Download Free Excel Invoice Template for Easy Billing

Managing financial transactions efficiently is crucial for any business. Having the right tools in place can save time, reduce errors, and help maintain professionalism. Creating clear and organized documents for requesting payments is essential for smooth business operations.

One of the best ways to ensure your payment requests are consistent and accurate is by utilizing a pre-designed file that can be easily tailored to your needs. These ready-to-use documents can be adapted for various purposes and provide a simple solution for tracking financial exchanges.

With the ability to customize the layout and details, you can ensure that your requests for payment reflect the branding and specific terms of your business. Whether you need to include taxes, discounts, or other unique elements, these customizable forms offer flexibility and efficiency.

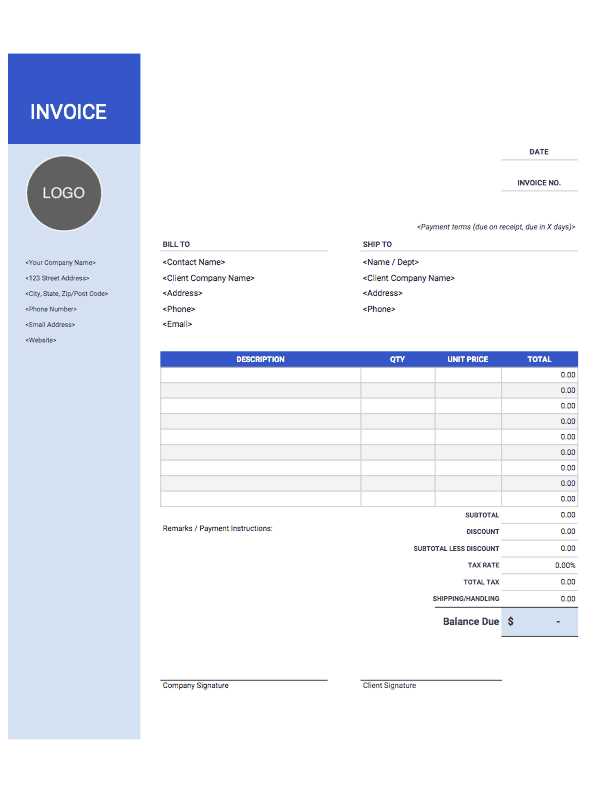

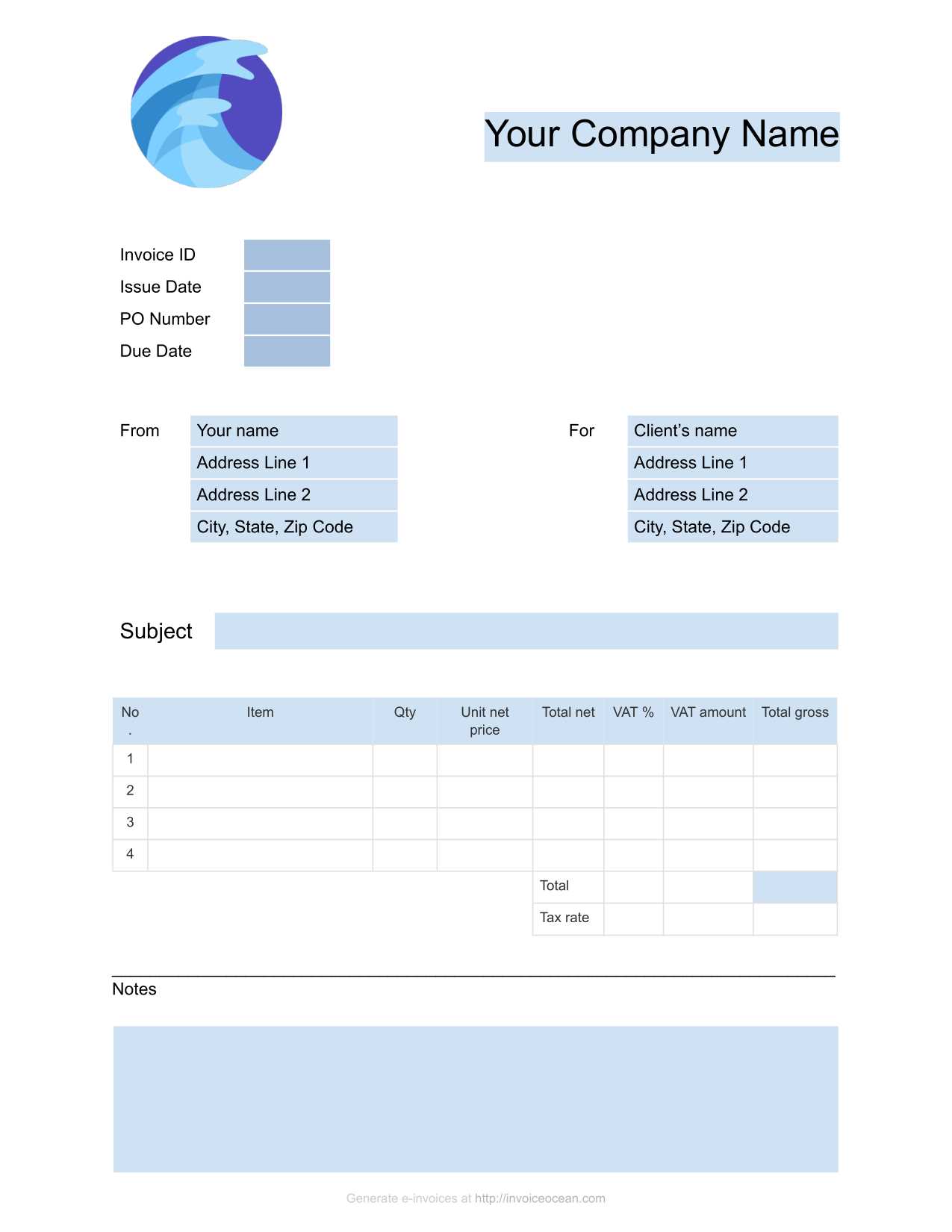

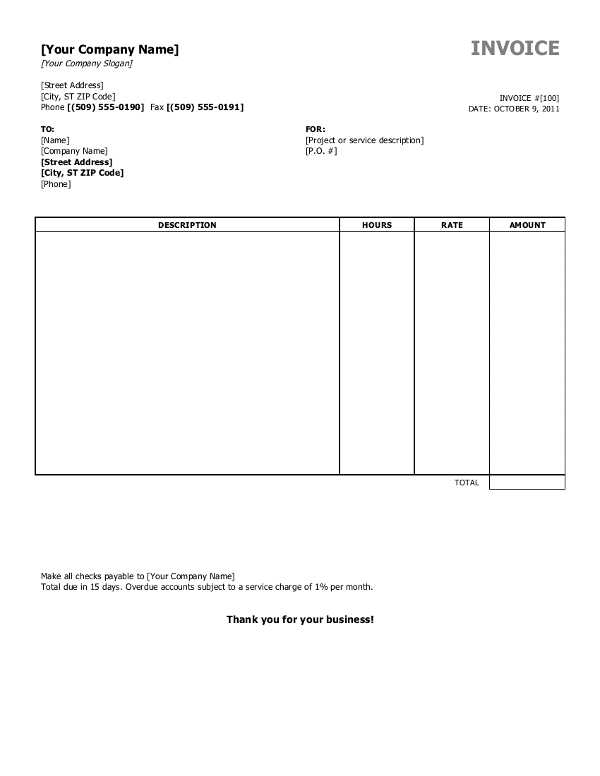

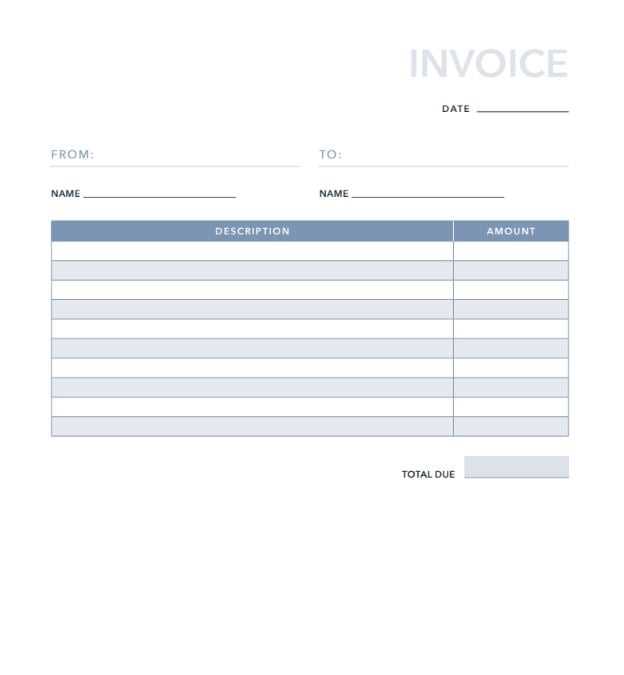

Excel Invoice Template Download

Having a ready-made document for requesting payments can make your financial management significantly easier. A customizable file that can be adapted to your specific business needs helps you stay organized and professional. With the right structure, you can streamline the billing process and ensure that every transaction is recorded accurately.

These pre-designed forms offer several advantages:

- Simple and quick to customize for different types of transactions.

- Professionally formatted, ensuring consistency and clarity.

- Allows easy tracking of payments and due amounts.

- Flexible design that can be tailored to suit your business style.

By using these ready-to-use documents, you save time and reduce errors in your financial dealings. Whether you are sending payment requests to clients or managing your own accounts, these files simplify the entire process.

Furthermore, you can easily adjust the details for specific needs such as adding discounts, taxes, or unique payment terms. This flexibility ensures that every document reflects your business’s particular requirements.

Why Use an Excel Invoice Template

Utilizing a pre-built document for requesting payments offers numerous advantages for businesses. It simplifies the process of creating financial requests, ensuring that all necessary details are included, formatted correctly, and easy to understand. This efficient approach not only saves time but also helps avoid common errors in manual document creation.

Key Benefits of Using a Pre-Formatted Document

- Efficiency: Quickly generate payment requests without starting from scratch.

- Professional Appearance: Maintain a consistent and clean look for every transaction.

- Customization: Adjust the structure to fit the unique needs of your business.

- Time-Saving: Reduce the time spent on designing and formatting each document.

How It Can Improve Your Financial Workflow

- Tracking: Easily keep records of all sent payment requests and their statuses.

- Accuracy: Minimize mistakes by following a proven structure for every document.

- Flexibility: Adapt the layout and content to suit various payment terms and client needs.

Overall, using a pre-designed document helps ensure that every financial request is handled efficiently, consistently, and professionally, allowing businesses to focus more on their core operations and less on administrative tasks.

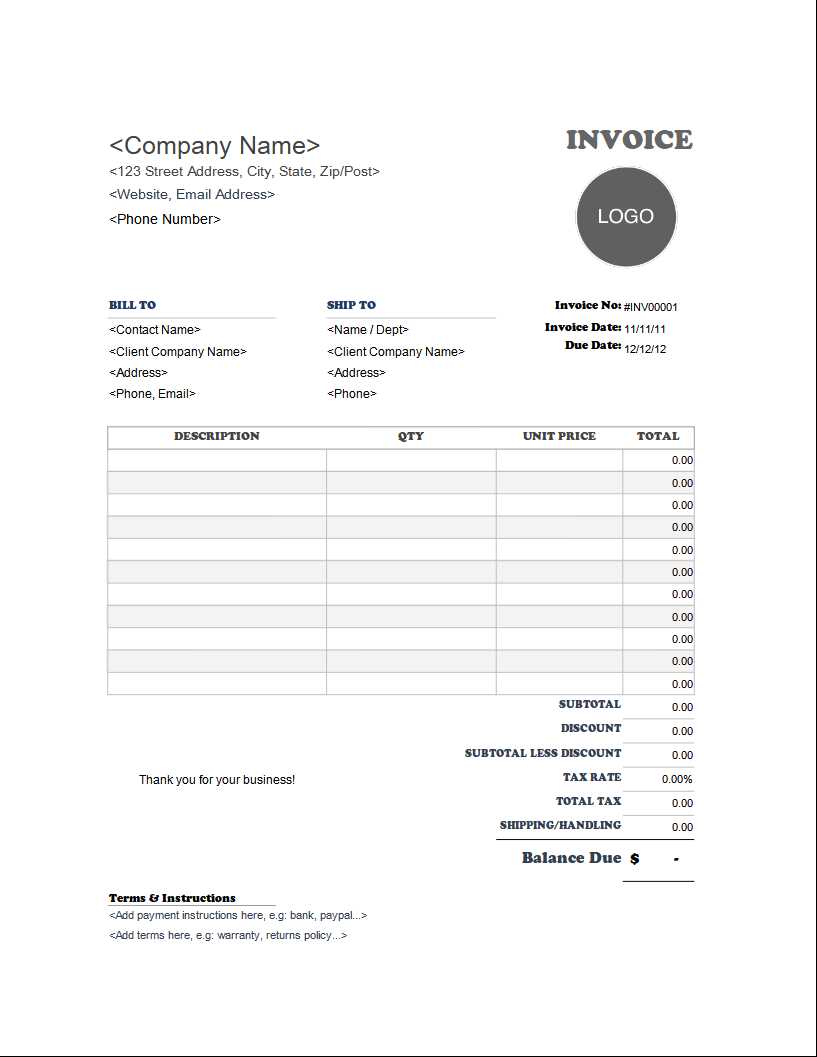

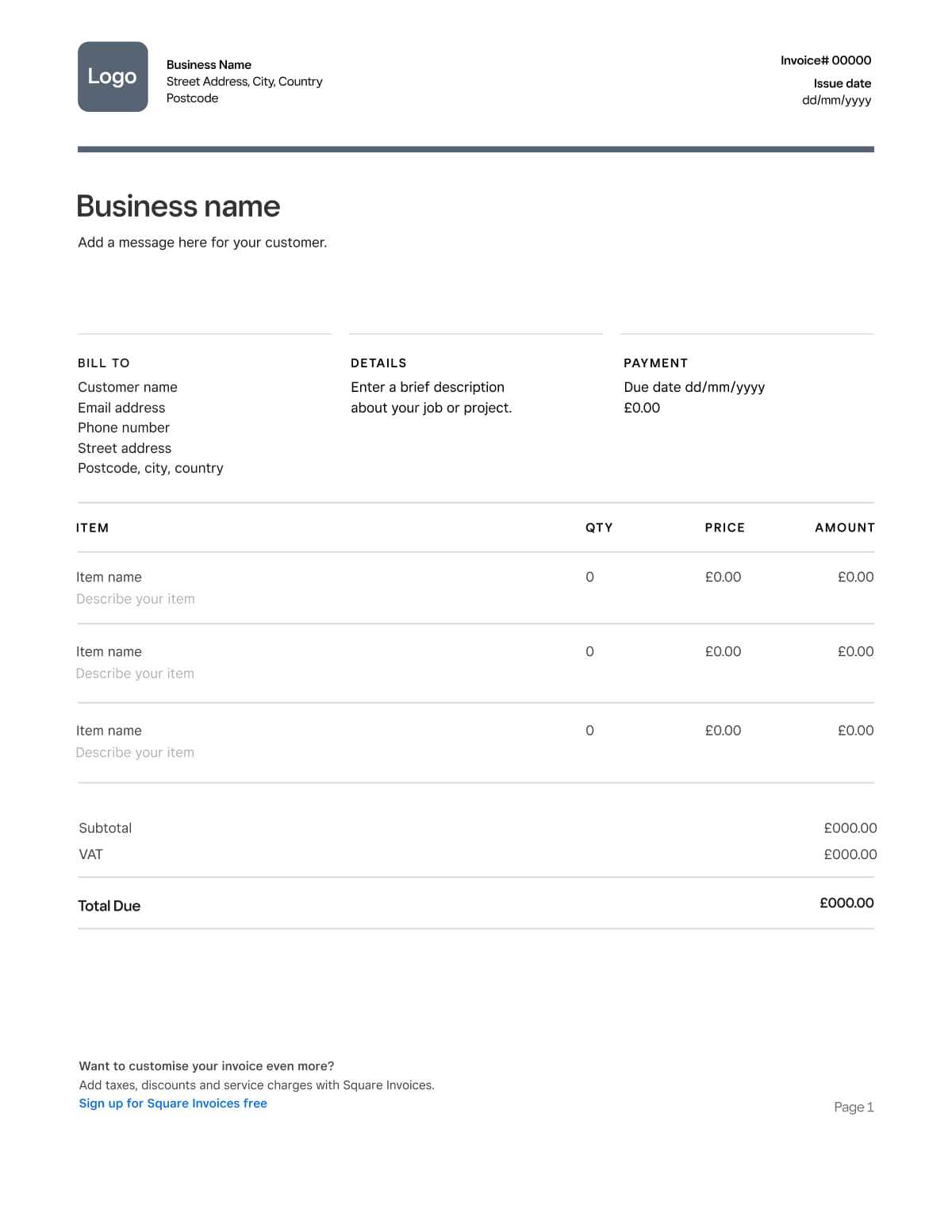

How to Customize Your Invoice Template

Customizing a pre-designed document for requesting payments allows you to make it fit your business’s unique needs. Adjusting the structure, layout, and information ensures that each request aligns with your branding and contains the necessary details for smooth financial transactions. Tailoring this document helps you create a consistent and professional image for your clients.

Follow these steps to customize your document:

- Edit Contact Information: Ensure that your business name, address, phone number, and email are updated so clients can easily reach you.

- Adjust Payment Terms: Modify the payment due date, discounts, or late fees to reflect the terms you offer.

- Add Your Logo: Incorporate your company logo to maintain brand consistency and make your document visually professional.

- Modify Line Items: Tailor the product or service details to reflect what you’re billing your clients for, including quantities, descriptions, and rates.

- Customize Currency: Change the currency symbol or format to suit your location or the client’s country.

Additional Tips:

- Color Scheme: Use colors that match your brand for a more personalized appearance.

- Remove Unnecessary Sections: If there are elements in the document that you don’t need, remove them to keep the layout clean and focused.

With these simple changes, you can ensure that your payment requests reflect your unique business needs while maintaining a professional and organized approach.

Benefits of Using Excel for Invoices

Utilizing a spreadsheet for creating payment requests offers several advantages, particularly in terms of efficiency, flexibility, and accuracy. By leveraging the powerful features of these tools, businesses can streamline their billing process, making it easier to manage financial transactions and ensure that all details are captured correctly.

Key Advantages of Using a Spreadsheet

- Ease of Use: Spreadsheets are user-friendly and easy to navigate, even for those without extensive technical knowledge.

- Customization: You can modify the structure to suit your specific needs, adding or removing sections as necessary.

- Cost-Effective: Most spreadsheet software is available at little to no cost, making it an affordable option for businesses of all sizes.

- Automation: Built-in functions allow for automatic calculations, reducing manual errors and saving time.

- Data Organization: Spreadsheets offer clear and organized layouts that help in managing large volumes of financial data.

Additional Features That Improve Workflow

- Tracking: Easily track outstanding payments and manage due dates with simple sorting and filtering options.

- Flexibility: Adjust the format and layout to match your branding or specific business requirements.

- Integration: Spreadsheets can integrate with other tools, such as accounting software, to simplify your financial management further.

By taking advantage of these benefits, businesses can ensure a smoother, more efficient billing process, ultimately improving their cash flow and reducing administrative overhead.

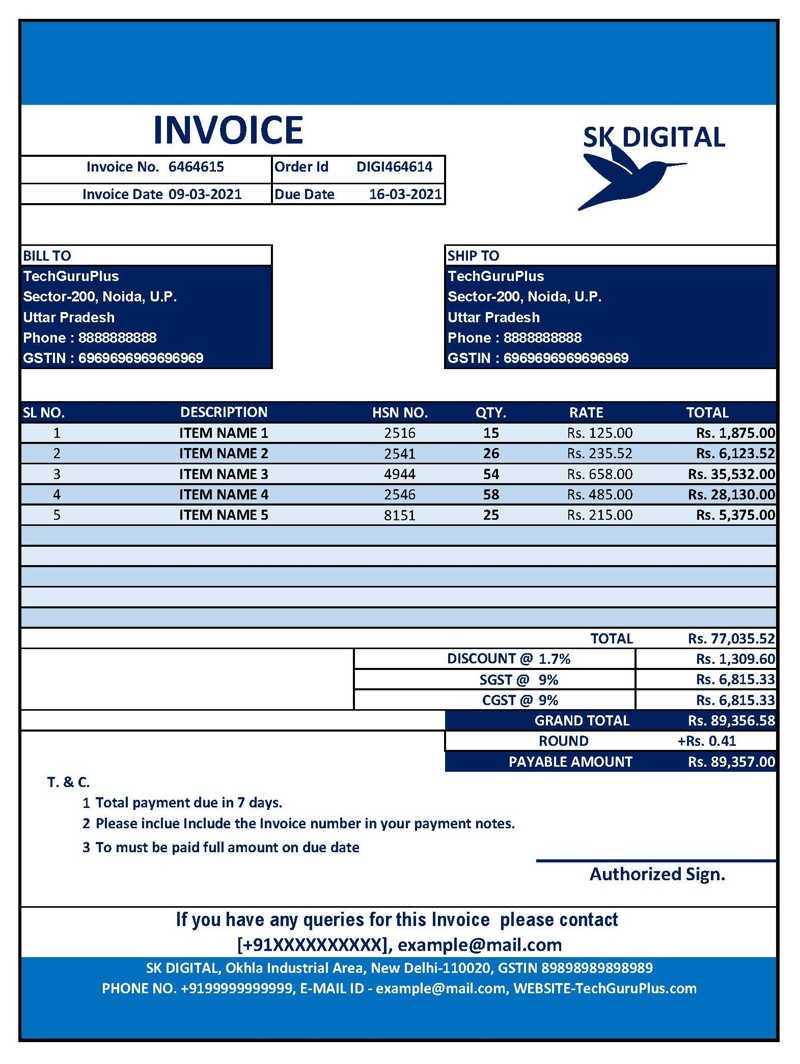

Top Features in an Excel Invoice Template

A well-structured document for requesting payments should include essential features that ensure clarity, efficiency, and ease of use. These elements not only make the process more streamlined but also help in maintaining professionalism and accuracy in every transaction. The right features enable customization, automate calculations, and help businesses stay organized.

Key Features for Efficient Billing

- Predefined Fields: Automatically set fields for customer details, product descriptions, amounts, and due dates to reduce manual entry and increase speed.

- Automatic Calculations: Built-in formulas that calculate totals, taxes, discounts, and balances automatically, reducing the risk of errors.

- Customizable Layout: The ability to modify the design, adjust column widths, and rearrange sections according to specific needs.

- Professional Design: A clean, organized layout that provides a visually appealing and easy-to-read format for both businesses and clients.

- Itemized Billing: Clear sections for listing products or services, quantities, unit prices, and total amounts, helping customers easily understand charges.

Additional Helpful Features

- Payment Terms Section: Include terms such as due dates, late fees, and discounts to ensure clarity and transparency.

- Branding Customization: Add your company’s logo, color scheme, and contact details for a professional and cohesive look.

- Currency and Date Formatting: Automatically adjust currency symbols and date formats based on your location or customer preferences.

These features ensure that every payment request is clear, precise, and professional, improving both customer experience and financial tracking for businesses.

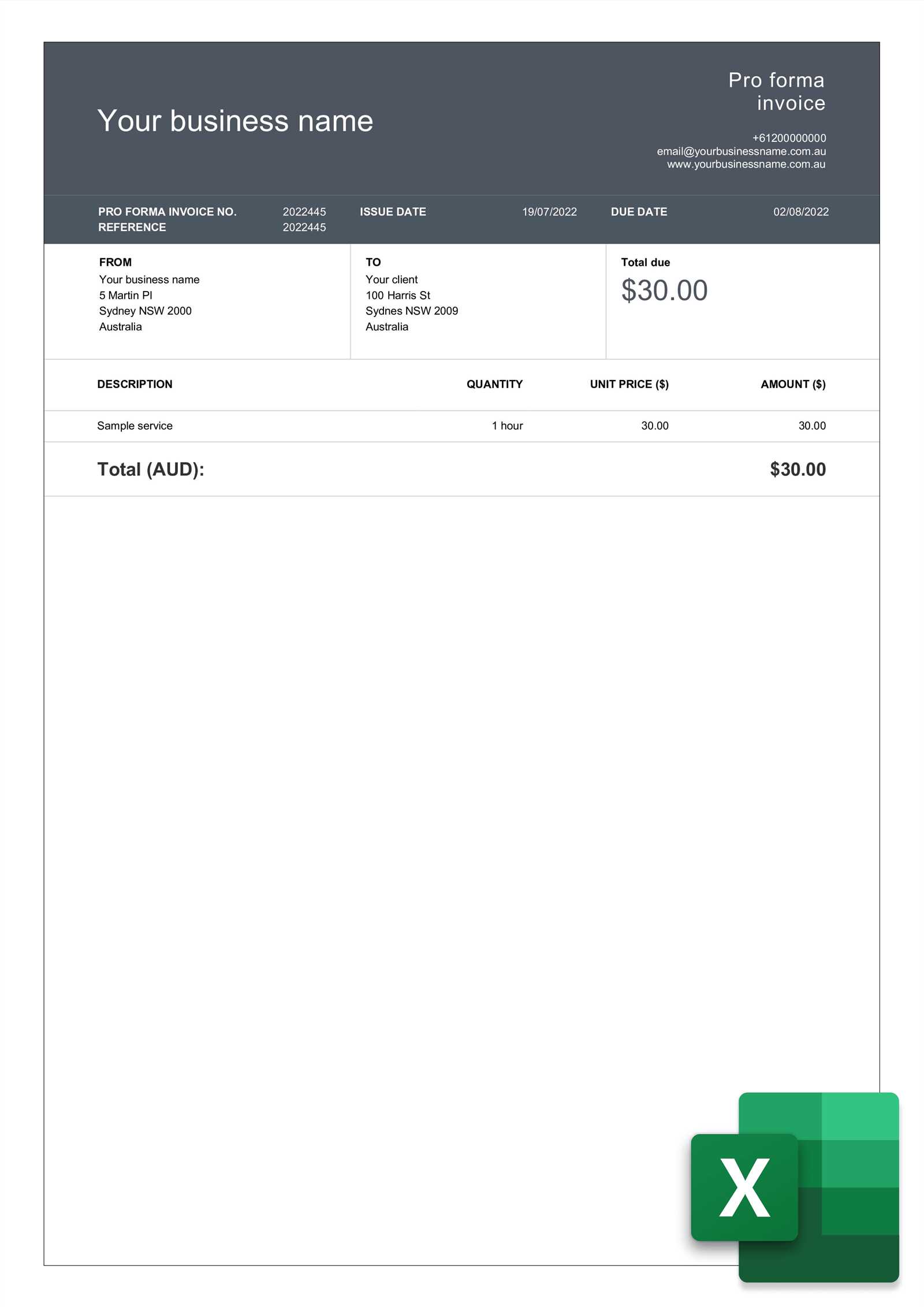

Free Excel Invoice Templates for Download

Accessing no-cost, ready-to-use documents for creating payment requests can save time and ensure consistency in your billing process. These pre-made files can be customized to fit your specific needs, providing an efficient way to request payments and keep financial records organized. Many of these options are easily editable and can be adjusted for various business types.

Where to Find Free Files

- Online Platforms: Many websites offer free downloadable files that can be easily customized to suit your business.

- Business Software Providers: Some accounting and invoicing software platforms offer free resources for creating payment requests, even without subscribing to their full service.

- Freelance Resources: Freelance marketplaces often provide free document templates that suit different industries, from consulting to retail.

Benefits of Using Free Documents

- Cost-Effective: These files come at no cost, providing a budget-friendly solution for small businesses and freelancers.

- Quick Setup: Simply download, customize, and start using the document immediately without the need to design one from scratch.

- Variety of Designs: There are different styles available, allowing you to choose one that aligns with your branding or business type.

These free resources offer an easy way to ensure that your payment requests are professional, consistent, and easy to manage. By downloading and customizing these documents, you can quickly implement an organized and effective billing system without incurring additional costs.

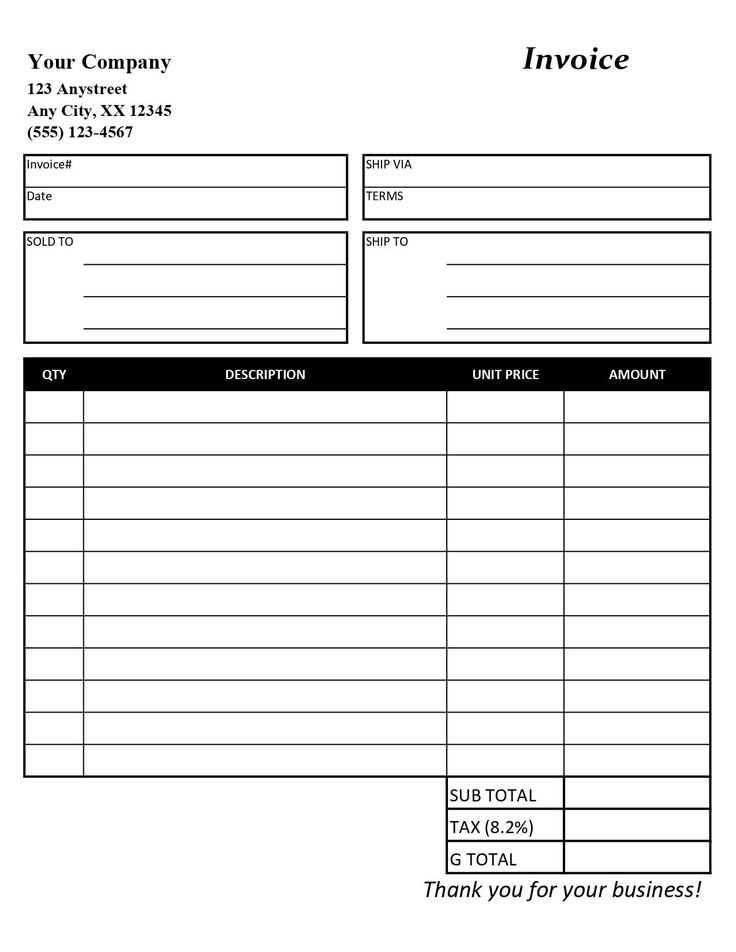

How to Edit Excel Invoice Templates

Customizing a pre-made document for payment requests is a straightforward process that allows you to tailor it to your specific needs. Whether you’re adjusting the layout, updating contact information, or changing the currency, the editing process helps you create a professional, branded document that suits your business requirements. Below are some simple steps to guide you through the process of making these adjustments.

Steps to Edit Your Payment Request Document:

- Open the Document: Start by opening the pre-designed file in your preferred software. If it’s a spreadsheet, ensure that the program you’re using supports all the necessary features for editing.

- Edit Text Fields: Update the fields with your business name, address, phone number, and other contact details. You can also change the recipient’s information.

- Modify Line Items: Adjust the list of products or services you’re billing for, including descriptions, quantities, unit prices, and totals. This ensures that the document reflects your current offerings.

- Adjust Payment Terms: Edit the payment due date, late fees, discounts, and any other terms that apply to your business or client agreement.

- Update Formatting: Make necessary changes to font size, colors, or alignment to match your business branding or aesthetic preferences.

- Save and Reuse: After editing, save the document in a format that suits your needs (such as PDF or Excel). You can now use it for future transactions without the need to re-edit each time.

Editing a pre-built file for payment requests is a simple yet effective way to maintain consistency, professionalism, and efficiency in your financial transactions. With these basic adjustments, you can quickly create personalized payment requests that reflect your business’s unique identity.

Common Mistakes in Invoice Creation

When creating payment request documents, it’s easy to overlook important details that can lead to confusion, delays, or even missed payments. Common errors often occur during the data entry process or while adjusting the layout, and these mistakes can affect both the clarity of the document and the professional image of your business. Recognizing and correcting these issues will help ensure smooth transactions and maintain strong client relationships.

Common Errors to Avoid

| Mistake | Description | Impact |

|---|---|---|

| Missing Contact Details | Leaving out your business contact information or the recipient’s address can cause communication delays and payment issues. | Confusion and potential payment delays |

| Incorrect Amounts or Calculations | Entering wrong product prices or neglecting to calculate taxes and totals properly can lead to errors in the final amount owed. | Incorrect billing and potential disputes |

| Unclear Payment Terms | Vague or incomplete payment due dates, fees, or discounts can cause misunderstanding between you and your client. | Confusion about payment deadlines and terms |

| Unprofessional Design | Using cluttered or inconsistent formatting can make your document difficult to read and seem unprofessional. | Poor business image and negative client experience |

| Not Including Unique Identifiers | Omitting reference numbers, dates, or other identifiers can complicate tracking and organizing financial records. | Difficulties in tracking payments and records |

How to Prevent These Mistakes

- Double-Check Details: Before finalizing your document, always verify that all contact details, amounts, and dates are correct.

- Use Built-in Functions: Make use of built-in formulas to automatically calculate totals, taxes, and other values to reduce the chance of error.

- Be Clear and Specific: Clearly state payment terms, deadlines, and any other necessary information to avoid misunderstandings.

- Professional Formatting: Ensure that the layout is neat, consistent, and easy to read. Use clear fonts, aligned sections, and adequate spacing.

- Include Reference Numbers: Always include unique identifiers such as invoice numbers or project codes for easy tracking and reference.

By paying attention to these common mistakes and taking steps to avoid them, you can ensure that your payment requests are clear, accurate, and professional, helping to maintain strong relationships with your clients and improving the efficiency of your business operations.

Creating Professional Invoices in Excel

Designing effective payment request documents involves more than just entering numbers. A well-organized and visually appealing document not only ensures that all necessary information is included but also helps in creating a positive impression with clients. By following a few simple guidelines, you can create professional documents that reflect your brand and maintain clarity in financial transactions.

- Use a Consistent Layout: A clean, organized layout with clearly defined sections helps the recipient easily identify essential details such as item descriptions, amounts, and payment terms.

- Incorporate Your Brand: Include your business logo, brand colors, and fonts to make the document align with your overall branding strategy.

- Include Detailed Information: Be sure to include specific details about the products or services provided, including quantities, unit prices, and totals. This helps prevent confusion and errors.

- Be Clear About Payment Terms: Clearly state the due date, accepted payment methods, and any late fees to ensure smooth transactions.

- Utilize Automated Calculations: Using formulas to calculate totals, taxes, and discounts will reduce the chance of errors and save time.

By taking the time to incorporate these elements into your documents, you’ll create professional, efficient, and easy-to-understand payment requests. These documents not only provide clarity for your clients but also help keep your financial records organized.

Save Time with Pre-made Templates

Creating detailed payment request documents from scratch can be time-consuming and tedious. However, by using pre-designed documents, you can significantly speed up the process while maintaining professionalism. These ready-made options allow you to focus more on customizing the details and less on formatting and layout, making the overall task more efficient.

- Instant Access to Structured Layouts: Pre-made documents provide a well-organized framework, allowing you to quickly fill in the necessary information without worrying about formatting.

- Reduce Repetitive Work: Once you’ve customized the document to fit your business needs, you can reuse it for multiple transactions, saving time on every new request.

- Streamline Data Entry: With pre-set fields, you can easily enter client information, product descriptions, and payment terms, reducing the chance of missing key details.

- Consistency Across Documents: Using a pre-designed format ensures uniformity in every payment request, which helps build trust with clients and strengthens your brand identity.

- Focus on What Matters: By using an existing framework, you can focus more on personalizing your requests and ensuring the accuracy of the details rather than spending time on the layout or design.

By leveraging pre-made documents, businesses can save valuable time and effort while ensuring that each payment request is both professional and consistent. This approach enhances productivity and allows you to focus on the most important aspects of your transactions.

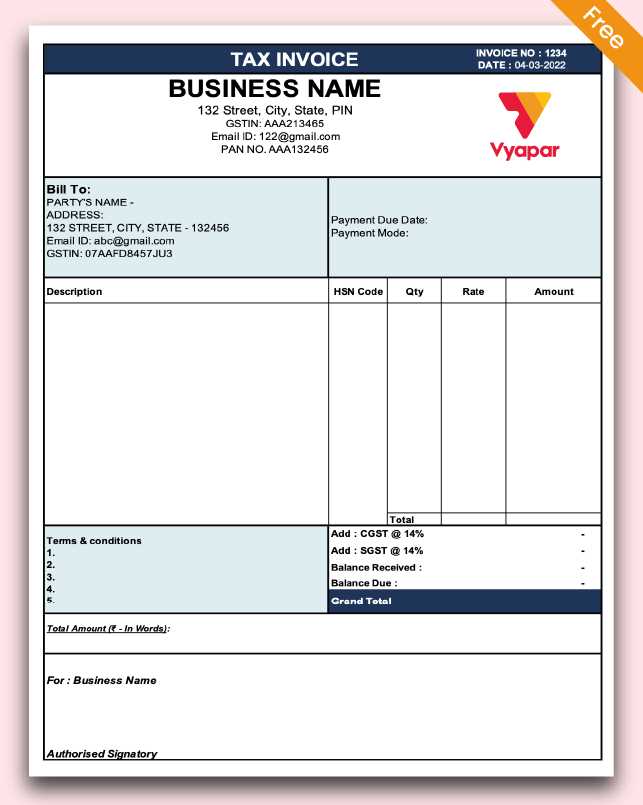

How to Add Tax and Discounts

Including taxes and discounts in your payment requests is essential for accurate billing. These elements can greatly impact the total amount due, and it’s important to apply them correctly to ensure transparency and avoid any confusion. Adding them is a simple process, and understanding how to do so efficiently can make the entire process much easier and more precise.

Adding Taxes

To add taxes, you need to calculate the appropriate tax rate based on the goods or services provided. Typically, tax rates vary by region, so make sure you’re using the correct percentage for your location or industry. Here’s how to calculate tax:

- Determine the tax rate: Check the applicable tax rate for your region or business sector.

- Apply the tax rate: Multiply the cost of the goods or services by the tax rate.

- Display tax clearly: Ensure that the tax amount is shown separately from the total amount to maintain transparency.

Adding Discounts

Discounts are often applied to encourage early payments or as a promotional offer. To add a discount, you must calculate the amount based on the total price or specific items. The discount should be clearly marked on the document, and you should subtract it from the overall total to arrive at the final amount due.

- Calculate the discount: Decide whether the discount is a flat amount or a percentage of the total.

- Apply the discount: Subtract the discount value from the subtotal to determine the final amount.

- Highlight the discount: Ensure that the discount amount is clearly indicated, so the client knows the amount being deducted.

By correctly adding taxes and discounts, you ensure that your payment requests are accurate and easy to understand, ultimately helping to prevent any confusion or disputes with clients.

Tracking Payments Using Excel Templates

Effectively managing payments is a crucial aspect of running any business. Keeping track of who has paid, when they paid, and how much they paid ensures smooth financial operations and helps maintain accurate records. By using structured tools, you can easily monitor these payments, prevent oversights, and stay on top of your accounts receivable.

Setting Up a Payment Tracker

One of the simplest ways to track payments is by creating a dedicated section within your payment request document or using a separate file to log transactions. Here are a few steps to set it up:

- Create a Payment Log: Include columns for the invoice number, client name, payment amount, payment date, and payment method.

- Record Each Transaction: As clients make payments, update the log with the relevant details, ensuring accuracy in both the payment amount and date.

- Use Formulas to Calculate Balances: Set up automatic calculations to track outstanding balances by subtracting payments from the total due amount.

Managing Outstanding Payments

Tracking unpaid balances is equally important. Keeping a close eye on overdue payments ensures that you can follow up with clients in a timely manner. Consider these tips to manage outstanding amounts:

- Highlight Overdue Payments: Use conditional formatting or color coding to easily identify overdue accounts.

- Set Payment Reminders: Set up automated reminders for clients with unpaid balances to encourage timely payments.

- Regularly Update Your Records: Continuously update your payment tracker to reflect new transactions and keep track of any outstanding amounts.

By using a structured method to track payments, you can ensure that you maintain control over your finances, reduce the risk of missed payments, and make the entire billing process more efficient.

Best Practices for Invoice Design

Creating a clear, professional, and visually appealing payment request is essential for ensuring smooth transactions and improving communication with clients. A well-designed document not only makes it easier for clients to understand their charges but also reflects positively on your business. By following some key design principles, you can create documents that are both functional and aesthetically pleasing.

Keep It Simple and Clear

The layout of your payment request should prioritize clarity. Avoid overloading the document with unnecessary information or overly complex formatting. Here are some tips to maintain simplicity:

- Use a Clean Layout: Keep sections well-organized with clear headings and enough white space between elements to avoid clutter.

- Limit Fonts and Colors: Stick to a couple of fonts and avoid using too many colors, as it can distract from the content.

- Use Easy-to-Read Text: Choose legible font types and sizes, ensuring your document is readable both in print and digital formats.

Highlight Key Information

Important details, such as the payment amount, due date, and any additional instructions, should be easy to locate. To ensure your clients don’t miss crucial information:

- Make Key Figures Stand Out: Use bold text or larger font sizes for the total amount due, payment instructions, and deadlines.

- Include Visual Cues: Consider using separators or borders to distinguish between sections (e.g., item list, payment summary, terms).

- Provide Clear Payment Instructions: Make it obvious how clients can make payments, whether it’s online, by check, or via other methods.

By following these best practices, you create a payment request that is professional, easy to understand, and efficient, which can help encourage timely payments and build trust with your clients.

Using Excel for Recurring Invoices

Managing regular payments can be time-consuming, especially when you need to send similar payment requests periodically. By utilizing structured tools, you can streamline the process, reduce manual effort, and ensure consistency in your financial operations. For businesses that deal with subscriptions or repeat clients, automating this process can save valuable time and resources.

Setting Up a Recurring Payment System

To effectively manage recurring payments, you’ll need to set up a system that can automatically track and generate the necessary documents. Here are a few steps to simplify this process:

- Create a Master Sheet: Design a master sheet that includes all the necessary fields for each customer, including payment amount, frequency, and due date.

- Use Formulas for Calculations: Set up formulas to calculate the total amount due based on the frequency of payments, whether weekly, monthly, or quarterly.

- Track Payment Dates: Include columns to track each payment’s due date, and set up reminders for when the next payment is coming up.

Automating the Process

Automation is key when it comes to recurring payments. By creating a template that can be reused, you can reduce the chances of human error and ensure that payments are sent on time. Consider the following:

- Pre-fill Details for Clients: Once your system is set up, you can automatically pre-fill client-specific information each time you need to send a new payment request.

- Use Date Functions: Utilize date functions to calculate future payment dates and adjust the invoice schedule without having to manually enter dates each time.

- Maintain Consistency: Keep the format consistent to make it easier for clients to recognize and process the request promptly.

By using an automated system for recurring payments, you can save time, reduce errors, and improve the efficiency of your financial operations.

Security Tips for Excel Invoice Files

When managing financial documents, it’s crucial to ensure that sensitive data is well-protected. Whether you’re dealing with payment records, customer information, or business transactions, taking the right precautions can help safeguard against unauthorized access and potential data breaches. Proper security practices are essential to maintaining the integrity of your documents and building trust with your clients.

Here are some key strategies to enhance the security of your files:

- Use Password Protection: Always set a strong password for your files to prevent unauthorized access. Ensure the password is unique and not easily guessable.

- Enable Encryption: Encrypt your documents to add an extra layer of protection. This ensures that even if the file is accessed, its contents remain unreadable without the proper decryption key.

- Restrict Permissions: Limit who can view or edit the file. Grant access only to those who need it and set permissions to control the ability to modify or share the file.

- Use Cloud Storage with Secure Backup: Store your files in a secure, encrypted cloud environment with regular backups. This prevents data loss and makes sure that your files are accessible only to authorized users.

- Track Changes: Enable version control and keep a log of changes made to your files. This helps you track modifications and detect any suspicious activity.

By implementing these security practices, you can protect your sensitive data and ensure that your financial documents remain safe from unauthorized access or tampering.

How to Share Excel Invoices Efficiently

Sharing financial documents quickly and securely is vital for smooth business operations. Whether you’re sending payment details, transaction records, or receipts to clients or partners, the process should be both efficient and secure. Choosing the right method to distribute your documents ensures that the information is received promptly and without any risk of errors or unauthorized access.

Here are several effective ways to share your documents:

- Email with Secure Attachments: Sending files via email is one of the most common methods. However, it’s essential to protect the attachment with a password or encryption to ensure security. Use a reputable email provider that offers end-to-end encryption to further protect sensitive information.

- Cloud Storage Services: Cloud platforms such as Google Drive or Dropbox allow you to upload your documents and share a secure link with recipients. You can control access by setting permissions–deciding whether the recipient can view, comment, or edit the file.

- Collaboration Tools: Using business collaboration platforms like Microsoft Teams, Slack, or Google Workspace allows for efficient document sharing within your team or with clients. These tools offer seamless integration and secure sharing options, including file tracking and version control.

- Direct File Sharing Apps: Tools like WeTransfer or SendAnywhere let you send large files directly. These services often come with expiration dates for the shared links, enhancing privacy by limiting access over time.

- Secure FTP Servers: For more sensitive documents, using a secure File Transfer Protocol (FTP) server may be appropriate. This method offers a high level of security for transferring large files over a protected network, with access granted only to authorized users.

By choosing one or a combination of these methods, you can ensure that your financial documents are shared with clients or colleagues quickly and securely, reducing the risk of errors and safeguarding sensitive information.

Integrating Excel Templates with Accounting Software

Connecting your financial spreadsheets with accounting platforms can streamline processes, save time, and improve the accuracy of your records. By integrating these tools, you can easily import and export data, ensuring that all financial information is up-to-date across various platforms. This integration minimizes the need for manual data entry and reduces the risk of errors in your accounts.

Here are the key steps to successfully integrate your financial records with accounting software:

- Exporting Data to Accounting Software: Many accounting platforms allow you to import data directly from spreadsheets. Ensure that the file format and structure align with the software’s requirements to guarantee smooth data transfer. Popular accounting tools like QuickBooks, Xero, or Zoho Books typically support CSV, TSV, or other commonly used formats.

- Automating Data Updates: Some advanced accounting tools offer integration features that allow real-time syncing between your spreadsheets and accounting software. By setting up automatic updates, you can eliminate the need for manual imports and exports, ensuring that all transactions and financial records are consistently reflected in both systems.

- Customizing Integration Settings: Depending on the accounting software you use, you can customize how data is mapped between the spreadsheet and the software. This ensures that each field, such as dates, amounts, and descriptions, is correctly aligned, allowing for accurate accounting entries and reports.

- Using API Connections: For more complex integrations, you can leverage API (Application Programming Interface) connections to link your financial records directly with your accounting system. APIs allow seamless data exchange and real-time updates, improving the efficiency of your accounting operations.

- Ensuring Data Security: When integrating tools, prioritize security to protect sensitive financial information. Use encryption methods, set up user access controls, and ensure that both your spreadsheets and accounting software are secure from unauthorized access.

Integrating your financial records with accounting software is an efficient way to maintain accurate, up-to-date information, saving both time and effort in managing your business’s finances. By automating these processes, you can focus more on decision-making and less on data entry, ensuring a smooth workflow across your financial operations.

Maintaining Consistency in Invoice Formats

Ensuring uniformity in your financial documents is essential for professionalism, clarity, and ease of tracking. A consistent approach across all records not only helps in improving communication with clients but also streamlines the process of managing accounts. By adhering to a standardized format, businesses can avoid confusion, reduce errors, and create a cohesive brand image.

To maintain consistency, consider the following practices:

- Use a Standardized Structure: Establish a fixed layout for all documents, ensuring that essential details like contact information, dates, and itemized charges appear in the same order. This consistency makes it easier for both you and your clients to find and reference key details.

- Define Clear Sections: Group related information together, such as payment terms, product/service details, and taxes. Keeping similar data in uniform sections will improve readability and make the documents easier to review.

- Uniform Fonts and Styling: Stick to one or two fonts and color schemes throughout all documents. Consistency in design contributes to a professional appearance, allowing clients to immediately recognize your business’s documents.

- Set a Naming Convention: Develop a naming system for your financial documents to make them easy to organize and retrieve. For example, using a consistent naming format like “CompanyName_Date” for each record will help in tracking and referencing past transactions.

- Incorporate Branding Elements: Add your company logo, brand colors, and other brand elements consistently across all documents. This reinforces your identity and ensures that every communication carries your business’s branding.

- Maintain Standardized Payment Terms: Clearly define payment terms, such as due dates and late fees, and use the same wording and structure in all records. This avoids any misunderstandings or inconsistencies in client communications.

By adhering to these practices, businesses can create a consistent and reliable system for generating financial documents, improving both internal operations and external relationships with clients.