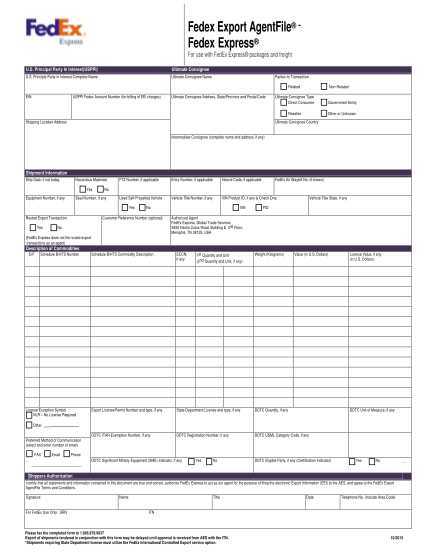

FedEx Commercial Invoice Template for UK Shipments

When sending goods internationally, having the right paperwork is crucial for smooth customs processing and fast delivery. For businesses and individuals alike, the correct documentation ensures that shipments meet regulatory requirements and avoid delays. This type of paperwork is a standard part of cross-border transactions, particularly for those sending items to or from the United Kingdom.

In this guide, we will explore how to prepare and use a shipping form specifically designed for UK-bound shipments. It provides all the necessary fields to declare the contents, value, and other relevant details of the package. By following the correct procedure, you can make sure that your shipments are processed efficiently and meet all import/export regulations.

Understanding the layout and key elements of this essential document is important to prevent mistakes and ensure compliance with shipping guidelines. Whether you’re a first-time shipper or an experienced business, having access to an easy-to-use form can simplify the process and save time.

FedEx Commercial Invoice Template UK Overview

When preparing a shipment for international delivery, it’s essential to have the right documentation to ensure smooth customs clearance. This particular form plays a vital role in detailing the specifics of the goods being shipped, including their value, origin, and other necessary information. It is required for cross-border shipments to the UK and helps authorities determine any applicable duties or taxes.

Key Features of the Shipping Document

This essential document serves several purposes during the shipping process. It not only describes the items being shipped but also outlines the sender and recipient information, helping both customs officers and courier services process the shipment without issues. Below are some important elements you will find in this type of form:

- Sender and recipient details: Includes addresses, contact information, and any special handling instructions.

- Description of goods: Clear identification of the items, including their nature, quantity, and unit values.

- Harmonized System codes: Used for customs classification and tariff calculations.

- Value and currency: The value of the items, often required for duty and tax assessment.

- Shipping terms: Information on shipping methods, delivery instructions, and payment details.

Why This Document Matters for UK Shipments

Without this completed form, your shipment could face delays, fines, or even be returned to the sender. Customs authorities in the UK rely on this form to accurately assess the value of the shipment and ensure compliance with import regulations. Providing accurate and complete information is crucial to avoid complications.

Moreover, this form can help facilitate faster processing and minimize disruptions in the shipping process, which is especially important for businesses that depend on timely deliveries. Using a pre-structured, easy-to-fill form ensures consistency and reduces the risk of mistakes.

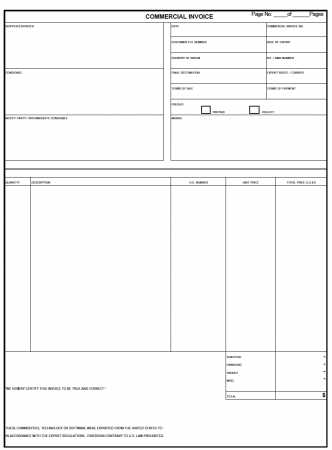

What is a Commercial Invoice

A shipping document is a critical part of the international transport process. It serves as a detailed declaration of the goods being transported and provides all necessary information for customs clearance. This form is required by customs authorities to assess duties, taxes, and ensure that the shipment complies with the import regulations of the destination country. The document essentially functions as a receipt, stating the value and nature of the goods being shipped.

Purpose of the Shipping Document

This particular form helps both the sender and recipient of goods communicate essential shipment details to customs officials. It helps authorities understand the contents of the package, its value, and the terms of sale. The document is essential for ensuring that the goods reach their destination without any delays caused by incomplete or incorrect information.

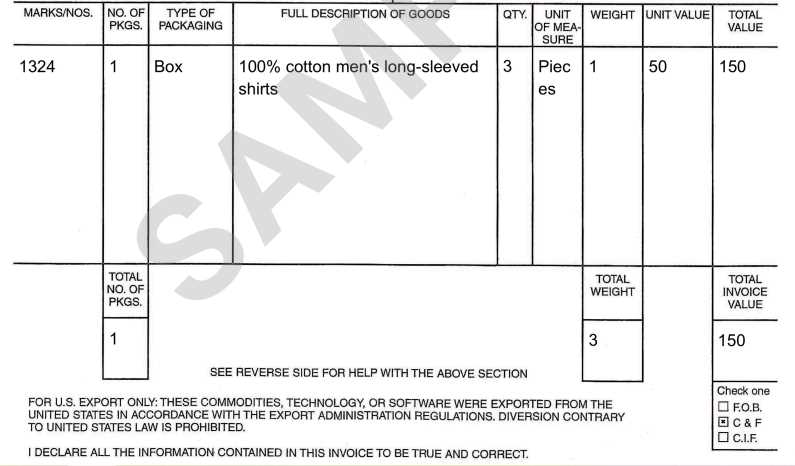

Typical Information Found in the Form

Various fields must be filled in to provide complete and accurate details. Below is a breakdown of the common elements you’ll find on the form:

| Field | Description |

|---|---|

| Sender’s Information | Details of the person or company sending the goods, including address and contact information. |

| Recipient’s Information | Details of the person or company receiving the goods, including address and contact information. |

| Description of Goods | A clear description of the items being shipped, including their quantity, weight, and type. |

| Value and Currency | The value of each item and the total shipment value, usually in the currency of the sender’s country. |

| Shipping Terms | Information about the agreed shipping method, costs, and responsibilities for delivery. |

By providing this detailed information, the shipping document ensures that customs officers have everything they need to process the shipment smoothly. Accurate completion of this document is crucial for avoiding potential delays or penalties at customs.

Why You Need a Shipping Document Form

When preparing goods for international shipment, having a structured and standardized form is essential for ensuring that all necessary information is provided to customs authorities. This form helps facilitate the smooth processing of shipments, reducing the risk of delays, fines, or complications during transit. It serves as an official record of the goods being transported and provides critical details needed for customs clearance.

Using a ready-made form specifically designed for international shipping can save time and effort. The structure is tailored to include all the required fields, making it easier for the sender to input accurate information. Without a properly completed form, shipments can be delayed, or even returned, due to missing or incorrect details.

Moreover, a standardized form helps ensure that all shipments are treated consistently, reducing the chance of confusion or errors during the shipping process. By using a professionally designed form, businesses and individuals alike can avoid unnecessary complications and speed up the overall process.

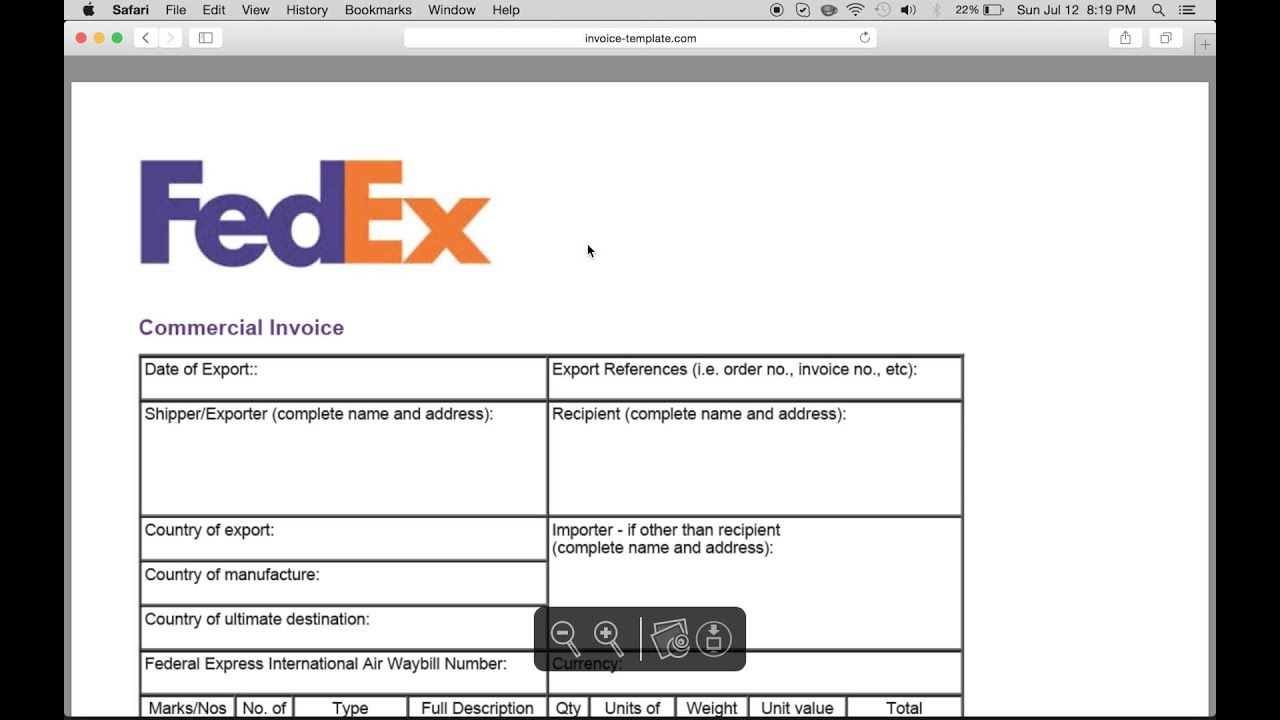

How to Download Shipping Document Form UK

When preparing a shipment for international delivery, obtaining the correct documentation is the first step in ensuring smooth customs clearance. This particular form can be easily downloaded from official platforms and used to provide all the necessary details about the goods being shipped. Here’s a step-by-step guide on how to get the required form for shipments to the UK.

Steps to Download the Form

To obtain the necessary shipping documentation for UK-bound packages, follow these simple steps:

- Visit the official courier service website or relevant platform offering the document.

- Locate the section dedicated to international shipping forms or customs documents.

- Select the specific form designed for UK shipments.

- Click the download link and save the file to your device.

- Ensure that you download the most up-to-date version to avoid any compatibility issues.

What You Need to Know Before Downloading

Before downloading the form, it’s important to understand that there may be different versions depending on the shipping destination or the size of your shipment. The form you download should match the nature of your goods and the shipping method chosen. Review the available options and select the correct one to ensure proper documentation for your specific needs.

| Form Type | Use Case |

|---|---|

| Standard Form | Used for general shipments to the UK, including small packages and non-commercial goods. |

| Business Form | For larger or commercial shipments, providing detailed item descriptions and values. |

| Customs Declaration Form | Required for items that need to be declared to customs due to their nature or value. |

Once the form is downloaded, you can begin filling it out with the relevant information about your shipment. Make sure to double-check all fields to avoid delays at customs.

Customizing the Shipping Document Form

When preparing goods for international shipment, personalizing your shipping form is essential for ensuring all details are accurate and specific to your shipment. A well-customized document ensures that all the necessary information is included, making the customs process smoother and more efficient. This customization allows you to tailor the form to reflect your shipment’s specifics, such as item descriptions, values, and any special requirements.

To customize the document effectively, you need to fill in the various sections based on the nature of your goods and shipping details. This involves adding the correct information in fields such as the item description, value, and country of origin. Additionally, you may need to modify the form based on your shipment’s size, weight, or any applicable shipping terms.

Key Sections to Customize

There are several key sections within the form that you will need to tailor according to the shipment details. Here are the most common areas that require customization:

- Sender and Recipient Information: Make sure that both your details and the recipient’s information are complete and accurate, including addresses and contact numbers.

- Item Description: Provide clear, precise descriptions of the goods, including their purpose and characteristics. This helps ensure that customs officers correctly classify the items.

- Value and Currency: Enter the accurate value of the goods in the proper currency. This is important for calculating taxes and duties.

- Shipping Terms: Customize the terms of shipping, specifying who pays for the freight, insurance, and any other associated costs.

Common Mistakes to Avoid When Customizing

While customizing the form, it’s important to avoid common mistakes that can cause delays or issues with customs. Double-check the following to ensure everything is in order:

- Incorrect or incomplete recipient details: Missing or incorrect address information can result in returned shipments or additional delays.

- Wrong item classification: Be sure the item description matches the actual goods, as misclassification can result in fines or confiscation of goods.

- Underestimating item values: If the declared value is too low, customs may charge additional taxes or penalties, or even reject the shipment.

By carefully customizing your shipping document form, you can avoid these pitfalls and ensure that your package reaches its destination without unnecessary delays or complications.

Key Fields in a Shipping Document

When preparing the required documentation for international shipments, certain fields must be filled in accurately to ensure smooth customs processing. These sections provide essential information about the goods being shipped, the sender, the recipient, and the terms of the shipment. Understanding which fields are crucial and how to fill them out properly can save time and prevent delays.

Here are the key fields that must be carefully completed when preparing the shipping document for international delivery, particularly for shipments to the UK:

Sender and Recipient Information

The first set of fields contains the details of both the sender and the recipient. This includes names, addresses, and contact information for both parties. It is vital that these fields are completed accurately to avoid delivery errors. Any discrepancies in the addresses could result in delays or the return of the shipment.

- Sender’s Name and Address: The full name, address, phone number, and email address of the person or company sending the goods.

- Recipient’s Name and Address: The full details of the person or business receiving the goods, including any additional instructions for delivery.

Description of Goods

Providing a detailed description of the items being shipped is crucial for customs clearance. This section ensures that customs officers can identify and classify the goods correctly. Be clear and concise in your description, including information such as the material, function, or purpose of the items. Misleading or vague descriptions can lead to issues at customs.

- Item Name and Category: Clear and accurate names for the goods, along with their category (e.g., electronics, clothing, food).

- Quantity and Unit Value: The number of units being shipped and their value per unit. This helps determine taxes and duties.

Value and Currency

Another critical field is the total value of the goods being shipped. This should include the value per item as well as the overall total of the shipment. Be sure to specify the currency in which the goods are valued. Incorrect values can cause issues with tax calculations and delay the processing of the shipment at customs.

- Individual Item Value: The price of each item in the shipment.

- Total Shipment Value: The overall value of the shipment, which is often used to assess duties and taxes.

- Currency: Specify the currency in which the value is stated, such as GBP or USD.

Shipping Terms

This section outlines the shipping agreement between the sender and the recipient. It covers the responsibilities of both parties, including who will pay for shipping, insurance, and any other charges. Clear terms help avoid confusion and ensure that both parties are on the same page regarding delivery costs and responsibilities.

- Freight Charges: Indicate whether the sender or the recipient will pay for the shipping costs.

- Incoterms: Specify the international commercial terms (e.g., DAP, FOB) that define the responsibilities of both parties.

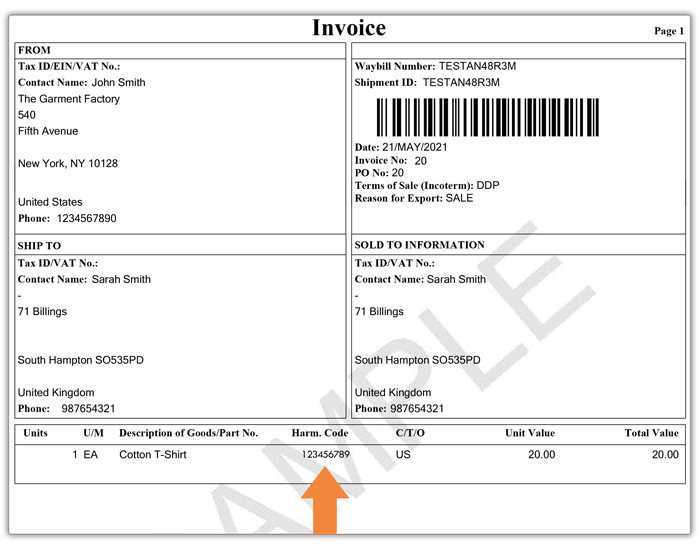

HS Code and Country of Origin

Customs requires that each product be assigned a Harmonized System (HS) code, which helps identify the product for tariff and tax purposes. The country of origin is also crucial for determining whether any trade restrictions or tariffs apply to the goods being shipped.

- HS Code: A standardized code that categorizes goods for international trade and determines applicable duties.

- Country of Origin: The country where the goods were manufactured or assembled.

By carefully completing these fields, you ensure that the shipment is fully documented and ready for smooth customs clearance, helping to avoid any unnecessary delays or complications during the shipping process.

Common Errors When Using the Shipping Document Form

While preparing the required paperwork for international shipments, there are several common mistakes that can delay the process or even cause shipments to be rejected. Ensuring accuracy in every section is crucial for smooth customs clearance and timely delivery. Here are some of the most frequent errors shippers make when completing their shipping documentation.

Incorrect or Missing Information

One of the most common mistakes is leaving out important details or providing incorrect information. This can result in shipment delays or additional fees. The most frequent errors include:

- Incomplete Sender or Recipient Details: Missing addresses, phone numbers, or incorrect contact information can cause delivery problems and delays.

- Incorrect Description of Goods: Vague or incorrect descriptions of the items can lead to customs delays and possible penalties.

- Wrong Shipping Terms: Failing to clearly state who is responsible for shipping costs or not specifying terms like Incoterms can create confusion and disputes later on.

Value and Currency Mistakes

Errors in declaring the value of the goods are not only common but also costly. Incorrect values can result in customs issues and unexpected charges. Common mistakes include:

- Undervaluing Goods: Providing an undervalued shipment to avoid taxes or duties can be seen as fraud by customs authorities, which can lead to fines or shipment confiscation.

- Incorrect Currency: Using the wrong currency when declaring the value of the items can lead to confusion and delay the customs process.

- Omitting Item Values: Forgetting to list the value of individual items in the shipment can result in incomplete documentation and delay the shipment.

Missing or Incorrect Harmonized System (HS) Code

The HS code is essential for classifying goods during customs clearance. Failing to assign the correct HS code can result in duties being assessed incorrectly or the shipment being delayed while authorities request clarification.

- Wrong HS Code: Using an incorrect code can lead to goods being misclassified, causing delays or additional fees.

- Omitting the HS Code: Leaving this section blank can result in the shipment being held at customs until the code is provided.

Failure to Follow Local Regulations

Each country has its own set of rules for import and export, and failing to adhere to these regulations can cause significant issues. Some common errors include:

- Incorrectly Classifying Restricted or Prohibited Goods:

Shipping Document vs Other Shipping Documents

When shipping goods internationally, different courier services provide their own variations of the necessary shipping documentation. While the overall purpose of these documents remains the same–to ensure smooth customs processing and accurate billing–each courier may have specific formats, features, and requirements. Understanding how one document differs from another can help streamline the shipping process and avoid mistakes.

In this section, we will compare the shipping document used by one major courier service with those of other popular shipping companies. We’ll explore the similarities and differences in how they handle key fields such as sender and recipient details, item description, and value declaration.

Key Differences

Although the general purpose of the document is the same, various shipping providers may structure their forms differently, which can affect the ease of use and accuracy when filling out the required information. Here are some notable differences:

- Format and Design: Some forms are more streamlined, focusing only on essential details, while others may include additional sections for things like customs exemptions or specific shipping options.

- Fields and Terminology: Different companies may use varying terminology for similar concepts. For example, one service might refer to the shipping cost as “freight charges,” while another might use “shipping fees” or “delivery charges.” Understanding these terms is important for correctly completing the document.

- Mandatory vs Optional Sections: Some forms might include fields that are optional, depending on the shipment type or destination, while others require more extensive details. For instance, one courier may request the Harmonized System (HS) code for all goods, while another may only require it for specific items.

Similarities Across Documents

Despite these differences, many shipping documents share common elements. These typically include:

- Sender and Recipient Details: In most cases, you will need to provide accurate contact information for both the sender and the recipient.

- Item Description and Value: A detailed description of the goods being shipped, along with their total value, is required for customs processing.

- Shipping Terms: Whether it’s for a door-to-door or port-to-port shipment, shipping terms define who is responsible for the costs and risks associated with the delivery.

Choosing the Right Document for Your Shipment

While each courier may offer slightly different forms, choosing the correct one for your shipment is essential to avoid delays or issues at customs. Consider factors like the type of goods, the destination, and the specific requirements of the courier service when selecting the form. If you are unsure, consulting the courier’s guidelines or using an online form that automatically fills in required fields can help ensure accuracy and compliance.

Step-by-Step Guide to Filling the Shipping Document Form

Filling out the required documentation for international shipments can seem complicated, but by following a clear, step-by-step process, you can ensure accuracy and prevent common errors. This guide will walk you through the essential steps for completing the shipping paperwork for your package, making sure you provide all necessary details for smooth customs clearance and timely delivery.

Step 1: Enter Sender and Recipient Information

The first section of the form requires you to provide complete and accurate details for both the sender and the recipient. This ensures that the shipment reaches the correct destination without delays. Here’s what you need to include:

- Sender’s Full Name and Address: Make sure the sender’s information is complete, including their full address, phone number, and email address.

- Recipient’s Full Name and Address: Include the recipient’s contact information, ensuring that the address is clear and correct. Pay attention to country-specific address formats.

- Contact Numbers: Include phone numbers for both parties in case of any delivery issues.

Step 2: Provide Detailed Information About the Goods

In this section, you’ll need to provide detailed descriptions of the goods being shipped. Accurate item descriptions help customs officers understand the contents of the package, preventing delays. Be sure to include:

- Item Name and Type: Clearly describe the items being shipped, such as “electronics,” “clothing,” or “books.” Avoid vague terms like “miscellaneous goods.”

- Quantity and Value: State how many units of each item are being shipped, along with the unit price and total value of the goods.

- Country of Origin: Indicate the country where the goods were manufactured or assembled.

Step 3: Fill in Shipping and Payment Terms

In this section, you will specify the terms of shipping, including who is responsible for the costs and what the agreed-upon terms of delivery are. It’s essential to include:

- Shipping Method: Indicate how the goods will be shipped (e.g., air, sea, or ground) and the delivery method (e.g., door-to-door, port-to-port).

- Freight Charges: Clarify whether the sender or the recipient will cover the shipping costs. This helps prevent confusion later on.

- Incoterms: Specify the international shipping terms, such as FOB (Free On Board) or DDP (Delivered Duty Paid), to define the responsibilities of both parties.

By following these steps a

How to Ensure Accuracy in Your Shipping Document

When completing essential shipping documentation for international deliveries, ensuring the accuracy of every detail is crucial to prevent delays, fines, or even the rejection of the shipment. Incorrect information can result in complications with customs clearance, incorrect duty assessments, or delivery issues. This section will guide you through the best practices to ensure that your shipping forms are error-free and ready for smooth processing.

Double-Check Sender and Recipient Information

One of the most common sources of errors in shipping documents is incorrect sender or recipient information. Even a small mistake in an address or phone number can lead to significant delays or failed deliveries. To avoid these issues:

- Verify Addresses: Ensure that both the sender’s and recipient’s addresses are complete and formatted correctly according to the destination country’s address system.

- Include Full Contact Information: Always include a valid phone number and email address for both parties, making it easier for the carrier or customs authorities to reach someone if necessary.

- Check for Typos: Carefully proofread the contact details to ensure there are no spelling errors or missing information that could cause confusion.

Review Item Descriptions and Values

Accurate descriptions of the items being shipped are essential for customs clearance and the correct assessment of duties and taxes. Common errors in this section include vague item descriptions or incorrect values. To avoid these mistakes:

- Provide Clear Descriptions: Be specific and detailed when describing the items. For example, instead of “electronics,” write “smartphone, model XYZ.”

- List Correct Values: Ensure the unit price and total value of the goods are accurate. This is important for calculating taxes, duties, and insurance coverage.

- Include Quantity and Weight: Double-check the number of units and total weight of the goods to ensure they align with the actual shipment.

Confirm Customs and Shipping Terms

Customs authorities rely on specific terms and classifications to assess duties and taxes, and any miscommunication in this area can cause delays. To ensure everything is accurate:

- Use Correct Harmonized System (HS) Codes: Make sure the items are classified under the correct HS code to avoid misclassification, which could lead to penalties or customs delays.

- Verify Shipping Terms: Clearly define the shipping terms (such as who pays for freight charges) and the Incoterms (like DDP or FOB), so there’s no confusion about responsibilities.

- Check for Restrictions: Ensure that the goods being shipped are not restricted or prohibi

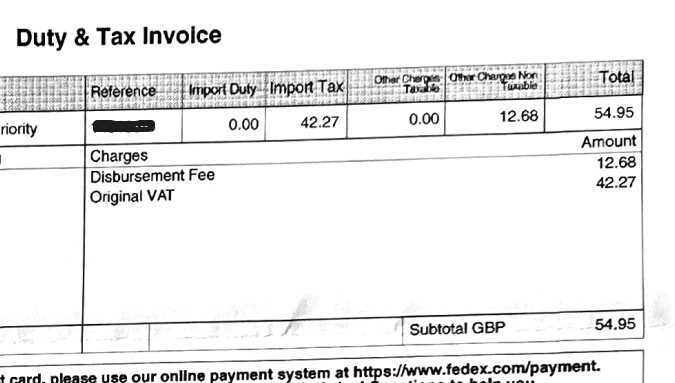

Understanding Duties and Taxes on Shipments

When shipping goods internationally, understanding the duties and taxes that apply to your shipment is essential to avoid unexpected costs or delays. These charges are imposed by the customs authorities of the destination country and are based on various factors such as the type of goods, their value, and the shipping terms. Knowing how duties and taxes work can help you accurately estimate the total cost of your shipment and ensure smooth processing at customs.

What Determines Duties and Taxes?

Duties and taxes on shipments are calculated based on several key factors. To better understand how these charges are applied, consider the following:

- Value of the Goods: The total value of the items being shipped plays a central role in calculating the duties and taxes. Customs usually assess charges based on the declared value, so it’s important to ensure that the value you provide is accurate and aligns with the goods’ market price.

- Product Classification: Goods are categorized under specific tariff codes, and the type of goods being shipped will determine the duty rate that applies. For example, electronics and clothing may have different duty rates.

- Country of Origin: The origin of the goods affects the duty rate, as certain countries have trade agreements that may reduce or eliminate certain fees. This is particularly important for items coming from regions with preferential trade terms.

- Shipping Terms (Incoterms): The responsibility for paying duties and taxes often depends on the agreed-upon shipping terms between the sender and recipient. Terms such as “Delivered Duty Paid” (DDP) or “Free On Board” (FOB) specify who is responsible for these costs.

How to Calculate and Pay Duties and Taxes

Calculating and paying duties and taxes can vary depending on the destination country. In most cases, the recipient is responsible for paying these charges upon arrival of the shipment. However, in some cases, the sender may choose to cover these fees in advance. Here are a few tips:

- Research Tariff Codes: Before shipping, research the specific tariff codes and duty rates that apply to the goods you are shipping. Some online tools and databases can help you determine the exact code for your product.

- Consider Duties in Your Shipping Costs: When preparing your shipment, be sure to factor in the cost of duties and taxes, especially for high-value goods. You can also check with the courier service for assistance in estimating these charges.

- Paying Duties in Advance: If you choose to pay duties and taxes upfront, some courier services offer options for prepayment, which can help avoid delays and provide a smoother

Handling International Shipments with a Leading Courier

When shipping goods internationally, choosing the right courier service can make a significant difference in ensuring timely delivery, proper customs clearance, and overall shipment reliability. One of the key aspects of a smooth shipping experience is understanding the specific requirements and procedures that each service provider follows. This section focuses on how to handle international shipments efficiently with one of the most well-known global shipping companies, ensuring that your goods arrive safely and on time.

Preparing for International Shipping

Before sending goods abroad, it is essential to be aware of all necessary documentation and packaging requirements. Proper preparation ensures that shipments comply with international trade regulations and avoid delays. Here are the key steps to take:

- Document Preparation: Ensure that all required paperwork, such as customs declarations, export permits, and shipping labels, is completed accurately. This paperwork often includes a description of the goods, their value, and origin.

- Correct Packaging: Make sure your items are securely packed according to the destination country’s guidelines. This helps prevent damage during transit and ensures the contents are compliant with import regulations.

- Check Prohibited Goods List: Different countries have specific rules about what can and cannot be imported. Review the list of prohibited or restricted items to avoid any issues during the shipping process.

Choosing the Right Shipping Method

Selecting the appropriate shipping method depends on several factors, such as the type of goods being shipped, the destination country, and the desired delivery time. Common shipping options include:

- Express Services: These services are ideal for urgent deliveries, offering fast transit times and door-to-door service. However, they tend to be more expensive than standard shipping options.

- Standard Shipping: If time is not a critical factor, standard international shipping may be more cost-effective, though the delivery time will generally be longer.

- Economy Shipping: For less time-sensitive shipments, economy shipping offers lower rates while still providing reliable delivery, though it may involve longer shipping times.

Customs Clearance and Duties

One of the most important aspects of international shipping is customs clearance. Each country has its own customs regulations, and failure to meet these requirements can lead to delays, additional fees, or even shipment rejection. To ensure your shipment clears customs smoothly, keep in mind the following:

- Accurate Documentation: Ensure that all customs forms are filled out correctly, including the accurate declaration of the value of the goods, their origin, and their classification according to international trade code

Frequently Asked Questions About Shipping Documents

When it comes to international shipping, certain documentation can often raise questions, particularly when it involves the financial aspects of the transaction. Understanding the requirements and addressing common concerns is key to ensuring smooth processing and avoiding delays. In this section, we address some of the most frequently asked questions regarding the necessary forms used for international shipments, specifically focusing on the common doubts surrounding their completion and submission.

What Information Do I Need to Provide on the Shipping Form?

When filling out the required shipping documents for international shipments, it’s essential to provide accurate and complete details to ensure that the package is processed correctly. Here are some common fields you’ll need to complete:

- Sender and Recipient Information: Include full names, addresses, phone numbers, and email addresses for both the sender and recipient.

- Item Descriptions: Clearly describe the contents of the package, including the quantity, value, and origin of the goods.

- Shipping Terms: Specify who will pay for shipping costs and any other fees related to the delivery.

How Do I Handle Duties and Taxes for International Shipments?

Understanding the duties and taxes associated with international shipments is essential for compliance with local customs regulations. Depending on the shipping terms and destination, either the sender or recipient may be responsible for paying these fees. Here are some key points:

- Recipient Responsibility: In many cases, the recipient will be responsible for paying duties and taxes upon receipt of the package.

- Prepaid Duties: Some carriers allow senders to prepay these fees, ensuring that the recipient does not face unexpected costs upon delivery.

- Clarify Shipping Terms: Use Incoterms (like DDP or FOB) to specify the party responsible for paying these fees in advance or upon delivery.

What Happens if the Document is Incomplete or Incorrect?

Incomplete or incorrect paperwork can cause delays in the delivery process or lead to customs issues. If your shipping document is not filled out properly, the package may be delayed or even returned. To avoid this:

- Double-Check All Fields: Ensure all fields are filled out with the correct information, including the sender’s and recipient’s contact details, item description, and value.

- Contact the Carrier: If you’re unsure about any section of the form, reach out to the carrier’s customer support for guidance to avoid making errors.

Can I Edit the Shipping Document After Submission?

Once the shipping document has been submitted, it may not be possible to make changes, especially if the shipment is

How to Submit Your Shipping Documentation

Submitting the correct paperwork is a vital step when sending goods internationally. Proper submission ensures that your shipment passes through customs without delays and reaches its destination on time. Whether you’re shipping items for business or personal reasons, it’s important to follow the right steps when submitting the necessary documents to the courier or customs authorities. In this section, we outline the best practices for submitting your shipping paperwork effectively.

Preparing Your Shipping Documents

Before submitting your shipping documentation, take the time to ensure that all required fields are completed accurately. Missing or incorrect information can cause significant delays. Here’s what you need to check:

- Complete all details: Make sure the sender and recipient information is accurate, including addresses, phone numbers, and email addresses.

- Item Descriptions: Ensure you’ve provided a clear and precise description of each item, including the quantity, value, and country of origin. This helps facilitate the customs process.

- Include Relevant Customs Codes: If applicable, make sure that you’ve included the correct product classifications (such as HS codes) for customs clearance.

Where to Submit Your Shipping Paperwork

The method of submitting your shipping documents depends on the carrier and the country of destination. Below are the general options for submitting your documentation:

- Online Submission: Many courier services allow you to submit shipping documentation electronically through their websites. This method is fast and ensures that your paperwork is attached to the shipment from the start.

- In-Person Submission: If you are physically dropping off your package at a courier location, you may need to hand over your documents in person. Ensure that all paperwork is completed before visiting the drop-off center.

- Automated Systems: For certain international shipments, automated systems at drop-off points or courier facilities may scan and validate your documents before the shipment is processed.

What Happens After Submission?

After submitting your shipping documentation, the next steps typically involve processing your shipment through customs clearance and final delivery. Be sure to track the status of your shipment to monitor any updates. If there are any issues with the paperwork, the carrier or customs authorities will usually notify you so that you can correct the errors.

By following these steps and submitting the necessary paperwork correctly, you ensure that your shipment complies with international regulations and reaches its destination smoothly.

Tips for Faster Shipment Processing

When shipping goods internationally, timely processing can be critical, especially for businesses that rely on fast delivery to meet customer expectations. However, delays can occur due to incorrect paperwork, insufficient documentation, or customs-related issues. To avoid these challenges and speed up the overall processing time, there are several best practices that can help ensure your shipments move through the system without unnecessary holdups.

Ensure Proper Documentation

One of the primary causes of delays in international shipments is incomplete or incorrect paperwork. To avoid this, ensure that all required documents are filled out accurately and completely:

- Accurate Descriptions: Provide clear and detailed descriptions of the goods being shipped. Include the quantity, value, and intended use of each item. Ambiguity can lead to delays as customs officials need to assess the contents more carefully.

- Correct Classification: Ensure that each item is classified under the correct customs codes (HS codes). This helps customs officials quickly determine the applicable tariffs and duties.

- Recipient Information: Double-check that the recipient’s address, phone number, and email are accurate. Incorrect contact details can cause confusion or delivery errors.

Choose the Right Shipping Method

Different shipping methods offer varying levels of speed and cost. Depending on how urgently the goods need to be delivered, consider the following options to speed up processing:

- Express Shipping: If time is of the essence, using express shipping services can expedite both transit and processing times. These services typically offer faster customs clearance and quicker delivery.

- Prepaid Duties and Taxes: If applicable, consider prepaying customs duties and taxes. This can help eliminate delays that occur when the recipient must pay fees upon arrival.

- Track Your Shipment: Stay informed by using tracking tools. Monitoring the shipment’s progress allows you to address any issues promptly, preventing unnecessary delays.

Proper Packaging and Labeling

Packaging and labeling play an important role in ensuring smooth shipment processing. The right packaging protects the contents of your shipment, and the correct labeling can prevent delays at customs.

- Clear Labeling: Label all packages with clear, legible information. Include both the sender’s and recipient’s details, as well as the shipment’s contents.