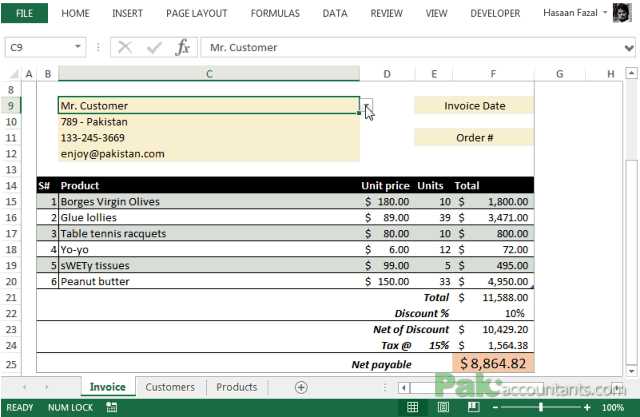

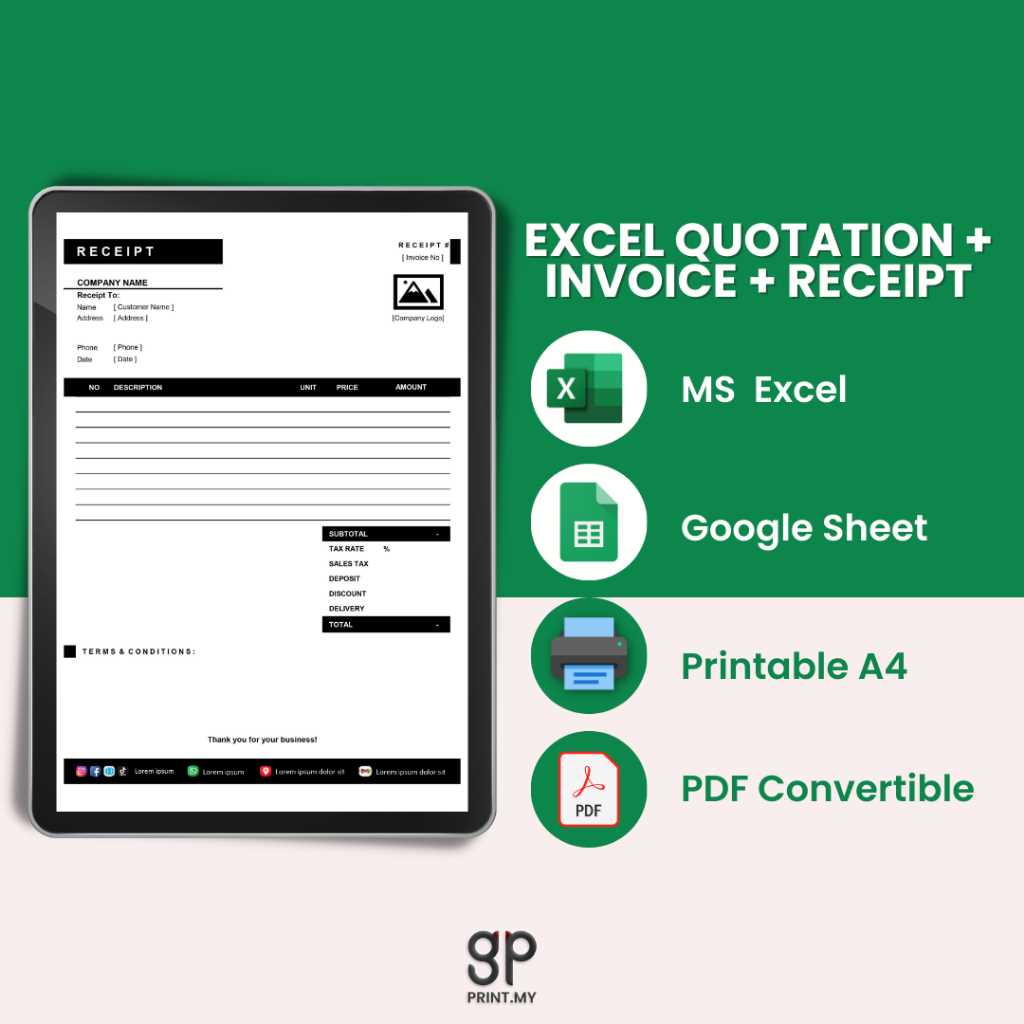

Excel Invoice Template with Discount Features for Easy Billing

Managing financial transactions efficiently is crucial for any business. One of the most essential tasks is generating clear and accurate payment requests for clients. A well-designed document not only helps in keeping records but also enhances the professionalism of your business communications. Whether you’re a freelancer, small business owner, or part of a larger enterprise, having a simple yet effective way to create these documents can save time and reduce errors.

Incorporating adjustments in pricing is often necessary for a variety of reasons, such as offering special rates or promotional offers. Being able to include such modifications seamlessly within your billing process ensures both transparency and ease for your clients. This can be achieved through powerful spreadsheet tools that allow for automatic calculations and customization to suit your needs.

Adopting a customizable solution that streamlines this task is key to avoiding manual errors and ensuring consistency across all financial correspondence. This approach not only improves accuracy but also makes the process quicker and more efficient, allowing you to focus on what matters most: growing your business.

Benefits of Using Billing Document Solutions

Utilizing pre-designed solutions for creating payment requests can significantly improve both efficiency and accuracy in financial management. These tools simplify the process of generating clear, professional documents, allowing businesses to focus on their core operations instead of spending time on repetitive tasks. Whether you’re handling a few transactions or managing a high volume of clients, such systems offer valuable advantages.

Time-Saving Efficiency

Automating key calculations and document formatting can drastically reduce the time spent on creating each request. Rather than manually inputting numbers and adjusting layouts for each client, these solutions can handle it all, instantly providing a polished result. This allows businesses to send documents faster and move on to other tasks.

Accuracy and Consistency

With built-in formulas for calculating totals, taxes, and adjustments, the risk of human error is minimized. Additionally, a standardized format ensures that all documents follow a consistent structure, which not only looks professional but also makes it easier for clients to review and understand the charges.

| Benefit | How It Helps |

|---|---|

| Automation | Reduces time spent on manual calculations and formatting. |

| Customization | Tailor documents to suit specific business needs and client preferences. |

| Professional Appearance | Ensures all documents are presented in a neat and uniform manner. |

| Accuracy | Prevents common errors in financial calculations. |

How to Create a Billing Document in a Spreadsheet

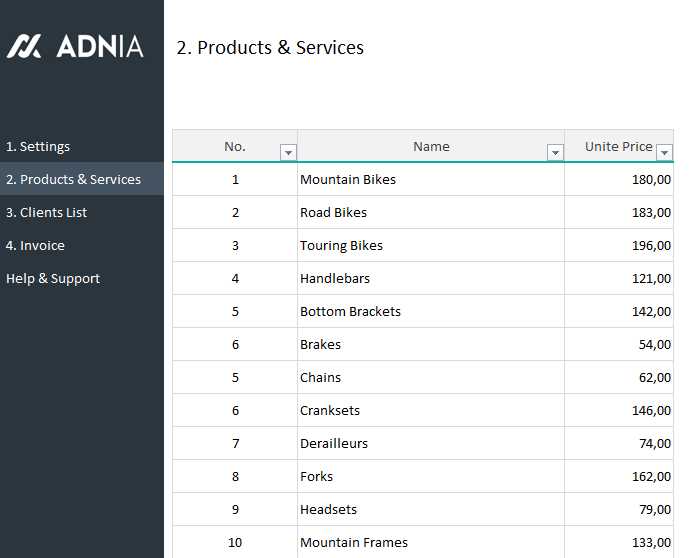

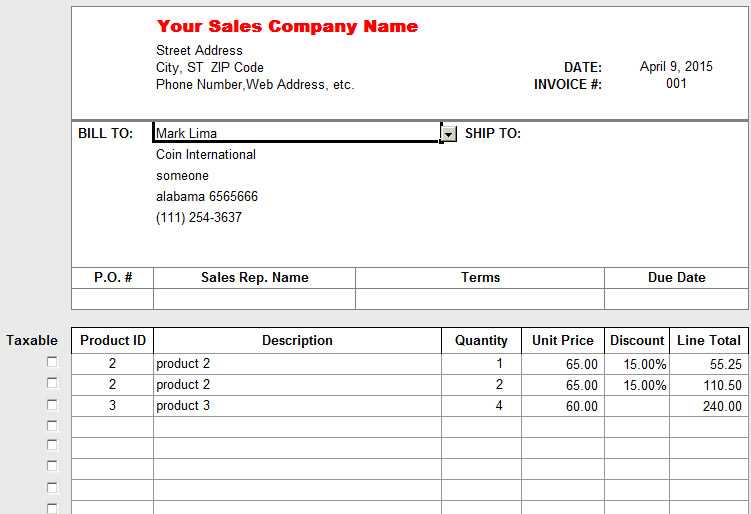

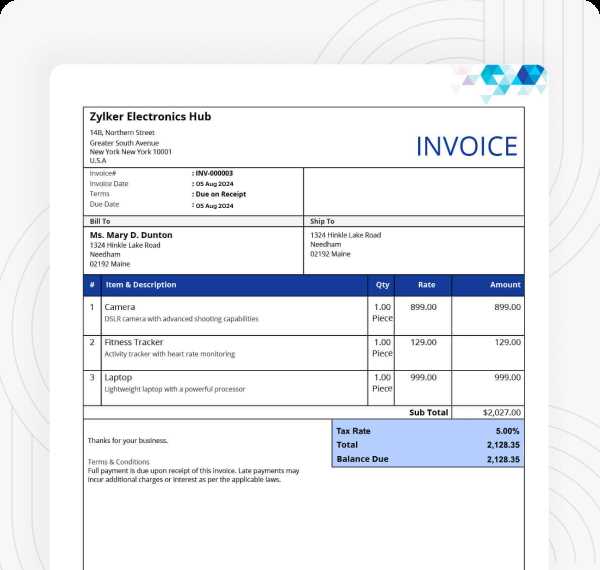

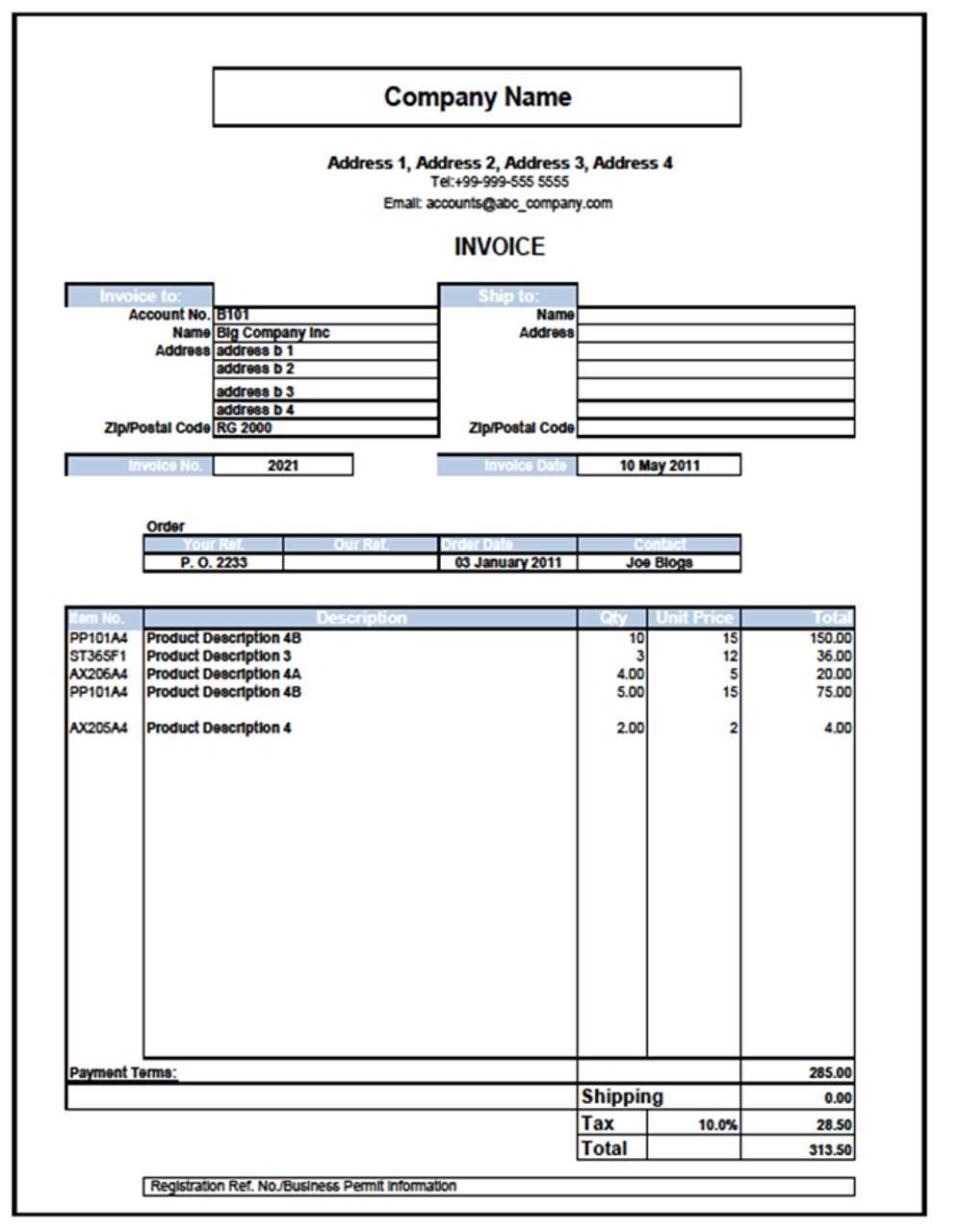

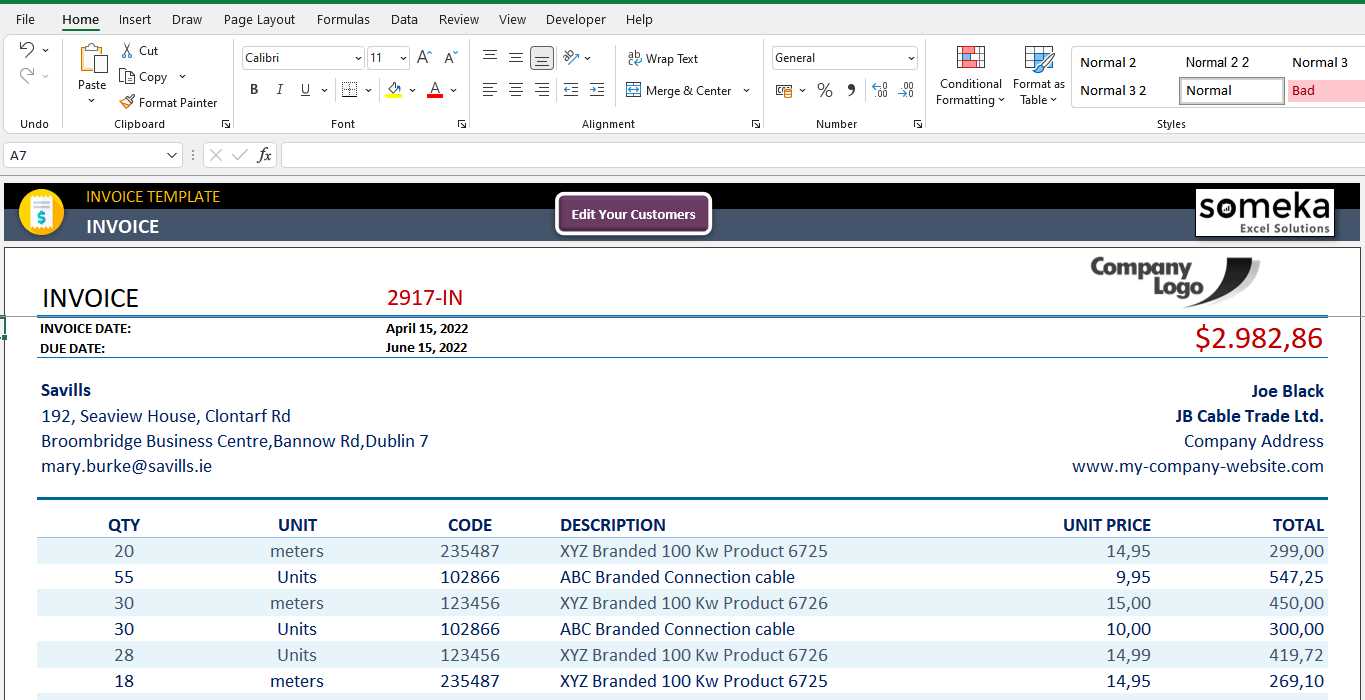

Creating a professional payment request in a spreadsheet application is a straightforward process that involves setting up a clear structure for presenting essential information. With the right setup, you can easily generate accurate documents every time, incorporating all the necessary details such as client names, product or service descriptions, and payment terms. This approach allows for quick customizations and simplifies financial management tasks.

Follow these simple steps to generate your first billing document:

| Step | Action |

|---|---|

| Step 1 | Create a new blank document. |

| Step 2 | Add the business name and contact information at the top. |

| Step 3 | Include the client’s name and contact details. |

| Step 4 | List the products or services provided, along with their quantities and unit prices. |

| Step 5 | Set up a field to automatically calculate the subtotal, taxes, and any other adjustments. |

| Step 6 | Ensure the total amount due is clearly displayed. |

| Step 7 | Save and send the document to the client in the preferred format. |

By following these basic steps, you can easily create professional payment requests that are both clear and efficient. Additionally, once you’ve set up your structure, it’s simple to reuse the document for multiple clients, making your billing process faster and more reliable.

Applying Adjustments to Pricing in Your Billing Documents

Offering special rates or price reductions can be a great way to incentivize clients and encourage repeat business. Integrating these price adjustments directly into your financial documents ensures that the process is streamlined, transparent, and accurate. By automating calculations for such adjustments, you can eliminate manual errors and save time when preparing payment requests.

To easily incorporate pricing adjustments, you can set up a field that automatically calculates the modified amount based on the original price. Here’s how you can apply such changes:

| Step | Action |

|---|---|

| Step 1 | Add a column for the original price of each item or service. |

| Step 2 | Include a column for the adjustment rate or amount (e.g., a percentage or flat rate). |

| Step 3 | Use a formula to subtract the discount from the original price to calculate the new price. |

| Step 4 | Update the total by adding up the adjusted prices. |

| Step 5 | Ensure the final amount due reflects the correct adjustments and is clearly displayed for the client. |

Once you’ve set up this system, applying price modifications becomes a quick and reliable task. Whether you are offering a seasonal promotion or a loyalty discount, this setup helps ensure your clients receive accurate billing documents with all adjustments properly accounted for.

Top Features of Billing Document Solutions

When creating payment requests, certain features make the process smoother and more efficient. A well-designed document system not only helps with accuracy but also provides flexibility, customization, and ease of use. The right set of features can greatly improve the overall experience for both businesses and their clients, ensuring that all financial transactions are documented clearly and professionally.

Ease of Customization

One of the most valuable features of modern billing systems is the ability to easily adjust the document layout to suit your business needs. You can tailor fields, adjust pricing structures, or include specific client details without much effort. This level of flexibility ensures that every payment request aligns with your branding and business requirements.

Automatic Calculations

Another essential feature is the ability to perform automatic calculations for totals, taxes, and price adjustments. This reduces the likelihood of human error and speeds up the entire process. Once you enter basic details, such as product prices and quantities, the document will handle all the complex math behind the scenes.

| Feature | Benefit |

|---|---|

| Custom Fields | Allows businesses to adapt the document to specific client needs or internal processes. |

| Formula Integration | Automatically calculates totals, taxes, and adjustments, saving time and ensuring accuracy. |

| Professional Layout | Ensures a polished and uniform appearance that enhances business credibility. |

| Reusability | Once set up, the system can be reused for multiple transactions, streamlining the billing process. |

By incorporating these key features, you can significantly improve the efficiency and accuracy of your financial documents, making the entire process more professional and less time-consuming.

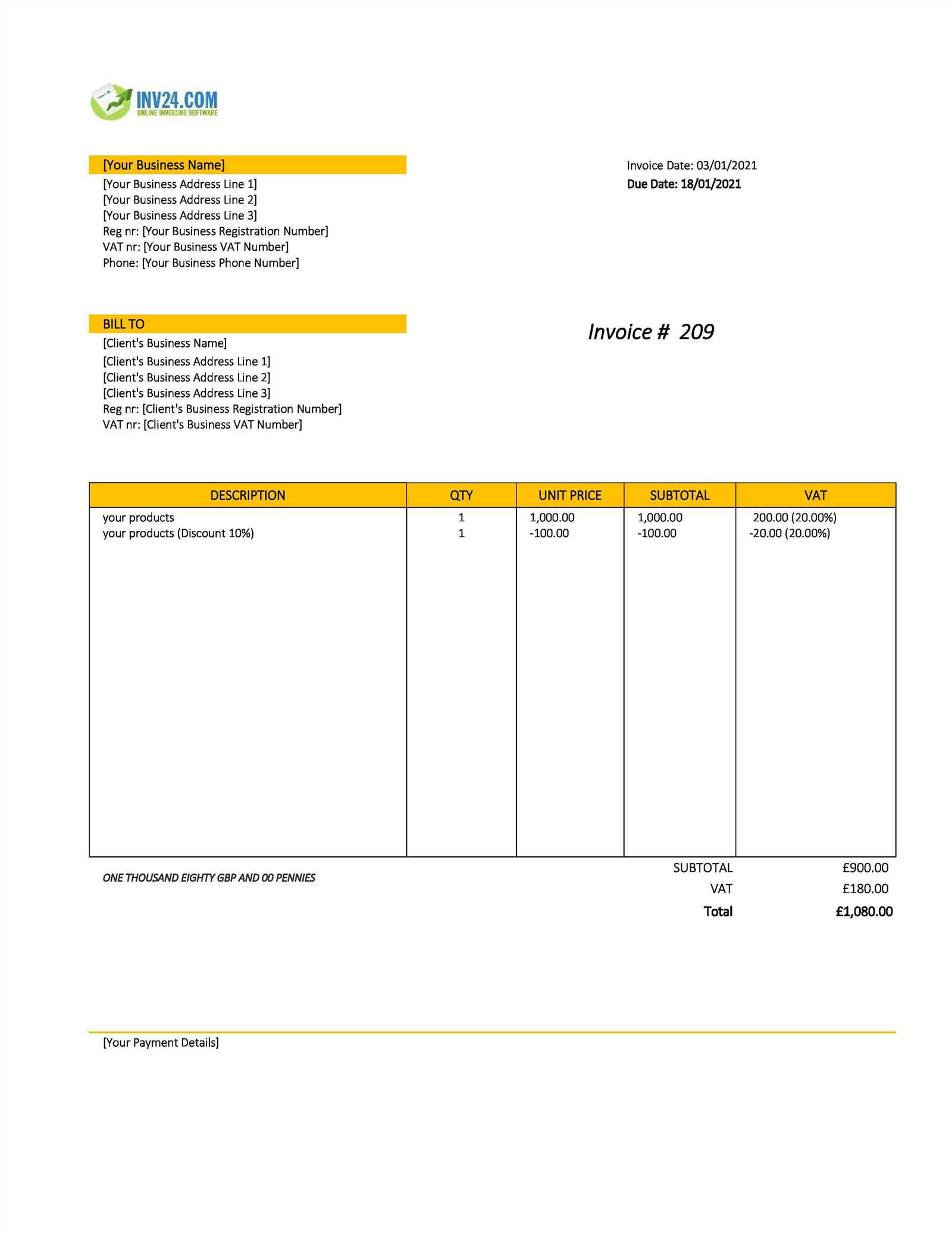

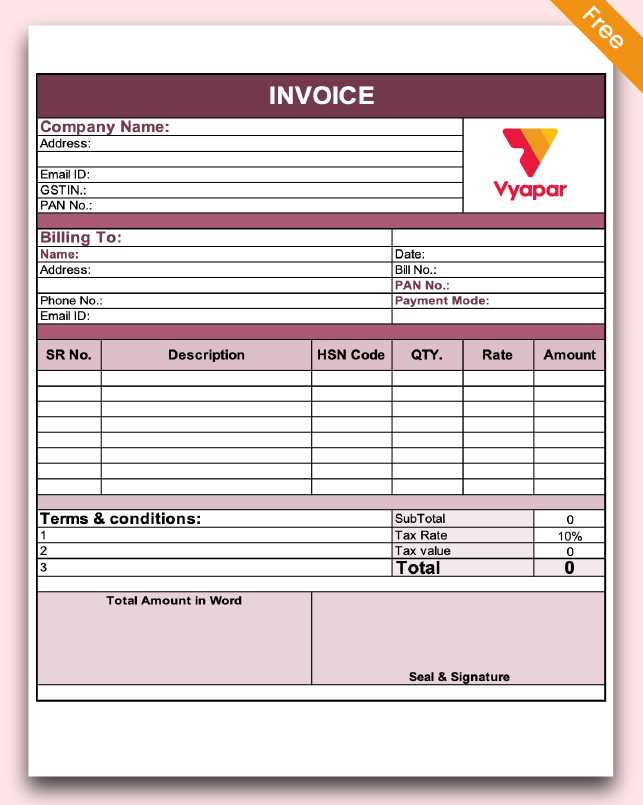

Customizing Billing Documents for Your Business

Every business has its own unique needs when it comes to creating financial records. Customizing your billing documents to reflect your brand, business structure, and specific requirements can help make the process more efficient and professional. By adjusting key elements, you can ensure that the document includes all necessary details and reflects the right level of professionalism, while also streamlining the workflow for your team.

Key Elements to Customize

When customizing your billing system, it’s important to focus on the key fields and sections that will impact both your internal processes and your client interactions. Here are the main areas to consider:

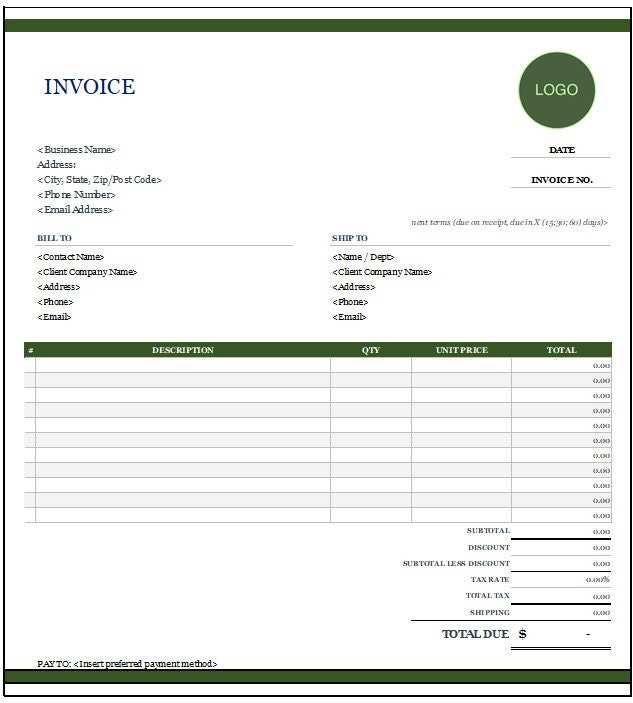

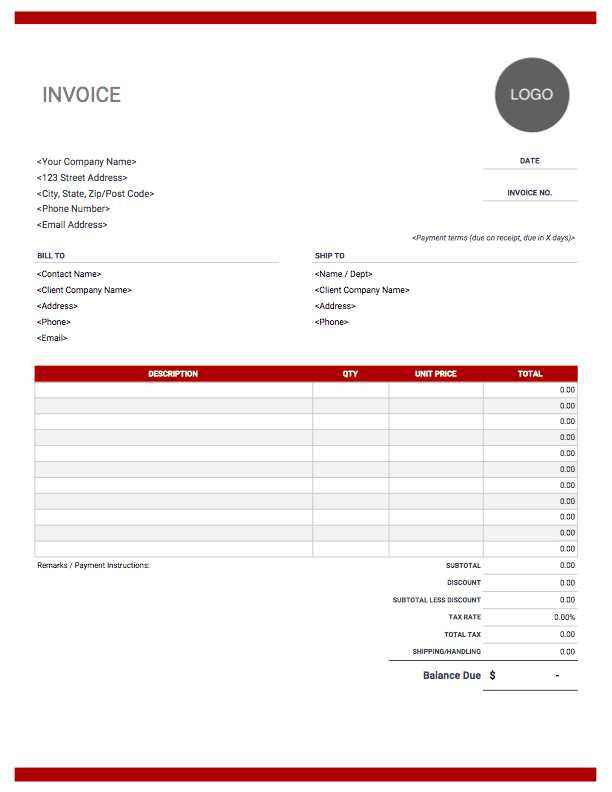

- Business Details: Customize the header to include your company’s name, logo, contact information, and website. This helps your client quickly identify who the document is from and how to reach you.

- Client Information: Make sure there is space for client contact details, ensuring that each document is personalized and accurate.

- Itemized List: Ensure you have clear columns for the product or service names, quantities, unit prices, and total amounts. You may also add columns for discounts, taxes, or other adjustments.

- Payment Terms: Customize the document to clearly state payment deadlines, accepted payment methods, and any late fee policies.

Additional Customization Tips

Beyond the basic structure, there are several other ways you can enhance your financial documents:

- Color Scheme: Adjust colors to match your company’s branding, making the document visually aligned with your overall business image.

- Font and Text Size: Choose a professional font and ensure readability by adjusting text size and spacing.

- Incorporating Logos: Adding your company logo at the top or in the footer helps reinforce your brand’s presence.

- Payment Instructions: Customize sections with detailed payment instructions, such as bank account numbers or PayPal links, for easy client processing.

By customizing the various elements of your financial records, you not only streamline the billing process but also present a cohesive and professional image to your clients. This approach ensures clarity, improves accuracy, and helps maintain consistency in all of your business transactions.

How Price Adjustments Are Calculated in a Spreadsheet

Calculating price reductions within a financial document is essential for ensuring accurate charges, especially when offering special rates or promotions. By utilizing formulas in a spreadsheet, you can automate these calculations, saving time and reducing the risk of manual errors. The process involves applying a specific percentage or flat amount to the original price, and it can be easily customized for various scenarios.

Basic Calculation Steps

To calculate price modifications, you need to set up a few essential fields and formulas. Here’s how it works:

- Original Price: Enter the initial cost of the product or service before any changes are applied.

- Adjustment Amount: Enter the percentage or fixed amount that needs to be subtracted from the original price. This can vary depending on the terms of the offer.

- Final Price: The system automatically calculates the reduced price based on the adjustment amount and displays it.

Formula for Calculating Adjustments

The most common approach is using a simple formula to apply the adjustment. For example, if you want to subtract 10% from an original price of $100, the formula would look like this:

- Original Price × Adjustment Percentage = Adjustment Amount

- Original Price – Adjustment Amount = Final Price

If you wanted to apply a flat rate, say $20, to a product priced at $100, the formula would be:

- Original Price – Flat Adjustment = Final Price

This method is highly adaptable, allowing for different types of reductions, such as percentage-based discounts or fixed amount deductions. Once set up, the calculations update automatically whenever the price or adjustment changes, making the entire process much more efficient.

Why Choose a Spreadsheet for Billing

Using a spreadsheet application for creating payment requests offers significant advantages for businesses of all sizes. It combines simplicity with flexibility, allowing you to quickly generate professional documents while also providing powerful tools to automate calculations and customization. This makes it a popular choice for both small businesses and larger enterprises looking for an efficient and reliable way to manage their financial records.

Flexibility and Customization

One of the main reasons businesses prefer spreadsheets for financial documents is the high degree of customization they offer. Whether you need to adjust the layout, add or remove specific fields, or calculate custom charges, spreadsheets provide all the tools you need to tailor the document to your exact requirements. This flexibility ensures that the document aligns with your business practices and client needs.

Automation and Accuracy

Another key benefit of using a spreadsheet for creating payment documents is the ability to automate complex calculations. By setting up formulas, you can easily compute totals, taxes, and any adjustments without having to manually crunch numbers each time. This reduces the likelihood of human error and saves valuable time, ensuring that your financial documents are always accurate and up-to-date.

| Feature | Benefit |

|---|---|

| Customization | Easily adjust the layout, fields, and calculations to match your business needs. |

| Automation | Automatically calculate totals, taxes, and other adjustments with built-in formulas. |

| Reusability | Once created, the system can be reused for multiple clients and transactions, saving time. |

| Professional Appearance | Design documents to appear clean, consistent, and well-organized, enhancing your business image. |

For businesses looking to streamline their billing process and maintain a high level of accuracy, using a spreadsheet-based solution is an ideal choice. It provides the right balance of flexibility, automation, and professionalism, making it an essential tool for managing finances effectively.

Steps to Add a Price Adjustment Field

Including a field for price modifications in your financial documents is an essential feature that can help reflect special offers or negotiated rates. By incorporating this field, you can automatically calculate the reduced amount based on predefined criteria, ensuring accuracy and consistency in your billing. This process can be set up quickly using basic formulas to handle different types of reductions, whether they are percentage-based or fixed amounts.

Follow these simple steps to add a price modification field to your document:

| Step | Action |

|---|---|

| Step 1 | Create a column next to your product or service list to indicate the price reduction. |

| Step 2 | Label the new column appropriately, such as “Price Adjustment” or “Discount Applied.” |

| Step 3 | Input the percentage or flat rate reduction for each item in the new column. |

| Step 4 | Add a formula to calculate the adjusted price by subtracting the adjustment from the original price. |

| Step 5 | Update the total amount by adding up the adjusted prices for all items. |

| Step 6 | Ensure the final amount due reflects the adjustments made and clearly display it at the bottom of the document. |

By following these steps, you will have a fully functional system that automatically applies price reductions and recalculates totals. This feature will save you time and reduce the potential for errors, making your financial records more efficient and professional.

Automating Document Updates in a Spreadsheet

Automating updates in financial documents can save a significant amount of time and effort, especially when dealing with recurring tasks like generating payment requests. By leveraging built-in formulas and functions, you can set up your system to automatically adjust key information such as totals, taxes, and pricing modifications. This approach ensures that every document remains accurate and up-to-date without the need for manual recalculations.

Using Formulas to Automate Calculations

Formulas are essential for automating the most common tasks in financial documents. For example, you can use a formula to calculate the subtotal by multiplying the quantity of each item by its price. Then, by adding additional formulas for taxes, adjustments, and final totals, you can ensure the document updates in real-time as you make changes.

Setting Up Auto-Updates for Client Details

Another useful feature is automating the inclusion of client information. By linking specific fields to a client database or using a drop-down menu, you can easily update customer details in just a few clicks. This reduces the chances of errors and ensures consistency in client communications.

By integrating these automated features, you can significantly improve the efficiency and accuracy of your financial document generation. Once set up, the process requires minimal input, allowing you to focus more on other aspects of your business.

Using Formulas for Accurate Price Reductions

Incorporating precise calculations into your financial documents is essential for maintaining accuracy, especially when offering price adjustments. By using formulas, you can automate the process of applying reductions, ensuring that the correct amount is subtracted from the original price based on predefined conditions. This not only saves time but also reduces the risk of human error, providing your clients with accurate and transparent billing information every time.

To apply price reductions accurately, it’s important to set up the right formulas that calculate both percentage-based and fixed amount adjustments. Whether you’re offering a percentage off the total price or a specific amount, the formula can be customized to automatically apply the change and update the total amount due. This ensures that you never have to manually adjust prices or worry about missing an important step.

By relying on automated formulas, you can ensure that your pricing is both consistent and transparent, making the entire billing process more efficient and trustworthy for your clients.

Designing a Professional Billing Document

Creating a polished and professional financial document is crucial for maintaining a strong business image and building trust with clients. A well-designed document ensures that all necessary details are clearly presented, making it easier for your clients to understand the charges and terms. A clean, organized layout not only enhances the document’s visual appeal but also makes it more functional and efficient.

When designing a financial record, there are several important elements to consider, including layout, typography, and organization. The goal is to create a document that is both aesthetically pleasing and easy to read, while ensuring that all relevant information is included and well-structured.

| Design Element | Best Practice |

|---|---|

| Header | Include your business name, logo, and contact details at the top to make your document easily identifiable and professional. |

| Client Information | Provide clear spaces for the client’s name, address, and contact information to personalize the document. |

| Itemized List | Use a clean table layout to list each product or service, including quantity, unit price, and total cost. This allows clients to quickly understand what they are being charged for. |

| Payment Terms | Clearly outline payment due dates, acceptable payment methods, and any late fees or discounts, if applicable. |

| Final Total | Ensure the total amount due is clearly highlighted, with breakdowns for taxes, adjustments, and any additional charges. |

By following these design best practices, you can create a document that reflects your professionalism and ensures that your clients can easily process their payments. An organized, well-designed billing record helps improve client relations and boosts the overall efficiency of your business transactions.

Tracking Payments with Billing Documents

Keeping track of payments is an essential part of managing your business finances. Accurate tracking helps you stay on top of outstanding amounts, monitor cash flow, and ensure timely payments. By utilizing a structured approach in your financial records, you can easily identify which payments have been made and which are still pending, all within the same system used to create the initial billing document.

Recording Payment Status

One of the simplest ways to track payments is by adding a column to your financial record for payment status. This column can be updated manually whenever a client makes a payment, allowing you to quickly see which accounts are settled and which still require attention. Common payment status labels include:

- Paid: Indicates that the full amount has been received.

- Partial Payment: Shows that only a portion of the total amount has been paid.

- Unpaid: Marks invoices that remain unsettled.

- Overdue: Flags payments that have passed the due date without being settled.

Automating Payment Tracking

For a more automated approach, you can use formulas to calculate whether a payment has been made in full or if an amount remains outstanding. For example, by entering the total amount due in one column and the amount received in another, a formula can be set up to display the difference and automatically update the status. This eliminates the need for manual updates and helps you stay on top of payments in real time.

By integrating payment tracking into your financial documents, you can streamline your process, reduce administrative effort, and improve cash flow management, all while maintaining clear and accurate records.

How to Manage Multiple Price Reductions in a Spreadsheet

Managing several price reductions on a single document can be a challenge, especially when they need to be applied in a specific order or according to certain conditions. However, by using the right formulas and structuring your financial records effectively, you can easily apply multiple adjustments while ensuring accuracy and consistency. This approach helps to streamline the process and avoid manual errors.

Setting Up Multiple Adjustment Fields

The first step in managing multiple price modifications is to create separate fields for each type of reduction. This can include columns for percentage-based reductions, flat-rate deductions, or promotional offers. By having distinct fields for each, you can clearly track how each adjustment impacts the final price, and it will be easier to apply or remove specific reductions as needed.

Using Formulas for Sequential Adjustments

When dealing with multiple price reductions, it’s important to apply them in the correct order. Typically, a percentage-based reduction is applied first, followed by a fixed amount deduction or a flat-rate offer. You can use formulas to ensure that each reduction is calculated sequentially. For example, if you are applying a 10% discount followed by a $5 reduction, the formula would first apply the percentage reduction to the total, then subtract the fixed amount from the adjusted price.

By setting up your document to automatically apply these reductions, you can ensure that your financial records remain accurate, even when dealing with multiple price adjustments. This approach saves time, reduces errors, and keeps your calculations consistent.

Save Time with Automated Billing Documents

Creating financial records manually for each transaction can be a time-consuming task, especially for businesses that handle numerous clients or transactions. By using pre-designed systems, you can significantly reduce the time spent on document creation and ensure that each document is accurate and consistent. Automation is the key to speeding up the process, allowing you to focus on other important aspects of your business.

Pre-Set Fields and Calculations

One of the main time-saving benefits of using automated systems for billing is that you can set up fields and calculations in advance. This means you don’t have to manually enter calculations for each transaction. Once set up, the system automatically computes totals, taxes, and other necessary charges, ensuring accuracy while saving time.

Reuse and Modify Existing Documents

Another significant advantage is the ability to reuse and modify existing documents. Instead of starting from scratch every time, you can simply update client details and specific charges. This makes the process much faster, especially for repeat customers or standard transactions.

| Benefit | How It Saves Time |

|---|---|

| Automated Calculations | Reduces the need for manual math and ensures accurate totals every time. |

| Pre-designed Structure | Eliminates the need to create documents from scratch, speeding up the entire process. |

| Customizable Fields | Quickly adjust details like prices and client information without reformatting the document. |

| Consistency | Ensures that every document follows the same format, reducing errors and improving professionalism. |

By using automated systems for your billing needs, you can save significant time while also improving the accuracy and consistency of your financial records. The time saved can then be redirected towards growing your business or managing other essential tasks.

Ensuring Accuracy in Price Reduction Calculations

When applying reductions to prices, accuracy is essential to ensure that customers are charged correctly and that your business maintains proper financial records. Even small errors in calculation can lead to discrepancies, potentially damaging customer trust and causing financial complications. Therefore, setting up an effective system to handle price modifications is crucial for smooth transactions and transparent billing.

To ensure accuracy, it’s important to use precise formulas that can automatically calculate the adjusted price based on predefined conditions. Whether you’re applying a percentage-based reduction or a fixed amount, formulas help reduce the risk of human error. Additionally, double-checking your input data, such as the original price and the terms of the reduction, further guarantees that calculations are correct.

Key factors to consider for accurate price reductions include:

- Correct Formula Usage: Always verify that the correct formula is being applied for each type of reduction, whether it’s a percentage off or a flat-rate amount.

- Data Entry: Make sure that the original price and reduction values are correctly entered into the document, as incorrect data will lead to inaccurate results.

- Consistent Format: Use a consistent format for input and calculations to avoid confusion and ensure that each reduction is applied uniformly.

- Real-Time Updates: Set up formulas that update in real-time to reflect any changes made, ensuring that the adjusted price is always up to date.

By carefully implementing these strategies, you can ensure that every price reduction is calculated accurately, providing your clients with precise and trustworthy billing details. The result is a more professional approach to pricing and greater confidence in your business operations.