Excel Invoice Template with Database for Easy Billing and Data Management

Efficient financial record-keeping is essential for any business. Automating tasks related to invoicing and tracking client information can save time and reduce errors. By using an organized approach to handle these processes, businesses can maintain better control over their operations and improve their overall efficiency.

A well-designed system allows users to quickly generate payment requests, while also ensuring that all client data is stored and easily accessible. Whether you’re managing a small startup or a growing enterprise, integrating financial records into a cohesive system can simplify accounting tasks and help you stay on top of your cash flow.

In this guide, we’ll explore how combining invoicing tools with powerful data management capabilities can transform your administrative workflow. You’ll learn how to create a seamless process that not only enhances accuracy but also helps you track and analyze business transactions more effectively.

Overview of Billing System Integration

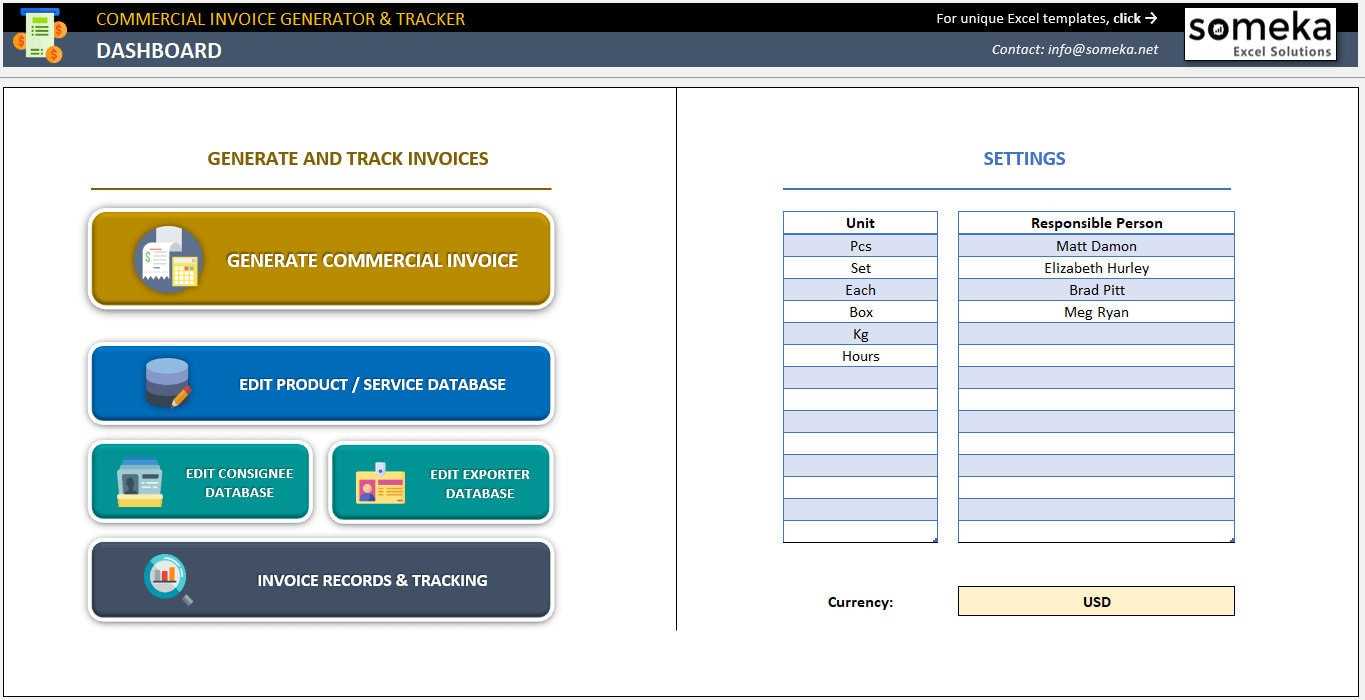

Managing business transactions and keeping client records organized can be a time-consuming task. A well-structured solution allows users to streamline these processes, creating a smooth flow between generating payment requests and storing key client information. By integrating these functions into a single system, businesses can save valuable time and improve accuracy in their financial operations.

This method enables users to quickly create documents for payments while maintaining an easily accessible list of clients, products, and services. It also offers the advantage of automatically updating records as new entries are made, ensuring that the data is always accurate and up-to-date. Such an approach minimizes the need for manual data entry, reducing the likelihood of human error.

Key Features of an Integrated System

Using a combined toolset for financial management provides various benefits, including automation of repetitive tasks and better tracking of revenue and client interactions. By leveraging built-in formulas and customizable fields, users can easily generate professional documents and follow up on outstanding payments without leaving the system.

Why This Approach is Beneficial for Small Businesses

Small businesses often struggle with balancing efficiency and accuracy, especially when managing multiple clients and transactions. The integration of invoicing and data storage simplifies this task, allowing owners to focus more on growth and customer relationships. The ability to track previous orders and client history in one place makes it easier to handle invoicing and payment follow-ups.

Why Use an Automated Billing System

Managing financial documents efficiently is crucial for maintaining smooth operations in any business. Using a structured solution to create payment requests can greatly simplify the process. With the right setup, business owners can automate repetitive tasks, reduce errors, and ensure consistency in every document produced.

An automated system provides several key advantages that help businesses stay organized while saving time and resources. Here are some of the main reasons why this approach is beneficial:

- Customization: Users can easily adjust the layout and fields to match their specific needs, ensuring that all essential information is included.

- Accuracy: Pre-set formulas and calculations minimize the risk of human error when adding figures and totals.

- Efficiency: Automating the creation and management of financial documents allows businesses to handle multiple clients without additional effort.

- Record-Keeping: Client details and transaction history are automatically stored and easily retrievable for future reference.

- Professional Appearance: The system generates clean, consistent documents that give a professional impression to clients.

By leveraging an automated approach, businesses can focus on core activities, knowing that their billing process is running smoothly and accurately.

Benefits of Data Integration in Billing Systems

Integrating client and transaction information into a centralized system offers several significant advantages. When billing processes are linked to a record-keeping tool, it allows businesses to automate the generation of payment requests while maintaining an accurate and up-to-date client history. This seamless flow of information enhances the overall efficiency of financial management tasks.

The following are some key benefits of incorporating data management into your billing process:

- Improved Accuracy: Automatically pulling client and transaction data reduces the risk of errors, ensuring that every document is precise and complete.

- Time Savings: Once the system is set up, generating new financial documents becomes quick and easy, saving valuable time compared to manual entry.

- Real-Time Updates: As transactions are made or new clients are added, the data automatically updates, providing accurate and current information at all times.

- Better Tracking: A linked system allows businesses to track previous payments, outstanding amounts, and client histories, making it easier to follow up when necessary.

- Reduced Manual Work: Eliminating the need for repetitive data entry frees up time for more important tasks, helping staff focus on higher-priority activities.

By combining the power of automated billing with integrated record-keeping, businesses can not only improve accuracy but also create a more efficient and organized workflow for managing their finances.

How to Create a Billing Document System

Designing a structured system for generating payment requests is an essential step in streamlining your business processes. A custom-built tool allows you to quickly produce professional documents that reflect your company’s branding while including all the necessary details for your clients. This guide walks you through the steps to create a personalized solution that suits your specific needs.

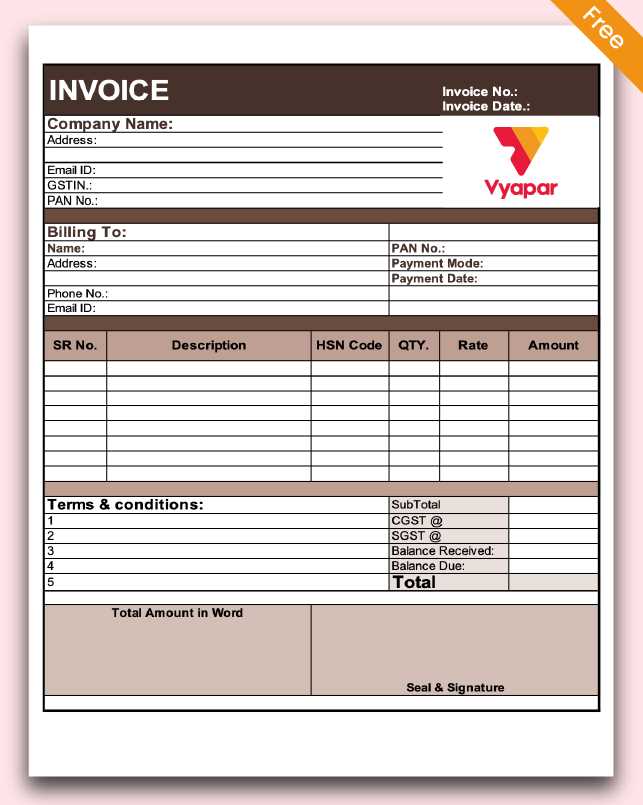

Step 1: Setting Up the Document Layout

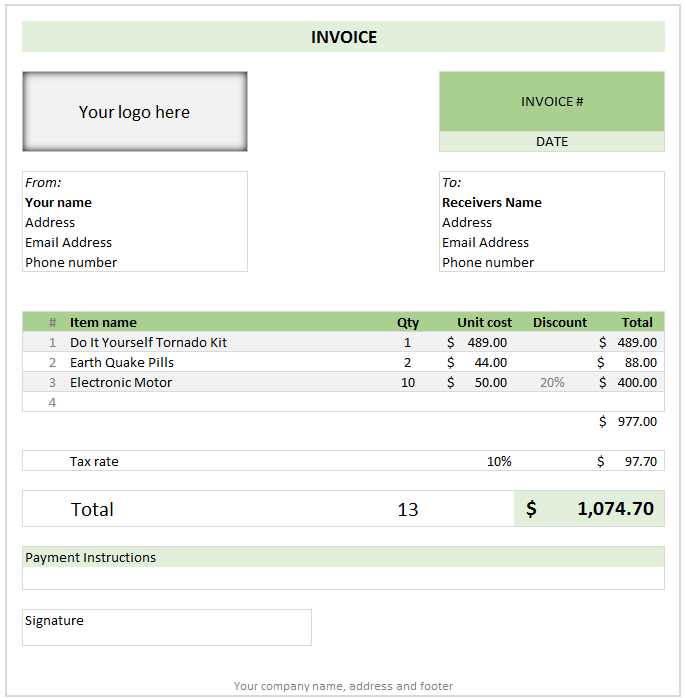

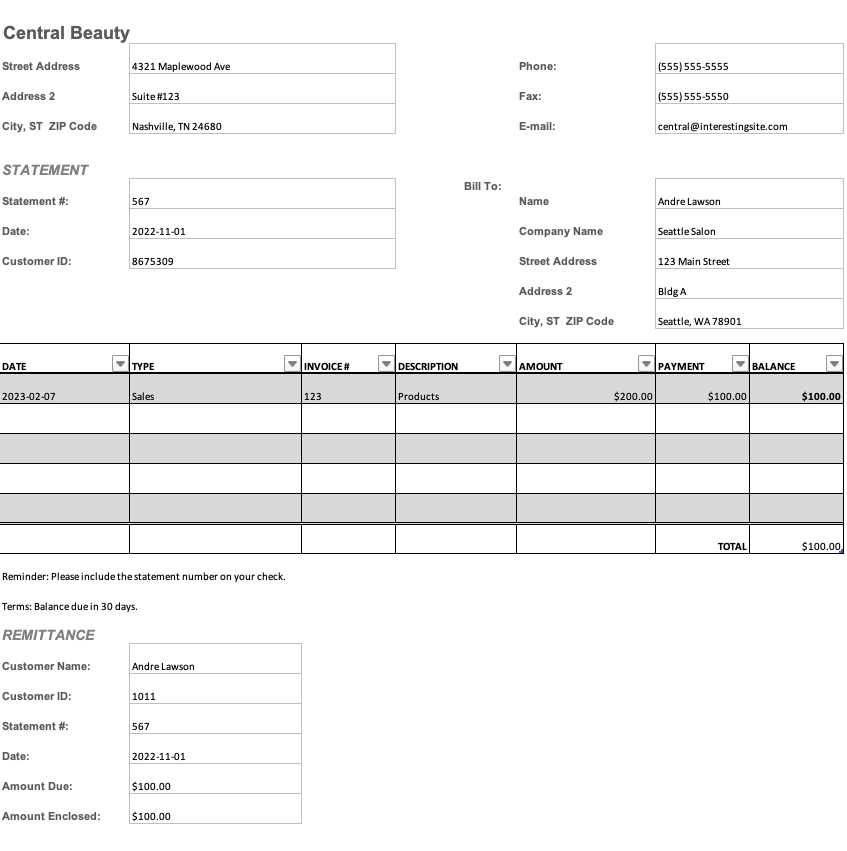

The first step is to determine the layout of your billing document. This includes sections for client details, items or services provided, payment terms, and any additional information you want to include. A clean, well-organized layout ensures that all important data is easy to find and read.

Step 2: Incorporating Data Fields

Once the layout is defined, you’ll need to set up the necessary fields for entering data, such as client name, address, product or service description, quantity, and price. This allows you to easily fill in the required information for each transaction. Here is an example of how you can structure the key sections:

| Client Information | Item/Service Details | Amount |

|---|---|---|

| Client Name: ___________ | Product/Service: ___________ | Price: ___________ |

| Address: ___________ | Quantity: ___________ | Total: ___________ |

| Email: ___________ | Discount: ___________ | Tax: ___________ |

| Phone: ___________ | Subtotal: ___________ | Grand Total: ___________ |

This structure helps to ensure that all the important elements are captured, making it easier to track sales and payments. After filling in the relevant data for each transaction, the system can automatically calculate totals and apply taxes, streamlining the entire process.

By following these steps, you will have a fully functional system that allows you to quickly create and manage your payment requests in an organized and professional way.

Setting Up a Record-Keeping System

Creating a well-organized system to store and manage client and transaction data is a critical part of efficient business operations. By establishing a central repository for important details, you can easily track previous sales, follow up on payments, and ensure that your records are always up to date. The setup process involves creating clear data fields and ensuring that the information is accessible and easy to manage.

Step 1: Organizing Data Fields

The first step in setting up your system is to decide on the essential fields that need to be included for each record. Common fields might include client name, contact information, service or product details, payment status, and transaction dates. By creating a table for these data points, you can store all relevant information in one place.

Step 2: Structuring the Data Table

Once the fields are decided, it’s time to create the table structure. This layout will allow you to enter, update, and retrieve information quickly. Below is an example of a simple setup that can be used to track key data:

| Client Name | Contact Info | Product/Service | Amount | Payment Status | Transaction Date |

|---|---|---|---|---|---|

| John Doe | [email protected] | Consulting | $500 | Paid | 01/15/2024 |

| Jane Smith | [email protected] | Design Services | $750 | Unpaid | 01/20/2024 |

Each row represents a different transaction, and by adding more data as needed, you can keep track of numerous clients and orders in an organized way. This structure not only simplifies the data entry process but also makes it easier to search and filter for specific infor

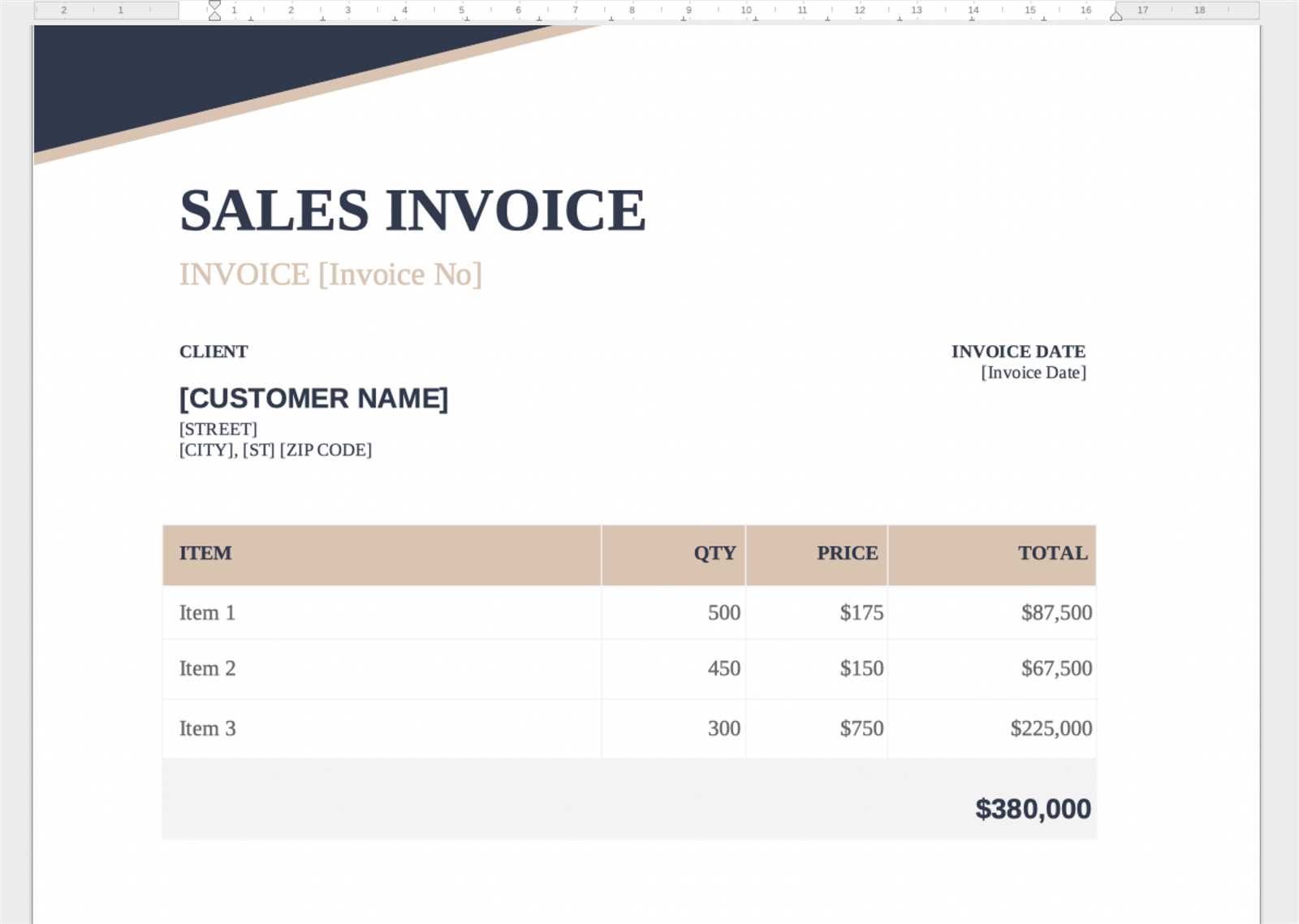

Customizing Your Billing Document Design

Personalizing the appearance of your payment request documents is an important step in creating a professional and consistent brand image. Customizing the layout and design allows you to present your business in a polished manner, ensuring that your clients receive clear and visually appealing documents. Tailoring the design to suit your company’s style and needs can improve readability and enhance your overall communication.

Step 1: Choosing a Layout

The first step in customizing your billing document is selecting a layout that aligns with your needs. Depending on the complexity of the transaction, you may want to opt for a simple one-page design or a more detailed format. Focus on ensuring that key details, such as client information, transaction items, and totals, are easy to locate. The layout should also leave space for your business logo, payment terms, and any additional notes you want to include.

Step 2: Formatting and Branding

Once the layout is in place, the next step is to incorporate your company’s branding. Use your brand colors, fonts, and logo to create a cohesive look that reflects your business identity. Consistent use of colors and typography not only strengthens brand recognition but also creates a professional impression. Here are some elements you can customize:

- Logo: Add your logo at the top of the document for easy identification.

- Colors: Use your brand colors for headings, borders, or highlights to make the document visually appealing.

- Fonts: Select fonts that are clear and easy to read, while aligning with your brand’s tone.

- Headers and Footers: Include important contact information and business details in the header or footer for easy reference.

These design elements will help make the document more engaging and professional while maintaining clarity and organization. Customizing the look and feel of your billing system is an effective way to enhance your client interactions and reinforce your business’s identity.

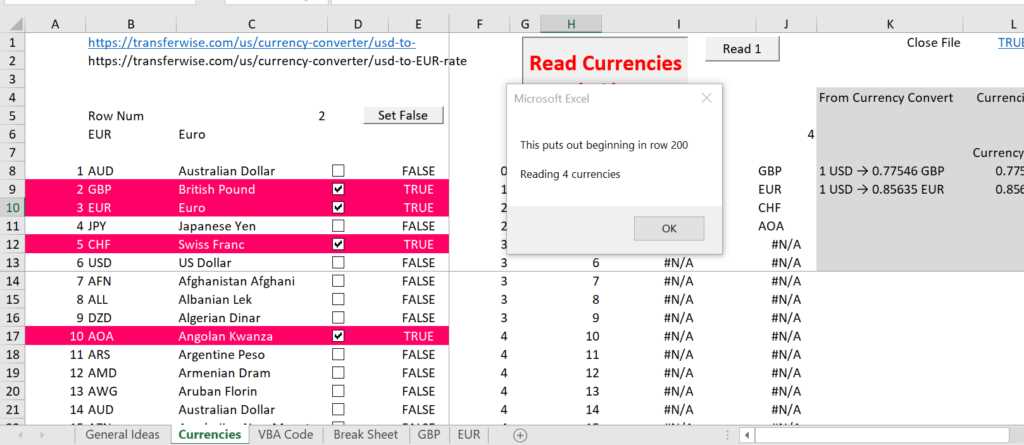

Linking Billing Data to a Record System

Integrating financial documents with a centralized record-keeping system can significantly improve efficiency and accuracy. By linking transaction details directly to your client and sales data, you can automate many manual processes, ensuring that information is always up to date and reducing the chance of errors. This connection allows for seamless data flow, eliminating the need to re-enter information each time a new document is created.

When transaction data is linked to your records, any updates made to client details or previous transactions are automatically reflected in the document, ensuring consistency across all platforms. For example, when creating a new billing document, the client’s name, contact information, and previous transaction history can be pulled directly from the system, minimizing the time spent searching for this information manually.

Benefits of Linking Data:

- Automation: Reduces the need for repetitive data entry by automatically pulling relevant details from the record system.

- Real-Time Updates: Any changes to client or transaction details are immediately reflected in new documents, ensuring accuracy.

- Consistency: Linking ensures that all documents are uniform and contain the same accurate information.

- Time Savings: Reduces the time needed to create and manage financial records by automating data input and calculations.

By setting up this integration, you can streamline your entire process, from generating documents to tracking payments, ensuring a smooth workflow that enhances both efficiency and client satisfaction.

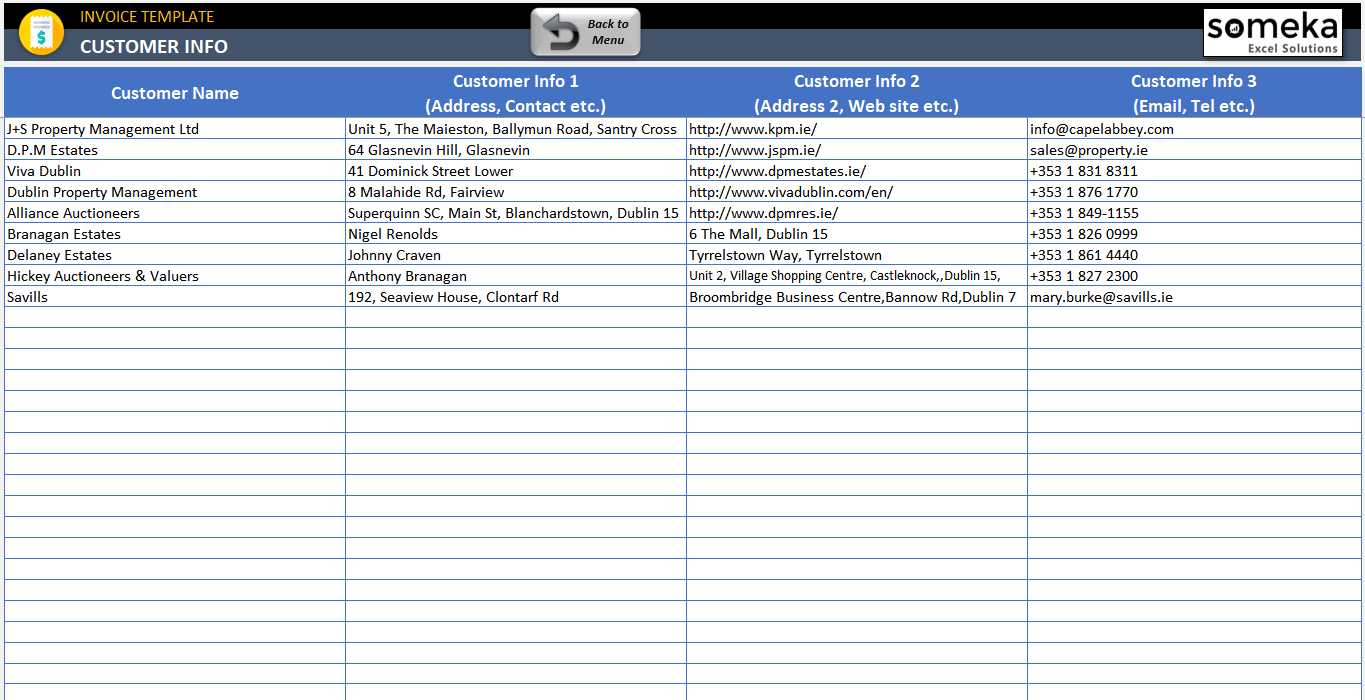

Tracking Client Information in a Record System

Organizing and managing client details efficiently is a key component of maintaining smooth business operations. By creating a structured system to track essential information, businesses can quickly retrieve contact details, transaction histories, and communication records, ensuring that no important data is overlooked. Proper client tracking can also help streamline follow-ups, improve customer service, and maintain accurate financial records.

Step 1: Creating Client Profiles

The first step in tracking client information is setting up dedicated profiles for each customer. These profiles should include basic contact details, such as name, email, phone number, and address, as well as specific transaction history, including products purchased, amounts paid, and outstanding balances. By storing this information in a well-organized format, it becomes much easier to refer to or update when needed.

Step 2: Using a Structured Table

One of the easiest ways to track client information is by using a structured table format. This allows for easy entry, sorting, and retrieval of data. A sample structure might include the following columns:

| Client Name | Contact Info | Last Purchase | Amount Spent | Outstanding Balance |

|---|---|---|---|---|

| John Doe | [email protected] | 01/15/2024 | $500 | $0 |

| Jane Smith | [email protected] | 01/20/2024 | $750 | $250 |

In this table, each row represents a client, and each column contains key details that help you quickly identify information like the last purchase date or the amount due. You can easily add or edit rows as new clients are added or transactions are made, ensuring that your records are always current.

Benefi

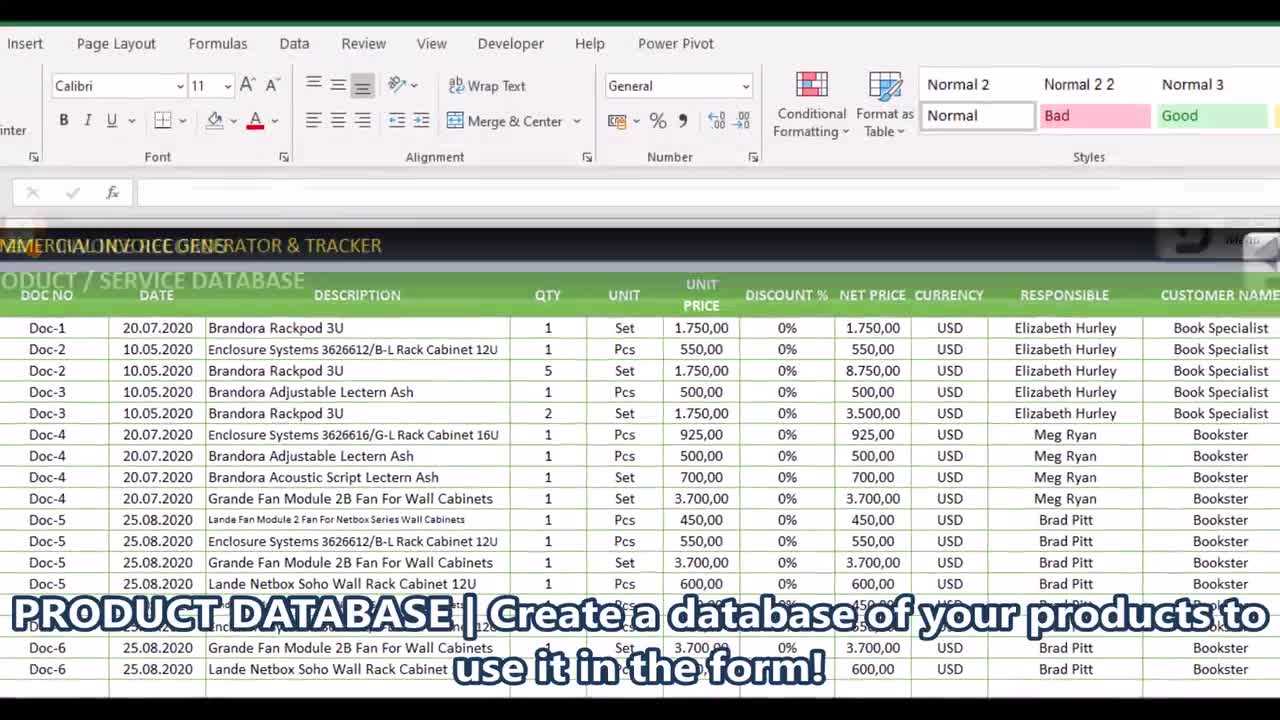

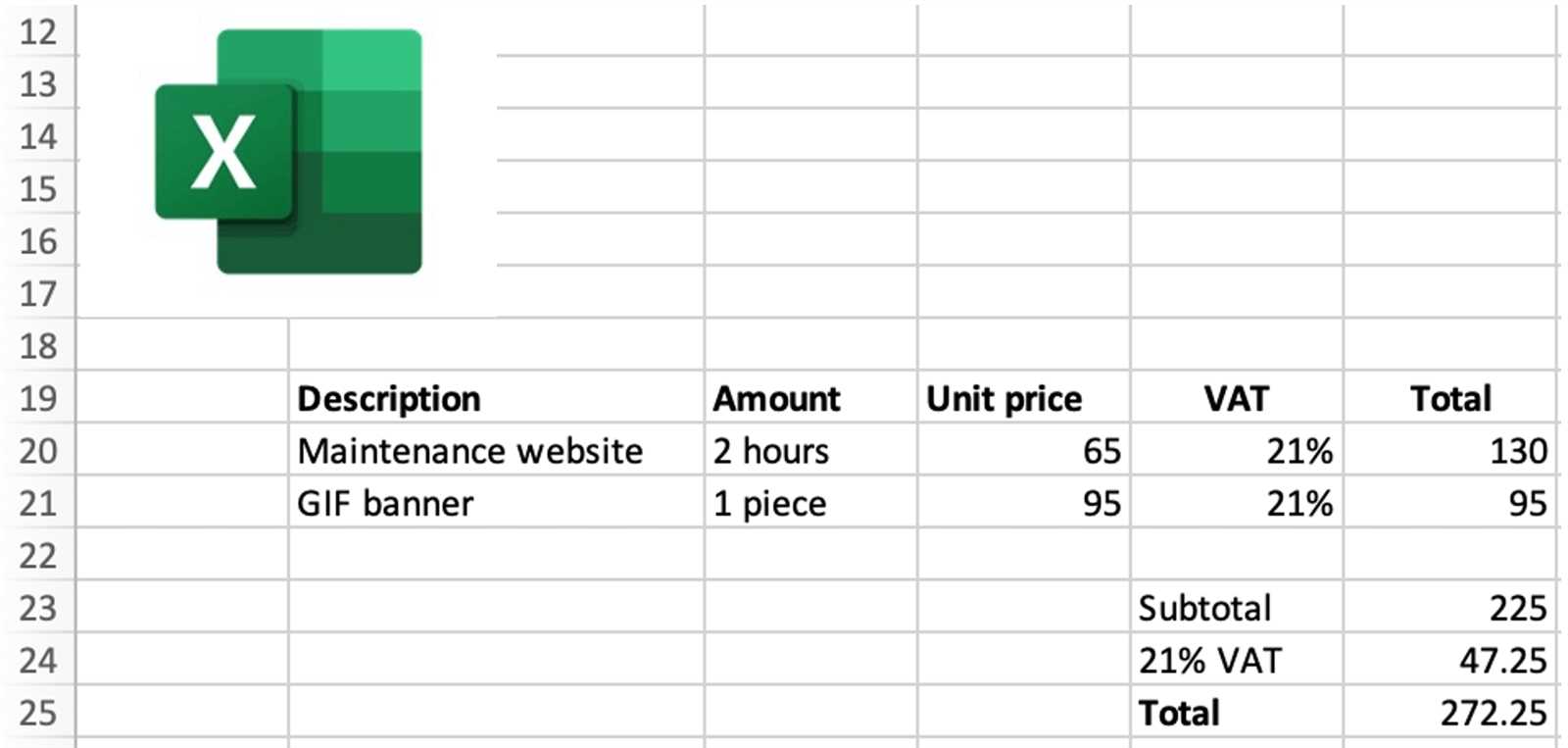

Automating Billing Document Generation with Formulas

Automating the creation of billing documents is one of the most efficient ways to save time and reduce manual errors. By using built-in formulas, you can streamline the entire process, ensuring that totals, taxes, discounts, and other calculations are performed automatically. This not only speeds up the task but also ensures accuracy every time a new document is generated.

Using formulas for calculation is a straightforward method to automate key parts of the process, such as adding up item totals, applying taxes, and calculating final amounts due. By setting up the necessary formulas, you can ensure that all calculations are done instantly whenever new data is entered, without needing to manually update the totals each time.

Example Formula Setup

Let’s break down a simple example where you can automate the calculation of item totals, tax, and the grand total using basic formulas:

| Item Description | Quantity | Price per Unit | Total |

|---|---|---|---|

| Consulting Service | 3 | $100 | =B2*C2 |

| Web Design | 2 | $200 | =B3*C3 |

In this example, the “Total” column automatically calculates the price based on quantity and unit price. You can then apply a tax formula, like:

Tax (10%): =SUM(D2:D3)*0.10

The final total can be calculated by adding the sum of the items and the tax:

Grand Total: =SUM(D2:D3)+E4

These formulas will automatically update every time the quantity or price is changed, eliminating the need for manual recalculations. Once the initial setup is complete, creating and updating your billing documents becomes much faster and error-free.

Advantages of Using Formulas for Automation:

- Efficiency: Automatically calculate totals, taxes, and discounts without manual intervention.

- Accuracy: Eliminate human errors in calculations, ensuring consistency across all documents.

- Time-Saving: Quickly generate documents by simply entering the necessary

Ensuring Accurate Data Entry in a Record System

Accurate data entry is essential for maintaining reliable records, especially when managing client information, transactions, and financial details. Incorrect or inconsistent data can lead to errors in reporting, missed payments, and confusion for both the business and its clients. Implementing strategies to minimize mistakes during data entry will help ensure the integrity of your information, save time, and enhance operational efficiency.

Step 1: Using Data Validation Rules

One of the most effective ways to ensure data accuracy is by setting up validation rules that limit the type of data that can be entered into each field. For example, you can restrict a column to accept only numerical values or ensure that dates are entered in a specific format. This can prevent users from making common entry mistakes and help maintain consistency across your records.

Example of Validation: If you are tracking payment amounts, set a rule to only allow numbers in the “Amount” column to prevent the accidental entry of text or symbols. You can also specify that the “Phone Number” field should only accept a set number of digits, ensuring that all entries are correctly formatted.

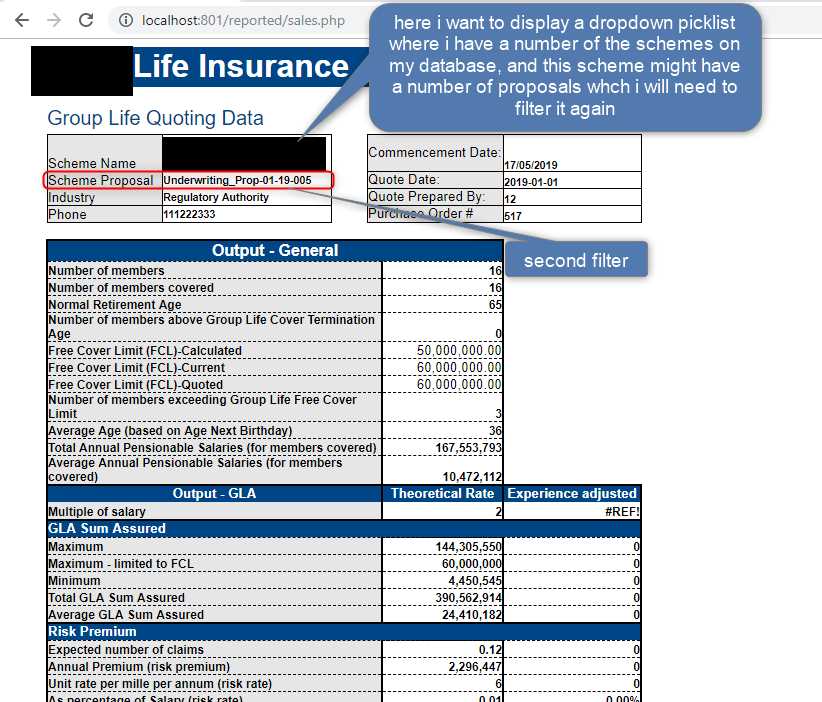

Step 2: Implementing Drop-down Lists

Another way to reduce errors is by using drop-down lists for fields where the options are limited. For example, if you need to enter payment status (Paid, Unpaid, Pending), using a drop-down list ensures that only these exact values are selected. This eliminates the possibility of spelling mistakes and ensures consistency in your records.

Drop-down lists are simple to create and provide a fast, efficient way to fill in repetitive data without the risk of inconsistencies. They are especially useful when managing large datasets or when multiple users are involved in data entry.

Benefits of Accurate Data Entry:

- Consistency: Ensures that all data follows the same format, making it easier to analyze and report.

- Efficiency: Reduces the time spent correcting errors and re-entering data.

- Improved Decision Making: Reliable and accurate data enables better insights and more informed business decisions.

By taking steps to enforce accurate data entry, businesses can mini

How to Organize Billing Records Efficiently

Efficiently managing financial documents is essential for smooth business operations. Proper organization ensures that records are easy to access, track, and update, which can save time and reduce the risk of errors. Implementing a structured approach to storing and categorizing transaction data allows businesses to streamline their accounting processes and maintain accurate financial records.

Step 1: Categorize Records by Date or Client

One of the first steps in organizing billing documents is determining how to categorize your records. Two common methods include sorting by date or by client. By organizing your records into clear categories, you can quickly locate past transactions or review data for specific clients.

- By Date: Create folders or sections for each month or year to track billing documents over time. This method is useful for businesses that need to quickly assess financial activity on a monthly or annual basis.

- By Client: Group records based on each client’s name or ID number. This approach is helpful for businesses that work with a large number of clients and need to retrieve past transactions quickly for follow-up or review.

Step 2: Use Clear Labeling and Indexing

Labeling your records clearly and consistently is another important step in organizing billing information. Each document should include relevant details such as the client’s name, transaction date, and total amount, making it easier to search through records when needed.

- Label Consistently: Use a consistent format for naming your records, such as “ClientName_TransactionDate_Amount” (e.g., “JohnDoe_2024-05-15_500”). This ensures that you can easily sort and find documents.

- Index Key Details: Maintain an index or summary sheet that lists all transactions and important details such as due dates, amounts, and payment statuses. This can serve as a quick reference guide to view your most important records at a glance.

Benefits of Organizing Billing Documents:

- Time Savings: Quickly locate past transactions or client information when you need it most.

- Improved Tracking: Easily monitor payment statuses, overdue amounts, and pending transactions.

- Better Financial Control: Keep accurate rec

Managing Multiple Clients in a Record System

Effectively managing a large number of clients is crucial for businesses that need to keep track of various transactions, communication, and other details. Organizing and storing client information in a structured manner helps ensure easy access to important data, quick updates, and streamlined processes. A well-organized system enables businesses to stay on top of their client relationships and manage workflows more efficiently.

Step 1: Creating a Centralized Client List

To manage multiple clients efficiently, it’s essential to have a centralized list that includes all relevant client details. By consolidating this information into one location, you can quickly retrieve contact data, transaction histories, and other key details. This list can include fields for client names, contact information, past transactions, payment statuses, and other important data.

Client Name Email Phone Number Last Purchase Amount Due John Doe [email protected] (123) 456-7890 01/15/2024 $250 Jane Smith [email protected] (987) 654-3210 01/20/2024 $450 This centralized list can be easily updated as new clients are added, transactions occur, or balances change. It also serves as a great resource for quick reference when you need to find client details for communication, follow-ups, or reporting purposes.

Step 2: Organizing Client Data by Categories

Once you have a centralized list, it’s important to organize client data into categories for easier management. Categorizing clients can help you quickly sort information, generate reports, and focus on specific groups when needed.

- By Industry or Sector: Group clients based on their business type or industry. This is helpful for tailoring

Advanced Features for Billing Document Systems

For businesses looking to enhance their billing workflows, integrating advanced features can significantly improve efficiency and accuracy. These features automate complex tasks, ensure consistent formatting, and enable customization for various needs. By utilizing advanced tools, companies can streamline their processes and better manage client transactions, all while saving time and reducing errors.

Advanced features allow for automated calculations, conditional formatting, and seamless data entry, making the process more dynamic and responsive. These functions can be tailored to accommodate unique business requirements, offering a more professional approach to document generation and management.

Key Features to Consider:

- Automated Calculations: Automatically compute totals, taxes, and discounts based on predefined formulas. This ensures accurate financial figures every time a document is created.

- Dynamic Data Entry: Use drop-down lists and auto-fill options to simplify the data entry process. This reduces errors and speeds up the creation of new records.

- Conditional Formatting: Highlight specific cells or rows based on conditions such as overdue payments, high amounts, or specific client categories. This allows you to quickly identify important data.

- Integrated Reporting: Generate automatic reports based on specific criteria, such as total sales by client or month. This helps you track business performance in real time.

- Custom Branding: Personalize documents by adding logos, custom fonts, and color schemes, ensuring that your billing documents align with your company’s branding guidelines.

By incorporating these advanced tools, businesses can enhance their document management systems, automate repetitive tasks, and improve the overall customer experience. These features not only increase efficiency but also ensure that all billing documents are consistent, professional, and error-free.

Tracking Payments and Outstanding Bills

Efficiently managing payments and tracking unpaid balances is critical for maintaining healthy cash flow and ensuring that all financial obligations are met. Keeping a detailed record of transactions, payment statuses, and outstanding amounts can help businesses stay organized and ensure they never miss a payment or overlook a due balance.

By setting up a clear system for monitoring payments and overdue bills, you can quickly identify clients who have outstanding amounts, prioritize follow-ups, and manage collections more effectively. This not only helps maintain financial stability but also improves relationships with clients by ensuring timely communication and resolution of issues.

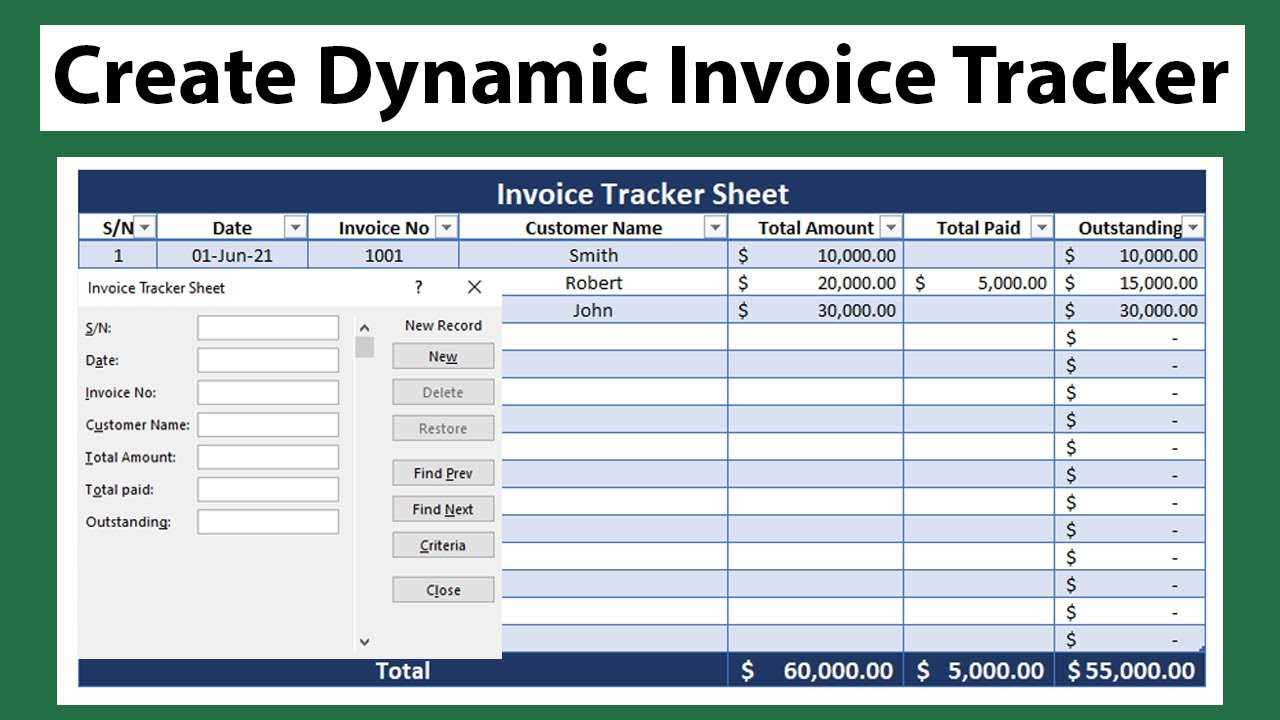

Step 1: Creating a Payment Tracker

One of the simplest and most effective ways to track payments is by creating a payment tracker. This can be a dedicated sheet or section in your system that records each transaction, including the amount paid, payment date, and the outstanding balance. By regularly updating this tracker, you can easily identify clients who still owe money and how much they owe.

- Column for Payment Date: Track when payments were made to keep up-to-date records of client transactions.

- Amount Paid: Record the exact amount of money received to help reconcile your records.

- Outstanding Balance: Automatically calculate the remaining amount due after each payment, allowing you to monitor balances in real-time.

Step 2: Categorizing Payment Status

Another useful step in managing payments is categorizing each record based on its payment status. This can help you quickly identify overdue amounts and prioritize follow-up actions. Using color-coded systems or specific tags for statuses like “Paid,” “Pending,” and “Overdue” can simplify the tracking process and ensure no payment is forgotten.

- Paid: Mark transactions that have been fully paid and no longer require attention.

- Pending: Flag payments that are in progress or awaiting confirmation.

- Overdue: Highlight transactions where payment has not been received by the agreed date. This category can help you prioritize clients that need a reminder or follow-up.

Benefits of Tracking Payments:

- Cash Flow Management: By keeping track of payments, you can predict your cash flow and plan accordingly.

- Timely Follow-Ups: Easily identify overdue payments and send reminders to clients before the situation worsens.

- Financial Transparency: Maintain clear and transparent records, making it easier to resolve disputes and clarify payment histories.

By implementing a system to track payments and outstanding bills, businesses can ensure financial stability, improve client relationships, and stay on top of their financial obligations. Regular updates and proactive monitoring are key to maintaining an organized and efficient payment process.

Exporting Billing Data from a Spreadsheet

Exporting financial data from a spreadsheet is an essential step for businesses that need to share or analyze information outside of the original document. Whether you’re sending the data to an accountant, transferring it to another software for analysis, or simply creating a backup, the ability to export your records efficiently ensures smooth data flow and accessibility across different platforms.

The process of exporting data involves selecting specific information, formatting it for use in other applications, and then saving or transferring it to the desired format. This allows businesses to maintain accurate records while also enabling the flexibility to work with the data in various contexts, such as reporting, auditing, or sharing with clients or stakeholders.

Common Export Formats:

- CSV (Comma-Separated Values): A widely used format for transferring tabular data. It is supported by most accounting software, making it a popular choice for businesses that need to import data into different systems.

- PDF: Ideal for generating finalized reports or documents that need to be shared in a secure and uneditable format. PDF exports are commonly used when sending invoices or statements to clients.

- XLSX: An Excel-compatible file format that preserves the structure and formulas of the original document, allowing for easy editing and further processing in spreadsheet programs.

By exporting your financial records, you can ensure that data is easily accessible for analysis, reporting, or sharing, and you can work seamlessly across various platforms and tools to support your business needs. The ability to export records accurately and in the appropriate format can significantly enhance productivity and collaboration within your team or with external parties.

Best Practices for Using Spreadsheet Designs

Using pre-designed systems in spreadsheets can help businesses streamline repetitive tasks, reduce errors, and enhance productivity. However, to make the most of these systems, it is crucial to follow some best practices that ensure efficiency, accuracy, and ease of use. By adopting the right strategies, users can maximize the effectiveness of these systems while minimizing common mistakes.

1. Organize and Label Data Clearly

Clear organization is key when using a structured system. Label columns and rows in a way that makes sense and ensures that anyone who uses the file can understand its structure. Proper labeling improves readability and minimizes confusion. Ensure that every category, such as client details or transaction data, is clearly marked and follows a consistent naming convention.

- Use Descriptive Headers: Column titles should clearly describe the information they contain, such as “Amount Due” or “Payment Date”.

- Ensure Consistent Formats: Use the same format for numbers, dates, and text throughout the document to prevent errors.

2. Maintain a Backup and Version History

Backing up your work is essential to prevent data loss. Save your work regularly, and consider keeping multiple versions of the document, especially before making major changes. This ensures you can recover older versions if necessary, and keeps your records safe in case of mistakes or accidental deletions.

- Save Incrementally: Create new versions each time significant changes are made, such as “File_v1”, “File_v2”, etc.

- Use Cloud Storage: Cloud-based storage solutions provide an added layer of security and allow for easy access across multiple devices.

By following these best practices, businesses can ensure that their systems are reliable, consistent, and easy to use, allowing for smoother workflows and fewer errors. Whether for tracking payments, managing client data, or generating reports, adopting a thoughtful approach to managing spreadsheet designs will improve overall business efficiency.

Common Mistakes to Avoid in Billing Documents

When managing financial records and creating documents for transactions, it’s easy to overlook small details that can lead to larger issues, such as miscommunication, errors in calculations, or delayed payments. Avoiding common mistakes is essential for maintaining accuracy, professionalism, and a smooth billing process. By addressing these frequent pitfalls, businesses can ensure that their financial documentation remains error-free and efficient.

1. Incorrect or Missing Client Information

One of the most common mistakes in financial documents is neglecting to include or inaccurately entering client details. This can lead to confusion or delays in payment, as clients may not be able to identify the document correctly. Always double-check that the client’s name, address, and contact information are accurate and up to date.

- Double-Check Contact Details: Ensure that client names, addresses, and other relevant information are correct before finalizing any documents.

- Update Regularly: Always keep the client database up to date to avoid errors in future documents.

2. Inconsistent or Incorrect Pricing

Another common mistake is failing to apply consistent pricing across all documents. This can happen when manual calculations are used, or when product or service rates change but the document is not updated. Always verify that prices, discounts, and taxes are correctly applied to each record to avoid confusion and potential loss of revenue.

- Use Automated Calculations: Leverage built-in formulas to ensure prices and totals are consistently accurate.

- Check for Rate Changes: Before generating new documents, verify that any changes in rates, taxes, or fees are reflected throughout the system.

3. Failing to Include Payment Terms

Leaving out payment terms or due dates can lead to misunderstandings and delayed payments. It is essential to clearly state when payment is due, as well as any applicable late fees or discounts for early payment. This not only helps set expectations but also encourages timely transactions.

- Clearly Define Payment Due Dates: Always specify when payments are due to avoid confusion.

- Include Terms: State any conditions related to payment, such as discounts for early payments or penalties for late ones.

4. Overlooking Calculations or Totals

Even the smallest errors in totaling amounts can lead to discrepancies in financial records. Always use formu

How to Save Time with Billing Systems

Managing financial records and generating documents can be time-consuming, especially when done manually. However, by utilizing automated tools and optimizing the way information is organized, businesses can save significant time. Streamlining tasks, such as creating documents, tracking payments, and managing client details, ensures a smoother workflow and reduces the potential for errors. Below are several strategies to help businesses save time when handling billing tasks.

1. Automate Repetitive Tasks

One of the most effective ways to save time is by automating repetitive tasks. This includes using formulas to automatically calculate totals, taxes, and discounts. Automating calculations eliminates the need to manually enter data each time, speeding up the process and minimizing the risk of errors.

- Use Formulas: Implement built-in functions like SUM, VLOOKUP, and IF statements to automatically calculate totals and apply rules.

- Pre-fill Data: Set up fields to auto-populate common information, such as client names, addresses, and item prices, based on previous records.

2. Use Pre-Formatted Systems

Pre-formatted systems allow for quick and easy generation of documents. Instead of starting from scratch every time, businesses can use standardized layouts that include all the necessary fields, labels, and formulas. This saves time by eliminating the need to manually set up each new document and ensures consistency across all records.

- Use Custom Fields: Create reusable fields for common information like client details, services provided, and payment terms to streamline the process.

- Implement Drop-Down Menus: Use drop-down menus to quickly select common items or services without needing to type out each description manually.

3. Track Client Information Efficiently

Maintaining an organized system for client data ensures that you can easily access and update information without having to search through numerous files. By setting up a system to track essential details like contact information, payment history, and transaction records, businesses can quickly generate accurate documents without re-entering the same details repeatedly.

- Create Client Records: Set up a central location for storing client details that can be accessed and updated easily whenever neede

- By Industry or Sector: Group clients based on their business type or industry. This is helpful for tailoring