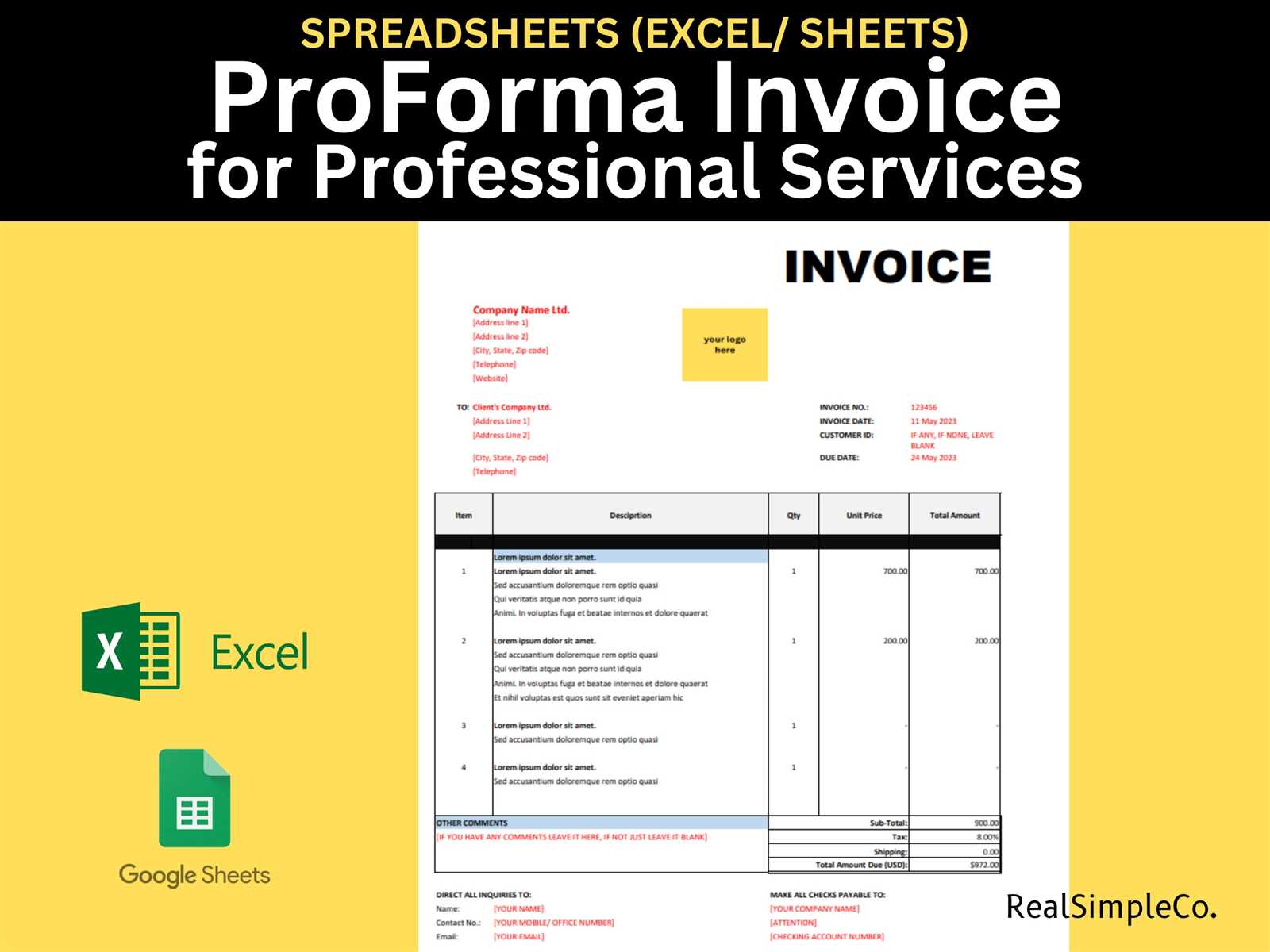

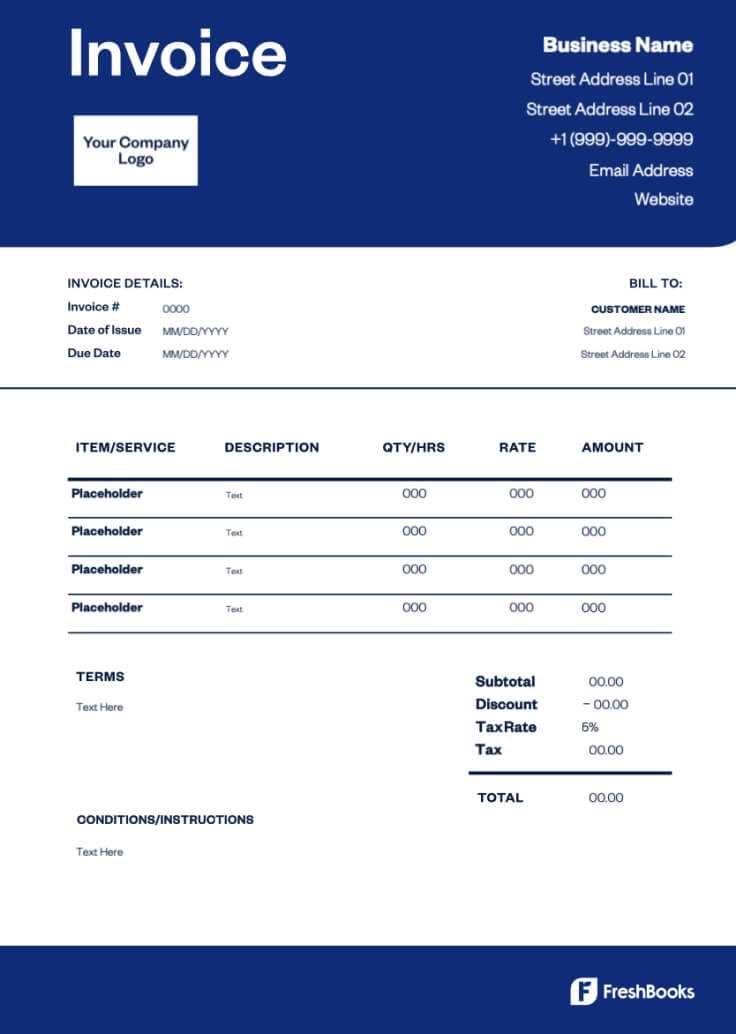

Excel Professional Services Invoice Template for Efficient Billing

Managing billing and payments is a crucial aspect of running any business. A streamlined and organized approach ensures timely payment collection and helps maintain a professional relationship with clients. With the right tools, invoicing becomes a simple yet effective process that saves both time and effort.

By utilizing customizable spreadsheets, entrepreneurs can create documents that meet their unique needs. These solutions allow for easy modifications, automatic calculations, and the ability to track outstanding amounts efficiently. With clear structure and consistency, such methods help avoid errors and confusion in financial dealings.

In this guide, we’ll explore how to set up a document that suits various business models, providing practical features such as payment tracking, cost breakdowns, and customizable fields. With the right setup, your billing workflow will be more effective, helping you focus on growth and client satisfaction.

Invoice Solutions for Service Providers

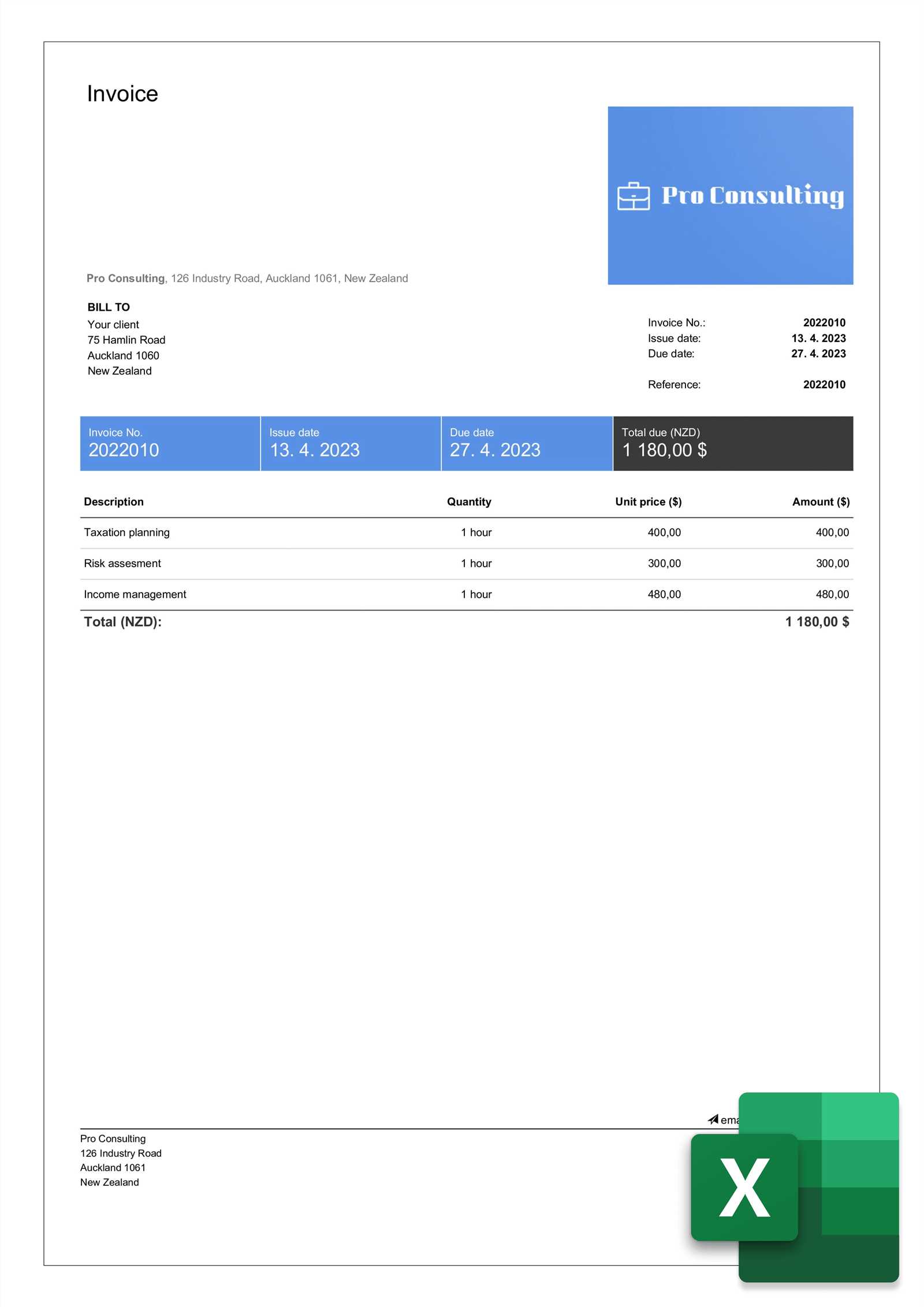

For those offering expert assistance or consulting, having a reliable and organized document for billing clients is essential. A well-structured payment request helps maintain professionalism and ensures smooth transactions. By using customizable formats, businesses can easily manage payments and track overdue amounts without the need for complex software solutions.

Service providers can benefit from documents designed specifically to simplify the process. These formats often include all necessary fields and calculations, making it easier to adapt to different client needs. Below are some key features commonly included in such documents:

- Clear client information: Easily input and update customer details, such as name, contact, and billing address.

- Breakdown of services: List each service or task provided, along with the corresponding price and duration.

- Automatic totals: Save time by using formulas to calculate the total amount, taxes, and any discounts.

- Payment terms: Clearly define payment deadlines, accepted methods, and late fees if applicable.

- Customization options: Adjust fonts, colors, and layout to fit your branding and professional image.

By utilizing these documents, you can improve accuracy and speed in your billing process, ensuring you never miss a payment and that your clients receive clear, transparent requests. Additionally, the flexibility to modify the format allows for easy adaptation to various business models and project types.

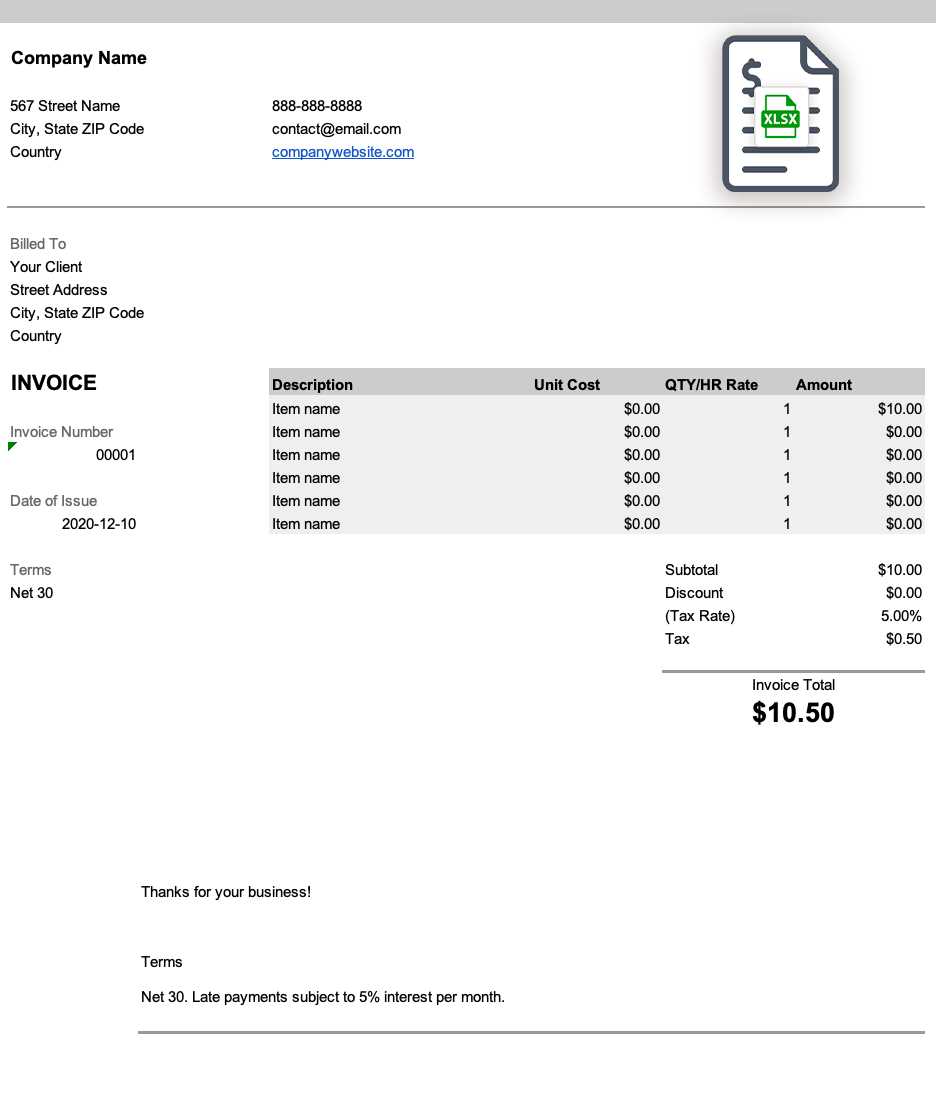

How to Create a Professional Payment Request in a Spreadsheet

Creating an effective and clear payment request document can significantly improve the way you manage transactions with clients. By designing a custom document tailored to your business needs, you ensure that all necessary details are included, making it easier for clients to understand the charges and make payments on time. The process can be quick and straightforward with the right approach, even if you are not familiar with complex software solutions.

Step 1: Set Up the Basic Structure

Start by setting up the basic layout of the document. Include fields such as your business name, contact information, and the client’s name and contact details. You should also add a unique reference number for easy tracking, along with the issue date and due date for payment. These elements provide clarity and help both parties stay organized.

Step 2: Add Details of the Work Provided

In the next section, list the services or tasks performed, including a brief description of each item, the quantity (e.g., hours worked or units provided), and the rate for each. You can then use simple calculations to automatically generate the total amount for each line item. This way, the client can clearly see what they are being charged for and why.

Once the basic structure is set up, add any additional elements such as taxes, discounts, or payment instructions. After that, make sure to format the document for readability–use bold headers, adjust font sizes, and include clear section separations. A well-organized document not only looks professional but also reduces the likelihood of disputes or confusion.

Top Benefits of Using Spreadsheets for Payment Requests

When managing client payments, using a flexible and customizable system can greatly enhance your efficiency and organization. A spreadsheet-based approach offers a range of advantages, from ease of use to the ability to quickly adapt the document to fit various business needs. It provides a powerful yet straightforward solution for professionals who want to streamline their billing process and ensure accuracy in their financial records.

Easy Customization and Flexibility

One of the primary advantages of using spreadsheets is the ability to easily modify the layout and fields to suit your unique requirements. You can tailor the document to match your branding, adjust the layout for readability, and add or remove sections as needed. This flexibility makes it simple to manage various billing models, whether you’re charging by the hour, project, or any other method.

Time-Saving Automation Features

Spreadsheets allow you to automate calculations, reducing the risk of manual errors and saving time. For example, formulas can automatically calculate totals, taxes, and discounts based on the data you enter. This not only speeds up the process but also ensures consistency across all your payment requests. With just a few key inputs, the document will instantly update, making it easier to focus on other aspects of your business.

Cost-effective: Unlike expensive invoicing software, using spreadsheets incurs no additional costs. All the tools you need are already built into spreadsheet programs, making this an affordable solution for any business size.

Easy Data Management: Storing payment requests in spreadsheets makes it easy to manage and track your transactions over time. You can sort and filter documents based on date, client, or payment status, providing you with a comprehensive overview of your financial situation at a glance.

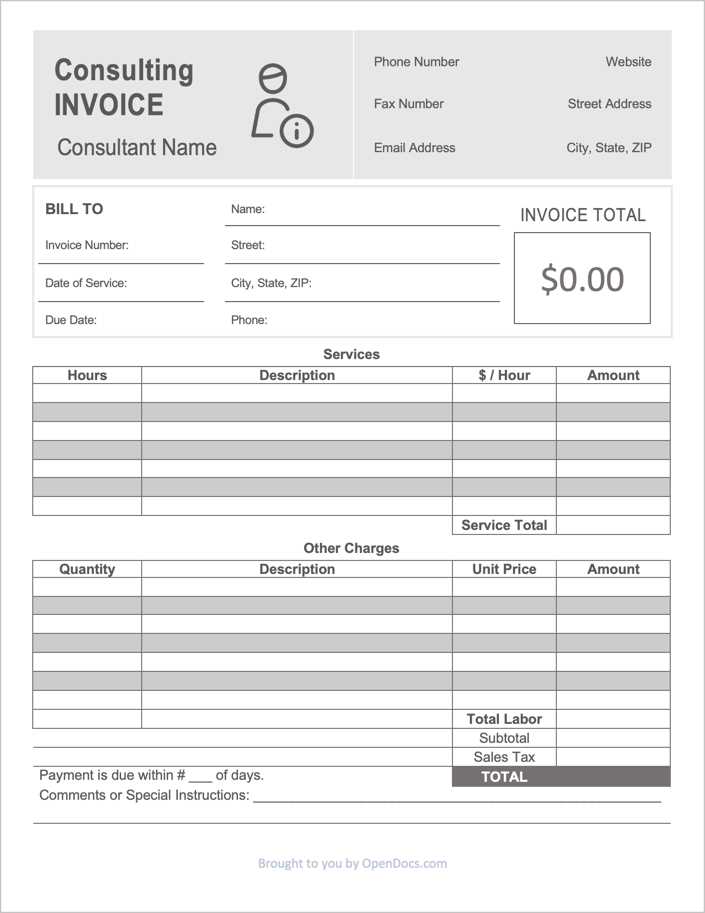

Essential Features of an Invoice Document

To ensure smooth and accurate billing, a well-structured payment request document must include key elements that allow both the client and the business to track the transaction effectively. These elements not only provide clarity but also help maintain a professional appearance. A well-designed document should contain all relevant details in a format that is easy to understand and process.

Clear Identification of Parties Involved

First and foremost, the document should clearly identify both the service provider and the client. This includes full names, contact details, and addresses. Having this information readily available helps avoid confusion and ensures that both parties know exactly who is involved in the transaction. Including a unique reference number for the document also helps track and reference the transaction easily in the future.

Detailed Breakdown of Charges

A key feature of any billing document is a detailed breakdown of the services or products provided. Each entry should clearly state the task performed, its cost, and any relevant quantities. This breakdown ensures transparency and makes it easier for the client to understand the charges. Additionally, having well-defined fields for rates, hours worked, or units delivered helps ensure accurate calculations and reduces the chance of misunderstandings.

Payment Terms and Deadlines: It is essential to include clear payment terms, such as the due date and accepted methods of payment. Specifying whether late fees apply for overdue payments also helps maintain professionalism and encourages timely transactions.

Additional Features: Other important sections to include are tax rates, any discounts offered, and a summary of the total amount due. A section for notes or additional comments can also be helpful for adding extra instructions or reminders for the client, further improving communication and clarity.

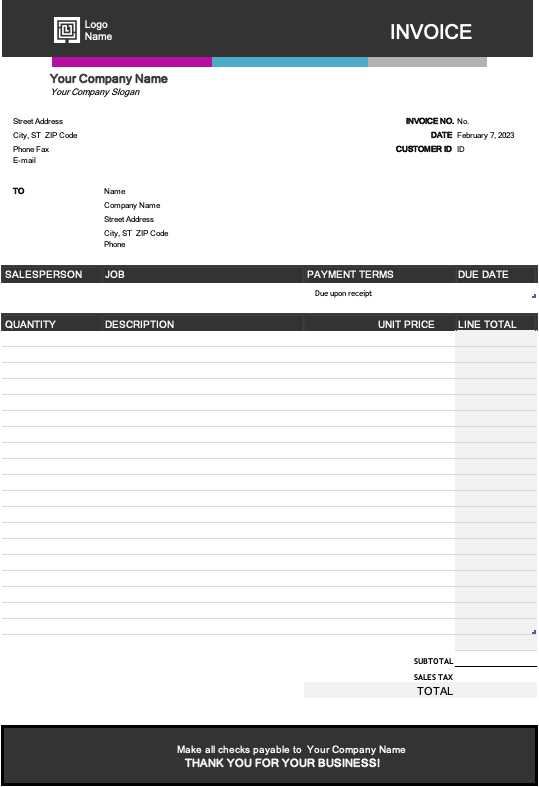

Customizing Your Excel Invoice Template

Personalizing your document layout allows you to create a streamlined and professional look that matches your brand’s identity. Whether you need to adjust the design or modify specific fields, making it your own is key to providing clarity and consistency for your clients. By fine-tuning the structure, you ensure all necessary information is presented efficiently and clearly, reflecting your business’s unique style.

The flexibility of most spreadsheet programs gives you the opportunity to alter fonts, colors, and cell sizes, while also adding your company logo or other branding elements. Customizing data fields, such as item descriptions, prices, or dates, allows you to tailor the document to meet your specific needs. Making sure that each part of the document aligns with your company’s visual and professional standards enhances both readability and trustworthiness.

For example, you can change column widths to fit detailed product or service descriptions, or reformat the numbers to display currency in the exact format required for your region. Furthermore, including your business contact details and payment instructions at the top of the document ensures that important information is easy to find for your clients, leading to fewer follow-up inquiries.

How to Add Tax and Discounts in Excel

Incorporating taxes and discounts into your financial documents is essential for accurately reflecting the total cost of a transaction. Whether you are applying a flat rate or a percentage-based deduction or addition, properly managing these calculations ensures transparency and helps maintain accurate records. By utilizing basic formulas and understanding where to place the relevant data, you can easily include these adjustments in your final amounts.

Adding Tax

To include a tax on your total amount, follow these simple steps:

- Determine the tax rate applicable to your transaction.

- In a new column, multiply the subtotal by the tax rate (e.g., 0.10 for 10% tax).

- Ensure that the total is automatically updated by adding the tax amount to the subtotal.

For example, if the subtotal is in cell B10 and the tax rate is 10%, the formula in a new cell would be:

=B10 * 0.10

This will calculate the tax amount, which can then be added to the original total to determine the final amount due.

Applying Discounts

To apply a discount, you can either subtract a fixed amount or use a percentage. Here’s how to do both:

- If it’s a fixed amount, simply subtract the discount from the subtotal.

- If it’s a percentage discount, multiply the subtotal by the discount rate and subtract the result from the total.

For a percentage discount of 15%, the formula would be:

=B10 - (B10 * 0.15)

Using Excel for Efficient Billing

Streamlining the billing process is essential for any business looking to manage its finances effectively. With the right approach, you can automate calculations, track payments, and ensure that all client transactions are accurately documented. By leveraging a spreadsheet program, you can easily create customizable records that keep everything organized, reducing the risk of errors and saving valuable time.

Automating Calculations

One of the biggest advantages of using a spreadsheet is its ability to automatically update totals, taxes, and discounts. This eliminates manual calculation errors and ensures consistency across multiple documents. Here’s how you can set up essential formulas for automatic updates:

- Subtotal Calculation: Multiply quantities by unit prices to calculate the subtotal for each item or service.

- Tax Calculation: Multiply the subtotal by the applicable tax rate to calculate the amount due.

- Discount Application: Subtract the discount amount or percentage from the subtotal before taxes.

- Total Calculation: Sum up the subtotal, taxes, and any additional fees to get the final amount owed.

By inputting the correct formulas once, you can have them automatically applied to new records, reducing repetitive tasks and increasing overall efficiency.

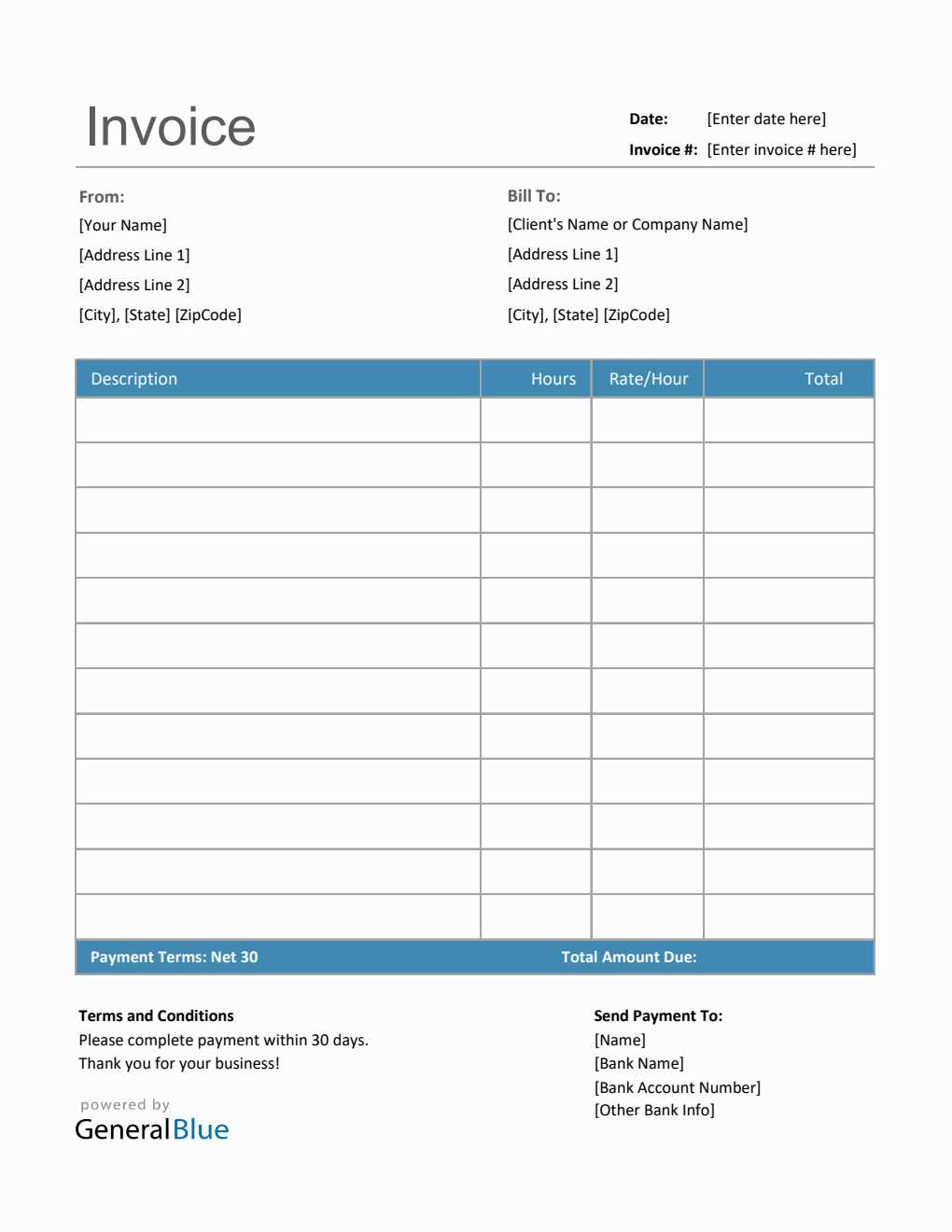

Tracking Payments and Outstanding Balances

Using a spreadsheet also allows you to monitor payment statuses in real time. You can create a simple system to track which invoices have been paid and which are still pending. Here are some ways to do this:

- Status Column: Add a column to indicate whether the payment has been received, is due, or is overdue.

- Due Date Reminders: Use conditional formatting to highlight upcoming due dates or overdue payments.

- Payment Tracking: Record payment dates and amounts in separate columns to maintain an accurate payment history.

This enables you to stay on top of your

How to Automate Invoice Calculations in Excel

Automating the calculation process for financial documents saves both time and reduces the risk of errors. By setting up formulas that handle the math automatically, you can focus on the more important tasks while ensuring that all figures are accurate. This method streamlines your workflow, especially when dealing with multiple entries or regular billing cycles. With the right formulas in place, every calculation–from subtotals to taxes–will update in real time as you make changes to the data.

Setting Up Basic Formulas

The key to automating calculations is understanding how to use basic formulas. Here are some fundamental ones to help you get started:

| Formula | Description | Example | |||

|---|---|---|---|---|---|

=A2*B2 |

Calculates the total for each item by multiplying quantity by unit price. | If A2 is 5 and B2 is 20, the result will be 100. | |||

=SUM(C2:C10) |

Calculates the sum of a range of values, typically for the subtotal. | If values from C2 to C10 are 10, 15, 20, etc., it will sum them up automatically. | |||

=C11*0.10 |

Calculates the tax by multiplying the subtotal (C11) by the tax rate (10%). | If C11 is 100, the result will be 10 (tax). |

| Client Name | Due Date | Amount Due | Amount Paid | Balance Remaining | Status |

|---|---|---|---|---|---|

| John Doe | 01/10/2024 | $500 | $500 | $0 | Paid |

| Jane Smith | 01/10/2024 | $750 | $300 | $450 | Partial |

This table allows you to easily update each entry as payments are received, and calculate any remaining balances automatically.

Using Formulas to Calculate Remaining Balances

To automatically calculate the balance remaining after each payment, use a simple formula. For instance, in the “Balance Remaining” column, subtract the “Amount Paid” from the “Amount Due.” The formula for this could be:

=C2-D2

Once the formula is set up, it will update the balance whenever a payment is entered. Additionally, you can use conditional formatting to highlight overdue payments or change the status automatically when the balance reaches zero.

Formatting Tips for Professional Invoices

Creating a well-organized and visually appealing financial document is essential for establishing credibility with clients. A clean and consistent design helps ensure that all relevant details are easy to find and understand. By following simple formatting guidelines, you can present your information in a way that’s not only professional but also makes the transaction process more efficient for both parties.

Essential Formatting Tips

To make sure your billing records stand out, consider these key formatting tips:

- Use Clear Headings: Start with a prominent heading at the top of the page that includes your business name, contact information, and the document title (e.g., “Payment Record” or “Transaction Statement”).

- Consistent Fonts and Colors: Stick to a simple, readable font for all text. Avoid overly decorative fonts and ensure that headings are distinct from the rest of the content. Use a consistent color scheme that aligns with your branding.

- Align Content Properly: Ensure all columns (e.g., descriptions, amounts, dates) are neatly aligned. This will make the document look more organized and easier to read.

- Leave Adequate Space: Don’t overcrowd

Common Mistakes to Avoid in Invoicing

When creating financial documents, small errors can lead to confusion, delayed payments, and even strained client relationships. Ensuring accuracy in every aspect of your record is essential to avoid these pitfalls. By being aware of common mistakes, you can streamline the process and maintain professionalism in all your transactions.

Top Mistakes to Watch Out For

- Missing or Incorrect Contact Information: Always double-check that both your and your client’s contact details are correct. Incorrect addresses, phone numbers, or email addresses can delay communications and payments.

- Incorrect or Missing Dates: Ensure that the date of issue and the payment due date are clearly stated. An incorrect date could lead to misunderstandings regarding payment terms.

- Unclear or Vague Descriptions: Provide clear and detailed descriptions of what is being billed. Vague terms like “work completed” or “consulting services” can cause confusion. Be specific about what is being provided and why.

- Mathematical Errors: Always verify the accuracy of your calculations. A small mistake in multiplying quantities or applying tax rates can lead to incorrect totals. Using automated calculations can help reduce this risk.

- Failure to Include Payment Terms: Clearly outline payment terms, such as the due date, late fees, and accepted payment methods. Without this information, clients may not know when and how to pay.

- Overlooking Discounts or Taxes: If you’re offering a discount or including tax, make sure these are applied correctly. Omitting these adjustments or incorrectly calculating them can lead to discrepancies.

How to Avoid These Mistakes

- Excel Templates vs. Other Invoicing Software

When managing financial documentation, businesses often face the decision of whether to use simple record sheets or invest in specialized software. Each option has its pros and cons, depending on the needs of the business and the complexity of the billing process. While spreadsheet-based solutions offer flexibility and cost-effectiveness, invoicing software typically provides more advanced features tailored to streamline operations. Understanding the differences between these two options can help you choose the best fit for your business.

Comparison of Key Features

Here’s a comparison of the most important features to consider when evaluating a record-keeping solution:

Feature Spreadsheet-Based Solution Invoicing Software Cost Usually free or low-cost (especially if using pre-made layouts) Typically subscription-based with monthly or annual fees Customization Highly customizable; can be tailored to your exact needs Less flexible; templates are provided but customization options are limited Ease of Use Requires some familiarity with formulas and layout design More user-friendly with simple interfaces designed specifically for invoicing Automation Basic automation, such as calculations, but limited f How to Protect Your Invoice Data in Excel

When managing financial records, securing sensitive information is crucial. Ensuring that your documents containing vital data remain confidential and protected from unauthorized access is a top priority. There are several measures you can take to safeguard your files from potential breaches and ensure only authorized individuals can modify or view the contents.

Use Password Protection

One of the simplest yet effective ways to keep your documents secure is by adding a password to limit access. By encrypting your file with a strong password, you can prevent unauthorized users from opening or editing the document. Make sure to choose a unique, complex password that combines letters, numbers, and special characters. Additionally, avoid using easily guessable passwords such as names or birthdates.

Limit Editing Permissions

Another key security measure is restricting editing capabilities. This ensures that only specific users can make changes to your data while others can only view it. You can lock certain cells, ranges, or entire sheets, allowing modifications only in designated areas. This feature helps maintain the integrity of your records, preventing accidental or intentional alterations by unauthorized parties.

By employing these strategies, you can protect your financial documents and ensure that your important information remains secure. Regularly updating passwords and reviewing permission settings will further enhance your protection against potential risks.

Saving and Sharing Your Excel Invoice Template

After creating a customized document to manage your billing, it’s important to know how to save it properly and share it with clients or team members. Whether you’re storing the file for future use or sending it to someone else, ensuring easy access and maintaining the integrity of the data is crucial. By following the right steps, you can guarantee that your work is preserved and shared seamlessly with others.

Choosing the Right Format

When saving your document, it’s essential to select the appropriate file format. If you need to retain all formatting and functionality, saving it in the original file type is ideal. However, if you want to share it with others who may not use the same software, consider exporting it as a PDF. This ensures that the layout and content remain consistent, regardless of the recipient’s software or device.

Sharing and Collaborating

For easy sharing, you can use cloud-based storage options like Google Drive or OneDrive. These platforms allow you to upload and share the file with specific individuals or groups. You can set permissions to control who can view or edit the document, making collaboration smooth and secure. For smaller files, email may be an option, but ensure the recipient is able to open and access the document without issues.

By understanding how to save and share your document efficiently, you can maintain organization and ensure that your work is always accessible when needed.

Improving Cash Flow with Excel Invoices

Effective management of payment schedules and financial documentation can significantly enhance cash flow. By streamlining the billing process and ensuring timely collection, businesses can maintain liquidity and meet their financial obligations. A well-organized approach to tracking payments helps reduce delays and minimizes the risk of overdue accounts.

Key Strategies to Enhance Cash Flow

- Set Clear Payment Terms: Always define the payment due date and conditions clearly. Consider offering early payment discounts to encourage prompt payments.

- Automate Reminders: Set up automatic payment reminders to notify clients about upcoming or overdue payments. Timely follow-ups can help avoid delays.

- Maintain Detailed Records: Keep accurate records of each transaction, including the date, amount, and payment status. This will help track outstanding balances and quickly identify any discrepancies.

- Offer Multiple Payment Methods: Provide clients with various ways to pay, such as bank transfers, online payment platforms, or checks. The easier it is for them to settle their dues, the faster you’ll receive your payments.

Leveraging Reports for Better Financial Insights

By regularly reviewing financial reports and payment histories, you can spot trends in your cash flow. Tracking which clients consistently pay on time versus those who delay can help you adjust payment terms or follow-up strategies accordingly. Monitoring cash flow with regular assessments ensures you can take proactive steps to avoid liquidity issues.

With these simple practices, you can keep your finances flowing smoothly, improving your busine