Free Electrical Invoice Template for Word Download and Customization

Managing payments and maintaining clear financial records is a vital part of any service-based business. For those working in trades, having an organized and professional approach to generating client statements is essential for smooth operations. This guide offers a simple and effective solution for creating consistent, accurate billing documents.

By using ready-made document formats, contractors and service providers can save time and avoid errors. These documents are easy to personalize with business details, pricing, and services rendered, helping you stay focused on the work at hand. Whether you’re dealing with routine jobs or large-scale projects, a well-structured billing method can enhance professionalism and ensure timely payments.

Efficient billing practices not only simplify record keeping but also build trust with clients. When your financial documents are clear and precise, clients feel more confident in the services you provide. Customizable formats are designed to meet the specific needs of different trades, allowing flexibility in the way invoices are presented and organized.

In the following sections, we will explore how to create a professional, customizable billing solution that fits your needs and helps you maintain financial clarity.

Essential Features of Billing Documents for Contractors

When creating a billing document for services provided, several key features are essential to ensure clarity, accuracy, and professionalism. A well-structured document not only helps streamline the payment process but also provides a clear record for both the service provider and the client. Below are the crucial components that every contractor’s billing document should include to meet both business needs and client expectations.

1. Business Information

- Company Name: Clearly display your business name at the top to establish identity.

- Contact Details: Include phone number, email address, and physical address for easy communication.

- Tax Identification Number: If applicable, include your tax ID or business registration number to maintain compliance.

2. Client Information

- Client’s Name and Address: Always include the full name and address of the person or company receiving the services.

- Client’s Contact Info: It’s useful to provide the client’s phone number or email in case follow-up is needed.

3. Clear Breakdown of Services

- Detailed Description: List each service or product provided along with a short description to avoid confusion.

- Quantity and Rate: Specify the number of hours worked, units supplied, or quantities delivered, along with the respective rates or pricing.

- Subtotal: Break down costs for each item or service to ensure transparency.

4. Payment Terms and Conditions

- Due Date: Clearly state when payment is expected to avoid delays.

- Accepted Payment Methods: Indicate what types of payments are accepted (bank transfer, check, etc.).

- Late Fees: If applicable, specify any penalties for overdue payments.

5. Professional Design Elements

- Branding: Include your company’s logo, color scheme, and fonts to enhance professionalism and consistency across all documents.

- Easy-to-Read Layout: Use clear headings, bullet points, and well-spaced sections to improve readability.

Including these essential features ensures your billing documents not only meet business standards but also foster trust and professionalism with your clients.

Why Use a Pre-designed Billing Document?

Having a pre-made format for billing is a practical solution for professionals looking to save time, reduce errors, and present a more organized and polished image to clients. Customizable formats offer a simple way to create accurate, clear, and consistent financial records without starting from scratch every time. Below are some key benefits of using a pre-designed billing document for your business.

| Benefit | Description |

|---|---|

| Time Savings | Ready-made documents allow you to fill in the necessary details quickly, reducing the time spent on administrative tasks. |

| Consistency | Pre-designed formats ensure uniformity in appearance and structure, helping you maintain professionalism across all client interactions. |

| Accuracy | With pre-structured fields and sections, it’s easier to avoid common mistakes like incorrect pricing or missing information. |

| Customizability | You can personalize the document to include your company branding, specific service details, and other preferences for a more tailored look. |

| Legal Compliance | Templates often include important legal and financial elements, such as tax identification numbers and payment terms, ensuring your documents meet industry standards. |

Using a pre-designed format not only simplifies the billing process but also contributes to smoother client interactions and better financial management for your business.

How to Customize Your Billing Document

Customizing your billing document allows you to make it reflect your unique business needs and maintain a professional image. Whether you want to include your company logo, change the layout, or adjust the payment terms, customization options help you create a document that suits your style while remaining functional and clear. Here’s how to make the most out of your billing format.

1. Adding Your Business Details

Start by including your business information at the top of the document. This should include your company name, address, phone number, and email. Including your logo or brand colors will give the document a professional touch and strengthen your company’s visual identity.

2. Personalizing Service and Payment Information

Adjust the sections for describing the services provided to reflect your specific offerings. Be clear and concise when listing each service, including quantities and rates. Additionally, make sure the payment terms–such as due dates, accepted payment methods, and penalties for late payments–are tailored to your business practices.

By customizing these elements, you ensure that the billing document is not only functional but also tailored to your brand and client needs. This level of personalization enhances the professional appearance of your records and improves communication with clients.

Best Practices for Creating Billing Documents in Word

When generating professional financial records, attention to detail and consistency are key. By following best practices, you can ensure that your documents are not only accurate but also easy to read and understand. Whether you’re handling a single client or a long list of transactions, adhering to certain guidelines can streamline your process and improve the client experience.

1. Use Clear and Consistent Formatting

Make sure your document is clean, organized, and easy to read. Use headings, bold text, and bullet points to highlight important details like the amount due, payment terms, and service descriptions. Keeping the font size and style consistent throughout the document contributes to a professional appearance.

2. Double-Check for Accuracy

Before sending any document, double-check all the details. Ensure that the services listed are correct, pricing is accurate, and the client information is up-to-date. A small mistake can cause confusion or delay payments. Take extra time to review the total amount, any discounts applied, and the payment deadline.

3. Include a Payment Breakdown

For transparency, always provide a clear breakdown of the services provided, their costs, and any taxes or additional fees. This helps clients understand exactly what they are paying for, reducing the chance of disputes.

4. Keep Your Branding Consistent

Incorporating your company logo, color scheme, and other branding elements into the document adds a professional touch and helps maintain consistency across all business communications. This reinforces your brand identity and fosters trust with clients.

By following these best practices, you ensure that your documents are clear, professional, and efficient, ultimately making your billing process more effective and reliable.

Top Advantages of Using Pre-designed Billing Documents

Utilizing pre-made formats for creating financial records offers several benefits that can save time, improve accuracy, and enhance professionalism. These ready-to-use documents provide a framework that simplifies the billing process and ensures consistency across all transactions. Below are some key advantages of using such formats in your business operations.

1. Time Efficiency

Using a pre-designed format allows you to quickly fill in the necessary details without needing to create a new document from scratch every time. This streamlined approach saves valuable time, allowing you to focus on your core work rather than spending hours formatting or adjusting layouts.

2. Consistency and Professionalism

Pre-made formats ensure that your documents maintain a consistent look and feel across all client communications. This consistency helps build trust and credibility with clients, who are more likely to feel confident in your professionalism when they see a polished, uniform format each time.

3. Error Reduction

With standardized fields and sections, the chances of missing key information or making formatting mistakes are minimized. These pre-built structures guide you in entering the correct data, ensuring that important details–such as pricing, payment terms, and contact information–are not overlooked.

4. Easy Customization

Although these formats come pre-built, they are also highly customizable. You can easily add your logo, adjust the layout to your preference, and tailor the content to match your specific needs. This level of flexibility makes it easy to maintain both personalization and efficiency.

5. Improved Client Communication

A well-organized document makes it easier for clients to understand the services provided, costs, and payment terms. When your documents are clear and professionally formatted, clients are more likely to pay on time and in full, reducing misunderstandings and delays.

Overall, using pre-designed formats for your financial records helps streamline processes, increase efficiency, and maintain a professional, consistent image with clients.

Tips for Accurate Billing in the Trades

Ensuring that your billing records are accurate is essential to maintaining good client relationships and proper financial management. Clear, precise details prevent confusion and delays in payments, while also helping to avoid disputes. Here are some practical tips to help you achieve accuracy when creating billing documents for your services.

1. Double-Check Service Descriptions

It’s essential to provide clear and detailed descriptions of the services you’ve rendered. Ensure that each task is explained in enough detail for the client to understand exactly what they’re being charged for. Vague descriptions can lead to misunderstandings and disputes over what was actually completed.

2. Be Transparent with Pricing

Always list your pricing clearly and break down the costs for each item or service. When clients can see a transparent breakdown of how you arrived at the total, they are more likely to accept the charges and pay promptly.

| Key Element | Tips for Accuracy |

|---|---|

| Service Description | Use specific language to explain what was done, including any additional materials or special requests. |

| Rates | List hourly rates, material costs, or flat fees clearly, and specify if there are any extra charges for specific tasks. |

| Discounts | If offering discounts, ensure the original price and discount amount are both clearly stated to avoid confusion. |

| Taxes | Include applicable taxes or fees and make sure they are calculated correctly, based on the tax rate in your area. |

By following these guidelines, you can ensure that your billing documents are accurate, transparent, and professional, which will help you maintain strong relationships with your clients and encourage timely payments.

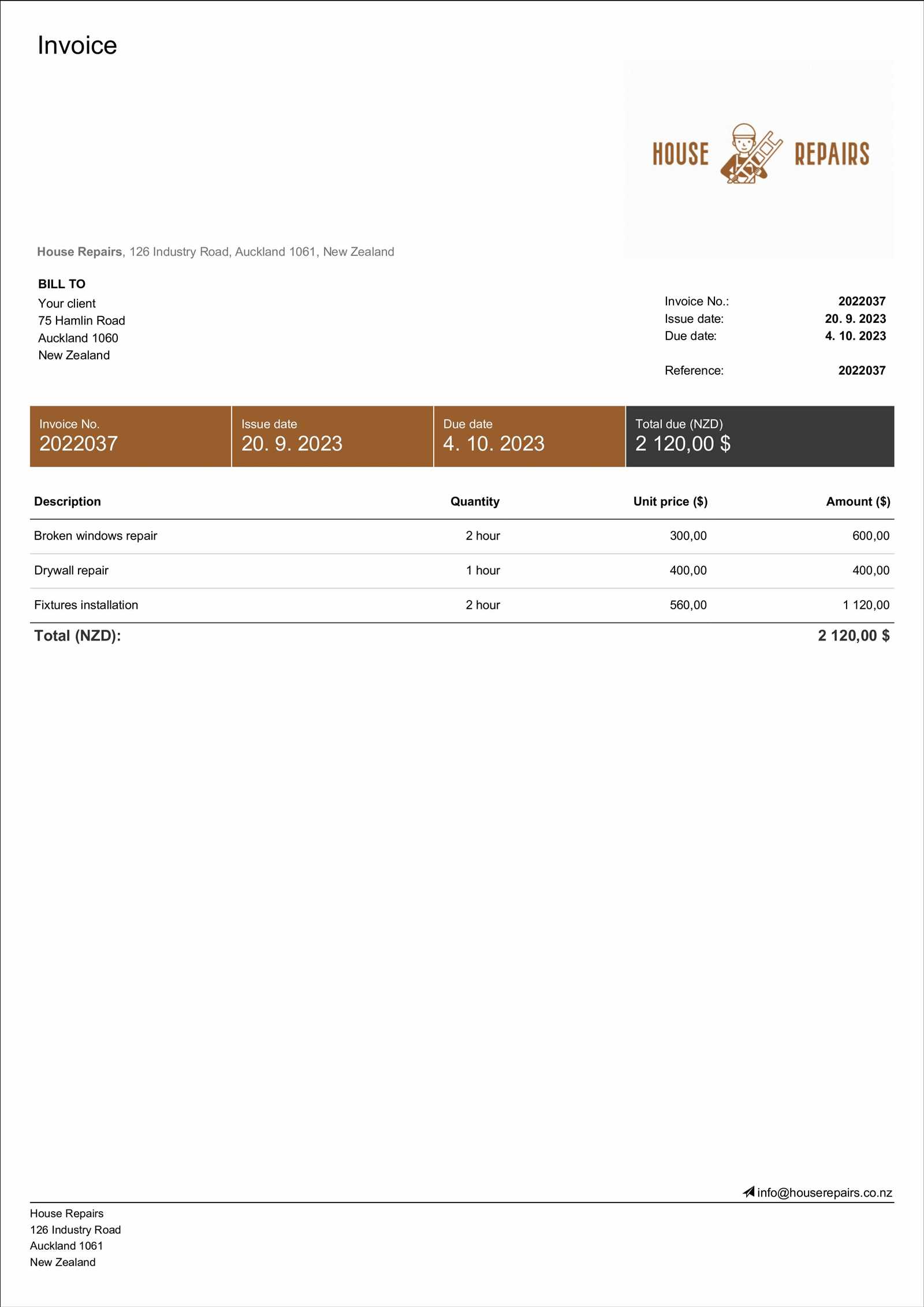

Understanding Billing Document Formatting

Proper formatting of financial documents is essential for clarity and professionalism. A well-organized layout ensures that all necessary details are presented in a way that is easy to read and understand, both for you and your clients. Knowing how to structure your document correctly can prevent errors, reduce misunderstandings, and speed up the payment process. Here are the key elements to focus on when formatting your billing records.

1. Clear Structure and Organization

Creating a structured format is the first step in ensuring your billing records are professional and easy to navigate. Here are some components that should be included:

- Header: Include your company name, contact details, and logo at the top for branding consistency.

- Client Information: Ensure that the client’s name, address, and contact details are clearly listed.

- Itemized List: Clearly list all services or products provided, along with the associated costs.

- Subtotal and Total: Provide a breakdown of all charges, including the subtotal, tax, and final amount due.

- Payment Terms: Be explicit about payment methods, due dates, and any late fees if applicable.

2. Formatting Tips for Readability

Once you’ve structured your document, it’s important to ensure it’s visually appealing and easy to follow. Here are some tips for improving readability:

- Use Headings: Make important sections stand out by using bold text or headings, such as “Subtotal” and “Total Due”.

- Consistent Fonts and Spacing: Choose a professional font (e.g., Arial or Times New Roman) and maintain consistent spacing between sections.

- Align Columns Properly: Ensure that amounts, dates, and descriptions align properly to avoid confusion. Use tables for clear organization.

- Highlight Important Information: Use bold or italic text sparingly to highlight key details like payment due dates or special terms.

By understanding these key formatting principles, you can create well-organized billing documents that enhance your professionalism and improve client communication.

How to Add Taxes and Discounts

Accurately calculating taxes and applying discounts is an essential part of creating precise financial records. Properly incorporating these elements ensures that your clients are billed correctly and in compliance with local regulations. Here are the steps to follow when adding taxes and discounts to your billing documents.

1. Adding Taxes

Taxes are typically added to the subtotal amount, and their rates can vary depending on your location or the nature of the services provided. To ensure correct tax application, follow these steps:

- Determine the Tax Rate: Research the applicable tax rate for your business or industry, such as sales tax or VAT.

- Calculate the Tax Amount: Multiply the subtotal by the tax rate to calculate the tax amount.

- Clearly Display the Tax: List the tax as a separate line item on the billing document to avoid confusion. Label it as “Tax” or “Sales Tax” with the appropriate percentage.

- Update the Total: Add the tax amount to the subtotal to get the final total amount due from the client.

2. Applying Discounts

Offering discounts is a common way to incentivize clients, but it must be done transparently. Here’s how to apply discounts properly:

- Choose the Discount Type: Decide if the discount will be a fixed amount or a percentage of the subtotal.

- Calculate the Discount: For a percentage discount, multiply the subtotal by the discount rate. For a fixed amount, simply subtract that amount from the subtotal.

- Label the Discount: Clearly list the discount as a separate line item, specifying the percentage or amount deducted.

- Adjust the Total: Subtract the discount from the subtotal (after tax, if applicable) to arrive at the new total amount due.

By properly calculating and presenting both taxes and discounts, you ensure clarity for your clients and help avoid any confusion or disputes over billing. It also demonstrates professionalism and attention to detail, contributing to smooth financial transactions.

Organizing Client Information on Your Billing Document

Properly organizing client information on your billing document is crucial for both clarity and effective communication. Ensuring that all relevant details are clearly presented not only helps avoid confusion but also speeds up the payment process. By structuring the client section efficiently, you make it easier for both you and your clients to reference key information quickly and accurately.

Here are the essential elements to include when organizing client details on your billing records:

- Client Name: Clearly state the full name of the individual or company receiving the service. This should be one of the first pieces of information at the top of the document.

- Contact Information: Include the client’s phone number and email address. This makes it easier to follow up on payments or address any issues.

- Billing Address: Ensure the client’s physical address is listed, especially if the service is location-specific or if you are required to mail a hard copy of the document.

- Client Account Number (if applicable): Some businesses use client IDs or account numbers for reference. If applicable, be sure to include this for quicker identification and reference.

By keeping the client’s information clearly organized and easy to locate, you ensure a smoother billing process and a more professional appearance in all your business transactions. Accurate and well-structured records help build trust and promote timely payments.

Incorporating Payment Terms Effectively

Clearly outlining payment terms is essential to ensure smooth transactions and avoid confusion between you and your clients. By specifying due dates, accepted payment methods, and any penalties for late payments, you create an understanding that helps both parties manage expectations. Here’s how to incorporate payment terms effectively in your financial records.

1. Define Clear Payment Due Dates

Make sure to specify exactly when the payment is expected. Ambiguous dates can lead to delays, so always provide a specific deadline for payment. Consider the following approaches:

- Due Upon Receipt: This means payment is expected immediately after the client receives the document.

- Net 30/45/60: A common practice, where the payment is due within 30, 45, or 60 days after the service is rendered or the document is issued.

- Custom Date: If you have an agreement with the client, specify a custom payment date that works for both parties.

2. Specify Accepted Payment Methods

Be sure to list the methods through which you accept payments. This prevents any misunderstandings and gives the client clear options. Common methods to include are:

- Bank Transfer: Provide your bank details for easy direct deposits.

- Online Payments: Platforms like PayPal, Stripe, or credit card payments.

- Cheque or Cash: If applicable, mention that you accept these forms of payment.

3. Include Late Payment Penalties

If you plan to charge fees for late payments, it’s important to clearly state these in your payment terms. Common penalty methods include:

- Late Fee: Charge a fixed fee after a certain number of days past the due date, such as $25 or $50.

- Interest Charges: Specify an interest rate (e.g., 1.5% per month) for overdue payments.

Including these elements in your payment terms ensures transparency and minimizes delays in payment processing. Clear and effective communication about payment expectations fosters positive client relationships and supports consistent cash flow for your business.

Why Consistent Branding Matters on Billing Documents

Maintaining consistent branding across all business communications, including financial documents, plays a significant role in building a professional image and fostering trust with clients. When your branding is clear and uniform, it helps create a cohesive identity for your business, making it easily recognizable and more memorable. Here’s why applying consistent branding to your billing documents is essential.

1. Builds Trust and Professionalism

When clients receive documents that are visually aligned with your brand, it signals that your business is established and reliable. A well-designed document featuring your company logo, colors, and fonts demonstrates attention to detail and professionalism, which encourages clients to treat the document seriously and pay on time.

2. Strengthens Brand Recognition

Consistent branding across all documents, including receipts, proposals, and billing records, helps clients recognize your business more easily. The use of uniform colors, typography, and logos ensures that your company’s identity remains top of mind, even in a transactional context. Over time, this enhances your visibility and makes your business stand out in a competitive market.

By integrating your brand into your billing documents, you contribute to your overall marketing strategy while improving communication with your clients. Consistency in design not only elevates your professionalism but also reinforces your brand’s presence in every interaction.

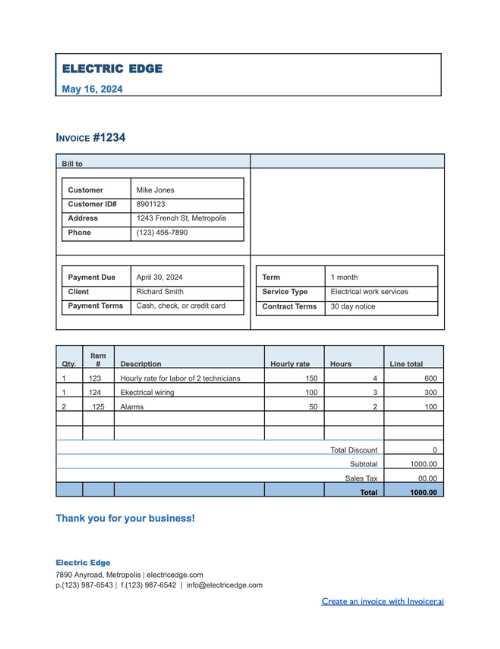

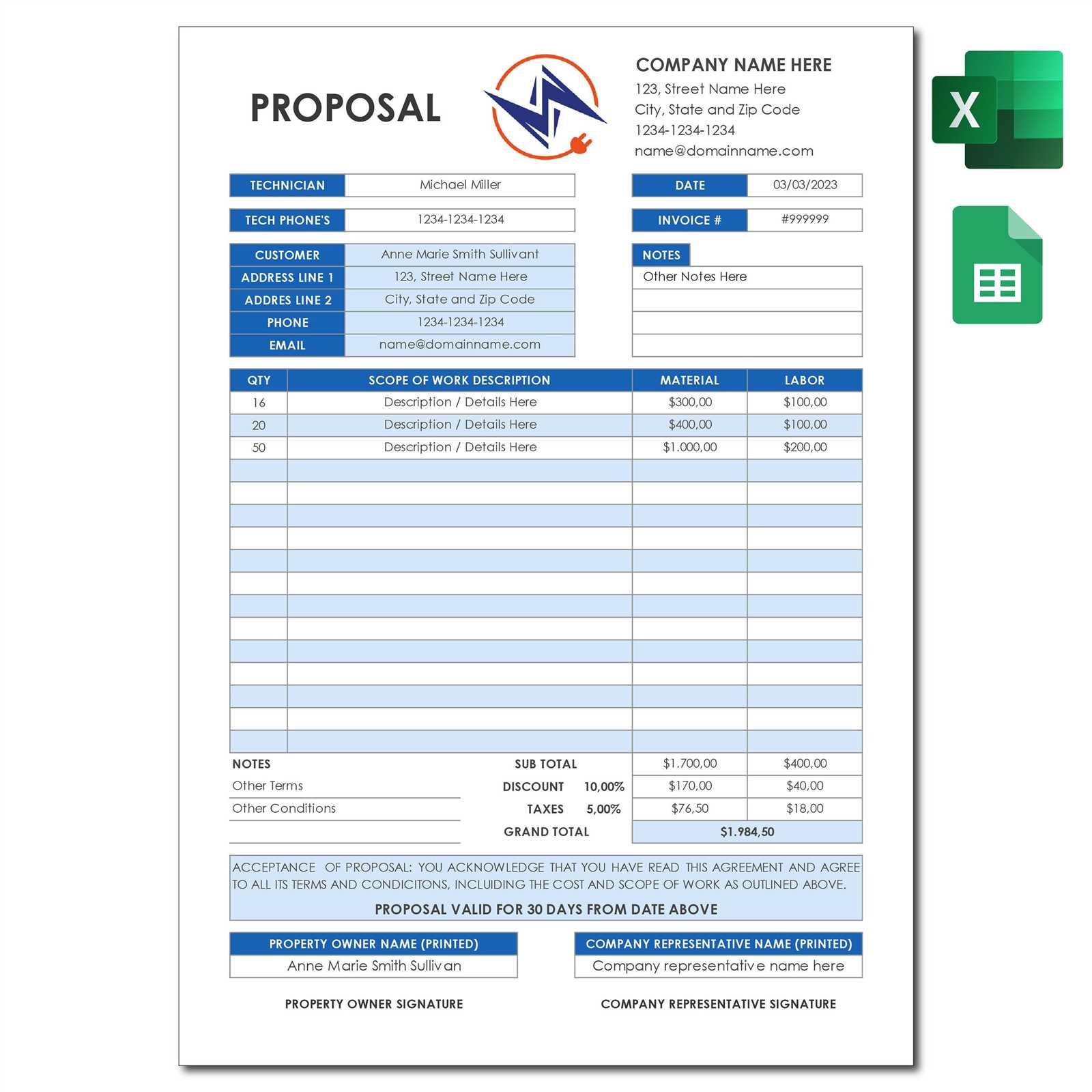

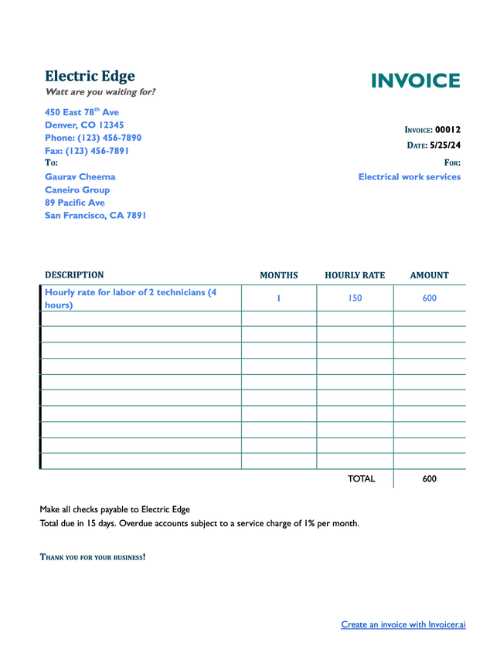

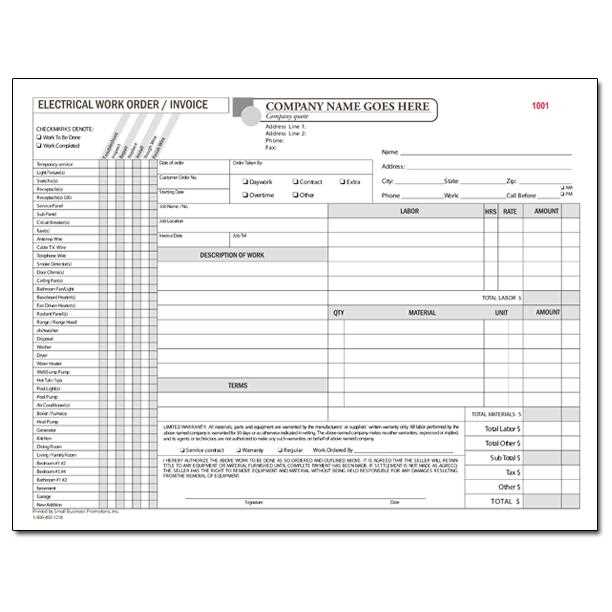

Invoice Template Options for Electricians

When running an electrical service business, having the right format for your billing records is essential for smooth transactions and clear communication with clients. The right design can not only ensure accuracy but also enhance your professionalism. Below are some popular options to consider when selecting a billing format that suits the needs of electricians.

1. Simple and Straightforward Design

If you’re looking for a basic, easy-to-use format, a simple layout with essential details may be all you need. This option typically includes space for:

- Service description

- Hours worked or materials used

- Total cost breakdown

- Client and service provider information

- Payment terms and due date

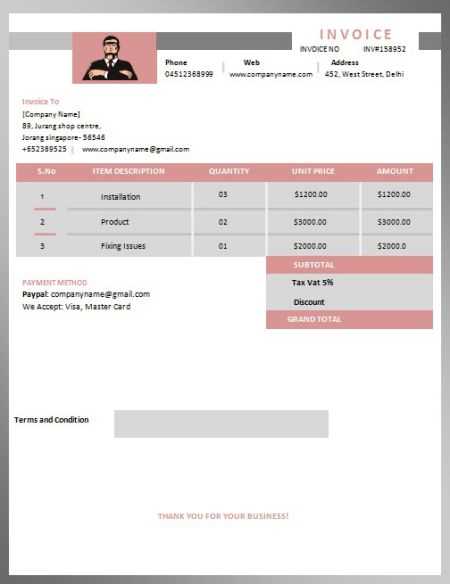

2. Detailed Itemized Format

A more detailed format breaks down each task performed and material used, providing a clearer view of the service charges. This option is great for larger projects where transparency is crucial. The detailed format can include:

- Individual task descriptions

- Unit prices for labor and materials

- Specific hours worked per task

- Tax and discount calculations

| Template Type | Features | Best For |

|---|---|---|

| Basic Design | Simple layout with key details | Small projects or routine work |

| Itemized Breakdown | Detailed task and material descriptions | Complex jobs with multiple tasks and expenses |

| Customizable Template | Ability to modify fields and design | Businesses with unique service offerings |

Choosing the right billing format depends on your business size, the type of services you offer, and your clients’ needs. Whether you prefer simplicity or need detailed breakdowns, the right format will help ensure transparency and accuracy in every transaction.

Common Mistakes to Avoid in Billing

Accurate and timely billing is crucial for maintaining smooth business operations and fostering good client relationships. However, mistakes in your billing process can lead to confusion, delays, and even disputes. Understanding and avoiding common errors in creating billing documents is essential for efficiency and professionalism. Here are some common mistakes to watch out for when preparing your billing records.

1. Inaccurate Client Information

One of the most basic mistakes is entering incorrect or incomplete client details. This can cause delays in payment or lead to confusion regarding where the payment should be sent. Always ensure that the client’s name, address, and contact information are up-to-date and accurate.

2. Failing to List All Charges

Leaving out certain charges can cause issues, especially if the client is unexpectedly billed for additional items or services. Be sure to include a detailed breakdown of all work completed and materials used. This prevents misunderstandings and helps clients see exactly what they’re paying for.

| Common Mistake | Consequences | Solution |

|---|---|---|

| Incorrect Client Information | Delayed payments, client frustration | Double-check client contact details before sending |

| Omitting Charges | Confusion over final price, disputes | Provide detailed itemized breakdown of services and materials |

| Missing Payment Terms | Late payments, unclear expectations | Always include clear due dates and payment instructions |

| Wrong Tax Calculations | Incorrect total due, potential legal issues | Use accurate tax rates and double-check calculations |

3. Missing Payment Terms

Another common mistake is not specifying payment terms, such as the due date, late fees, or accepted payment methods. Clear payment terms help avoid delays and ensure both you and the client have the same expectations. Always be explicit about when payment is due and how it should be made.

4. Incorrect Tax Calculations

Tax miscalculations are a frequent error that can lead to overcharging or undercharging clients. Make sure you’re using the correct tax rate for your area and accurately applying it to the total charges. Double-check the tax amount before finalizing the document.

By avoiding these common mistakes, you can ensure a smoother billing process, minimize confusion, and maintain strong client relationships. Always double-check your details and ensure clarity to keep your transactions transparent and efficient.

How to Track Payments with Billing Templates

Tracking payments efficiently is essential for managing your cash flow and ensuring timely follow-up on outstanding balances. Using a structured billing record, you can easily monitor which payments have been made, which are due, and which are overdue. Here’s how you can effectively track payments using customizable billing templates.

1. Include a Payment Status Section

A simple way to track payments is to include a “Payment Status” field on your billing document. This section can indicate whether the payment is “Paid,” “Pending,” or “Overdue.” Keeping this information updated allows both you and your clients to quickly see the status of their payment. The status field can be manually updated as payments are received or marked as overdue when the payment is delayed.

2. Use a Payment Log Table

For more detailed tracking, you can incorporate a payment log directly into your billing record. This log can track each payment, including partial payments, and give a clear view of how much is still owed. Here’s an example of what to include:

| Payment Date | Amount Paid | Payment Method | Balance Remaining |

|---|---|---|---|

| 10/01/2024 | $100 | Bank Transfer | $200 |

| 10/15/2024 | $150 | Credit Card | $50 |

| 10/20/2024 | $50 | Cash | $0 |

With this payment log, you can easily track the history of payments, update the balance due, and ensure that no payments are missed. This detailed tracking ensures you remain on top of your financial transactions and can address overdue payments promptly.

3. Set Clear Payment Deadlines

To avoid confusion, always set clear payment deadlines on your billing records. This helps both you and your client understand when the payment is expected. You can also add an “Overdue” notice or reminder in the document once the payment deadline has passed, helping you stay proactive in collecting outstanding balances.

Using these methods, you can effectively track payments, stay organized, and ensure timely follow-up, ultimately leading to better financial management for your business.

Integrating Your Billing Format with Accounting Tools

Efficient financial management requires seamless integration between your billing records and accounting software. By connecting your billing documents to digital tools, you can automate many tasks, track payments more effectively, and reduce the chances of errors. Here’s how you can integrate your billing records with accounting tools to streamline your workflow.

1. Use Accounting Software with Import Features

Many modern accounting platforms offer features that allow you to import your billing records directly. This eliminates the need for manual data entry and helps maintain consistency across your financial records. Common options include:

- QuickBooks: Supports importing data from various file formats, including Excel and CSV, allowing you to automatically update your financial statements.

- Xero: This tool allows integration with cloud-based storage systems, making it easier to access and update your financial records from anywhere.

- FreshBooks: Great for small businesses, FreshBooks integrates with templates and automatically tracks payments and expenses.

2. Customize Your Template for Easy Data Entry

To make integration smoother, customize your billing document to match the data fields used by your accounting software. For instance, ensure that your billing record includes the necessary columns like:

- Service date

- Service description

- Payment terms

- Total amount

- Taxes and discounts

By using consistent labels and formats, you make it easier to import this data into your accounting system without confusion or errors.

3. Automate Payment Tracking

Once your billing records are integrated with accounting tools, set up automatic payment tracking. Many accounting systems allow you to set up reminders for upcoming payments, late fees, and account balances. Some features include:

- Automatic invoice reminders: These tools will notify both you and the client when payments are due or overdue.

- Payment status tracking: Accounting software can automatically mark payments as “paid,” “pending,” or “overdue” based on the information you import.

Integrating your billing format with accounting tools not only saves time but also ensures that your financial records are accurate and up-to-date. This synchronization can help you keep better track of your finances, reduce manual work, and improve cash flow management.

How to Save and Share Your Billing Record

Once you’ve created your billing document, the next steps are ensuring it is saved securely and shared efficiently with your clients. Properly saving and distributing your records not only helps maintain a professional image but also ensures that both you and your client have easy access to the information whenever needed. Here are some tips on how to save and share your billing record.

1. Save Your Billing Document in the Right Format

Choosing the correct file format is essential for ease of access and compatibility with various devices and software. Consider the following options:

- PDF: This is the most common and preferred format for sharing, as it preserves your document’s layout and can be opened on almost any device without editing restrictions.

- Excel/CSV: Useful for tracking multiple transactions and when you need to import data into accounting software for further processing.

- Cloud Storage: Saving your document to a cloud-based service such as Google Drive or Dropbox ensures you can access it from anywhere and share it easily with others.

2. Share Your Billing Record Efficiently

Sharing your billing document securely and professionally ensures prompt payment and clear communication. Here are some best practices for sharing:

- Email: Attach your billing document as a PDF file and send it via email to your client. Always include a clear subject line, such as “Billing for [Service Name]” and a polite message regarding the due date.

- File Sharing Services: If the file size is large or you need to share multiple records, use platforms like Google Drive, Dropbox, or OneDrive. Share the link to the file with your client and set appropriate access permissions (view only or edit).

- Direct Client Portals: For businesses with frequent transactions, consider using a client portal where clients can log in, view their billing records, and even make payments directly.

By saving your billing records in the right format and using secure, professional methods to share them, you can ensure that your business operations run smoothly and that your clients have easy access to their billing information.

Free Resources for Downloading Billing Templates

If you’re looking for professional billing documents but don’t want to start from scratch, there are several free resources available online where you can download customizable billing formats. These templates can save you time and help you create accurate, well-organized records for your business. Here are some popular platforms offering free templates for download.

1. Microsoft Office Templates

Microsoft Office offers a wide range of free, customizable templates for various purposes, including billing. These documents are fully editable and can be tailored to your specific needs. Simply visit the Microsoft Office templates page, search for the relevant billing document, and download it in Excel, Word, or PDF format.

- Website: Microsoft Office Templates

- Formats available: Excel, Word, PDF

- Features: Easy customization, pre-built fields for details, clean and professional layouts

2. Google Docs Templates

Google Docs provides free access to various billing document templates that can be accessed and edited online. The great thing about Google Docs is its collaboration features, allowing you to work on the document with colleagues or clients in real time. Once you’ve made your edits, you can easily download or share your document via email or link.

- Website: Google Docs

- Formats available: Google Docs, Excel (Google Sheets)

- Features: Cloud-based editing, easy sharing, real-time collaboration

3. Invoice Generator Websites

Several online platforms allow you to create and download billing documents for free. These platforms are ideal for quick use, offering user-friendly interfaces where you simply enter your details, and they generate a billing document ready for download.

- Website: Invoice Generator

- Website: Invoicely

- Website: Bill.com

- Features: Customizable fields, instant download, ability to store previous documents

These free resources make it easy to download and customize billing formats that fit your needs. Whether you’re looking for a simple document to track payments or a more complex layout for detailed records, these platforms offer a variety of options without any cost. Try them out and streamline your billing process today!