Download the Best Entertainment Invoice Template for Efficient Billing

Managing payment requests for creative services can often be a complex task. Whether you’re a freelancer, event organizer, or part of the entertainment industry, it’s essential to present clear and professional payment documentation. A well-structured billing statement not only ensures that your clients understand the charges but also improves your chances of receiving timely payments.

Having the right tools at your disposal can make this process much smoother. With the right structure and design, your financial documents can look professional and leave a lasting impression. By adopting a systematic approach to creating these forms, you can eliminate confusion and avoid common mistakes that often lead to delays in payment.

Customizing your billing documents allows you to meet your unique business needs while ensuring compliance with industry standards. Whether you need to include specific service descriptions, payment terms, or additional fees, an organized format can simplify the task. This guide will show you how to create, customize, and manage your payment requests more effectively, ensuring both professionalism and efficiency.

Entertainment Invoice Template Guide

Creating a professional document for requesting payment is an essential step in any business transaction. A well-organized financial form ensures clarity, prevents confusion, and accelerates the payment process. Whether you’re offering a performance, organizing an event, or providing other creative services, it’s crucial to use a format that highlights all necessary details in an easy-to-understand manner.

The key to an effective payment request lies in its structure. It should contain all relevant information like the services provided, payment terms, and due dates, while maintaining a clear and concise presentation. By following a structured approach, you can avoid errors and misunderstandings that often arise from poorly designed forms.

Essential Elements of a Payment Request

To ensure your payment request is both clear and professional, include the following components:

| Component | Description |

|---|---|

| Contact Information | Include both your details and your client’s, such as names, addresses, and phone numbers. |

| Service Description | Provide a detailed breakdown of the services rendered, including dates and locations if applicable. |

| Payment Amount | List the total amount due, along with itemized charges if necessary. |

| Payment Terms | Specify due dates, late fees, and accepted payment methods. |

Customizing Your Payment Document

Once you’ve mastered the basics, it’s important to tailor your form to fit your business needs. Customization can range from simple tweaks in formatting to including additional information such as taxes or specific client requests. The goal is to create a document that reflects your business’s professionalism while addressing both your

What is an Entertainment Invoice?

A payment request document is an essential tool for professionals offering creative services. It is a formal way of requesting payment for work completed, detailing the services provided and the amount due. This document ensures transparency between the service provider and the client, helping to establish clear expectations and avoid confusion.

Such a document is typically used in industries that involve performance, events, or other creative endeavors, where the services are often intangible or customized. It acts as both a record and a formal reminder of what has been agreed upon regarding payment terms and conditions.

The key purpose of this document is to provide a structured format for professionals to request payment for services rendered. It ensures that both the provider and the client have a clear understanding of the transaction and its details. Without this, payment issues and disputes can arise, leading to delays and frustration for both parties.

Key Features of This Document

- Client and Provider Information: Both parties’ names, addresses, and contact details.

- Details of the Services Rendered: A description of the work completed, including dates and locations if relevant.

- Total Amount Due: The full amount payable, often broken down into individual charges for different services or products.

- Payment Terms: Information about the payment deadline, accepted methods of payment, and any late fees.

- Tax Information: If applicable, the document should include details on applicable taxes or surcharges.

Why is It Important?

For service providers, creating a formal payment request is crucial for maintaining professionalism and ensuring they are compensated fairly and on time. It helps avoid misunderstandings, simplifies tracking payments, and provides legal protection in case of disputes. Additionally, it helps establish trust with clients by providing a transparent breakdown of services and costs.

Why Use an Entertainment Invoice Template?

Having a standardized form for requesting payments can greatly simplify the financial aspects of any creative business. Whether you’re a freelancer, performer, or event planner, using a pre-designed document ensures that every transaction is handled consistently and professionally. By relying on a structured format, you eliminate the need to create a new document from scratch every time, saving you valuable time and effort.

Such a tool not only streamlines the billing process but also minimizes the chances of errors. With a consistent design, you can easily include all the necessary details, such as client information, service descriptions, and payment terms, without overlooking any key components. This efficiency leads to faster payment processing and a smoother experience for both you and your clients.

Consistency and Professionalism

Using a pre-made form ensures that every request you send is consistent in style and content. This level of consistency can make your business appear more organized and professional, which can be a significant advantage when building trust with clients. A well-structured document is more likely to be taken seriously, improving the chances of prompt payments and fewer disputes.

Time and Cost Efficiency

Creating a customized payment form for each project can be time-consuming, especially when you’re working with multiple clients. A reusable, customizable structure allows you to quickly adapt the document for different jobs without starting from scratch each time. This time-saving tool not only reduces effort but also helps you manage multiple projects simultaneously without getting bogged down in paperwork.

Additionally, using a consistent form can help reduce administrative costs, as the time spent on revisions and corrections is minimized. The more streamlined your billing process, the faster you can focus on delivering quality services to your clients.

Benefits of Customizing Your Invoice

Personalizing your payment request document provides significant advantages for both you and your clients. A customized form allows you to reflect your brand identity, while also offering greater flexibility to include specific terms or details relevant to the job. This tailored approach not only ensures clarity but can also foster a more professional image, setting you apart from others in your industry.

By adapting the document to suit your needs, you can add specific information that may be unique to each project, such as client preferences, custom services, or special payment arrangements. This level of attention to detail not only helps avoid misunderstandings but also increases the likelihood of prompt and accurate payments.

Key Advantages of Customizing Your Payment Request

Here are some important benefits that come with personalizing your financial documents:

| Benefit | Description |

|---|---|

| Branding and Professionalism | Incorporating your logo, color scheme, and brand elements helps present a cohesive and professional image. |

| Clearer Communication | Customizing allows you to include specific details relevant to the service, reducing the chances of confusion or disputes. |

| Flexibility | You can adapt your forms to meet the unique needs of each project, whether it’s for payment milestones, additional fees, or special terms. |

| Improved Payment Tracking | Including relevant tracking numbers, due dates, or invoice numbers helps you stay organized and easily follow up on unpaid amounts. |

Customizing for Specific Needs

Different projects may require different details, such as payment schedules, milestone payments, or varying tax rates. A personalized format allows you to adjust these sections according to the nature of the work and the agreement with the client. For instance, you can include payment instructions for international clients, or special discounts and promotions for repeat business, making the document more comprehensive and relevant to each unique job.

Key Information to Include in an Invoice

When creating a document to request payment, it is essential to include all necessary details to ensure clarity and avoid misunderstandings. A well-structured document provides both the service provider and the client with a clear understanding of the transaction, making the process smoother and more efficient. Including the right information ensures that both parties are on the same page regarding services rendered, costs, and payment expectations.

While the specific content may vary depending on the nature of the services provided, there are several key elements that should always be included to make the document clear, professional, and legally sound.

Essential Components

Here are the main details you should include in any payment request document:

- Client and Service Provider Information: Both parties’ full names, addresses, phone numbers, and email addresses.

- Document Number and Date: Assign a unique reference number for the document, and include the issue date for tracking purposes.

- Description of Services: A detailed list of the services provided, including the scope of work, time frame, and any special terms.

- Amount Due: The total amount charged for the services rendered, along with a breakdown of individual costs if applicable.

- Payment Terms: The payment due date, accepted methods of payment, and any late fees or interest charges for overdue payments.

- Tax Information: If applicable, include details about sales tax, VAT, or other taxes that are relevant to the transaction.

- Additional Notes: Any extra information that may be relevant, such as terms of service, discount details, or instructions for future payments.

Why These Details Matter

Including these components in your payment request ensures that both parties understand the specifics of the transaction and agree on all terms before the payment is made. It also protects both the service provider and the client by offering a clear reference in case of disputes or questions. By outlining all the necessary details, you help ensure a smooth payment process and maintain a professional relationship with your clients.

How to Create an Entertainment Invoice

Creating a professional document for payment requests is an essential part of any business transaction, especially in creative fields. A well-structured payment request ensures both clarity and efficiency, helping to avoid misunderstandings between the service provider and the client. By following a straightforward process, you can easily create a document that is clear, professional, and accurate.

To craft a detailed and organized payment request, there are specific steps and components to consider. Ensuring that all key information is included and formatted correctly will not only streamline the payment process but also help you maintain a professional appearance with your clients.

Steps to Create a Payment Request Document

Follow these steps to create an effective payment request for any creative service:

- Gather Necessary Information: Collect details such as the client’s name, contact information, services provided, and agreed-upon payment terms.

- Choose the Right Format: Decide whether to use a physical or digital document. A digital version is more commonly used today and allows for easy editing and sharing.

- Include Key Details: Ensure your document contains the essential components: both parties’ information, service descriptions, total charges, payment terms, and deadlines.

- Double-Check Accuracy: Verify that all the information is accurate, including the amount due, service descriptions, and any taxes or discounts applied.

- Review and Send: Before submitting, review the document for clarity and correctness. Once everything looks good, send it to the client through their preferred communication method.

Customizing Your Document

While there are basic elements every payment request should include, you can customize it to fit your business needs. Here are some customization tips:

- Brand Identity: Add your company logo and use your brand colors to personalize the document and make it consistent with your business image.

- Payment Terms: Clearly state the payment due date, accepted methods of payment (bank transfer, credit card, etc.), and any late fees for overdue payments.

- Itemized Charges: If you offer multiple services or products, break down the costs into individual line items to ensure transparency and prevent confusion.

- Special Instructions: If you have specific instructions regarding payments, such as i

Choosing the Right Invoice Format

When creating a document to request payment, selecting the correct format is essential for ensuring that your request is both professional and easy to process. The format you choose should reflect your business needs, the nature of your services, and how you want to interact with clients. By picking the right layout and structure, you ensure that the payment process is smooth, efficient, and transparent.

There are a few key factors to consider when choosing the best format for your payment request. You can opt for a physical document, a digital one, or even an automated system, depending on what works best for your workflow and your client base. Below are some of the considerations to keep in mind when deciding which format suits your business the most.

Factors to Consider When Choosing a Format

- Ease of Use: Choose a format that you find simple to create and easy for your clients to understand. This will save you time and reduce the chances of mistakes.

- Client Preferences: Some clients may prefer a digital document, while others may prefer something printed. Understanding your client’s preferred communication method can guide your decision.

- Customization: Ensure the format you choose allows you to add all necessary details and adapt to different types of services or agreements. Flexibility is important for tailoring the document to your needs.

- Professionalism: The format you choose should align with your business’s branding. A polished, clean design is important for making a good impression.

- Accessibility: If you work with international clients, consider a format that is universally accessible and can be easily shared or printed in different formats, such as PDF or Word.

Popular Formats for Payment Requests

Here are a few of the most common formats used for creating payment request documents:

- Digital Documents (PDF, Word, Excel): Digital formats are the most widely used today due to their convenience, easy sharing capabilities, and ability to integrate with payment systems.

- Physical Documents: While less common in the digital age, printed documents can still be useful in certain industries or for clients who prefer physical copies.

- Online Billing Systems: Automated systems allow for quick creation, customization, and tracking of payment requests. These platforms often integrate with payment gateways, speeding up the payment process.

- Custom Billing Software: Specialized software can

Best Tools for Designing Invoices

Creating a professional and well-designed payment request form requires the right tools. Whether you are looking for a simple layout or a highly customizable design, the right software can help you produce documents that are both functional and visually appealing. By using the right tools, you can save time, maintain consistency, and ensure that your financial documents represent your business professionally.

There are a variety of options available, ranging from basic word processors to specialized software that offers advanced features for billing and financial management. Choosing the right tool depends on your specific needs, such as the complexity of your services, the volume of clients, and the level of customization you require.

Top Tools for Payment Request Design

Here are some of the best tools to help you create a polished and effective payment request document:

- Canva: A user-friendly design tool that offers customizable templates and drag-and-drop features. It’s perfect for those who want a visually appealing and easy-to-create document without needing advanced design skills.

- Microsoft Word: A classic and reliable option, Word offers a variety of templates and customization options. It’s great for those who prefer working with a familiar platform and need something quick and straightforward.

- Google Docs: Ideal for collaboration, Google Docs allows multiple people to edit and review the document in real time. It also offers integration with Google Sheets for easy financial tracking.

- QuickBooks: An all-in-one financial tool, QuickBooks helps you create professional payment request documents while also tracking payments and managing accounting. It’s perfect for businesses that want a complete solution for invoicing and bookkeeping.

- Zoho Invoice: A cloud-based invoicing tool that provides customizable templates and features for automated billing. It also integrates with a variety of payment gateways for easy online transactions.

- FreshBooks: A cloud accounting tool that includes customizable payment request forms and automatic reminders for overdue payments. It’s ideal for freelancers and small businesses looking to streamline their financial processes.

Choosing the Right Tool for Your Business

The best tool for creating your payment request form depends on your specific needs. If you are looking for simplicity and speed, tools like Canva or Microsoft Word may be the best fit. However, if you require more advanced features such as payment tracking and integration with accounting sy

How to Avoid Common Billing Mistakes

Billing errors can lead to delays, misunderstandings, and even damage to your professional reputation. It’s important to be vigilant and meticulous when preparing financial documents to ensure that everything is clear, accurate, and complete. By avoiding common billing mistakes, you can maintain smooth transactions and build trust with your clients.

There are several key mistakes that many professionals make when preparing their payment requests. These errors, whether related to missing information, unclear terms, or incorrect calculations, can complicate the payment process and result in delayed or missed payments. By learning how to avoid these mistakes, you can make sure that your billing process is efficient and error-free.

Common Billing Mistakes and How to Avoid Them

Below are some of the most common mistakes made in financial documents and tips on how to prevent them:

Error How to Avoid It Missing or Incorrect Client Information Always double-check the client’s name, address, and contact details before sending the document. Using outdated or incorrect information can cause confusion or delays. Unclear Service Descriptions Provide detailed descriptions of the services rendered, including any specific terms or conditions agreed upon. Vague or incomplete descriptions can lead to disputes about what was delivered. Wrong Payment Amount Double-check the total amount and ensure that any discounts, taxes, or additional fees are accurately applied. Mistakes in calculations can delay payment or cause the client to question the charges. Omitting Payment Terms Clearly outline the payment terms, including due dates, accepted methods of payment, and any late fees. If payment terms are vague or missing, it can lead to delayed payments or confusion. Failure to Include an Invoice Number Always assign a unique invoice number to each document for easy reference and tracking. Without an invoice number, clients may struggle to locate the document or cross-reference it in their records. Not Tracking Payments Keep a record of when payments are made and ensure that they are properly recorded in your financial system. Failing to track payments can lead to confusion or missed follow-ups on overdue amounts. How to Improve Your Billing Accuracy

To further reduce the likelihood of mistakes, consider using automated tools or billing software to streamline the process. The

How to Add Taxes to Your Invoice

When creating a financial document for a client, it’s important to accurately include any applicable taxes. Including the correct tax amount ensures that you comply with local regulations and that your client is aware of the total cost of the service. The process of adding taxes to your payment request can vary depending on your location and the type of goods or services you provide, but the key is to be clear, transparent, and precise in your calculations.

Depending on your business’s location, the tax rate may differ, and there may be specific rules on how to apply these taxes. By following the right steps and ensuring you include the necessary details, you can avoid complications and ensure that both you and your client are on the same page regarding the final payment amount.

Steps to Add Taxes

Follow these steps to correctly add taxes to your payment request:

- Determine Applicable Tax Rate: Find out the tax rate that applies to the goods or services you provided. This can vary by country, state, or even municipality, so make sure you’re using the correct rate for your location.

- Calculate the Tax Amount: Multiply the total amount of the services by the tax rate to determine the amount owed in taxes. For example, if the total amount is $500 and the tax rate is 10%, you would calculate $500 * 0.10 = $50 in taxes.

- Itemize Taxes Separately: Clearly list the tax amount as a separate line item on your document. This ensures that your client can easily see how much tax they are being charged. You can also specify the tax rate to avoid any confusion.

- Include Total Amount: After adding the tax amount, ensure that the total cost is clearly stated. This will be the sum of the service cost and the tax amount, and it is essential for th

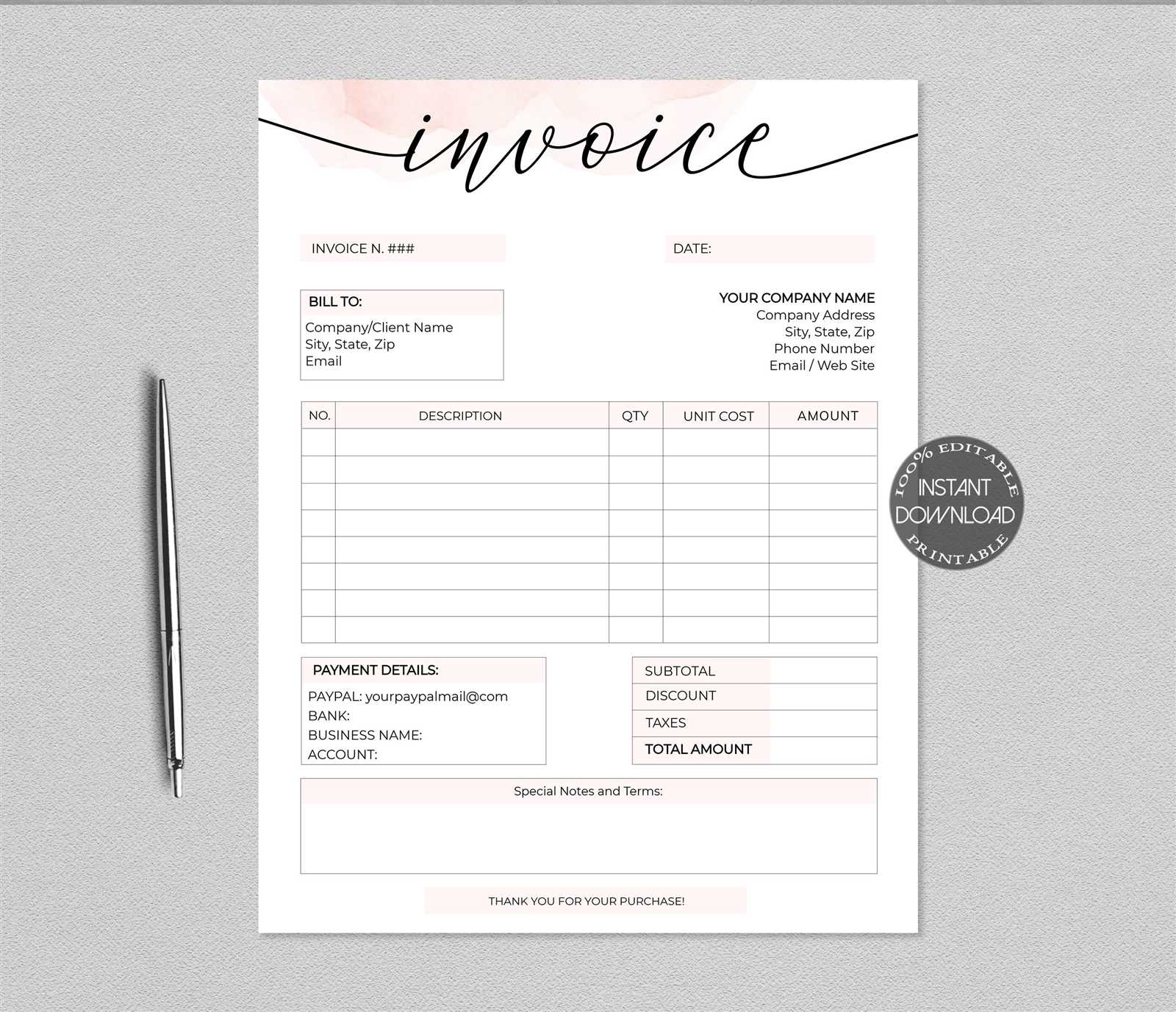

Ensuring Professional Invoice Appearance

Creating a payment request document that looks polished and professional is essential for maintaining a strong business image. A well-designed document not only conveys professionalism but also instills confidence in your clients. The appearance of your document plays a significant role in ensuring that your business is taken seriously and that all details are easily understood.

There are several aspects of document presentation to consider, from the layout and design to the font choices and spacing. By paying attention to these details, you can ensure that your payment requests are both functional and visually appealing, which can help speed up the payment process and build trust with your clients.

Key Elements of a Professional Payment Request Document

To ensure your document appears professional, consider the following elements:

- Clear Layout: A clean and organized layout is crucial. Use headers, bullet points, and tables to break down information into easy-to-read sections. A cluttered or difficult-to-follow layout can confuse clients and delay payment.

- Consistent Branding: Incorporate your company’s logo, color scheme, and fonts to make the document consistent with your brand identity. This adds a personal touch and reinforces your business image.

- Legible Fonts: Use easy-to-read fonts such as Arial, Times New Roman, or Helvetica. Avoid overly decorative fonts, which can make your document harder to read, especially for important details like totals or payment terms.

- Proper Alignment and Spacing: Ensure all text is properly aligned and there is enough space between sections. Crowded or misaligned text makes the document appear unprofessional and harder to navigate.

- High-Quality Paper or Digital Format: If you are sending a physical document, ensure it’s printed on high-quality paper. For digital documents, ensure the format is professional (such as PDF), and that it is properly formatted for easy viewing on all devices.

Common Mistakes to Avoid

Here are a few mistakes to avoid when designing your payment request document:

- Using Too Many Fonts or Colors: Stick to one or two fonts and a cohesive color scheme to avoid overwhelming the reader.

- Ignoring White Space: Don’t overcrowd the document with too much information in a small space. Allowing for adequate white space makes the document easier to read and looks more organized.

- Overloading with Text: Keep your wording concise and to the point. Too much text can make the document appear cluttered and unprofessional.

By focusing on these aspects, you can ensure that your payment requests are not only clear and accurate but also visually appealing, helping to maintain a positive and professional relationship with your clients.

How to Track Payments Efficiently

Effectively managing payments is a critical aspect of running any business. Without an organized system for tracking payments, it becomes easy to lose track of due amounts, deadlines, and client accounts. A streamlined payment tracking process helps ensure timely collections, reduces errors, and provides clarity for both you and your clients.

By implementing a systematic approach to payment tracking, you can keep track of payments received, outstanding balances, and payment due dates. Whether you prefer manual methods or automated tools, staying organized is key to maintaining financial clarity and avoiding misunderstandings.

Methods for Tracking Payments

Here are some of the most effective ways to monitor and track your payments:

- Manual Record Keeping: For small businesses or freelance workers, manually logging payments in a ledger or spreadsheet can be a straightforward solution. Create columns for client names, amounts due, received payments, and due dates to track each transaction.

- Payment Tracking Software: Automated tools like QuickBooks, FreshBooks, or Zoho Invoice provide digital solutions for tracking payments. These platforms allow you to send payment reminders, record transactions, and generate financial reports.

- Bank Reconciliation: Regularly compare your payment records with your bank statements to ensure that all payments have been processed correctly. This helps catch any discrepancies and keeps your financial data up to date.

- Payment Confirmation Emails: Always send clients a confirmation email once a payment has been received. This provides both parties with a record of the transaction and prevents confusion in case of any discrepancies later on.

Tips for Streamlining Payment Tracking

To improve your payment tracking process, consider the following best practices:

- Set Clear Payment Terms: Ensure that your clients are aware of the payment terms and deadlines from the outset. Clear terms reduce confusion and make it easier to track when payments should be made.

- Use Payment Reminders: Send timely reminders to clients about upcoming or overdue payments. Automated tools can help schedule these reminders to save time and ensure follow-ups are consistent.

- Maintain Detailed Records: Keep accurate records of every transaction, including the date, amount, and payment method. This ensures you have a comprehensive overview of your finances and can easily resolve any disputes.

- Organize by Client: Organize your records by client so you can quickly see which payments have been received, which are overdue, and what the current balances are for each account.

With these methods and tips, you can effectively track payments, stay on top of your financial obligations, and maintain strong relationships with your clients. An organized approach to pay

Handling Late Payments in Entertainment

Late payments are a common challenge in many industries, and the entertainment sector is no exception. Whether you’re working as a freelancer, contractor, or part of a larger organization, delayed payments can disrupt cash flow and complicate financial planning. It’s essential to have clear strategies in place to address this issue while maintaining professional relationships with your clients.

Managing late payments effectively involves a combination of preventive measures, clear communication, and a structured follow-up process. By establishing expectations upfront and using diplomatic yet firm tactics when payments are overdue, you can minimize the impact of late payments on your business.

Strategies to Address Late Payments

Here are some practical strategies to handle late payments in the entertainment industry:

- Set Clear Payment Terms: From the start, ensure that your clients understand the payment deadlines, accepted payment methods, and any late fees that may apply. Clear terms reduce the chances of misunderstandings and set the tone for timely payments.

- Send Polite Reminders: If a payment is overdue, a polite reminder is often enough to prompt action. It’s important to remain professional in your communication, politely reminding clients of their payment obligation.

- Implement Late Fees: Include late fees in your payment terms to encourage timely payment. A small penalty can help motivate clients to prioritize your payment over others, especially if they know there will be consequences for delays.

- Offer Payment Plans: For clients facing financial difficulties, offering a payment plan can help ensure you still receive compensation. This allows your clients to pay in installments, making it easier for them to fulfill their obligations without putting too much strain on their finances.

- Use Contracts for Protection: Always have a formal agreement or contract in place before beginning any project. A well-drafted contract should outline the payment schedule, expectations, and any repercussions for late payments. This adds a layer of protection in case you need to take further action.

What to Do If Payments Remain Unpaid

If a client continues to delay payments despite reminders, you may need to escalate the situation. Consider the following actions:

- Reach Out Directly: A phone call or personal email can sometimes resolve issues that are overlooked through other means. Direct communication may help uncover the cause of the delay and find a mutually agreeable solution.

- Involve a Collection Agency: If the payment remains unpaid for an extended

Legal Considerations in Entertainment Invoicing

When creating a billing document for services rendered, it is important to understand the legal aspects involved in the process. The payment request not only outlines the agreed-upon terms between you and your client but also serves as a legal document that can protect both parties in case of disputes. Being aware of your legal obligations and ensuring that your document adheres to the relevant laws can help avoid potential issues down the line.

From payment terms to taxes and contract enforcement, there are several legal elements to consider when creating a payment request. By ensuring that all necessary legal details are included and that your document is clear and accurate, you can safeguard your interests and maintain professional standards in your business dealings.

Key Legal Aspects to Include

When preparing your payment request, make sure to incorporate the following legal considerations:

- Clear Payment Terms: Clearly define the payment amount, due date, and any penalties for late payment. This helps establish expectations and minimizes the risk of future disputes.

- Tax Information: Include any applicable tax rates or sales tax information, ensuring compliance with local tax laws. Depending on your location, failing to include this information could result in penalties or fines.

- Client’s Information: Make sure to accurately include your client’s full legal name, business name (if applicable), and contact details. This ensures that there is no confusion about who is responsible for payment.

- Late Payment Clauses: If you plan to charge interest or fees on late payments, include a clause that specifies the rate and when it will be applied. This can discourage late payments and incentivize timely settlement.

- Dispute Resolution: Consider adding a clause outlining how disputes will be handled. Specify whether issues will be resolved through mediation, arbitration, or through legal proceedings in a specific jurisdiction.

Contractual and Jurisdictional Considerations

In addition to the content of the payment request itself, you must consider the broader legal framework in which it operates:

- Written Agreements: Whenever possible, establish a written contract or agreement before beginning any work. This agreement should detail the scope of work, payment schedule, and any other important conditions that both parties have agreed to.

- Jurisdiction and Governing Law: In case of a legal dispute, it is important to specify which jurisdiction’s laws will govern the agreement. This is particularly relevant for businesses working with clients across different regions or countries.

- Retention of Rights: Depending on the type of work, ensure that your payment request or contract specifies the retention of intellectual property rights or licensing agreements, if applicable. This is important in creative industries where ownership of the work is often a key concern.

Being aware of these legal considerations when preparing a payment request can help ensure that both parties are clear on the terms and that the document holds up if legal action is required. Properly structured documents will not only facilitate smoother transactions but also protect your business in the long run.

Understanding Payment Terms and Conditions

Payment terms and conditions are a crucial part of any business transaction. They define the expectations and obligations of both parties involved in the agreement, ensuring clarity regarding payment timelines, methods, and penalties for late payments. Understanding these terms is essential for smooth financial operations and can prevent potential conflicts between you and your clients.

By setting clear guidelines from the outset, you not only protect your business interests but also establish a foundation of trust and professionalism. In this section, we’ll explore the key components of effective payment terms and the best practices for communicating them with your clients.

Key Components of Payment Terms

When outlining payment conditions, it’s important to cover the following elements:

- Payment Due Date: Specify when the payment is due. This could be a fixed date, such as 30 days after receipt of the billing document, or based on specific milestones achieved in the project.

- Accepted Payment Methods: Clearly state the acceptable forms of payment, such as bank transfers, credit cards, checks, or online payment platforms like PayPal or Stripe. This helps avoid confusion and delays.

- Late Payment Fees: To encourage timely payment, consider including a clause outlining the penalties for late payments. This can be a fixed fee or a percentage of the overdue amount charged after a certain number of days past the due date.

- Discounts for Early Payment: Some businesses offer a discount if the payment is made before the due date. This can incentivize clients to pay sooner and improve cash flow.

Communicating Payment Terms Effectively

To ensure that both parties understand and agree to the payment terms, consider these best practices:

- Be Transparent: Clearly present your payment terms upfront in all agreements, contracts, and on your billing documents. Transparency reduces the risk of misunderstandings.

- Confirm Agreement: Make sure the client agrees to the payment terms before starting the work. You can do this in writing or through email communication to avoid potential disputes later.

- Send Timely Reminders: If a payment is approaching or overdue, send polite reminders to keep the client informed. Automated reminders can help maintain consistency and professionalism.

By defining and communicating your payment conditions effectively, you can ensure smoother transactions and stronger business relationships. Clear payment terms also provide legal protection in case of non-payment or disputes, helping you maintain control over your financials.

Digital vs. Paper Invoices: Pros and Cons

When it comes to requesting payment for services rendered, businesses have the option of choosing between digital and paper billing methods. Both have their own advantages and disadvantages, and the decision depends on factors such as convenience, cost, environmental impact, and client preferences. Understanding the pros and cons of each can help you choose the best approach for your business needs.

In this section, we’ll explore the differences between digital and paper-based billing, highlighting the key benefits and challenges of each method to help you make an informed decision.

Advantages of Digital Billing

Digital payment requests have become increasingly popular due to the numerous benefits they offer to businesses and clients alike:

- Speed and Efficiency: Digital requests can be sent instantly to clients via email or online platforms. This significantly reduces the time needed for delivery and ensures faster payment processing.

- Cost-Effective: Eliminating the need for paper, postage, and printing reduces overhead costs. Businesses save money on materials and time spent on physical mail handling.

- Environmental Benefits: Digital billing is an eco-friendly alternative, reducing paper waste and contributing to sustainability efforts.

- Easy Record Keeping: Digital records are easier to store, manage, and search. You can organize them by date, client, or status, making it simpler to track payments and manage your finances.

- Integration with Accounting Tools: Many digital billing systems integrate with accounting and bookkeeping software, streamlining financial management and reducing the chances of errors.

Drawbacks of Digital Billing

While digital billing has many benefits, there are a few potential drawbacks to consider:

- Dependence on Technology: Digital billing requires access to the internet and a device to send and receive the payment request. In some cases, clients may not be comfortable using online payment systems.

- Privacy Concerns: Some clients may have concerns about security and the privacy of online transactions, especially when personal information is involved.

- Technical Issues: There can be occasional technical issues, such as email delivery failures or website downtime, which can delay the process.

Advantages of Paper Billing

Despite the growth of digital options, paper

Tips for Faster Invoice Processing

Efficient processing of payment requests is crucial for maintaining healthy cash flow in any business. Delays in payment can create financial strain, slow down operations, and lead to frustration with clients. By streamlining the preparation and management of payment requests, you can speed up the entire process, ensuring quicker settlements and more reliable financial stability.

This section offers practical strategies that can help you reduce delays and improve the efficiency of your billing operations, from creating clear documents to implementing automated follow-ups.

Best Practices for Efficient Billing

To speed up payment processing and minimize errors, follow these key practices:

- Be Clear and Detailed: Ensure that all relevant information is included in your payment requests, such as the breakdown of services, agreed-upon amounts, and payment terms. A clear, concise document reduces the chance of confusion and disputes, speeding up the approval and payment process.

- Send Immediately After Service Completion: The sooner you send your payment request after completing a service, the sooner the client can begin processing it. Delay in issuing the request can lead to delays in payment, as clients may prioritize other requests they receive earlier.

- Provide Multiple Payment Options: The more payment methods you offer, the more convenient it is for clients to settle their accounts. Offering options like bank transfers, credit cards, or online payment platforms can expedite the process by giving clients flexibility.

- Ensure Accurate Contact Details: Make sure your payment request includes correct and up-to-date contact information, both for yourself and the client. Incorrect details can lead to miscommunications or delays in processing the payment.

- Automate Reminders: Use automation tools to send reminders about upcoming or overdue payments. Automated systems can help reduce the need for manual follow-ups, ensuring that clients are consistently reminded without requiring extra time or effort.

Effective Communication and Follow-Up

Clear communication with clients is essential to ensure that payment requests are processed promptly. Here are some additional tips for maintaining smooth commun

Examples of Payment Request Formats

Choosing the right format for your billing documents can make a significant difference in how professional and clear your communication appears to clients. Different industries and business types may require variations in layout, design, and content. Understanding various styles of payment requests can help you select the best one that suits your business needs and client expectations.

Below, we’ll explore a few examples of common formats, highlighting the structure, key details, and design elements that can be included to ensure your billing documents are clear and effective.

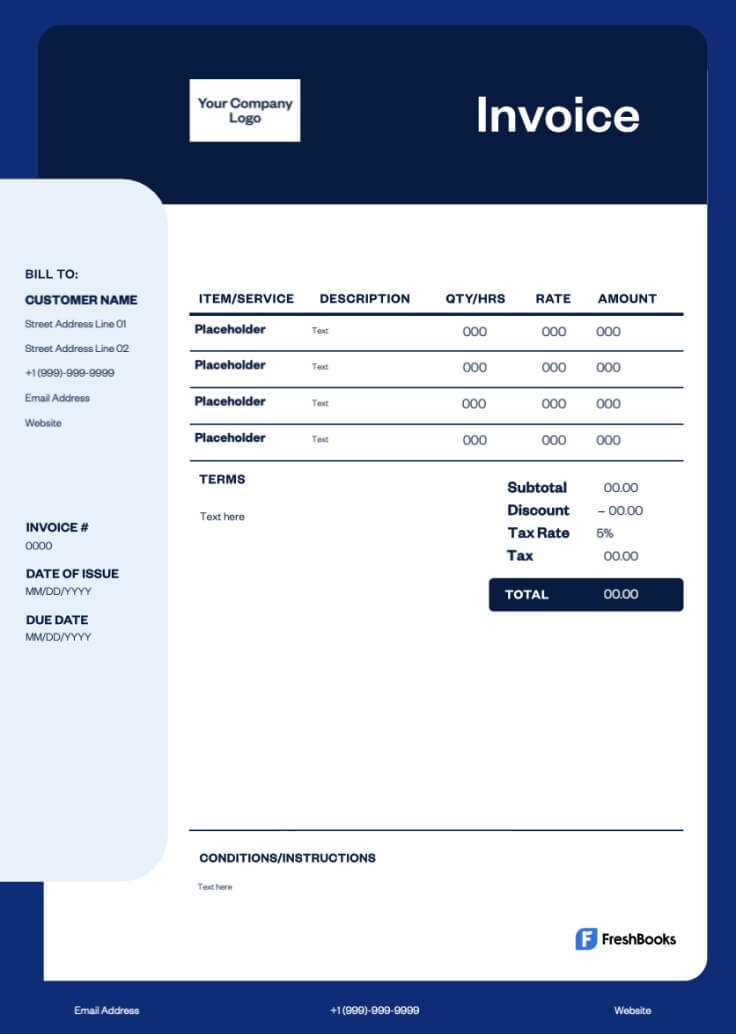

Basic Payment Request Format

A simple and straightforward format that is widely used for standard billing. This layout is ideal for smaller transactions or ongoing services.

- Header: Your business name, logo, and contact details at the top.

- Recipient Information: Client name, company, and contact details beneath the header.

- Invoice Number and Date: Include a unique reference number and the date the payment request is issued.

- Itemized List of Services: A clear breakdown of the services provided, along with the corresponding charges.

- Total Due: The total amount due, including taxes or any discounts.

- Payment Terms: Clearly state when payment is due, available methods, and any penalties for late payments.

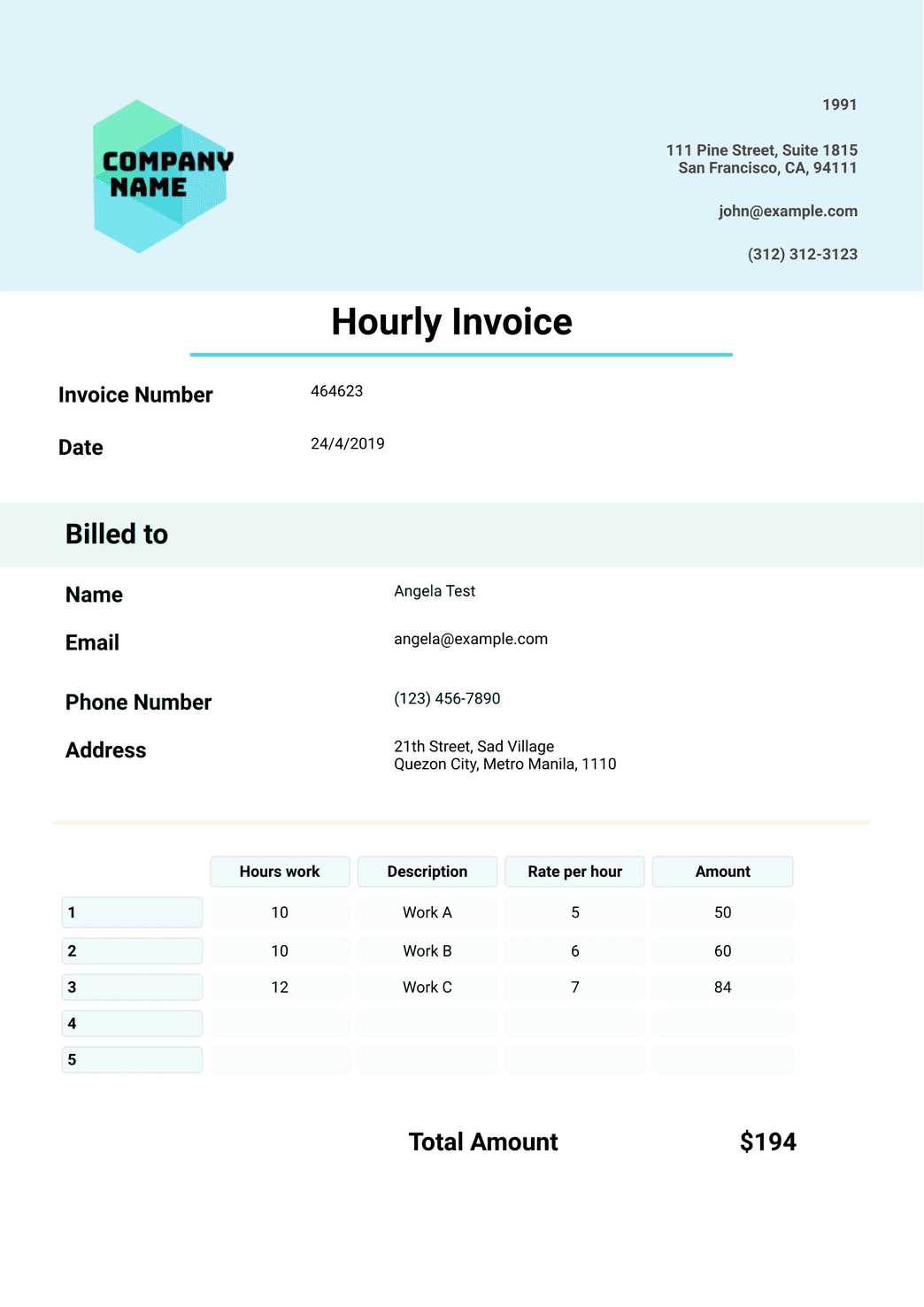

Detailed Payment Request Format for Large Projects

This format is more detailed and typically used for larger or more complex projects. It is particularly suitable for businesses that provide high-value services or products.

- Header and Recipient Information: Same as the basic format, but with additional fields for project or contract numbers.

- Scope of Work: A detailed description of the services or products provided, with dates and milestones.

- Progress Billing: If the project spans over a longer period, progress payments for different phases or milestones should be included.

- Tax Information: Detailed breakdown of taxes, including sales tax or other applicable charges.

- Payment Instructions: Provide payment methods in detail, such as bank account information, credit card options, or online payment instructions.

- Terms and Conditions: Include legal terms, such as payment terms, refund policies, or any penalties for late payment.

By adapting these examples to fit the specific needs of your business, you can create professional and effective documents that streamline your billing process and i