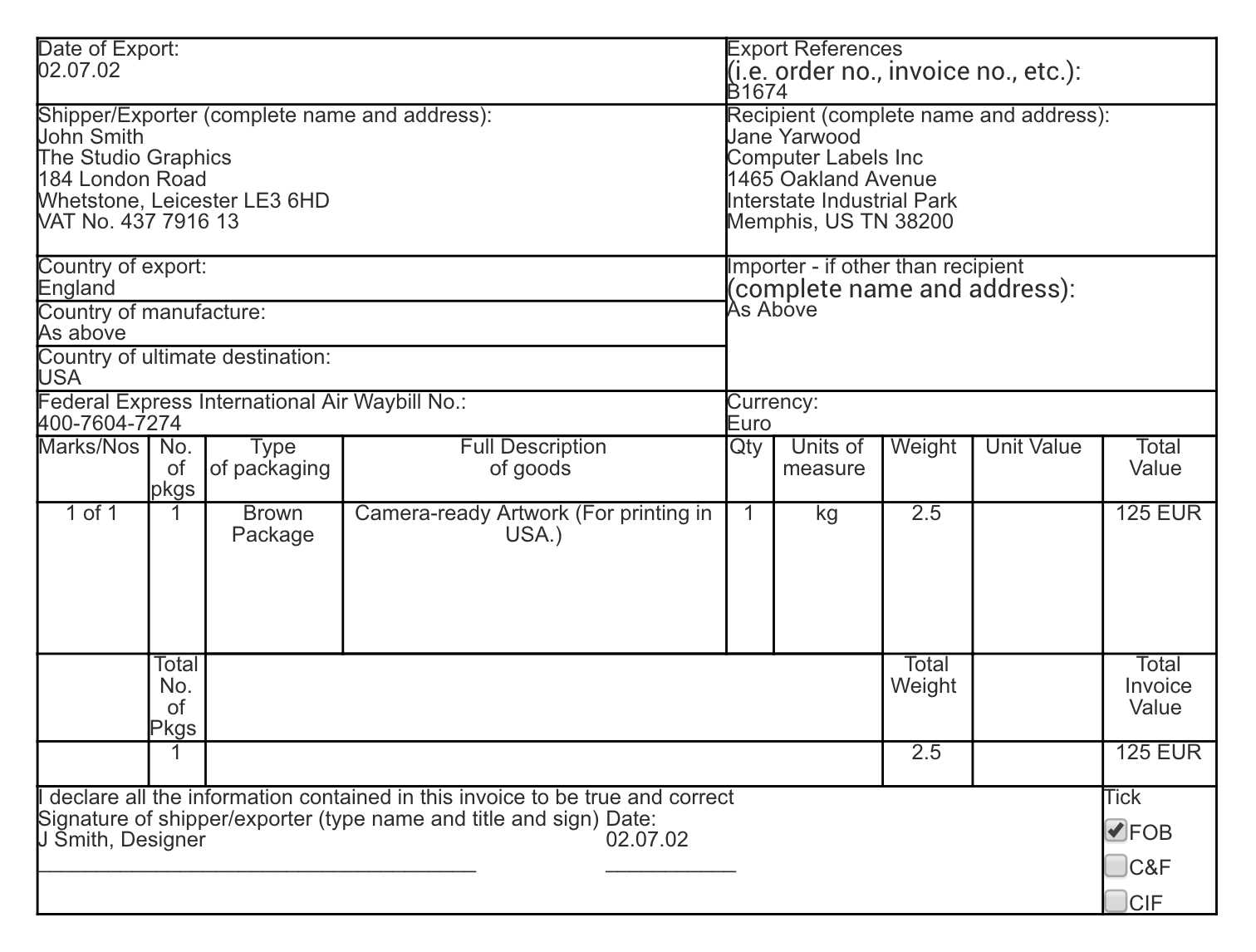

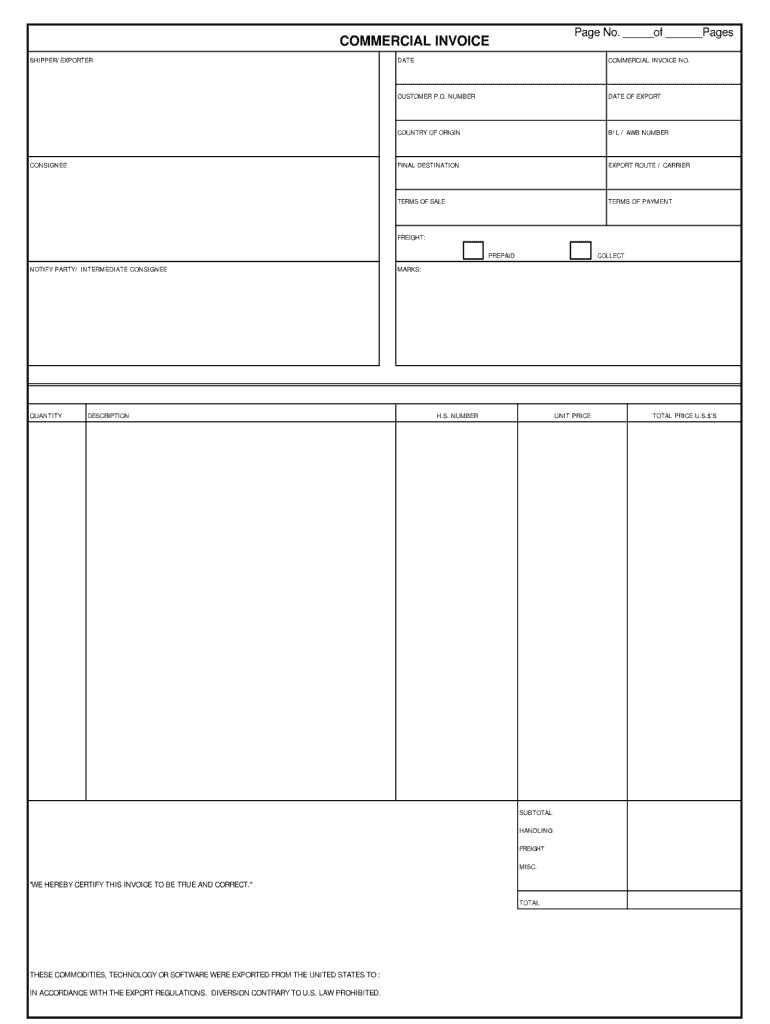

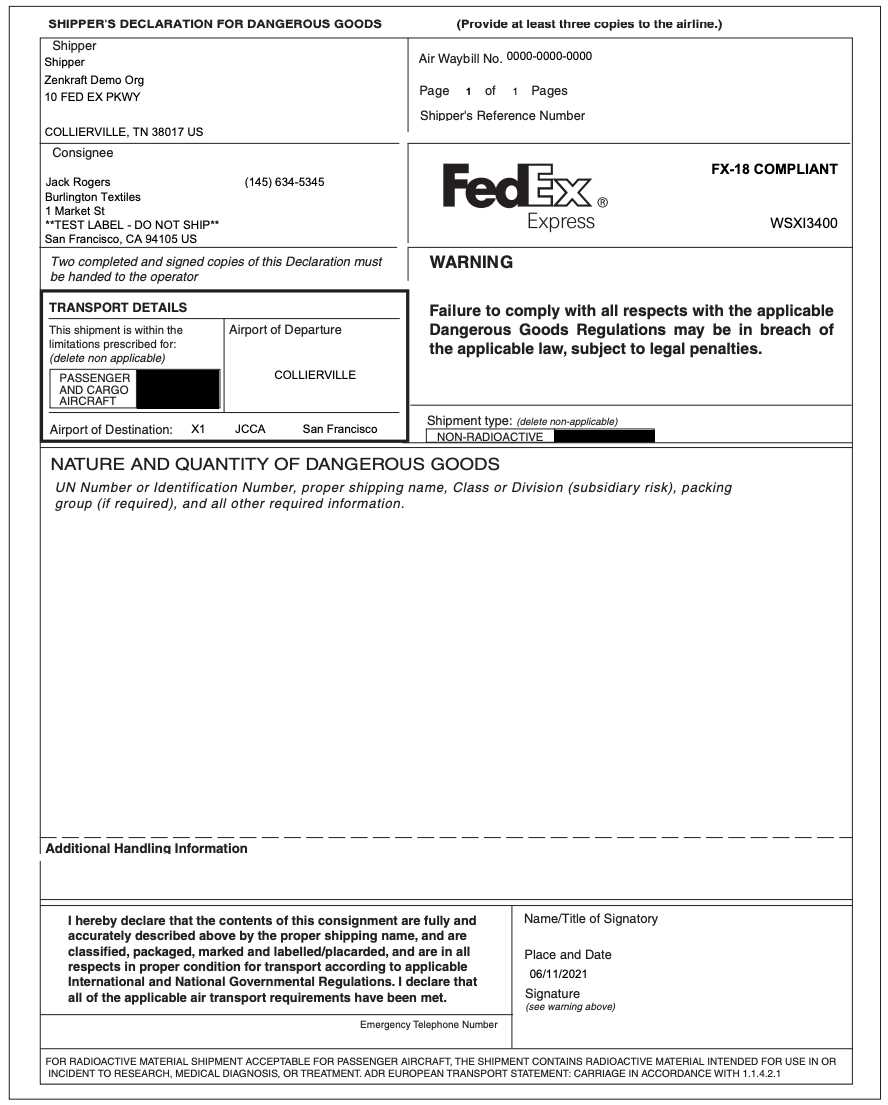

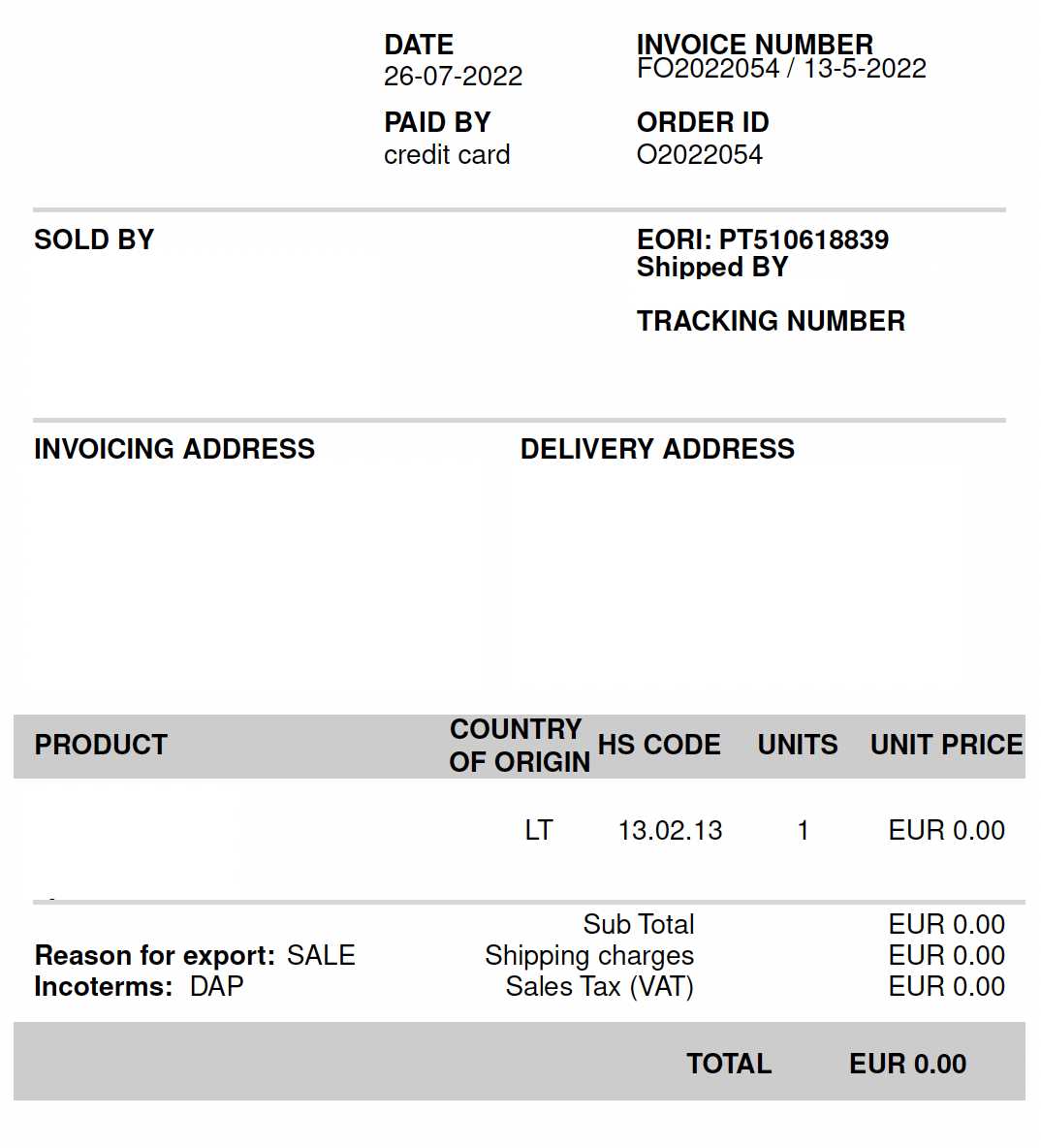

The following are key components typically required in shipping documents:

- Sender and Recipient Details: Names, addresses, and contact information of both the shipper and receiver.

- Item Description: A clear and detailed description of the products being sent, including quantity and value.

- Country of Origin: The country where the items were manufactured or produced.

- Harmonized Code: An international classification system used to identify products for tax and duty purposes.

- Value of Goods: The commercial value of the goods, which determines applicable taxes and duties.

- Reason for Shipment: Whether the goods are being sold, gifted, or returned, and any relevant supporting documentation.

Understanding these

What Is a Shipping Documentation Form

A shipping documentation form is a crucial document used in international trade to provide necessary information about the goods being shipped. This form serves as a record of the transaction and ensures that the shipment complies with the rules and regulations of both the sending and receiving countries. It contains detailed information about the items, their value, and their origin, which are essential for smooth processing and clearance at checkpoints.

Purpose of the Document

The primary purpose of this document is to provide authorities with a clear understanding of what is being shipped, its value, and its purpose. It is required by regulatory agencies to assess and classify the goods correctly. These forms also help determine any applicable taxes, duties, or restrictions on the items being shipped, ensuring that the shipment complies with international trade laws.

Key Information Included

These forms generally include the following details:

- Sender and Recipient Details: The full names, addresses, and contact information of both the shipper and the recipient.

- Description of Goods: A precise description of each item being sent, including the quantity and value of the products.

- Country of Origin: The country where the items were manufactured or produced.

- Harmonized Code: An international system for classifying products based on their nature, which determines how duties and taxes are applied.

- Shipment Value: The total value of the goods being shipped, which plays a key role in calculating potential duties or taxes.

In essence, this document acts as a bridge between the shipper and customs authorities, helping to facilitate efficient and compliant cross-border shipments.

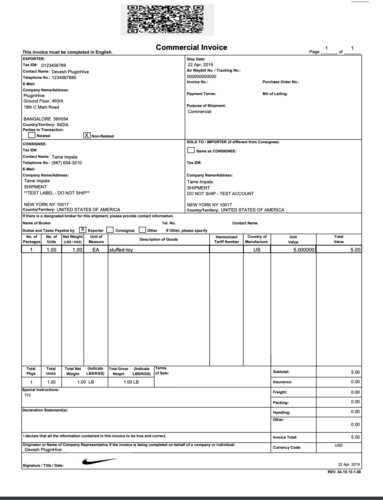

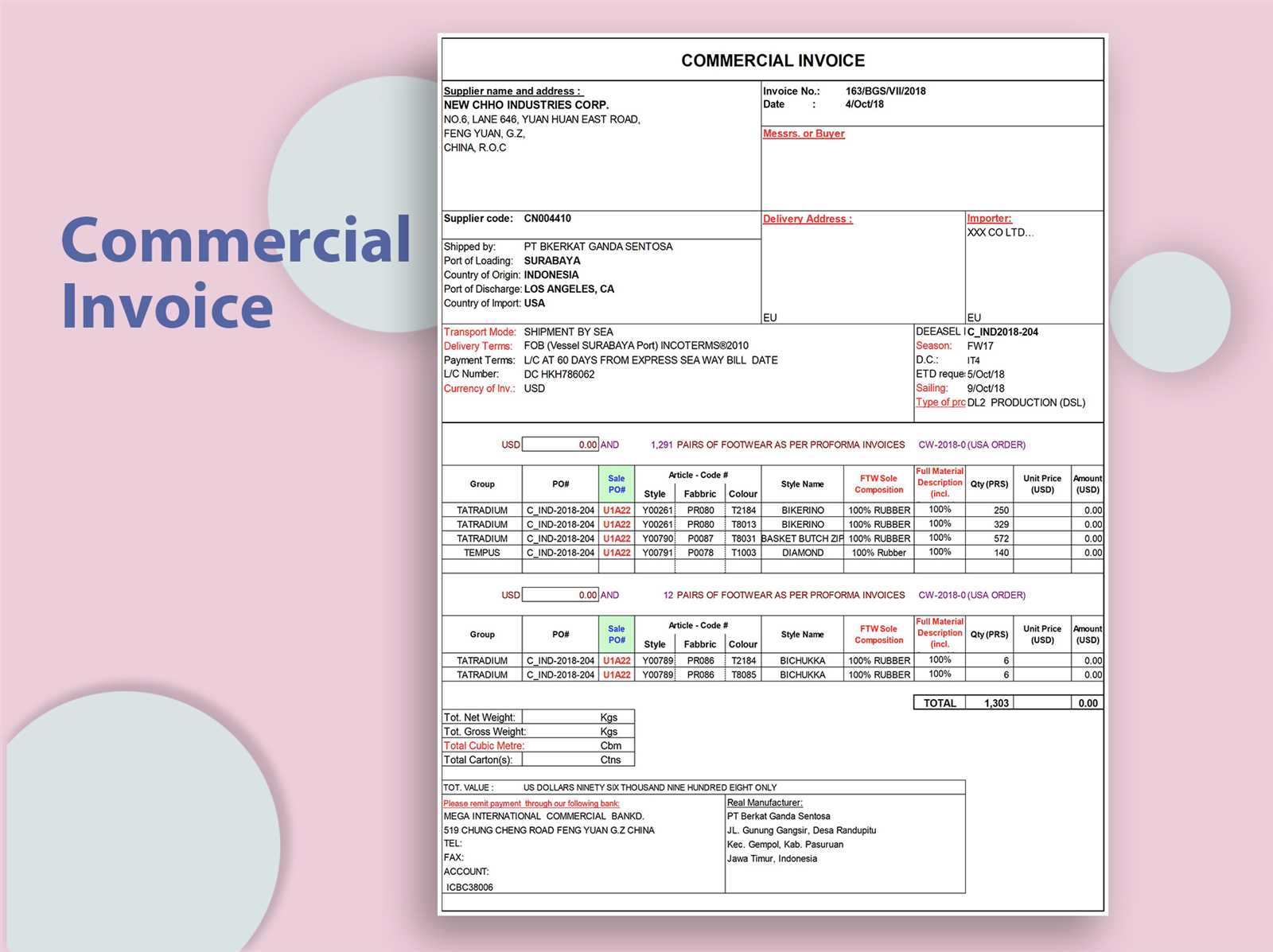

How to Fill Out a Shipping Documentation Form

Completing shipping paperwork accurately is essential to ensure your goods clear all necessary checkpoints without delay. Properly filled-out forms provide a clear description of the items, their value, and other key details that customs officials need to process the shipment efficiently. A correctly completed document can prevent potential issues such as fines, shipping delays, or even shipment rejection.

Here are the steps to correctly complete the required documentation:

- Enter Shipper and Recipient Information: Start by providing accurate details of both the sender and recipient. This includes full names, addresses, phone numbers, and email addresses. Double-check the contact information to avoid issues with delivery or customs inquiries.

- Describe the Goods: Clearly describe each item being shipped. Include the type of product, its purpose (e.g., sale, gift, repair), and any distinguishing features. Be as specific as possible to avoid confusion. If the shipment contains multiple items, list each item separately with a brief description.

- Include the Value of Goods: Enter the correct commercial value of each item in the shipment. This is crucial for determining any applicable duties or taxes. Ensure the value matches the actual sale price or fair market value to prevent discrepancies during the clearance process.

- Provide Country of Origin: Indicate the country where each item was manufactured or produced. This is essential for proper classification and tariff determination. If the goods are made in multiple countries, list each one separately.

- Harmonized Code (HS Code): Include the appropriate harmonized code for each product. This internationally recognized system helps categorize goods for tariff and tax purposes. Ensure you enter the correct code to avoid complications during inspection.

- Reason for Shipment: Specify the reason for the shipment, such as sale, gift, or return. This helps regulatory authorities understand the nature of the transaction and ensures compliance with local laws.

After filling out all the required fields, review the informat

Essential Details in Shipping Documentation

When preparing shipping paperwork for international transactions, providing specific details is critical for ensuring smooth processing and compliance with regulations. Each section of the document serves a unique purpose, and missing or incorrect information can lead to delays, fines, or rejection of the shipment. Below are the key components that must be included in any shipping form to meet requirements and expedite clearance.

Key Information to Include

There are several important fields that must be filled out carefully to avoid complications during the shipment process:

- Sender and Receiver Information: Include the full names, addresses, phone numbers, and email addresses of both the sender and recipient. This helps ensure that the shipment is routed correctly and that any issues can be resolved quickly.

- Description of Goods: Provide a detailed description of the items being shipped, including their nature, function, and quantity. Vague or incomplete descriptions can lead to confusion or delays with authorities.

- Value of Goods: The total value of the goods must be declared accurately. This value is essential for calculating applicable taxes, duties, and insurance coverage.

- Country of Origin: Indicate the country where each item was produced or manufactured. This information is necessary for tariff and regulatory purposes.

- HS Code: The Harmonized System (HS) code is an internationally recognized classification for goods. It is used to identify products for customs and tariff purposes and helps authorities process the shipment efficiently.

- Reason for Shipment: Clarify whether the items are for sale, personal use, repair, or any other specific reason. This helps customs authorities determine how to handle the shipment based on its purpose.

Reviewing

Common Mistakes on Fedex Invoices

When dealing with shipping documents, it’s essential to avoid common errors that can delay the process and lead to additional costs. These mistakes can stem from a lack of attention to detail or misunderstanding the requirements. Ensuring that every field is filled correctly and the information is accurate can help streamline the shipment and reduce the risk of complications.

- Incorrect or Incomplete Recipient Information: Providing the wrong address, contact number, or country details is one of the most frequent mistakes. Even small discrepancies can cause the shipment to be delayed or returned.

- Improper Description of Goods: Vague or unclear descriptions of items being shipped can lead to customs issues or even fines. It’s crucial to be specific and accurate about the nature and value of the items.

- Missing or Incorrect Harmonized Codes: Incorrect classification of goods using the wrong tariff code can result in customs delays or unexpected charges. Always ensure that the right codes are listed based on the destination country’s regulations.

- Failure to Declare Correct Value: Undervaluing goods can lead to penalties, while overvaluing can result in unnecessary taxes. Ensure the declared value reflects the true worth of the items being shipped.

- Omitted Signatures: Some documents require signatures for verification. Failing to sign the necessary sections can delay processing and may cause the shipment to be held up.

- Incorrect Currency or Units of Measurement: Using the wrong currency or measurement units (weight, volume, etc.) can cause confusion and may require correction before processing can proceed.

By paying careful attention to these details, you can avoid delays, extra costs, and ensure smooth processing of your shipments. Taking the time to double-check all information before submitting it can save both time and money in the long run.

Why Accuracy Matters for Customs

When it comes to international shipping, ensuring precision in all the provided details is crucial for smooth and timely processing. Even a small error in documentation can lead to significant delays, fines, or even the refusal of the shipment. Accuracy in all aspects of the shipping process helps prevent complications and ensures that shipments are handled efficiently across borders.

Impact of Inaccurate Information

Providing inaccurate or incomplete details can have serious consequences for both the sender and the recipient. Some of the key issues that arise from errors include:

- Delays in Processing: Incorrect information may cause a shipment to be held for further investigation, resulting in extended delivery times.

- Unnecessary Fees: Mistakes in valuation or classification can lead to unexpected taxes or additional charges.

- Legal Penalties: Providing false or misleading data can result in fines or even legal consequences, depending on the severity of the error.

Key Areas Where Precision is Vital

- Item Description: A vague or incorrect description of the goods can lead to misunderstandings or issues with the authorities at the destination country.

- Value Declaration: Incorrectly declaring the value of goods can result in over- or under-payment of duties and taxes, which may trigger an audit or fine.

- Proper Classification: Misclassifying goods under the wrong tariff codes can cause delays in clearing and potentially wrongfully applied charges.

- Correct Contact Information: If the recipient’s details are wrong or incomplete, shipments can be returned or held up, leading to delays or loss of goods.

Ensuring every detail is correctly filled out can help avoid these issues, ensuring the smooth delivery of goods without unnecessary complications or delays. The more accurate the data, the more efficient the process will be, both for the sender and the receiver.

Steps to Prepare Fedex Documentation

Preparing accurate and complete shipping documentation is essential for ensuring smooth processing and timely delivery of packages. Proper paperwork ensures that goods are correctly classified, valued, and described, which helps avoid delays, unexpected costs, or legal issues. Following the correct steps can make the entire shipment process more efficient and hassle-free.

1. Gather Necessary Information

The first step in preparing shipping paperwork is collecting all the required details about the goods being sent. This includes:

- Item Descriptions: Provide clear and accurate descriptions of each item being shipped, including their materials, uses, and quantities.

- Value of Goods: Declare the correct value for each item. Be sure to include any additional costs, such as shipping or insurance, if necessary.

- Sender and Recipient Details: Ensure the full address, contact number, and other relevant information are complete for both the sender and recipient.

2. Complete the Required Forms

Once you have gathered all the necessary information, the next step is to fill out the required documentation. Be sure to:

- Fill in Accurate Descriptions: Make sure the descriptions on the forms match the actual goods being shipped to avoid confusion.

- Enter Correct Harmonized Codes: Use the correct tariff classification codes for the goods to ensure they are processed according to the destination country’s rules.

- Check Shipping Method: Choose the appropriate delivery option, whether it’s express or standard, depending on the urgency of the shipment.

After completing the forms, double-check all entries for accuracy. Mistakes at this stage can lead to unnecessary delays or penalties. Once the forms are reviewed, attach them to the shipment and ensure they are visible for inspection during transit.

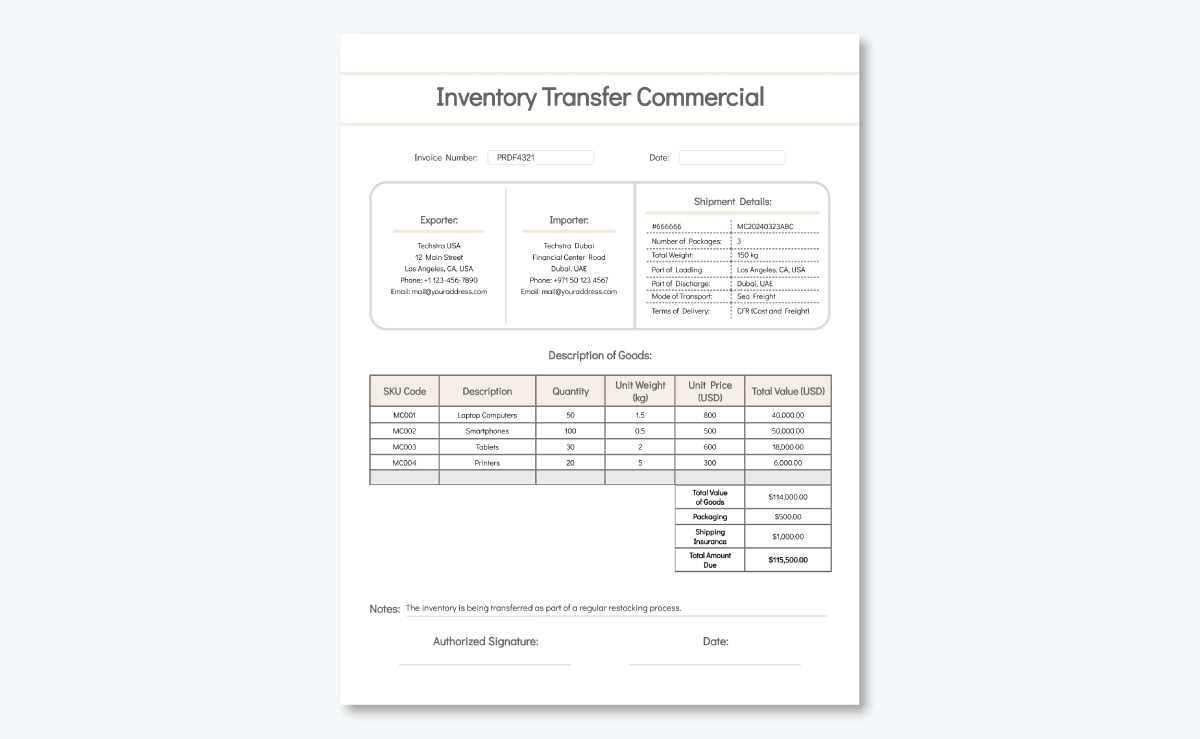

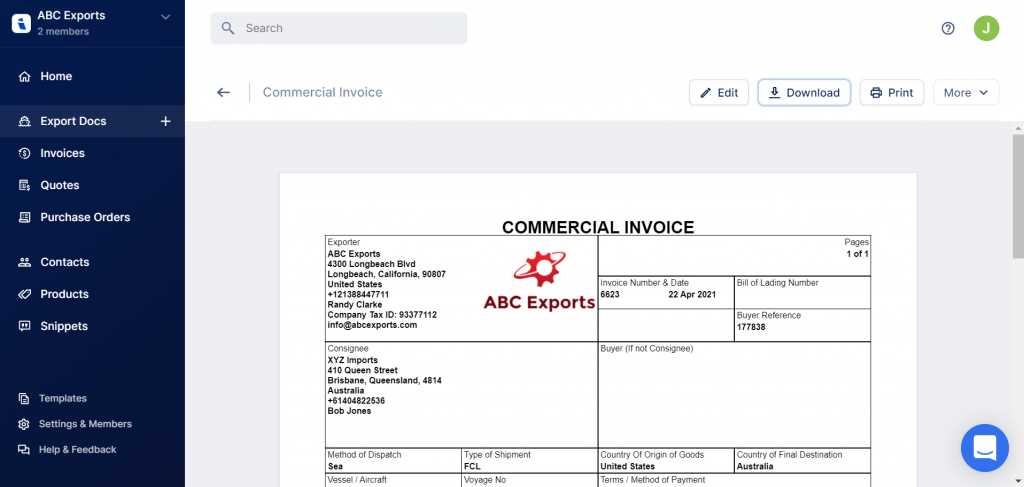

Invoice Template for International Shipments

When shipping goods across borders, it’s essential to have the right paperwork to ensure smooth processing at all stages of transit. The proper documentation helps outline the details of the shipment, including item descriptions, values, and applicable fees. A comprehensive shipping document is required to meet both sender and recipient obligations and to comply with international trade regulations.

Below is an example of the key sections that are typically included in shipping paperwork for international shipments:

| Field | Description | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sender Information | Name, address, and contact details of the person or company sending the goods. | ||||||||||||||

| Recipient Information | Name, address, and contact details of the person or company receiving the goods. | ||||||||||||||

| Item Description | A clear and accurate description of each item being shipped, including the material, purpose, and quantity. | ||||||||||||||

| Value of Goods | The declared value of each item, including any additional costs such as shipping or insurance, if applicable. | ||||||||||||||

| Harmonized Code | The correct tariff code for each item, used to classify the goods according to international trade regulations. | ||||||||||||||

| Shipping Method | The selected shipping method (e.g.

How to Avoid Delays with FedexTimely delivery is crucial when shipping goods internationally, and ensuring that everything is in order before sending your package is key to preventing delays. Many factors can contribute to holdups during transit, but careful planning and attention to detail can minimize the risk of issues arising. Properly preparing your shipment documentation and following best practices can help keep things moving smoothly.

|