Free Electrical Invoice Template Excel Download and Customization Guide

Efficient billing is crucial for any business, especially for professionals in the electrical industry. Whether you’re a freelancer or running a small company, creating clear and accurate documents for services rendered ensures timely payments and helps maintain professional relationships with clients.

In this guide, we’ll explore how customizable, easy-to-use tools can simplify the process of creating payment requests. By using the right tools, you can focus more on your craft while automating administrative tasks like billing, saving both time and effort in the long run.

Additionally, we’ll look at how these tools can be tailored to meet specific needs, ensuring that each transaction is clear and precise. You’ll discover how flexibility and convenience in document creation can improve your workflow, allowing you to present a polished and professional image to clients.

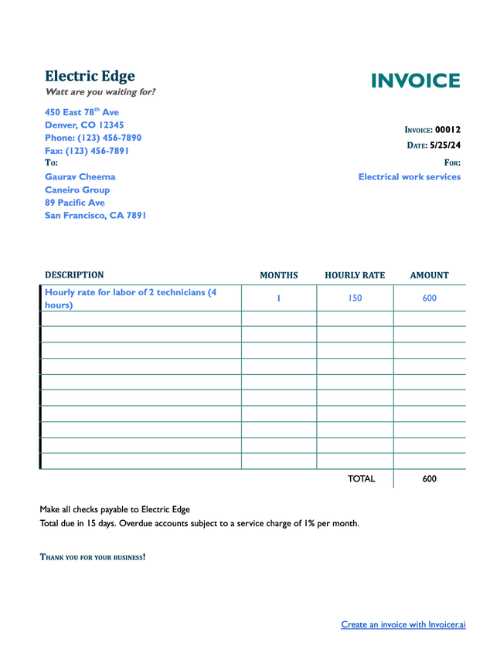

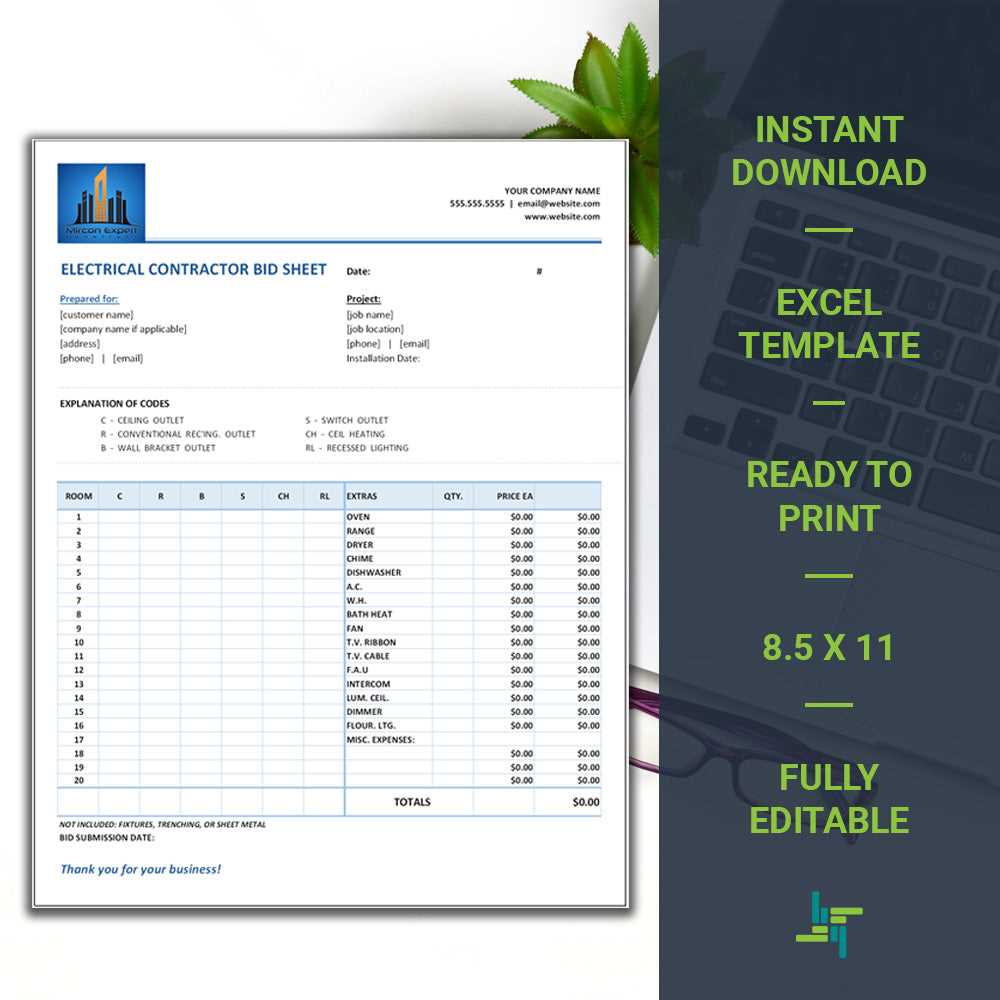

Understanding Electrical Invoice Templates in Excel

When managing billing processes for your business, having a well-organized and efficient method for creating payment requests is essential. A structured document that can be easily modified and updated helps reduce errors and ensures consistency in transactions. These customizable tools are designed to streamline the task, allowing you to generate accurate payment records in just a few simple steps.

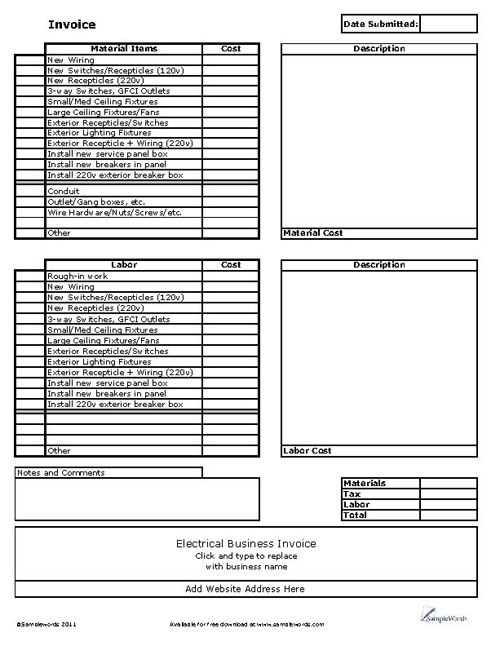

In the case of service-based industries, where transactions vary widely from job to job, using flexible documents becomes even more critical. Such tools provide all the necessary fields to include detailed information such as labor, materials, time worked, and applicable taxes. They also ensure that each document adheres to a professional format and can be tailored to specific client needs.

Key benefits of using such tools include:

- Efficiency: Automating the process of creating payment documents saves valuable time that can be better spent on other tasks.

- Consistency: A standardized format guarantees uniformity in every document, making it easier to track records and maintain professionalism.

- Flexibility: Customizable fields allow you to adjust each document to fit specific client requirements or project details.

- Accuracy: With predefined formulas for calculations, the risk of human error in billing is minimized, ensuring precise totals and amounts.

By understanding the power of these documents, you can streamline your billing process, improve client relations, and enhance your overall workflow. A well-crafted document not only reflects the quality of your work but also reinforces your commitment to professionalism in business transactions.

How to Create an Invoice in Excel

Creating a professional payment document from scratch may seem daunting, but it doesn’t have to be. With the right tool, you can easily build a structured and clear document that reflects the details of your services and ensures smooth transactions. Whether you’re handling one-time or recurring jobs, this process can be quick and efficient once you understand the basic steps involved.

Step-by-Step Guide to Building Your Document

Follow these simple steps to craft a well-organized bill for your clients:

- Open a New Spreadsheet: Start by creating a new file to give yourself a clean slate for each new payment document.

- Set Up Your Header: Include your business name, logo, address, contact information, and any relevant details about your business. It’s important to make this section professional and easy to read.

- Client Information: Below the header, add fields for the client’s name, address, and contact details to personalize each document.

- List of Services: Create a table to detail the services provided. Include columns for description, quantity, rate, and total. Make sure the columns are clear and well-organized for easy reading.

- Include Tax and Discounts: If applicable, provide separate fields for adding taxes and discounts to the total amount. Be sure to use formulas to automatically calculate these values based on the data you’ve entered.

- Final Total: At the bottom of the table, clearly display the total amount due. This should include all services, taxes, and discounts, with a bold font to make it stand out.

- Payment Terms: Don’t forget to include payment terms, such as due dates, accepted payment methods, and any late fees if applicable.

Formatting for Clarity and Professionalism

Once you have entered all the necessary information, it’s essential to format the document so that it looks clean and professional. Some formatting tips include:

- Bold Key Information: Use bold fonts for headings, totals, and important dates to make them stand out.

- Align Data Properly: Make sure the text and numbers are aligned correctly in each column to enhance readability.

- Use Borders and Shading: Adding subtle borders or shaded areas to tables can help separate sections and make the document more organized.

- Keep It Simple: Avoid unnecessary colors or graphics that may distract from the main content. A simple, clean design reflects professionalism.

Once everything is set up, save the document for future use. You can now easily

Why Use Excel for Electrical Invoices

Choosing the right tool to manage billing can significantly improve the efficiency of your business operations. A widely accessible and versatile option for creating professional documents is the use of spreadsheet software. This software offers a user-friendly interface and a variety of features that make it ideal for building customizable payment requests, especially for those working in service-based industries.

One of the main advantages of using a spreadsheet for your billing needs is the ability to automate calculations. This reduces the likelihood of errors and ensures that all totals are accurate. Additionally, the tool offers flexibility, allowing users to adjust formats, fields, and information as needed for each job or client. Here’s a brief overview of why it’s a great choice:

| Benefit | Description |

|---|---|

| Automation | Built-in formulas allow automatic calculations for totals, taxes, and discounts, saving time and reducing mistakes. |

| Customization | Fields such as item descriptions, rates, and quantities can be easily adjusted to fit the specifics of any project. |

| Consistency | Templates can be saved and reused for future jobs, ensuring a uniform format for every client interaction. |

| Data Management | Spreadsheets allow you to store and manage historical data, making it easier to track past transactions and customer information. |

| Affordability | Unlike specialized software, spreadsheets are often part of office suites you may already own, making them a cost-effective choice. |

Overall, the flexibility and practicality of spreadsheet software provide a range of benefits that streamline the billing process, enhance accuracy, and ensure professionalism. By leveraging its features, you can focus more on providing excellent service while handling payments efficiently and effectively.

Key Features of Electrical Invoice Templates

When creating professional billing documents, having the right features in place is essential to ensure clarity and accuracy. These documents are not just about listing charges; they need to convey important details in a structured, easy-to-understand manner. The right document setup can streamline your billing process, minimize errors, and improve client satisfaction.

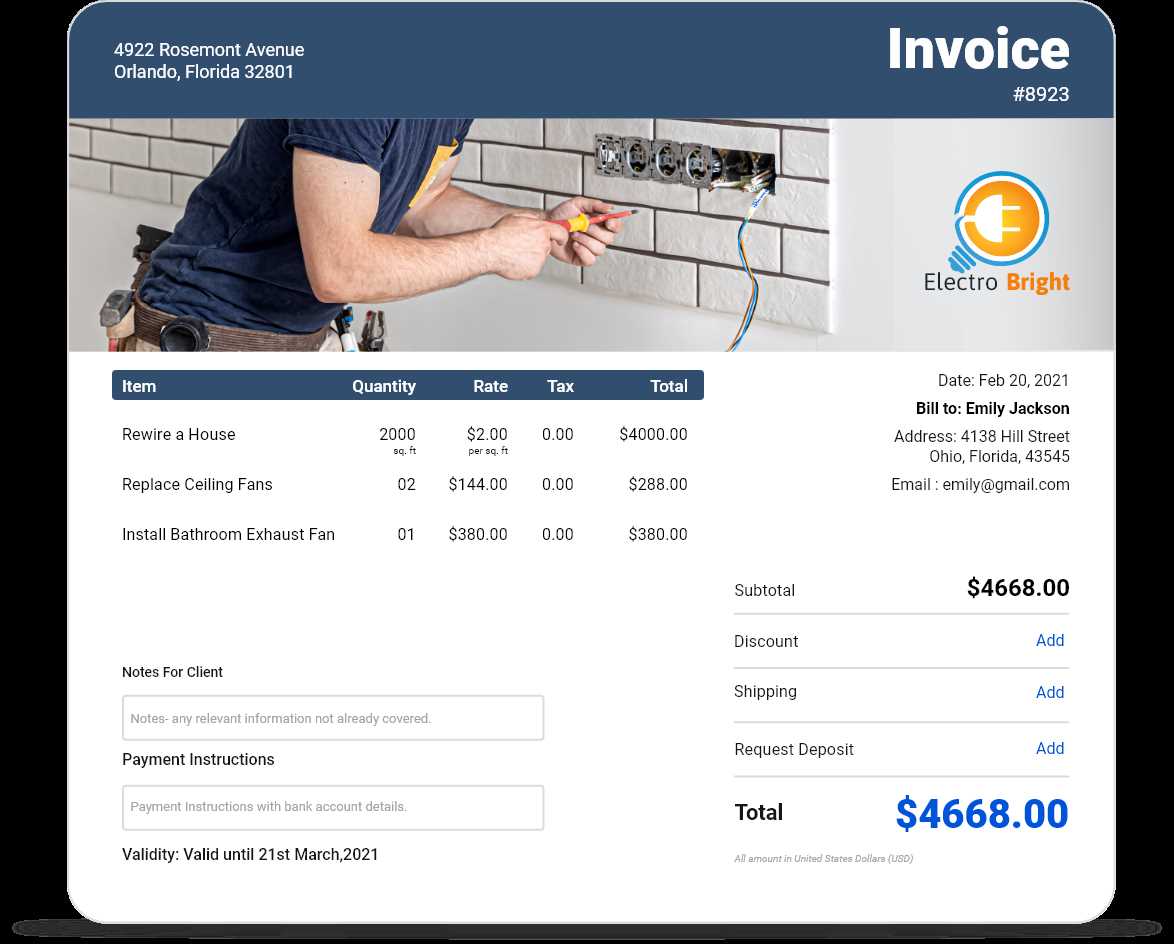

Essential Features for Effective Billing Documents

A well-designed payment document should include several key elements that make it clear and functional. These features are not only necessary for accurate financial tracking but also help maintain a professional appearance when dealing with clients. Here are the key features you should expect:

- Client and Business Information: Clearly display both your business and client details, including names, addresses, and contact numbers. This ensures that both parties are easily identifiable.

- Itemized List of Services: Break down the services provided into categories, showing descriptions, quantities, rates, and totals. This transparency helps clients understand what they’re being charged for.

- Dates: Include both the service date and the payment due date. This makes it easy to track when the work was completed and when payment is expected.

- Tax Calculations: Automated tax calculations based on your region ensure that applicable taxes are accurately applied to the total amount, reducing errors.

- Payment Terms: Clear payment terms, including accepted payment methods and late fees (if applicable), give your clients a clear understanding of how and when to pay.

Additional Features for Streamlining the Process

In addition to the core features mentioned above, there are several other benefits to consider that can further enhance your document’s functionality and ease of use:

- Pre-filled Fields: Fields such as project descriptions or hourly rates can be pre-filled, saving you time when creating new documents.

- Customizable Layout: Having the ability to adjust fonts, colors, and borders ensures that each document reflects your company’s branding and style.

- Automated Calculations: Use formulas to automatically calculate totals, discounts, taxes, and balances, ensuring accuracy with minimal effort.

- Tracking Capabilities: Some tools allow you to keep track of paid and unpaid documents, helping you manage outstanding balances more effectively.

By utilizing these features, you can create a more efficient and professional process for managing your financial records, ensuring you get paid promptly and keep clients satisfied.

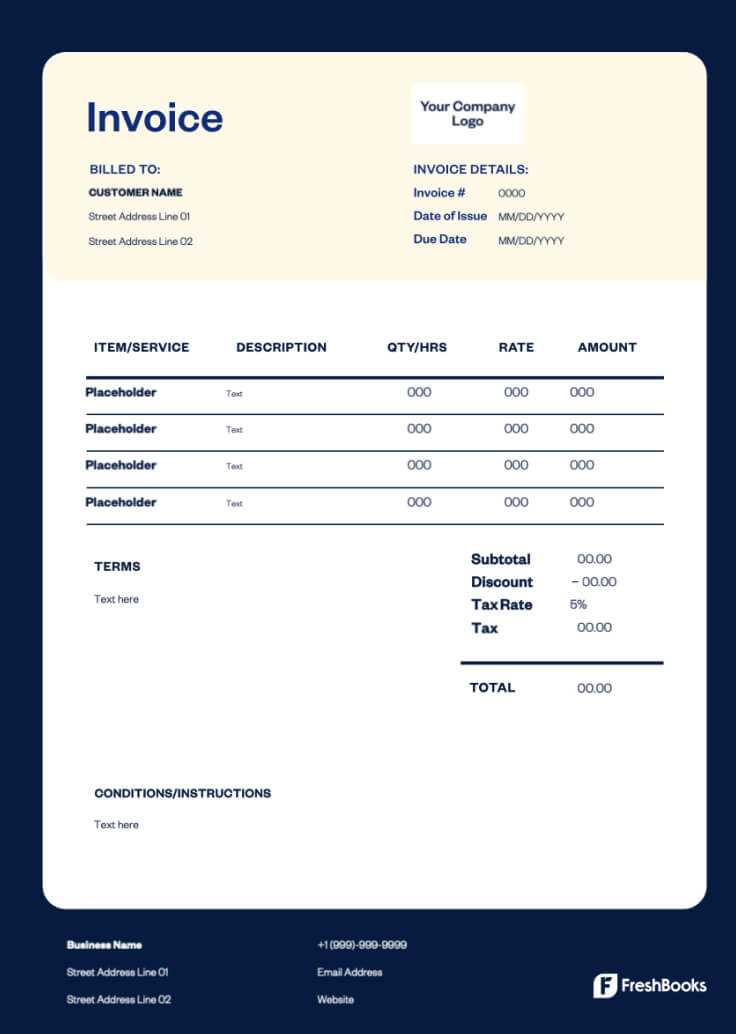

Customizing Your Billing Document in Excel

Creating a payment document that fits the unique needs of your business and clients is essential for maintaining a professional image. Customization allows you to add specific details, adjust the layout, and tailor the content to match your brand, all while keeping the process efficient and organized. With the right adjustments, you can ensure that every document reflects your business style and meets client expectations.

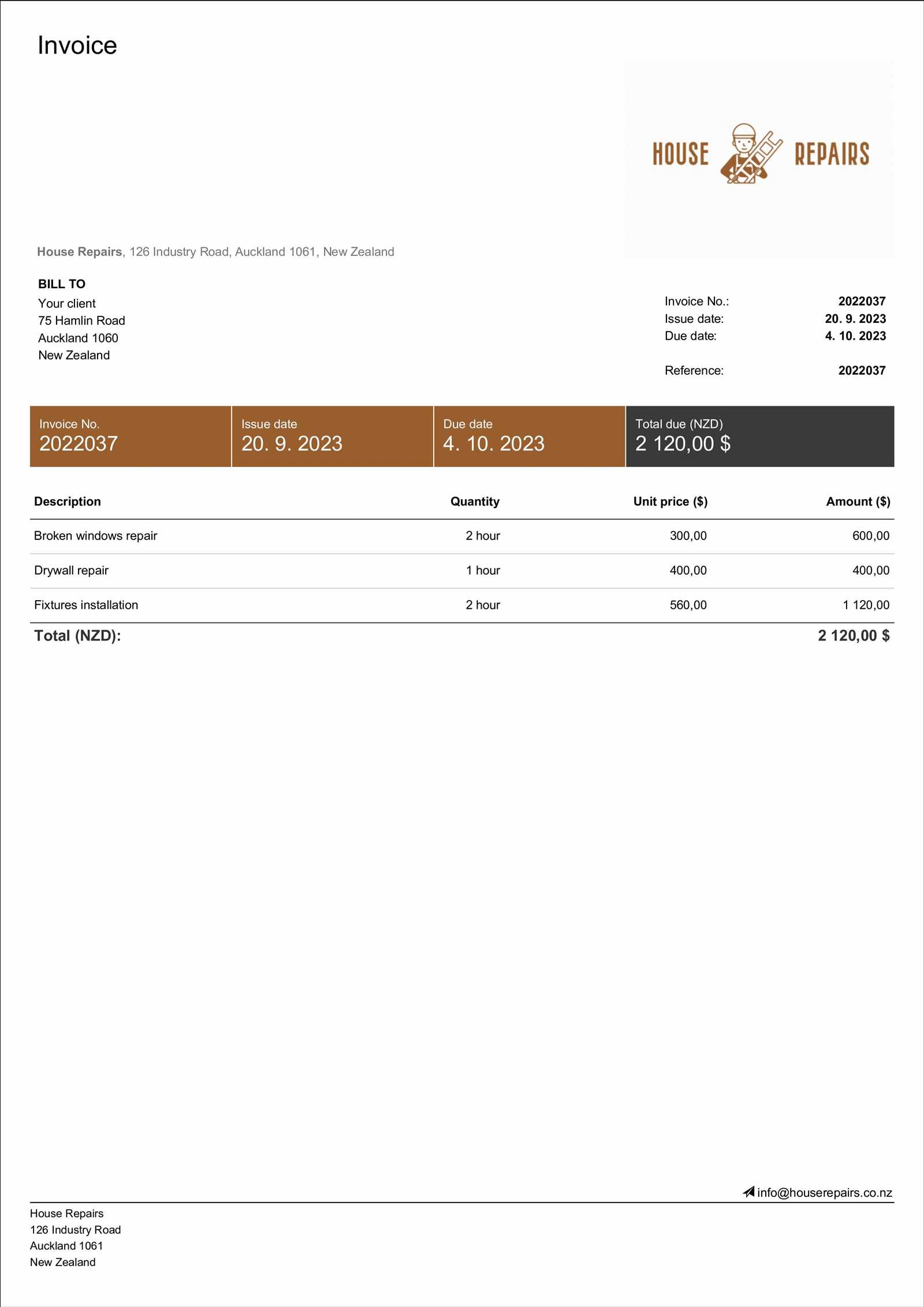

Adjusting the Layout and Design

One of the first steps in customization is adjusting the design and layout of the document. A clean, well-organized format not only looks professional but also makes the document easier for clients to understand. Here are some elements you can modify:

- Header Customization: Add your company logo, business name, and contact information in the header to reinforce your branding.

- Font Styles: Choose fonts that are easy to read and reflect your company’s identity. Consistent font styles throughout the document will enhance its professional appearance.

- Color Scheme: You can select colors that match your business’s brand or industry standards, ensuring your document is visually appealing while staying professional.

- Table Adjustments: Modify the size, alignment, and shading of your service details table to make it easier for clients to review the breakdown of charges.

Adding or Removing Fields

Depending on the type of work you do, you may need to add specific fields or remove unnecessary ones. Customization options make it easy to adapt your document to your needs:

- Adding Custom Sections: If you provide specific services or items, you can add extra fields to detail these offerings, such as labor costs, material expenses, or special fees.

- Adjusting Calculations: Modify the formulas for totals, taxes, or discounts to fit your pricing structure, ensuring everything is automatically calculated correctly.

- Removing Unnecessary Fields: If certain sections are not relevant to a particular job or client, you can remove them to keep the document concise and focused.

- Including Payment Instructions: You can also add custom payment methods or instructions, making it clear how clients should settle their balances.

By customizing your document, you can create a personalized experience for your clients, making each interaction feel unique while maintaining a professional approach to billing. These small adjustments can go a long way in establishing trust and improving communication.

Benefits of Excel Invoice Templates for Electricians

For service professionals, having a streamlined and efficient way to manage payment requests is essential. Using a digital tool to create and manage these documents offers several advantages, especially for electricians who deal with a variety of clients and services. The ability to quickly generate clear and accurate bills not only saves time but also ensures that no important details are overlooked.

Time-Saving Automation

One of the key benefits of using spreadsheet-based billing tools is automation. By entering job-specific details like hours worked, materials used, and hourly rates, the tool can automatically calculate totals, taxes, and discounts. This feature significantly reduces manual calculation errors and saves valuable time that would otherwise be spent on math and data entry. Electricians can create a new payment request in minutes, which means more time for focusing on work.

Improved Professionalism and Accuracy

Using a structured, standardized layout for payment documents helps present a more professional image to clients. The consistent format ensures that all necessary details–such as job descriptions, costs, and due dates–are included in every document. This reduces misunderstandings and confusion. Furthermore, the risk of human error is minimized with automatic calculations and predefined fields, leading to more accurate billing.

- Clear and Structured Layout: Clients appreciate a well-organized document that makes it easy to understand the charges and payment terms.

- Customizable for Different Projects: The ability to customize fields for different types of services ensures that each bill reflects the specifics of the job.

- Instant Updates: If a change is made to a rate or material cost, the document can be updated instantly, ensuring that all bills reflect the most current information.

- Record Keeping: Digital billing makes it easier to store and track historical data, providing an efficient way to manage client records and payment history.

In summary, using digital tools for billing not only improves the speed and accuracy of generating payment documents but also enhances client relations by ensuring transparency and professionalism. By adopting such tools, electricians can reduce administrative burden, streamline their operations, and maintain a high standard of service.

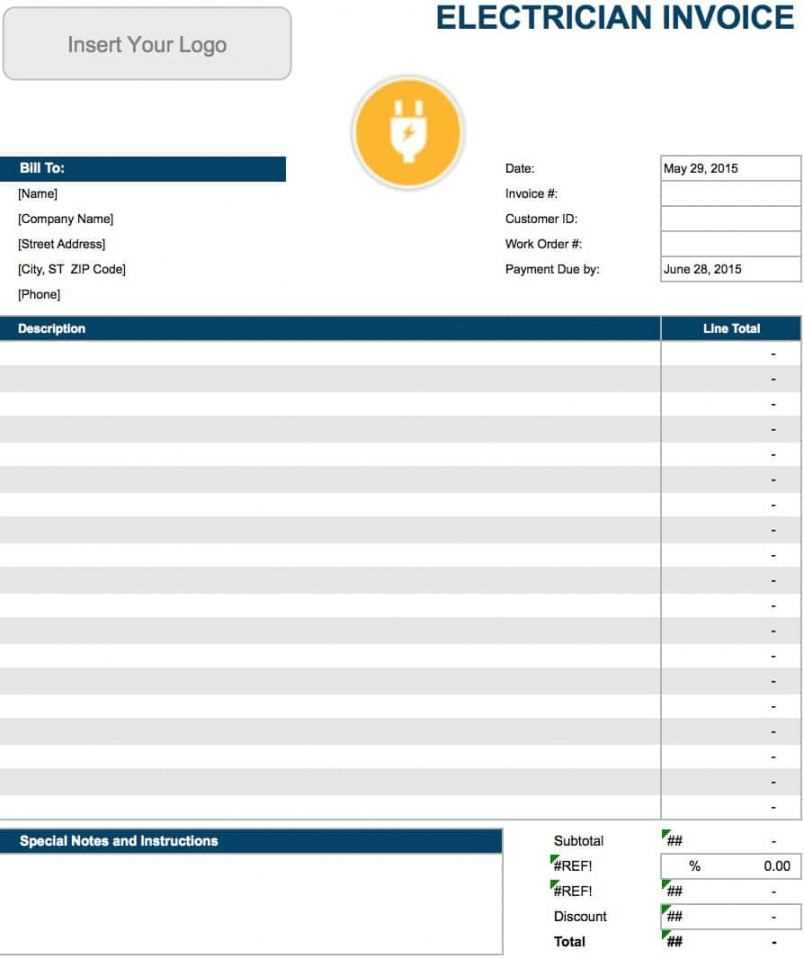

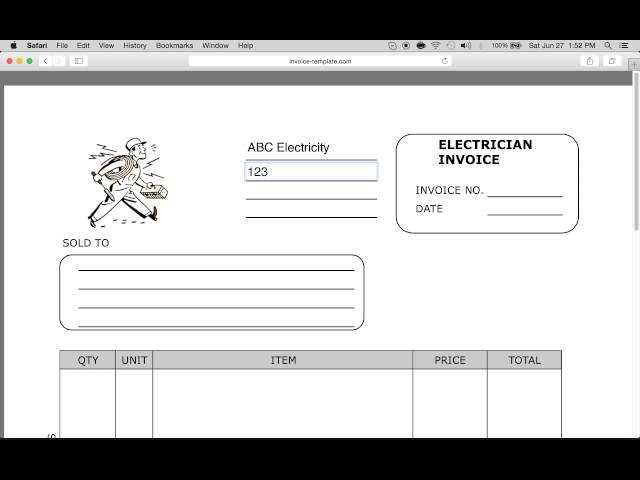

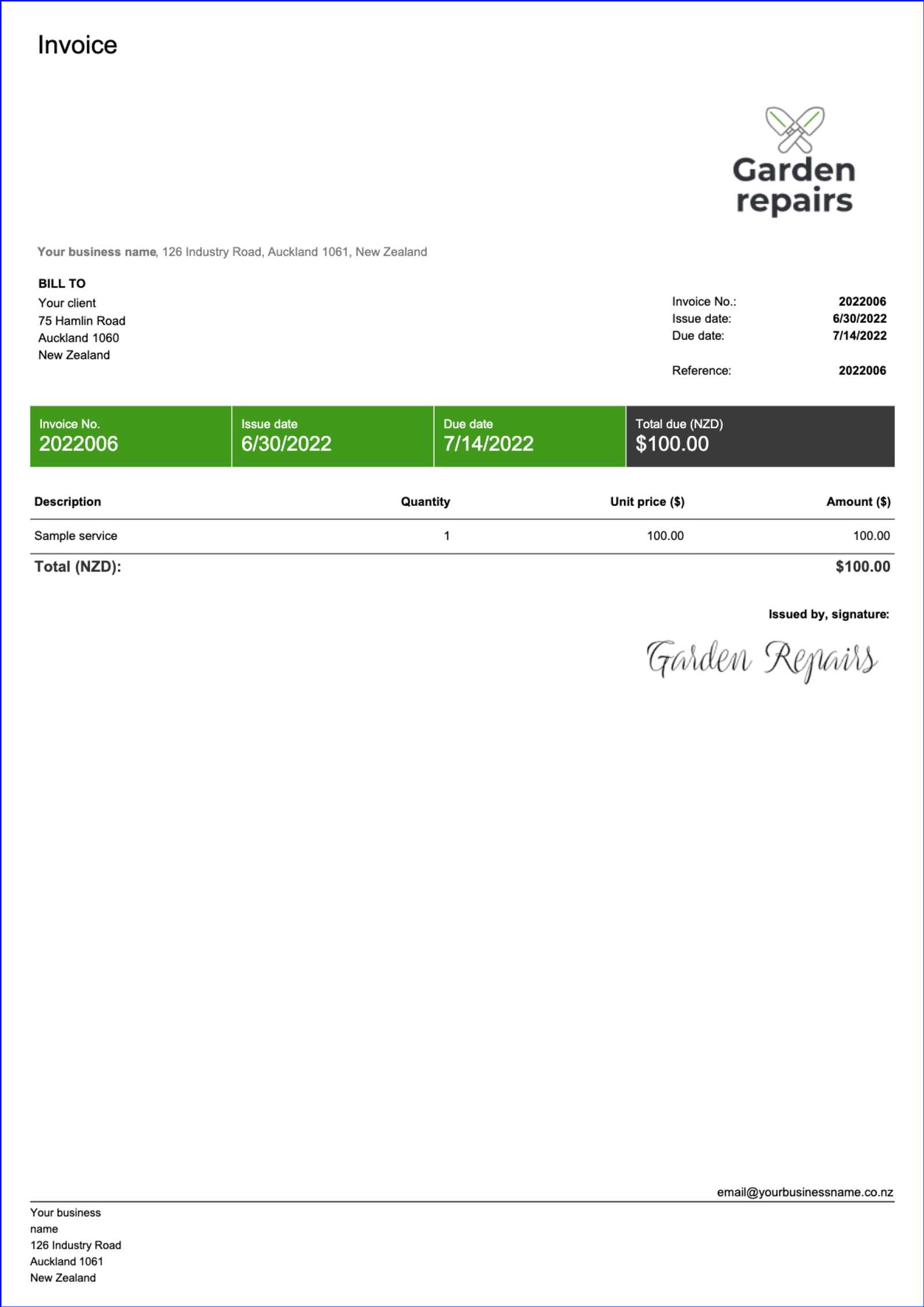

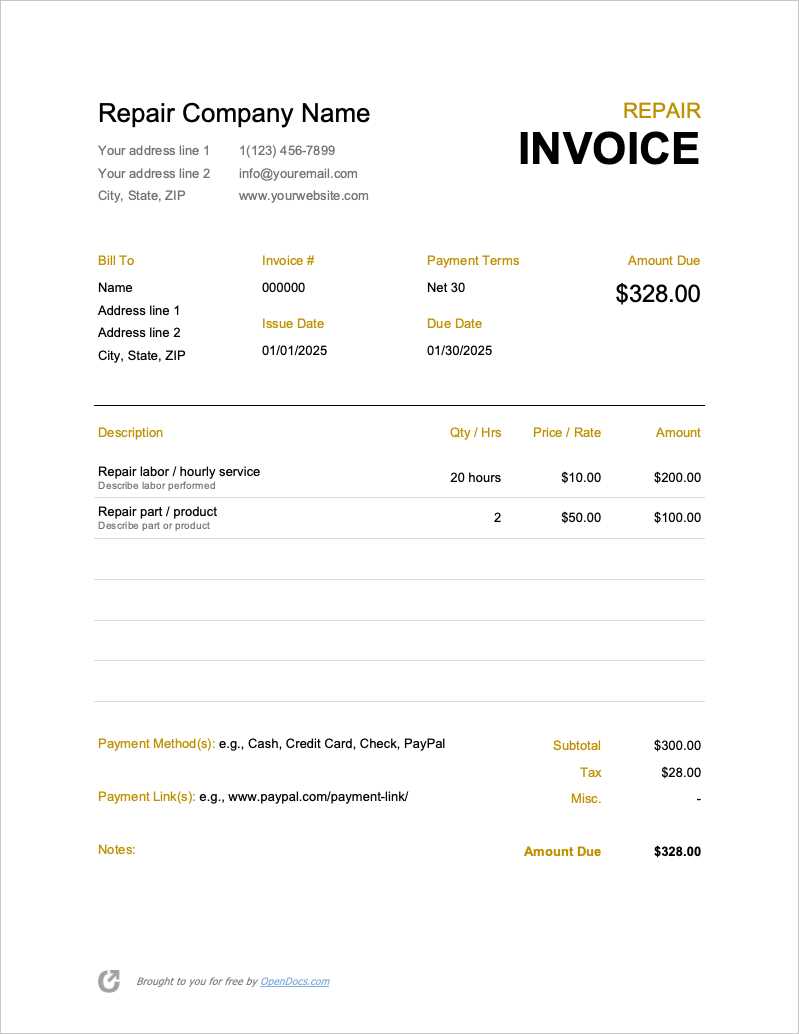

Free Electrical Invoice Templates to Download

Accessing ready-made, customizable billing documents is an excellent way to save time and ensure your payment requests are professional and accurate. There are numerous free resources available online that offer a variety of pre-designed formats tailored to meet the needs of different service providers. These documents can be easily downloaded, personalized, and used to create clear and concise payment records.

By using these free resources, professionals can quickly create custom payment requests without having to start from scratch. Whether you need to adjust the design, add more fields, or tailor the content for a specific client, these documents provide a solid foundation to work from.

Here are some benefits of using free downloadable billing documents:

- No Cost: Many high-quality resources are available completely free of charge, making them an affordable option for small businesses and freelancers.

- Easy Customization: Most downloadable documents are designed with customization in mind, allowing you to easily input your business details, services, and rates.

- Time Efficiency: By downloading a pre-made format, you skip the process of designing a document from the ground up, which means less time spent on administrative tasks.

- Variety of Formats: Whether you prefer simple or more detailed designs, you can find templates that suit your specific needs, from basic billing forms to more comprehensive ones that include payment terms, tax calculations, and client information.

Once downloaded, these documents can be stored digitally, ensuring easy access for future use. By using these free resources, you can streamline your billing process, maintain accuracy, and present a polished image to clients without additional costs.

Common Mistakes in Billing Documents

When creating payment documents, it’s easy to overlook certain details, which can lead to confusion or delays in payment. Even small errors can impact your professionalism and cause frustration for both you and your clients. Understanding the most common mistakes and knowing how to avoid them can help you streamline your billing process and maintain clear communication with customers.

Here are some of the most frequent errors found in payment documents:

- Missing or Incorrect Contact Information: Not including accurate contact details for both your business and the client can cause confusion. Always double-check that names, addresses, and phone numbers are correct.

- Inaccurate Item Descriptions: Failing to clearly describe the work done or materials used can result in clients questioning the charges. Be sure to include detailed and accurate descriptions for every service provided.

- Incorrect or Missing Calculations: One of the biggest mistakes is miscalculating totals or forgetting to add taxes, discounts, or fees. Automated calculation fields can help prevent this issue.

- Unclear Payment Terms: Not specifying payment due dates, accepted methods, or late fees can lead to delayed payments. Make sure your terms are clear and easily understood.

- Omitting Dates: Always include both the service date and the due date on your document. This helps clients track when the work was completed and when payment is expected.

- Failure to Follow a Consistent Format: A disorganized or inconsistent layout can make the document harder to read and less professional. Stick to a standardized format to ensure clarity and professionalism.

By being aware of these common mistakes, you can avoid them and create payment records that are both accurate and easy for your clients to understand. Taking the time to carefully review each document will help you maintain a high level of professionalism and reduce the risk of misunderstandings or payment delays.

How to Add Tax and Discounts in Excel

In any business transaction, it’s crucial to accurately calculate and apply applicable taxes and discounts to ensure correct billing. By adding these elements to your payment documents, you provide transparency and ensure that your clients are clearly informed of all charges. Fortunately, most spreadsheet tools offer easy-to-use formulas that can automate this process, reducing the risk of manual errors.

Here’s a simple guide on how to add both taxes and discounts to your document:

Adding Tax to Your Document

To calculate tax on the total amount of your services or products, you’ll first need to know the tax rate applicable in your region. Here’s how you can add it:

- Step 1: In the cell where you want to display the tax amount, enter the following formula:

=Total Amount * Tax Rate. For example, if your total amount is in cell B5 and the tax rate is 10%, the formula would look like this: =B5*0.10. - Step 2: The result will automatically show the calculated tax amount. To add it to the total, simply sum the original amount and tax amount together.

- Step 3: Display the total amount due after tax by using the formula:

=B5 + (B5*0.10), where B5 is your original total, and 0.10 is the tax rate.

Applying Discounts to Your Document

If you need to apply a discount to the total amount, you can easily subtract a percentage based on the original cost. Here’s how:

- Step 1: In the cell for the discount, enter the formula:

=Total Amount * Discount Rate. For example, if your total amount is in cell B5 and the discount is 15%, use: =B5*0.15. - Step 2: Subtract the discount from the total by using the formula:

=B5 – (B5*0.15). This will show the new total amount after applying the discount.

Combining Tax and Discounts

In many cases, you ma

Managing Multiple Clients with Excel Invoices

When working with multiple clients, it’s important to keep track of all payments, services provided, and outstanding balances. Using a digital tool for creating and managing billing documents can simplify the process, allowing you to stay organized and efficient. With the ability to handle numerous accounts, keep detailed records, and quickly generate new documents, this approach helps save time and reduce errors.

Here are some strategies for effectively managing multiple clients using spreadsheet-based payment documents:

Organizing Client Information

One of the first steps to managing multiple clients is to ensure all necessary client details are stored in an organized way. Using separate sheets or sections within a document for each client allows for easy tracking of individual jobs and payments.

- Separate Sheets for Each Client: Create individual tabs within your workbook for each client. This way, you can keep each client’s information, billing history, and payments in one place.

- Client Contact Information: Make sure to include all relevant details, such as name, address, phone number, and email, for quick reference when creating new payment requests.

- Service History: Keep a detailed record of the services provided to each client, including dates, descriptions, and any relevant costs. This will help when generating new documents for repeat clients.

Automating Calculations and Payments

Automating calculations can save you time when dealing with multiple clients and ensure consistency across all your payment requests.

- Use Formulas for Consistency: Apply formulas for taxes, discounts, and totals to ensure calculations are accurate for every client. This helps maintain a standardized format across all your documents.

- Track Payments and Outstanding Balances: Include a section for tracking payments received, amounts due, and outstanding balances. This can help you quickly identify which clients have pending payments and avoid late fees.

- Summary Page: Create a summary page that automatically pulls key data from each client’s sheet, such as total payments, outstanding balances, and job totals. This gives you a quick overview of all your accounts in one place.

Customizing for Individual Clients

While maintaining consistency is important, you may also want to customize documents for individual clients, depending on their needs or specific agreements.

- Client-Specific Terms: Some clients may have different payment terms or rates. Customize these fields for each client so that all details are accurate.

- Adjust Layout for Different Needs: Depending on the complexity of the work or the type of serv

Electrical Invoice Template Excel Download Free Editable and Customizable How to Track Payments with Spreadsheet Templates

Tracking payments efficiently is essential for maintaining healthy cash flow and keeping your financial records organized. Using a digital tool for creating billing documents provides a simple way to not only generate requests but also track whether payments have been received or are still outstanding. By incorporating payment tracking into your workflow, you can easily monitor balances, due dates, and payment histories, ensuring you stay on top of your finances.

Setting Up a Payment Tracking System

To track payments effectively, create a system within your document that allows you to monitor each client’s payment status. This can be done by adding a dedicated column or section to your billing document where you can record payment details and due dates.

- Payment Status Column: Add a column to track whether a payment has been made. This can include options like “Paid,” “Unpaid,” or “Partially Paid.”

- Payment Date: Record the date when the payment is made. This helps you keep track of when each payment was received and ensures you don’t miss any deadlines.

- Amount Paid: Include a column for the amount paid, which allows you to easily see if a client has paid in full or if there is a remaining balance.

- Balance Remaining: You can calculate the remaining balance by subtracting the payment from the total amount. This can be done automatically using formulas to reduce manual errors.

Automating Calculations and Summaries

Spreadsheets allow you to automate the payment tracking process, which reduces the chances of human error and ensures accuracy. You can set up automatic calculations that will update the balance remaining as soon as a payment is recorded.

- Automated Balance Calculation: Use a simple formula to subtract the amount paid from the total charge. For example, if the total charge is in cell B5 and the amount paid is in C5, use this formula: =B5 – C5 to show the remaining balance.

- Payment Summary: Create a summary table that automatically aggregates the total amount received from all clients. This will help you quickly assess the overall payments you’ve collected over a certain period.

- Conditional Formatting: Use color codes to highlight unpaid balances or overdue payments. For example, you can use red for overdue payments and green for paid ones, which allows you to quickly identify which clients need follow-up.

Generating Reports for Financial Analysis

By regularly updating and tracking payments, you can generate useful financial reports that provide insights into your cash flow and outstanding balances. These reports can help you plan better and follow up wi

Integrating Your Billing Document with Accounting Software

Integrating your billing system with accounting software can streamline your financial management and improve accuracy. By syncing your payment records with an accounting tool, you can easily track income, expenses, and manage taxes. This integration eliminates the need for manual data entry, reduces errors, and provides a clearer picture of your financial health.

Why Integration is Beneficial

Integrating billing documents with accounting software brings several advantages that simplify the financial tracking process. Here are some key reasons why this integration is beneficial:

- Time-Saving: Automatically transferring billing data to accounting software saves time and prevents duplicate work, eliminating the need for manual entry.

- Improved Accuracy: Integration reduces the chances of human error when entering transaction details, ensuring that all information is consistent and correct across systems.

- Better Financial Insights: With all your financial data in one place, it’s easier to track profits, losses, and expenses, giving you a clearer understanding of your business’s financial health.

- Seamless Tax Preparation: Integrated systems can automatically calculate taxes, making tax filing easier and more accurate when it’s time to prepare your returns.

- Real-Time Updates: Integration allows you to access up-to-date financial data, so you’re always informed about your current cash flow, outstanding payments, and total earnings.

Steps to Integrate Your Billing Document with Accounting Software

Integrating billing data with accounting software can be done in a few steps, depending on the software and tools you use. Here’s a general process:

- Select Compatible Software: Choose accounting software that is compatible with your billing documents, such as QuickBooks, Xero, or FreshBooks. Many of these platforms allow seamless import of payment data.

- Export Your Billing Data: Export your billing records from your spreadsheet into a file format that can be imported into your accounting software, such as CSV or QuickBooks-compatible files.

- Map Your Fields: When importing, ensure that the fields in your billing document (e.g., client name, amount, payment status) match the corresponding fields in the accounting software.

- Sync Automatically: Set up automatic synchronization if your accounting software supports it. This will allow your billing records to update in real time as soon as a new document is created.

- Reconcile Regularly: Periodically reconcile the data in your accounting software with your billing system to ensure everything is accurate and up-to-date.

By integrating your payment documents with accounting software, you can streamline your financial operations and maintain better control over your finances. This setup will save time, reduce errors, and improve your overall e

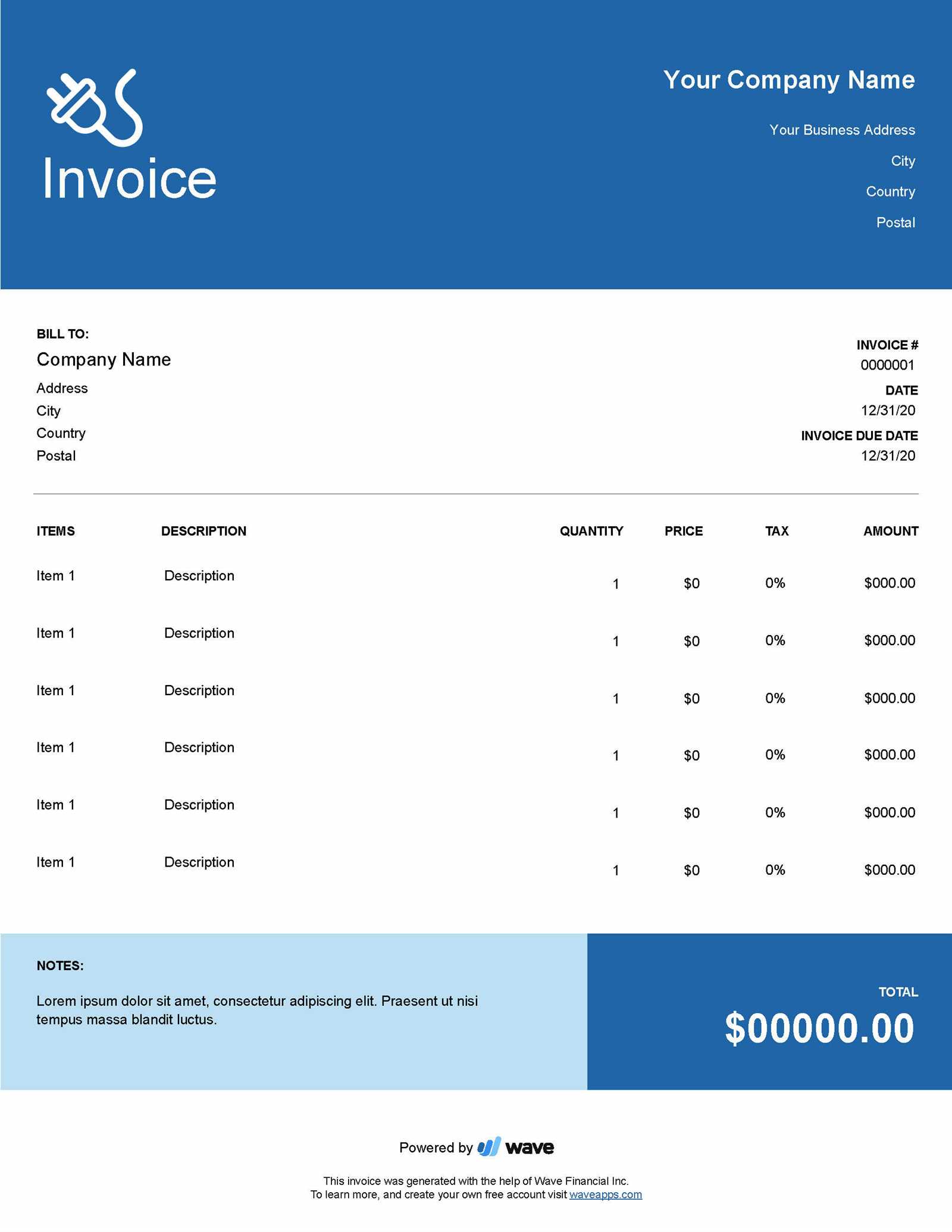

Maintaining Professionalism with Document Design

A well-designed payment document not only ensures clarity but also reflects your professionalism and attention to detail. The design of your billing documents plays a crucial role in how clients perceive your business. A polished, organized layout helps convey trustworthiness and competence, while a cluttered or poorly formatted document can create confusion and diminish the perceived quality of your services.

Maintaining professionalism through your billing document design involves several key elements that work together to create a clean, easy-to-read format. From consistent branding to clear breakdowns of charges, each detail contributes to the overall image you present to your clients.

Here are some essential design considerations to maintain professionalism when creating your payment documents:

- Use Clear Fonts and Spacing: Choose easy-to-read fonts, such as Arial or Calibri, and ensure there is enough spacing between sections for better readability. Avoid using too many different fonts or sizes, as this can make the document look cluttered.

- Include Your Branding: Incorporate your company’s logo, color scheme, and contact details at the top of the document. This reinforces your brand identity and makes the document easily recognizable to your clients.

- Organize Information Clearly: Break down the charges and services in a structured manner, using tables or bullet points where applicable. This makes it easier for your clients to understand the services provided and the associated costs.

- Ensure Consistency: Consistency in design, such as using the same font sizes for similar sections or aligning text properly, creates a professional appearance and builds trust with your clients.

- Use a Clean Layout: Avoid overcrowding the document with unnecessary information. Focus on the essentials, such as client details, service descriptions, amounts due, and payment terms. Leave ample white space to give the document an open and clean look.

- Professional Language: The tone of the document is just as important as the design. Use polite and formal language, and ensure all fields are filled out correctly. A well-written document communicates respect and professionalism.

By paying attention to these design elements, you can create documents that not only look professional but also convey a sense of competence and reliability. A well-crafted document can help reinforce positive client relationships and foster trust, making the payment process smoother and more efficient for both parties.

How to Save Time on Billing with Spreadsheets

Streamlining the billing process is essential for any business, especially when you have multiple clients or projects to manage. Using a digital system can significantly reduce the time spent on creating and sending payment documents. By leveraging spreadsheet tools, you can automate calculations, save frequently used information, and quickly generate consistent billing documents, ultimately saving you valuable time.

Key Strategies to Save Time

Here are some effective ways to cut down on the time spent on generating and managing payment records:

- Use Pre-built Formulas: Setting up formulas for common calculations such as totals, taxes, and discounts can save you the effort of manually calculating these values each time. For example, you can create formulas that automatically update the final amount as you input service costs or adjust the tax rate.

- Create a Master Document: Set up a base document with all standard fields pre-populated (e.g., your company name, client details, payment terms). This can be saved as a template and used for all future projects, allowing you to focus on just the specific details for each new client or job.

- Utilize Drop-Down Lists: Using drop-down lists for common entries, such as payment methods, service types, or client names, helps you quickly fill in repetitive information, reducing manual typing and improving consistency.

- Automate Date and Time Stamps: Use formulas that automatically insert the current date and time, so you don’t have to manually track when a document was created or when a payment is due.

- Group Similar Tasks: Instead of creating documents one at a time, try grouping similar tasks together. For example, set aside a time each week to generate all client records for that period, then send them out in one batch. This minimizes the time spent switching between different tasks.

Efficient Document Organization

Keeping your billing documents well-organized is just as important as automating calculations. The more structured your system, the faster you can access and modify your records when needed.

- Use Separate Sheets for Clients: Create individual tabs for each client within a single spreadsheet file. This will allow you to store all relevant billing information in one place without the need to search through multiple files.

- Implement a Summary Page: Set up a summary page that compiles key financial data from each client sheet, such as outstanding balances or payment statu