Modern Excel Invoice Template for Streamlined Billing

Organizing financial records and billing documents can be a complex task for any business. Having a structured, ready-made format helps streamline the entire process, allowing for quick updates and clear organization. A well-designed form is essential to ensure that all necessary details are included, from client information to payment terms. This approach not only saves time but also brings consistency to the way you handle payments and keep track of transactions.

Whether you’re working with large amounts of data or managing just a few clients, a pre-formatted solution can be tailored to suit your needs. You can easily adjust details, add branding, and set up automatic calculations, making the process more efficient and reducing manual work. These forms provide a user-friendly way to manage finances, helping you stay organized without needing complex software.

With easy access to adaptable options, even those with limited experience can quickly learn to create clear, detailed records. From small businesses to larger companies, using a customizable document helps maintain professionalism and ensures accuracy in every transaction. This approach not only simplifies tracking but also supports better financial planning and customer communication.

Excel Modern Invoice Template Guide

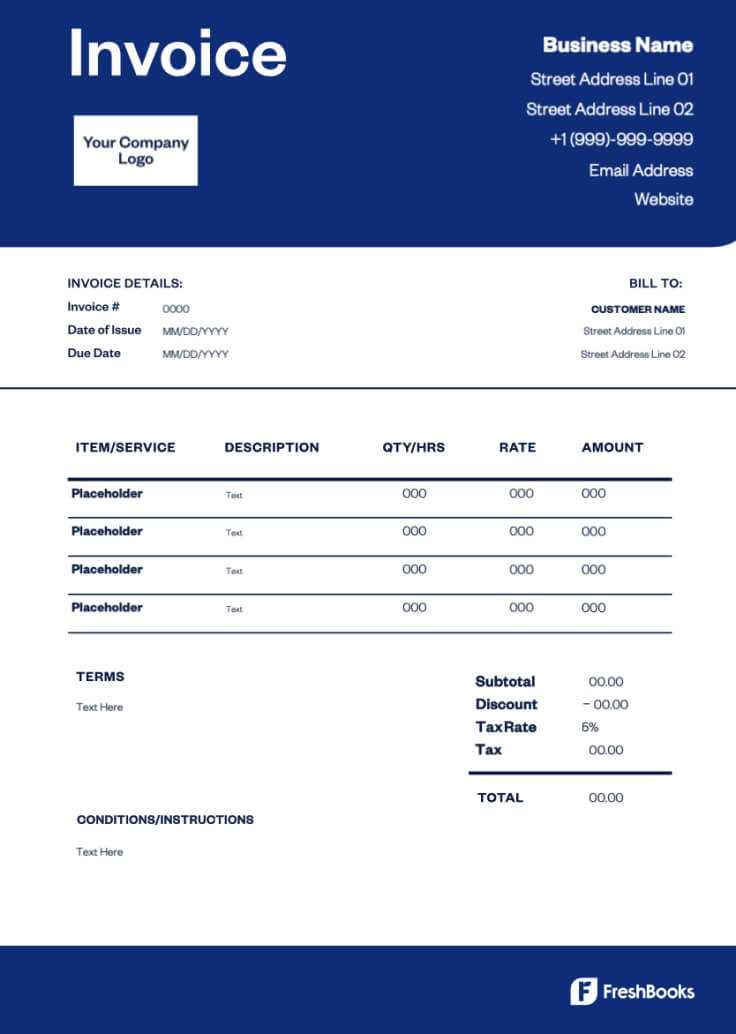

Creating organized financial documents is essential for any business looking to streamline its billing and maintain professional standards. By using pre-made forms designed specifically for payment processing, you can save time, improve accuracy, and establish a consistent approach to tracking transactions. This guide walks you through the steps of setting up and personalizing these forms, making it easy to maintain detailed, professional records.

A well-structured document allows for flexible customization, whether you’re adding company branding, adjusting formatting, or incorporating automated features for calculations. This adaptability ensures that the layout meets specific needs, helping you focus on content rather than design. With options to include client details, service descriptions, and pricing information, these forms help make sure that all critical aspects are covered.

To enhance productivity, consider setting up automated calculations for items like totals and taxes, reducing manual entry and the risk of error. Additionally, saving your forms in various formats for sharing–such as PDFs–enables quick, reliable communication with clients. This approach provides a seamless experience for both you and your customers, ensuring that your payment process is clear, efficient, and professional.

How to Create Invoices in Excel

Setting up structured financial documents can greatly simplify your billing process. By building a clear, organized layout, you can ensure that all essential information is accurately recorded, making it easier to manage client transactions and payment tracking. This approach not only enhances your workflow but also reflects a professional image to customers.

To start, outline key sections, such as company details, client information, itemized lists of products or services, and payment terms. By organizing these areas logically, you create a smooth flow that helps recipients quickly understand charges and due dates. Adding fields for automatic calculations can further streamline the process, handling totals and taxes without the need for manual input.

Once your format is complete, consider saving it as a reusable document to avoid creating new files from scratch each time. This allows for consistent formatting and speeds up future work. Sharing files in different formats, like PDFs, also ensures that clients receive a stable, uneditable version, which is ideal for record-keeping and clear communication.

Benefits of Using Excel Templates

Employing ready-made formats for financial documents offers numerous advantages, especially in terms of efficiency and consistency. With a structured layout that’s easy to customize, businesses can quickly produce polished records that convey professionalism and attention to detail. This approach reduces the need for manual setup, allowing you to focus on content rather than design.

One of the key advantages is the time saved in preparation. A pre-designed format includes all essential sections, so you don’t have to start from scratch each time. Custom fields, automatic calculations, and predefined layouts simplify the process, making it accessible even to those with minimal technical knowledge. This can significantly cut down on administrative workload, freeing up resources for other business tasks.

Moreover, using a consistent format across all financial records helps establish a uniform brand image. It ensures that each document contains the same key information in the same order, reducing the likelihood of errors. Additionally, these formats often include options to save as PDFs or other secure formats, making it easy to share with clients while ensuring that the document remains unchanged. This combination of efficiency, reliability, and clarity is invaluable for any growing business.

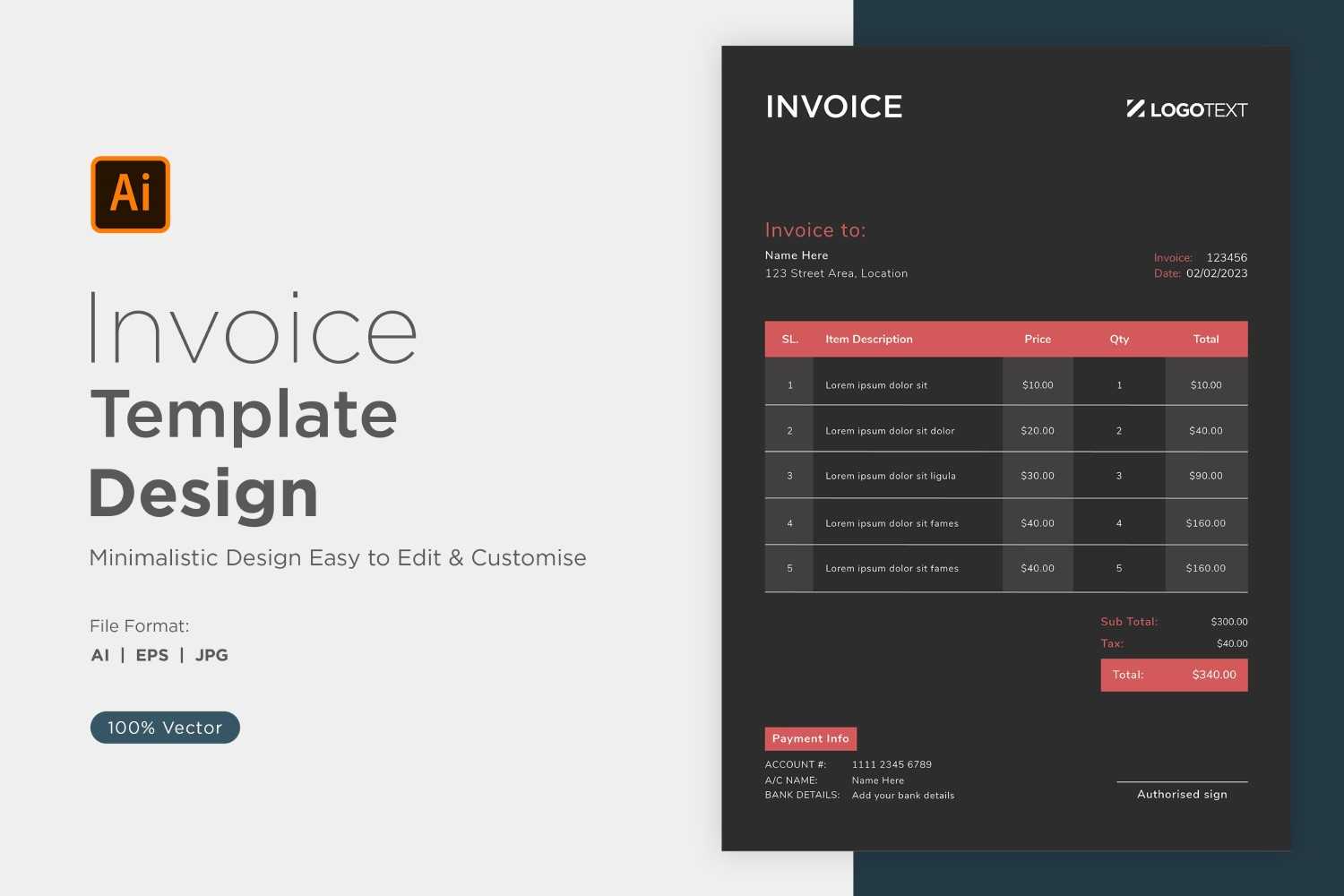

Customizing Your Invoice Design

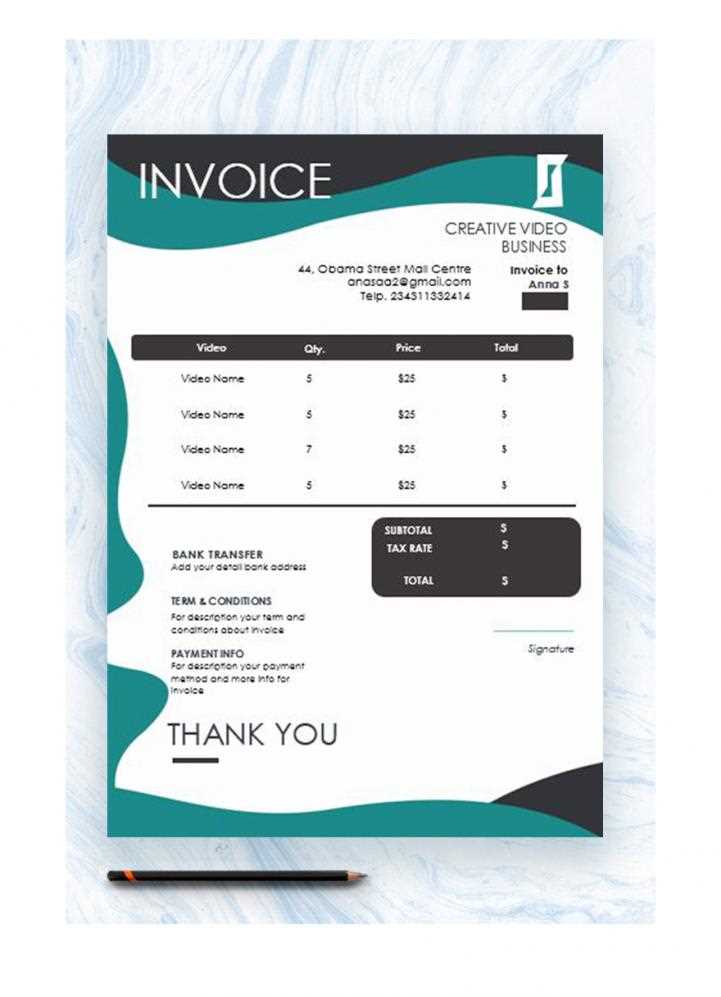

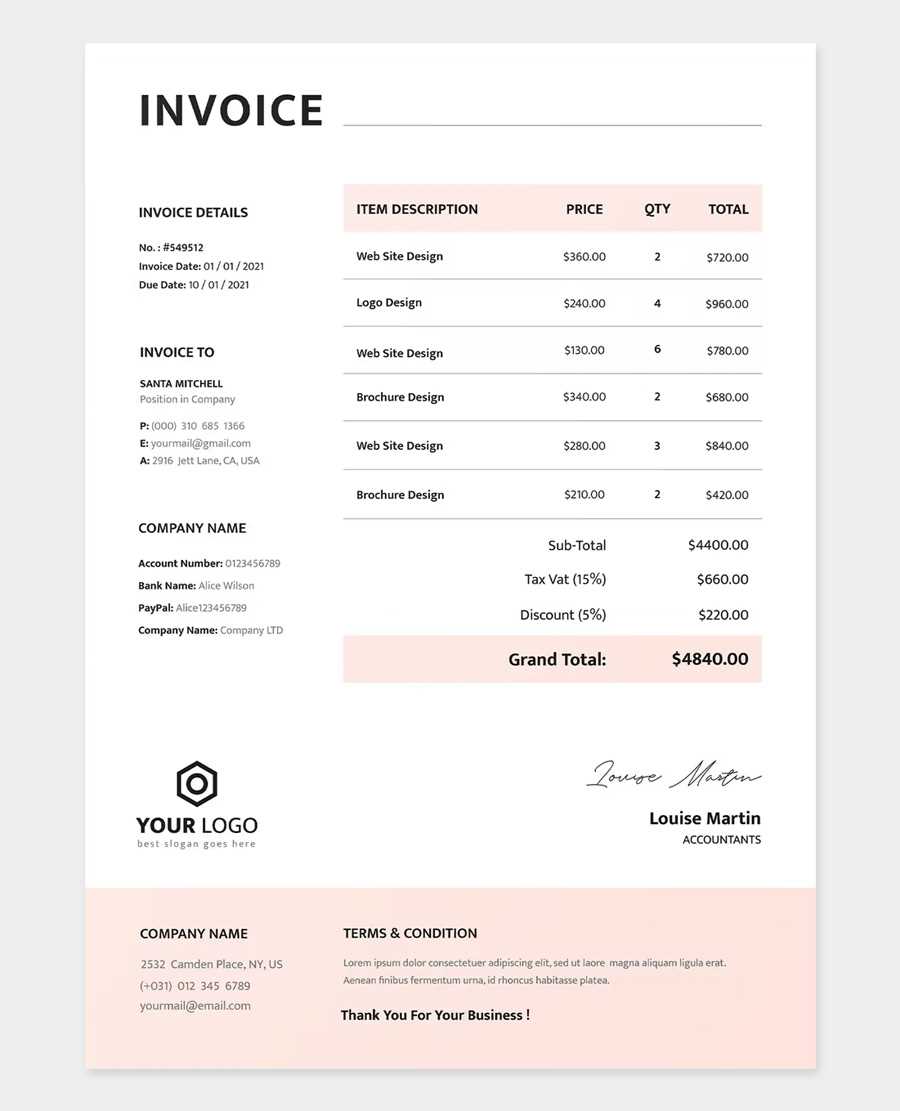

Tailoring financial documents to reflect your brand and meet specific business needs adds a personal touch and enhances professionalism. By customizing the layout, colors, and fields, you can ensure that every detail aligns with your company’s identity, making each document unique and easily recognizable by clients.

To help personalize your document, consider these key elements:

- Logo and Branding: Adding your company logo, colors, and fonts reinforces brand identity. This helps make your documents visually cohesive and memorable.

- Headers and Footers: Including headers with your business name and footers with contact information provides easy access to essential details for clients.

- Custom Fields: Depending on your industry, you may want additional fields, such as specific payment terms, product codes, or service details. Adding these sections ensures all relevant information is cl

Essential Features for Modern Invoices

In a well-crafted billing document, certain features are indispensable to ensure clarity, accuracy, and ease of use. Incorporating these key elements not only improves readability but also enhances the efficiency of managing transactions. From detailed itemization to automated totals, these features are essential for producing reliable and professional documents that meet current business standards.

Key Information Sections

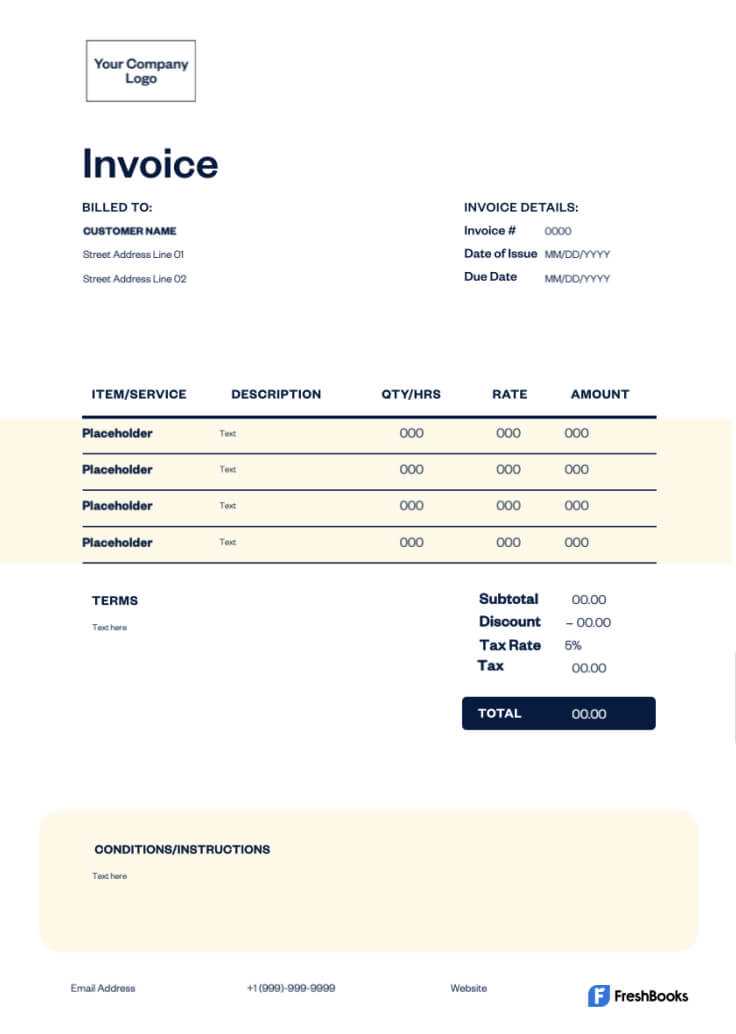

Each document should be organized with clear sections that outline essential transaction details. These fields help both you and the client stay informed about each part of the billing process. Consider including the following areas:

Section Description Company Information Your business name, address, contact details, and branding elements such as a logo. Client Details The recipient’s name, address, and relevant contact information for a streamlined process. Itemized List A breakdown of each produ Essential Features for Modern Invoices

In a well-crafted billing document, certain features are indispensable to ensure clarity, accuracy, and ease of use. Incorporating these key elements not only improves readability but also enhances the efficiency of managing transactions. From detailed itemization to automated totals, these features are essential for producing reliable and professional documents that meet current business standards.

Key Information Sections

Each document should be organized with clear sections that outline essential transaction details. These fields help both you and the client stay informed about each part of the billing process. Consider including the following areas:

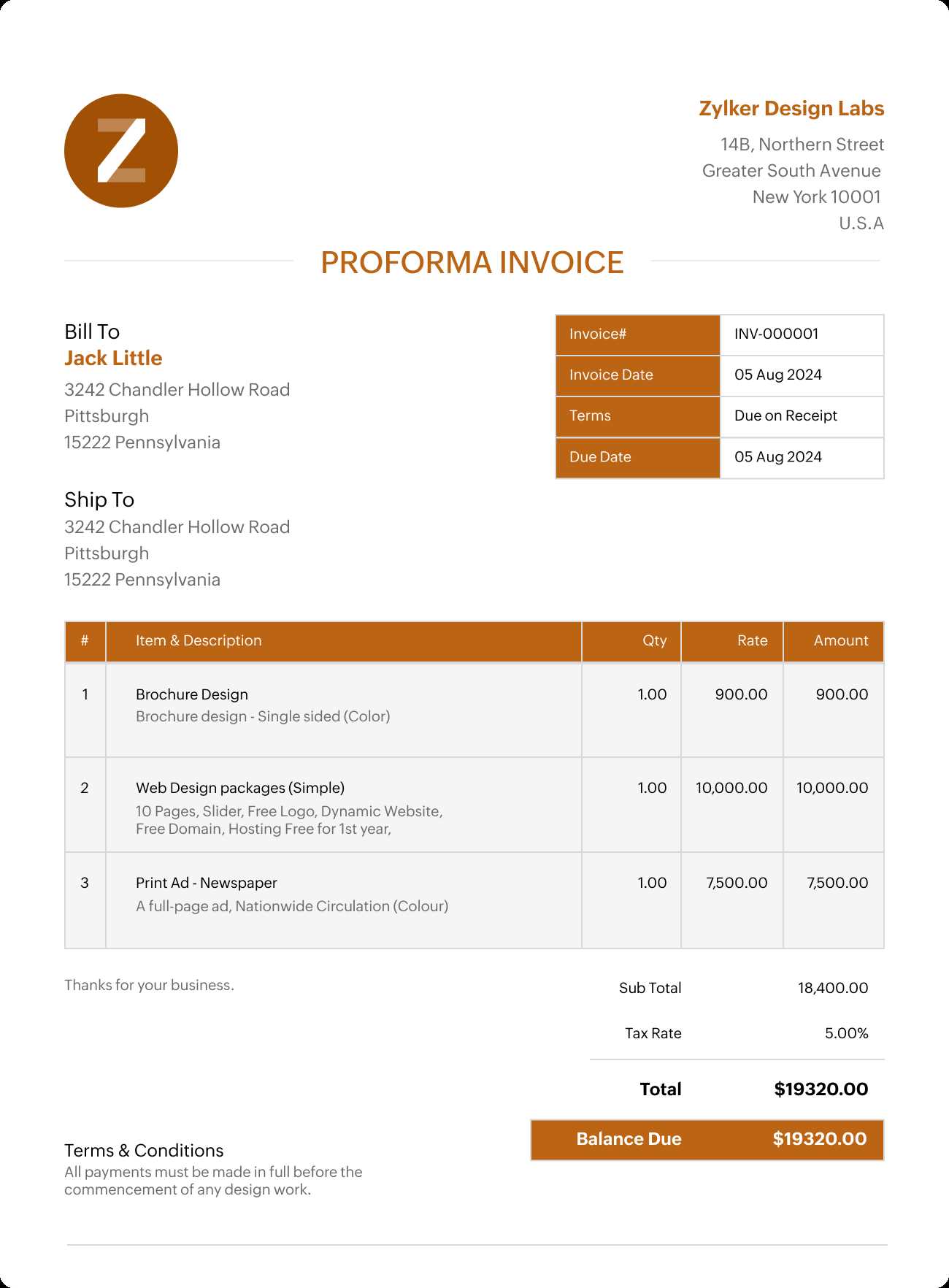

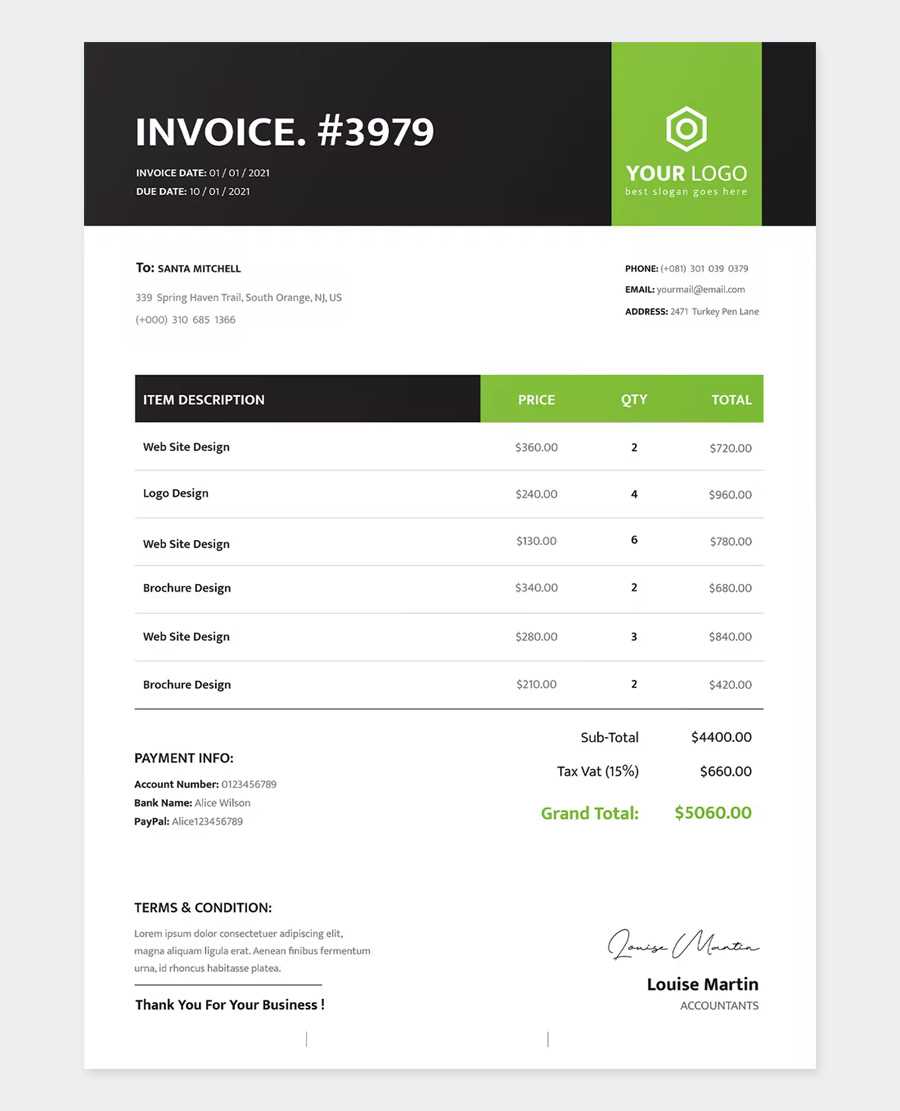

Section Description Company Information Your business name, address, contact details, and branding elements such as a logo. Client Details The recipient’s name, address, and relevant contact information for a streamlined process. Itemized List A breakdown of each product or service, including descriptions, quantities, and unit prices. Total and Subtotal Automated fields calculating subtotal, applicable taxes, discounts, and the final amount. Payment Terms Details such as due date, accepted payment methods, and any applicable late fees. Additional Functionalities

Including automated functions can streamline the document creation process and reduce the chance of errors. Important features to consider include:

Feature Purpose Auto-Calculation Automatically calculates totals, taxes, and discounts, minimizing manual work. Customizable Fields Allows you to adapt the form for specific products or services unique to your business. Save as PDF Creates a stable, shareable file format, ideal for sending to clients and keeping consistent records. By incorporating these essential sections and features, your billing documents can become a more efficient, reliable, and professional tool in your business processes.

Formatting Tips for Professional Invoices

Creating a polished and professional billing document involves thoughtful formatting choices that enhance readability and convey a sense of trustworthiness. By adhering to specific guidelines, you can ensure that your documents not only present the necessary information clearly but also reflect your brand’s identity effectively. The right formatting can make a significant difference in how clients perceive your business.

Use Consistent Layouts

Consistency in layout is crucial for a professional appearance. Here are some formatting tips to maintain uniformity:

- Alignment: Ensure that all text is aligned properly, preferably left-aligned for readability. Important headings can be centered for emphasis.

- Font Selection: Choose a clear and professional font, such as Arial or Calibri, and use it consistently throughout the document. Avoid using more than two different font types.

- Font Size: Use a readable font size, typically between 10 and 12 points for body text, and larger sizes for headings.

Enhance Visual Appeal

In addition to layout consistency, consider these elements to improve the overall aesthetic:

- White Space: Utilize adequate spacing between sections and items to prevent overcrowding and enhance clarity.

- Color Scheme: Use colors that align with your branding while ensuring that the text remains legible against the background.

- Bold and Italics: Apply bold for headings and important figures, while italics can be used for additional explanations or notes.

By applying these formatting tips, you can create documents that not only provide essential information but also reflect a high level of professionalism and attention to detail, thereby building trust with your clients.

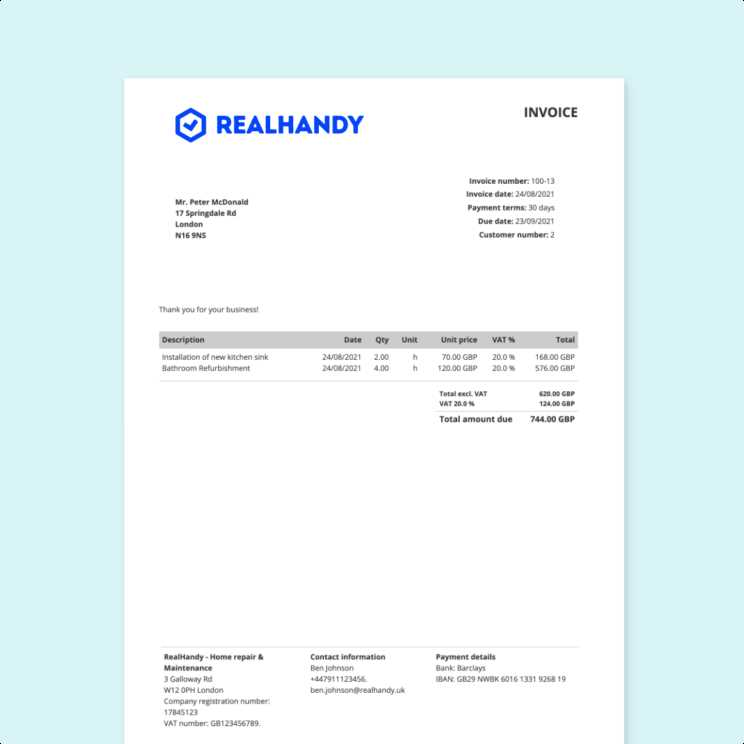

Adding Your Logo to Invoices

Incorporating your business logo into billing documents not only enhances branding but also establishes a professional appearance. A well-placed logo can reinforce your identity and make your documents easily recognizable. This addition is a straightforward way to communicate your brand’s essence and leave a lasting impression on clients.

Choosing the Right Logo

When selecting a logo for your documents, consider the following factors to ensure it aligns well with your overall branding:

- Resolution: Use a high-resolution image to avoid pixelation. A clear logo conveys professionalism.

- Size: Choose a size that fits well within the document layout without overwhelming the content. A smaller logo in the header is typically effective.

- Color Scheme: Ensure the colors of the logo complement the overall color palette of your document for a cohesive look.

Inserting Your Logo

Here are steps to effectively add your branding to your documents:

- Placement: Position the logo at the top of the document, ideally in the header section, where it can be easily seen.

- File Format: Use commonly accepted formats such as PNG or JPEG for easy insertion and compatibility.

- Consistency: Make sure to use the same logo across all your documents to maintain brand consistency.

By integrating your logo thoughtfully, you can enhance the visual appeal of your billing documents while reinforcing your brand identity in the eyes of your clients.

Saving and Sharing Invoice Files

Efficiently managing and distributing your billing documents is essential for smooth business operations. Knowing how to save and share these files can streamline communication with clients and ensure prompt payments. Proper handling of your documents not only protects your information but also enhances professionalism in your interactions.

Best Practices for Saving Files

When it comes to saving your documents, consider the following tips:

- File Format: Save your documents in widely used formats such as PDF or DOCX to ensure compatibility across different devices and platforms.

- Organized Structure: Create a logical folder structure on your device to store documents. Use clear naming conventions that include the client’s name and the date for easy retrieval.

- Backup Regularly: Ensure your files are backed up to prevent data loss. Utilize cloud storage solutions for automatic backups and easy access.

Effective Sharing Methods

Sharing your documents with clients can be done through various methods. Here are some effective options:

- Email: Attach the saved file to an email, providing a brief message that outlines the contents and any necessary actions required from the client.

- Cloud Services: Use platforms like Google Drive or Dropbox to share documents. This method allows you to send a link rather than large file attachments.

- Client Portals: If applicable, utilize secure client portals that enable direct uploads and downloads of important documents, ensuring privacy and security.

By following these practices for saving and sharing your billing documents, you can enhance your workflow, maintain organization, and ensure that your clients receive timely and accessible information.

Step-by-Step Invoice Creation Process

Creating effective billing documents requires a systematic approach to ensure clarity and professionalism. Following a structured process helps maintain consistency and ensures that all necessary information is included. This guide outlines the essential steps to produce polished and comprehensive documents that can facilitate smooth transactions.

1. Gather Necessary Information

Before starting the creation process, collect all relevant details, including:

- Client’s name and contact information

- Your business name and contact details

- Description of goods or services provided

- Pricing and payment terms

- Date of service delivery

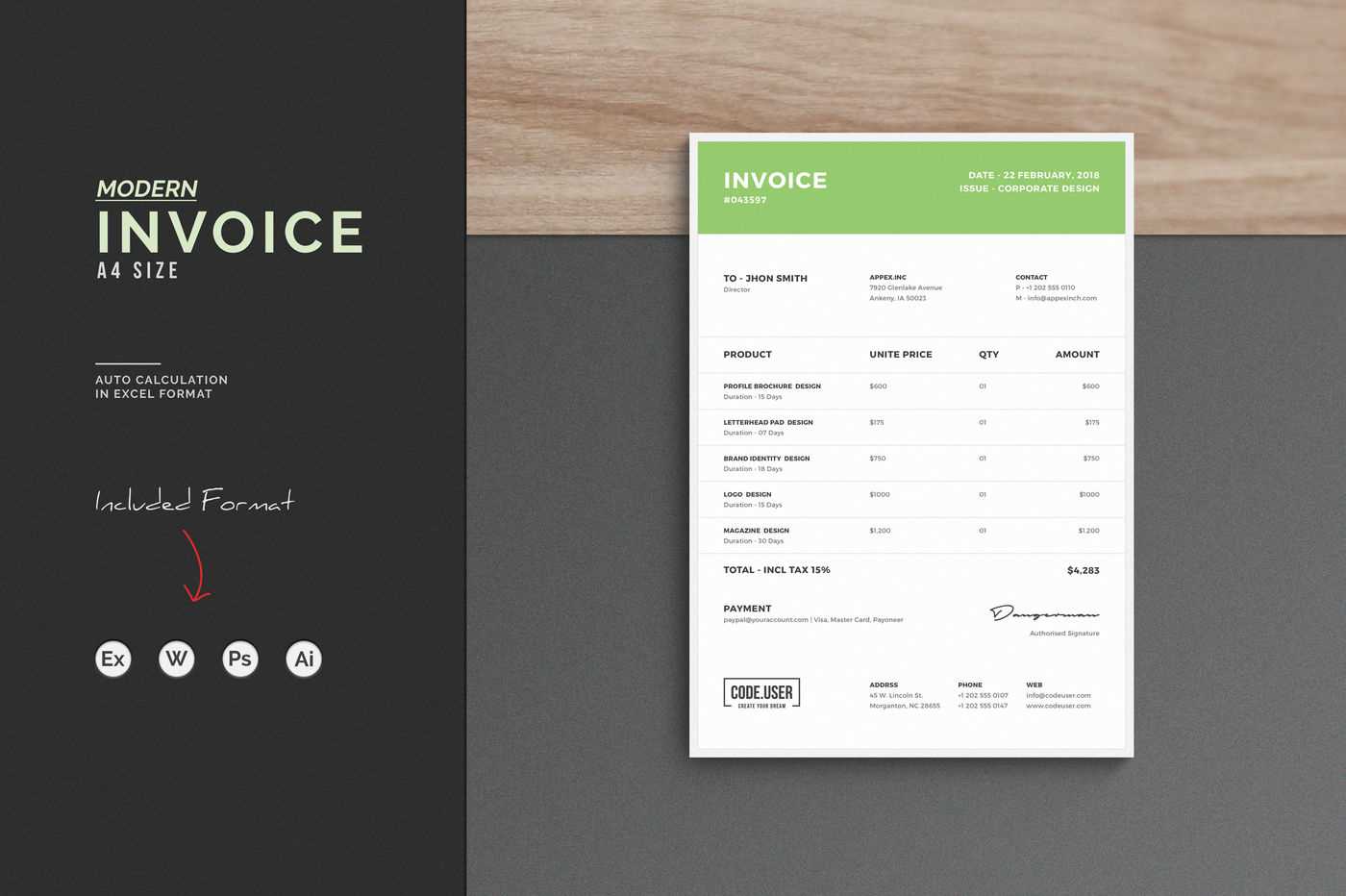

2. Choose a Suitable Format

Select a suitable format for your document. Popular options include spreadsheets and word processors, which offer flexibility in layout and design. Ensure the chosen format allows easy editing and customization.

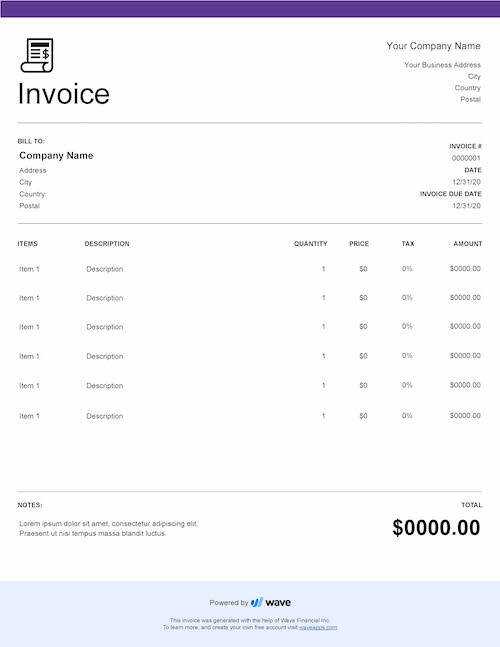

3. Design the Document Layout

Create a clear and organized layout that includes:

- A header with your business logo and contact information

- A section for the client’s details

- A list of services or products rendered, including descriptions and costs

- Total amount due and payment instructions

4. Review for Accuracy

Before finalizing the document, review it thoroughly to ensure that all information is accurate. Check for spelling errors, correct pricing, and completeness of details to avoid misunderstandings.

5. Save and Distribute

Once reviewed, save the document in a widely accepted format such as PDF for distribution. Choose an appropriate method for sharing it with the client, whether through email or a cloud service, ensuring that it is accessible and secure.

By following these steps, you can streamline the process of creating billing documents, enhancing your professional image while ensuring clarity and efficiency in financial transactions.

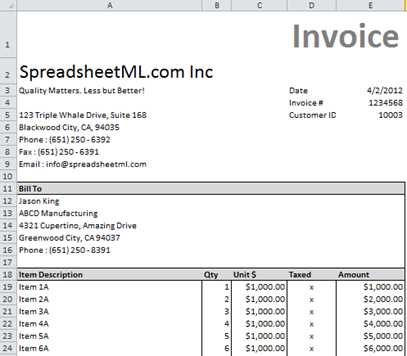

Using Formulas to Automate Totals

Incorporating automated calculations into your financial documents can significantly enhance accuracy and efficiency. By using formulas, you can effortlessly compute totals, taxes, and discounts, reducing the likelihood of errors while saving valuable time. This section will explore the benefits of leveraging formulas to streamline your calculations.

Formulas can be used to automatically calculate various components within your billing documents. Below is a simple example of how to set up a basic table that includes item descriptions, quantities, prices, and the calculated totals:

Item Description Quantity Unit Price Total Product A 2 $50.00 =B2*C2 Product B 3 $30.00 =B3*C3 Product C 1 $20.00 =B4*C4 Grand Total =SUM(D2:D4) In this example, the formula in the “Total” column multiplies the quantity of each item by its unit price, while the grand total sums up all individual totals. By utilizing such formulas, you can ensure that updates to quantities or prices are automatically reflected in the totals, simplifying your workflow and maintaining consistency in your documents.

Organizing Client Information Efficiently

Maintaining a well-structured database of client details is crucial for any business looking to enhance relationships and streamline operations. Efficient organization of this information enables quick access, improved communication, and better service delivery. In this section, we will discuss methods to effectively categorize and manage client data.

To achieve an organized client database, consider implementing the following strategies:

- Consistent Data Entry: Ensure that all information is recorded uniformly. This includes standardizing formats for names, addresses, and contact numbers, which will help in minimizing confusion.

- Use of Categories: Group clients based on relevant criteria such as industry, location, or purchasing habits. This categorization makes it easier to analyze trends and tailor your services to meet specific needs.

- Regular Updates: Set a schedule to review and update client information regularly. This practice ensures that your records remain accurate and up-to-date, allowing for better decision-making.

- Utilizing Search Functions: Leverage search features to quickly locate client profiles. This can save time and increase efficiency, particularly when dealing with a large volume of data.

By implementing these strategies, businesses can create a more efficient and user-friendly system for managing client information. This not only enhances operational effectiveness but also fosters stronger relationships with clients through timely and relevant communication.

Protecting Your Invoice Data in Excel

Securing sensitive information is paramount for any business, especially when dealing with financial documents. Effective measures must be taken to safeguard data against unauthorized access and potential loss. In this section, we will explore strategies to enhance the security of your financial records.

Implementing Password Protection

One of the simplest ways to secure your documents is by using password protection. This feature restricts access to authorized users only. Choose a strong password that combines letters, numbers, and special characters to maximize security.

Regular Backups

Creating regular backups is essential to prevent data loss due to unforeseen events such as system failures or accidental deletions. Store copies of your financial documents in multiple locations, including cloud storage and external drives. This ensures that your data remains safe and retrievable.

By incorporating these protective measures, you can significantly reduce the risk of data breaches and ensure that your financial information remains confidential and intact. Prioritizing security not only protects your business but also fosters trust with clients and stakeholders.

Exporting Invoices as PDFs from Excel

Transforming your financial documents into a widely accepted format is essential for ease of sharing and professional presentation. The Portable Document Format (PDF) ensures that your records maintain their layout and can be viewed on any device without alteration. This section will guide you through the process of converting your financial statements into PDF files efficiently.

To begin, open your document and ensure that all details are accurately entered. Next, navigate to the ‘File’ menu and select the ‘Save As’ option. In the dialogue box, you will find a dropdown menu labeled ‘Save as type.’ From this menu, choose PDF. Make sure to select an appropriate location on your computer to save the new file.

Once you have chosen the desired settings, click ‘Save.’ The document will be converted, and a PDF version will be created in the location you specified. This format is ideal for sending to clients or for archiving purposes, as it preserves the integrity of the content while providing a professional appearance.

By exporting your documents as PDFs, you enhance the professionalism of your communications and ensure that important information remains intact during transmission.

Tracking Payments with Excel Templates

Maintaining a clear record of financial transactions is crucial for effective business management. By utilizing well-structured worksheets, you can monitor incoming payments and manage your cash flow more efficiently. This section will provide insights on how to effectively track your receivables using organized spreadsheets.

Setting Up Your Payment Tracker

Creating an efficient payment tracking system involves a few simple steps:

- Create a New Worksheet: Begin by opening a blank sheet where you can design your tracking system.

- Define Key Columns: Include essential fields such as:

- Date of transaction

- Client name

- Amount due

- Payment status

- Notes or comments

- Input Data: As payments are received, enter the relevant information into the respective columns to keep your records current.

Utilizing Formulas for Automation

To enhance your tracking process, consider incorporating formulas to automatically calculate totals and outstanding balances. This will save you time and reduce the risk of manual errors. For instance, use the SUM function to quickly determine the total amount received and the balance remaining for each client.

By implementing a systematic approach to tracking payments, you can ensure timely follow-ups and maintain a healthy cash flow, contributing to the overall success of your business.

Using Conditional Formatting for Invoices

Implementing visual cues in your financial documentation can greatly enhance clarity and ensure important details are easily recognizable. By utilizing dynamic formatting features, you can automatically change the appearance of certain data based on specified criteria. This approach not only improves readability but also helps in quickly identifying critical information, such as overdue amounts or high-value transactions.

Below is an example of how to set up conditional formatting for various financial metrics:

Criteria Formatting Action Example Overdue Payments Change cell color to red $500 (Past Due) Paid Amounts Change font to green $300 (Paid) High Value Transactions Bold text $1,000 (High Value) By establishing rules for visual differentiation, you can streamline your review process and ensure you address critical items promptly. As you apply these formatting options, you will find that they not only enhance the aesthetic appeal of your documentation but also support efficient financial management.

Common Errors When Making Invoices

Creating accurate financial documents is essential for maintaining professionalism and ensuring timely payments. However, mistakes can occur during the preparation process, leading to confusion and potential delays in receiving funds. Understanding and recognizing these common pitfalls can help you streamline your documentation process and enhance clarity for your clients.

1. Incorrect Calculations

Mathematical errors can significantly impact the total amount owed. Double-checking calculations for subtotals, taxes, and final amounts is crucial to prevent discrepancies that may affect your cash flow.

2. Missing Client Information

Omitting important details, such as client names, addresses, or contact numbers, can result in miscommunication. Ensure that all necessary information is included to facilitate easy identification and processing of payments.

3. Inconsistent Formatting

Using varying styles and formats throughout your financial documents can lead to a disorganized appearance. Maintaining a consistent layout, font, and color scheme enhances readability and presents a professional image to your clients.

4. Delayed Sending

Timing is key in the financial realm. Delaying the delivery of your documents can lead to late payments. Establish a routine to send out your paperwork promptly after services are rendered.

By being aware of these common errors and implementing strategies to avoid them, you can create more efficient and accurate financial documentation, fostering trust and reliability in your business relationships.

Choosing the Right Spreadsheet Layout

Selecting an appropriate design for your financial documents is crucial for effective communication and presentation. The right format can enhance clarity, improve organization, and contribute to a professional image. When considering different designs, it’s essential to evaluate various factors to ensure that the chosen option meets your needs and those of your clients.

1. Assess Your Business Needs

Before selecting a layout, identify your specific requirements. Consider the nature of your services, the types of transactions you conduct, and the information that needs to be displayed. A more complex format might be necessary for detailed projects, while simpler designs could suffice for straightforward services.

2. Evaluate Visual Appeal

Aesthetics play a vital role in how your documents are perceived. Choose a layout that reflects your brand’s identity, using appropriate colors, fonts, and graphics. A visually appealing design can make a lasting impression on clients.

3. Look for Customization Options

Flexibility in adjusting the layout to suit your specific preferences is important. Opt for designs that allow easy modifications, such as adding or removing sections, changing fonts, or incorporating your logo. This customization ensures that the document aligns with your unique style.

4. Consider User-Friendly Features

Choose a design that is intuitive and easy to navigate. Users should be able to fill out the necessary fields without confusion. Clear headings, labels, and structured sections can enhance usability, making it easier for both you and your clients.

Factor Considerations Business Needs Complexity of services and required information Visual Appeal Brand identity and aesthetic quality Customization Flexibility to modify sections and designs User-Friendly Ease of navigation and clarity of layout By carefully considering these aspects, you can select a layout that not only meets your functional needs but also enhances your professional image, facilitating better communication with your clients.