Best Excel Invoice Template NZ for Easy Billing and Professional Invoices

Creating professional and organized billing documents is essential for any business. Whether you are a freelancer, a small enterprise, or a larger corporation, managing payments efficiently helps maintain a smooth workflow and fosters trust with clients. An effective system allows you to track transactions accurately and save valuable time in your daily operations.

Utilizing simple, customizable documents that align with local requirements can greatly enhance the billing process. By choosing the right structure, you can ensure clarity and consistency, which benefits both your business and your customers. The ability to adapt these documents to suit specific needs makes them a powerful tool in managing financial interactions.

Efficient record-keeping not only simplifies payment tracking but also ensures that all necessary details are captured, reducing the chances of errors. This approach supports accurate reporting, improving your financial management and ultimately contributing to better business outcomes.

Excel Invoice Template NZ for Professionals

For professionals in New Zealand, creating clear and structured billing documents is essential to maintain credibility and ensure timely payments. Customizable solutions that allow users to input specific business details are a practical approach to managing financial interactions. These documents offer a streamlined process that makes it easier to communicate with clients and maintain an organized record of transactions.

Designing a personalized document tailored to individual business needs can significantly improve efficiency. A professional billing sheet should include essential information such as services rendered, payment terms, and tax calculations. By using tools that allow flexibility in layout, professionals can create a polished look that aligns with their business standards.

Automation features can further enhance the process, ensuring calculations are accurate and reducing manual entry errors. This helps professionals focus on their core tasks while also promoting transparency and trust with clients. Ultimately, an optimized billing system contributes to a smoother workflow and better client relationships.

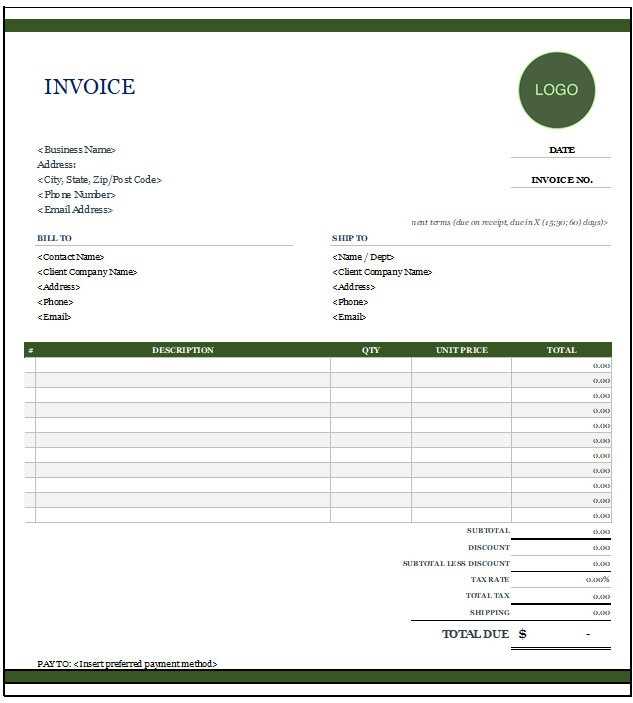

Customizing Your Invoice Template in Excel

Personalizing your billing sheet to fit your business needs is a key step in creating a streamlined process. Customization allows you to adjust various elements, ensuring that every document you send to clients reflects your brand identity and includes the necessary details for smooth transactions. Whether it’s adjusting the layout, adding company branding, or modifying calculation formulas, a tailored document can significantly improve the efficiency of your financial operations.

Here are some key areas to consider when customizing:

| Customization Aspect | Description |

|---|---|

| Business Information | Ensure your business name, address, contact details, and tax ID are clearly displayed at the top of the document for easy reference. |

| Design and Branding | Incorporate your logo and brand colors to make the document visually appealing and consistent with your other business materials. |

| Item Descriptions | Modify the columns to suit the types of services or products you offer, including space for detailed descriptions, quantities, and prices. |

| Tax Calculations | Include customizable fields for GST or other applicable taxes, ensuring accurate and automatic calculations based on the amounts entered. |

| Payment Terms | Adjust sections for payment methods, due dates, and any other conditions relevant to your business’s billing process. |

By customizing these aspects, you can ensure that each document serves your specific needs while maintaining a professional appearance. A well-designed and personalized billing document not only saves time but also builds credibility with your clients.

Top Features of NZ Invoice Templates

When choosing a billing document for your business, it’s important to consider features that simplify the process and ensure accuracy. The right structure can streamline communication with clients and support proper financial management. For businesses in New Zealand, certain features in billing forms help align with local practices and regulations, making transactions clearer and more efficient.

Automatic Calculations

One of the most valuable features in a billing sheet is the ability to automatically calculate totals, taxes, and discounts. This minimizes human error and speeds up the entire billing process. Whether it’s adding goods and services or calculating the GST, automated formulas save you time and ensure accuracy in every document.

Customizable Fields

Another essential feature is flexibility in adjusting fields to match the specific needs of your business. You can modify sections for services provided, product descriptions, or payment terms. This ensures that each document is tailored to your business operations and offers a professional and consistent presentation to clients.

Incorporating these features helps businesses maintain clarity and compliance while reducing administrative burdens, ultimately contributing to smoother and faster transactions.

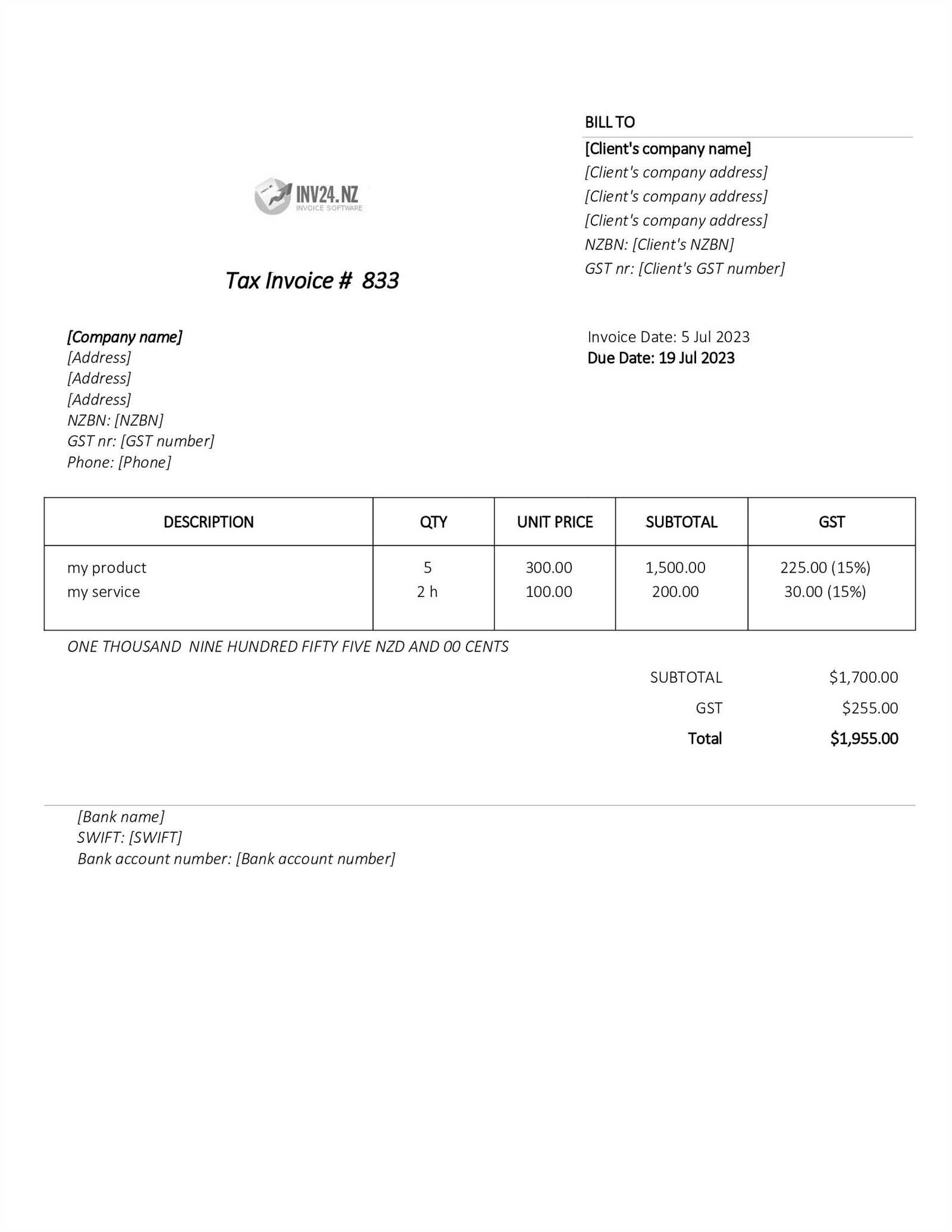

How to Add GST in Excel Invoices

For businesses in New Zealand, adding Goods and Services Tax (GST) to billing documents is a crucial step in ensuring compliance with local tax laws. Including GST in your financial documents not only helps you stay within legal requirements but also provides transparency to your clients regarding the tax they are paying. Understanding how to apply this tax correctly can save time and prevent errors in the long run.

Understanding GST Calculation

To add GST to your documents, the first step is to determine the correct GST rate, which in New Zealand is typically 15%. Once this rate is established, you can easily calculate the tax by multiplying the total amount of goods or services by the GST rate. This is typically done through a simple formula that automatically updates when the amounts are adjusted, ensuring accuracy in every transaction.

Steps for Adding GST to Your Documents

Here’s how you can set up your document to include GST:

- Enter the subtotal for all items or services before tax.

- Calculate the GST amount by multiplying the subtotal by 0.15 (the GST rate).

- Add the GST amount to the subtotal to get the total amount due, including tax.

By automating this process, you can quickly calculate and display GST, making your billing more efficient and reducing the risk of miscalculations. With the proper setup, all future billing will reflect the correct tax rates with minimal effort.

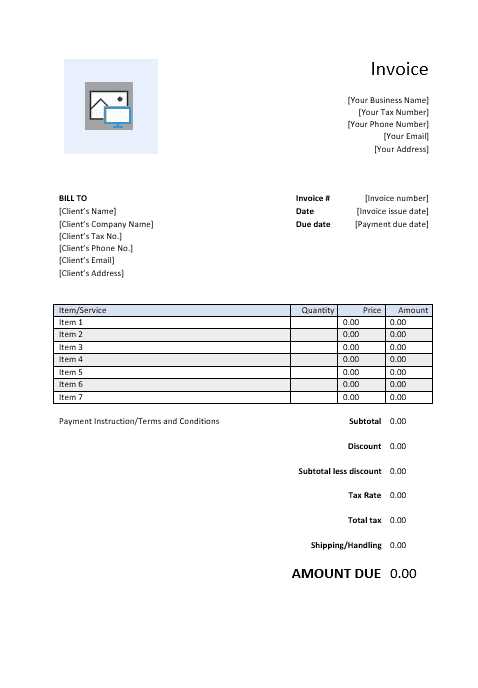

Easy Steps to Create Invoices

Creating professional billing documents doesn’t have to be complicated. By following a simple process, you can ensure that each document is accurate, clear, and reflects the services or products provided. The key is to focus on essential details and use tools that make the process easy and efficient. Here are some straightforward steps to create a well-structured billing document.

Step 1: Add Your Business Information

The first step in creating a billing document is to add your business details at the top. This ensures that the recipient knows who the payment is for and how to contact you if needed.

- Business name

- Contact details (address, phone, email)

- Tax registration number (if applicable)

Step 2: List Products or Services Provided

Next, you should clearly list the products or services you provided. Be specific about each item to avoid confusion. Include descriptions, quantities, and prices for each entry.

- Describe each product or service clearly.

- Include the quantity or hours worked.

- Provide the unit price for each item.

- Calculate the total cost for each item or service.

Step 3: Add Tax and Total Amount

Once you’ve listed the items, you need to calculate the applicable tax and the total amount due. This is where automation in your document setup can save you time.

- Apply the tax rate (e.g., 15%) to the subtotal.

- Add any additional fees or discounts, if applicable.

- Calculate the final total, including tax and adjustments.

By following these easy steps, you can create a clear and professional billing document in no time, ensuring accuracy and smooth transactions with your clients.

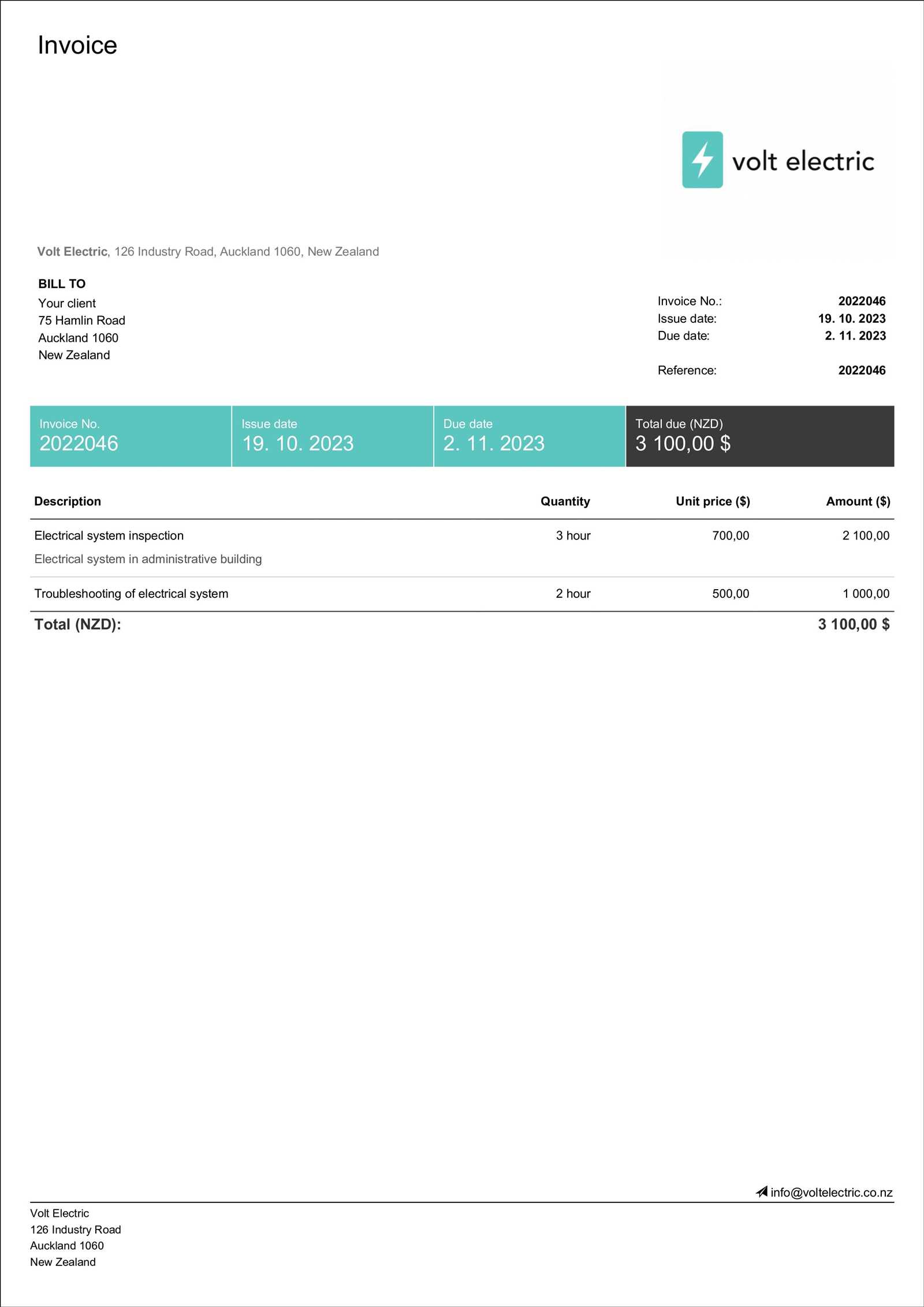

Choosing the Best Format for Invoices

Selecting the right structure for your billing documents is crucial to ensure clarity, professionalism, and ease of use. The format you choose can influence how easily your clients understand the charges and how efficiently you manage payments. Whether you need a simple layout or a more detailed structure, it’s important to consider functionality, readability, and customization options to suit your business needs.

The ideal format should provide essential details such as business information, a clear breakdown of services or products, payment terms, and any applicable taxes. It should also allow for easy adjustments to suit different clients or services. By choosing the best format, you ensure that your documents reflect your professionalism while also being easy to understand and process for both you and your clients.

Why Use Excel for Invoice Creation

Using a spreadsheet tool for generating billing documents offers numerous advantages, especially for small businesses and freelancers. Its flexibility, ease of use, and automation features make it an ideal choice for creating professional financial documents quickly and efficiently. With the right setup, you can customize and update your records with minimal effort, ensuring accuracy and consistency in every transaction.

Key Advantages of Using a Spreadsheet

- Customizable Layout: You can easily adjust the structure to meet your specific needs, including adding or removing fields, changing fonts, and inserting logos.

- Automation: Automatic calculations for totals, taxes, and discounts save time and reduce the risk of errors.

- Data Organization: You can store and organize your financial data in one place, making it easier to track payments and manage client details.

- Cost-Effective: Many spreadsheet tools are free or low-cost, offering a budget-friendly solution for small businesses.

How Spreadsheets Streamline the Billing Process

Spreadsheets allow you to automate repetitive tasks such as calculating totals or applying tax rates. This not only saves time but also ensures that every document is consistent and accurate. Additionally, you can easily create multiple copies of the same structure for different clients, adjusting the amounts and details as needed. This efficiency makes spreadsheet-based billing an excellent tool for streamlining your financial processes.

Free Excel Invoice Templates for NZ

For businesses in New Zealand, having access to free billing document formats can significantly reduce administrative costs and streamline the payment process. These ready-made solutions can be easily customized to suit various business needs and ensure compliance with local tax laws. With just a few simple adjustments, you can create professional and accurate documents that meet your requirements without the need for expensive software or tools.

Here are some key benefits of using free billing formats:

- Cost-Effective: Access to free formats eliminates the need for expensive software or subscriptions.

- Easy Customization: Most free solutions allow you to modify elements like company information, product descriptions, and tax rates.

- Time-Saving: Pre-designed structures help you avoid starting from scratch, making it quicker to generate documents.

- Local Adaptation: Many free formats cater to the specific tax and legal requirements of New Zealand businesses, including GST calculations.

By using these free solutions, you can create clear, accurate, and professional billing documents with minimal effort, ensuring your financial processes are efficient and well-organized.

Designing a Clean and Effective Layout

When creating financial documents, having a well-organized and visually appealing structure is crucial for ensuring clarity and professionalism. A clean design not only makes the document easier to read but also improves the overall experience for clients, ensuring that important details such as amounts, payment terms, and contact information stand out. The layout should be simple, intuitive, and easy to navigate, so clients can quickly find the information they need.

Key Elements of an Effective Layout

To create a successful layout, it’s important to focus on a few key elements:

- Clear Headings: Use bold or larger fonts to highlight important sections such as “Billing Details”, “Itemized List”, and “Total Amount Due”. This helps readers quickly locate the information they need.

- Proper Spacing: Ensure there is enough space between sections to avoid a cluttered look. This will make the document easier to read and less overwhelming.

- Consistent Fonts: Use a simple, professional font throughout the document. Avoid using too many different font styles or sizes, as this can create a disorganized appearance.

Utilizing Structure for Easy Navigation

The layout should guide the reader through the document without confusion. Organize the information logically, starting with your business details at the top, followed by the service/product description, then the pricing information, and finally, payment terms and instructions. By using consistent formatting and aligning items properly, you ensure that the document is not only professional but also user-friendly.

Tracking Payments Using Excel Invoices

Managing payments effectively is a crucial part of running any business. By keeping accurate records of transactions, you can easily track the status of each payment, monitor overdue amounts, and ensure that your financials are always up to date. A well-organized system allows you to quickly identify which clients have paid, which are still outstanding, and any follow-up actions needed.

Using a spreadsheet tool for tracking payments offers a range of benefits, such as automatic updates, quick calculations, and the ability to view payment history for each client. You can set up columns to record payment dates, amounts received, and any outstanding balances, allowing you to track every aspect of the payment process in one convenient location. This system also enables you to generate reports, helping you make informed decisions about cash flow management.

Common Mistakes in Invoice Formatting

Proper formatting of financial documents is essential for ensuring clarity and preventing confusion for both the sender and the recipient. However, common errors in layout and design can lead to misunderstandings, delayed payments, or even disputes. Recognizing and addressing these issues is key to creating professional and effective billing records.

Frequent Formatting Errors

- Unreadable Text: Using fonts that are too small or too elaborate can make important information difficult to read. Stick to clear, simple fonts and ensure that the text size is large enough for easy reading.

- Missing Information: Omitting critical details such as payment terms, business contact information, or item descriptions can cause delays or confusion. Ensure that every section is complete before sending.

- Poor Organization: A cluttered or disorganized layout makes it harder for the recipient to quickly locate essential details. Keep the design clean and logical, with ample spacing between sections.

How to Avoid Mistakes

To avoid these formatting errors, double-check the document before sending it out. Make sure that all the necessary details are included, such as business name, client information, and a breakdown of products or services. Additionally, ensure that your design is simple and easy to follow, with clearly defined headings and consistent formatting throughout the document. Taking the time to review your billing records helps maintain professionalism and ensures smooth transactions.

How to Automate Invoice Calculations

Automating the calculation of totals, taxes, and discounts in financial documents can significantly reduce errors and save time. By using built-in functions and formulas, you can ensure that the calculations are accurate every time, allowing you to focus on other important tasks. This streamlined approach not only increases efficiency but also ensures consistency in your billing process.

To automate calculations, you can set up formulas for basic operations such as addition, subtraction, and multiplication. For example, you can automatically calculate the total cost of products or services by multiplying the quantity by the unit price. Additionally, you can set up percentage formulas to calculate taxes or discounts based on the values in the document.

Key Steps to Automate Calculations:

- Use Functions: Utilize basic functions like SUM, PRODUCT, and PERCENTAGE to perform calculations based on entered data.

- Link Cells: Create links between cells so that changes in one area automatically update the corresponding total or tax calculation.

- Set Conditional Formatting: Implement conditional formatting to highlight key figures like totals or overdue amounts for better visibility.

By incorporating these automation techniques, you can eliminate manual errors and create more reliable financial documents with minimal effort. This approach not only improves accuracy but also speeds up the overall process of preparing and sending billing records.

Best Practices for Invoice Design

Designing a professional and functional billing document is key to ensuring clarity and fostering positive business relationships. A well-designed document not only conveys necessary information but also reflects the professionalism of your business. By following best practices in layout, structure, and presentation, you can create documents that are easy to understand and look polished.

Key Elements of Good Design

A good layout ensures that all critical information is easy to find and understand. Here are some key design elements to consider:

- Consistency: Maintain a uniform style throughout, using the same fonts, colors, and formatting for headings and sections. This makes the document appear cohesive and organized.

- Clear Sectioning: Divide the document into logical sections, such as business information, itemized charges, and payment terms. This helps the reader navigate the document quickly.

- Readability: Use clear and legible fonts, ensuring that the text is easy to read. Keep font sizes consistent for body text, but use larger or bold fonts for headings to create a visual hierarchy.

Additional Tips for Enhancing Clarity

Beyond the basics, a few additional tips can make your document stand out:

- White Space: Avoid clutter by leaving enough space between sections and text. White space improves readability and makes the document feel less overwhelming.

- Visual Appeal: A simple yet professional design can make a positive impression. Consider adding your business logo and using complementary colors to make the document visually appealing without overwhelming the recipient.

- Clear Payment Instructions: Ensure payment terms and methods are easy to locate. Highlight deadlines and payment options so clients can make payments without confusion.

By adhering to these best practices, you can ensure that your billing documents are both visually appealing and functional, helping to maintain a professional image while streamlining the payment process.

How to Save Time with Templates

Using pre-designed documents can greatly reduce the time spent on creating new ones from scratch. With ready-made structures, you can simply fill in the necessary details, saving hours of work. This approach not only increases efficiency but also ensures consistency in all your documents, allowing you to focus on other important tasks.

Key Benefits of Using Pre-Designed Documents

Pre-built structures provide several advantages that can help streamline your workflow:

- Consistency: By using a standard format, you ensure that all documents have the same look and feel, creating a professional image and reducing the likelihood of errors.

- Quick Setup: Rather than starting from a blank page, you can quickly insert relevant details such as dates, amounts, and services provided. This reduces the time it takes to create a document.

- Efficiency: Automating common elements, like headers or payment terms, eliminates the need for repetitive tasks, allowing you to focus on customization instead.

Customizing Pre-Made Documents for Your Needs

While pre-designed documents are a great starting point, it’s essential to make small adjustments to suit your specific needs. This can be done by:

- Incorporating Branding: Add your company’s logo and brand colors to personalize the document and make it align with your business identity.

- Adjusting Sections: Modify sections to include any specific information you may need, such as additional payment terms or customized discount options.

By using pre-built structures and customizing them for your needs, you can save valuable time while maintaining a professional and consistent appearance for all your documents.

Understanding Invoice Compliance in NZ

In New Zealand, businesses are required to follow certain regulations when issuing billing documents. These requirements ensure that all documents meet legal standards and are in line with tax obligations. Understanding the compliance guidelines for these documents is crucial to avoid potential penalties and maintain a smooth business operation.

Key Compliance Requirements in New Zealand

To be compliant, there are specific details that must appear on all billing documents issued in New Zealand:

- GST Number: If your business is registered for Goods and Services Tax (GST), this must be clearly displayed on the document. It confirms your legal status and facilitates proper tax reporting.

- Unique Document Number: Each billing document must have a unique reference number for tracking and record-keeping purposes. This helps businesses and tax authorities monitor transactions effectively.

- Clear Breakdown of Charges: All costs, including taxes and fees, must be listed separately. This ensures transparency and provides recipients with a clear understanding of the charges.

Why Compliance Matters

Ensuring your documents meet New Zealand’s compliance standards is essential for avoiding issues during audits or disputes. Non-compliant documents can lead to fines or penalties and complicate the tax filing process. By understanding and implementing these requirements, businesses can not only stay within the law but also build trust with clients and customers.