Free Example Invoice Template for Easy and Professional Billing

Managing financial transactions and keeping track of payments is a critical task for any business. Having a well-organized and consistent method to issue payment requests ensures clarity and professionalism in your dealings with clients. The right approach to creating billing documents can save you time, reduce errors, and help maintain good relationships with your customers.

One of the easiest ways to streamline this process is by using pre-designed forms that include all the necessary components. These tools not only help you maintain consistency but also ensure that every essential detail is included, from service descriptions to payment terms. By customizing these forms to your specific needs, you can create professional-looking documents with minimal effort.

Whether you’re running a small business or freelancing, having a clear and efficient system for generating payment requests is essential. In this guide, we will explore different ways to create and personalize such documents, ensuring you meet both legal requirements and client expectations.

What is an Invoice Template

When managing financial transactions, having a standardized document to request payment is essential for maintaining clarity and professionalism. This document serves as a formal request for compensation for goods or services rendered. It outlines the specifics of the transaction, such as the amount due, payment terms, and a description of the provided services or products.

Rather than creating a new document from scratch each time, businesses often use pre-designed forms that include all the necessary fields. These ready-made structures simplify the process of generating requests, ensuring that all important details are covered while saving time and effort. They can be easily customized to fit the unique needs of any business or individual.

Why Use an Invoice Template

Using a standardized document for requesting payment can significantly improve the efficiency and professionalism of your billing process. A well-structured form ensures that all relevant information is included consistently, reducing the chances of errors or confusion. Whether you’re a freelancer or running a small business, the benefits of utilizing such a system are numerous.

Benefits of Using Pre-Designed Forms

- Time-Saving: Pre-built structures allow for quick and easy customization, so you don’t have to start from scratch each time you need to issue a request.

- Consistency: Using the same format ensures that your documents always contain the necessary details, leading to fewer mistakes and confusion.

- Professional Appearance: A polished and uniform document conveys professionalism to your clients, enhancing your brand’s credibility.

- Legal Compliance: Certain fields and information may be required by law, and using a pre-designed form helps ensure that you meet these requirements.

How It Simplifies Financial Management

- Clear Communication: Including specific details like payment terms and due dates minimizes misunderstandings between you and your clients.

- Tracking and Record Keeping: Structured documents make it easier to maintain accurate records for future reference and tax purposes.

- Cu

Benefits of Customizable Invoice Formats

Using adaptable billing forms offers a range of advantages, particularly for businesses and individuals who need to tailor documents to specific needs or industries. Customizable formats allow you to adjust various components of your financial requests, ensuring they accurately reflect the services provided, payment terms, and branding requirements.

Flexibility and Personalization

- Branding Consistency: With the ability to modify design elements, you can incorporate your company logo, color scheme, and font style, creating a consistent and professional appearance across all financial documents.

- Service-Specific Adjustments: Custom formats allow you to add or remove sections depending on the nature of your offerings, whether it’s detailed descriptions, hourly rates, or flat fees.

- Adaptable Payment Terms: You can easily change the payment schedule or terms to meet the needs of different clients, whether you’re offering discounts, installments, or immediate payment requirements.

Improved Efficiency and Accuracy

- Streamlined Workflow: Customizable options enable quicker document creation, as you can save your preferred layout and reuse it for multiple transactions.

- Minimized Errors: Having a consistent structure reduces the chances of forgetting important details, ensuring that each request is complete and accurate.

- Easy Updates: As your business grows or changes, the ability to quickly update your format ensures your billing practices remain aligned with new services, pricing, or legal requirements.

How to Create an Invoice Template

Creating a structured payment request document is a simple yet crucial task for any business. By building a customized form, you ensure that every financial transaction is clearly documented, including all the essential details for both you and your clients. The process of creating such a document is straightforward and can be easily adapted to your unique needs.

To begin, you should focus on the core components that must be included in every request for payment. These typically consist of your business information, client details, a description of the goods or services, the total amount due, payment terms, and due date. Once you have these sections outlined, you can choose to add extra fields that are specific to your industry or personal preferences.

Using word processing or spreadsheet software, you can easily create a basic structure with editable fields. Once the layout is designed, save the document as a reusable file that can be updated for each new transaction. With a well-built form, you’ll be able to save time, reduce errors, and ensure your financial dealings are transparent and professional.

Essential Elements of an Invoice

To ensure smooth and transparent financial transactions, it’s important to include key information in any payment request. A well-organized document not only helps both parties understand the details of the transaction, but it also ensures legal and professional compliance. The essential elements should cover all the necessary aspects of the business arrangement to avoid confusion or disputes.

The most important sections of such a document include identification details, a clear description of the goods or services provided, pricing, and payment terms. Each section serves a specific purpose, whether it’s outlining the nature of the transaction, specifying the amount due, or providing contact information for follow-up questions.

- Business Information: Include the name, address, and contact details of your company, along with your business registration number if applicable.

- Client Information: Make sure to list the client’s full name or business name, as well as their address and contact details.

- Transaction Date: Clearly state the date when the goods or services were delivered or when the agreement was made.

- Description of Goods or Services: Provide a detailed breakdown of what was provided, including quantities, unit prices, and any relevant descriptions.

- Total Amount Due: State the total amount to be paid, including any taxes, discounts, or additional fees.

- Payment Terms: Specify the due date, any late payment penalties, and available payment methods.

- Unique Reference Number: Assign a unique identification number to help track the document and prevent confusion.

Choosing the Right Invoice Layout

Selecting the right format for your payment request document is crucial for clarity and professionalism. A well-organized layout ensures that all relevant information is easily accessible and that the transaction details are presented clearly. The layout should not only suit your business needs but also align with your brand’s identity, providing a balance between functionality and aesthetics.

Factors to Consider When Choosing a Layout

- Clarity and Simplicity: Keep the layout clean and straightforward, making it easy for clients to quickly find important details like the amount due and payment terms.

- Brand Consistency: Choose a design that reflects your company’s branding, including logo, color scheme, and font style, for a cohesive look across all documents.

- Flexibility: The layout should allow for easy customization, so you can adjust it as needed for different services, clients, or pricing models.

- Space Efficiency: Ensure there’s enough space to include all required information without overcrowding the document or making it too lengthy.

Common Layout Elements

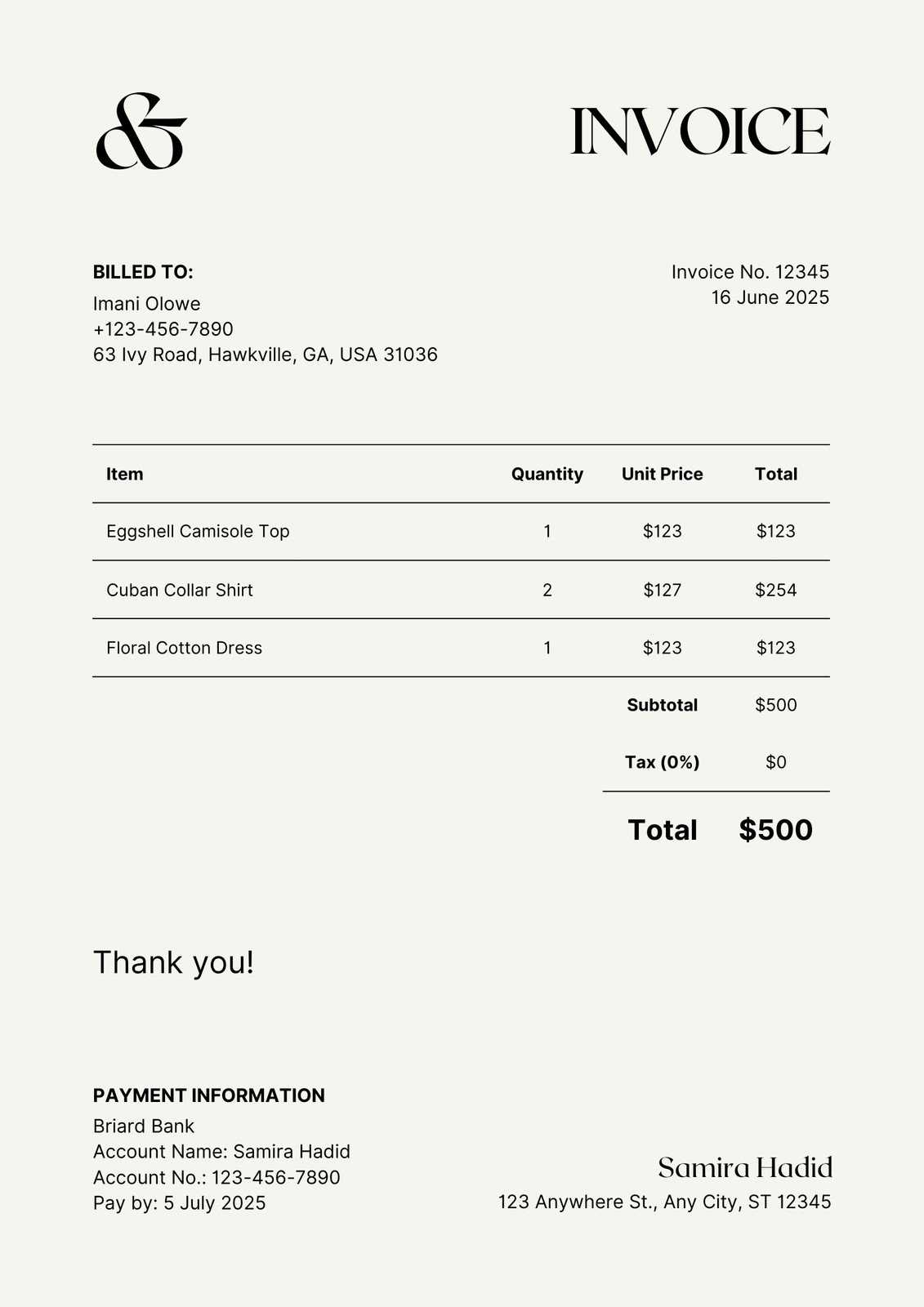

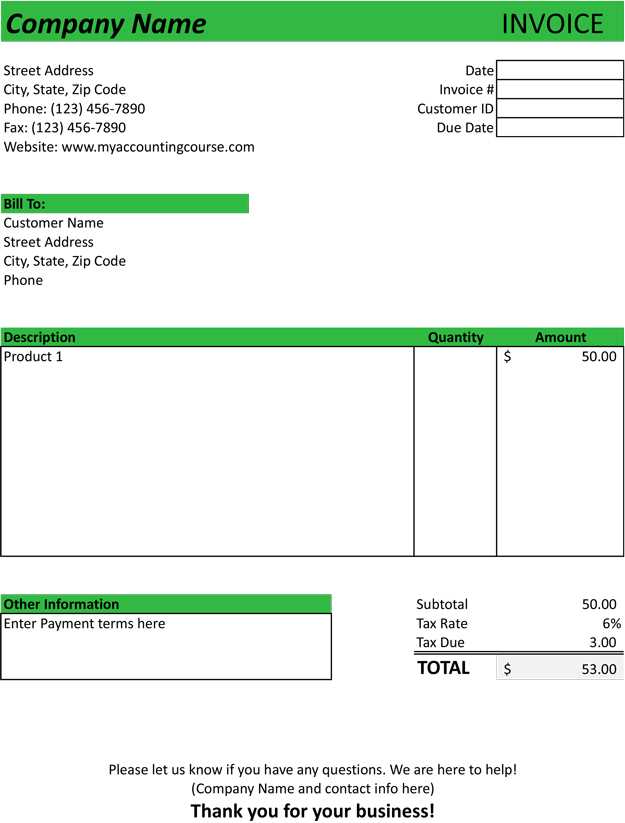

A good layout typically includes several key components. Below is an example of how these elements can be structured in a table format:

Section Details Header Includes your company name, logo, and contact information. Client Information Client name, address, and contact details. Transaction Details Itemized list of products/services provided, with quantities and prices. Total Amount Due Sum of the trans Free Invoice Templates for Small Businesses

For small business owners, managing finances can be time-consuming, especially when it comes to creating clear and professional payment requests. Fortunately, there are many free resources available that offer pre-designed forms, making it easy to generate accurate billing documents without the need for complicated software. These free options are ideal for businesses looking to save time and money while maintaining a professional image.

Many online platforms provide customizable formats that are easy to download and use. These tools are designed to simplify the billing process, allowing small businesses to focus on their core operations instead of spending time on administrative tasks.

Advantages of Using Free Resources

- Cost-Efficiency: Free options eliminate the need for expensive software or subscriptions, allowing small businesses to keep overhead costs low.

- Time-Saving: Ready-made structures reduce the time spent designing and formatting payment requests, helping you get paid faster.

- Ease of Use: Most free options are user-friendly and require little to no technical knowledge, making them accessible even to non-experts.

- Customizable: You can easily adjust fields and layout to suit your specific needs, ensuring that your documents are aligned with your business style.

Where to Find Free Resources

- Online Platforms: Websites like Google Docs, Microsoft Office, and others offer free customizable forms with a variety of layouts suitable for different industries.

- Freelance Websites: Many freelan

Common Invoice Mistakes to Avoid

Even the most well-intentioned businesses can make mistakes when preparing payment request documents. These errors can lead to delayed payments, confusion, or even strained relationships with clients. Understanding the common pitfalls and taking steps to avoid them can help ensure a smoother billing process and prompt payments. Below are some of the most frequent mistakes made when creating financial documents and tips on how to prevent them.

Frequent Errors in Payment Requests

Error How to Avoid Missing or Incorrect Client Information Always double-check the client’s name, address, and contact details before finalizing the document. Omitting Payment Terms Clearly outline due dates, late fees, and accepted payment methods to avoid confusion or disputes. Not Including a Unique Reference Number Assign a unique number to each document to keep track of payments and simplify record-keeping. Unclear or Incomplete Descriptions Provide detailed descriptions for each service or product, including quantities, rates, and any special conditions. Incorrect Calculations Double-check the math to ensure the total amount due is accurate, including taxes, discounts, and additional fees. Additional Tips to Improve Accuracy

- Review Before Sending:How to Personalize Your Invoice Template

Personalizing your billing documents is an effective way to create a unique and professional appearance that reflects your business’s identity. Customizing key elements such as the layout, branding, and content ensures that your requests for payment are not only clear and accurate but also aligned with your company’s values and style. By adding personal touches, you can strengthen your relationship with clients while maintaining consistency across all your financial documents.

Steps to Customize Your Billing Document

- Add Your Branding: Incorporate your company logo, brand colors, and fonts to give the document a polished and consistent look. This helps reinforce your business identity with every interaction.

- Customize the Layout: Adjust the layout to suit the nature of your business. For example, if you provide services, you might want to add more space for service descriptions. Alternatively, product-based businesses can focus on itemized lists.

- Personalize the Greeting: Instead of using a generic heading, consider addressing the client by name or adding a custom message of appreciation for their business.

- Include Custom Payment Terms: Tailor the payment terms to suit specific client agreements, such as offering installment options or discounts for early payments.

Enhancing Client Experience

- Detailed Descriptions: Providing detailed descriptions of products or services not only clarifies the transaction but also helps avoid confusion and potential disputes.

- Add a Professional Touch: Include a message at the bottom of the document thanking the client for their business or encouraging future collaborations. A simple “Thank you for choosing us” can go

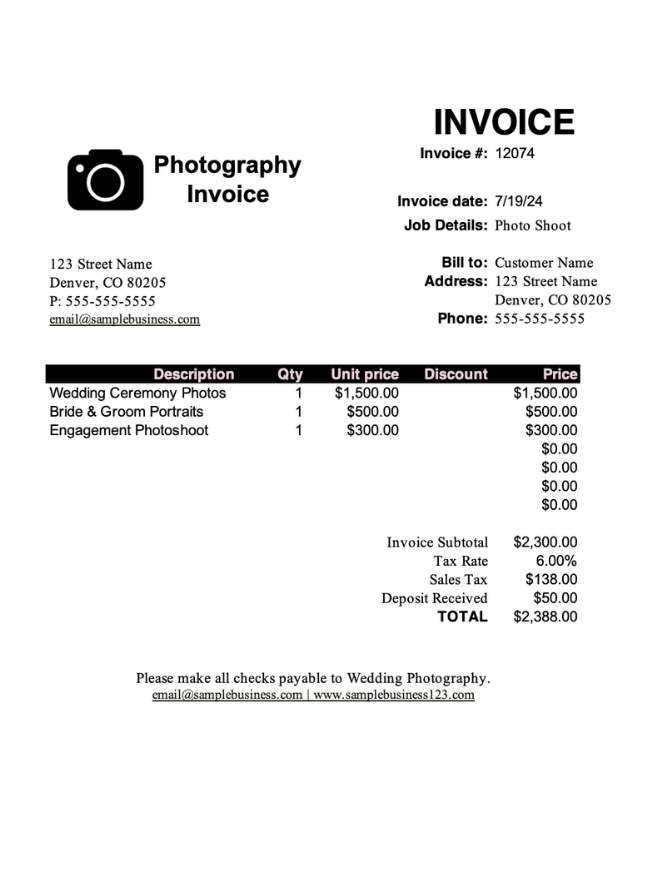

Invoice Template for Freelancers and Contractors

For freelancers and contractors, having a clear and professional document for requesting payment is essential to maintaining a successful business. Unlike traditional employees, freelancers often work with multiple clients and on diverse projects, making it vital to ensure that each billing document is tailored to the specific work completed. A well-structured payment request can help streamline this process, reduce confusion, and ensure timely payments.

When creating a billing document for freelance or contracted work, certain elements become even more important. It’s crucial to include detailed descriptions of the services provided, the hourly or flat-rate fees, and any special terms that were agreed upon. Additionally, a professional format will help you stand out and build credibility with your clients.

Key Elements for Freelancers and Contractors

- Detailed Service Breakdown: Clearly list each service rendered, including the date, hours worked, or specific milestones completed.

- Rates and Payment Terms: Specify whether you charge by the hour, per project, or on a retainer basis. Include agreed-upon payment terms, such as deposit requirements or due dates.

- Contractual Considerations: Include any special terms that were discussed, such as late fees, cancellation policies, or specific client responsibilities.

- Client Contact Information: Ensure the client’s full name, business name (if applicable), and contact details are included to avoid any confusion about who the payment is intended for.

Why It’s Important for Freelancers

- Clarity: With multiple clients, it’s important that both parties understand exactly what is being billed and for what services. A clear document prevents misunderstandings.

- Professionalism: Presenting a polished, well-organized document increases your credibility and strengthens your business reputation.

- Tracking and Record-Keeping: Having a standardized structure helps you stay organized, making it easier to track payments, manage taxes, and maintain records for future reference.

By tailoring your documents for each specific project and client, you can ensure smooth transactions and maintain strong professional relationships with your clients. Whether you’re a writer, designer, consultant, or contractor, a well-crafted payment request goes a long way in setting the tone for a professional collaboration.

Top Features to Look for in Templates

When choosing a payment request document format, certain features can significantly enhance both the efficiency and professionalism of your financial communications. A well-designed document should not only be easy to use but also flexible enough to accommodate various client needs and project types. Knowing what to look for in a format can save you time, reduce errors, and ensure that your billing process runs smoothly.

Essential Features for an Effective Billing Document

- Customizability: The ability to easily adjust fields such as client details, services rendered, and payment terms is crucial. Whether you’re working with one-time clients or long-term contracts, your document should be adaptable.

- Professional Design: A clean and organized layout with space for all necessary details will not only enhance clarity but also improve the professional appearance of your business. Look for formats that include headings and sections for easy navigation.

- Itemized Breakdown: A good document should allow you to list individual items or services with quantities, rates, and descriptions. This helps clients understand exactly what they’re being charged for.

- Tax and Discount Calculations: Automatically calculating taxes and discounts can save you time and reduce the risk of errors. Ensure that the format supports the inclusion of both taxes and any special offers or deductions.

- Due Date and Payment Terms: Clearly outlining the payment due date and terms is vital. Look for formats that allow you to set custom payment deadlines, late fees, or installment plans.

Additional Features to Consider

- Branding Options: The ability to include your company logo, brand colors, and contact information will ensure that your documents align with your brand’s identity.

- Unique Reference Number: A customizable field for a unique reference number or invoice ID is important for tracking and organizing payments.

- M

Using Invoice Templates in Excel

Excel is one of the most popular tools for managing business finances, and it can be an excellent option for creating payment request documents. With its powerful features for calculations, data organization, and customization, Excel allows you to quickly generate professional-looking forms that can be easily modified for different clients and projects. Using a ready-made layout in Excel can save time, reduce errors, and improve overall workflow efficiency.

Benefits of Using Excel for Billing Documents

- Automatic Calculations: Excel’s built-in formulas can automatically calculate totals, taxes, discounts, and any other fees, reducing the chances of manual errors.

- Customization: You can easily adjust the layout and design to suit your specific business needs, whether you need to add more fields for additional information or change the formatting to match your branding.

- Data Organization: Excel offers great flexibility when it comes to managing and sorting your financial data. You can track your past transactions and keep an organized record of all your billing documents in one file.

- Cost-Effective: If you already use Excel for other tasks, there is no need to invest in additional software or services. Excel is a free, familiar tool for many small businesses.

How to Use Excel for Creating Payment Requests

- Choose or Create a Layout: You can either use a pre-designed layout available within Excel or create one from scratch using tables, borders, and formatting tools.

- Insert Key Information: Include your business name, contact details, client information, and a breakdown of services or products. Make sure the document includes the total amount due, tax rates, and p

PDF Invoice Templates for Professional Billing

When it comes to presenting financial documents in a polished and professional manner, PDF formats are widely considered the gold standard. Unlike other file types, PDFs preserve the layout and formatting, ensuring that your billing documents look the same across all devices and platforms. Whether you’re working with clients across the globe or simply aiming to streamline your payment collection process, using a PDF format for billing is both efficient and effective.

Why Choose PDF for Billing Documents?

- Professional Appearance: PDFs are often seen as more formal and reliable, offering a clean, consistent presentation that enhances your business’s credibility.

- Universal Compatibility: PDFs can be opened on virtually any device or operating system, ensuring that your clients can easily access and view the document without compatibility issues.

- Security Features: PDFs allow for password protection, digital signatures, and encryption, offering greater security for sensitive financial information.

- Easy to Print and Share: PDFs maintain their formatting when printed or shared via email, ensuring that clients receive the document exactly as intended.

How to Use PDF for Billing

- Select a Ready-Made Layout: Choose from a variety of pre-designed forms available in PDF format. These templates often come with the necessary fields for business and client details, as well as the a

How to Automate Invoice Generation

Automating the creation of payment requests can save businesses significant time and reduce the potential for human error. By setting up systems that automatically generate and send financial documents based on specific triggers, you can streamline the billing process and ensure consistency across all transactions. With automation tools, recurring tasks such as data entry, calculations, and document formatting can be handled with minimal manual input, allowing you to focus on other aspects of your business.

Benefits of Automating Billing Documents

- Increased Efficiency: Automation eliminates repetitive manual tasks, such as filling in client details and calculating totals, speeding up the entire process.

- Reduced Errors: Automated systems are less prone to mistakes than manual data entry, ensuring that calculations, taxes, and totals are always accurate.

- Consistent Output: Automation ensures that every document follows the same structure and format, maintaining a professional and uniform appearance across all requests for payment.

- Time Savings: Once set up, automated systems require little to no ongoing effort, saving you valuable time that can be used for other important tasks.

Steps to Automate Your Payment Request Process

- Choose an Automation Tool: There are various software tools and platforms available for automating billing, such as accounting software or dedicated invoicing tools. Choose one that integrates with your existing systems and meets your specific needs.

- Set Up Client Data: Input your clients’ details into the system, including contact information, payment terms, and any recurring services. Most platforms will allow you to save client profiles for future use.

- Define T

Legal Considerations in Invoice Templates

When creating a financial document for requesting payment, it’s essential to understand the legal requirements that apply to your business transactions. A well-structured payment request not only ensures clarity between you and your client but also helps protect your rights in case of disputes. There are several legal aspects to consider, such as proper documentation, payment terms, and compliance with local laws. Incorporating these elements into your financial documents can prevent future complications and enhance your business’s professionalism.

Key Legal Aspects to Include

- Clear Payment Terms: Clearly state the agreed-upon payment amount, due date, and any late fees or interest that may apply. This helps avoid disputes over what was agreed upon and protects your rights if payment is delayed.

- Accurate Client Information: Ensure that the client’s full name, address, and contact details are correct. This information is essential for both legal purposes and ensuring that payments are directed to the right person or entity.

- Tax Information: Depending on your location, you may need to include tax identification numbers and the applicable sales tax rates on your documents. This is particularly important for businesses that are required to charge tax on products or services.

- Contractual Clauses: If you have specific terms of service or a contract with the client, reference these terms in your document. For example, include the agreed-upon payment schedule or special conditions regarding refunds or cancellations.

Compliance with Local and International Laws

- Understanding Jurisdiction: Be aware of the legal requirements in your country or state, as these can vary significantly. Local laws may govern tax rates, invoicing procedures, and what must be included in a billing document.

- Cross-Border Transactions: If you’re dealing with international clients, ensure your document complies with international regulations, including currency conversions, tax requirements, and language preferences.

- Digital Signature and Electronic Invoices: In some regions, digital signatures are legally binding, and electronic versions of documents are considered as valid as paper copies. Be sure to include any legal disclaimers regarding electronic transactions if applicable.

By ensuring your payment documents are legally sound, you

Integrating Invoice Templates with Accounting Software

Integrating payment request documents with accounting software can significantly enhance the efficiency and accuracy of your financial operations. By syncing the two systems, you can automate the process of generating, sending, and tracking financial documents while maintaining up-to-date records of your transactions. This integration not only reduces manual data entry but also helps streamline your overall business operations, improving both productivity and accuracy.

Advantages of Integration

- Time Efficiency: Automation reduces the time spent on creating and sending payment requests, allowing you to focus on other key business tasks.

- Improved Accuracy: By syncing your documents with your accounting software, you minimize the risk of manual errors in calculations, client details, and totals.

- Real-Time Data Sync: Your financial records are updated in real time, ensuring that your accounting system always reflects the most current status of your business finances.

- Seamless Financial Tracking: With everything in one place, it’s easier to track payments, monitor outstanding balances, and generate reports for tax and financial analysis.

Steps to Integrate Payment Documents with Accounting Software

- Choose Compatible Software: Select accounting software that supports integration with the billing tool or document generation system you use. Many modern accounting platforms offer built-in invoice features or support for third-party integrations.

- Sync Client Data: Ensure that your client database is synchronized between both systems. This will allow you to auto-populate client details such as name, address, and payment terms directly into the financial documents.

- Customize Your Layout: Tailor your payment request format to match your business needs, while ensuring that all necessary fields for tax, payments, and services are included in both the software and the document.

- Automate Document Generation: Set up rules for when and how payment requests should be generated. For example, automate the creation of documents based on project milestones, subscription renewals, or recurring services.

- Track Payments and Outstanding Balances: Once documents are sent, use your accounting software to automatically track payments, send reminders for overdue payments, and manage your overall financial health.

Integrating billing systems with accounting software offers a powerful solution for businesses seeking to improve efficiency, reduce errors, and stream

- Review Before Sending:How to Personalize Your Invoice Template