Email Invoice HTML Template for Effective Billing

In today’s digital world, sending detailed and well-structured billing information is crucial for maintaining a professional image and ensuring clear communication with clients. An effective approach to this process involves using electronic formats that are both visually appealing and functional, making transactions smoother and more efficient for both businesses and their customers.

By adopting modern formats that are easy to customize and adapt, businesses can improve their workflow and provide clients with clear, professional documents that highlight essential payment details. These documents not only serve their practical purpose but also reflect a business’s commitment to quality and reliability.

Tailoring these documents to match branding guidelines and incorporating key features like payment links or tracking options can further enhance their effectiveness. The ability to automate the creation of these communications also reduces administrative workload, allowing for faster processing and fewer errors.

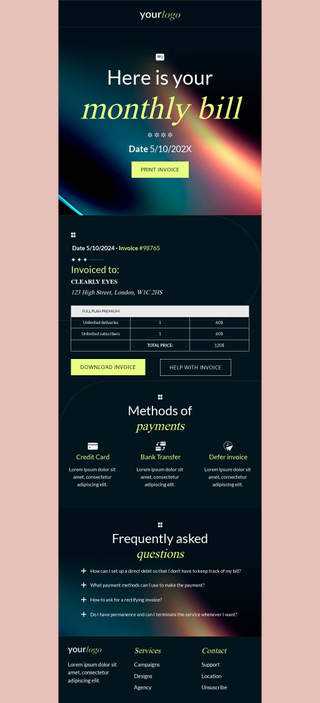

Email Invoice HTML Template

Creating a structured and professional document for financial transactions is essential for businesses that want to streamline their communication with clients. A well-organized format not only ensures clarity but also adds a touch of professionalism, enhancing the overall client experience. With the right design and functionality, such documents can be easily customized to fit various business needs while remaining user-friendly and efficient.

Key Features of a Professional Billing Format

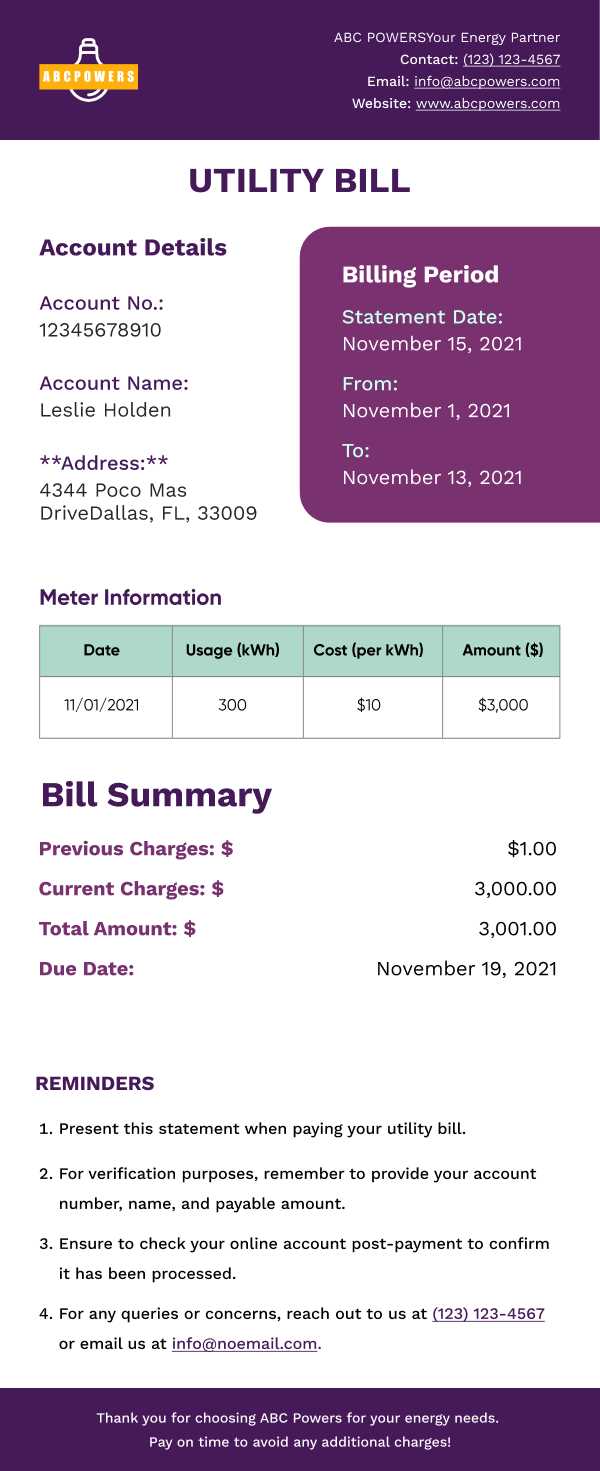

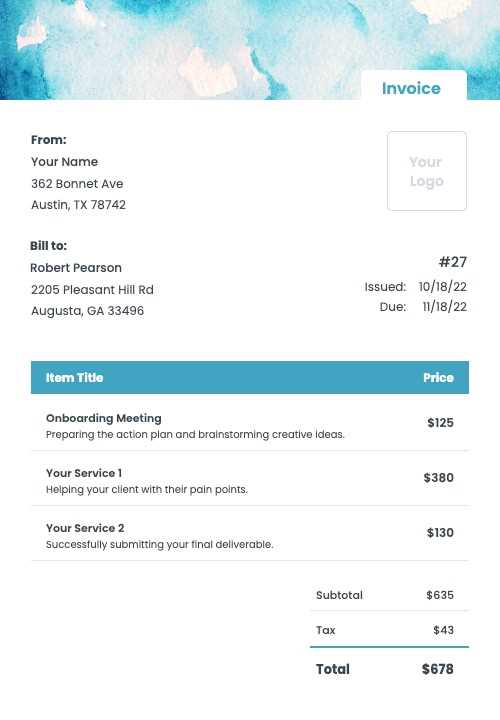

When designing a financial document, it’s important to include all necessary information in a clear and concise manner. Elements like transaction details, payment instructions, and contact information should be easily accessible and prominently displayed. Customization options can also be integrated to reflect the brand’s identity, such as logos, color schemes, and font styles, which make the communication more personalized and aligned with the company’s image.

Optimizing for Readability and Compatibility

Incorporating a clean, organized structure is crucial to ensure that clients can quickly understand the key details of the transaction. Additionally, compatibility across various devices and platforms is essential. Ensuring that these documents display correctly across all devices–whether viewed on a desktop or mobile–will improve the user experience. Testing across multiple email clients and browsers will help avoid formatting issues and ensure smooth delivery every time.

Understanding Email Invoices and Their Benefits

In the modern business environment, electronic billing systems offer a streamlined approach to managing financial transactions. These digital communications are designed to convey key details of payments in a clear and professional manner, providing both businesses and clients with an efficient method of tracking and processing payments. The shift towards these solutions has become increasingly important as companies look for ways to simplify their administrative tasks and enhance customer service.

Time-Saving and Efficiency

One of the primary benefits of using digital billing solutions is the significant reduction in the time required for document creation and distribution. Traditional paper-based methods often involve delays in preparation, printing, and mailing. With digital formats, businesses can instantly generate and send detailed billing information to clients, reducing the administrative workload and speeding up the entire payment cycle. Automation features also allow businesses to schedule recurring documents and minimize manual input.

Enhanced Accuracy and Tracking

Another key advantage is the improved accuracy of digital documents. Manual entry errors, which are common with paper forms, are minimized when generating digital records. Moreover, businesses can easily track the delivery and receipt of these documents, ensuring clients receive their billing statements on time. This system provides clear insights into the status of each transaction, making it easier to follow up on overdue payments or address potential discrepancies.

Why Choose HTML for Invoices

Using a web-based format for generating and sending financial documents has become an increasingly popular choice among businesses due to its flexibility and ease of customization. The digital nature of these documents allows companies to create visually appealing and functional communications that are compatible with various devices and platforms. Unlike traditional methods, this approach ensures that businesses can maintain a professional image while streamlining their billing processes.

Advantages of Web-Based Formats

Here are some key reasons why businesses should consider using this approach:

- Customizability – You can easily tailor the look and feel of the document to match your brand’s identity, from logos to color schemes and fonts.

- Responsive Design – These documents automatically adjust to different screen sizes, ensuring they look great on both desktop and mobile devices.

- Fast Distribution – You can send digital documents instantly, speeding up the process and reducing the time required to deliver important information.

- Easy Integration – Web-based formats can be integrated with payment systems, allowing you to include clickable payment links directly in the document.

Improved Tracking and Security

Digital formats also offer advanced tracking features. Businesses can monitor when a document is opened, ensuring that clients receive and view their billing information. Additionally, these documents can be secured with encryption, preventing unauthorized access to sensitive data. By opting for this approach, companies not only enhance their operational efficiency but also provide a higher level of security for both their business and their clients.

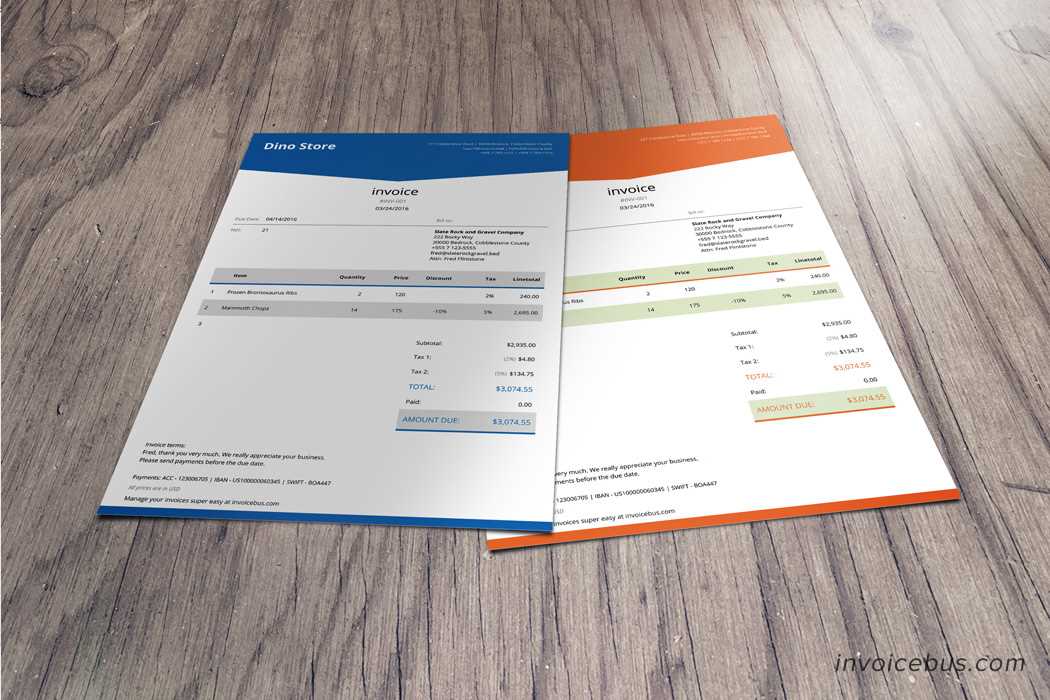

Essential Elements of an Invoice Template

To ensure clarity and professionalism in financial documents, it is crucial to include several key elements that provide both businesses and clients with all necessary details. A well-structured document not only facilitates smooth transactions but also enhances trust and transparency between both parties. By carefully considering the content and layout, companies can ensure that their communications are both effective and easy to understand.

Key Information to Include

Here are the essential components that should be featured in every professional billing document:

- Business Information – Include your company’s name, address, contact details, and logo to make the document easily identifiable and consistent with your brand identity.

- Client Information – Clearly display the client’s name, address, and any other relevant contact details to ensure proper identification of the recipient.

- Transaction Date – The date when the document is issued should be clearly visible, indicating when the payment is due.

- Payment Details – Clearly list the items or services provided, their quantities, unit prices, and the total amount due, ensuring there are no ambiguities about the charges.

- Payment Instructions – Include clear instructions on how to make the payment, whether by bank transfer, credit card, or another method. Adding clickable payment links can streamline the process further.

Additional Features to Enhance Functionality

In addition to the basic elements, consider incorporating these features to improve functionality:

- Due Date – Highlight the deadline for payment to ensure clients are aware of when the payment is expected.

- Unique Reference Number – Including a unique reference number helps track and match payments with ease.

- Terms and Conditions – Briefly outline any terms regarding late fees, refunds, or other important business policies related to payments.

Creating a Professional Invoice Layout

Designing a well-organized and visually appealing layout for financial documents is crucial for creating a lasting professional impression. A clean and structured layout ensures that all essential information is easily accessible, while also making the document look polished and credible. By paying attention to details like spacing, typography, and alignment, businesses can create an effective document that is both functional and aesthetically pleasing.

Focus on Readability

One of the key principles in designing a professional layout is ensuring that the content is easy to read and understand. Use clear, legible fonts and maintain a consistent style throughout the document. Important information such as transaction details, due dates, and payment instructions should be highlighted with appropriate headings and bold text. Whitespace is equally important; avoid clutter by leaving enough space between sections to make the document appear clean and well-organized.

Consistent Branding and Visual Elements

A professional layout should reflect your brand identity. Incorporate your company logo, brand colors, and a consistent font style that aligns with your corporate materials. However, it’s important to maintain a balance – excessive use of logos or colors can detract from the document’s clarity. Keep the design simple yet elegant, focusing on delivering the necessary information in a way that is visually pleasing and easy to navigate. Subtle design elements, such as borders or shaded sections, can help break the content into manageable chunks while maintaining a cohesive look.

Customizing Email Invoices for Your Brand

Personalizing your financial documents is an essential step in maintaining a consistent brand presence across all communications. Customization allows you to align these documents with your company’s identity, making them easily recognizable and more professional. By integrating your brand’s visual elements, you can enhance the overall experience for your clients and reinforce your company’s image.

Branding Elements to Include

To create a cohesive look, include your company logo, business name, and contact information at the top of the document. Additionally, choosing a color palette that matches your brand’s visual identity helps make the document feel like an extension of your marketing materials. The font style should also be consistent with your other communications, ensuring a unified and professional appearance. Subtle elements such as customized borders or background colors can further enhance the layout while keeping it functional.

Personalized Messages and Payment Instructions

Incorporating personalized elements such as a custom message or thank-you note at the end of the document can help build better relationships w

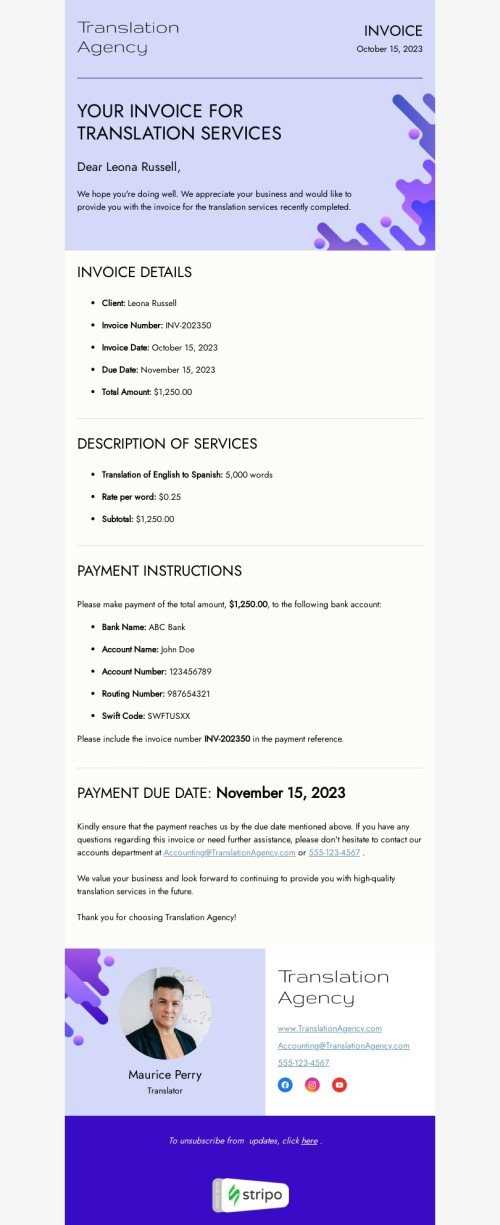

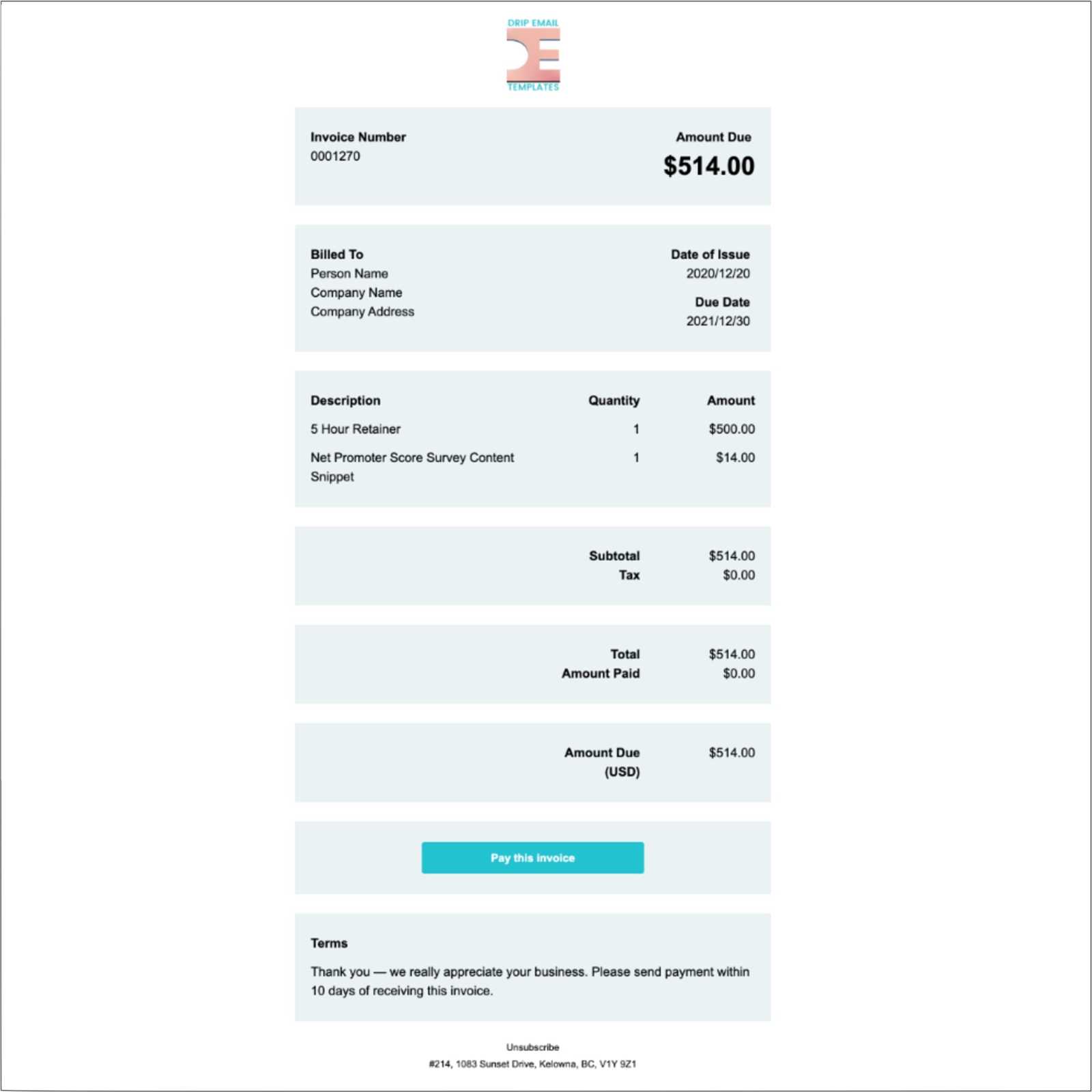

How to Add Payment Information to Templates

Including clear and accurate payment details is a crucial part of any financial document. By providing clients with all necessary instructions and options, businesses can ensure that the payment process is smooth and straightforward. The key to effective payment information is clarity–clients should easily understand how to make their payments, and all essential details should be easy to find.

Key Payment Information to Include

When adding payment details, make sure to cover the following elements:

- Payment Methods – List all available payment options, such as bank transfers, credit card payments, or online payment platforms.

- Account Details – Provide the necessary account numbers, routing codes, or links for digital payment gateways.

- Due Date – Clearly state the deadline by which payment should be received to avoid late fees or penalties.

- Amount Due – Reiterate the total amount owed, including taxes, discounts, or any additional charges.

Formatting Payment Information for Clarity

To ensure your clients can quickly access payment instructions, format the payment section clearly and distinctly from other content. Use bold text to highlight critical details such as the amount due and payment deadlines. Organize the information into bullet points or numbered lists for easy reading. Additionally, including clickable payment links or QR codes can provide clients with a seamless payment experience directly from the document.

Optimizing HTML Invoices for Mobile Devices

As mobile usage continues to grow, it’s essential that your financial documents are easily accessible and readable on smartphones and tablets. A well-optimized layout ensures that recipients can quickly view and process billing details, regardless of the device they use. By focusing on responsive design and ensuring that all critical information is visible without zooming or excessive scrolling, you can enhance the user experience and make payment processes more efficient.

Best Practices for Mobile Optimization

When designing for mobile, consider the following tips to ensure your document remains functional and easy to navigate:

- Responsive Design – Ensure the layout adapts to different screen sizes by using a fluid layout that automatically adjusts based on the device.

- Font Size – Use larger, readable fonts to ensure that text is legible without the need to zoom in. Avoid tiny font sizes that might be hard to read on small screens.

- Concise Content – Keep the content clear and to the point. Remove any unnecessary elements or large blocks of text that can overwhelm mobile users.

- Easy Navigation – Arrange the document in a single-column format, ensuring users can scroll smoothly and avoid horizontal scrolling.

Key Elements for Mobile-Friendly Design

Here are specific elements to focus on for optimal mobile viewing:

- Clear Call-to-Action – Make sure payment buttons or links are easy to click on smaller screens by making them large and well-spaced.

- Visual Hierarchy – Use bold text, headings, and spacing to guide users’ eyes to the most important details, such as the amount due and payment instructions.

- Minimalist Design – Avoid clutter by removing unnecessary graphics or background images that can distract from the main content.

By incorporating these practices, businesses can create documents that not only look great on any device but also improve the client’s ability to quickly and easily process payments on the go.

Ensuring Compatibility Across Email Clients

To ensure a seamless experience for recipients, it’s important to design your documents with compatibility in mind. Different email platforms render content in various ways, and some may display your document incorrectly or fail to display certain elements altogether. By following best practices and testing your content across a range of email clients, you can avoid issues and deliver a consistent, professional experience to all users, regardless of the platform they use.

Common Compatibility Issues

There are several challenges that may arise when trying to ensure compatibility across various email platforms:

- Rendering Differences – Not all email clients support the same coding standards, leading to variations in how content is displayed.

- Font Support – Some email clients do not support custom fonts, meaning the default fonts may be used instead, affecting the document’s visual appearance.

- Image Blockers – Some platforms may block images by default, which can affect the layout if your document relies heavily on visuals.

- Responsive Design Issues – On mobile devices, certain email clients may fail to render responsive designs properly, making content hard to read or navigate.

Best Practices for Cross-Client Compatibility

To overcome these challenges and ensure consistent viewing across different platforms, consider the following strategies:

| Best Practice | Benefit |

|---|---|

| Use inline CSS | Improves compatibility, as some email clients do not support external stylesheets or embedded CSS. |

| Test in multiple email clients | Ensures that your document renders correctly across popular platforms like Gmail, Outlook, and Apple Mail. |

| Avoid relying on images for key content | Prevents issues if images are blocked or fail to load on some clients. |

| Use table-based layouts for structure | Ensures a more consistent layout across email clients, especially in older versions. |

By following these practices, you can enhance the likelihood that your document will display correctly across a range of email clients, improving both readability and overall user experience.

Automating Invoice Generation with HTML Templates

Automating the creation of financial documents can save businesses significant time and effort. By utilizing automated systems, you can quickly generate documents with accurate, up-to-date information without manual input. This process eliminates errors, ensures consistency, and speeds up the entire billing cycle. With the right tools in place, businesses can seamlessly integrate data from various sources, ensuring invoices are ready for delivery as soon as needed.

How Automation Enhances Efficiency

Automation streamlines the entire billing process by eliminating the need for repetitive tasks. Instead of manually entering details such as amounts, dates, or client information, an automated system can pull this data directly from a database or accounting software. The document layout remains consistent, and updates are reflected instantly across all generated documents. Key benefits include:

- Time Savings – Automatically generates documents, allowing employees to focus on more valuable tasks.

- Reduced Errors – By pulling data directly from reliable sources, human error is minimized.

- Consistency – The format, layout, and information presented in each document are uniform, maintaining a professional appearance across all communications.

Tools for Automating Document Creation

There are several software tools and platforms available that can assist in automating the document generation process. These tools typically integrate with other business systems, allowing data such as client names, amounts, and payment terms to be automatically populated. Many platforms also offer customizable fields to suit the unique needs of a business, ensuring that each document is tailored to specific requirements.

By automating this process, businesses can enhance their operational efficiency, reduce administrative burden, and improve accuracy in financial documentation.

Best Practices for Email Invoice Design

Designing professional and clear financial documents is key to ensuring recipients understand the billing details and can process payments efficiently. A well-structured and visually appealing layout helps convey important information in an organized manner. By following best practices in design, businesses can improve user experience, reduce misunderstandings, and enhance the overall professionalism of their communications.

Key Design Elements

When designing a billing document, several important elements contribute to a seamless and user-friendly experience:

- Clear Branding – Include your company logo and brand colors to create a cohesive look and strengthen your brand identity.

- Readable Fonts – Use easy-to-read fonts and maintain proper contrast between text and background to improve readability.

- Concise Information – Ensure that all relevant details, such as amounts, dates, and payment instructions, are easy to find and clearly formatted.

- Responsive Layout – Design with mobile responsiveness in mind, ensuring your document looks great on any device.

Best Practices for Formatting and Layout

Creating a professional and well-organized layout is essential for making documents easy to navigate. Follow these best practices to enhance the structure:

- Simple Structure – Use a clean, organized layout with distinct sections (e.g., header, itemized list, payment details) to improve readability.

- Clear Call-to-Action – Highlight the payment button or link to ensure recipients can quickly take action.

- Consistent Alignment – Align text, tables, and columns consistently to create a polished and structured appearance.

- Limit Graphics – Avoid excessive use of images or graphics that might distract from the main content.

By adhering to these design principles, businesses can ensure that their documents are not only visually appealing but also functional, ensuring a smooth and efficient payment process for their clients.

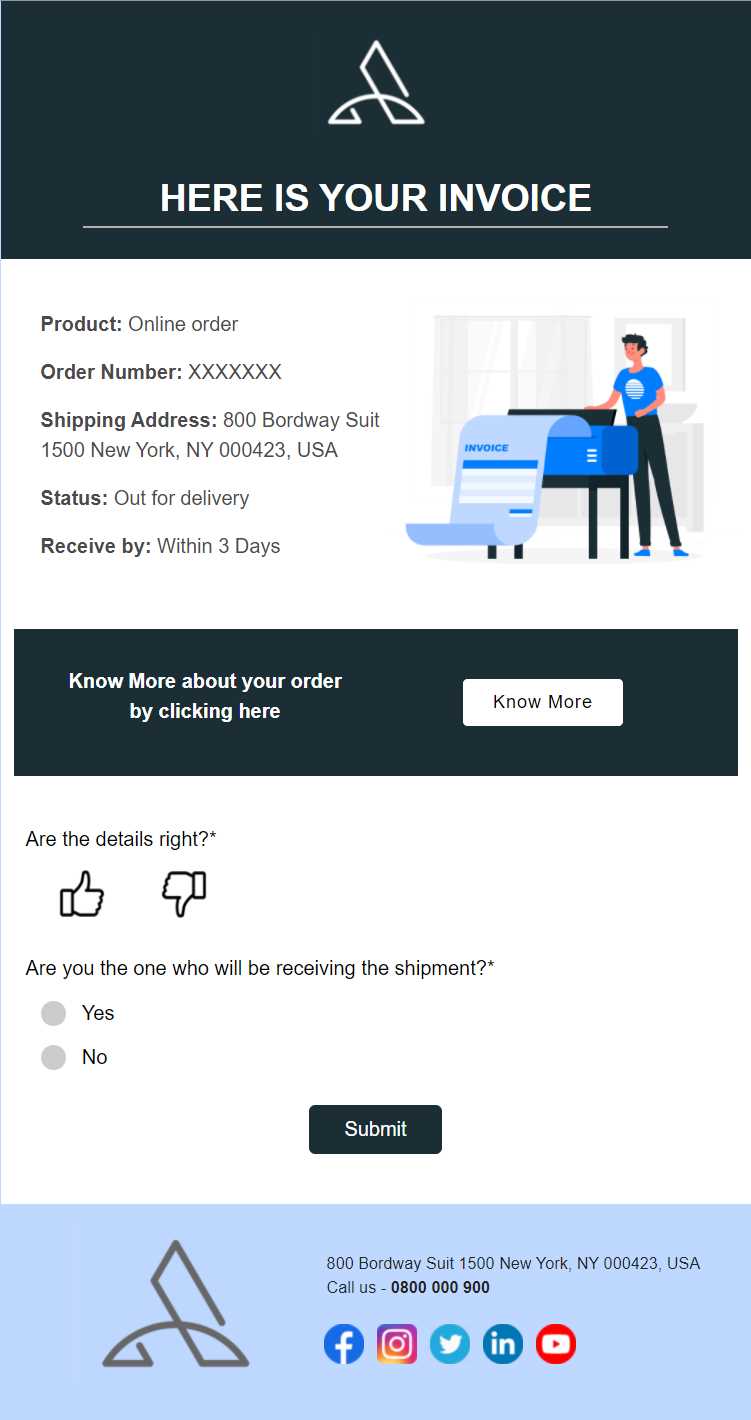

Adding Interactive Features to HTML Invoices

Interactive elements can greatly enhance the functionality and user experience of financial documents. By incorporating features that allow recipients to interact directly with the content, businesses can streamline the payment process and provide additional value. These features can range from clickable payment links to dynamic data fields that automatically update based on user input, making the document more efficient and user-friendly.

Interactive Elements to Enhance User Experience

Incorporating interactive features can make financial documents more engaging and functional. Here are some key elements to consider:

- Clickable Payment Links – Provide direct links to payment gateways so recipients can quickly complete transactions.

- Interactive Data Fields – Allow clients to update certain fields, such as payment amounts or quantities, directly within the document.

- Dynamic Calculations – Include automatic calculations for totals or taxes that update when input data is changed.

- Embedded Forms – Add forms for feedback or for clients to request further information or support without leaving the document.

Example of Interactive Features in Action

Here is an example table layout that integrates interactive elements for a more dynamic user experience:

| Item | Quantity | Price per Unit | Total |

|---|---|---|---|

| Product A | $10.00 | $10.00 | |

| Product B | $15.00 | $15.00 | |

| Grand Total | $25.00 | ||

function calculateTotal() {

var quantityA = document.getElementById(‘quantityA’).value;

var quantityB = document.getElementById(‘quantityB’).value;

var totalA = 10 * quantityA;

var totalB = 15 * quantityB;

document.getElementById(‘totalA’).innerText = ‘$’ + totalA.toFixed(2);

document.getElementById(‘totalB’).innerText = ‘$’ + totalB.toFixed(2);

document.getElementById(‘grandTotal’).innerText = ‘$’ + (totalA + totalB).toFixed(2);

}

By adding such features

Tracking and Monitoring Sent Invoices

Tracking and monitoring sent financial documents is essential for businesses to ensure timely payments and maintain proper records. By keeping track of these documents, companies can monitor whether recipients have received and viewed the files, ensuring that no communication is missed and that follow-ups can be made promptly. Effective tracking also provides insights into customer behavior, helping to identify any delays in processing payments and improving overall cash flow management.

Key Features for Tracking Financial Documents

There are several key features that can help businesses track and monitor the status of sent financial records:

- Read Receipts – Enable tracking to confirm when the recipient opens the document.

- Delivery Confirmation – Get notifications when the document is successfully delivered to the recipient’s inbox.

- Payment Links Tracking – Monitor when a recipient clicks on the payment link or accesses the payment gateway.

- Reminder Automation – Set automated reminders to notify recipients of outstanding payments or actions needed.

- Document History – Maintain a history of all documents sent, including timestamps and any changes made to the content or payment details.

Methods of Tracking and Monitoring

To effectively track and monitor sent financial documents, businesses can use the following methods:

- Cloud-Based Platforms – Use cloud services with built-in tracking features to store and manage documents, providing easy access and status updates.

- Custom Analytics – Implement analytics tools that allow businesses to track user interactions with documents, including time spent on viewing and clicking links.

- Manual Follow-Ups – In cases where automated tracking is unavailable, businesses can create follow-up schedules to manually check if payments have been received.

By adopting these tracking and monitoring methods, businesses can enhance their financial management process, ensuring that records are properly handled and payments are collected on time.

Security Considerations for HTML Invoices

When handling electronic financial documents, ensuring their security is paramount to protect both your business and your clients. These documents often contain sensitive information, such as payment details and personal data, which can be targeted by cybercriminals. It is essential to take preventive measures to secure the transmission and storage of these files to avoid unauthorized access, data breaches, and fraud.

One critical aspect is securing the channels through which these documents are sent. Using encrypted communication channels ensures that the information remains private and cannot be intercepted during transmission. Additionally, ensuring the document itself is protected with encryption or password protection provides an extra layer of security, safeguarding against unauthorized viewing or tampering.

Another important security measure is verifying the authenticity of the recipient before sending the document. This can be achieved by employing secure authentication methods, such as multi-factor authentication, to confirm that the intended recipient is authorized to receive the financial information.

Furthermore, businesses should also focus on implementing robust internal security protocols to protect their systems from external threats. Regularly updating software and using firewalls and anti-malware tools can help prevent cyberattacks aimed at stealing sensitive data.

By taking these security considerations into account, businesses can significantly reduce the risk of unauthorized access and protect their financial operations and client data from potential threats.

Integrating Payment Links in Invoice Templates

One of the key features of modern financial documents is the ability to include direct payment options, enabling recipients to settle their dues quickly and conveniently. By embedding payment links within these documents, businesses can streamline the payment process, reduce delays, and improve cash flow. Payment links not only provide an easy way for customers to complete transactions, but they also enhance the overall user experience, making it easier to process payments directly from the document.

Integrating payment links requires careful planning to ensure the links are functional, secure, and easy to use. The link should lead to a secure payment gateway, ensuring that sensitive customer information is protected throughout the transaction. Additionally, businesses can include multiple payment options, such as credit card, bank transfer, or digital wallets, providing customers with flexibility and convenience.

Moreover, it is important to ensure that the link is clearly visible and accessible, ideally placed at a prominent position within the document. This makes it easy for the recipient to find and use the link without having to search through the entire document.

By integrating payment links into financial records, businesses not only enhance the convenience for their customers but also improve the efficiency of their payment collection processes.

Common Mistakes to Avoid in Email Invoices

When creating and sending financial documents, there are several common pitfalls that businesses should be mindful of to ensure their communications are clear, accurate, and professional. These mistakes can lead to confusion, delays, and frustration for both the sender and the recipient. Being aware of these errors and taking steps to avoid them can help businesses maintain a smooth and efficient payment process.

One of the most frequent issues is incorrect or missing details. Whether it’s an incorrect payment amount, missing due dates, or inaccurate recipient information, these errors can cause delays and even disputes. Always double-check the data before sending to ensure everything is correct.

Unreadable or cluttered formats can also be a major hindrance. A financial document that is difficult to read or poorly organized can confuse the recipient and may result in payments being delayed. Make sure to use a clean, simple layout with clear headings, concise descriptions, and easy-to-read fonts.

Failure to include essential payment instructions is another mistake to avoid. If the recipient does not know how to make a payment or where to go for payment processing, they might delay the payment or not pay at all. Ensure all necessary instructions, such as payment links or bank details, are clearly stated and easy to follow.

Finally, not following up after sending the document can lead to missed payments. It’s important to maintain communication with clients, offering reminders and confirming receipt to avoid misunderstandings.

How to Test and Validate Your Template

Ensuring the accuracy and functionality of your document design is crucial to providing a seamless experience for your recipients. Before sending out any financial document, it’s essential to thoroughly test its structure, content, and compatibility across different platforms. This process helps identify and correct any potential issues that may arise, ensuring that the document appears correctly and the information is clearly communicated.

Testing for Cross-Platform Compatibility

One of the first steps in testing is to check how your document renders across different devices and software. For example, what looks perfect on a desktop might not display correctly on mobile devices or within various email applications. It’s important to use tools that simulate different viewing environments, such as responsive design checkers, to ensure that your document adapts well to all screen sizes and platforms.

Validating Data and Functionality

Once you’re confident that your document looks good across devices, the next step is to validate its content and functionality. This includes double-checking any personalized data, such as payment amounts, client names, and dates. Additionally, if you’re using dynamic elements, such as clickable links or buttons, test them to make sure they work properly and lead to the intended destination. A document that looks great but contains broken links or incorrect details can create confusion and disrupt the payment process.