Example of Invoice Template for Your Business Needs

Managing financial transactions is a critical part of any business. To ensure smooth and accurate record-keeping, it’s essential to have a structured way to request payments for goods or services rendered. A well-organized document helps streamline this process, providing clarity for both the provider and the recipient.

Customizable solutions can simplify the creation of such documents, making them suitable for a wide range of industries. These documents can be easily tailored to meet specific business requirements, saving time and reducing errors in the billing process.

Whether you’re a freelancer, a small business owner, or a large corporation, having a reliable method for preparing these documents is key to maintaining professional relationships and ensuring timely payments. With the right approach, you can enhance your business’s financial efficiency and foster trust with your clients.

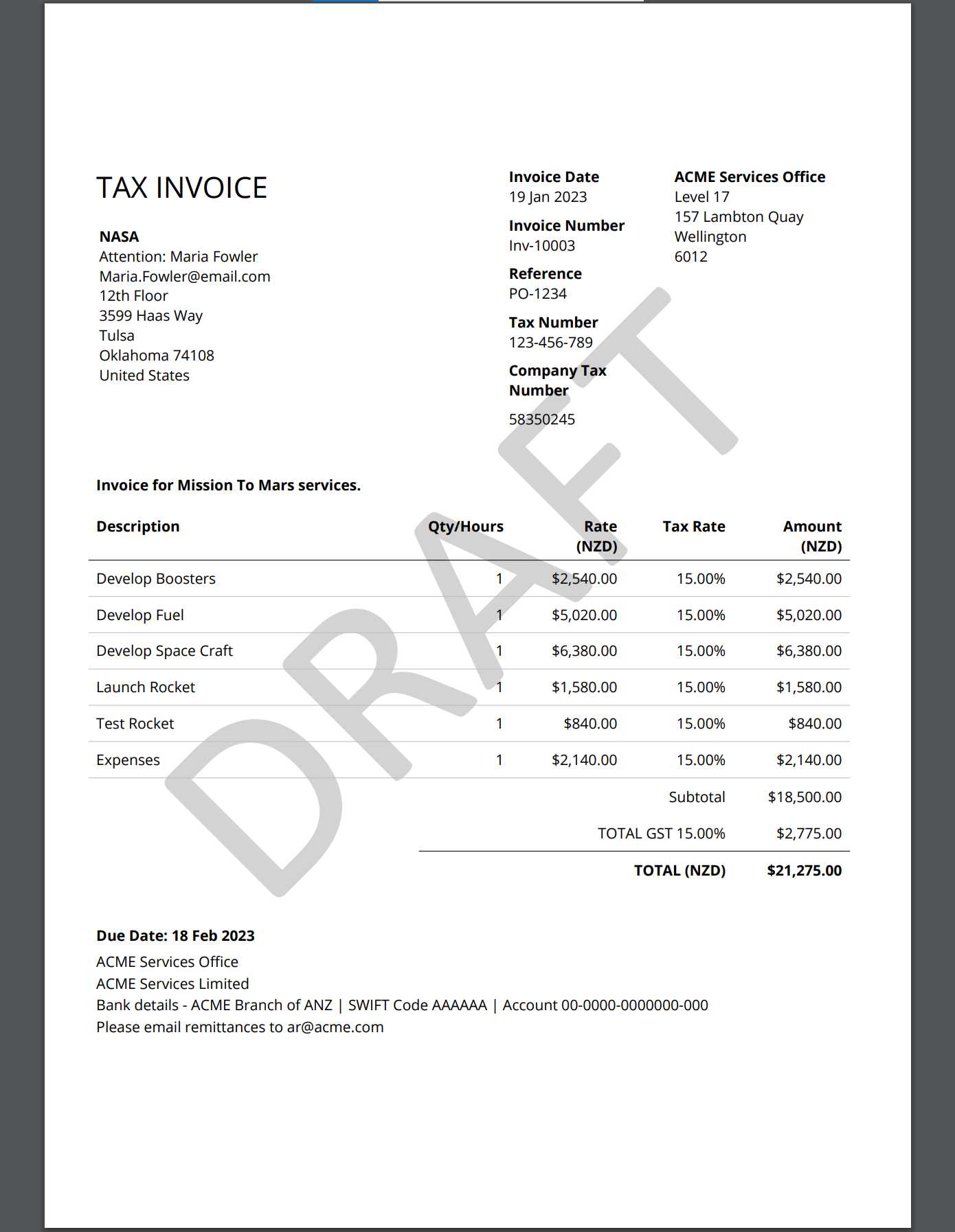

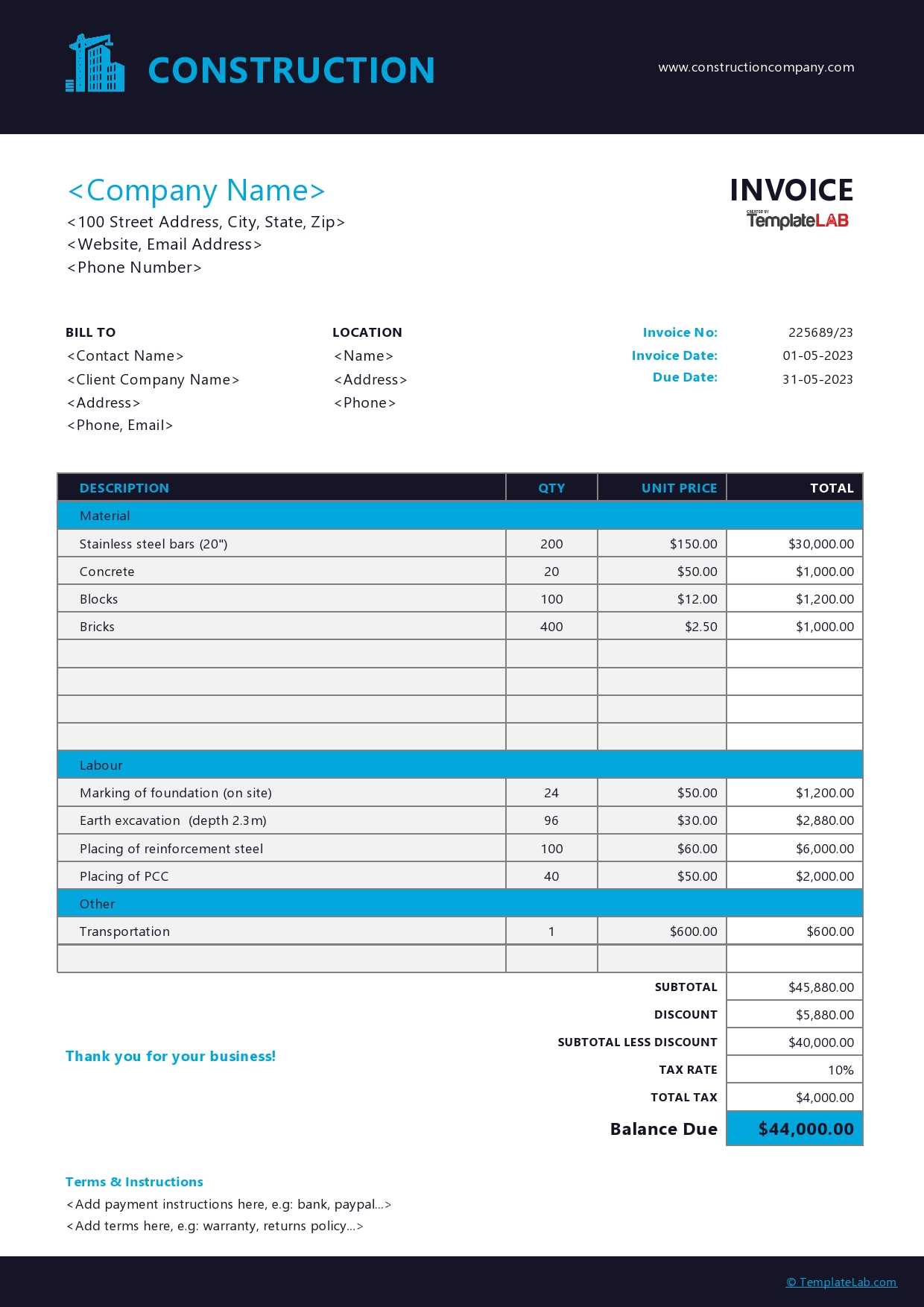

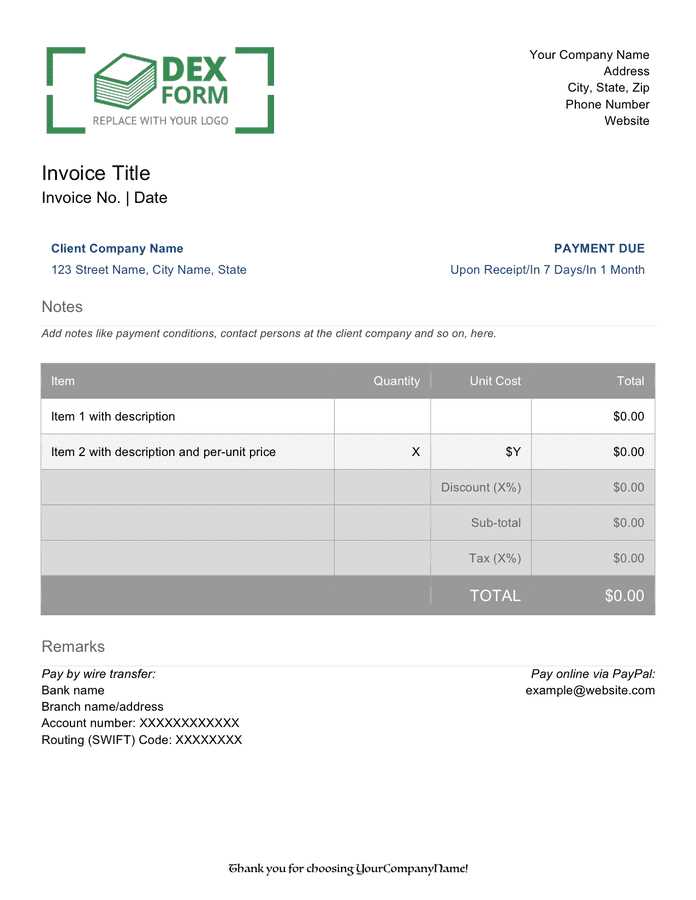

Example of Invoice Template

Having a well-structured document for billing purposes ensures that all necessary details are clearly outlined. This document serves as an official request for payment, ensuring both parties have the correct information for a smooth transaction. By using a pre-designed layout, businesses can save time while maintaining professionalism in every interaction.

Key Elements to Include

- Sender’s Information: Name, address, and contact details of the company or individual requesting payment.

- Recipient’s Information: Name, address, and contact details of the person or company being billed.

- Transaction Details: A detailed list of services or products provided, including quantities and unit prices.

- Payment Terms: Clear instructions on when and how the payment should be made.

- Unique Reference Number: A specific number for tracking and managing the document.

Why Use a Structured Format

- Helps avoid confusion by clearly separating key sections.

- Ensures consistency across all business transactions.

- Can be easily customized to fit the needs of any business, whether large or small.

- Streamlines the payment process, reducing delays and misunderstandings.

By following a standard structure, businesses can ensure clarity and professionalism in their financial dealings, fostering trust and encouraging prompt payments from clients.

Understanding the Importance of Invoice Templates

Having a standardized document for billing is essential for businesses of all sizes. It ensures that every transaction is properly documented and provides clear instructions for payment. This process helps avoid misunderstandings and delays, benefiting both the service provider and the client. A consistent approach not only streamlines operations but also builds trust and professionalism.

Efficiency is one of the main reasons to use a pre-designed format for financial documents. It saves time by eliminating the need to create each billing statement from scratch, allowing business owners to focus on other important tasks. Additionally, it guarantees that no critical information is overlooked, which can often lead to costly mistakes.

By using a well-organized layout, companies can present themselves as reliable and professional. Clients are more likely to pay on time when they can easily understand the details of the transaction. The use of such tools ensures that the financial process runs smoothly, benefiting both the business and its customers.

How to Create an Invoice from Scratch

Creating a billing document from the ground up requires attention to detail and an organized approach. Whether you’re managing a small business or freelancing, it’s important to include all the relevant information that both parties need for a smooth transaction. A well-crafted document ensures clarity and avoids confusion during the payment process.

Here are the key steps to follow:

| Step | Description |

|---|---|

| 1. Contact Information | Include your business or personal details (name, address, and phone number) and those of the recipient. |

| 2. Document Number | Assign a unique reference number for easy tracking and future reference. |

| 3. Date and Due Date | Specify when the document was issued and the payment due date. |

| 4. List of Products or Services | Provide a detailed breakdown of what was sold or services rendered, including quantities and prices. |

| 5. Total Amount Due | Calculate the total cost, including any applicable taxes or discounts. |

| 6. Payment Instructions | Clearly state how the payment should be made, including preferred methods and terms. |

By following these steps, you can ensure that your financial documents are clear, professional, and accurate, reducing the risk of errors or confusion in the future.

Essential Elements of a Professional Invoice

For any business, a well-structured billing document is a crucial tool for maintaining professionalism and ensuring timely payments. A clear and complete document not only outlines the services or products provided but also helps prevent misunderstandings between the service provider and the client. Including the right components ensures that all necessary details are communicated effectively.

Key Components to Include

- Contact Information: Include both the provider’s and the recipient’s name, address, and contact details.

- Unique Reference Number: A specific number for each document to make tracking and referencing easier.

- Service/Product Breakdown: A detailed list of the items or services provided, including prices and quantities.

- Payment Terms: Clear instructions on when and how the payment should be made, including accepted payment methods.

- Due Date: The date by which the payment is expected.

Additional Considerations

- Taxes and Fees: Ensure that all applicable taxes or additional charges are included and clearly itemized.

- Discounts or Adjustments: If applicable, provide a breakdown of any discounts applied or adjustments made to the total amount.

- Notes or Special Instructions: Include any important details, such as late fees, payment reminders, or additional information about the transaction.

By carefully including these essential elements, you can create a professional and accurate document that facilitates smooth transactions and maintains a positive relationship with clients.

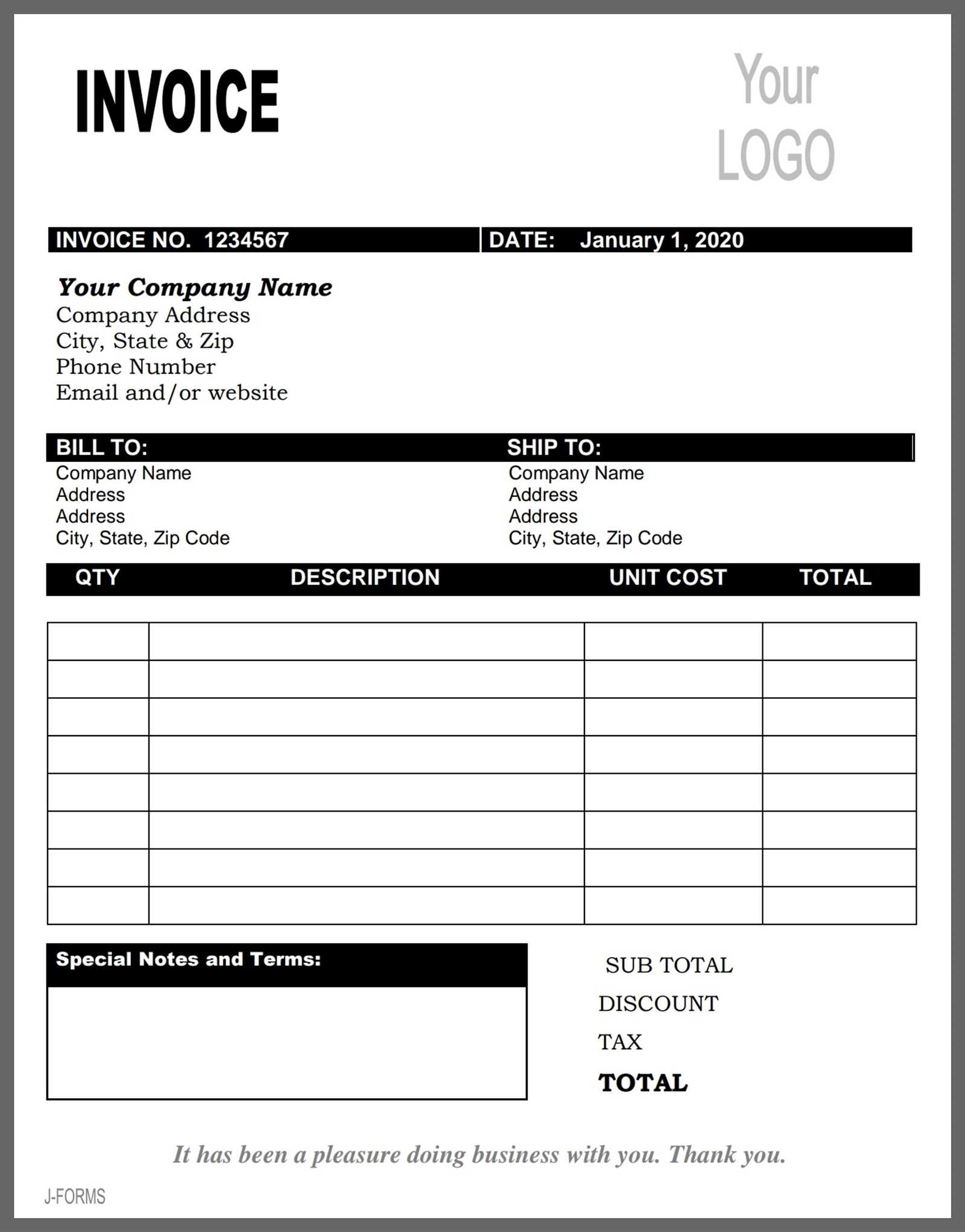

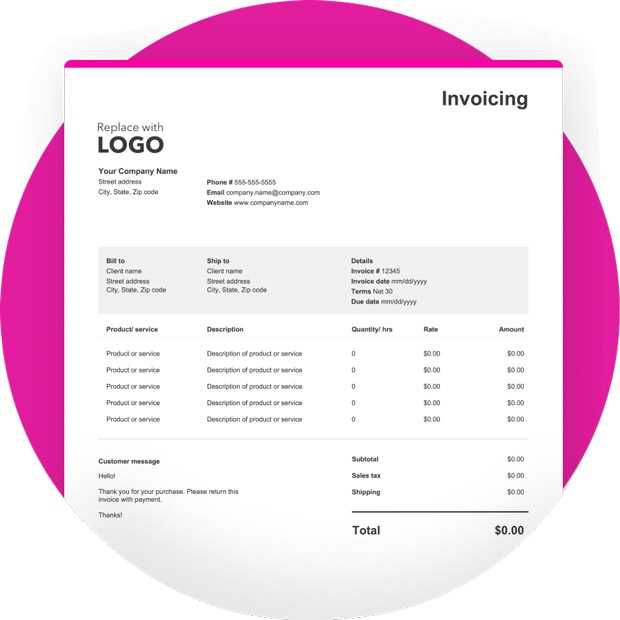

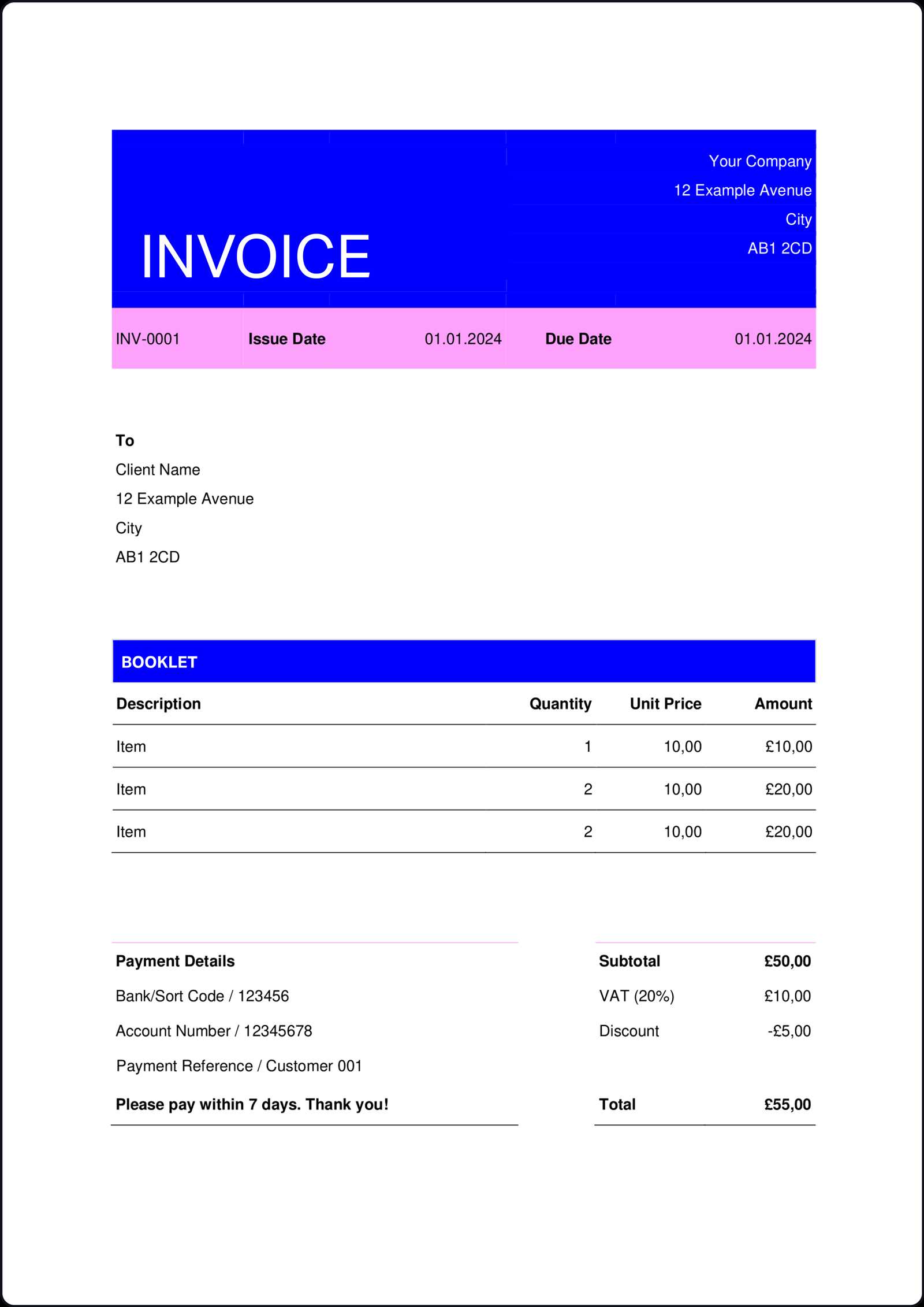

Choosing the Right Invoice Format for Your Business

Selecting the appropriate structure for your billing documents is essential for ensuring that transactions are smooth and clear. Different businesses have different needs, and the right format should reflect the nature of your services or products. A well-chosen format makes the billing process more efficient and reduces the chances of errors or confusion.

When deciding on a format, consider the following factors:

- Business Type: The format should align with the products or services you offer. For example, a service-based business may require more detailed breakdowns of time spent or hours worked, while a product-based business may need to list each item sold with quantities and prices.

- Client Preferences: Some clients may have specific requirements for how they like to receive billing information, such as a certain style or additional information like purchase order numbers.

- Payment Methods: Ensure the format allows for clear communication of your preferred payment methods and instructions, whether that’s bank transfers, credit cards, or online payment platforms.

There are several popular formats to choose from, including:

- Simple Format: Best for small businesses or freelancers who need quick, no-frills documents. It includes essential information like service descriptions, payment terms, and total amounts.

- Itemized Format: Ideal for businesses with many products or services. It includes a detailed list of items, quantities, prices, and totals for each item or service.

- Professional Format: Often used by larger companies, this format can include branding elements, client references, and more complex tax calculations.

Choosing the right layout for your business ensures that both you and your clients understand the terms of the transaction. By selecting a structure that suits your needs, you can improve payment efficiency and present a more professional image to clients.

Benefits of Using Pre-Made Invoice Templates

Using ready-made structures for billing documents offers several advantages, especially for businesses looking to save time and maintain consistency. These pre-designed layouts can streamline the billing process, ensuring that all essential details are included without the need to start from scratch each time. By adopting a standardized approach, companies can focus more on delivering their products or services rather than worrying about formatting and content accuracy.

One of the key benefits is efficiency. With a pre-made structure, you can quickly fill in the necessary details for each transaction, reducing the time spent creating documents from the ground up. This allows you to process multiple transactions in less time, freeing up resources for other business needs.

Another advantage is consistency. A uniform layout ensures that all your billing documents look professional and follow the same structure. This creates a sense of trust and reliability, as clients are more likely to take your business seriously when all documents are presented neatly and clearly.

Additionally, using these ready-made solutions can help avoid errors. Since the format is already designed to meet industry standards, it reduces the risk of missing key information or making mistakes that could delay payments or cause misunderstandings.

In conclusion, pre-made billing structures provide a convenient, professional, and error-free way to manage financial transactions. By adopting them, businesses can ensure that their billing process is streamlined, saving both time and effort while maintaining professionalism.

Customizing Your Invoice Template for Specific Needs

Adapting your billing document to meet the unique requirements of your business is essential for ensuring clarity and precision. While a standard structure can serve general purposes, tailoring it to reflect your specific offerings and client preferences can enhance professionalism and make the document more effective. Customization allows you to present your services or products in a way that aligns with your brand and business practices.

One of the first things to consider when adjusting your structure is the level of detail. Depending on the nature of your business, you may need to include additional fields or explanations. For example, a service-based business might benefit from adding a section for the time spent on each task, while a product-based business may require a breakdown of items, quantities, and unit prices.

Branding is another important factor to consider. By incorporating your company’s logo, color scheme, and fonts, you can ensure that the document reflects your business’s identity. This adds a professional touch and makes the document instantly recognizable to your clients.

Payment terms can also be customized to suit your business model. Whether you prefer to offer early payment discounts, define payment deadlines, or specify late fees, adjusting these terms helps manage client expectations and improve cash flow.

Finally, including additional notes or instructions can help clarify specific payment conditions, delivery terms, or other important details. This customization can reduce misunderstandings and ensure a smooth transaction process.

Customizing your billing documents ensures that they meet the specific needs of your business and clients, ultimately helping to streamline operations and maintain strong professional relationships.

How to Add Taxes and Discounts to Invoices

When creating a financial document, it’s important to include all applicable taxes and discounts to ensure the total amount due is accurate. These adjustments not only help you comply with legal requirements but also provide clarity for your clients. Including taxes and discounts in the right format ensures that the billing process is transparent and fair for both parties.

Adding Taxes

To calculate and add taxes correctly, follow these steps:

| Item | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

| Product/Service 1 | $100 | 10% | $10 | $110 |

| Product/Service 2 | $200 | 10% | $20 | $220 |

Start by calculating the tax for each item or service provided. The tax rate is applied to the amount for each individual item, and then you can sum up the total tax to be added. This makes the calculation straightforward and transparent for the customer.

Applying Discounts

Discounts can be applied either as a fixed amount or a percentage. Here’s how to apply them:

| Item | Original Price | Discount | Price After Discount |

|---|---|---|---|

| Product/Service 1 | $100 | 10% | $90 |

| Product/Service 2 | $200 | $30 | $170 |

To apply a percentage discount, multiply the original price by the discount rate, and subtract this amount from the original price. If you offer a fixed discount, simply subtract the discount amount directly. Always ensure that the discount is clearly shown so that both parties understand the adjustment.

By accurately adding taxes and discounts, you can ensure that your documents reflect the true cost of the transaction, maintaining transparency and fostering trust with your clients.

Common Mistakes to Avoid in Invoicing

Managing billing documents accurately is essential to ensure smooth transactions and maintain positive client relationships. However, there are common errors that can lead to confusion, delayed payments, or even strained business relationships. Being aware of these mistakes can help businesses avoid complications and ensure that their billing process runs efficiently and effectively.

One frequent mistake is failing to include clear payment terms. Without clearly stating when payments are due or any late fees, clients may delay payment or misinterpret expectations. It’s essential to specify a payment deadline, preferred payment methods, and any penalties for overdue payments.

Incomplete or incorrect details are another issue. Leaving out crucial information such as client contact details, the description of services or products, or the total amount due can lead to confusion. Always double-check that all fields are completed and accurate before sending the document.

Not accounting for taxes or forgetting to apply discounts correctly can cause discrepancies in the final amount. Ensure that all relevant taxes are calculated and included, and apply any discounts to avoid overcharging or undercharging the client.

Another common mistake is using inconsistent formats. A billing document that lacks a uniform structure can appear unprofessional. Stick to a consistent layout and style to create a cohesive experience for your clients.

Lastly, delaying the creation and sending of documents can result in late payments. It’s important to send the billing document promptly after completing the service or delivering the product to ensure clients can pay on time and maintain cash flow.

By avoiding these common errors, businesses can improve their billing process, enhance professionalism, and foster better relationships with clients, ultimately leading to smoother financial operations.

How to Save and Share Your Invoice

Once your billing document is finalized, it’s essential to know how to store and share it effectively. Proper storage ensures you can easily access records when needed, while efficient sharing helps maintain clear communication with your clients and facilitates timely payments. There are several methods available for saving and distributing these documents, each offering convenience and security.

To begin, saving your billing document in a standard, easily accessible format is key. Many businesses choose to save documents as PDF files because they are universally compatible and maintain formatting across different devices. Ensure that the file is named clearly with relevant details, such as the client’s name and the billing date, to make future retrieval easier.

Additionally, cloud storage solutions are ideal for securely storing documents while ensuring they are accessible from any location. Popular services like Google Drive, Dropbox, or OneDrive offer easy-to-use platforms where you can organize and back up your documents. Be sure to organize your files into folders for better tracking and retrieval.

When it comes to sharing your completed document, the most common method is through email. Attach the saved file directly to the email and ensure that the subject line and message are professional and clear. Provide a brief summary in the body of the email, reiterating the payment terms and due date to avoid any misunderstandings.

Secure sharing options like encrypted email or file-sharing platforms can be considered for sensitive transactions, particularly when dealing with larger sums or confidential information. This ensures that both parties’ data remains protected throughout the process.

In conclusion, knowing how to save and share your billing documents effectively is crucial for maintaining a smooth and organized financial workflow. By choosing the right storage and sharing methods, businesses can reduce errors, increase efficiency, and keep client communication professional and clear.

Invoice Template for Small Business Owners

For small business owners, creating accurate and professional billing documents is crucial for maintaining cash flow and fostering strong relationships with clients. These documents not only help you get paid on time but also ensure transparency and avoid any potential disputes. Having a reliable and customizable billing format can save time and reduce errors in your financial management process.

Here are some key elements that small business owners should include when crafting a billing document:

- Business Information: Always include your business name, address, contact information, and logo. This establishes your brand identity and makes it easy for clients to get in touch with you if needed.

- Client Information: Ensure that the client’s name, company name (if applicable), and contact details are clearly listed. This helps prevent confusion, especially when working with multiple clients.

- Unique Invoice Number: Assigning a unique number to each document helps keep track of transactions, maintain organization, and ensure that clients can easily reference specific records when needed.

- Detailed Description of Products/Services: Provide clear details of the products or services provided. Include item descriptions, quantities, rates, and any additional information that helps the client understand the charges.

- Payment Terms and Due Date: Specify the payment due date, payment methods, and any terms or conditions that apply (e.g., late fees or early payment discounts).

- Taxes and Discounts: If applicable, make sure to include relevant taxes or any discounts that apply. Clear calculations will prevent confusion over the final amount due.

- Total Amount Due: Clearly display the total amount due after taxes and discounts. This makes it easy for your clients to see exactly how much they need to pay.

For small business owners, using a consistent, easy-to-understand billing format is essential for ensuring that clients pay on time and that your business operations run smoothly. Creating and customizing a billing document that fits your specific needs can save you time and help keep your records organized.

Digital vs. Paper Invoices: Which is Better?

When it comes to billing, businesses have two main options: sending traditional paper documents or opting for digital formats. Each approach has its advantages and challenges, making it important to understand the key differences. Choosing the right method depends on factors such as convenience, cost, and your clients’ preferences.

Digital formats have become increasingly popular due to their speed and efficiency. Sending electronic billing documents eliminates the need for printing, postage, and physical storage, making it a more environmentally friendly and cost-effective choice. Furthermore, digital versions can be easily tracked, saved, and shared via email or cloud services, ensuring quick delivery and reducing the risk of losing important documents.

One significant benefit of paper documents is their traditional appeal, especially for businesses that work with clients who are not as comfortable with technology or prefer physical copies. Paper versions can also be easier for some clients to keep track of, especially in industries where physical records are still a standard. However, the time and cost associated with printing, mailing, and storing paper documents can quickly add up.

Digital billing documents also allow for easy customization and integration with accounting software, providing additional functionality for managing finances. Automated reminders and payment tracking are other notable advantages that make it easier for businesses to keep on top of their financial activities. On the other hand, paper billing tends to be more rigid, requiring manual updates and efforts to ensure timely payments.

Ultimately, the decision comes down to the specific needs of your business and your clients. Digital billing may offer greater convenience and efficiency, while paper documents may be necessary for certain industries or client preferences. By understanding the strengths and limitations of each method, businesses can make informed choices that align with their operations and customer base.

Using Invoice Templates for International Transactions

Handling transactions across borders requires careful attention to detail and an understanding of international regulations. A well-organized billing document is essential to ensure smooth communication and timely payments when working with clients from different countries. Using a structured format can help businesses manage these transactions efficiently and avoid common pitfalls.

One of the primary benefits of using a standardized billing format for international transactions is the ability to include all the necessary information that varies by country. Currency conversion rates, payment terms, and applicable taxes may differ from one region to another, and it’s important to account for these variations in the billing document. Customizable formats allow businesses to easily update the document to suit the specific requirements of each country or client.

In addition to currency and tax differences, international transactions may require the inclusion of other elements such as import/export codes, VAT numbers, or specific legal disclaimers. A structured document ensures that all required information is included, reducing the likelihood of errors and ensuring compliance with local laws and international standards.

Another important consideration when working with overseas clients is language barriers. For businesses dealing with international customers, it may be helpful to create versions of the billing document in multiple languages. This not only makes it easier for clients to understand the details of the charges but also fosters a more professional and customer-friendly experience.

Overall, using a customizable, well-organized billing format can significantly streamline international transactions. By ensuring that all necessary details are included and adjusting for any regional differences, businesses can improve efficiency, reduce misunderstandings, and ultimately strengthen their global relationships.

Top Free Invoice Templates Available Online

For small businesses, freelancers, or anyone managing financial transactions, finding the right billing format is crucial. Fortunately, the internet offers a wide range of free and easily accessible formats that can help streamline your administrative tasks. These ready-made options often come with built-in features designed to help you keep track of important payment details while ensuring professionalism in every transaction.

Benefits of Using Free Templates

Using pre-designed formats offers several advantages, including:

- Time-saving: Skip the need to create a document from scratch, allowing you to focus more on your work.

- Customizability: Most free options allow you to adjust fields such as business name, services provided, and payment terms.

- Professional appearance: Ready-made designs often come with a clean, organized layout that adds credibility to your business.

- Cost-effective: Many high-quality options are completely free, meaning no extra costs for simple financial management.

Top Free Options to Explore

Here are some of the best platforms offering free formats suitable for a variety of business needs:

- Google Docs: A simple, customizable solution with multiple design options available through Google Drive.

- Microsoft Word: A classic and user-friendly tool, with many free templates available on the official website or through Office apps.

- Canva: Offers stylish and visually appealing layouts that are highly customizable for any industry.

- Wave Financial: This platform not only provides free customizable formats but also integrates with accounting software, making it a convenient option for business owners.

- Zoho Invoice: Known for its professional look and easy-to-use interface, Zoho offers a free version with essential features for small businesses.

By choosing from these free, high-quality options, you can save time, maintain a professional image, and ensure that every transaction is processed smoothly. Whether you’re just starting out or managing ongoing business operations, these platforms provide the flexibility to meet your billing needs without any additional cost.

How to Automate Invoicing with Templates

Automating the billing process can save time, reduce errors, and increase efficiency for businesses of all sizes. By using pre-structured formats, you can set up a system that generates and sends billing documents automatically, allowing you to focus on growing your business instead of manually handling each transaction. This process is especially valuable for companies with recurring clients or frequent transactions.

Benefits of Automating Billing

Automating your billing process offers several key benefits:

- Time savings: Automated systems can generate and send documents without manual input, reducing administrative workload.

- Consistency: Automated systems ensure that every document follows a uniform format, maintaining professionalism across all transactions.

- Accuracy: Pre-filled fields and formulas reduce the likelihood of human error, ensuring that all calculations are correct.

- Payment tracking: Many automated systems include tracking features that allow you to see when payments are received and follow up on overdue amounts.

Steps to Automate Your Billing Process

Here are the steps to set up an automated billing system using pre-made formats:

- Choose an automation tool: Many online platforms like FreshBooks, QuickBooks, or Zoho offer integrated invoicing solutions with automation capabilities.

- Set up recurring billing: For clients with regular payments, you can set up a recurring billing cycle that automatically generates and sends billing documents on a set schedule.

- Customize your format: Ensure the format includes all necessary fields such as client details, payment terms, and itemized lists of charges. Most platforms offer customization options for easy personalization.

- Link payment methods: Integrate online payment options like PayPal, Stripe, or credit card processing to allow for easy, immediate payments right from the document.

- Track and follow up: Utilize automated reminders and overdue notices to ensure timely payments without manual intervention.

By implementing automation, businesses can streamline their financial processes, reduce the time spent on manual tasks, and improve overall accuracy. Setting up an automated system may take a little time upfront, but the long-term benefits in efficiency and reliability are well worth the investment.

Legal Requirements for Invoices in Different Countries

When conducting business internationally, it is crucial to understand that billing documents are not just a form of transaction record; they are also subject to local laws and regulations. Different countries have specific legal requirements regarding what must be included in these documents, and failing to comply can lead to penalties or complications. These requirements can vary greatly based on factors like the type of business, the country in which it operates, and whether the client is local or international.

Key Legal Elements Across Borders

While requirements differ by jurisdiction, some common elements are generally mandated to ensure that documents are legally valid:

- Identification of the business: Most countries require the name, address, and tax identification number (TIN) of the business issuing the document.

- Transaction details: The date, a unique reference number, and a detailed description of goods or services provided must be included to create a clear and accurate record.

- Tax information: Many jurisdictions mandate that tax rates, such as VAT (Value Added Tax) or sales tax, be explicitly listed on the document, with the total tax amount clearly outlined.

- Currency: In some countries, the currency used for the transaction must be specified, especially in cross-border transactions.

- Payment terms: Payment deadlines and any associated late fees are often required to avoid confusion or disputes over payment.

Country-Specific Considerations

Let’s take a look at how requirements may differ across some of the world’s key regions:

- European Union: In the EU, VAT is a crucial consideration. Invoices must display VAT numbers, both for the issuer and the recipient, in addition to the applicable VAT rates. EU businesses also need to comply with the EU-wide VAT invoicing rules.

- United States: While there is no federal requirement for specific information on billing documents, individual states may have their own rules, particularly when it comes to sales tax. Additionally, businesses must follow guidelines for electronic records and reporting where applicable.

- Australia: In Australia, tax invoices must show specific details, including the total amount of GST (Goods and Services Tax) included in the transaction. GST-registered businesses are required to issue tax invoices for most transactions over a certain value.

- India: In India, GST compliance is crucial, and businesses must ensure that all relevant details, such as the GSTIN (Goods and Services Tax Identification Number), are included on the document for tax purposes. Additionally, businesses must follow the electronic invoicing system where mandated by the government.

Implications of Non-Compliance

Not adhering to the local regulations can result in legal challenges, penalties, or delayed payments. For instance, an incorrectly formatted billing document may not be accepted as a valid proof of transaction in certain jurisdictions. This can lead to issues with tax filings, customer disputes, or loss of business credibility.

To avoid these complications, businesses should stay informed of the specific requirements for each country they operate in and ensure that all their billing practices meet local standards.