Email Template for Unpaid Invoice How to Effectively Request Payment

When clients fail to settle their financial obligations, it can create unnecessary stress for businesses. Crafting a polite yet firm message that encourages prompt payment is crucial in maintaining both cash flow and professional relationships. The right communication approach can make all the difference in ensuring timely settlements without damaging client rapport.

Understanding how to structure your communication with clear instructions and a respectful tone is key. Whether it’s a gentle reminder or a more urgent request, your words should reflect professionalism while prompting action. The goal is not just to collect what’s owed, but to do so in a manner that preserves trust and encourages future business interactions.

By using effective wording and timing, you can significantly improve the chances of getting paid on time. A well-crafted letter can communicate the seriousness of the situation while still keeping the door open for positive collaboration down the line. In this guide, we’ll explore how to create these crucial messages that can help keep your operations running smoothly.

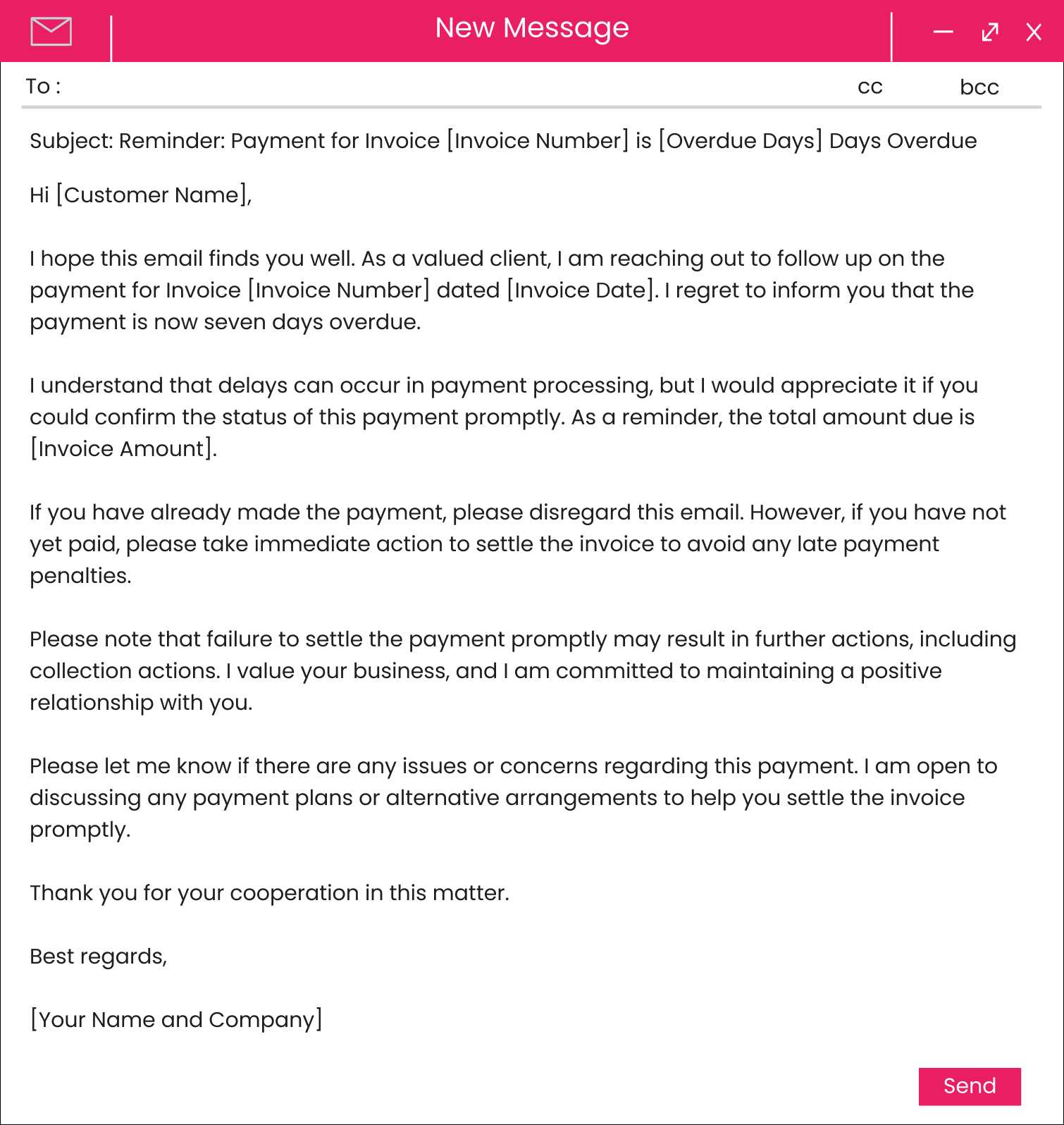

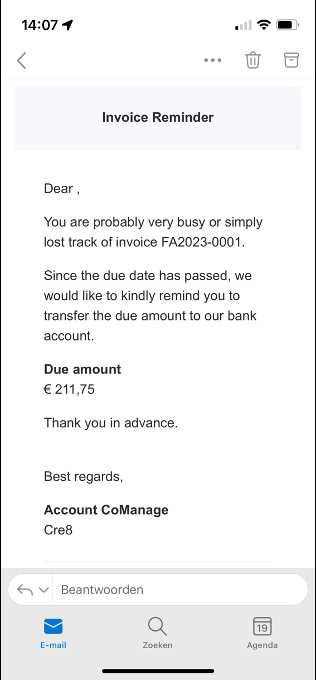

Email Template for Unpaid Invoice

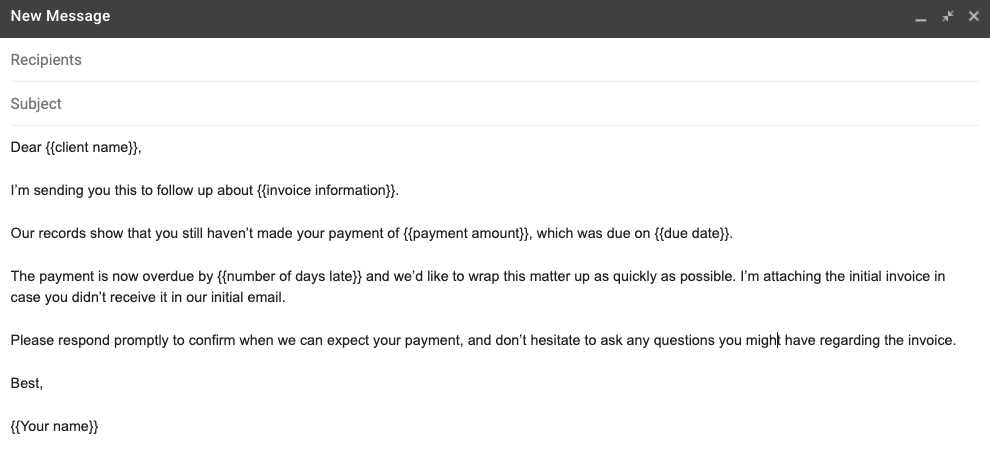

When a payment is overdue, it’s essential to communicate clearly and professionally with your client to encourage prompt resolution. A well-crafted message not only reminds the client of their outstanding balance but also reinforces your business’s expectations and fosters a sense of urgency. Below is a sample structure you can adapt for different situations when requesting overdue payments.

Sample Message Structure

This structure balances a polite tone with a firm reminder of the obligation, providing the necessary details without sounding confrontational.

| Section | Description |

|---|---|

| Greeting | Start with a friendly and respectful salutation, using the client’s name. |

| Introduction | Briefly remind the client of the outstanding balance and the original payment terms. |

| Payment Reminder | Politely mention the overdue amount and specify the due date. Include payment details for convenience. |

| Action Request | Clearly state what you expect from the client (e.g., payment by a certain date). |

| Closing | End the message courteously, offering assistance and expressing your appreciation for their attention to the matter. |

Example of a Payment Reminder

Here’s an example of how you might structure such a request:

Dear [Client Name],

I hope this message finds you well. I wanted to follow up regarding the outstanding balance of [Amount], which was due on [Original Due Date]. We kindly ask that you arrange payment at your earliest convenience.

For your convenience, the payment details are as follows:

Bank Name: [Bank Name]

Account Number: [Account Number]

Amount Due: [Amount]

If there are any issues or concerns regarding this payment, please feel free to contact us. We look forward to resolving this promptly.

Thank you for your attention to this matter.

Best regards,

[Your Name]

[Your Position]

[Company Name]

Why You Need an Invoice Reminder

In business, keeping track of outstanding payments is critical to maintaining healthy cash flow. Often, clients forget or delay settling their financial obligations, which can lead to unnecessary disruptions. Sending a timely reminder is an effective way to ensure that both parties are clear about the payment status and that the transaction is completed without further delays.

Minimize Delays in Payments

A reminder helps reduce the chances of payment delays by providing a gentle nudge to the client. Without a clear follow-up, many clients may simply forget about the pending amount, especially in the midst of their own financial responsibilities. Sending a courteous reminder keeps the issue at the forefront of their attention, increasing the likelihood of prompt payment.

Maintain Professional Relationships

Communicating about overdue balances in a professional manner is key to preserving positive relationships with clients. A well-written reminder reinforces the expectation of timely payments, yet does so in a respectful and non-confrontational way. This can prevent misunderstandings and potential friction, helping you maintain a strong and ongoing business relationship.

Additionally, consistent follow-ups create a sense of reliability in your business operations. Clients are more likely to adhere to payment terms if they know that you are organized and proactive in your approach to managing financial matters. By setting clear expectations and following through on them, you strengthen your credibility and trustworthiness as a business partner.

How to Structure Your Payment Request

Crafting an effective payment request involves more than simply asking for money. The way you structure your message can influence whether the recipient will act promptly or delay payment further. A well-organized request that is clear, professional, and polite can ensure that your client understands the urgency while maintaining a positive business relationship.

Key Elements of a Payment Request

A structured approach helps convey all necessary details while remaining courteous and direct. Below are the main components to include when crafting your request:

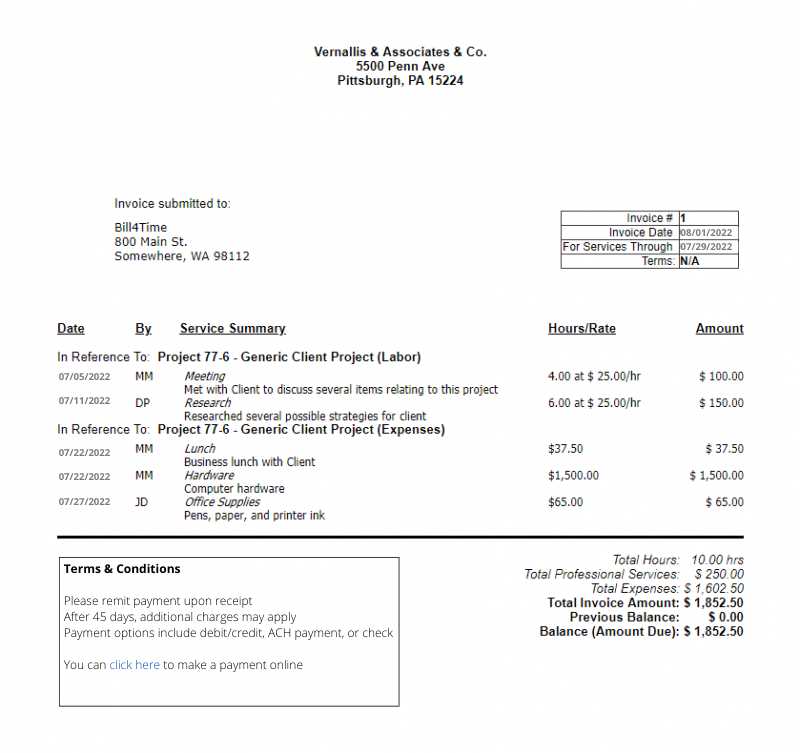

- Clear Introduction: Start by identifying yourself and the reason for the communication.

- Details of the Amount Due: Be specific about the balance, including any relevant dates and services rendered.

- Payment Instructions: Clearly state how and where the payment should be made, including account details or payment portals.

- Due Date: Reinforce the expected payment deadline and express the importance of adhering to it.

- Polite Closing: End with a courteous statement, offering assistance if needed and reinforcing your appreciation for their prompt action.

Organizing the Message for Maximum Clarity

Breaking the message down into clearly defined sections allows the recipient to quickly understand the request. For example, consider highlighting important information such as the total amount due, payment methods, and the due date in bold text or bullet points. This draws attention to the key points and reduces the risk of confusion.

By structuring your payment request in this way, you create a clear, professional, and respectful communication that encourages timely payment while maintaining positive client relations.

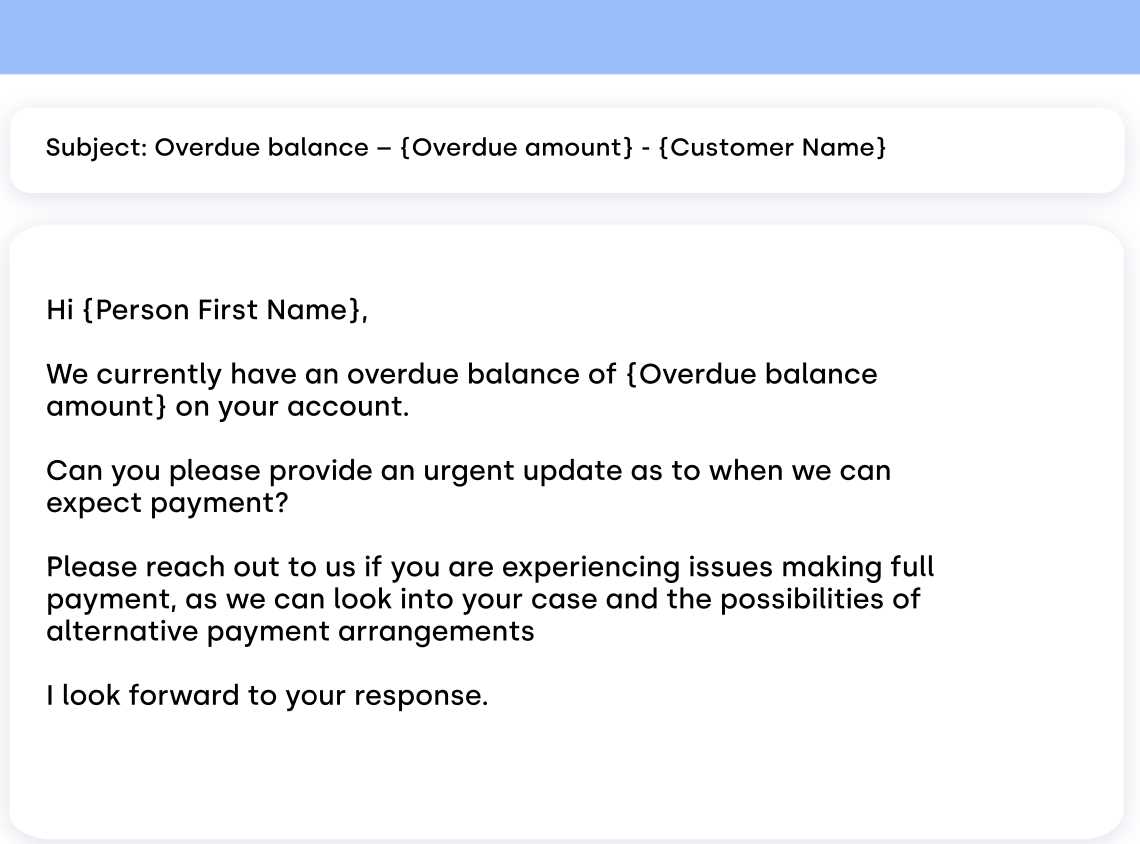

Key Elements in Payment Reminder Emails

When sending a payment reminder, certain components should be included to ensure the message is effective, clear, and polite. These elements help create a structured, professional communication that prompts action without being overly aggressive. The balance between firmness and respect is crucial to maintaining a positive relationship with your client while also emphasizing the importance of timely payment.

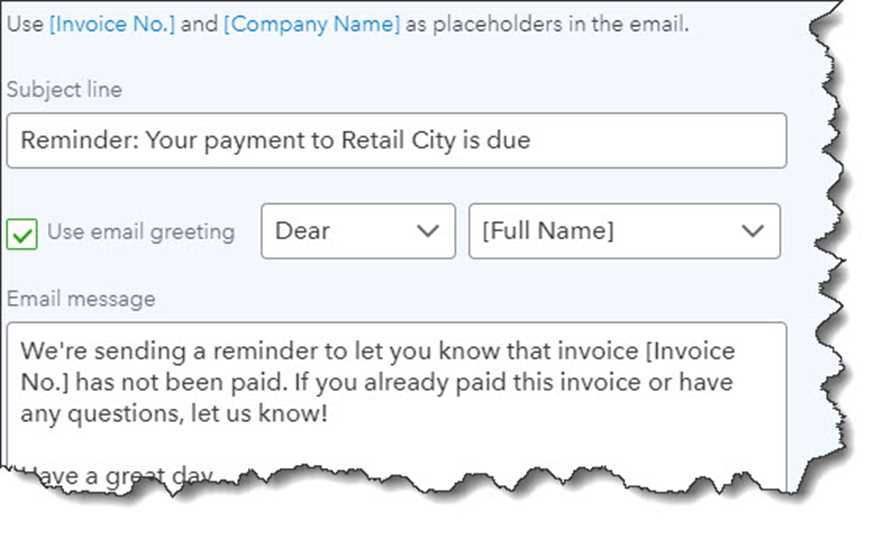

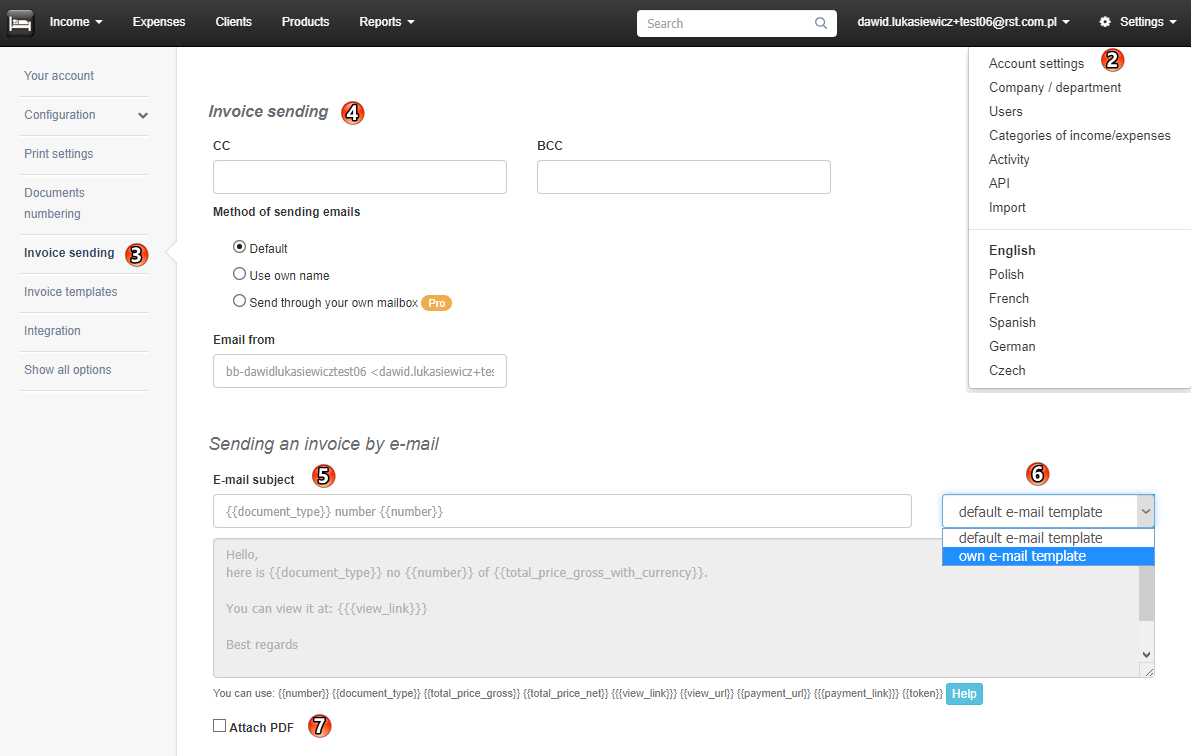

1. Clear Subject Line: The subject should immediately convey the purpose of the message, so the recipient understands its importance. Something direct like “Payment Reminder for [Amount]” can get the attention needed.

2. Personalization: Always address the recipient by name and, if possible, reference their specific transaction. Personalizing the reminder makes it feel less generic and more focused on the individual situation.

3. Concise Explanation of the Situation: Briefly outline the amount owed, the service or product provided, and the original due date. This helps avoid any confusion and gives context to the recipient.

4. Polite and Professional Tone: Keep the tone courteous and professional. Even though the message is about overdue payments, it should remain friendly. Offering assistance or flexibility can be a nice touch that encourages cooperation.

5. Clear Call to Action: Be specific about what you want the recipient to do next. Whether it’s paying immediately or confirming when they’ll pay, provide clear instructions or a link to the payment method.

6. Payment Details: Include all necessary payment information, such as account numbers or online payment links, so that the recipient can act without unnecessary delays.

7. Reminder of Consequences: While you want to remain professional, gently remind the recipient of any late fees or other consequences of continued non-payment. This serves as a subtle prompt to take action.

By integrating these key elements, your reminder will not only increase the likelihood of prompt payment but also help maintain a positive, ongoing relationship with your clients.

Best Practices for Writing Polite Payment Requests

When requesting overdue payments, maintaining a polite and respectful tone is essential. A well-crafted request can prompt prompt action without damaging client relationships. The key to success lies in striking the right balance between firmness and courtesy. Below are several best practices to ensure that your payment requests are both effective and polite.

Key Strategies for a Courteous Request

- Use a Friendly Greeting: Start with a warm and professional salutation, addressing the recipient by name. This helps set a respectful tone from the beginning.

- Be Clear but Gentle: Clearly state the reason for your communication but avoid sounding accusatory or confrontational. Use phrases like “I’d like to gently remind you” or “I wanted to follow up on.”

- Provide Context: Mention the original due date and the amount due without sounding too insistent. This keeps the message informative while reminding the recipient of their obligation.

- Offer Assistance: If there are any issues or concerns preventing payment, express your willingness to discuss or work out a solution. Acknowledge that sometimes misunderstandings or technical issues may occur.

- Express Appreciation: Always thank the client in advance for their attention to the matter. Showing gratitude can help maintain goodwill.

- Be Specific but Not Aggressive: Clearly outline how the payment should be made, but avoid threatening or demanding language. Use polite phrases like “please arrange for payment by [date]” instead of “you must pay immediately.”

Effective Language to Use

Choosing the right words is crucial in crafting a polite yet effective request. Here are some phrases that can make your payment request sound more considerate:

- “I hope this message finds you well…” – A friendly opening helps set the right tone.

- “I would appreciate it if…” – A polite way to request action without being too forceful.

- “Please let us know if there’s any issue…” – Showing understanding and offering help encourages open communication.

- “Thank you for your prompt attention to this matter.” – A polite closing that reinforces the urgency without being pushy.

By following these best practices, you can ensure that your payment requests are not only effective in collecting

When to Send an Unpaid Invoice Email

Timing is crucial when requesting payment for services or goods rendered. Sending a reminder too early may seem unnecessary, while waiting too long can result in delays that affect your cash flow. Understanding the right moment to send a payment request can increase the likelihood of receiving timely payment and preserve a positive relationship with your client.

Generally, the best time to reach out is shortly after the payment deadline has passed. However, it’s important to consider the nature of your relationship with the client and any previous interactions. Here are some general guidelines for when to send a payment reminder:

- Immediately After the Due Date: If the payment deadline has just passed, a gentle reminder is appropriate. It may simply be a friendly follow-up, acknowledging that the client may have overlooked the payment.

- 3-7 Days After the Due Date: If no payment has been received within the first week, it’s time to send a more formal reminder. Be polite but firm, reiterating the terms of the agreement and requesting payment within a specified time frame.

- Two Weeks After the Due Date: After two weeks, the tone should be slightly firmer, as the delay has now become significant. At this point, you might also want to mention potential late fees or other consequences for continued non-payment.

- One Month After the Due Date: If the payment is still outstanding after a month, it’s time to escalate the communication. This reminder may need to outline next steps, such as involving a collection agency or taking legal action if payment is not made promptly.

In general, the earlier you address late payments, the better. Clear, timely communication helps prevent late payments from becoming a recurring issue, and addressing them early can preserve your professional reputation and client trust.

How to Avoid Being Too Pushy

When requesting payment, it’s important to maintain a balance between urgency and professionalism. While it’s essential to remind clients of their financial obligations, being overly aggressive or persistent can strain your business relationships. The key is to encourage prompt action without making your client feel uncomfortable or pressured.

1. Use a Polite Tone: Always maintain a respectful and friendly tone in your communication. Even when emphasizing the importance of timely payment, you should avoid sounding confrontational or impatient. A courteous approach is more likely to motivate the client to pay than an aggressive one.

2. Be Clear but Not Demanding: Clearly outline what is expected, but avoid language that demands immediate payment. Instead of saying, “You must pay by the end of the day,” you can phrase it as, “We would greatly appreciate receiving payment by [date].” This provides a sense of urgency without seeming forceful.

3. Give the Client Room to Respond: Sometimes clients may have valid reasons for a delay, such as financial issues or internal processing delays. Acknowledge this possibility in your message by saying something like, “If there are any issues or concerns with this payment, please let us know.” This opens the door for communication without applying pressure.

4. Avoid Frequent Follow-Ups: It’s tempting to send multiple reminders when a payment is overdue, but excessive follow-ups can come across as pushy. Instead, space out your reminders appropriately, and consider following up only if the payment remains outstanding after a reasonable period.

5. Be Understanding: Show empathy in your messages. Understanding that your clients may be dealing with their own challenges can create a more cooperative atmosphere. Expressing patience can foster goodwill, making clients more likely to settle their balance on time.

By striking the right tone and giving your client space, you can ensure your requests are effective without damaging your business relationship. A polite and professional approach will encourage prompt payments while maintaining positive client interactions.

Handling Late Payments Professionally

When payments are delayed, it’s important to handle the situation with professionalism and tact. While late payments can be frustrating, how you address them can significantly impact your relationship with clients and your business’s reputation. A well-thought-out approach that is firm but respectful can encourage timely resolution while preserving positive professional relationships.

The first step in addressing overdue payments is to communicate clearly and professionally. Avoid being confrontational, and instead focus on offering solutions or understanding. Below is a simple framework for managing late payments in a way that shows both professionalism and respect for the client’s situation.

| Step | Description |

|---|---|

| Initial Reminder | Send a polite follow-up after the payment due date, gently reminding the client of the overdue balance and offering assistance if needed. |

| Second Follow-Up | If no response is received after the initial reminder, follow up again with a more formal message, outlining the consequences of continued non-payment. |

| Offer Payment Options | If the client is experiencing difficulties, consider offering flexible payment terms or splitting the balance into smaller installments. |

| Escalate Professionally | If the issue persists, you may need to involve a third-party collection agency or legal action, but ensure you have made all reasonable attempts to resolve the matter amicably first. |

By following this structured process, you can handle late payments efficiently and with professionalism. It’s important to remain patient but firm, and show understanding when appropriate. This approach not only helps in securing payment but also in maintaining strong, long-term client relationships.

Legal Considerations for Unpaid Invoices

When dealing with overdue payments, it’s essential to be aware of the legal aspects surrounding the collection process. While sending reminders and following up with clients is a standard part of business practice, understanding your legal rights and obligations ensures that you handle the situation properly and avoid potential legal complications. If a payment remains outstanding for a long period, legal action may become necessary, but it should be approached carefully and with full knowledge of the laws governing financial disputes.

Know Your Rights: As a business owner or service provider, you have the right to request payment for services or goods rendered. In most jurisdictions, a contract (written or verbal) forms the basis for any transaction, and if the client fails to honor the agreement, you are entitled to pursue payment. However, it’s important to understand the specifics of any contractual agreement, such as payment terms, penalties, or interest rates on overdue amounts.

Late Fees and Interest: Many businesses incorporate late fees or interest into their payment terms as a way to encourage timely settlement. Depending on your location, there may be limits on how much you can charge in fees or interest. Be sure to review applicable local laws and make sure that your terms are compliant with regulations before enforcing them.

Sending a Demand Letter: If initial reminders and follow-ups do not result in payment, a demand letter is often the next step. This formal letter should clearly outline the amount owed, the payment due date, and the consequences of continued non-payment. While demand letters are not legal actions themselves, they often serve as a precursor to legal proceedings and can be highly effective in prompting payment.

Legal Action and Small Claims Court: If the outstanding amount is substantial and other attempts at resolution have failed, pursuing legal action might be necessary. Depending on the size of the debt, small claims court can be an option. In this case, you may not need an attorney, but you will need to gather all relevant documentation, including contracts, invoices, and communication records, to support your case.

Involving a Collection Agency: If you prefer not to pursue legal action directly, you can consider hiring a collection agency. These agencies specialize in recovering debts, and while they take a fee or percentage of the amount recovered, they often have the resources to deal with difficult cases. Keep in mind that using a collection agency can impact your business’s reputation, so it’s best used when other efforts have failed.

Seek Legal Advice: If you are unsure of how to proceed or if you feel the situation may escalate, seeking legal counsel can help clarify your options and protect your business. Legal professionals can help you understand local laws and advise on the best course of action based on your specific circumstances.

In conclusion, dealing with overdue payments requires not only strong communication skills but also a solid understanding of the legal aspects of debt recovery. By taking the appropriate steps, you can ensure that your business is protected and that you are well-positioned to resolve payment issues

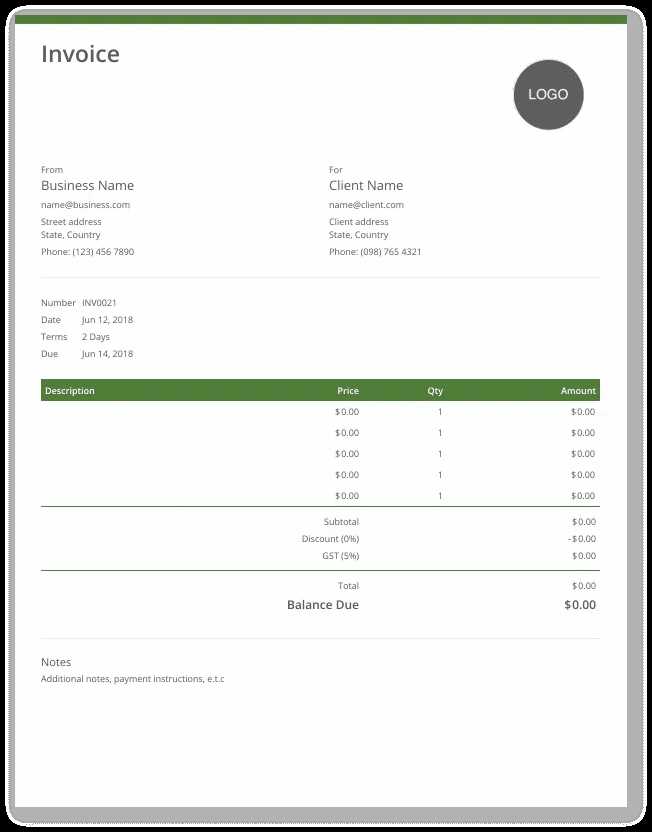

Crafting a Clear Payment Due Date

Establishing a clear payment due date is a crucial element in ensuring timely payments and maintaining good business relationships. A well-defined deadline not only sets expectations but also helps avoid misunderstandings or delays. It’s essential to communicate the due date in a manner that is both easy to understand and professionally stated. Below are some key tips for crafting a clear and effective payment deadline.

Tips for Setting and Communicating a Payment Due Date

- Be Specific: Always state the exact due date rather than a vague term like “end of the month” or “soon.” For example, “Payment is due by 5:00 PM on [specific date].”

- Avoid Ambiguity: Make sure there’s no confusion around whether the due date is a calendar day or a business day. If necessary, clarify this in your message: “Due date: March 15, 2024 (business day).”

- Provide Enough Time: Ensure the due date gives your client adequate time to process the payment. Generally, 30 days is a standard period, but depending on the agreement, this can vary.

- Highlight the Due Date: Emphasize the deadline in your message, such as by using bold text or a separate section to make it stand out.

- Set Consequences for Late Payments: Politely mention any penalties or fees that will apply if the payment is not made on time. However, avoid sounding overly harsh or threatening.

Examples of Clear Payment Due Dates

- “Please make your payment by 5:00 PM on [Date].”

- “Payment is due within 30 days from the date of this notice, by [Date].”

- “Kindly ensure the balance is settled by [Date] to avoid any late fees.”

By setting a precise and clear deadline, you not only reduce the chance of delayed payments but also help ensure your clients understand the importance of adhering to the agreed terms. A straightforward payment due date promotes smoother transactions and helps maintain a professional reputation.

How to Address Different Payment Methods

When requesting payment for goods or services, it’s important to accommodate different methods of payment to ensure convenience for your clients. Offering multiple payment options not only improves the chances of receiving payment on time, but it also demonstrates flexibility and customer service. However, when requesting payment, it’s crucial to clearly specify the preferred method and include all necessary details for each option to avoid confusion.

Clarifying Available Payment Options

Depending on your business, you may accept a variety of payment methods, including bank transfers, credit cards, online payment platforms, or checks. It’s essential to provide the recipient with all the relevant information for each option, so they can choose the most convenient one for them. Here’s how to address different payment methods professionally:

- Bank Transfers: Clearly provide your bank account details, including account number, sort code, and the name of the bank. If applicable, specify the payment reference to make tracking easier.

- Credit or Debit Cards: If you accept card payments, offer clear instructions for online payment portals, or provide a secure link where clients can make payments. Ensure the payment process is as simple as possible.

- Online Payment Systems: Include relevant details for payment systems such as PayPal, Stripe, or other online services. Be sure to provide both the necessary account or email address and any transaction ID for easy verification.

- Checks: If you accept checks, provide the full address to which checks should be sent. Clarify any requirements regarding the check (e.g., payable to your business name) to prevent delays in processing.

Providing Clear Instructions

For each method, it’s important to offer concise and easy-to-follow instructions to ensure that the payment process goes smoothly. Providing clear, step-by-step guidelines minimizes the chances of mistakes or misunderstandings, which could delay payment further. If there are any specific details or requirements for a given payment method, make sure to highlight those points.

By addressing multiple payment methods in a structured and transparent way, you make it easier for clients to settle their balances promptly, reducing delays and keeping your financial transactions efficient.

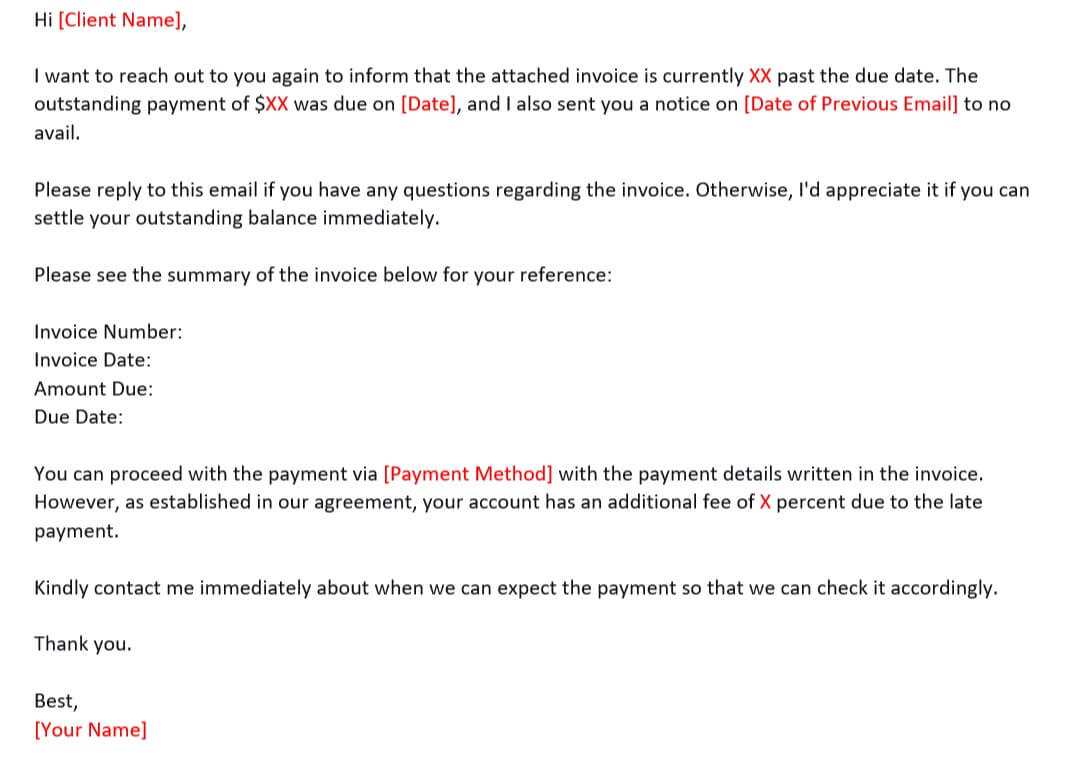

Personalizing the Invoice Follow-Up Email

When following up on outstanding payments, personalizing your communication can make a significant difference in encouraging timely action while maintaining a positive client relationship. A personalized message shows that you value the client and understand their specific situation, rather than sending a generic reminder that may feel impersonal or automated. Tailoring your follow-up approach helps foster better communication and trust, which is essential for future business dealings.

Why Personalization Matters

Personalization not only demonstrates professionalism but also humanizes the process of addressing late payments. By using the client’s name and referencing specific details about the transaction, you remind them of their obligations without sounding like a generic or automated message. This creates a sense of accountability while still being courteous and understanding. Here are a few ways to personalize your follow-up communication:

- Use the Client’s Name: Always begin by addressing your client by name. A simple “Dear [Client’s Name]” can make a big difference in making the communication feel more personal and less like a mass message.

- Reference Specifics of the Transaction: Mention specific details such as the products or services provided, the agreed-upon terms, or the date of the original agreement. This shows that you are not just sending a blanket message but are addressing their individual situation.

- Acknowledge Any Prior Communication: If you’ve already had prior conversations about the payment, reference them to show that you are keeping track and are engaged in the process. For example, “As we discussed last week, the payment is due by [date].”

How to Customize the Follow-Up Message

When drafting your follow-up, consider the tone and phrasing. A personalized message should feel warm yet professional, showing empathy for any delays without being overly formal. Here’s an example of a personalized message structure:

- Greeting: Use the client’s name to start the message, such as “Dear [Client’s Name],”

- Recap of Agreement: Briefly mention the service or product provided, e.g., “I hope you are enjoying [product/service].”

- Gentle Reminder: Politely remind them of the amount due and the date it was due, e.g., “I wanted to kindly remind you that the balance of [amount] was due on [date].”

- Offer Assistance: Let the client know you are available to discuss any issues they may have, e.g., “Please feel free to reach out if there are any concerns or issues with the payment process.”

- Closing: End the message with appreciation, such as “Thank you for your attention to this matter, and I look forward to your prompt response.”

By adding a personal touch to your follow-up, you not only improve the chances of receiving payment but also maintain a respectful, professional relationship with your client, enhancing long-term business success.

Common Mistakes in Payment Request Emails

When sending a request for overdue payments, the way the message is framed can significantly impact its effectiveness. Many businesses make common mistakes that can either delay payment further or harm their relationship with the client. It’s important to understand what these mistakes are so you can avoid them and increase your chances of timely resolution. Below are some of the most frequent errors made when crafting payment reminders.

Frequent Mistakes in Payment Requests

- Being Too Aggressive: A harsh or overly demanding tone can alienate the client and potentially damage your professional relationship. It’s important to remain firm yet polite, even when the payment is overdue.

- Vague or Unclear Information: Failing to specify the amount owed, due date, and any relevant transaction details can lead to confusion. Be clear and concise in your request to avoid any misunderstandings.

- Not Offering Payment Options: Not providing clients with multiple payment methods can delay the process. Always include various payment options and make it as easy as possible for them to pay.

- Ignoring Previous Communication: Failing to reference prior discussions or reminders can make the follow-up feel disconnected. Always acknowledge previous conversations to maintain context and continuity.

- Missing Deadlines or Payment Terms: If you don’t specify the due date or any penalties for late payments, it may cause delays as the client may not feel a sense of urgency. Be sure to clearly outline all terms, including any fees for overdue balances.

- Being Too Informal: While it’s important to be friendly, using overly casual language in a professional setting can come off as unprofessional. Keep the tone respectful and businesslike, while still being courteous.

How to Avoid These Mistakes

To avoid these common mistakes, focus on clear, respectful communication. Ensure your message is straightforward, specifying all the necessary details. Stay polite yet assertive, offering solutions where necessary and maintaining a professional tone. This approach will help you address overdue payments more efficiently and preserve valuable business relationships.

How to Deal with Non-Responsive Clients

Dealing with clients who do not respond to payment reminders can be frustrating and challenging. Silence or lack of communication from a client can delay resolution and put a strain on business relationships. However, it’s important to approach these situations with patience and professionalism, while taking strategic steps to encourage a response and secure the payment. Here are some tips on how to effectively handle non-responsive clients.

Steps to Take When Facing Non-Responsive Clients

- Double-Check Your Communication: Ensure that your previous messages have been sent to the correct contact information and that your client has received them. It’s possible that they overlooked the message or there was a technical issue. Consider sending a polite follow-up, ensuring the message was received and offering a way for the client to get in touch with any questions or concerns.

- Send a Gentle Reminder: After a reasonable amount of time has passed, send a courteous reminder. Make sure the tone remains professional and friendly, acknowledging that they may have missed the earlier communication. Be clear but not demanding in your request for payment.

- Offer Flexibility: If your client is experiencing financial difficulties, be open to offering flexible payment terms. This could include splitting the payment into smaller installments or extending the deadline. Demonstrating empathy can help maintain a positive relationship and encourage the client to resolve the issue.

- Contact Alternative Channels: If your previous communication methods have been ineffective, try reaching the client through other channels, such as phone calls or messaging apps. Sometimes, emails can be missed or overlooked, and a personal touch can be more effective in securing a response.

- Use Formal Communication: If informal approaches have failed, consider sending a formal letter. A more official tone can often prompt a response, signaling the seriousness of the situation. This letter should include clear details about the outstanding amount, the agreed-upon terms, and potential next steps.

- Set a Final Deadline: If repeated attempts at contact have not worked, inform the client of a final deadline for payment. Be firm, yet respectful, stating that further actions, such as involving a collections agency or taking legal steps, will be considered if payment is not received by the stated date.

- Consider Professional Assistance: If all else fails, you may want to involve a professional collections service. While this can be an uncomfortable step, it may be necessary for recovering the amount owed. Be mindful that involving a third party can affect your business relationship, so it should be approached with care.

By following these steps, you can encourage non-responsive clients to address their outstanding payments while maintaining professionalism and protecting your business. Flexibility, persistence, and clear communication are key to resolving these situations effectively.

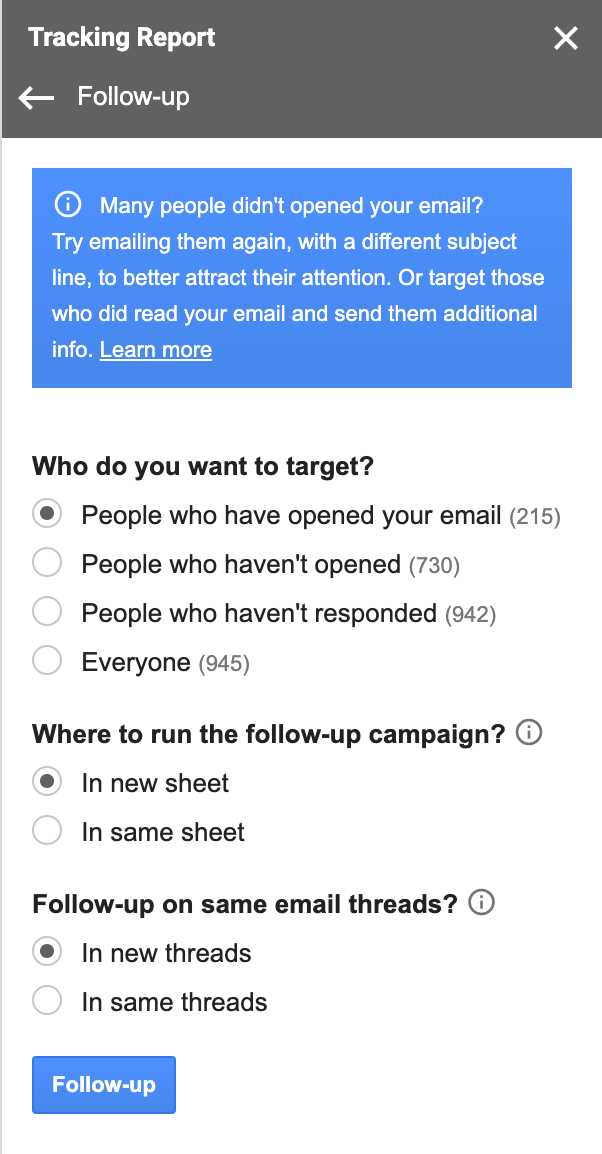

Follow-Up Emails: How Many Is Too Many

When it comes to requesting overdue payments, it’s essential to strike the right balance between persistence and professionalism. Sending too many reminders can come across as overly aggressive, damaging your relationship with the client, while sending too few may cause delays in resolving the payment issue. Understanding how often to follow up is key to maintaining good business relationships while ensuring timely payment. Below are some guidelines to help you determine the ideal frequency for follow-ups.

Factors to Consider Before Sending Multiple Follow-Ups

The number of reminders you send should depend on several factors, including the length of time the payment has been overdue, your relationship with the client, and your payment terms. It’s crucial to consider the context of the situation before sending frequent follow-ups. The following table outlines some of these factors:

| Time Passed Since Due Date | Recommended Follow-Up Frequency | Tone of Communication |

|---|---|---|

| 1-7 Days | One initial reminder | Polite, gentle reminder |

| 8-14 Days | One or two additional reminders | Firm but friendly, acknowledging possible issues |

| 15-30 Days | Final notice with a clear deadline | Professional and direct, outlining next steps |

| Over 30 Days | Consider escalation (phone call, legal steps) | Formal, with clear mention of possible actions |

How to Know When You’ve Sent Too Many Follow-Ups

While following up is important, you should avoid bombarding the client with excessive reminders. Sending too many requests can be perceived as harassment, which may lead to a breakdown in communication and strain the business relationship. It’s important to monitor the tone and frequency of your reminders. If you’ve already sent multiple notices and received no response, it may be time to consider alternative methods, such as a formal letter or legal action, rather than continuing to send additional requests.

In general, you should aim for no more than three to four reminders over a reasonable period, spaced out by at least a week. If the payment remains unresolved, escalate the matter appropriately. The key is to stay professional, patient, and respectful while ensuring that your message is clear and that you take necessary steps if the situation does not improve.

When to Involve a Collection Agency

At some point, despite repeated reminders and efforts to communicate with a client, overdue payments may remain unresolved. In such cases, businesses are faced with the decision of whether to involve a collection agency. This step should not be taken lightly, as it can impact your relationship with the client and introduce additional costs. Understanding when it is appropriate to escalate the matter to a professional collections service is crucial for ensuring that you make the right decision at the right time.

Signs That It’s Time to Involve a Collection Agency

There are several indicators that suggest it may be time to turn to a collection agency for assistance in recovering the outstanding balance. Some of these include:

- Repeated Attempts Have Failed: If multiple attempts to reach the client–whether through phone calls, reminders, or follow-ups–have not resulted in any communication or payment, it may be time to escalate the situation.

- Excessive Time Has Passed: If the payment is significantly overdue (typically 60 days or more), and there has been no resolution despite all efforts, a collection agency may be necessary to recover the funds.

- Client is Unresponsive or Avoiding Communication: If the client is not responding to your messages, and there is no indication that they intend to pay, professional intervention may be needed to prompt a resolution.

- Lack of a Viable Payment Plan: If the client is unwilling or unable to propose a realistic payment plan and there are no signs of payment being made, turning to a collection agency can help facilitate the recovery process.

Considerations Before Involving a Collection Agency

Before taking the step of involving a third-party collection agency, consider the following points:

- Client Relationship: Consider the long-term impact on your relationship with the client. Involving a collection agency can permanently damage business ties, so make sure it’s the best course of action.

- Cost of Collection: Understand the fees associated with using a collection agency. Many agencies charge a percentage of the recovered amount, which may be significant depending on the size of the debt.

- Legal Implications: Be aware of the legal ramifications, as certain jurisdictions have specific rules and regulations when it comes to debt collection practices. Make sure that the collection agency you choose operates within legal boundaries.

Involving a collection agency is a last resort, but sometimes it is necessary to ensure that your business is paid for the goods or services provided. By making an informed decision, you can take the appropriate steps to recover the debt without compromising your long-term business goals.

Setting Payment Terms to Avoid Delays

Establishing clear and comprehensive payment terms at the outset of any business transaction is essential to ensure timely payments and avoid future misunderstandings. By setting expectations early on, both you and your clients can avoid delays and reduce the risk of payment issues. Clear payment terms serve as a guideline for both parties and set the tone for how financial matters will be handled throughout the business relationship. Below are some effective strategies for creating payment terms that help minimize delays.

Key Considerations When Setting Payment Terms

When defining your payment terms, there are several important factors to consider that can help streamline the process and ensure timely payments:

- Specify Payment Deadlines: Be clear about the exact due date for each payment. Terms like “Net 30” or “Due on Receipt” should be explicitly stated in the agreement, so there is no ambiguity about when the payment is expected.

- Outline Late Fees: Including a penalty for late payments can incentivize clients to pay on time. Specify the percentage or flat fee that will be charged if the payment is overdue, and make sure clients are aware of these terms before finalizing the agreement.

- Offer Flexible Payment Options: Offering multiple payment methods (e.g., credit cards, bank transfers, checks) can reduce friction and make it easier for clients to pay. Clients are more likely to pay on time if they can choose the payment method that works best for them.

- Consider Milestone Payments: For larger projects or long-term agreements, it can be helpful to break payments into smaller installments. This ensures that payments are made periodically, reducing the risk of delays for large sums due at the end of a project.

- Clarify Payment Terms for Disputes: Define how any disputes over the terms or amount will be handled, including a clear process for resolving any issues that arise. This helps prevent delays that may occur if there is confusion or disagreement over the amount owed.

Effective Communication of Payment Terms

It’s crucial to ensure that your payment terms are clearly communicated to your clients upfront. Provide these details in writing, whether it’s in your contracts, quotes, or formal agreements. Make sure both parties agree to these terms before work begins, and remind clients of the terms as the payment date approaches. Transparent communication reduces the chance of delays and helps maintain a positive working relationship.

By setting clear, fair, and well-structured payment terms, you can avoid many of the issues that lead to late payments and ensure smoother cash flow for your business.

How to Build Better Client Relationships

Strong, lasting relationships with clients are the foundation of a successful business. Building trust, maintaining open communication, and offering consistent value are key components of fostering these relationships. When clients feel valued and understood, they are more likely to engage in long-term partnerships, recommend your services to others, and make timely payments. By focusing on these elements, you can establish a positive and professional rapport that benefits both parties in the long run.

Essential Practices for Strengthening Client Relationships

There are several strategies you can implement to build better relationships with your clients:

- Clear and Transparent Communication: Always keep clients informed about the progress of projects, any potential delays, and any changes in terms or expectations. Regular updates help to avoid misunderstandings and show clients that you are proactive and organized.

- Be Responsive: Respond to inquiries and concerns promptly. Clients appreciate businesses that are easily accessible and quick to address issues, which builds trust and shows reliability.

- Show Appreciation: Make an effort to express gratitude for your clients’ business. Simple gestures, like sending thank-you notes or offering special promotions, go a long way in strengthening the bond between you and your clients.

- Personalize Your Interactions: Taking the time to understand your clients’ unique needs, preferences, and challenges shows that you care about their success. Personalization can range from tailoring your services to their specific requirements to remembering important milestones like anniversaries or birthdays.

- Deliver Consistent Value: Ensure that you are providing high-quality work and services on time. Clients expect consistent value, and when you meet or exceed their expectations, it reinforces their trust in your business.

Handling Difficult Situations Professionally

Even in the best relationships, challenges may arise. Whether it’s addressing delayed payments, changes in project scope, or misunderstandings, how you handle these situations is crucial for maintaining a strong client relationship. Always approach problems with a solution-oriented mindset and work collaboratively with your client to resolve issues quickly and professionally. By focusing on solutions, rather than blame, you can turn difficult moments into opportunities to demonstrate your commitment to their success.

Building better client relationships requires ongoing effort and attention. By consistently following these practices, you create a positive, professional environment that will lead to greater satisfaction and loyalty over time.