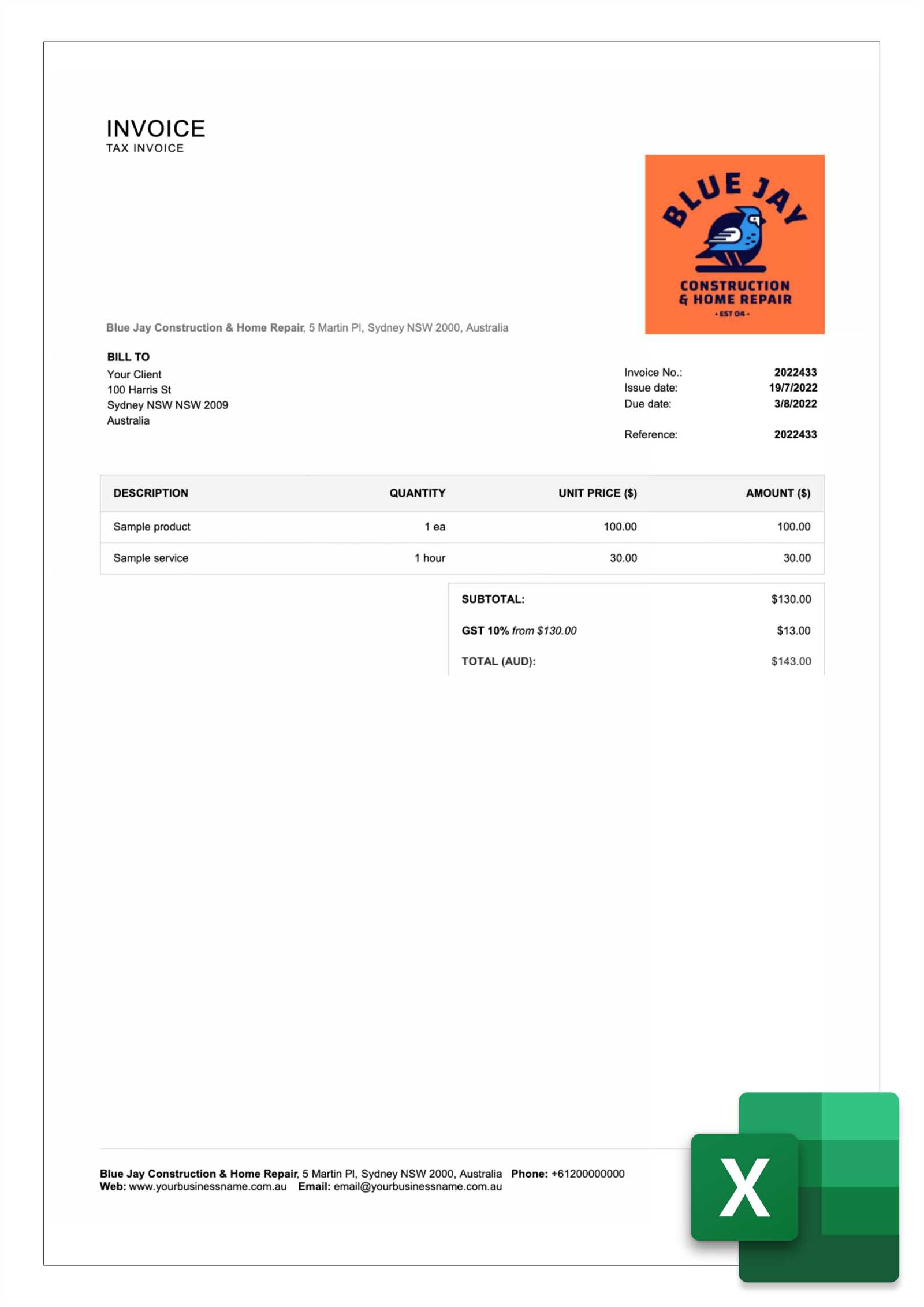

Excel Invoice Template Australia for Efficient Invoicing

Efficient billing is essential for any business, large or small. Using ready-made forms can simplify this process, allowing companies to manage payments smoothly without creating complex structures from scratch. These forms not only reduce the time spent on administrative tasks but also help maintain a professional image, crucial for customer trust and satisfaction.

Customizable forms designed for financial documentation allow businesses to easily track payments, organize records, and ensure accurate financial summaries. By adapting a pre-made format, companies can achieve a consistent layout that meets local standards while tailoring it to their

Ready-Made Billing Solutions for Australian Businesses

For many companies, creating structured billing documents that align with industry standards can be time-consuming. Ready-made billing solutions simplify this task, providing a streamlined way to issue professional documents that communicate essential payment details. These tools support businesses in organizing finances efficiently, ensuring every document includes necessary information and presents it in a clear, user-friendly format.

Benefits of Using Structured Billing Forms

Adopting pre-designed formats offers several advantages. Businesses save time by not needing to design billing layouts from scratch, allowing employees to focus on core tasks. These solutions also improve accuracy, as they include fields for every essential detail, reducing the risk of errors or missing information. Moreover, using a standardized format helps build credibility, presenting clients with documents that reflect professionalism and trustworthiness.

Customization for Local Compliance

In the context of Australian regulations, these structured billing forms can be customized to ali

Benefits of Using Digital Spreadsheets for Billing

Digital spreadsheets have become essential for managing business finances, offering a flexible platform to handle billing efficiently. With customizable formats and automated functions, these tools allow businesses to stay organized and reduce the time spent on manual data entry. Companies can quickly generate documents that communicate payment details clearly, making it easier for clients to understand charges and due dates.

Time efficiency is one of the primary advantages of using spreadsheets for billing. Ready-made structures allow businesses to prepare professional documents in minutes, saving time compared to creating each one individually. Additionally, many functions support automated calculations, which minimize human error and ensure accuracy in totals, taxes, and other essential figures.

Enhanced data tracking is another benefit. Digital spreadsheets can store and organize past records, making it easier to track payments, manage accounts, and maintain comprehensive financial documentation. This setup provides quick access t

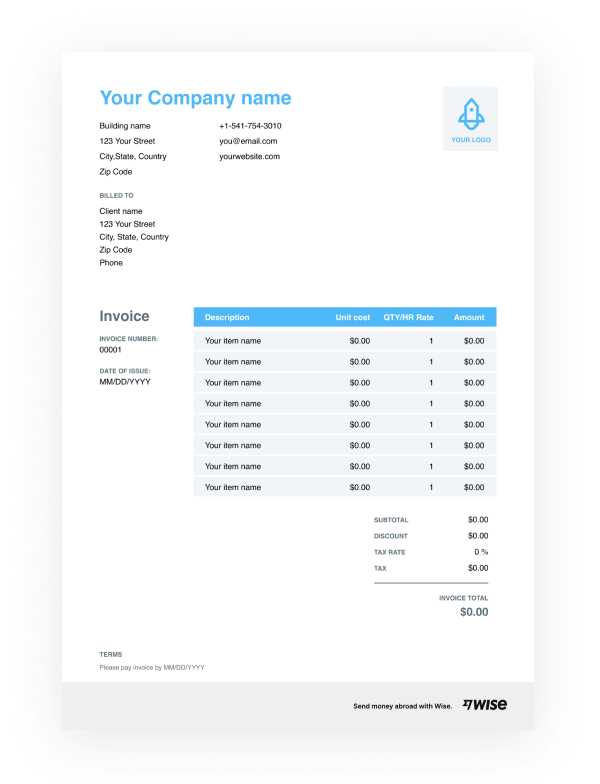

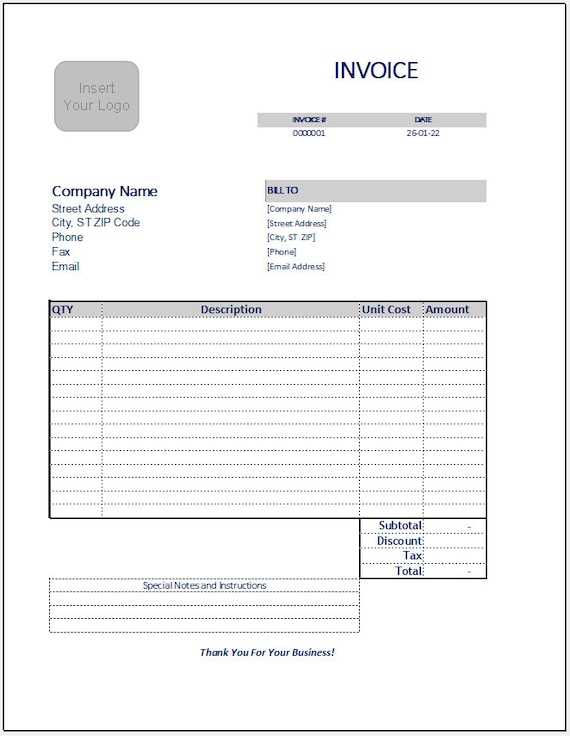

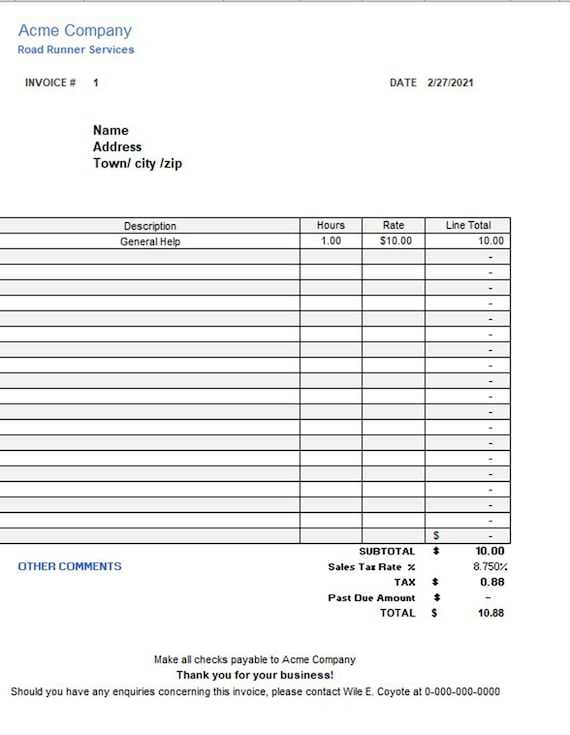

How to Create a Billing Document in a Spreadsheet

Creating a structured billing document in a digital spreadsheet is a straightforward process that can greatly simplify financial management for businesses. By setting up a clear, organized format, businesses can ensure that all essential payment details are included and easy to understand. With the flexibility of a spreadsheet, customization options allow for a tailored approach that fits specific needs, from layout adjustments to branding elements.

To start, open a blank spreadsheet and set up the basic structure. Create sections for business information, client details, itemized charges, and payment terms. Adding automated calculations for totals and taxes can improve accuracy and efficiency, reducing manual work and minimizing errors. Use clear headings to make each section easy to read, ensuring that important details like contact information and payment deadlines are

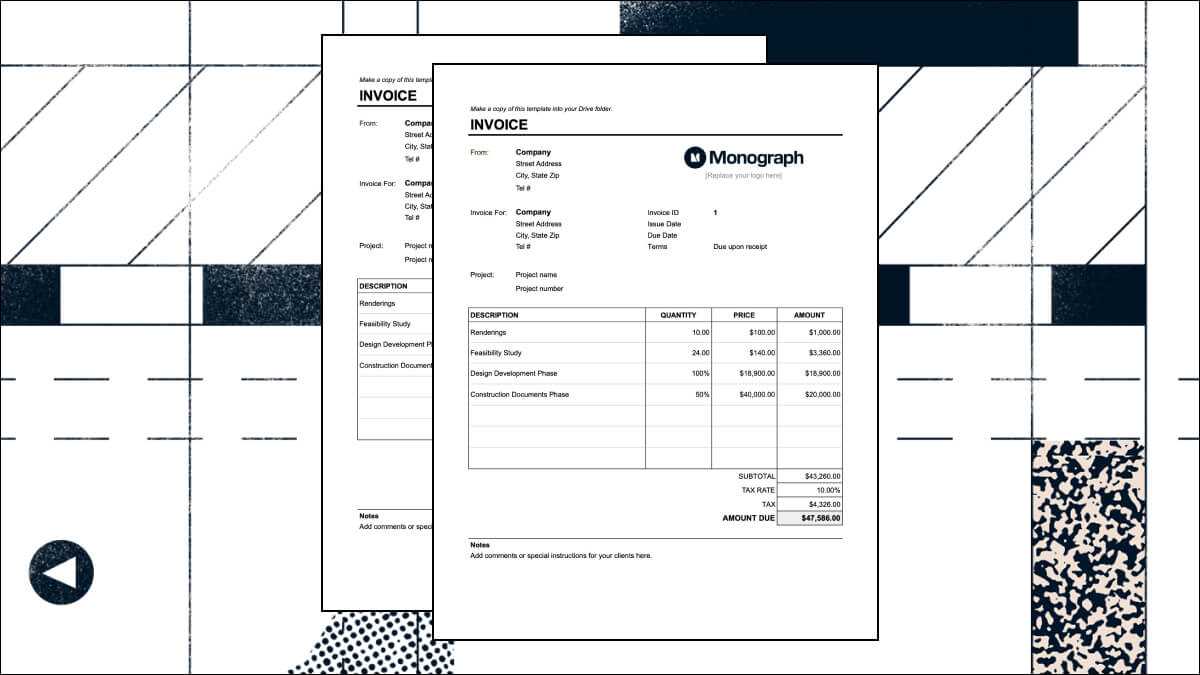

Features to Look for in Templates

When selecting a pre-made format for billing, it’s essential to choose one that includes features tailored to business needs. A well-structured layout not only improves organization but also enhances the document’s clarity, making it easier for clients to understand charges and payment terms. The right features can simplify the entire billing process, from initial setup to payment tracking.

A strong billing form should include automated calculation fields to ensure accuracy in totals and taxes, reducing the chance of manual errors. Look for formats with designated sections for client information, payment terms, and due dates, which help keep the document clear and professional. This setup also

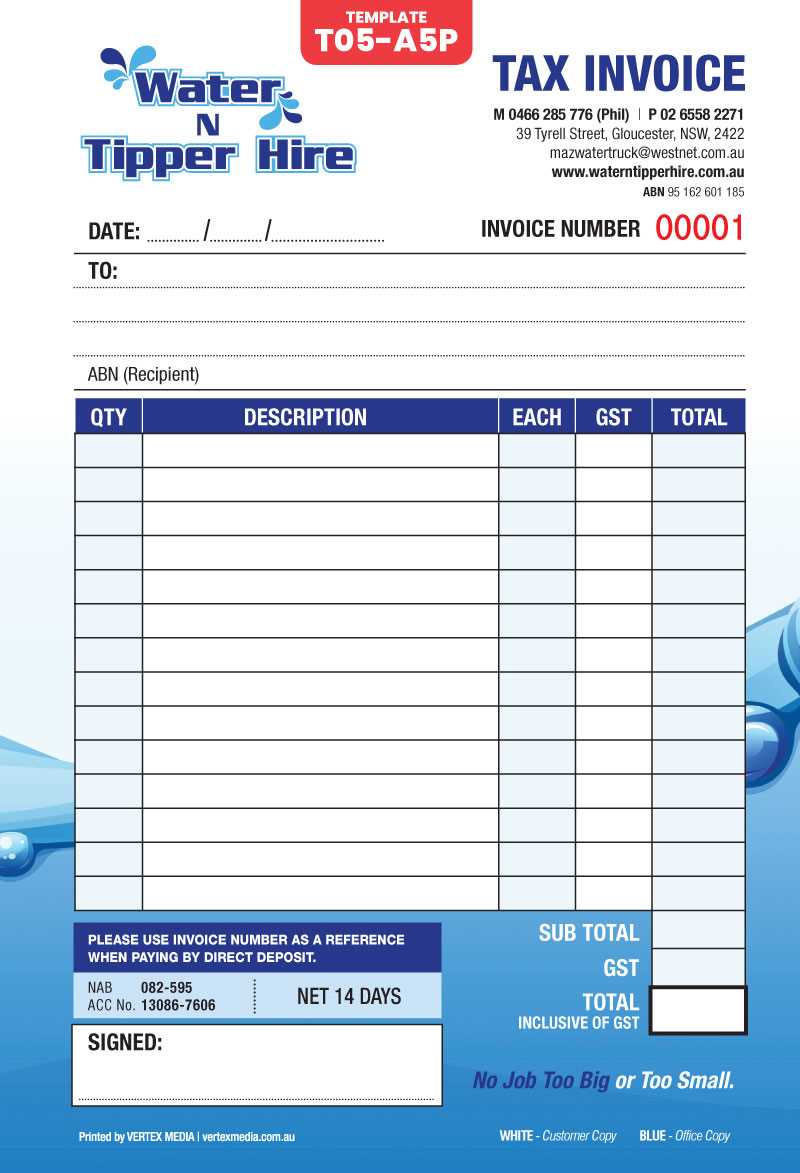

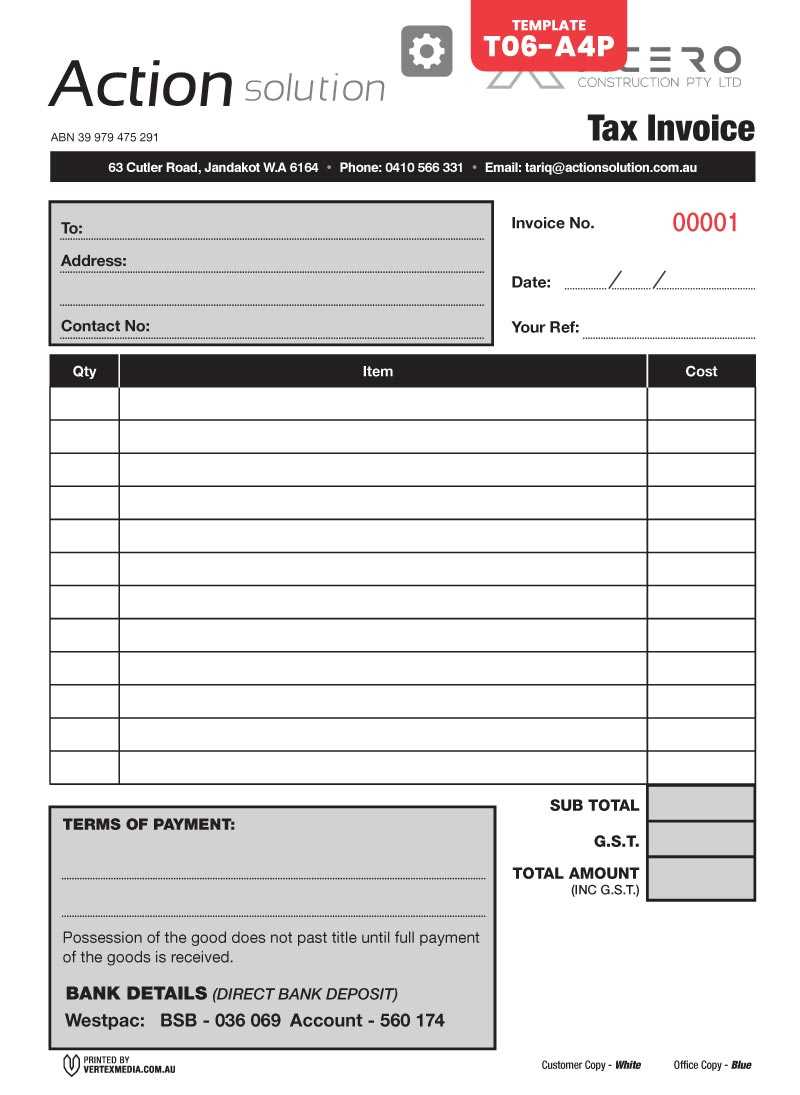

Best Free Billing Formats for Australian Businesses

For businesses looking to streamline their billing process without incurring extra costs, free pre-designed forms offer a convenient and efficient solution. These layouts provide all essential sections, making it easy to create professional-looking documents that meet standard business needs. By choosing formats specifically tailored for local requirements, companies can ensure compliance with tax and accounting regulations.

One popular option includes customizable forms that allow for quick input of key details, such as business and client information, service descriptions, and payment terms. Many free options also offer built-in calculations, automatically updating totals and taxes as data is entered, saving valuable time and minimizing the risk of errors. This makes them particularly helpful for small businesses or freelancers who need to manage their billing independently.

Other useful choices include forms that support visual customization, enabling businesses to add logos, adjust

Customizing Your Billing Document Format

Personalizing a billing document can greatly enhance its professional appearance and align it with your company’s branding. By adjusting key elements, you can ensure that every document you send reflects your business identity, while also ensuring that all necessary information is clearly presented for the client’s ease of understanding. Customization allows businesses to streamline processes while maintaining consistency across all transactions.

Adjusting Layout and Design

The first step in customization is modifying the layout to suit your needs. This may involve resizing columns, adding or removing sections, and altering font styles or sizes to improve readability. You can incorporate your business logo and choose colors that match your brand’s identity, ensuring the document looks professional and cohesive. Additionally, you can adjust the position of elements, such as moving the payment terms or due date to make the most important information stand out.

Adding Custom Fields and Calculations

Another important customization is adding specific fields relevant to your business. This could include additional charges, discounts, or project-specific details. Implementing automated calculations ensures that totals, taxes, and other important values are updated instantly when you make changes, reducing errors and saving time. By tailoring your form to include all necessary information, you can ensure that your billing process is both efficient and clear.

Tips for Professional Billing Document Design

Creating a polished and professional billing document is crucial for making a good impression on your clients. A well-designed document not only reflects your business’s attention to detail but also ensures that important information is easily accessible and clear. Following a few design principles can help you achieve a clean and effective layout that enhances both the visual appeal and functionality of your documents.

- Keep it simple and organized: Avoid clutter by limiting the amount of information on the document. Use clear headings and spacing to separate sections like contact details, itemized charges, and payment terms.

- Use readable fonts: Choose easy-to-read fonts for both headers and body text. Stick to simple styles and avoid using more than two or three fonts to maintain consistency.

- Highlight key details: Make important information, such as the due date and total amount, stand out. Use bold or larger font sizes to emphasize these details without overwhelming the reader.

- Brand your documents: Add your business logo and use your brand’s color scheme to make the document look consistent with your overall marketing materials. This reinforces your business identity and adds professionalism.

- Ensure clarity: Organize data logically, making sure the charges are easy to follow. If necessary, include brief descriptions for each line item to avoid confusion.

By following these tips, you can ensure your billing documents not only look professional but also effectively communicate all necessary details to your clients.

Adding Your Business Information to Billing Documents

Including accurate and clear business details on each billing document is essential for establishing credibility and ensuring smooth communication with your clients. Properly formatted business information not only helps clients recognize the document as official but also provides them with the necessary details to contact you for any follow-up queries or payments.

Key Details to Include

To create a comprehensive and professional document, make sure to include the following information:

- Business Name: Clearly state your full business name at the top of the document. This helps clients identify your company at a glance.

- Contact Information: Include your phone number, email address, and business address. This ensures clients can reach you easily for inquiries.

- ABN or ACN: In some regions, it’s necessary to include your Australian Business Number (ABN) or Australian Company Number (ACN) for legal purposes.

- Website: Adding your website link is a good way to guide clients to additional resources or services.

Positioning the Information

The placement of your business details is crucial for a clean and professional layout. Typically, this information is placed at the top of the document, either in the header section or aligned to the left. This makes it easy for clients to quickly access your contact details if needed.

By ensuring that your business information is included and well-positioned, you can create clear, official documents that foster trust and professionalism with your clients.

How to Automate Billing in Spreadsheet Software

Automating your billing process can save you time and reduce errors, allowing you to focus on other aspects of your business. By utilizing certain features in spreadsheet software, you can set up systems that handle calculations, reminders, and other repetitive tasks automatically. This can streamline the way you manage payments and ensure that your clients receive accurate, timely documents.

Steps to Automate Billing

Follow these steps to automate your billing process and create a more efficient workflow:

- Set up a template: Create a base document that includes all the essential sections for your billing system, such as client details, payment terms, and itemized charges.

- Use formulas for calculations: Add formulas to automatically calculate totals, taxes, and discounts. This ensures that figures are always accurate and up-to-date.

- Integrate date functions: Use date functions to automatically update the due date and track overdue payments. You can set the document to show the next payment date based on your billing cycle.

- Set reminders: Implement conditional formatting or alerts that highlight overdue payments. This will help you keep track of outstanding amounts without manual intervention.

Additional Automation Features

- Link client details: Store client information in a separate sheet and link it to your billing document. This way, when you need to send a new bill, the client’s details will automatically populate in the relevant sections.

- Create recurring billing cycles: If you offer subscription-based services, you can set up automated recurring cycles to generate new documents at specific intervals.

By automating key aspects of the billing process, you can significantly reduce the amount of manual work required while improving accuracy and efficiency in your business.

Managing Taxes in Australian Billing Documents

Properly handling taxes in your billing documents is crucial for compliance with local regulations and to avoid errors that could affect your business finances. In Australia, taxes such as the Goods and Services Tax (GST) need to be correctly calculated and presented on any financial record. By following a few guidelines, you can easily incorporate the correct tax rates and ensure your documents are both accurate and professional.

Understanding GST and Other Tax Rates

In Australia, the Goods and Services Tax (GST) is applied to most goods and services. It is important to be familiar with the tax rates and know how to calculate the tax amount for the services or products you provide. The current GST rate is typically 10%, but some goods and services may be exempt or subject to different rates.

- Standard rate: Most goods and services are taxed at a rate of 10%.

- Exempt items: Certain goods, such as basic foods and medical services, are GST-free.

- Reduced rate: Some items, such as certain health and education services, may be taxed at a reduced rate.

Incorporating Tax Information into Billing Documents

When preparing your billing documents, ensure that the tax is clearly stated. This transparency helps avoid confusion with clients and ensures that you are meeting legal requirements. Here’s how to manage tax information effectively:

- Clearly label tax sections: Include separate sections for the goods or services provided and the tax amount to make it clear what the client is being charged.

- Ensure tax is added correctly: Use the correct tax rate and apply it to the subtotal of your charges to get the total amount owed.

- Provide tax identification details: In some cases, you may need to include your Australian Business Number (ABN) and specify whether the transaction is subject to GST.

By following these steps and accurately managing taxes in your billing documents, you can ensure smooth transactions with clients and maintain compliance with Australian tax laws.

Tracking Payments with Billing Systems

Keeping track of payments is a crucial aspect of managing your finances and maintaining a clear record of transactions. A well-organized system allows you to monitor which clients have paid and which payments are still outstanding. Using structured tools helps you stay on top of overdue payments and ensures that no transaction is missed.

Creating a Payment Tracking System

A payment tracking system helps you to track and categorize payments for services or goods provided. To create an efficient system, it’s important to have the following information readily available:

- Client details: Include customer names, contact information, and transaction reference numbers.

- Payment dates: Clearly state the due date for each payment to avoid confusion.

- Amount paid: Record the exact amount each client has paid, ensuring it’s matched against the correct services or products.

- Outstanding balance: Keep track of any unpaid amounts and due dates for follow-up.

Using Tools to Simplify Payment Tracking

There are various ways to simplify the payment tracking process, including using pre-built systems that offer automatic updates. These tools can help you:

- Track multiple payments: Easily monitor payments from multiple clients in one place, categorizing them by date or status.

- Automate reminders: Set up automated payment reminders for overdue amounts to reduce manual follow-ups.

- Generate reports: Create detailed financial reports that summarize your income, outstanding payments, and payment history.

By implementing a simple and effective tracking method, you can stay organized and reduce the likelihood of missing payments or facing financial discrepancies.

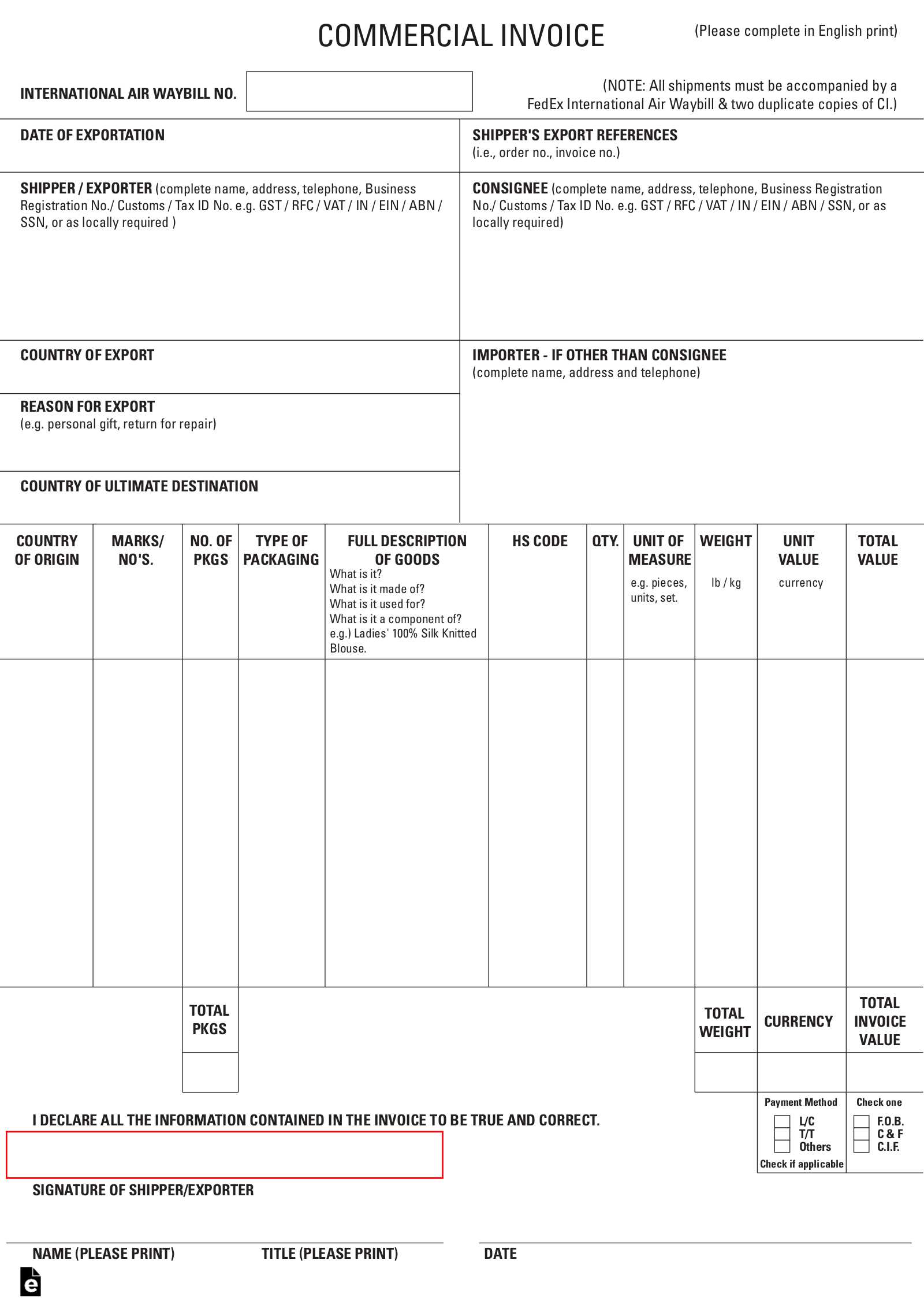

Essential Elements of an Australian Invoice

When creating a document for billing, certain components are essential to ensure the document is clear, professional, and legally compliant. These elements help both the sender and recipient to understand the payment details and ensure proper processing. Including all necessary information avoids confusion and ensures a smooth transaction process.

Below are the key components that should be included in any billing document:

- Business Information: This includes the name, address, and contact details of the business issuing the bill. It also includes the Australian Business Number (ABN) if applicable.

- Client Details: The recipient’s name or business name, address, and contact information must be included to avoid any confusion over who the payment is for.

- Unique Identification Number: Each document should have a unique reference number for easy tracking and future reference.

- Itemized List of Goods or Services: Clearly list the products or services provided, along with quantities, individual prices, and any applicable taxes.

- Payment Terms: Specify when the payment is due and the accepted methods of payment. It’s also important to note any late fees or discounts for early payment.

- Total Amount Due: Provide the final amount that the recipient must pay, including taxes and any additional charges or discounts.

Including these essential elements ensures that your billing document is complete, professional, and easy to understand. It also helps ensure that both parties are on the same page regarding the terms and expectations.

Common Mistakes in Invoice Templates

When creating a document for billing purposes, there are several common errors that can arise. These mistakes can lead to confusion, delays in payment, or even legal complications. It’s important to be mindful of these potential pitfalls to ensure that all transactions are smooth and hassle-free. Below are some of the most frequently encountered mistakes that should be avoided.

Missing or Incomplete Information

- Omitting Contact Information: Failing to include your business or the client’s full contact details can make it difficult for the recipient to reach out for clarification or payment.

- Missing Reference Number: Every document should have a unique reference number for identification purposes. Without it, tracking payments can become complicated.

- Incomplete Item Descriptions: Vague descriptions of goods or services can lead to disputes or confusion about what has been provided.

Incorrect or Confusing Pricing

- Inaccurate Calculations: Simple math errors, such as incorrect totals or tax calculations, can undermine the credibility of the document and cause payment delays.

- Not Listing Taxes Separately: If taxes are included in the overall total without a separate line item, it can create confusion and lead to legal issues, especially if you’re required to show tax details for compliance purposes.

- Not Providing Payment Terms: Without clear payment deadlines or instructions, clients might delay payments or misunderstand the expectations.

By avoiding these common mistakes, you can ensure that your billing documents are professional, accurate, and easy to understand, which will help facilitate timely payments and maintain positive relationships with your clients.