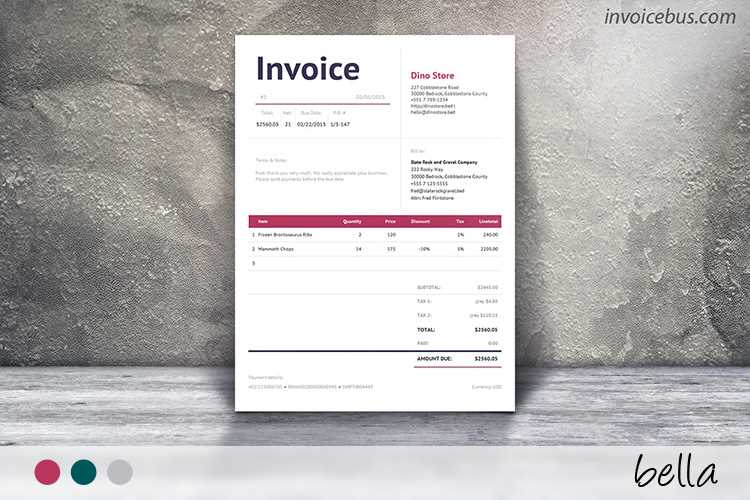

Elegant Invoice Template for Professional Billing

In today’s competitive business world, the way you present your financial documents can say a lot about your professionalism. Well-structured and visually appealing documents not only convey important information but also leave a lasting impression on your clients. Whether you’re a freelancer or running a small business, having a polished and attractive billing design is essential for building trust and credibility.

Streamlining your billing process with a well-crafted document can make all the difference in how your business is perceived. A well-organized layout, combined with an intuitive structure, ensures that clients understand the charges, terms, and payment details quickly and without confusion.

Additionally, customizing these documents to reflect your brand identity can strengthen your business presence. By carefully selecting colors, fonts, and other visual elements, you can create a consistent and professional image that resonates with your audience. This simple yet powerful tool can help elevate your customer experience and enhance client relationships.

Elegant Billing Document: A Comprehensive Guide

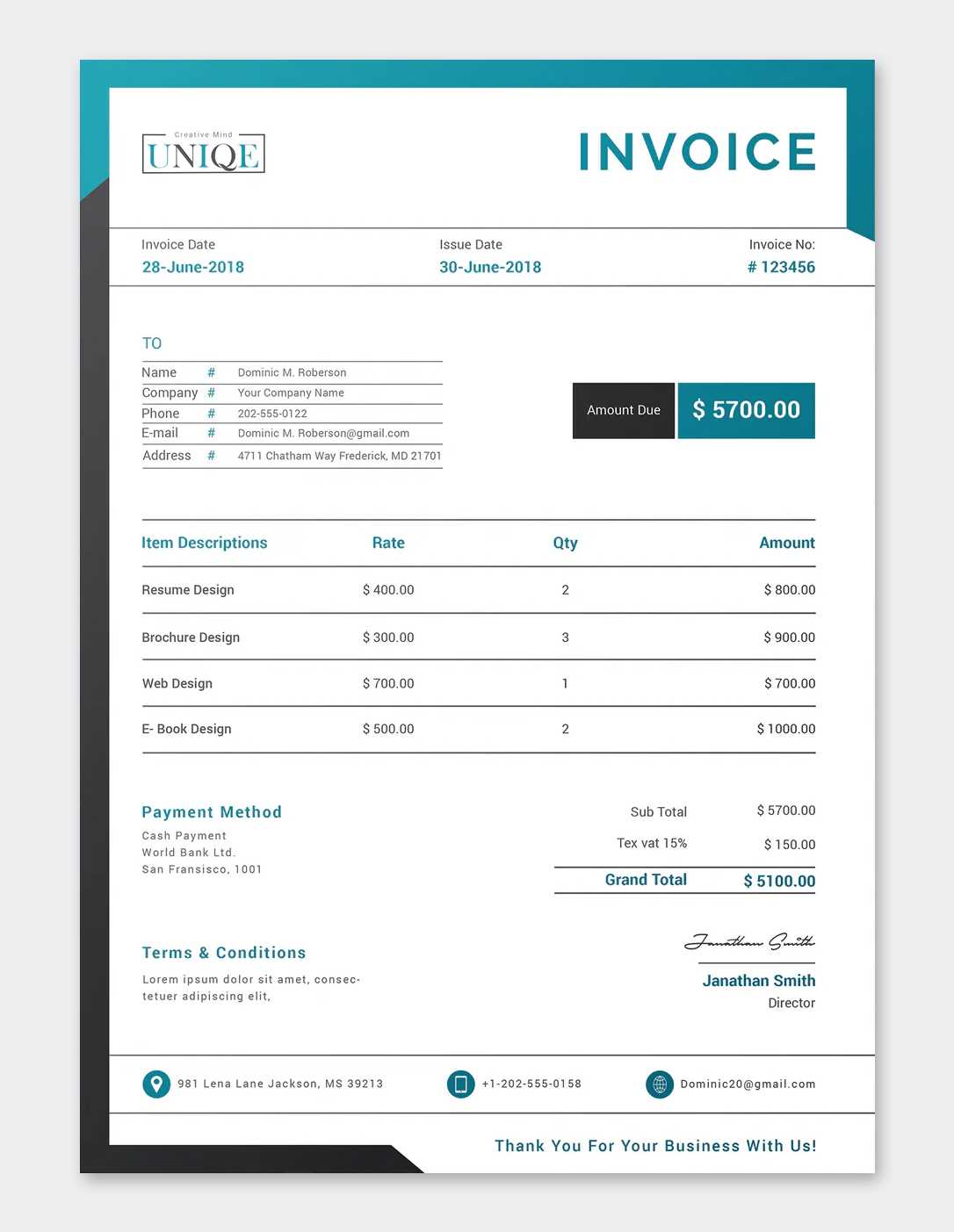

Creating professional and visually appealing billing documents is an essential part of managing a business. The design and layout of your financial records can enhance clarity, improve client trust, and reflect the professionalism of your business. This guide explores how to craft a clean, functional, and attractive billing statement that effectively communicates key information while maintaining an organized structure.

Key Features of a Professional Billing Document

A well-designed billing statement should include all necessary details in a clear and readable format. Below are the fundamental elements every professional document should have:

- Business Information: Include your company’s name, address, contact details, and logo.

- Client Information: Add the client’s name, company (if applicable), and their contact details.

- Itemized List of Services: Clearly list the products or services provided, with descriptions, quantities, and individual prices.

- Payment Terms: Include the payment due date, methods accepted, and any late fees or discounts for early payment.

- Total Amount Due: Highlight the total balance that needs to be paid.

- Unique Reference Number: Each document should have a unique identifier for tracking and record-keeping purposes.

Design Tips for a Polished and Clear Document

Design plays a key role in the effectiveness of your billing document. The following tips can help you create a statement that not only looks good but is easy to read:

- Keep it Simple: Use a minimalist approach with sufficient white space. Avoid overcrowding the document with too much text or unnecessary graphics.

- Choose Professional Fonts: Use clear, legible fonts like Arial or Times New Roman. Make sure the text is easy to read on both desktop and mobile devices.

- Highlight Key Information: Bold or underline essential details such as the total amount due or the payment deadline.

- Use Consistent Branding: Incorporate your company colors, logo, and branding elements to ensure your document reflects your business identity.

By following these guidelines, you can create a billing document that not only looks professional but also fosters trust with your clients. A well-crafted document speaks to your attention to detail and can leave a lasting impression, encouraging prompt payments and reinforc

Why Choose an Elegant Billing Design

When managing finances and communicating with clients, the presentation of your business documents can significantly impact how your services are perceived. A well-crafted and visually appealing design can elevate the professionalism of your communications, helping to create a lasting positive impression. Choosing an aesthetically pleasing layout for your financial documents is not just about looks; it’s about creating a seamless experience for both you and your clients.

Impact on Client Trust and Perception

A visually appealing document speaks volumes about your attention to detail and the level of professionalism you bring to your work. Clients are more likely to take your business seriously if your financial records are neatly structured and easy to understand. A thoughtfully designed document can also convey reliability and instill confidence, which is crucial for maintaining strong business relationships.

Improved Clarity and Functionality

Design is not just about making a document look attractive; it’s also about enhancing its functionality. Clear, well-organized layouts help clients quickly locate the necessary information, such as the amount due, payment terms, and due dates. An intuitive and easy-to-read format reduces the risk of errors or confusion, ensuring smoother transactions and fewer disputes over billing details.

Incorporating clean lines, balanced spacing, and well-chosen typography can make your documents more user-friendly. The ease of navigating through the content reflects well on your business, showing that you value your clients’ time and are committed to transparency.

Key Features of an Effective Billing Document

To ensure that your financial documents are both functional and professional, it’s essential to include the key components that provide clarity, accuracy, and transparency. A well-designed record should not only present essential information but also make it easy for both you and your clients to understand the details of the transaction. Below are the key features that make a billing document effective and efficient.

Essential Elements for a Clear Record

An effective billing statement includes a variety of crucial details to ensure smooth communication and avoid any misunderstandings. Here are the must-have components for a professional document:

- Business Information: Include your company name, logo, address, and contact details so clients know exactly who issued the document.

- Client Details: Provide your client’s full name or company name, address, and other relevant contact information for accurate record-keeping.

- Unique Reference Number: Each document should have a unique ID to track payments and maintain proper accounting records.

- Itemized List of Products or Services: Clearly list each item or service provided, including descriptions, quantities, individual prices, and applicable taxes.

- Total Due: Clearly state the total amount the client owes, with any taxes, discounts, or adjustments highlighted.

- Payment Terms and Due Date: Include specific instructions on how and when payment should be made, and whether there are late fees or early payment discounts.

Design and Layout Considerations

The structure of your document is just as important as the information it contains. A clean, logical layout helps to avoid confusion and makes the document easier to navigate. Here are some tips for effective design:

- Simple, Professional Fonts: Use clear, legible fonts that make the document easy to read and navigate, such as Arial, Helvetica, or Times New Roman.

- Logical Organization: Group related sections together (e.g., business and client details, itemized list, and payment information) to make the document intuitive and user-friendly.

- Visual Hierarchy: Use bold text, headings, and spacing to highlight key pieces of information like totals, due dates, and payment instructions.

- Consistent Branding: Ensure your design elements reflect your brand identity, including colors, logos, and fonts, for a professional and cohesive look.

By integrating these key features, you will create a document that not only provides all necessary information but also enhances your professional image and facilitates smooth transactions with your clients.

How a Professional Billing Document Boosts Credibility

The way you present your financial records has a significant impact on how clients perceive your business. A well-organized and professionally designed document communicates attention to detail, reliability, and a commitment to quality. When your financial records are clear, consistent, and polished, they can elevate your business reputation and instill confidence in your clients.

Professional appearance is crucial in making a positive first impression. A thoughtfully designed document reflects your brand’s values and reinforces the idea that you take your work seriously. Clients are more likely to trust a business that provides them with clear, transparent, and easy-to-understand records. This trust can lead to stronger, long-term relationships and prompt payments.

Moreover, a well-structured document also shows that you respect your clients’ time. By making key information easy to find–such as payment terms, due dates, and amounts owed–you demonstrate your commitment to transparency and efficient communication. This can help avoid misunderstandings and minimize the risk of disputes, further strengthening your professional reputation.

Incorporating consistent branding elements such as your logo, company colors, and fonts in your billing records also adds to your professional image. It helps clients recognize your business at a glance and provides a sense of continuity across all your communications. This cohesive experience can make your business appear more established and trustworthy, encouraging clients to work with you again in the future.

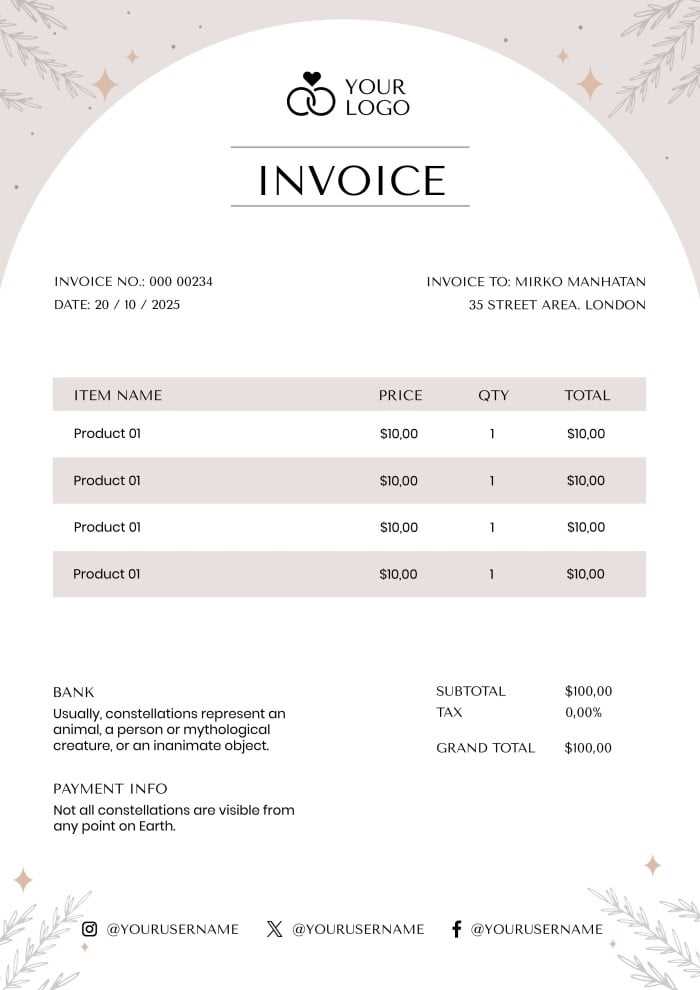

Customizing Your Billing Document for Branding

Aligning your financial records with your brand’s identity is an important step in creating a consistent and professional image across all client interactions. Customizing your business documents ensures that every communication reflects your unique style and reinforces your brand’s message. A personalized billing record not only enhances its visual appeal but also strengthens your business presence and increases recognition with clients.

Elements to Personalize for a Strong Brand Identity

There are several key aspects of your document design that can be customized to reflect your business’s visual identity:

- Logo: Incorporate your company logo at the top of the document. This instantly identifies your business and creates a sense of professionalism.

- Color Scheme: Use your brand colors consistently throughout the document. This helps reinforce your company’s identity and gives the record a polished, cohesive look.

- Font Choices: Select fonts that align with your brand’s tone–whether that’s a modern, clean font or something more traditional. Consistency in font usage across all communications strengthens your overall brand identity.

- Tagline or Slogan: If your business has a tagline or slogan, consider including it at the bottom of the document to further reinforce your brand message.

- Watermark or Background Design: A subtle watermark or light background design can enhance the visual appeal of your document while keeping it professional and easy to read.

Why Customization Matters

Customizing your billing documents to reflect your brand does more than just make them look appealing. It communicates that your business values consistency and professionalism, which can help foster trust and loyalty among your clients. A personalized design makes the document feel more personal, as if it’s tailored to the specific business relationship, rather than a generic, one-size-fits-all approach.

Furthermore, consistent branding across all customer touchpoints–whether it’s your website, email communications, or physical documents–creates a seamless experience that reinforces your business’s presence. Clients are more likely to remember and recognize your business when every interaction feels cohesive and professionally executed.

Best Tools for Creating Professional Billing Documents

Creating visually appealing and well-organized billing records can be a time-consuming task if you don’t have the right tools. Thankfully, there are various software programs and online platforms designed to streamline the process, offering pre-built designs, customizable options, and intuitive interfaces to help you craft polished documents quickly and efficiently. Below are some of the best tools for designing and managing your billing paperwork.

Top Software Solutions for Billing Document Creation

These tools offer a variety of features to simplify the creation and management of your financial records, whether you’re a freelancer or running a small business:

- QuickBooks: A comprehensive accounting solution that allows you to create custom billing documents, manage expenses, track payments, and handle tax calculations–all in one place.

- FreshBooks: Known for its user-friendly interface, FreshBooks helps you design professional billing records, track time, and send invoices seamlessly, making it a great choice for service-based businesses.

- Zoho Invoice: This cloud-based tool offers customization options to suit your brand’s identity, along with features for recurring billing, automated reminders, and detailed reporting.

- Wave: A free option for small businesses, Wave allows you to create simple yet effective billing documents, track payments, and send reminders without any upfront cost.

- Canva: While primarily a graphic design tool, Canva offers customizable billing document designs that you can tailor to your branding, with options for adding logos, colors, and more.

Online Platforms for Easy Customization

If you’re looking for something easy to use without the need for extensive accounting knowledge, these online platforms provide pre-made designs and user-friendly customization tools:

- Invoice Generator: A simple online tool for creating professional documents in minutes. You can add your business logo, client information, and services, then download the result as a PDF.

- PayPal Invoicing: PayPal’s built-in invoicing feature allows you to design and send customizable billing records direc

How to Make Your Billing Document Stand Out

In a crowded business world, making your financial records stand out is essential for leaving a positive and lasting impression on your clients. A standout billing document not only reflects your professionalism but also serves as a reminder of your attention to detail and commitment to quality. Whether you’re looking to create a unique design or improve the content’s clarity, there are several ways to elevate your document and make it memorable.

Design Elements That Capture Attention

Visually appealing records are more likely to catch your client’s eye and leave a lasting impact. Consider the following design tips to make your billing documents more striking:

- Use High-Quality Branding: Ensure your company logo and branding elements are prominently displayed. A well-placed logo not only makes the document feel more official but also strengthens your brand identity.

- Incorporate Custom Colors: Select a color scheme that aligns with your brand. Using your business’s signature colors will make your document feel more personal and cohesive.

- Include a Personalized Message: Add a short thank-you note or message to express appreciation for the client’s business. This small touch can help humanize the process and build goodwill.

- Professional Typography: Choose clear, stylish fonts that are easy to read but also complement your brand’s personality. Use bold and italic styles to highlight key information such as the total amount due or due date.

Additional Tips for Enhanced Impact

Beyond design, the way you organize and present the information can also help your document stand out. Consider these tips to improve both functionality and presentation:

- Itemized Details: Provide a clear, detailed breakdown of services or products. This helps to avoid any confusion and reassures clients that they’re being billed fairly and accurately.

- Clear and Easy-to-Find Payment Information: Make sure the payment terms, due date, and methods are highly visible. This makes the process simpler for clients, reducing the chances of delayed payments.

- Professional Formatting: Consistently aligned text, clean borders, and organized sections will make your document appear polished and easy to navigate. A well-structured layout shows attention to detail and professionalism.

By incorporating these elements, you can create billing records that not only stand out but also reflect the high standard of service your clients expect. A memorable document fosters trust and encourages clients to return for future business interactions.

Essential Elements in a Billing Document

To create a clear and professional billing document, it’s important to include all the necessary information in a structured and easily readable format. A well-crafted record ensures both parties understand the terms of the transaction, avoiding confusion and potential disputes. Below are the key components every document should have to be effective and functional.

Key Information to Include

An effective billing document must cover all aspects of the transaction. The following details are essential for clarity and completeness:

- Business Details: Include your company name, logo, address, and contact information at the top. This ensures the document is easily recognizable and professional.

- Client Information: Clearly state the client’s name, address, and contact details. This is crucial for record-keeping and ensuring the correct individual or company receives the billing.

- Unique Reference Number: Each document should have a distinct identifier for tracking and accounting purposes. This is especially useful when managing multiple clients or projects.

- Itemized List of Products or Services: Provide a detailed breakdown of what is being charged. This should include descriptions, quantities, unit prices, and any applicable taxes or discounts.

- Total Amount Due: Clearly highlight the total sum that is owed, including any taxes or adjustments. Make this amount easy to find to avoid confusion.

- Payment Terms: Include information on the payment due date, accepted methods of payment, and any late fees or early payment discounts. This will ensure both parties are on the same page regarding when and how payment is expected.

Design Considerations for Clarity and Professionalism

The layout and design of your document play a key role in its effectiveness. A clean, well-structured format makes it easier for your client to understand the details. Consider the following tips for optimizing your document’s design:

- Logical Structure: Organize the document into clearly defined sections, such as business information, client details, items or services, and payment terms. This makes it easy to scan and locate important details.

- Readable Fonts: Use clear, professional fonts that are easy to read. Avoid overly decorative styles that could detract from the document’s professionalism.

- Use of White Space: Incorporate ample white space between sections to improve readability. A cluttered document can be overwhelming and difficult to navigate.

By including these essential elements and keeping the design clean and organized, you ensure that your billing document is both functional and professional. This helps build trust with your clients and creates a positive impression of your business’s efficiency and attention to detail.

Design Tips for a Clean and Clear Billing Document

A well-designed billing document should be easy to read and navigate, with clear sections and logical flow. A clean layout helps clients quickly understand the details of the transaction, which can prevent confusion and ensure timely payments. Below are key design tips to help you create a professional and user-friendly financial record.

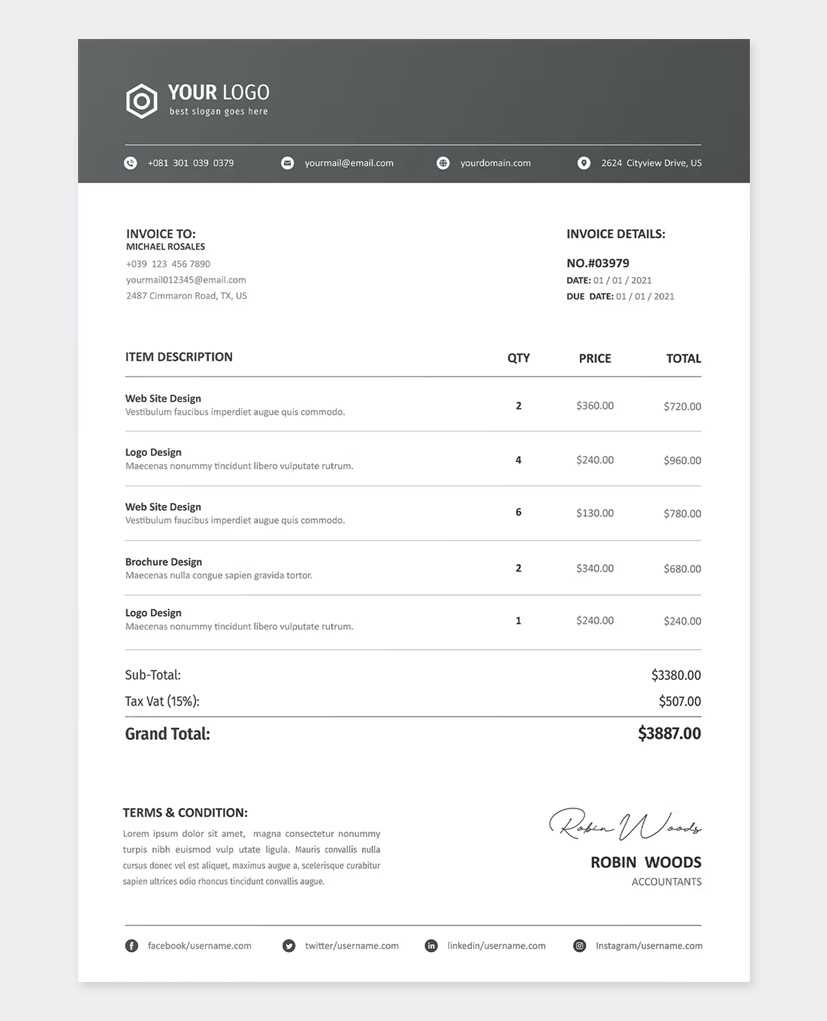

Effective Layout and Organization

Clear organization is essential to creating a billing document that is both functional and professional. The following design tips will improve the structure and readability of your record:

- Use Consistent Alignment: Align text and numbers properly to create a clean, structured look. This makes the document easier to scan and ensures the information flows logically.

- Break Content into Sections: Divide your document into distinct sections, such as business details, client information, itemized list, and payment terms. This will make the document easier to digest and ensure that key information is easy to find.

- Incorporate Bold Headings: Use bold text for headings and subheadings to highlight important sections and guide the reader through the document.

Use Tables for Clarity and Readability

Tables are a powerful tool for organizing information in a way that is easy to read and understand. Below is an example of how to present product or service details in a table format:

Item Description Quantity Unit Price Total Web Design Services 1 $1,000.00 $1,000.00 SEO Optimization 1 $500.00 $500.00 Total Amount Due $1,500.00 Using tables helps clearly separate individual charges, making it easier for your clients to review and understand the costs. This structure also allows for quick updates and modifications when needed.

Other Important Design Elements

- Limit Colors and Fonts: Stick to one or two primary colors and professional fonts. Avoid using too many colors or fancy fonts, as they can make the document appear cluttered and unprofessional.

- Leave Adequate White Space: Ensure there is enough white space between sections to avoid overcrowding. Proper spacing makes the document look clean and helps improve readability.

- Highlight Important Information: Use bold or larger fonts for key details like the total amount due and due dates. This ensures that critical information stands out and is easily noticed by your clients.

By following these design tips, you can create a billing document that is clear, organized, and visually appealing, helping to streamline communication with your clients and make a professional impression every time.

Incorporating Your Business Logo on Billing Documents

Including your business logo in your financial records is an important step in creating a consistent brand image. Your logo serves as a visual representation of your company and helps establish professionalism and trust. By placing it on your billing documents, you reinforce your brand identity and make your communications instantly recognizable to your clients.

Why Your Logo Matters

Your logo is one of the most important elements of your brand’s identity. When it appears on your financial documents, it does more than just enhance the visual appeal. It also conveys that your business is legitimate and organized. Here are some reasons why it’s important to include your logo:

- Brand Recognition: Consistently using your logo across all business materials helps clients easily recognize your company, strengthening brand recall.

- Professional Image: A document that features your logo appears more official and polished, which can boost client confidence and make your business seem more established.

- Consistency Across Communications: Incorporating your logo into all customer-facing documents creates a cohesive experience, whether it’s a billing record, contract, or email correspondence.

Where to Place Your Logo

The placement of your logo is key to ensuring it enhances the overall design without overwhelming the document. Here are some best practices for positioning your logo:

- Top Center or Top Left: The most common and professional placement for a logo is at the top of the page, either centered or aligned to the left. This ensures it’s the first thing your client sees.

- Maintain Balance: While your logo should be visible, avoid making it too large or too dominant. It should complement the other elements of the document without overpowering the content.

- Consistent Placement: If you’re using your logo on multiple documents, keep its placement consistent. This creates a unified look and feel across all your business communications.

By thoughtfully incorporating your logo into your billing documents, you reinforce your business’s professional image and build trust with your clients. A well-placed logo communicates your commitment to quality and attention to detail, leaving a positive impression every time.

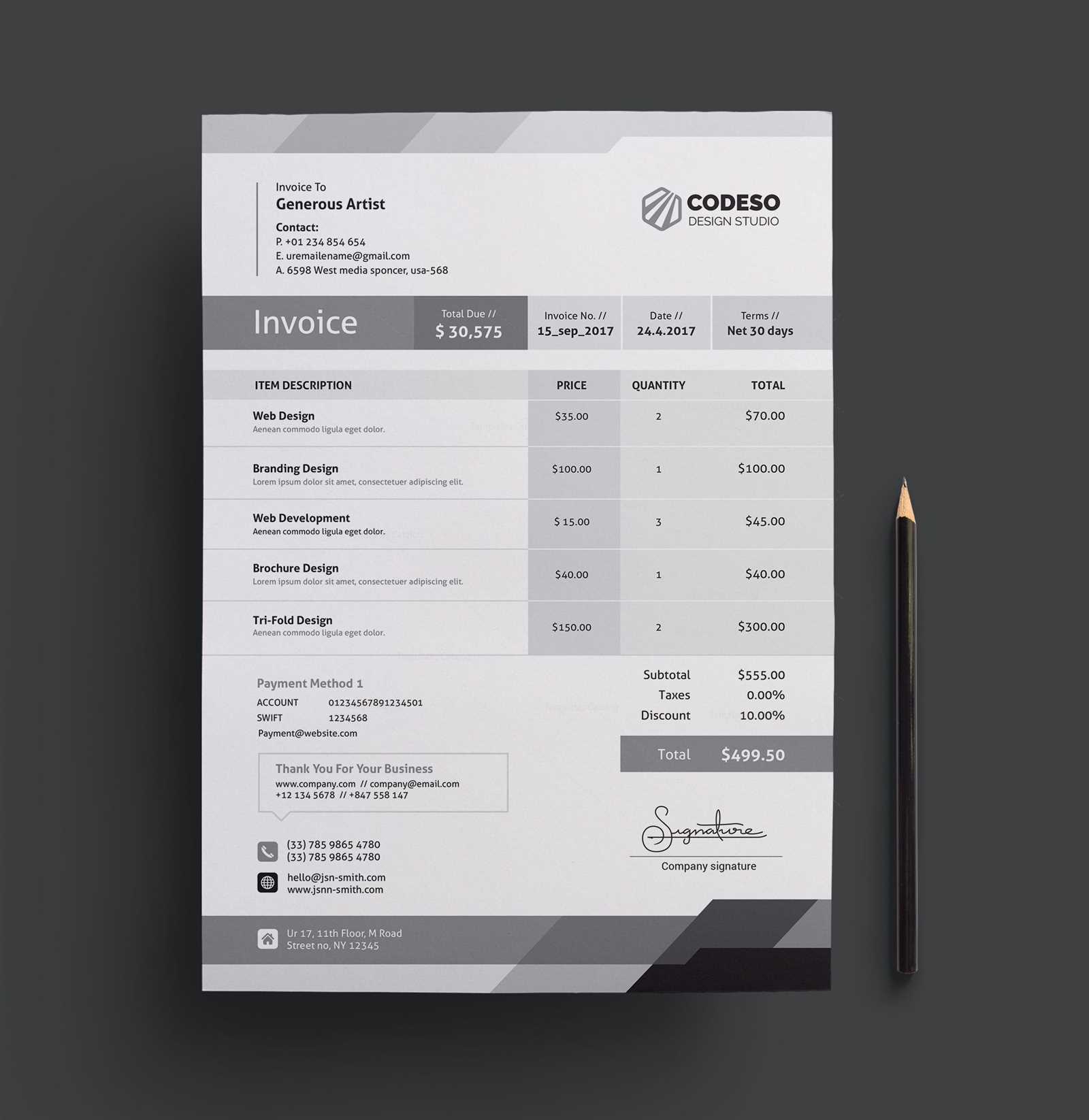

Choosing the Right Colors for Billing Documents

Colors play a significant role in creating a visually appealing and professional financial record. The right color scheme can make the document more engaging, easier to read, and help reflect your brand identity. However, it’s important to choose colors that not only look good but also maintain clarity and professionalism. Below are key factors to consider when selecting colors for your financial documents.

Factors to Consider When Choosing Colors

When selecting a color scheme, it’s important to keep both aesthetic and functional considerations in mind. Here are some key points to guide your choice:

- Brand Consistency: Your color palette should align with your brand’s identity. If you already use specific colors in your logo, website, or marketing materials, incorporate them into your billing documents to maintain a cohesive brand image.

- Readability: Choose colors that ensure the text remains easy to read. High contrast between background and text is essential, so avoid using light text on light backgrounds or dark text on dark backgrounds.

- Emotional Impact: Different colors evoke different emotions. For example, blue conveys trust and professionalism, while green can suggest growth or eco-friendliness. Consider what emotions you want to evoke with your document.

- Minimalism: Using too many colors can make the document look cluttered and unprofessional. Stick to a simple color scheme, ideally two to three main colors, to maintain a clean and polished look.

Color Combinations That Work

Here are some effective color combinations for professional billing documents:

- Blue and White: Blue is widely regarded as a trustworthy and dependable color, while white offers a clean, neutral backdrop. This combination is perfect for conveying professionalism and simplicity.

- Gray and Dark Blue: Gray tones combined with darker shades of blue create an elegant and sophisticated look. This pairing is ideal for businesses that want to project a serious, corporate image.

- Black and Gold: A classic combination that exudes luxury and high-end services. Use gold accents for headings or important information, while keeping the text in black for maximum readability.

- Green and White: Green represents growth and stability, making it a great choice for environmentally-conscious or financial services. Paired with white, it creates a balanced and fresh design.

Tips for Effective Color Use

Here are a few additional tips for applying colors to your documents:

- Highlight Key Information: Use accent colors to draw attention to important details, such as the total amount due or the payment due date. This helps ensure that these details are easy to find at a glance.

- Avoid Overuse of Bright Colors: Whil

How to Format Your Billing Document for Clarity

Proper formatting is essential for making your financial documents clear and easy to understand. A well-structured document allows clients to quickly find important details like the total amount due, payment terms, and a breakdown of charges. By following a logical format and using visual cues, you can create a document that minimizes confusion and fosters timely payments.

Key Formatting Elements for a Clear Document

To ensure your financial document is easy to read and follow, consider the following formatting best practices:

- Use Headings and Subheadings: Break up your document into distinct sections, such as “Client Details,” “Itemized Charges,” and “Payment Terms.” This helps guide the reader’s eye and makes it easier for them to find the information they need.

- Keep Sections Organized: Ensure that each section has a clear, consistent structure. For example, the itemized list of charges should include columns for the description, quantity, price, and total for each item. Consistency helps the reader quickly absorb the information.

- Align Text and Numbers Properly: Ensure that text and numbers are aligned neatly. Align numbers in columns to the right so that the decimal points line up for easy comparison, and keep text aligned to the left for readability.

- Use Bullet Points and Lists: When presenting items, charges, or terms, use bullet points or numbered lists to break up the text. This makes the information more digestible and easier to follow.

Visual Enhancements for Better Readability

Incorporating certain design elements can enhance the clarity of your financial document without making it feel cluttered:

- Ample White Space: Don’t overcrowd the document with too much information. Leave enough space between sections and lines of text to give the reader room to breathe. White space makes the document feel more open and easier to navigate.

- Font Size and Style: Use clear, legible fonts in a size that is easy to read. Avoid using multiple font styles; instead, rely on bold or italicized text to highlight key information. A font size of 10-12 pt is ideal for body text.

- Contrast for Readability: Ensure there is enough contrast between the background and text color to make the document easy to read. Dark text on a light background is generally the best choice for most professional documents.

By paying attention to formatting details such as section organization, text alignment, and visual elements, you can create a billing document that is not only functional but also easy for clients to navigate. A well-formatte

Common Mistakes to Avoid in Billing Documents

While creating a professional billing document, there are several common errors that can affect the clarity, professionalism, and effectiveness of the document. These mistakes can lead to confusion, delays in payments, or even disputes. Avoiding these pitfalls ensures that your communication is clear and that your business maintains a professional image.

Key Mistakes to Watch Out For

Here are some of the most common errors made when creating financial documents and how to avoid them:

- Incorrect or Missing Client Information: Failing to include the client’s correct name, address, or contact details can cause confusion or delivery issues. Always double-check the information to ensure it’s accurate before sending it out.

- Missing or Inaccurate Dates: Omitting important dates, such as the date of issue, due date, or payment terms, can create misunderstandings. Always make sure that these details are clearly listed and accurate to avoid payment delays.

- Unclear Payment Terms: Vague payment terms can lead to uncertainty about when payments are due or how they should be made. Clearly state your payment terms, including due dates, late fees, and accepted payment methods.

- Failure to Itemize Charges: Listing only a total amount without breaking down the individual charges can leave clients confused or suspicious. Always include a detailed, itemized list of services or products provided, along with their costs.

- Using Inconsistent Formatting: Inconsistent fonts, sizes, and styles can make your document look unprofessional and difficult to read. Keep the design uniform across the document, using clear headings, bullet points, and consistent text styles for better readability.

- Omitting Reference Numbers: Not including a unique reference number for each document can complicate tracking and accounting. Always assign a distinct number to each billing document for easy reference and record-keeping.

- Failure to Proofread: Typos, grammatical errors, or incorrect calculations can undermine the professionalism of your document. Always take the time to proofread before sending it out to ensure everything is accurate and error-free.

How to Avoid These Mistakes

To prevent these common errors, follow these tips:

- Double-check client information: Verify all details, such as names, addresses, and contact numbers, before finalizing your document.

- Be thorough with dates: Always include the date of issue, payment due date, and any other important dates related to the transaction.

- Use a consistent, professional format: Choose a clear font and stick to it throughout the document. Ensure the layout is easy to follow and visually appealing.

- Include a unique reference number: Make it a habit to assign a reference number to each document for easy identification and record-keeping.

- Proofread thoroughl

How to Save Time with Billing Document Formats

Creating billing records from scratch for each client can be time-consuming and repetitive. However, by using pre-designed formats, you can significantly reduce the time spent on generating these documents. These ready-made layouts allow you to quickly input specific details without worrying about formatting, calculations, or overall structure. With a few adjustments, you can create professional, accurate records in a fraction of the time it would take to start from zero.

Benefits of Using Pre-Designed Formats

Adopting pre-designed billing structures can streamline your workflow and improve your efficiency. Here are some of the key benefits:

- Consistency: Using the same structure for every document ensures uniformity in presentation. This not only saves time but also reinforces your brand’s image.

- Fewer Errors: Pre-built formats come with predefined fields, which reduce the chances of making mistakes. By filling in the appropriate data, you can avoid the common errors associated with creating records from scratch.

- Speed: The most significant benefit is the time saved. Instead of focusing on formatting, you can spend more time working on your core business tasks, such as providing services or communicating with clients.

- Customization Options: Many formats allow for easy customization, so you can adjust them to suit specific client needs or business requirements while keeping the basic structure intact.

How to Maximize Efficiency with Pre-Designed Formats

To get the most out of pre-designed billing formats, consider the following tips:

- Save Frequently Used Information: If you regularly issue bills to the same clients, save their details in the format so that you only need to input new data, such as dates or specific charges, each time.

- Automate Calculations: Use templates that automatically calculate totals and taxes, reducing the chances of manual errors and saving time during the billing process.

- Standardize Your Design: Choose a layout that suits your brand and use it consistently. A standardized design means you won’t have to adjust formatting or style each time, making the entire process quicker.

- Leverage Digital Tools: Use digital tools and software that can generate billing documents from pre-designed formats. This allows you to send invoices directly from the system, making the process even faster and more efficient.

By utilizing ready-made structures for your billing documents, you not only save time but also create a more streamlined and professional approach to client transactions. With the right tools, you can manage your financial paperwork with ease and focus on growing your business.

Understanding Document Numbering Systems

A consistent and logical numbering system for your financial records is essential for maintaining organization, simplifying tracking, and ensuring legal compliance. By implementing a clear numbering system, you can easily reference previous transactions, reduce the risk of duplicate or missed records, and streamline your bookkeeping. The format you choose can vary based on your business needs, but it’s important to establish a system that works for you and your clients.

Types of Numbering Systems

There are several approaches to structuring document numbers. Each system offers its own advantages, depending on the scale of your operations and the type of records you manage. Below are some of the most common numbering methods:

Numbering System Description Advantages Sequential Numbering Each document is assigned a unique number that follows a simple sequence, such as 001, 002, 003, etc. Easy to implement, helps keep a clear record of all transactions, ideal for small to medium businesses. Year-Based Numbering This system includes the year as part of the number, for example, 2023-001, 2023-002. Helps keep documents organized by year, making it easier to sort and track them over time. Client-Based Numbering Each client is assigned a unique prefix followed by a sequential number, such as CLIENT123-001. Great for businesses that handle many clients, allowing for easy identification of transactions by client. Custom Numbering Businesses can create their own customized numbering system, incorporating various elements like client name, date, or project code. Offers flexibility and customization, ideal for businesses with specific needs or multiple departments. Best Practices for Numbering Documents

Regardless of the numbering system you choose, there are a few best practices to follow to ensure consistency and accuracy:

- Maintain Uniqueness: Every document should have a unique identifier to avoid confusion or duplication. This is especially important for larger organizations with multiple departments.

- Start Fresh Each Year: If you’re using a system that includes dates, reset the numbering system annually to keep it organized and easier to track.

- Use Leading Zeros for Sequential Numbers: This helps maintain consistency in the appearance of numbers (e.g., 001, 002, 010), especially if you expect to generate hundreds or thousands of records.

- Keep it Simple: Avoid overly complicated numbering systems that may confuse your team or clients. A simple, easy-to-understand structure will save time and reduce errors.

By understanding and implementing a logical numbering system for your financial documents, you create a foundation for better recordkeeping, organization, and overall efficiency. Whether you choose a sequential approach or a more customized method, a well-structured numbering system is an essential tool for maintaining accurate and organized financial records.

Billing Documents for Different Industries

Different industries have unique requirements when it comes to creating financial records. While the general structure may be similar, the type of information included, as well as the layout, can vary depending on the nature of the business. By tailoring your billing records to the specific needs of your industry, you can ensure accuracy, improve clarity, and enhance your professional image. Below, we explore how billing documents differ across various sectors and what to include in each.

Billing Documents for Service-Based Industries

For businesses that offer services–such as consulting, design, or IT support–billing documents typically focus on detailing the work completed. These records should reflect the time spent, the specific services rendered, and any relevant terms for payment. Key features often include:

- Hourly Rates: Clearly stating hourly rates and the total time spent on a project or task is essential in service-based industries.

- Project Milestones: If applicable, break down the project into specific milestones or stages and provide costs for each phase.

- Service Descriptions: Offer clear descriptions of the work done to avoid confusion about what services were provided.

- Payment Terms: Be specific about due dates, payment methods, and penalties for late payments.

Billing Documents for Product-Based Businesses

For businesses that sell physical products, the structure of a financial document often includes an itemized list of the products sold, along with quantities, prices, and taxes. These records need to be clear and easy to read to avoid any misunderstandings about what has been purchased. Important features for product-based businesses include:

- Product Details: List each product with a brief description, quantity, unit price, and total cost.

- Inventory Codes: Including inventory or product codes helps streamline recordkeeping and inventory management.

- Sales Tax: Clearly state the applicable sales tax for each item or the entire order to ensure transparency.

- Shipping Information: If applicable, include shipping charges, delivery methods, and expected arrival dates.

Billing Documents for Freelancers and Contractors

Freelancers and independent contractors often work with clients on a project-by-project basis. The financial documents they issue must outline the scope of work, payment terms, and any deadlines or deliverables. Some essential elements to include are:

- Project Scope: A clear description of the agreed-upon work, including the services rendered, deliverables, and timelines.

- Payment Structure: Outline whether payment is based on an hourly rate, flat fee, or project-based terms, along with the total cost.

- Due Dates: Clearly sta