Free Excel Invoice Template for Quick and Easy Billing

Managing financial transactions can be a challenging task for any business. However, having the right tools at your disposal can simplify the process, saving time and ensuring accuracy. One such tool is a customizable document that allows you to create professional records for payments and services rendered. These records help streamline your business operations, ensuring that every detail is accounted for and nothing is overlooked.

Using a ready-made, easily adjustable layout can make the process even more efficient. By choosing a customizable design, you can tailor each document to meet your unique needs, adding specific details like payment terms, client information, and product descriptions. This not only helps maintain professionalism but also enhances communication with clients, making transactions smoother.

Whether you are a freelancer, small business owner, or part of a larger organization, having an organized approach to billing is crucial. By utilizing tools that allow you to quickly generate accurate documents, you can focus more on growing your business and less on administrative tasks. Moreover, such resources are often available without any cost, making them an ideal choice for entrepreneurs looking to manage their finances efficiently.

Free Excel Invoice Template for Business

For any business, creating consistent and professional billing records is essential for maintaining accurate financial tracking. Whether you’re working with clients on a regular basis or providing one-time services, having a well-structured document that clearly outlines transactions can streamline the entire process. Using an adaptable document for this purpose allows for efficient invoicing without the need for complicated software or expensive tools.

With a customizable billing layout, you can easily manage client details, service descriptions, and payment terms. This allows you to focus on the quality of your work rather than worrying about manual calculations or design inconsistencies. A well-designed document can reduce the risk of errors and help ensure timely payments, making it a key tool for both small businesses and freelancers alike.

In addition to being cost-effective, these documents are simple to access and modify. Many platforms offer downloadable versions that cater to various business needs. This means that with just a few adjustments, you can generate the perfect record that suits your business model. As a result, you can manage financial transactions with professionalism and efficiency, no matter the scale of your operations.

Why Use an Excel Invoice Template

When it comes to handling financial records, businesses often seek ways to streamline their processes. One of the most effective methods for ensuring consistency, accuracy, and professionalism in billing is by utilizing a digital tool designed for creating and managing payment requests. These tools allow you to produce structured and clear documents that simplify tracking payments and managing client interactions. Using such a tool saves time and reduces the likelihood of errors, ensuring your records are always well-organized and easy to read.

Time and Cost Efficiency

One of the key reasons to choose a digital solution for creating billing documents is its time-saving nature. These tools come with pre-designed structures, which means you don’t have to spend time manually formatting or designing each document. You can simply input the relevant details and generate the final version in a matter of minutes. Additionally, most of these resources are free to download or available at low costs, making them an affordable option for any business, large or small.

Customization and Flexibility

Another significant advantage is the ability to customize the document according to your specific needs. You can adjust various fields to suit your business model, including adding product descriptions, payment terms, and client contact details. This flexibility ensures that the document accurately reflects the nature of your services and maintains professionalism across different client interactions.

| Feature | Benefit |

|---|---|

| Pre-designed Structure | Faster document creation with minimal formatting required |

| Customizable Fields | Adapt the document to suit your unique business needs |

| Cost-effective | Save money by using available and affordable options |

| Accuracy | Reduce human errors by using automated calculations |

Ultimately, using a digital solution for creating payment records brings both convenience and accuracy, ensuring you maintain a professional image and manage your finances efficiently.

Benefits of Customizing Your Invoice

Customizing your billing documents offers a range of advantages that can enhance both the functionality and professionalism of your business transactions. When you tailor your financial records to match your specific needs, you create a more streamlined process that saves time and reduces errors. Customization allows you to include important details such as your company’s branding, unique payment terms, and client-specific information, all of which can make your documents clearer and more engaging.

Enhancing Professionalism

One of the primary benefits of adjusting your documents is the ability to present a polished and professional image to clients. By incorporating your business logo, brand colors, and consistent formatting, you reinforce your company’s identity and show attention to detail. A personalized document gives your clients confidence that they are working with a well-organized business, which can improve your overall reputation and encourage prompt payments.

Improved Clarity and Accuracy

Customizing your documents also allows for greater clarity. You can include specific fields that are relevant to your business, such as payment terms, tax information, and detailed descriptions of services or products provided. This reduces the chances of confusion, ensuring that both you and your clients are on the same page. With accurate, easy-to-read records, disputes are less likely to arise, and the payment process becomes smoother for both parties.

In the long run, customizing your financial records can save time, improve communication, and boost your business’s credibility. By tailoring your documents, you create an efficient workflow that supports positive client relationships and maintains consistency across all transactions.

How to Download Excel Invoice Templates

Accessing customizable documents for billing purposes has never been easier. Numerous platforms offer easy-to-use options that can be downloaded in just a few clicks. These resources are ideal for businesses that need professional documents without the hassle of creating them from scratch. By selecting the right platform and choosing the best layout, you can quickly get started with generating accurate payment requests for your clients.

Downloading such documents is simple and typically requires only a few basic steps. Most online resources provide a wide selection of formats, ranging from basic templates to more complex designs with additional features. Many of these resources are available at no cost, which makes them even more attractive to small business owners and freelancers.

| Step | Action |

|---|---|

| Step 1 | Visit a reliable platform offering downloadable business documents |

| Step 2 | Select the document that best suits your business needs |

| Step 3 | Click the download button and save the file to your computer |

| Step 4 | Open the downloaded file and input your details |

Once downloaded, these documents can be customized with your business name, logo, contact information, and specific terms of service. You can then save and send them to clients, making the process both efficient and professional. The flexibility and ease of use of these resources make them an essential tool for businesses of all sizes.

Key Features of Free Invoice Templates

When managing financial transactions, having a clear and professional document to track payments is crucial. Ready-made solutions that assist with creating these documents come with a variety of useful features designed to simplify the process, save time, and ensure accuracy. These essential functions help businesses of all sizes create professional and well-organized records with minimal effort.

Customizable Design – The ability to adjust the layout and structure allows users to tailor the document to meet their specific needs. Whether it’s adding company logos, adjusting the color scheme, or changing the text, personalization helps create a unique look that reflects the brand’s identity.

Automatic Calculations – Built-in formulas enable automatic summing of amounts, taxes, and totals. This feature eliminates the need for manual calculations, reducing the risk of errors and making the entire process more efficient.

Itemized Lists – Including a detailed breakdown of goods or services ensures clarity for both parties involved. This feature allows for easy listing of items, quantities, rates, and discounts, providing transparency in transactions.

Professional Layout – The structure of the document ensures that important details such as payment terms, contact information, and due dates are clearly visible. A clean and organized format makes it easier to read and process.

Customizable Payment Terms – Flexible options for setting deadlines, interest rates, and other payment conditions can be easily configured. This ensures that businesses can communicate clear expectations to clients, reducing misunderstandings.

Trackable Information – Features that allow you to include unique reference numbers or tracking IDs help to maintain a systematic approach to record-keeping, making it easier to locate past transactions and ensure proper accounting.

Multi-currency and Multi-language Support – For international transactions, some solutions offer multi-currency and multi-language capabilities, allowing for wider adaptability across different regions and client bases.

Incorporating these key attributes into your financial records helps streamline the billing process, enhance professionalism, and maintain accuracy, ensuring both business owners and clients are well-informed at every step.

Step-by-Step Guide to Using Excel Templates

Creating accurate and professional financial documents can seem daunting, but with the right tools, the process becomes simple and efficient. Using pre-designed structures can streamline the workflow, ensuring that you meet all the necessary requirements without having to start from scratch. This guide will walk you through the essential steps to effectively use these pre-configured documents for your business needs.

Follow the steps below to get started and customize your document for your specific requirements:

| Step | Action | Details |

|---|---|---|

| 1 | Select a Document | Choose a suitable pre-structured file that aligns with your needs, whether it’s for billing, services, or products. |

| 2 | Open the File | Double-click to open the document in your spreadsheet application. It will automatically load with a default layout. |

| 3 | Enter Company Information | Update the header section with your company’s name, address, contact details, and logo to personalize the document. |

| 4 | Fill in Customer Details | Input the client’s name, address, and contact information in the appropriate fields to customize the document for each transaction. |

| 5 | List Products or Services | Enter the details of the items provided, including descriptions, quantities, and rates. Adjust the list as necessary to match the specific order. |

| 6 | Apply Discounts and Taxes | If applicable, input any discounts or taxes to ensure accurate calculations of the total amount due. |

| 7 | Review and Adjust | Before finalizing the document, review all the entered details for accuracy and make adjustments where needed. |

| 8 | Save and Send | Save the completed document, then send it via email or print it out for your client. |

By following these steps, you can easily create polished and accurate documents that save you time and ensure that all the necessary information is included. The pre-configured setup takes care of the calculations and layout, so you can focus on providing great service to your clients.

How to Customize Your Excel Invoice

Tailoring your financial document to fit your specific business needs is essential for creating a professional and accurate record. Customizing it allows you to align the layout, information, and design with your branding while ensuring it contains all necessary details. Below are the steps to personalize the layout, content, and features of your document.

Adjusting the Layout and Design

The layout and design of your financial record can greatly impact its readability and professionalism. Here’s how you can customize it:

- Change the Header: Replace the generic header with your company’s logo, name, and contact details. You can also adjust the font size and color to match your branding.

- Modify Column Widths: Ensure that all columns are wide enough to display the necessary data clearly without cutting off any information.

- Add or Remove Rows: You can add extra rows for additional products or services or remove unnecessary rows to keep the document tidy.

- Adjust Font Styles: Change fonts and text sizes for different sections (e.g., larger text for headings) to make the document visually appealing.

Customizing Content and Calculations

Customizing the content and formulas is important to ensure that the details of each transaction are correct. Follow these steps to modify the content:

- Update Client Details: Enter the customer’s name, address, and contact information in the designated fields to personalize each record.

- List Specific Products or Services: Include the description, quantity, rate, and any additional information for each item or service provided.

- Modify Payment Terms: You can adjust the payment due date, late fees, or discounts to reflect your business terms.

- Update Calculation Fields: Double-check formulas for summing totals, applying taxes, or calculating discounts to ensure they are accurate and relevant to your needs.

- Insert Custom Notes: Add any personalized messages or instructions to the footer of the document, such as “Thank you for your business” or payment instructions.

By following these steps, you can create a more tailored, effective, and professional-looking document that reflects your business’s identity and meets all your transaction requirements.

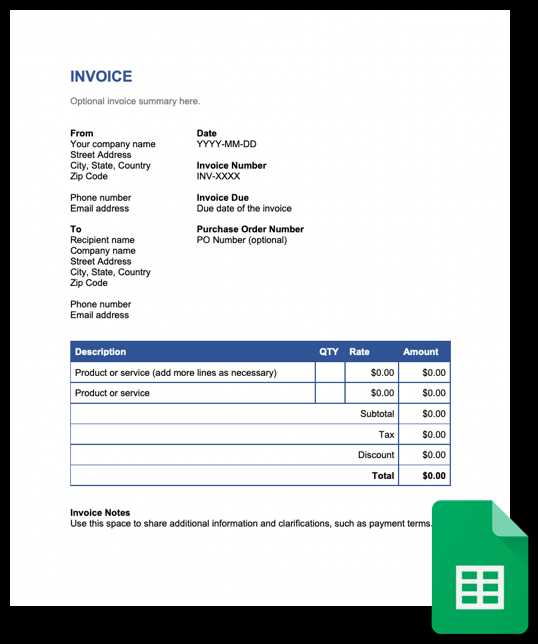

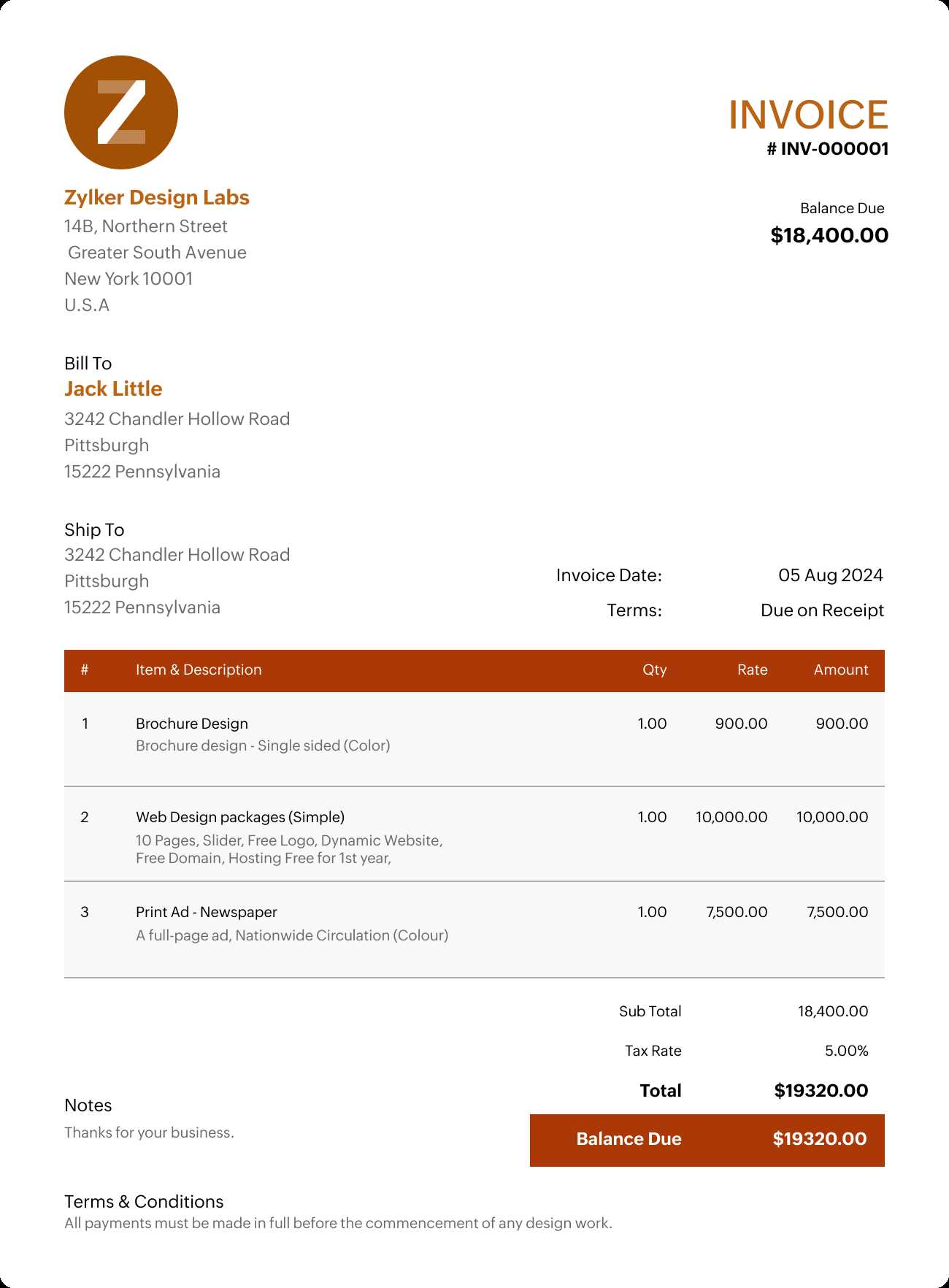

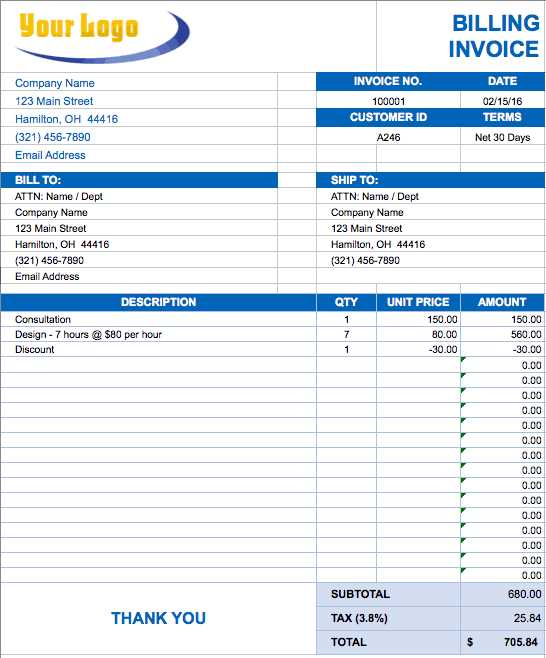

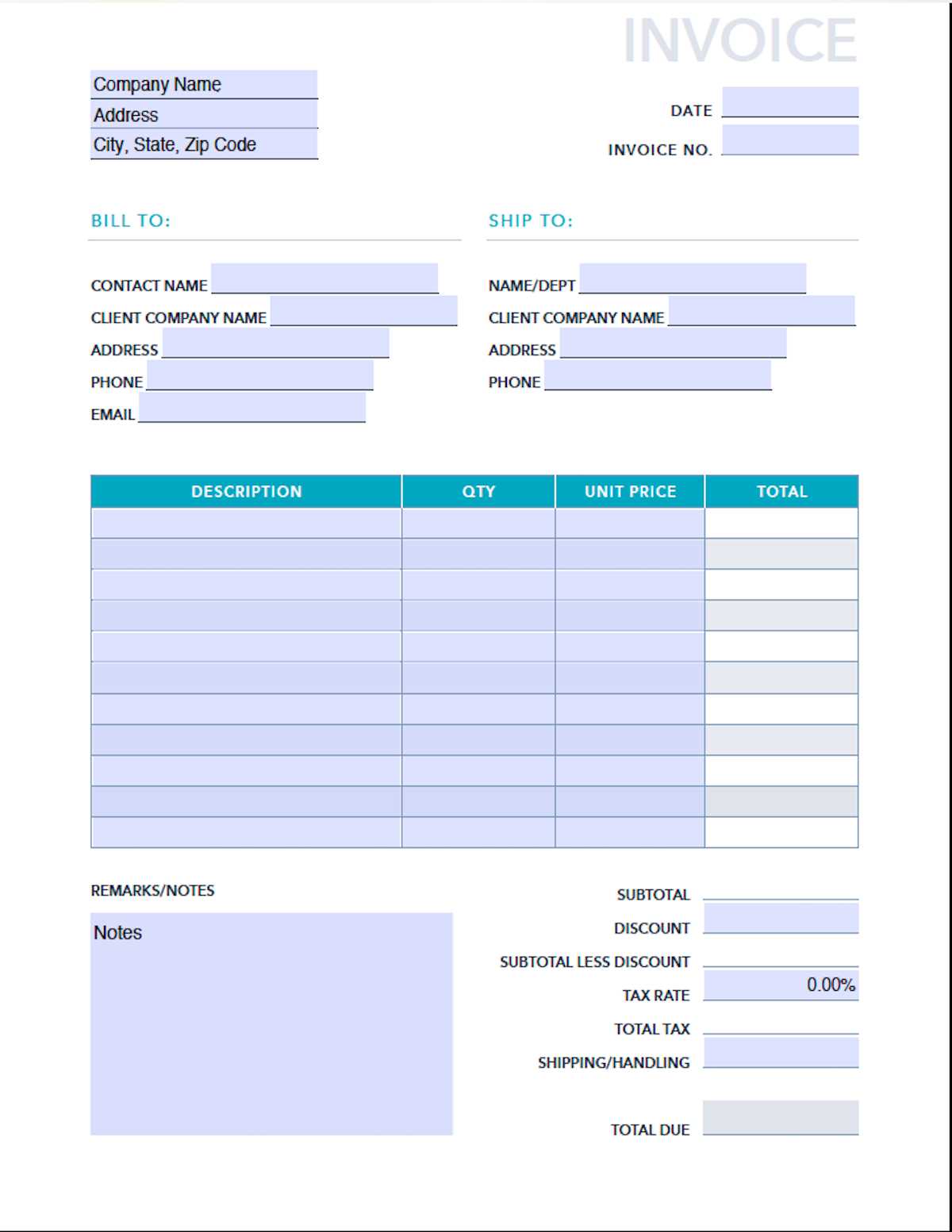

Best Excel Invoice Templates for Small Businesses

Small businesses need reliable and easy-to-use solutions for managing their billing and financial documentation. A well-organized, professional record can help ensure that payments are processed smoothly and efficiently. There are several pre-made options that provide the necessary structure for creating polished documents while saving time. Below are some of the top choices for small businesses looking to streamline their financial operations.

- Simple and Clean Design – A straightforward layout with clear sections for client information, services, quantities, and total amounts. This is ideal for businesses that need a quick and efficient solution without unnecessary complexity.

- Itemized Billing Template – For businesses that sell multiple products or services, an itemized document allows for detailed breakdowns. This style includes separate lines for each product/service, price per unit, quantity, and total, providing transparency and clarity for both you and your clients.

- Professional and Polished Design – A more refined and formal look, often featuring branding elements such as logos and custom fonts. This is suitable for businesses that want to present a more corporate image and impress clients with a high-end appearance.

- Service-Based Format – Specifically designed for service providers, this layout focuses on hours worked or project milestones rather than physical products. It includes fields for the service description, hourly rate, time spent, and project-specific details.

- Recurring Billing Setup – For businesses that operate on a subscription or recurring billing model, this format helps track regular payments, recurring discounts, and next due dates. It’s ideal for clients who require ongoing services like maintenance or monthly subscriptions.

- Minimalist Design – For businesses looking to keep things simple and straightforward, a minimalist style focuses on the essentials, using clean lines, basic fonts, and a no-frills approach. It’s ideal for freelancers and small startups.

Choosing the right design depends on the nature of your business and the type of clients you serve. Whether you need something simple or more comprehensive, these options provide flexibility and functionality to make the billing process easier and more professional.

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is essential for maintaining good business practices and ensuring timely payments. However, small errors can lead to confusion, delays, and even lost income. Understanding the common pitfalls and how to avoid them can help streamline your billing process and foster stronger relationships with your clients.

1. Missing or Incorrect Contact Information

One of the most common mistakes is forgetting to include or incorrectly listing your company’s contact details. Ensure your business name, address, phone number, and email are accurate. Similarly, double-check the client’s information to avoid sending documents to the wrong address.

2. Unclear Payment Terms

Failing to specify the payment due date, late fees, or discounts can lead to misunderstandings. Always make payment terms clear, including when the payment is expected and any penalties for overdue amounts. Clear terms help avoid confusion and set expectations right from the start.

3. Incorrect or Missing Item Details

Always include a detailed description of the products or services provided. Leaving out key information like quantities, unit prices, or item codes can create confusion and result in disputes. Double-check the figures to ensure everything matches the agreement.

4. Calculation Errors

One of the most critical aspects of your document is accuracy in totals and calculations. Small errors in adding up prices or applying tax rates can make a huge difference. Double-check all sums, and make use of built-in formulas to avoid manual mistakes.

5. Not Using Unique Reference Numbers

Each document should have a unique reference number for easy tracking and record-keeping. Failing to use these numbers can make it difficult to reference or follow up on payments, especially for businesses with a high volume of transactions.

6. Lack of Professional Design

A cluttered or unprofessional-looking document may reduce your business’s credibility. A clean, simple design with a clear structure improves readability and helps convey professionalism. Avoid unnecessary graphics, colors, or fonts that could make the document look unorganized.

7. Missing Taxes or Discounts

Always verify that any applicable taxes or discounts are correctly applied. Omitting these can either lead to undercharging your clients or not complying with tax laws. Include tax rates and discount percentages clearly in the breakdown.

8. No Space for Notes or Additional Information

Sometimes, you may need to include special instructions, messages, or additional information for your client. Leaving no space for this can be problematic. Always provide a section at the bottom or a designated area for any remarks or custom terms.

By being mindful of these common mistakes, you can ensure that your financial documents are professional, accurate, and easy for clients to understand. This helps a

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Add Tax and Discounts to Invoices

Including taxes and discounts in financial documents is essential for accuracy and transparency in transactions. Properly adding these elements ensures that clients are billed correctly, and your business complies with relevant tax regulations. Here is a step-by-step guide on how to effectively include taxes and discounts in your documents.

Adding Tax to Your Documents

Taxes are a critical aspect of financial records, and ensuring they are applied correctly is vital for both legal compliance and clarity. Follow these steps to add taxes:

- Determine the Tax Rate: Identify the applicable tax rate based on your region or industry. This rate can vary depending on local tax laws or the type of goods or services provided.

- Calculate the Tax Amount: Multiply the taxable amount (usually the subtotal of your products or services) by the tax rate. For example, if the subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Include the Tax on the Document: Create a line item for tax in your document, listing the tax rate, tax amount, and total amount with tax included. This ensures transparency for the client.

Applying Discounts to Your Document

Discounts can be applied either as a fixed amount or as a percentage. Here’s how to include them properly:

- Fixed Discount: If you’re offering a specific discount amount, subtract this from the total before finalizing the total amount. For example, if the total before discount is $500 and the discount is $50, your new total will be $450.

- Percentage Discount: For percentage-based discounts, calculate the discount by multiplying the total amount by the discount percentage. For example, a 10% discount on a $500 total would result in a $50 discount, making the new total $450.

- Show Discount Clearly: Clearly indicate the discount applied, whether it’s a fixed amount or percentage, to ensure transparency for the client. This can be shown as a line item or in a summary at the bottom of the document.

By following these steps, you can ensure that both taxes and discounts are correctly applied, making your financial documents clear and accurate for your clients. This not only helps maintain good relationships but also ensures your business is compliant with tax regulations.

How to Send Excel Invoices to Clients

After creating a professional document for billing purposes, the next step is ensuring it reaches your client in an efficient and secure manner. Sending these documents electronically allows for quick delivery and reduces paper waste. Below are a few methods to properly share your financial records with clients, ensuring they receive the necessary information promptly.

1. Sending via Email

The most common method for sending documents is through email. To send your document via email, follow these steps:

- Save the File: Save your document in a widely accepted file format like PDF or keep it in its original format for easy editing. PDFs are recommended because they preserve the formatting and prevent any accidental changes.

- Attach the File: Open your email client and create a new message. Attach the saved document by clicking on the attachment icon and selecting the file from your computer.

- Write a Clear Subject Line: Include a subject line that clearly references the document, such as “Payment Due for Services Rendered – [Your Company Name].”

- Include a Professional Message: In the body of the email, briefly explain the contents of the attachment, mention the payment terms, and include your contact details for any questions.

2. Using Cloud Storage Links

For clients who prefer to download the document directly from a secure cloud storage platform, you can upload the file and share the download link. Here’s how:

- Upload the Document: Upload the file to a cloud storage platform such as Google Drive, Dropbox, or OneDrive.

- Set Permissions: Ensure the document’s permissions allow the recipient to view or download the file. Set the link to “view-only” to prevent any accidental changes.

- Share the Link: Copy the shareable link and paste it into the body of your email, along with a brief message explaining the document and the payment due date.

3. Using Online Payment Platforms

If you use an online payment system, such as PayPal or Stripe, many of these platforms allow you to send payment requests directly to clients, often with the document attached. To do this:

- Create a Payment Request: Log into your payment platform and create a request for the specific amount due, attaching the financial document if the platform allows.

- Include Payment Instructions: Provide any necessary instructions for how the client can pay, such as bank details or a payment link.

- Send the Request: After reviewing all details, send the request directly to the client through the platform’s messaging system.

4. Sending Physical Copies

While electronic methods are the fastest, some clie

Printable vs. Digital Excel Invoices

When managing business transactions, choosing between printed and digital documents can significantly impact how you communicate with clients and manage records. Both formats have their own advantages depending on the nature of your business and client preferences. Understanding the benefits and challenges of each option helps ensure you select the best approach for your needs.

Printable Invoices

Printed versions are often preferred for clients who prefer paper records or require physical copies for their bookkeeping. This format provides a tangible document that can be filed or handed over in person. Printing is ideal for businesses that operate in more traditional industries or deal with clients who do not use digital systems regularly. However, printing can be time-consuming and incur additional costs for paper and postage.

Digital Invoices

On the other hand, digital documents are more convenient and eco-friendly. Sending invoices electronically allows for faster delivery and can streamline the payment process through integrated online payment systems. Digital formats are easier to store, search, and organize, making them a preferred option for businesses that prioritize efficiency and environmental sustainability. However, they require both the business and the client to be comfortable with digital tools, and there may be occasional concerns regarding cybersecurity or email delivery issues.

Ultimately, the choice between printable and digital documents depends on factors such as client preferences, business processes, and the need for physical records. Many businesses opt to offer both options to accommodate a wider range of client needs.