EU Commercial Invoice Template for Your Business Needs

In international trade, accurate and well-structured documents are essential for smooth transactions between businesses. These forms not only ensure clarity but also help comply with various legal and customs requirements across borders. Having a ready-to-use structure can greatly simplify the process, saving time and reducing the risk of errors.

In this guide, we will explore how to create and customize a document format that meets the needs of European business transactions. Whether you’re a seller or a buyer, understanding the necessary elements and following best practices can improve the efficiency of your global operations.

Understanding the details of what should be included in these documents is crucial. Elements such as item descriptions, prices, tax codes, and shipping terms play an important role in ensuring that both parties have a clear record of the exchange.

By using the right structure, businesses can easily generate the required paperwork for customs clearance and invoicing, all while maintaining professionalism and compliance with European standards.

EU Business Document Guide

Creating accurate and clear documentation is essential for any cross-border transaction. It ensures both parties have a detailed record of the exchange and meets all necessary legal and customs requirements. This section covers the fundamental structure and key components of such documents, providing an easy-to-follow guide to help streamline your processes.

Understanding what needs to be included in these forms is vital for smooth international trade. Essential details like the description of goods, pricing, and shipping terms must be clearly outlined. The following table shows the primary elements you should consider when preparing your document:

| Element | Description |

|---|---|

| Business Information | Details of the seller and buyer, including company names and addresses. |

| Goods Description | Clear description of the items being exchanged, including quantities and specifications. |

| Price and Currency | Unit prices, total amounts, and currency used for the transaction. |

| Payment Terms | Conditions outlining how and when the payment should be made. |

| Shipping Information | Details of delivery methods, transport costs, and terms of delivery. |

| Customs Codes | Specific codes and classifications used for customs clearance and tariffs. |

By ensuring these elements are correctly represented, you can avoid common mistakes and streamline the process of completing your business transactions across Europe. Properly formatted documentation is not just a legal requirement, but also an essential tool for effective communication between trading partners.

What is a Business Transaction Document?

A business transaction document is a crucial form used to record the details of a trade between two parties. It serves as an official record that outlines the goods or services being exchanged, along with the terms of the sale. This document is often required for customs clearance and can help both the seller and the buyer ensure that all aspects of the transaction are properly documented and agreed upon.

Key Functions of the Document

This form acts as proof of the transaction and plays an essential role in international trade. It provides clarity on the agreed prices, the nature of the goods, and the payment terms, ensuring both parties understand their obligations. It is also used by customs authorities to assess tariffs and taxes for goods being imported or exported.

Legal and Financial Importance

Legal Compliance: The document is necessary for ensuring that both parties comply with local and international trade laws, especially in the European Union, where specific rules govern trade between member states.

Financial Tracking: It is also useful for financial tracking, serving as a reference for accounting and auditing purposes. The information provided in this document helps businesses maintain transparency and properly document their earnings or expenses.

Why Use an EU Business Document Format?

Using a standardized structure for business documents offers numerous advantages, particularly when dealing with international trade. It ensures that all required information is consistently included and presented in a clear, professional manner. For businesses engaged in cross-border transactions within the European Union, adhering to a specific format can greatly simplify the process and ensure compliance with legal and regulatory requirements.

Consistency and Efficiency

Having a pre-designed structure allows businesses to save time by eliminating the need to create documents from scratch for every transaction. A consistent format ensures that all necessary details are included without overlooking crucial elements, such as tax codes, delivery terms, and item descriptions. This not only speeds up the process but also reduces the likelihood of errors that could lead to complications later on.

Legal Compliance and Simplified Customs Procedures

Regulatory Requirements: Many countries, especially within the EU, have strict rules regarding the content and format of documents used for international trade. Using a standard format helps ensure that your documents meet these legal requirements, making it easier to clear customs and avoid potential delays.

Streamlined Customs Process: Customs authorities rely on properly formatted paperwork to assess tariffs, taxes, and other duties. By adhering to a recognized format, businesses can expedite the customs clearance process, reducing the chances of goods being held up or subjected to unnecessary inspections.

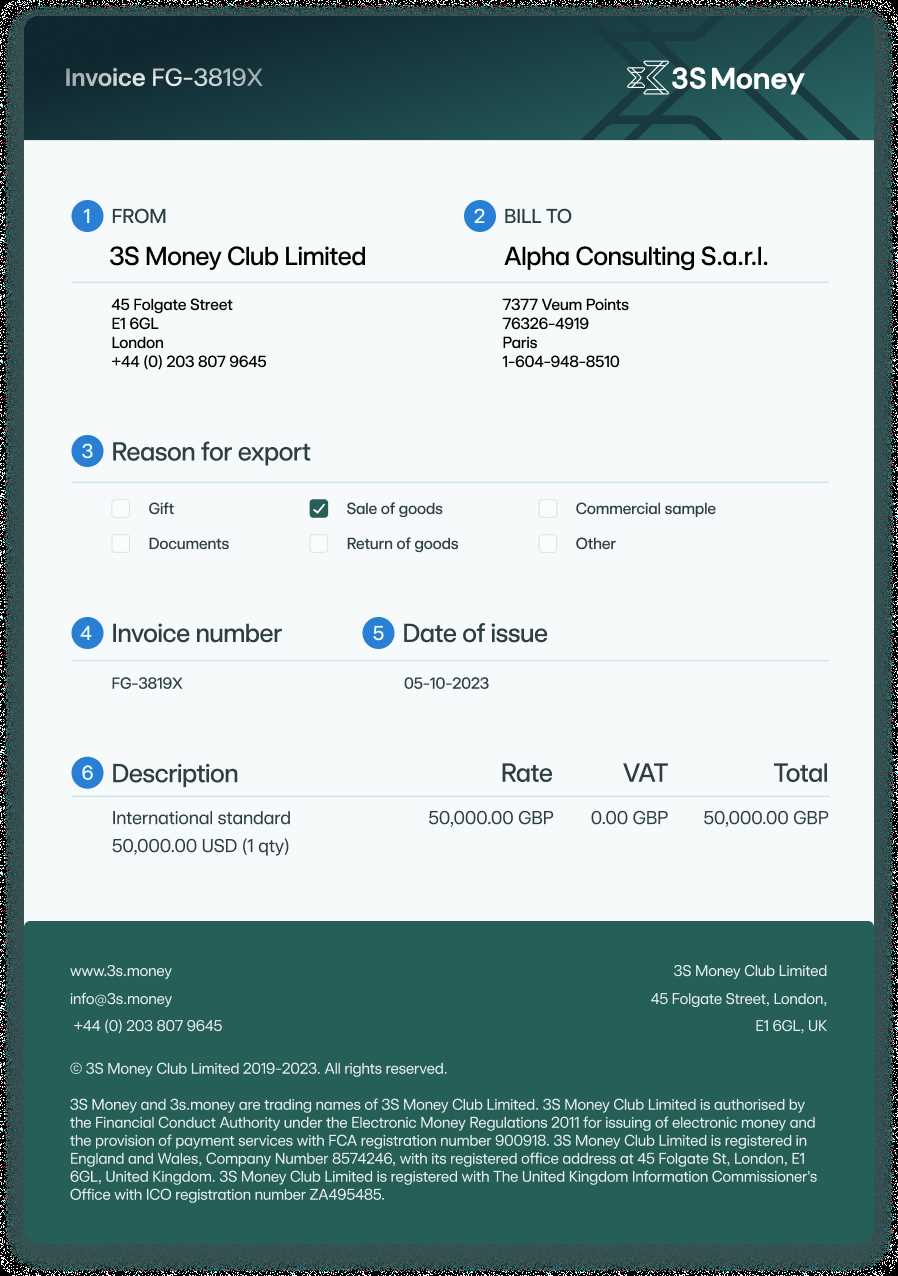

Key Elements of a Business Transaction Document

To ensure clarity and compliance in international transactions, it is essential to include specific details in every business document. These details provide a comprehensive record of the exchange, protect both parties involved, and help facilitate smoother customs clearance. Below are the key elements that should be present in a well-structured business document.

| Element | Description |

|---|---|

| Seller and Buyer Information | Names, addresses, and contact details of both the seller and the buyer to ensure proper identification of all parties involved. |

| Goods Description | A detailed description of the products being exchanged, including quantities, specifications, and any relevant identification numbers (such as serial numbers). |

| Pricing and Currency | The unit price and total price of the goods, as well as the currency in which the transaction is being conducted. |

| Payment Terms | Terms and conditions outlining when and how the payment should be made, including any applicable late fees or discounts. |

| Shipping Information | Details of the delivery method, including transport company, shipping address, and expected delivery timeframes. |

| Customs Codes | Specific tariff codes or harmonized system (HS) codes used for customs clearance to determine any applicable duties and taxes. |

Including these critical elements helps businesses avoid misunderstandings and ensures that both legal and financial requirements are met. Properly documenting each aspect of the transaction reduces the risk of errors and ensures the smooth processing of the goods, particularly when crossing borders.

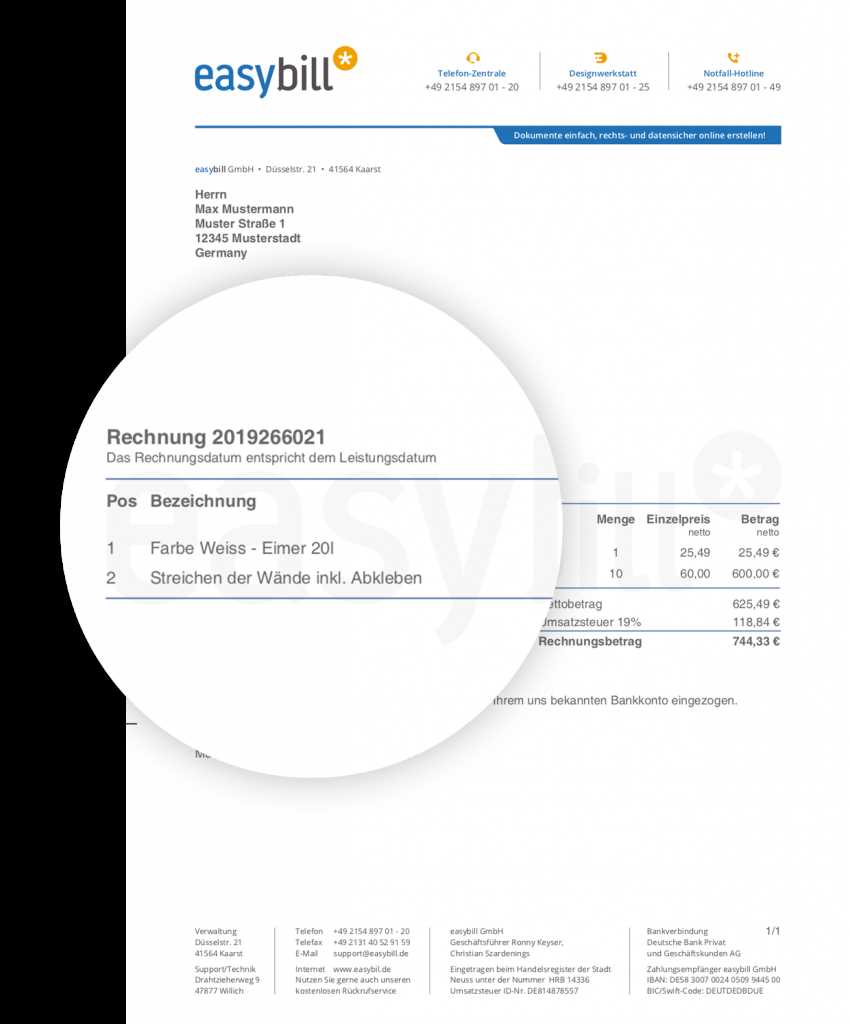

How to Customize Your Business Document Format

Customizing your business document format is essential to ensure that it meets the specific needs of your transaction and adheres to legal requirements. A tailored structure not only helps present the necessary details clearly but also allows you to align the format with your company’s branding and operational processes. Here’s how you can personalize your document for better efficiency and professionalism.

Steps to Personalize Your Document

- Adjust Header Information: Include your company logo, business name, and contact details in the header. This establishes a professional look and ensures the document is clearly associated with your brand.

- Modify Terms and Conditions: Customize payment terms, delivery methods, and other contractual obligations to fit your specific agreement with the customer or supplier.

- Update Product Descriptions: Tailor the list of items by adding detailed descriptions, quantities, and unit prices relevant to the current transaction.

- Include Shipping and Tax Details: Adjust shipping information and tax codes as per the requirements of the destination country, ensuring compliance with local regulations.

- Adjust Currency and Payment Details: Make sure the payment terms and currency match the agreement you have with the other party. Specify payment methods, dates, and any applicable discounts or penalties.

Useful Tools for Customization

Many digital tools and software applications make the customization process straightforward. These tools allow you to input variables such as customer details, product descriptions, and shipping addresses, and automatically generate a document in your preferred format. Additionally, you can save these customized versions for future use, making it easier to handle repeated transactions.

By taking the time to adjust and personalize the format, businesses can ensure that their documents are not only compliant but also efficient and professional. A well-customized document format helps prevent errors, speed up transactions, and improve communication with clients and suppliers alike.

Understanding VAT and Tax Information

When conducting business across borders, it’s crucial to correctly manage tax-related information, especially Value Added Tax (VAT) and other applicable duties. This section explains the importance of including accurate tax details in your business documentation and how they impact both the seller and buyer, particularly in the European Union.

The Role of VAT in International Trade

VAT is a consumption tax placed on goods and services, which varies from country to country within the EU. Understanding how VAT works is essential for ensuring your transactions are compliant with both local and international laws.

- Standard Rates: Each EU member state has its own VAT rate, which may differ for different types of goods and services.

- Exemptions and Reduced Rates: Certain products or services may be exempt from VAT, or subject to a reduced rate depending on local legislation.

- Cross-Border VAT: When goods are sold across EU borders, different rules apply regarding whether VAT should be charged and how it is handled by both the seller and buyer.

How to Include Tax Information in Documents

Accurate tax details must be included in business documents to ensure proper accounting and avoid complications with customs or tax authorities. Here are the key elements to consider:

- VAT Registration Number: Ensure that both the seller’s and buyer’s VAT registration numbers are clearly stated, particularly when goods are moving across EU borders.

- Tax Rate and Amount: Clearly display the applicable tax rate and the corresponding tax amount for each item or service, as this will be used to calculate the total tax liability.

- Tax Jurisdiction: Indicate the country or region that applies the tax, ensuring compliance with local tax laws.

- Intra-community Transactions: For sales within the EU, make sure to specify whether the sale qualifies as an intra-community transaction, as this affects how VAT is charged or exempted.

Incorporating precise VAT and tax information into your documentation ensures that your transactions are legally compliant, minimizing the risk of delays or penalties. Understanding these requirements is not only important for accurate reporting but also for maintaining smooth business operations in the EU market.

Common Mistakes in Business Document Creation

Creating business documents can seem straightforward, but small errors can lead to significant issues, such as delays in payments, misunderstandings, or compliance problems. By understanding the common mistakes in document preparation, businesses can take steps to avoid them, ensuring smooth and efficient transactions.

Frequent Errors in Document Preparation

There are several common mistakes that can arise during the creation of business documents. These errors not only affect the accuracy of the records but can also create unnecessary complications when it comes to legal or financial reporting.

| Error | Consequences |

|---|---|

| Incorrect Buyer/Seller Information | Missing or incorrect names, addresses, or contact details can cause delays in payment processing and delivery issues. |

| Missing or Incorrect Product Details | Without accurate descriptions, quantities, and item codes, the buyer may not receive the right products, leading to disputes or returns. |

| Failure to Specify Payment Terms | Ambiguity regarding payment deadlines or methods can result in payment delays or missed deadlines. |

| Incorrect Tax Information | Incorrect VAT rates or tax codes can cause compliance issues, resulting in fines or delays in customs clearance. |

| Omitting Shipping Details | Not including accurate shipping addresses or delivery timelines can cause goods to be sent to the wrong location or delayed. |

How to Avoid These Mistakes

To avoid these common errors, businesses should establish a standard process for creating their documents. This includes reviewing all the details carefully, ensuring compliance with relevant tax and shipping laws, and double-checking contact information. By using reliable software or tools, many of these mistakes can be minimized or even eliminated entirely.

Proper training and a clear system for document creation will help businesses avoid the costly consequences of these common mistakes, ensuring that all transactions run smoothly and are legally compliant.

How to Include Shipping Information

Accurate shipping details are essential in any transaction, as they ensure the timely delivery of goods to the correct destination. Including clear and comprehensive shipping information in your business documents helps prevent errors, delays, and confusion during the fulfillment process. Here’s how to properly include shipping information in your document.

Key Shipping Details to Include

- Recipient’s Name and Address: Clearly state the full name, address, and contact details of the recipient to avoid any misdeliveries. Make sure to include street addresses, postal codes, city, and country.

- Shipping Method: Specify the chosen shipping carrier or method (e.g., air freight, sea freight, or courier services). This helps the receiver know what to expect in terms of delivery timeframes and service levels.

- Delivery Date or Timeframe: Indicate the expected delivery date or a general timeframe, ensuring both parties are aware of when the goods should arrive.

- Tracking Number: If available, provide a tracking number for the shipment. This allows both parties to monitor the shipment’s progress and track any potential delays.

- Shipping Costs: Clearly outline any shipping charges, including handling fees or additional costs that may apply. This ensures transparency and avoids disputes over payment.

- Customs Information: For international shipments, include relevant customs information, such as Harmonized System (HS) codes, required for customs clearance and to avoid unnecessary delays at borders.

Best Practices for Including Shipping Information

To ensure that shipping details are easy to understand, structure the information clearly within the document. It’s a good practice to place the shipping section in a prominent position, such as directly under the item list or at the bottom of the document, so it is easy to locate when needed.

Incorporating these critical shipping elements into your business documents ensures smooth transactions and helps prevent delays during the shipping process. By providing accurate, clear, and complete shipping details, you improve customer satisfaction and streamline operations for both the seller and the buyer.

Digital vs. Paper Invoices: Pros and Cons

When managing business transactions, companies often face the choice between using digital or paper-based documents. Each option has its own set of advantages and challenges, and understanding these can help businesses make informed decisions about which method is best suited for their operations.

Advantages and Disadvantages

Both digital and paper documents have their own unique benefits and limitations. Below is a comparison of the two approaches to help identify which might be more effective for specific needs.

| Aspect | Digital Documents | Paper Documents |

|---|---|---|

| Cost | Generally lower cost as no paper, printing, or physical storage is required. | Higher cost due to paper, printing, postage, and physical storage needs. |

| Speed | Faster delivery, as documents can be sent instantly via email or digital platforms. | Slower delivery, dependent on postal services. |

| Storage | Easy to store, search, and organize electronically without physical space. | Requires physical storage space, which can lead to clutter and organizational challenges. |

| Security | Vulnerable to hacking or technical issues, but secure encryption and backups can mitigate this risk. | Susceptible to physical damage, loss, or theft. Copies need to be manually secured. |

| Environmental Impact | Environmentally friendly as no paper or ink is used. | Less eco-friendly, as paper production and printing contribute to waste and resource consumption. |

Choosing the Best Option for Your Business

The decision between digital and paper documents ultimately depends on your business’s needs, goals, and existing infrastructure. Digital documents are ideal for fast-paced, tech-savvy environments, while paper documents may still be preferred in industries that require physical records or where internet access is limited. Weighing the pros and cons of both options will help you select the method that provides the best balance of efficiency, cost, and security for your business.

EU Customs Requirements for Invoices

When engaging in international trade, especially within the European Union, businesses must ensure their documents meet specific customs requirements. These requirements help facilitate smooth border crossings and ensure that goods are cleared for entry or exit from the EU without delays. Understanding these regulations is essential for maintaining compliance and avoiding unnecessary penalties or delays.

For transactions involving the movement of goods between EU member states or with countries outside the EU, certain information must be included in business documents to meet customs standards. These details ensure that customs authorities can properly assess the goods, calculate duties and taxes, and ensure compliance with import/export laws.

Key Information for EU Customs Compliance:

- Detailed Description of Goods: Clear descriptions of the products being shipped are required. This includes their type, quantity, and value to facilitate accurate classification and tariff assessment.

- Origin of Goods: The country of origin must be specified to determine whether any preferential trade agreements or tariffs apply. This helps customs officials understand whether any exemptions or reduced rates are available under trade agreements.

- HS Codes: The Harmonized System (HS) code is necessary to classify goods for customs purposes. It provides a standardized classification for international trade and ensures that duties and taxes are applied correctly.

- Transaction Value: The total value of the goods being shipped should be clearly stated, including the currency used, to calculate the applicable duties, VAT, and other taxes.

- Consignment and Shipping Details: Including the recipient’s address, shipping method, and tracking number helps ensure accurate customs processing. These details help customs officials verify that the shipment aligns with the documentation provided.

- Customs Declarations: In some cases, additional customs declarations or certificates of authenticity may be required, particularly for restricted or controlled goods.

Ensuring that these details are included in all relevant documents can prevent delays at customs checkpoints and ensure that goods are processed efficiently. By adhering to these EU customs requirements, businesses can ensure smoother international transactions and maintain compliance with EU laws.

How to Save Time with Templates

In today’s fast-paced business environment, time is a valuable resource. One way to increase efficiency and streamline repetitive tasks is by using predefined documents. These structured formats allow businesses to quickly fill in necessary details without starting from scratch each time, saving time and reducing the chances of errors.

By utilizing standardized forms for routine processes, such as transaction documentation or customer agreements, you can avoid manual formatting and ensure consistency across all your documents. This approach helps businesses complete tasks faster, allowing employees to focus on more complex and critical responsibilities.

Benefits of Using Predefined Formats

- Consistency: A pre-established structure ensures that all required information is included every time, avoiding missed details or inconsistent formats.

- Efficiency: Time spent on repetitive tasks is significantly reduced. With templates, information can be entered quickly, eliminating the need to format or create documents from scratch.

- Accuracy: Using a predefined structure reduces human error. Once the information is entered, the document is ready to be sent without worrying about missing essential components.

- Professional Appearance: Templates provide a polished, uniform look to all business communications, which helps maintain a professional image and fosters trust with clients and partners.

Customizing Templates for Your Needs

While templates save time, it’s also important to adapt them to your specific business requirements. Many document systems allow customization, where fields can be added, removed, or adjusted to suit the context of different transactions or client needs. This ensures that while you’re saving time, the documents still meet your particular standards and regulations.

Legal Considerations for Commercial Invoices

When engaging in cross-border transactions, it’s important to ensure that the necessary documentation complies with both local and international laws. These documents serve as legal records of the transaction, and ensuring they are properly structured can help avoid disputes and legal issues. Understanding the legal requirements for these documents ensures that businesses can smoothly navigate international trade while meeting regulatory obligations.

Different countries, including those within the European Union, may have varying requirements for the format and content of documents. Failing to meet these legal standards can result in delayed shipments, fines, or difficulties during customs clearance. Therefore, it is crucial to familiarize yourself with the laws that govern these essential records to maintain legal compliance.

Key Legal Requirements

- Accurate and Complete Information: All relevant details, such as the goods being traded, transaction value, and buyer/seller information, must be clearly stated. Inaccurate or incomplete documents can lead to legal complications, such as customs fines or tax discrepancies.

- Tax Identification Numbers: It is required to include tax identification numbers of both the seller and the buyer to comply with tax regulations, especially when conducting international business. These numbers ensure proper VAT handling and customs duties.

- Compliance with Trade Laws: The documents must adhere to international trade agreements and the specific regulations of the destination country. This may include specific tariff codes, product descriptions, and customs certifications to meet local trade and import-export laws.

- Signatures and Certification: Certain documents may require signatures or certifications by authorized personnel. This is particularly important when dealing with regulated or restricted goods. In some cases, official stamps or notary services may be required for legal validity.

Common Legal Pitfalls

- Incorrect Classification: Incorrectly classifying goods can lead to non-compliance with customs regulations and the wrong application of duties and taxes. Always use the correct Harmonized System (HS) code and verify product descriptions.

- Failure to Include Required Documentation: Missing documents, such as certificates of origin or export licenses, can delay shipments and result in legal fines. Ensure all necessary paperwork is included to avoid any legal disputes.

In conclusion, understanding the legal considerations surrounding these critical documents is essential for ensuring smooth business operations, especially when dealing with international shipments and cross-border trade. By following the necessary legal guidelines, businesses can protect themselves from costly legal issues and improve the efficiency of their trade processes.

Best Practices for Invoice Accuracy

Maintaining precision in your business documentation is crucial for ensuring smooth transactions and avoiding legal or financial disputes. Accurate records not only help in complying with regulations but also ensure clarity in business relationships. When creating transaction documents, it’s important to follow best practices that reduce errors and streamline the process. This leads to a more efficient workflow and fosters trust with clients and partners.

By implementing consistent procedures, businesses can improve the accuracy of their records, minimize misunderstandings, and expedite the approval process. Here are some strategies to help you achieve accuracy in your business documents:

Key Strategies for Accurate Documents

- Double-check Information: Before finalizing any document, ensure that all information is correct. This includes the buyer and seller details, product descriptions, and amounts. Mistakes in these areas can lead to delays or incorrect payments.

- Use Predefined Formats: Utilizing standardized formats helps ensure that all required fields are filled out correctly and consistently. This reduces the chances of missing important details and creates uniformity across your business documents.

- Review Terms and Conditions: Always double-check the terms of the transaction, such as payment terms, delivery instructions, and taxes. Ensuring these elements are accurately reflected in your records prevents misunderstandings later.

- Automate Calculations: Using software that automatically calculates totals, taxes, and discounts can help reduce human error. This also speeds up the process, allowing staff to focus on more critical tasks.

Common Errors to Avoid

- Incorrect Pricing: Ensure that the correct prices are applied, and discounts or taxes are accurately calculated. Incorrect pricing can lead to financial disputes and damage to your business reputation.

- Missing Details: Always include essential information such as payment methods, tax identification numbers, and shipping instructions. Missing details can result in confusion or delays in processing.

- Failure to Include Supporting Documents: Depending on the transaction, supporting documents (e.g., contracts, receipts, or certifications) may be necessary. Missing these documents can cause delays in payment or shipment.

By adhering to these best practices, businesses can minimize errors and ensure that their records are accurate, complete, and legally compliant. Taking the time to implement these strategies not only reduces mistakes but also strengthens your professional relationships with clients and partners.

How to Handle Multiple Currencies

Dealing with multiple currencies in international business transactions requires careful planning and attention to detail. In a globalized economy, businesses often need to convert prices and totals into different currencies, which can add complexity to the process. To ensure accuracy and clarity, it is important to implement strategies that help manage currency conversions and avoid costly mistakes. The right approach not only makes the process smoother but also strengthens relationships with international clients and partners.

When handling different currencies, you should consider several factors, such as exchange rates, potential fees, and the timing of conversions. Below are some best practices to follow when working with multiple currencies:

Effective Strategies for Currency Management

- Use Real-Time Exchange Rates: To maintain accuracy, always use real-time exchange rates when converting amounts between currencies. Exchange rates can fluctuate frequently, so it is important to ensure that the correct rates are applied at the time of the transaction.

- Standardize Currency Notations: Make sure that all currency values are clearly marked with their respective symbols or codes (e.g., USD for U.S. dollars, EUR for euros). This will prevent confusion and ensure that both parties understand the exact value being discussed.

- Consider Currency Conversion Fees: When making payments or receiving funds in different currencies, be aware of any associated conversion fees. These fees can affect the final amount received or paid, so it’s essential to account for them in the transaction.

- Settle in One Currency: Whenever possible, it is beneficial to agree on a single currency for settlement to simplify the process. This can help reduce the risks associated with currency fluctuations and make the payment process more straightforward.

Common Challenges When Managing Multiple Currencies

- Exchange Rate Fluctuations: Currency values can change rapidly, which can impact the final amount paid or received. This can lead to discrepancies and unexpected costs. To manage this, businesses may choose to lock in exchange rates in advance or use hedging tools to mitigate risk.

- Complex Accounting Requirements: Keeping track of transactions in multiple currencies can complicate accounting processes. Using specialized software or an accountant familiar with multi-currency management can help streamline the process and ensure compliance with tax laws.

- Cross-Border Payment Delays: Payments made in foreign currencies may be subject to additional processing time, depending on the banks or payment systems involved. It is essential to plan for potential delays to avoid disruptions in the transaction flow.

By carefully considering exchange rates, standardized currency practices, and potential challenges, businesses can effectively manage multiple currencies in their transactions. With these strategies, companies can minimize confusion, reduce risks, and maintain smooth international operations.

Template Tools and Software Recommendations

In today’s digital age, creating professional documents for business transactions has never been easier. There are various tools and software options available that can help streamline the process, offering customization and automation to suit specific business needs. These platforms not only save time but also ensure consistency and accuracy in the final documents. Whether you are preparing records for shipping, sales, or international trade, using the right software can improve efficiency and reduce errors.

Below are some of the most recommended tools and software solutions for creating professional business documents:

Popular Tools for Document Creation

- Microsoft Word: A widely used word processing tool that offers a range of pre-built templates for creating formal documents. It allows for easy customization, such as adding company logos, adjusting fonts, and changing layouts to match your brand.

- Google Docs: A cloud-based solution that allows users to create and share documents in real-time. Google Docs offers easy collaboration, and its templates are fully customizable. It also integrates well with Google Sheets for working with data such as pricing and totals.

- Canva: Known for its graphic design capabilities, Canva also provides customizable document templates. It’s particularly useful for creating visually appealing documents with professional designs, logos, and branding elements.

Specialized Software for Business Documents

- QuickBooks: A leading accounting software that not only helps with invoicing but also offers document creation tools for managing transactions, pricing, and sales data. It’s ideal for businesses that need to keep track of finances alongside creating essential business documents.

- Zoho Invoice: A cloud-based invoicing software that allows users to create, send, and track documents with ease. Zoho Invoice offers templates specifically designed for businesses, and its automation tools help save time by generating documents based on customer data.

- FreshBooks: Another popular cloud-based platform, FreshBooks offers customizable templates for generating business documents. It also includes tools for time tracking, expense management, and invoicing, making it ideal for small businesses and freelancers.

Choosing the right tool or software largely depends on your specific needs. Whether you need a simple document for internal use or a professional layout for international transactions, using the right platform will enhance your productivity and help maintain a consistent, professional image.

How to Secure Your Invoice Data

When it comes to managing business documents, especially those containing sensitive information like pricing, client details, and payment terms, ensuring the security of that data is essential. Whether you’re handling electronic or paper-based records, protecting this information is key to maintaining client trust and complying with data protection regulations. Here are some important strategies to help you secure your business data effectively.

Best Practices for Digital Document Security

- Use Strong Passwords: Always set strong, unique passwords for any system or software where sensitive documents are stored. Avoid using easily guessed passwords and make sure to update them regularly.

- Encrypt Files: For electronic records, encryption is one of the most effective ways to secure your documents. Use encryption tools to ensure that files are only accessible to authorized individuals.

- Two-Factor Authentication: Enable two-factor authentication (2FA) on accounts or platforms where documents are stored. This extra layer of security helps protect against unauthorized access, even if passwords are compromised.

- Secure Cloud Storage: If you’re using cloud services to store your documents, make sure to choose a provider with robust security measures in place, such as end-to-end encryption and regular security audits.

Ensuring Paper Document Security

- Lock Files in Cabinets: For physical records, always store sensitive documents in locked file cabinets or secure rooms. Limit access to these areas to authorized personnel only.

- Shred Documents: When physical copies of documents are no longer needed, make sure to shred them to prevent unauthorized individuals from accessing the information.

- Keep Records in a Safe: For highly sensitive documents, consider investing in a fireproof or burglar-proof safe for added protection against theft or damage.

Monitoring and Compliance

It is important to regularly audit your data protection practices to ensure that your security measures remain effective. This includes reviewing access logs, conducting vulnerability assessments, and staying up to date with the latest security protocols. Compliance with relevant data protection laws, such as the GDPR in the EU, should also be a priority to avoid legal consequences.

| Security Measure | Digital | Paper |

|---|---|---|

| Password Protection | ✔ | ✘ |

| Encryption | ✔ | ✘ |

| Physical Storage | ✔ (Cloud/Server) | ✔ (Lock Cabinets) |

| Shredding/Destruction | ✔ (Digital Shredding) | ✔ (Paper Shredding) |

By implementing these security practices, you can ensure that your business records remain protected from unauthorized access, theft, and data breaches. Whether you’re working with electronic or physical documents, the safety of your sensitive information should always be a priority.