Event Photography Invoice Template for Streamlined Billing

Managing payments and maintaining clear financial records is essential for anyone offering creative services. A well-organized billing system not only improves client relationships but also helps ensure timely payments and minimizes misunderstandings. By using structured billing methods, you can make the payment process easy for both you and your clients.

Professionally crafted billing documents provide clarity regarding services rendered, costs, and payment terms. They are essential tools for building trust and maintaining transparency. With a reliable billing process, you can spend less time on paperwork and more time focusing on your craft.

In this guide, you’ll discover tips for setting up clear and efficient billing practices tailored to creative work. We’ll explore essential components, customization options, and the benefits of various digital solutions to help you develop a streamlined approach that suits your unique needs.

Event Photography Invoice Template Guide

Organizing payment documents effectively is crucial for smooth client interactions and successful project completion. A well-structured billing document serves as a key communication tool, helping to clarify costs, terms, and expectations between you and your clients. Implementing a consistent format can streamline the entire payment process and reduce potential misunderstandings.

Key Components of a Professional Billing Document

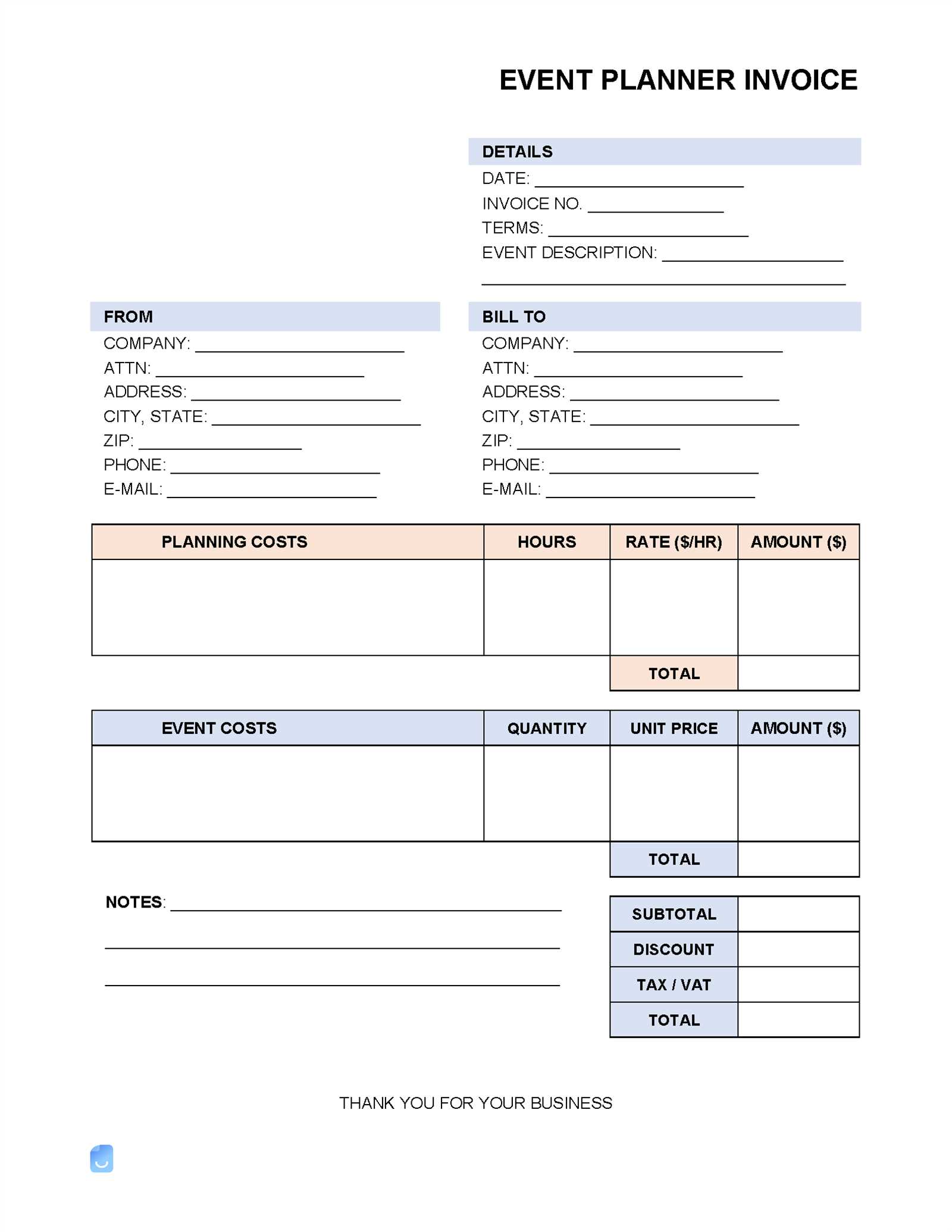

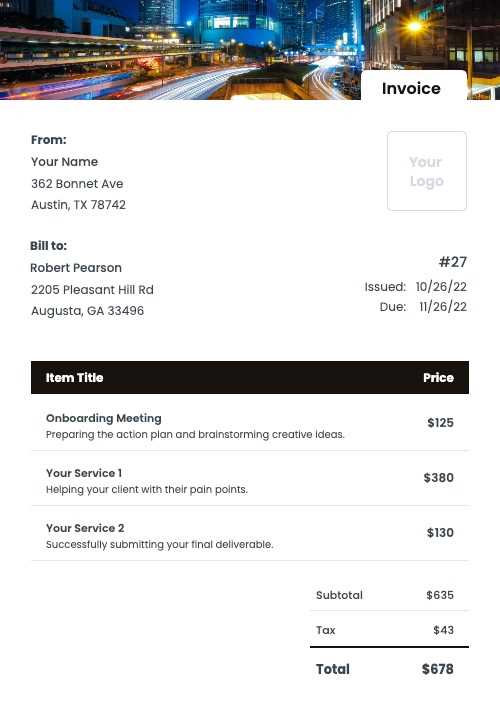

Creating a reliable billing document involves including all essential details that both you and your clients need. These typically include the service date, a description of the work provided, and clear itemization of charges. Providing this level of detail ensures clients understand the breakdown of costs and makes record-keeping easier for future reference.

Enh

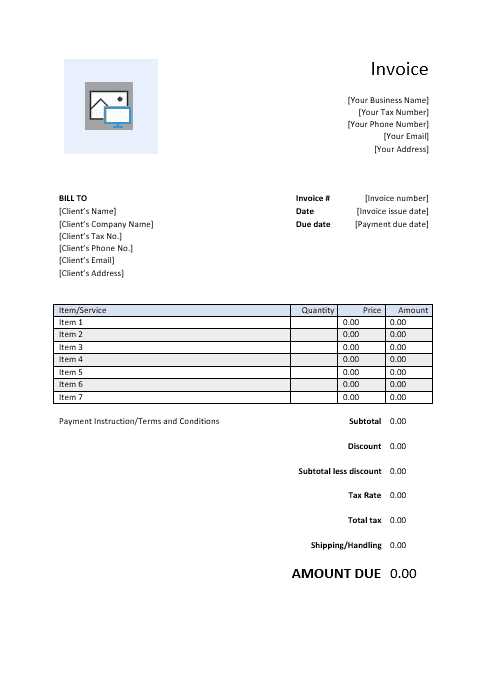

Why Use an Invoice Template

For creative professionals, handling payments smoothly and professionally is crucial for maintaining a strong relationship with clients. Using a pre-designed billing format offers consistency, making each transaction clear and straightforward. This organized approach can save time and reduce potential errors, allowing you to focus more on your work.

Benefits of a Standardized Billing Format

- Time Efficiency: With a pre-set structure, there’s no need to create new documents from scratch for each client, reducing the time spent on administrative tasks.

- Professional Presentation: A consistent format gives your business a polished look, helping build trust with clients and leaving a positive impression.

- Error Reduction: By following an organized layout,

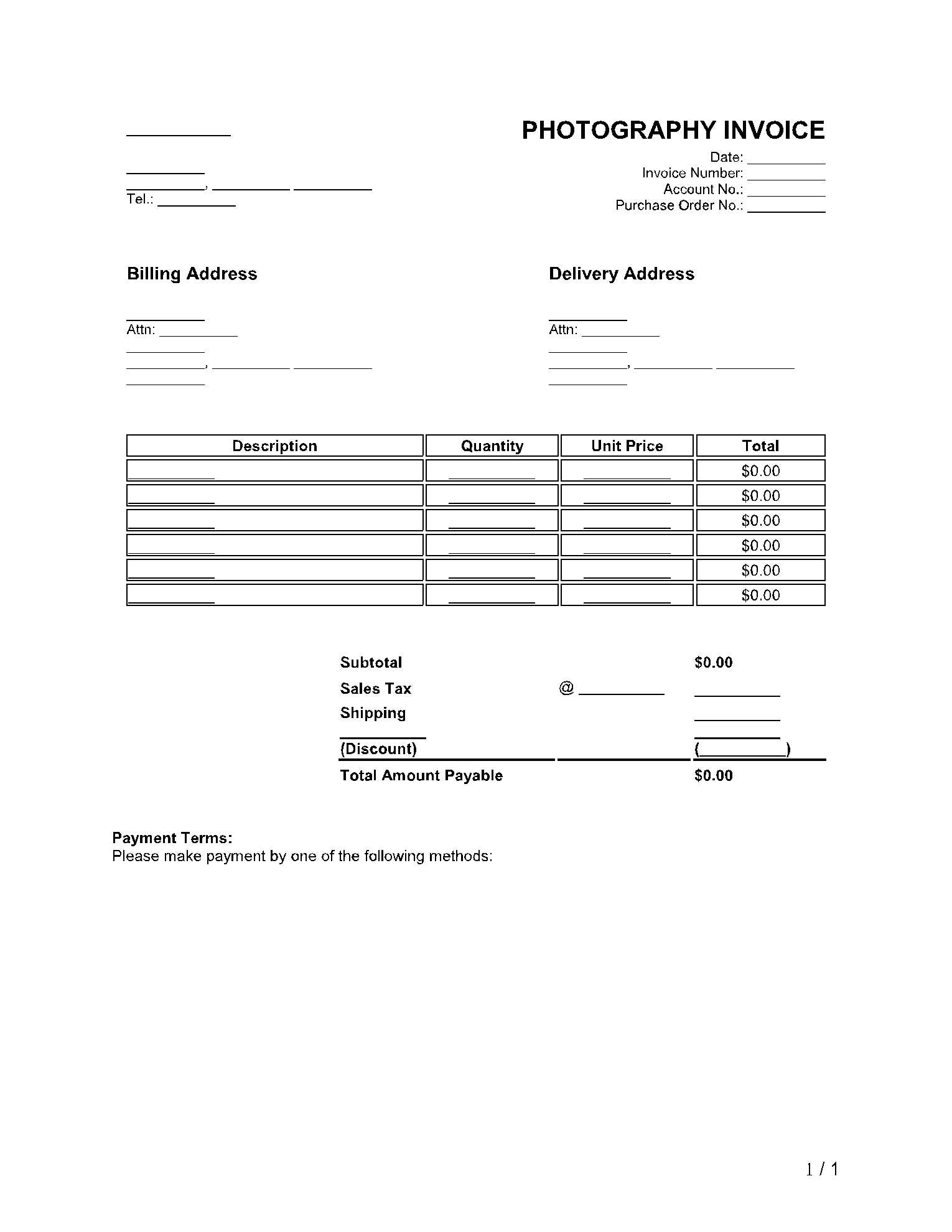

Essential Elements of an Invoice

A comprehensive billing document provides both you and your client with clarity, ensuring all necessary details of the transaction are clearly outlined. Including certain key components enhances transparency, reduces the likelihood of disputes, and makes tracking payments simpler. A structured layout allows for easy navigation, helping clients understand the charges and terms associated with your services.

Key Information to Include

To create a fully informative document, several essential details should be present. This information supports effective communication and contributes to a professional presentation.

Element Description Contact Information Both your and the client’s contact details, including name, address, phone number, and email for clear Essential Elements of an Invoice

A comprehensive billing document provides both you and your client with clarity, ensuring all necessary details of the transaction are clearly outlined. Including certain key components enhances transparency, reduces the likelihood of disputes, and makes tracking payments simpler. A structured layout allows for easy navigation, helping clients understand the charges and terms associated with your services.

Key Information to Include

To create a fully informative document, several essential details should be present. This information supports effective communication and contributes to a professional presentation.

Element Description Contact Information Both your and the client’s contact details, including name, address, phone number, and email for clear identification. Unique Document Number An individual identifier for each transaction, which helps with tracking and future reference. Service Date The date or period when the work was performed, providing context for the charges listed. Itemized List of Services A breakdown of the work provided, often detailing each service and associated cost for full transparency. Total Amount Due The full cost of all listed services, calculated for clarity on the amount owed. Payment Terms Details regarding due dates, accepted payment methods, and any late fees, helping to set clear expectations. Importance of Including Detailed Descriptions

Each element in the document plays a role in providing the client with a complete understanding of the service. Detailed descriptions and itemization make it easier to understand charges, while clear payment terms help avoid any payment delays. A well-organized document benefits both parties by fostering transparent communication.

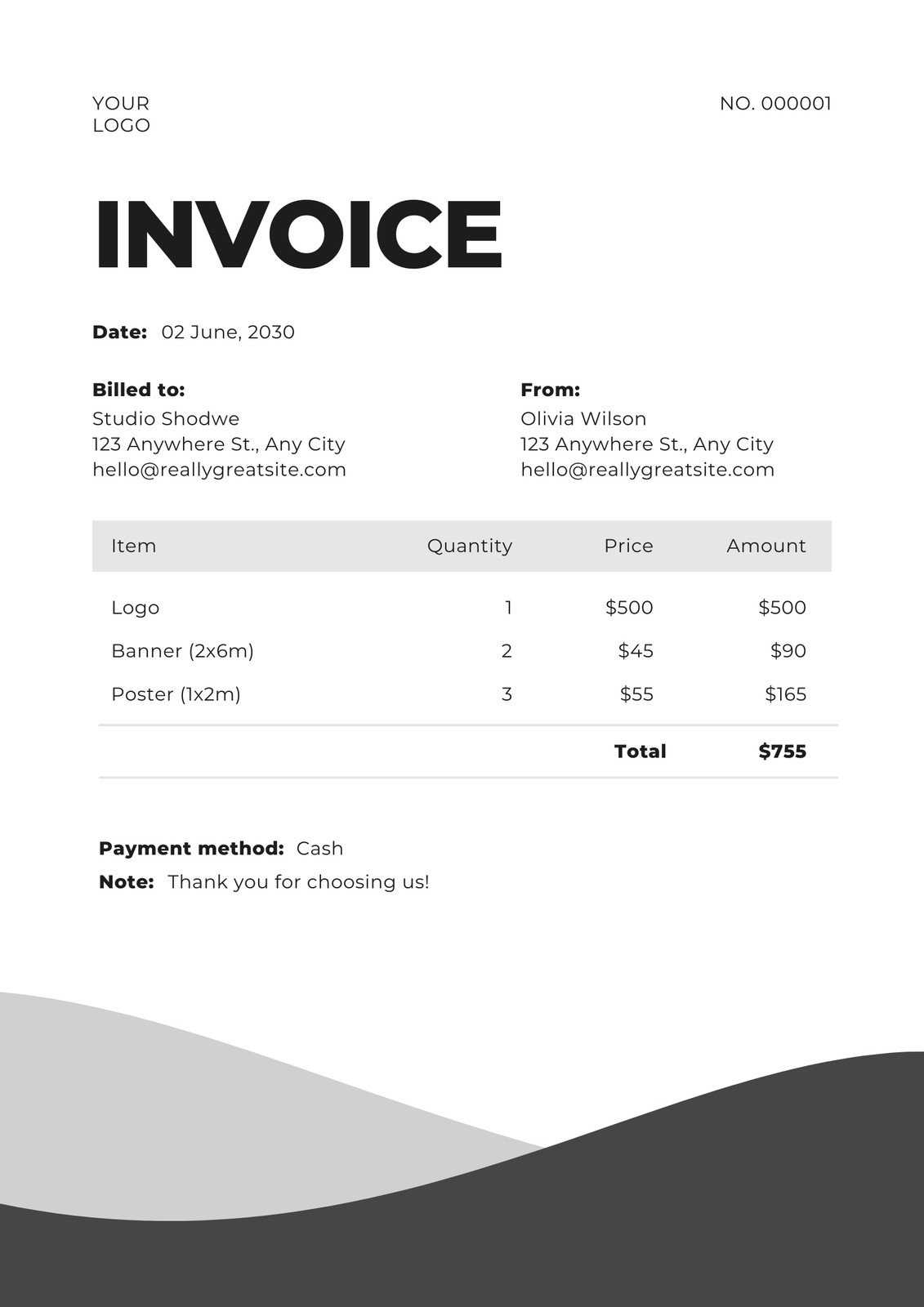

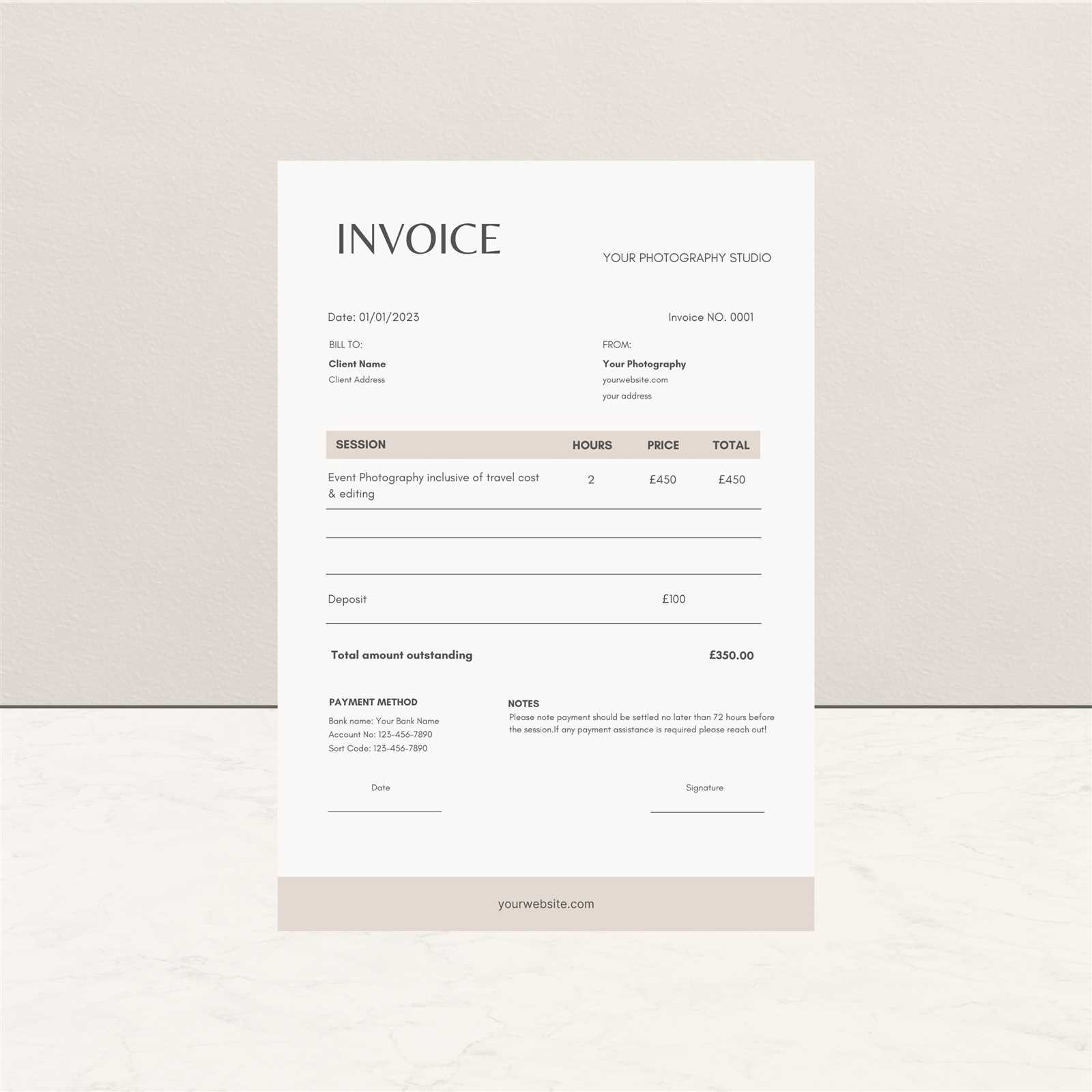

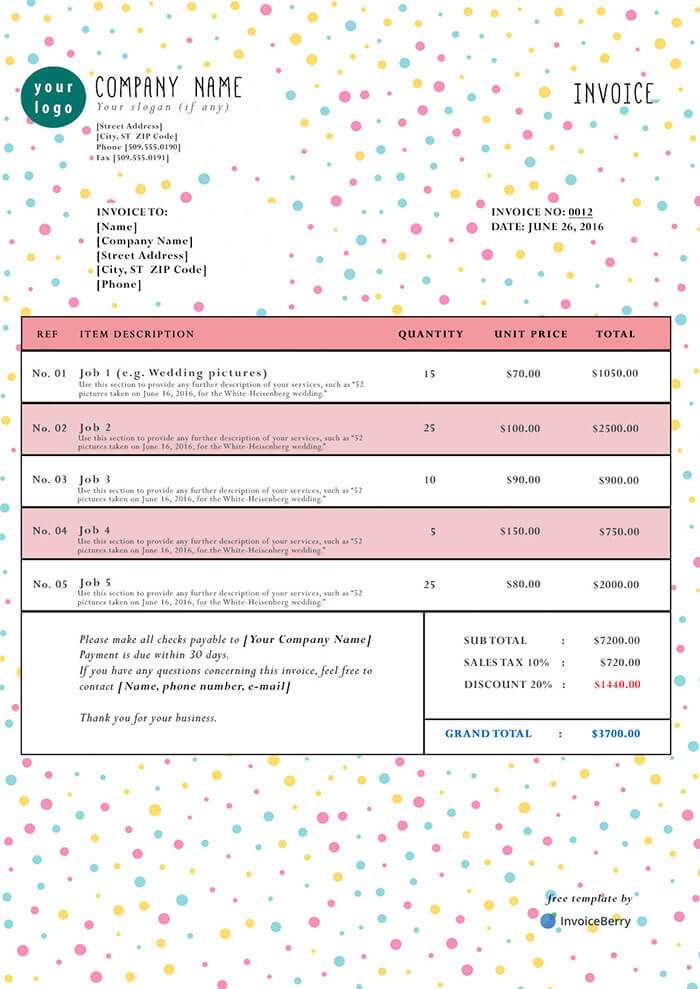

Tips for Professional Invoice Design

Creating a polished billing document is essential for presenting a professional image to clients. A well-designed format not only improves readability but also reflects positively on your business. The structure, layout, and content should all contribute to a clear, organized, and visually appealing document that conveys reliability and attention to detail.

Design Essentials for a Polished Look

- Keep It Simple: Use a clean, minimalist layout with a limited color palette to enhance readability. Avoid excessive graphics or fonts that might distract from the document’s purpose.

- Consistent Branding: Incorporate your logo, business name, and brand colors. Consistency in branding reinforces your identity and makes

Tips for Professional Invoice Design

Creating a polished billing document is essential for presenting a professional image to clients. A well-designed format not only improves readability but also reflects positively on your business. The structure, layout, and content should all contribute to a clear, organized, and visually appealing document that conveys reliability and attention to detail.

Design Essentials for a Polished Look

- Keep It Simple: Use a clean, minimalist layout with a limited color palette to enhance readability. Avoid excessive graphics or fonts that might distract from the document’s purpose.

- Consistent Branding: Incorporate your logo, business name, and brand colors. Consistency in branding reinforces your identity and makes the document look professional.

- Prioritize Legibility: Choose fonts that are easy to read, ensuring text size is appropriate. Headings should stand out, while smaller details can use a slightly smaller font for a balanced look.

Additional Tips for Enhanced Clarity

- Use Clear Headings: Label each section, such as contact information, service details, and payment terms. This helps clients quickly locate the information they need.

- Highlight Important Information: Emphasize critical details like payment deadlines and amounts due using bold or larger font sizes to ensure they stand out.

- Ensure Digital Compatibility: Optimize the document for digital use by choosing file formats, like PDF, that are accessible on multiple devices without altering the design.

A professional design leaves a lasting impression, making it easier for clients to understand and fulfill their payment obligations. Attention to these design elements helps convey a high standard of service and encourages prompt, smooth transactions.

Managing Payment Terms and Deadlines

Clear guidelines around payment expectations are crucial for a smooth and professional financial process. Setting clear due dates and specific terms helps to avoid misunderstandings and ensures that all parties are on the same page regarding payment obligations. Well-defined terms also create a positive client experience by establishing trust and transparency.

Setting Up Clear Payment Terms

- Define Payment Due Dates: Clearly state when the payment is expected. Use precise terms such as “Net 30” (30 days after receipt) or “Due Upon Receipt” to avoid ambiguity.

- Specify Accepted Payment Methods: List the methods you accept, such as bank transfer, credit card, or online platforms. This gives clients flexibility and simplifies the payment process.

- Outline Late Fees: Mention any charges for late payments, if applicable. This encourages timely payment and ensures that clients are aware of any penalties for delays.

Communicating and Following Up

- Send Reminders Before the Due Date

Tracking Invoices and Payments

Effective tracking of financial documents and payments is essential for maintaining a smooth cash flow and ensuring that all dues are settled promptly. Keeping accurate records helps avoid errors, streamline the accounting process, and maintain a clear overview of outstanding amounts. A robust system for tracking payments not only improves financial management but also supports a professional image in business transactions.

Methods for Tracking Financial Documents

- Use Digital Tools: Leverage accounting software or spreadsheet tools to track payments and outstanding balances. These tools allow easy updates and provide a quick overview of your financial status.

- Assign Unique Identifiers: Give each document a unique reference number. This will simplify the process of cross-referencing records and tracking specific payments more effectively.

- Set Up a Payment Schedule: Establish a clear timeline for when payments are due and when to follow up. Setting reminders for specific dates will help you stay on top of outstanding amounts.

Efficient Payment Monitoring

- Monitor Payment Status Regularly: Keep track of which payments have been received and which are still pending. This will prevent missed payments and ensure timely follow-ups.

- Send Payment Confirmations: After receiving payments, always send confirmation notices to clients. This maintains transparency and assures them that their payment was successfully processed.

- Keep Backup Records: Maintain backup copies of all financial records, including receipts and payment confirmations, in case of discrepancies or audits.

By implementing a reliable system for tracking financial documents and payments, you can ensure that no transaction is overlooked, fostering stronger client relationships and better financial organization.

Common Mistakes to Avoid in Invoicing

When managing financial transactions, it’s important to ensure that all billing procedures are handled with precision. Small errors in financial documents can lead to confusion, delayed payments, and a loss of credibility with clients. Avoiding common mistakes is essential to maintaining a professional reputation and a smooth workflow in financial dealings.

Key Errors to Watch Out For

Mistake Impact Solution Missing or Incorrect Details Causes confusion and delays in payment Ensure all information is accurate, including client details and payment terms Unclear Payment Terms Leads to misunderstandings and late payments Clearly outline payment due dates and methods Failure to Include Unique Identifiers Hinders tracking and referencing Assign a unique number or reference code to each document Not Providing a Clear Breakdown of Charges Can create disputes and confusion Provide a detailed list of services or items with clear pricing Additional Tips for Accuracy

- Double-Check for Typos: Small errors in spelling or figures can lead to misunderstandings, so always review your documents before sending them.

- Avoid Ambiguity in Descriptions: Ensure that the descriptions of services provided are clear and detailed to prevent misinterpretation.

- Track the Status of Payments: Always monitor payment receipts and remind clients about overdue balances in a polite manner.

By being mindful of these common mistakes and following best practices, you can maintain a smooth and professional billing process that fosters trust and efficiency with your clients.

Protecting Your Work with Clear Terms

When providing services, it is crucial to ensure that the expectations and responsibilities between you and your clients are well defined. Having clear and detailed agreements helps protect both parties, ensuring that the terms of the contract are understood and respected. This reduces the likelihood of disputes and ensures that your work is valued and compensated fairly.

Important Aspects to Include

- Scope of Services: Clearly outline the services you will provide to avoid misunderstandings about what is included in the agreement.

- Payment Terms: Specify how much the client will pay, when the payment is due, and any additional charges such as late fees.

- Usage Rights: Clearly state how the work can be used and whether the client has exclusive rights or if there are any limitations.

- Cancellation and Refund Policy: Define the conditions under which the client can cancel, and whether any refunds or rescheduling are allowed.

- Delivery Timeline: Provide a clear timeline for when the work will be delivered and any milestones or progress updates along the way.

Benefits of Clear Terms

- Protects Your Intellectual Property: Ensures that your creative work is properly credited and not used in ways you haven’t agreed upon.

- Reduces Confusion: Helps both you and the client understand what is expected, leading to smoother projects and better communication.

- Sets Expectations for Payment: Clearly communicates how and when you will be paid, reducing the chance of late or missed payments.

- Prevents Disputes: Well-defined terms help avoid misunderstandings that could lead to conflicts or legal issues.

By including these elements in your agreements, you can ensure that your professional services are protected and that your clients understand the terms and conditions clearly. This creates a transparent and fair relationship that benefits both parties.

Best Software for Invoice Creation

Choosing the right software to handle your billing and financial documentation is essential for maintaining professionalism and organization. The best tools simplify the process, automate tasks, and help you create accurate and polished documents. Below are some of the top solutions available that cater to various business needs, offering flexibility and user-friendly features for creating detailed and well-structured documents.

Software Key Features Best For QuickBooks Comprehensive accounting features, customizable templates, online payment integration Small to medium businesses that need accounting and billing integration FreshBooks User-friendly interface, automated payment reminders, time tracking Freelancers and small businesses looking for simplicity and efficiency Zoho Invoice Custom branding, multi-currency support, automatic tax calculations Companies with international clients needing invoicing flexibility Wave Free billing software, simple interface, recurring invoices Freelancers and small businesses on a budget Bill.com Automated accounts payable and receivable, cloud-based document storage Medium to large businesses needing high-level billing and accounting Each of these options offers unique features tailored to different business needs. Whether you’re a freelancer looking for simplicity or a large business needing advanced financial tools, there is software available to streamline your documentation process and ensure you remain organized.

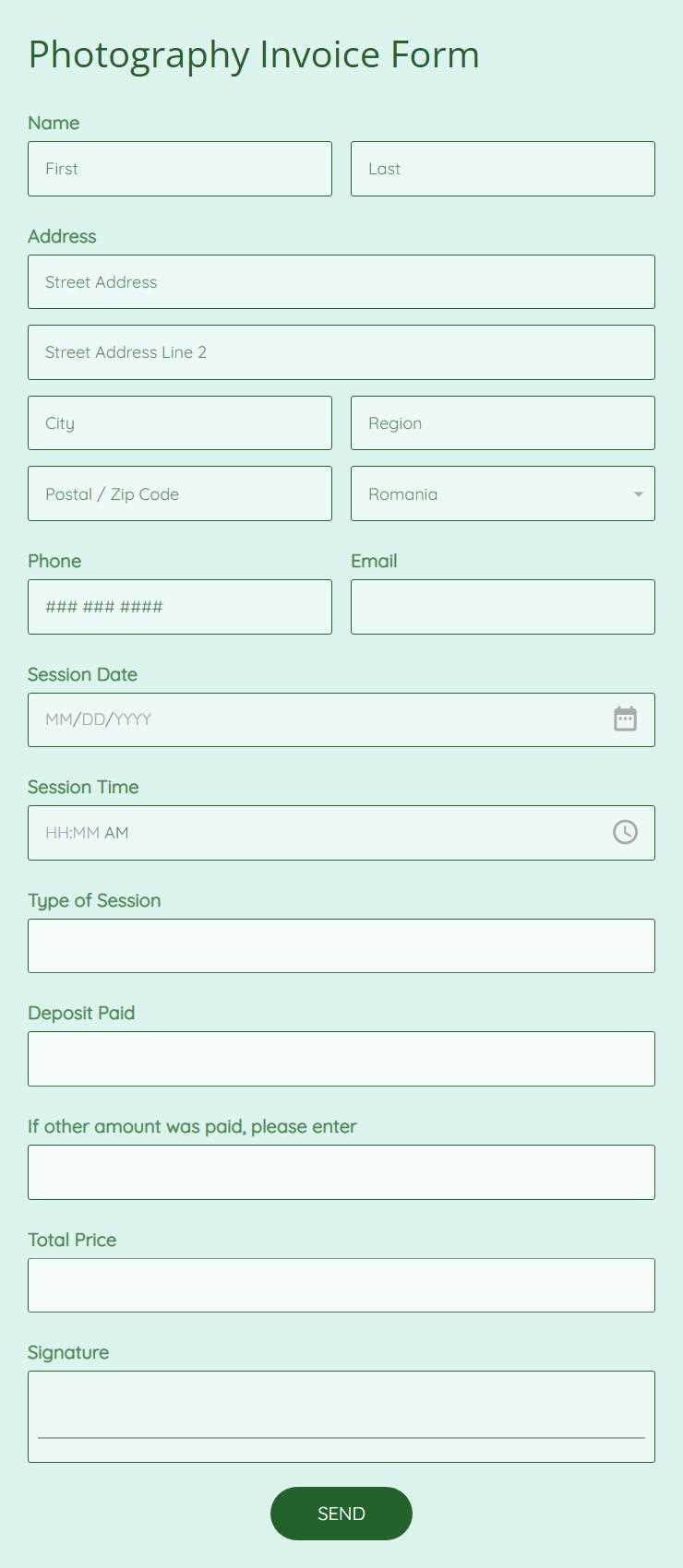

Using Mobile Apps for Invoicing

Mobile applications have revolutionized the way businesses manage billing and financial documentation on the go. These tools offer flexibility, allowing professionals to create and send documents from anywhere, without the need for a desktop computer. With just a smartphone or tablet, you can streamline the process, keep track of payments, and ensure timely document delivery to clients. Below is a list of some popular apps that cater to various invoicing needs.

App Key Features Best For Invoicely Simple interface, multi-currency support, automatic tax calculations Freelancers and small business owners needing basic invoicing features PayPal Here Instant payment processing, mobile point-of-sale, easy integration with PayPal Businesses that require seamless payment acceptance on the go Zoho Books Expense tracking, invoice reminders, time tracking integration Businesses looking for a comprehensive mobile solution with accounting features QuickBooks Self-Employed Track expenses, create and send invoices, tax calculations Self-employed individuals needing a simple and reliable invoicing app Wave Free invoicing, accounting features, recurring invoices Freelancers and small businesses seeking a free and easy-to-use mobile app With these mobile applications, professionals can manage their financial operations more efficiently, allowing for better organization and faster document delivery, regardless of their location.

Invoicing for Different Event Types

When managing billing for various occasions, it’s important to tailor the documents to meet the specific needs of each type of gathering. Different types of services, durations, and complexities require distinct approaches to ensure clarity and professionalism. Below, we explore how to adapt billing for a variety of occasions.

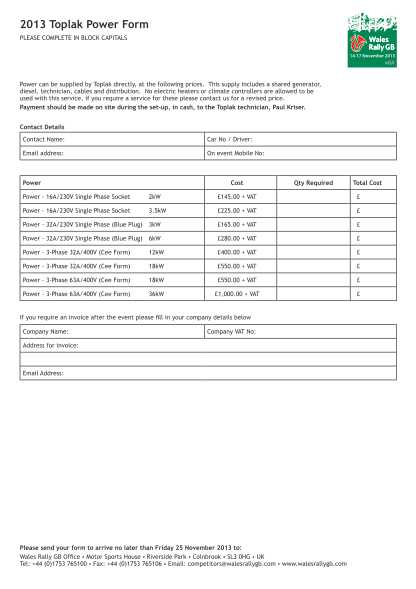

Corporate Gatherings

For business-related occasions, invoices often require more detailed descriptions of services provided, such as equipment rental, staff time, and any specialized services like technical support or custom setups. These documents should clearly outline each charge to avoid any confusion. Additionally, including payment terms and deadlines is crucial in corporate billing, as many clients may have different payment cycles.

Private Celebrations

For personal milestones such as weddings, birthdays, or anniversaries, it’s essential to create documents that are not only clear but also personal and reflective of the event. You may want to include a breakdown of packages offered, along with any additional services like décor or special requests. Payment schedules can vary greatly for these types of gatherings, so it’s important to be clear on deposit requirements and the final due amount.

Regardless of the occasion, ensuring that all billing details are transparent, specific, and easy to understand helps in maintaining professional relationships and ensuring timely payments.

Tax and Legal Considerations for Invoices

When preparing payment documents, it’s crucial to be aware of the tax and legal aspects that govern their creation and submission. Understanding the requirements can help ensure compliance with local regulations and protect both service providers and clients. This section highlights key considerations to keep in mind when issuing payment requests.

Tax Compliance

One of the most important elements to include in any payment document is the proper calculation of taxes. Depending on your location and the nature of the services offered, you may need to apply sales tax, VAT, or other relevant taxes. Ensure that the tax rate is clearly stated, and any exemptions or special considerations are reflected in the calculation. Failure to include taxes correctly can result in fines or legal issues, so it’s essential to keep up-to-date with the applicable tax laws in your jurisdiction.

Legal Requirements

In addition to tax considerations, there are various legal aspects to address. For example, many regions require that certain details appear on payment documents, such as your business registration number, the client’s contact information, and a clear description of the services provided. Having these details ensures that the document meets legal standards and can be used in case of disputes. Furthermore, maintaining accurate records can be vital for both tax reporting and contractual obligations.

By staying informed about tax regulations and legal requirements, service providers can avoid common pitfalls and build trust with clients while ensuring proper documentation.

Creating Digital vs. Printed Invoices

When it comes to requesting payment for services rendered, businesses have the option of using digital or physical documents. Both methods have their advantages and disadvantages, depending on the preferences of the service provider and the client. This section explores the key differences between digital and printed documents, helping you make an informed choice on which method best suits your needs.

Advantages of Digital Documents

Digital documents offer several benefits that make them a popular choice for many service providers:

- Convenience: They can be easily created, shared, and stored electronically, making them a quick and efficient option for both parties.

- Environmentally Friendly: Since there is no need for paper, digital documents help reduce environmental impact.

- Cost-Effective: There are no printing, paper, or postage costs involved when using digital formats.

- Automation: With the help of software, you can automate the process of creating and sending documents, saving time and minimizing errors.

Advantages of Printed Documents

Despite the growing trend of digital documents, there are still some reasons why physical copies might be preferred:

- Professionalism: Some clients might view printed documents as more formal and trustworthy, especially in industries where face-to-face interactions are common.

- Paper Trail: Physical documents provide a tangible record that clients may find easier to file and keep track of, especially in industries with strict documentation requirements.

- Customization: Printed documents allow for creative formatting and presentation, which can be useful for building a brand identity.

Both methods have their own set of advantages, so consider your specific needs, preferences, and those of your clients before deciding which format to use.

Handling Late Payments Professionally

Late payments can be a common issue for businesses, but managing them with professionalism and tact is essential for maintaining strong client relationships. Addressing overdue payments promptly, while remaining respectful and fair, is key to ensuring that you are compensated for your work without damaging your reputation. In this section, we will explore effective strategies for handling delayed payments professionally.

Communicate Clearly and Promptly

The first step in dealing with late payments is open and clear communication. If a payment is overdue, reach out to the client as soon as possible to remind them of the outstanding balance. Keep the tone polite and professional, as misunderstandings can sometimes occur. Consider the following approaches:

- Send a Friendly Reminder: A gentle nudge can often resolve the issue without tension. You can send an email or message asking if the payment was received or if any issues have arisen.

- Provide Payment Details: Include the payment amount, due date, and any other relevant information in your reminder to avoid confusion.

- Set Clear Deadlines: When following up, be specific about the new payment deadline to help encourage timely action.

Implement Clear Late Fees and Policies

To minimize the occurrence of late payments, consider establishing clear terms for late fees and overdue charges. This helps set expectations from the beginning and ensures that clients understand the consequences of delayed payments. Some helpful tips include:

- Define Late Fees: Specify a percentage or flat fee for late payments in your initial agreement. This creates an incentive for clients to pay on time.

- Offer Payment Plans: If a client is facing financial difficulties, providing the option of installment payments can help resolve the issue amicably.

- Stay Professional: Even when enforcing fees or policies, always keep the communication polite and focused on finding a solution.

By handling late payments professionally, you not only increase the likelihood of getting paid on time but also maintain a positive working relationship with your clients.

Improving

Continuous enhancement is crucial for any business, ensuring efficiency, client satisfaction, and consistent growth. By refining processes and adopting new strategies, you can enhance the overall experience for both you and your clients. This section explores several ways to make significant improvements in your operations and service offerings.

Evaluate Current Practices

Start by reviewing your existing workflows and identifying areas where there is room for improvement. This can include everything from administrative tasks to client interactions. Pay attention to the time spent on each task and any challenges that arise. By addressing inefficiencies early on, you can improve productivity and reduce stress.

Seek Client Feedback

Regular feedback is one of the most effective ways to enhance your offerings. Asking clients for their opinions on your services, delivery, and overall experience can provide valuable insights. Implementing their suggestions can help you build stronger relationships and meet their expectations more effectively.

Invest in Technology

Technological tools can significantly streamline many aspects of your work. Whether it’s automating administrative tasks, using project management software, or adopting digital platforms for communication, the right tools can free up your time to focus on higher-value activities. Ensure that you are up-to-date with the latest advancements that can enhance your workflow.

Enhance Communication Skills

Effective communication is key to successful interactions with clients, colleagues, and partners. By improving your communication skills, both written and verbal, you can ensure that expectations are clear and misunderstandings are minimized. Practicing active listening and being responsive to inquiries can create a more positive atmosphere for everyone involved.

By continuously working to improve your practices, you can build a stronger, more efficient business that attracts repeat clients and fosters long-term success.