Free Export Invoice Template for Effortless Invoicing

In today’s global marketplace, crafting detailed and well-organized documents for international transactions is essential. Businesses of all sizes, from small enterprises to large corporations, rely on these documents to communicate with clients, streamline transactions, and ensure accuracy in billing and record-keeping. Without a clear, structured format, the process can quickly become confusing, leading to delays and potential misunderstandings.

Structured documents help in simplifying complex information, presenting data in an organized way that both parties can easily understand. With a reusable layout, companies can quickly generate accurate records, saving time while ensuring professional standards. These tools are especially valuable for businesses that frequently interact with clients or suppliers abroad, allowing them to manage and process essential data smoothly.

Using a well-designed document format tailored for international trade not only enhances efficiency but also fosters trust between business partners. Companies can maintain consistent records and focus on key tasks, such as relationship-building and growth, rather than spending excessive time on administrative work. For those new to the process, having an adaptable

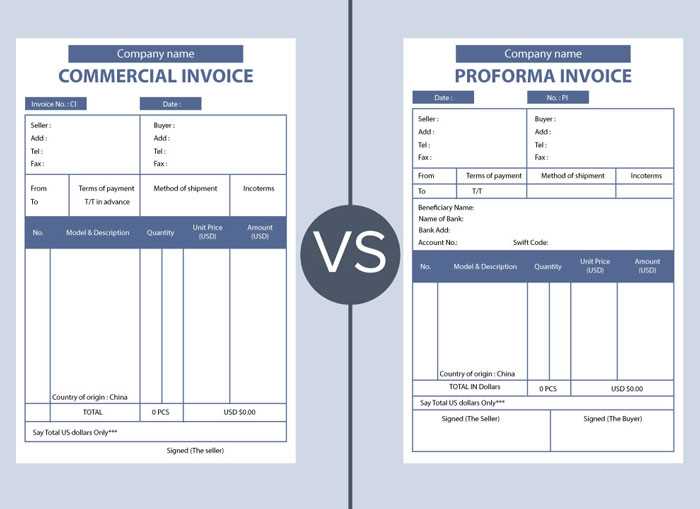

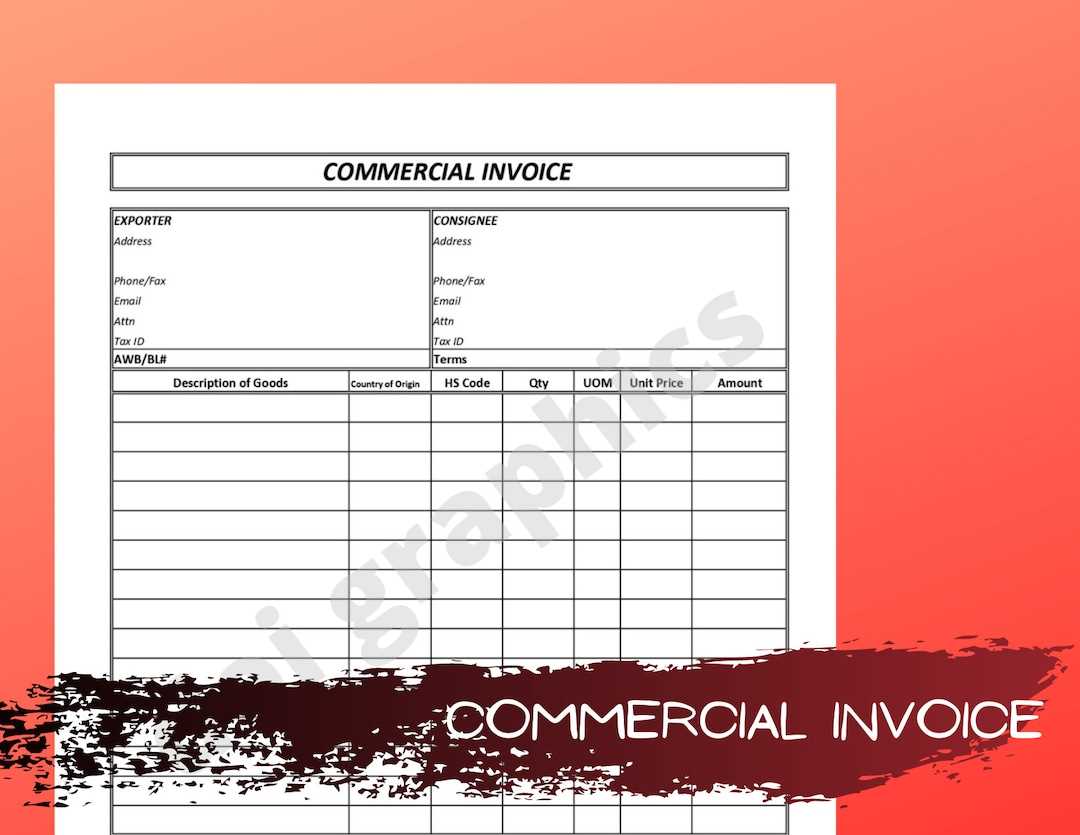

Export Invoice Template for Global Trade

For businesses involved in international transactions, having a clear and consistent format for financial documents is essential. A standardized form streamlines the exchange of information, making it easier for both parties to understand and verify details. This approach reduces errors, improves clarity, and fosters trust, all of which are crucial in cross-border operations where clear communication is key.

A well-structured document benefits both the sender and receiver, offering a straightforward layout that presents essential details without unnecessary complexity. This standardized approach allows companies to manage global transactions effectively, helping them keep records organized and professional.

- Consistent Information Flow: Ensures all required details are present, reducing back-and-forth communication and potential misunderstandings.

- Professional Presentation: A polished layout reflects positively on the business, making a strong impression on partners and clients abroad.

- Time Efficiency: A reusable design minimizes the time spent creating new do

Benefits of Using an Invoice Template

For businesses handling regular transactions, having a standardized layout for billing documents can streamline processes significantly. By adopting a pre-formatted structure, companies can ensure that all necessary details are consistently included, enhancing efficiency and reducing the likelihood of errors. This structured approach simplifies documentation, allowing companies to focus more on their core activities rather than spending excess time on administrative work.

A well-crafted form helps maintain a professional appearance, which can positively impact the business’s image in the eyes of clients and partners. This uniformity not only reinforces brand reliability but also makes communication more straightforward, as recipients know where to find each piece of information. Such clarity is essential in facilitating prompt payments and minimizing any potential misunderstandings.

Moreover, utilizing a ready-made document format is cost-effective. It saves time on design, allowing employees to reuse the layout rather than starting from scratch with each transaction. This consistency in design and information presentation also contributes to better record-keeping, making it easier to track and reference past transactions when needed.

Ultimately, a reusable document structure offers clear benefits for any business engaged in regular transactions. It boosts productivity, foster

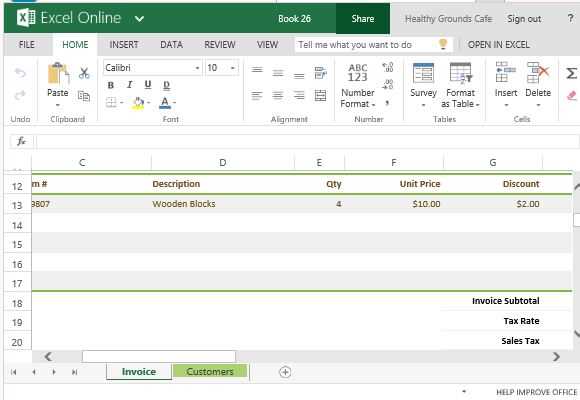

How to Customize Your Invoice

Creating a personalized billing document can significantly enhance the professionalism and functionality of your business operations. Tailoring the layout and details of your billing form ensures that it aligns with your brand and meets specific client needs. By making a few key adjustments, you can ensure that each document not only reflects your company’s identity but also provides clarity and precision in all transaction details.

Selecting Essential Information

Begin by identifying the critical pieces of information that must be included in every transaction document. This generally includes sections for payment terms, itemized lists, contact details, and reference numbers. Customizing these sections to fit your industry’s standards or adding fields specific to your services can make the document more relevant and easier for clients to review.

Adding Branding Elements

Incorporating your company’s logo, color scheme, and font style helps distinguish your document from generic layouts, making it immediately recognizable. This small but impactful touch reinforces your brand’s identity

Top Features to Look For

Choosing the right layout for your billing documents can greatly impact the efficiency and clarity of your financial transactions. Certain elements can make a form more user-friendly, adaptable, and effective for both your business and clients. Knowing which features to prioritize will help you select a design that meets all your operational needs and streamlines the billing process.

- Customizable Fields: A flexible structure allows you to tailor sections based on specific client or transaction requirements, making the document versatile and efficient.

- Automated Calculations: Integrated functions for automatic tax, total, and discount calculations help minimize manual errors and save time, especially in complex transactions.

- Clear Payment Terms: A dedicated area for payment terms and deadlines ensures that both parties understand expectations, which can lead to faster payments.

- Professiona

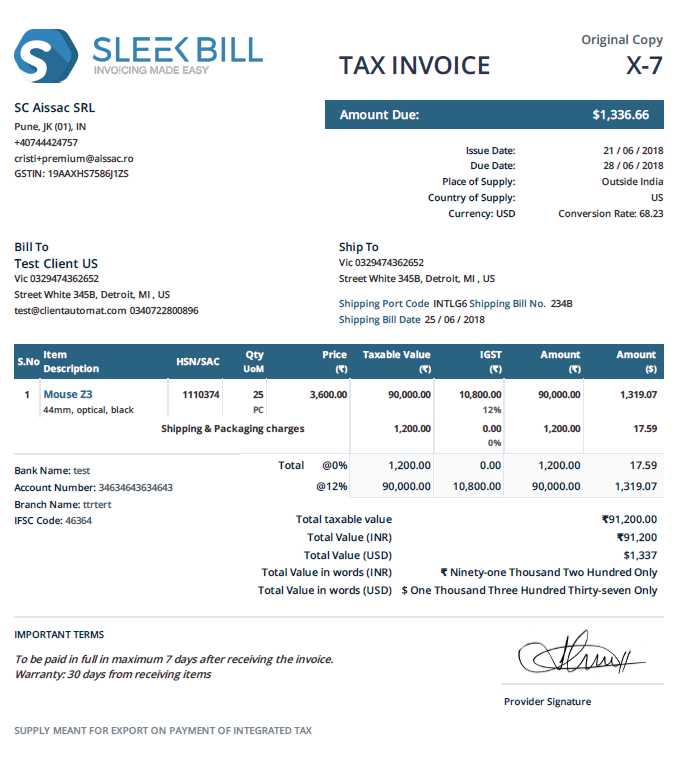

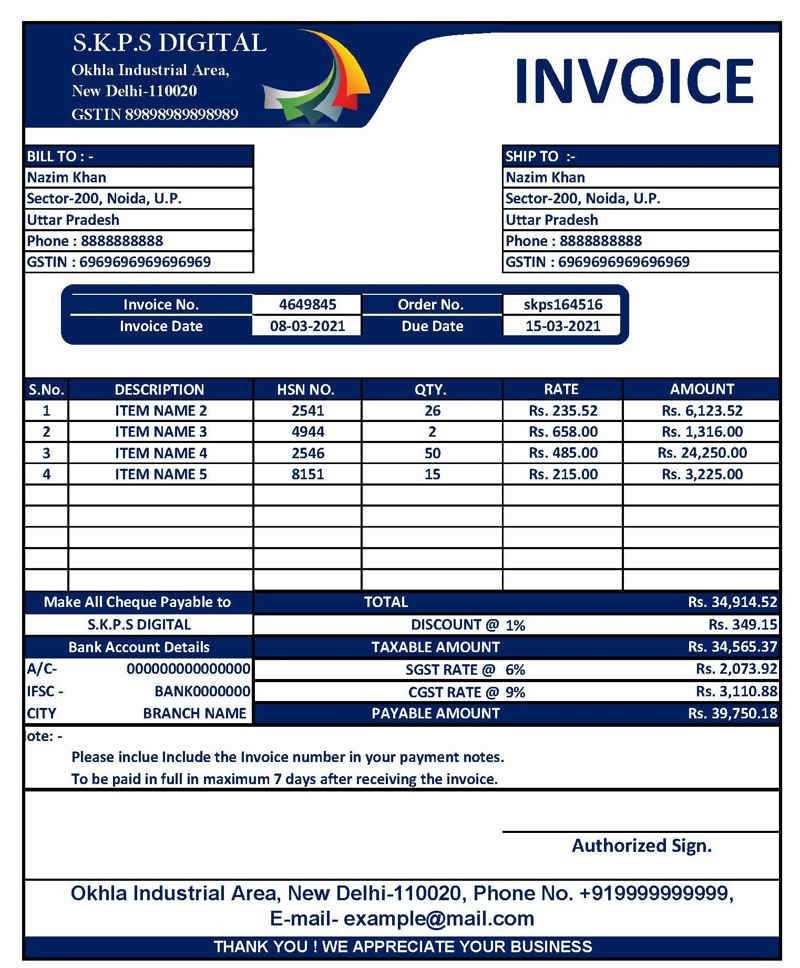

Creating a Professional Invoice Format

A polished and well-organized billing document not only simplifies transactions but also enhances your company’s reputation. An effective format combines essential information with a clear layout, helping clients easily understand the details of each transaction. Crafting a structured and professional layout can lead to smoother financial operations and positive client relations.

Key Elements for a Clear Structure

- Contact Information: Display the contact details for both parties prominently, including addresses, phone numbers, and email addresses to facilitate easy communication.

- Unique Identification Numbers: Add a distinctive reference or ID number for each document to simplify tracking and future reference.

- Itemized Details: Organize a list of products or services

Creating a Professional Invoice Format

A polished and well-organized billing document not only simplifies transactions but also enhances your company’s reputation. An effective format combines essential information with a clear layout, helping clients easily understand the details of each transaction. Crafting a structured and professional layout can lead to smoother financial operations and positive client relations.

Key Elements for a Clear Structure

- Contact Information: Display the contact details for both parties prominently, including addresses, phone numbers, and email addresses to facilitate easy communication.

- Unique Identification Numbers: Add a distinctive reference or ID number for each document to simplify tracking and future reference.

- Itemized Details: Organize a list of products or services, including descriptions, quantities, and individual prices, ensuring transparency and avoiding potential misunderstandings.

- Total Breakdown: Clearly present subtotals, applicable taxes, and the final amount, allowing clients to see the full cost with each component clearly itemized.

Design Tips for a Professional Look

- Branding Consistency: Incorporate your business logo, colors, and fonts, maintaining consistency with other company materials and reinforcing brand recognition.

- Readable Font and Layout: Use a clean font and adequate spacing to make the document easy to read, ensuring that information is accessible at a glance.

- Simple Visual Accents: Utilize lines or subtle shading to separate sections, adding to the document’s readability without overloading the design.

- Clear Payment Terms: Dedicate a section to payment instructions and deadlines, guiding clients through the payment process and encouraging timely transactions.

Designing a professional format that prioritizes readability and brand identity can make your documents not only functional but also a reflection of your business’s commitment to quality. With an organized and visually appealing layout, clients can process the information quickly, leading to better communication and satisfaction.

Common Mistakes in Export Invoices

When preparing billing documents for international trade, it’s crucial to ensure accuracy to avoid delays or complications in payments. Even small mistakes can lead to confusion, missed payments, or legal issues. Understanding the most common errors and how to prevent them is key to ensuring smooth transactions and maintaining positive business relationships.

Common Errors to Avoid

- Incorrect or Missing Contact Information: Failing to include accurate business details such as addresses, phone numbers, and email addresses can cause communication issues.

- Failure to Include Payment Terms: Not specifying due dates, accepted payment methods, or late fees can lead to confusion regarding the timing of payments.

- Missing or Incorrect Tax Details: Errors in tax calculations or failing to list applicable tax rates can create discrepancies between what was agreed upon and what is being paid.

- Omitting Reference Numbers: Without unique reference or order numbers, tracking and verifying transactions becomes difficult for both parties.

Impact of Small Mistakes

Type of Mistake Potential Consequences Missing Payment Instructions Delays in payment and confusion for clients Incorrect Product Details Disputes over what was delivered and billing discrepancies Unclear Terms and Conditions Misunderstandings that could lead to legal issues or disputes Wrong Currency or Amounts Overpaid or underpaid amounts leading to financial losses Understanding Export Invoice Requirements

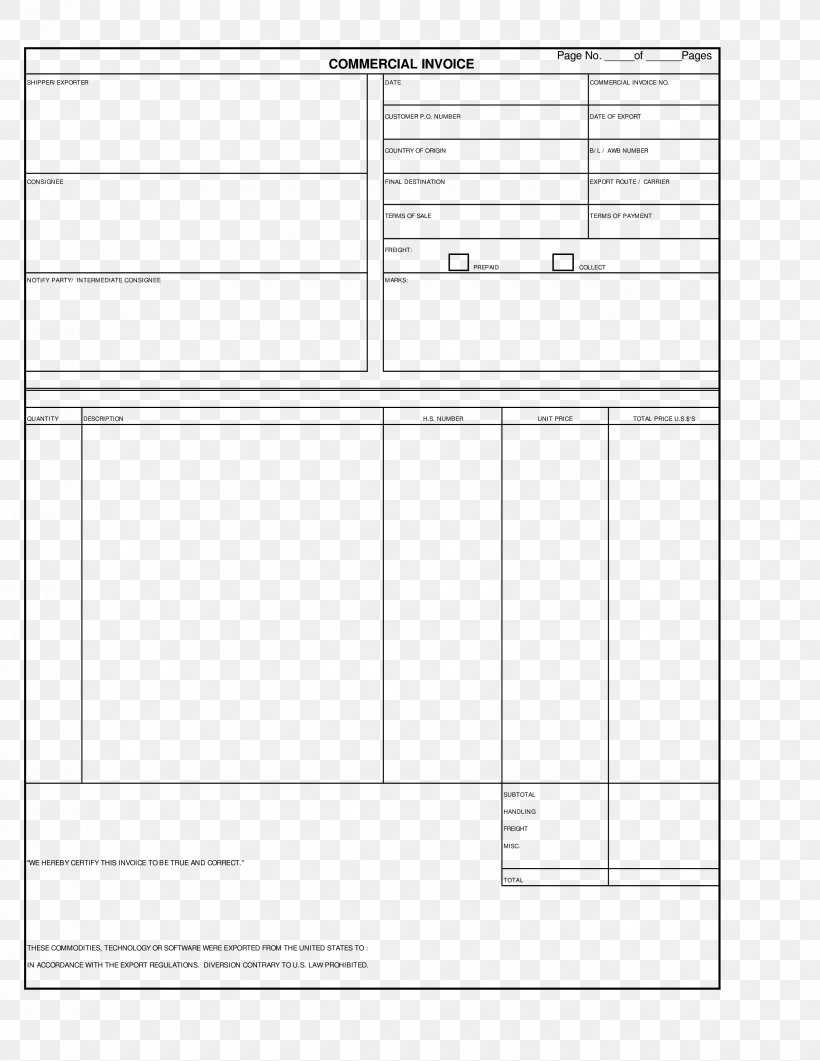

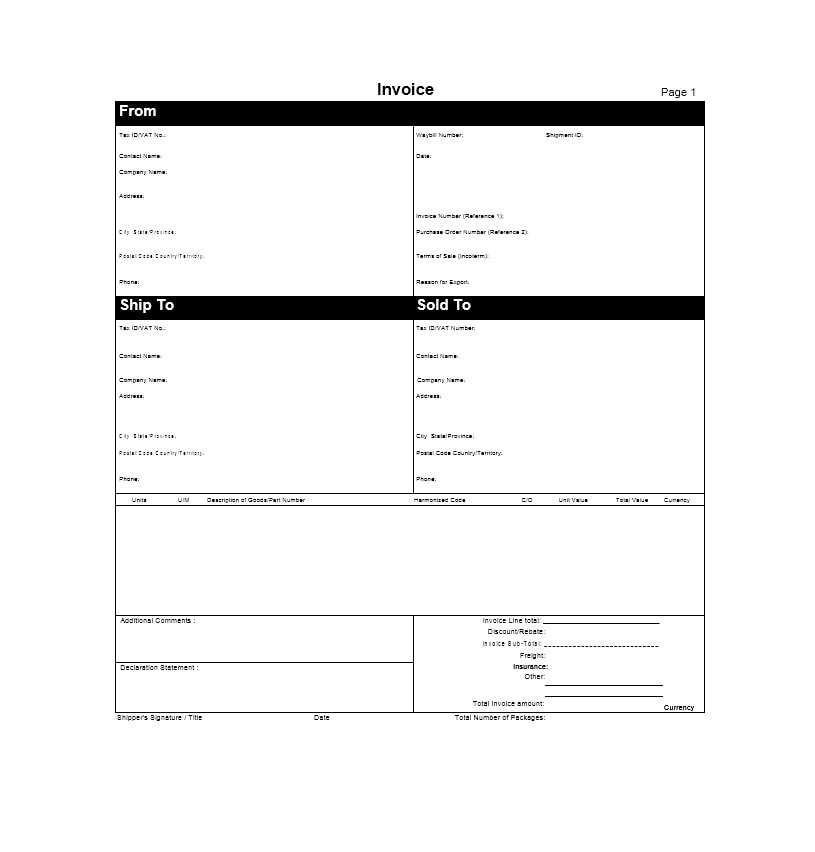

When conducting international transactions, it is essential to meet specific documentation standards. Properly preparing the necessary financial records ensures that shipments can proceed smoothly and that payments are processed efficiently. Comprehending the key elements required for these documents is crucial for businesses to stay compliant with customs regulations and avoid unnecessary delays.

Essential Components for Accurate Documentation

- Complete Seller and Buyer Details: Always include the full names, addresses, and contact information of both parties involved in the transaction.

- Description of Goods or Services: Clearly outline what is being sold, including quantities, item numbers, and detailed descriptions.

- Transaction Date and Reference Number: Provide a unique reference number along with the date of the transaction to facilitate tracking and future inquiries.

- Payment Terms and Conditions: Specify when payment is due, accepted methods, and any penalties for late payments to avoid confusion.

Documentation Specifics for Global Trade

- Harmonized System (HS) Codes: For customs clearance, include the HS code, which classifies products based on international standards.

- Currency and Payment Methods: Indicate the currency in which the transaction is being made, along with the available payment methods such as wire transfer or credit card.

- Shipping Information: Ensure that the delivery terms, including Incoterms, and the shipment tracking number are mentioned clearly for proper coordination.

By understanding the necessary requirements for these documents, businesses can avoid potential pitfalls such as delays at customs or disputes with clients. Accurate and comprehensive records help facilitate smooth international transactions and foster strong professional relationships across borders.

Streamlining Your Billing Process

Optimizing the billing procedure can significantly improve cash flow, reduce errors, and enhance the overall efficiency of business operations. A streamlined approach allows for faster processing and ensures that both the service provider and the client are on the same page, minimizing misunderstandings. With the right tools and strategies, businesses can automate and simplify their financial workflows to save time and resources.

Automation is Key

Using automated systems to generate and manage billing records can reduce the time spent on repetitive tasks and minimize human error. Automated tools can also ensure consistency across all transactions, making it easier to track payments and follow up on overdue accounts. By setting up recurring billing schedules for regular clients, businesses can eliminate the need for manual entries, saving both time and effort.

Clear and Consistent Communication

Establishing clear communication with clients about payment expectations and due dates is crucial for an efficient process. Using standardized templates and including all necessary details–such as the payment methods, terms, and any applicable fees–helps to avoid confusion and fosters transparency. A well-organized system ensures that both parties are aware of the terms and reduces the likelihood of disputes.

Digital Tools for Enhanced Efficiency

Leveraging digital tools for invoicing and payment management can streamline the entire process. Many software platforms allow for seamless integration with accounting systems and provide real-time updates on the status of payments. Furthermore, adopting digital payment options, such as online transfers or credit card payments, speeds up the transaction process and reduces delays caused by traditional payment methods.

By simplifying and automating the billing cycle, businesses can not only enhance their operational efficiency but also improve customer satisfaction. A well-structured approach ensures faster payments, fewer errors, and a smoother overall experience for both the business and its clients.

Legal Compliance in Export Invoices

Ensuring legal compliance when preparing financial documentation for international transactions is essential for avoiding penalties and maintaining smooth business operations. Various regulations govern the creation and submission of these records, and adhering to them is crucial for businesses engaged in cross-border trade. Failing to meet the legal requirements can lead to delays, fines, and even disputes with authorities or clients.

Key Legal Requirements for International Transactions

- Accurate Seller and Buyer Information: Both parties’ details, including full legal names, addresses, and identification numbers, must be correctly documented. This is vital for regulatory and tax purposes.

- Proper Classification of Goods: Goods and services must be clearly described, and their classification must adhere to global standards to avoid customs issues. For most international transactions, products need to be identified with Harmonized System (HS) codes.

- Clear Payment Terms: The terms of payment, including due dates and methods, should be clearly specified to prevent misunderstandings and disputes. This information helps in enforcing the contract and ensuring timely payments.

- Tax Compliance: Depending on the region, the proper tax rates (such as VAT or sales tax) should be applied and documented. Businesses need to be aware of any exemptions or tax treaties that may affect their transactions.

Common Legal Issues to Avoid

- Incorrect or Missing Documentation: Omitting required documents or providing incorrect details can result in significant delays during customs clearance or payment processing.

- Failure to Understand Local Regulations: Different countries have unique legal and financial regulations that must be adhered to. Understanding these rules is critical for staying compliant and avoiding potential fines.

- Ambiguities in Terms of Service: Vague or unclear terms in financial agreements can lead to disputes over payment obligations, delivery conditions, and other critical aspects of the transaction.

By understanding and following the necessary legal requirements, businesses can avoid costly errors and ensure that their international trade activities proceed smoothly. Proper documentation helps build trust with clients and ensures that financial records are ready for any legal or tax audits.

Calculating Taxes and Fees

Accurately determining taxes and additional charges is a critical aspect of financial transactions, particularly when dealing with cross-border exchanges. Proper calculation not only ensures compliance with local regulations but also helps businesses maintain transparency and build trust with clients. Understanding the various components involved in these calculations is essential for effective financial management.

One of the first steps in this process is identifying the applicable tax rates for different goods and services. Each country has its own tax regulations, and rates can vary significantly depending on the nature of the products being sold. It is crucial to research and apply the correct rates based on the classification of the goods. Additionally, businesses should stay informed about any potential exemptions or reduced rates that may apply to certain items.

Fees are another important consideration in the calculation process. These may include shipping costs, handling charges, and other expenses incurred during the transaction. Accurate estimation of these fees is vital for presenting a clear and comprehensive financial document to the buyer. Businesses should factor in all relevant costs to avoid unexpected expenses that could affect profitability.

To simplify the process of calculating taxes and fees, many businesses use specialized software or tools designed for financial management. These tools can automate calculations, apply relevant rates, and generate accurate financial documentation, reducing the risk of errors and ensuring compliance with regulations.

In summary, meticulous attention to the calculation of taxes and fees is essential for effective financial operations in any trade activity. By ensuring accuracy in these calculations, businesses can enhance their credibility and foster positive relationships with their clients.

Export Invoicing for Small Businesses

For small enterprises looking to expand their reach into international markets, managing financial documents is a crucial aspect of operations. Effectively handling financial documentation can streamline transactions and ensure smooth interactions with clients abroad. This section explores the importance of accurate financial documentation for small businesses engaged in international trade.

Importance of Accurate Documentation

Proper documentation serves as a foundation for successful financial transactions. It not only provides a clear record of sales but also ensures compliance with various regulations. Small businesses must pay attention to detail when creating these documents, as inaccuracies can lead to delays, disputes, and potential financial penalties. Maintaining precise records helps build credibility and trust with customers, paving the way for future business opportunities.

Tools and Strategies for Small Businesses

Utilizing the right tools can greatly simplify the process of managing financial records. There are various software solutions available that cater specifically to small businesses, allowing them to create customized financial documents tailored to their needs. These tools often come with built-in templates that simplify data entry and minimize the chances of errors.

Additionally, small businesses should stay informed about the financial regulations in their target markets. This knowledge helps ensure that all required information is included in the documentation and that it meets local compliance standards. Regular training and updates on financial best practices can also empower small business owners and their teams to handle financial matters more effectively.

In summary, effective management of financial documentation is essential for small businesses involved in international trade. By focusing on accuracy and utilizing appropriate tools, these enterprises can navigate the complexities of global transactions with greater confidence.

Best Practices for Quick Payments

Timely financial transactions are essential for maintaining healthy cash flow in any business. Ensuring prompt payments not only improves relationships with clients but also supports the overall financial stability of the organization. This section highlights effective strategies that businesses can implement to encourage faster payments from their customers.

Clear Payment Terms

Establishing clear and concise payment terms from the outset is crucial. Businesses should outline the due dates, acceptable payment methods, and any potential late fees in their contracts or financial documents. By providing this information upfront, clients are more likely to adhere to the payment schedule. Additionally, consider offering early payment discounts as an incentive for clients to settle their accounts sooner.

Streamlined Billing Process

A well-organized billing process can significantly reduce the time it takes for customers to make payments. Using digital solutions to send invoices can expedite delivery and make it easier for clients to pay. Implementing automated reminders for upcoming due dates can also help keep payments on track. Businesses should ensure that their financial documents are easy to understand and contain all necessary details to facilitate prompt payments.

In summary, implementing best practices for timely payments is essential for maintaining cash flow and fostering positive relationships with clients. By establishing clear payment terms and streamlining the billing process, businesses can encourage quicker transactions and enhance their financial efficiency.

Tracking Int

Effective monitoring of financial transactions is crucial for any business engaged in international trade. Keeping track of essential documents, payments, and shipments ensures that operations run smoothly and minimizes the risk of errors or delays. This section explores the significance of diligent tracking methods and the tools available to streamline this process.

Utilizing Technology can greatly enhance tracking capabilities. Various software solutions are available that allow businesses to automate the monitoring of transactions and related documentation. These tools provide real-time updates on the status of payments and shipments, enabling companies to stay informed and react promptly to any issues that arise.

Regular Audits are also an important aspect of effective tracking. By periodically reviewing transactions and related documents, businesses can identify discrepancies and address them proactively. This not only helps in maintaining accurate records but also ensures compliance with regulations and standards that govern international trade.

In conclusion, adopting robust tracking practices is vital for companies operating in the global marketplace. Leveraging technology and conducting regular audits can significantly improve the management of financial transactions and documentation, leading to enhanced operational efficiency and reliability.