Face Painting Invoice Template for Easy Billing and Professional Service

Running a business that involves artistic services requires efficient ways to document transactions and manage payments. For individuals offering services like event entertainment or artistic expression, providing clients with clear, professional statements is essential. These documents not only ensure timely payment but also reinforce the credibility of your work.

Creating a well-structured document for billing is more than just a formality; it reflects the quality of your service and your attention to detail. Whether you’re working at a children’s party or a corporate event, a customized bill helps establish trust and transparency with your clients.

By using a customizable template, you can streamline your payment process, saving time and reducing errors. The right structure will allow you to easily include essential details such as the date, services provided, costs, and payment methods, all in a professional format that suits your style of work.

Face Painting Invoice Template for Artists

For any artist providing on-site services, having a streamlined and professional billing method is essential. A well-organized document for requesting payment allows clients to see a clear breakdown of services rendered, ensuring there are no misunderstandings. It also helps build trust with your clients and portrays you as a serious business professional.

Benefits of Using a Billing Document

Using a structured form for payment requests offers numerous advantages. First, it saves time by automating calculations and standardizing the format. Second, it reduces the chances of mistakes in billing, as all the necessary fields are already included. A personalized document can be adjusted to include your unique branding, making your business look polished and professional.

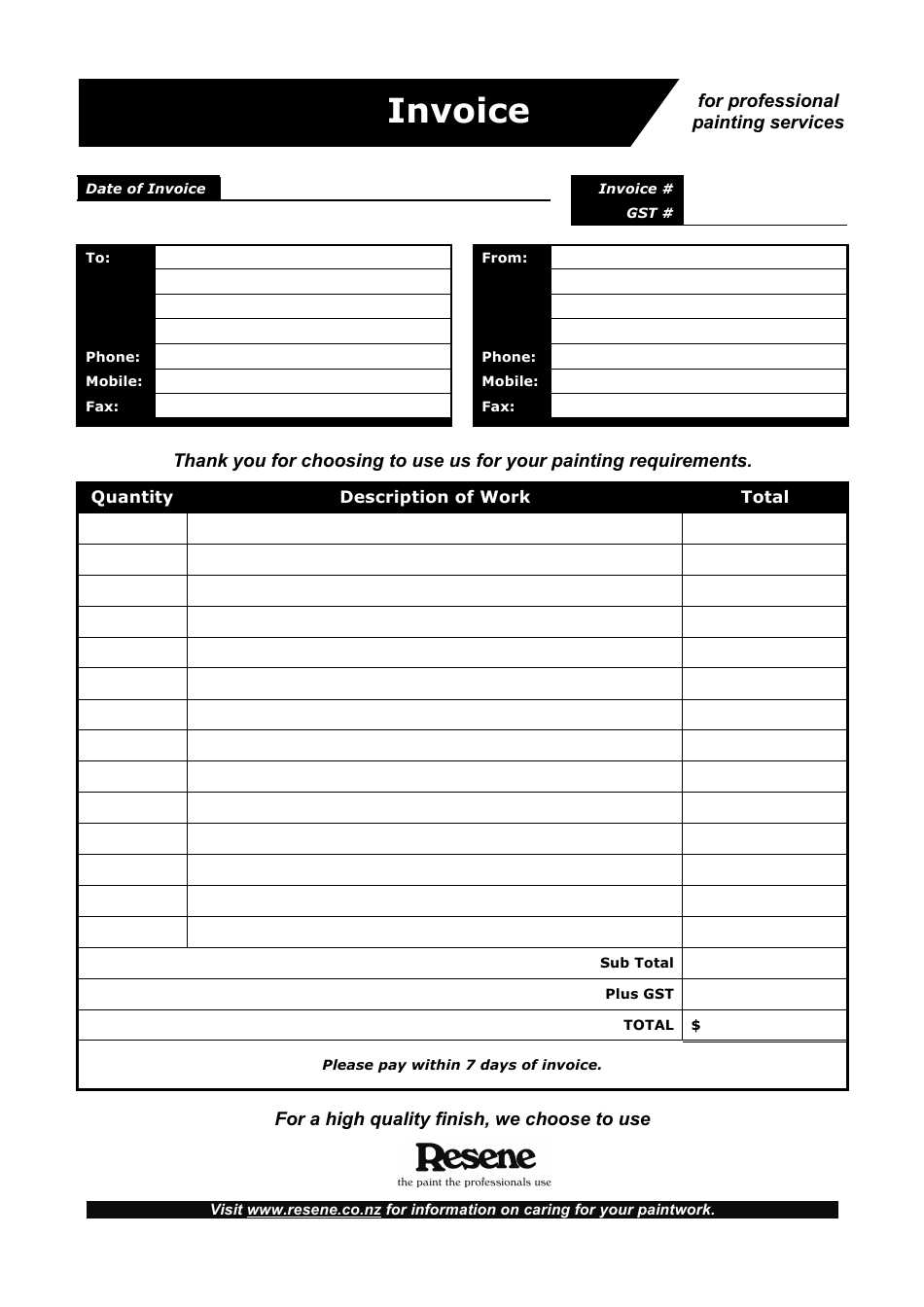

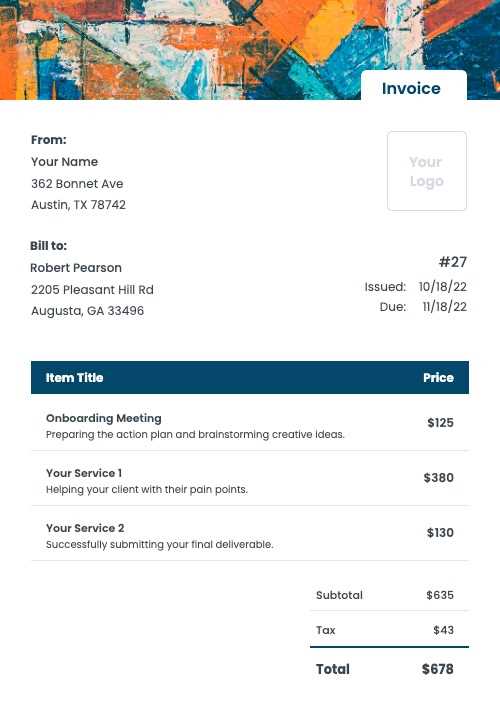

Key Elements to Include

When preparing your billing statement, it’s important to cover all necessary details. Key sections should include client information, a list of services provided, the total cost, and available payment methods. Additionally, you can incorporate a space for any discounts or taxes, depending on your pricing structure. Customizing these aspects helps ensure your clients understand exactly what they are paying for, making the transaction smoother.

Benefits of Using an Invoice Template

For artists and service providers, organizing billing information efficiently is crucial for maintaining a smooth workflow. Utilizing a pre-designed form for payment requests offers several benefits, from saving time to reducing errors. This tool helps you manage client details, service costs, and payment terms in a professional and consistent manner, making it easier to track and follow up on transactions.

Time and Effort Savings

One of the primary advantages of using a structured document is the significant amount of time it saves. Instead of manually creating each document from scratch, you can simply fill in the relevant details for each client. This allows you to focus more on your creative work and less on administrative tasks.

Enhanced Professionalism

By using a standardized document, you present yourself as a serious and organized professional. Clients are more likely to trust someone who provides a clear, concise breakdown of services and costs. It also makes following up on payments easier, as all the necessary details are in one place.

| Benefit | Description |

|---|---|

| Consistency | Ensure every client receives the same professional, well-structured billing format. |

| Accuracy | Automated fields reduce the risk of errors in calculations and data entry. |

| Customization | Adapt the document to include your unique business branding and pricing details. |

How to Customize Your Invoice

Customizing your payment request document ensures it aligns with your unique business needs and branding. By adjusting key elements, you can present a more personal touch while maintaining professionalism. The flexibility of a customizable form allows you to highlight your services, pricing structure, and contact details, all while staying true to your business style.

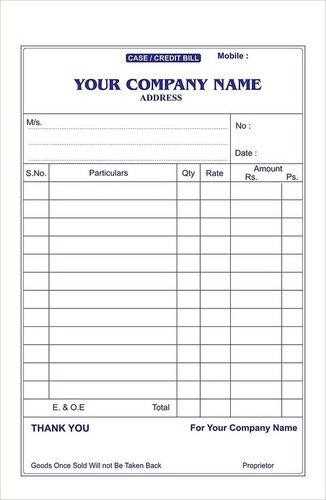

Adjusting Essential Details

Start by including your business name, logo, and contact information at the top of the document. This establishes your identity and makes it easy for clients to reach out with any questions. Next, be sure to clearly list the services provided, the cost for each, and any applicable discounts or taxes.

Adding Personal Branding

Incorporating your branding elements into the document, such as your business colors or font choices, can make your payment request stand out. This personal touch not only helps reinforce your brand identity but also adds a level of consistency across your client communications.

| Customizable Element | Benefit |

|---|---|

| Business Details | Helps clients quickly identify your company and contact you with ease. |

| Service Breakdown | Clearly lists what the client is paying for, avoiding confusion. |

| Personalized Branding | Enhances your professionalism and reinforces your brand identity. |

Essential Information for Accurate Invoices

To ensure that your billing process runs smoothly and professionally, it’s important to include all the necessary details in your payment request documents. Providing accurate and complete information helps prevent any confusion and ensures both you and your clients are on the same page. Missing details or unclear entries can lead to delays and payment issues.

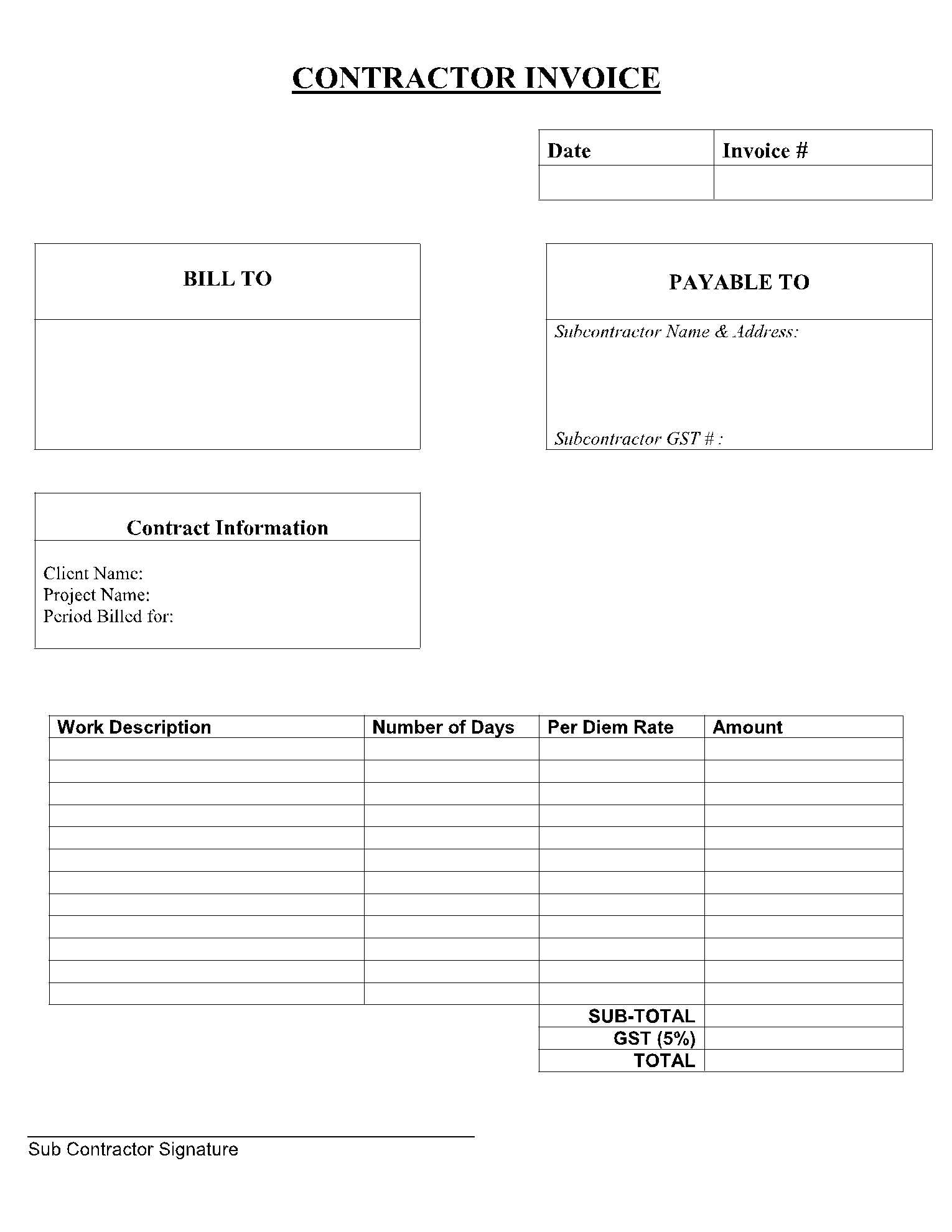

Key Elements to Include

The primary components of an effective billing document should include the date of service, a detailed list of the work completed, the amount for each service, and the total cost. Additionally, include the payment due date and payment methods to clarify how the transaction should proceed.

Client and Service Information

Including both your contact details and those of your client is essential for easy communication. Clearly specifying the services performed, with a breakdown of costs for each, will help avoid misunderstandings. It’s also important to note any additional fees or discounts that apply, ensuring transparency in the billing process.

Common Mistakes to Avoid in Invoices

When preparing payment requests, it’s easy to overlook small details that can cause confusion or delay in receiving payment. Even minor errors can create a negative impression or lead to misunderstandings with clients. Being aware of common mistakes will help you maintain professionalism and ensure that your transactions are smooth and hassle-free.

Key Errors to Watch Out For

- Incomplete Client Information: Failing to include full contact details, such as the client’s name, address, and phone number, can lead to communication issues.

- Missing Payment Terms: Not clearly stating payment due dates or accepted methods can cause delays and confusion.

- Unclear Service Descriptions: Vague or incomplete descriptions of services provided can result in clients questioning charges.

- Incorrect Calculations: Mistakes in pricing or totals can lead to disputes and delay payment.

How to Avoid These Mistakes

- Double-check All Entries: Ensure that all client details, services, and costs are correctly entered before sending the document.

- Include Clear Payment Instructions: Specify payment methods, deadlines, and late fees if applicable.

- Maintain Consistency: Use the same format for all documents to avoid errors and ensure clarity.

How to Track Your Earnings with Invoices

Tracking your income is essential for any business, especially when you are providing on-site or event-based services. Keeping a record of all transactions not only helps you stay organized but also ensures that you can easily manage finances, monitor cash flow, and prepare for tax season. Using detailed payment requests can be an effective tool for monitoring earnings over time.

By properly documenting each transaction, you create a clear financial record that can be referred back to when needed. This allows you to track which clients have paid, how much they owe, and whether there are any outstanding payments. Accurate records also help you identify patterns in your business, such as peak service periods or pricing trends.

Tips for Effective Tracking:

- Use Unique Reference Numbers: Assign a unique number to each payment request to easily reference and track past transactions.

- Record Payment Status: Clearly indicate whether a payment has been received or is still pending to avoid confusion.

- Keep Detailed Records: Include full descriptions of the services provided, rates, and any discounts or additional charges.

- Review Regularly: Periodically check your earnings to ensure that all payments are accounted for and to identify any potential issues early.

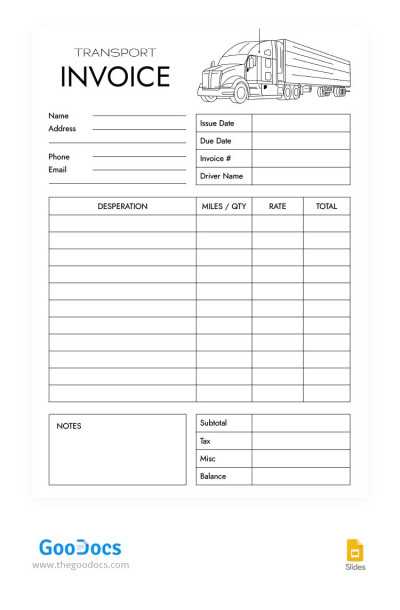

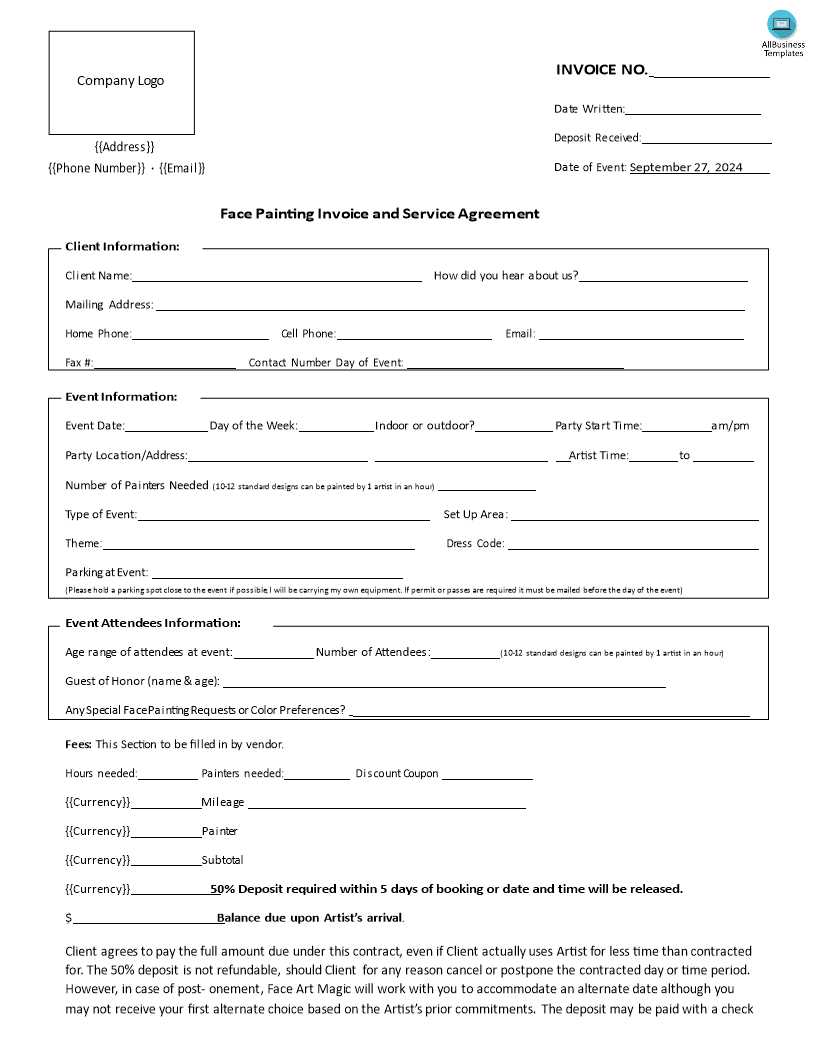

Creating Professional Invoices for Events

When providing services for events, it’s essential to ensure that your payment requests are both professional and clear. A well-crafted document not only outlines the services rendered but also communicates the value of your work to clients. Whether for a birthday party, a corporate event, or any special occasion, presenting an organized payment request will help solidify your reputation as a reliable professional.

To create a professional document, begin by including all relevant details about the event, such as the date, location, and type of services provided. Be sure to list your rates, any additional costs, and payment terms clearly. A thorough breakdown of the charges will not only help the client understand the cost but also minimize the chance of disputes later on. Additionally, having a polished and consistent format reinforces your professional image.

How to Add Taxes to Your Invoice

When providing services, it’s important to ensure that your payment requests reflect the correct total amount, including applicable taxes. Adding taxes correctly helps you comply with legal requirements and ensures that you receive the full payment due. The process of including taxes in your payment request is straightforward once you know the appropriate tax rates and how to calculate them.

To add taxes to your request, first determine the relevant tax rate for your location and the services you provide. Then, calculate the tax amount by multiplying the service cost by the tax rate. Once you’ve calculated the tax, clearly list it as a separate line item on your payment request. Be sure to indicate the tax rate used and specify whether the amount is inclusive or exclusive of taxes. This transparency helps prevent misunderstandings with clients.

Steps for Adding Taxes:

- Identify the Tax Rate: Research the applicable tax rate for your location and industry.

- Calculate the Tax: Multiply the total service cost by the tax rate to determine the tax amount.

- Include the Tax as a Line Item: Clearly label the tax amount on the payment request and specify the rate applied.

- Ensure Transparency: Make sure the client understands whether the tax is included or added separately.

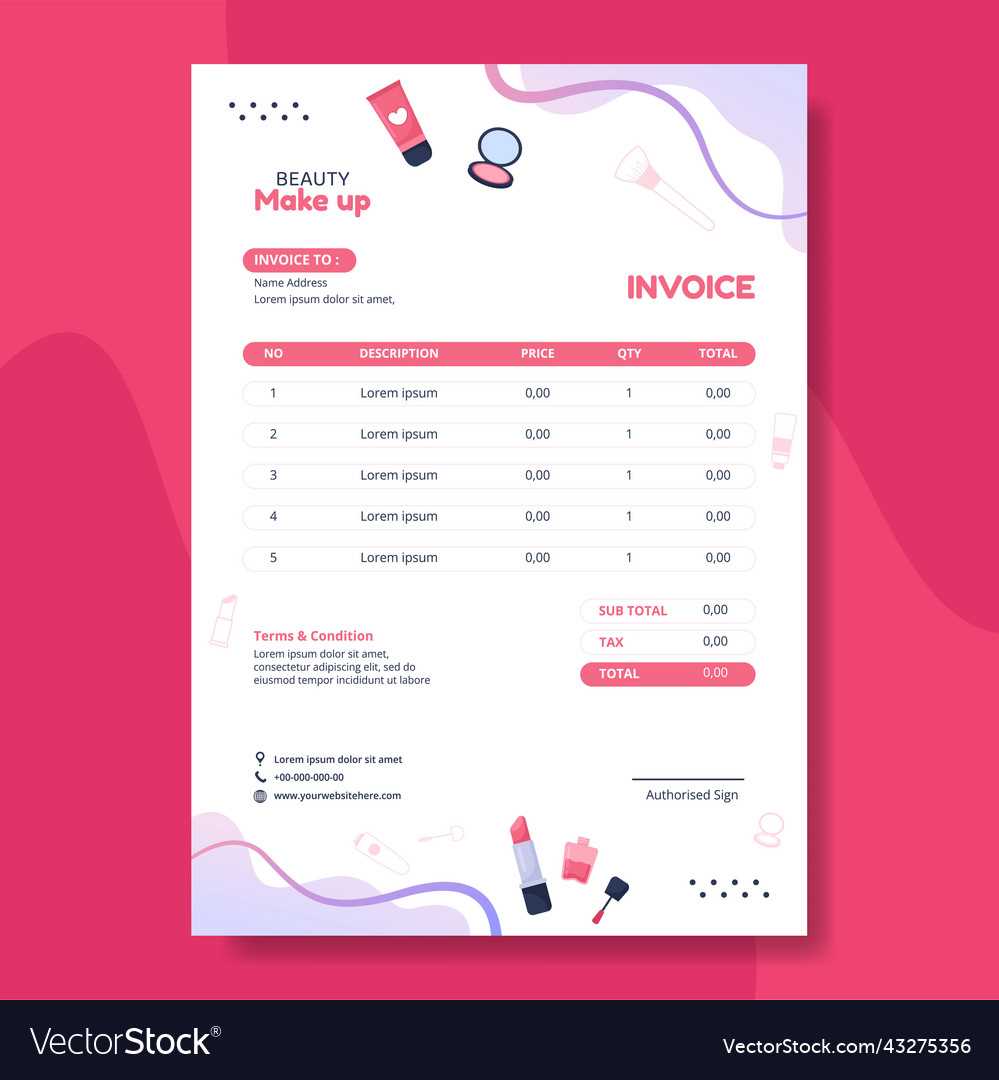

Designing a Visually Appealing Invoice

Creating a well-designed payment request document is not just about listing services and charges; it’s about presenting the information in a clear, professional, and aesthetically pleasing way. A visually appealing document can help leave a lasting impression on clients, making them feel confident in your business. Additionally, a clean layout ensures that key details, like costs and terms, are easy to read and understand.

Elements of an Attractive Payment Request

- Use of Space: Ensure there is enough white space to avoid clutter and make the document easy to scan.

- Consistent Fonts: Choose professional and easy-to-read fonts. Limit the use of different font styles to maintain visual harmony.

- Brand Colors: Incorporate your brand colors to make the document feel personalized and aligned with your business identity.

- Clear Section Dividers: Use borders or lines to clearly separate different sections, such as service details, payment terms, and total amounts.

Design Tips for Better Presentation

- Logo Placement: Position your business logo at the top to enhance brand recognition.

- Professional Layout: Keep the layout simple and structured. Avoid too much text in one area to maintain clarity.

- Highlight Important Details: Use bold or colored text to emphasize key information such as the total amount due and payment due date.

Integrating Payment Options into Your Invoice

Providing multiple payment methods in your billing documents can streamline the payment process and make it easier for clients to settle their dues. Offering a variety of payment options increases convenience and ensures that clients can choose the method that works best for them. Clear instructions on how to pay are essential to avoid confusion and delays.

To effectively integrate payment options, it is important to clearly list all available methods, such as bank transfers, credit card payments, or online payment platforms. Additionally, including any relevant account details or links will help clients complete their payments quickly and without issues. Transparent communication about payment methods can also enhance your professionalism and improve customer satisfaction.

Common Payment Methods to Include

- Bank Transfer: Provide your bank account number and routing details for clients who prefer to pay via direct transfer.

- Credit or Debit Card: Mention if you accept card payments and provide any necessary processing details or links to a secure payment portal.

- Online Payment Platforms: Include links to platforms like PayPal, Venmo, or Stripe for clients who prefer digital transactions.

- Checks: For clients who prefer traditional methods, indicate if you accept checks and provide relevant mailing instructions.

Clear Instructions for Payment

- Specify Payment Deadlines: Clearly state the due date for payments to avoid late fees and misunderstandings.

- Provide Payment Links: If using digital platforms, include clickable links to the payment portal for easy access.

- List Currency Information: Include the currency in which the payment should be made, especially for international clients.

Using Digital Invoices for Convenience

Switching to digital payment requests offers numerous advantages that can enhance both efficiency and client experience. Digital documents are faster to generate, easier to send, and more convenient for clients to access and pay. By moving away from paper-based systems, you can save time, reduce costs, and ensure that payments are processed quickly and securely.

One of the main benefits of digital requests is the ability to send them instantly via email or through online payment systems, making the process much more convenient for both parties. Digital records are also easier to store, track, and organize, reducing the risk of lost or misplaced documents. With the growing reliance on technology, adopting digital systems can help your business stay competitive and improve overall client satisfaction.

Advantages of Digital Payment Requests

- Speed and Efficiency: Digital documents can be created and sent in minutes, ensuring faster payment cycles.

- Easy Access: Clients can view and pay directly from their computers or mobile devices, making transactions more accessible.

- Automated Reminders: Digital platforms can automatically send reminders for overdue payments, helping reduce late fees.

- Better Organization: Digital records are easier to organize and search through, reducing the risk of human error.

How to Transition to Digital Requests

- Choose a Digital Platform: Select an online system or software that allows you to create and send payment requests easily.

- Ensure Security: Make sure the digital platform you use has proper security measures to protect both your and your client’s data.

- Stay Professional: Design your digital documents to reflect your brand’s identity and ensure clarity and professionalism in all communications.

Legal Considerations When Billing Clients

When requesting payment from clients, it is essential to ensure that the terms and conditions of the transaction are clear, legally binding, and compliant with local regulations. Properly documenting the agreement helps avoid disputes and protects both parties involved. Understanding your legal obligations not only safeguards your business but also enhances your professional reputation.

It is crucial to outline payment expectations in detail, including the amount due, payment methods, deadlines, and any applicable taxes. Clearly stated terms will minimize misunderstandings and ensure that clients are aware of their responsibilities. Additionally, keeping accurate records of all transactions is necessary for tax purposes and potential legal issues.

Key Legal Elements to Include

- Payment Terms: Clearly state the due date and any late fees or interest charges for overdue payments.

- Tax Information: Include details about applicable taxes or VAT, ensuring compliance with tax laws in your jurisdiction.

- Refund Policy: Outline any conditions under which refunds may be offered or if non-refundable terms apply.

- Contractual Agreement: Mention if the client has agreed to specific terms or a contract that outlines the services and obligations.

Protecting Your Business Legally

- Legal Dispute Resolution: Define how any disputes will be handled, including mediation or arbitration procedures if needed.

- Document Retention: Keep copies of all payment requests and related correspondence for legal and financial purposes.

- Intellectual Property Rights: Specify any rights to ownership of work, if applicable, and when ownership of services or materials transfers to the client.

How to Offer Discounts in Your Invoice

Offering discounts is a great way to incentivize customers, build loyalty, and encourage prompt payments. Whether you’re providing a special deal for repeat clients or offering a limited-time promotion, it’s essential to communicate the discount terms clearly in your payment requests. This not only helps maintain transparency but also ensures that clients understand how the discount affects the total amount due.

Discounts can take various forms, such as percentage reductions, flat-rate offers, or seasonal deals. By including these discounts in your documentation, you make it clear to your customers what they’re saving, fostering goodwill and increasing the likelihood of repeat business. However, it’s important to outline the discount conditions–such as the validity period or minimum spend–so there are no misunderstandings.

Types of Discounts to Include

- Early Payment Discounts: Encourage clients to pay sooner by offering a reduction in the total price if payment is made before a certain date.

- Volume Discounts: Offer a price reduction for customers who make large purchases or book multiple services in one go.

- Referral Discounts: Reward clients who refer new customers by giving them a discount on their next service or purchase.

- Seasonal Discounts: Provide special pricing during particular times of the year to attract business during slow periods.

How to Present Discounts Clearly

- Highlight the Discount: Clearly show the amount or percentage off in your documentation, and subtract it from the total amount due to show the final price.

- Specify Terms: Include any conditions for the discount, such as a minimum purchase requirement or a deadline for eligibility.

- Break Down Savings: For transparency, break down the discount in your payment request, showing both the original price and the discounted price.

Tracking Payments from Your Clients

Keeping an accurate record of payments from clients is essential for maintaining financial organization and ensuring timely follow-ups. Properly tracking payments helps to avoid confusion, ensures that you are paid in full, and allows you to monitor your cash flow effectively. By establishing a system to track payments, you can stay on top of outstanding balances, which is crucial for running a smooth and professional business.

Whether you choose to use digital tools or manual methods, tracking payments should include key details such as the amount paid, the payment method, the date received, and the service or product it corresponds to. A clear and consistent tracking process will help you identify any missed payments or discrepancies, making it easier to address any issues with clients promptly.

Methods for Tracking Payments

- Spreadsheets: A simple and effective method for tracking payments is by using a spreadsheet, where you can record the amount, client details, payment date, and status of each transaction.

- Accounting Software: Many online tools and accounting software programs allow you to automatically track payments, generate reports, and send reminders to clients with overdue balances.

- Payment Logs: Keep a manual log or digital record of payments received, which can be cross-referenced with your bank statements to ensure accuracy.

Benefits of Payment Tracking

- Improved Cash Flow Management: By tracking payments, you can predict when you will receive income and plan for business expenses accordingly.

- Enhanced Client Relationships: A well-maintained payment tracking system ensures that you can quickly address any issues with clients and provides a professional level of transparency.

- Financial Accuracy: Tracking payments ensures that you have up-to-date records for accounting and tax purposes, reducing the risk of errors or discrepancies.

Why You Need Detailed Service Descriptions

Providing clear and detailed descriptions of the services you offer is essential for both you and your clients. When you outline the specifics of each service, it helps set clear expectations and reduces misunderstandings. A well-described service can make your offerings more transparent, ensuring that clients know exactly what they are paying for and the value they are receiving. This practice not only promotes trust but also contributes to a professional image, giving your clients confidence in your work.

In many cases, vague or incomplete descriptions can lead to disputes or confusion regarding the scope of the service. By being thorough in your descriptions, you minimize the risk of miscommunication, ensuring that both parties are on the same page. Furthermore, it makes it easier to justify your pricing, as clients can clearly see what is included in the cost and the time or effort required to complete the service.

Benefits of Detailed Descriptions

- Clarity: A clear breakdown of services prevents confusion and ensures that clients understand exactly what they are paying for.

- Trust: When clients know exactly what to expect, it builds trust and strengthens your professional reputation.

- Pricing Justification: By specifying what is included in each service, you can better explain your pricing and avoid disputes over costs.

What to Include in a Service Description

- Timeframe: Include an estimate of how long the service will take, whether it’s a few hours or multiple sessions.

- Scope: Clearly state what is and isn’t included in the service to avoid any misunderstandings about the extent of your work.

- Materials Used: Specify any materials or resources that will be used, especially if they contribute to the overall cost.

How to Handle Late Payments in Invoices

Late payments can be an inevitable part of doing business, but managing them effectively is essential to maintaining healthy cash flow and professional relationships. When clients delay payments, it’s important to have a strategy in place that balances assertiveness with professionalism. Clear communication and a firm, yet courteous, approach will help you address overdue amounts and minimize future delays.

One key aspect of handling late payments is having clear terms outlined in advance. This ensures that clients are aware of payment expectations from the beginning. However, even with well-defined terms, late payments can still occur. In such cases, it’s vital to follow up promptly, keeping a record of all communications, and consider using appropriate late fees if necessary. Offering flexible payment options may also encourage timely payments and strengthen client relationships.

Steps to Address Overdue Payments

- Send a Reminder: Politely remind your clients that their payment is due. This can be done through a friendly email or message that includes all relevant details.

- Set a Deadline: If the payment is significantly overdue, clearly communicate a final deadline for payment to avoid further delay.

- Charge Late Fees: If your terms allow, consider implementing a late fee to encourage timely payments in the future.

Preventing Future Late Payments

- Clear Terms: Ensure that your payment terms are clearly stated in your agreements to avoid misunderstandings.

- Incentivize Early Payments: Offer discounts or benefits for early payments to motivate clients to pay on time.

- Set Up Automatic Reminders: Use digital tools to send automated reminders before and after the payment due date.