Excel Proforma Invoice Template for Streamlined Billing

Managing business transactions can be time-consuming and complicated without the right tools. Whether you’re a freelancer, small business owner, or part of a larger company, using a structured document for billing is essential for clarity and efficiency. A well-organized record not only saves time but also helps ensure that all necessary details are clearly communicated to your clients.

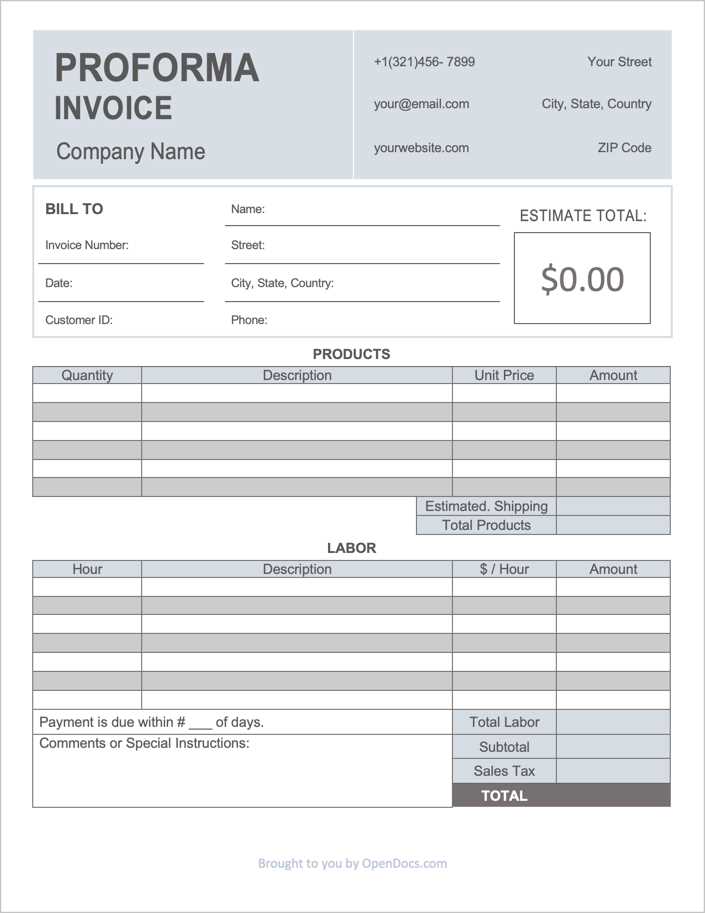

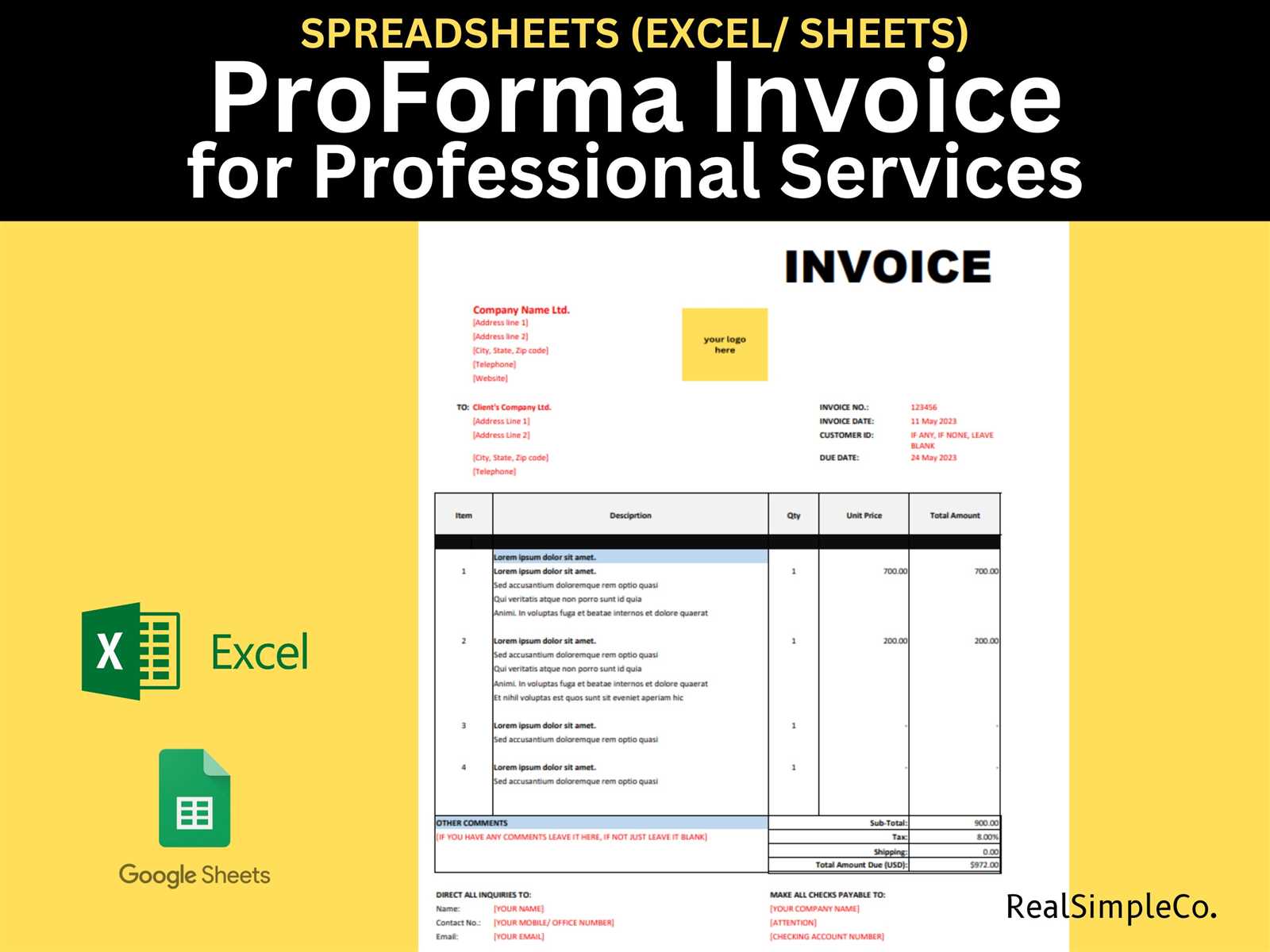

One of the most effective ways to create professional billing records is by using customizable spreadsheets. These documents allow you to input all relevant details such as product descriptions, quantities, pricing, and payment terms. By using a ready-made format, you eliminate the risk of missing essential information or creating inconsistencies that could lead to disputes.

In this guide, we will explore how to create and use such a document, highlighting its advantages and practical features. With the right setup, you’ll be able to generate accurate records quickly, making the financial aspect of your business smoother and more organized.

Excel Proforma Invoice Template Overview

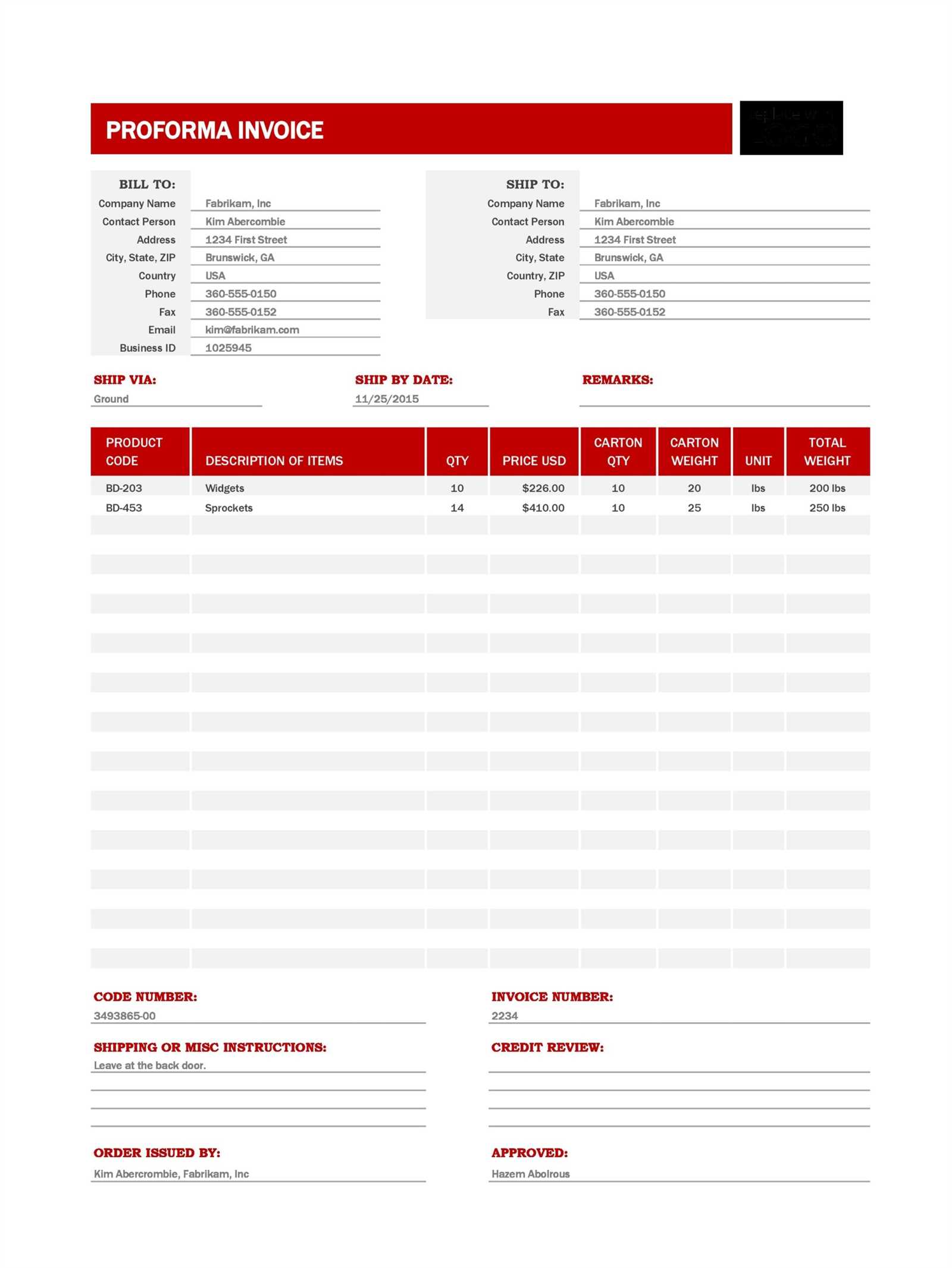

A well-organized document for business transactions can be a powerful tool for managing sales and ensuring smooth communication with clients. By using a predefined structure, you can quickly create accurate records that reflect the agreed-upon terms, quantities, and pricing details. This process not only improves efficiency but also reduces the likelihood of errors or misunderstandings that could arise from custom-built documents.

The concept of using a structured spreadsheet for billing allows for easy customization to suit different business needs. With fields for item descriptions, quantities, pricing, and payment conditions, such a record keeps everything in one place, making it easy to review and share. Whether you are dealing with a single transaction or multiple clients, this approach provides a consistent format that simplifies the management of sales and payments.

This type of document also offers flexibility, as it can be adjusted to meet the requirements of various industries and business models. By utilizing a standard format, you ensure that all necessary details are included while maintaining a professional appearance. As a result, this solution becomes an indispensable tool for businesses looking to streamline their financial operations and maintain accurate records with minimal effort.

Why Use an Excel Template for Invoices

Using a structured document for business billing offers numerous advantages, particularly when it comes to consistency, efficiency, and accuracy. Instead of starting from scratch each time, a pre-designed format allows for quick data entry while maintaining a professional appearance. This can save time and reduce the chances of making costly errors, ensuring that all the required details are included every time a record is created.

Time-Saving and Efficiency

One of the most significant benefits of using a pre-built document is the amount of time saved. With a ready-made format, you can focus on inputting the specific details of a transaction, rather than spending time formatting or worrying about layout. This leads to faster processing of transactions, enabling businesses to meet deadlines and maintain a smoother workflow.

Consistency and Professionalism

Having a consistent format for all billing documents ensures that your records look professional and are easy for clients to understand. A uniform structure also helps reduce confusion, as clients will become accustomed to seeing the same style of document for each interaction. This level of professionalism can improve your company’s reputation and enhance trust between you and your clients.

By utilizing such a document, businesses can maintain better organization, reduce administrative work, and ensure that all billing details are accurate and consistent. This simple solution ultimately contributes to a more streamlined financial process, freeing up resources to focus on growth and customer satisfaction.

Key Features of Proforma Invoices

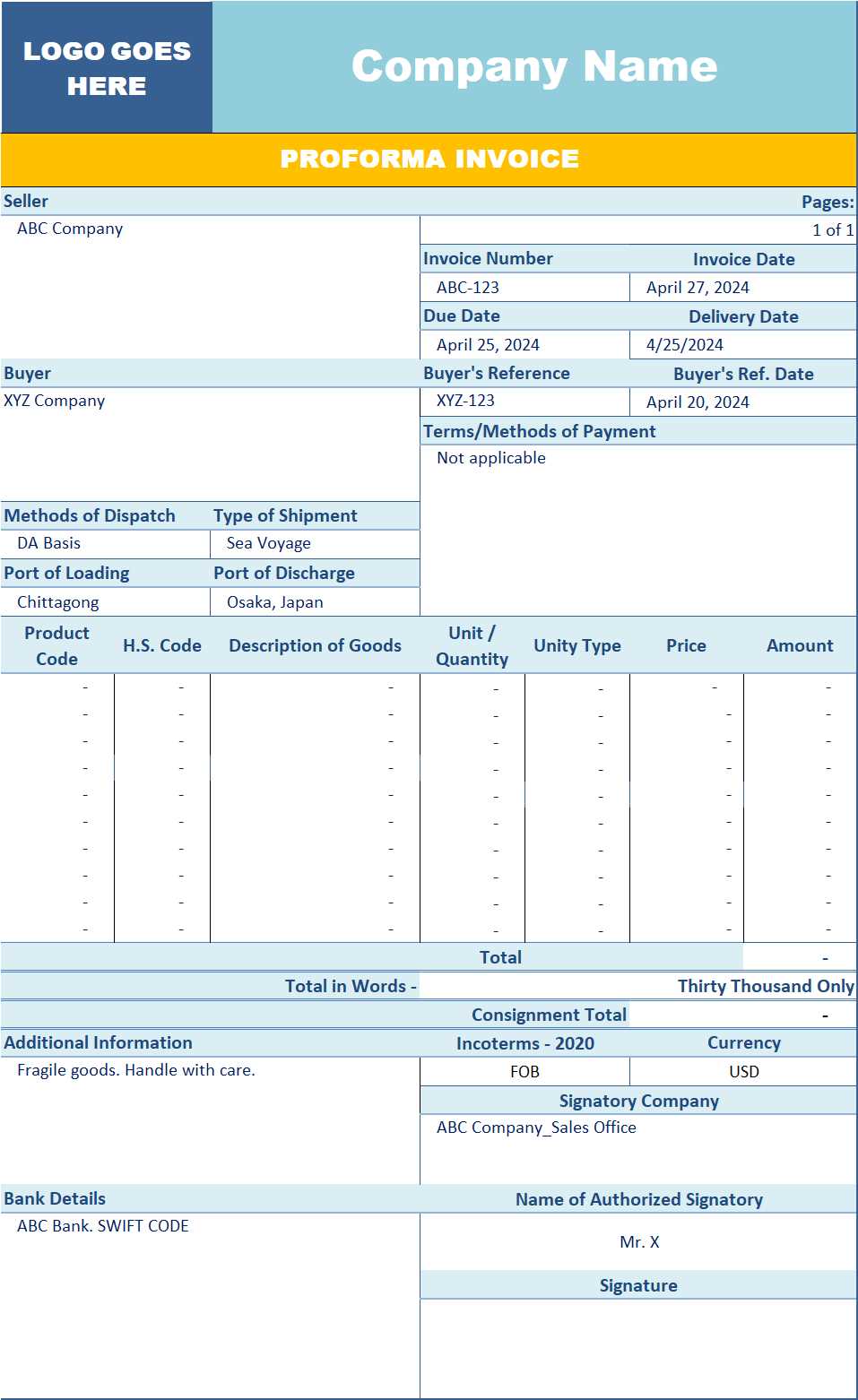

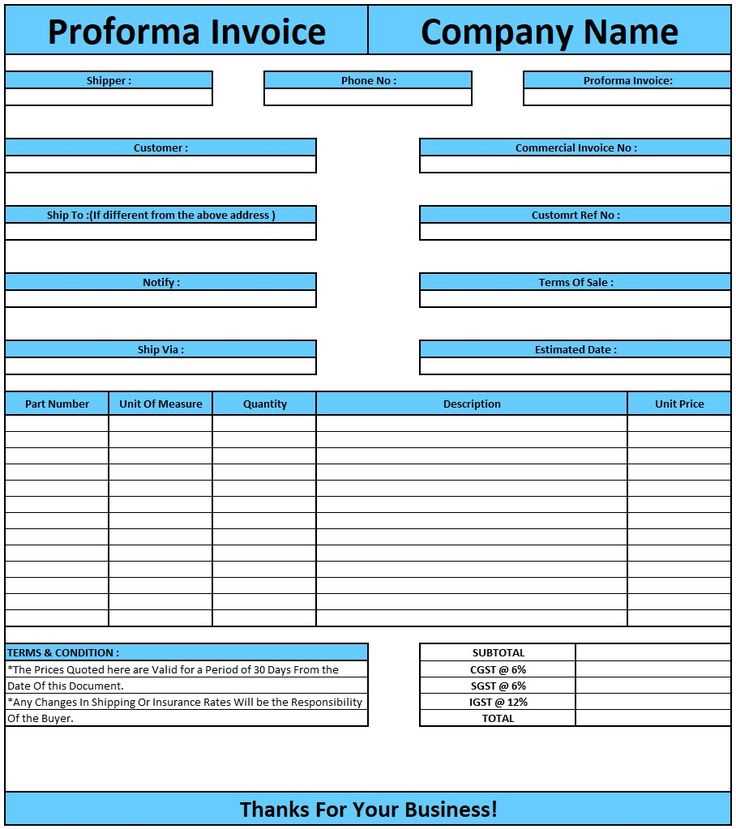

A well-designed billing document is essential for both businesses and clients to understand the terms and details of a transaction. These records not only provide a clear outline of products or services being offered but also establish a framework for payment terms, pricing, and delivery. Certain features are crucial in making such a document effective, as they ensure clarity, reduce disputes, and facilitate smoother financial processes.

Essential Elements of a Billing Record

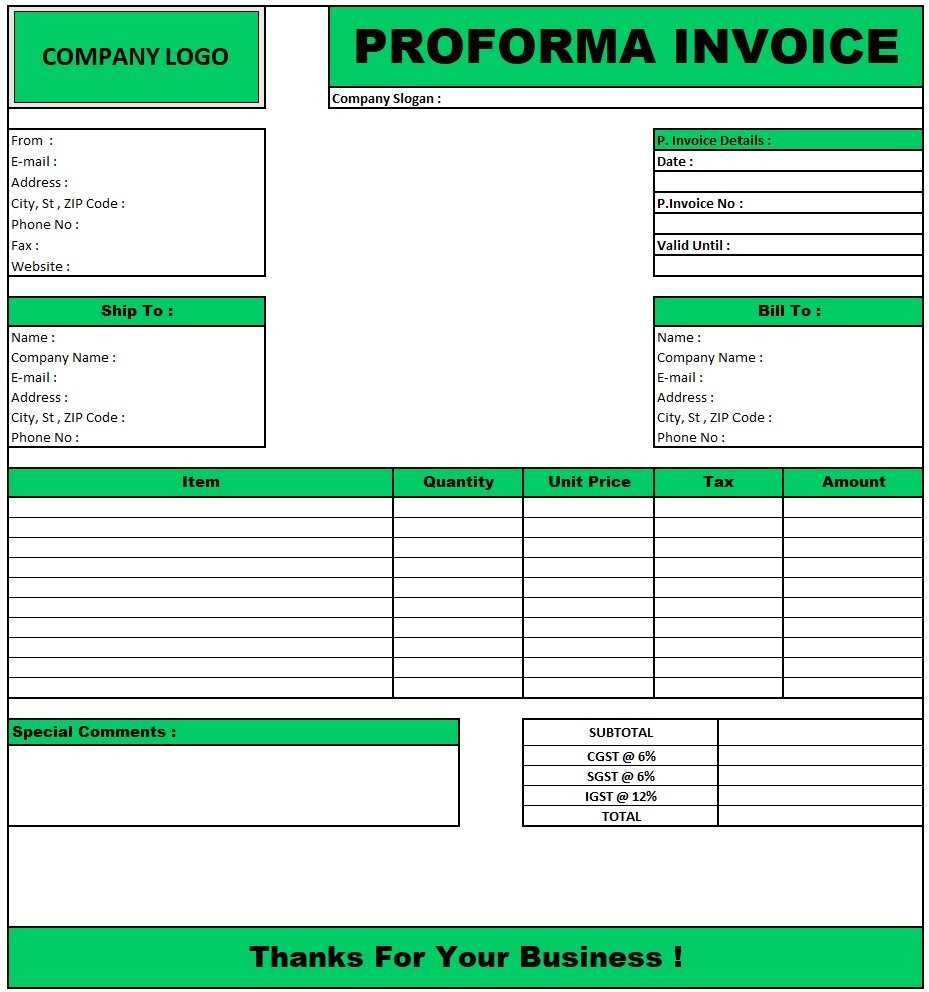

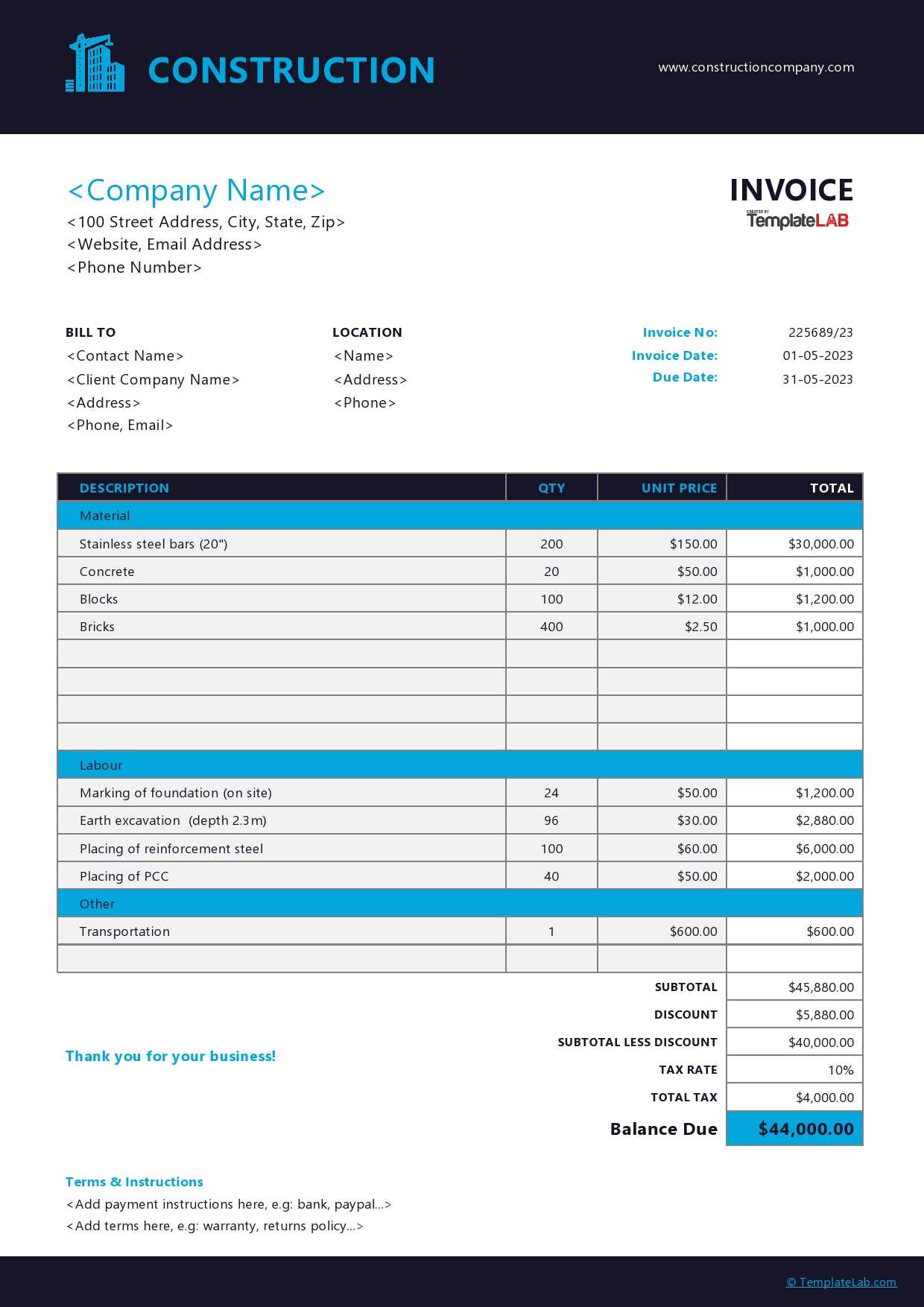

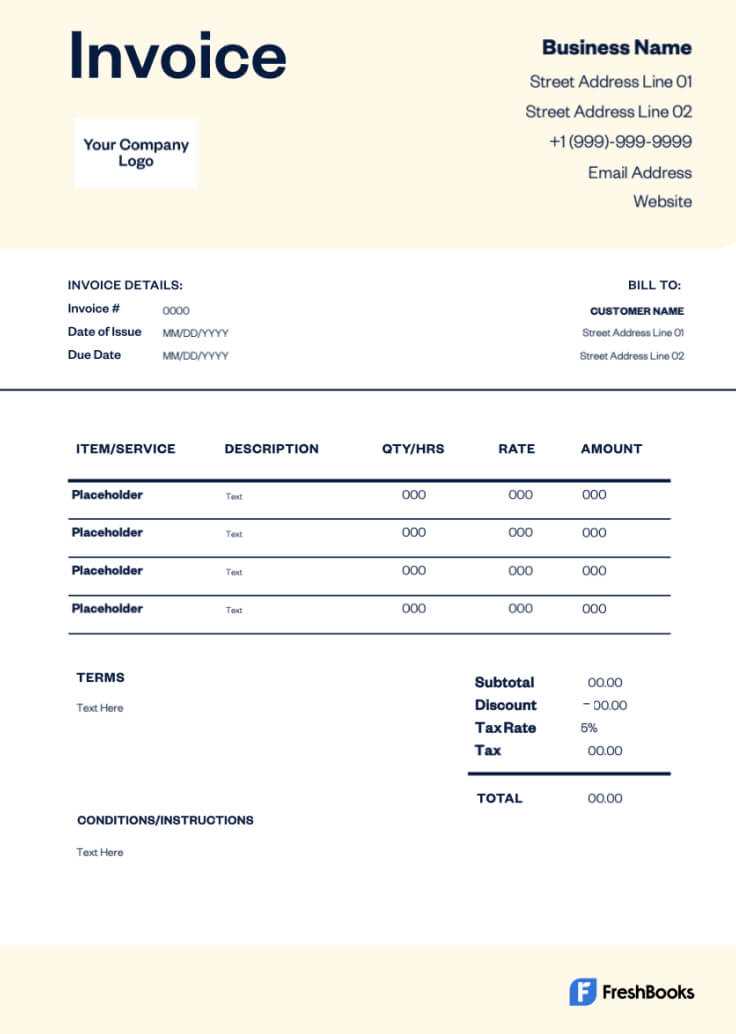

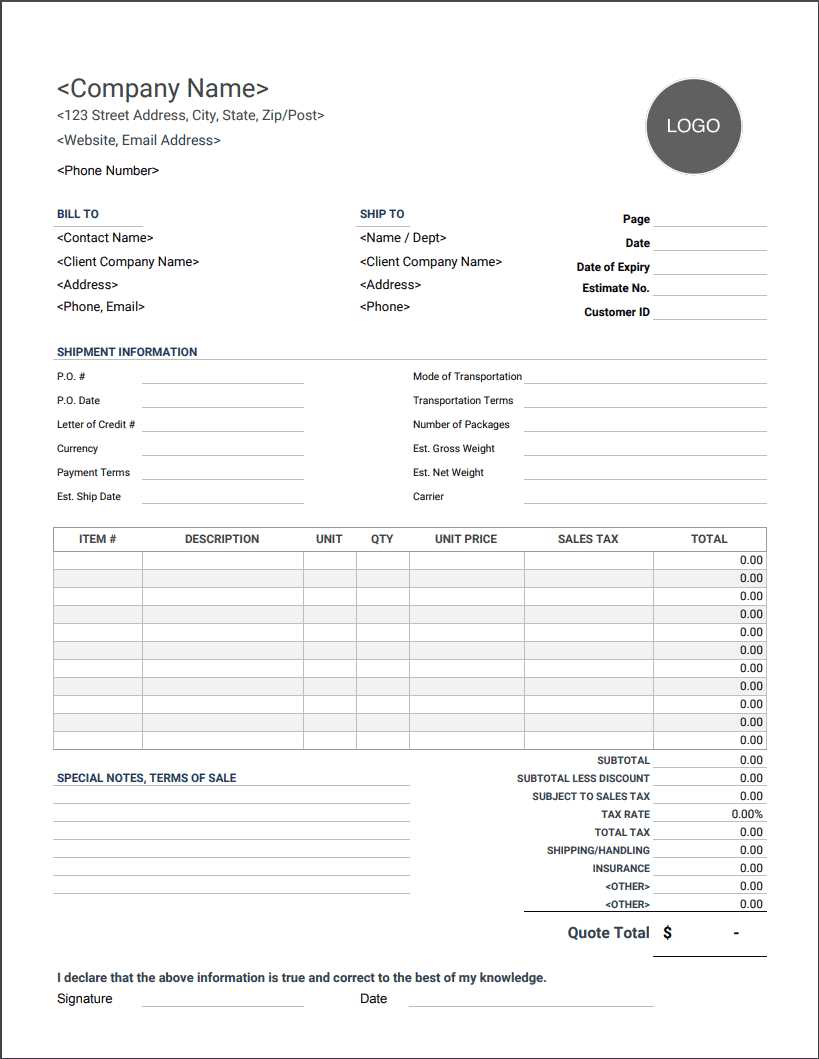

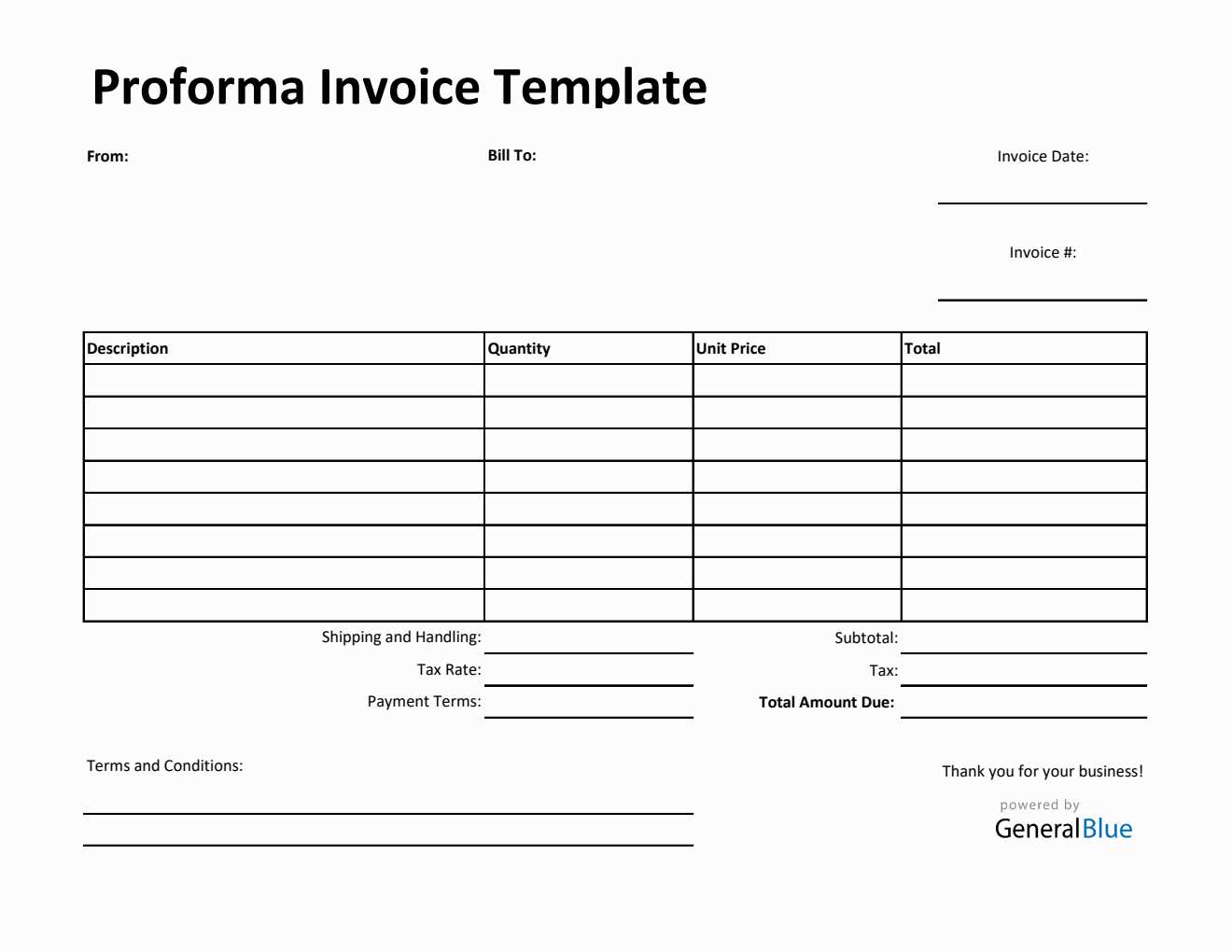

Every structured document for business transactions should include specific information to be legally valid and easily understood. The key features typically consist of customer details, item descriptions, quantities, prices, and payment terms. The following table illustrates the most common elements found in such a document:

| Element | Description |

|---|---|

| Client Information | Name, address, contact details |

| Transaction Date | Date of the transaction or agreement |

| Product/Service Details | Description, quantity, price |

| Payment Terms | Due date, payment method, conditions |

| Additional Charges | Shipping, taxes, discounts, etc. |

Flexibility and Customization

Another important feature is the ability to customize the layout to fit the specific needs of your business. Whether it’s adjusting the appearance, adding additional fields, or altering the structure to reflect different types of services or products, customization ensures that the document aligns with your brand identity and business requirements.

These features make such a document not only an important business tool but also an essential means of communication, ensuring both parties are on the same page regarding the terms of the transaction.

How to Create a Proforma Invoice in Excel

Creating a structured billing document for your business transactions can be a straightforward process if you have the right format. By using a spreadsheet application, you can quickly input all necessary information, ensuring accuracy and consistency in every record. This method allows you to maintain a professional look while also making the process more efficient, minimizing the risk of errors.

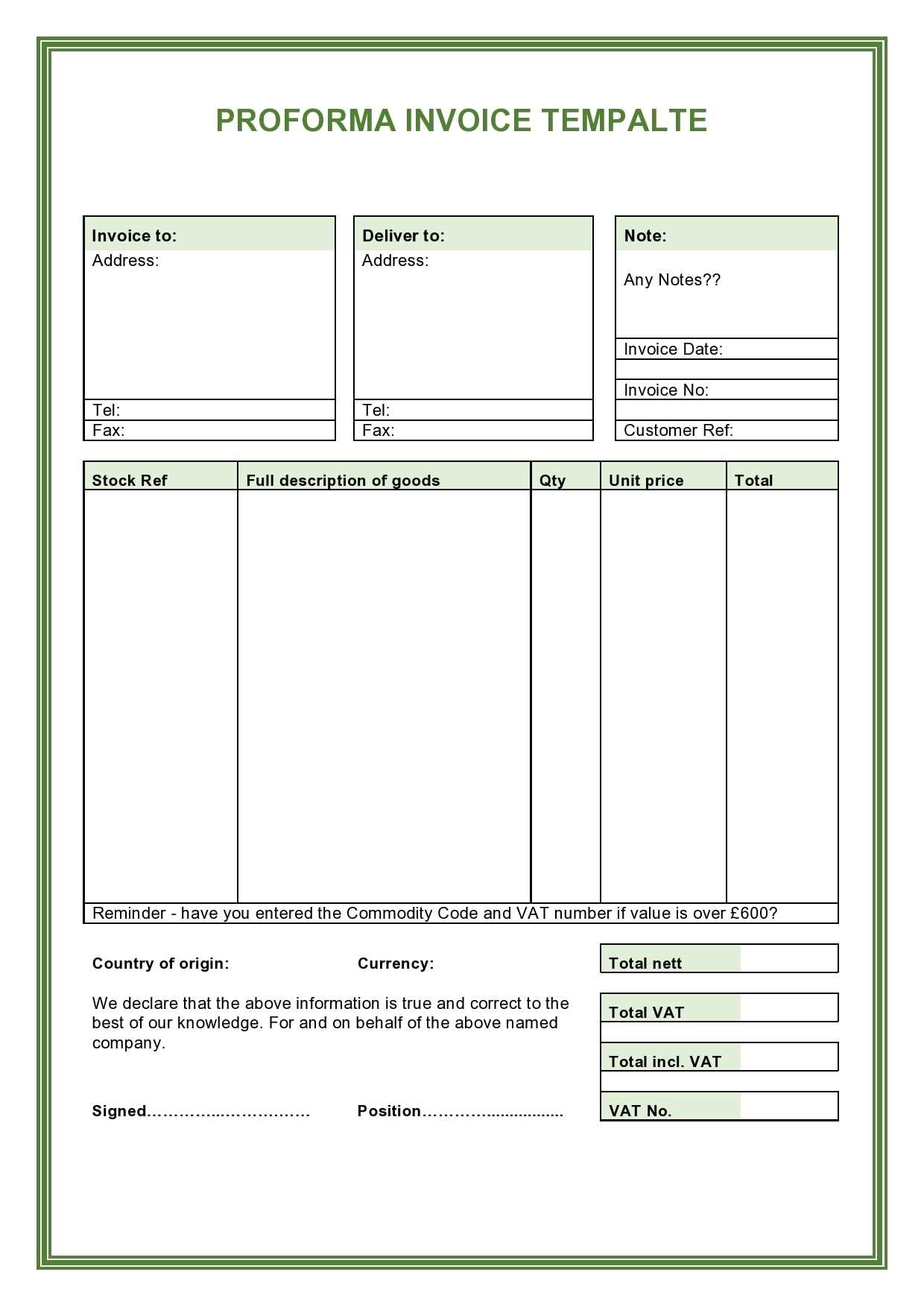

To create such a document, start by setting up the basic structure. Begin with fields for the recipient’s information, including name, address, and contact details. Follow this with spaces to list the products or services being offered, including descriptions, quantities, and prices. Then, include a section for payment terms and any additional fees, such as taxes or shipping costs.

Next, make sure the document is clear and easy to read. You can use cell borders, bold headings, and different font sizes to separate sections. This not only makes the record visually appealing but also helps ensure that key information stands out. Finally, once the structure is set up, you can save this file as a master document, ready for customization with each new transaction.

With a little practice, creating such a document becomes a quick and reliable process. Once the basic layout is created, you can reuse it, adjusting details as needed for each client or transaction. The simplicity and flexibility of this approach make it an ideal solution for businesses of all sizes.

Benefits of Excel Over Other Invoice Tools

When it comes to creating professional documents for billing or financial transactions, certain software solutions offer unmatched versatility and control. Unlike specialized platforms, a widely known spreadsheet application provides a level of customization that allows users to tailor their documents with ease, ensuring they meet specific business needs. The flexibility to modify structures and formulas in real time makes it a powerful tool for both small businesses and larger enterprises.

Customization and Flexibility

One of the key advantages of using a spreadsheet application over other dedicated billing tools is the ability to fully customize the format and functionality. Users can add complex calculations, adjust layouts, and integrate various business requirements without being limited by pre-designed features. This customization ensures that each document can be aligned with branding, regulations, or industry standards with minimal effort.

Cost-Effectiveness

Many specialized tools require subscriptions or upfront payments, while a spreadsheet program is often available as part of existing software packages, reducing additional costs. For freelancers, small businesses, or startups, using an existing tool without incurring further expenses offers a significant financial benefit, especially when scaling operations. No recurring fees are required to access core functions, making it a practical choice for cost-conscious users.

Comparison Table: Features Overview

| Feature | Spreadsheet Solution | Specialized Tool |

|---|---|---|

| Customization | Fully customizable with formulas and designs | Limited customization options |

| Cost | Low or no cost for existing users | Subscription-based or one-time fee |

| Integration with Other Tools | Easy to integrate with various business software | Varies by tool, may require additional purchases |

| User Experience | Familiar interface for most users | Learning curve for new users |

In conclusion, the flexibility, cost-effectiveness, and customization options available with this solution make it an ideal choice for businesses of all sizes, offering more control compared to many niche platforms.

Customizing Your Excel Proforma Invoice

When creating a document for billing or financial purposes, customization is essential to make it truly reflect your business needs and branding. Tailoring a document layout and functionality allows you to incorporate unique elements that align with your company’s identity, while ensuring that all necessary details are accurately captured. Adjusting the structure, appearance, and content can improve the document’s clarity and enhance professionalism.

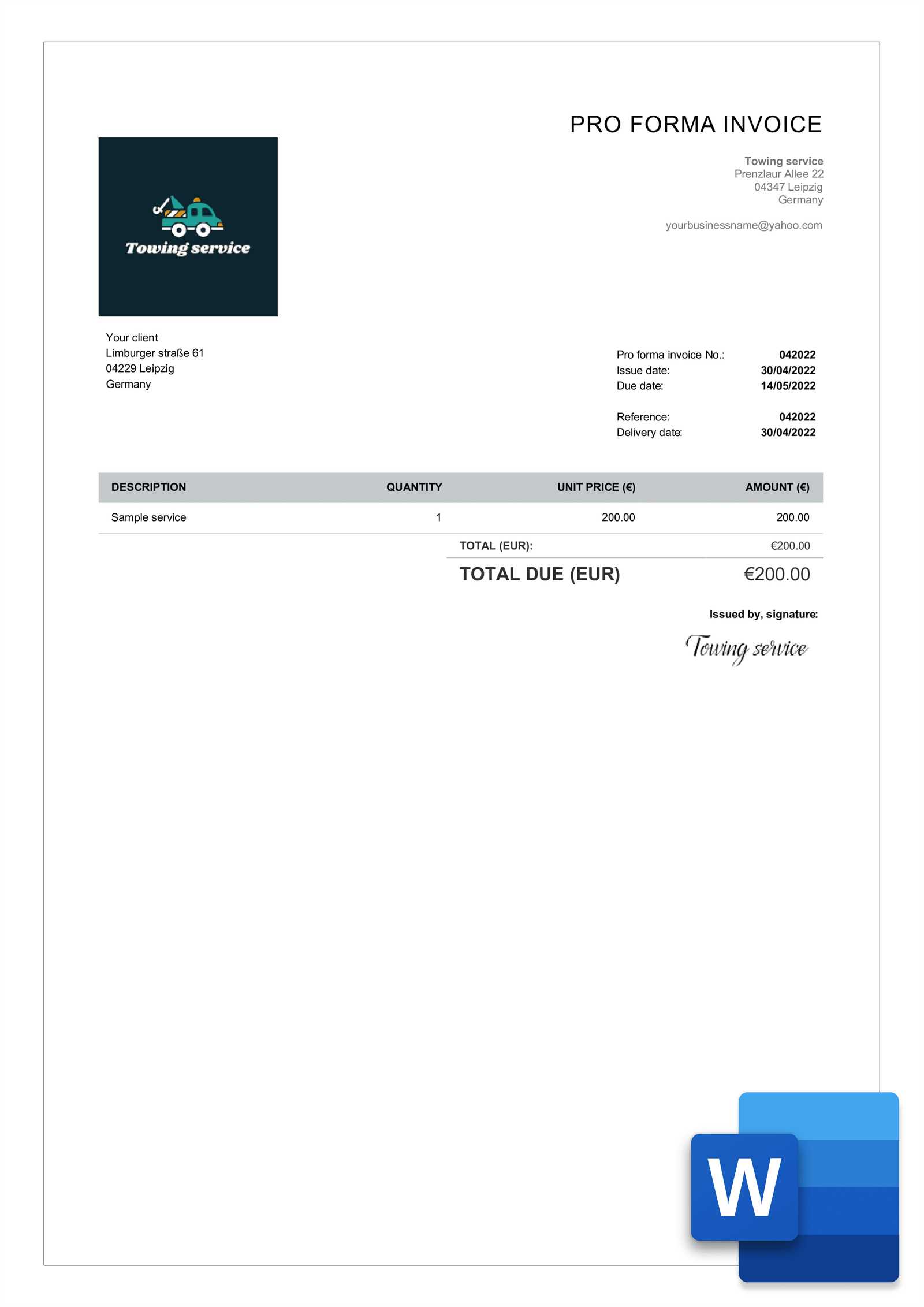

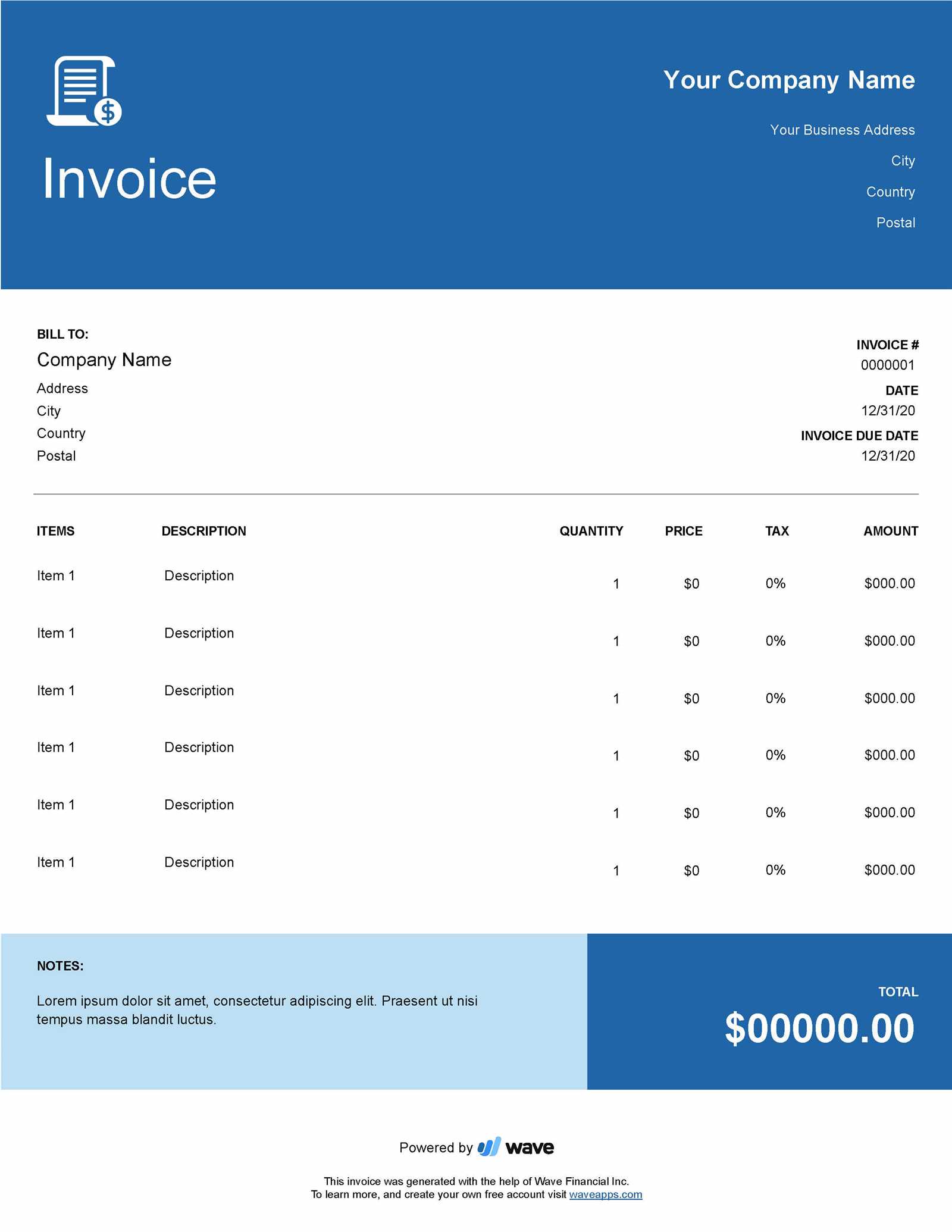

First, consider the design elements. You can modify fonts, colors, and logos to create a document that matches your company’s visual identity. Including your company’s logo at the top, for example, adds a professional touch and strengthens brand recognition. Additionally, adjusting the header and footer with relevant business information such as contact details, terms of service, or payment methods provides a cohesive look.

Another important aspect is the ability to customize the layout. Depending on the nature of the transaction, you might want to adjust column widths, rows, and the overall alignment of text. Creating distinct sections for different types of charges or grouping items logically can help recipients easily understand the details. You can also add or remove fields to suit your needs, whether that means including extra spaces for discount calculations or modifying the tax breakdown to reflect different regions.

For greater accuracy and efficiency, it’s also possible to insert formulas and conditional formatting. Automatically calculating totals, taxes, and other charges based on input values can save time and reduce human error. Highlighting overdue payments or flagged items in different colors helps improve document visibility and helps ensure that important details are not overlooked.

By customizing these elements, you can create a fully tailored document that not only meets legal or financial standards but also aligns with your brand and specific business processes.

Common Mistakes in Proforma Invoices

When preparing financial documents for transactions, attention to detail is essential. Even small errors can lead to confusion, miscommunication, or delays in payment. Several common mistakes often occur during the creation of such documents, many of which could be easily avoided with a careful review of the details. These mistakes can impact professionalism and even hinder smooth business operations.

Incorrect or Missing Information

One of the most frequent mistakes is failing to include accurate or complete information. Missing essential details, such as the buyer’s contact information, business address, or product description, can cause confusion and delay processing. Additionally, failing to include your own company’s full details, including tax identification number or business registration, can make the document appear unprofessional and lead to potential legal issues. Always double-check the document for completeness before sending it.

Errors in Calculation or Pricing

Another common issue involves incorrect calculations or pricing errors. This could include wrong totals, incorrect tax rates, or failing to apply discounts correctly. Even minor discrepancies can cause frustration for clients and may result in payment disputes. Using formulas or automation features in your spreadsheet can help prevent such errors and ensure that totals are calculated consistently every time.

Additionally, currency errors are a concern for international transactions. Mixing up currencies or incorrectly applying exchange rates can lead to misunderstandings, especially when dealing with global clients or suppliers. Always ensure that currency symbols and amounts match the agreement made with the client.

Lack of Clear Terms and Conditions

Failing to clearly define payment terms and conditions is another common mistake. Whether it’s the payment due date, the method of payment, or the agreed-upon delivery terms, it’s important to explicitly state these details to avoid disputes later. Make sure these terms are visible and easy to understand, as ambiguity in the agreement can result in complications and delays.

By paying attention to these common mistakes and reviewing your documents thoroughly, you can improve the accuracy, professionalism, and effectiveness of your billing statements.

Saving and Sharing Excel Invoices

Once your billing document is created, the next step is ensuring it’s properly saved and shared with the relevant parties. Efficiently managing these documents not only helps maintain organization but also ensures that the files can be easily accessed and distributed to clients, suppliers, or colleagues. There are several options for saving and sharing, each suited to different needs and circumstances.

Saving Your Document

When it comes to saving your billing file, there are a few best practices to consider:

- Use a clear naming convention: Include the date, recipient’s name, or a reference number in the filename for easy identification. For example, “Invoice_JohnDoe_2024-11-05” makes it easy to find later.

- Choose the right file format: The most common formats are .xlsx and .xls, which preserve all your document’s functionalities. If you need to send the file in a way that cannot be altered, consider saving it as a .pdf.

- Backup your files: Always store your documents in more than one location, whether it’s a cloud service or an external hard drive, to prevent data loss.

Sharing Your Document

Sharing the document efficiently and securely is just as important as saving it. Here are some popular methods:

- Email: The most direct method is to attach the file to an email. Ensure that the file size is manageable for email attachments, or use cloud services to share larger files.

- Cloud Storage: Platforms like Google Drive, OneDrive, and Dropbox allow you to store the file online and share it via a link. This method also facilitates real-time collaboration and easy updates.

- File Transfer Services: For larger documents or sensitive information, using a file transfer service like WeTransfer can be a safe and efficient choice. These services allow for secure sharing without needing the recipient to have specific software.

It’s important to ensure that any sensitive information, such as payment terms or customer data, is protected when sharing. Using password-protected files or encrypted emails can add an extra layer of security when dealing with confidential documents.

How to Automate Invoice Calculations in Excel

Automating calculations within your billing documents can save you significant time and reduce the chances of errors. By setting up the right formulas and functions, you can easily calculate totals, taxes, discounts, and more, with no need for manual input each time you create a new document. This not only speeds up the process but also ensures accuracy and consistency across all your financial statements.

Using Formulas for Automatic Calculations

The first step to automation is using formulas that will automatically calculate key values based on your input. For example, you can use the following formulas:

- SUM: To automatically add up item totals. For instance, if you have a column with item prices, the formula

=SUM(A2:A10)will total the prices in that range. - Multiplication: To calculate the total for each item by multiplying the unit price by the quantity. Use a formula like

=B2*C2(where B is the price per unit and C is the quantity). - Tax Calculation: To calculate sales tax or VAT, simply multiply the subtotal by the tax rate. For example,

=A1*0.15will calculate a 15% tax on the amount in cell A1. - Discounts: To apply discounts automatically, you can set a formula like

=A2-(A2*0.10), which applies a 10% discount to the value in cell A2.

Using Conditional Formatting for Better Visibility

Conditional formatting allows you to highlight certain cells based on the values they contain. For instance, you can set rules to highlight overdue payments, show negative balances in red, or emphasize items that exceed a certain price threshold. This provides a quick visual reference and helps you spot important details at a glance.

To set conditional formatting, select the range of cells you want to format, then navigate to the “Conditional Formatting” option in the menu. From there, you can define rules that change the appearance of the cells based on certain criteria, like greater than, less than, or equal to a specified value.

By setting

Using Excel Templates for Multiple Clients

Managing documents for multiple clients can be time-consuming if done manually. However, by creating a structured format that can be reused for different clients, you can save valuable time and ensure consistency across all your financial records. A well-organized document can be tailored for each client while keeping a standard layout, making the process more efficient and professional.

Benefits of Using a Reusable Document Format

Having a standardized format for all your clients allows you to quickly input their specific details without rebuilding the structure from scratch every time. You can create a file where the core structure–such as item lists, payment terms, and tax calculations–remains constant, while client-specific details such as names, addresses, and service descriptions are easily updated. This approach offers several advantages:

- Time Efficiency: You save time by reusing the same layout and formulas for different clients, reducing the need to start from zero each time.

- Consistency: Every document follows the same format, which helps maintain a professional and organized appearance.

- Minimized Errors: Automated calculations and fixed structures reduce the chances of making mistakes when inputting information.

Setting Up a Standardized Layout

To make the most of a reusable structure, start by creating a standard layout that can be easily customized for each new client. Here’s an example of the type of information that should remain consistent across documents:

| Section | Description |

|---|---|

| Header | Company name, logo, and contact information |

| Client Information | Client’s name, address, and contact details (easily editable per client) |

| Item List | Descriptions, quantities, and unit prices (editable per transaction) |

| Tax and Discount | Pre-set formulas for calculating tax and discount values based on input |

| Totals | Automatically generated total based on item cost and adjustments |

With this layout in place, yo

Best Practices for Accurate Proforma Invoices

Creating precise and reliable billing documents is crucial for smooth business operations and clear communication with clients. Ensuring the accuracy of every detail in these documents helps avoid confusion, delays, and potential disputes. By following a set of best practices, you can improve the reliability and professionalism of your records while maintaining transparency in financial transactions.

Key Best Practices

To ensure your billing documents are accurate and effective, follow these best practices:

- Double-check client information: Always verify the client’s name, address, and contact details before sending. Incorrect or incomplete information can lead to delays or misunderstandings.

- Use clear descriptions: Provide detailed, clear descriptions for each item or service. Avoid vague terms and ensure that the quantity, unit price, and total are clearly stated.

- Automate calculations: Set up automatic calculations for totals, taxes, and discounts. This helps avoid errors and ensures that every calculation is consistent and accurate across documents.

- Include payment terms: Clearly state the payment due date, acceptable methods of payment, and any penalties for late payments. Well-defined terms prevent ambiguity and help clients understand their obligations.

- Review before sending: Always review the document for errors before finalizing it. This includes checking for any typos, calculation mistakes, and ensuring all fields are properly filled in.

Additional Tips for Accuracy

In addition to the core practices, here are a few additional tips to further improve accuracy:

- Use consistent formatting: Maintain a standardized layout for easy readability. Consistent fonts, alignment, and structure make it easier to spot mistakes.

- Track changes: If you make any adjustments to the document, track those changes. This helps you keep a history of edits and ensures that the most up-to-date version is used.

- Incorporate automatic reminders: Set up reminders for payment due dates to avoid overlooking overdue balances.

By adopting these best practices, you can significantly reduce the risk of errors, improve your document accuracy, and enhance your professionalism with clients. A clear, accurate record is key to smooth transactions and strong business relationships.

Tracking Proforma Invoices in Excel

Efficiently managing and tracking financial documents is essential for keeping your business organized and ensuring timely payments. By setting up a tracking system, you can easily monitor the status of each transaction, identify overdue payments, and stay on top of your accounting tasks. A well-structured tracking system helps you keep records accurate and up-to-date, making it easier to follow up with clients and ensure a smooth workflow.

Creating a Tracking System

To create an effective tracking system, consider including the following key columns in your document:

- Document Number: Assign a unique number to each document for easy reference.

- Client Name: Include the name of the client or company to whom the document is addressed.

- Issue Date: Record the date the document was created or sent to the client.

- Due Date: Clearly state the payment due date to keep track of deadlines.

- Status: Indicate the current status (e.g., “Paid,” “Unpaid,” “Pending”).

- Amount: Track the total amount due for each document.

- Payment Date: Record the date the payment was received, if applicable.

Using Conditional Formatting and Filters

Conditional formatting can help visually highlight overdue documents, making it easier to spot payments that are past due. For example, you can set rules to change the color of cells if the due date is in the past and the payment status is still marked as “Unpaid.”

In addition to conditional formatting, using filters allows you to quickly sort through your tracking list. You can filter by client, status, or due date, helping you find relevant information faster and manage follow-ups effectively.

Using Formulas to Automate Tracking

Formulas can significantly improve your tracking system by automating calculations and updates. For instance:

- Sum Calculation: Use the

=SUMformula to automatically calculate the total amount due or the total of all unpaid balances. - Days Overdue: To calculate how many days a document is overdue, use a formula like

=TODAY()-F2(where F2 is the due date), which will give the number of days si

Integrating Excel with Accounting Software

Efficient financial management often requires using multiple tools that work seamlessly together. By integrating your spreadsheet-based records with accounting software, you can streamline processes, minimize data entry errors, and enhance reporting capabilities. This integration helps automate data synchronization between different platforms, ensuring that your financial information remains accurate and up to date across all systems.

Why Integration Matters

Integrating your spreadsheets with accounting software offers several benefits that enhance your workflow:

- Automation: Automatically sync data from your spreadsheets to your accounting software, reducing manual data entry and the potential for errors.

- Efficiency: Streamline processes such as generating financial reports, tracking expenses, and updating records by consolidating your data in one place.

- Accuracy: With automated syncing, you eliminate the need for double-checking information between systems, ensuring consistency and minimizing discrepancies.

- Time-saving: Once set up, integration allows you to quickly transfer data, making financial tasks faster and more efficient.

How to Set Up Integration

Setting up an integration between your spreadsheet and accounting software involves a few key steps:

- Choose compatible software: Ensure that the accounting platform you are using supports integration with spreadsheets or third-party applications. Many popular accounting systems, like QuickBooks or Xero, offer direct integration options with spreadsheet tools.

- Use data import/export features: Most accounting software allows you to import data from CSV or Excel files. Similarly, you can export your data from your accounting software back into your spreadsheet for further analysis.

- Leverage integration tools: Use specialized third-party tools or connectors, such as Zapier, that facilitate seamless data transfers between your spreadsheet and accounting software without manual intervention.

- Test the integration: Before fully relying on the integration, conduct tests to ensure that the data is transferred correctly and that all formulas, fields, and calculations align between the two platforms.

Example Integration Workflow

Here’s an example of how the integration process might look for a small business:

Step Action 1 Enter client and transaction details in your spreadsheet (product descriptions, quantities, amounts). 2 Automatically sync data to your accounting software, which updates the client accounts and records the transa Legal Considerations for Proforma Invoices

When preparing preliminary billing documents for business transactions, it is essential to understand their legal implications. These documents, while not legally binding in the same way as final invoices, must still adhere to certain rules to avoid any potential disputes. Clarity and transparency are key elements, ensuring both parties are aware of their responsibilities and the terms of the transaction.

Accuracy of Information is critical. Any details provided, such as the description of goods or services, pricing, and delivery terms, should be correct and precise. While these documents are typically not enforceable in the same manner as finalized financial statements, they can be used as a reference in case of conflicts. Inaccuracies may lead to misunderstandings or disputes, potentially complicating future transactions.

Another important consideration is the currency and taxes involved. Even though such documents are not always a final agreement, specifying the currency and tax rates can help prevent confusion, especially in international trade. If tax rates or fees are unclear or incorrect, it can lead to legal issues down the line when the actual transaction occurs.

Compliance with local regulations is also vital. Different countries and regions have distinct rules regarding documentation for trade, including what information must appear on documents before a formal transaction can take place. Failing to include required details, such as seller and buyer contact information or appropriate legal disclaimers, may render the document non-compliant with local laws.

Lastly, while these documents are not considered legally binding agreements, their contents can still be used in a legal context. If a dispute arises, parties involved might refer to them as evidence of the intended terms of the sale. Therefore, it is essential to prepare these documents with the same care and attention as any other official paperwork to mitigate potential legal issues in the future.

How to Avoid Invoice Disputes

Ensuring smooth financial transactions between businesses and clients requires clear communication and attention to detail. Disagreements over payment can often be avoided by establishing transparent terms and making sure that all parties involved are on the same page from the beginning. By being meticulous in the preparation of billing documents and addressing potential issues upfront, both sellers and buyers can reduce the likelihood of conflicts.

Clear Communication of Terms is one of the most effective ways to prevent disputes. Before finalizing any deal, make sure that all aspects of the transaction, including prices, delivery schedules, and payment terms, are discussed and agreed upon. This clarity helps to avoid any confusion when it’s time to settle the account.

Another key factor is accurate documentation. Ensure that every detail on the billing document is correct and consistent. Small mistakes such as incorrect amounts, missing items, or unclear descriptions can cause significant issues when payment time arrives. Double-checking all figures and information can prevent misunderstandings later on.

Establishing Payment Deadlines is equally important. Set clear deadlines for when payment is expected and communicate any consequences of late payment. By establishing this framework early in the process, both parties understand the timing and expectations surrounding the financial exchange.

Below is an example of key details that should be included in any billing document to avoid disputes:

Detail Description Item or Service Description Clearly describe the product or service provided, including quantities and specifications. Price and Payment Terms Ensure the price is accurate and specify when payment is due, along with acceptable payment methods. Tax and Additional Fees List any taxes, shipping fees, or other charges that will be added to the total cost. Delivery Terms State the expected delivery date, location, and any related conditions for the shipment. Contact Information Include accurate contact details for both parties, including names, addresses, and phone numbers. By following these practices, businesses can reduce the risk of misunderstandings and disputes over financial matters. A proactive approach to communication and accurate documentation can make all the difference in maintaining positive relationships and ensuring timely payments.

Proforma Invoices vs Commercial Invoices

Understanding the difference between preliminary billing documents and final billing statements is essential for businesses involved in trade and commerce. These documents may appear similar, but they serve distinct purposes and are used at different stages of the transaction. While both outline the details of a sale, they differ in terms of legal standing, timing, and the level of commitment from the buyer and seller.

Preliminary vs Final Documents

Preliminary documents are typically issued before a formal transaction takes place. They provide an estimate or a preview of the transaction, including the goods or services being sold, the price, and other terms. These documents are usually not legally binding but can serve as a reference for discussions or negotiations.

- Used to outline the potential terms of a transaction

- Serves as a tool for negotiation

- Does not represent a finalized agreement

In contrast, final billing statements are issued once the goods or services have been delivered, and both parties have agreed on the terms. These documents carry legal weight and serve as the official record of the transaction, demanding payment according to the outlined terms.

- Issued after the transaction has occurred

- Legally binding

- Used for actual payment processing

Key Differences

- Legal Status: Preliminary documents are not enforceable, while final bills are legally binding.

- Purpose: Preliminary documents act as an estimate or proposal, whereas final statements confirm the completion of a sale and require payment.

- Timing: Preliminary documents are issued before the transaction is completed, while final bills are provided afterward.

- Payment Terms: Payment may not be expected with a preliminary document, but payment is due once the final bill is issued.

Understanding these differences can help businesses manage their financial documentation more effectively and ensure smoother transactions. Both types of documents have important roles, but it is essential to use them at the appropriate stages of the sales process to avoid confusion or legal complications.

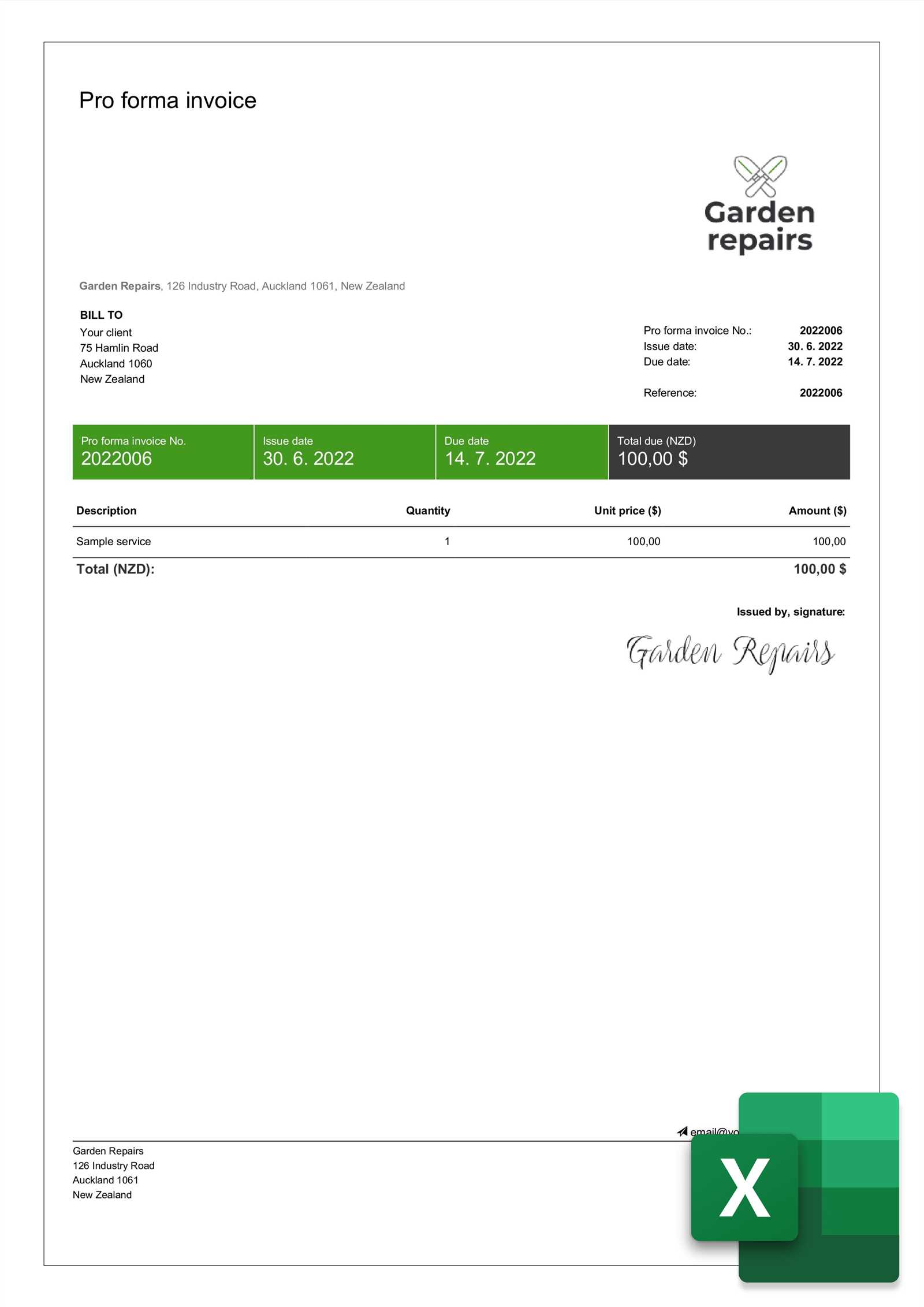

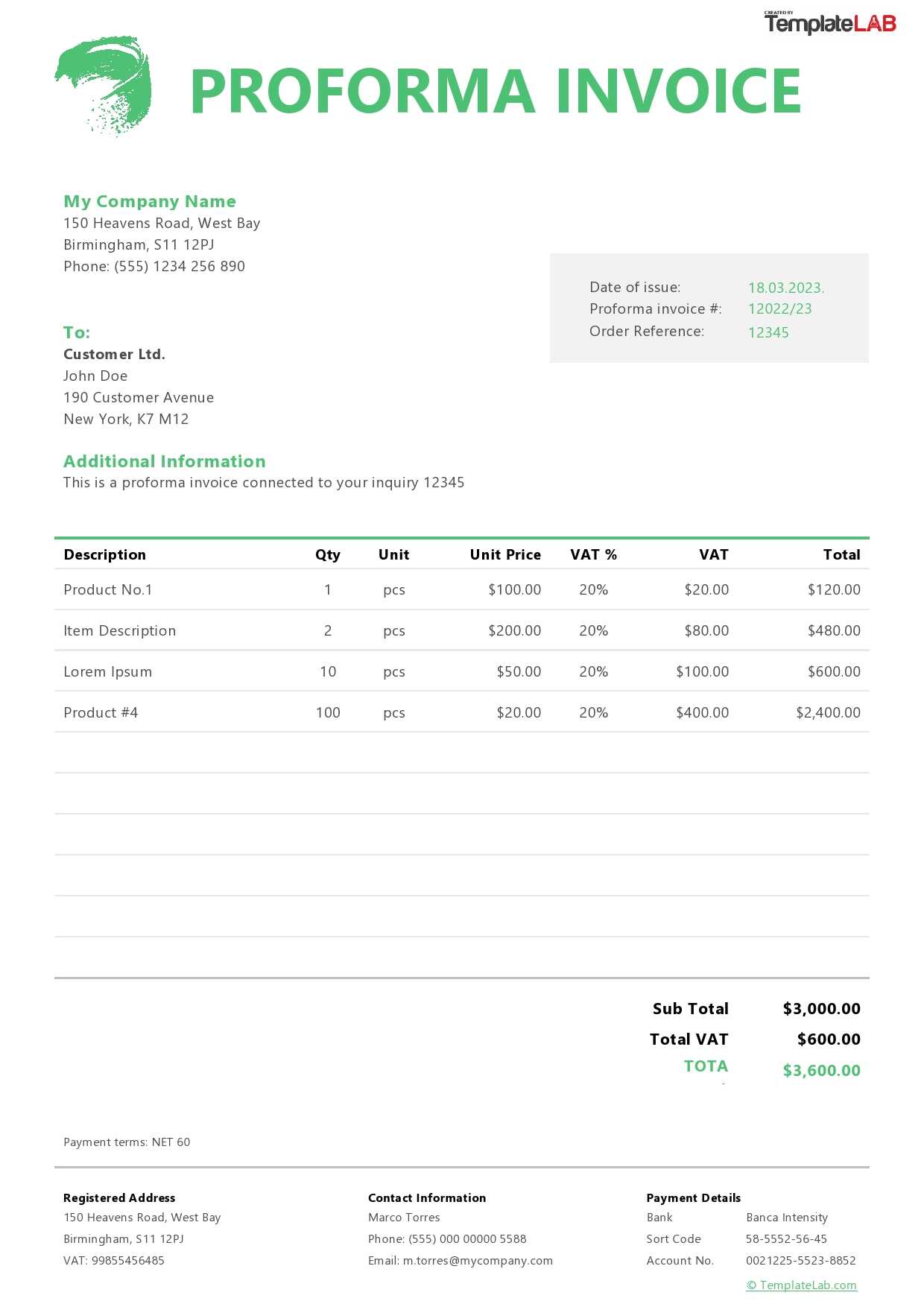

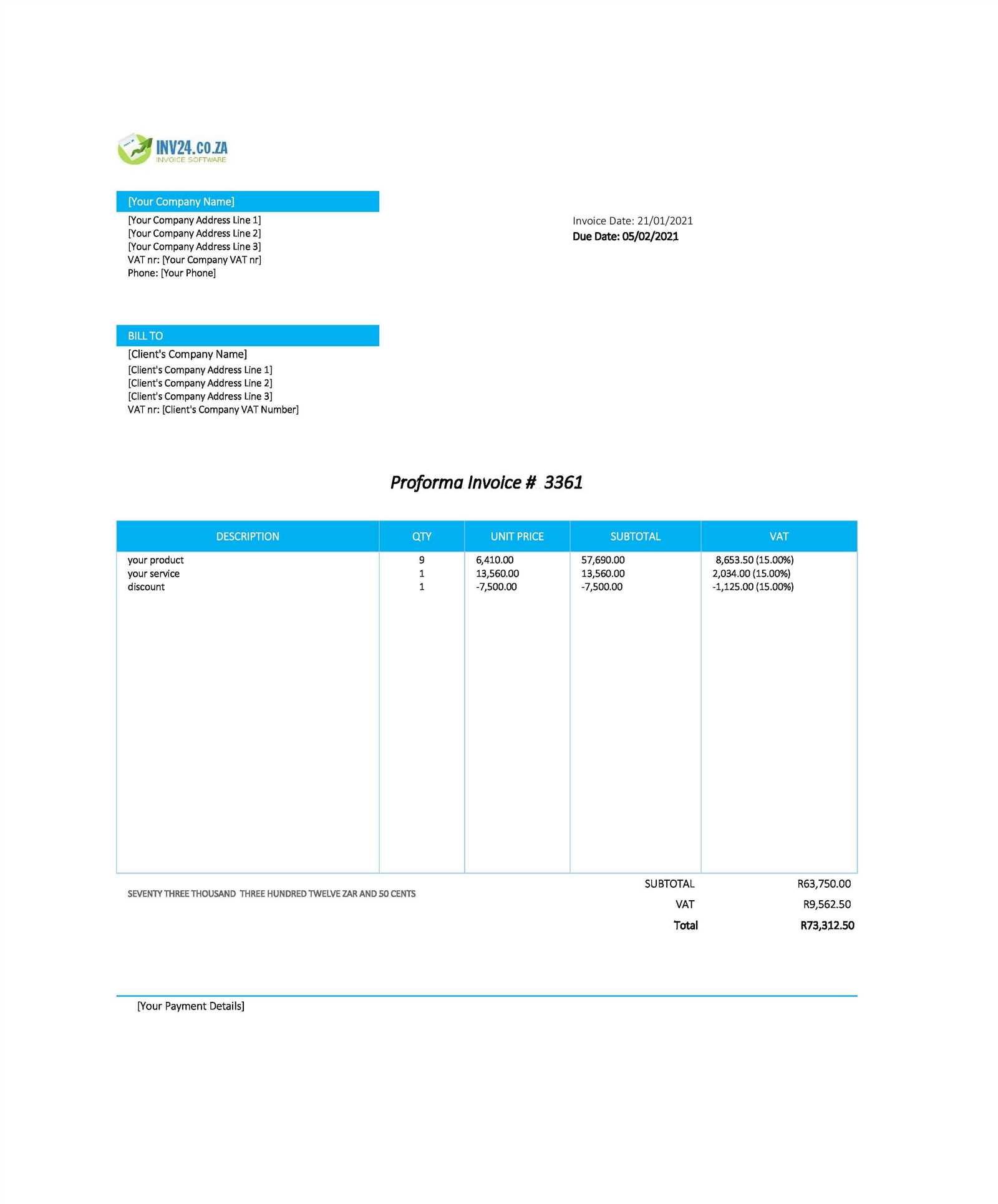

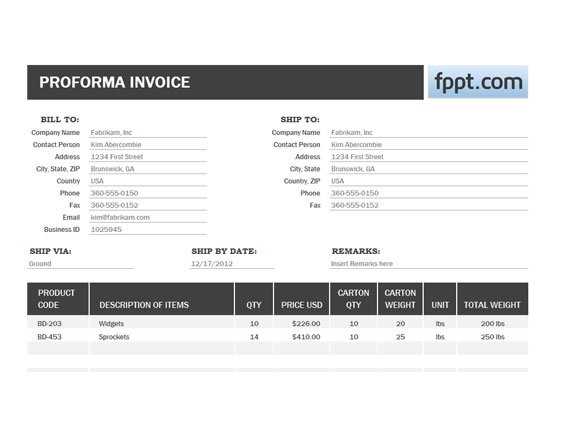

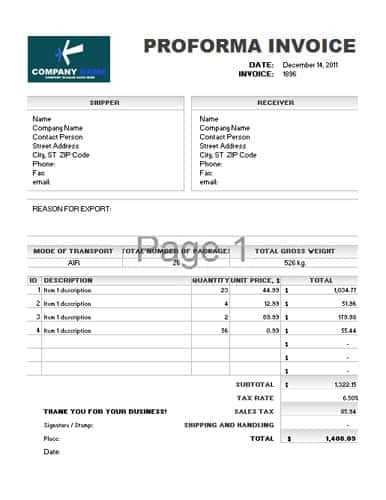

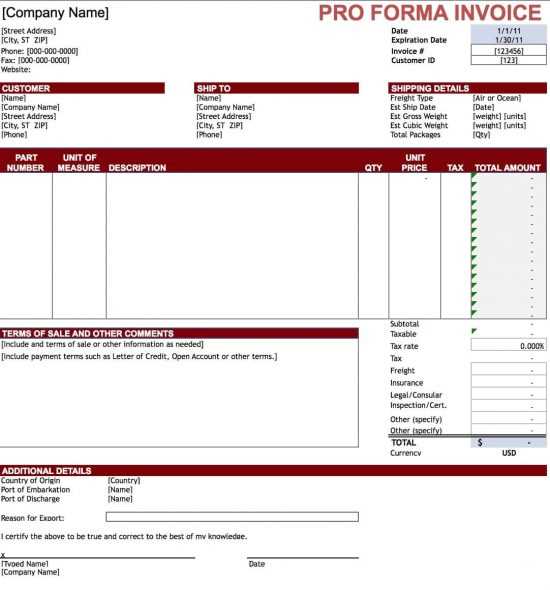

Free Excel Templates for Proforma Invoices

When it comes to preparing preliminary billing documents, having access to ready-made structures can save time and ensure accuracy. Free downloadable formats can simplify the process, allowing businesses to quickly create professional-looking records without the need for specialized software. These resources typically provide all the necessary fields and sections, ensuring that nothing important is overlooked.

Advantages of Using Free Downloadable Formats

One of the main benefits of using these free resources is the ease of customization. Most downloadable formats are designed to be flexible, allowing users to adjust the layout, wording, and fields according to their specific business needs. Whether you’re dealing with international clients or local transactions, these structures can accommodate various pricing models, currencies, and tax rates.

- Quick and easy setup

- Customizable to fit business-specific needs

- No additional software required

- Helps maintain professionalism

Where to Find Free Downloadable Formats

These resources can be found on a variety of online platforms, including business-focused websites, accounting blogs, and financial forums. Many websites offer free versions of these documents in multiple file formats, including those that can be opened with popular spreadsheet software. Make sure to choose a source that is reliable and offers formats that meet the legal and business standards for your region.

- Business resource websites

- Online accounting communities

- Financial blogs and forums

By utilizing these free downloadable formats, companies can save valuable time while ensuring they maintain accurate and well-organized preliminary records, contributing to smoother transactions and clearer communication with clients.