Electrical Invoice Template PDF for Easy Download and Customization

Maintaining clear and accurate records of services provided is crucial for any business. Crafting effective billing documents helps ensure smooth financial transactions and strengthens professional relationships with clients. With the right approach, generating these documents becomes a streamlined process, saving you time and reducing errors.

Whether you’re in the construction, maintenance, or service industry, having a structured format for your charges is essential. Many business owners opt for ready-to-use formats that can be quickly adapted to meet their needs. These ready-made solutions provide an efficient way to issue detailed and well-organized records that reflect the scope of the work performed and the cost associated with it.

In this guide, we explore the advantages of using customizable formats that simplify the billing process. From understanding key components to learning how to tailor the content, this approach ensures that you present clear, professional, and legally sound documents every time you complete a job.

Understanding the Importance of Billing Documents

Proper documentation of services provided is essential for any business. A well-organized and clear record not only ensures transparency in financial dealings but also protects both the service provider and the client. This record serves as an official proof of the transaction, outlining the agreed-upon charges and the scope of work performed.

For businesses in the service industry, creating accurate and professional records is vital for maintaining a trustworthy reputation. It helps avoid misunderstandings regarding payment, facilitates timely compensation, and can be referenced in case of disputes. These documents also assist in tracking earnings and expenses, contributing to better financial planning and management.

Why Accurate Billing Matters

Providing precise records allows businesses to maintain a professional image and ensures that both parties are on the same page regarding expectations. Clear documentation is especially important when dealing with large-scale projects, where multiple services are rendered over time. By outlining specific tasks and corresponding costs, businesses can prevent confusion and ensure timely payment.

The Role of Structured Records in Business Growth

Having a consistent

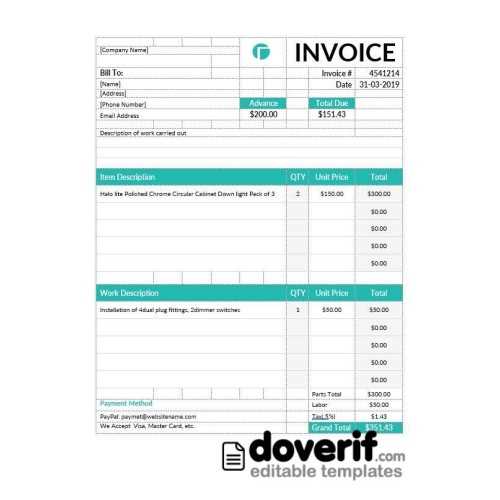

What is an Invoice Format for Service Billing

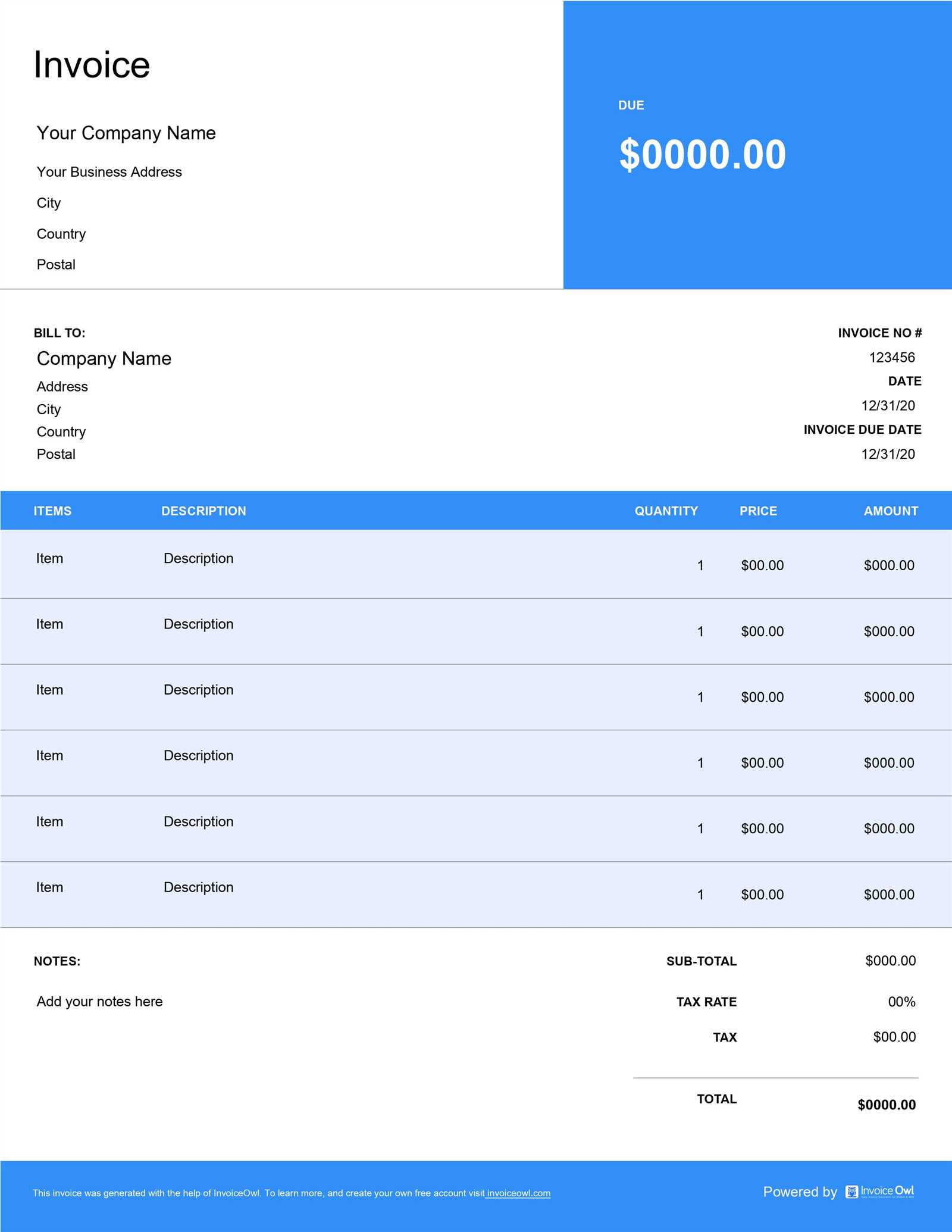

An effective billing document is a structured record used to outline the details of a transaction between a service provider and a client. It typically includes information such as the services rendered, the associated costs, payment terms, and the date the service was completed. Using a predefined format for creating these documents simplifies the process and ensures consistency across all transactions.

These structured documents serve several essential purposes, including clear communication of charges, serving as a record of work completed, and facilitating smooth financial transactions. Service providers often utilize specific formats that can be customized to reflect the unique nature of each project or job performed.

Key Components of a Billing Record

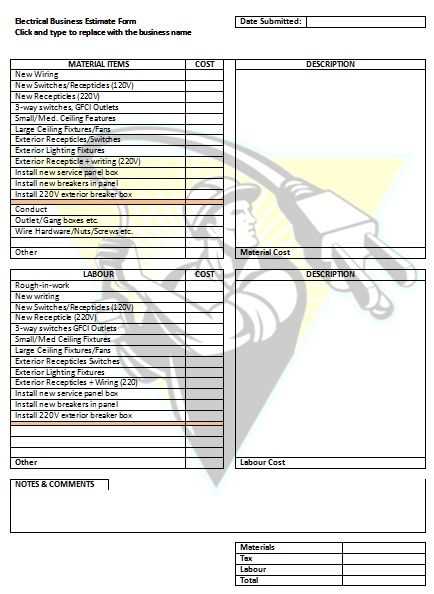

- Service Description: A clear list of tasks completed or products delivered.

- Cost Breakdown: Detailed pricing for each service or product provided.

- Payment Terms: Information about due dates, late fees, or payment methods accepted.

- Contact Information: Details for both the service provider and client, including address and phone numbers.

- Tax Information: Details of any applicable taxes or fees based on the service or location.

Benefits of Using a Pre-Formatted Record

- Time-Saving: Pre-designed formats eliminate the need to manually create records from scratch.

- Consistency: Using a set structure ensures all important details are included every time.

- Professionalism: A well-organized document reflects positively on the business and builds client trust.

- Accuracy: Reduces the risk of missing critical information or making errors in calculations.

Benefits of Using Digital Billing Formats

Utilizing digital billing formats offers numerous advantages for businesses that need to send clear, professional records of services or products provided. These formats allow for easy customization, consistency, and secure sharing, making them a preferred option for many service providers. The flexibility of digital formats simplifies the process and enhances both efficiency and organization in managing client transactions.

Key Advantages of Digital Billing Formats

- Professional Presentation: Pre-designed formats ensure that your records look polished and consistent every time, which helps establish trust with clients.

- Ease of Customization: You can quickly adapt these formats to suit different clients, projects, or services, saving time and reducing manual work.

- Portability: Digital formats are easy to send via email or file-sharing platforms, ensuring quick delivery and reducing postal costs.

- Security: Digital files can be encrypted or password-protected, ensuring that sensitive client information remains secure.

- Accessibility: Files can be accessed from any device, allowing you to manage records on the go or from multiple locations.

Why Digital Records Improve Efficiency

- Faster Processing: With digital documents, there is no need for printing or manual filing. You can quickly create, modify, and send records.

- Reduce Errors: Using a set structure reduces the chances of leaving out important details or making calculation mistakes.

- Environmentally Friendly: By eliminating the need for paper, digital formats contribute to reducing paper waste and are more eco-conscious.

- Easy Storage and Retrieval: Digital records are easy to store and organize, making it simple to find and reference past transactions.

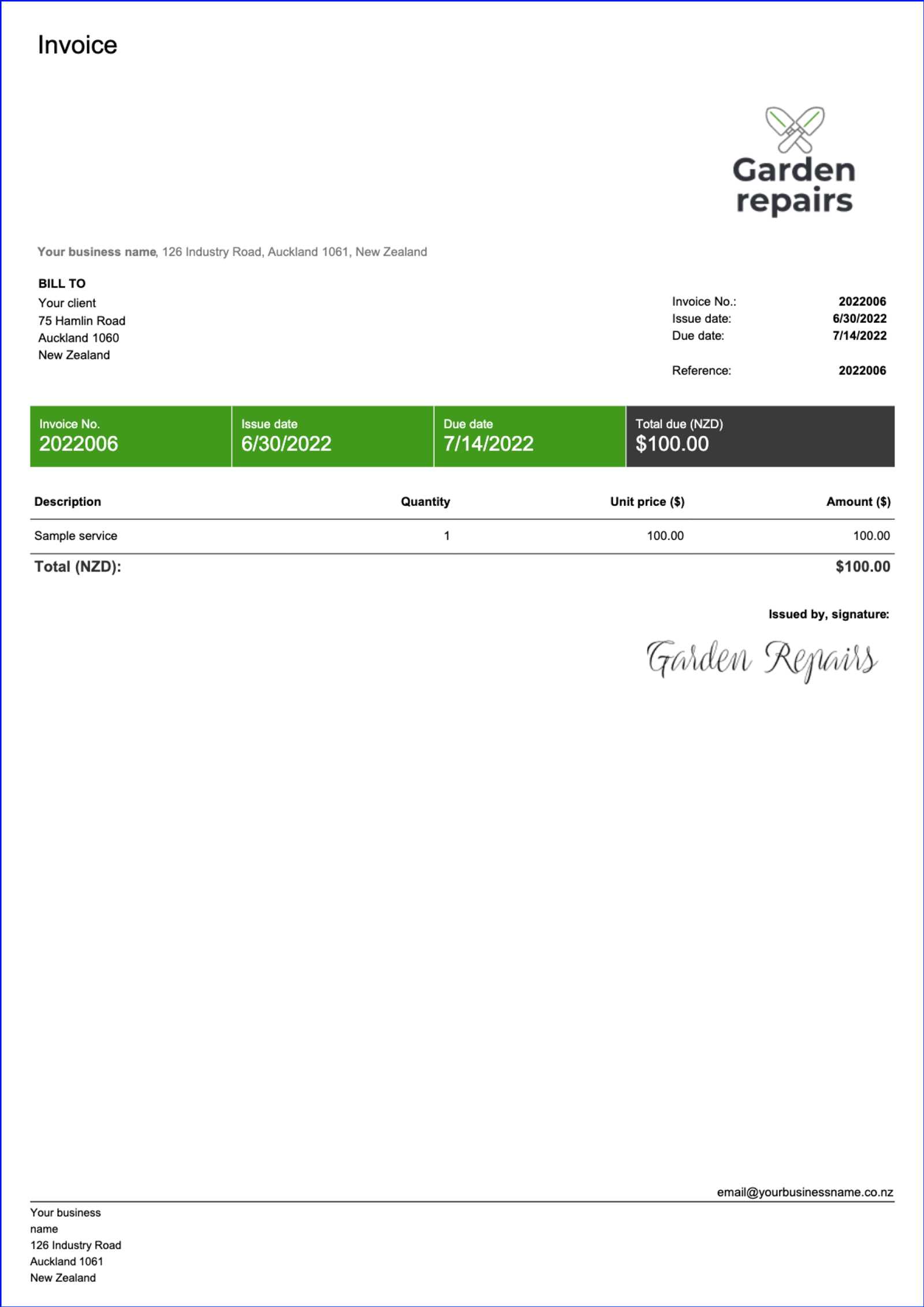

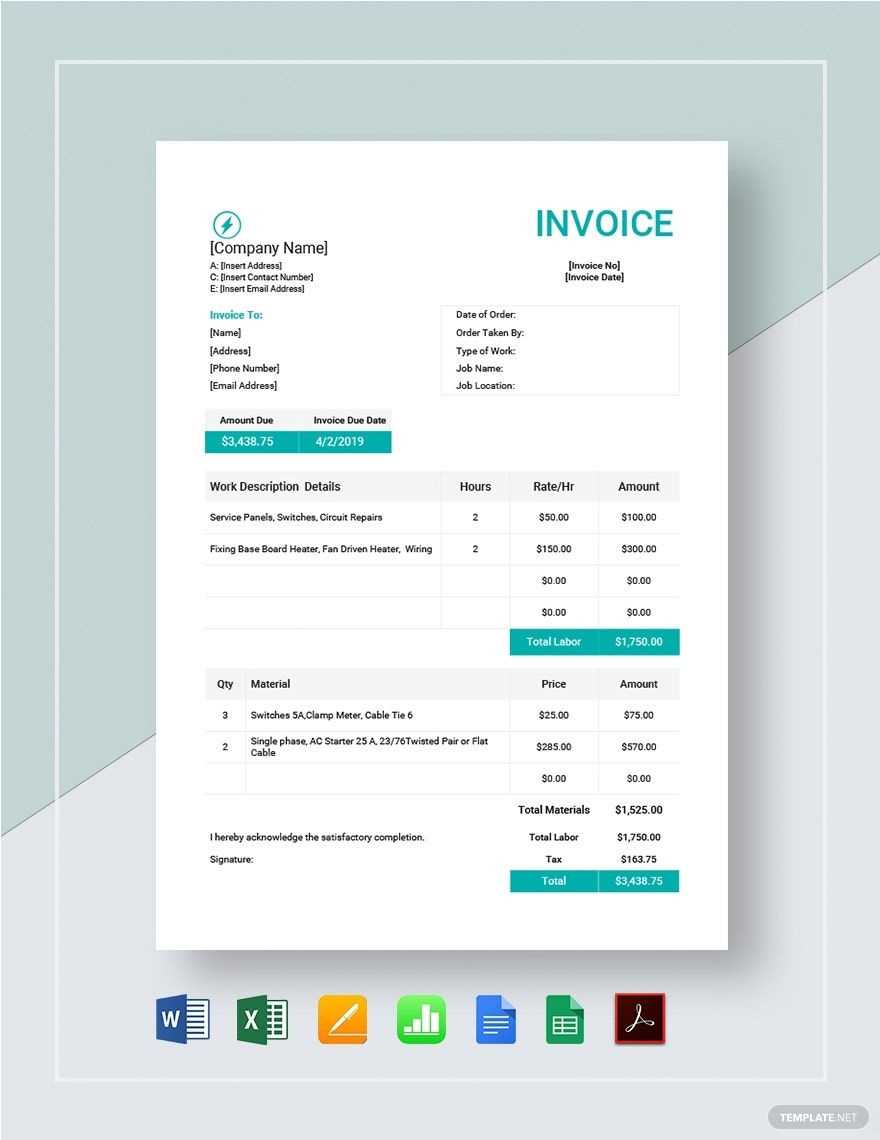

How to Customize Service Billing Records

Customizing service billing records allows businesses to personalize their documents to better fit their brand, client needs, and the specific details of each project. By adjusting key elements such as design, content, and layout, you can ensure that each record is accurate, professional, and tailored to the service provided. Personalizing these documents makes them more effective in conveying important information and maintaining client trust.

Key Customization Elements

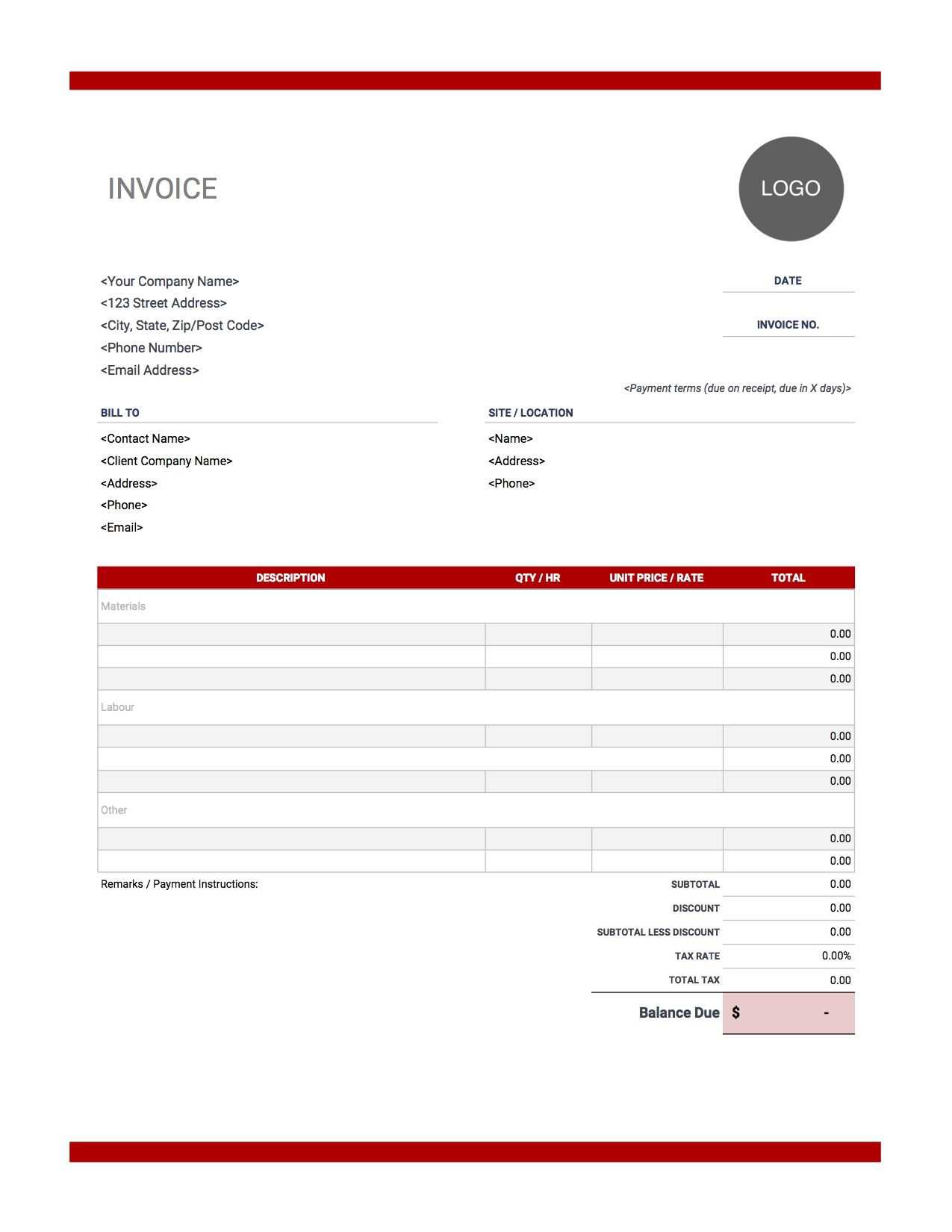

- Company Branding: Add your business logo, contact details, and a professional design to create a consistent and recognizable look.

- Service Description: Clearly outline the specific services provided, including any additional work completed outside the original scope.

- Payment Terms: Adjust the payment due date, accepted payment methods, and any late fee policies as needed for each project.

- Tax Details: Customize the tax rates according to your location or the applicable regulations for the services rendered.

- Client Information: Include client-specific data such as their name, address, and job reference number to ensure accurate records.

Adjusting Layout for Clarity

- Table Format: Use a clean, easy-to-read table layout for listing services, pricing, and totals to enhance readability.

- Section Order: Arrange sections logically, starting with service details, followed by payment terms, and ending with the total amount due.

- Font Style and Size: Choose a professional, legible font with appropriate sizes to ensure readability and consistency across all records.

Common Mistakes in Service Billing Records

When creating billing documents, it’s easy to overlook certain details that can lead to confusion, delays, or disputes with clients. Whether due to lack of attention or an unclear template, these mistakes can have a significant impact on the efficiency and professionalism of your business. Avoiding these errors ensures that your records are accurate, transparent, and well-received by clients.

Frequent Errors in Service Billing Records

- Missing Client Information: Not including full client details, such as their address or job reference number, can cause delays or misunderstandings.

- Unclear Service Descriptions: Failing to clearly describe the services rendered can lead to confusion or disputes about what was provided and why it was billed.

- Inaccurate Pricing: Errors in calculating costs, forgetting discounts, or failing to account for all services can result in incorrect totals that could harm client trust.

- Omitting Payment Terms: Not specifying when payment is due, the accepted payment methods, or any penalties for late payment can create uncertainty around financial expectations.

- Neglecting Tax Information: Not including or incorrectly calculating applicable taxes can lead to compliance issues and cause friction with clients.

- Formatting Issues: Poor layout, such as unclear sections or misaligned tables, can make it difficult for clients to understand the document and impact the professional appearance.

How to Avoid These Mistakes

- Double-Check Client Information: Always verify the details you’ve entered to ensure accuracy and avoid future confusion.

- Be Specific with Descriptions: Write clear, concise descriptions for each service or product, including the scope of work performed.

- Review Pricing and Taxes: Double-check calculations and tax rates to ensure accuracy and avoid discrepancies later.

- Outline Payment Terms: Clearly state the payment due date, methods of payment accepted, and any applicable late fees.

- Use Professional Layouts: Select a clean, easy-to-read format that helps organize information logically and makes the document easy for clients to navigate.

Choosing the Right Format for Your Business

Selecting the appropriate format for your billing records is an important step in ensuring your financial documents are clear, professional, and aligned with your business needs. The right format will help you maintain consistency, improve efficiency, and present your services in a way that enhances your brand’s credibility. Whether you’re a small business owner or part of a larger enterprise, choosing the right structure is key to smooth client interactions and timely payments.

Factors to Consider When Choosing a Format

- Industry Needs: Different industries have varying requirements for what should be included in a billing record. Choose a format that reflects the specifics of your business, whether it’s a service-based or product-based company.

- Branding: Your billing document should reflect your business’s identity. Select a format that allows for customization with your logo, business colors, and contact information to enhance your brand image.

- Clarity and Simplicity: The format you choose should be easy to read and understand. Opt for clear sectioning and organized content to prevent confusion and ensure that clients know exactly what they’re being billed for.

- Customizability: Make sure the format is flexible enough to adapt to different job types, service descriptions, and varying pricing structures without becoming cumbersome or overly complicated.

- Compliance and Legal Requirements: Choose a format that meets your local tax laws, regulations, and industry standards. It should provide space for necessary legal information, such as tax rates or licensing details.

Benefits of Choosing the Right Format

- Efficiency: A good format will streamline the process of generating and sending billing documents, saving you time and reducing errors.

- Professionalism: Well-organized records give clients confidence in your business, reflecting attention to detail and reliability.

- Improved Client Relations: Clear and accurate billing helps foster positive relationships with clients by reducing disputes and ensuring they understand exactly what they’re paying for.

- Better Financial Management: Consistent formatting allows for easy tracking and organizing of financial records, making accounting and tax filing simpler.

Best Software for Editing Billing Records

Choosing the right software for editing your financial documents can significantly streamline the process of creating, customizing, and managing your business records. Whether you are looking for an easy-to-use tool for basic modifications or a more advanced option to handle complex billing needs, the right software can save time, improve accuracy, and maintain consistency across all your documents.

Top Software Options for Editing Billing Documents

- Microsoft Excel: A powerful tool for creating customized billing records, offering advanced calculation capabilities and flexibility in layout and design. Ideal for businesses that require frequent adjustments or have complex pricing structures.

- QuickBooks: Designed specifically for small business accounting, QuickBooks offers automated billing and invoicing features that integrate seamlessly with accounting tools, helping to keep track of payments and balances.

- Zoho Invoice: An online solution that allows users to create, edit, and send customized billing documents. It includes templates, time-tracking features, and integrates with various payment gateways for ease of use.

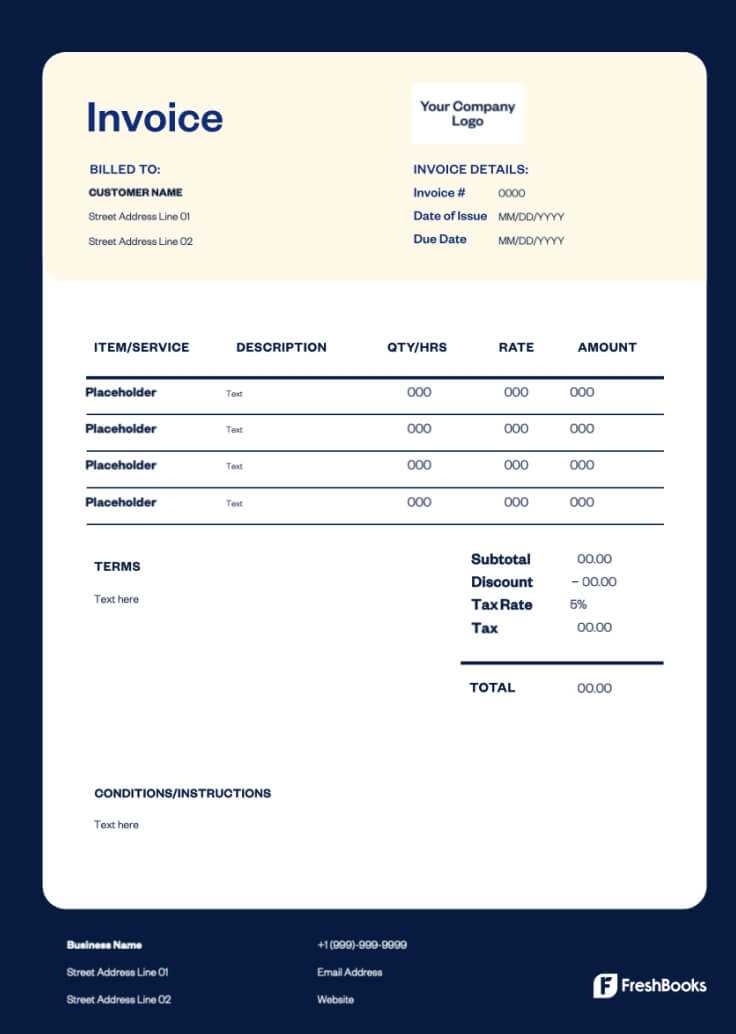

- FreshBooks: This software simplifies billing with easy-to-use templates and customer management features. It’s particularly suited for freelancers and small businesses that need to streamline billing and payment processing.

- Wave Accounting: A free, cloud-based accounting platform that offers simple billing document creation and management tools. It’s a great option for small businesses and independent contractors who want a user-friendly solution without any cost.

Factors to Consider When Choosing Software

- Ease of Use: Ensure the software has an intuitive interface, so you can easily create and modify records without a steep learning curve.

- Customization Options: Look for software that allows you to personalize layouts, fonts, and fields to match your brand and specific business needs.

- Integration with Other Tools: Choose software that can integrate with your existing accounting or payment systems to reduce manual data entry and streamline your workflow.

- Cloud-Based vs. Desktop: Cloud-based options allow you to access and edit records from anywhere, while desktop versions might offer more advanced offline capabilities.

- Pricing: Consider the cost of the software, especia

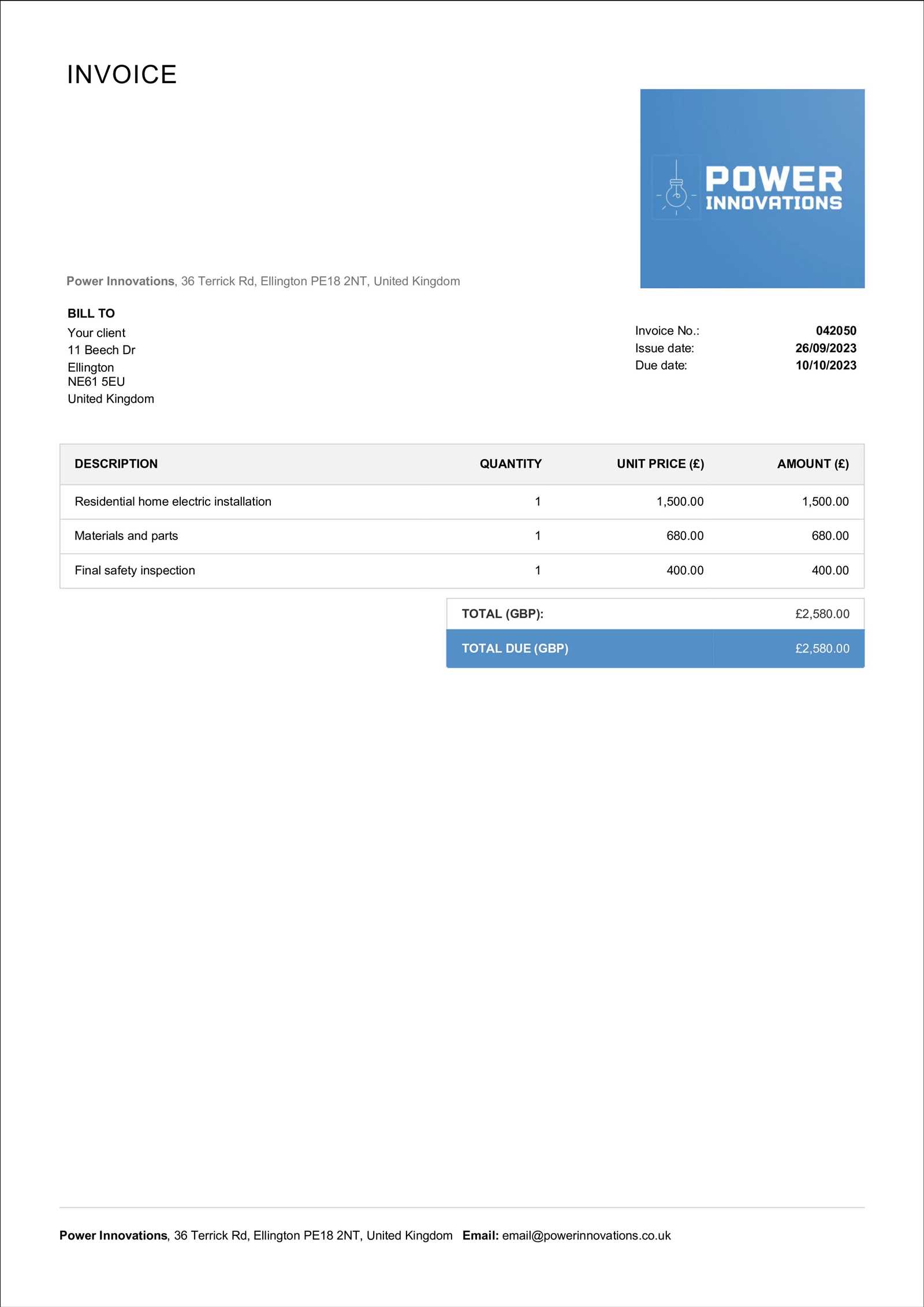

Key Elements of a Billing Document

When creating a financial record for services provided, it’s essential to include certain components to ensure clarity, accuracy, and professionalism. A well-structured document not only communicates the value of the work but also helps both parties keep track of payments and expectations. Understanding the key elements that should be present will allow you to create clear and effective billing statements that meet both business and legal requirements.

Essential Components of a Billing Record

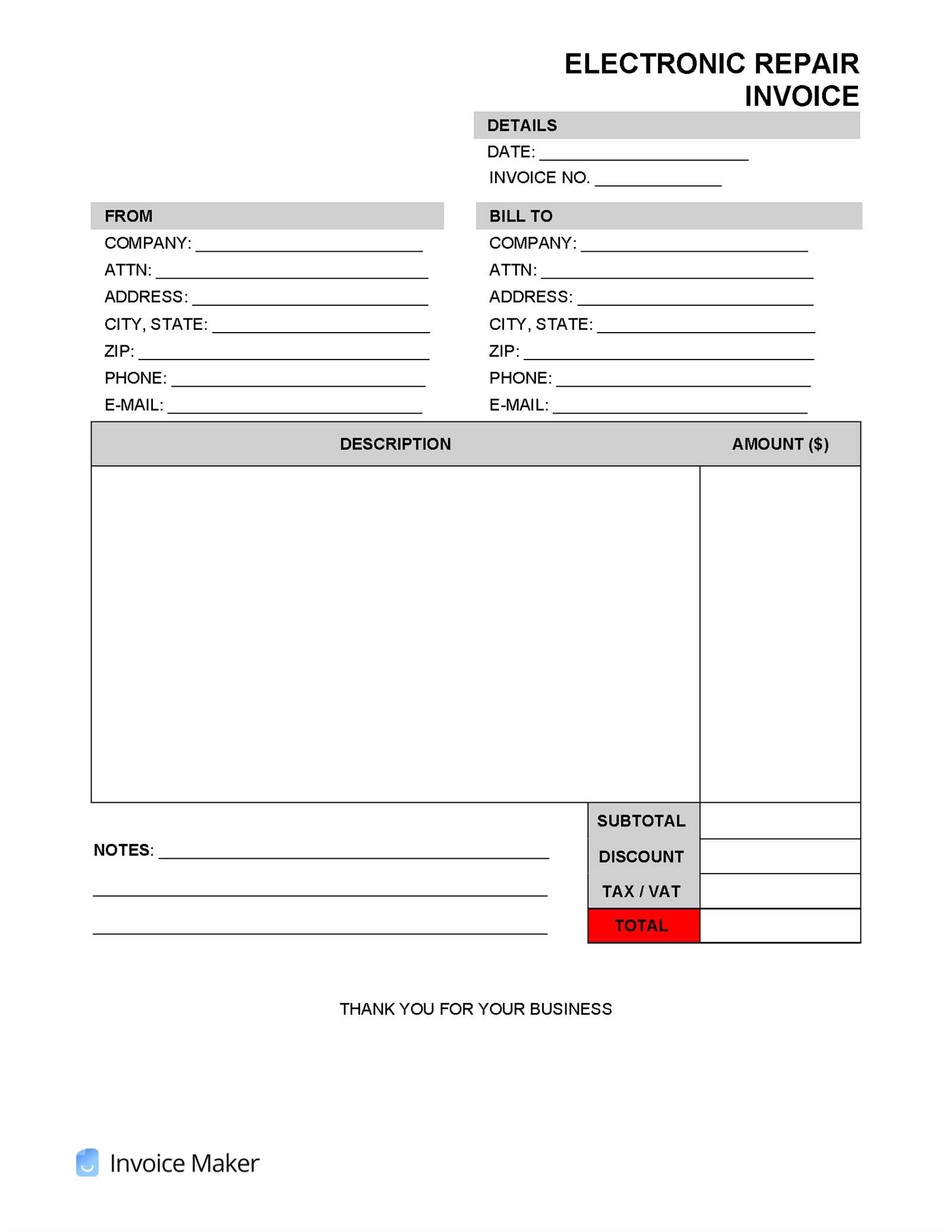

- Business Information: This includes your company’s name, address, contact details, and logo. It’s crucial for identifying your business and creating a professional appearance.

- Client Information: The client’s name, address, and relevant contact details should be included to avoid any confusion and ensure the document reaches the right person.

- Document Number: A unique reference number is important for tracking and organizing records. It helps both you and the client identify the transaction in the future.

- Date of Issue: Clearly indicate the date the document was created to help track payment timelines and avoid misunderstandings.

- Description of Services or Goods: Each service or product provided should be described in detail, with specific quantities, prices, and any additional notes if applicable. This ensures transparency.

- Payment Terms: Define the due date, payment methods accepted, and any applicable late fees or penalties. This establishes clear expectations for both parties.

- Total Amount Due: Provide a breakdown of the total amount, including any taxes, discounts, or additional charges to give a full picture of the payment required.

Additional Optional Elements

- Tax Information: If applicable, include the relevant tax rates, such as sales tax or value-added tax (VAT), to ensure that the document meets legal requirements and is clear to the client.

- Notes or Special Instructions: Adding any important instructions or clarifications can help prevent misunderstandings and set the tone for future business dealings.

- Thank You Message: A polite thank you message can help maintain a positive relationship with the client and encourage repeat business.

How to Include Tax Information on Billing Records

Incorporating tax details in financial documents is essential to ensure compliance with local laws and provide clarity to your clients. Accurately listing taxes not only helps you meet regulatory requirements but also prevents misunderstandings about the total amount due. Including this information in a clear and organized manner ensures that both you and your client are on the same page when it comes to payment obligations.

Here are key steps to follow when including tax information:

Tax Category Tax Rate Amount Sales Tax 8% $40 Service Tax 5% $25 To clearly include tax information:

- Tax Identification: Specify the type of tax being applied, such as sales tax, value-added tax (VAT), or service tax.

- Tax Rate: List the applicable tax percentage for each category. Ensure that the rate is accurate for the specific region or service type.

- Tax Amount: Clearly display the amount for each tax type, calculated based on the price of goods or services provided.

- Total Tax: Include a section at the end of the document showing the total tax amount, adding it to the base price to provide the full amount due.

- Tax Exemptions: If applicable, note any exemptions or deductions that might reduce the total tax amount, especially for non-profit organizations or specific regions with tax incentives.

By organizing and presenting tax details clearly, you not only comply with tax regulations but also help foster transparent and professional relationships with clients.

Ensuring Accurate Billing for Services

Accurate billing is essential to maintaining trust and transparency with clients. When providing professional services, it is crucial to clearly outline all the charges, ensure correct calculations, and avoid errors that could lead to disputes or dissatisfaction. By following a few key practices, businesses can streamline the billing process, improve customer relationships, and reduce the risk of mistakes.

Here are some steps to ensure accuracy in your billing records:

- Detail Every Service: Clearly describe the services provided, including the time spent, materials used, and any additional fees. This helps the client understand the breakdown of charges and prevents confusion.

- Double-Check Calculations: Always review your calculations before sending the document. Verify hourly rates, quantities, and total amounts to make sure no errors were made during the process.

- Use Clear Pricing Structures: Implement a consistent pricing model for all services and ensure that the client is aware of these rates in advance. This eliminates the possibility of surprise charges.

- Accurate Tax Application: Ensure the correct tax rates are applied to the total amount based on the location and nature of the service. This helps avoid discrepancies and ensures compliance with local regulations.

- Include Payment Terms: Specify the payment due date and any late fees or discounts. This makes it clear when payments are expected and helps avoid delays or misunderstandings.

By following these guidelines, businesses can improve the accuracy and reliability of their billing process, ensuring that clients are satisfied and that transactions proceed smoothly.

How to Send Billing Documents to Clients

Delivering billing records to clients promptly and securely is crucial for maintaining good business practices and ensuring timely payments. Whether you choose to send them via email, postal mail, or another method, it’s important to ensure that the document is clear, professional, and easy to process for the recipient. Here are a few steps to make sure the sending process is as smooth as possible for both you and your client.

When sending a billing document, consider the following methods:

Delivery Method Pros Cons Email Fast, cost-effective, eco-friendly Requires internet access, may end up in spam folder Postal Mail Hard copy, more formal Slower, additional postage costs Online Payment Platforms Secure, allows easy payment May require account setup for both parties To ensure the process goes smoothly, follow these steps:

- Check the Recipient’s Contact Details: Double-check the client’s email address or postal address to avoid sending the document to the wrong recipient.

- Include a Clear Subject Line: When sending by email, make sure the subject line is direct, including the reference number and the phrase “Payment Due” to make the purpose clear.

- Choose a Suitable Format: If sending electronically, consider using a widely recognized file format like a Word document or a secure attachment format. For physical mail, ensure the print quality is high and readable.

- Set Payment Instructions: Whether you’re sending a digital or physical copy, include clear instructions on how the client should make the payment, including accepted methods and any relevant deadlines.

By carefully considering the best method for sending billing records, you can improve your workflow, reduce the chance of errors, and ensure that clients receive and process their payments efficiently.

Payment Terms to Include in Billing Records

Including clear payment terms in your billing records is vital to ensure both parties understand their obligations and avoid confusion. Payment terms outline when and how the client should pay, what fees may apply, and any expectations regarding late payments. Establishing these terms upfront can help smooth the payment process and reduce misunderstandings.

Here are some common payment terms to consider including:

Standard Payment Terms

- Net 30: Payment is due within 30 days from the date the document is issued.

- Net 15: Payment is due within 15 days from the date of issue.

- Due on Receipt: Payment is due immediately upon receiving the document.

Additional Payment Terms

- Late Fees: Specify the late fee or interest that will be charged if payment is not made on time.

- Early Payment Discount: Offer a discount if the client settles the payment ahead of the due date.

- Payment Methods Accepted: Clarify the payment methods you accept, such as bank transfers, credit cards, or online platforms.

- Partial Payments: State whether clients can pay in installments or if a full payment is required upfront.

By clearly outlining payment expectations, you ensure that both you and your clients are on the same page, reducing the likelihood of payment delays or disputes.

How to Track Payment for Billing Records

Monitoring the status of payments for your billing records is an essential aspect of managing your finances. Keeping track of payments helps you stay organized, avoid missed payments, and quickly identify overdue amounts. With the right approach and tools, you can efficiently manage the payment process and ensure that all transactions are recorded accurately.

Here are some effective methods for tracking payments:

Tracking Method Description Benefits Spreadsheets Track payments manually using spreadsheet software like Excel or Google Sheets. Easy to set up, low cost, flexible Accounting Software Utilize specialized software that automatically tracks payments and generates reports. Automated tracking, integrated with other financial tools Online Payment Systems Use platforms like PayPal or Stripe to manage payments and track transaction history. Real-time tracking, easy integration with billing systems When tracking payments, it’s essential to maintain accurate records. Here are some tips:

- Record the Date of Payment: Note the exact date when each payment is made to avoid confusion later.

- Note the Payment Method: Document the method used for each transaction (e.g., bank transfer, credit card).

- Follow Up on Overdue Payments: Set reminders or alerts to follow up with clients who have not made payments on time.

- Use Payment Status Indicators: Mark each transaction as “Paid,” “Pending,” or “Overdue” to track progress easily.

By using the right tools and maintaining a consistent tracking method, you can ensure that all payments are properly recorded and your financial processes run smoothly.

Legal Considerations for Billing Records

When creating billing documents, it’s essential to ensure that all legal requirements are met to avoid disputes and ensure the document is enforceable. Legal considerations in the billing process can include providing accurate information, adhering to tax laws, and following contract terms. Understanding the rules and regulations that apply to financial transactions can protect your business and ensure compliance with local and national laws.

Key Legal Elements in Billing Documents

There are several legal aspects that need to be considered when issuing billing records, including the following:

Legal Requirement Description Accurate Business Information Ensure that your business name, address, and contact details are correct and up-to-date. Client Details Include the client’s name, address, and contact information as part of the official record. Terms and Conditions Clearly outline payment terms, due dates, and any penalties for late payments. Tax Information Comply with tax regulations by including the correct tax rates and amounts, if applicable. Signature/Authorization For some contracts, a signature or authorization from both parties may be required to validate the document. Understanding Your Legal Obligations

It is crucial to understand the legal implications of the documents you issue. Depending on your region or industry, there may be specific rules regarding payment terms, dispute resolution, and the inclusion of certain information. Consulting with a legal professional can help ensure that your billing records comply with relevant laws and that your business is protected in the event of a dispute.

Failure to comply with legal requirements may result in fines, delays, or difficulty enforcing payment. Therefore, taking the time to ensure your billing practices align with the law is an investment in the security and integrity of your business.

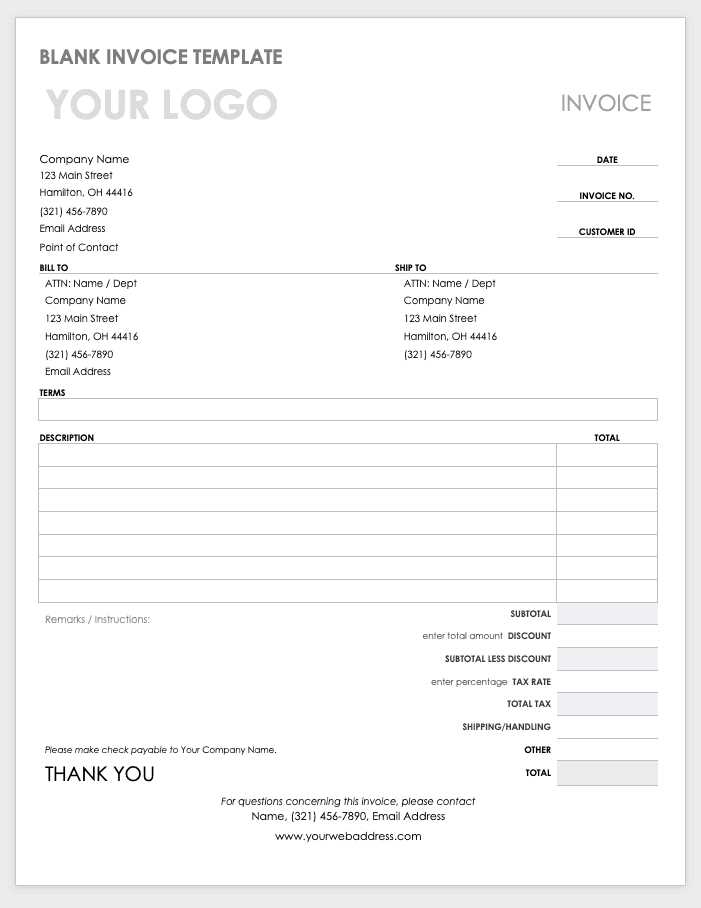

How to Create an Invoice from Scratch

Creating a billing document from the ground up allows you to fully customize the format and ensure all necessary details are included. This process requires attention to detail and a good understanding of what information is essential for both your business and the client. Below are the steps to guide you in creating a professional and accurate billing statement.

Steps to Create a Billing Document

Follow these steps to craft a complete and clear record of services or products provided:

- Include Your Business Information

Start by adding your business details such as name, address, phone number, and email. This ensures the recipient knows who is issuing the document. - Include Client Information

Next, include the client’s name, address, and contact details. This helps both parties identify who the document is intended for. - Provide a Unique Reference Number

Assign a unique reference number to the document for future tracking and to ensure there are no mix-ups with other records. - List Products or Services Provided

Provide a clear and detailed list of the goods or services offered, including quantities, unit prices, and any other relevant information. Be as specific as possible to avoid confusion. - Include Dates

Specify the date the goods or services were provided and the payment due date. This establishes a clear timeline for both parties. - Calculate Total Amount

Sum up the charges for all items, add any applicable taxes or fees, and provide the final total for the client to pay. - Outline Payment Terms

Clearly state your payment terms, including the due date, accepted payment methods, and any penalties for late payments. - Include Legal and Tax Information

Ensure you comply with tax regulations by listing any applicable tax rates or business registration details, if required.

Final Touches

Before finalizing, review the document to make sure all the details are accurate. Double-check the calculations and ensure that there are no errors in client or product information. Once you’re confident everything is in order, send the billing statement to the client in your preferred format, whether electronically or in print.

Creating a billing document from scratch gives you full control over the process and ensures it meets your specific needs. By following the steps outlined above, you can create clear, accurate, and professional records for your business transactions.

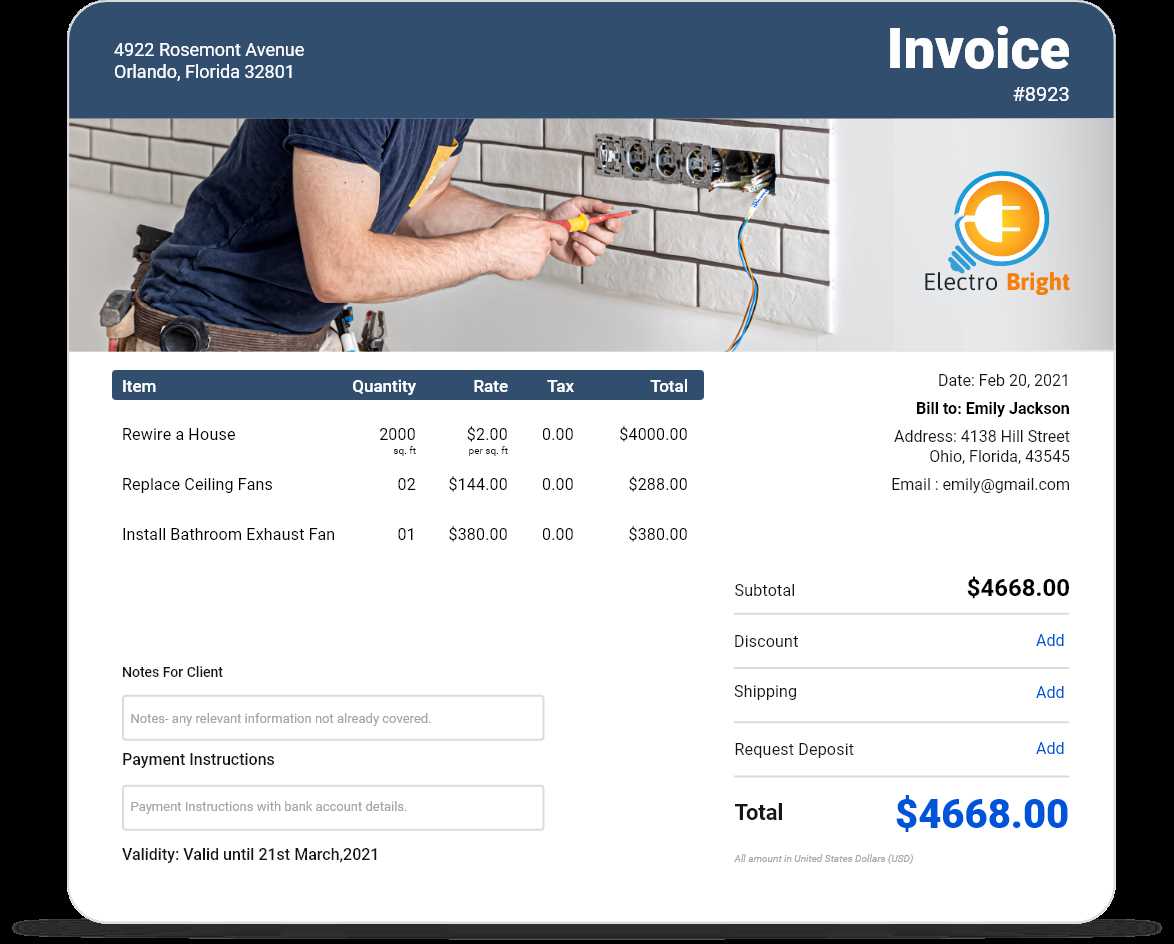

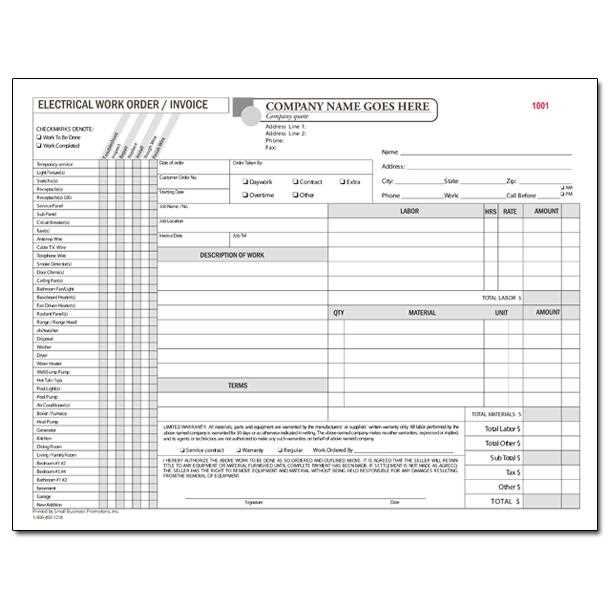

Best Practices for Electrical Invoicing

Efficiently managing financial documentation is essential for maintaining smooth operations in any business. Following best practices for creating and handling billing records ensures accuracy, professionalism, and clarity, helping to establish trust with clients and avoiding misunderstandings. Below are some key practices to consider when managing these essential documents.

Accurate and Detailed Information

One of the most important aspects of any financial document is the clarity and accuracy of the information presented. Make sure to include:

- Complete business and client details – Always provide your business’s name, contact information, and tax details. Similarly, ensure the client’s information is accurate.

- Clear itemization – List all products or services provided, including quantities, unit prices, and applicable discounts.

- Precise totals – Double-check the sums and include any applicable taxes or additional charges to avoid errors in the final amount.

Timely and Transparent Communication

Effective communication is key to any successful business transaction. Here are some tips:

- Issue documents promptly – Send the financial record as soon as the transaction is complete to ensure both parties are on the same page regarding payment expectations.

- Clearly state payment terms – Specify when payments are due and outline acceptable methods of payment to avoid confusion.

- Maintain transparency – If any fees or changes occur, communicate them clearly to the client before finalizing the document.

By following these best practices, you can ensure that all financial documents are professional, accurate, and clear, ultimately fostering better relationships with your clients and streamlining your business processes.

Free Resources for Electrical Invoice Templates

There are numerous online platforms that provide free resources for creating professional billing documents. These resources can help businesses save time and reduce the cost of generating essential financial records. Whether you’re looking for customizable designs, basic formats, or advanced features, many websites offer templates that cater to various needs and industries. Below are some useful platforms where you can find these resources.

Online Template Providers

Several websites specialize in offering free document designs. These platforms provide easy-to-edit forms that can be tailored to your specific requirements:

- Canva – Known for its user-friendly interface, Canva offers a variety of editable billing forms that can be customized with your business details and branding.

- Invoice Generator – A simple tool for creating basic records with the ability to download in various formats. It’s perfect for quick, no-cost billing.

- Zoho Invoice – While Zoho offers premium services, it also provides free templates for small businesses, with a range of design options to choose from.

Open-Source Options

If you prefer using open-source solutions, there are a number of free platforms that allow for greater customization. These tools are ideal for those with some technical know-how who want more control over the final product:

- Microsoft Office Templates – Both Word and Excel offer free downloadable billing forms that can be edited and saved according to your preferences.

- Google Docs – Google offers free document templates that can be easily accessed, edited, and shared directly from your browser.

Using these resources allows you to produce professional documents without the need for expensive software, making it an ideal option for businesses of all sizes.