Event Invoice Template for Easy and Professional Billing

Managing payments for your services can be a challenging task, especially when you need a structured and clear approach to handle various client requests. Having the right system in place not only makes billing easier but also helps maintain professionalism and transparency. By using a well-organized method, you ensure that clients understand what they are paying for and how much they owe.

Whether you are handling a small gathering or a large-scale project, having a pre-designed system to outline costs, track payments, and issue receipts can save both time and effort. This approach reduces the chance of errors and ensures that your clients receive accurate documentation for all services rendered.

Customization is key when it comes to setting up a system that works for your unique needs. Tailoring your documentation can help address specific services, payments, and additional charges, making it a flexible tool to adapt as your business grows. An organized structure will also help you maintain a consistent approach across different clients and events.

In this guide, we will explore how to create and implement an effective structure to streamline your billing process, making it easier for you to manage and more efficient for your clients to pay. With the right setup, you’ll minimize confusion and focus more on delivering quality service.

Understanding Event Invoices and Their Importance

When managing a service-based business, clear communication regarding financial transactions is essential for maintaining trust with clients. Properly documenting the costs associated with a service ensures both parties are on the same page and helps prevent misunderstandings. These documents play a vital role in outlining what is owed, why, and when, creating a solid foundation for smooth financial dealings.

Having a structured method to present charges, fees, and payment terms not only enhances professionalism but also serves as a record for future reference. Whether you’re providing a one-time service or managing an ongoing project, clarity and organization in your billing process can set you apart from competitors and establish credibility.

The Role of Clear Documentation in Business Transactions

By clearly specifying the costs for each service or item, you ensure that clients understand what they are paying for. This transparency helps in reducing disputes and encourages timely payments. A well-constructed document serves as both a receipt and a formal request for payment, reinforcing the expectations on both sides.

Benefits of Accurate Financial Records

Beyond immediate payments, keeping detailed records of transactions is important for long-term business health. These documents can be used for tax purposes, financial analysis, and future planning. Additionally, maintaining accurate documentation helps track outstanding balances, providing insight into cash flow and helping to manage finances more effectively.

In conclusion, using a well-organized approach for documenting financial transactions fosters trust, efficiency, and professionalism in your business. It ensures that clients are clear on their obligations and helps you maintain smooth operations as you grow.

Key Components of an Event Invoice

When it comes to billing clients for services rendered, having a clear and comprehensive document is essential. This document should outline all the necessary details to ensure transparency and accuracy in the transaction process. Each section plays a crucial role in making sure both the service provider and the client understand the charges, terms, and expectations.

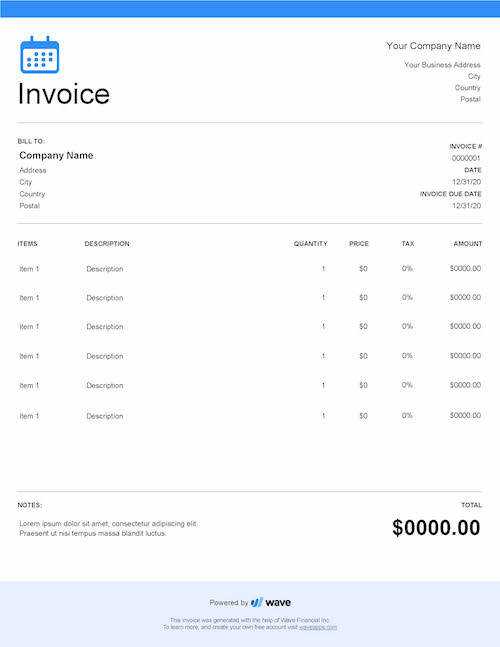

The main components of a well-structured billing document include identification information, a breakdown of services, payment terms, and any additional notes or instructions. These elements are critical for providing clarity, reducing misunderstandings, and ensuring a smooth payment process.

Client and Service Provider Details

The first section should clearly list the names and contact information of both the client and the service provider. This ensures that there is no confusion about who is involved in the transaction. Having these details up front also helps in case there are any follow-up inquiries or issues.

Service Description and Costs

Clearly itemizing the services provided is a key element of the document. This section should break down each service or product, including quantity and price. Providing a detailed list ensures that the client understands exactly what they are paying for and how the final amount is calculated. Itemization can also help avoid disputes by offering a transparent view of the costs involved.

Payment Terms should also be outlined clearly, including the due date, payment methods accepted, and any applicable late fees. Specifying these terms up front helps prevent delays and ensures that both parties are aligned on when and how payment will be made.

Finally, it’s important to include any additional information such as discounts, taxes, or other fees that may apply. These elements ensure that the document is complete and that the client has all the information needed to make a payment promptly.

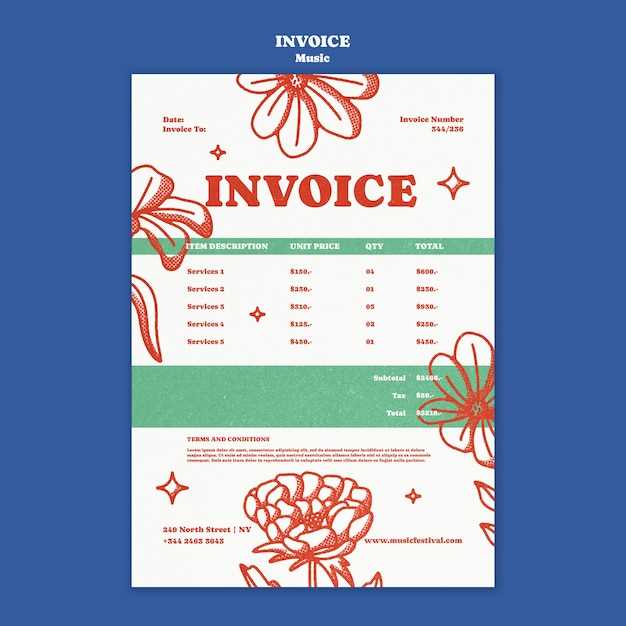

How to Customize an Event Invoice Template

Personalizing your billing documents is essential to ensure that they align with your brand and meet the specific needs of your business. Customization allows you to include all the relevant information in a format that is easy to understand, while also reflecting your unique business identity. The process involves tailoring the structure, adding necessary details, and making the document look professional.

Start by adjusting the header of the document to include your company logo, name, and contact information. This immediately establishes your brand identity and makes the document look more professional. You can also customize the layout and design elements such as fonts, colors, and headings to match your business’s visual style.

Next, modify the sections to ensure that all relevant information is included. This means adjusting the itemized list of services provided, adding any special instructions or terms, and customizing the payment section to reflect your preferred payment methods and timelines. For instance, you can offer multiple payment options or include specific payment terms like discounts for early payments or penalties for delays.

Don’t forget to make the document flexible for different types of services. For example, if you provide various pricing packages, include areas where you can adjust the quantities and prices accordingly. This way, each bill can be personalized for each client without having to create a new document from scratch every time.

Finally, ensure that the document remains easy to use. Overcomplicating the layout or structure can confuse clients, so keep it simple and clear. A customized, well-organized billing document not only makes the payment process easier but also enhances your professionalism and the client’s overall experience.

Common Mistakes to Avoid in Event Invoices

When preparing billing documents for your services, attention to detail is crucial to avoid errors that could lead to confusion or delayed payments. Mistakes in your documents not only make the payment process harder but may also harm your professional reputation. It’s important to be aware of these common pitfalls to ensure smooth and accurate transactions with your clients.

Inaccurate or Missing Information

One of the most common mistakes is leaving out crucial details or making errors in the information presented. This could include incorrect client details, service descriptions, or pricing. Such inaccuracies can lead to misunderstandings and delayed payments. To avoid this, always double-check the following:

- Client’s name, address, and contact details

- Accurate description of services provided

- Correct pricing and totals

- Proper due date and payment terms

Unclear Payment Terms

Failing to clearly state payment terms can result in confusion or delayed payments. If your client doesn’t understand when and how to pay, it’s more likely that they’ll miss the deadline. Ensure you are clear about:

- Accepted payment methods

- Due dates for payment

- Late fees or discounts for early payment

Additionally, some businesses fail to specify the currency for payments, especially in international transactions. Always include this to avoid ambiguity.

Overcomplicating the Layout

Another mistake is cluttering the document with too much information or an overly complex design. While it’s important to include all necessary details, it’s equally essential that the document remains clean, organized, and easy to read. Stick to a simple structure and avoid unnecessary elements that might distract or confuse the reader.

Not Following Legal Requirements

Each region or country may have specific legal requirements for business transactions. Neglecting to include these required details could lead to issues, particularly during tax season or audits. Be sure to include any legally required information, such as:

- Tax identification numbers

- Applicable taxes

- Legal disclaimers or terms and conditions

By being mindful of these common mistakes and carefully reviewing each document before sending it, you can avoid confusion, reduce payment delays, and maintain your professional reputation.

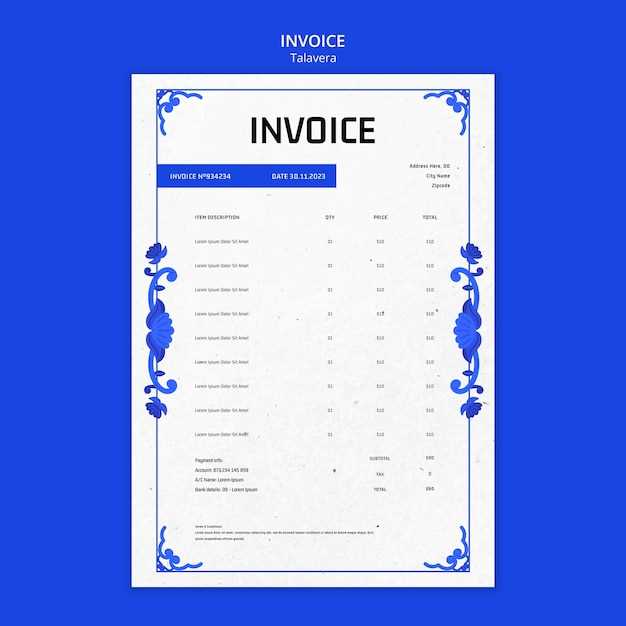

Choosing the Right Event Invoice Format

Selecting the proper structure for your billing documents is essential for ensuring clarity, efficiency, and professionalism. The format you choose will influence how easily your clients can understand the charges, make payments, and maintain records. A well-organized and easily navigable format can streamline the entire process, benefiting both you and your clients.

There are several factors to consider when deciding on the most suitable layout for your documents. These include the type of services you provide, the level of detail required, and your preferred method of communication with clients. Whether you opt for a simple or detailed design, the goal is to make sure the document is clear, accurate, and easy to process.

Simplicity vs. Detail

Depending on your business model, you may need a more straightforward layout or one that is highly detailed. If you offer a wide range of services, breaking down each component separately may be necessary for transparency. On the other hand, if your offerings are straightforward, a simple layout can suffice. Consider the following:

- Simple Format: Ideal for quick, clear bills that are easy to read and understand.

- Detailed Format: Suitable for businesses that provide multiple services or need to show an itemized breakdown of costs.

Customization and Flexibility

Another important consideration is customization. Your format should be adaptable to different situations, allowing you to include or omit certain sections as necessary. For instance, some projects may involve additional charges or discounts that should be reflected in the document. Choose a structure that allows you to easily add extra fields without making the document too complicated or cluttered.

In conclusion, the format you choose will set the tone for your client relationships. Whether you go with a minimalistic or a more detailed design, always ensure the final product is easy to navigate, accurate, and professional. A well-chosen format will help ensure your clients feel confident and informed throughout the entire payment process.

Event Invoice Templates for Different Occasions

Different types of services and occasions require unique approaches when it comes to preparing billing documents. Each situation may involve varying levels of detail, additional charges, or specific terms. Whether you’re organizing a small gathering or a large corporate event, it’s important to have the right format in place to ensure clarity and professionalism.

Customizing your billing documents to suit the specific needs of each occasion can help streamline the process and make transactions smoother. Below are some common scenarios and how you can tailor your structure accordingly:

1. Small Gatherings or Personal Services

For smaller, more personal occasions, such as private parties or one-time services, you may not need a detailed breakdown of costs. A simple structure with a clear total is usually sufficient. Key elements should include:

- Service description: A brief summary of the services provided.

- Total cost: An all-inclusive price, with no need for detailed itemization.

- Payment terms: Clear due date and payment options.

2. Corporate Events and Large Functions

For larger-scale occasions, such as corporate events, conferences, or weddings, the document needs to be more detailed. Clients often require an itemized list to understand the various costs associated with each service. Consider including:

- Itemized breakdown: A list of services, products, and any additional charges, such as rentals or catering fees.

- Discounts or packages: If applicable, include any special deals or bundled pricing.

- Extended payment terms: Allow for more flexible payment deadlines or installment options.

3. Recurring Services or Long-Term Projects

When billing for ongoing services, such as monthly retainer fees or long-term projects, it’s important to clearly outline the agreed-upon schedule and expectations. A recurring format may look like this:

- Service schedule: Clearly define the frequency and scope of services.

- Monthly or quarterly totals: Break down payments by time period.

- Additional terms: Specify conditions for renewal, service changes, or cancellation.

4. Special Offers or Promotions

If you are running a special promotion or offering discounts, it’s important to clearly reflect these in your document. Special pricing should be highlighted so the client can easily see any savings or promotions that apply. Key elements might include:

- Discounts: Show original price vs. discounted price.

- Promotional terms: Include any expiration dates or conditions for special offers.

- Bonus services: If offering add-ons or extras, clearly list these as part of the deal.

By tailoring your billing documents to match the specific nature of each occasion, you ensure

How to Calculate Event Costs Accurately

Accurately calculating the costs associated with your services is essential for ensuring that both you and your clients are on the same page. Whether you are providing a one-time service or managing a complex project, understanding the full scope of costs will help you set realistic pricing and avoid unexpected expenses. A detailed cost calculation allows you to account for every aspect of your service while also ensuring a fair price for both parties.

To calculate the total amount you should charge, it’s important to break down all potential expenses into categories. This process ensures that you consider every aspect of the service, from initial planning to final execution. Whether it’s labor, materials, or additional fees, each item must be accounted for to create a transparent, accurate final price.

1. Break Down Direct Costs

Direct costs refer to the expenses directly tied to the service you provide. These could include things like:

- Labor costs: This includes the time spent by you and your team to prepare, execute, and clean up after the service.

- Materials or supplies: Items such as decorations, equipment, or consumables that are used during the service.

- Venue or location fees: If you are using a location, consider the rental costs or permits required for the event.

2. Account for Indirect Costs and Overhead

Indirect costs are those that are not directly tied to a specific task but still necessary for running your business. These may include:

- Transportation: The cost of getting equipment, team members, or supplies to the event location.

- Insurance: Costs related to coverage or liability for the services provided.

- Administrative expenses: This includes office supplies, communication tools, or booking management systems.

Don’t forget to add a margin for profit on top of the calculated costs. This ensures that you are not just covering your expenses but also generating revenue for your business.

By carefully calculating both direct and indirect costs, you can arrive at an accurate and fair total for the services you offer. This transparency helps build trust with your clients, and a well-calculated pricing structure ensures that you remain profitable while providing high-quality service.

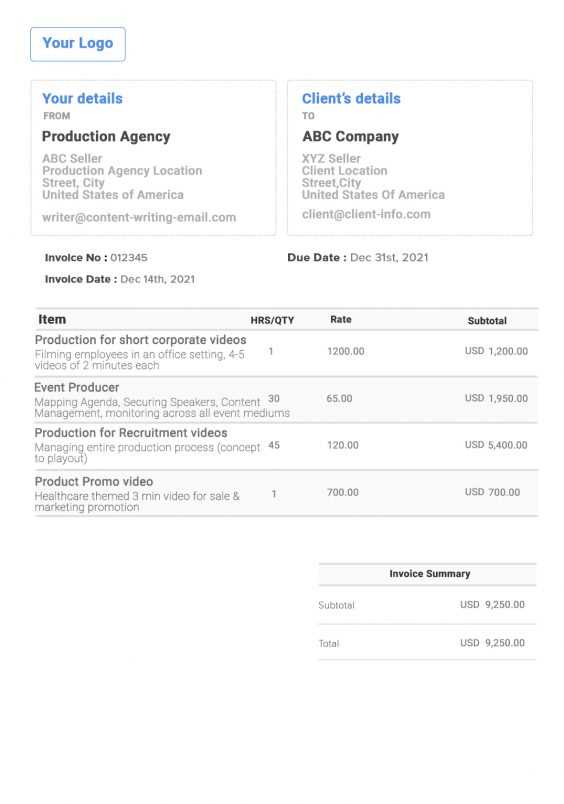

Benefits of Using an Event Invoice Template

Having a structured format for documenting and requesting payments is essential for any business. It not only helps organize your financial transactions but also ensures consistency, accuracy, and professionalism in every billing cycle. By using a ready-made structure, you can save time, avoid errors, and create clear, detailed records that benefit both you and your clients.

Adopting a consistent format for your billing documents brings a variety of advantages. It simplifies the process of tracking payments, reduces the likelihood of mistakes, and ensures that clients have all the information they need for seamless transactions. Below are some of the key benefits:

1. Time-Saving and Efficiency

With a standardized format, you no longer have to manually create each document from scratch. This is especially helpful if you handle a high volume of clients or recurring services. By simply filling in the relevant details, you can generate a professional document in a fraction of the time.

2. Consistency and Professionalism

Using a pre-designed structure ensures that all of your documents follow a consistent format, which adds to your credibility and professionalism. A clean, well-organized document instills confidence in your clients and demonstrates that you are serious about your work and your business practices.

| Benefit | Details |

|---|---|

| Time Efficiency | Quickly generate billing documents without starting from scratch. |

| Accuracy | Reduces the risk of errors by providing a structured format. |

| Professional Appearance | Ensures that your documents look polished and consistent every time. |

| Customization | Easily customize for different clients or services, while maintaining structure. |

By adopting a structured approach, you not only streamline your internal processes but also enhance your clients’ experience. They will appreciate the clarity and organization in your billing, which can contribute to stronger, more trusting business relationships.

Legal Requirements for Event Invoices

When creating financial documents to request payment for services, it’s essential to ensure they comply with local laws and regulations. These documents serve as a formal record of transactions and may be subject to tax and legal requirements. Adhering to these legal guidelines helps protect your business, ensures transparency, and avoids potential legal issues with clients or tax authorities.

Depending on your location and the type of service provided, there are certain key elements that must be included to comply with legal standards. These requirements can vary by country, state, or even industry. Below are some of the most common legal requirements that should be considered when preparing your billing documents:

1. Business Identification Details

It’s important to include certain identifying information about your business in every billing document. This helps establish the legitimacy of your company and allows tax authorities to track financial transactions. Essential details may include:

- Business name: The registered name of your company.

- Business address: The physical or registered address of the company.

- Tax identification number (TIN): A unique number issued by tax authorities to identify your business for tax purposes.

- VAT or sales tax registration number: If applicable, especially for businesses involved in the sale of taxable goods or services.

2. Tax and Payment Details

Most jurisdictions require that your financial documents reflect the correct tax information and payment terms. This includes:

- Tax rates: If your services are taxable, the applicable rate of sales tax or VAT should be clearly listed.

- Amount before and after tax: The document should show the subtotal of the service cost and any applicable taxes, along with the final total amount.

- Payment terms: Clearly state when payment is due, acceptable methods of payment, and any late payment penalties.

Not including these details may lead to complications during tax filing or audits, so it is important to stay compliant with the tax laws relevant to your business operations.

3. Clear Service Description

In addition to identifying your business and complying with tax rules, you must provide a clear description of the services rendered. This helps avoid disputes and ensures that both parties understand the charges involved. For legal compliance, the description should be detailed enough to provide clarity, and any contractual terms should be stated in writing, especially if you are billing for a long-term project or retainer.

By ensuring that your financial documents meet these legal requirements, you protect both your business and your clients. This creates trust, maintains transparency, and reduces the likelihood of disputes or legal complications down the road.

How to Create a Professional Event Invoice

Creating a polished and professional billing document is essential for establishing credibility and ensuring that payment processes go smoothly. A well-crafted document not only reflects the quality of your services but also builds trust with your clients. Whether you’re sending a one-time bill or a recurring payment request, the key to a professional appearance lies in clarity, structure, and accuracy.

The first step in creating a professional document is to ensure that it contains all the essential elements in a clear and organized layout. This includes providing all necessary business information, clearly outlining the services provided, and specifying payment terms. Below are some best practices for crafting a document that will leave a positive impression on your clients and simplify the payment process.

1. Use a Clear and Organized Layout

A clean, structured layout is the foundation of a professional billing document. This makes it easier for your client to review the charges, understand the breakdown, and proceed with payment. Consider the following layout tips:

- Header: Include your business name, logo, and contact information at the top of the document for easy recognition.

- Client Information: Include the client’s name, address, and any other relevant details.

- Service Breakdown: List each service or product provided with clear descriptions, quantities, and prices. This provides transparency and helps avoid misunderstandings.

- Total and Taxes: Show a subtotal for services, then clearly list applicable taxes and the final total amount due.

2. Ensure Accuracy and Clarity

Clarity and accuracy are paramount in any professional document. Mistakes or ambiguities can create confusion, cause delays, or even damage your reputation. Double-check all figures and information before sending the document. Pay attention to the following:

- Correct Pricing: Make sure that the pricing aligns with any agreed-upon terms or contracts.

- Payment Instructions: Clearly state how the client can make a payment, whether by bank transfer, credit card, or another method. Include the payment due date and any penalties for late payments.

- Contact Information: Provide a direct way for the client to reach you in case of questions or concerns regarding the bill.

By following these guidelines, you can ensure that your documents are not only functional but also professional, improving your client’s experience and encouraging timely payments. A clear, well-organized billing document is a reflection of your attention to detail and your commitment to quality service.

Tips for Efficient Event Billing Practices

Efficient billing is a key element of any successful business, especially when dealing with multiple clients or projects. Properly managing your payment requests ensures a smooth cash flow, minimizes errors, and keeps your clients satisfied. Streamlining the process helps reduce administrative work, avoids delays, and guarantees that all payments are made on time and in full.

To improve the efficiency of your billing process, it’s important to adopt certain best practices that save you time, reduce stress, and enhance professionalism. Here are some practical tips to help you manage your billing with ease and confidence.

1. Automate Whenever Possible

Using automation tools can significantly speed up the billing process. Instead of manually creating each request, consider using software that allows you to generate and send billing documents with just a few clicks. Automation can help you:

- Save time: Create recurring requests for regular clients or long-term projects with ease.

- Minimize errors: Automation reduces the risk of manual mistakes in calculations or formatting.

- Ensure consistency: Standardized formats help maintain a professional appearance across all documents.

2. Set Clear Payment Terms and Deadlines

Setting clear payment terms from the outset helps avoid confusion and encourages timely payments. Be transparent with your clients about the payment schedule, deadlines, and any penalties for late payments. Key details to include are:

- Due date: Specify when the payment is expected, whether it’s within 30 days, 15 days, or another timeframe.

- Late fees: If you charge for late payments, outline these fees upfront to avoid disputes later.

- Accepted payment methods: List the payment methods you accept (e.g., bank transfer, credit card, checks).

3. Keep Detailed Records

Maintaining thorough records is essential for tracking payments and resolving potential disputes. Ensure that all billing documents are well-organized and stored securely. This includes:

- Storing a copy: Keep a copy of every request you send to clients for future reference.

- Tracking payments: Log payments as they come in and cross-reference them with outstanding balances.

- Clear documentation: Include any contracts, agreements, or service descriptions to clarify the scope of work and prevent confusion.

By following these tips, you can enhance the efficiency of your billing practices, reduce administrative burdens, and create a more professional experience for your clients. Clear processes and timely requests contribute to better busine

Streamlining Event Payments with Templates

Efficiently managing payments can significantly improve your business operations and ensure smooth transactions. By adopting pre-designed structures for your payment requests, you can speed up the billing process, reduce errors, and maintain consistency across all transactions. Using a ready-made structure for financial documents can help you focus on delivering high-quality services while ensuring that payments are processed quickly and correctly.

With streamlined structures, you eliminate the need to start from scratch for every billing request. This allows you to customize the necessary details while maintaining a professional format that your clients will find easy to understand. By including all essential information, such as pricing breakdowns, payment terms, and contact details, you can ensure a faster and more efficient payment cycle.

Moreover, using a consistent structure helps in reducing confusion, minimizes the chances of missing important information, and ensures that your clients receive clear, accurate requests. This process also minimizes follow-up work, as most clients will have all the details they need to make payments on time, leading to better cash flow management.

How to Handle Late Payments for Events

Late payments are an unfortunate reality in many industries, and when they occur, they can disrupt your cash flow and impact your business operations. However, managing late payments effectively is crucial to maintaining a healthy relationship with your clients while ensuring that you get paid promptly. By setting clear expectations and implementing proactive strategies, you can reduce the occurrence of delays and handle them smoothly when they do arise.

Handling late payments requires a balance between being firm about your policies and remaining professional. Clear communication and a well-established process are key to ensuring that clients understand the consequences of delays and are motivated to fulfill their obligations on time. Here are some practical strategies for addressing late payments.

1. Set Clear Payment Terms from the Start

One of the most effective ways to avoid late payments is to establish clear, upfront payment terms. When working with clients, make sure that you communicate your payment expectations from the beginning, including:

- Due date: Specify the exact date by which payment is expected. Whether it’s within 30, 15, or 7 days, be clear about the deadline.

- Late fees: Outline any penalties for delayed payments, such as interest or flat fees. Make sure clients are aware of these fees before they agree to the terms.

- Accepted payment methods: List all payment methods you accept (e.g., credit cards, bank transfers, checks) to make it as easy as possible for clients to pay on time.

2. Send Gentle Reminders Before the Due Date

Sometimes, clients simply forget about the payment deadline. To reduce the chances of late payments, send a gentle reminder a few days before the due date. This reminder can be a polite email or message, briefly noting the upcoming payment due date and offering assistance if needed. This step shows professionalism and helps clients stay on track.

3. Follow Up Promptly After the Due Date

If payment is not received on time, don’t hesitate to follow up immediately. Send a polite but firm reminder, referencing the original agreement and the due date. The follow-up should include:

- Polite tone: Begin by thanking them for their business and acknowledge any previous communications.

- Clear reference: Mention the amount due, the original due date, and any late fees that may now apply.

- Flexible options: If needed, offer alternative payment methods or even a short grace period to make the payment easier for the client.

4. Consider Payment Plans for Larger Balances

If the outstanding amount is significant and the client is unable to pay the full balance at once, consider offering a payment plan. Breaking the payment into smaller, manageable installments can encourage clients to settle their debt without causing strain on their finances. Ensure tha

Integrating Event Invoices with Accounting Software

Integrating payment requests with accounting software can streamline your financial management process, saving time and reducing the risk of errors. By automating the flow of billing data into your accounting system, you can ensure more accurate records, faster processing, and better financial insights. This integration allows you to track payments, manage expenses, and generate reports without manual data entry, enhancing both efficiency and accuracy in your business operations.

Many businesses today use accounting software to manage their finances, and integrating billing documents into these systems helps create a seamless workflow. By connecting your billing system with accounting tools, you can eliminate the need for double-entry and ensure that all transactions are recorded consistently. Here’s how integrating your billing processes with accounting software can benefit your business.

1. Streamlined Data Entry

One of the primary benefits of integration is that it automates the data transfer process. Instead of manually entering each transaction into your accounting software, the data from your payment requests can be automatically uploaded. This eliminates human errors, reduces administrative time, and ensures that your accounting records are always up-to-date. With this integration, you can:

- Automatically sync client information from billing requests into your accounting system.

- Track payments and outstanding balances in real-time, with accurate updates reflected across all your platforms.

- Generate financial reports based on accurate, integrated data, improving the quality of your business insights.

2. Improved Financial Tracking and Reporting

Integrating billing data with accounting software also helps you maintain better control over your finances. With real-time tracking of payments, overdue balances, and service charges, your accounting software can generate detailed reports that give you a clear overview of your business’s financial health. These reports can be critical for:

- Monitoring cash flow by tracking incoming payments and upcoming expenses.

- Ensuring compliance with tax regulations, as all records will be easily accessible for audits or tax filings.

- Making informed decisions based on accurate and timely financial data.

Integrating your payment management process with accounting software helps eliminate manual processes, improves the accuracy of financial data, and provides you with a clearer picture of your business’s financial standing. By taking advantage of this technology, you can focus on growing your business while staying on top of your financial obligations.

How to Send Event Invoices to Clients

Sending payment requests to clients in a professional and efficient manner is crucial for ensuring timely payments and maintaining positive business relationships. The way you deliver these documents can affect how clients perceive your professionalism and can influence the speed at which you receive payment. Understanding the best practices for sending financial requests helps streamline the process and ensures that all necessary details are communicated clearly.

There are several methods for sending payment requests, each with its own advantages. Whether you prefer email, physical mail, or an online payment system, ensuring clarity and proper communication is key. Below, we’ll explore the best approaches to delivering payment documents to clients and tips to improve the likelihood of on-time payments.

1. Send Digital Copies via Email

Email is one of the most efficient ways to send payment requests. It allows for quick delivery, easy tracking, and convenient responses. Here’s how to send your billing documents effectively via email:

- Attach the document: Include the payment request as a PDF or other universally accepted format to ensure it is easily readable on any device.

- Clear subject line: Use a concise subject line that clearly indicates the purpose of the email, such as “Payment Request for [Service Provided].”

- Include payment details: In the email body, briefly restate the total amount due, due date, and payment methods accepted.

- Provide contact information: Offer your contact information for any questions or issues related to the payment.

2. Use an Online Payment System

Another effective way to send and manage payment requests is through online payment platforms. These platforms often allow you to send digital requests directly through their system, simplifying the payment process for your clients. Some benefits of using these platforms include:

- Automatic reminders: Many online payment systems can send automatic reminders to clients before and after the due date.

- Easy payment processing: Clients can make payments directly through the platform, saving time for both parties.

- Integrated tracking: You can easily track payments, view status updates, and monitor outstanding balances.

By using digital methods like email or online platforms, you can increase the speed and efficiency of your payment collection process, reducing the time spent on manual follow-ups and ensuring that your clients have all the information they need to process their payments smoothly.

How to Track Event Invoice Payments

Tracking payments effectively is an essential part of managing your business’s cash flow. Keeping an accurate record of all received payments helps ensure that you’re not only paid on time but also maintain transparency with your clients. A well-organized system for tracking outstanding balances and completed transactions can save you time, reduce errors, and prevent potential disputes.

There are several methods you can use to track payments, depending on the tools and systems you have in place. From manual spreadsheets to integrated accounting software, the key is to have a reliable method that allows you to easily view the status of each transaction. Below are some practical ways to monitor payment progress.

1. Use Accounting Software

One of the most efficient ways to track payments is by utilizing accounting software. Most accounting platforms offer integrated payment tracking features that allow you to automatically update the status of payments, view outstanding balances, and generate real-time financial reports. With this method, you can:

- Automate updates when a payment is received.

- Keep detailed records of all transactions, including payment dates and amounts.

- Easily generate reports on overdue or pending balances.

2. Create a Payment Tracking Spreadsheet

For those who prefer a more hands-on approach, creating a payment tracking spreadsheet can be a simple yet effective solution. In this spreadsheet, you can list all payment requests, their due dates, and mark off payments as they are received. Key columns to include are:

- Client name or business name.

- Amount due and payment due date.

- Status of payment (e.g., pending, paid, overdue).

- Payment method (e.g., bank transfer, credit card, cash).

- Payment date and amount received.

3. Set Up Payment Reminders

Setting up automated reminders for both you and your clients can help ensure payments are tracked efficiently. This can be done using accounting software or email reminders. By sending a reminder before the payment is due or after the deadline passes, you increase the chances of receiving payment without much delay. You can also include details on the outstanding balance and the consequences of delayed payments in these reminders.

By using these methods, you can ensure accurate tracking of your received payments, minimize the chance of oversight, and maintain a smooth, efficient payment process. This will allow you to focus on growing your business, knowing your financial transactions are organized and up-to-date.