Excel Invoice Template That Calculates Totals Automatically

Managing business transactions efficiently is crucial for any organization, and one of the most time-consuming tasks is generating accurate financial records. Invoices are central to this process, but without the right tools, they can quickly become a source of errors and delays. Fortunately, there are powerful solutions available that simplify this process, ensuring quick and accurate documentation with minimal manual effort.

By using an automated system, you can eliminate the need for complex math or manual adjustments every time a new record is generated. These systems handle everything from basic calculations to advanced features like tax inclusion and itemized summaries, making them essential for businesses looking to optimize their billing workflow. Whether you’re handling a small number of transactions or managing large volumes, automation can save valuable time and reduce the risk of mistakes.

Automation in billing allows for consistency and precision, which in turn leads to more reliable financial tracking and smoother interactions with clients. The simplicity of setting up a robust tool also means that even users with minimal technical experience can create professional-quality documents quickly and efficiently. As a result, the ability to generate accurate statements is no longer a challenge, but a streamlined, hassle-free process.

Why Use an Automated Billing System

Efficient financial management is essential for any business. Having a reliable method to generate detailed records of transactions can significantly streamline operations. Automation plays a key role in this process by minimizing manual input, ensuring accuracy, and saving time. Implementing a system designed to simplify financial documentation offers several benefits that can improve productivity and reduce errors.

Key Advantages of Automated Solutions

- Time-saving: Automation removes the need to manually calculate values, saving hours spent on repetitive tasks.

- Consistency: With predefined formulas, the system ensures the same calculation method every time, reducing inconsistencies.

- Accuracy: Automatic math eliminates human error, leading to precise and trustworthy documents.

- Customization: Easy-to-edit features allow the system to fit the specific needs of different businesses, from itemizing services to adjusting for taxes.

How Automation Improves Business Workflow

- Efficient Record Keeping: Instantly generate accurate transaction records, making it easier to track payments and manage accounts.

- Client Trust: Providing professional, error-free statements helps build trust with clients and partners.

- Easy Updates: Updates to pricing, taxes, or services can be applied across all documents with minimal effort.

- Cost-effective: Reducing the time spent on manual calculations means fewer resources spent on administrative tasks.

By incorporating automated tools, businesses can create an efficient, error-free workflow that enhances both productivity and professionalism.

Benefits of Automated Billing Calculations

Automating financial processes offers several advantages, particularly when it comes to generating documents that require precise arithmetic. By reducing manual input, businesses can ensure faster, more accurate results while eliminating the risk of human error. Automated calculation systems not only simplify the process but also improve efficiency and consistency across all transactions.

Key Benefits of Automated Calculations

- Improved Efficiency: Automated systems can quickly generate documents without the need for manual updates, significantly speeding up the workflow.

- Greater Accuracy: Pre-set formulas ensure that all figures are calculated precisely, preventing costly mistakes in financial reporting.

- Consistency Across Documents: Every document is created using the same standardized formulas, providing a uniform approach to calculating figures each time.

- Reduced Time Spent on Administrative Tasks: With automatic calculations, the time required for data entry and manual checking is drastically reduced.

How Automation Helps in Financial Management

- Fewer Errors: Automatic calculations eliminate the possibility of miscalculations or missed details, which are common when performing manual math.

- Scalability: As your business grows, an automated system can handle an increasing volume of transactions without the need for additional staff or resources.

- Improved Client Relations: Providing accurate, timely documents helps build trust with clients, reducing the need for corrections or follow-up communication.

- Better Reporting: Automated solutions allow for seamless tracking of financial data, making it easier to monitor income, expenses, and overall business performance.

By incorporating automated calculation systems into your financial processes, you can streamline operations, reduce errors, and enhance the overall efficiency of your business management. These systems ensure smooth and reliable transaction tracking, supporting business growth and improving client satisfaction.

How to Create a Billing Document with Automated Calculations

Creating a system to generate professional billing statements doesn’t have to be complicated. By setting up a basic structure with automatic calculations, you can save time and ensure accuracy every time you need to prepare a new document. With a few simple steps, you can create a customized tool that streamlines your financial paperwork and enhances your business efficiency.

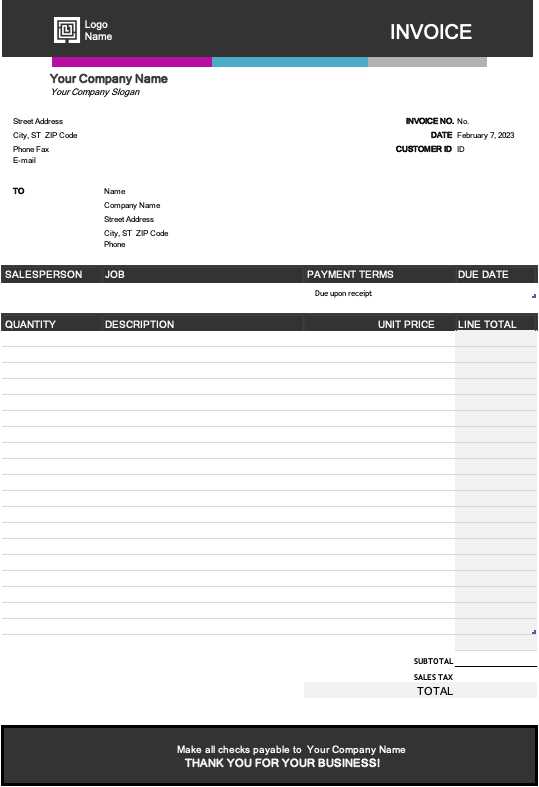

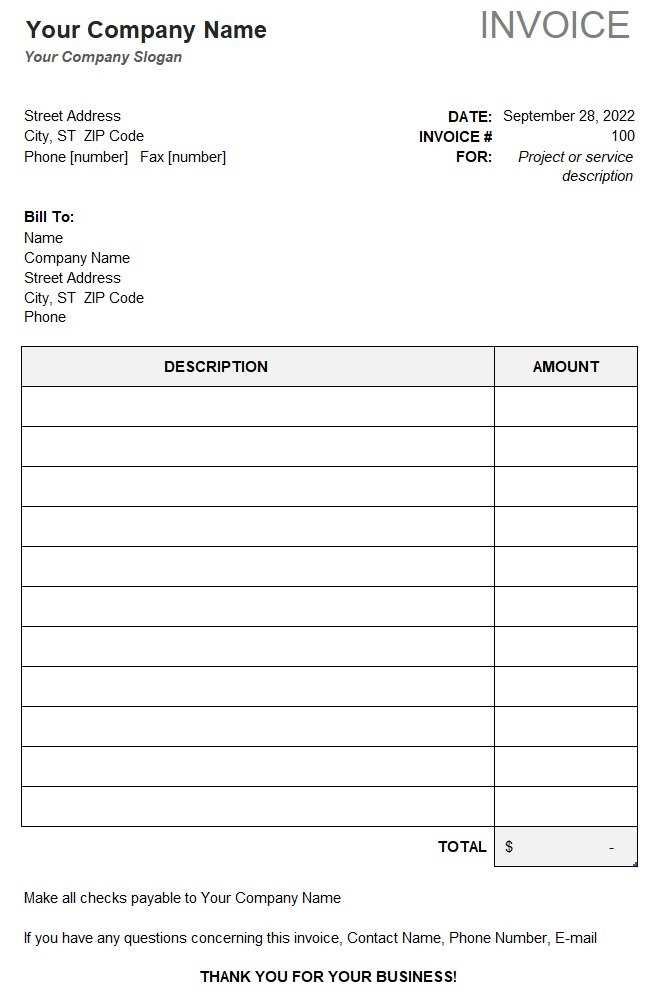

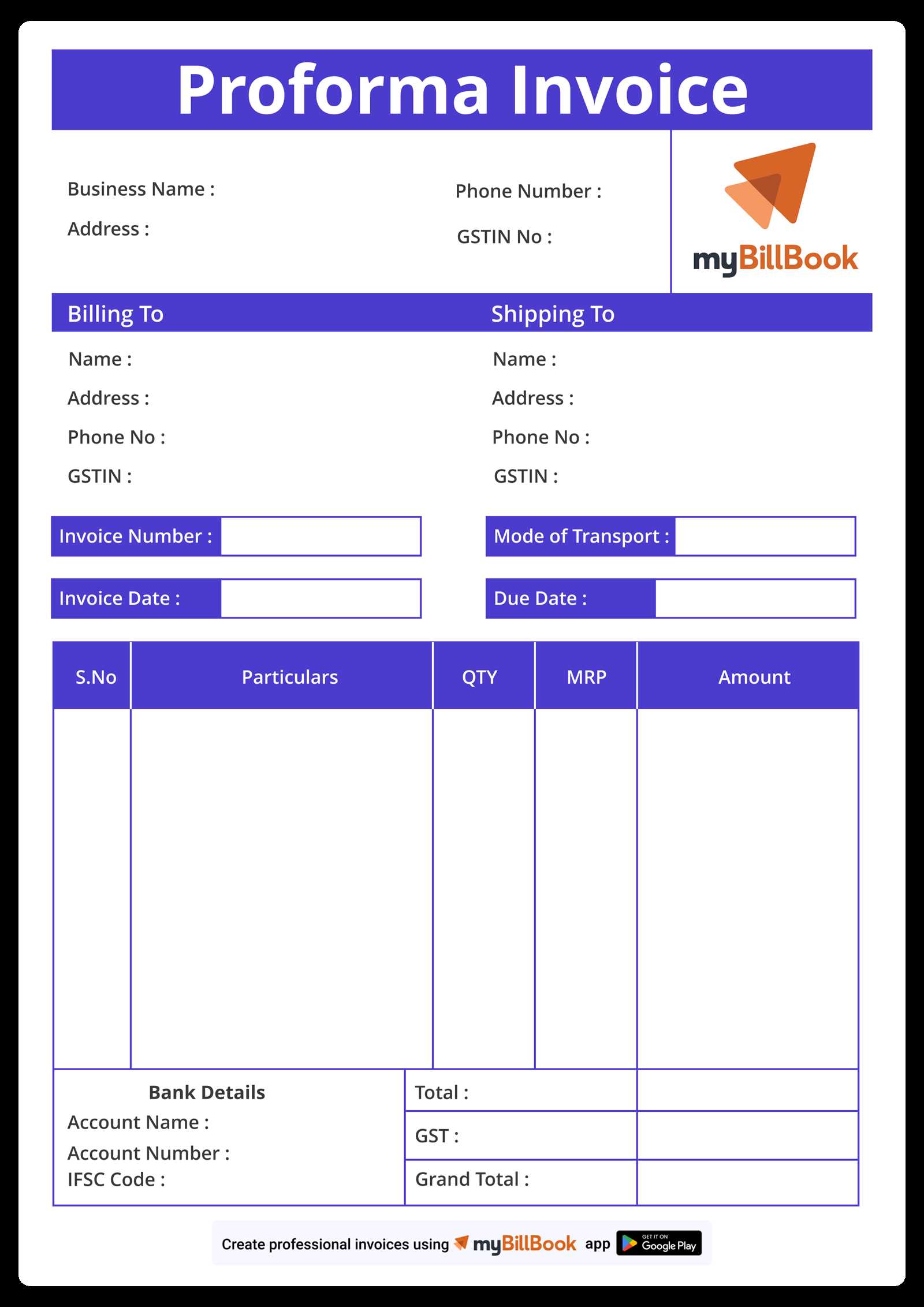

Step 1: Set Up the Basic Structure

Start by laying out the essential elements that should appear in every document. These typically include the client’s details, your business information, a list of services or products, and a place for the final amount owed. Organize this information into clear sections, using rows and columns to ensure everything is easy to read and well-organized.

- Client and company details (name, address, contact information)

- Description of products or services

- Quantity and unit price for each item

- Fields for taxes, discounts, and other adjustments

- A section for the final amount

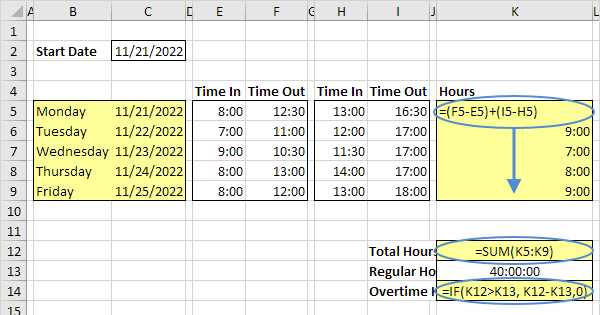

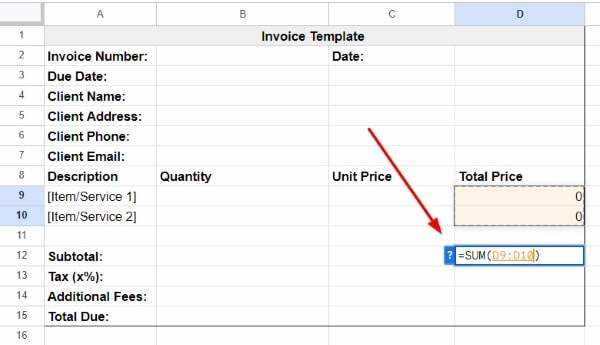

Step 2: Add Automatic Calculation Features

Once the basic layout is in place, you can add calculation functionality to streamline the process. The key is to use formulas that automatically update the amounts as you modify the quantity or price of each item. For example, the system can multiply the quantity by the unit price to generate a subtotal for each line item, then sum up all the subtotals to give the final amount due.

- Use multiplication formulas to calculate the cost of each item

- Apply tax rates and discounts automatically

- Sum all amounts using the SUM function for quick total calculations

- Ensure the final amount adjusts dynamically based on changes in the input data

By following these steps, you can easily create a billing document that saves time, reduces errors, and improves your overall financial workflow.

Step-by-Step Guide to Setting Up a Billing Document

Creating a well-structured billing document with automated features is a straightforward process that can significantly improve your workflow. By following a few simple steps, you can ensure that all calculations are handled efficiently and consistently, allowing you to focus more on your business and less on paperwork. This guide walks you through the essential stages of setting up a functional and professional financial record.

Step 1: Prepare the Basic Layout

The first step in setting up a functional document is organizing the layout. Think of the document as a structured form where each section is dedicated to a specific type of information. Arrange the fields logically, beginning with your business details and client information at the top, followed by the list of products or services provided. Below this, there will be sections for any adjustments, taxes, and the final amount owed.

- Enter your business name, address, and contact details at the top.

- Leave space for client information such as name, address, and contact.

- List items or services provided with columns for quantity, price, and descriptions.

- Include areas for taxes, discounts, and additional charges.

- Make room for the final amount owed.

Step 2: Add Automated Calculations

Once you have the basic layout, you can proceed to add automatic calculation features. These allow the system to update the amounts based on the quantities and prices you input, reducing the need for manual work and ensuring accuracy. The essential functions to use are multiplication for individual items and summation for subtotals and the final amount.

- Set up a formula to multiply the quantity by the unit price to calculate the cost per item.

- Use a SUM formula to add up the costs of all items for a subtotal.

- Include any formulas for adding taxes or applying discounts.

- Finally, ensure the final amount adjusts automatically based on changes in any previous data.

By following these simple steps, you can create a professional, error-free document that handles all financial calculations for you, allowing you to generate accurate records quickly and easily.

Customizing Billing Documents for Your Business

Each business has unique needs when it comes to financial documentation. To ensure accuracy and efficiency, it’s important to tailor your financial record-keeping tools to match the specifics of your business operations. By customizing your documents, you can include relevant information, adjust the layout for better clarity, and implement features that suit your pricing structure, services, or products.

Essential Customization Options

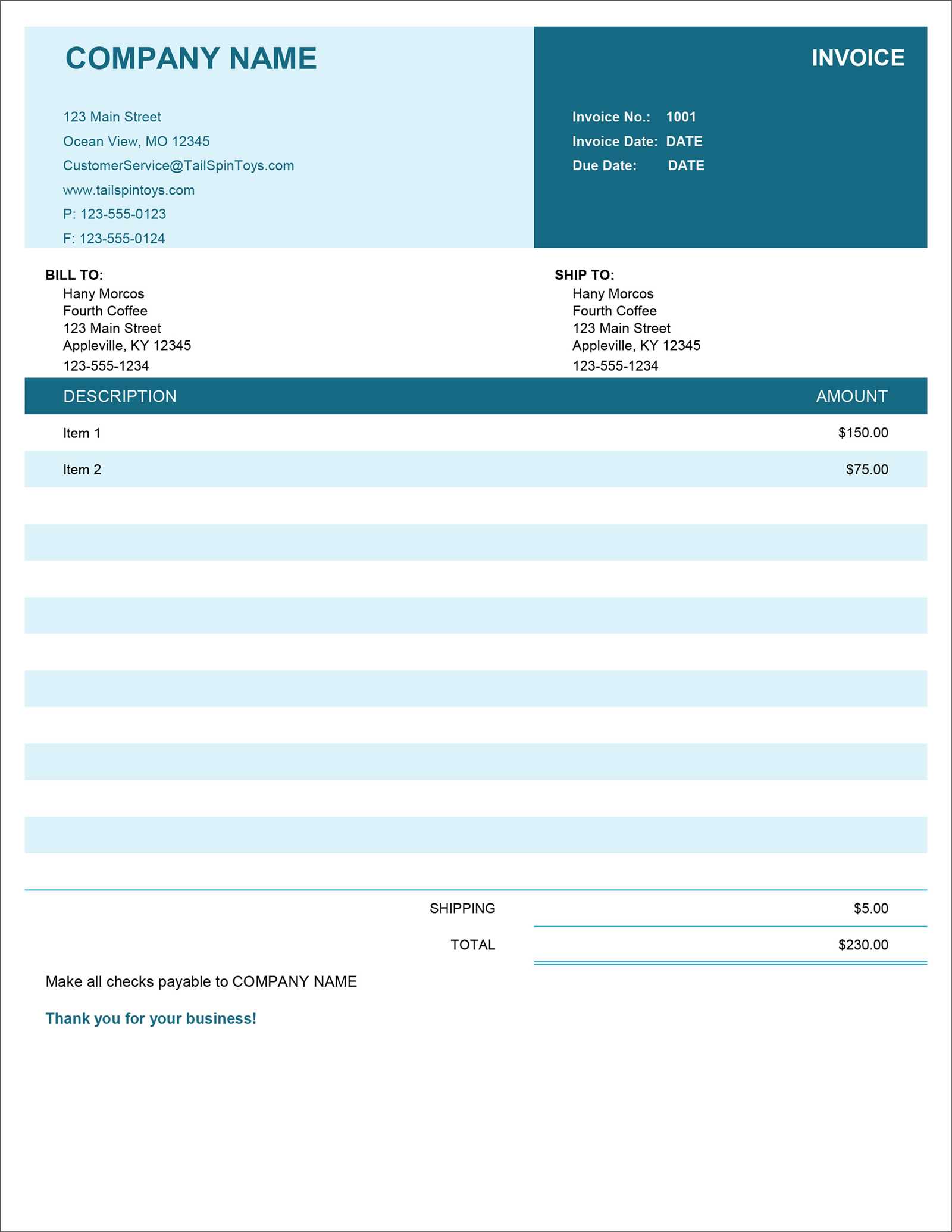

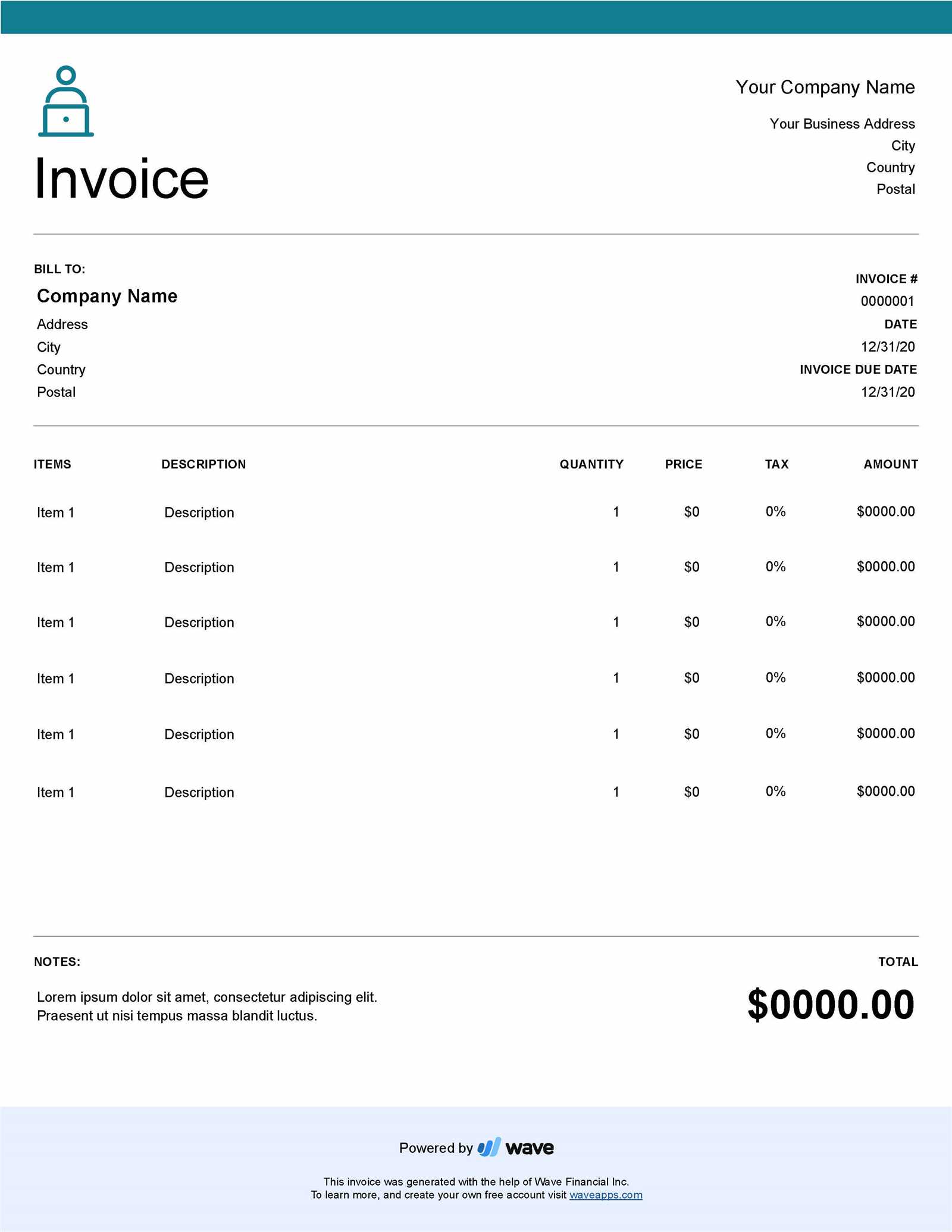

- Personalized Business Information: Add your company name, logo, and contact details at the top of the document to make it look professional and easily identifiable.

- Customizable Fields: Include fields for specific information such as client names, order numbers, or project references to tailor the document to different types of work.

- Product/Service Descriptions: Add or remove columns based on the nature of your business, whether you’re offering products or services. Make sure to include space for detailed descriptions if needed.

- Tax Rates and Discounts: Adjust tax rates or apply discounts specific to the region or client type. Custom formulas can ensure that these values are automatically factored into the final amount.

- Currency and Formatting: Choose the appropriate currency symbols and formats to match the geographic location of your business or clients. You can also format numbers to ensure consistency in decimal places or rounding.

Implementing Business-Specific Features

- Multiple Pricing Tiers: If your business offers different pricing based on volume or type of service, customize the document to include pricing tiers and ensure accurate application of discounts or special rates.

- Due Dates and Payment Terms: Include payment terms or deadlines to set clear expectations with clients. You can also add automatic reminders for overdue payments to help with tracking.

- Project-Based Adjustments: If your services are project-based, customize the sections to allow for easy tracking of milestones, progress, or additional costs that may arise during the course of the project.

- Multiple Language Support: If you serve clients in different regions, consider creating versions of your document in multiple languages to ensure clear communication.

By making these adjustments, you can create a financial tool that not only fits the way your business operates but also enhances your professional image and improves client interactions. Customization ensures that the document meets your specific needs while maintaining accuracy and clarity in all calculations.

Tips for Personalizing Billing Document Design

Designing a professional and personalized financial record can enhance both the readability and visual appeal of your documents. A well-designed document reflects your business’s brand and makes a positive impression on clients. By adjusting the layout, fonts, and colors, you can ensure that your financial documents stand out while remaining functional and easy to understand.

Key Elements to Personalize

- Branding: Include your company logo and color scheme to create a consistent brand image. This helps clients easily recognize your business and adds a professional touch.

- Typography: Choose clear, legible fonts that match your brand’s style. Avoid using too many different fonts, as this can make the document look cluttered and unprofessional. Use bold or italics to highlight key information like totals and due dates.

- Layout: Make sure the layout is clean and well-organized. Group related information together, such as client details, services/products, and amounts. This makes it easy for both you and your clients to quickly find what’s important.

- Spacing: Use ample spacing between sections to avoid a cramped appearance. Clear separation between different elements makes the document easier to read and navigate.

Advanced Personalization Ideas

- Custom Fields: Depending on your business, you may want to add custom fields such as project numbers, purchase order IDs, or job descriptions. Tailoring these fields ensures the document reflects the specifics of each transaction.

- Visual Elements: Consider adding borders, background shading, or subtle lines to organize information visually. These design elements can help draw attention to important areas like the final amount due or payment instructions.

- Interactive Features: For more advanced customization, you can add interactive features such as dropdown menus for services or automatic date fields, which can make the document easier to fill out and update.

By focusing on these key aspects, you can create financial documents that are both functional and visually appealing. A well-designed document enhances professionalism, improves clarity, and reinforces your brand identity with every transaction.

Setting Up Formulas for Final Amount Calculation

Automating the process of calculating the final amount is essential for streamlining financial documentation. With the right formulas in place, you can ensure that all figures are accurately computed without the need for manual input. Setting up these formulas allows for seamless updates whenever data changes, saving time and reducing the risk of errors.

Essential Formulas for Accurate Calculations

To calculate the final amount due, you’ll typically need to combine multiple calculations such as item costs, tax rates, and any discounts. Below are the core formulas that help automate these tasks:

| Item Description | Quantity | Unit Price | Subtotal |

|---|---|---|---|

| Product A | 2 | $50 | =B2*C2 |

| Product B | 3 | $30 | =B3*C3 |

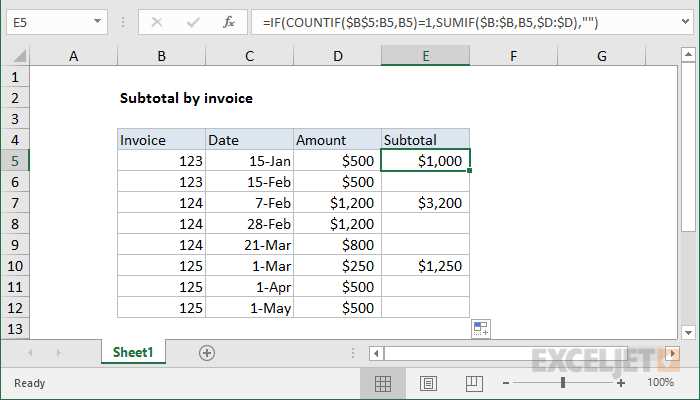

The basic calculation for each item is a multiplication formula, where the quantity (column B) is multiplied by the unit price (column C). This gives you the subtotal for each product or service. You can use the SUM function to add up all subtotals and calculate the overall amount due:

| Subtotal |

|---|

| =SUM(D2:D3) |

In the example above, the SUM function will add the subtotals from cells D2 and D3 to get the overall amount before taxes or discounts.

Incorporating Additional Calculations

Once the basic item prices are added up, you can incorporate other factors such as taxes, discounts, and additional fees:

| Tax Rate | Discount | Final Amount |

|---|---|---|

| 8% | 10% | =E2*(1+F2)-G2 |

In this example, the formula first applies the tax rate (cell F2) to the subtotal (E2), then subtracts the discount (cell G2) to give the final amount. This approach ensures that all necessary adjustments are automatically included in the final calculation.

By setting up these formulas, you create a system where the final amount is calculated instantly, removing the need for manual math and ensuring accurate results every time.

Using Functions to Calculate Final Amounts

One of the main advantages of using automated systems for financial records is the ability to perform calculations effortlessly. By leveraging built-in functions, you can set up your document to quickly add up values, apply formulas for taxes or discounts, and generate an accurate final amount. Understanding how to use these functions can greatly reduce the time spent on calculations and improve the accuracy of your documents.

Common Functions for Calculating Amounts

There are several key functions that make calculating final amounts straightforward. Here are some of the most commonly used ones:

- SUM: The SUM function adds up a range of values, making it ideal for calculating the total cost of multiple items or services. For example, to add the costs of different products, you would use

=SUM(B2:B6), where B2:B6 represents the range of cells with the item prices. - PRODUCT: The PRODUCT function multiplies values together. It’s useful for calculating the cost of a specific item based on quantity and price. For instance,

=PRODUCT(B2,C2)would multiply the quantity in B2 by the unit price in C2. - IF: The IF function helps with conditional calculations. For example, you can apply a discount only if certain conditions are met, such as if the total amount exceeds a specific value. An example formula would be

=IF(D2>100, D2*0.9, D2), which applies a 10% discount if the total amount in D2 is greater than 100. - ROUND: The ROUND function ensures that the final number is rounded to the desired number of decimal places. For example,

=ROUND(D2, 2)rounds the value in D2 to two decimal places, which is especially useful when dealing with currency.

Practical Examples of Using Functions

- Calculate Subtotal: To calculate the subtotal for all items, use the SUM function to add up the individual item costs, such as

=SUM(C2:C5)where C2 to C5 are the individual item subtotals. - Apply Tax: If you need to apply a tax rate to the subtotal, use t

Common Errors in Financial Document Setups

While setting up automated financial records, it’s common to encounter a few errors that can affect the accuracy of calculations and the overall integrity of the document. These mistakes can arise from incorrect formulas, data entry issues, or misconfigured settings. Identifying and understanding these common issues can help prevent problems and ensure your records are reliable and professional.

Typical Errors and How to Avoid Them

- Incorrect Formula References: One of the most frequent errors is using the wrong cell references in formulas. For example, referencing a wrong row or column can result in incorrect results. Always double-check the cell references used in your formulas to ensure they are pointing to the correct data.

- Missing Parentheses: Formulas often require parentheses to define the order of operations. Forgetting to close parentheses can lead to errors in the calculation, resulting in incorrect totals. Always verify that parentheses are correctly placed, especially when dealing with complex formulas.

- Not Using Absolute References: When copying formulas across cells, failing to lock specific cell references using the dollar sign (e.g., $B$2) can cause the formula to adjust incorrectly. This is crucial when you need certain references to stay fixed while others change dynamically.

- Data Entry Mistakes: Simple typing errors, such as entering an extra zero or missing a decimal point, can throw off your calculations significantly. It’s essential to double-check your data entries before finalizing any document.

- Unformatted Numbers: Not formatting numbers correctly can lead to confusion, especially when dealing with currency. Without the proper number formatting (e.g., two decimal places or the currency symbol), the values may look incorrect or inconsistent.

- Forgetting to Update Formulas: After making changes to your data, sometimes formulas don’t automatically adjust to reflect those updates. Always ensure that formulas are recalculated by hitting “Enter” after modifying any related data or by pressing “F9” to refresh calculations.

How to Troubleshoot and Fix Errors

- Use Formula Auditing: Most spreadsheet programs offer a formula auditing tool that helps trace the source of errors. This feature allows you to highlight cells referenced in formulas, making it easier to spot problems.

- Check Cell Formats: Ensure that all cells containing numbers or currency values are formatted correctly, so they display as intended. Inconsistent formatting can lead to confusion and misinterpretation of data.

- Test Formulas with Sample Data: Before finalizing any document, test your formulas with sample data to ensure they work as expected. This can help identify errors early on and correct them before they impact your calculations.

- Regularly Review and Update: As your business grows or pricing changes, be sure to update the formulas and data used in your documents. Regular reviews help ensure that your calculations remain accurate over time.

By understanding these common errors and knowing how to avoid or fix them, you can create accurate and reliable financial records with ease. Proper setup and regular checks will minimize the risk of mistakes and help you ma

How to Avoid Calculation Mistakes

When creating automated financial documents, it’s easy to make calculation errors, especially when working with complex data sets or multiple formulas. These mistakes can lead to inaccurate financial records, missed deadlines, and potential issues with clients or partners. By following a few simple practices, you can minimize the risk of such errors and ensure that your final amounts are always correct.

Best Practices for Avoiding Errors

- Double-Check Formula References: Always ensure that your formulas are referencing the correct cells. An incorrect reference can skew results, so it’s essential to confirm that each formula is pointing to the correct data, especially when copying formulas across different rows or columns.

- Use Absolute and Relative References Correctly: When working with formulas that need to stay fixed (such as tax rates or fixed charges), use absolute references (e.g., $B$2). For dynamic data that should change with each row or column, use relative references (e.g., B2). This ensures that formulas work properly when copied or moved.

- Break Down Complex Calculations: If your document involves multiple steps or complex calculations, break them down into simpler parts. This not only makes it easier to track where mistakes might occur but also allows for easier troubleshooting and adjustments as needed.

- Use Built-in Functions: Rather than manually calculating totals or applying complex formulas, use built-in functions like SUM, PRODUCT, or ROUND. These functions are designed to minimize human error and ensure that calculations are performed correctly every time.

- Test with Sample Data: Before finalizing your document, test it with sample data. This helps verify that all formulas are working as expected and that the calculations match your intended results. If anything seems off, it’s much easier to correct it before the document is in use.

Additional Tips for Accuracy

- Regularly Review Your Work: Regular reviews of your document, especially after updates or changes, help spot any calculation issues early. Check for formula errors, misplaced decimal points, or incorrect cell references.

- Use Error Alerts: Many spreadsheet programs allow you to set up error alerts for invalid calculations or missing data. Enabling these alerts can help you spot potential issues before they affect your final amounts.

- Loc

How to Save Time with Automated Billing Documents

Creating billing records manually can be a time-consuming task, especially when dealing with numerous transactions or clients. Automating key aspects of the process, such as calculations, formatting, and repetitive data entry, can save valuable time. With the right setup, you can streamline the creation and management of financial documents, leaving you with more time to focus on your core business activities.

Key Ways to Save Time

- Automated Calculations: By setting up formulas to automatically calculate item costs, taxes, and discounts, you eliminate the need for manual math. As soon as you input the relevant data, such as quantities and prices, the document updates instantly with the correct totals. This reduces human error and speeds up the entire process.

- Reusability: Once you have set up a well-structured document, you can reuse it for multiple transactions without needing to start from scratch each time. Customizable fields allow you to quickly adjust client details or itemized lists, saving you from repeatedly creating new documents for similar tasks.

- Predefined Layouts: With a pre-designed structure, you don’t have to worry about the arrangement of data or formatting. Standardized templates ensure consistency across documents, allowing you to simply plug in the new information, which reduces the time spent on formatting and organizing each new file.

- Data Validation: Implementing data validation rules ensures that only the correct types of data are entered, reducing the risk of mistakes and the need for time-consuming corrections. For instance, setting up drop-down menus for common fields (like payment terms or item descriptions) can speed up data entry and ensure accuracy.

- Bulk Updates: Many automated systems allow you to apply changes to multiple records at onc

Streamlining Your Billing Process with Automated Systems

Managing your billing process can be time-consuming, especially when you’re handling multiple clients and transactions. By using automated systems to organize and process your financial records, you can significantly speed up your workflow and reduce errors. A well-structured approach allows you to quickly create accurate documents, track payments, and maintain consistency across all transactions.

Steps to Simplify Your Billing System

- Centralize Client Information: Store all your client details in one location. This includes contact information, payment terms, and past transactions. By having everything in a single file, you can quickly populate new records without having to search through separate documents or systems.

- Automate Calculations: Set up automated formulas for calculating item costs, taxes, and final amounts. Once you enter the quantity and unit price, the system will automatically update the totals for you. This eliminates the need for manual calculation, reducing the risk of errors and speeding up the process.

- Use Predefined Layouts: Save time by creating a standard format for all your financial documents. With a consistent structure in place, you don’t need to worry about layout every time you generate a new document. Simply update the necessary fields with current details and the document is ready to send.

- Set Up Reminders and Alerts: Incorporate automated reminders to track important dates such as payment due dates or upcoming deadlines. Alerts can notify you when a client’s payment is overdue, ensuring that no invoice goes unnoticed and helping you stay on top of your accounts receivable.

- Streamline Repetitive Tasks: If you frequently send invoices with similar details, create a master file where you can quickly copy and paste or import information from previous transactions. This will save you time when dealing with recurring clients or services.

Additional Tips for Efficiency

- Integrate with Other Tools: If you use other business management tools such as accounting software or customer relationship management (CRM) systems, consider integrating these with your billing system. This integration can help automate data flow, reducing the time spent on manual entry and ensuring accuracy across your documents.

- Track Payments Automatically: Instead of manually updating each transaction, use a system that automatically tracks payments as they are made. By linking your documents to your payment processing tools, you can instantly update your records, saving you from the hassle of manual reconciliation.

- Customize Your Documents for Different Clients: Tailor your documents to suit different clients or industries. By setting up different sections or terms that automatically adjust based on the client’s preferences, you can reduce the time spent on customizations for each new job.

By streamlining your

Integrating Tax Rates into Billing Documents

Including taxes in your financial documents is essential for accurate billing and compliance with local regulations. Automating the process of adding taxes to your calculations not only saves time but also reduces the risk of errors. By integrating tax rates into your documents, you can ensure that the correct amounts are always applied, whether you’re dealing with multiple rates or varying jurisdictions.

One of the most efficient ways to incorporate tax rates is by setting up formulas that automatically calculate the tax based on the item price and applicable rate. Whether you’re working with a flat rate or tiered taxation, these automated formulas ensure that taxes are applied correctly every time, with no manual effort required.

Setting Up Tax Calculation

- Define Tax Rates: Start by determining the tax rates for your business. This could be a standard sales tax rate or multiple rates depending on the location or product category. Once defined, you can input these rates into your document as constants that will be used in your calculations.

- Set Up Formulas: Use a simple formula to calculate tax based on item prices. For instance, multiplying the price by the tax rate gives you the tax amount for each item. You can then sum the tax amounts for a final figure, ensuring accuracy and consistency.

- Handle Multiple Tax Rates: If your business operates in multiple locations with different tax rates, consider setting up a separate column to select the appropriate rate for each transaction. This allows for flexible tax calculations depending on the region or specific product category.

- Dynamic Calculations: Ensure that your tax calculations update automatically when you change item prices or quantities. By linking your formulas to dynamic cells, any change in the product details will instantly adjust the tax amount and final total.

Tips for Accuracy and Compliance

- Regularly Update Tax Rates: Tax rates may change due to new legislation or shifts in local tax policies. Make sure to keep your rates up to date to avoid overcharging or undercharging customers.

- Use Tax-Specific Fields: Clearly label your tax calculations in your documents. This ensures transparency for your customers and makes it easier to verify tax details during audits or reviews.

- Test and Validate: Before finalizing your document, test your tax calculations with different scenarios to ensure that all rates are applied correctly. This will help prevent any discrepancies or errors in your financial records.

Integrating taxes directly into your automated billing setup can save significant time and effort. It ensures that your documents are accurate, compliant, and professional, making the entire process more efficient for both you and your clients.

Applying Tax Calculation in Billing Documents

Accurate tax application is a crucial component of financial documentation. Without the proper setup, taxes can easily be miscalculated, leading to discrepancies in payments or compliance issues. Automating the tax calculation process within your financial documents helps ensure that the correct amount is always applied, saving you time and reducing the risk of errors.

By applying automated tax formulas to your financial records, you can seamlessly calculate the amount due based on the item’s cost and applicable tax rate. This method can handle both simple and complex tax structures, such as flat rates, variable rates, or region-based taxation, all while updating dynamically as you adjust prices or quantities.

Steps to Apply Tax Calculation

- Set the Tax Rate: Begin by defining the tax rate you will apply. If your business operates in multiple locations or product categories with different rates, you can use separate columns for each rate. This ensures that you can apply the correct tax to each item or service.

- Use a Formula for Tax Amount: Once the rate is established, use a simple formula to calculate the tax. For instance, multiply the unit price by the tax rate to get the tax for each individual item. This tax amount can then be summed to show the total tax for all items in the document.

- Automate Calculations for Multiple Items: If you have a list of items with varying quantities, ensure that your tax formula applies to each row automatically. This can be done by referencing the appropriate cells that contain the item price and quantity, making the process efficient for large orders.

- Account for Discounted Prices: If you offer discounts, you can set up your formulas to apply tax only to the discounted price. This ensures that taxes are calculated on the final amount after any reductions, which is essential for accurate billing.

Tips for Smooth Tax Calculation

- Check for Local Tax Laws: Tax laws can vary by region or even by product type. Be sure to research the applicable tax laws in your area to ensure that your documents comply with local regulations.

- Update Tax Rates Regularly: Tax rates may change over time due to legislation. Make sure to regularly update the rates in your system to prevent errors in future transactions.

- Double-Check for Consistency: Consistently apply the same tax formula throughout the document. Double-check that all references are correct and that tax is being applied to the correct columns and rows.

- Test with Sample Data: Before finalizing the document, test your setup with sample data to ensure that taxes are applied correctly and calculations are accurate.

Incorporating automated tax calculations into your financial documents simplifies the billing process, reduces the chance of human error, and ensures your records are always compliant. By streamlining this process,

Tracking Payments Using Automated Billing Records

Efficiently tracking payments is an essential part of managing your business’s cash flow. By keeping accurate records of all transactions, you can easily monitor which clients have paid, which are overdue, and which are yet to be processed. Automating this process within your billing documents ensures that payment tracking is seamless, organized, and up-to-date without the need for manual updates.

With the right system in place, you can quickly mark payments as received, update balances, and generate reports that give you a clear view of your financial status. Whether you’re managing a few clients or hundreds, automating payment tracking within your documents can save you time and prevent errors.

Setting Up Payment Tracking in Your Documents

- Payment Status Column: Add a dedicated column to track the payment status of each transaction. You can mark payments as “Paid,” “Pending,” or “Overdue,” making it easy to see which records require follow-up. This helps in managing outstanding amounts efficiently.

- Record Payment Amounts: Include a column to enter the amount paid by the client. This allows you to easily compare the total amount due with what has been paid, helping to ensure that all payments are accurately reflected in your records.

- Automatic Balance Update: Set up formulas to automatically subtract the payment received from the total due, so the balance is updated in real time. This helps you monitor remaining balances without needing to manually adjust numbers every time a payment is made.

- Due Date Tracking: Include a column for due dates and use conditional formatting to highlight overdue payments. By linking due dates to the payment status, you can quickly identify which invoices require action and avoid missing follow-up opportunities.

Using Tables to Track Payments Effectively

Tables are a great way to organize and track your payment history. By setting up a table for each billing record, you can easily sort and filter the information by payment status, due date, or client. This makes it simple to generate reports or review all open accounts in one view.

Client Name Amount Due Amount Paid Balance Payment Status Due Date Client A $500.00 $500.00 How to Monitor Paid and Unpaid Invoices

Tracking whether payments have been made for each transaction is vital for effective financial management. By clearly identifying which bills are paid and which are outstanding, you can easily follow up on overdue payments, maintain cash flow, and avoid missed or forgotten charges. Proper monitoring not only helps keep your records accurate but also ensures that your clients are aware of their payment status.

Setting up a system for tracking paid and unpaid amounts within your financial documents can save time and reduce errors. Using visual cues, automatic updates, and organized columns allows you to instantly see which transactions have been settled and which are still pending. This proactive approach helps you stay on top of outstanding balances and makes it easier to manage overdue accounts.

Steps to Track Paid and Unpaid Balances

- Create a Payment Status Column: One of the most efficient ways to monitor payments is by adding a “Payment Status” column. In this column, you can mark whether a payment has been made or is still pending. Typical labels might include “Paid,” “Pending,” “Overdue,” or “Partially Paid.” This provides a quick reference point to check the status of any transaction.

- Use Conditional Formatting: Conditional formatting is a powerful tool to visually highlight payments that are overdue or still unpaid. You can set rules to automatically change the color of the “Payment Status” column based on the status, such as turning “Overdue” entries red. This makes it easy to identify which bills need follow-up.

- Link Payments to Outstanding Amount: Make sure to connect the paid amounts with the remaining balance. For example, as a payment is received, you can subtract it from the total amount due. This way, the outstanding balance is updated automatically, reducing the need for manual tracking.

- Monitor Due Dates: Another important step is to include a “Due Date” column. By tracking when each payment is due, you can sort and filter your documents to quickly identify overdue accounts. You can even set up automated reminders to alert you when payments are approaching or overdue.

Tracking Paid vs Unpaid Records

- Sort and Filter Data: To effectively manage your accounts, use sorting and filtering functions. Sorting by payment status allows you to group all unpaid transactions together, while filtering by due date helps you identify the most urgent payments that need attention.

- Track Partial Payments: For transactions where only a partial amount has been paid, ensure that your system accounts for these as well. This will help you track remaining balances and avoid any

Improving Invoice Accuracy in Billing Documents

Ensuring the accuracy of your financial documents is crucial for maintaining professional relationships and preventing errors in payment processing. Mistakes in calculations, item descriptions, or pricing can lead to disputes, delayed payments, and loss of trust from clients. By implementing organized systems and using automated tools, you can reduce the risk of human error and improve the overall accuracy of your documents.

Accuracy can be achieved through various methods, including setting up proper formulas, standardizing data entry, and utilizing built-in features to automate repetitive tasks. These strategies help maintain consistency and ensure that the details in your financial records are always correct, reducing the chances of costly mistakes and time-consuming revisions.

Steps to Improve Accuracy in Billing Records

- Use Correct Formulas: One of the most common mistakes is entering incorrect or incomplete formulas. Ensure that formulas for multiplying quantities, applying discounts, and adding taxes are correctly implemented and applied across all relevant rows. Double-check your cell references to avoid errors when copying formulas across multiple rows.

- Automate Calculations: Use built-in functions to automatically calculate subtotals, taxes, and final amounts. This not only saves time but also reduces the risk of manual errors. Functions like SUM, PRODUCT, and IF can help automate complex calculations and ensure they are performed consistently across all entries.

- Standardize Data Entry: Consistency is key when entering client information, product descriptions, or pricing. By using predefined lists, drop-down menus, or data validation rules, you can prevent mistakes such as incorrect item names, misquoted prices, or inconsistent formatting.

- Cross-Check Data: Before finalizing your documents, always cross-check key details like client names, dates, quantities, and prices. It’s easy to overlook small discrepancies, especially in lengthy records. Using an error-checking approach will help identify and correct these mistakes before sending out the document.

Leveraging Built-In Tools for Accuracy

- Conditional Formatting: Conditional formatting allows you to highlight unusual or incorrect entries automatically. For instance, you can use it to flag negative values, unbalanced totals, or mismatched tax rates. This visual aid can help you spot potential errors at a glance.

- Templates and Presets: Using preset layouts and templates can help eliminate common mistakes by ensuring that each document follows the same format and structure. This makes it easier to spot discrepancies and ensures that no critical information is overlooked.

- Data Validation: To ensure that only valid entries are accepted, you can set up data validation rules. For example,

Best Practices for Error-Free Invoicing

Creating accurate financial documents is essential for maintaining smooth transactions with clients and ensuring timely payments. Even small mistakes in pricing, quantities, or calculations can cause confusion, delays, and disputes. By following best practices, you can minimize errors and enhance the reliability of your billing process, improving both efficiency and professionalism.

To achieve error-free billing, it’s important to establish clear guidelines, use automation tools, and maintain consistency in data entry. With the right steps in place, you can streamline the process and reduce the likelihood of common mistakes that can disrupt cash flow or harm business relationships.

Key Practices for Avoiding Errors

- Double-Check Client and Order Details: Always verify client names, addresses, and order information before finalizing the document. Small discrepancies, such as a misspelled name or incorrect order number, can lead to confusion and delays in payment.

- Standardize Pricing and Terms: Make sure that pricing, discounts, and payment terms are consistent across all transactions. By maintaining a pricing sheet or using a fixed list of services and their costs, you can avoid accidentally changing rates or offering incorrect discounts.

- Use Automated Calculations: Automating the calculation of subtotals, taxes, and final amounts helps ensure that these figures are accurate every time. Formula-driven approaches can reduce human error in math-intensive documents.

- Incorporate Payment Instructions Clearly: Clearly state the payment terms, due dates, and available payment methods. Avoid ambiguity and make sure clients know exactly how and when to pay, helping prevent misunderstandings and payment delays.

Tools to Ensure Accuracy

- Utilize Predefined Fields: Pre-filling certain fields such as tax rates, payment terms, and service descriptions can help prevent misentries. Customizable fields also allow you to quickly adjust information while maintaining consistency across all your documents.

- Implement Data Validation: Use data validation rules to limit the possibility of incorrect entries. For example, restrict the input of dates to ensure they fall within a reasonable range or only allow numeric values in price fields.

- Review Calculations with Auditing Tools: Regularly use built-in auditing tools to check for discrepancies in your document. This can help identify common mistakes like missing calculations or incorrect formulas, ensuring your final documents are error-free.

By implementing these best practices, you can significantly reduce the chance of errors, improve cli