Email Template for Sending Invoice to Client and Streamlining Your Billing Process

Effective communication with customers is key to maintaining strong business relationships, especially when it comes to financial matters. Ensuring that your payment requests are clear, polite, and professional can help streamline the process and encourage timely settlements. The tone and structure of your correspondence play a vital role in achieving these goals.

Mastering the art of written communication involves not only providing the necessary payment details but also presenting them in a way that reflects your business values. Whether you’re contacting a long-time partner or a new customer, how you ask for payment can impact their perception of your professionalism.

In this guide, we will explore how to construct a well-structured message that balances clarity and courtesy. From addressing the recipient appropriately to ensuring all payment terms are easy to follow, you’ll find strategies to create correspondence that encourages prompt action without compromising your professional image.

Essential Message Structure for Payment Requests

When requesting payment, it’s important to ensure your message is professional, clear, and respectful. A well-constructed note can set the right tone and encourage swift processing of the outstanding balance. Structuring the content properly is essential for making the recipient feel both informed and valued.

Start with a polite greeting and address the recipient in a way that reflects your business relationship. Whether you are on first-name terms or prefer a formal address, this small detail sets the stage for the communication. Always ensure that the message feels personal, yet maintains a professional demeanor.

Next, clearly specify the amount due and the relevant details of the transaction, such as dates or services rendered. This transparency helps avoid confusion and shows that you are organized. Provide a call to action by specifying the preferred method of payment and the timeline for completing the transaction. Remember, offering multiple payment options can increase the likelihood of quicker resolutions.

Conclude with a courteous thank you or acknowledgment of the recipient’s cooperation, leaving the door open for further communication if necessary. A professional closing reassures your contact that you value the partnership and are open to addressing any questions or concerns.

Why Professional Invoices Matter

Clear and well-structured payment requests are essential for maintaining positive relationships with your customers. They not only ensure that you receive the correct amount in a timely manner but also reflect the professionalism of your business. When transactions are conducted smoothly, it builds trust and enhances your reputation in the market.

Professional documentation shows that your business is organized and reliable. It creates a sense of legitimacy, making clients more likely to pay promptly and without dispute. A well-prepared request eliminates misunderstandings and minimizes the chance of delays, which can ultimately improve cash flow and business operations.

In addition to financial benefits, clear communication through well-crafted payment requests can lead to stronger, long-term business relationships. Clients are more likely to return for future projects if they feel confident in your ability to handle financial matters efficiently and respectfully.

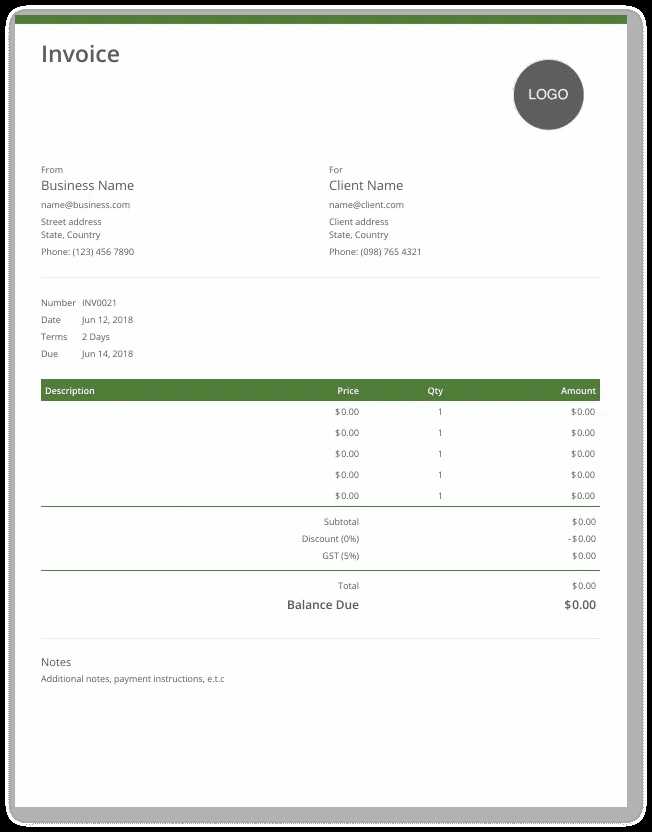

Key Elements of an Effective Payment Request Message

Creating a professional and efficient message to request payment involves more than just asking for money. It requires including specific details that will help your recipient easily understand the charges, payment terms, and instructions. A well-structured communication ensures clarity and encourages timely settlement of outstanding balances.

Important Components to Include

The following elements should be present in every payment request message to ensure it is effective:

| Element | Purpose |

|---|---|

| Clear Subject Line | Indicates the purpose of the message and grabs the recipient’s attention. |

| Professional Greeting | Sets the tone of the message and builds rapport with the recipient. |

| Invoice Details | Includes the amount owed, services or products provided, and relevant dates. |

| Payment Instructions | Clearly explains how the recipient can pay, including methods and any relevant account information. |

| Due Date | Indicates the deadline for payment to avoid any confusion or delays. |

| Polite Closing | Ends the message on a courteous note, leaving a positive impression. |

Why These Elements Matter

Including these key details not only ensures clarity but also helps build trust. Clients appreciate receiving clear and professional requests, which can lead to faster payments and a stronger ongoing business relationship. A message that is easy to understand reduces the risk of mistakes and fosters a smooth transaction process.

Crafting a Clear Subject Line for Payment Requests

The subject line of a payment request message plays a crucial role in ensuring the recipient opens and reads the correspondence promptly. A well-crafted subject provides the first impression of the message and helps the recipient immediately understand its purpose. Clear and direct wording can improve response rates and reduce delays in processing payments.

Key Principles for a Strong Subject Line

When writing the subject line, it’s essential to be concise yet informative. Avoid vague phrases and get straight to the point. Here are some key guidelines:

- Be Specific: Clearly state the reason for the message. Example: “Outstanding Balance for Services Rendered in October”.

- Include Relevant Dates: If applicable, mention specific dates, such as when the payment is due. Example: “Payment Due for August Contract – Due by 30th”.

- Maintain Professional Tone: The subject line should reflect the professionalism of your business, especially when communicating about finances.

Examples of Effective Subject Lines

Here are a few examples that effectively communicate the purpose of the message:

- “Payment Reminder: Amount Due for March Services”

- “Action Required: Payment Due for Project XYZ by [Date]”

- “Final Notice: Payment Due for Contract #12345”

A clear and concise subject line not only helps the recipient identify the message’s importance but also reduces the likelihood of it being overlooked or ignored. It’s the first step in ensuring your payment request is processed efficiently and professionally.

How to Personalize Your Payment Requests

Personalizing payment-related messages is essential for maintaining strong, professional relationships with your customers. A personalized message not only adds a human touch but also makes the recipient feel valued, which can lead to quicker and more positive responses. By tailoring the content, you ensure that the communication feels relevant and specific to the individual recipient.

Here are several ways to add a personal touch to your payment request communications:

| Personalization Element | Why It Matters |

|---|---|

| Use the Recipient’s Name | Addressing the recipient by their name makes the message feel less automated and more thoughtful. |

| Reference Specific Projects or Services | Relating the payment request to specific work done or products delivered shows attention to detail. |

| Custom Payment Terms | Including personalized payment terms based on previous agreements demonstrates flexibility and consideration. |

| Express Gratitude | A simple thank-you for their business helps strengthen the customer relationship. |

By incorporating these elements, your messages will feel more tailored and less transactional, creating a more positive experience for the recipient. Personalization helps build rapport and trust, encouraging a smoother, more efficient payment process.

Best Practices for Payment Request Etiquette

Maintaining professionalism and courtesy when requesting payments is essential to fostering long-term relationships with your customers. Proper etiquette not only ensures that the payment process runs smoothly, but it also reflects positively on your business. A respectful and clear approach can prevent misunderstandings and encourage timely payments.

Key Etiquette Guidelines

Here are some best practices to follow when crafting a professional payment request:

| Practice | Description |

|---|---|

| Be Polite and Courteous | Always use respectful language and express gratitude for the recipient’s business. |

| Maintain a Professional Tone | Even if the payment is overdue, keep the tone neutral and polite. Avoid sounding accusatory or demanding. |

| Provide Clear Instructions | Ensure that payment details, deadlines, and methods are easy to understand. This reduces confusion and promotes faster action. |

| Send a Timely Reminder | Don’t wait too long to follow up. A polite reminder can prompt the recipient to act without feeling pressured. |

Why Etiquette Matters

Good manners and professionalism can set you apart from other businesses. When you approach financial transactions with respect and clarity, you not only encourage prompt payments but also build trust with your customers. Clients are more likely to continue working with you if they feel valued and well-treated throughout every stage of the business relationship.

How to Format a Payment Request Message

Proper formatting is crucial when requesting payment from your customers. A well-organized and visually clear message not only ensures that all necessary details are easy to find but also presents your business as professional and reliable. By following a structured approach, you can help recipients quickly understand the content, which can lead to faster payment processing.

Steps to Follow for Clear Formatting

Here are the essential steps to properly format your payment request message:

- Start with a clear subject line – Make sure the subject directly reflects the content of the message. Keep it concise but informative, like “Payment Due for [Project Name] by [Due Date].”

- Use a polite greeting – Begin with a friendly and professional salutation such as “Dear [Name],”. This sets a positive tone.

- Provide detailed payment information – List all charges, including the amount due, services rendered, and relevant dates. Use bullet points or numbered lists to make it easy to read.

- Include payment instructions – Specify how the payment can be made, including payment methods and relevant details like bank account numbers or online portals.

- Set a deadline – Clearly state when the payment is due. This helps avoid any confusion or delays.

- End with a professional closing – Close the message politely with a sentence such as “Thank you for your prompt attention to this matter.” A courteous thank-you can go a long way in maintaining a positive relationship.

Formatting Tips for Enhanced Clarity

- Use short paragraphs – Break up your content into small, digestible paragraphs. Long blocks of text can be overwhelming and difficult to read.

- Highlight important details – Use bold text to highlight key information, such as the amount due and the payment deadline.

- Use a clean, professional layout – Keep the format simple with no excessive fonts or colors. A clean, organized layout looks more professional and is easier to follow.

By following these steps and tips, you can create a well

Ensuring Your Payment Request Message is Read

Ensuring that your payment request message gets noticed and read is essential to prompt action. A well-crafted message can easily be overlooked if it doesn’t stand out in a crowded inbox. By following certain strategies, you can increase the likelihood that your communication will be opened, understood, and acted upon in a timely manner.

Strategies to Improve Readability and Visibility

To maximize the chances of your message being read, consider these key tactics:

- Craft a clear and concise subject line – The subject line is the first thing the recipient will see, so make sure it clearly communicates the purpose of your message. Example: “Payment Reminder: Amount Due for [Service/Product Name]”.

- Time the message well – Send the payment request during business hours or at times when the recipient is likely to check their inbox, such as early in the morning or after lunch.

- Keep the message concise – Avoid lengthy paragraphs. Focus on the most important details and use bullet points or short sentences to make the message scannable.

- Personalize the message – A personalized greeting and a customized message tailored to the recipient’s specific transaction will grab their attention and make the message feel more relevant.

- Highlight key information – Make the amount due, payment deadline, and payment instructions stand out using bold or underlined text.

Follow-Up Strategies to Ensure Action

Sometimes, even the best formatted messages can be overlooked. If your payment request isn’t acted upon promptly, follow-up communication is necessary:

- Send a gentle reminder – If the payment deadline is approaching or has passed, send a polite follow-up reminder. Keep the tone friendly and professional.

- Check for delivery issues – If the recipient hasn’t responded, confirm that your message was successfully delivered. Sometimes, messages may get caught in spam filters.

- Offer assistance – If there is any confusion regarding the payment details, provide a way for the recipient to contact you for clarification.

By implementing these strategies, you can significantly improve the chances that your payment request will not only be read but also prompt a swift and positive response.

Choosing the Right Tone for Your Payment Request Message

The tone of your payment request plays a crucial role in determining how the recipient will respond. Striking the right balance between professionalism and politeness can encourage timely payments while maintaining a positive relationship with your customers. The tone you choose should reflect both the urgency of the request and the nature of your business relationship.

Factors to Consider When Choosing a Tone

The tone of your message will vary depending on the situation and the recipient. Consider the following factors when deciding how to approach your communication:

- Relationship with the recipient – If you have an ongoing business relationship with the recipient, a friendly and courteous tone may be appropriate. For new clients, however, you may want to maintain a more formal approach.

- Payment history – If the recipient has a history of timely payments, you can be more casual and appreciative. For overdue payments, a more neutral or formal tone may be necessary to convey the seriousness of the situation.

- Urgency of the payment – If the payment is past due, it’s important to maintain a polite yet firm tone, indicating the need for immediate attention without sounding confrontational.

Examples of Different Tones

Here are some examples of how to adjust the tone of your payment request message based on the context:

- Polite and Friendly: “Dear [Name], I hope you’re doing well. I wanted to gently remind you that the payment for [service/product] is due on [date]. We truly appreciate your business and look forward to continuing our collaboration.”

- Professional and Direct: “Dear [Name], I would like to inform you that payment for [service/product] is now due. Please make the payment by [date] to avoid any delays in service. If you have any questions, feel free to reach out.”

- Firm but Courteous: “Dear [Name], this is a reminder that payment for [service/product] is now overdue. Kindly arrange for payment at your earliest convenience. If there are any issues, please contact us to resolve them promptly.”

By selecting the appropriate tone, you can ensure that your payment request is both effective and respectful, fostering a positive business relationship and encouraging timely responses.

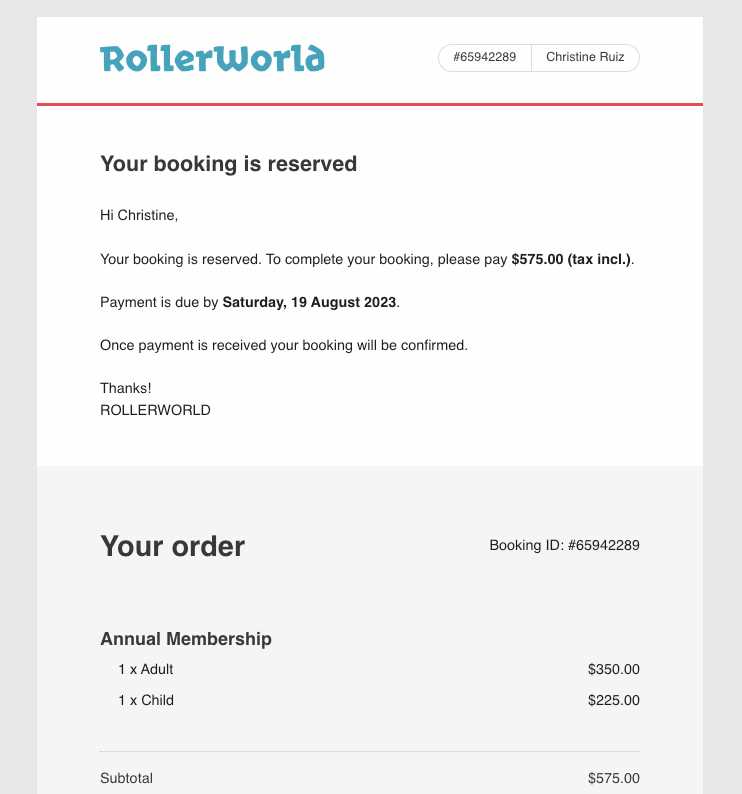

How to Include Payment Instructions Clearly

Providing clear and easy-to-understand payment instructions is essential for ensuring that the recipient can complete the transaction without confusion. Clear instructions help avoid delays and misunderstandings, making the entire process smoother for both parties. The goal is to provide all the necessary details in a simple and organized manner, so the recipient can act promptly.

To make sure the payment process is clear, consider including the following essential elements:

| Instruction Element | Details |

|---|---|

| Payment Methods | Clearly list the available payment methods such as bank transfer, credit card, or online payment platforms. |

| Account Information | Provide the relevant details needed for payment, such as bank account number, routing number, or PayPal address. |

| Amount Due | State the exact amount owed and confirm the currency if applicable, ensuring there’s no ambiguity. |

| Due Date | Highlight the payment deadline to create urgency and avoid any delays. |

| Reference Information | If necessary, include a reference number or invoice ID that should be mentioned when making the payment to ensure proper tracking. |

| Contact Details | Provide your contact information in case the recipient has any questions or needs assistance with the payment process. |

By laying out payment instructions in a structured and detailed manner, you eliminate any potential confusion and encourage timely payment. A clear, straightforward approach helps build trust and keeps the transaction professional.

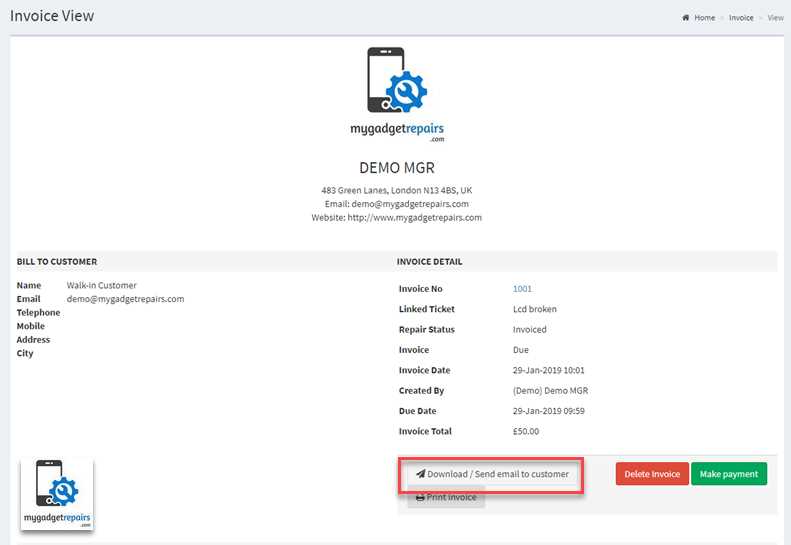

Sending Invoices on Time: A Guide

Timely submission of payment requests is critical for maintaining smooth cash flow and upholding professionalism. When payment reminders are issued promptly and consistently, they not only ensure that you receive compensation on time, but they also demonstrate a strong commitment to your business’s operations. Delaying or missing these communications can result in payment delays, missed opportunities, and strained relationships.

Why Timely Payment Requests Matter

Sending requests promptly helps in several ways:

- Ensures Cash Flow – Delays in requesting payments can lead to cash flow issues, affecting your ability to meet business expenses.

- Improves Professionalism – Consistently delivering payment requests on time reflects well on your business’s organization and reliability.

- Reduces the Risk of Forgotten Payments – Sending a request shortly after the service is completed or product is delivered increases the likelihood that payment will be made on time.

Best Practices for Timely Payment Requests

To ensure that your payment requests are sent promptly and professionally, follow these best practices:

- Set Clear Payment Deadlines – Establish clear, well-communicated deadlines in your agreement or contract to avoid confusion later.

- Use a Payment Schedule – When applicable, create a schedule that outlines when payments are expected throughout the project or service period, and follow it strictly.

- Automate the Process – Utilize tools and software that allow for automated reminders and invoicing, helping you stay on top of deadlines.

- Monitor Payment Due Dates – Keep track of when each payment is due and schedule regular reminders to stay ahead of delays.

By implementing these best practices and committing to a timely invoicing process, you help ensure that your business maintains a steady and reliable income stream while fostering professional relationships with your customers.

Follow-Up Messages for Unpaid Amounts

Following up on overdue payments is an important aspect of maintaining healthy financial operations. When payments are not made by the due date, a well-crafted reminder is necessary to prompt action while maintaining a positive relationship with the customer. The key is to remain professional, polite, and clear about the next steps. A carefully worded message will help you recover payments without damaging your reputation.

Different Approaches for Follow-Up Messages

Depending on the payment status and the relationship with the recipient, your follow-up message may vary in tone and urgency. Here are a few examples of how to approach an overdue payment reminder:

- Polite Reminder (1st Follow-Up)

For a first reminder, a friendly and understanding tone is ideal. This message assumes the recipient may have simply overlooked the payment.

- Subject: Friendly Reminder: Payment Due for [Service/Product]

- Message: “Dear [Name], I hope this message finds you well. We noticed that payment for [service/product] was due on [date]. Could you please check and arrange for payment at your earliest convenience? Let us know if you need any further details.”

- Second Reminder (Polite but Firm)

If the first follow-up was ignored, a second message should be slightly firmer, while still remaining polite and respectful.

- Subject: Reminder: Payment for [Service/Product] Due

- Message: “Dear [Name], I hope all is well. I’m writing to follow up on the payment for [service/product], which was due on [date]. We kindly ask that you make the payment by [new date]. If you have already processed this, please disregard this notice. Thank you for your attention.”

- Final Notice (Urgent and Professional)

If the payment has still not been received, a final reminder with a sense of urgency is necessary. The message should convey the seriousness of the situation, without being overly confrontational.

- Subject: Final Reminder: Payment

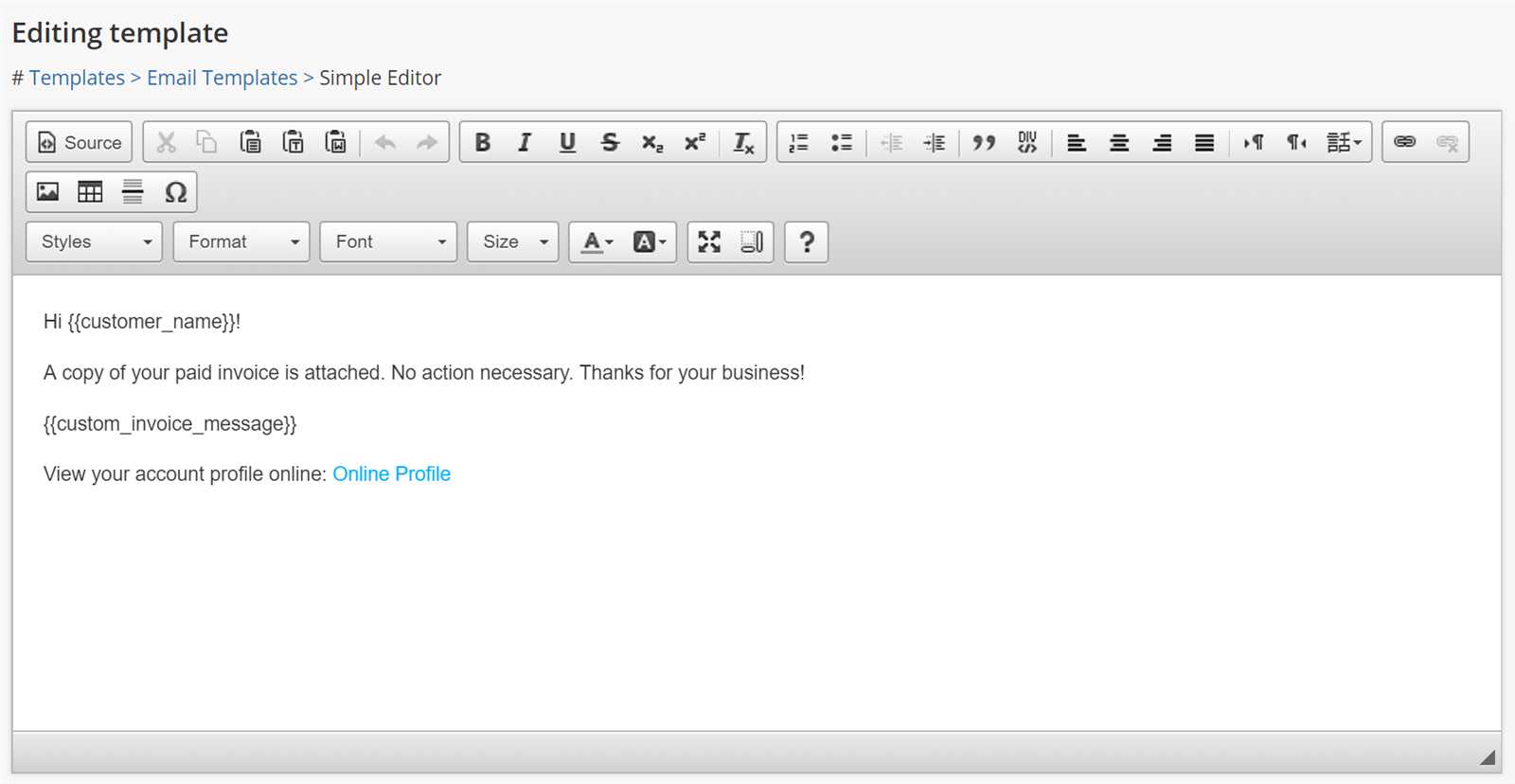

Using Automation for Payment Request Messages

Automation has become an essential tool for businesses looking to streamline their payment collection process. By automating payment reminders and related communications, you can save time, reduce errors, and ensure that your payment requests are sent on time, every time. Automation helps you stay organized and consistent while allowing you to focus on other critical tasks.

Benefits of Automating Payment Requests

Integrating automated systems into your payment request process offers several key advantages:

- Consistency – Automated systems ensure that every payment request follows the same format and is sent at the right time, reducing the risk of missing deadlines.

- Time Efficiency – Automation eliminates the need for manually creating and sending each payment request, freeing up time for other business activities.

- Accuracy – With automation, you can reduce human error by automatically populating the correct payment details, recipient information, and deadlines.

- Scalability – As your business grows, automated systems can easily handle an increasing number of transactions, without the need for additional manual work.

- Improved Cash Flow – By ensuring timely and consistent reminders, automation helps speed up payments, contributing to more predictable cash flow.

How to Automate Payment Requests

To effectively implement automation in your payment request system, follow these steps:

- Choose the Right Software – Select a platform or tool that integrates with your accounting system and allows for the customization of messages and payment schedules.

- Set Up Custom Reminders – Configure automated reminders that are sent before and after the payment due date, ensuring your recipients receive timely notifications.

- Customize the Message Content – Tailor the message templates to include personalized details, such as the recipient’s name, the amount due, and the due date, to make the communication more relevant.

- Monitor Responses – Even though the process is automated, make sure to regularly check for any responses or issues, and address them promptly to avoid payment delays.

- Review and Adjust

Common Mistakes in Payment Request Messages to Avoid

Even the most professional businesses can fall into common traps when requesting payments. Small errors in the communication process can lead to confusion, delays, or even lost revenue. By understanding and avoiding these mistakes, you can ensure your payment reminders are clear, professional, and effective in prompting action.

Common Errors to Avoid

Here are some common pitfalls businesses should be aware of when crafting payment reminders:

- Unclear Payment Details – Failing to provide specific payment instructions, such as account numbers, payment platforms, or reference information, can confuse recipients and delay payment.

- Missing Deadlines – Not clearly stating the payment due date or forgetting to mention overdue status can make it unclear when payment is expected. Always include a specific deadline.

- Overly Complex Language – Using jargon or complex terms can create misunderstandings. Aim for simplicity and clarity in every message.

- Failing to Personalize – Generic messages can make the recipient feel like an afterthought. Including personal touches, such as their name or specific details about the transaction, can create a more professional impression.

- Neglecting a Friendly Tone – A too-casual or too-demanding tone can negatively impact the relationship. It’s essential to strike the right balance between professionalism and friendliness.

- Not Following Up – Failing to send follow-up messages after a payment is overdue can result in forgotten payments. Always send polite reminders at regular intervals.

- Missing Contact Information – Not providing a way for the recipient to reach you for questions or issues can frustrate them, leading to delayed payments. Always include relevant contact details.

How to Avoid These Mistakes

To avoid these common pitfalls, implement the following strategies when crafting your payment requests:

- Be Clear and Direct – Ensure all payment information, deadlines, and methods are clearly stated and easy to understand.

- Stay Consistent – Use a consistent structure and tone in all payment messages to maintain professionalism.

- Personalize Your Messages – Include the recipient’s name and details about the transaction to make the message feel more relevant and personal.

- Follow Up on Time – Send timely reminders if payment hasn’t been made by the deadline, using a polite but firm tone.

- Include Contact Information – Always provide an easy way for the recipient to contact you should they have any questions or concerns.

By avoiding these common mistakes, you can improve y

How to Handle Payment Disputes via Communication

When a disagreement arises over a payment request, handling it efficiently and professionally is crucial to maintaining positive business relationships. A clear and well-crafted response can resolve misunderstandings quickly, while a poorly handled dispute may result in delayed payments or strained partnerships. It’s important to approach disputes with a calm, objective, and solution-focused mindset.

Steps to Resolve Payment Disputes

If a dispute arises, follow these steps to ensure a smooth and effective resolution:

- Stay Calm and Professional – Regardless of the nature of the dispute, it’s essential to maintain professionalism. Keep your tone neutral and avoid sounding defensive or confrontational.

- Review the Details Thoroughly – Before responding, carefully review the payment request, terms, and any supporting documents. Verify that there was no error on your end, and ensure that all details are accurate.

- Clearly Address the Discrepancy – Once you’ve identified the issue, clearly explain the discrepancy or misunderstanding. Provide evidence to support your position, such as contracts, agreements, or proof of delivery.

- Be Open to Discussion – If the recipient has a legitimate concern or question, show willingness to discuss the matter further. Acknowledge their point of view and work together to find an acceptable resolution.

- Offer a Solution – Propose a fair solution that addresses both parties’ concerns. Whether it’s a corrected payment amount, an extended deadline, or a discount, offering a resolution can help resolve the dispute quickly.

Best Practices for Responding to Payment Disputes

To handle disputes efficiently and effectively, keep these best practices in mind:

- Use Clear, Concise Language – Avoid ambiguity in your responses. Clearly explain the facts and proposed resolution in simple, direct language.

- Provide Supporting Documentation – Include any relevant documents such as receipts, contracts, or correspondence to back up your claims and clarify any confusion.

- Be Respectful and Empathetic – While you may feel that you are in the right, it’s important to approach the situation with respect and empathy for the recipient’s perspective.

- Set Clear Expectations – Make sure the recipient understands what steps will be taken next and what actions they need to take to resolve the issue.

- Follow Up – After the dispute has been resolved, follow up to ensure that payment is made promptly or

Legal Considerations When Requesting Payments

When requesting payments, it’s essential to understand the legal implications of the process to avoid misunderstandings or disputes. Failing to comply with local laws and regulations can lead to penalties, delayed payments, or damaged business relationships. To protect your interests and maintain legal compliance, it’s crucial to consider certain legal aspects when preparing and submitting payment requests.

Key Legal Aspects to Keep in Mind

When crafting payment requests, be aware of the following legal considerations:

- Clear Terms and Conditions – Clearly outline the terms of payment, including due dates, amounts, and any applicable fees. Having well-defined terms helps prevent disputes and ensures that both parties are on the same page regarding expectations.

- Proper Documentation – Keep accurate records of all transactions, including contracts, agreements, and payment history. These documents can serve as evidence if any issues arise or legal action becomes necessary.

- Compliance with Tax Laws – Ensure that your payment requests include all necessary tax information, such as VAT, sales tax, or withholding tax, based on the jurisdiction in which you operate. This ensures compliance with tax regulations and prevents legal issues down the line.

- Consumer Protection Laws – Be aware of consumer protection regulations that may apply to your transactions, especially when dealing with individuals or small businesses. These laws may require specific language or disclosures to ensure fair treatment of consumers.

- Late Payment Penalties – Clearly state the consequences of late payments, including any fees or interest charges. It’s important to ensure that these penalties are within legal limits and are disclosed upfront to avoid legal challenges.

Best Practices for Legal Compliance

To ensure you remain legally compliant when requesting payments, follow these best practices:

- Review Local Laws – Familiarize yourself with the legal requirements related to payment requests in your region or the region where your recipient is located. Laws regarding payment terms, interest rates, and dispute resolution can vary widely.

- Use Clear and Professional Language – Avoid ambiguous terms or vague language in your payment requests. Make sure all terms are stated clearly, leaving no room for misinterpretation.

- Provide Transparent Payment Instructions – Make sure the recipient knows exactly how to make a payment and what details are required (such as reference numbers or payment methods). Transparency reduces confusion and ensures smooth transactions.

- Seek Legal Advice When Necessary – If you’re unsure about any legal aspect of the payment request process, consult with a legal professional to ensure your business complies with relevant laws and regulations.

By considering these legal aspects and taking the necessary steps to comply with local regulations, you can reduce the risk of disputes and ensure smooth financial transactions with all parties involved.

- Subject: Final Reminder: Payment