Free English Invoice Template for Easy Billing and Professional Invoices

Running a business often involves managing numerous transactions, and one of the key components of maintaining financial order is ensuring that every payment is properly documented. A well-structured payment document serves not only as a formal request for payment but also as an important record for both the seller and the buyer. It is essential that such documents are clear, professional, and easy to understand, reducing the risk of errors and delays.

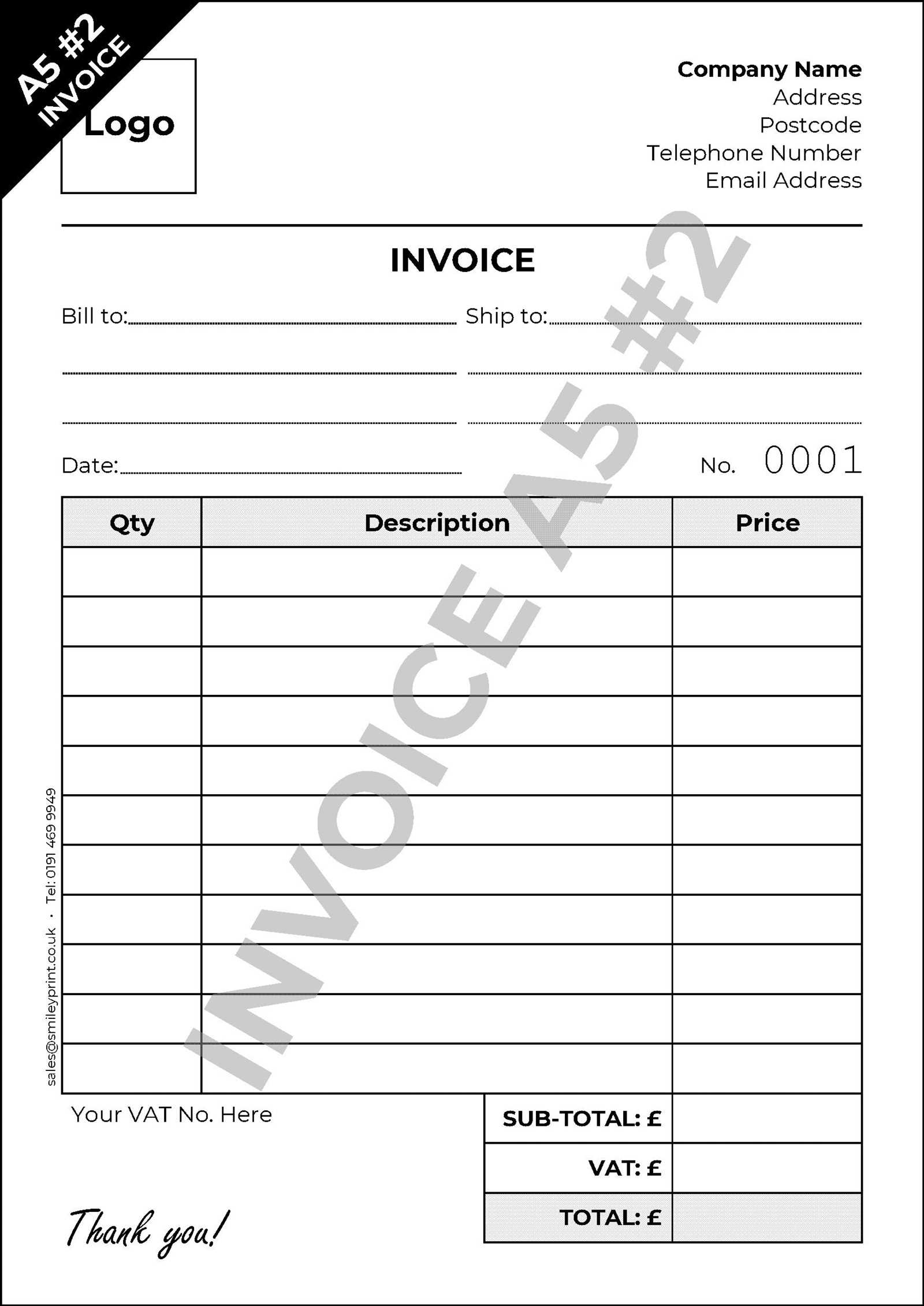

For small business owners, freelancers, or anyone who regularly provides services or goods, using a pre-designed form can simplify the entire process. With the right structure, these forms can be tailored to meet specific business needs while ensuring compliance with local financial practices. A customizable billing form can save time, minimize mistakes, and give your business a more polished, professional image.

Customizable billing documents allow for easy adaptation depending on the nature of the transaction and specific client requirements. Whether you are dealing with recurring charges or one-time payments, having a standardized format ensures that all the necessary details are included, streamlining your workflow and enhancing customer satisfaction. In this guide, we will explore the benefits of using such documents and how to make them work best for your business.

Why You Need a Structured Billing Document

In any business, having a standardized format for payment requests is crucial to ensure smooth transactions. A consistent approach to documenting sales or services offered not only provides clarity to clients but also helps you stay organized and professional. By using a pre-designed structure, you eliminate the need to start from scratch each time, saving time and reducing the chance of overlooking important details.

There are several key reasons why utilizing such a structured format can greatly benefit your business:

- Consistency: A uniform document ensures that each request for payment contains all the necessary details, such as payment terms, dates, and amounts, which helps avoid confusion.

- Time-saving: With a pre-made layout, you can quickly generate new payment requests, allowing you to focus more on your work rather than formatting documents.

- Professionalism: A well-organized form conveys a sense of professionalism, making your business appear more reliable and trustworthy to clients.

- Legal Compliance: Proper documentation of transactions ensures you meet local legal requirements, helping protect both your business and your clients in case of disputes.

- Financial Organization: Keeping records in a structured way makes it easier to track payments, outstanding amounts, and financial reports over time.

By implementing a streamlined, structured approach to payment requests, you not only make your work more efficient but also enhance your business’s reputation and operational smoothness.

How to Create a Billing Document

Creating a professional payment request document is essential for maintaining clear financial records and ensuring that your clients understand the details of the transaction. A well-structured request helps avoid confusion, establishes trust, and ensures both parties are aligned on the terms of payment. By following a few key steps, you can easily create a document that is both informative and clear.

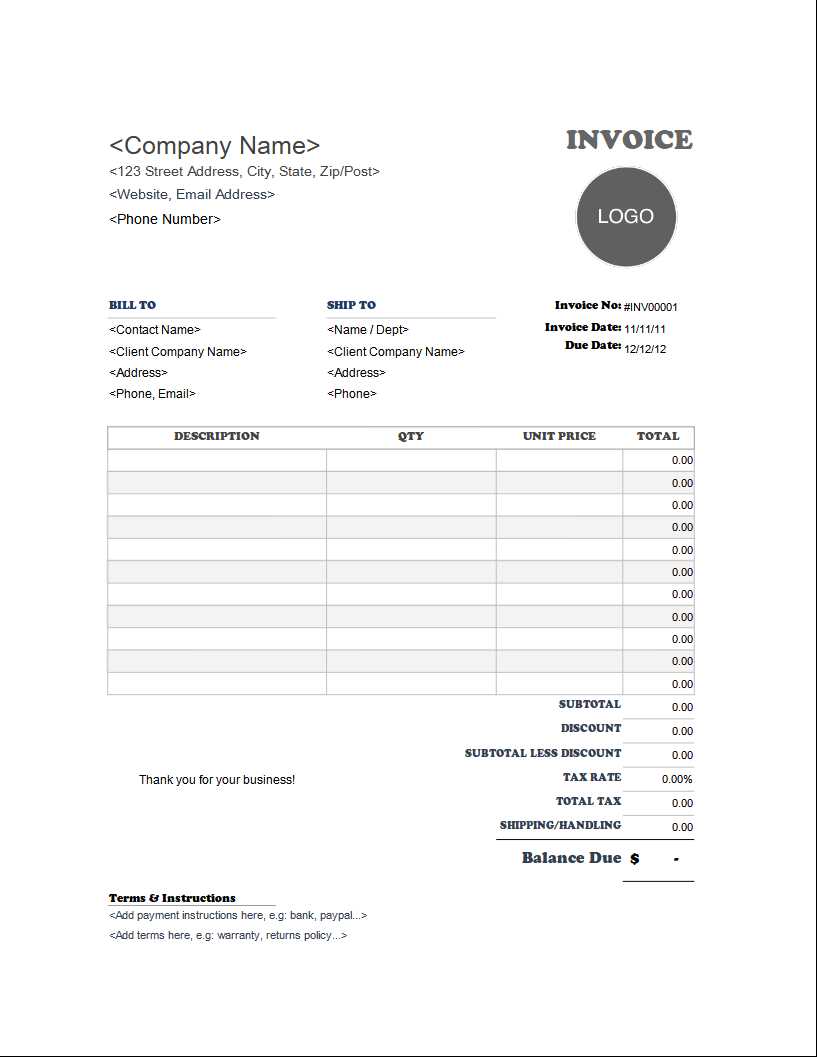

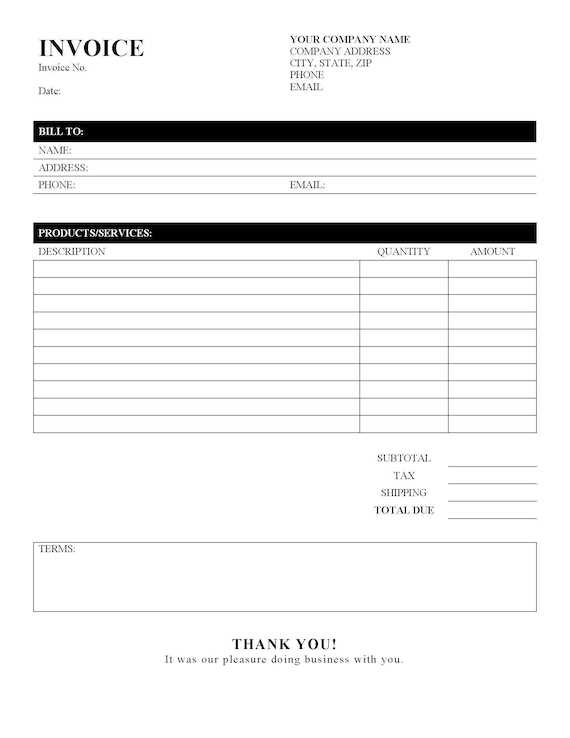

First, include all the necessary details to make the document comprehensive. Start with the names and contact information of both parties involved. Clearly state the products or services provided, along with a breakdown of the charges. Ensure that the total amount due is prominently displayed, and include the payment terms, such as due dates or late fees. If applicable, add any tax information or discounts offered. Finally, include payment instructions, whether it’s via bank transfer, credit card, or other methods.

Once the content is clear and complete, double-check for any mistakes or missing information. Consistency in design and format can also make a significant impact on how the document is perceived. Aim for a layout that is easy to read and professional, with a clean, organized presentation of the details.

With these simple guidelines, you can create an efficient, effective payment document that helps streamline your billing process and ensures prompt and accurate payments.

Key Elements of a Billing Document

To ensure clarity and professionalism in every financial transaction, it’s essential that each payment request contains certain critical components. These elements not only make the document easy to understand but also help avoid confusion and potential disputes. By including all the necessary information in a structured format, both you and your clients can quickly process payments with minimal back-and-forth.

Basic Information: The document should start with your business’s name, contact details, and logo, as well as the recipient’s information. This ensures that both parties are easily identifiable and that there is no ambiguity about the transaction.

Unique Reference Number: Each document should have a unique identification number for easy tracking. This number helps you manage records and enables clients to reference specific requests when making payments or addressing queries.

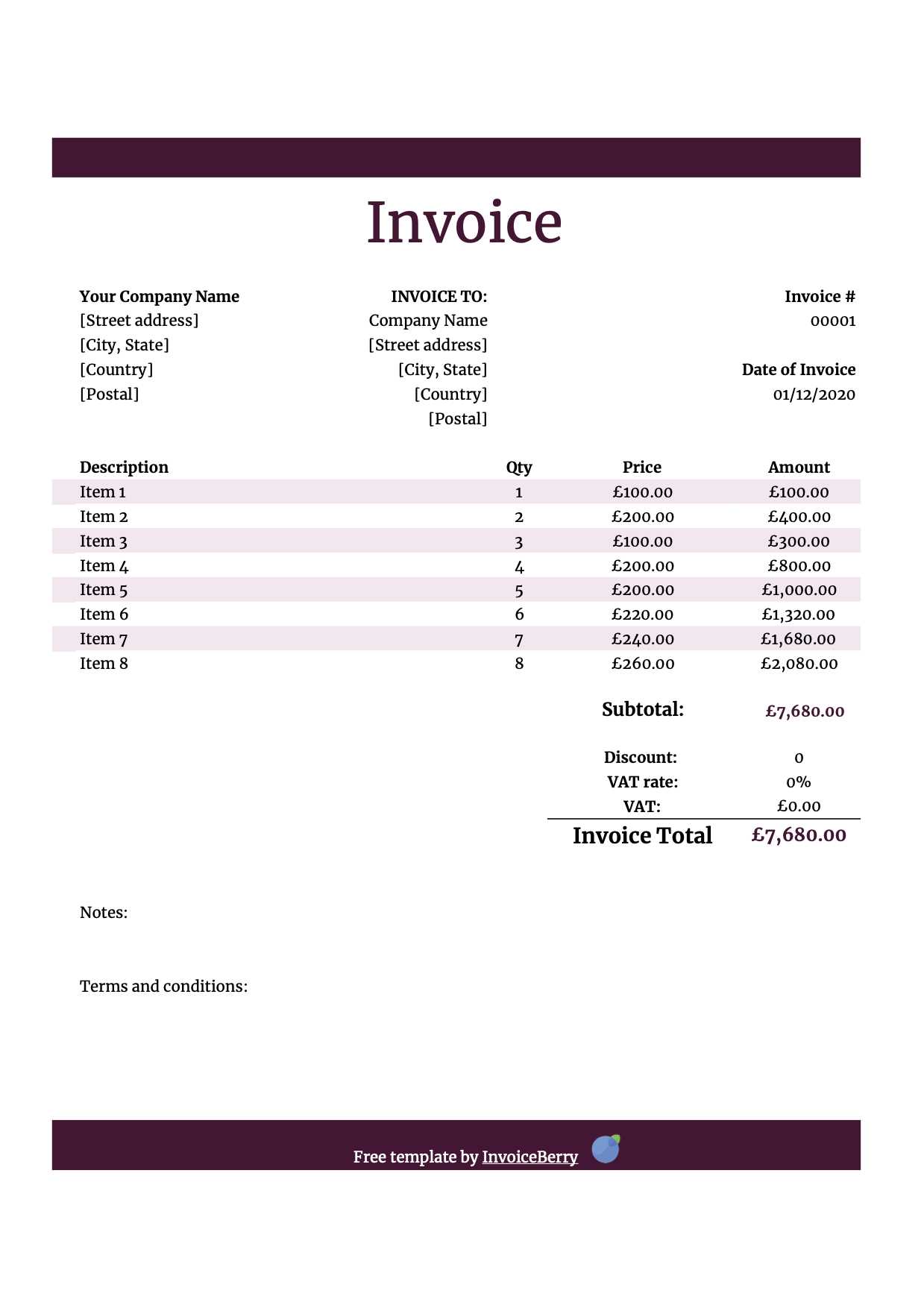

Clear Description of Products/Services: A concise breakdown of the products or services provided is crucial. Include quantities, individual rates, and a brief description to ensure transparency and avoid misunderstandings. Each item or service should be clearly listed with the corresponding cost.

Total Amount Due: The most important detail is the total sum owed. This amount should be calculated accurately, including any taxes, discounts, or additional fees. It’s essential that this number stands out and is easy for the client to identify.

Payment Terms: Clearly state the terms of payment, including due dates, accepted payment methods, and any penalties for late payments. If applicable, include details about early payment discounts or installment options to further clarify the terms.

Additional Information: Depending on the nature of the transaction, you may need to include other details such as tax identification numbers, project milestones, or references to contracts. These additional elements can help further clarify the agreement and provide legal protection if needed.

By ensuring these core elements are present in every document, you set a solid foundation for smooth, efficient, and professional transactions with your clients.

Benefits of Using a Standard Billing Format

Implementing a consistent structure for all your payment requests offers numerous advantages for both you and your clients. A standardized approach ensures that all necessary details are clearly presented, reducing the risk of confusion or errors. It also promotes a professional image and helps streamline the entire billing process, making it easier to manage and track transactions.

Improved Efficiency: When you use a pre-designed structure, you save valuable time by eliminating the need to create a new document from scratch each time. The consistency of the format ensures that all relevant information is automatically included, speeding up the process and reducing the chances of missing important details.

Enhanced Professionalism: A well-organized and uniform document communicates professionalism to your clients. It shows that your business is detail-oriented and serious about maintaining clear records, which can help build trust and establish long-term relationships with your customers.

Easy Tracking and Record Keeping: A standardized format makes it easier to track payments and manage your financial records. Each document follows the same layout, making it simple to reference past transactions, identify outstanding amounts, and generate reports for tax or accounting purposes.

Better Client Understanding: Clients will appreciate the clarity and simplicity of a standard format. When they receive a consistent, easy-to-read document, it reduces the chances of confusion and helps them process payments more quickly, leading to faster payment cycles and fewer disputes.

Legal Protection: Having a uniform structure for all your payment requests ensures that all legal requirements are met. The clear presentation of essential information, such as payment terms and tax details, can protect both you and your clients in the event of a dispute.

By adopting a standard format for all your payment documents, you simplify your operations, enhance professionalism, and foster better communication with your clients, all of which contribute to the smooth running of your business.

Customizing Your Billing Document

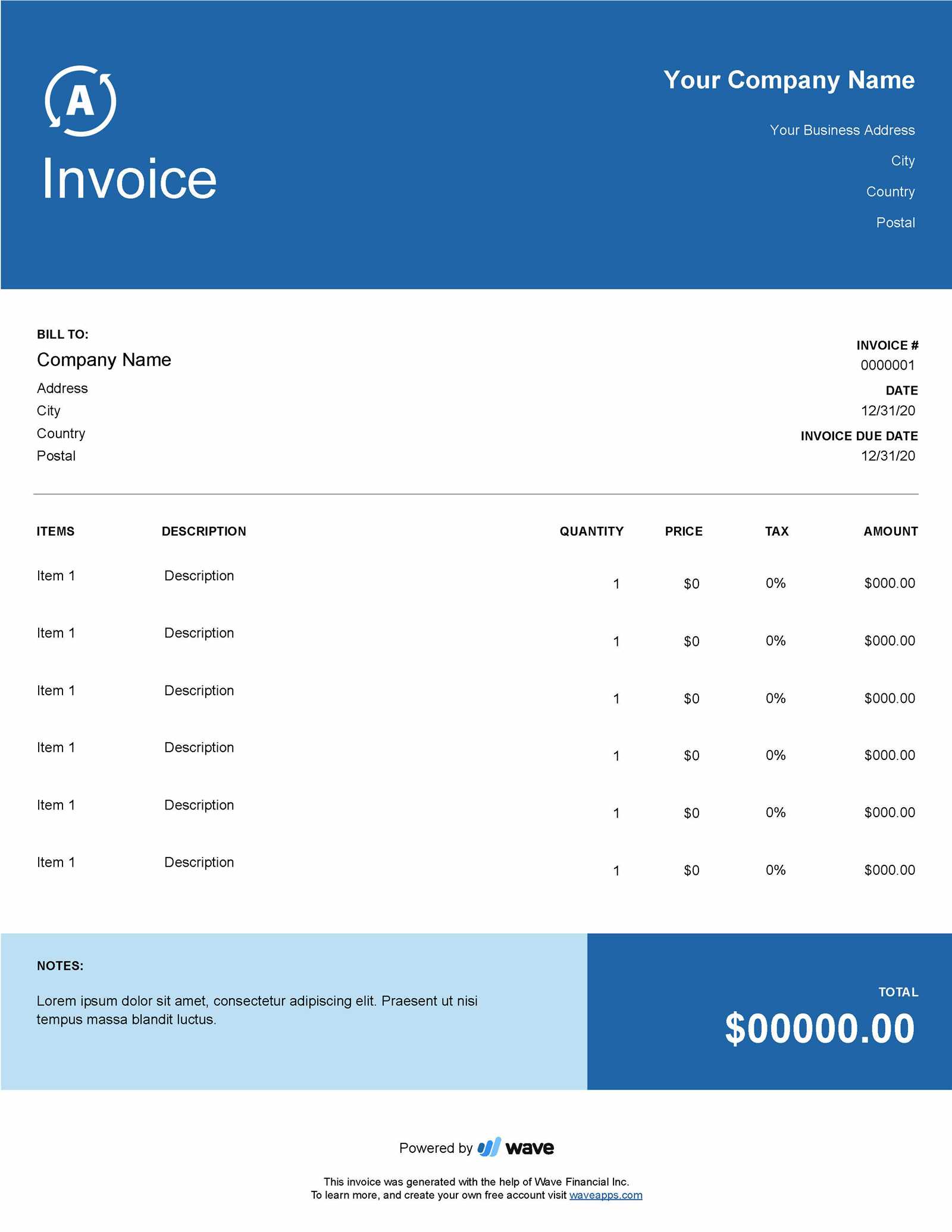

Adapting a payment request form to meet the specific needs of your business is crucial for maintaining consistency and professionalism. By personalizing the structure, you can ensure that it reflects your brand, includes all necessary details, and aligns with your business operations. Customization not only saves time but also enhances the client experience by making the document more relevant and clear.

Branding and Design: Customizing the design of your document allows you to incorporate your business logo, color scheme, and font choices. This small touch reinforces your brand identity and helps establish a professional image that clients will recognize. Consistent branding throughout all your communication, including payment requests, builds trust and credibility.

Adjusting for Specific Services or Products: Every business is unique, and the nature of your offerings may require specific details in the payment document. You can easily adjust sections to include product descriptions, service hours, or customized pricing breakdowns. This allows you to tailor the request to each individual transaction, making it more precise and informative for your clients.

Flexibility with Payment Terms: Customizing a payment document also gives you the flexibility to define specific payment conditions. You can include early payment discounts, late fee policies, or installment plans, depending on your business model. This flexibility allows you to set clear expectations with clients and encourage timely payments.

Language and Currency: If you deal with clients in different regions or countries, it’s important to adjust language and currency options. Customizing the text to suit specific cultural or regional requirements ensures better communication and a smoother transaction process. Additionally, you can modify the currency and tax information according to local regulations, making your request universally accessible.

By customizing your billing documents, you ensure that each request is clear, professional, and tailored to your specific business needs, ultimately enhancing the client experience and streamlining your financial processes.

Choosing the Right Billing Document for Your Business

Selecting the right structure for your payment requests is a crucial step in ensuring efficiency and professionalism in your business transactions. The format you choose should not only meet your specific needs but also reflect the nature of your business and how you interact with clients. A well-suited document can help you maintain clear communication, track payments, and create a positive impression on your customers.

When choosing the right format, consider the following factors:

- Business Type: Different businesses require different levels of detail. For instance, freelancers may need a simpler form, while larger service providers might require more complex layouts with sections for labor rates, materials, and project milestones.

- Brand Image: The design of your document should align with your brand’s identity. Choose a format that allows you to incorporate your logo, business colors, and professional fonts, giving your payment requests a polished, cohesive look.

- Customization Flexibility: Opt for a format that can be easily customized to fit various types of transactions. Whether you’re billing a one-time service or an ongoing contract, having the ability to modify fields ensures that each document is accurate and tailored to the specific situation.

- Legal and Tax Requirements: Consider the legal requirements for billing in your location. Choose a structure that allows you to include necessary details like tax numbers, payment terms, and any other regional regulations that may apply to your business.

- Ease of Use: The format should be simple to fill out and edit. Look for a structure that makes it easy to add or remove information and calculate totals automatically. A user-friendly layout ensures that you can quickly generate accurate documents without wasting time on complex formatting.

By choosing the right structure for your business, you ensure that your payment requests are clear, professional, and suited to the specific needs of your clients and industry. The right format can help streamline your billing process, reduce errors, and maintain a high standard of service.

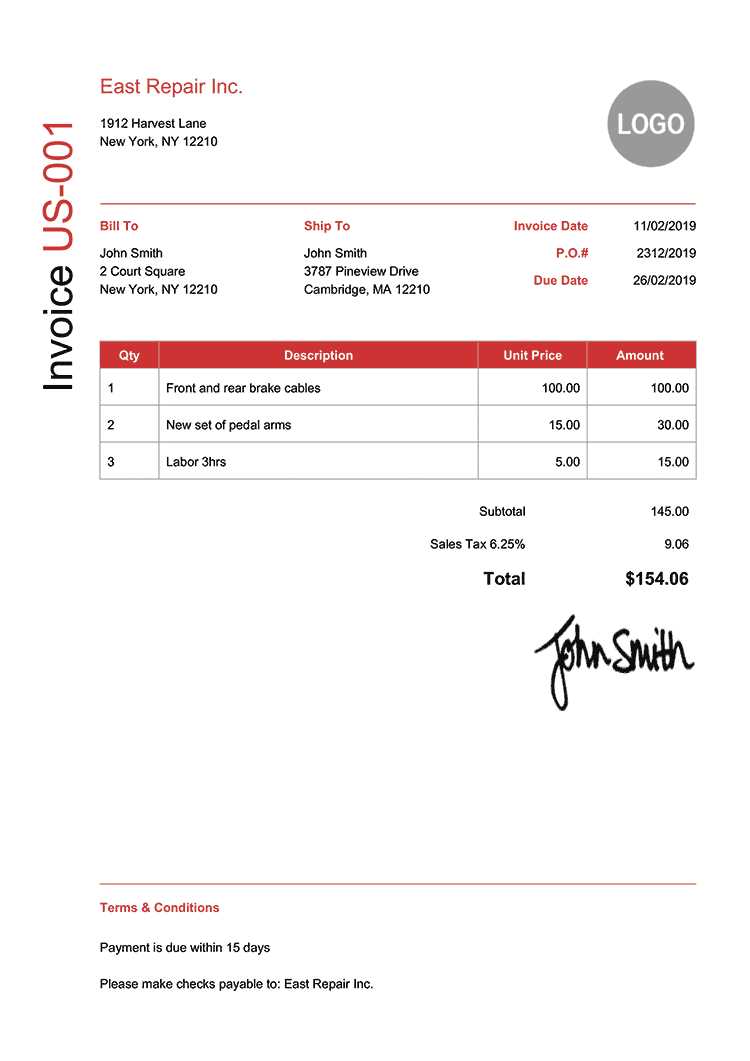

How to Add Taxes to a Billing Document

When creating a payment request, it is essential to ensure that taxes are accurately calculated and included. Including tax details in your document helps avoid confusion with clients and ensures compliance with local regulations. Depending on your location and the nature of your business, taxes may vary, so it’s important to properly account for them when preparing your request.

Step-by-Step Guide to Adding Taxes

Follow these steps to add taxes to your payment request correctly:

- Identify the Tax Rate: Determine the applicable tax rate for your region and the products or services you are offering. This may include sales tax, VAT, or other local taxes.

- Calculate Tax Amount: Multiply the subtotal of your products or services by the tax rate. For example, if your subtotal is $200 and the tax rate is 10%, the tax amount will be $20.

- Include a Separate Tax Line: Add a dedicated line item to the document that clearly states the tax amount. This helps the client understand how much they are being charged for tax separately from the goods or services.

- Adjust the Total Amount: Once the tax is calculated, add the tax amount to the subtotal to determine the final total. Ensure this total is clearly displayed at the bottom of the document to avoid any confusion.

Best Practices for Tax Inclusion

- Be Transparent: Always show the tax rate and total tax amount clearly to your clients. This ensures transparency and fosters trust.

- Stay Updated on Local Laws: Tax laws can change, so regularly review your local tax regulations to ensure you are applying the correct rates.

- Provide Tax Details for Clients: If required, include your tax identification number and other relevant details to provide the necessary information for clients and government authorities.

By carefully adding taxes to your payment requests, you ensure clarity, legal compliance, and a professional approach that strengthens your business operations.

Common Mistakes in Billing Documents

When preparing a payment request, it’s easy to overlook certain details that can lead to confusion or delays in payment. Even minor errors can cause misunderstandings, affect cash flow, and harm the professional image of your business. Being aware of common mistakes can help ensure that your payment requests are accurate, clear, and easy to process for both you and your clients.

Common Mistakes to Avoid

Here are some of the most frequent errors businesses make when preparing their payment documents:

| Error | Consequences | How to Avoid |

|---|---|---|

| Missing or Incorrect Dates | Delays in payment and confusion over deadlines | Always double-check the issue date and due date before sending |

| Unclear or Missing Payment Terms | Clients may misunderstand when and how to pay, leading to delayed payments | Clearly state payment methods, due dates, and any late fees or discounts |

| Incorrect or Missing Contact Information | Difficulty in reaching the business for payment or clarification | Ensure your business name, address, phone number, and email are accurate |

| Failure to Include Taxes | Legal and financial complications, client confusion | Always calculate and display applicable taxes separately from the subtotal |

| Not Including a Unique Reference Number | Confusion when tracking payments or communicating with clients | Assign a unique number to each request for easy reference |

Best Practices for Avoiding Mistakes

- Be Clear and Consistent: Always use a uniform format for your documents to avoid missing important details.

- Double-Check Calculations: Ensure that all amounts, including taxes and totals, are accurate.

- Include All Necessary Information: Include clear descriptions of the goods or services provided and their corresponding charges.

- Proofread Before Sending: A final review of your document can help catch small errors that might otherwise go unnoticed.

By avoiding these common mistakes, you can streamline your billing process, improve client satisfaction, and reduce the likelihood of payment delays or disputes.

Free Billing Forms for Small Businesses

For small business owners, managing finances efficiently is crucial for growth and sustainability. One of the easiest ways to streamline the process is by using a pre-designed form that simplifies the billing process. Many businesses, especially startups and freelancers, can benefit from free, customizable forms that are easy to use and maintain a professional appearance. These forms help ensure that every payment request is clear, accurate, and sent on time, without the need for complex software or high costs.

There are several advantages to using free forms for billing:

- Cost-Effective: Free forms eliminate the need for expensive accounting software or custom design services, allowing small businesses to manage payments without additional overhead costs.

- Time-Saving: Pre-designed layouts make it easy to generate new requests quickly, saving you time that would otherwise be spent creating each document from scratch.

- Customizable: Most free forms can be easily edited to suit your specific needs. Whether you’re billing for a single service or multiple products, the layout can be adjusted to reflect the details of each transaction.

- Professional Look: A well-designed form adds credibility to your business, making a strong first impression on clients and helping to ensure prompt payments.

- Easy to Use: Simple, user-friendly forms can be filled out quickly, even by those with little experience in accounting or document design.

Some of the most popular sources for free forms include:

- Microsoft Word or Excel: Offers a variety of downloadable forms with basic customization options.

- Google Docs or Sheets: Provides free, easily shareable forms that can be edited and stored online for easy access.

- Online Platforms: Websites like Canva, Zoho, and Invoice Generator offer free templates that are specifically designed for businesses of all sizes.

- Freelance Platforms: Many freelance platforms also provide free forms to help independent contractors create professional billing documents.

By using free forms, small business owners can ensure they maintain a professional approach to payments while focusing their resources on other aspects of business development.

What Information Should Be Included in a Billing Document

To ensure clarity and prevent any confusion between you and your clients, it is essential to include certain key details in every payment request. These components not only help to formalize the transaction but also facilitate smoother communication and ensure that both parties are aligned on the terms of the agreement. Whether you’re billing for products, services, or a combination of both, the document must be thorough and precise.

Key Elements to Include

Here is a list of the most important information to include in any billing document:

| Element | Description |

|---|---|

| Your Business Information | Include your company’s name, address, contact number, email, and website if available. This helps your client easily identify the source of the document. |

| Client’s Information | Make sure to list the client’s full name, company name (if applicable), address, and contact details so the payment is attributed correctly. |

| Unique Reference Number | Each payment request should have a unique number for tracking purposes. This helps both you and your client identify the transaction quickly. |

| Issue and Due Date | The issue date marks when the document was created, and the due date tells the client when payment is expected. |

| Itemized List of Products/Services | Provide a clear breakdown of the products or services provided, including descriptions, quantities, and individual prices. This ensures transparency. |

| Total Amount Due | Clearly state the total amount owed, including taxes, fees, or discounts. This is often placed at the bottom of the document for emphasis. |

| Payment Terms and Methods | Specify payment methods (e.g., credit card, bank transfer) and any terms such as discounts for early payment or penalties for late payment. |

| Tax Information | Include any applicable tax rates and your tax identification number if required by law. This ensures compliance with local regulations. |

Additional Optional Information

- Purchase Order Number: If relevant, including the purchase order number helps link the payment request to a specific order.

- Notes or Terms: A section for any specific terms or agreements related to the transaction can be useful, especially for complex projects.

- Late Fee Details: If your payment terms include penalties for overdue payments, be sure to mention them clearly.

Including all of the above details in your payment request ensures that the document is comprehensive, professional, and legally compliant, helping to prevent misunderstandings and delays in payment.

How to Track Payments with Billing Documents

Effectively managing payments is essential for any business. To ensure that transactions are completed smoothly, it’s important to keep track of which payments have been made and which are still pending. Using a well-organized payment request system allows you to easily monitor and follow up on payments, minimizing delays and improving cash flow.

Steps to Track Payments

Here’s how you can track payments with your payment requests:

- Assign a Unique Reference Number: Each document should have a distinct reference number. This makes it easier to link payments to specific requests and track which have been paid or are overdue.

- Record Payment Dates: Mark the date when each payment is received. This helps in tracking payment schedules and identifying overdue amounts quickly.

- Note the Payment Method: Always include details about how the payment was made (e.g., bank transfer, credit card, check). This is crucial for reconciling your accounts.

- Update the Status Regularly: Update the status of the payment (paid, pending, overdue) after every transaction. This can be done manually or by using accounting software to automate the process.

- Monitor Outstanding Amounts: Keep a record of any outstanding balances. If a payment is partially made or missed, having the remaining balance documented ensures you can follow up with clients promptly.

Using Software or Tools for Payment Tracking

In addition to manually tracking payments, you can also use digital tools to help streamline the process:

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero can help automate the tracking of payments, update statuses in real-time, and send reminders for overdue balances.

- Spreadsheets: For those who prefer a more hands-on approach, a simple spreadsheet can be an effective way to track payments, as long as it’s updated regularly.

- Online Platforms: Many online billing platforms allow you to track payments and generate reports automatically, providing a quick overview of

Legal Requirements for Billing Documents

When issuing a payment request, businesses must ensure they comply with various legal requirements. These requirements vary by country and sometimes by industry, but they generally include necessary details that provide transparency and help protect both the business and the client. Adhering to these standards not only helps maintain legal compliance but also ensures smooth financial transactions and avoids disputes.

Essential Legal Information to Include

To ensure compliance, your payment request should contain the following key elements:

Element Description Why It’s Important Business Identification Information Your full business name, address, and tax identification number (TIN) or VAT number (if applicable). Legally required for tax reporting and helps the recipient verify your business. Client’s Information The client’s full name, address, and contact details. Ensures the request is properly attributed to the right client. Unique Reference Number A unique number assigned to each document for identification and tracking. Helps you and your client refer to a specific transaction, aiding in record-keeping and audits. Detailed List of Products/Services A breakdown of the products or services provided, including quantities and unit prices. Ensures that both parties are clear about what is being billed for and its associated costs. Issue and Due Dates The date the document was issued and the date by which payment is due. Clarifies the time frame for payment, which is important for both parties’ legal and financial planning. Applicable Taxes Any applicable tax rates (e.g., VAT, sales tax) and the total tax amount charged. How to Design a Professional Billing Document

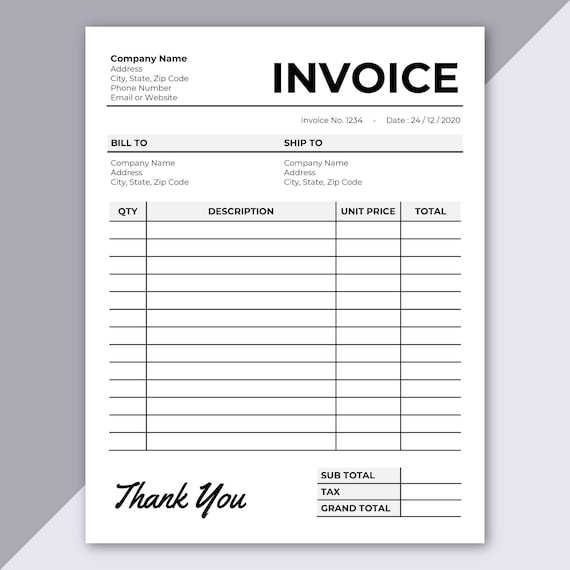

Designing a professional billing document is essential for creating a good impression with your clients. A well-structured, clear, and aesthetically pleasing document not only facilitates timely payments but also reinforces your brand identity. By following a few simple design principles, you can ensure that your document looks professional and includes all the necessary details for a smooth transaction process.

Key Design Elements to Include

When designing your billing document, focus on clarity, structure, and consistency. Here are the main elements to consider:

- Company Branding: Include your business logo, name, and contact details at the top. This reinforces your brand and ensures your client can easily reach you if needed.

- Clear Breakdown of Charges: Organize the document with clear headings for each section. Include an itemized list of goods or services provided, their individual prices, quantities, and any applicable taxes.

- Readable Fonts and Layout: Choose legible fonts with a consistent size throughout the document. Use a clean and simple layout to enhance readability, avoiding clutter and unnecessary decorations.

- Distinct Sections: Ensure the different sections–such as billing details, item descriptions, payment terms, and taxes–are clearly separated with headings or borders for easy navigation.

- Payment Details: Include the total amount due, due date, and payment instructions. Highlight this section so that your client can easily find the necessary information to make a payment.

Designing for Ease of Use

While a professional appearance is important, it’s equally crucial to make the document easy for your clients to understand and use. Here are a few tips to improve usability:

- Keep it Simple: Avoid overloading the document with excessive details. Focus on the most important information, such as the services provided, the total cost, and how to make a payment.

- Provide Clear Payment Instructions: Specify how the client should pay–whether through bank transfer, credit card, or another method. If applicable, mention payment terms such as discounts for early payments or penalties for late payments.

- Ensure Compatibility: Design your document in a way that allows it to be easily viewed and edited across different devices and platforms. Formats like PDF are often preferred for their consistency and easy sharing capabilities.

By focusing on these design principles, you can create a polished and professional document that not only hel

Digital vs Paper Billing Documents: What to Choose

When deciding how to send payment requests, businesses have two primary options: digital or paper-based documents. Both methods have their own advantages and drawbacks, and the right choice depends on factors such as your business needs, client preferences, and environmental considerations. Understanding the benefits and challenges of each approach will help you make a more informed decision.

Advantages of Digital Billing Documents

Digital documents have become the preferred method for many businesses due to their convenience and efficiency. Here are some key benefits of going digital:

- Speed: Digital documents can be created, sent, and received almost instantly, speeding up the entire billing and payment process.

- Cost-Effective: With no need for printing or postage, digital billing can significantly reduce administrative costs, especially for businesses with a high volume of transactions.

- Environmental Impact: Digital documents are paperless, which helps reduce your business’s environmental footprint.

- Easy Tracking and Organization: Digital documents can be stored and organized easily, making it simpler to track payments and maintain accurate financial records.

- Security and Automation: Digital payment requests can be encrypted, ensuring the privacy of sensitive data. Additionally, automated reminders and follow-ups can be set up to ensure timely payments.

Advantages of Paper Billing Documents

While digital documents are growing in popularity, paper-based billing still has some advantages, particularly in certain industries or for businesses that deal with clients who prefer physical records. Here are some reasons to consider using paper:

- Client Preference: Some clients, particularly those in older generations or in certain industries, may prefer receiving paper-based billing documents.

- Legal Requirements: In some cases, businesses may be required to issue physical copies for legal or tax purposes, depending on local regulations.

- Tangible Record: A physical document can feel more official or authoritative to some clients, and it’s often easier for clients to refer to a printed document during meetings or audits.

- No Technology Barrier: Paper billing doesn’t require your clients to have internet access or familiarity with digital to

How to Send Your Billing Document to Clients

Once you’ve created your payment request, the next step is to send it to your client in a way that is both efficient and professional. The method you choose can depend on your business model, client preferences, and the nature of your relationship with the client. Whether you opt for digital or physical delivery, it’s important to ensure the document is clear, secure, and delivered promptly.

Methods for Sending Your Payment Request

There are several ways to send your payment request, each with its own benefits. Below are the most common methods used by businesses:

Method Pros Cons Email - Fast and efficient

- Cost-effective

- Easy to track and manage

- Can be overlooked or lost in spam

- Requires both parties to have internet access

Postal Mail - Preferred by clients who are not tech-savvy

- Provides a physical, tangible copy

- Slower than digital methods

- Involves printing and postage costs

Online Payment Platforms - Seamless payment integration

- Allows clients to pay directly through the document

- Requires setup and familiarity with the platform

- Platform fees may apply

Best Practices for Sending Your Payment Request

Regardless of the method you choose, it’s important to follow these best practices to ensure that your document reaches the client effectively:

- Clearly Label the Document: Use a clear subject line or title, such as “Payment Request for [Service/Product].” This makes it easier for clients to recognize and prioritize.