Excel Legal Invoice Template for Efficient Billing

Managing payments and keeping track of transactions is a crucial part of any professional service. Creating clear, well-organized documents to request compensation for work completed helps ensure smooth business operations and prevents misunderstandings. Whether you are a consultant, attorney, or freelancer, an effective billing system can save you time and increase your credibility with clients.

With the right tools, customizing your billing forms to fit your specific needs can be straightforward. By utilizing a flexible format, you can quickly adapt to various payment structures, from hourly rates to flat fees, and accommodate the unique requirements of each client. This approach not only streamlines the process but also minimizes errors and delays in receiving payment.

Streamlining the invoicing process can help you focus more on your work while ensuring that clients are billed accurately and professionally. Using simple yet powerful tools available to you, you can create a system that works for both you and your clients, making financial management an easier and more efficient task.

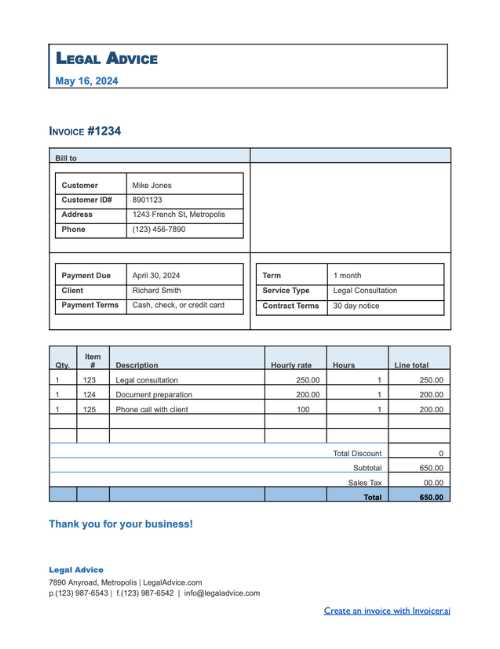

Creating a Professional Legal Invoice

In the professional world, requesting payment for services rendered is a key component of maintaining business relationships. A well-structured document outlining the details of services provided not only facilitates clear communication but also reinforces your professionalism. Crafting an effective billing statement requires attention to detail and an understanding of both the client’s needs and the format that ensures accuracy and compliance.

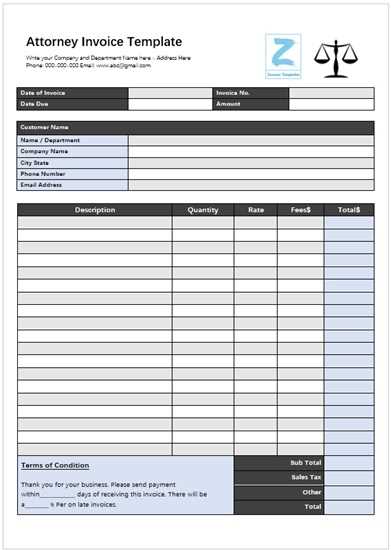

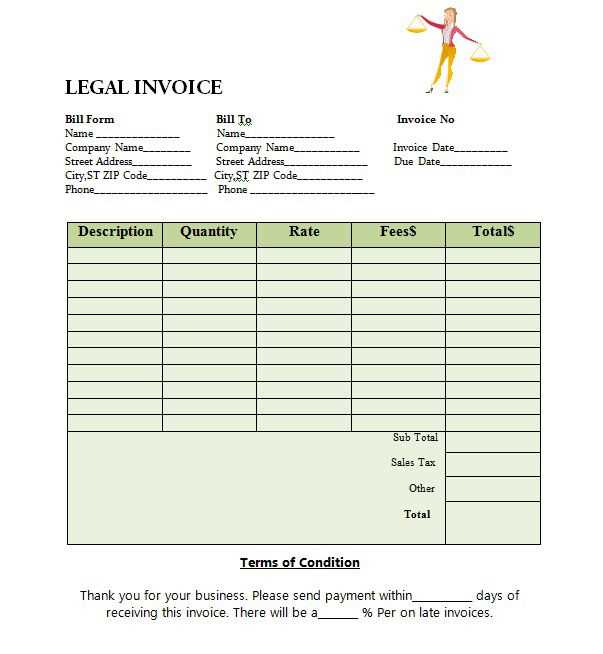

To ensure your statement is professional and easy to process, it should include the following elements:

- Client Information: Include the client’s full name, address, and contact details to avoid confusion and ensure proper delivery.

- Service Details: Describe the work performed, including the scope, duration, and any special terms agreed upon.

- Payment Terms: Clearly state the payment methods accepted, due dates, and any applicable late fees.

- Breakdown of Charges: Provide a detailed list of all services and corresponding costs to avoid disputes over amounts owed.

- Unique Identifiers: Assign a reference number or code for the statement to help track payments and maintain proper records.

These elements contribute to creating a well-organized and professional billing statement, ensuring both you and your client are clear about the financial transaction. It is essential that the document is simple to understand, concise, and free of errors to foster trust and facilitate prompt payments.

Benefits of Using Excel for Billing

When managing financial transactions, having a flexible, easy-to-use system can significantly improve efficiency. Using a digital platform for creating and managing payment requests streamlines the process and offers several advantages. A well-structured format allows for quick adjustments, ensuring that all necessary information is included, accurate, and presented professionally.

Customization and Flexibility

One of the main benefits of utilizing a spreadsheet program is the ability to fully customize the layout and structure of your documents. You can easily tailor the design to suit your specific needs, adding or removing fields based on the types of services provided. This flexibility means you can adapt the format as your business grows or as client requirements change.

Automation and Accuracy

With automated features, such as built-in formulas for calculations and data validation tools, the chances of errors are minimized. You can automate tasks like calculating totals, applying taxes, and managing due dates. This automation not only saves time but also ensures that all figures are accurate, helping to maintain a high level of professionalism and reducing the need for manual corrections.

Increased efficiency through automation and customization helps you maintain a smooth workflow while reducing the risk of mistakes. By utilizing a system that allows for quick updates and easy tracking, you can ensure your clients receive the correct information and that payments are processed promptly.

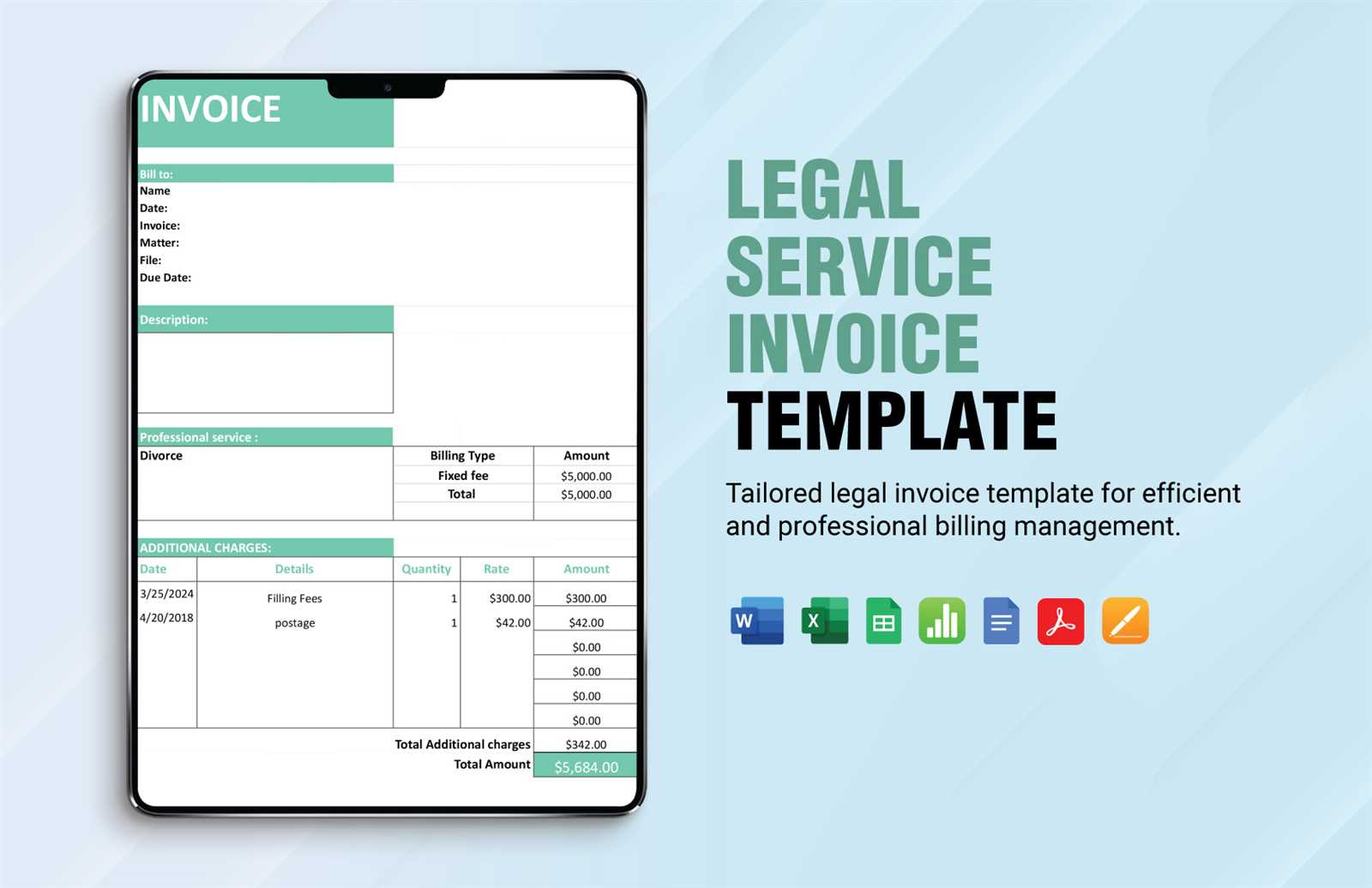

Customizing Your Billing Document

Adapting your billing document to meet specific business needs is essential for maintaining professionalism and clarity. Tailoring the layout and content allows you to present a personalized approach that reflects your services, brand, and client preferences. A customized form ensures that all necessary details are included in an organized manner, providing both you and your clients with an easy-to-understand overview of the transaction.

Key customization options include:

- Branding Elements: Incorporate your business logo, color scheme, and contact information to ensure the document is aligned with your branding.

- Service Descriptions: Adjust the section for detailing services to match the type of work you provide, whether it’s project-based, hourly, or flat-rate services.

- Payment Terms: Customize payment deadlines, accepted methods, and any penalties for late payments based on your business policies.

- Formatting: Organize the document with clear headings and sections to improve readability, helping clients quickly understand the charges and due dates.

By adjusting these elements, you can create a tailored document that not only enhances the clarity of financial transactions but also reflects your professional approach and strengthens client trust.

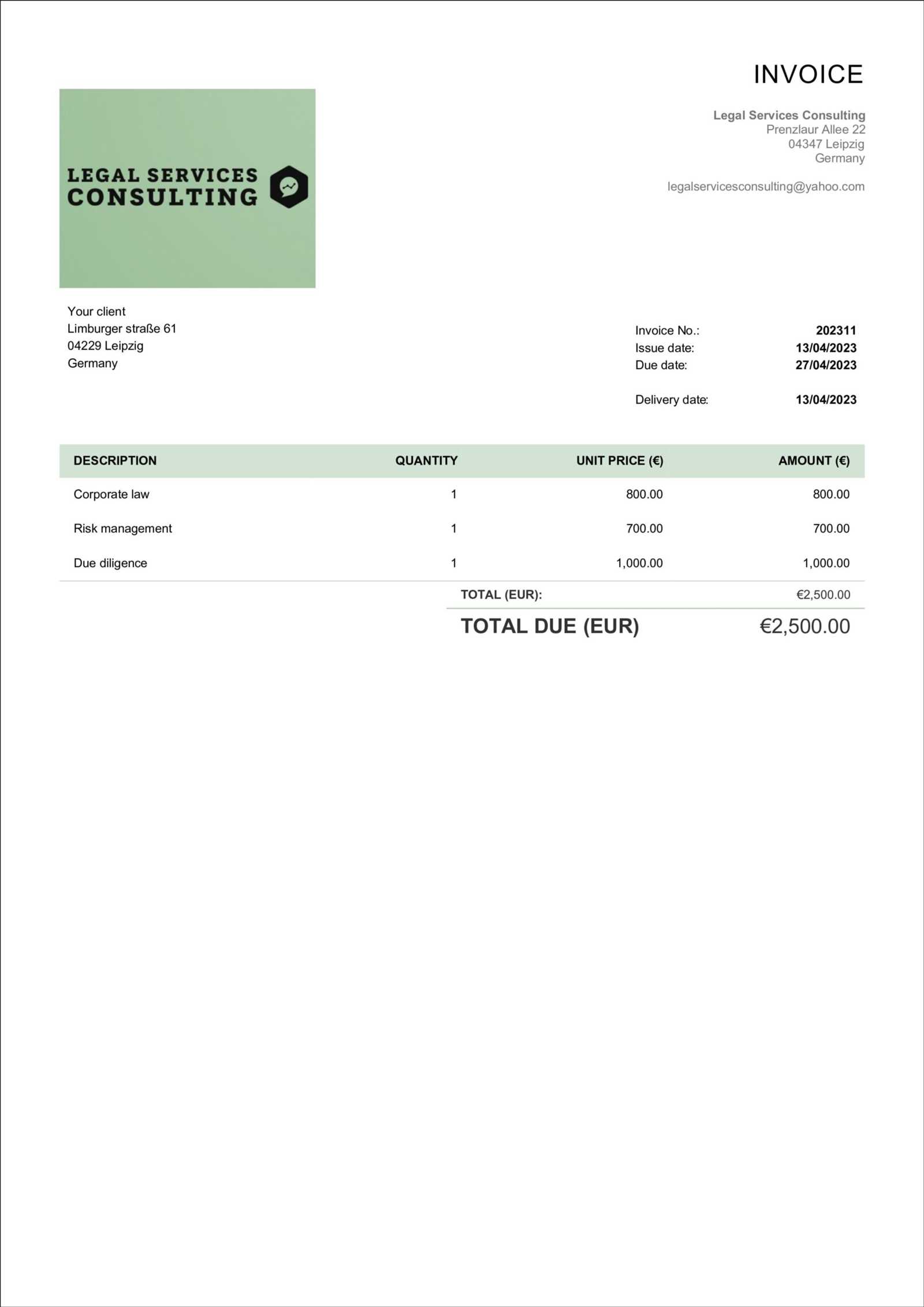

Essential Fields in Billing Documents

To create a clear and comprehensive request for payment, it is important to include specific information that ensures both you and your client are aligned on the terms and details of the transaction. A well-organized document should cover key areas that outline the services rendered, the costs involved, and the payment terms to avoid any confusion.

Key Information to Include

For an effective document, these core elements should be included:

- Client Details: The recipient’s name, address, and contact information ensure the document is properly directed and all communications are accurate.

- Service Description: A clear and concise breakdown of the work completed, including dates, hours worked, and specific tasks, helps clarify what the client is being charged for.

- Itemized Costs: Each service or product provided should be listed with corresponding charges to give the client a transparent view of how the total is calculated.

- Payment Terms: State the due date, acceptable payment methods, and any late fees to avoid misunderstandings and ensure timely payments.

- Unique Reference Number: A unique identifier for the document allows both parties to easily track and reference the transaction for future correspondence.

Additional Information for Clarity

In addition to the core elements, you may want to include:

- Discounts or Adjustments: If applicable, clearly list any discounts, refunds, or adjustments made to the overall charge.

- Tax Information: Specify applicable taxes, if any, to ensure transparency and compliance with tax regulations.

- Notes Section: An area for additional comments or specific instructions can help clarify any special conditions agreed upon with the client.

Including these essential fields will provide both clarity and professionalism, making it easier for your clients to process the payment and for you to track your finances.

How to Add Taxes to Billing Documents

Including taxes in payment requests is a critical step to ensure compliance with local regulations and provide clarity to clients regarding the total amount due. Accurately applying tax rates helps avoid any misunderstandings and ensures that the correct amount is being requested. This process is straightforward once you understand the steps involved in calculating and adding taxes to your statement.

Follow these steps to add taxes effectively:

| Step | Description |

|---|---|

| 1 | Identify the Tax Rate: Determine the applicable tax rate for your location or the client’s jurisdiction. This could be a flat percentage or based on the type of service provided. |

| 2 | Calculate the Tax Amount: Multiply the total amount for services by the tax rate to get the tax value. For example, if the service charge is $500 and the tax rate is 10%, the tax would be $50. |

| 3 | Add the Tax to the Total: Once the tax amount is calculated, add it to the original service charge to get the final total. Using the previous example, $500 + $50 results in a total of $550. |

| 4 | Display Tax Information: Clearly list the tax amount separately on the statement, so the client understands the breakdown of the total cost. |

By following these simple steps, you ensure that taxes are added correctly, maintaining transparency and adhering to local tax laws. Be sure to check for any changes in tax rates and update your billing statements accordingly to avoid errors.

Automating Billing Calculations

Streamlining the process of calculating totals and applying various charges is crucial for maintaining efficiency in financial management. Automating these calculations helps to reduce errors and save valuable time, allowing you to focus on other essential tasks. By using built-in tools, you can easily set up a system where charges are calculated automatically based on input values, ensuring accuracy in every transaction.

Steps to Automate Calculations

To automate the calculations in your billing document, follow these steps:

- Set Up Basic Formulas: Use basic arithmetic formulas, such as addition and multiplication, to calculate service charges, taxes, and discounts automatically.

- Incorporate Tax Calculations: Add a formula to automatically calculate tax based on a set percentage. For example, multiply the subtotal by the tax rate to get the tax amount.

- Include Discounts: If offering a discount, set up a formula to subtract the discount percentage from the subtotal to get the adjusted total.

- Calculate Total Amount: Set a formula that sums the charges, taxes, and any additional fees, providing the total amount due at the bottom of the document.

Additional Tips for Automation

- Use Data Validation: Implement data validation rules to restrict inputs, ensuring that only numerical values are entered into certain fields, which helps prevent errors.

- Apply Conditional Formatting: Highlight key figures like totals or overdue amounts using conditional formatting to make them easily identifiable.

- Link Multiple Sheets: If tracking multiple transactions or clients, link sheets together to automatically pull information, saving you the effort of entering data manually.

By automating calculations, you ensure accuracy, minimize mistakes, and speed up the entire process. This not only improves your productivity but also provides your clients with timely and error-free payment requests.

Managing Multiple Client Billing Statements

Handling multiple payment requests from various clients can become complex without a structured system. Organizing and tracking these documents efficiently is key to ensuring that each client’s details are accurately recorded, payments are tracked, and no due amounts are overlooked. A well-organized approach allows you to manage numerous accounts without confusion or delays.

Organizing Client Information

To effectively manage multiple accounts, you can implement the following strategies:

- Separate Documents: Keep each client’s records in individual files or sheets to avoid confusion. This will help you quickly find and update a specific client’s details without sifting through unrelated information.

- Tracking System: Use a simple tracking system to monitor the status of each payment, including due dates, payment amounts, and whether a client has paid or is overdue.

- Client Identifiers: Assign each client a unique ID or reference number for easy identification. This helps when searching or cross-referencing data across different accounts.

Automating Payment Tracking

Automation can greatly simplify the process of keeping track of due and paid amounts:

- Due Date Reminders: Set up automatic reminders for upcoming due dates so you can follow up with clients before payments become overdue.

- Summary Sheets: Use summary sheets to consolidate information from individual client records. This way, you can easily view overall payment statuses and balances without opening multiple files.

- Batch Updates: If applicable, update multiple client records at once by linking data fields or using batch-processing tools to ensure consistent information across documents.

By staying organized and using automation tools, you can efficiently manage multiple client accounts while ensuring accurate and timely tracking of all payment requests.

Tracking Payments and Outstanding Balances

Keeping track of payments and outstanding amounts is crucial for maintaining a healthy cash flow and ensuring that clients fulfill their financial obligations. By closely monitoring which payments have been received and which balances remain unpaid, you can avoid potential misunderstandings and keep your business operations running smoothly. An organized system helps you follow up on overdue amounts promptly and ensures that your financial records are accurate.

To effectively manage payments and balances, consider implementing the following strategies:

- Record Payment Dates: Always update your records when payments are received. Include the payment date and the amount paid to ensure that your balance sheet remains up to date.

- Outstanding Balance Column: Create a column to display the remaining balance for each client, making it easier to identify outstanding amounts at a glance.

- Clear Payment Terms: Establish and clearly communicate payment terms upfront. This includes due dates, accepted methods of payment, and any penalties for late payments, which helps prevent confusion later.

With these strategies, you can easily track which clients have paid and which have outstanding balances, making follow-up easier and ensuring your financial records stay accurate.

Billing Document Formatting Tips

Properly formatting your payment requests not only ensures clarity but also helps maintain a professional image. Well-structured documents are easier for clients to understand and process, making it more likely they will pay promptly. Whether you are creating a simple statement or a detailed breakdown, paying attention to layout, readability, and organization is essential.

Key Formatting Guidelines

Here are some best practices to follow when formatting your billing documents:

- Consistent Layout: Use a clear and consistent layout. Ensure that each section, such as contact information, itemized charges, and total amount, is clearly separated and easy to find.

- Readable Fonts: Choose simple, professional fonts such as Arial or Times New Roman. Avoid using overly decorative fonts that could distract from the content.

- Use of Tables: When listing charges, use tables to clearly outline each item, the rate, quantity, and total amount. This allows for easy comparison and avoids confusion.

- Highlight Key Information: Make important details like the total amount due or due date stand out by using bold text or a larger font size.

Additional Tips for Professional Appearance

- Include Your Branding: If you have a company logo, include it at the top of the document to reinforce your brand identity and add a professional touch.

- Proper Alignment: Align text and figures neatly to make the document look polished and easy to follow. Ensure that all columns and rows in tables are aligned properly.

- Clear Payment Instructions: Provide clear instructions on how clients should pay, including payment methods, terms, and your bank details or online payment link.

By following these formatting tips, you can create professional and easy-to-read documents that will help streamline your billing process and improve client relations.

Document Date and Numbering System

Assigning a clear and consistent date and numbering system to your payment documents is essential for maintaining organized records. A well-structured approach helps both you and your clients easily reference specific transactions, ensuring that no payment gets overlooked. Properly managing the date and document number can also be crucial for accounting and tax purposes, making it easier to track payments and stay compliant with financial regulations.

Here are some best practices for setting up a reliable system for dates and numbering:

- Unique Document Numbers: Assign a unique number to each payment document to easily distinguish between different records. Consider using a sequential numbering system, starting from a particular number for each year (e.g., 2024-001, 2024-002) to keep track of documents over time.

- Clear Date Format: Use a consistent date format, such as day/month/year (DD/MM/YYYY) or month/day/year (MM/DD/YYYY), to avoid confusion, especially if you’re working with clients from different regions.

- Issue Date: Always include the date the document is created or sent to the client. This helps both parties identify when the transaction was initiated and helps track due dates for payment.

- Due Date: Include a clearly marked due date that indicates when the payment should be made. This helps prevent misunderstandings and ensures both you and your client are on the same page regarding payment deadlines.

By implementing a clear date and numbering system, you not only improve organization but also create a professional and reliable way of handling your payment records. This approach provides easy reference for both you and your clients, helping streamline communication and ensure timely payments.

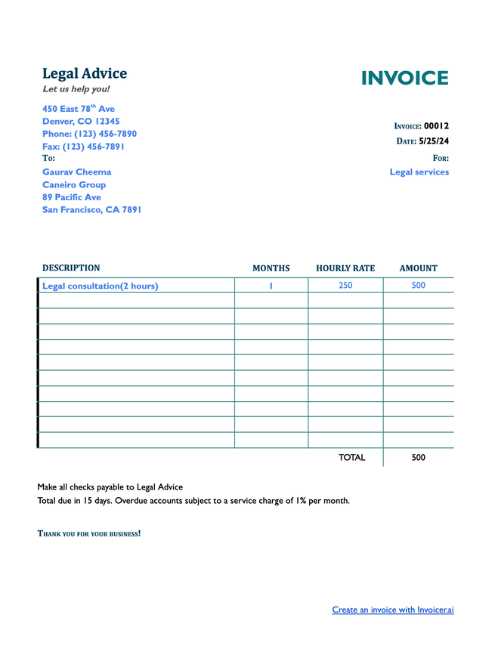

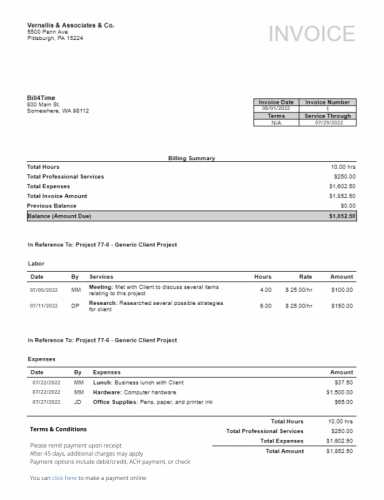

Incorporating Hourly Rates into Billing Documents

When charging clients based on time spent on a project or task, it’s crucial to clearly present the hourly rates and the total cost of services provided. Properly incorporating this information into your payment request documents ensures transparency and helps clients understand how their charges are calculated. By detailing hours worked and rates applied, you eliminate ambiguity and reduce the potential for disputes over billing.

Here are key considerations for integrating hourly rates into your documents:

- Clearly State the Rate: Always specify the hourly rate at the beginning of the document, either in the header or near the detailed breakdown of services. This makes it clear to the client how charges are calculated.

- Itemize Hours Worked: Break down the work performed by listing each task or service along with the number of hours spent. This allows the client to see exactly where their time is being billed.

- Include Total Hours: At the end of the breakdown, provide a sum of the total hours worked. This ensures that both you and the client are on the same page regarding the time spent on the project.

- Provide Subtotals: For transparency, include subtotals for each individual task or service based on the number of hours worked and the rate applied. This gives clients a clear picture of how the final amount is determined.

By clearly incorporating hourly rates into your documents, you ensure that clients are fully aware of the charges and the work that has been completed, fostering trust and avoiding misunderstandings.

How to Handle Discounts on Billing Documents

Offering discounts is a common practice to incentivize clients or reward loyal customers. When applying discounts, it’s important to clearly display the reduction in price to avoid confusion and ensure that both parties agree on the final amount. Properly documenting discounts in your payment records not only maintains transparency but also ensures that clients understand how the final total is calculated.

Here are key steps to effectively manage and display discounts in your billing documents:

- Clearly Show the Discount: Indicate the discount amount separately, either as a percentage or a fixed amount. Make sure it is visible in the breakdown of charges, so clients can easily see the adjustment.

- Specify the Discount Terms: If the discount is based on specific conditions (e.g., early payment or bulk purchases), clearly mention the terms and conditions in the document. This helps the client understand why they are receiving the reduction.

- Apply the Discount to the Subtotal: Subtract the discount from the subtotal before calculating the final total. This ensures that the client sees the full discount applied to the amount due.

- Provide a Clear Total: After applying the discount, ensure the final amount due is clearly marked, showing both the original amount and the adjusted price after the discount. This avoids any confusion over the final amount the client needs to pay.

By following these steps, you can handle discounts professionally, ensuring clarity and transparency in your payment records while offering value to your clients.

Ensuring Legal Compliance with Billing Documents

It is crucial to ensure that your payment records comply with the applicable legal requirements in your jurisdiction. Compliance not only protects your business but also helps you avoid legal disputes, fines, or penalties. Proper documentation is essential for tax purposes, financial audits, and resolving any potential disagreements with clients.

Here are some key aspects to consider to ensure compliance with legal regulations when preparing your billing records:

- Include All Required Information: Depending on your location, certain details must be included, such as your business name, contact information, tax identification number, and the client’s details. These requirements may vary, so it is important to verify local regulations.

- Accurate Tax Calculation: Ensure that applicable taxes are calculated correctly and clearly displayed on the document. Failure to include the correct tax rate or not applying it properly can result in legal issues.

- Retention Period: Keep copies of all billing documents for the required retention period as specified by tax authorities or local laws. This helps in case of audits or disputes over payments.

- Follow Payment Terms: Ensure that your payment terms are clear and comply with the standard practices in your region. This includes specifying payment deadlines, late fees, and any applicable interest rates.

- Clear and Transparent Language: Use clear and precise language in your payment records to avoid any ambiguity. This can help in the event of a dispute and ensure that the terms are understood by both parties.

By adhering to these legal requirements, you ensure that your billing records are compliant, minimizing the risk of issues down the line and establishing trust with your clients.

Best Practices for Sending Billing Documents

Sending payment records to clients efficiently and professionally is key to maintaining a smooth and productive business relationship. Ensuring that the process is clear, timely, and well-organized helps avoid misunderstandings, delays in payment, and potential disputes. The manner in which you deliver your payment details can also reflect the professionalism of your business.

Here are some best practices to follow when sending your billing documents:

- Send Promptly: Aim to send your payment records as soon as possible after the service is rendered or product is delivered. Delaying the process can create confusion and push back payment timelines.

- Use Professional Channels: Send the records through formal communication channels, such as email with a PDF attachment or through a secure invoicing platform. This ensures that the document is received, and it adds an official record of the transaction.

- Provide Clear Payment Instructions: Include detailed payment instructions, such as accepted methods of payment, bank details (if necessary), and the due date. This reduces the chance of errors or delays from the client’s side.

- Follow Up as Needed: If payment is not received within the agreed time frame, send a polite reminder. Keeping communication open can help address any potential issues before they escalate.

- Track Sent Documents: Keep a record of all sent documents, including the date and method of delivery. This will serve as a reference in case there is a need to clarify any issues related to the document.

By adhering to these best practices, you can ensure a smooth process for both you and your clients, while also reinforcing your professionalism and reliability.

Common Mistakes to Avoid in Billing

Proper billing is crucial for maintaining healthy cash flow and professional relationships with clients. Even small errors can lead to delays in payments, misunderstandings, or disputes. Being aware of common mistakes helps ensure that the process is smooth and effective, minimizing the risk of problems down the line.

Here are some common billing mistakes to watch out for:

- Incorrect or Missing Information: Failing to include necessary details like the client’s name, contact information, and the correct payment terms can cause confusion and delays in processing payments.

- Errors in Pricing or Calculation: Mistakes in calculating the total cost, applying discounts, or not factoring in taxes can lead to client dissatisfaction and may require follow-up corrections.

- Not Setting Clear Payment Terms: Failing to specify the due date, late fees, or accepted payment methods can leave room for ambiguity, making it harder to collect payments on time.

- Forgetting to Include Purchase Details: If your bill does not outline what services or products were provided, clients may question the charges, causing delays in payment.

- Not Tracking Sent Bills: Failing to keep a record of which documents were sent, when, and how they were delivered can create confusion and complicate follow-up actions.

- Neglecting to Send Timely Reminders: Waiting too long to remind clients of overdue payments can harm your cash flow. Sending polite reminders helps maintain a steady revenue stream.

By avoiding these mistakes, you can streamline the billing process, improve payment collections, and maintain strong client relationships.