Email Invoice to Client Template for Streamlined Billing

Effective communication with customers is key when it comes to requesting payments for goods or services. An efficient way to handle this process involves creating professional documents that outline the details of the transaction. These documents should be clear, concise, and easy to understand to ensure smooth processing of payments.

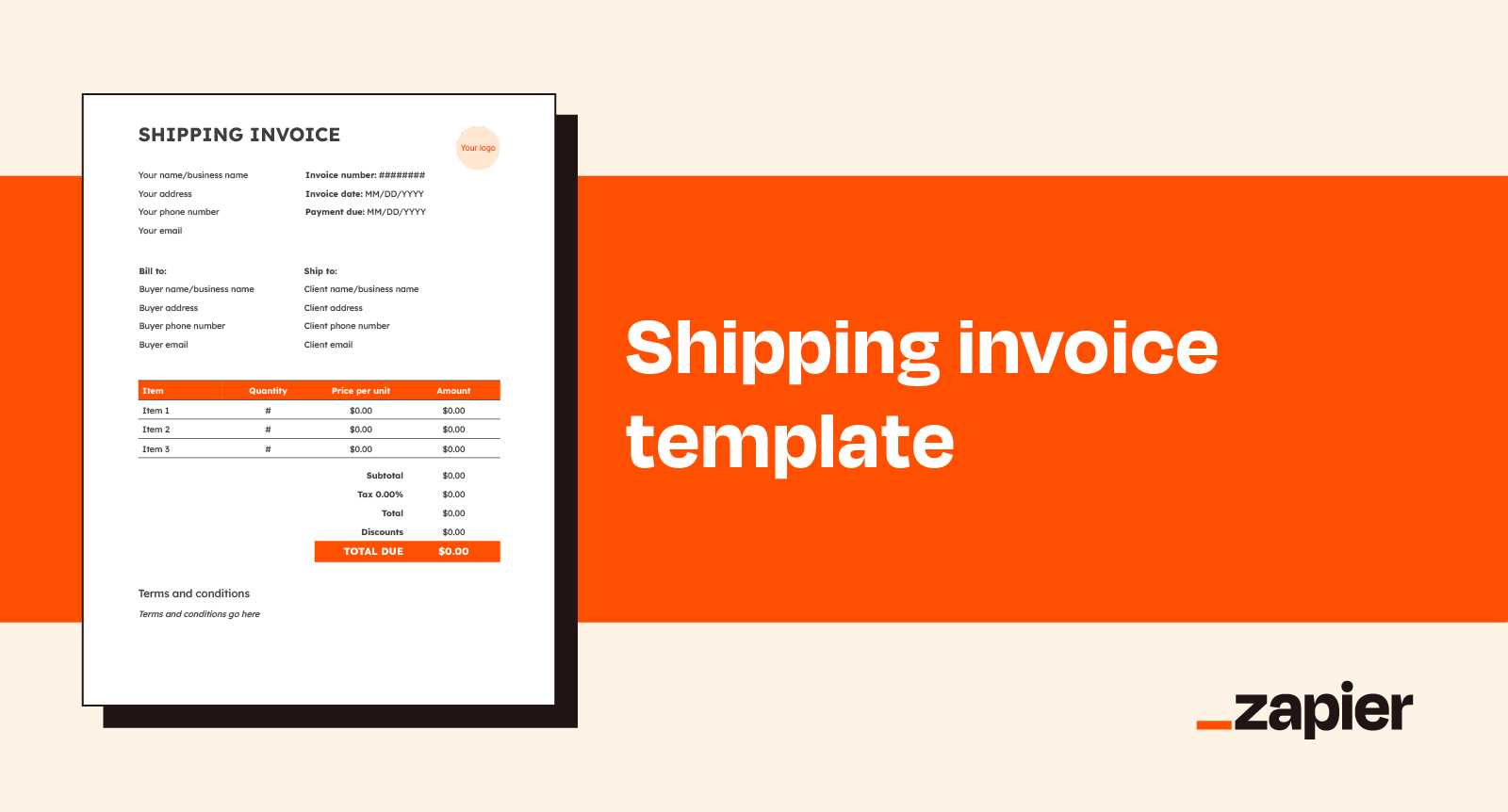

Automating this process can significantly reduce the time spent manually managing billing procedures. A well-structured document, when sent correctly, can not only save time but also maintain a professional image for your business. By using a predefined layout, businesses can create a consistent and organized approach to financial transactions.

Customized designs for these documents allow businesses to tailor the message to match their branding and specific needs. This includes adding relevant payment terms, deadlines, and other details to avoid confusion. With the right structure and approach, businesses can simplify payment requests and improve cash flow management.

Email Invoice to Client Template

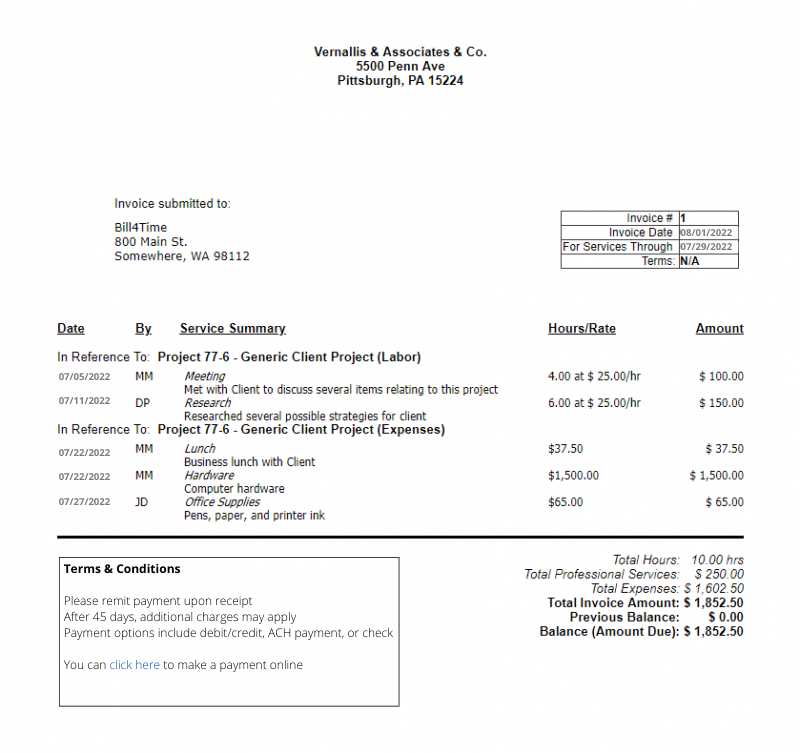

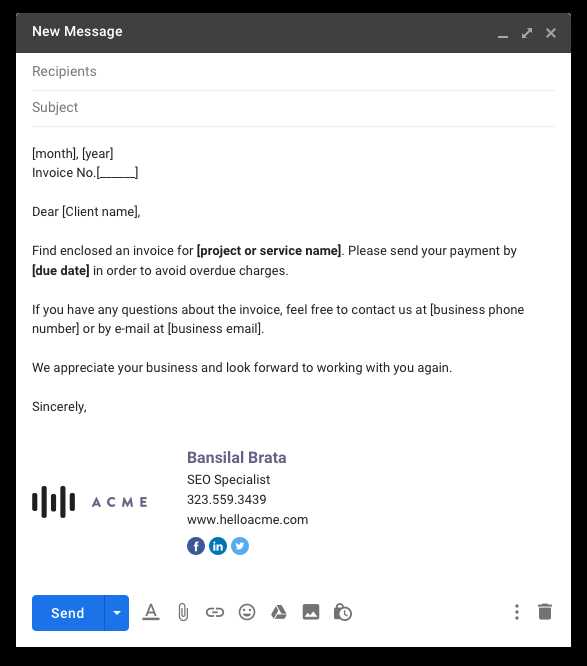

When it comes to requesting payments, having a consistent and professional approach is essential. A well-organized document helps ensure that all necessary information is communicated clearly, reducing the chances of errors or misunderstandings. This process involves creating a document that includes key details such as amounts due, services provided, and payment terms, all of which should be presented in a straightforward and accessible way.

To make the process even more efficient, utilizing a structured format can save time and maintain a uniform look for each communication. By using a reusable structure, businesses can easily send out payment requests without the need to start from scratch each time. This ensures that no important information is overlooked and helps to establish a professional image with every transaction.

Customization is also a vital component. Whether it’s adjusting the layout or adding specific instructions, tailoring the structure to fit individual needs makes each communication more relevant and personal. A clear call to action for payment, along with well-defined instructions, can help facilitate faster and smoother transactions.

Importance of Professional Invoices

Having a well-designed document for payment requests plays a crucial role in ensuring smooth financial transactions. A structured and clear document not only facilitates faster processing but also establishes credibility with the recipient. When a business sends a properly organized request for payment, it demonstrates attention to detail and professionalism.

Professional documents create a sense of trust and reliability, which can encourage timely payments and foster long-term business relationships. Whether you’re dealing with one-time customers or repeat business, the appearance and accuracy of your request can influence how the recipient perceives your business.

Clear terms and precise information in these documents are essential for avoiding misunderstandings and disputes. By including detailed breakdowns, payment deadlines, and methods, businesses can ensure that the recipient knows exactly what is expected. This level of transparency not only improves cash flow management but also strengthens overall business practices.

How to Create an Effective Invoice

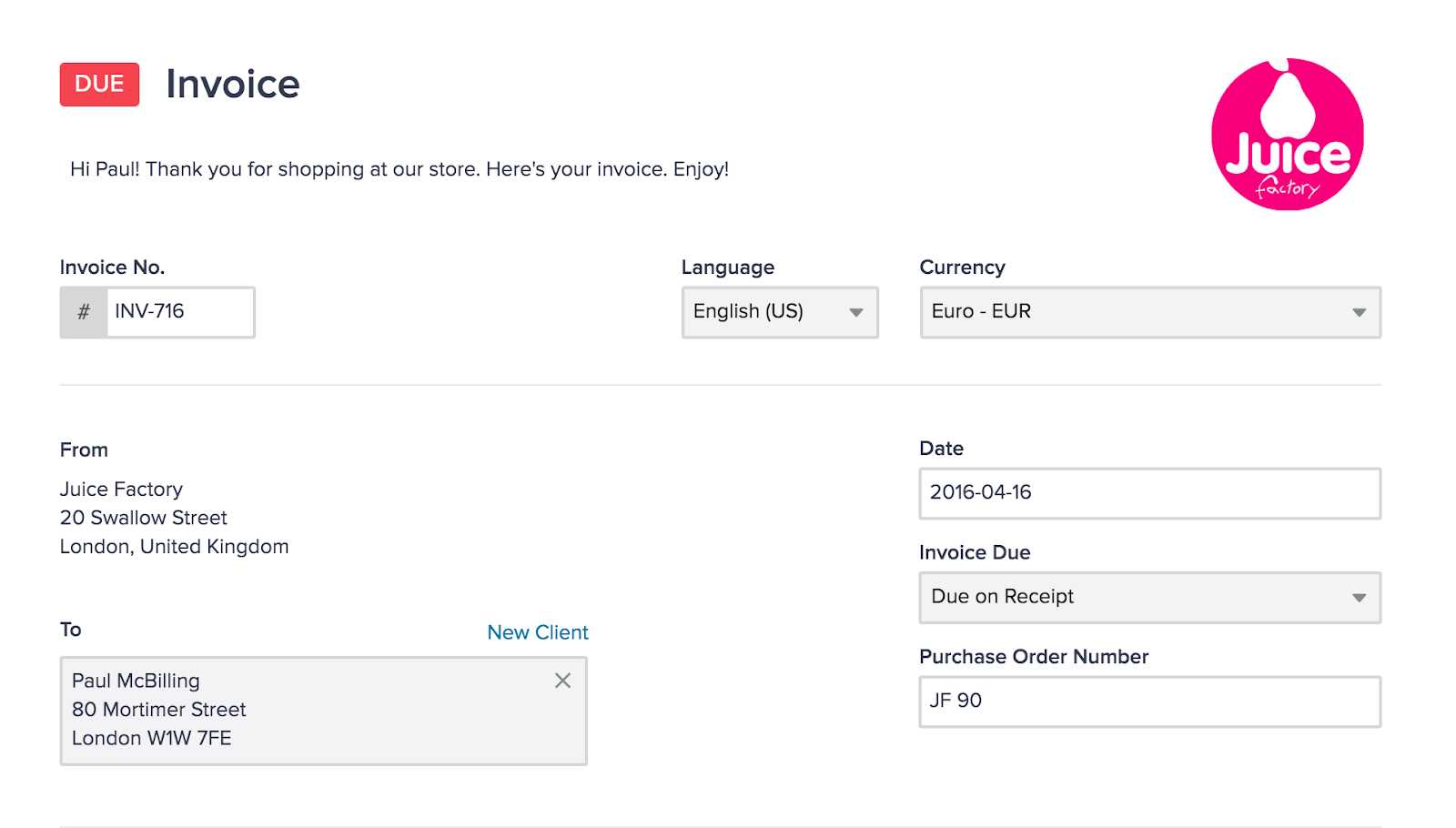

Designing a clear and efficient document for requesting payment requires careful consideration of both the structure and the content. The goal is to make the document easy to understand, while providing all the necessary details the recipient needs to process the payment quickly and accurately. An effective request should include key components such as itemized charges, payment instructions, and relevant deadlines.

One important aspect is ensuring that all information is organized logically. The document should be structured in a way that highlights important details, such as the total amount due and payment terms. Using a table format can greatly enhance readability and ensure that both parties are clear on the specifics of the transaction.

| Description | Amount |

|---|---|

| Service/Product Name | $100.00 |

| Additional Fees | $10.00 |

| Total Due | $110.00 |

By structuring the document clearly and including all essential information, businesses can ensure a smooth and efficient payment process, minimizing any potential confusion or delays.

Key Elements of an Invoice Template

When creating a document to request payment, several essential components ensure clarity and accuracy. Each part of the document should be carefully crafted to provide all necessary information, from details about the product or service to instructions for completing the payment. Including these elements helps avoid confusion and fosters a smooth financial transaction.

Essential Information

At the heart of any payment request is the inclusion of fundamental details. This includes the contact information of both parties, the date of the transaction, and a breakdown of what is being charged. Properly identifying each element ensures that both the sender and recipient are on the same page regarding the terms of the agreement.

Payment Instructions and Terms

Clearly defined instructions and deadlines are crucial for avoiding delays. The document should specify how and when payment should be made, including any late fees or discounts for early settlement. This ensures the recipient understands their obligations and the agreed-upon timeline.

| Description | Amount |

|---|---|

| Service Provided | $250.00 |

| Discount | -$20.00 |

| Total Due | $230.00 |

By organizing the document in a clear, structured way, businesses can ensure that the payment request is both professional and easy to process, minimizing the chance of errors or delays.

Best Practices for Sending Invoices

Sending a well-structured document requesting payment is only one part of the process; how and when it is sent also plays a crucial role in ensuring timely and successful transactions. By following a few best practices, businesses can optimize the process, making it easier for both parties to handle payments smoothly.

Timely Delivery

Sending your request promptly is essential to avoid any delays in payment. It’s best to send the document as soon as possible after the goods or services have been delivered. This not only helps maintain a healthy cash flow but also sets the right expectations for the recipient. The sooner the recipient receives the document, the sooner they can process the payment.

Clear Communication and Follow-Up

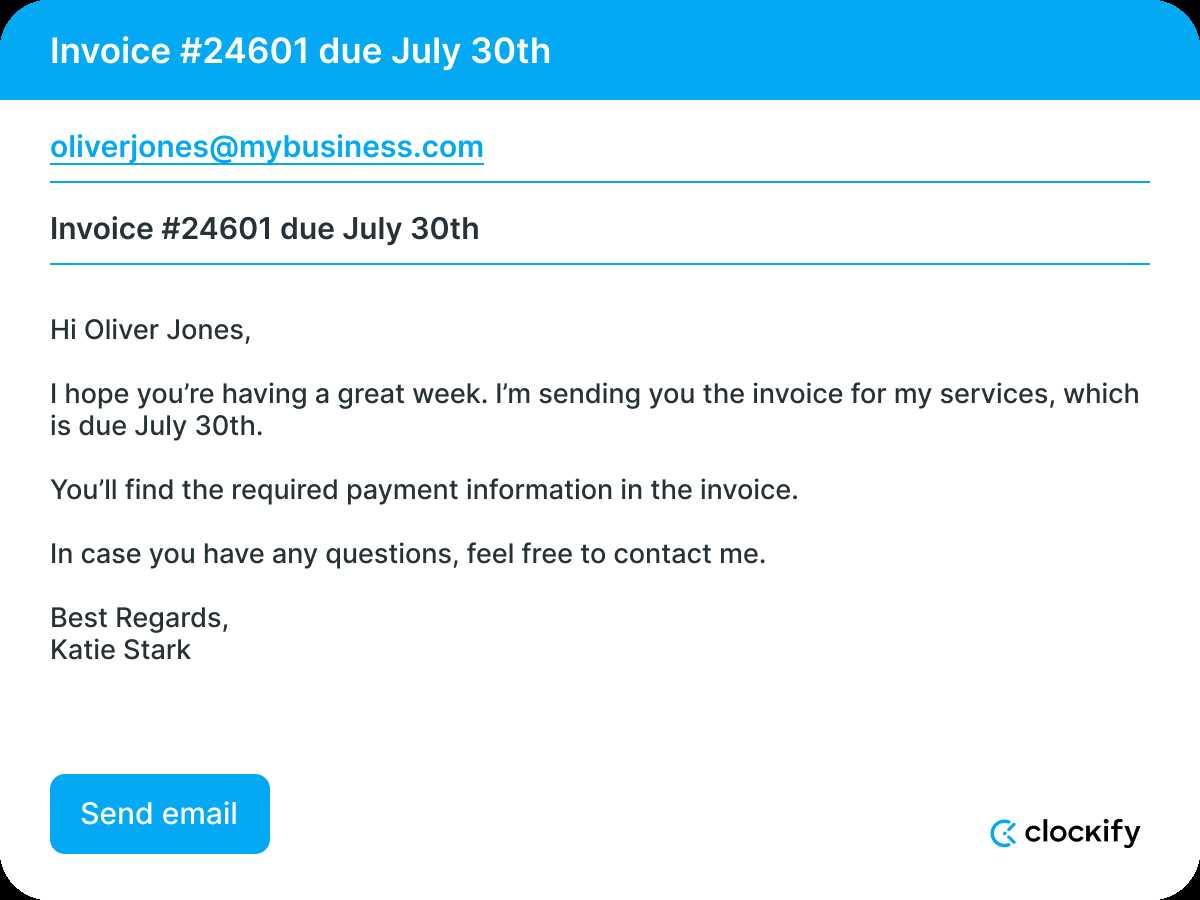

Ensure clarity by providing all necessary details in the document. If additional information is required, such as specific payment methods or reference numbers, include these instructions. After sending the request, it’s good practice to follow up if the payment hasn’t been made within the agreed time frame. A polite reminder can help avoid unnecessary delays and maintain a professional relationship.

Choosing the Right Format for Invoices

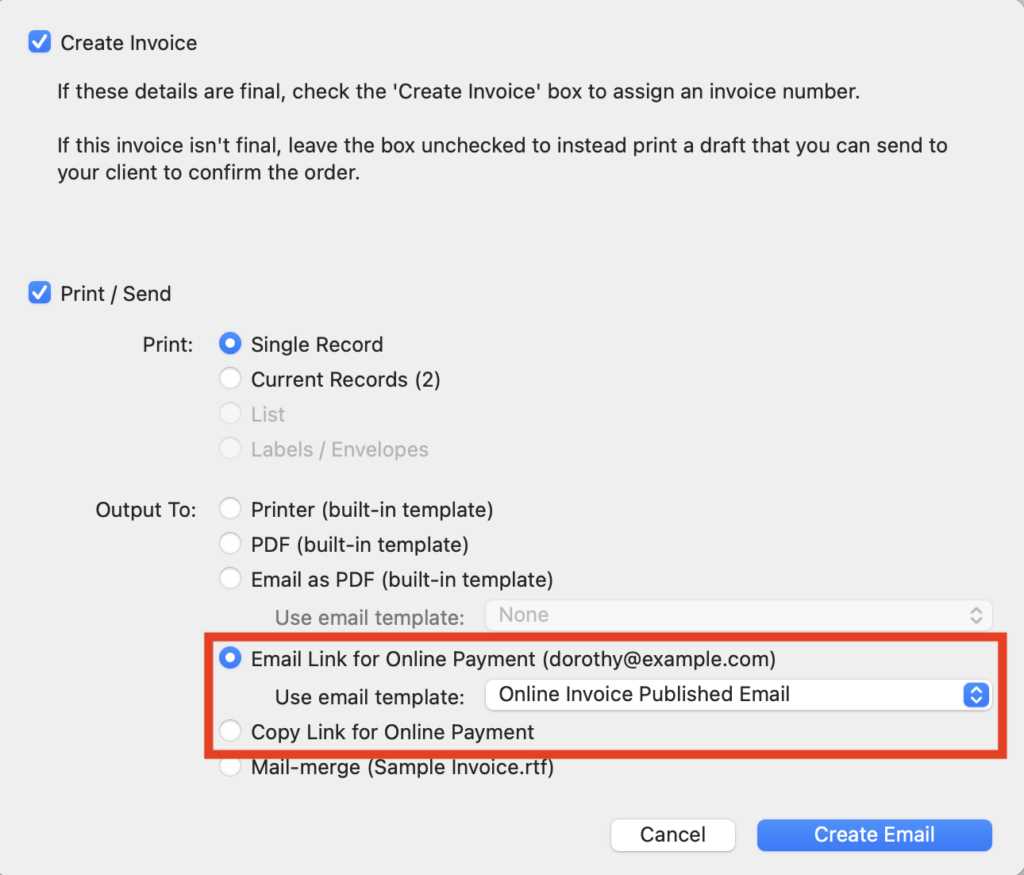

Selecting the appropriate format for requesting payment can significantly impact the efficiency and professionalism of your transactions. The right structure not only ensures that all necessary details are included but also enhances the recipient’s ability to process the payment quickly and accurately. Different formats may be suited for different types of transactions, so it’s important to consider what works best for your business needs.

Consideration for Different Formats

There are several options when it comes to formatting payment requests. Some formats are more suitable for larger businesses, while others may be better for freelancers or small enterprises. Below are some common formats to consider:

- PDF Format: Ideal for professional presentation and easy sharing across platforms.

- Word Document: Allows for customization, but may not appear as polished as a PDF.

- Spreadsheet (Excel or Google Sheets): Useful for clients who prefer detailed breakdowns and easy tracking of charges.

- Online Platforms: Some businesses use specialized software that can automate payment requests and streamline the process.

Choosing the Best Option for Your Business

Each format has its advantages depending on the scale and nature of your business. Consider the preferences of your recipients and the tools that make the most sense for your workflow. For instance, if your recipients require detailed breakdowns, a spreadsheet may be the best option. On the other hand, for a more professional look, a PDF might be preferred.

Customizing Your Payment Request Document

Personalizing your request for payment can make a significant difference in how it is received. By customizing the layout and content, you can create a document that not only reflects your business brand but also caters to the specific needs of your recipients. This approach can enhance the clarity, professionalism, and effectiveness of the communication.

Incorporating Your Brand

Branding your request is essential for maintaining consistency in all customer-facing communications. Adding your logo, business colors, and fonts helps reinforce your company’s identity and makes the document feel more professional. A branded document can also help recipients recognize the source immediately, which can improve the chances of quicker response and payment.

Personalizing the Message

Personalization goes beyond branding–it includes tailoring the message to suit each transaction. Including specific details such as project names, customer references, or discounts can make the payment request more relevant and show attention to detail. A personalized message creates a more positive experience for the recipient, fostering stronger customer relationships.

Common Mistakes to Avoid in Invoices

When preparing a document to request payment, it is crucial to avoid errors that can delay transactions or cause confusion. Small mistakes in the structure, content, or details of the document can lead to misunderstandings and may even affect cash flow. Being mindful of these common pitfalls can help ensure that the process runs smoothly for both parties.

Incorrect or Missing Information

Incomplete details can create confusion and lead to delays. Ensure that all necessary information is included, such as accurate amounts, payment deadlines, and clear descriptions of products or services. Double-checking these details before sending the document can prevent unnecessary back-and-forth and potential disputes.

Unclear Payment Terms

Ambiguous payment instructions can result in missed payments or misunderstandings about when and how the payment is due. It’s essential to clearly outline the payment methods, deadlines, and any late fees or early payment discounts. Providing clear and unambiguous terms will help the recipient understand exactly what is expected, ensuring smoother transactions.

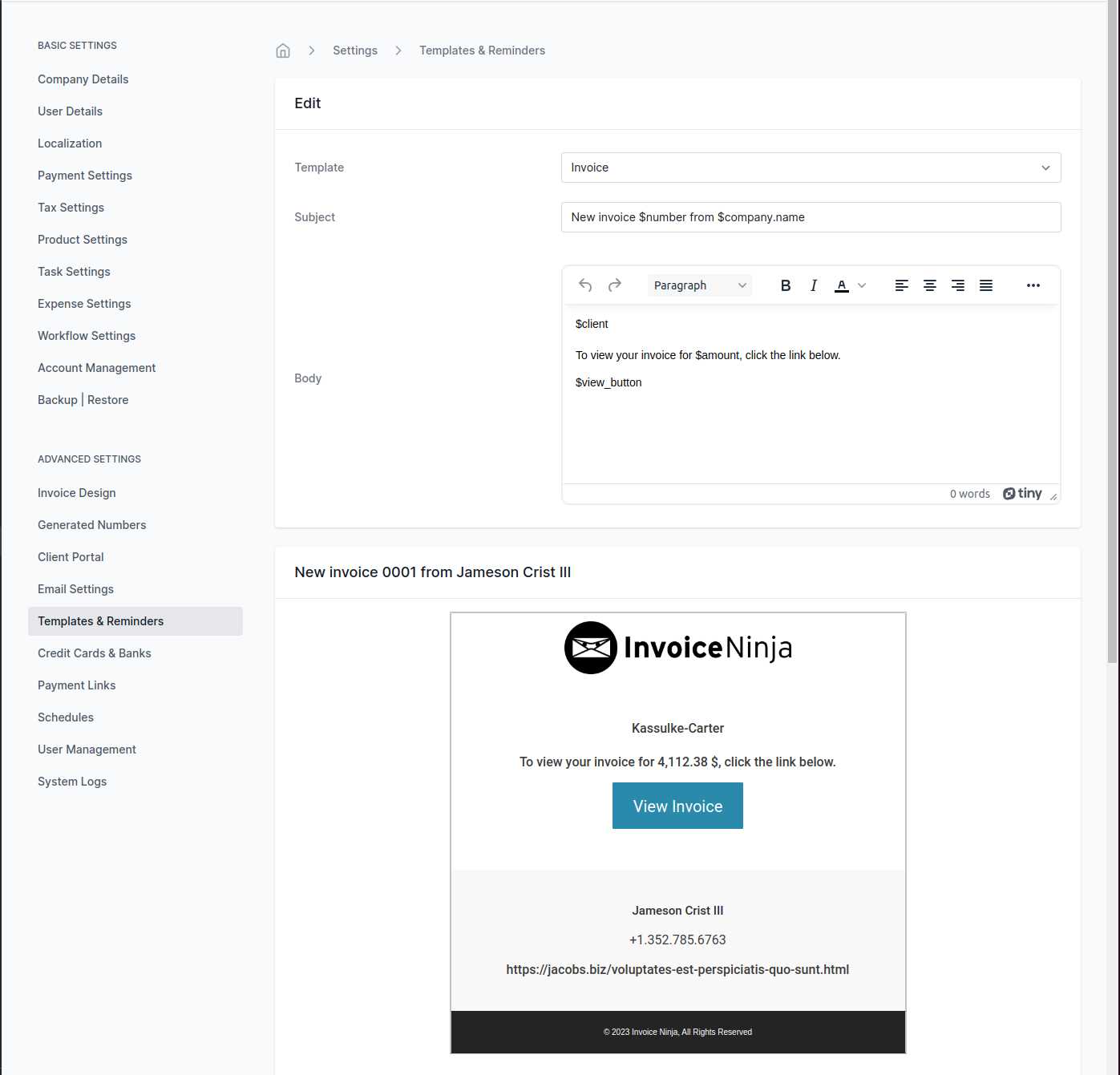

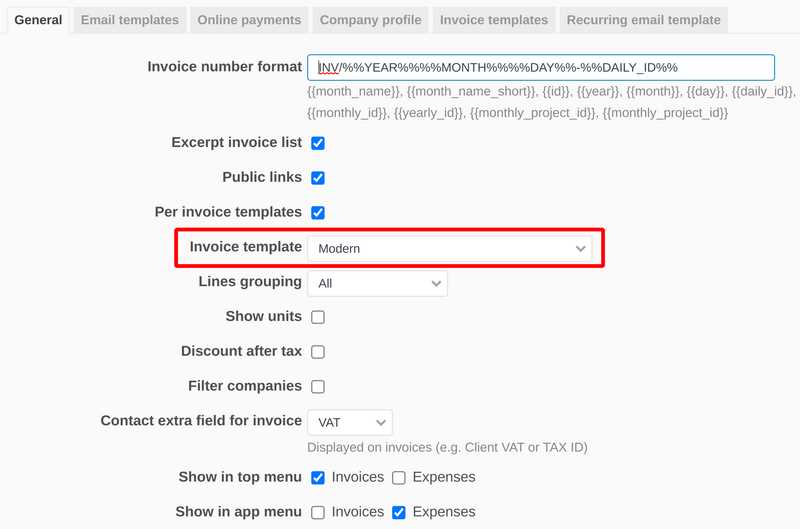

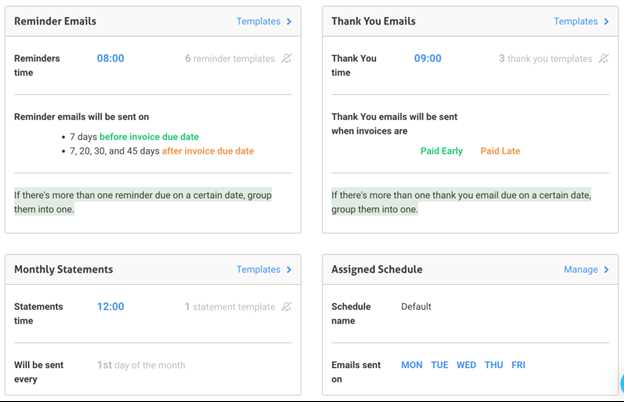

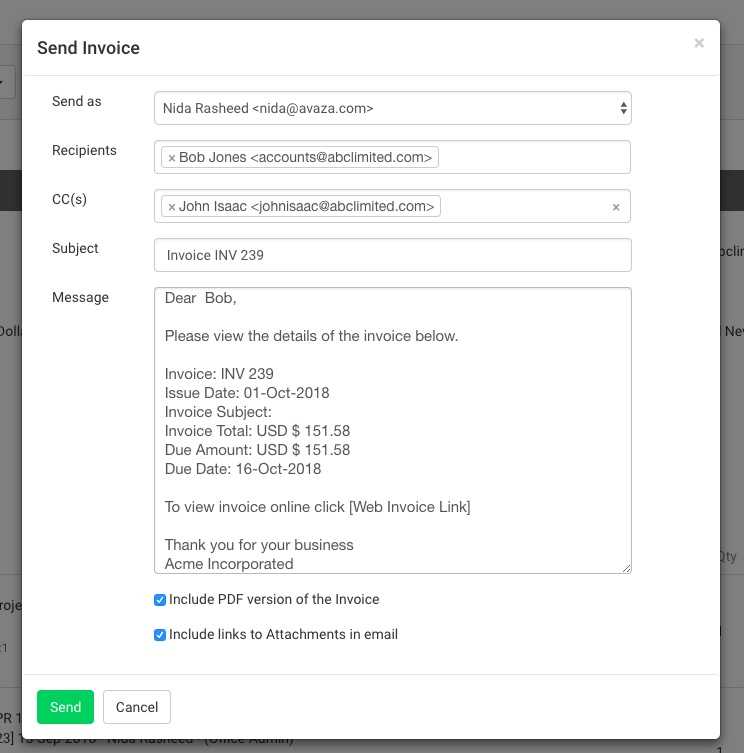

How to Automate Payment Request Sending

Automating the process of sending payment requests can save significant time and effort while ensuring consistency and timeliness. By using software or tools to streamline the sending process, businesses can reduce manual work and eliminate the risk of forgetting to send a request. Automating this task is especially useful for businesses with a high volume of transactions.

Choosing the Right Software

There are various platforms available that can help automate the sending of payment requests. When selecting a tool, consider features such as integration with accounting systems, customizability, and reporting capabilities. Below is a comparison of common options:

| Platform | Key Features | Cost |

|---|---|---|

| QuickBooks | Automated reminders, integration with accounting | $25/month |

| FreshBooks | Customizable templates, recurring billing | $15/month |

| Zoho Books | Invoice scheduling, payment gateway integration | $12/month |

Setting Up Automated Workflows

Once you’ve chosen the right platform, setting up automated workflows is the next step. This includes scheduling when payment requests should be sent, customizing the content, and selecting the recipients. Many tools allow you to set specific triggers, such as after a service is completed or a product is shipped, to automatically generate and send the request without manual intervention.

Legal Considerations for Payment Requests

When creating documents to request payment, businesses must adhere to certain legal requirements to ensure they are compliant with regulations and protect both parties. These considerations vary depending on the jurisdiction and type of transaction, but there are common standards that should always be followed to avoid disputes and ensure smooth legal processes.

Essential Legal Elements

To ensure that your request for payment is legally sound, it is important to include specific details that may be required by law. These include:

- Business Identification: Include your business name, contact details, and registration number (if applicable).

- Recipient Information: Always list the full name or company name of the recipient along with contact details.

- Clear Terms of Payment: State the amount due, the due date, and any penalties for late payment.

- Applicable Taxes: Ensure that the appropriate tax amounts are included according to local laws and regulations.

- Terms and Conditions: If applicable, reference the terms and conditions of the agreement under which the transaction is taking place.

Complying with Local Regulations

Different regions have their own rules regarding what must be included in a legally binding request for payment. It is essential to be familiar with these regulations to avoid legal complications. For instance, in some countries, certain forms of taxes or licensing details must be included in every request, while in others, the presence of a formal signature might be necessary. Ensure that you understand the local laws applicable to your business and jurisdiction to remain compliant.

Tracking Payments with Digital Requests

Effective tracking of payments is crucial for maintaining accurate financial records and ensuring timely transactions. When sending payment requests, having a reliable system to monitor whether payments have been received or are still pending can save time and reduce the chances of errors. Automated tools and digital platforms allow businesses to track the status of each payment request easily.

Key Features for Tracking Payments

To efficiently track the status of your payment requests, it’s essential to include specific features that allow for seamless monitoring. Some important aspects to consider include:

- Automated Reminders: Set up automatic notifications that alert recipients about upcoming due dates and overdue payments.

- Payment Confirmation: Ensure that your system notifies you once a payment has been processed or received.

- Tracking Links: Include unique payment links that allow customers to easily access their payment status.

- Dashboard for Monitoring: Use a centralized dashboard to view and track all outstanding requests, making it easy to follow up when needed.

Managing Outstanding Payments

Managing unpaid amounts requires a proactive approach. Implementing tools that can show which requests are overdue and tracking payment history can help you stay organized. Consider these steps to improve payment follow-up:

- Regularly check for overdue payments and prioritize them in your follow-up process.

- Send personalized reminders for overdue payments, offering payment options or discounts for early settlements.

- Use the tracking features to reconcile payments with your financial records for accuracy.

Design Tips for Payment Request Documents

The design of a payment request document plays a crucial role in ensuring clarity, professionalism, and ease of use. A well-designed document not only reflects positively on your business but also makes it easier for recipients to understand the details and process the payment. A clean, structured layout with clear sections will enhance the user experience and minimize confusion.

Keep It Clean and Simple

Simplicity is key when designing a document. A cluttered or overly complicated layout can make the document difficult to read and confusing for the recipient. Stick to a minimalist design, focusing on the essential elements like the amount due, payment terms, and recipient details. Avoid using excessive graphics or too many colors, which may detract from the document’s professionalism.

Use Clear and Readable Fonts

Choose legible fonts that are easy to read on all devices and screen sizes. Sans-serif fonts like Arial or Helvetica are often preferred for their clean lines and modern look. Ensure that the font size is large enough to be read easily without straining the eyes, particularly for important details such as payment amounts and due dates.

Organize Information Effectively

Clear structure helps recipients quickly locate key information. Use sections, bold text, or borders to visually separate different parts of the document, such as contact information, payment details, and terms. Including a table to organize product or service details is an excellent way to improve clarity and ensure all necessary information is easily accessible.

Including Payment Terms in Payment Requests

Clear and precise payment terms are essential for ensuring both parties understand when and how the payment should be made. Specifying these terms helps avoid confusion and potential delays in payment. Whether you offer flexibility with due dates or outline late fees, defining the payment conditions is key to managing expectations and ensuring smooth transactions.

Key Elements to Include

When outlining payment terms, there are several critical details that should be included to ensure clarity:

- Due Date: Clearly state the date by which the payment should be made. This eliminates any ambiguity for the recipient.

- Payment Methods: List acceptable payment options, such as bank transfers, online payment platforms, or checks, to ensure there are no delays in processing.

- Late Fees: If applicable, mention any fees that will be charged if the payment is not received by the due date.

- Discounts for Early Payment: Offering a discount for early payment can encourage prompt settlement of amounts owed.

Communicating Payment Terms Effectively

It is important to present the payment terms in a way that is easy to understand and prominently displayed within the document. Use simple language and bullet points, making sure the recipient can quickly locate this information without difficulty. Avoid lengthy or overly complex clauses that might confuse the reader or make the terms seem vague.

Using Digital Signatures in Payment Requests

Digital signatures are a secure and efficient way to authenticate documents and ensure their integrity. When used in payment request documents, they provide an added layer of trust and legal validation. Incorporating these signatures allows businesses and recipients to verify that the document has not been altered and that it is genuinely from the intended sender.

Benefits of Digital Signatures

There are several advantages to using digital signatures in payment request documents:

- Enhanced Security: Digital signatures offer a higher level of protection against fraud by using encryption methods that prevent unauthorized alterations.

- Legal Validity: Many jurisdictions recognize digital signatures as legally binding, providing assurance that the document is official and enforceable.

- Time and Cost Savings: By eliminating the need for physical signatures and paper processing, digital signatures streamline workflows and reduce operational costs.

- Faster Processing: Recipients can sign the document electronically, speeding up the approval and payment processes.

How to Implement Digital Signatures

To implement digital signatures, businesses can use various software solutions that integrate with document management systems. These tools allow for secure signature placement and tracking of the signing process. Additionally, it’s important to inform recipients about the use of digital signatures and the security measures in place to protect their information.

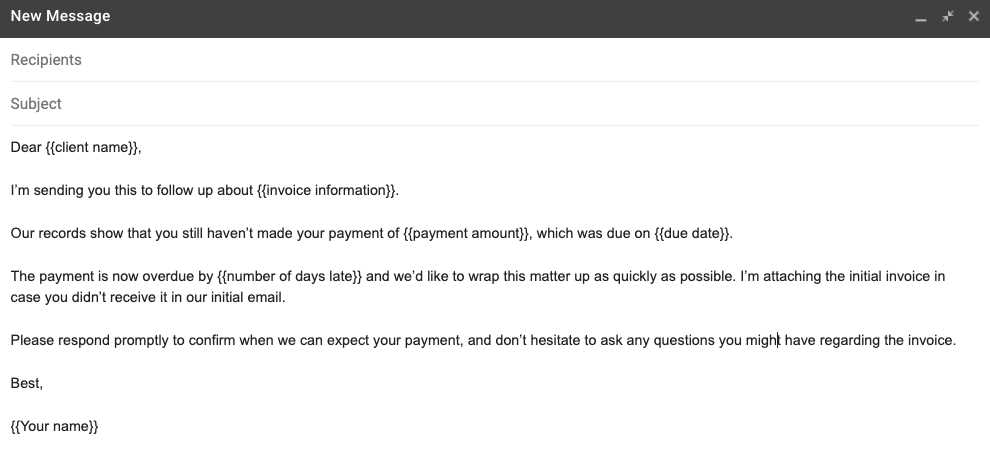

How to Handle Late Payments

Managing overdue payments is a crucial part of maintaining healthy cash flow for any business. Delays in settling financial obligations can disrupt operations and cause unnecessary stress. To effectively handle late payments, it is important to have a clear strategy that encourages prompt action while maintaining professional relationships with payers.

Steps to Address Late Payments

Here are some strategies to address late payments in a professional and effective manner:

- Send Friendly Reminders: Often, late payments are a result of forgetfulness. Sending a polite reminder shortly after the due date can encourage the payer to settle the amount without feeling pressured.

- Clarify Payment Terms: Make sure the payment terms, such as due dates and accepted payment methods, are clearly defined in your agreements and on any official documents. Ambiguity can lead to misunderstandings and delays.

- Offer Payment Extensions: For customers experiencing financial difficulties, offering a payment extension or installment plan can facilitate the process while ensuring that you receive the payment over time.

- Implement Late Fees: Charging a reasonable late fee can incentivize timely payments and discourage delays. Be sure to outline these fees clearly in the initial agreements.

- Follow Up Professionally: If a payment remains overdue, follow up with a more formal notice. This could include a direct phone call or a written notice outlining the potential consequences of continued non-payment.

When to Take Legal Action

If the payment is significantly overdue and all attempts to resolve the issue amicably have failed, it may be necessary to take legal action. This should be a last resort, as it could strain your relationship with the payer. Always ensure that your agreements include clauses on late payments and collection procedures to protect your business.

Ensuring Invoice Deliverability

Ensuring that your financial documents reach the intended recipients is vital for maintaining smooth business operations and timely payments. Issues with deliverability can lead to confusion, delayed payments, and strained business relationships. By taking the right steps, you can increase the chances that your documents are successfully delivered and opened by the recipient.

Key Factors Affecting Deliverability

Several factors can influence whether your documents reach their intended destination. Understanding these can help mitigate potential issues and ensure smooth communication.

| Factor | Impact on Deliverability | Action to Improve |

|---|---|---|

| Recipient’s Contact Information | Incorrect or outdated email addresses can prevent delivery. | Regularly update contact information to ensure accuracy. |

| File Size | Large files may get blocked by spam filters or email servers. | Keep files under the recipient’s server limit or use cloud links. |

| Subject Line and Content | Emails with suspicious subject lines or content can trigger spam filters. | Ensure professional language and avoid excessive links or attachments. |

| Email Server Reputation | Emails sent from poorly configured servers may be flagged as spam. | Use a trusted email service provider with a good sending reputation. |

| File Format | Uncommon or unsupported file formats may not be opened by the recipient. | Use widely accepted file formats like PDF for easy access. |

Best Practices for Enhancing Deliverability

To maximize the likelihood that your financial documents reach their destination and are seen by the recipient, follow these best practices:

- Confirm Contact Details: Before sending any documents, confirm the recipient’s email address and ensure it is accurate and current.

- Use Recognizable Subject Lines: Avoid generic or misleading subject lines. Instead, use clear and relevant titles that make the purpose of the message evident.

- Provide Multiple Payment Options: Including alternative payment methods can reduce friction and encourage faster action on the recipient’s part.

- Test Deliverability: Consider sending a test email to ensure it gets through to the intended recipient’s inbox and isn’t flagged by spam filters.

- Track Delivery Status: Using tools that allow you to track whether the message was delivered and opened can help you gauge the effectiveness of your delivery strategy.