Excel Invoice Template India Free Download and Customization

Managing financial documents is a crucial part of any business operation, especially when it comes to billing clients. Creating clear, accurate, and professional statements can help streamline business processes and maintain smooth transactions. This section will explore how you can easily manage and generate billing documents using simple software tools that allow for customization and flexibility.

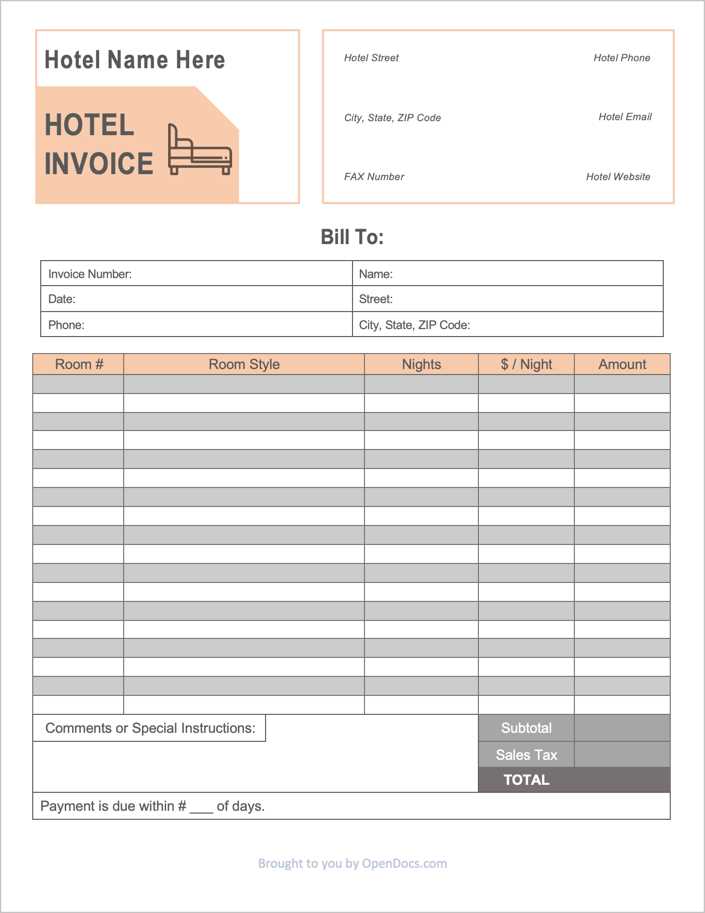

By utilizing customizable formats, businesses can tailor documents to meet specific needs, whether it’s for a small start-up or a larger enterprise. These tools enable the inclusion of all necessary information, such as payment terms, client details, and tax calculations, in a format that is easy to read and understand. With the right approach, managing payments and keeping track of income becomes a more organized and efficient process.

Easy-to-use software solutions make it possible for anyone, regardless of technical skill, to generate professional documents with just a few clicks. From setting up payment details to customizing the appearance of your records, the options available provide ample support for businesses in various industries. Whether you’re an individual freelancer or a large company, managing your financial records effectively is key to long-term success.

Invoice Management Tools for Indian Businesses

For businesses in India, having a streamlined way to create billing records is essential for maintaining financial organization. Whether you are managing a small business or a growing enterprise, using simple, customizable solutions can ensure that all necessary details are included in every transaction. These tools allow for quick generation of statements that are both clear and professional, helping businesses maintain accuracy and efficiency in their financial dealings.

Key Features of Customizable Billing Solutions

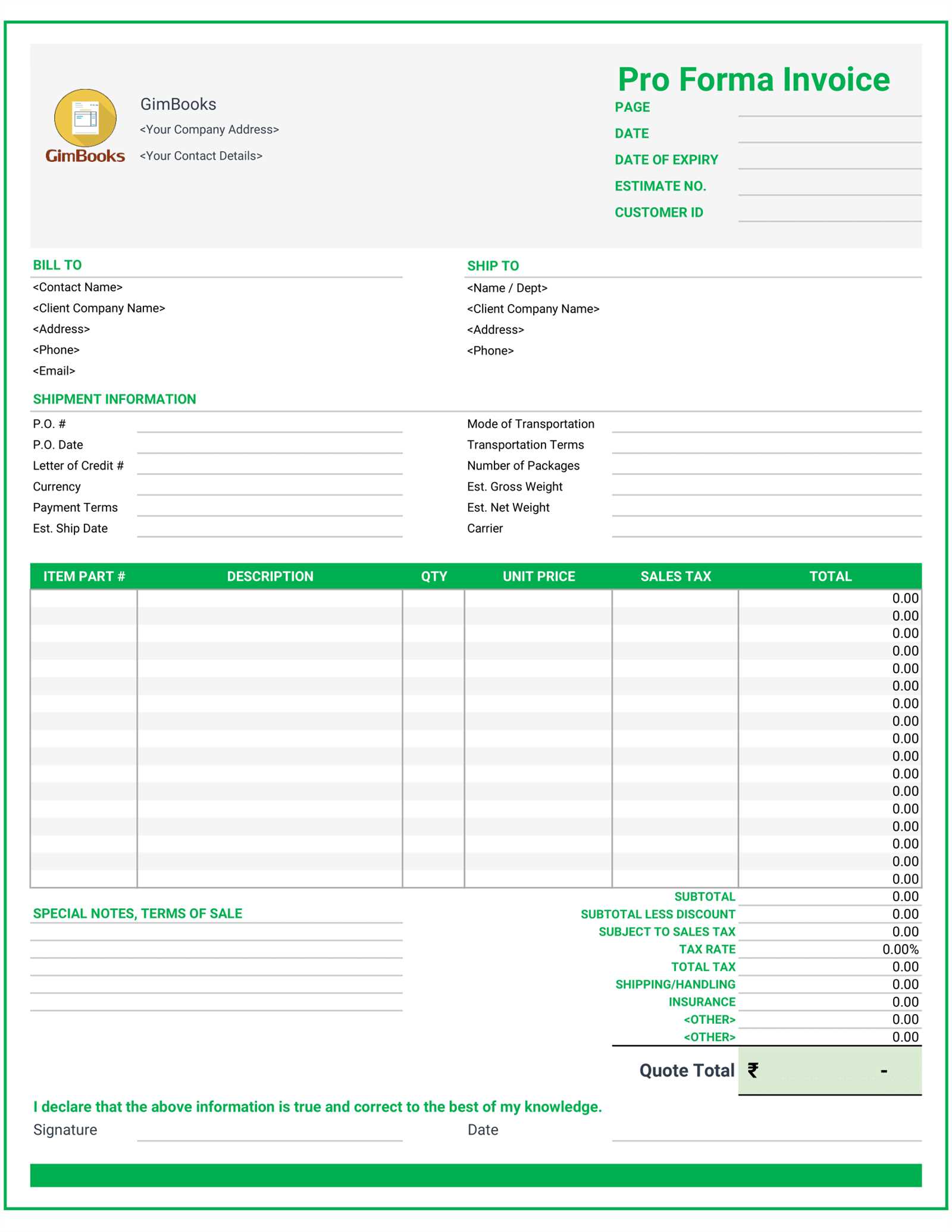

Modern tools for creating billing documents offer a variety of features that allow users to tailor their records to meet specific requirements. These include the ability to add client details, product or service descriptions, payment terms, and tax calculations. Customization options also include the formatting of text and layout, ensuring that every document is aligned with the business’s branding and communication style.

How These Solutions Benefit Businesses

By using customizable solutions, businesses can reduce errors, save time, and improve client relationships. The ability to easily update and modify the information on each document makes it easier to keep track of payments, due dates, and outstanding balances. Additionally, these solutions often allow businesses to store and organize past records for future reference or audits.

| Feature | Description |

|---|---|

| Customization | Ability to adjust format, add business logos, and personalize information. |

| Tax Calculations | Automatic calculation of taxes based on local rates and inclusion in documents. |

| Payment Tracking | Keep a record of all payments and monitor outstanding amounts with ease. |

| Professional Design | Generate visually appealing documents with clear and organized layouts. |

Why Choose Spreadsheet Software for Billing

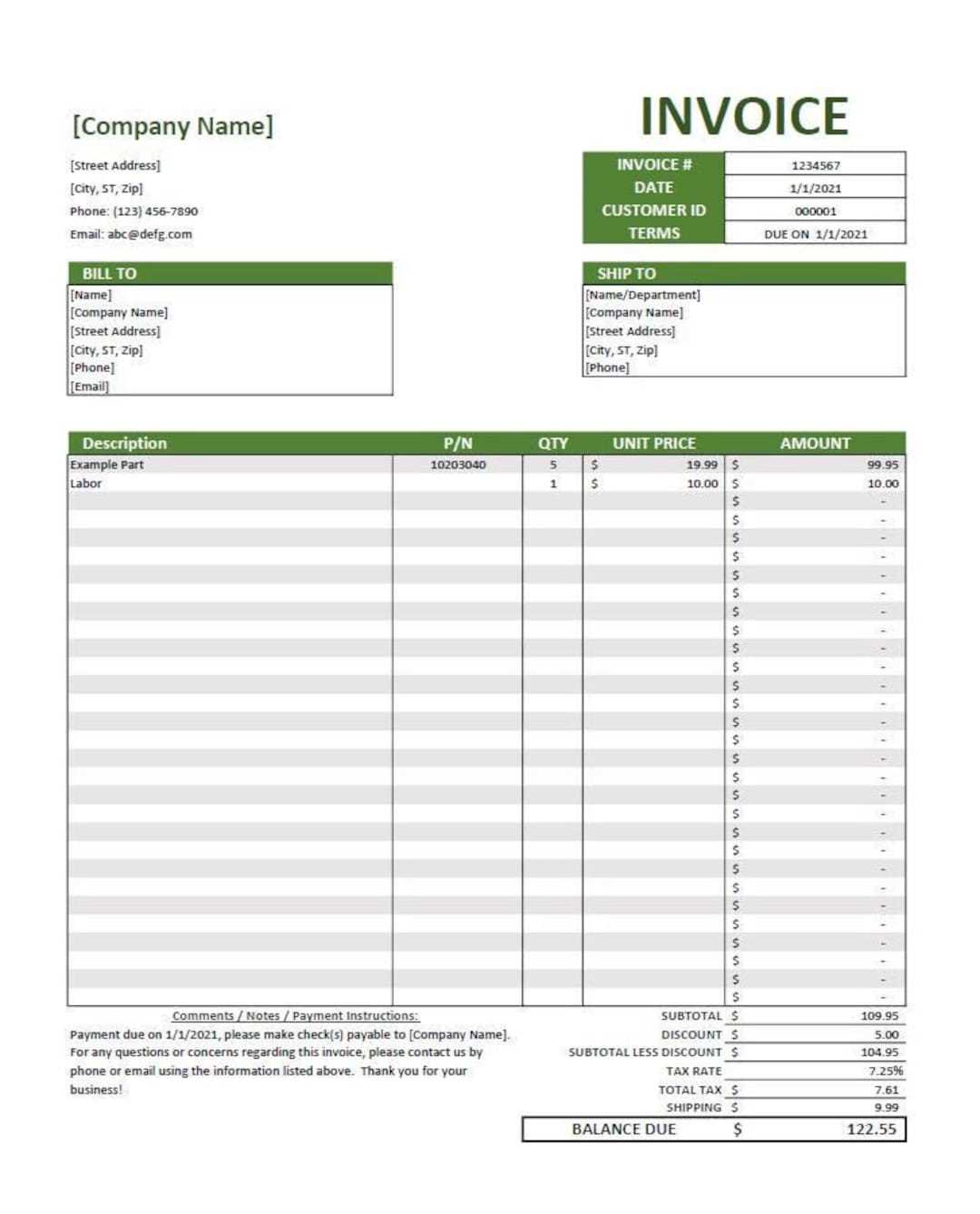

When managing financial records, simplicity and flexibility are key. For many businesses, using widely available spreadsheet tools offers an easy and cost-effective solution. These tools allow users to create detailed financial documents that can be quickly customized, ensuring accuracy and professionalism in every transaction. Whether you are handling payments for a small business or larger enterprise, spreadsheet software offers features that help streamline the billing process.

Advantages of Using Spreadsheet Software

- Cost-Effective: Most spreadsheet software comes at no extra cost, especially when basic features are sufficient for your needs.

- Flexibility: Customization options allow users to adjust formats, add or remove sections, and create documents that align with their business needs.

- Easy to Use: With a user-friendly interface, even those with minimal experience can create and manage billing documents.

- Automation: The ability to use formulas for automatic calculations, such as taxes or totals, saves time and reduces the chances of human error.

Features That Benefit Small and Large Businesses

- Customizable Layout: Adjust the design of the document to match your branding or preferred style.

- Data Organization: Easily track payments, due dates, and outstanding amounts in a structured format.

- Integration: Import and export data between other financial tools or accounting systems to maintain seamless records.

- Collaboration: Share documents with team members or clients for easy communication and updates.

Benefits of Using Billing Document Solutions

For businesses, managing financial records efficiently is crucial for maintaining smooth operations. One of the most effective ways to ensure consistency and professionalism in your financial dealings is by using pre-designed solutions that allow for quick document generation. These tools offer numerous advantages, especially when it comes to saving time and reducing errors in the billing process.

By utilizing pre-made designs, businesses can easily create accurate records that contain all necessary details, such as client information, payment terms, and item descriptions. The streamlined process not only improves efficiency but also helps maintain a high level of consistency across all transactions, making it easier to track and manage payments over time.

Key benefits include:

- Time-Saving: Quickly generate documents without having to create each from scratch.

- Consistency: Ensure a uniform style and structure across all your financial records, helping to maintain professionalism.

- Accuracy: Reduce the risk of human error by using pre-set formulas and fields for calculations.

- Customizability: Adjust fields and formatting to meet your specific business needs and client preferences.

- Easy Tracking: Keep a record of all past transactions in an organized and easily accessible manner.

These tools not only improve the efficiency of document creation but also contribute to a more organized and professional approach to business financial management.

How to Customize Your Billing Document

Customizing your financial records to fit your business needs is essential for creating professional and clear documents. With the right tools, you can easily modify different aspects of the document, from the layout and design to the fields and calculations. Customization ensures that your records accurately reflect your business identity and meet specific requirements, such as including detailed tax calculations or payment terms.

Adjusting the Layout and Design

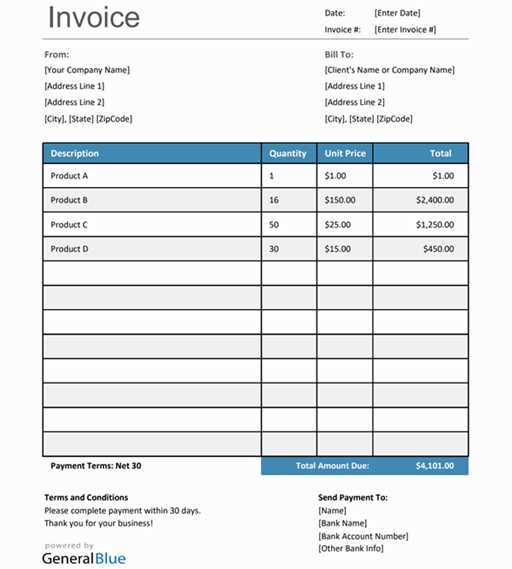

The layout of your document plays a crucial role in making it easy for your clients to read and understand. Start by adjusting the sections, such as header and footer, to include your company’s logo, contact details, and payment information. You can also modify fonts, colors, and styles to align the design with your branding. A clean, simple layout is key to ensuring clarity and professionalism.

Incorporating Essential Fields and Calculations

Next, ensure that your document includes all necessary fields such as client name, item descriptions, quantities, and rates. These details are crucial for transparent communication with your clients. Additionally, you can use built-in formulas to automatically calculate totals, taxes, and discounts. This automation not only saves time but also helps prevent errors in your financial records.

Steps to follow:

- Modify the header to include your business name and contact information.

- Update fields to match your pricing structure, including rates, taxes, and totals.

- Choose a professional and simple font for easy readability.

- Use formulas for automatic calculations, such as adding taxes or calculating discounts.

- Save your customized document for future use or sharing with clients.

By customizing your billing documents, you ensure that they not only look professional but also meet your specific business and client needs.

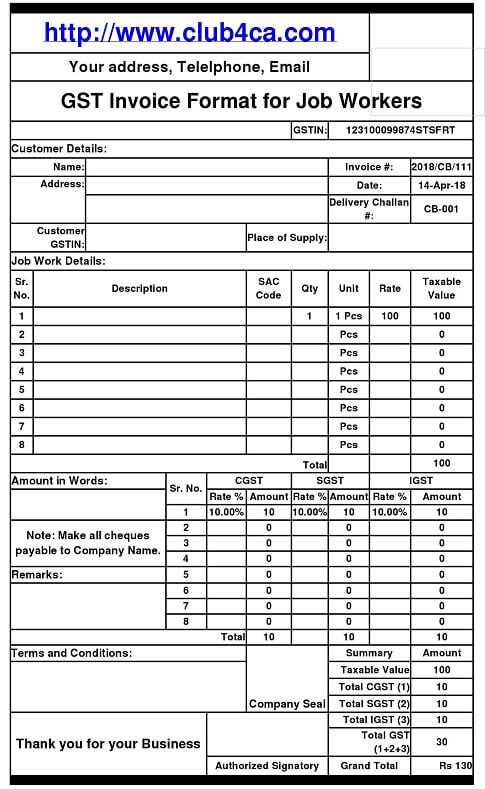

Top Features of Indian Billing Documents

When managing financial records, having the right features can make a significant difference in both efficiency and accuracy. Billing solutions for businesses in India offer various functionalities that ensure all necessary details are included and that calculations are accurate. These features not only help streamline the billing process but also ensure compliance with local regulations, such as taxes and payment terms.

Key features of these tools include automated calculations, customization options, and seamless integration with other business systems. These options make it easier to generate professional documents while minimizing errors and improving overall productivity.

Key Features to Look for

- Automatic Tax Calculations: Automatically calculate Goods and Services Tax (GST) or other applicable taxes, ensuring accurate records.

- Customizable Fields: Add or remove sections to match your business requirements, including payment terms, discounts, and product descriptions.

- Easy-to-Use Interface: Simple design that allows even users with minimal technical skills to create professional documents.

- Multiple Currency Support: Capability to handle payments in different currencies, which is useful for businesses with international clients.

- Data Organization: Organized fields for tracking transactions, client details, and due dates, making it easier to monitor payments.

- Branding and Personalization: Option to include company logos, customized color schemes, and fonts to maintain a professional image.

- Recurrent Billing Options: Set up templates for recurring billing, saving time for subscription-based services or regular clients.

- Export and Sharing Options: Easily export documents in various formats like PDF for sharing with clients via email or print.

With these features, businesses can enhance their financial management processes, ensure compliance with local regulations, and build stronger client relationships.

Free Billing Document Solutions for Indian Businesses

For businesses looking to streamline their financial processes, free solutions are a great way to get started without incurring extra costs. These customizable documents can be easily modified to fit specific needs, whether you’re a freelancer or running a small business. Many free tools are available online, offering a range of features that help create professional and accurate records, ensuring both convenience and compliance with local requirements.

These solutions typically come with pre-set fields for client details, product descriptions, and pricing, allowing businesses to quickly generate documents without having to manually format everything. The flexibility of these tools means that even businesses with limited technical expertise can create and manage financial records with ease.

| Feature | Description |

|---|---|

| Customization | Free solutions can be personalized to include business logos, payment terms, and other essential details. |

| Easy-to-Use Interface | Designed for users with minimal experience, offering a simple and straightforward approach to document creation. |

| Automatic Calculations | Built-in formulas for taxes, totals, and discounts reduce the chance of errors and save time. |

| Free to Use | These solutions are available without any upfront costs, making them accessible to businesses of all sizes. |

| Download and Share | Download the finished documents in various formats like PDF, or share directly with clients via email. |

By utilizing these free tools, businesses can simplify their financial management and generate professional documents without any additional investment.

How to Create a Billing Document in a Spreadsheet

Creating a professional financial record from scratch is a straightforward task when using a spreadsheet program. These tools allow users to efficiently manage details like client information, product or service descriptions, payment terms, and totals. The ability to customize each section according to business needs makes it easy to maintain accurate and clean records. With a few simple steps, anyone can create a polished document that looks professional and meets all necessary requirements.

To create a billing record, start by organizing the document into clear sections that include relevant information like your company’s details, the client’s information, and a list of items or services provided. Then, include fields for amounts, discounts, and taxes. Lastly, use simple formulas to calculate totals and generate the final figure automatically.

| Step | Action |

|---|---|

| 1 | Set up a header with your company name, address, and contact details. |

| 2 | Insert client information, including name, address, and contact details. |

| 3 | List the products or services provided, along with descriptions, quantities, and unit prices. |

| 4 | Use formulas to automatically calculate totals, taxes, and discounts if applicable. |

| 5 | Insert payment terms and due date. |

| 6 | Double-check the document for accuracy before saving or sending it. |

By following these simple steps, you can quickly create professional and accurate financial documents, whether for a one-time transaction or regular billing.

Choosing the Right Billing Document Format

When creating financial records, selecting the right format is crucial for ensuring that the document is both professional and functional. The format not only affects the document’s appearance but also plays a key role in organizing information clearly and logically. Different formats may be suited to different business models, depending on the complexity of the transactions, the number of items, or the specific details required for each record.

Considerations When Choosing a Format

There are several factors to keep in mind when deciding which structure best fits your business needs. The right format can help streamline your workflow, reduce errors, and improve communication with clients.

- Business Size and Frequency of Transactions: Small businesses or freelancers might prefer simpler formats, while larger businesses may need more detailed and comprehensive structures.

- Client Requirements: Consider whether your clients have specific format preferences, such as particular fields or layout designs.

- Ease of Use: Choose a format that is easy to fill out and understand, minimizing the chance for mistakes during data entry.

- Automation Options: If you handle frequent transactions, look for formats that allow for automatic calculations and fields that can update based on entered data.

Popular Formats to Consider

- Simplified Format: Ideal for small transactions, focusing on essential details like client name, date, items, and amounts.

- Detailed Format: Suitable for more complex billing, including descriptions, discounts, taxes, and payment terms.

- Recurring Billing Format: Best for subscription services, with pre-set recurring dates and amounts.

By carefully choosing the right structure, businesses can ensure that their financial records are both professional and efficient, providing clear communication and fostering trust with clients.

Common Mistakes to Avoid in Billing Documents

Even small errors in financial records can lead to confusion, delays in payments, or even legal issues. It’s crucial to ensure that every detail is accurate when creating financial statements for transactions. Understanding the common mistakes that businesses make when preparing these documents can help prevent costly oversights and ensure that the process remains smooth and professional.

Below are some of the most frequent mistakes businesses should watch out for when preparing billing records:

- Incorrect Client Details: Failing to accurately enter the client’s name, address, or contact information can result in miscommunication and payment delays.

- Missing or Incorrect Dates: Omitting important dates such as the issue date or due date can cause confusion, especially when there are payment deadlines involved.

- Wrong or Incomplete Amounts: Double-checking the amounts listed for products or services is crucial. Simple errors in pricing or quantity can lead to discrepancies in payments.

- Omitting Taxes: Forgetting to include applicable taxes or applying the wrong tax rate can lead to legal issues or incorrect payment amounts.

- Lack of Payment Terms: Not clearly stating the payment terms, including methods of payment or late fees, can create misunderstandings about when and how the payment should be made.

- Failure to Include a Clear Breakdown: Not providing a detailed list of services or products may leave clients confused about what they are being charged for.

By avoiding these common mistakes, businesses can maintain clarity, professionalism, and ensure that payments are processed without unnecessary delays or disputes.

How to Add Tax Calculations in Billing Documents

Calculating taxes accurately is an essential part of managing financial records. It ensures that you are charging the correct amount and complying with local regulations. Whether you are dealing with a single rate or multiple tax rates, adding tax calculations to your financial documents can be done quickly using a few simple steps. By incorporating automatic calculations, you can save time and reduce the risk of errors.

Here is a step-by-step guide on how to add tax calculations to your financial records:

- Enter the Total Amount: Start by entering the cost of goods or services provided before tax is applied.

- Set Up Tax Rate: Identify the applicable tax rate. For example, if the sales tax rate is 18%, you will use this value for the calculation.

- Apply the Tax Formula: Multiply the total amount by the tax rate to calculate the tax amount. For instance, if the total is $100 and the tax rate is 18%, the formula would be: Total Amount x Tax Rate.

- Calculate the Final Total: Add the tax amount to the original total to get the final amount payable. Use the formula: Total Amount + Tax Amount.

- Verify the Tax Calculation: Double-check the tax figures to ensure they are correctly calculated and reflected in the document.

To automate these calculations, you can use built-in functions that perform these steps as soon as you enter the values. This makes the process faster and reduces the chance of errors.

Once the tax calculation is correctly set up, the billing document will automatically adjust any changes in price, ensuring that taxes are applied consistently across all transactions.

Formatting Tips for Professional Billing Documents

Creating a professional and visually appealing financial document is crucial for leaving a good impression on clients and ensuring clear communication. Proper formatting not only enhances readability but also ensures that all necessary information is presented in an organized manner. A well-structured document can make it easier for both you and your clients to review and process the details quickly.

Key Elements of a Professional Billing Document

When formatting your financial records, it’s important to focus on clarity and simplicity. Here are some key tips to keep in mind:

- Clear and Legible Fonts: Use easy-to-read fonts such as Arial or Times New Roman, with a font size between 10 and 12 for the body text. This ensures that all information is readable.

- Proper Alignment: Align all text and numbers consistently. For example, align prices and totals to the right for easy scanning, and center the header information to give the document a clean look.

- Consistent Styling: Maintain consistency in the use of bold, italics, and underlined text. Use bold for section headings or totals and italics for notes or additional information.

- Use of Lines or Borders: To separate sections or group information, use borders or lines to create clear distinctions between different parts of the document.

- Include Relevant Contact Information: Make sure your business name, address, phone number, and email are clearly visible at the top of the document for easy reference.

Creating a Professional Layout

To help organize the information efficiently, here’s an example layout:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product 1 | 2 | $50 | $100 |

| Product 2 | 1 | $75 | $75 |

| Subtotal | $175 | ||

| Tax (18%) | $31.50 | ||

| Total Amount Due | $206.50 | ||

By applying these formatting tips, your billing documents will not only look more professional but also be easier for clients to understand and process. Always keep the layout clean and simple, and avoid cluttering the document with unnecessary details.

How to Track Payments with Financial Documents

Effectively managing payments is essential for maintaining healthy cash flow and ensuring that all transactions are accounted for. By organizing payment records, you can easily track outstanding balances, monitor incoming funds, and quickly identify any discrepancies. Using a systematic approach to track payments can help streamline your financial processes and improve your overall business operations.

Here’s how to set up a simple payment tracking system:

| Client Name | Invoice Number | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|---|

| John Doe | 001 | $500 | $500 | 01/15/2024 | Paid |

| Jane Smith | 002 | $300 | $0 | Pending | Unpaid |

| Mark Johnson | 003 | $200 | $200 | 01/20/2024 | Paid |

To effectively track payments, follow these steps:

- Record the Transaction Details: Enter all relevant information, including the client’s name, invoice number, amount due, amount paid, and payment date.

- Track Payment Status: Update the status column to reflect whether the payment has been made, is pending, or overdue.

- Monitor Overdue Payments: Regularly check the payment status for any overdue amounts and send reminders or follow-ups to clients when necessary.

- Reconcile Payments: Compare your payment records with your bank statements to ensure that all amounts received match the recorded payments.

By maintaining a payment log and regularly updating the status of each transaction, you can easily manage your finances and keep track of outstanding payments. This will help you avoid confusion and ensure timely payments from clients.

Using Spreadsheets for Multiple Clients

Managing transactions for several clients can be a daunting task, especially when each has different billing schedules and payment terms. However, using a well-structured financial document for each client simplifies this process. By customizing a document to suit multiple clients, you can efficiently track payments, maintain records, and ensure timely follow-ups. These records not only help in managing financial workflows but also allow you to organize client-specific details with ease.

Benefits of Managing Multiple Clients with a Single Document

Here are some reasons why using a unified structure for various clients is highly effective:

- Easy Organization: Having all client records in one place eliminates the need for separate files and provides a consolidated overview of your financial status.

- Streamlined Data Entry: Templates designed for multiple clients enable you to easily input the same data fields, such as name, service provided, payment terms, and due date, without the need to start from scratch each time.

- Consistent Updates: Once a template is set up, it’s simple to make consistent updates across multiple clients, ensuring no client information is overlooked.

How to Set Up a Spreadsheet for Multiple Clients

To effectively manage billing and payments for numerous clients, consider following this structure:

| Client Name | Service Description | Amount Due | Payment Terms | Due Date | Status |

|---|---|---|---|---|---|

| Client A | Web Development | $1,000 | Net 30 | 02/15/2024 | Paid |

| Client B | Consulting | $500 | Net 45 | 03/01/2024 | Pending |

| Client C | Marketing Services | $750 | Net 30 | 02/25/2024 | Paid |

Each client has their own set of rows where all relevant data–such as the type of service or product, payment terms, due date, and current status–can be tracked. This structure ensures that you have a complete and updated view of all your financial dealings.

Additionally, you can use conditional formatting to highlight overdue payments or pending transactions, making it easier to stay on top of outstanding balances. By organizing your client data into these structured categories, you can provide better service, ensure smoother transactions, and maintain an organized system for managing multiple clients.

Managing Invoice Data in Excel

Efficiently handling transaction records is crucial for any business. By organizing your financial data in a clear and systematic way, you can streamline the billing process and ensure accurate tracking of payments, due dates, and amounts. Using a digital platform to manage this information allows for quick updates, easy retrieval, and automatic calculations, which saves time and reduces the likelihood of errors.

One of the primary benefits of digital records is the ability to sort, filter, and analyze data with ease. Whether you’re managing a few clients or hundreds, having a central system for all your financial records helps you stay on top of payments and identify any discrepancies quickly. Additionally, having structured data allows you to generate reports or summaries with just a few clicks, making it easier to evaluate business performance over time.

Key Steps to Manage Financial Data

- Organize Data into Categories: Create separate columns for important details such as client name, service provided, payment terms, amounts due, and due dates. This will make it easier to track and manage information for multiple clients.

- Use Formulas for Automatic Calculations: Use formulas to calculate totals, taxes, and discounts automatically. This reduces manual work and ensures consistency in your calculations.

- Regularly Update Payment Status: Keep track of whether payments are completed, pending, or overdue. Marking payments as “Paid” or “Pending” ensures you are always aware of your financial status.

Best Practices for Managing Payment Data

To keep your records accurate and up to date, here are some helpful tips:

- Consistent Data Entry: Enter data consistently and avoid mixing formats. For example, always use the same format for dates (e.g., MM/DD/YYYY) and currency (e.g., USD, INR) across all records.

- Regular Backups: Ensure that your data is backed up regularly to avoid the loss of important information due to unexpected issues like software crashes or hardware failures.

- Review Data Frequently: Regularly review your records to ensure that no errors have been made and that all payments are correctly recorded.

By managing your financial data effectively, you can save time, reduce errors, and ensure that your business operations run smoothly. Structured records also make it easier to generate reports for tax filings, audits, or financial analysis. Whether you’re managing a small business or a large enterprise, keeping your financial records in order is essential for long-term success.

How to Save and Print Invoices

Efficiently saving and printing your financial records is crucial for maintaining accurate documentation and ensuring smooth transactions with clients. By using a systematic approach, you can easily manage your records and access them whenever needed. Whether you need to send a copy to your clients or store a hard copy for future reference, proper saving and printing practices help maintain consistency and avoid errors.

In today’s digital age, most businesses rely on digital platforms to create and store financial documents. These digital files can be saved in various formats, such as PDFs or spreadsheets, which provide flexibility for sharing and archiving. Once your document is prepared, printing it can be done with just a few clicks, ensuring that you have a physical copy when needed.

Steps to Save Financial Records

- Choose the Right Format: When saving, choose a format that ensures compatibility and easy access. PDFs are a popular choice due to their universal compatibility and secure file structure.

- Organize Files by Client or Date: Use clear naming conventions and folders to keep track of each document. For example, use a format such as “ClientName_Month_Year” to easily locate a specific file when needed.

- Use Cloud Storage: Store your documents in cloud storage platforms for easy access across different devices and for added security against data loss.

How to Print Financial Records

- Select the Correct Printer Settings: Before printing, make sure your printer settings are configured for the document’s size and layout. This ensures that your printed copy is clear and legible.

- Preview Before Printing: Always preview the document before printing to check for formatting errors or missing information. This helps avoid wasting paper or ink on incorrect copies.

- Choose Print Quality: For professional results, choose a high print quality setting to ensure that all details are crisp and readable.

By following these simple steps, you can efficiently save and print your business documents, ensuring they are well-organized and easy to retrieve when needed. Proper storage and printing also help maintain professional communication with clients and ensure accurate record-keeping for future reference or auditing purposes.

Understanding Indian GST in Invoices

The Goods and Services Tax (GST) is an essential component of the taxation system in many countries, especially for businesses operating within specific regions. When creating financial documents, it’s crucial to include GST details to ensure legal compliance and accurate tax reporting. This tax structure affects how businesses calculate, collect, and report sales and purchases, making it an integral part of any business transaction.

For businesses in India, GST is applied on most goods and services, and understanding how to properly account for it in your documents is key to smooth operations and avoiding potential fines. From adding the right GST rates to categorizing transactions correctly, this system ensures that businesses remain within legal frameworks while simplifying the tax-paying process.

GST Rates and How They Apply

- Standard Rate: The primary GST rate in India is typically around 18%, though it can vary depending on the type of goods or services being exchanged.

- Reduced Rates: Certain essential items, like food products, medicines, and educational materials, may be subject to a lower GST rate, often 5% or even 0%.

- Exemptions: Some services and goods are exempt from GST, meaning no tax is added to the price.

How to Include GST in Financial Documents

- Separate GST Fields: Ensure your financial documents have distinct fields for GST calculations. This helps in keeping the tax details clear and easy to track.

- GST Identification Number (GSTIN): Include your business’s GSTIN in all official documents to validate the tax status and avoid confusion.

- Breakdown of Taxes: Provide a clear breakdown of the taxes applied to each item or service, ensuring the total includes both the base price and the applicable tax rate.

By accurately understanding and applying GST in your financial documentation, you help ensure that your business operates within the country’s legal guidelines and maintains transparency with clients. This also aids in simplifying your tax filing and making tax payments easier for your business.

Sharing and Sending Excel Invoices

Once financial documents have been created and verified, sharing them with clients or business partners is the next crucial step. The method of sending these documents plays a significant role in ensuring that they are received correctly, accessed easily, and stored securely. There are various ways to send financial documents, each with its advantages and best practices.

Whether sending through email, cloud services, or direct file sharing, it’s important to consider the convenience, security, and efficiency of each method. Here are some of the most common approaches:

Methods for Sending Financial Documents

- Email: Sending financial documents as email attachments is the most common method. Be sure to compress large files if necessary and include a clear subject line to ensure proper identification.

- Cloud Services: Using cloud-based storage options like Google Drive, Dropbox, or OneDrive allows for secure, easily accessible sharing. Links to documents can be shared with clients or colleagues, enabling real-time access and collaboration.

- Direct File Sharing: For more secure and immediate transfers, direct file-sharing platforms or secure FTP servers are useful. This method can ensure high security, especially when dealing with sensitive financial data.

Best Practices for Sending Financial Documents

- Use Password Protection: To protect the contents of your financial documents, consider using password protection for PDF or document files before sending them. This ensures that only authorized individuals can view or edit the content.

- Verify Recipient Information: Double-check that you are sending the document to the correct email address or shared link. A wrong recipient could lead to a breach of privacy or lost documents.

- Provide Clear Instructions: Include a brief message explaining the document’s purpose, any actions required, and the due dates. This adds clarity and ensures that recipients understand the context of the communication.

By following these guidelines, you ensure that your financial documents are shared securely and efficiently, helping your business transactions proceed smoothly and professionally.

Using Excel for Small Business Invoicing

Managing financial transactions effectively is essential for any small business, and having a streamlined way to create, track, and manage payment requests can save time and reduce errors. A spreadsheet program offers a simple yet powerful solution for handling these tasks, allowing small business owners to generate customized billing documents with ease.

By using a spreadsheet tool, businesses can set up a system that suits their needs. Whether it’s keeping track of due payments, adding taxes, or generating reports for bookkeeping purposes, spreadsheets can be adapted to meet a variety of invoicing requirements. Below are a few key reasons why small businesses can benefit from using this tool:

Advantages of Using a Spreadsheet for Billing

- Cost-Effective: Spreadsheets are often free or come at a low cost, making them an ideal solution for small businesses that want to save money on expensive invoicing software.

- Customizable: With a spreadsheet, you can easily adjust the design and layout to match your business branding, or create a structure that suits your specific needs.

- Easy to Update: It’s simple to update or amend any detail on a billing document, from customer names to service descriptions or pricing, without the need to start over from scratch.

- Automated Calculations: Spreadsheets can perform calculations automatically, such as adding totals, applying taxes, or generating discounts, reducing the risk of manual errors.

Tracking and Organizing Financial Data

Spreadsheets can also help small businesses organize and track their financial records. By keeping all invoices in one place, businesses can quickly access past transactions, monitor outstanding payments, and generate reports on income and expenses. A well-maintained system provides clarity and makes accounting tasks easier during tax season or when seeking financing options.

Setting Up a Billing System

Setting up an efficient invoicing system using a spreadsheet is simple. A typical setup might include columns for client information, itemized services or products, quantities, prices, taxes, and due dates. By using built-in functions, such as SUM for total calculations or DATE for generating time-based information, you can quickly create accurate, professional-looking billing documents.

Example Table Layout

| Client Name | Service/Product | Quantity | Unit Price | Total | Due Date |

|---|---|---|---|---|---|

| John Doe | Web Design | 1 | $500 | $500 | 10/10/2024 |

| Jane Smith | SEO Services | 2 | $200 | $400 | 10/15/2024 |

By implementing such a setup, small businesses can ensure that invoicing remains organized, accurate, and professional, all while maintaining full control over the process.