How to Use an Electronic Invoice Template for Streamlined Billing

In today’s fast-paced business environment, efficient management of financial transactions is crucial. One of the most effective ways to simplify this process is by using a structured document to record payments, charges, and client information. This tool not only saves time but also minimizes errors, ensuring that your billing process is both smooth and professional.

With the right system in place, managing outgoing payments, generating reports, and keeping track of all financial exchanges becomes easier than ever. Customizable forms allow you to tailor the design and information fields to your specific needs, improving both clarity and consistency. This approach can help businesses of all sizes reduce administrative overhead while enhancing accuracy in financial dealings.

Whether you are a freelancer, small business owner, or part of a larger enterprise, adopting a digital solution for your payment records is a step forward in reducing manual work. The advantages extend beyond simplicity–these tools often come with features such as automatic reminders and integration with accounting systems, making them a powerful addition to any business’s workflow.

Electronic Invoice Template Overview

In any business, clear and accurate billing is a key aspect of maintaining good relationships with clients and ensuring timely payments. A well-structured billing document serves as a professional way to communicate payment details, making transactions transparent and easy to process. By using a digital version of these documents, businesses can streamline their operations and reduce manual errors that are common with paper-based methods.

Such a tool offers flexibility and customization, allowing users to modify fields based on their specific needs. These forms can include essential elements like client information, itemized lists of services or products, payment terms, and due dates. Additionally, the ability to store and retrieve past records quickly adds to the efficiency of managing finances, especially for growing businesses that deal with a high volume of transactions.

Overall, switching to a digital format not only saves time but also enhances accuracy and professionalism. With automated calculations, easy sharing options, and the ability to integrate with accounting systems, these documents provide businesses with a comprehensive solution to their billing needs.

What is an Electronic Invoice

A digital billing document is an essential tool for businesses to request payment from clients or customers. It serves as a formal record of a transaction, listing the products or services provided, their cost, and other relevant details. Unlike paper-based records, this method is quicker, more efficient, and can be easily stored or shared electronically.

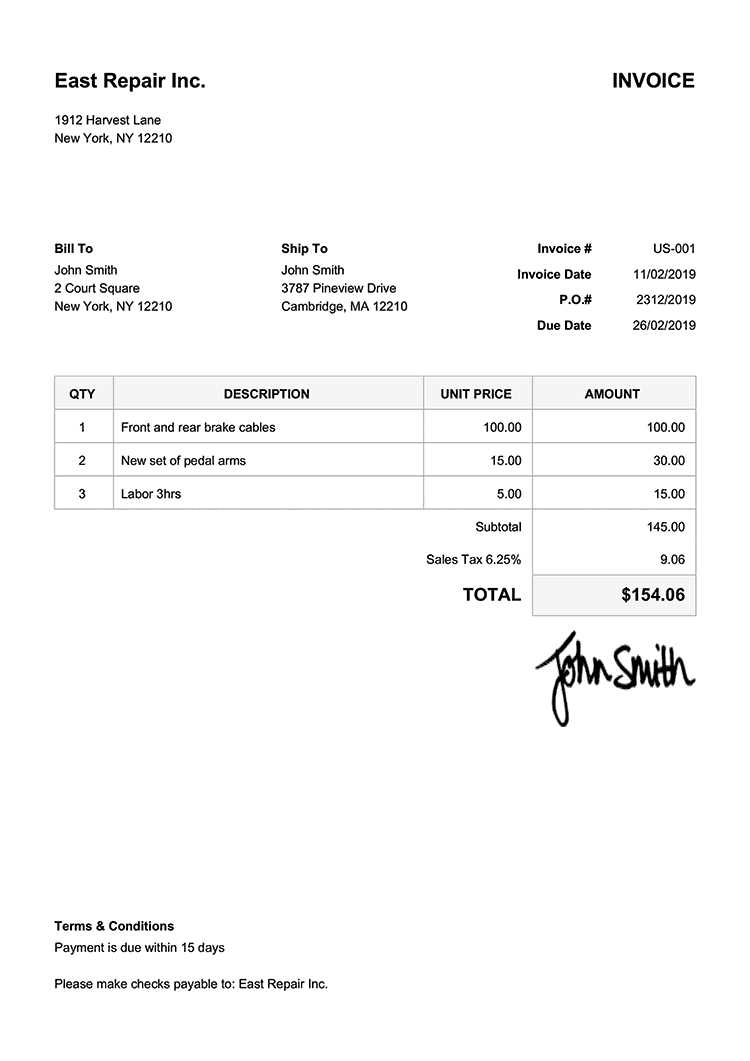

This digital document typically includes the following key elements:

- Client Information: Name, address, and contact details of the recipient.

- Seller Details: Contact information of the business issuing the bill.

- Itemized List: A breakdown of products or services provided, including quantity and price.

- Payment Terms: The agreed-upon payment schedule, including due dates and any late fees.

- Unique Identifier: A reference number for easy tracking and organization.

Unlike traditional paper-based documents, this approach offers several advantages, including:

- Speed: Faster delivery via email or other digital platforms.

- Accuracy: Automated calculations reduce the chance of errors.

- Convenience: Stored electronically, allowing for easy access and retrieval at any time.

- Cost-effective: Reduces the need for printing, mailing, and storage costs.

In essence, this digital version of a billing record not only simplifies the process of requesting payments but also brings a level of professionalism and efficiency that is critical for modern businesses.

Benefits of Using Electronic Invoices

Adopting a digital approach to billing provides numerous advantages for businesses of all sizes. By replacing traditional paper-based methods with automated, digital solutions, companies can improve their efficiency, reduce costs, and streamline financial management. This transition not only benefits the internal operations of a business but also enhances the client experience.

Some of the key benefits include:

- Increased Efficiency: With automated processes, there is no need for manual entry or calculations. This reduces the time spent on creating and managing billing records, allowing employees to focus on more important tasks.

- Faster Delivery: Digital documents can be sent instantly via email or other online platforms, ensuring clients receive them without delays. This is especially beneficial for businesses that need quick turnaround times.

- Cost Savings: Eliminating the need for paper, printing, and postage significantly reduces operational costs. Additionally, the digital storage of records cuts down on physical storage requirements.

- Improved Accuracy: Automated systems reduce human error by calculating totals, taxes, and discounts automatically. This ensures that the billing process is accurate and reliable.

- Better Organization: Storing digital records makes it easy to access, search, and retrieve past documents whenever needed. This improves record-keeping and makes managing finances more efficient.

How to Create an Invoice Template

Creating a customized billing document is an essential task for any business. This process involves designing a professional form that captures all the necessary details of a transaction while also being easy to use and understand. A well-structured document ensures that all relevant information is clear and accessible, helping both you and your clients stay organized.

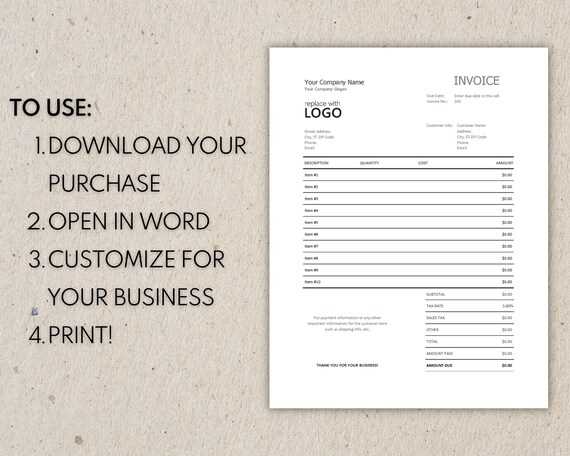

Step 1: Choose a Format

The first step in creating a billing document is deciding on the format. You can use software like Microsoft Word, Google Docs, or specialized accounting tools that offer pre-designed templates. These tools allow you to create a custom layout that fits your business needs. Consider factors like ease of use, flexibility, and the ability to save or export the final product in various formats (PDF, Word, etc.).

Step 2: Add Key Information

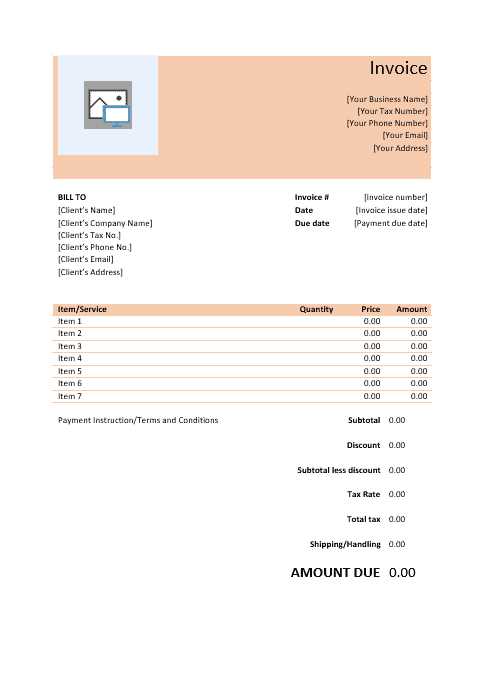

Next, include all the essential elements that make up a comprehensive billing form. Some of the critical sections to include are:

- Business Information: Your business name, address, contact details, and logo for a professional appearance.

- Client Information: Name, address, and contact details of the recipient.

- List of Products/Services: A clear breakdown of what is being billed, including descriptions, quantities, and individual prices.

- Payment Terms: Payment due date, applicable taxes, and any late fees or discounts.

- Unique Reference Number: A tracking number for easy organization and future refer

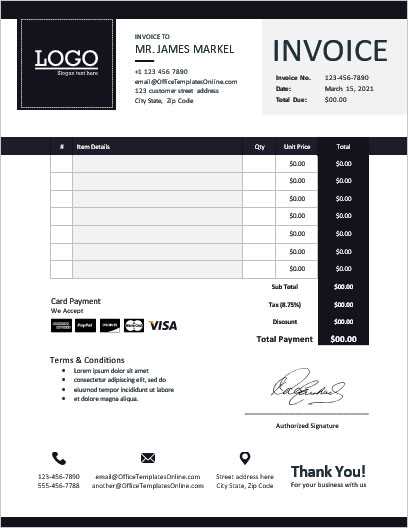

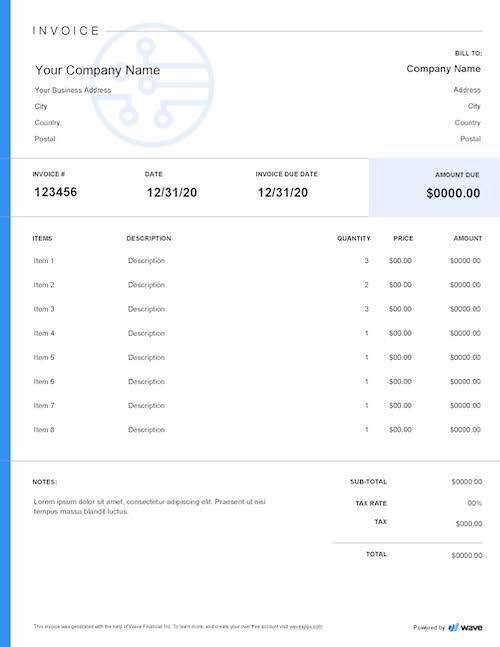

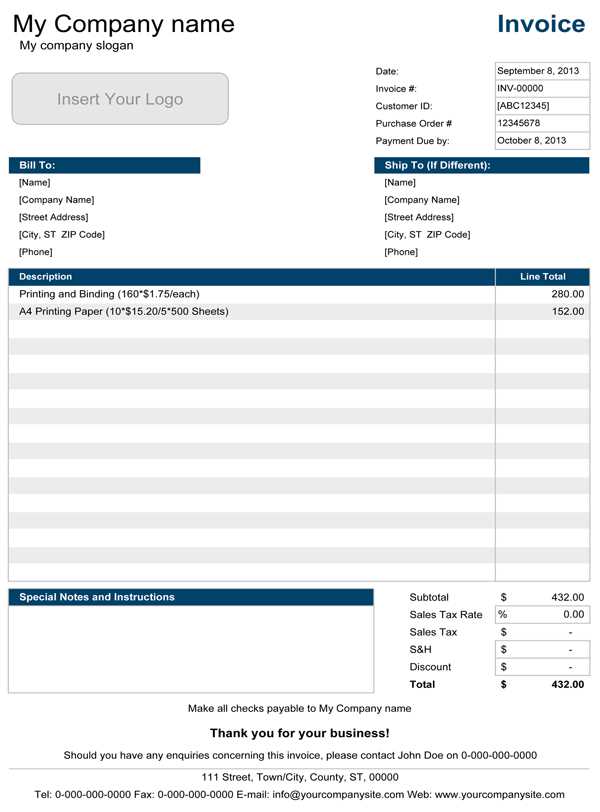

Common Features of Invoice Templates

Most billing documents share a set of core characteristics designed to make transactions clear and professional. These elements help ensure that both the sender and receiver understand the details of the financial exchange, reducing errors and improving communication. Regardless of the industry or the nature of the transaction, certain features remain consistent across all formats.

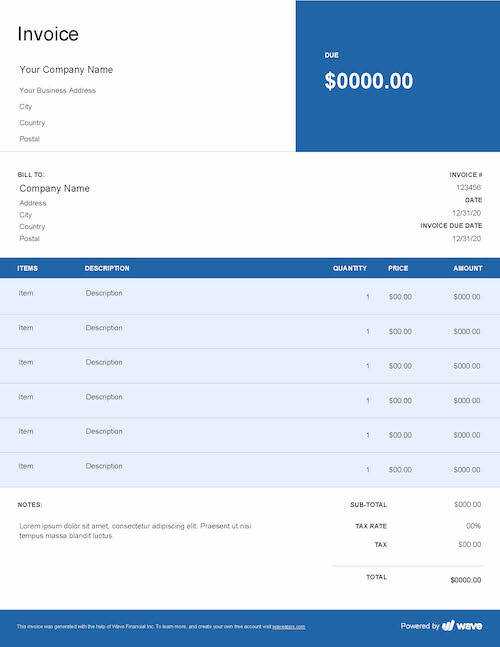

Header Information is crucial for identifying the sender and recipient, including full names, addresses, and contact details. This ensures that both parties can easily reference and follow up on the payment details if necessary. Typically, this section also includes a unique reference number, which simplifies tracking and organization for record-keeping purposes.

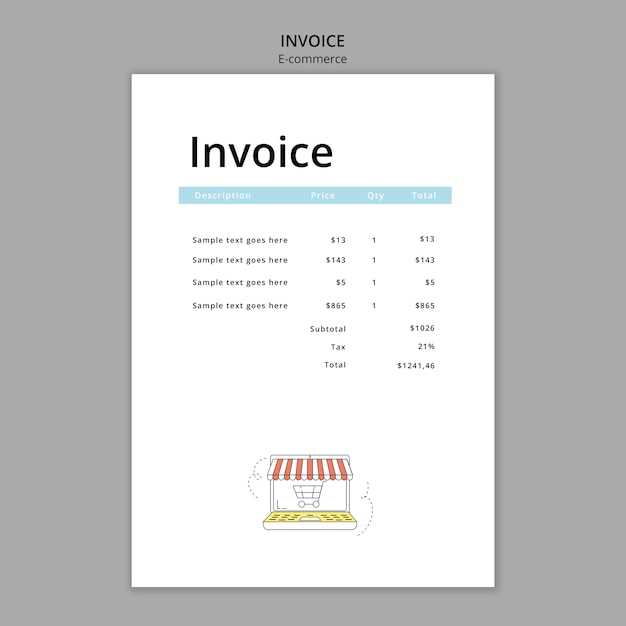

Itemization is another essential feature. A clear breakdown of the goods or services provided, including quantities, unit prices, and the total cost for each line, makes it easy to understand what has been purchased and how the total amount is calculated. This transparency helps prevent misunderstandings and ensures the client is fully informed about what they are paying for.

The payment terms section outlines the due date, accepted payment methods, and any late fees or discounts for early payment. Clear payment instructions reduce confusion and help facilitate timely transactions, which is beneficial for both parties involved.

Finally, a total amount field consolidates all charges into a single figure. This is the final sum that the customer is expected to pay, inclusive of any applicable taxes, fees, or discounts. Properly highlighting this number ensures that there are no ambiguities regarding the amount due.

Choosing the Right Template for Your Business

Selecting the right document format is essential for streamlining transactions and ensuring professionalism. The design and structure you choose should align with your company’s needs, helping you communicate clearly with clients and maintain a consistent brand identity. The right approach can improve the efficiency of your billing process and make financial exchanges smoother for both you and your customers.

Customization options are one of the first considerations. A flexible layout that allows for modifications to suit your specific products, services, or industry is important. Whether you need to include additional fields, adjust design elements, or highlight particular details, having a customizable structure can save you time and ensure that each document fits your business requirements.

User-friendly design is another key factor. Choose a format that is easy to navigate, both for you when creating the document and for your clients when reviewing it. A clean and simple layout with well-organized sections ensures that key information such as prices, dates, and payment terms stand out, minimizing confusion and delays in processing payments.

Branding elements should also be incorporated. Your document layout is an extension of your business’s identity, so it’s important that the design reflects your brand’s colors, logo, and overall style. A consistent and professional look helps establish trust and reinforces your company’s image in the eyes of your customers.

Finally, consider compatibility and integration. Choose a format that works seamlessly with your existing systems, such as accounting software or payment platforms. This ensures smooth data flow, reducing the risk of errors and improving overall efficiency in managing financial transactions.

Customizing Your Document

Tailoring your billing format to meet your specific business needs can significantly improve the clarity and professionalism of your transactions. By adjusting certain elements, you ensure that the document accurately represents your brand and conveys all necessary details to your clients in an organized manner. Customization allows you to stand out while maintaining efficiency and accuracy in financial communications.

Branding and Visual Appeal

One of the most important aspects of personalization is incorporating branding elements. This includes your company logo, color scheme, and font choices. Aligning your document’s design with your overall brand identity reinforces recognition and helps build trust with your clients. A cohesive, branded document reflects a polished, professional image, which can enhance your reputation and customer satisfaction.

Tailoring Content for Specific Needs

Customization also means adjusting the content structure to suit the unique needs of your business. You can add or remove fields such as payment terms, product descriptions, or specific service details. Consider whether you need to display extra information like shipping instructions, discounts, or tax breakdowns. This flexibility ensures the document is as informative and relevant as possible, reducing the chance of confusion or disputes.

By fine-tuning both the visual and content aspects, you create a document that serves not only as a payment request but as a clear, professional representation of your business.

How to Save Time with Templates

Using a pre-designed structure for financial documents can drastically reduce the amount of time spent on administrative tasks. Instead of starting from scratch with every new transaction, you can leverage ready-made formats that only require minor adjustments. This streamlined approach helps maintain consistency while freeing up time for other important tasks in your business operations.

Automating Repetitive Tasks

By utilizing a ready-made format, many of the repetitive elements–such as contact information, payment terms, and itemized lists–are automatically populated. This eliminates the need to manually enter the same details for every document, speeding up the process. You can also save frequently used details, such as discounts or standard charges, which are easily inserted with just a few clicks.

Reducing Errors and Improving Accuracy

Another benefit of using a pre-designed layout is that it helps minimize human error. Since the core structure is already in place, there’s less chance of leaving out important information or misplacing figures. With fewer errors to correct, the overall process becomes faster and more efficient, allowing for faster turnarounds on payments and client interactions.

By adopting this approach, you ensure that the time spent on each transaction is minimized, improving the overall workflow and boosting productivity in your business.

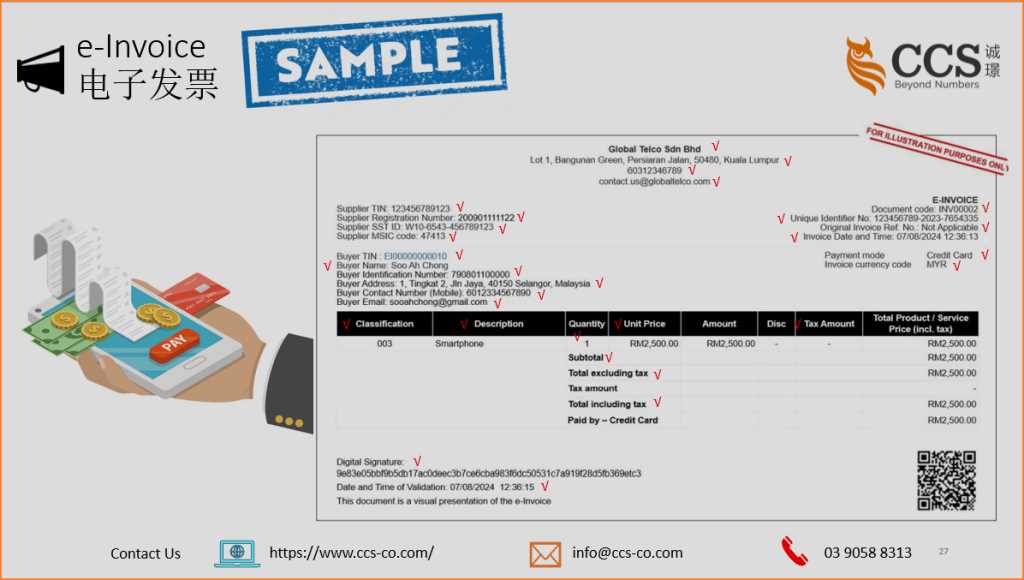

Ensuring Compliance with Tax Laws

Maintaining adherence to tax regulations is crucial for any business. When preparing financial documents, it’s important to include all the necessary information that tax authorities require. This not only ensures that your business stays compliant but also minimizes the risk of errors that could lead to fines or penalties. Using the right format can simplify this process by ensuring that all required fields are properly filled out and that the document complies with local laws.

Here are some key elements to consider when creating documents that comply with tax regulations:

- Proper Tax Identification: Ensure that your business’s tax identification number and the client’s tax ID (if applicable) are included. This is essential for both domestic and international transactions.

- Accurate Tax Rates: Always apply the correct tax rate based on the location of the transaction and the nature of the goods or services. This will prevent over- or under-charging your clients and ensure that tax is correctly calculated.

- Detailed Breakdown: Provide a clear breakdown of taxable and non-taxable items, along with the corresponding tax amounts. This transparency is not only required by tax authorities but also helps customers understand what they are being charged for.

- Regulatory Language: Some regions require specific wording or disclaimers to be included in financial documents. For example, statements related to VAT exemption or tax exemptions may be necessary depending on your business type or location.

- Timely Updates: Tax laws frequently change, and it’s essential that your document structure is flexible enough to accommodate updates in tax rates, applicable exemptions, and other regulatory changes.

By incorporating these essential components into your financial

Free vs Paid Invoice Templates

When choosing a structure for billing documents, businesses often face the decision between using a free option or investing in a paid solution. Each has its own set of advantages and limitations, which can impact the overall efficiency, professionalism, and customization of your financial communications. Understanding the differences can help you make an informed choice based on your specific needs and resources.

Free options are appealing because they require no upfront cost and can be easily accessed from various online platforms. These formats are typically straightforward, with basic layouts and essential fields to include transaction details. While free designs may work well for small businesses or one-time users, they often lack advanced features such as customization or integration with accounting systems. Additionally, many free options may contain watermarks or limited branding capabilities, which could make them less professional in the eyes of clients.

Paid solutions, on the other hand, provide greater flexibility and often come with a range of features designed to meet the needs of growing businesses. These options allow for more advanced customization, including the ability to add company logos, adjust tax calculations, and include specific payment terms. Paid designs also tend to have better support for integration with financial software, making them ideal for businesses that require a higher level of functionality and consistency. However, the upfront cost may be a consideration for smaller businesses or those just starting out.

Ultimately, the choice between free and paid solutions comes down to your business needs. If you are looking for simplicity and minimal cost, a free option might suffice. But if your business requires more robust functionality, customization, and long-term scalability, investing in a paid option could be the more effective solution.

How to Automate Your Billing Process

Automating your billing workflow can save significant time and reduce human error in your financial operations. By using automation tools, you can streamline repetitive tasks, ensuring that transactions are processed quickly and accurately. This not only improves efficiency but also allows you to focus more on other aspects of your business, such as customer service and growth.

Steps to Automate Your Billing System

To start automating, follow these key steps:

- Choose the Right Software: Select a billing software or platform that fits your business needs. Look for features such as recurring billing, customizable fields, and integration with your accounting tools.

- Set Up Recurring Payments: For businesses with regular clients or subscription-based models, set up recurring billing schedules. This way, payments are processed automatically on set intervals without manual intervention.

- Integrate with Your Accounting System: Link your billing platform with your accounting software to ensure that all transactions are recorded and updated in real time. This integration helps to maintain accurate financial records without the need for manual data entry.

- Automate Reminders and Notifications: Configure automatic reminders for overdue payments or upcoming due dates. These notifications can be sent via email or text, reducing the need for manual follow-up.

- Utilize Pre-set Templates: Use pre-designed billing documents to ensure consistency and accuracy. Automating the generation of these documents can significantly reduce the time spent on formatting and manual data entry.

Benefits of Automation

- Increased Efficiency: Automation elimin

Common Mistakes to Avoid in Invoices

Creating accurate billing documents is essential for maintaining clear communication with clients and ensuring timely payments. However, certain mistakes can lead to confusion, delayed payments, or even legal issues. By being mindful of common errors and taking steps to avoid them, you can improve the effectiveness of your financial transactions and avoid unnecessary complications.

Key Errors to Watch Out For

- Missing or Incorrect Client Information: Ensure that all client details, such as the name, address, and contact information, are correct. Inaccuracies can delay payment and cause confusion, especially if the document is used for tax purposes.

- Incorrect Dates: Double-check the issue date and payment due date. Incorrect or inconsistent dates can create confusion about when payment is expected, leading to delays or disputes.

- Unclear Payment Terms: Clearly state your payment terms, including accepted methods and any penalties for late payment. Vague or missing payment terms can lead to misunderstandings about when and how clients should pay.

- Omitting Tax Information: Be sure to include any applicable taxes, such as VAT or sales tax, with the correct rates. Failure to do so can cause problems with both clients and tax authorities.

- Ambiguous Item Descriptions: Clearly describe the goods or services provided, including quantities and unit prices. Vague or incomplete descriptions can lead to confusion about what the client is paying for, which may result in disputes or non-payment.

- Calculating Errors: Always double-check your math. Even small errors in calculations can lead to discrepancies in the amount due, causing frustration for both you and your client.

- Forgetting Contact Information: Include clear contact details, including a phone number or email address, so clien

Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software can significantly enhance the efficiency and accuracy of your financial management. By connecting these tools, you can automate data entry, synchronize transaction records, and streamline your overall workflow. This integration helps reduce manual errors, saves time, and ensures that your financial data is consistently up-to-date across all platforms.

Benefits of Integration

- Automated Data Transfer: Automatically transferring billing information to your accounting system reduces the need for manual data entry, minimizing human error and saving valuable time.

- Real-time Financial Tracking: Integration ensures that all transactions are recorded in real time, allowing you to monitor cash flow, outstanding payments, and financial reports instantly.

- Seamless Record-Keeping: By linking your documents with accounting software, you can maintain accurate, organized records of all transactions, making audits and tax filings much easier.

- Improved Reporting: Automated integration allows you to generate detailed financial reports, such as profit and loss statements, without needing to manually compile data from different sources.

How to Integrate

- Choose Compatible Software: Ensure that your billing platform and accounting software are compatible. Many modern accounting systems offer direct integration options or plugins to connect with popular billing tools.

- Set Up Automation Rules: Configure your software to automatically transfer transaction data from the billing document to your accounting system. This may include syncing customer details, amounts, payment terms, and taxes.

- Test and Verify: After setting up the integration, conduct tests to ensure that the data transfers correctly and that the accounting system reflects accurate transaction details.

Integrating your billing structure with accounting software not only saves time but also enhances the accuracy and consistency of your financial records. With proper setup, you can achieve a more streamlined, automated process that keeps your business running smoothly and efficiently.

Understanding Invoice Numbering Systems

In every business transaction, assigning a unique reference code to each document is crucial for tracking, organizing, and ensuring accuracy. This system of numbering helps maintain order, makes retrieval easier, and serves as an essential part of financial documentation. Without a clear and consistent numbering structure, it would be difficult to manage records, especially when dealing with large volumes of transactions.

The numbering system often follows a logical sequence that increases incrementally with each new entry. This ensures there is no duplication and that each document can be easily identified. Many businesses also incorporate specific identifiers within the numbering format, such as dates, client codes, or project identifiers, to further categorize and streamline the filing system.

When setting up a system, it is important to consider the scale of the business, as well as future growth. A well-structured approach can adapt over time, allowing for the expansion of operations without disrupting existing processes. Whether using a simple numerical order or a more complex alphanumeric structure, the goal is to create a system that is both practical and scalable.

Ultimately, a reliable numbering system serves not only for internal organization but also for external purposes, such as auditing and legal compliance. It helps establish a clear trail of transactions, reducing the risk of errors and enhancing transparency between businesses and their clients.

How to Send Electronic Invoices Securely

Ensuring the safe transmission of financial documents is a critical aspect of modern business operations. When sending sensitive materials such as bills or payment requests, it’s vital to implement measures that prevent unauthorized access, tampering, or loss of data. Protecting this information not only secures transactions but also builds trust with clients and partners.

Key Security Measures

To send documents safely, a combination of encryption, secure channels, and authentication is essential. Below are some of the most effective strategies to enhance security:

- Use Encrypted File Formats: When sending files, ensure they are encrypted to protect sensitive details from being intercepted. Formats like PDF with password protection are commonly used.

- Choose Secure Delivery Methods: Instead of sending documents via standard email, opt for secure portals or services that provide end-to-end encryption and ensure that only authorized recipients can access the files.

- Verify Recipient Identity: Before transmitting any material, confirm the identity of the recipient through multiple channels to avoid sending data to the wrong person.

- Implement Two-Factor Authentication: This adds an extra layer of security when accessing or sending documents, reducing the risk of unauthorized access even if login credentials are compromised.

Best Practices for Long-Term Security

Beyond individual transactions, businesses should establish long-term practices for securing their communication systems:

- Regularly update software and security protocols to protect against vulnerabilities.

- Train employees on safe handling and sending of sensitive information, emphasizing the importance of strong passwords and secure networks.

- Monitor and audit the sending and receiving of important documents to detect any suspicious activity or breaches quickly.

By taking these precautions, businesses can minimize risks and ensure the secu

Tracking Payments with Invoice Templates

Efficiently managing and tracking payments is crucial for maintaining a smooth cash flow and ensuring that financial records remain accurate. A well-structured document helps businesses not only request payments but also monitor their status, making it easier to follow up on overdue amounts and reconcile accounts. By organizing payment details systematically, companies can streamline their financial processes and avoid confusion.

Including specific fields for payment status, due dates, and amounts paid can provide clear visibility into a client’s outstanding balance. Additionally, tracking these details within a central system allows for faster updates and better reporting, reducing the time spent manually checking payment statuses.

Here are some key elements to incorporate in tracking payments:

- Payment Terms: Clearly define payment due dates and terms, such as net 30 or net 60, to avoid confusion and ensure timely payments.

- Payment Status: Use a section to update whether the payment is “Paid,” “Pending,” or “Overdue.” This provides a quick reference to monitor outstanding amounts.

- Payment Method: Record how the payment was made (e.g., bank transfer, credit card, check) to reconcile with your financial system more easily.

- Partial Payments: If applicable, note any partial payments made and update the balance accordingly to keep track of remaining amounts.

Using such a structured approach not only helps keep your records organized but also facilitates communication with clients regarding their payment statuses, making the entire billing process more efficient and transparent.

Updating Your Invoice Template for Growth

As your business expands, it’s essential to adapt your billing and financial documentation processes to accommodate the increasing volume of transactions and clients. The tools and structures that worked when you first started may need adjustments to ensure smooth operations and maintain professionalism. Updating your billing documents to reflect the growth of your company can streamline operations, improve communication, and avoid errors as your business scales.

Here are several key areas to focus on when revising your billing documents for growth:

- Customizing for Different Client Needs: As your customer base diversifies, you may need to customize your documents to better suit various client segments. This can include adding special terms, discount structures, or payment methods that cater to specific groups.

- Incorporating Additional Information: With growth, you may have new services or products to track. Make sure your billing documents can accommodate expanded item lists, multiple tax rates, or project-specific details.

- Scaling Automation Features: As your transaction volume increases, it becomes more important to automate the generation, delivery, and tracking of documents. Integrating with accounting software or using invoicing systems can help reduce manual work and improve accuracy.

- Ensuring Compliance: As your business expands into new regions or markets, tax laws and regulatory requirements may change. Regularly updating your documentation to stay compliant with local laws is essential to avoid legal issues.

By regularly reviewing and updating your billing system to meet the demands of your growing business, you ensure that you maintain a professional and efficient process, which fosters trust and reliability with your clients and partners.

Best Practices for Invoice Design

A well-designed billing document not only ensures that your clients receive clear, easy-to-read information, but also reflects your professionalism and attention to detail. An organized layout with the right elements in place can help prevent confusion, reduce the risk of errors, and make payment processes smoother. Whether you’re creating the document manually or using a digital tool, paying attention to design is essential for a seamless customer experience.

Key Elements of a Well-Designed Billing Document

When designing your billing document, there are several core components to consider ensuring clarity and ease of use:

- Clear Branding: Include your company logo, name, and contact information prominently at the top. This helps to establish credibility and makes it easy for the client to reach you if needed.

- Structured Layout: Organize the document in a way that is visually appealing and easy to follow. Use headings and sections to separate key information, such as items, pricing, and totals.

- Accurate Details: Clearly display details such as product or service descriptions, quantities, unit prices, and applicable taxes. This transparency helps avoid misunderstandings.

- Payment Terms: Specify the payment due date, accepted payment methods, and any late fees or discounts for early payment. This makes expectations clear from the start.

- Legible Font and Size: Use fonts that are easy to read, and ensure that text is large enough to be legible on all devices or printed formats.

Enhancing User Experience and Functionality

In addition to clear layout and essential deta