Top Excel for Mac Invoice Template for Simple Invoicing

Managing payments and organizing financial transactions is crucial for businesses of all sizes. One of the easiest ways to stay on top of your finances is by using digital tools designed to simplify the task. Creating professional-looking documents to request payments can save time, reduce errors, and provide a clear record of transactions.

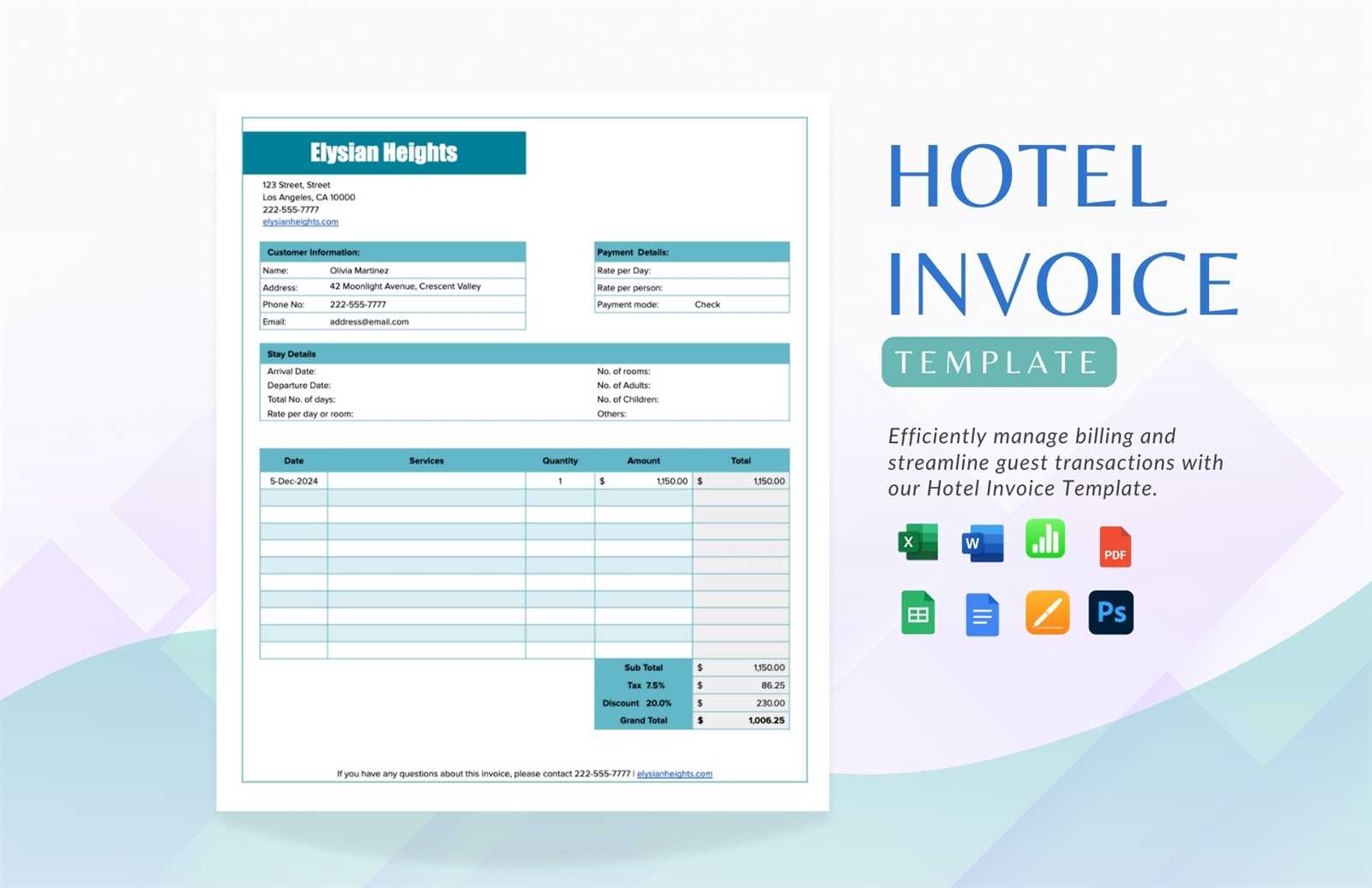

By utilizing pre-designed spreadsheets, you can quickly generate professional documents that include all necessary details like amounts due, item descriptions, and payment terms. These customizable files allow you to tailor each document to your specific needs, ensuring that your business maintains a polished, consistent appearance when dealing with clients.

Whether you’re a freelancer, small business owner, or managing a larger company, using streamlined documents for financial requests can enhance productivity and ensure accuracy. With just a few adjustments, you can create personalized documents that help maintain a smooth flow of transactions.

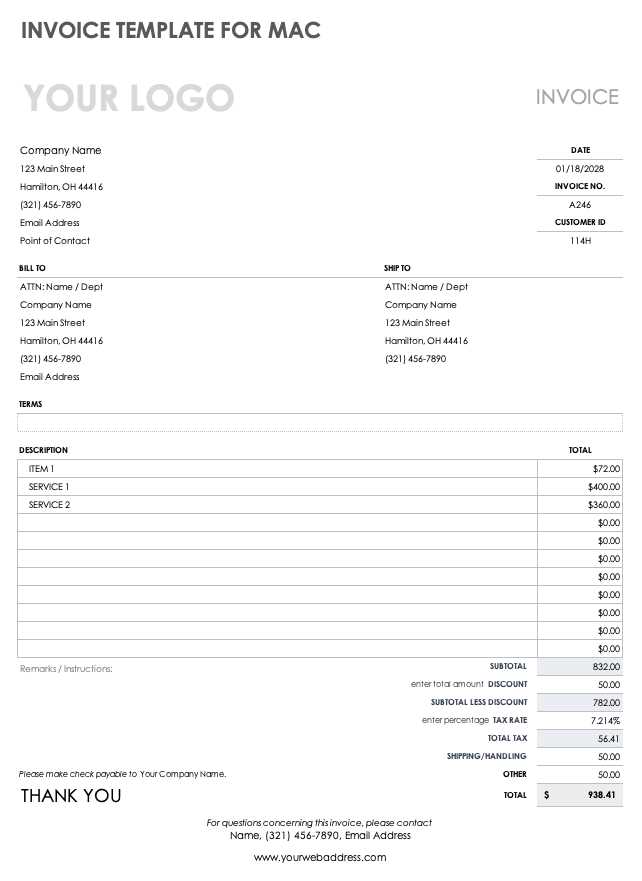

Invoice Document Overview

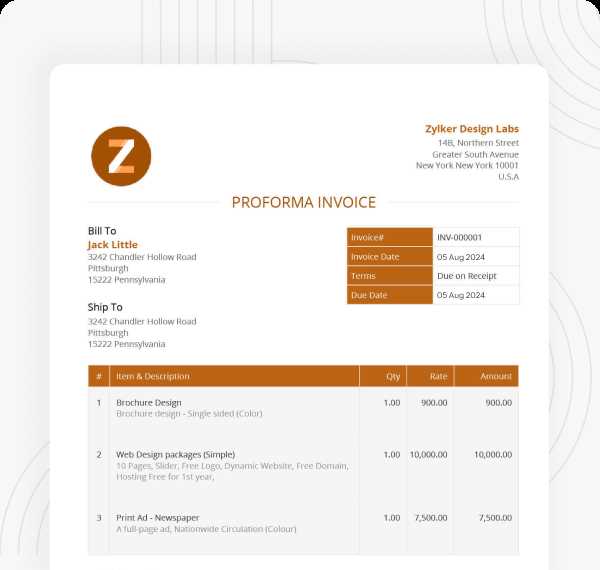

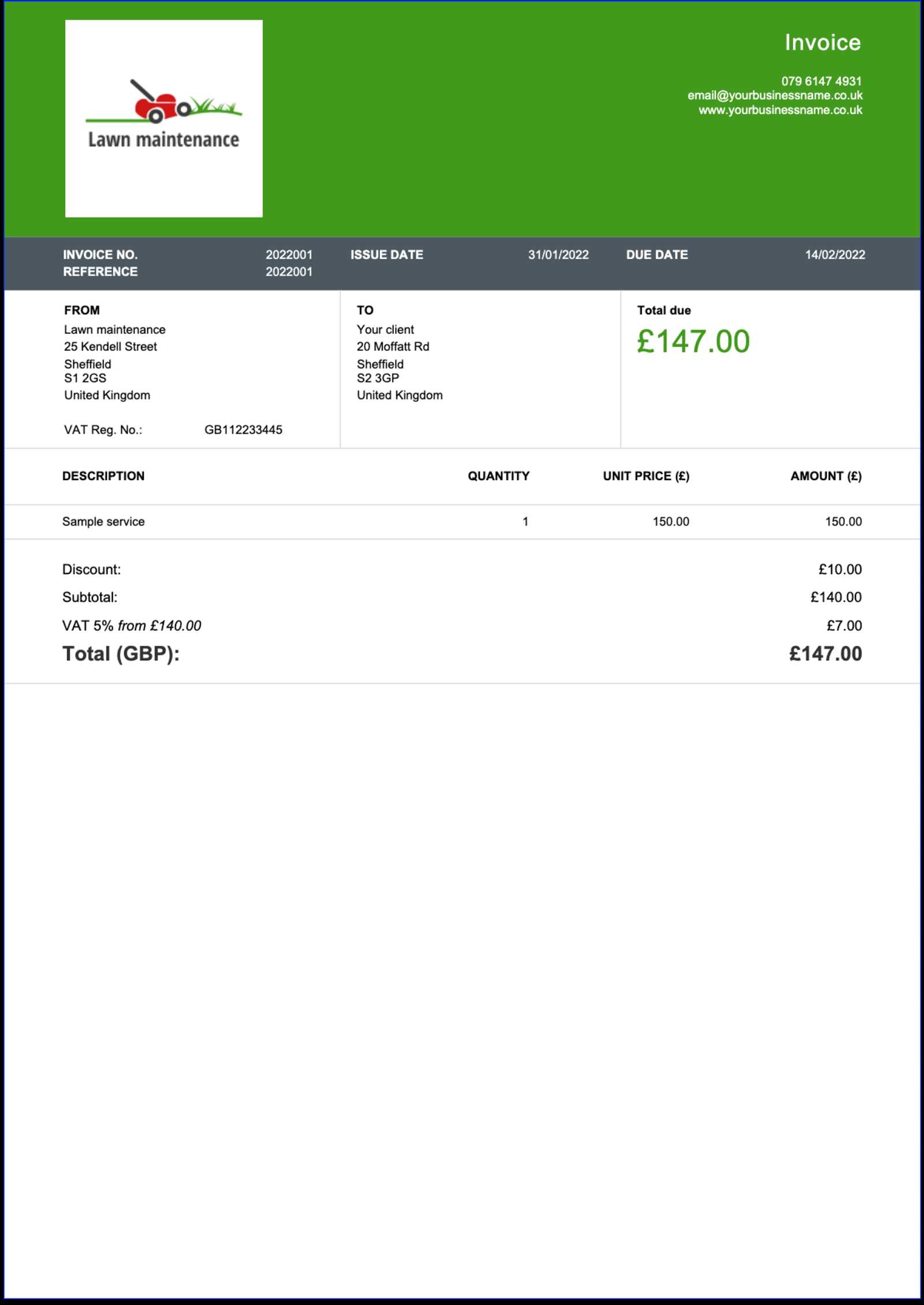

Creating professional billing documents is essential for ensuring smooth financial transactions. With customizable solutions available in spreadsheet programs, managing the details of a payment request has never been easier. These solutions are designed to save time and reduce errors, offering an efficient way to handle your financial needs.

The tools provide a clean and organized layout that allows businesses to quickly input essential information such as amounts, descriptions, payment terms, and due dates. By utilizing ready-made formats, you can focus more on the business aspect of transactions rather than spending time formatting and designing each document from scratch.

Such systems are especially helpful for individuals or small businesses that need to streamline their processes. The ease of use and flexibility make these tools an excellent choice for managing multiple transactions efficiently, ensuring that each document looks professional and contains all necessary details for smooth processing.

Why Use Templates for Invoicing?

Having a structured, pre-designed format to create payment requests can drastically improve the efficiency and accuracy of your financial processes. Instead of starting from scratch each time, ready-to-use formats allow businesses to quickly input relevant data, ensuring consistency and professionalism with every document.

Time-Saving Efficiency

One of the key advantages of using such solutions is the significant time saved. With everything laid out in a clear and organized manner, you can focus on entering the details rather than spending time on formatting or design. This streamlined process allows for faster completion of tasks, which is especially important for businesses that handle numerous transactions.

Consistency and Professionalism

These pre-made documents help maintain a consistent look for every financial interaction. Whether you’re a freelancer or managing a small business, ensuring that all your documents follow the same structure promotes a trustworthy and professional image to clients. This consistency can also help in building strong, reliable business relationships.

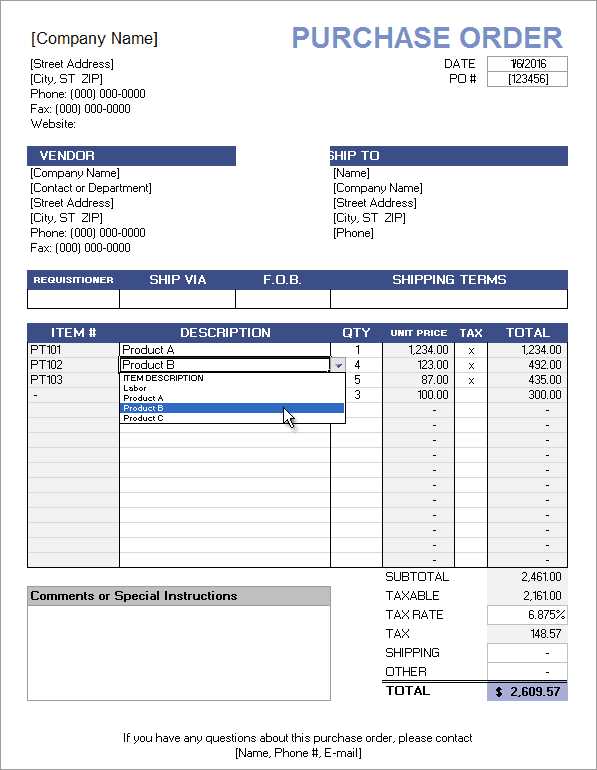

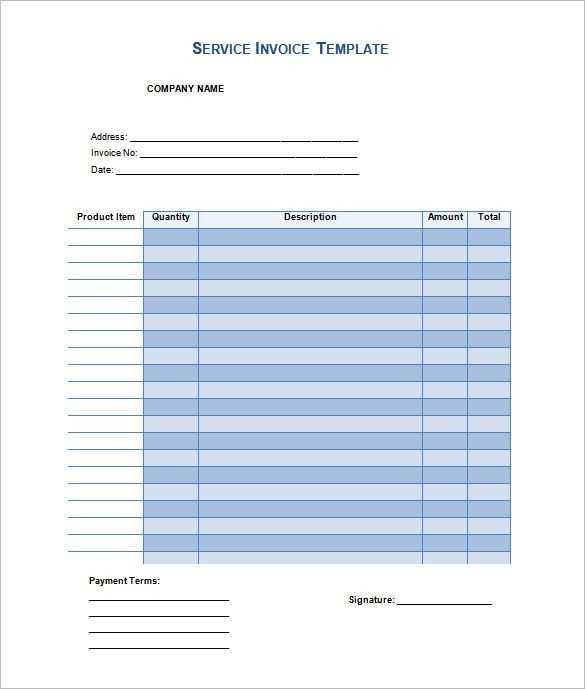

How to Choose the Right Format

Selecting the right structure for your payment requests is crucial to ensure that all necessary details are clearly presented while maintaining a professional appearance. The ideal format should meet your specific needs, whether you’re dealing with simple or complex transactions, and should make it easy for clients to understand payment terms and other important information.

Consider the Level of Detail

When choosing a format, it’s important to think about the complexity of your business. If your transactions are straightforward, a minimalist design might suffice. However, if you’re dealing with multiple items, taxes, or discounts, you may want to opt for a more detailed layout that can accommodate these variables easily.

Focus on Customization Options

Ensure the format allows flexibility in customizing sections such as payment terms, dates, and business details. The ability to quickly edit and adjust the layout ensures you can tailor the document for each client or project, making it a versatile option for various business scenarios.

Key Features of Billing Document Formats

Using pre-designed document structures offers several advantages when managing financial requests. These tools come with a variety of features that help businesses stay organized, reduce errors, and ensure consistency across all transactions. Whether you are sending a simple payment request or a detailed breakdown, these features make the process smoother and more professional.

Customizable Fields

One of the most important features of these formats is their flexibility. You can easily edit and customize fields to match your specific needs, from adding company details to modifying the payment terms. This level of customization ensures that each document is tailored to your business and client requirements.

Automated Calculations

Many of these solutions offer built-in formulas that automatically calculate totals, taxes, and discounts, reducing the chances of human error. This feature not only saves time but also ensures that your financial documents are accurate and up-to-date, with minimal manual input.

Professional Layout

These formats are designed to create visually appealing documents that convey professionalism. With a clean, organized structure, they help present financial information clearly, making it easy for clients to understand the breakdown of charges and payment details at a glance.

Customizing Formats for Your Business

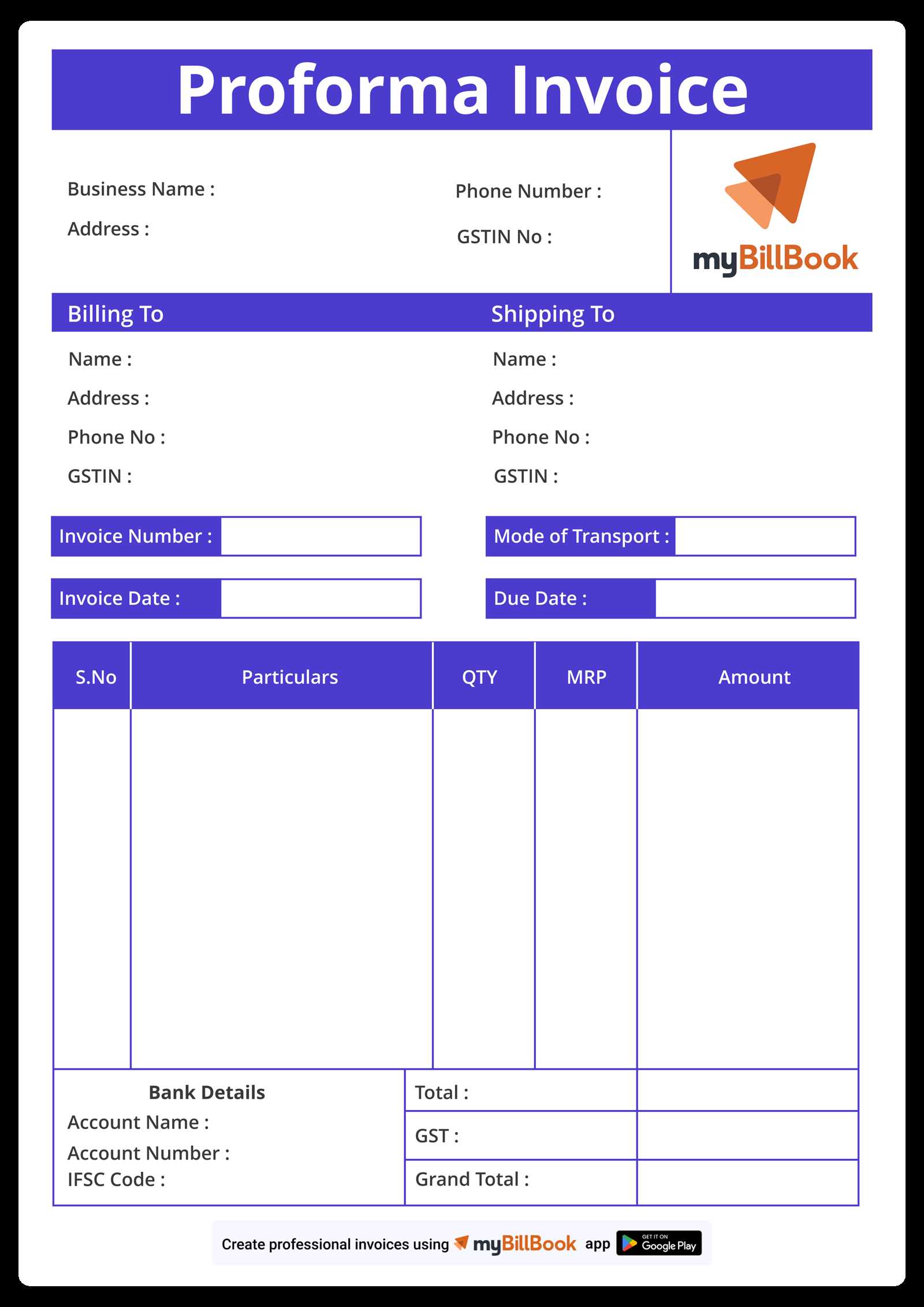

Adapting pre-designed structures to meet your specific business needs is essential for creating documents that reflect your brand and operations. Customization allows you to incorporate unique elements like logos, colors, and specific terms that match the style and tone of your company. By tailoring these solutions, you can ensure consistency and professionalism across all your financial requests.

Here are some ways you can personalize your document layout:

- Business Information: Update fields with your company name, address, and contact details to make each document specific to your business.

- Logo and Branding: Add your company logo and choose colors or fonts that align with your brand identity.

- Payment Terms: Customize payment terms, including due dates, late fees, and discount offers, to fit your business model.

- Itemized Details: Modify the sections for products or services, including descriptions, pricing, and quantities, to suit the types of transactions you handle.

These adjustments make the document not only functional but also a reflection of your brand’s professionalism, helping to build trust and credibility with clients.

Saving Time with Pre-made Formats

Using ready-made solutions can significantly reduce the time spent on preparing financial documents. These pre-designed structures are set up with all the necessary fields and calculations, allowing you to focus on entering the relevant information without worrying about formatting or layout. This streamlined approach makes it easier to produce accurate and professional documents quickly.

Efficiency Boost

Instead of starting from scratch each time you need to send a payment request, pre-made formats come with essential sections already set up. This not only speeds up the process but also ensures that no important detail is missed. Here’s how these solutions can save you time:

- No Need for Formatting: The structure is already set, so there’s no need to spend time adjusting margins, fonts, or colors.

- Built-in Calculations: Automatic totals and taxes help avoid manual calculations, reducing errors and saving time.

- Consistency Across Documents: Using the same format for every transaction saves you from reinventing the wheel for each new request.

More Time for Your Business

By cutting down on the time spent preparing payment documents, you free up valuable resources to focus on other aspects of your business. Whether it’s acquiring new clients, managing operations, or improving services, the time saved with pre-designed structures can be better spent growing your business.

Step-by-Step Guide to Format Setup

Setting up a pre-designed structure for your financial documents is a simple process that can be completed in just a few steps. With the right guidance, you can customize the layout to meet your business’s specific needs. This streamlined process ensures that your documents are consistent, professional, and accurate every time you create one.

Step 1: Open the Pre-designed Structure

The first step is to select and open the pre-designed format you want to use. These formats typically come with predefined fields for business information, itemized charges, and payment details. Once opened, you can begin customizing it for your specific needs.

Step 2: Enter Your Business Information

Start by filling in the basic details such as your company name, address, and contact information. This is crucial for ensuring that your clients can easily reach you if they have any questions about the payment request.

- Company Name: Add your business name at the top of the document.

- Contact Information: Include your phone number, email, and website, if applicable.

- Logo: Insert your company logo for a more personalized and professional touch.

Step 3: Add Payment Details

Next, fill in the payment specifics such as the products or services being billed, the quantity, and the price. Many formats will include automatic calculation features to ensure the totals are accurate.

- Itemized List: Enter descriptions of the products or services.

- Price and Quantity: Input the unit price and quantity for each item.

- Discounts and Taxes: If applicable, include any discounts or tax rates.

Step 4: Review and Save

After entering all the relevant information, review the document to ensure accuracy. Check for any missing details, errors in calculations, or formatting issues. Once everything looks good, save the document with a name that reflects the transaction, making it easier to find later.

Inserting Your Business Information

Accurate and complete business information is essential for creating professional financial documents. This section ensures that your clients can easily identify your company and contact you if necessary. Including all relevant details from the outset helps build trust and credibility, while also ensuring clarity in the communication of payment terms.

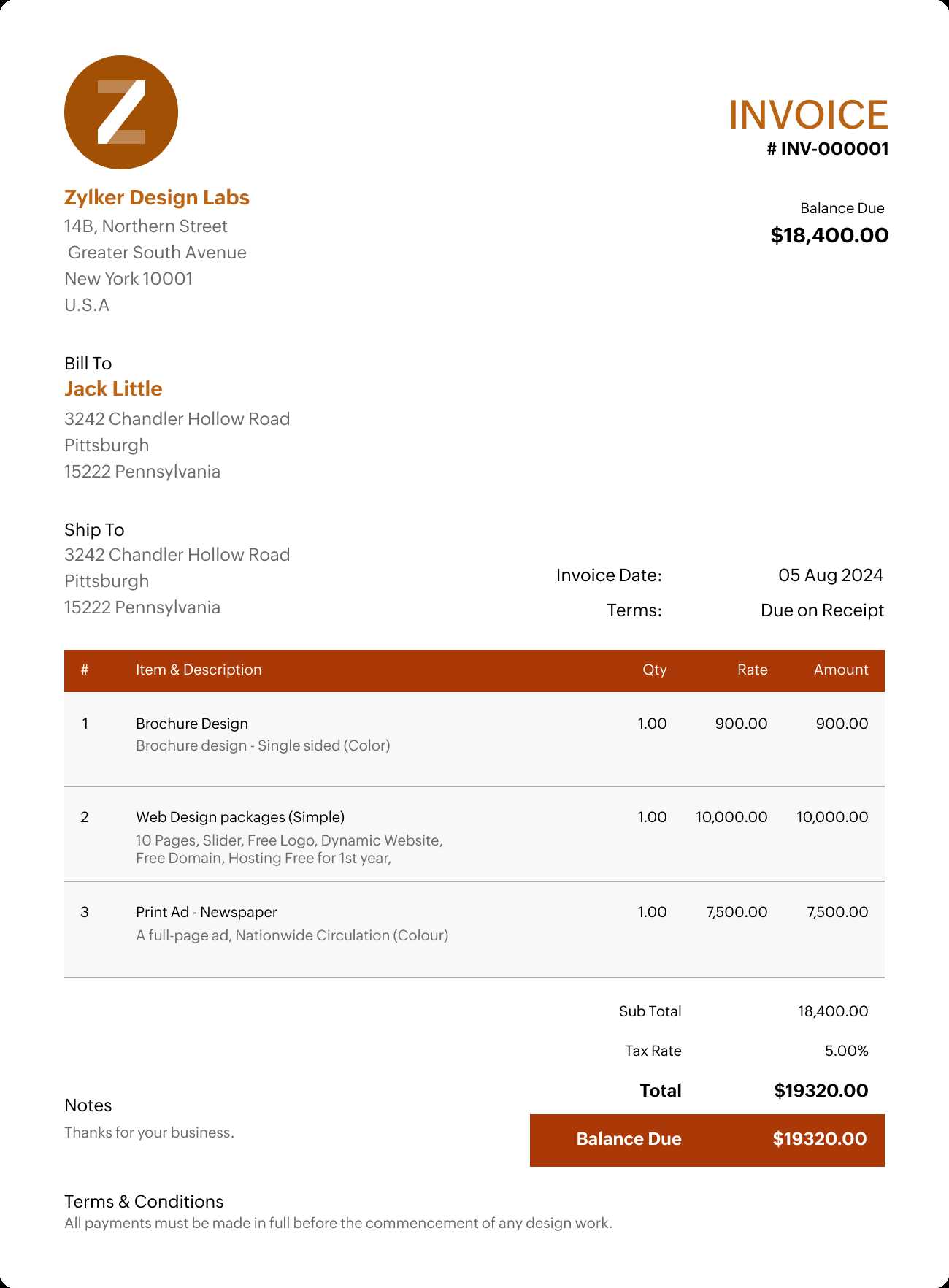

Here are the key elements to include when entering your business information:

- Company Name: Place your business name at the top of the document, typically in a bold or larger font, to make it stand out.

- Business Address: Include the full address of your business, which may include your street address, city, and postal code.

- Phone Number: Add a contact number where clients can reach you for any questions or concerns about the transaction.

- Email Address: Provide an email address for more formal communication or for clients who prefer to contact you via email.

- Website URL: If your business has a website, include the link so clients can easily find more information about your services or products.

Once you’ve filled in these essential details, you can move on to adding other specific elements, such as the document’s date, the payment terms, and any client-specific information. This step sets the foundation for creating a well-structured and professional financial document.

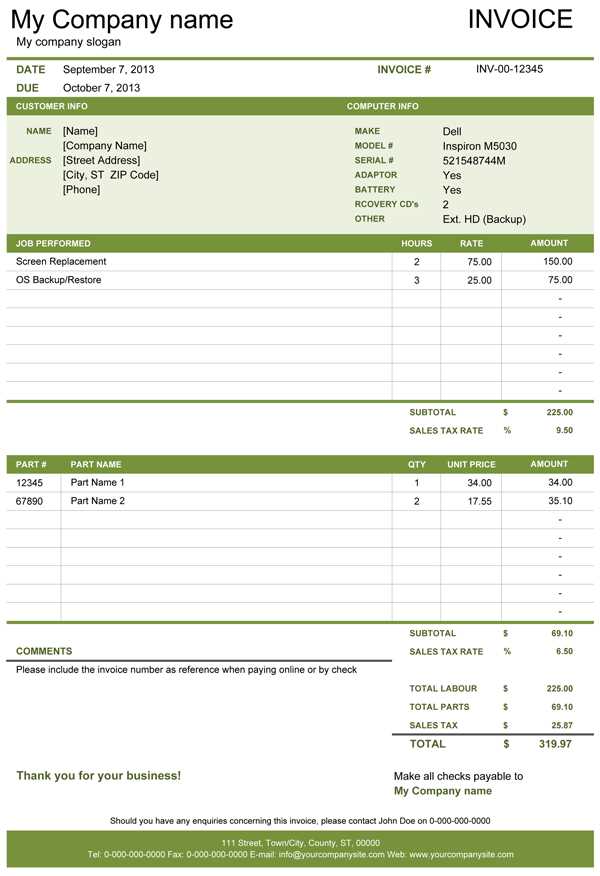

Adding Itemized Charges and Taxes

When creating financial documents, it’s essential to clearly outline each charge and any applicable taxes. Providing a detailed breakdown helps clients understand exactly what they are paying for and ensures transparency. This section will guide you through the process of accurately adding itemized charges and applying tax rates.

Follow these steps to add charges and taxes to your document:

Step 1: List Each Charge

Start by entering each product or service provided, one by one. For each item, include a clear description, the quantity, and the unit price. This allows clients to see exactly what they are being billed for.

- Item Description: Provide a brief but clear description of the product or service.

- Quantity: Specify the amount of each product or service.

- Unit Price: Indicate the price per item or service.

- Total Amount: Multiply the quantity by the unit price to get the total for each item.

Step 2: Apply Taxes

If your business is required to charge taxes, make sure to apply the appropriate tax rates to each item or to the entire subtotal. Some formats will automatically calculate taxes, but it’s important to ensure accuracy when entering tax information.

- Tax Rate: Enter the tax rate percentage for each item or service, depending on local tax laws.

- Tax Calculation: Calculate the tax by applying the rate to the subtotal. If needed, break down the tax for clarity.

- Total with Tax: Add the tax to the subtotal to arrive at the final amount due for each item or the overall bill.

By adding these detailed charges and taxes, you ensure that your clients receive a transparent and accurate bill, reducing confusion and making the payment process easier for both parties.

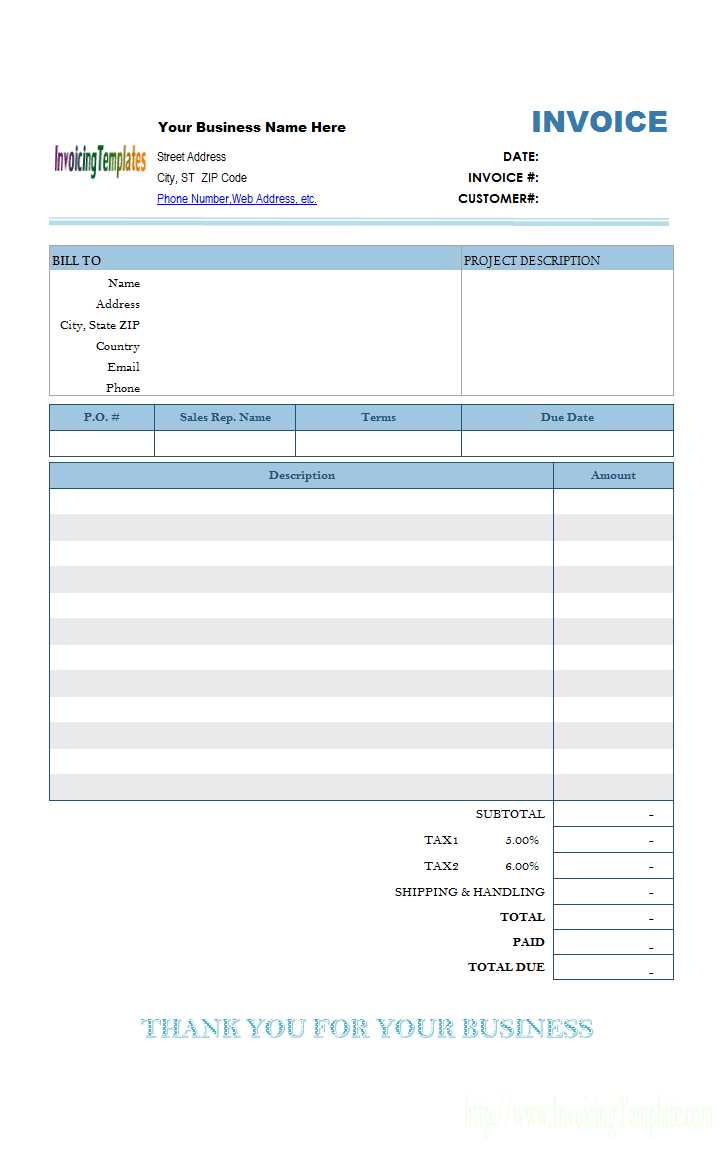

Formatting the Layout for Professionalism

Ensuring that your financial documents look professional is crucial for building trust with your clients. A well-organized and visually appealing document reflects your attention to detail and commitment to quality. This section covers the essential formatting tips to make your document clean, clear, and professional.

Choosing the Right Fonts and Colors

Fonts and colors play a significant role in the overall appearance of your document. The right combination can make your document easier to read and visually appealing, while the wrong choices can make it seem unprofessional.

- Font Style: Choose a simple, readable font like Arial, Calibri, or Times New Roman. Avoid overly decorative or difficult-to-read fonts.

- Font Size: Use a standard size, such as 10–12 pt for the body text. Ensure that headers are slightly larger to create a hierarchy and improve readability.

- Colors: Use a neutral color scheme, such as black or dark gray for text, and reserve color accents for headers or highlights. Avoid bright or clashing colors.

Organizing the Layout for Clarity

Clear organization helps guide the reader’s eye through the document and ensures that important information stands out. Structuring your layout effectively makes it easier for clients to understand the details quickly.

- Spacing: Use adequate spacing between sections and items to avoid a cluttered look. Ensure there is enough space between headings, text, and fields.

- Alignment: Keep text aligned consistently–left-aligned for most content and center-aligned for headings or totals. Consistent alignment enhances readability.

- Borders and Shading: Use subtle borders and shading to define sections without making the document too busy. A light border around the total amount can make it stand out.

By following these simple yet effective formatting tips, you can ensure your financial documents are visually professional, easy to read, and well-organized. This will help leave a positive impression on your clients and strengthen your brand’s credibility.

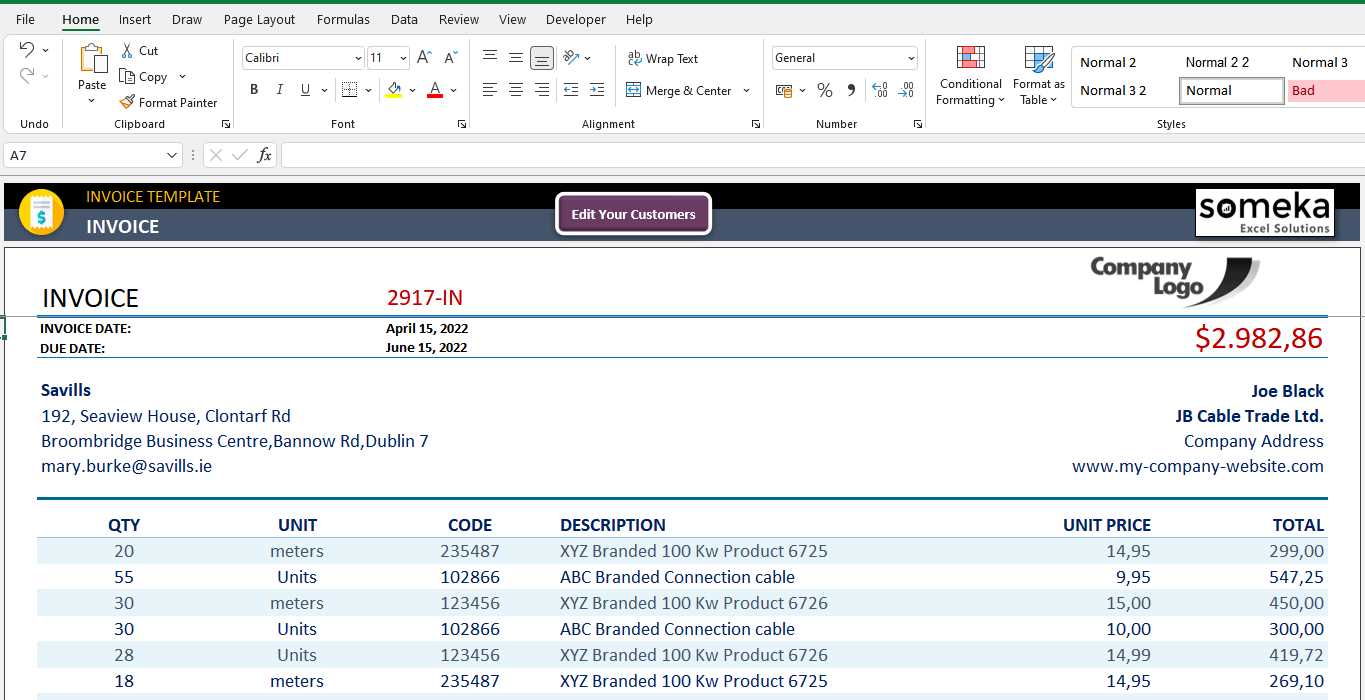

Optimizing Spreadsheet Software for Efficient Billing

Improving the workflow of creating financial documents can save time and reduce errors. By using advanced features of spreadsheet software, you can automate calculations, streamline data entry, and ensure accuracy across multiple documents. This section outlines how to optimize your workflow for faster and more efficient billing.

Utilizing Functions and Formulas

Spreadsheets offer a variety of functions that can automate repetitive tasks. Using these tools will help ensure accuracy and speed up the document creation process.

- SUM Function: Automatically calculate totals by using the SUM function. This can save time and eliminate errors when adding multiple charges or fees.

- Tax Calculations: Apply formulas to quickly calculate applicable taxes based on the subtotal, avoiding manual calculations.

- Data Validation: Use data validation to restrict the input of incorrect data, reducing mistakes and ensuring that all fields are filled correctly.

Streamlining Repetitive Tasks

There are several ways to streamline repetitive tasks in your financial documents to increase efficiency.

- Custom Shortcuts: Set up custom keyboard shortcuts to quickly access commonly used functions, reducing the time spent navigating the software.

- Macros: Create macros for frequent tasks such as generating reports, applying formatting, or entering standard data like business information.

- Pre-built Layouts: Save time by using pre-built layouts that can be reused for every billing document, allowing for quick customization without starting from scratch.

By optimizing your spreadsheet software for billing, you’ll not only reduce the time spent creating documents but also increase the consistency and accuracy of your financial records. This allows you to focus on what matters most–growing your business.

Using Formulas for Automatic Calculations

Automating calculations within your financial documents can significantly reduce manual effort and improve accuracy. By leveraging built-in functions, you can easily perform complex calculations without the need for repetitive data entry. This section explains how to use formulas to streamline and automate the process of generating totals, taxes, and other key values in your documents.

Basic Arithmetic Functions

The foundation of automated calculations relies on basic arithmetic functions that can instantly process data. These include:

- SUM: Automatically adds up a range of values, such as line items or charges, to generate a total amount.

- SUBTRACTION: Easily subtract one number from another, such as when applying discounts or deductions.

- AVERAGE: Calculate the average of a set of numbers, helpful for pricing trends or cost breakdowns.

Advanced Calculations

For more intricate financial processes, advanced functions allow you to tailor your calculations to meet specific needs:

- TAX CALCULATION: Use formulas like

=A1*0.15to automatically calculate tax based on a percentage rate. - DISCOUNT APPLICATION: Automatically apply discounts by using formulas that multiply by a discount rate, such as

=B2*(1-0.10)to apply a 10% discount. - COMPLEX CONDITIONAL FORMULAS: Leverage functions like IF and AND to calculate amounts based on certain conditions, such as varying prices for different quantities or customer types.

By incorporating these formulas into your documents, you can automate many aspects of financial calculations, which not only saves time but also ensures greater consistency and accuracy in your records. With less manual data entry, you can focus more on running your business efficiently.

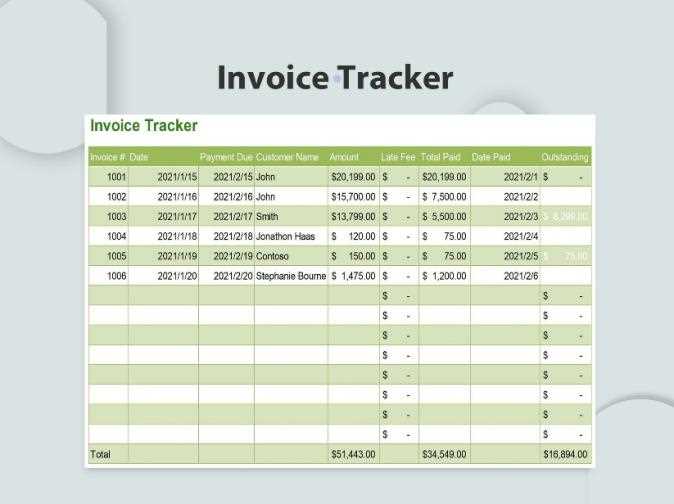

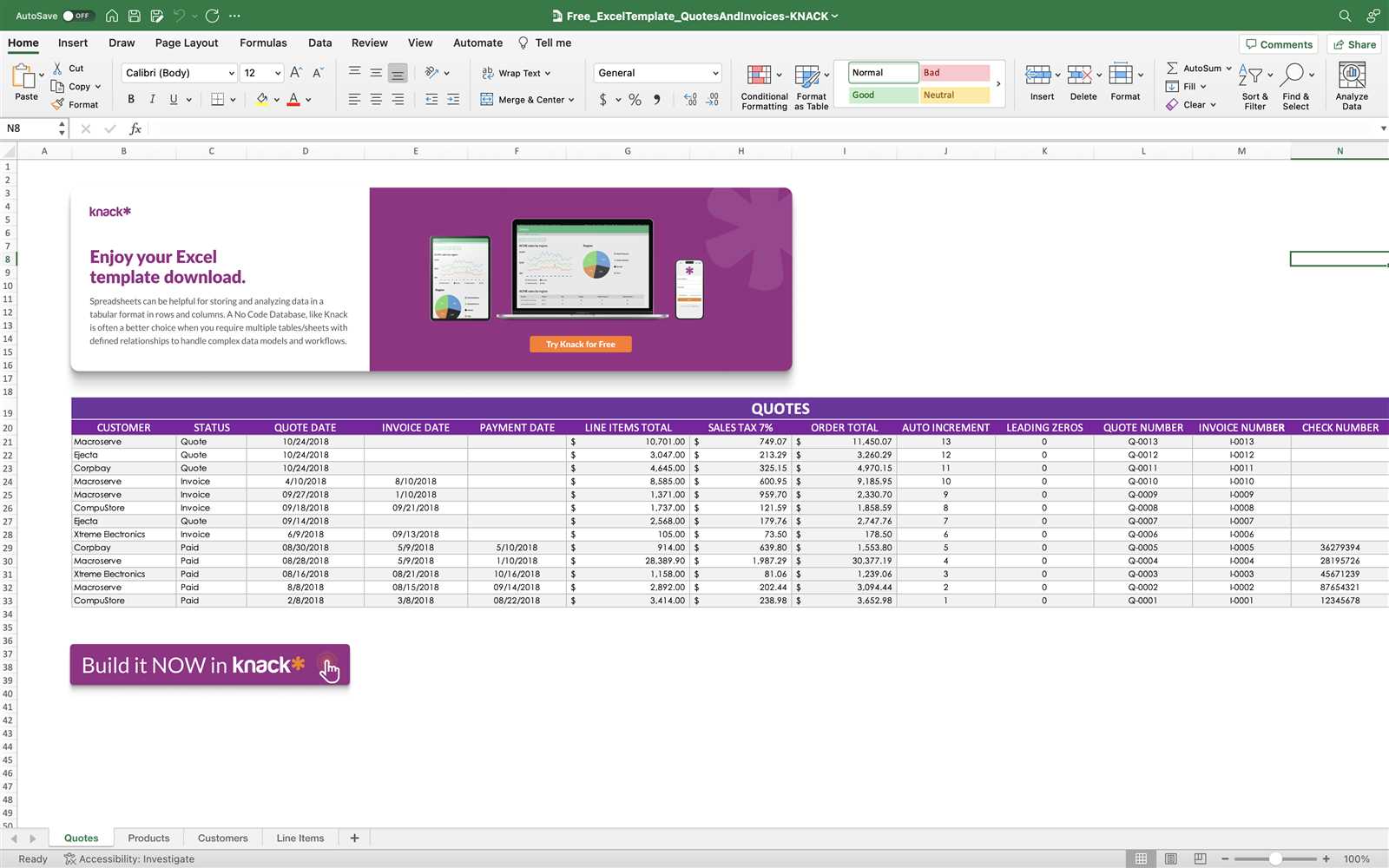

Tracking Payments with Financial Documents

Monitoring the status of payments is crucial for maintaining cash flow and keeping financial records accurate. Using the built-in features of spreadsheet software, you can easily track whether clients have paid, when the payment was made, and what amounts remain outstanding. This section will explore how to set up a simple tracking system for payments and keep your records organized.

Setting Up a Payment Tracker

To effectively track payments, create a table that includes essential information like the payment status, due date, and amount. Below is an example of how you can structure your table:

| Client Name | Amount Due | Amount Paid | Remaining Balance | Payment Status | Payment Date |

|---|---|---|---|---|---|

| John Doe | $500.00 | $300.00 | $200.00 | Partial | 2024-11-01 |

| Jane Smith | $750.00 | $750.00 | $0.00 | Paid | 2024-11-05 |

Each row in the table represents a separate transaction, and you can quickly calculate outstanding amounts by using simple formulas, such as subtracting the “Amount Paid” from the “Amount Due” column. Additionally, the payment status column helps you easily categorize payments as “Paid”, “Partial”, or “Unpaid” based on the information entered.

Automating Payment Tracking

To make payment tracking even more efficient, you can use conditional formatting to visually highlight overdue payments or those that have been fully paid. This will help you quickly identify which accounts need follow-up actions.

- Highlight Overdue Payments: Use conditional formatting rules to automatically highlight any unpaid balances past their due date.

- Track Payment History: Keep track of past payments and their dates to easily reference when a payment was made.

By using this system, you can stay organized and ensure that no payment is overlooked, ultimately improving cash flow management and reducing administrative burden.

Spreadsheet Solutions for Small Business Billing

Managing financial transactions can be a time-consuming task, especially for small businesses with limited resources. Using pre-built digital forms for tracking services, products, and payments offers a practical solution to simplify the billing process. This section will guide you through how these tools can benefit small business owners and help streamline their administrative tasks.

Why Small Businesses Need Billing Solutions

For small businesses, maintaining a consistent and professional approach to billing is essential. Having a structured, customizable billing sheet not only saves time but also helps avoid errors and delays in receiving payments. By utilizing a digital system, businesses can create invoices, track payments, and maintain clear financial records–all in one place. Here are some benefits:

- Time Efficiency: Speed up the process of creating and sending bills, reducing the amount of time spent on manual calculations.

- Accuracy: Eliminate the risk of human error with built-in formulas that automatically calculate totals, taxes, and discounts.

- Customization: Tailor the format to fit your business needs, whether you’re invoicing for products, services, or both.

Key Features of Billing Solutions for Small Enterprises

When selecting a tool to handle your billing, certain features can significantly enhance its effectiveness. A good billing solution should offer:

- Pre-filled Fields: Automatically input customer information and payment terms to save time.

- Tax Calculation: Easily apply taxes based on region or product type to ensure correct charges.

- Multiple Currency Support: Ideal for businesses with international clients, allowing for easier currency conversions.

- Payment Tracking: Keep tabs on outstanding payments and due dates with built-in reminders.

By using a billing solution that incorporates these features, small businesses can improve their invoicing efficiency, maintain organized financial records, and provide a better experience for clients.

How to Share and Export Your Billing Document

Once you’ve created a billing document for your services or products, it’s important to know how to share it efficiently with your clients. Whether you need to send it via email, print it out, or store it for future reference, understanding the export and sharing options is essential for smooth business operations.

Exporting Your Document for Easy Sharing

To ensure that your client can easily access and review the billing document, exporting it in a universally recognized format like PDF is a great option. PDFs maintain the integrity of your document’s formatting and are compatible across different devices and operating systems.

- Choose the Right Format: PDF is the most common and professional format for sharing billing documents, as it prevents changes and is easy to view on any device.

- Export Process: Most spreadsheet programs offer an “Export” or “Save As” option, allowing you to choose PDF as the file type.

- Email Sharing: After exporting the document, you can attach it to an email for quick delivery to your client. Simply click the “Attach” button in your email client and select the file.

Printing and Sending Physical Copies

If you prefer to send a physical copy of your billing document, printing is a straightforward option. Ensure the document is formatted correctly to fit standard paper sizes and looks professional when printed.

- Check Formatting: Before printing, make sure the layout is optimized for printing. Adjust margins, font size, and ensure no content is cut off.

- Print to PDF: If you want to keep a digital copy for your records, you can “Print” the document to a PDF file as well.

- Mailing: After printing, place the document in an envelope, add postage, and send it to the client via standard mail.

| Action | Benefit |

|---|---|

| Emailing (PDF) | Fast, professional, and secure delivery |

| Printing (Physical Copy) | Ideal for clients who prefer paper documents |

By utilizing the appropriate sharing and export methods, you can ensure that your billing process is efficient, secure, and accessible for your clients.

Advantages of Using Spreadsheet Software Over Other Tools

When it comes to managing billing and financial records, selecting the right software can significantly impact productivity and accuracy. While there are many tools available, using a spreadsheet application offers unique benefits that streamline processes and enhance efficiency. Its flexibility and accessibility make it a preferred choice for many businesses.

Customization and Flexibility

One of the primary advantages of using a spreadsheet program is its high level of customization. Unlike dedicated billing software, which may limit certain features, spreadsheet applications allow users to fully tailor the layout, formulas, and fields according to their needs. This flexibility means you can create a document that aligns perfectly with your specific requirements without having to adapt to a rigid system.

- Custom Fields: Add unique fields such as discount codes, special instructions, or custom tax rates.

- Formula Flexibility: Set up complex calculations with ease, ensuring accurate and efficient financial tracking.

- Design Control: Adjust colors, fonts, and layouts to match your business’s branding and professional image.

Ease of Use and Familiarity

Another advantage is the widespread familiarity with spreadsheet applications. Many people are already comfortable with the interface, making it easier to get started without the need for extensive training. This reduces the learning curve and helps businesses implement the tool quickly, allowing for faster adoption and fewer errors.

- User-Friendly: The interface is intuitive, with most features easily accessible through basic menus.

- Common Knowledge: Spreadsheet software is widely used in many industries, so employees and users often already have experience with it.

- Efficiency: The tools and features are designed to work together, allowing for quick updates and adjustments when necessary.

In comparison to more specialized tools, spreadsheet applications provide a level of ease, customization, and flexibility that can be adapted for any business, regardless of its size or complexity.

Tips for Managing Multiple Invoices Efficiently

Handling a large volume of billing documents can quickly become overwhelming if not managed properly. To keep your processes organized and reduce errors, it’s important to adopt strategies that streamline the task of tracking and processing multiple records. Here are some practical tips to help manage your documents more effectively.

1. Organize Your Files Clearly

One of the most effective ways to manage numerous records is by organizing them into easily accessible categories. Use folders, subfolders, or even color-coding systems to separate active, paid, and overdue records. This ensures that each document is where it needs to be and can be quickly located when needed.

- Use Descriptive Names: Label files with client names, dates, or other relevant identifiers to help with quick identification.

- Folder Structure: Organize documents by month, year, or client to simplify navigation.

- Backup Files Regularly: Ensure that all records are backed up to prevent data loss.

2. Automate Repetitive Tasks

One of the biggest time-savers when managing multiple billing documents is automation. By utilizing built-in features such as formulas or macros, you can automate repetitive calculations and tasks, reducing the chances of human error and increasing efficiency.

- Use Calculations: Automatically calculate totals, taxes, and discounts to avoid manual errors.

- Set Reminders: Automate reminder emails for overdue payments to stay on top of collections.

- Create Batch Processing: Group similar tasks together, such as generating statements or applying the same rates to multiple records.

3. Track Payment Status

Staying on top of which payments have been made and which are still pending is crucial for managing multiple records. Implement a simple tracking system, such as a payment status column, to mark which documents have been paid, partially paid, or are still outstanding.

- Payment Tracking Column: Add a column to your records to indicate the status of each payment (paid, pending, overdue).

- Color Code Status: Use different colors for paid and unpaid statuses to make it easier to spot pending documents.

- Set Alerts: Set up email or calendar reminders to follow up on overdue payments.

By following these steps, you can streamline the process of managing multiple billing documents, making it easier to stay organized and reduce the time spent on administrative tasks.