Excel Tax Invoice Template for Australia Download and Customization Guide

Efficient and accurate billing is essential for any business, ensuring smooth transactions and compliance with financial regulations. Many businesses rely on digital tools to create well-organized, professional records that simplify the entire invoicing process. A customizable document format offers flexibility and saves valuable time, allowing business owners to focus on core operations.

By using a pre-designed structure, you can quickly generate professional invoices tailored to your specific needs. These customizable files allow you to adjust details such as payment terms, service descriptions, and tax calculations, all while maintaining a consistent, polished appearance. This level of customization makes it easy to manage your financial records and streamline payment collection.

Whether you’re a freelancer or running a large company, having a reliable system to create billing documents is crucial for maintaining transparency and trust with your clients. With the right tools, invoicing becomes not just a task, but an opportunity to enhance professionalism and improve cash flow management.

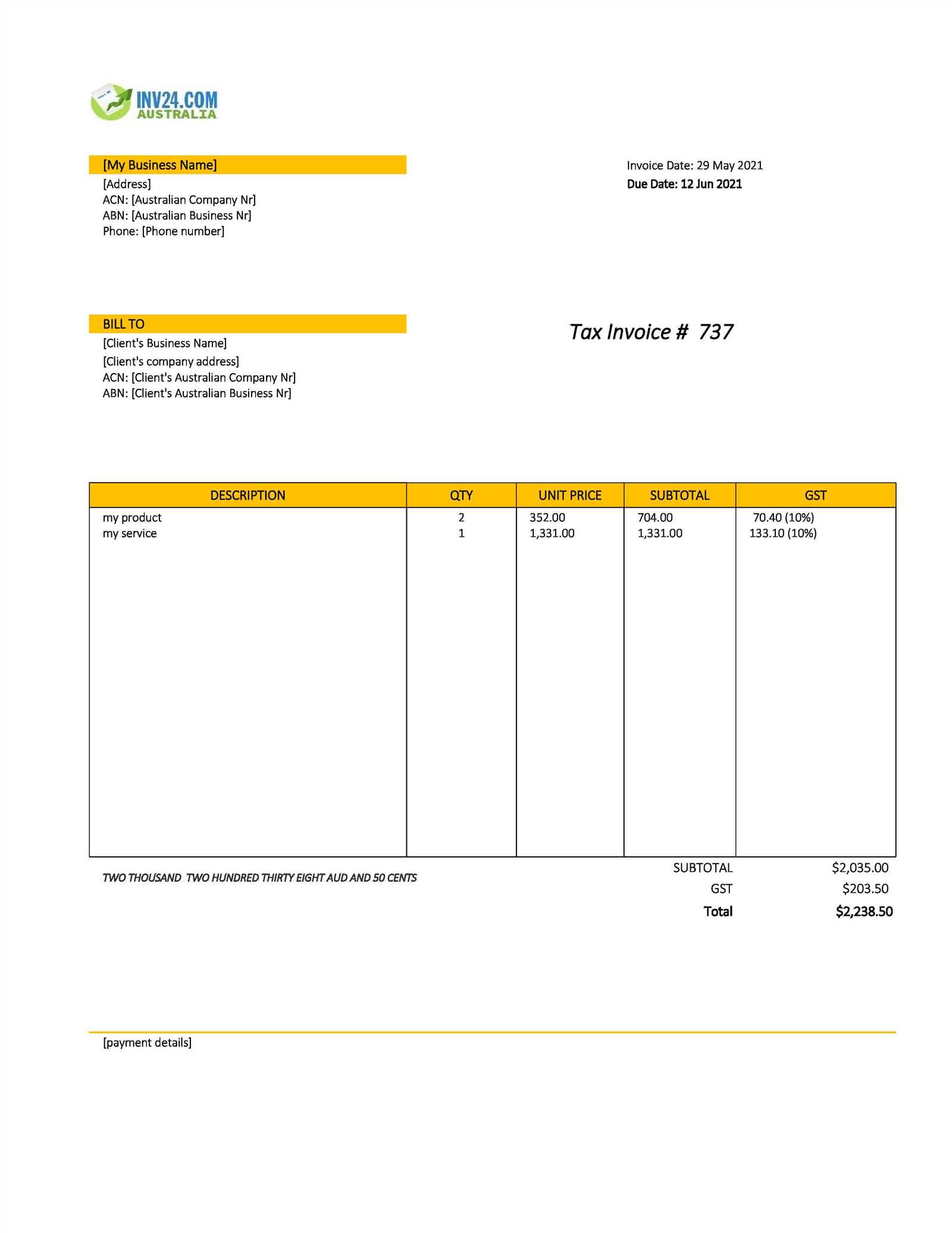

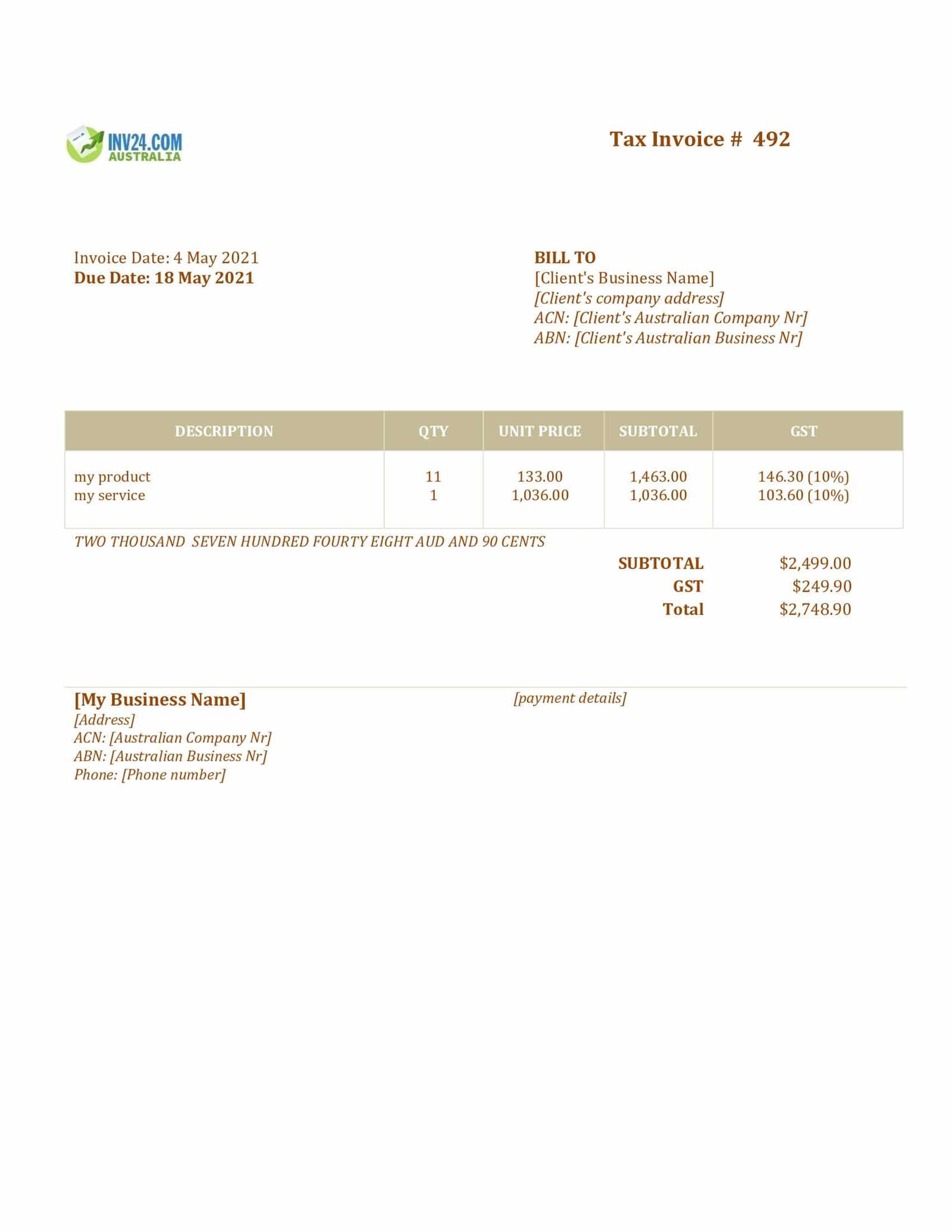

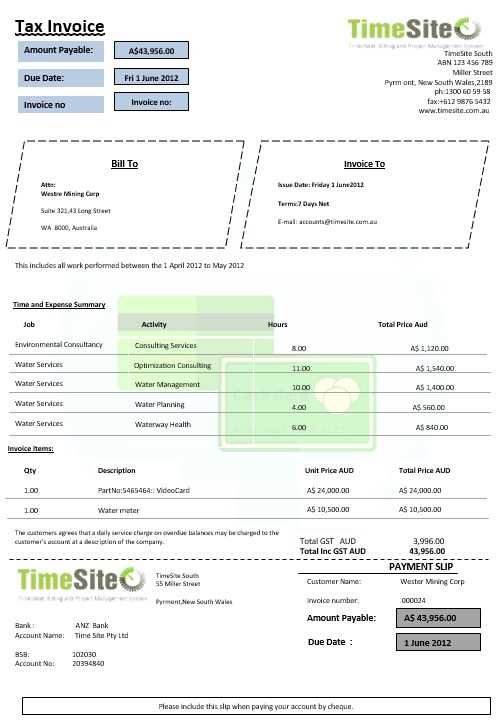

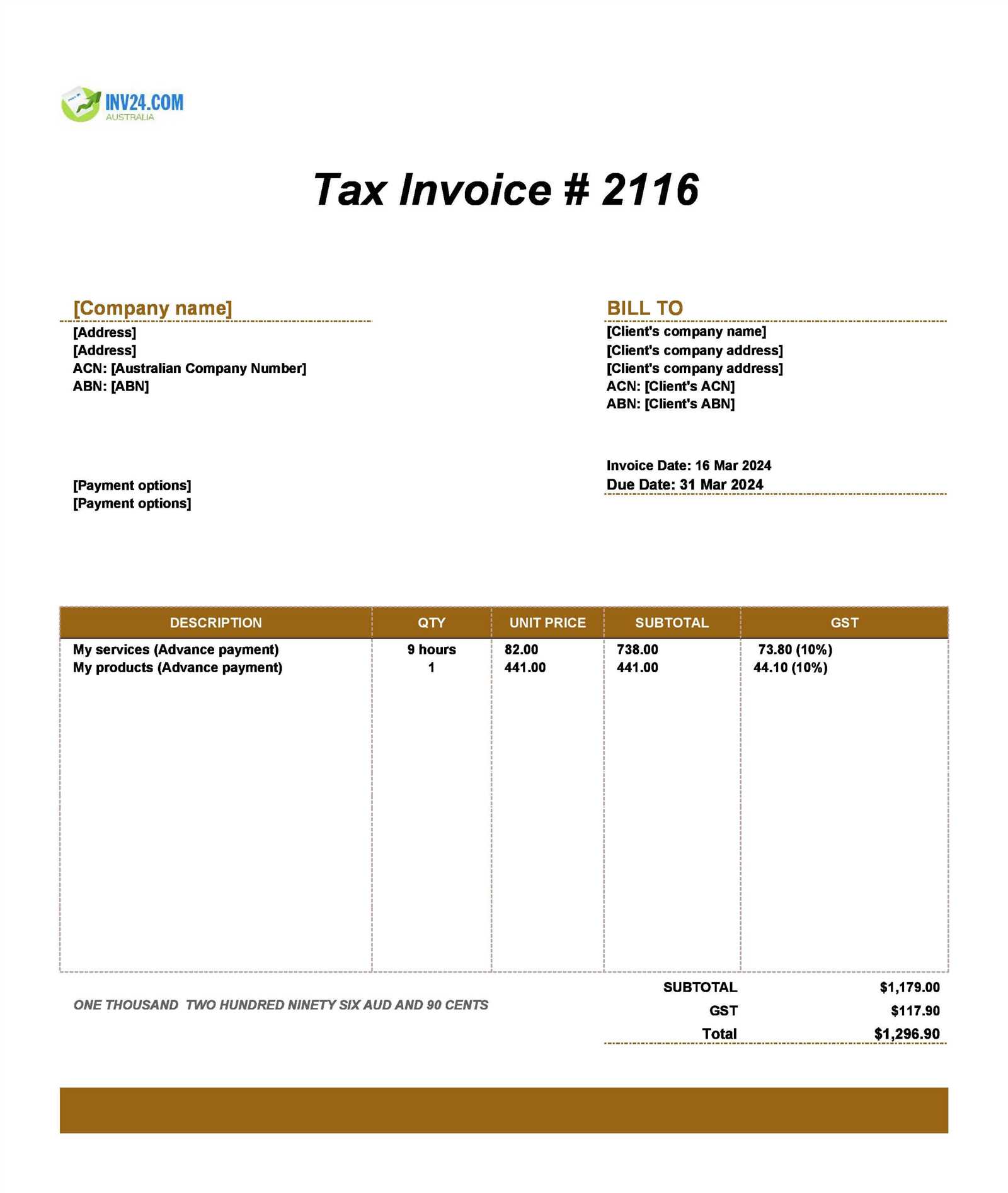

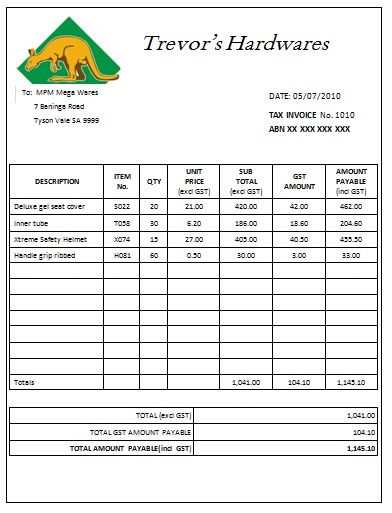

Excel Tax Invoice Template for Australia

Creating a detailed and compliant billing document for your business can be a straightforward process when you use the right tools. A well-structured file designed for generating professional financial records ensures accuracy, reduces errors, and saves you valuable time. These documents can be customized to meet specific needs, including adhering to local regulations and reflecting essential information for transactions.

For business owners in Australia, a tailored billing sheet can help simplify the creation of documents that include required details such as goods or services sold, payment terms, and applicable fees. Using a structured format also guarantees that you stay organized and professional while complying with legal requirements.

Here are key elements you should consider when setting up your billing document:

- Business Information: Include your company name, address, and contact details for clear identification.

- Client Details: List the customer’s name, contact information, and their business details if applicable.

- Description of Services or Goods: Provide a clear breakdown of the items or services provided, including quantities and prices.

- Payment Terms: Clearly state the payment due date, accepted payment methods, and any late fees if applicable.

- Applicable Fees: Ensure that all relevant charges, including any government-imposed fees, are included.

- Unique Reference Number: Use a sequential reference number for easy tracking of all records.

- GST Information: Include any goods and services tax if required, and ensure accurate calculations.

By incorporating these essential elements, you ensure that your financial documents are both professional and compliant. Adjusting this file for different clients and projects is a breeze, making it a versatile tool that can be used repeatedly without much effort. Additionally, these customizable sheets are designed to work well with various accounting software, helping you keep everything in one place.

Why Use an Excel Invoice Template

Using a structured file to manage billing can significantly improve your efficiency and ensure accuracy. It offers a simple yet effective way to create professional-looking records without needing to manually format each one. A well-designed document can save you time, reduce errors, and help you maintain consistency in your financial dealings.

Advantages of Using a Structured Billing File

- Time-saving: A ready-made document allows you to quickly generate professional records without starting from scratch.

- Consistency: Having a set structure ensures that all necessary information is included, avoiding omissions or mistakes.

- Customization: Easily modify the file to reflect your specific business needs, from adding logos to adjusting payment terms.

- Reduced Errors: With preset formulas and sections, the chance of manual calculation errors is minimized.

- Cost-effective: These files are often free or very low cost, making them a budget-friendly option for small businesses.

How It Improves Your Business Processes

- Professional Appearance: Presenting your clients with a polished, well-organized document enhances your credibility.

- Better Record Keeping: A consistent format makes it easier to track past transactions and manage finances.

- Compliance: Using an accurate, structured record helps ensure that your business complies with local regulations, including tax requirements.

- Integration with Accounting Tools: Structured documents can be integrated with software to streamline your entire financial process.

Overall, using a structured file to generate billing records simplifies a complex task and allows you to maintain a high level of professionalism, efficiency, and compliance. With these advantages, it becomes an indispensable tool for any business.

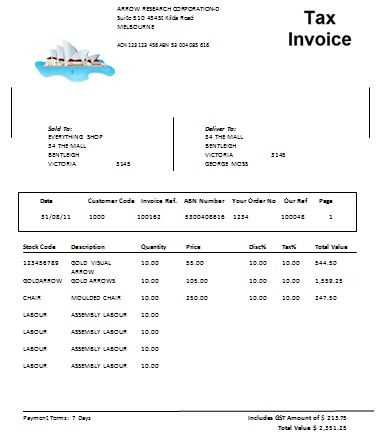

Key Features of Tax Invoices in Australia

In order to maintain transparency and comply with local laws, certain details must be included when issuing financial records in Australia. These documents are not only important for tracking transactions but also ensure that businesses meet the country’s regulatory requirements. Key features help guarantee that the document contains all necessary information for both the issuer and the recipient.

Essential Information for Compliance

- Seller Details: The business name, address, and contact information must be clearly displayed.

- Buyer Information: Including the recipient’s name and contact details ensures both parties are identified.

- Description of Goods/Services: A clear breakdown of products or services provided, including quantities, pricing, and dates.

- Unique Document Number: Each record should have a sequential number for tracking purposes.

- Date of Issue: The date on which the document is created must be noted, providing a timeline of the transaction.

- Payment Terms: Specify due dates, accepted payment methods, and any applicable late fees.

Additional Features for Full Transparency

- GST Information: If applicable, businesses must clearly indicate any Goods and Services Tax charged, along with the GST amount.

- Total Amount Due: The overall sum owed should be clearly marked, including tax and any additional fees.

- ABN (Australian Business Number): Including your ABN is a legal requirement for businesses issuing these records.

- Bank Details: Some businesses may include their bank account information to make payment easier for clients.

By ensuring all these elements are included, businesses can create accurate, professional records that comply with local laws and protect both the seller and the buyer. This level of detail helps avoid any misunderstandings and simplifies

How to Download an Excel Template

Downloading a ready-made file to assist with creating professional billing records is a quick and simple process. These pre-designed documents can be customized to fit your specific business needs, helping you save time and avoid errors. By selecting the right file, you can start using it immediately, making the process more efficient and ensuring accuracy in every transaction.

Steps to Download the Right File

- Choose a Trusted Source: Start by selecting a reputable website or platform that offers reliable and free-to-use billing formats.

- Review the Features: Make sure the document has all the necessary fields such as customer details, item descriptions, and pricing structures.

- Check for Compatibility: Verify that the file is compatible with your software, whether it’s for spreadsheets or accounting tools.

- Click the Download Button: Once you’ve found the right file, simply click the download button to save it to your device.

Customizing Your Downloaded File

- Open the File: Use your preferred spreadsheet program to open the downloaded document.

- Edit the Information: Fill in your business name, client details, and any other specific information that’s relevant to the transaction.

- Save and Share: Once customized, save the document and share it with your client via email or other communication channels.

By following these simple steps, you can quickly access and personalize a billing file that suits your business, he

Step-by-Step Guide to Customizing Invoices

Personalizing a billing document allows you to tailor it specifically to your business needs and ensure that all the necessary details are clearly presented. Customizing your records is an essential step for maintaining professionalism and compliance with industry standards. This guide will walk you through the process of adapting a pre-designed format to suit your unique requirements.

Step 1: Open the Document

The first step in customizing your billing file is to open it in your preferred spreadsheet program. Ensure that the document is formatted correctly and that all essential sections are included, such as payment terms, item descriptions, and totals.

Step 2: Add Your Business Information

- Company Name: Enter your business name at the top of the document.

- Contact Details: Include your business address, phone number, and email address for easy communication.

- Logo (Optional): You may also choose to add your business logo for a more professional appearance.

Step 3: Customize Client Information

- Client Name: Enter the name of the customer or company you’re billing.

- Contact Information: Include the customer’s address, email, and phone number for reference.

- Client ID (Optional): If you assign client IDs for tracking purposes, ensure to include it in the document.

Step 4: Update Product or Service Details

- Description: List each product or service provided, along with a clear description of each.

- Quantity: Indicate the number of items or hours worked for each service.

- Price: Ensure that unit prices are accurate, and total them up to provide a clear summary.

- Additional Costs: If applicable, add any additional charges or fees such as shipping or handling costs.

Step 5: Set Payment Terms and Due Date

- Payment Terms: Specify the payment methods you accept (bank transfer, credit card, etc.) and any late fees for overdue payments.

- Due Date: Clearly state the payment due date to avoid confusion and ensure timely payments.

Step 6: Review and Save

Before finalizing, double-check the information to make sure everything is correct, from item descriptions to the total amount due. Once everything looks good, save the document and make a backup copy if necessary. You can then send it to the client via email or print it out as needed.

By following these steps, you can easily customize your billing documents to suit your business needs, ensuring accuracy and professionalism in every transaction.

Understanding GST on Australian Invoices

In many countries, businesses are required to charge an additional percentage on goods and services they sell, known as a consumption tax. In Australia, this is known as the Goods and Services Tax (GST). It is crucial for businesses to correctly apply and display this tax on their billing records to ensure compliance with local regulations and to maintain transparency with clients.

The GST is typically set at 10% of the sale price, and it applies to most goods and services. However, there are some exemptions and special rules for certain items, like basic food, medical supplies, and education services. Understanding how and when to apply GST is essential for businesses to avoid errors and penalties from the Australian Taxation Office (ATO).

When creating a billing document, the GST must be clearly shown in a separate line, so the customer can see exactly how much tax is being added to the total price. This makes the breakdown of charges transparent and ensures that both the business and the client understand the financial details of the transaction.

It’s important to note that businesses with an annual turnover above the GST registration threshold (currently AUD 75,000) must register for GST with the ATO. Once registered, these businesses must charge GST on their sales and remit the tax to the government. For smaller businesses or individuals who aren’t registered, GST is not applicable to their transactions.

By properly managing GST in your billing documents, you ensure that your business remains compliant with local tax laws and provides clear, accurate financial records for your clients.

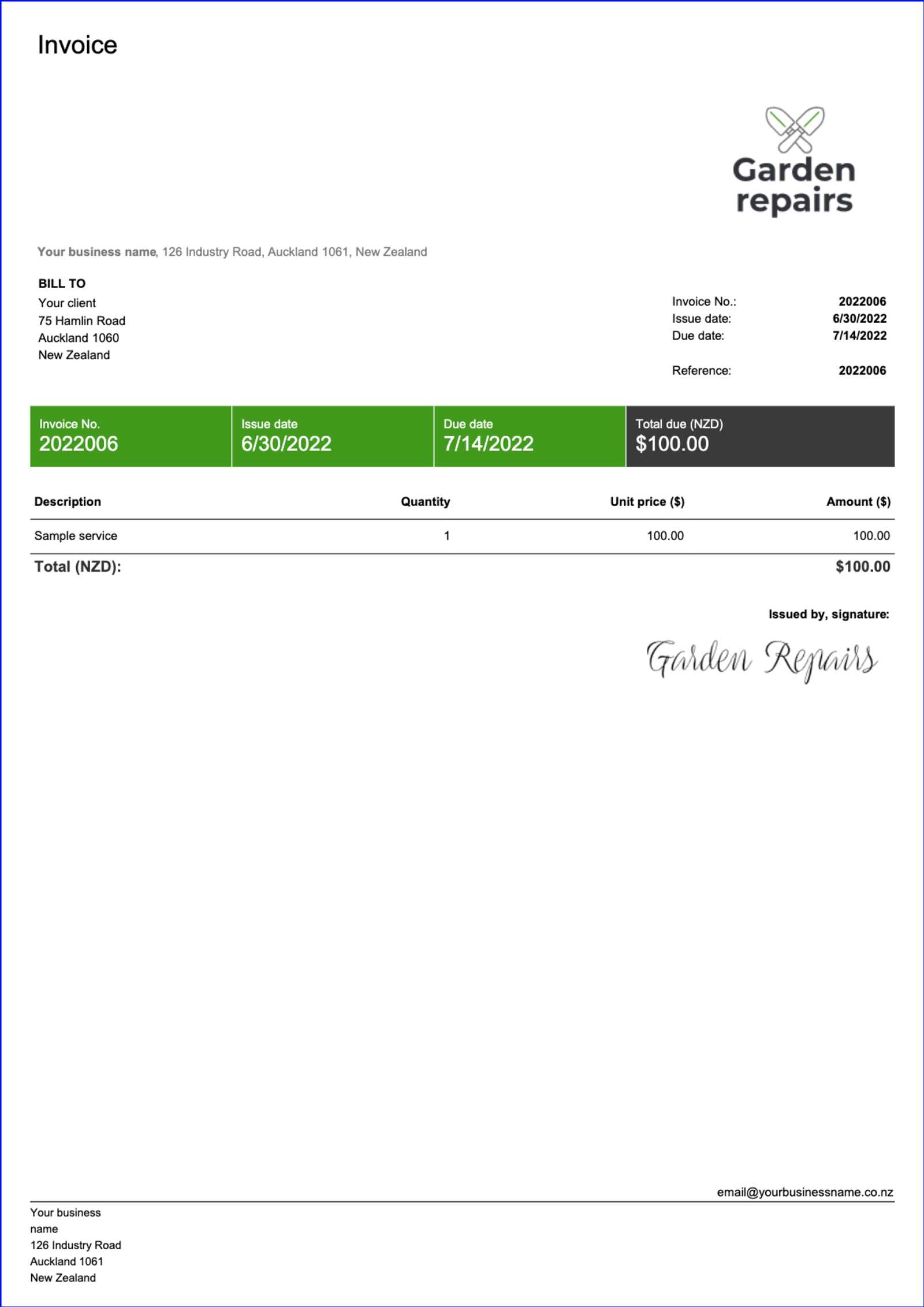

Creating Professional Invoices in Excel

Crafting a professional and organized document for billing is essential to maintain credibility and streamline your financial processes. A clean, well-structured record not only reflects your business’s professionalism but also ensures smooth transactions and clear communication with clients. By using a structured format, you can efficiently manage your sales and reduce the risk of errors.

Key Elements of a Professional Billing Document

To create an effective billing record, there are several key elements to consider. Each part of the document should be clear and easy to read to avoid any confusion for the recipient.

- Company Information: Include your business name, contact details, and logo to establish your brand’s identity.

- Client Information: Ensure the recipient’s details, including name, address, and contact information, are clearly listed.

- Detailed Breakdown: Clearly describe the products or services provided, with unit prices and quantities, along with any discounts applied.

- Payment Terms: State the due date for payment, any late fees, and preferred payment methods.

- Clear Total: Make sure the total amount, including taxes and additional fees, is easy to locate.

Formatting Tips for a Professional Look

Once the necessary information is entered, formatting the document properly can make a big difference in how it is perceived. A clean layout, proper alignment, and consistent fonts give the document a polished, professional appearance.

- Use Clear Headings: Organize the sections with bold headings so each part of the document is easy to navigate.

- Consistent Font Style: Stick to one or two professional fonts, like Arial or Times New Roman, and keep font sizes consistent for readability.

- Proper Alignment: Align text to the left for readability and ensure the amounts are right-aligned to make calculations easy to follow.

- Use Gridlines or Borders: Adding borders or gridlines between sections can help separate different areas of information, improving clarity.

By paying attention to both content and design, you can create a professional document that enhances your business’s image and facilitates smooth transactions with clients.

Common Mistakes When Using Invoice Templates

While using a pre-designed format for creating billing records can save time and ensure consistency, it is easy to overlook important details or make mistakes that can lead to confusion or errors in payments. Being aware of common pitfalls and knowing how to avoid them is key to ensuring that your documents are both accurate and professional.

Missing or Incorrect Information

One of the most common mistakes when using a ready-made document is failing to include or update essential details. It’s easy to forget to replace placeholder text or to overlook updating business information. This can result in incomplete or outdated records being sent to clients, which can cause delays in payment or confusion.

- Incorrect Client Information: Ensure that client details, such as name, address, and contact information, are correct and up-to-date.

- Missing Payment Terms: Always include clear payment due dates, accepted payment methods, and any late fees to avoid misunderstandings.

- Inaccurate Pricing: Double-check the prices, quantities, and totals to ensure accuracy and avoid overcharging or undercharging customers.

Not Adhering to Legal Requirements

Another significant mistake is failing to comply with local business regulations or legal requirements. Even if the format looks correct, not including necessary details, like registration numbers or tax amounts, can lead to complications for your business, especially during audits or tax filings.

- Omitting GST or Other Taxes: If applicable, make sure to include the correct tax rates and amounts, and clearly show these charges on the document.

- Failure to Include Your ABN: For businesses in certain regions, including your Australian Business Number (ABN) is a legal requirement for all formal billing records.

- Not Including Unique Invoice Numbers: Sequentially numbered documents are important for organization and legal tracking.

By being mindful of these common mistakes, you can ensure that your billing documents are both accurate and compliant, fostering smoother transactions and stronger client relationships.

How to Add Your Business Logo

Including your company logo in billing documents adds a professional touch and reinforces your brand identity. It’s a simple step that can help make your business stand out while giving the document a polished, cohesive look. Adding a logo to your record is easy to do, and it ensures that your brand is visible every time a client receives a document from you.

Here’s how you can add your business logo to your billing document:

Step 1: Prepare Your Logo File

Before adding your logo, make sure it is saved in a compatible image format, such as JPG, PNG, or GIF. If you have a high-quality vector file (like SVG or EPS), that’s even better, as it ensures the logo remains sharp when resized.

Step 2: Insert the Logo into the Document

- Open the Document: Start by opening your billing document in your preferred spreadsheet program.

- Select the Header Area: Typically, the logo is placed in the header section of the document, usually on the top left or center.

- Insert the Image: Use the “Insert” or “Add Image” option in your program’s menu, and choose your logo file from your computer.

- Resize as Needed: Once the logo is inserted, you may need to adjust the size to fit neatly within the header area without overwhelming the text.

Step 3: Position and Align the Logo

After inserting the logo, it’s important to ensure that it’s aligned correctly. You can position it to the left, right, or center depending on your design preference. Just make sure the placement doesn’t interfere with the other essential details on the document, like the client’s information or the payment terms.

Step 4: Save Your Document

Once you’re happy with the logo’s placement, save your file. If you plan to reuse the document, consider saving it as a master copy so you can easily update the information for future billing records.

By following these steps, you can ensure that your business logo appears on all your billing documents, helping to reinforce your brand image and creating a more professional experience for your clients.

Tips for Proper Invoice Numbering

Numbering your billing records correctly is essential for organizing transactions and ensuring compliance with legal requirements. A clear and consistent numbering system helps track payments, prevents confusion, and allows for easy reference in the future. Whether you are just starting or have been in business for years, establishing a well-organized system for assigning numbers is crucial for maintaining accurate records.

Best Practices for Numbering Your Billing Documents

- Use a Sequential System: Always assign numbers in a consistent, chronological order. This makes it easier to track past records and avoid duplicating numbers.

- Start with a Unique Prefix: Consider using a prefix, such as the year (e.g., 2024) or a short code for your business, to help easily categorize and identify documents. For example, “INV-2024-001” indicates the first document issued in 2024.

- Avoid Gaps or Repetition: Never skip numbers or reuse them. Gaps in your numbering sequence can cause confusion and disrupt the order, while repetition can lead to errors when reconciling accounts.

- Consider Using a Digital System: If you’re generating many records, using a digital or accounting program to automatically assign sequential numbers can save time and ensure accuracy.

- Include Prefix for Different Types of Records: If you issue various types of documents (e.g., estimates, orders, or payments), consider using separate prefixes or categories for each. This keeps everything organized and helps you distinguish between different types of documents at a glance.

Additional Tips for Managing Your Numbering System

- Use Leading Zeros: If you plan on having a large number of documents, use leading zeros to maintain uniformity. For example, use “INV-2024-001” instead of “INV-2024-1” to make sure the numbers stay aligned when sorted.

- Track Your Numbers in a Spreadsheet: Keep a record of assigned numbers in a separate spreadsheet or document. This ensures that no number is skipped or repeated and can be referenced quickly.

- Review Regularly: Periodically check your system for consistency and accuracy. Make sure all records are numbered properly, and resolve any discrepancies promptly.

By following these tips for proper number

Formatting Your Invoice for Clarity

Proper formatting of your billing document is essential to ensure that all details are easy to read and understand. A clear and well-organized layout not only improves the professionalism of the document but also helps avoid misunderstandings, allowing both you and your client to quickly locate the necessary information. Clear formatting makes the payment process smoother and more efficient for both parties.

Key Formatting Tips for a Clean and Professional Look

- Use Clear Headings: Each section of your document should be clearly labeled with headings such as “Client Information,” “Item Descriptions,” and “Payment Terms.” This helps recipients easily navigate the document.

- Highlight Important Information: Key details like the total amount due, payment due date, and contact information should be made more noticeable. You can use bold text or larger font sizes for emphasis.

- Keep It Simple: Avoid cluttering your document with unnecessary graphics or excessive text. Stick to the essentials and ensure that the information flows logically from one section to the next.

- Use Ample White Space: Don’t overcrowd the document. Leave enough space between sections, rows, and columns to make the document easy on the eyes. Proper spacing also enhances readability.

- Align Text Properly: Ensure that text is properly aligned. For example, numbers should be right-aligned to make calculations easier, and text should be left-aligned to improve readability.

Formatting the Tables and Lists

- Separate Information with Borders: Using borders or lines to separate sections like item lists, subtotals, and taxes can make the document look organized and ensure that nothing gets overlooked.

- Keep Columns Consistent: Make sure the columns for quantity, description, price, and total are consistently aligned. This allows for easy scanning and comparison.

- Use Bullet Points or Numbered Lists: When listing items or services, consider using bullet points or numbered lists. This improves clarity and ensures each item stands out on its own.

By following these formatting tips, you can create a clean, easy-to-understand billing document that reduces the chances of confusion and enhances your business’s professionalism. A well-formatted document builds trust with your clients and helps streamline the payment process.

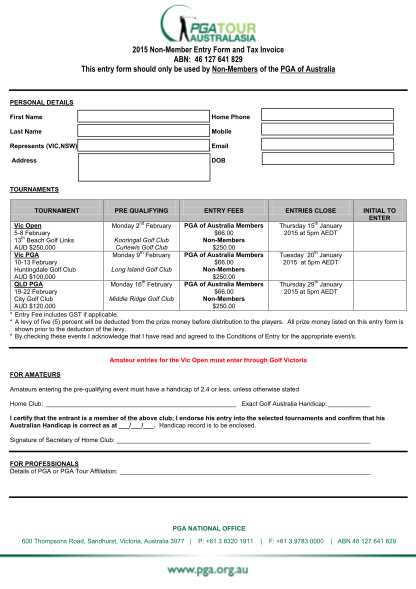

Incorporating Payment Terms in Excel

Clearly stating payment terms in your billing documents is essential to ensure both you and your client are on the same page regarding due dates, accepted payment methods, and any applicable fees. By specifying these terms upfront, you help manage expectations and reduce the likelihood of misunderstandings or late payments. Incorporating payment details into your billing format not only ensures legal compliance but also establishes professionalism in your transactions.

When adding payment terms to your billing document, it’s important to include several key components. These terms provide the necessary details for your client to understand when and how to make payments, along with any potential penalties for late payments.

Key Elements to Include in Payment Terms

- Due Date: Clearly state the date by which payment is expected. This helps set clear expectations and provides a reference point for both parties.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfer, credit card, or online payment platforms. This ensures that your client knows how to complete the transaction.

- Late Fees: Specify any late payment penalties, including how much extra will be charged after the due date. This encourages prompt payment and protects your business from delays.

- Discounts for Early Payment: If applicable, mention any discounts for early settlement, which can incentivize clients to pay sooner.

- Bank Details or Payment Link: If you’re requesting payment through bank transfer or another method, provide the necessary bank account details or a payment link to make the process as easy as possible for the client.

Including these details not only makes your billing documents more informative but also ensures that your clients have all the necessary information to complete the transaction on time. A well-defined payment structure improves cash flow and promotes smoother business operations.

How to Incorporate Payment Terms in Your Document

- Positioning: Place the payment terms clearly at the bottom of the document or near the total amount due. This makes it easy for clients to find.

- Formatting: Use bold text, bullet points, or underlining to make payment terms stand out. This ensures that your client doesn’t miss this critical information.

- Consistency: Use the same language and format across all your documents to maintain consistency and avoid confusion.

How to Handle Multiple Currencies

When doing business internationally, it is crucial to manage payments in different currencies. Having the ability to correctly present multiple currencies in your billing records helps avoid confusion and ensures that your clients understand the amounts they owe. Proper currency management can also prevent costly errors related to conversions and exchanges, ensuring smooth transactions across borders.

To handle multiple currencies effectively, it’s important to clearly display both the local currency and any foreign currencies involved in the transaction. You should also include the exchange rate used and make sure that the final amount due is clearly indicated in the appropriate currency.

Key Considerations for Dealing with Multiple Currencies

- Always Display the Currency Symbol: Clearly state which currency is being used by including the appropriate symbol (e.g., $, €, £) or the currency code (e.g., USD, EUR, GBP) next to amounts.

- Provide the Exchange Rate: If you are dealing with multiple currencies, include the exchange rate used for the conversion. This helps ensure transparency in case there are any questions about the rates applied.

- Show Totals in a Single Currency: If your document includes different currencies, it’s helpful to provide a total amount due in a single, preferred currency (usually the one of the seller’s business location) for simplicity.

- Include Payment Method Details: If the payment method supports currency conversion (e.g., PayPal or bank transfers), mention it so your client knows how to make the payment in the correct currency.

Example of Multiple Currency Handling

Here is an example of how you might structure the document when dealing with more than one currency:

| ItemEnsuring Compliance with Australian Tax Laws

Ensuring that your business operations comply with local financial regulations is essential for maintaining transparency and avoiding penalties. Adhering to the required laws helps you build trust with clients and authorities, ensuring smooth transactions and proper record-keeping. Compliance is particularly important when managing financial documents, as it ensures you meet all legal requirements for reporting and collecting payments. For businesses operating in certain regions, including Australia, there are specific legal obligations to follow, especially when issuing documents related to payments and transactions. Knowing the key rules and incorporating them into your documents is crucial for both avoiding fines and ensuring that all relevant details are correctly presented to clients. Key Compliance Aspects for Financial Documents

Common Compliance Pitfalls to Avoid

By ensuring that your documents align with the legal framework, you help safeguard your business against potential fines or disputes while maintaining a professional reputation. Stay How to Save and Share Invoices in ExcelOnce your billing documents are ready, it’s important to save them in a format that ensures both easy access and protection. Storing these documents properly ensures that you can retrieve them quickly when needed for future reference, audits, or payment follow-ups. Additionally, knowing how to share these documents securely with clients can help maintain professionalism and streamline communication. When saving and sharing financial documents, consider the most efficient methods that provide both convenience and security. Using the right formats and tools ensures that your clients can easily open and view the document, while maintaining the integrity of the information contained within. Saving Your Documents for Future Access

Sharing Documents with Clients

By properly saving and sharing your billing documents, you can maintain an organized system, ensure your clients receive the correct documen Integrating Excel Templates with Accounting SoftwareStreamlining financial processes is essential for businesses looking to improve efficiency and accuracy. One effective way to achieve this is by integrating your billing documents with accounting systems. This integration allows you to reduce manual data entry, minimize errors, and keep all your financial records synchronized across different platforms. By connecting your billing data with accounting software, you create a seamless workflow that enhances overall productivity. Integrating your billing format with accounting systems not only saves time but also ensures that all financial records are properly maintained, which is crucial for tax filing, reporting, and general business management. There are various methods to link your documents with software, and choosing the right one depends on your business needs and the tools you’re using. Benefits of Integration

How to Integrate with Accounting Software

Integrating your financial documents with accounting software makes it easier to manage your business fi Benefits of Using Excel for InvoicesManaging billing documents efficiently is vital for any business, and utilizing spreadsheet software offers numerous advantages for streamlining the process. Whether you’re a small business or a large enterprise, using spreadsheets to create and manage payment documents can significantly enhance productivity and accuracy. With customizable features, easy formatting, and the ability to automate calculations, spreadsheets are a practical solution for businesses aiming to improve their billing processes. Spreadsheets provide flexibility, allowing you to design your documents according to specific needs. Additionally, they can integrate seamlessly with other business tools, such as accounting software, making financial management simpler and more accurate. Below are some key benefits of using spreadsheet software for your billing documents. Key Benefits

Integration with Other Systems

Incorporating spreadsheets into your billing process offers flexibility, efficiency, and precision. By taking advantage of these benefits, businesses can streamline their financial workflows and maintain a professional image while saving both time and resources. Top Free Excel Templates for Australian BusinessesFor small businesses and startups, using pre-designed documents can save both time and effort, especially when managing routine administrative tasks like billing and reporting. Many online platforms offer free resources that allow entrepreneurs to create professional documents without the need for specialized software. These resources can be easily customized to suit the specific needs of your business, helping you stay organized and efficient. When it comes to creating financial documents, there are several free options available that are well-suited for businesses in Australia. These resources come with built-in features that simplify the process, ensuring that the documents comply with local regulations and business standards. Below are some of the top free resources that Australian businesses can use for managing payments and financial records. 1. Simple Billing and Payment Record TemplatesThese basic templates are ideal for businesses that need to track payments and manage simple transactions. With fields for client information, product descriptions, quantities, and pricing, these templates offer an easy way to generate billing documents and monitor payments. They can be tailored for any business type, from service providers to product sellers.

2. Expense Tracking and Budgeting TemplatesThese templates are perfect for businesses looking to manage their expenses and keep track of their financial health. The templates typically include sections for tracking various expenses, such as office supplies, utilities, and employee wages, while also providing a budget overview. This helps business owners stay on top of their finances and ensure they remain within their budget.

3. Client Payment Reminder and Follow-Up TemplatesFor businesses with a large number of clients, keeping track of unpaid bills can be a challenge. These templates are designed to help remind clients of overdue payments in a professional manner. With built-in sections for payment terms and overdue charges, these documents provide a clear and polite reminde |

|---|