Download Free Excel Invoice Templates for Easy Billing

Managing payments and tracking transactions is a crucial aspect of any business, no matter the size. One of the most important tasks is creating clear and professional documents that outline the services or products provided, along with the corresponding amounts due. These documents not only ensure timely payments but also help maintain transparency with clients.

Luckily, there are simple yet effective tools available to streamline this process. By using customizable documents, entrepreneurs can save time while ensuring that their records are organized and easy to understand. These solutions can be tailored to suit various industries, offering a versatile way to handle financial paperwork without unnecessary complexity.

Whether you’re a freelancer or a growing company, having the right structure in place for your billing is essential. In the following sections, we will explore the advantages of using editable formats for creating detailed and accurate financial records, simplifying your workflow, and maintaining professionalism with minimal effort.

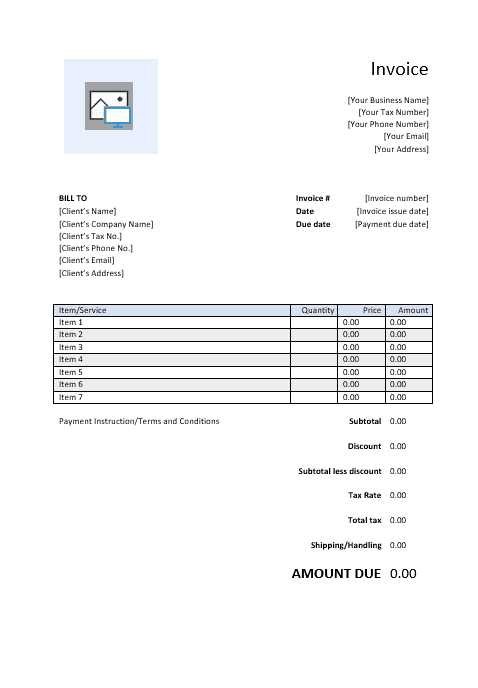

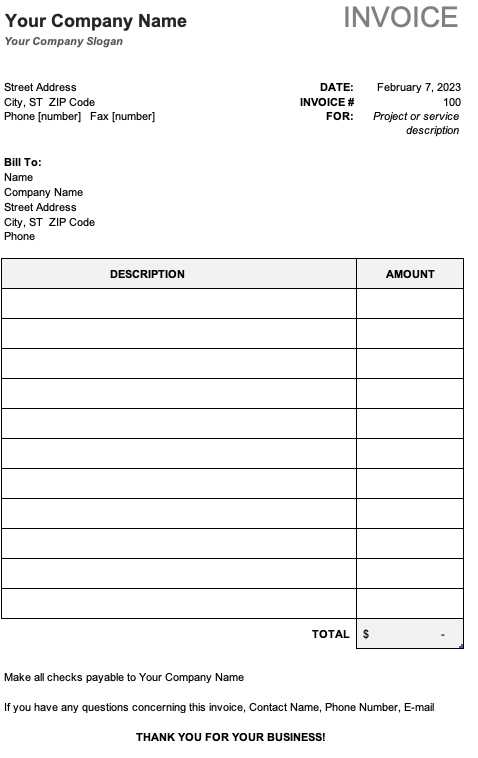

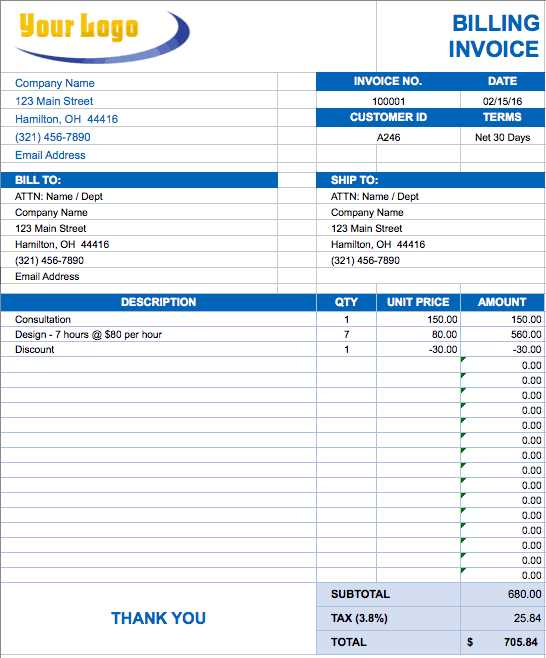

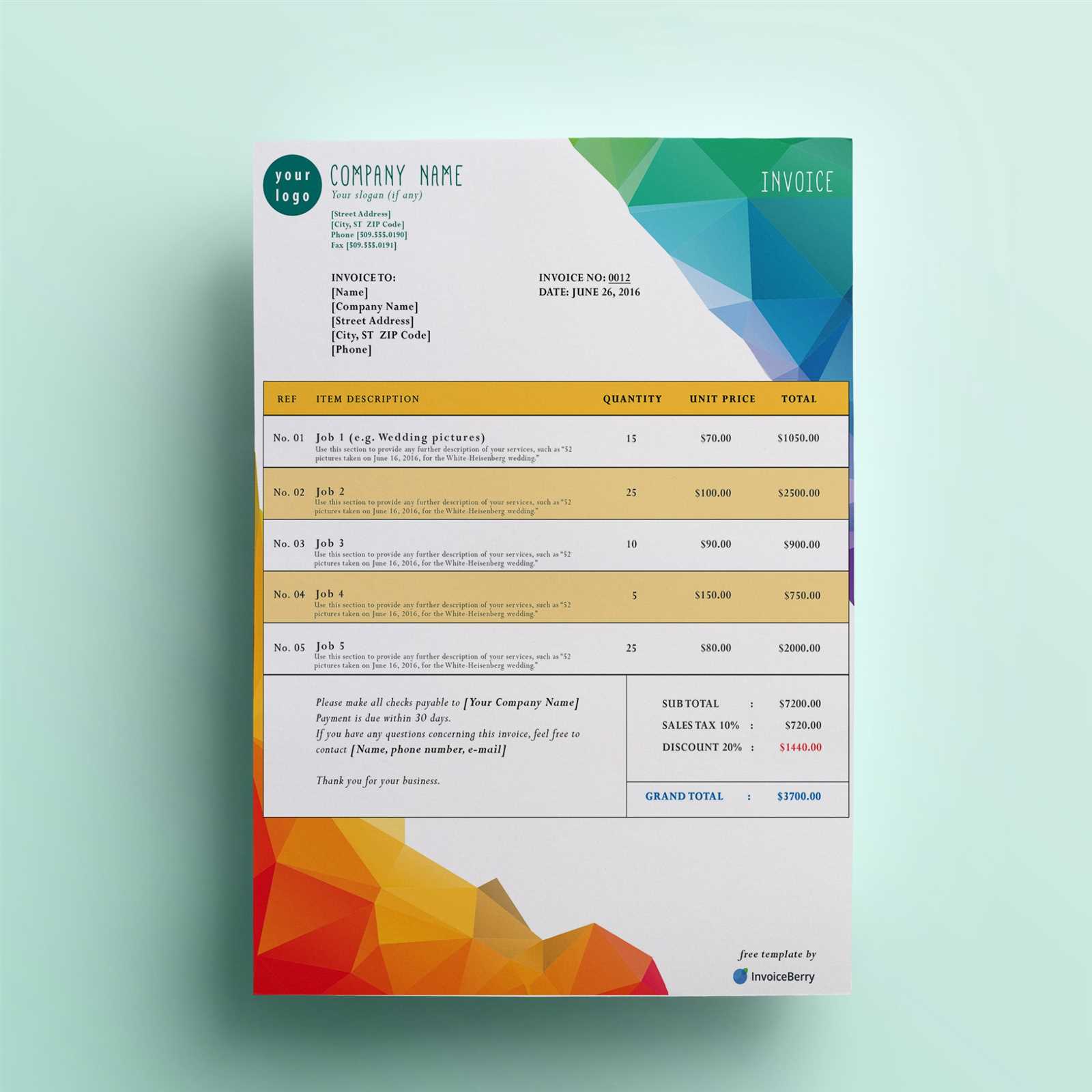

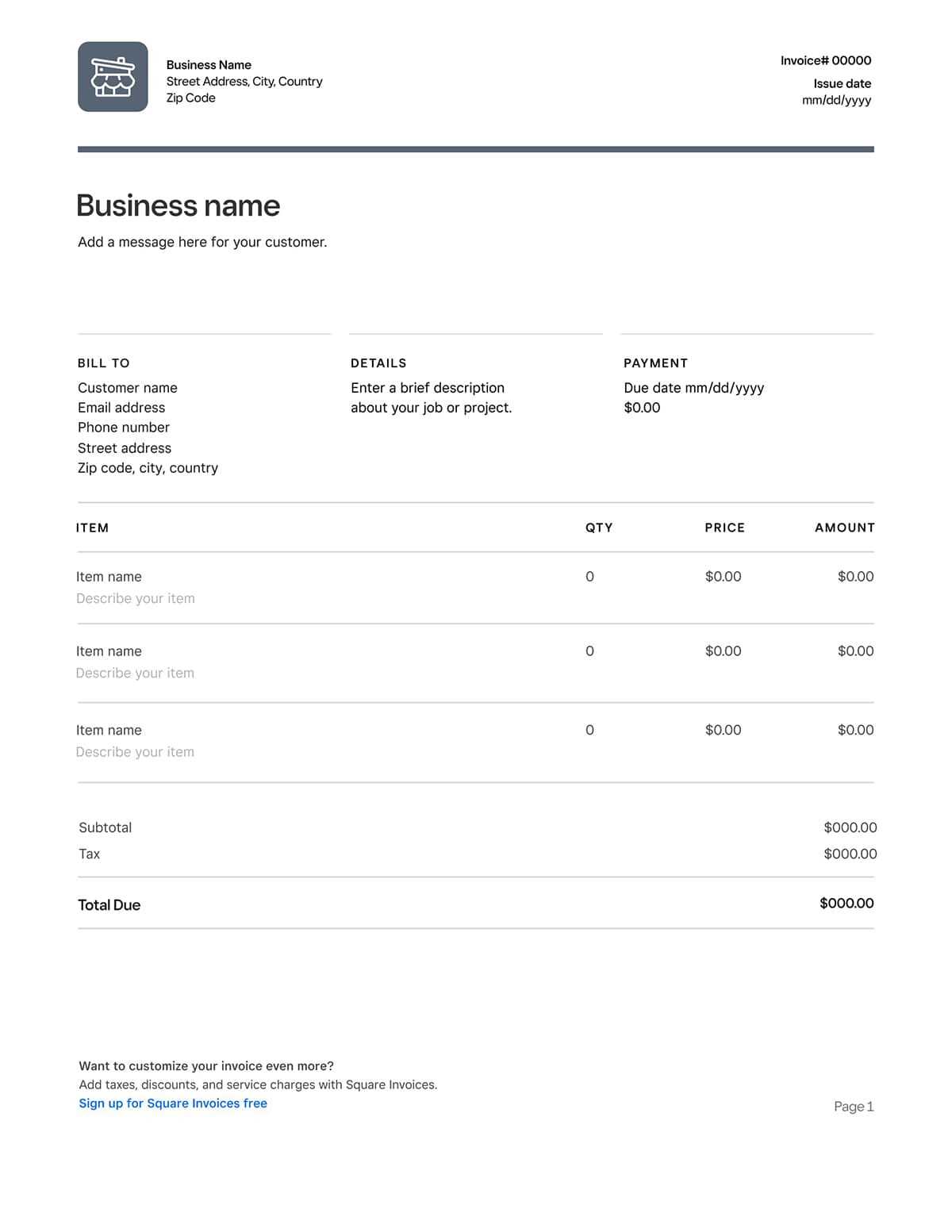

Free Invoice Templates for Excel

Efficiently managing client billing is essential for any business. By utilizing pre-designed, customizable documents, you can simplify the process of creating professional records for transactions. These resources provide a structured format, allowing you to easily input relevant details such as payment amounts, dates, and service descriptions, ensuring clarity and accuracy.

Accessing ready-made options for financial paperwork means less time spent on formatting and more focus on your core business activities. Whether you’re just starting or managing multiple clients, these solutions help maintain consistency and organization in your records, while offering the flexibility to adapt as your needs change.

By incorporating these helpful documents into your workflow, you can ensure timely payments and streamline the entire billing process, all while maintaining a professional image with minimal effort.

Why Use Excel for Invoicing

When it comes to tracking payments and managing financial documents, many businesses turn to digital solutions that offer simplicity, flexibility, and ease of use. Utilizing spreadsheet software for creating and organizing billing records provides a powerful yet accessible option for small and large companies alike. With just a few basic tools, you can quickly generate professional documents that meet your business needs.

Cost-Effective and Easy to Use

One of the biggest advantages of using spreadsheet software is its cost-effectiveness. Most businesses already have access to this software, meaning there’s no need to invest in additional expensive software or services. The platform also offers an intuitive interface, allowing even those with minimal technical skills to create and manage billing records with ease.

Customizable and Flexible Solutions

Another key benefit is the high level of customization available. You can modify document formats to match your specific requirements, whether you need to adjust the layout, add custom fields, or include additional details such as tax rates or discounts. This adaptability ensures that the tool can meet the unique needs of any business, from freelancers to large corporations.

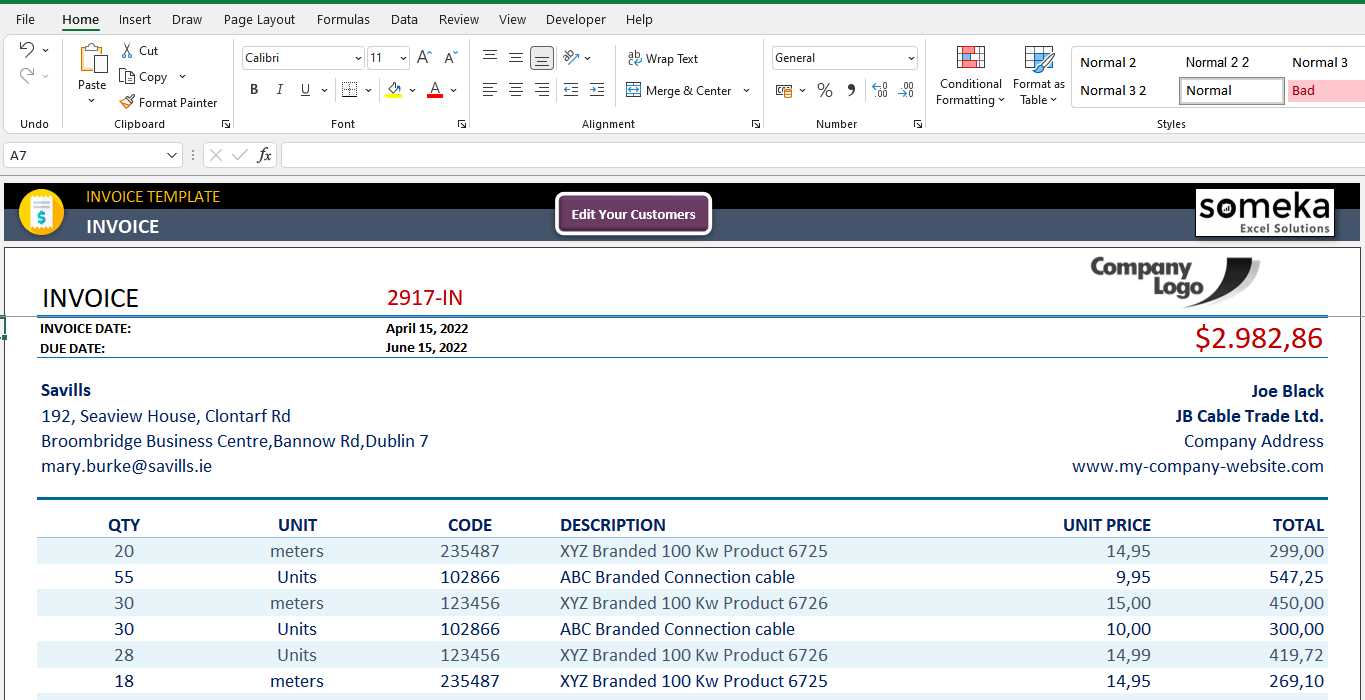

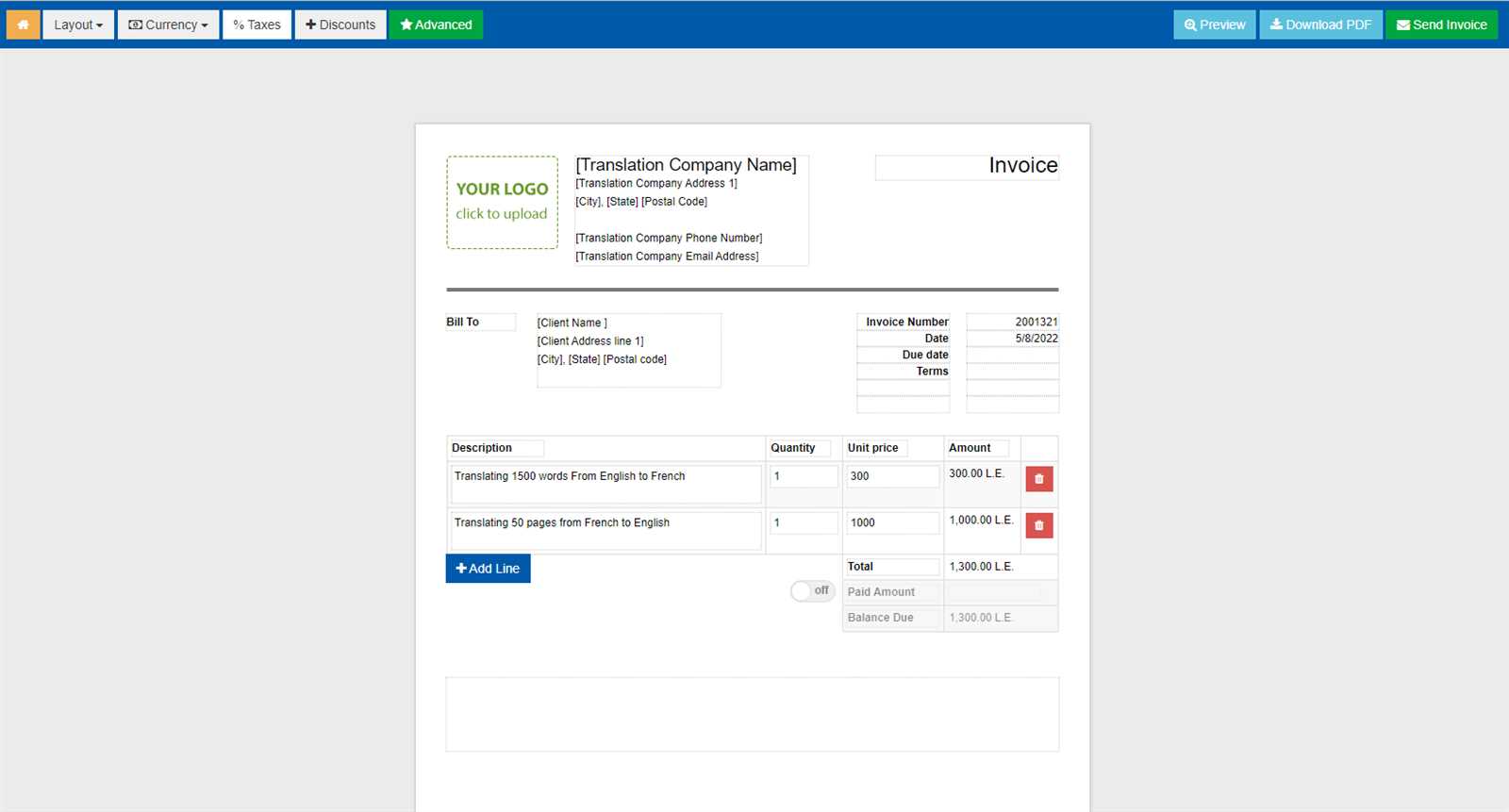

How to Create Custom Invoices in Excel

Designing tailored billing documents allows businesses to ensure that their records meet both client expectations and legal requirements. Customization gives you full control over the content and layout, ensuring that every necessary detail is clearly displayed and easy to understand. Whether you are adjusting the design or adding specific fields, the process can be quick and efficient.

Step 1: Set Up Basic Information

Start by defining the key sections of your document. You’ll want to include elements like your business name, address, and contact details at the top. Following that, list the client’s information and the date of the transaction. Having these fields in place ensures that each document is personalized and ready for further customization.

Step 2: Add Service or Product Details

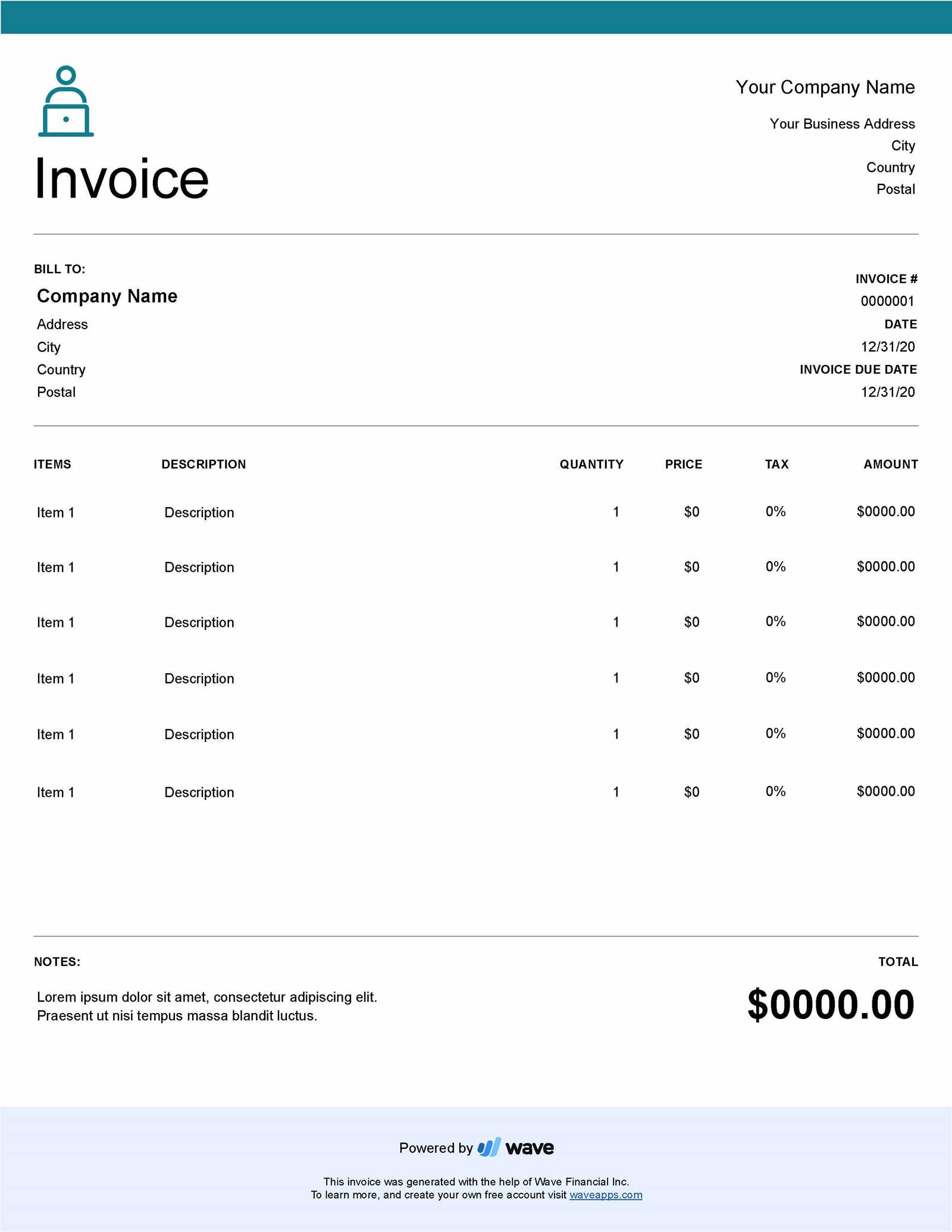

Next, structure the section where you will describe the products or services provided. This is typically done in a tabular format for clarity and ease of reading. Here’s an example of how to organize the information:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Service | 5 hours | $50 | $250 |

| Software License | 1 | $120 | $120 |

Ensure that each entry is properly aligned and that calculations are accurate. You can also add additional columns for discounts or taxes if necessary.

Step 3: Finalize and Save

After entering all the relevant details, double-check everything for accuracy. Once satisfied, save the document and prepare it for distribution to your client. By following these simple steps, you can create personalized, professional records that enhance your business transactions.

Top Features of Excel Invoice Templates

When choosing a digital document for tracking payments and managing billing, certain characteristics can make the process smoother and more efficient. The right tools offer built-in functionalities that simplify calculations, ensure accuracy, and maintain professionalism. Understanding the key features of these tools can help you select the best option for your business needs.

1. Customizable Layout

One of the primary advantages of using pre-designed billing documents is the ability to adjust the layout to fit your specific needs. Here are a few customization options available:

- Ability to change the logo, colors, and fonts

- Adjusting the structure to highlight important sections

- Adding or removing fields such as discounts, tax rates, and payment terms

2. Automated Calculations

Another key feature is the ability to automate financial calculations. This removes the risk of human error and speeds up the billing process. Typical automated functions include:

- Subtotal and total amount calculations

- Tax percentage application

- Discount calculations

3. Professional Design

Professional-looking documents build trust with your clients. These digital billing solutions offer clean, organized designs, including:

- Clear sectioning for company and client details

- Well-organized tables for product or service descriptions

- Space for terms and conditions, payment methods, and additional notes

These features combine to create an efficient, reliable, and visually appealing method for managing business transactions.

Benefits of Free Invoice Templates

Using pre-designed billing documents offers numerous advantages for businesses looking to streamline their payment management process. These resources provide a ready-made structure that simplifies the creation of professional, accurate records. By leveraging these tools, companies can save time and reduce the likelihood of mistakes, while maintaining consistency across all transactions.

1. Cost Savings

One of the most significant benefits of these ready-to-use resources is the cost savings. There’s no need to invest in expensive software or hire specialists to design customized paperwork. Instead, businesses can access professional-grade documents at no charge. Here’s how it helps:

- No subscription fees or one-time purchase costs

- Immediate access to templates with no setup required

- Reduced need for external services, such as accountants or designers

2. Time Efficiency

Pre-made billing documents save a considerable amount of time by eliminating the need for creating new paperwork from scratch. The structure is already in place, and the fields are clearly marked for easy input. Here are some specific time-saving features:

- Quickly enter service details and amounts without formatting

- Automated calculations for totals, taxes, and discounts

- Instantly generate a clean, professional document ready for distribution

3. Easy Customization

Even with a pre-built document, businesses still have the flexibility to make adjustments as needed. Customization options allow you to:

- Modify the layout to suit your brand’s style

- Add personalized terms and conditions

- Include specific payment instructions or notes for clients

These advantages make pre-designed billing solutions an ideal choice for businesses looking to maintain professionalism, save on costs, and increase operational efficiency.

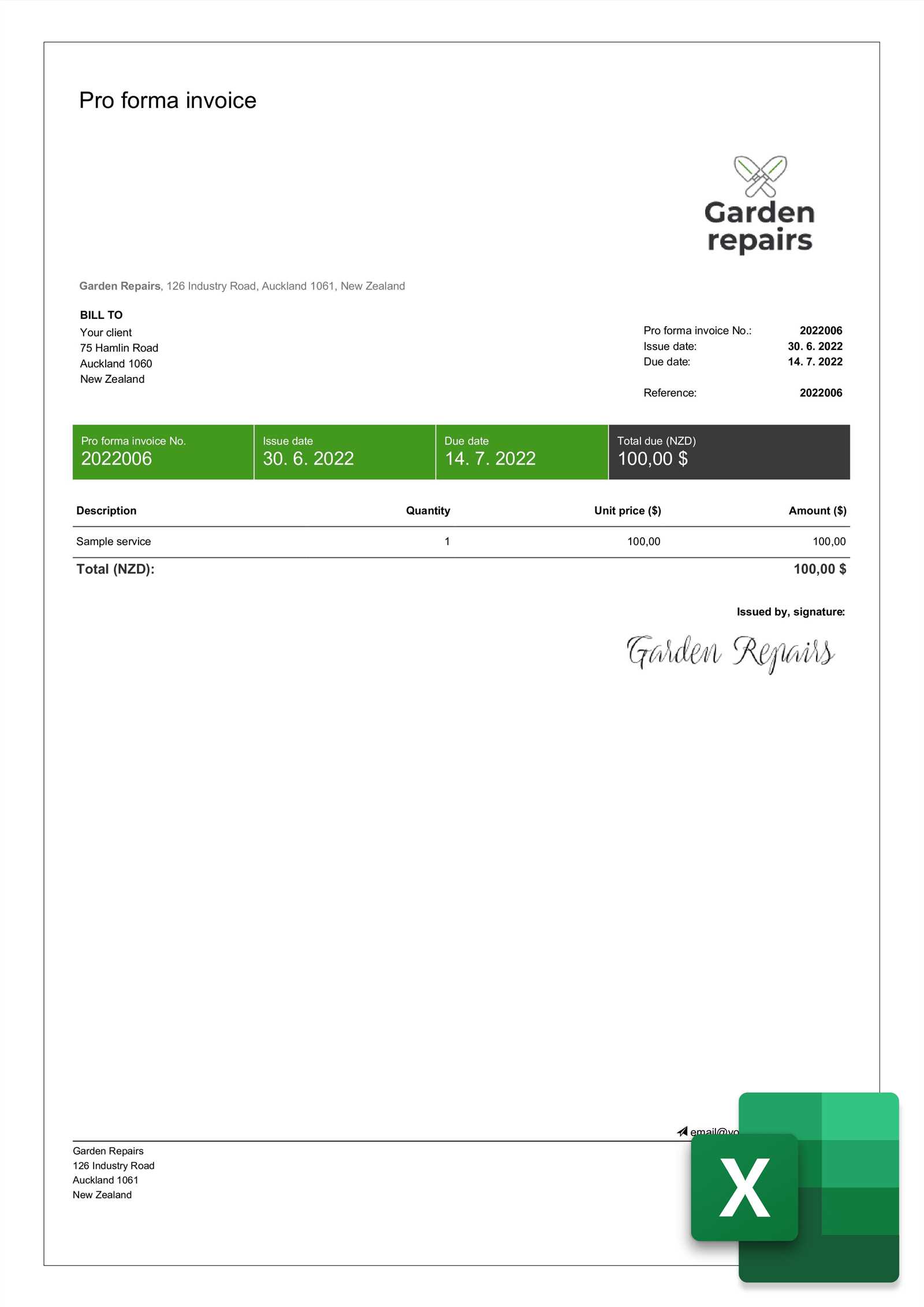

Choosing the Right Invoice Template

Selecting the right document for tracking payments is crucial to maintaining accurate financial records and ensuring smooth transactions with clients. The ideal format will not only reflect your business’s professionalism but also cater to your specific needs, such as the type of services provided or the complexity of the payment terms. With many options available, it’s important to consider several factors before making a choice.

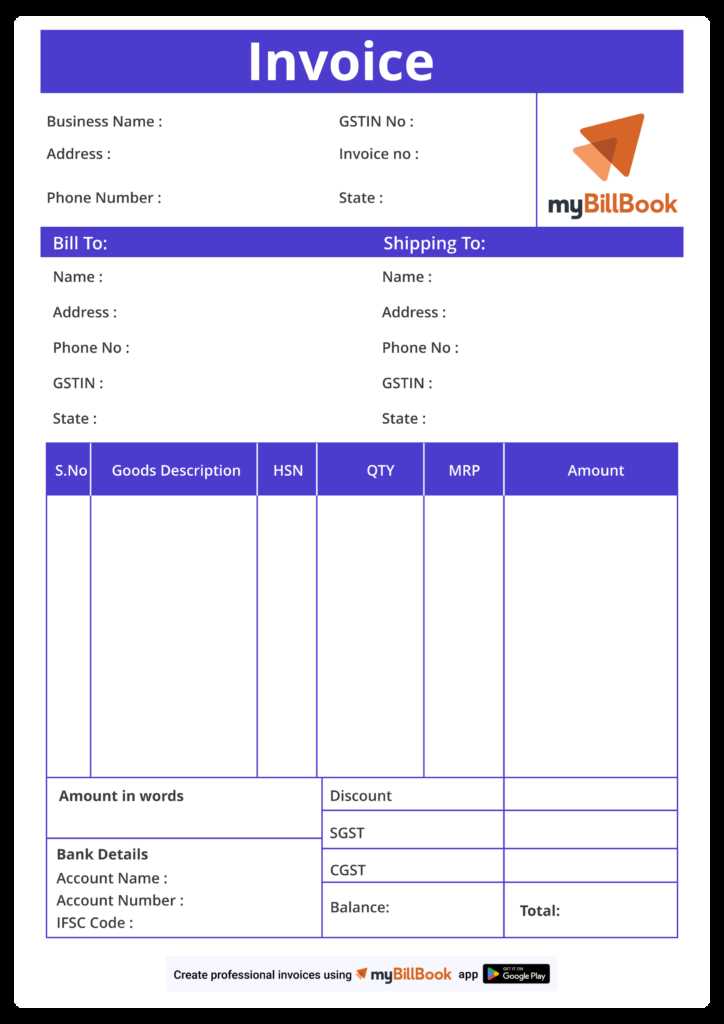

1. Consider Your Business Needs

Every business has unique requirements when it comes to managing payments. Before choosing a document format, it’s essential to assess your needs and determine what elements must be included. Key considerations might include:

- Type of goods or services offered

- Frequency of transactions (one-time vs. recurring)

- Inclusion of discounts, taxes, or special payment terms

- Space for additional information, such as project descriptions or timelines

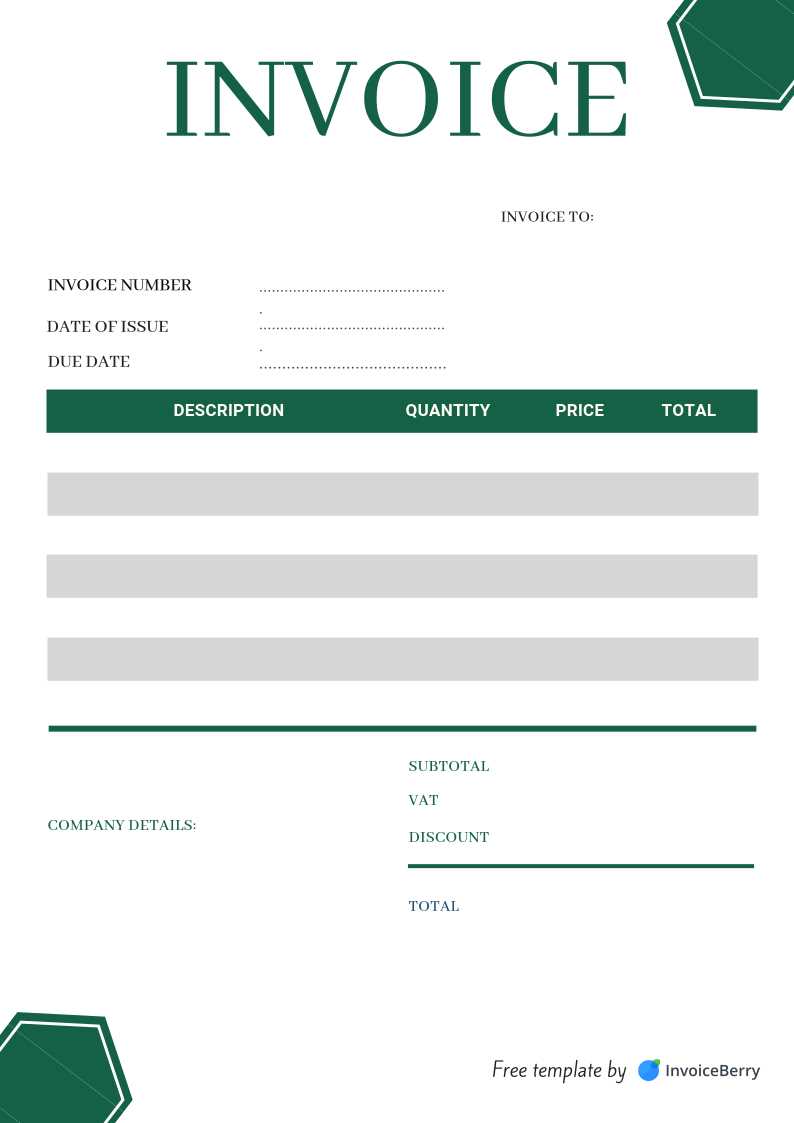

2. Evaluate Design and Functionality

The layout and design of the document should be both clear and functional. Choose a format that allows for easy entry of information while maintaining readability for your clients. Look for these design features:

- Simple and clean layout for easy navigation

- Clearly defined sections for client details, services, and payment information

- Automated fields for totals, taxes, and discounts to avoid errors

- Customizable design elements to match your branding or preferred style

By taking the time to select a format that aligns with your specific business needs and ensuring it offers the necessary functionality, you can improve your billing process and maintain better relationships with your clients.

How to Download Free Invoice Templates

Accessing pre-designed billing documents online is a simple and effective way to streamline your payment management process. Whether you need a one-time solution or a recurring tool, many resources are available for quick download, allowing you to get started right away. The process is usually straightforward, but there are a few steps to follow to ensure you choose the right format for your business.

1. Identify Reliable Sources

To begin, it’s essential to find trustworthy websites that offer downloadable resources. Many websites offer a variety of options, so it’s important to select platforms known for quality and security. Here are some tips:

- Look for reputable sites with good reviews and a track record of providing useful resources.

- Ensure the website offers safe download options to avoid potential malware.

- Check if the resources are customizable and compatible with your preferred software.

2. Select the Right Format

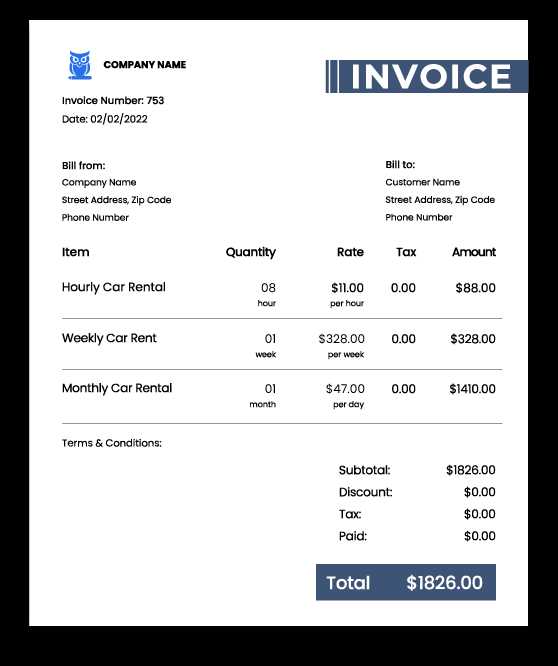

Once you’ve identified a reliable source, it’s time to choose the right document. There are different formats available based on your needs, such as:

- Basic documents with essential fields for quick billing

- More complex layouts with sections for taxes, discounts, and payment terms

- Industry-specific designs tailored for different sectors (e.g., freelancers, consultants, retailers)

3. Download and Customize

After selecting the most suitable document, simply follow the website’s instructions to download it to your device. Once it’s saved, you can easily modify the content to reflect your business details, clients’ information, and the services or products provided.

By following these steps, you can quickly access the tools you need to manage your payments and maintain a professional relationship with clients.

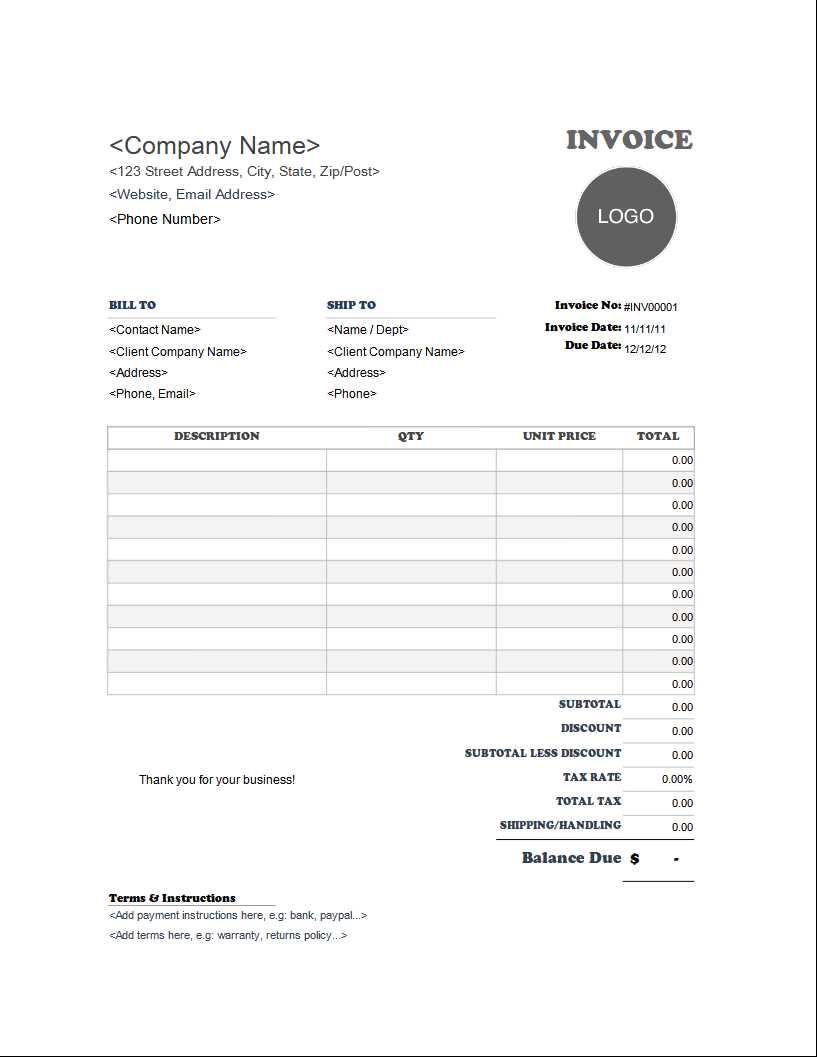

How to Personalize Your Invoice Design

Customizing your billing documents allows you to create a unique and professional look that reflects your brand’s identity. Personalizing the design can help your business stand out, create a more memorable experience for your clients, and ensure consistency in all your financial records. Fortunately, making adjustments to the layout and appearance is simple and can be done in just a few steps.

1. Adjust Branding Elements

To ensure that your document aligns with your company’s visual identity, start by incorporating key branding elements. These may include:

- Logo: Place your company logo at the top or in the header section to reinforce your brand recognition.

- Colors: Choose your business’s primary color scheme for text, headings, or backgrounds to create a cohesive look.

- Fonts: Select professional fonts that match your brand’s style, ensuring they are easy to read and align with your business image.

2. Customize Layout and Structure

Tailoring the layout can help you highlight the most important details and make the document easier to navigate. Consider the following adjustments:

- Rearrange sections: Move important fields such as the total amount, payment terms, or client details to positions that are easily noticeable.

- Adjust spacing: Ensure there is enough white space around sections to avoid a cluttered look and make the document more user-friendly.

- Add extra fields: If necessary, include additional information such as project descriptions, terms of service, or payment instructions.

By taking these steps, you’ll create a professional and unique billing document that reflects your business values while providing all necessary information in a clear, organized way.

Tracking Payments with Excel Invoices

Efficiently managing and tracking payments is a vital part of maintaining a smooth cash flow for any business. Using a well-organized document helps you monitor outstanding balances, payment statuses, and client histories with ease. A simple yet effective approach can greatly reduce the risk of missed payments and improve financial management.

1. Set Up Payment Tracking Columns

One of the first steps in tracking payments is to include specific columns that help you stay organized. Essential fields might include:

- Invoice Number: A unique identifier for each transaction.

- Due Date: The expected date for payment to be made.

- Payment Status: A field to mark if the amount is “Paid,” “Unpaid,” or “Partial.”

- Payment Date: When the client actually paid the amount.

- Balance Due: The remaining amount if the payment is partial.

2. Automate Calculations and Updates

Automating certain calculations can help streamline the tracking process and reduce errors. For example:

- Outstanding Balance: Automatically calculate the balance due by subtracting the paid amount from the total amount.

- Late Fees: Set up formulas to calculate any late fees if payment is overdue.

- Total Payments: Use sum functions to calculate the total amount collected over a period of time.

By incorporating these strategies, you’ll have an organized, automated way to track payments, which will help improve cash flow and reduce administrative burden.

Saving Time with Pre-Made Templates

One of the biggest advantages of using pre-designed billing documents is the amount of time it can save. Instead of creating records from scratch each time, you can simply fill in the necessary details, ensuring consistency and efficiency. These ready-to-use solutions allow you to focus more on your core business activities and less on administrative tasks.

1. Eliminate the Need for Manual Formatting

With pre-designed formats, there’s no need to worry about adjusting margins, font sizes, or aligning text. The layout is already set, so you can immediately input details like service descriptions, payment amounts, and client information. This reduces the time spent on formatting and allows you to get your documents ready faster.

2. Speed Up Data Entry

These documents are structured in a way that makes data entry much quicker. Fields are clearly labeled, and the layout is organized logically, allowing you to:

- Quickly fill in product or service details without having to think about organization.

- Use automated calculations for totals, taxes, and discounts, reducing manual errors.

- Generate multiple copies for different clients or recurring billing periods in a fraction of the time.

By utilizing pre-built solutions, you can drastically cut down the time spent on creating and managing financial records, leaving more time for growth and client relationships.

Using Excel Templates for Small Businesses

For small businesses, managing administrative tasks efficiently is key to maintaining smooth operations and ensuring financial accuracy. Ready-made digital documents can greatly simplify processes like billing, reporting, and tracking payments. These solutions provide an affordable and easy way to keep financial records organized without the need for expensive software or additional resources.

1. Cost-Effective Solution

Small businesses often operate on tight budgets and need to find cost-effective tools to manage daily tasks. Ready-to-use financial documents offer an ideal solution because they are typically available at no cost and require minimal setup. Key benefits include:

- No additional software or subscriptions required.

- Easy to download and use with existing software.

- Reduces the need for hiring external accountants or bookkeepers for basic tasks.

2. Streamlined Workflow

These resources help small businesses save time by simplifying the creation of essential documents. With predefined fields for customer details, services rendered, payment terms, and totals, these tools speed up the process significantly. Other benefits include:

- Automated calculations: Automatically update totals, taxes, and discounts.

- Customizable fields: Adjust the layout to suit your business needs.

- Organized records: Keep track of payments and outstanding balances easily.

3. Professional Appearance

Presenting a polished and professional image is essential, even for small businesses. Using well-structured billing documents helps enhance credibility and ensures consistency across all customer transactions. With these tools, you can:

- Customize the document with your logo and branding.

- Ensure uniformity in format, making your business appear more professional.

- Build trust with clients by providing clear and organized documents.

By adopting ready-to-use solutions, small businesses can improve their financial processes, save time, and focus on what matters most–growing their business.

How to Include Taxes on Your Invoice

Including taxes on your billing documents is an essential part of ensuring compliance with local tax laws and providing transparency to your clients. Accurately calculating and clearly displaying the tax amount helps avoid misunderstandings and maintains professionalism. This section will guide you through the process of incorporating taxes into your financial records in a straightforward manner.

1. Understand Tax Rates

Before you can include taxes, it’s important to know the applicable tax rates for your products or services. Depending on your location and the nature of your business, different rates may apply. Consider the following:

- Sales Tax: This is the most common tax applied to goods and services and varies by region.

- Value-Added Tax (VAT): Used in some countries, this tax is applied at each stage of the supply chain.

- Service Tax: If you provide services, this tax may be applicable in certain jurisdictions.

2. Calculate Tax Amount

Once you know the tax rate, the next step is to calculate the tax amount. This is done by multiplying the taxable amount by the applicable rate. For example, if the total cost of goods or services is $500 and the tax rate is 10%, the tax amount would be:

- Tax Amount = $500 × 10% = $50

3. Add the Tax to the Total

After calculating the tax amount, add it to the original total of the goods or services provided. The final amount to be paid by your client will include both the base price and the tax. For instance:

- Original Total: $500

- Tax: $50

- Final Total: $550

4. Display Taxes Clearly

It’s important to display the tax breakdown clearly on your document to avoid confusion. Typically, you should include:

- Tax rate (e.g., 10% or VAT at 20%)

- The amount of tax applied

- The final total including tax

By following these steps, you can ensure that your billing process is accurate, transparent, and fully compliant with tax regulations, fostering trust and clarity in your client relationships.

Creating Recurring Invoices in Excel

For businesses with ongoing services or subscription-based models, automating the creation of repeat billing documents can save valuable time and reduce errors. Setting up recurring payment records ensures that clients are billed on time, every time, with minimal manual effort. This guide will walk you through how to create automated billing entries for regular transactions.

1. Set Up a Template for Recurring Payments

The first step in creating recurring billing records is to set up a basic structure that includes all necessary fields for each transaction. A standard layout will usually contain the following:

- Client details (name, address, contact info)

- Description of the product or service provided

- Billing period (e.g., monthly, quarterly)

- Amount due for the service

- Payment terms (due date, late fees, etc.)

2. Use Simple Formulas for Automation

Once you’ve created the basic structure, you can use simple formulas to automatically update the billing amount for each cycle. For example:

- Auto-fill Dates: Set up a series of dates to reflect the billing period (e.g., monthly, every 1st of the month).

- Recurring Amount: If the payment amount is fixed, use the same value each month. If it varies, you can set up a cell that allows manual entry for each cycle.

- Late Fees: Include formulas to automatically calculate any late payment penalties based on payment terms.

3. Automate Document Duplication

Instead of creating a new record from scratch each time, you can use the existing setup and easily replicate it. This can be done by copying the initial record and adjusting the relevant details for the current billing period. Here are some tips:

- Duplicate Documents: Duplicate your existing layout to create new billing records for each cycle.

- Update Dates: Adjust the date and billing period to match the new payment term.

- Review Payment History: Track payments by adding a column to record whether the previous cycle was paid.

4. Save and Store for Future Use

Once the structure is set, save your document as a master copy that you can easily update for each new billing cycle. You can store these files for future reference or share them with clients via email as needed. To simplify, consider:

- Using cloud storage for easy access and sharing.

- Organizing by month or client for easy reference.

Editing Invoice Templates in Excel

Customizing your billing records allows you to tailor them to your business’s specific needs and branding. Whether you’re adjusting the layout, adding new fields, or incorporating your company’s logo, editing existing formats can help you create a more professional and efficient document. Here’s how you can easily modify your current records to fit your requirements.

1. Modifying the Layout

The first step in editing your document is to adjust the layout to make it more user-friendly or aesthetically pleasing. You can:

- Resize Columns and Rows: Adjust the width and height to ensure all information fits properly and is easy to read.

- Rearrange Sections: Move fields around to prioritize key information like due dates, amounts, or services provided.

- Change Cell Alignment: Align text and numbers to ensure consistency and clarity throughout the document.

2. Adding or Removing Fields

If your business requires additional information, you can easily add new fields, such as extra service details, payment instructions, or customer references. Conversely, if there are any unnecessary sections, they can be deleted to simplify the document. Here’s how to do it:

- Insert New Rows or Columns: Add fields for additional data, such as project descriptions or delivery terms.

- Remove Unnecessary Sections: Delete any columns that are no longer relevant, such as discounts or payment notes.

- Merge Cells: For better organization, merge cells to create larger spaces for headings or more detailed descriptions.

3. Customizing Branding

To personalize your billing document, incorporate your company’s branding elements such as colors, logos, and fonts. Customizing these visual elements can help reinforce your brand’s identity and make your documents look more professional:

- Add Your Logo: Place your company logo at the top of the document to enhance brand recognition.

- Choose Brand Colors: Use your business’s color scheme for headings, borders, and other key sections.

- Select Appropriate Fonts: Choose professional, easy-to-read fonts that match your brand’s personality.

4. Automating Calculations

If the document includes prices, taxes, or discounts, you can set up automatic calculations to save time and reduce errors. Simple formulas can help calculate totals, taxes, and other amounts without having to do the math manually each time:

- Use SUM Functions: Automatically calculate totals by adding up amounts in the relevant fields.

- Tax and Discount Calculations: Create formulas that automatically apply tax rates or discounts based on the amounts entered.

- Balance Due: Se

Exporting and Printing Excel Invoices

Once your billing document is complete, you may need to share it with clients or print it for your records. Exporting and printing digital records is a simple process, but it’s important to ensure the document is in the correct format and maintains its professional appearance. Whether you’re sending a digital copy or printing a hard copy, the steps to exporting and printing are straightforward and can be tailored to your needs.

1. Exporting the Document for Digital Use

If you need to send the document to your client electronically, it’s essential to export it in a format that is easily accessible and professional. Here are common options for exporting:

- PDF Format: Exporting your document as a PDF ensures that the formatting remains intact and can be opened on any device without alteration.

- CSV or Text Files: If you need to share just the data (for example, to integrate with another system), exporting as a CSV or text file may be the best option.

- Cloud Storage: Save the document to a cloud service like Google Drive or Dropbox, making it easy to share a link with clients or team members.

2. Printing the Document for Physical Records

If you need to print a physical copy of your document, the process is just as simple. Printing ensures that you have a hard copy for your own records or to provide to clients in person. Here are some tips for printing:

- Check Print Settings: Before printing, ensure that the page size, margins, and layout are properly configured to avoid misprints.

- Preview Before Printing: Always preview your document before sending it to the printer to make sure everything fits on the page and appears as intended.

- Use High-Quality Paper: For professional documents, print on quality paper to make a better impression on your clients.

3. Tips for Managing Digital and Physical Copies

It’s essential to keep track of both digital and physical records of your transactions. Here are a few strategies to stay organized:

- Label Files Clearly: Use clear, consistent naming conventions for your digital files to make them easy to find later (e.g., “ClientName_Month_Year”).

- Store Records Securely: Use secure digital storage or cloud services to protect your files from loss, and keep printed records in an organized filing system.

- Keep Backups: Always have backups of your digital documents, in case of hardware failure or other issues.

By exporting and printing your billing records in the right format, you can ensure that both you and your clients have access to clear, professional documents that are easy to store and manage. Whether shar

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining trust with clients and ensuring timely payments. However, there are several common mistakes that can lead to confusion, delays, or disputes. Avoiding these errors will help streamline your payment process and improve your overall business efficiency. Below are some of the most frequent issues that can arise when preparing financial records and how to address them.

1. Missing or Incorrect Client Information

One of the simplest mistakes is neglecting to include accurate client details or providing incorrect contact information. Failing to do so can lead to misunderstandings or delayed payments. Make sure to include:

- Correct company name and address

- Client contact details (email and phone number)

- Accurate purchase order or reference numbers, if applicable

2. Calculation Errors

Errors in adding or calculating totals can result in disputes and delays. Even a small mistake can cause confusion and erode trust. To prevent these issues:

- Double-check all math calculations, especially for taxes, discounts, or additional charges.

- Consider using automatic formulas or tools to handle calculations and reduce the risk of human error.

- Ensure that the final amount matches the agreed terms with your client, including payment schedules.

3. Unclear Payment Terms

Unclear or missing payment terms can cause confusion about when and how payments should be made. To avoid this mistake:

- Clearly state the due date and payment methods available (bank transfer, credit card, etc.).

- Specify any late payment fees or interest charges for overdue amounts.

- If applicable, include early payment discounts to incentivize clients to pay sooner.

4. Not Including Tax Information

In some regions, it’s legally required to display tax amounts separately on your billing documents. Failure to include this can lead to non-compliance issues or confusion with your clients. Make sure to:

- Clearly indicate the tax rate applied to the transaction.

- Include a breakdown of the taxable amount and total tax.

- Ensure that tax calculations comply with local regulations.

5. Lack of Itemization

Being vague about what is being charged can lead to misunderstandings. Instead of simply listing a generic “services rendered” or “goods supplied,” it’s important to provide a detailed description of each item or service provided:

- Break down the charges for each individual product or service.

- Include quantities, unit prices, and any applicable discounts or promotions.

- Provide clear, easy-to-understand descriptions of the services or products for transparency.

6. Missing Invoice Number

Each billing document should have a unique reference number for tracking purposes. Without an invoice number, it can beco

Why Free Templates Are Ideal for Startups

For startups, managing costs and resources efficiently is crucial in the early stages of business growth. When it comes to administrative tasks such as creating professional billing documents, many new businesses face the challenge of balancing quality and affordability. Using pre-designed solutions can be a game-changer by providing an easy, cost-effective way to handle essential business functions without compromising on professionalism. Here’s why utilizing these solutions is particularly beneficial for startups.

1. Cost Savings

One of the most significant advantages for new businesses is the cost savings that come with using no-cost solutions. Instead of investing in expensive software or hiring professionals to create documents from scratch, startups can leverage ready-made solutions to reduce overhead costs. This allows the company to focus financial resources on growth areas such as marketing, product development, and hiring key staff.

- Zero initial investment: There’s no need to purchase expensive software or subscription plans.

- Access to high-quality documents: Even without a significant budget, startups can use well-designed templates that give them a professional edge.

- Flexible options: Many of these pre-made solutions are customizable, allowing businesses to tweak them according to their specific needs.

2. Time Efficiency

For a startup, time is an invaluable resource. Every minute counts when you’re building your business, and creating documents manually can be time-consuming. By using ready-to-use solutions, startup owners and employees can focus on other critical tasks instead of spending hours on document design and formatting.

- Pre-built structure: Most solutions come with pre-defined sections and layouts, which means you don’t have to start from scratch.

- Easy to modify: Customizing these solutions to fit specific client requirements is quick and simple, saving you both time and effort.

- Consistency: Using the same layout for all documents ensures consistency in your communication and helps maintain a professional image.

3. Professional Appearance

As a new business, it’s important to establish credibility and project professionalism from day one. Using high-quality, pre-designed solutions can help startups avoid looking amateurish while still creating polished, well-organized documents. Even without the resources to hire a designer, startups can impress clients with documents that look as though they were created by professionals.

- Industry-standard designs: Pre-made options often follow best practices and industry standards, giving your business a credible appearance.

- Custom branding: Many solutions allow for customization, so you can add your logo and brand colors to ensure consistency with your business identity.

- Client trust: A professionally designed docum