Email Template for Sending Invoices Professionally

When conducting business, clear communication with clients regarding payments is essential. A well-crafted message requesting compensation not only helps maintain professional relationships but also ensures timely financial transactions. The tone, structure, and clarity of your message play a significant role in achieving this goal.

Crafting an effective communication that accompanies a bill requires attention to detail. From maintaining professionalism to providing all necessary payment information, every aspect contributes to a smooth and efficient exchange. Whether you’re managing multiple clients or handling occasional transactions, having a reliable structure for these communications saves time and reduces errors.

Structured approaches make these interactions smoother, ensuring your clients understand the amount due and the payment terms without confusion. Additionally, adopting a polite yet firm tone reinforces the importance of timely settlements, which can prevent delays in your cash flow. A clear, concise message also minimizes the chance of misunderstandings or disputes.

How to Create an Effective Invoice Email

To ensure timely payments and maintain professional relationships, it is important to communicate payment requests clearly and efficiently. A well-crafted message not only provides the necessary payment details but also sets the right tone, making it easier for your clients to act promptly. Whether you’re reminding a customer of a due balance or sending a formal request, the structure and content of your message are crucial for a positive outcome.

Key Elements of an Effective Payment Request

- Clear subject line: Make sure the subject of your message directly reflects the purpose, such as “Payment Due for [Service/Product].”

- Professional greeting: Address the recipient by name, maintaining a formal yet friendly tone.

- Concise payment details: Include the amount due, the due date, and any relevant reference numbers or details related to the transaction.

- Easy-to-understand instructions: Provide clear instructions on how to complete the payment, including accepted payment methods and any necessary links.

- Polite call to action: Encourage prompt payment with a courteous reminder, without sounding too demanding.

Tips for Maintaining a Professional Tone

- Use polite language and avoid overly casual expressions. Keep the tone professional and respectful.

- Incorporate brief and precise wording to avoid confusion, and ensure all essential details are easily accessible.

- Close with a thank you note or appreciation for the client’s business, reinforcing a positive relationship.

By following these guidelines, you can ensure that your payment reminders are not only clear and professional but also effective in securing timely compensation. A thoughtful approach makes it easier for clients to take the necessary actions, reducing the risk of delayed payments and maintaining your business’s cash flow.

Why a Professional Invoice Email Matters

When requesting payment for services rendered or products delivered, the way you present your request plays a critical role in the outcome. A polished and professional message not only reflects well on your business but also sets the right tone for the transaction. A well-composed request for payment can encourage timely action, reduce misunderstandings, and strengthen client relationships.

Building Trust and Credibility

Clients are more likely to pay promptly when they receive clear, professionally written communication. A formal approach demonstrates your attention to detail and business acumen, which builds trust. When your payment requests are handled professionally, clients are reassured that they are dealing with a reliable and reputable business.

Minimizing Delays and Confusion

Without clear and organized messaging, there is a higher chance of confusion or missed details, which can lead to payment delays. A structured request eliminates any ambiguity by outlining exactly what is owed and when it is due. By offering easy-to-understand instructions, you make the payment process seamless and straightforward for your clients, increasing the likelihood of on-time payments.

In summary, maintaining professionalism in your payment requests is not just about formalities; it’s about fostering trust, encouraging timely transactions, and ensuring that your business maintains a positive cash flow. Clear and thoughtful communication is key to maintaining smooth financial operations.

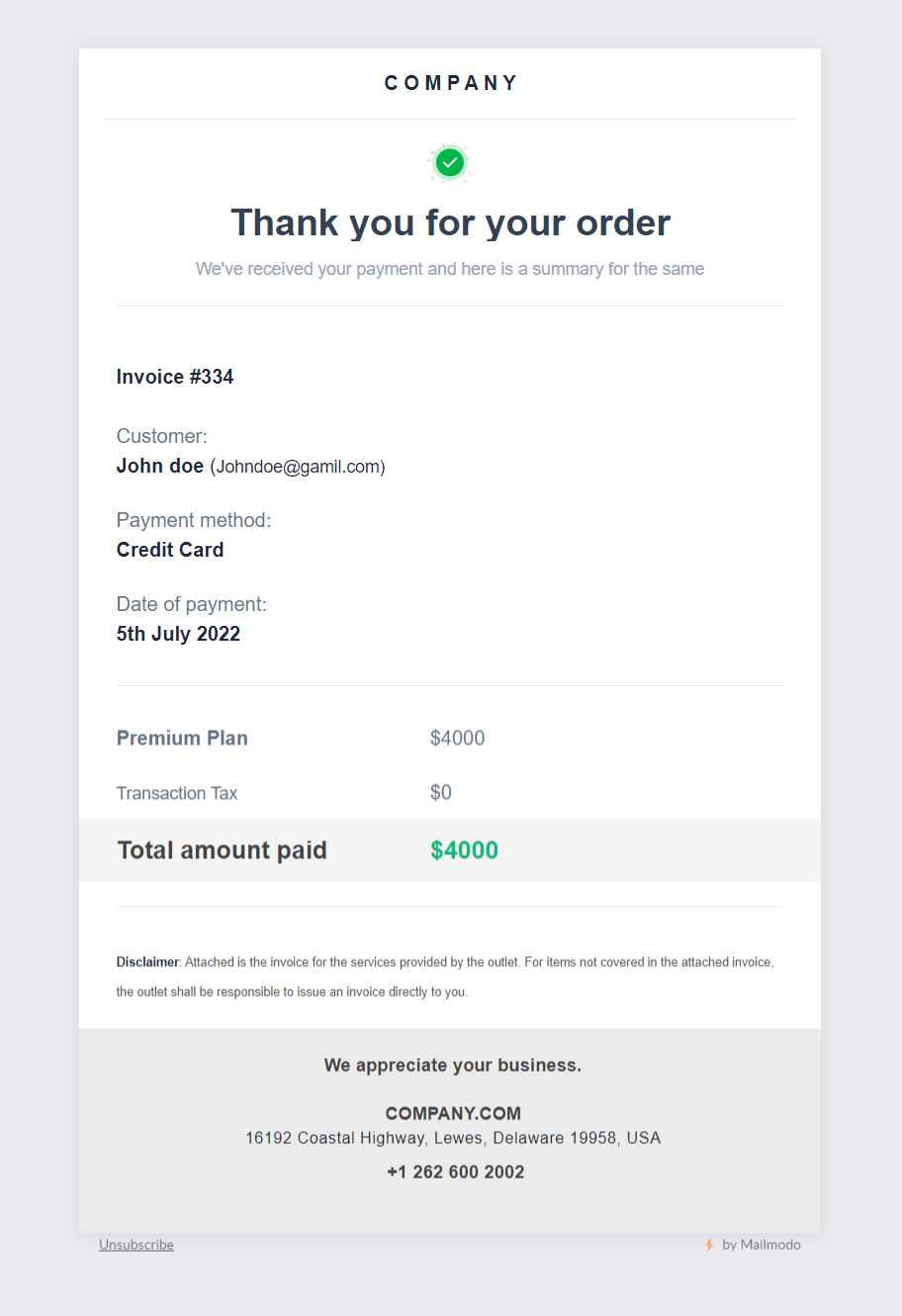

Essential Elements of an Invoice Email

To ensure that your request for payment is clear and effective, certain key components must be included in your communication. A well-structured message helps your client understand the due amount, payment method, and important dates, reducing the chance of delays or confusion. Each element of the message plays a specific role in conveying the necessary information in a professional manner.

Key Components to Include

- Clear subject line: A concise and direct subject line sets expectations right away. Examples: “Payment Due for [Service/Product]” or “Outstanding Balance for [Client Name].”

- Personalized greeting: Address your client by name to establish a more personal connection. A professional salutation helps keep the tone respectful.

- Detailed breakdown of charges: Provide a clear, itemized list of the charges. This could include the description of the product or service, quantity, rate, and total cost for each item.

- Due date: Specify when the payment is expected, clearly stating the due date to avoid any confusion about timing.

- Payment instructions: List the available methods for completing the payment. Include any necessary details like bank account numbers, online payment links, or other instructions relevant to the transaction.

- Contact information: Include your phone number or email address in case the client has questions or needs further clarification regarding the payment.

Creating a Polite and Professional Tone

- Thank you note: End the message with a polite expression of gratitude for the client’s business, which reinforces a positive relationship.

- Friendly reminder: Include a gentle reminder about the importance of timely payment. Avoid being overly aggressive while maintaining a firm request.

By ensuring all these elements are included, you create a message that is both professional and efficient, making it easier for clients to understand their obligations and act accordingly. A well-o

Best Practices for Sending Invoice Emails

Effective communication is key when requesting payments from clients. A professional approach not only helps ensure that you receive payments on time, but also enhances your reputation as a reliable business partner. Following certain best practices can streamline the process, reduce errors, and foster positive relationships with your clients.

Maintain Professionalism and Clarity

Clear and concise communication is essential. Avoid overly complex language and focus on providing all necessary details in a straightforward manner. Clients should be able to quickly understand the amount due, due date, and how to make the payment. Always use a formal yet friendly tone, addressing your client by name and thanking them for their business.

Timing is Everything

Sending your payment requests at the right time can greatly influence the chances of receiving timely payments. Send your request well in advance of the due date, allowing clients enough time to process and act on the request. Avoid last-minute reminders unless absolutely necessary. Regular follow-ups, spaced appropriately, help keep the payment on the client’s radar without sounding pushy.

Use a Professional Format

When preparing your request, ensure it follows a clean and organized structure. Break down the details clearly, with a simple layout that includes key elements such as the amount due, payment terms, and due date. This makes it easier for clients to find the information they need and ensures that your message doesn’t get lost in a cluttered presentation.

Automate When Possible

If you regularly handle multiple payments, consider using tools to automate reminders and track due amounts. Setting up automatic notifications for overdue balances can save time and ensure no payment request is forgotten.

Be Polite and Courteous

Politeness can go a long way in building long-term client relationships. Always thank your clients for their business, express appreciation for their prompt attention to the payment, and offer assistance if needed. A

Common Mistakes in Invoice Emails

When communicating important financial information, clarity and professionalism are key. Often, individuals make mistakes that can lead to confusion or misunderstandings. These errors can range from technical issues to more subtle oversights that affect the recipient’s ability to process the request quickly and accurately. Avoiding these common pitfalls ensures that both parties remain on the same page, reducing the likelihood of delays or miscommunication.

One frequent issue is the lack of clear reference to the transaction. If the message does not include relevant identifiers such as invoice number or date, the recipient might struggle to find the correct record in their system. This can delay the review or payment process. It’s crucial to provide all necessary details in a concise and structured manner, without overloading the message with extraneous information.

Another mistake is sending incomplete or ambiguous details. Missing amounts, dates, or unclear descriptions of services can lead to confusion or disputes. Providing a well-organized summary of the charges with appropriate breakdowns helps ensure that everything is understood at first glance, minimizing the back-and-forth that may otherwise occur.

Failure to include proper contact information is also problematic. Recipients should have a clear way to reach out for clarification or issues. Not providing a direct phone number, email address, or a clear avenue for resolving questions can frustrate the recipient, leading to delays or unresolved issues.

Finally, using a tone that is either too formal or too casual can be off-putting. Striking the right balance in the level of professionalism is important. Overly stiff language may create unnecessary barriers, while an overly informal approach might be seen as unprofessional. Aim for a tone that is courteous, clear, and respectful to maintain a positive business relationship.

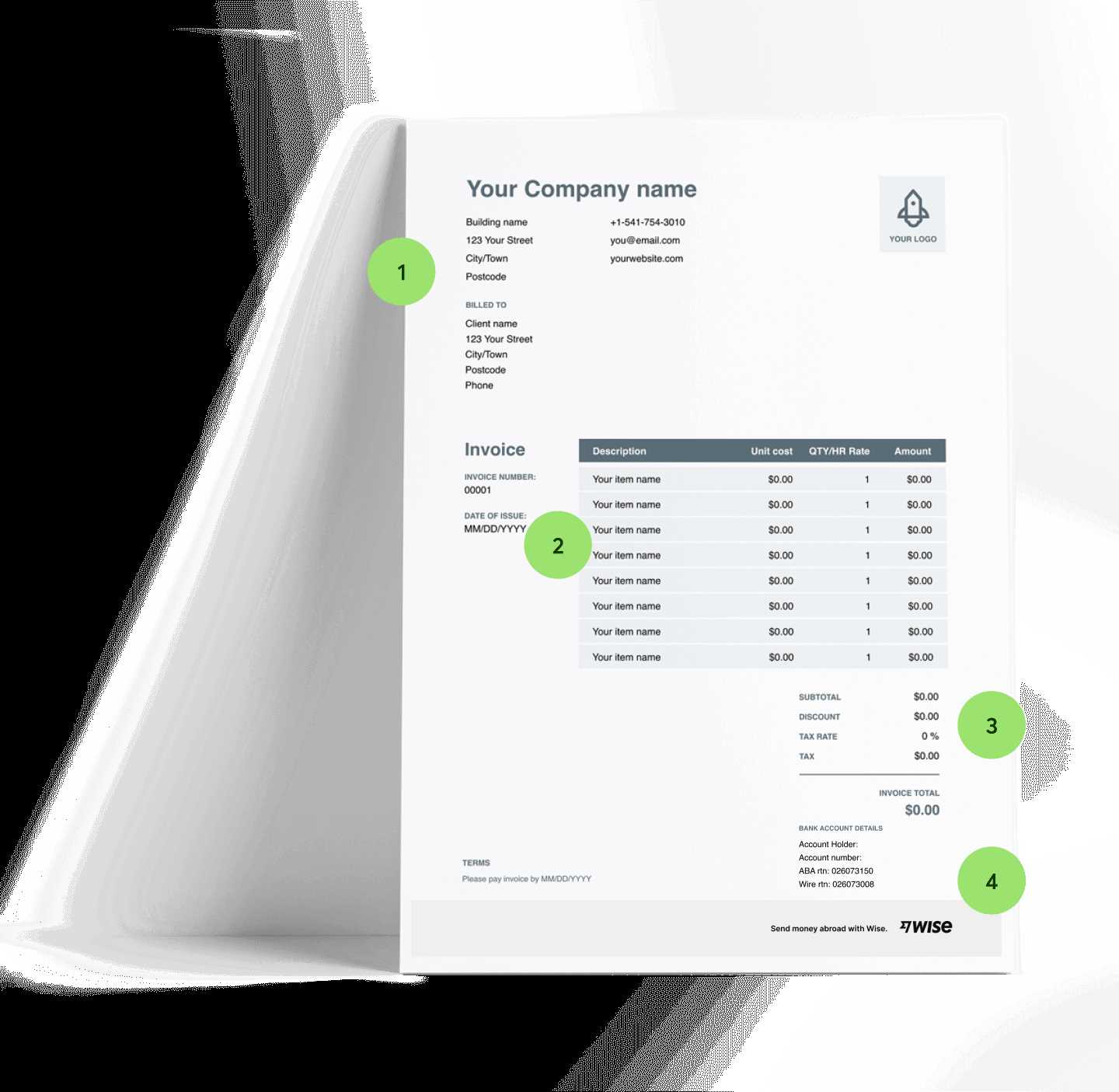

How to Format Your Invoice Email

When communicating about payment details, the structure and organization of the message can significantly impact its clarity and effectiveness. A well-formatted note not only makes it easier for the recipient to understand but also enhances the likelihood of timely processing. Proper layout, key information, and a professional tone are essential to ensure the communication is smooth and efficient.

Here are some key steps to consider when structuring your message:

- Clear Subject Line: Ensure the subject is precise and directly related to the financial matter. Examples include “Payment Request for [Service/Product Name]” or “Amount Due for Recent Services”. This helps the recipient immediately recognize the nature of the communication.

- Personalized Greeting: Address the recipient by name if possible. Using a generic greeting may make the message feel less personal and more like a bulk communication.

- Professional Tone: Keep the tone respectful and courteous. Even though the purpose of the communication is financial, avoid overly casual language or being too formal. A balanced tone fosters positive business relationships.

- Provide Key Information: List all relevant details clearly, such as:

- Amount Due

- Due Date

- Description of Goods or Services Provided

- Payment Methods Accepted

- Clear Payment Instructions: Explain how the recipient should make the payment. This can include bank details, links to online payment systems, or instructions for sending a cheque, depending on your preferred method.

- Polite Closing: Conclude with a polite call to action, such as “Please let me know if you have any questions” or “Looking forward to your prompt payment”. Always include a thank you for their time and business.

By following these simple formatting guidelines, you ensure t

Personalizing Your Invoice Email Message

Tailoring your communication to the recipient can make a significant difference in how your message is received. Personalizing the content not only shows attention to detail but also helps build trust and a stronger business relationship. A well-crafted and thoughtful message can encourage prompt payment and create a positive impression, even when dealing with sensitive financial matters.

Why Personalization Matters

Personalized messages feel more ge

Creating a Clear Subject Line for Invoices

The subject line plays a crucial role in how your financial requests are perceived and acted upon. A clear, direct, and informative subject line ensures the recipient immediately understands the purpose of the communication. By setting the right expectations from the outset, you make it easier for the recipient to prioritize the message and take the necessary actions without delay.

Why a Clear Subject Line Matters

A concise and relevant subject line provides clarity and ensures your message stands out. Without a clear subject, the recipient may overlook or ignore the message, potentially delaying payment or causing confusion. A well-crafted subject line helps avoid these issues by making the request instantly recognizable and easy to act upon.

Tips for Crafting an Effective Subject Line

- Be Specific: Include key details, such as the amount due or the service provided. For example: “Payment Due for Graphic Design Services – $500” or “Balance Due for Web Development Project – Invoice #12345”.

- Use Clear Identifiers: Reference important identifiers like invoice numbers, dates, or project names to make it easy for the recipient to locate the record. Example: “Payment Request – Project XYZ – Invoice #67890”

- Keep I

How to Attach Invoices in Emails

Attaching relevant documents to your message is a critical part of financial communication. Ensuring the recipient can easily access the necessary files is essential for a smooth transaction process. Proper attachment formatting and clarity can prevent confusion, streamline the payment process, and reduce delays.

Steps for Properly Attaching Documents

- Choose the Right File Format: PDF is the most commonly accepted format as it is universally accessible and preserves the layout. Avoid using editable formats like Word documents, as they may cause concerns about security or editing.

- File Naming Conventions: Name the file clearly to help the recipient identify it quickly. A good format would be “[Your Company Name]_[Invoice Number]_[Date].pdf”. This makes it easy for the recipient to organize and reference the document.

- Check the File Size: Large files can be difficult to open or may not be received due to file size limitations. Compress the file if necessary without compromising its quality. Ensure the file is under the recipient’s maximum attachment size limit (usually 10MB to 25MB).

- Double-Check the Attachment: Before you send the message, always ensure the correct file is attached. There is nothing worse than informing someone about an attachment only to find that it was forgotten or the wrong document was included.

- Provide Context in the Message Body: Refer to the attachment in your message, and let the recipient know what it contains. For example, “Attached is the detailed breakdown for the services rendered in the last month” ensures clarity and

How to Handle Late Payments via Email

Dealing with overdue payments can be a delicate issue that requires both professionalism and tact. The goal is to gently remind the recipient of their outstanding balance while maintaining a positive business relationship. A well-crafted message can encourage prompt resolution of the matter without causing unnecessary friction.

When to Follow Up

It is important to determine the appropriate timing for a follow-up. Generally, sending a reminder a few days after the due date is reasonable. If no response is received, a second message can be sent a week or two later, depending on your company’s payment terms. The key is to remain polite yet firm in your communication.

Key Points to Address in Your Message

- Polite Reminder: Start with a gentle reminder about the due payment, avoiding any accusatory language. For example, “I hope this message finds you well. I wanted to kindly remind you that the payment for [service/product] was due on [date].” This sets a respectful tone for the message.

- Clear Details: Include relevant information to help the recipient easily locate the outstanding amount. Reference the specific service or product, the due date, and any unique identifiers like invoice numbers. This makes it easier for them to process the payment.

- Offer Assistance: Provide the recipient with a chance to explain any issues they may have encountered with the payment. A statement like “Please let me know if you encountered any issues processing the payment” shows flexibility and a willingness to resolve potential problems.

- Firm Deadline: After offering a polite reminder, make it clear that further action may be required if the balance remains unpaid. For example, “If we do not receive the payment by [new deadline], we may need to discuss alternative options for payment.” This sets a clear expectation without sounding overly harsh.

- Reiterate Payment Methods: Reaffirm the payment details and methods available. Make it easy for the recipient to complete the payment by including all the necessary information, such as bank details, payment portal links, or cheque instructions.

By taking a calm and professional approach, you can handle overdue payments effi

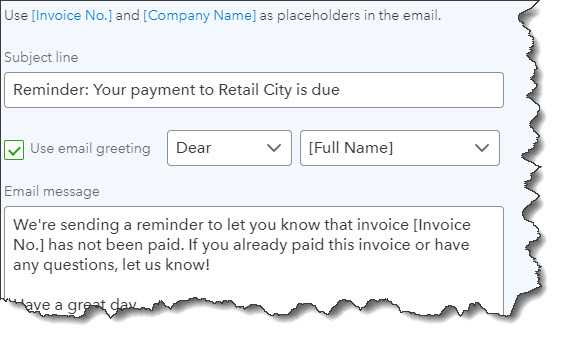

Automating Your Invoice Emails

Automating your communication process can save time, reduce errors, and improve efficiency when handling payment requests. By setting up automated workflows, you can ensure that reminders, requests, and other related communications are sent promptly without requiring manual intervention each time. This approach streamlines the payment process and helps maintain consistent follow-up.

Benefits of Automation

Automating the distribution of payment requests and reminders offers several advantages for businesses:

- Time Savings: Once set up, automation eliminates the need to manually create and send individual messages, freeing up valuable time for other tasks.

- Consistency: Automation ensures that each recipient receives a message at the right time, with no delays or inconsistencies, helping to maintain professional communication standards.

- Reduced Errors: By eliminating manual entry, you reduce the risk of mistakes, such as missing payment details or incorrect information.

- Improved Cash Flow: Timely and consistent follow-ups increase the likelihood of prompt payments, helping to maintain a healthy cash flow.

How to Automate Your Payment Requests

- Choose the Right Software: Select a tool or platform that supports automation for payment-related messages. Many accounting and invoicing tools offer built-in features that automate reminders and notifications.

- Set Up Trigger Points: Configure the system to send messages at appropriate intervals. For example, one reminder can be sent immediately after the due date, followed by another in 7 days, and a final notice 14 days later.

- Customize the Messages: Even in an automated system, personalization is important. Include recipient-specific information, such as the outstanding amount, service details, and due dates. Most automation platforms allow you to insert dynamic fields for easy customiza

Using Email Templates for Invoices

Having pre-designed message structures for financial communications can greatly improve efficiency and consistency. By using reusable structures, you save time while ensuring that all necessary details are included in each communication. This approach reduces the risk of errors and maintains a professional tone across all interactions.

Why Use Pre-Formatted Messages

Pre-designed structures provide a number of benefits for handling financial requests:

- Consistency: Reusing a structure ensures that every message follows the same format, maintaining a professional and cohesive style across all communications.

- Time Efficiency: Instead of creating a new message from scratch each time, you can focus on personalizing the details, speeding up the process of preparing financial requests.

- Reduced Errors: A standardized structure minimizes the chances of omitting important details or making formatting mistakes, ensuring that each message contains all necessary information.

- Professionalism: Having a polished, structured message boosts your business’s credibility and helps establish trust with clients or partners.

Key Elements to Include in Your Pre-Formatted Message

- Clear Subject Line: The subject should immediately indicate the purpose of the message, such as “Outstanding Payment for [Service/Product]” or “Balance Due for [Project Name].”

- Personalized Greeting: Address the recipient by name or with a respectful salutation to make the message feel more tailored and professional.

- Detailed Breakdown: Include specifics about the amount due, the due date, and any relevant transaction or reference numbers to help the recipient quickly understand the purpose of the communication.

- Payment Instructions: Clearly explain how to make the payment, including any relevant payment methods, bank details, or links to online payment portals.

- Polite Closing: End the message with a courteous and professional note, such as “Thank you for y

Key Tips for a Polite Payment Reminder

Sending a reminder for overdue payments can be a sensitive task. It’s important to strike the right balance between being polite and firm, ensuring that the recipient understands the importance of settling the balance without damaging the business relationship. A well-crafted reminder can prompt prompt payment while maintaining a positive and professional tone.

Essential Components of a Polite Payment Reminder

Here are some key tips to keep in mind when drafting a reminder message:

- Be Courteous: Begin the message with a friendly and professional tone. A simple “I hope you’re doing well” or “I trust all is well with you” helps set a positive tone before addressing the overdue payment.

- State the Facts Clearly: Provide essential details about the outstanding balance, such as the amount due, the service or product provided, and the original due date. This ensures the recipient understands exactly what is being referred to and why the payment is necessary.

- Avoid Accusatory Language: Keep the language neutral and non-confrontational. Instead of saying “You have not paid,” consider using phrases like “We noticed that payment has not yet been received” or “It appears that the payment is still pending.”

- Offer Assistance: Sometimes, delays happen due to unforeseen circumstances. Include a line such as “Please let us know if there’s any issue with processing the payment” or “If you need any assistance, don’t hesitate to reach out.” This shows flexibility and helps maintain a positive relationship.

- Provide a New Deadline: Politely remind the recipient of the importance of making the payment by specifying a new deadline, for example, “We kindly ask that payment is made by [new due date].” This communicates urgency without being overly harsh.

- Show Appreciation: End the reminder by thanking the recipient for their time and cooperation. A phrase like “We truly appreciate your prompt attention to this matter” reinforces a respectful and professional approach.

Additional Tips for a Respectful Reminder

- Keep i

Setting Up Email Notifications for Payments

Establishing a reliable system to alert customers about financial transactions is essential for smooth business operations. By configuring automatic notifications, you can ensure that clients are promptly informed about important updates regarding their payments. This helps in maintaining transparency and minimizing confusion, ultimately improving customer satisfaction.

Key Considerations for Payment Alerts

- Choose the right timing for notifications: whether it’s immediately after the transaction or on a recurring schedule.

- Personalize the message content to reflect the nature of the transaction and your brand tone.

- Ensure clarity in all details, such as amounts, due dates, and instructions for completing the payment.

- Enable tracking or receipt confirmations to keep customers informed about the status of their payments.

Steps to Set Up Payment Notifications

- Access the settings of your payment processing platform or system.

- Locate the notification options, typically under “communications” or “alerts.”

- Choose the type of transaction or event you want to trigger a notification for, such as successful payments, upcoming due dates, or overdue reminders.

- Craft clear, concise messages that reflect the nature of the alert, ensuring it is easy to understand.

- Test the notifications before activating them to verify they are working as expected.

How to Keep Invoice Emails Professional

Maintaining professionalism in communication regarding financial matters is crucial for fostering trust and ensuring smooth transactions. Crafting clear, polite, and well-organized messages is key to presenting a professional image and enhancing customer relationships. Below are several tips to ensure that your communications about payments are effective and respectful.

Key Elements of Professional Communication

- Use formal and polite language, avoiding slang or overly casual phrasing.

- Maintain a clear and concise subject line that reflects the purpose of the message.

- Include all relevant details such as the amount due, payment due date, and any applicable reference numbers.

- Ensure the tone remains respectful, even when reminding the recipient of overdue payments.

- Double-check for grammar and spelling errors before sending to maintain credibility.

Best Practices for Structuring the Message

- Begin with a polite greeting, addressing the recipient by their full name or business title.

- State the purpose of the communication early on, making it clear that it concerns a financial matter.

- Provide all necessary payment information in a clean, easily readable format, such as in bullet points or a table.

- Finish with a courteous closing, offering assistance if the recipient has any questions or needs further details.

- Include contact information or a support line for additional inquiries to further enhance professionalism.

Legal Considerations When Sending Invoices

When communicating financial obligations to clients, it is essential to be mindful of the legal aspects involved. Proper documentation and adherence to relevant laws help prevent disputes and ensure that both parties are protected. Understanding these legal considerations can safeguard your business and maintain positive relationships with customers.

Key Legal Requirements

- Clear and Accurate Information: Ensure that all details, such as the amount due, payment terms, and due dates, are accurate and clearly presented.

- Comply with Tax Laws: Depending on your location and the nature of the transaction, include any applicable taxes (e.g., VAT, sales tax) and follow the appropriate tax regulations.

- Retention of Records: Retain a copy of all communications regarding financial matters, as these documents may be needed for accounting, audits, or legal purposes.

- Payment Terms: Clearly state the agreed-upon payment terms, including late fees or penalties if applicable, in order to ensure both parties are aligned on expectations.

- Legal Notices: Include any necessary disclaimers or legal notices, such as your business registration number or legal entity information, where required by law.

Consumer Protection and Privacy Laws

- Data Protection: Always safeguard customer information in compliance with data privacy laws like GDPR or CCPA. Ensure that any sensitive data is stored securely and used only for legitimate purposes.

- Dispute Resolution: Outline a process for handling any disputes regarding payment, whether through customer service, mediation, or legal action.

- Consumer Rights: Be aware of consumer protection laws that govern payment terms and conditions, especially in cases where your customer is a private individual or small business.

How to Follow Up on Unpaid Invoices

Chasing overdue payments is a necessary part of business operations, but it requires a careful approach to maintain professional relationships while ensuring that your finances stay in order. It is essential to strike the right balance between being firm and polite, encouraging clients to settle their dues without causing friction. Below are steps to effectively follow up on unpaid balances.

Best Practices for Follow-Up Communications

- Start with a friendly reminder: If the payment is only slightly overdue, a courteous message can be enough to prompt action without causing tension.

- Be clear and direct: When communicating about overdue amounts, make sure to include all relevant details such as the original due date, the amount owed, and any previous reminders.

- Offer payment options: Sometimes delays occur because the client has difficulty with payment methods or terms. Providing flexibility can help resolve the situation more quickly.

- Keep a professional tone: Even if the payment is overdue, maintaining a professional demeanor shows that you are serious but also respectful.

- Set a deadline for payment: Be specific about when you expect the overdue balance to be settled, and explain any consequences for continued non-payment, such as late fees or suspension of services.

When to Take Further Action

- If the payment is not received after multiple follow-ups, it may be time to escalate the matter by involving a collections agency or legal advisor.

- Before taking legal steps, always make sure you have sent at least two or three reminders and have a clear record of all correspondence.

- Consider offering a payment plan if the client is experiencing financial difficulty. This can help recover the amount over time while preserving the relationship.